Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Spirit Airlines, Inc. | save-20200722.htm |

EXHIBIT 99.1

Spirit Airlines Reports Second Quarter 2020 Results

MIRAMAR, Fla., July 22, 2020 - Spirit Airlines, Inc. (NYSE: SAVE) today reported second quarter 2020 financial results.

Ended the second quarter 2020 with $1.2 billion of unrestricted cash and short-term investments

| Second Quarter 2020 | Second Quarter 2019 | ||||||||||||||||||||||

| As Reported | Adjusted | As Reported | Adjusted | ||||||||||||||||||||

| (GAAP) | (non-GAAP)1 | (GAAP) | (non-GAAP)1 | ||||||||||||||||||||

| Revenue | $138.5 million | $138.5 million | $1,013.0 million | $1,013.0 million | |||||||||||||||||||

| Pre-tax Income (Loss) | $(212.5) million | $(364.4) million | $148.6 million | $150.1 million | |||||||||||||||||||

| Pre-tax Margin | (153.4)% | (263.1)% | 14.7% | 14.8% | |||||||||||||||||||

| Net Income (Loss) | $(144.4) million | $(285.8) million | $114.5 million | $115.7 million | |||||||||||||||||||

| Diluted Earnings (Loss) Per Share | $(1.81) | $(3.59) | $1.67 | $1.69 | |||||||||||||||||||

“The COVID-19 pandemic negatively impacted our second quarter results. However, we were encouraged by our June results and believe they illustrate that when leisure travel demand rebounds and stabilizes, our leading low-cost structure positions us well to be among the first to return to profitability. We increased our schedule in June as a result of encouraging, albeit tenuous, signs of demand improving. This worked out well for us. The favorable dynamics of our low-cost structure, a slight rebound in demand for June, and an uptick in forward bookings for July resulted in favorable cash dynamics for the month of June. In fact, if you exclude an early principal payment of nearly $50 million related to our aircraft deferral agreement and extension of our pre-delivery deposit facility, on an average daily cash basis2, we were break-even for the month of June,” said Ted Christie, Spirit’s President and Chief Executive Officer.

COVID-19

“For our Guests who are ready to travel again, we are pleased to welcome them back. We are taking purposeful steps to provide a safe and healthy experience for our Guests and our Team Members. I am proud of how our entire team has stepped up in response to COVID-19, adapting to enhanced cleaning processes and changes in operational procedures, maintaining productivity amidst a changing work environment, connecting with our Guests in innovative ways, and proactively cutting costs and taking actions to preserve liquidity,” said Ted Christie, Spirit’s President and Chief Executive Officer.

As the COVID-19 pandemic continues to evolve, the Company's financial and operational outlook remains subject to change. The Company continues to monitor the impacts of the pandemic on its operations and financial condition, and to implement mitigation strategies while working to preserve cash and protect the long-term sustainability of the Company. The Company has implemented measures for the safety of its Guests and Team Members as well as to mitigate the impact of COVID-19 on its financial position and operations. Please see the Company’s Quarterly Report on Form 10Q for the period ending June 30, 2020 for additional disclosures regarding these measures.

1

Capacity and Operations

As the global COVID-19 pandemic spread throughout the U.S., demand for air travel declined rapidly. In response to this decline in demand, the Company reacted quickly to cut flying. Second quarter capacity was down 83.2 percent compared to the second quarter 2019. In part due to the Company quickly adjusting its network, load factors increased from 17.9 percent in April to 79.1 percent in June.

The Company estimates its capacity for July, August, and September will be down approximately 18, 35, and 45 percent, respectively, compared to the same periods last year. For the third quarter 2020, capacity is estimated to be down 32 percent year over year. The situation remains very fluid and actual capacity adjustments may be different than what the Company currently expects.

Operational performance in April 2020 was negatively impacted by the dramatic schedule changes following the onset of the COVID-19 pandemic. As measured by the DOT, Spirit's April Completion Factor was 80.2 percent, second among reporting carriers, and on-time performance was 74.6 percent, or third among reporting carriers. For the months of May and June 2020, Spirit achieved a DOT Completion Factor3 of 100 percent and on-time performance3 for May and June was 96.8 percent and 94.2 percent, respectively. These outstanding results, based on preliminary data, earned Spirit a first place ranking in both categories as measured by the DOT for both May and June 2020.

Revenue Performance

Total operating revenue for the second quarter 2020 was $138.5 million, a decrease of 86.3 percent year over year, due to the significant decline in air travel demand as a result of the COVID-19 pandemic.

The amount of breakage, brand-related4 and other revenues recognized in any given period are not directly driven by the number of passenger flight segments flown. Due to reduced air travel demand resulting from the COVID-19 pandemic, which drove a significant decrease in passenger flight segments, breakage, brand-related4 and other revenues in the second quarter 2020 accounted for 43.6 percent of total revenue compared to 8.5 percent in the second quarter 2019. Given this and the significant decrease in passenger flight segments year over year, breakage, brand-related4 and other revenues were the primary drivers of the increases in both ticket and non-ticket revenue per passenger flight segment in the second quarter 2020. Fare revenue per passenger flight segment increased 23.0 percent year over year and non-ticket revenue per passenger flight segment increased 49.5 percent year over year.

Cost Performance

For the second quarter 2020, total GAAP operating expenses decreased 61.3 percent year over year to $328.9 million, which includes $151.9 million of special items. Adjusted operating expenses for the second quarter 2020 decreased 43.3 percent year over year to $480.8 million5. These changes were primarily driven by a 92.5 percent decrease in fuel expense and reductions in various other expenses related to volume of flight operations, such as landing fees & other rents, distribution, and ground handling. Salaries, wages and benefits expense was about flat compared to the same period last year despite an 11.6 percent year over year increase in our pilot and flight attendant workforce prior to the onset of the COVID-19 pandemic. In March, Spirit suspended hiring across the Company except to fill essential roles.

Fleet

Year-to-date through June 30, 2020, Spirit took delivery of nine new A320neo aircraft, three of which were delivered during the second quarter 2020. Two of the aircraft delivered in the second quarter were debt-financed and one was secured under a direct operating lease. The Company ended the second quarter 2020 with 154 aircraft in its fleet.

During the second quarter 2020, Spirit entered into an agreement with Airbus ("the Deferral Agreement") to defer certain aircraft deliveries originally scheduled in 2020 and 2021. Under the terms of the Deferral Agreement, the Company now anticipates a total of 12 aircraft deliveries in 2020 (compared to 16 as previously planned) and a total of 16 in 2021 (compared to 25 as previously planned).

2

The Company has secured debt financing for two of the remaining 2020 aircraft deliveries and the final delivery will be financed with a sale/leaseback transaction. Of the 2021 aircraft deliveries, ten are secured under direct lease arrangements and we have not secured financing for the remaining six. The first aircraft to deliver in 2021 not yet financed is scheduled for delivery in mid-June 2021.

In June, Spirit amended its 2018 pre-delivery deposit financing facility to extend the expiration date

from December 30, 2020 to March 31, 2021. As part of this amendment, the Company agreed to make an unscheduled principal payment of nearly $50 million during the second quarter 2020.

Liquidity and Capital Deployment

Spirit ended the second quarter 2020 with unrestricted cash, cash equivalents, and short-term investments of $1.2 billion.

"We started the year with strong momentum, but the global pandemic had a significant adverse impact on our second quarter results. I thank our entire team for their efforts in helping us to manage through this crisis. As we progressed through the quarter, our cash burn2 declined primarily due to the improvement in net sales. Our average daily cash burn2 trended from about $9.5 million in April to about $1.5 million in June," said Scott Haralson, Spirit’s Chief Financial Officer. “As the health and financial impacts of the COVID-19 pandemic continue to unfold, we are making tactical changes to preserve cash while maintaining our flexibility to respond when leisure demand eventually recovers. Looking forward, based on current demand trends which have flattened since June, we estimate our average daily cash burn2 for the third quarter 2020 will range between $3 and $4 million."

To enhance liquidity during the second quarter 2020, the Company:

•Increased its senior secured revolving credit facility (“the 2022 RCF”) commitment amount from $110 million as of March 31, 2020 to $180.0 million as of June 30, 2020. As of June 30, 2020, the Company had fully drawn the available amount of $180.0 million under the 2022 RCF;

•Completed the public offering of $175.0 million aggregate principal amount ($168.3 million in proceeds, net of issuance costs) of 4.75% convertible senior notes due 2025; and

•Completed a primary public offering of 20,125,000 shares of its voting common stock. The Company received proceeds of $192.4 million, net of issuance costs, from this stock offering.

In April 2020, Spirit entered into a Payroll Support Program ("PSP") agreement with the U.S. Department of the Treasury ("Treasury"), under which the Company was eligible for a total of $334.7 million. Of this amount, a total of $264.3 million will be in the form of a direct grant from Treasury and $70.4 million will be in the form of a low-interest, 10-year note. Also, in connection with its participation in the PSP, the Company will issue to Treasury warrants to purchase up to 500,150 shares of the Company’s common stock at a strike price of $14.08. As of June 30, 2020, the Company had received total PSP proceeds of $301.3 million, and had issued to Treasury $60.4 million in notes and warrants to purchase 428,829 shares valued at $2.5 million. The Company recorded the remaining $238.4 million direct grant amount as a liability within deferred salaries, wages and benefits on the Company’s condensed balance sheets. The Company recognized $123.9 million of the deferred salaries, wages and benefits in the second quarter 2020 within special credits on the Company’s condensed statement of operations. The Company expects to receive the remaining $33.4 million of PSP proceeds at the end of July 2020 and in exchange will issue to Treasury an additional $10.0 million in notes, plus warrants to purchase additional 71,321 additional shares of the Company's common stock.

The Company has applied for additional funds under the CARES Act secured loan program (the "Loan Program"). The expected maximum availability to the Company under the Loan Program is approximately $741 million, in the form of a secured loan. The loan amount is dependent on the amount and types of collateral accepted, which may result in an actual loan of less than $741 million principal amount. The

3

Company has until September 30, 2020 to determine whether or not to participate in the Loan Program. The PSP funds and, if received, the loan funds, subject the Company to certain ongoing restrictions under the CARES Act.

Total capital expenditures for 2020 are estimated to be approximately $560 million (approximately $215 million net of financings), of which $112 million ($28 million net of financings) is expected to be incurred in the third and fourth quarters of 2020.

Tax Rate

The Company recorded a $23.8 million discrete tax benefit in the second quarter 2020 related to the finalization of the Net Operating Loss carryback to tax year 2013. During the quarter, the Company amended its 2018 income tax return to claim bonus depreciation in order to utilize the five-year carryback period pursuant to tax law changes from the CARES Act. On a GAAP basis, the Company's tax rate for second quarter 2020 was 32.0 percent. Excluding this discrete tax benefit and special items, the Company's effective tax rate for the second quarter 2020 was 21.6 percent.

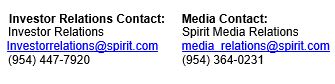

Conference Call/Webcast Detail

Spirit will conduct a conference call to discuss these results tomorrow, July 23, 2020, at 10:00 a.m. Eastern US Time. A live audio webcast of the conference call will be available to the public on a listen-only basis at http://ir.spirit.com. An archive of the webcast will be available under "Events & Presentations" for 60 days.

About Spirit Airlines

Spirit Airlines (NYSE: SAVE) is committed to delivering the best value in the sky. We are the leader in providing customizable travel options starting with an unbundled fare. This allows our Guests to pay only for the options they choose — like bags, seat assignments and refreshments — something we call À La Smarte. We make it possible for our Guests to venture further and discover more than ever before. Our Fit Fleet® is one of the youngest and most fuel-efficient in the U.S. We serve destinations throughout the U.S., Latin America and the Caribbean and are dedicated to giving back and improving those communities. Come save with us at spirit.com. At Spirit Airlines, we go. We go for you.

Investors are encouraged to read the Company's periodic and current reports filed with or furnished to the Securities and Exchange Commission, including its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, for additional information regarding the Company.

End Notes

(1) See "Reconciliation of Adjusted Net Income, Adjusted Pre-tax Income, and Adjusted Operating

Income to GAAP Net Income" table below for more details.

(2) Estimated average daily cash burn rate is calculated as the sum of operating cash outflows, debt service, fleet capex net of financing and pre-delivery deposit payments. It does not include the impact of any financings, capital raises, or the funds from PSP.

(3) Preliminary data using DOT methodology for on-time performance (A:14) and completion factor.

(4) Breakage revenue consist of unredeemed flight credits that expired unused, no-show revenue, and cancellation fees. Brand-related revenue consist of the sale of $9 Fare ClubTM membership and the marketing component of the Company's Co-branded credit card revenue.

(5) See "Reconciliation of Adjusted Operating Expense to GAAP Operating Expense" table below for more details.

4

Forward-Looking Statements

Forward-Looking Statements in this report and certain oral statements made from time to time by representatives of the Company contain various forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the Securities Act), and Section 21E of the Securities Exchange Act of 1934, as amended (the Exchange Act) which are subject to the “safe harbor” created by those sections. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. All statements other than statements of historical facts are “forward-looking statements” for purposes of these provisions. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “predict,” “potential,” and similar expressions intended to identify forward-looking statements. Forward-looking statements include, without limitation, statements regarding the Company's intentions and expectations regarding revenues, cash burn, capacity and passenger demand, additional financing, capital spending, operating costs, hiring, and stakeholders, vendors and government support, as well as statements regarding the Company’s restatement and amendment to its previously filed 10-K and remediation of its material weakness. Such forward-looking statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking statements. Factors include, among others, the extent of the impact of the COVID-19 pandemic on the Company’s business, results of operations and financial condition, and the extent of the impact of the COVID-19 pandemic on overall demand for air travel, restrictions on the Company’s business by accepting financing under the CARES Act, the competitive environment in our industry, our ability to keep costs low and the impact of worldwide economic conditions, including the impact of economic cycles or downturns on customer travel behavior, and other factors, as described in the Company’s filings with the Securities and Exchange Commission, including the detailed factors discussed under the heading “Risk Factors” in the Company’s amended Annual Report on Form 10-K/A for the fiscal year ended December 31, 2019, as supplemented in the Company’s Quarterly Report on Form 10-Q for the fiscal quarters ended March 31, 2020 and June 30, 2020. Furthermore, such forward-looking statements speak only as of the date of this release. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements. Risks or uncertainties (i) that are not currently known to us, (ii) that we currently deem to be immaterial, or (iii) that could apply to any company, could also materially adversely affect our business, financial condition, or future results. Additional information concerning certain factors is contained in the Company's Securities and Exchange Commission filings, including but not limited to the Company's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K.

5

SPIRIT AIRLINES, INC.

Condensed Statements of Operations

(unaudited, in thousands, except per-share amounts)

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||||||||

| June 30, | Percent | June 30, | Percent | ||||||||||||||||||||||||||||||||

| 2020 | 2019 | Change | 2020 | 2019 | Change | ||||||||||||||||||||||||||||||

| Operating revenues: | |||||||||||||||||||||||||||||||||||

| Passenger | $ | 130,817 | $ | 994,430 | (86.8) | $ | 884,367 | $ | 1,832,495 | (51.7) | |||||||||||||||||||||||||

| Other | 7,712 | 18,526 | (58.4) | 25,243 | 36,257 | (30.4) | |||||||||||||||||||||||||||||

| Total operating revenues | 138,529 | 1,012,956 | (86.3) | 909,610 | 1,868,752 | (51.3) | |||||||||||||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||||||||||||||

| Aircraft fuel | 19,910 | 265,006 | (92.5) | 233,118 | 494,642 | (52.9) | |||||||||||||||||||||||||||||

| Salaries, wages and benefits | 213,579 | 216,375 | (1.3) | 454,059 | 420,276 | 8.0 | |||||||||||||||||||||||||||||

| Landing fees and other rents | 40,348 | 64,711 | (37.6) | 107,469 | 124,360 | (13.6) | |||||||||||||||||||||||||||||

| Depreciation and amortization | 69,113 | 54,913 | 25.9 | 135,104 | 105,639 | 27.9 | |||||||||||||||||||||||||||||

| Aircraft rent | 49,256 | 46,522 | 5.9 | 94,402 | 92,304 | 2.3 | |||||||||||||||||||||||||||||

| Distribution | 11,352 | 40,602 | (72.0) | 45,095 | 76,321 | (40.9) | |||||||||||||||||||||||||||||

| Maintenance, materials and repairs | 19,227 | 34,688 | (44.6) | 53,303 | 66,292 | (19.6) | |||||||||||||||||||||||||||||

| Loss on disposal of assets | — | 1,550 | NM | — | 3,463 | NM | |||||||||||||||||||||||||||||

| Special credits | (151,911) | — | NM | (151,911) | — | NM | |||||||||||||||||||||||||||||

| Other operating | 58,039 | 124,651 | (53.4) | 187,347 | 233,713 | (19.8) | |||||||||||||||||||||||||||||

| Total operating expenses | 328,913 | 849,018 | (61.3) | 1,157,986 | 1,617,010 | (28.4) | |||||||||||||||||||||||||||||

| Operating income (loss) | (190,384) | 163,938 | (216.1) | (248,376) | 251,742 | (198.7) | |||||||||||||||||||||||||||||

| Other (income) expense: | |||||||||||||||||||||||||||||||||||

| Interest expense | 27,792 | 25,266 | 10.0 | 51,670 | 50,237 | 2.9 | |||||||||||||||||||||||||||||

| Capitalized interest | (3,757) | (2,975) | 26.3 | (7,421) | (5,532) | 34.1 | |||||||||||||||||||||||||||||

| Interest income | (1,949) | (7,066) | (72.4) | (5,542) | (13,990) | (60.4) | |||||||||||||||||||||||||||||

| Other (income) expense | 66 | 144 | NM | 47 | 377 | NM | |||||||||||||||||||||||||||||

| Total other (income) expense | 22,152 | 15,369 | 44.1 | 38,754 | 31,092 | 24.6 | |||||||||||||||||||||||||||||

| Income (loss) before income taxes | (212,536) | 148,569 | (243.1) | (287,130) | 220,650 | (230.1) | |||||||||||||||||||||||||||||

| Provision (benefit) for income taxes | (68,108) | 34,068 | (299.9) | (114,874) | 50,073 | (329.4) | |||||||||||||||||||||||||||||

| Net income (loss) | $ | (144,428) | $ | 114,501 | (226.1) | $ | (172,256) | $ | 170,577 | (201.0) | |||||||||||||||||||||||||

| Basic earnings (loss) per share | $ | (1.81) | $ | 1.67 | (208.4) | $ | (2.33) | $ | 2.49 | (193.6) | |||||||||||||||||||||||||

| Diluted earnings (loss) per share | $ | (1.81) | $ | 1.67 | (208.4) | $ | (2.33) | $ | 2.49 | (193.6) | |||||||||||||||||||||||||

| Weighted average shares, basic | 79,601 | 68,439 | 16.3 | 74,061 | 68,410 | 8.3 | |||||||||||||||||||||||||||||

| Weighted average shares, diluted | 79,601 | 68,620 | 16.0 | 74,061 | 68,568 | 8.0 | |||||||||||||||||||||||||||||

NM: "Not Meaningful".

6

SPIRIT AIRLINES, INC.

Condensed Statements of Comprehensive Income (Loss)

(unaudited, in thousands)

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||

| June 30, | June 30, | ||||||||||||||||||||||

| 2020 | 2019 | 2020 | 2019 | ||||||||||||||||||||

| Net income (loss) | $ | (144,428) | $ | 114,501 | $ | (172,256) | $ | 170,577 | |||||||||||||||

| Unrealized gain on short-term investment securities and cash and cash equivalents, net of deferred taxes of $5, $29, $59 and $67 | 18 | 98 | 203 | 228 | |||||||||||||||||||

| Interest rate derivative loss reclassified into earnings, net of taxes of $15, $19, $39 and $46 | 48 | 54 | 89 | 101 | |||||||||||||||||||

| Other comprehensive income | $ | 66 | $ | 152 | $ | 292 | $ | 329 | |||||||||||||||

| Comprehensive income (loss) | $ | (144,362) | $ | 114,653 | $ | (171,964) | $ | 170,906 | |||||||||||||||

7

SPIRIT AIRLINES, INC.

Selected Operating Statistics

(unaudited)

| Three Months Ended June 30, | |||||||||||||||||

| Operating Statistics | 2020 | 2019 | Change | ||||||||||||||

| Available seat miles (ASMs) (thousands) | 1,809,874 | 10,775,878 | (83.2) | % | |||||||||||||

| Revenue passenger miles (RPMs) (thousands) | 894,900 | 9,157,488 | (90.2) | % | |||||||||||||

| Load factor (%) | 49.4 | 85.0 | (35.6) | pts | |||||||||||||

| Passenger flight segments (thousands) | 900 | 8,953 | (89.9) | % | |||||||||||||

| Block hours | 27,423 | 157,182 | (82.6) | % | |||||||||||||

| Departures | 10,754 | 58,517 | (81.6) | % | |||||||||||||

| Total operating revenue per ASM (TRASM) (cents) | 7.65 | 9.40 | (18.6) | % | |||||||||||||

| Average yield (cents) | 15.48 | 11.06 | 40.0 | % | |||||||||||||

| Fare revenue per passenger flight segment ($) | 70.82 | 57.60 | 23.0 | % | |||||||||||||

| Non-ticket revenue per passenger flight segment ($) | 83.03 | 55.54 | 49.5 | % | |||||||||||||

| Total revenue per passenger flight segment ($) | 153.85 | 113.14 | 36.0 | % | |||||||||||||

| CASM (cents) | 18.17 | 7.88 | 130.6 | % | |||||||||||||

| Adjusted CASM (cents) (1) | 26.57 | 7.86 | 238.0 | % | |||||||||||||

| Adjusted CASM ex-fuel (cents) (2) | 25.47 | 5.41 | 370.8 | % | |||||||||||||

| Fuel gallons consumed (thousands) | 18,997 | 122,447 | (84.5) | % | |||||||||||||

| Average fuel cost per gallon ($) | 1.05 | 2.16 | (51.4) | % | |||||||||||||

| Aircraft at end of period | 154 | 135 | 14.1 | % | |||||||||||||

| Average daily aircraft utilization (hours) | 2.0 | 12.8 | (84.4) | % | |||||||||||||

| Average stage length (miles) | 960 | 1,004 | (4.4) | % | |||||||||||||

| Six Months Ended June 30, | |||||||||||||||||

| Operating Statistics | 2020 | 2019 | Change | ||||||||||||||

| Available seat miles (ASMs) (thousands) | 12,723,808 | 20,604,922 | (38.2) | % | |||||||||||||

| Revenue passenger miles (RPMs) (thousands) | 8,843,863 | 17,290,518 | (48.9) | % | |||||||||||||

| Load factor (%) | 69.5 | 83.9 | (14.4) | pts | |||||||||||||

| Passenger flight segments (thousands) | 8,554 | 16,773 | (49.0) | % | |||||||||||||

| Block hours | 185,270 | 300,612 | (38.4) | % | |||||||||||||

| Departures | 68,928 | 110,692 | (37.7) | % | |||||||||||||

| Total operating revenue per ASM (TRASM) (cents) | 7.15 | 9.07 | (21.2) | % | |||||||||||||

| Average yield (cents) | 10.29 | 10.81 | (4.8) | % | |||||||||||||

| Fare revenue per passenger flight segment ($) | 45.04 | 55.57 | (18.9) | % | |||||||||||||

| Non-ticket revenue per passenger flight segment ($) | 61.31 | 55.85 | 9.8 | % | |||||||||||||

| Total revenue per passenger flight segment ($) | 106.35 | 111.42 | (4.6) | % | |||||||||||||

| CASM (cents) | 9.10 | 7.85 | 15.9 | % | |||||||||||||

| Adjusted CASM (cents) (1) | 10.29 | 7.83 | 31.4 | % | |||||||||||||

| Adjusted CASM ex-fuel (cents) (2) | 8.46 | 5.43 | 55.8 | % | |||||||||||||

| Fuel gallons consumed (thousands) | 136,942 | 232,275 | (41.0) | % | |||||||||||||

| Average fuel cost per gallon ($) | 1.70 | 2.13 | (20.2) | % | |||||||||||||

| Average daily aircraft utilization (hours) | 6.8 | 12.5 | (45.6) | % | |||||||||||||

| Average stage length (miles) | 1,011 | 1,016 | (0.5) | % | |||||||||||||

(1)Excludes operating special items.

(2)Excludes fuel expense and operating special items.

8

The Company is providing a reconciliation of GAAP financial information to non-GAAP financial information as it believes that non-GAAP financial measures provide management and investors the ability to measure the performance of the Company on a consistent basis. These non-GAAP financial measures have limitations as analytical tools. Because of these limitations, determinations of the Company's operating performance excluding unrealized gains and losses or special items should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP. These non-GAAP financial measures may be presented on a different basis than other companies using similarly titled non-GAAP financial measures.

Calculation of Total Non-Ticket Revenue per Passenger Flight Segment

(unaudited)

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||

| June 30, | June 30, | ||||||||||||||||||||||

| (in thousands, except per segment data) | 2020 | 2019 | 2020 | 2019 | |||||||||||||||||||

| Operating revenues | |||||||||||||||||||||||

| Fare | $ | 63,769 | $ | 515,696 | $ | 385,216 | $ | 932,041 | |||||||||||||||

| Non-fare | 67,048 | 478,734 | 499,151 | 900,454 | |||||||||||||||||||

| Total passenger revenues | 130,817 | 994,430 | 884,367 | 1,832,495 | |||||||||||||||||||

| Other revenues | 7,712 | 18,526 | 25,243 | 36,257 | |||||||||||||||||||

| Total operating revenues | $ | 138,529 | $ | 1,012,956 | $ | 909,610 | $ | 1,868,752 | |||||||||||||||

| Non-ticket revenues (1) | $ | 74,760 | $ | 497,260 | $ | 524,394 | $ | 936,711 | |||||||||||||||

| Passenger segments | 900 | 8,953 | 8,554 | 16,773 | |||||||||||||||||||

| Non-ticket revenue per passenger flight segment ($) | $ | 83.03 | $ | 55.54 | $ | 61.31 | $ | 55.85 | |||||||||||||||

(1)Non-ticket revenues equals the sum of non-fare passenger revenues and other revenues.

Special Items

(unaudited)

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||

| June 30, | June 30, | ||||||||||||||||||||||

| (in thousands) | 2020 | 2019 | 2020 | 2019 | |||||||||||||||||||

| Operating special items include the following: | |||||||||||||||||||||||

| Loss on disposal of assets (1) | — | 1,550 | — | 3,463 | |||||||||||||||||||

| Operating special credits (2) | (151,911) | — | (151,911) | — | |||||||||||||||||||

| Total operating special items | $ | (151,911) | $ | 1,550 | $ | (151,911) | $ | 3,463 | |||||||||||||||

(1)Includes amounts primarily related to the disposal of excess and obsolete inventory.

(2)Special credits consisted of $123.9 million of deferred salaries, wages and benefits recognized in connection with the grant component of the PSP with the Treasury and $28.0 million related to the CARES Act Employee Retention Credit.

9

Reconciliation of Adjusted Operating Expense to GAAP Operating Expense

(unaudited)

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||

| June 30, | June 30, | ||||||||||||||||||||||

| (in thousands, except CASM data in cents) | 2020 | 2019 | 2020 | 2019 | |||||||||||||||||||

| Total operating expenses, as reported | $ | 328,913 | $ | 849,018 | $ | 1,157,986 | $ | 1,617,010 | |||||||||||||||

Less operating special items expense (credit) | (151,911) | 1,550 | (151,911) | 3,463 | |||||||||||||||||||

| Adjusted operating expenses, non-GAAP (1) | 480,824 | 847,468 | 1,309,897 | 1,613,547 | |||||||||||||||||||

| Less: Fuel expense | 19,910 | 265,006 | 233,118 | 494,642 | |||||||||||||||||||

| Adjusted operating expenses excluding fuel, non-GAAP (2) | $ | 460,914 | $ | 582,462 | $ | 1,076,779 | $ | 1,118,905 | |||||||||||||||

| Available seat miles | 1,809,874 | 10,775,878 | 12,723,808 | 20,604,922 | |||||||||||||||||||

| CASM (cents) | 18.17 | 7.88 | 9.10 | 7.85 | |||||||||||||||||||

| Adjusted CASM (cents) (1) | 26.57 | 7.86 | 10.29 | 7.83 | |||||||||||||||||||

| Adjusted CASM ex-fuel (cents) (2) | 25.47 | 5.41 | 8.46 | 5.43 | |||||||||||||||||||

(1)Excludes operating special items.

(2)Excludes operating special items and fuel expense.

Reconciliation of Adjusted Net Income, Adjusted Pre-Tax Income, and Adjusted Operating Income to GAAP Net Income

(unaudited)

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||

| June 30, | June 30, | ||||||||||||||||||||||

| (in thousands, except per share data) | 2020 | 2019 | 2020 | 2019 | |||||||||||||||||||

| Net income (loss), as reported | $ | (144,428) | $ | 114,501 | $ | (172,256) | $ | 170,577 | |||||||||||||||

| Add: Provision (benefit) for income taxes | (68,108) | 34,068 | (114,874) | 50,073 | |||||||||||||||||||

| Income (loss) before income taxes, as reported | (212,536) | 148,569 | (287,130) | 220,650 | |||||||||||||||||||

| Pre-tax margin | (153.4) | % | 14.7 | % | (31.6) | % | 11.8 | % | |||||||||||||||

| Add special items expense (credit) (1) | $ | (151,911) | $ | 1,550 | $ | (151,911) | $ | 3,463 | |||||||||||||||

| Adjusted income (loss) before income taxes, non-GAAP (2) | (364,447) | 150,119 | (439,041) | 224,113 | |||||||||||||||||||

| Adjusted pre-tax margin, non-GAAP (2) | (263.1) | % | 14.8 | % | (48.3) | % | 12.0 | % | |||||||||||||||

| Add: Total other (income) expense | 22,152 | 15,369 | 38,754 | 31,092 | |||||||||||||||||||

| Adjusted operating income (loss), non-GAAP (2) | (342,295) | 165,488 | (400,287) | 255,205 | |||||||||||||||||||

| Adjusted operating margin, non-GAAP (2) | (247.1) | % | 16.3 | % | (44.0) | % | 13.7 | % | |||||||||||||||

| Provision (benefit) for income taxes (3) | (78,634) | 34,411 | (94,304) | 50,875 | |||||||||||||||||||

| Adjusted net income (loss), non-GAAP (2) | $ | (285,813) | $ | 115,708 | $ | (344,737) | $ | 173,238 | |||||||||||||||

| Weighted average shares, diluted | 79,601 | 68,620 | 74,061 | 68,568 | |||||||||||||||||||

| Adjusted net income (loss) per share, diluted (2) | $(3.59) | $1.69 | $(4.65) | $2.53 | |||||||||||||||||||

| Total operating revenues | $ | 138,529 | $ | 1,012,956 | $ | 909,610 | $ | 1,868,752 | |||||||||||||||

(1)See "Special Items" for more details.

(2)Excludes operating special items.

(3)Excludes amounts related to the discrete tax benefits of $31.1 million recorded in first quarter 2020 and $23.8 million recorded in second quarter 2020.

10