Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BOK FINANCIAL CORP | bokf-20200722.htm |

Second Quarter 2020 Earnings Conference Call July 22, 2020 1

Legal Disclaimers Forward-Looking Statements: This presentation contains forward-looking statements that are based on management's beliefs, assumptions, current expectations, estimates and projections about BOK Financial Corporation, the financial services industry, the economy generally and the expected or potential impact of the novel coronavirus (COVID-19) pandemic, and the related responses of the government, consumers, and others, on our business, financial condition and results of operations. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “plans,” “projects,” “will,” “intends,” variations of such words and similar expressions are intended to identify such forward-looking statements. Management judgments relating to and discussion of the provision and allowance for credit losses, allowance for uncertain tax positions, accruals for loss contingencies and valuation of mortgage servicing rights involve judgments as to expected events and are inherently forward-looking statements. Assessments that acquisitions and growth endeavors will be profitable are necessary statements of belief as to the outcome of future events based in part on information provided by others which BOK Financial has not independently verified. These various forward-looking statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions which are difficult to predict with regard to timing, extent, likelihood and degree of occurrence. Therefore, actual results and outcomes may materially differ from what is expected, implied or forecasted in such forward-looking statements. Internal and external factors that might cause such a difference include, but are not limited to changes in government, consumer or business responses to, and ability to treat or prevent further outbreak of, the COVID-19 pandemic, changes in commodity prices, interest rates and interest rate relationships, inflation, demand for products and services, the degree of competition by traditional and nontraditional competitors, changes in banking regulations, tax laws, prices, levies and assessments, the impact of technological advances, and trends in customer behavior as well as their ability to repay loans. For a discussion of risk factors that may cause actual results to differ from expectations, please refer to BOK Financial Corporation’s most recent annual and quarterly reports. BOK Financial Corporation and its affiliates undertake no obligation to update, amend, or clarify forward-looking statements, whether as a result of new information, future events, or otherwise. Non-GAAP Financial Measures: This presentation may refer to non-GAAP financial measures. Additional information on these financial measures is available in BOK Financial’s 10-Q and 10-K filings with the Securities and Exchange Commission which can be accessed at www.BOKF.com. All data is presented as of June 30, 2020 unless otherwise noted. 2

Steven G. Bradshaw Chief Executive Officer 3

Second Quarter Summary Net Income $142.2 Q2 Q1 Q2 $137.6 ($mil, exc. EPS) 2020 2020 2019 $110.4 Net Income $64.7 $62.1 $137.6 Diluted EPS $0.92 $0.88 $1.93 $2.00 $1.93 $62.1 $64.7 $1.56 Net income before taxes $80.1 $79.3 $175.4 $0.88 $0.92 Provision for credit losses $135.3 $93.8 $5.0 Pre-provision net revenue* $215.8 $173.1 $180.4 2Q19 3Q19 4Q19 1Q20 2Q20 Net income attributable to shareholders *Non-GAAP measure Net income per share - diluted Noteworthy items impacting profitability: • Record pre-provision net revenue on strong fee income which now represents 43% of total revenue • Fee income growth driven by record performance in Brokerage & Trading and Mortgage • Efficiency ratio remains below 60% even with the mix of revenue shifting toward fee businesses • $135.3 million provision for credit losses driven by adverse economic outlook and risk grade migration. Material reserve build should be largely complete after this quarter assuming economic forecast is in line going forward • Net interest revenue was up $16.7 million, and margins improved due to decreasing deposit costs and the relatively elevated nature of LIBOR early in the quarter 4

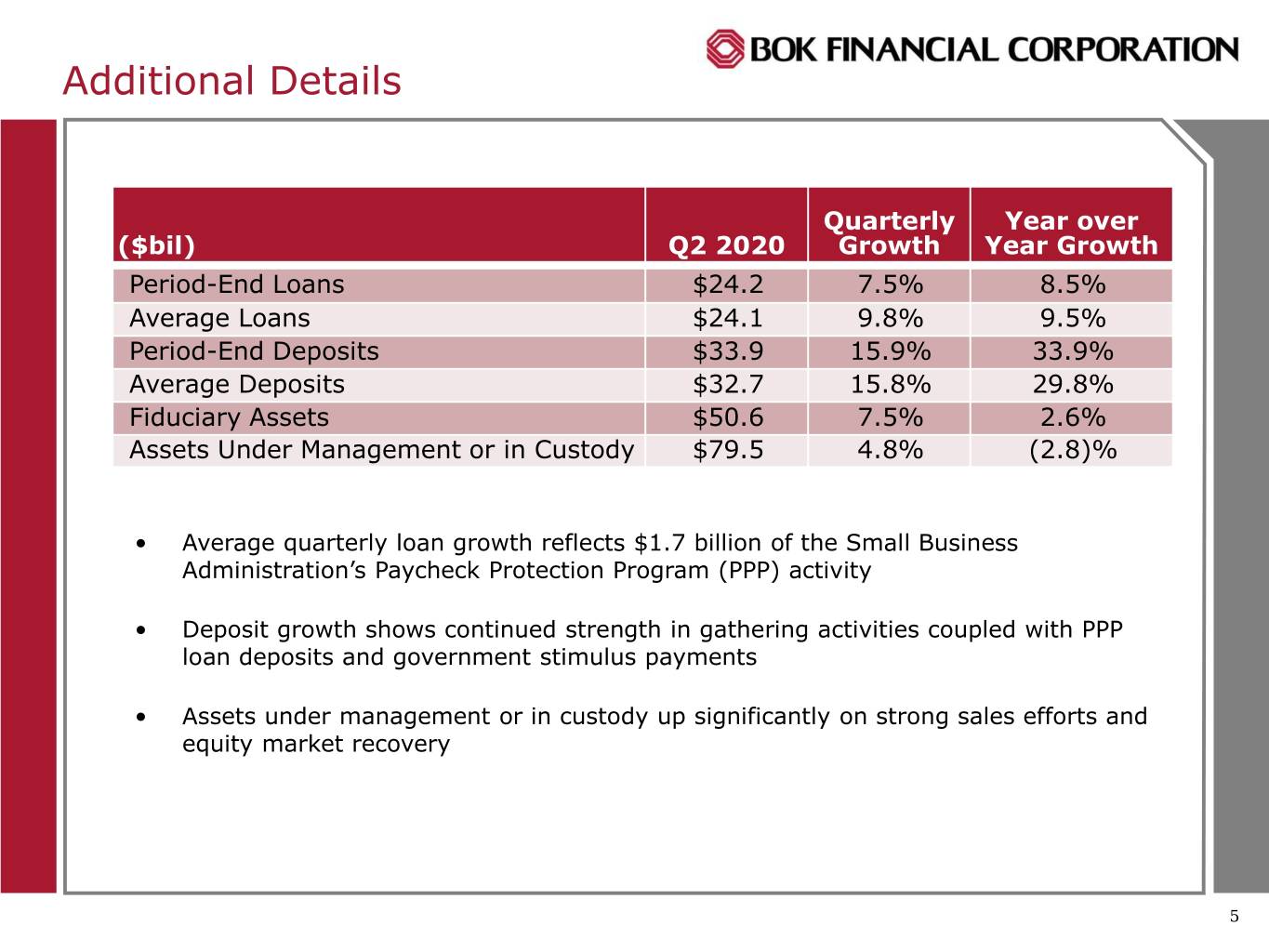

Additional Details Quarterly Year over ($bil) Q2 2020 Growth Year Growth Period-End Loans $24.2 7.5% 8.5% Average Loans $24.1 9.8% 9.5% Period-End Deposits $33.9 15.9% 33.9% Average Deposits $32.7 15.8% 29.8% Fiduciary Assets $50.6 7.5% 2.6% Assets Under Management or in Custody $79.5 4.8% (2.8)% • Average quarterly loan growth reflects $1.7 billion of the Small Business Administration’s Paycheck Protection Program (PPP) activity • Deposit growth shows continued strength in gathering activities coupled with PPP loan deposits and government stimulus payments • Assets under management or in custody up significantly on strong sales efforts and equity market recovery 5

Stacy Kymes EVP-Corporate Banking 6

Loan Portfolio Seq. Jun 30, Mar 31, Jun 30, Loan YOY Loan ($mil) 2020 2020 2019 Growth Growth Energy $3,974.2 $4,111.7 $3,921.4 (3.3)% 1.3% Services 3,779.9 3,955.7 4,105.1 (4.4)% (7.9)% Healthcare 3,289.3 3,165.1 2,926.5 3.9% 12.4% General business 3,115.1 3,563.5 3,383.9 (12.6)% (7.9)% Total C&I $14,158.5 $14,796.0 $14,336.9 (4.3)% (1.2)% Commercial Real Estate 4,554.1 4,450.1 4,710.0 2.3% (3.3)% Paycheck Protection Program 2,081.4 -- -- -- -- Loans to Individuals 3,361.8 3,217.9 3,208.7 4.5% 4.8% Total Loans $24,155.9 $22,464.0 $22,255.7 7.5% 8.5% • PPP loans added $2.1 billion to the portfolio • Healthcare balances increased primarily due to growth in balances from our hospital systems clients • Commercial Real Estate increased as paydowns from refinances into the permanent market slowed during the second quarter • Energy commitments declined $360 million from Q1 2020 and $630 million from Q4 2019 on downward adjustments in borrowing bases this quarter 7

Marc Maun EVP-Chief Credit Officer 8

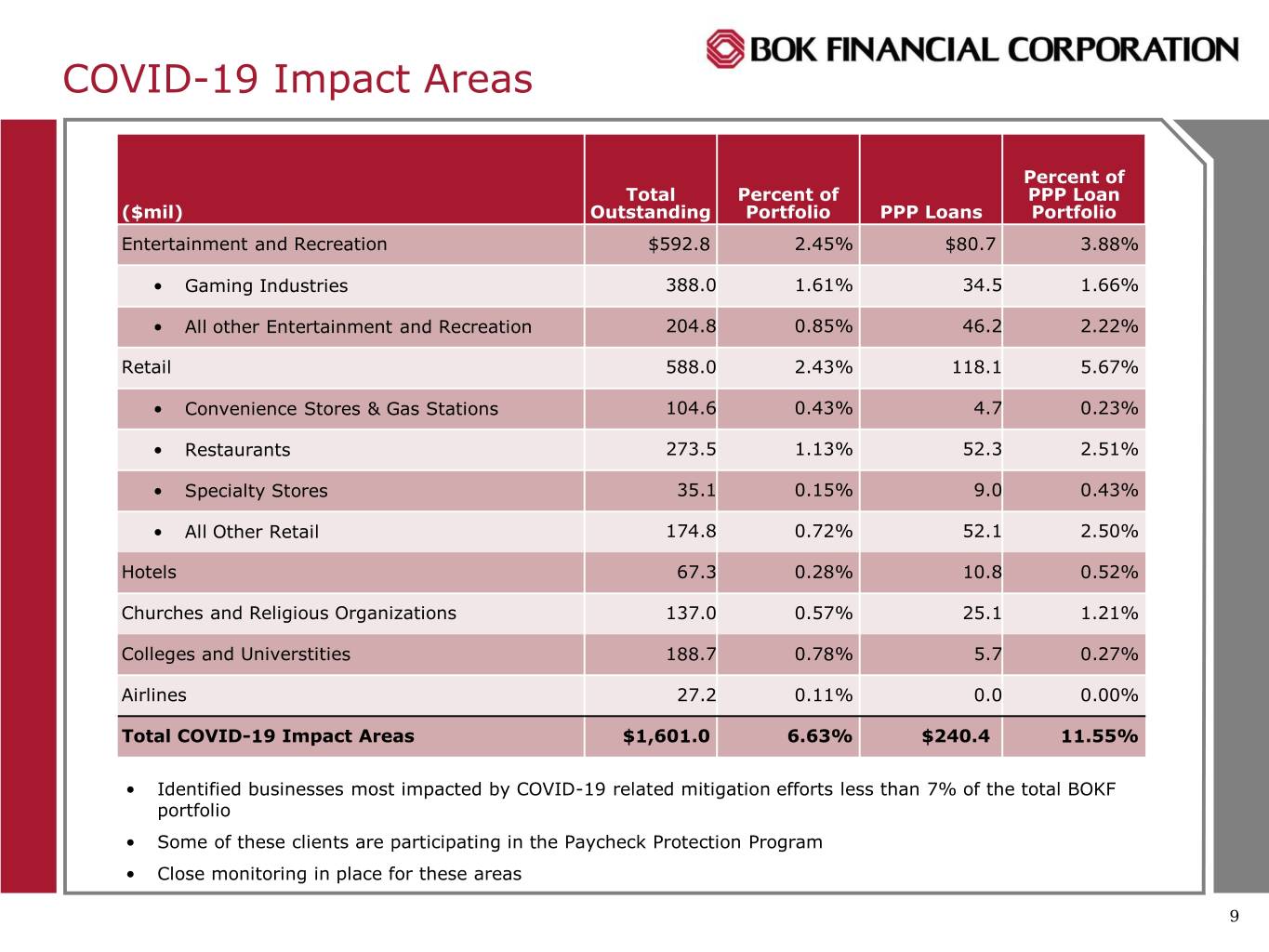

COVID-19 Impact Areas Percent of Total Percent of PPP Loan ($mil) Outstanding Portfolio PPP Loans Portfolio Entertainment and Recreation $592.8 2.45% $80.7 3.88% • Gaming Industries 388.0 1.61% 34.5 1.66% • All other Entertainment and Recreation 204.8 0.85% 46.2 2.22% Retail 588.0 2.43% 118.1 5.67% • Convenience Stores & Gas Stations 104.6 0.43% 4.7 0.23% • Restaurants 273.5 1.13% 52.3 2.51% • Specialty Stores 35.1 0.15% 9.0 0.43% • All Other Retail 174.8 0.72% 52.1 2.50% Hotels 67.3 0.28% 10.8 0.52% Churches and Religious Organizations 137.0 0.57% 25.1 1.21% Colleges and Universtities 188.7 0.78% 5.7 0.27% Airlines 27.2 0.11% 0.0 0.00% Total COVID-19 Impact Areas $1,601.0 6.63% $240.4 11.55% • Identified businesses most impacted by COVID-19 related mitigation efforts less than 7% of the total BOKF portfolio • Some of these clients are participating in the Paycheck Protection Program • Close monitoring in place for these areas 9

ACL Combined ACL Portfolio Economic Combined ACL 03/31/20 Changes Factors 06/30/20 $54.6 million $70.1 million $468.5 Impairments Macroeconomic million variables Balances Weightings assigned Risk grades based on three $343.8 scenarios million Payment profiles • Combined ACL includes reserves for unfunded commitments • Excludes allowances for investment securities and mortgage banking activities • Total reserves assigned to Energy at 06/30/20 were $176.5 million 10

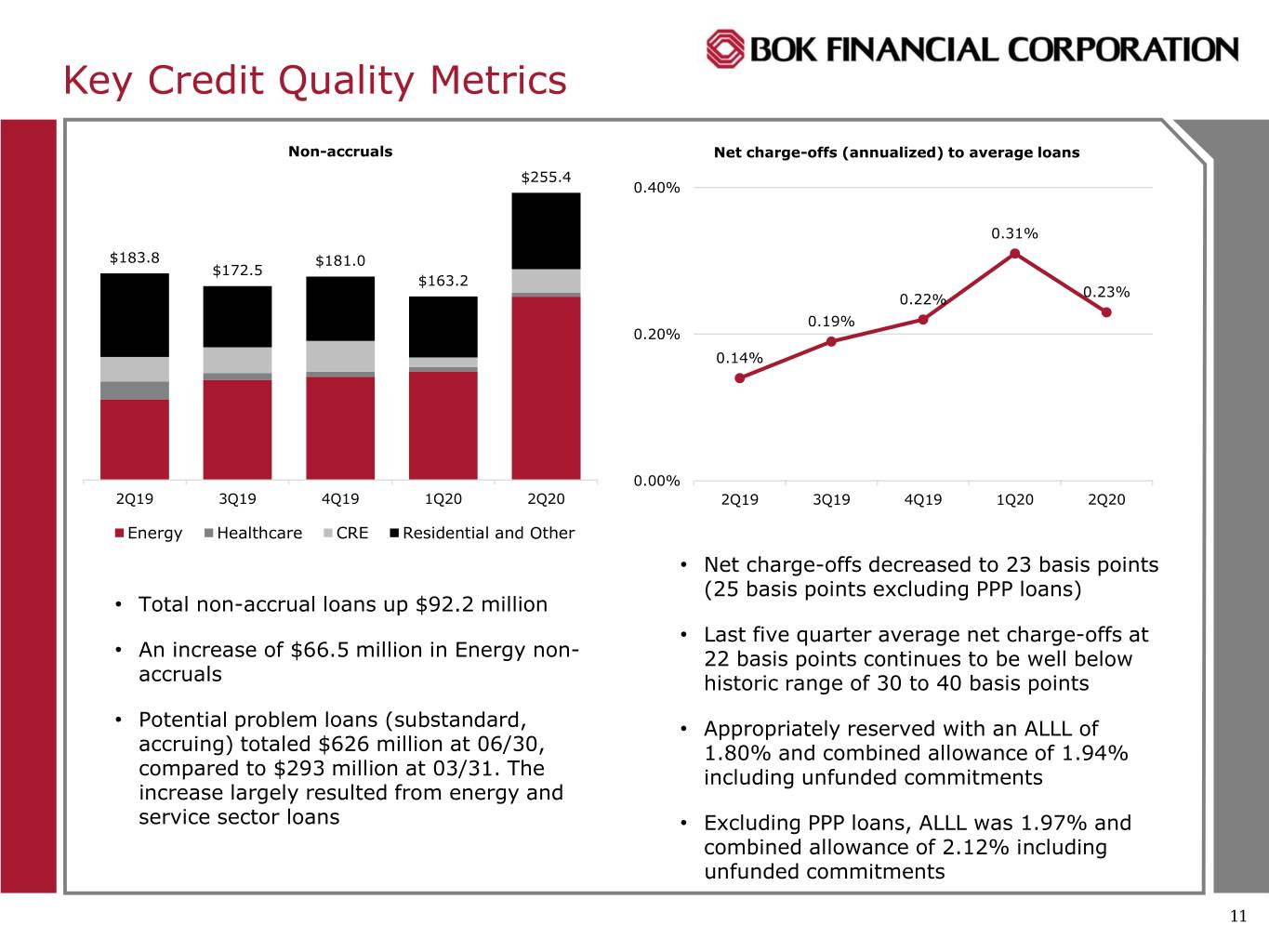

Key Credit Quality Metrics Non-accruals Net charge-offs (annualized) to average loans $255.4 0.40% 0.31% $183.8 $181.0 $172.5 $163.2 0.23% 0.22% 0.19% 0.20% 0.14% 0.00% 2Q19 3Q19 4Q19 1Q20 2Q20 2Q19 3Q19 4Q19 1Q20 2Q20 Energy Healthcare CRE Residential and Other • Net charge-offs decreased to 23 basis points (25 basis points excluding PPP loans) • Total non-accrual loans up $92.2 million • Last five quarter average net charge-offs at • An increase of $66.5 million in Energy non- 22 basis points continues to be well below accruals historic range of 30 to 40 basis points • Potential problem loans (substandard, • Appropriately reserved with an ALLL of accruing) totaled $626 million at 06/30, 1.80% and combined allowance of 1.94% compared to $293 million at 03/31. The including unfunded commitments increase largely resulted from energy and service sector loans • Excluding PPP loans, ALLL was 1.97% and combined allowance of 2.12% including unfunded commitments 11

Scott Grauer EVP-Wealth Management 12

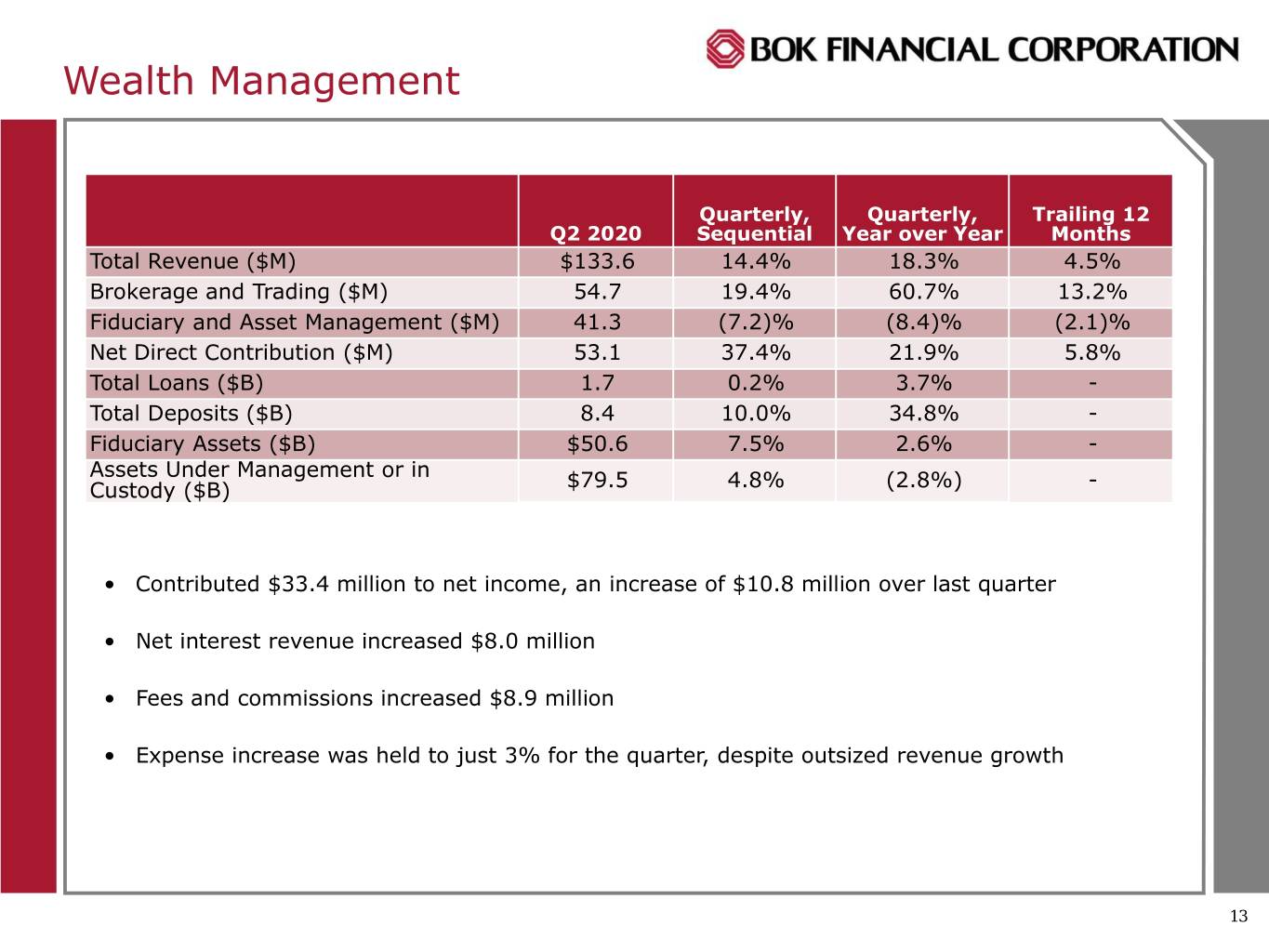

Wealth Management Quarterly, Quarterly, Trailing 12 Q2 2020 Sequential Year over Year Months Total Revenue ($M) $133.6 14.4% 18.3% 4.5% Brokerage and Trading ($M) 54.7 19.4% 60.7% 13.2% Fiduciary and Asset Management ($M) 41.3 (7.2)% (8.4)% (2.1)% Net Direct Contribution ($M) 53.1 37.4% 21.9% 5.8% Total Loans ($B) 1.7 0.2% 3.7% - Total Deposits ($B) 8.4 10.0% 34.8% - Fiduciary Assets ($B) $50.6 7.5% 2.6% - Assets Under Management or in Custody ($B) $79.5 4.8% (2.8%) - • Contributed $33.4 million to net income, an increase of $10.8 million over last quarter • Net interest revenue increased $8.0 million • Fees and commissions increased $8.9 million • Expense increase was held to just 3% for the quarter, despite outsized revenue growth 13

Steven Nell Chief Financial Officer 14

Net Interest Revenue and Margin ($millions) Q2 2020 Q1 2020 Q4 2019 Q3 2019 Q2 2019 Net interest revenue $278.1 $261.4 $270.2 $279.1 $285.4 Net interest margin 2.83% 2.80% 2.88% 3.01% 3.30% Yield on loans 3.63% 4.50% 4.75% 5.12% 5.39% Cost of interest-bearing deposits 0.34% 0.98% 1.09% 1.17% 1.13% Cost of whole borrowings 0.44% 1.57% 1.92% 2.39% 2.62% • Net interest income increased $16.7 million from the previous quarter ($3.1 million excluding the PPP impact) • Net interest margin up 3 basis points from previous quarter ◦ LIBOR remained elevated early in the quarter ◦ Interest-bearing deposit costs down 64 basis points for the quarter • Excluding the impact of PPP loans and discount accretion, net interest margin was 2.82% compared to 2.80% in the previous quarter 15

Fees and Commissions Revenue, $mil Growth: Quarterly, Quarterly, Trailing 12 Q2 2020 Sequential Year over Year Months Brokerage and Trading $62.0 22.1% 53.0% 12.0% Transaction Card 22.9 4.8% 4.7% 1.2% Fiduciary and Asset Management 41.3 (7.2)% (8.4)% (2.1)% Deposit Service Charges and Fees 22.0 (15.6)% (21.5)% (5.5)% Mortgage Banking 53.9 45.1% 91.7% 21.3% Other Revenue 11.5 (6.7)% (7.7)% (1.7)% Total Fees and Commissions $213.7 10.9% 21.3% 5.1% • Brokerage and Trading continued outperformance due to lower rate environment coupled with market volatility • Fiduciary and Asset Management down due to fee waivers resulting from lower interest rates, coupled with changes in asset volumes and market conditions. These decreases were partially offset by an increase in seasonal tax preparation fees. • Mortgage Banking lower rate environment spurred strong refinance and purchase volumes and margin expansion caused by industry-wide capacity constraints • Service charges down due to waived overdraft protection fees and fees for excessive withdrawals, along with other fees for our clients in light of the pandemic 16

Expenses %Incr. %Incr. ($mil) Q2 2020 Q1 2020 Q2 2019 Seq. YOY Personnel expense $176.2 $156.2 $160.3 12.8% 9.9% Other operating expense $119.2 $112.4 $116.8 6.0% 2.0% Total operating expense $295.4 $268.6 $277.1 10.0% 6.6% Efficiency Ratio 59.57% 58.62% 59.51% • Personnel expense up $20.1 million split between an increase in cash-based incentive compensation and deferred compensation. Deferred compensation expense increase is offset by an increase in the value of related investments included in Other gains (losses) • Non-personnel expense up primarily due to increased mortgage banking costs and occupancy and equipment expense • $3.0 million charitable contribution to the BOKF Foundation, including an incremental $1 million charitable contribution to aid those in our communities with food insecurity 17

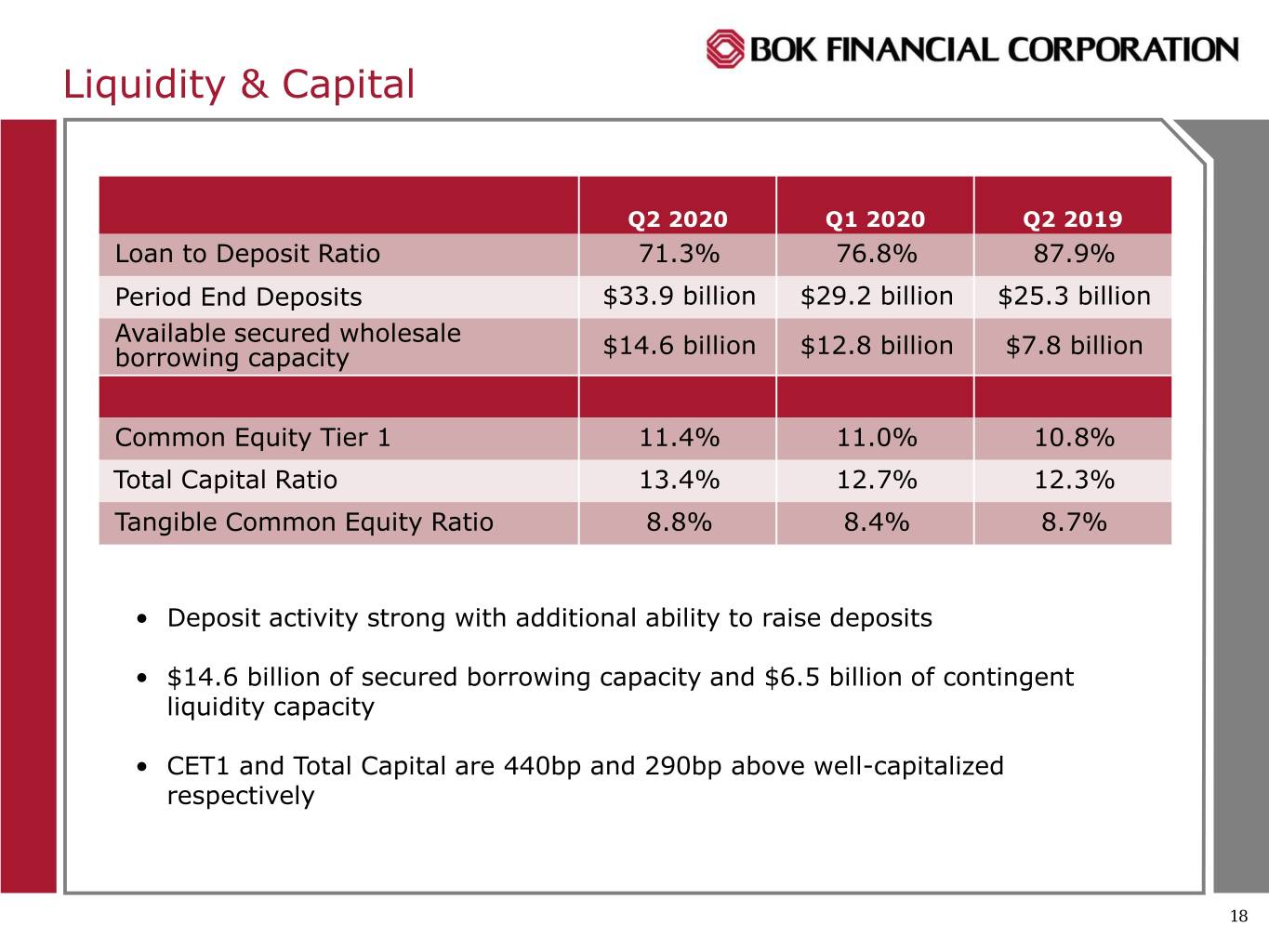

Liquidity & Capital Q2 2020 Q1 2020 Q2 2019 Loan to Deposit Ratio 71.3% 76.8% 87.9% Period End Deposits $33.9 billion $29.2 billion $25.3 billion Available secured wholesale borrowing capacity $14.6 billion $12.8 billion $7.8 billion Common Equity Tier 1 11.4% 11.0% 10.8% Total Capital Ratio 13.4% 12.7% 12.3% Tangible Common Equity Ratio 8.8% 8.4% 8.7% • Deposit activity strong with additional ability to raise deposits • $14.6 billion of secured borrowing capacity and $6.5 billion of contingent liquidity capacity • CET1 and Total Capital are 440bp and 290bp above well-capitalized respectively 18

Forecast and Assumptions • Loan growth to remain soft for the foreseeable future • Available-for-sale security portfolio yield expected to decrease as prepayments force reinvestment at lower rates • Incremental deposit cost capture possible, though most has been realized to-date • Fee revenues to continue to show strength, though seasonality in the mortgage industry to temper current levels of production • Operating expenses should remain at relatively same levels as has been seen the past few quarters • Significant loan loss reserve building to abate assuming our economic forecast is in line going forward • Quarterly cash dividend will remain in place 19

Steven G. Bradshaw Chief Executive Officer 20

Question and Answer Session 21