Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - ServisFirst Bancshares, Inc. | exh_991.htm |

| 8-K - FORM 8-K - ServisFirst Bancshares, Inc. | f8k_072020.htm |

EXHIBIT 99.2

ServisFirst Bancshares, Inc. NASDAQ: SFBS Second Quarter Supplemental Data July 20, 2020

Forward - Looking Statements 2 ▪ Statements in this presentation that are not historical facts, including, but not limited to, statements concerning future operations, results or performance, are hereby identified as "forward - looking statements" for the purpose of the safe harbor provided by Section 21E of the Securities Exchange Act of 1934 and Section 27A of the Securities Act of 1933. The words "believe," "expect," "anticipate," "project," “plan,” “intend,” “will,” “would,” “might,” “could” and similar expressions often signify forward - looking statements. Such statements involve inherent risks and uncertainties. ServisFirst Bancshares, Inc. cautions that such forward - looking statements, wherever they occur in this presentation or in other statements attributable to ServisFirst Bancshares, Inc., are necessarily estimates reflecting the judgment of ServisFirst Bancshares, Inc.’s senior management and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward - looking statements. Such forward - looking statements should, therefore, be considered in light of various factors that could affect the accuracy of such forward - looking statements, including: the global health and economic crisis precipitated by the COVID - 19 outbreak; general economic conditions, especially in the credit markets and in the Southeast; the performance of the capital markets; changes in interest rates, yield curves and interest rate spread relationships; changes in accounting and tax principles, policies or guidelines; changes in legislation or regulatory requirements; changes in our loan portfolio and the deposit base; economic crises and associated credit issues in industries most impacted by the COVID - 19 outbreak, including the restaurant, hospitality and retail sectors; possible changes in laws and regulations and governmental monetary and fiscal policies, including, but not limited to, economic stimulus initiatives; the cost and other effects of legal and administrative cases and similar contingencies; possible changes in the creditworthiness of customers and the possible impairment of the collectability of loans and the value of collateral; the effect of natural disasters, such as hurricanes and tornados, in our geographic markets; and increased competition from both banks and non - bank financial institutions. The foregoing list of factors is not exhaustive. For discussion of these and other risks that may cause actual results to differ from expectations, please refer to “Cautionary Note Regarding Forward - looking Statements” and “Risk Factors” in our most recent Annual Report on Form 10 - K and our other SEC filings. If one or more of the factors affecting our forward - looking information and statements proves incorrect, then our actual results, performance or achievements could differ materially from those expressed in, or implied by, forward - looking information and statements contained herein. Accordingly, you should not place undue reliance on any forward - looking statements, which speak only as of the date made. ServisFirst Bancshares, Inc. assumes no obligation to update or revise any forward - looking statements that are made from time to time.

Investor Presentation Update 3 ▪ In light of the pandemic we are providing the following slides in an effort to offer a more granular look into our loan portfolios and address other recent developments ▪ We are carefully monitoring our loan exposures where we see potential increased credit risk, including: – Hotels – Restaurants – Oil and Gas – Retail CRE

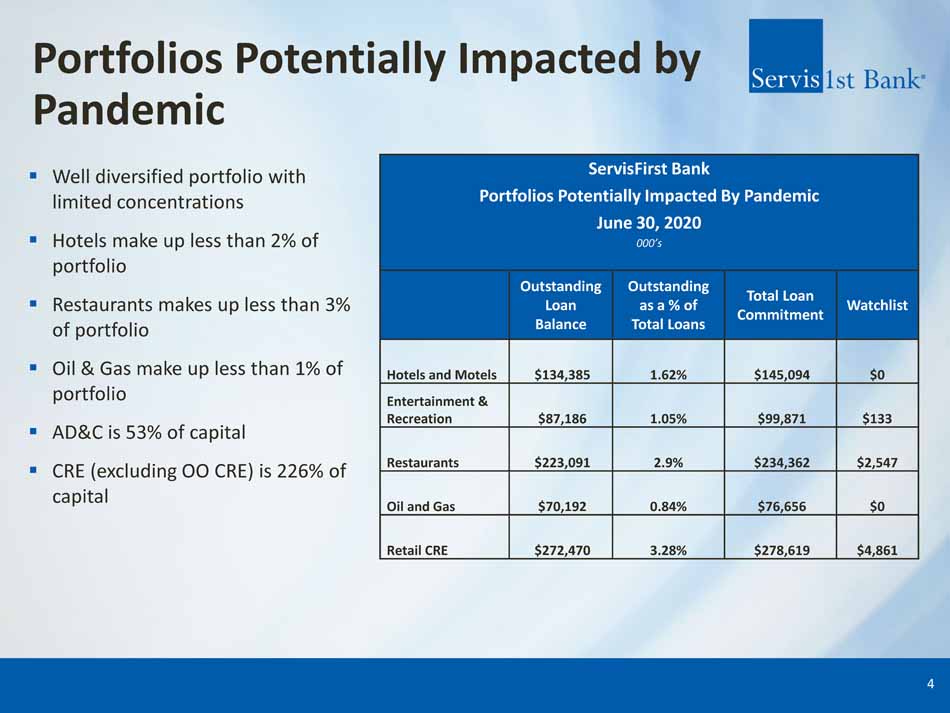

Portfolios Potentially Impacted by Pandemic 4 ▪ Well diversified portfolio with limited concentrations ▪ Hotels make up less than 2% of portfolio ▪ Restaurants makes up less than 3% of portfolio ▪ Oil & Gas make up less than 1% of portfolio ▪ AD&C is 53% of capital ▪ CRE (excluding OO CRE) is 226% of capital ServisFirst Bank Portfolios Potentially Impacted By Pandemic June 30, 2020 000’s Out s t a nd i ng Loan Balance Out s t a nd i ng as a % of Total Loans Total Loan Co mm it me n t Watchlist Hotels and Motels $134,385 1 . 62% $145,094 $0 Entertainment & Recreation $87,186 1 . 05% $99,871 $133 Restaurants $223,091 2.9% $234,362 $2,547 Oil and Gas $70,192 0 . 84% $76,656 $0 Retail CRE $272,470 3 . 28% $278,619 $4,861

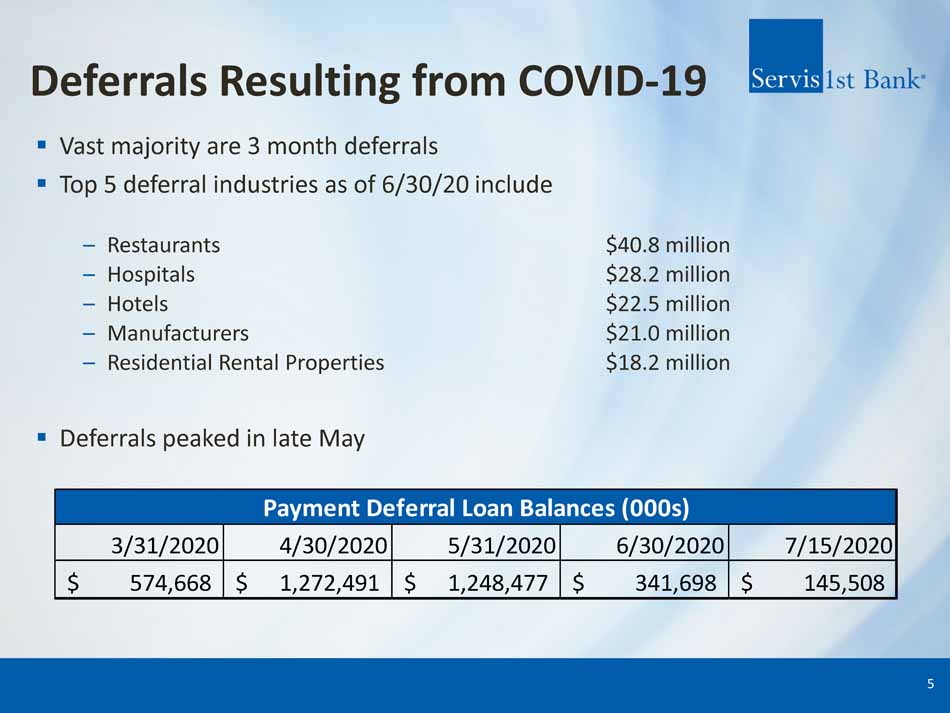

Deferrals Resulting from COVID - 19 5 ▪ Vast majority are 3 month deferrals ▪ Top 5 deferral industries as of 6/30/20 include – Restaurants – Hospitals – Hotels – Manufacturers – Residential Rental Properties $40.8 million $28.2 million $22.5 million $21.0 million $18.2 million ▪ Deferrals peaked in late May Payment Deferral Loan Balances (000s) 3/31/2020 4/30/2020 5/31/2020 6/30/2020 7/15/2020 $ 574,668 $ 1,272,491 $ 1,248,477 $ 341,698 $ 145,508

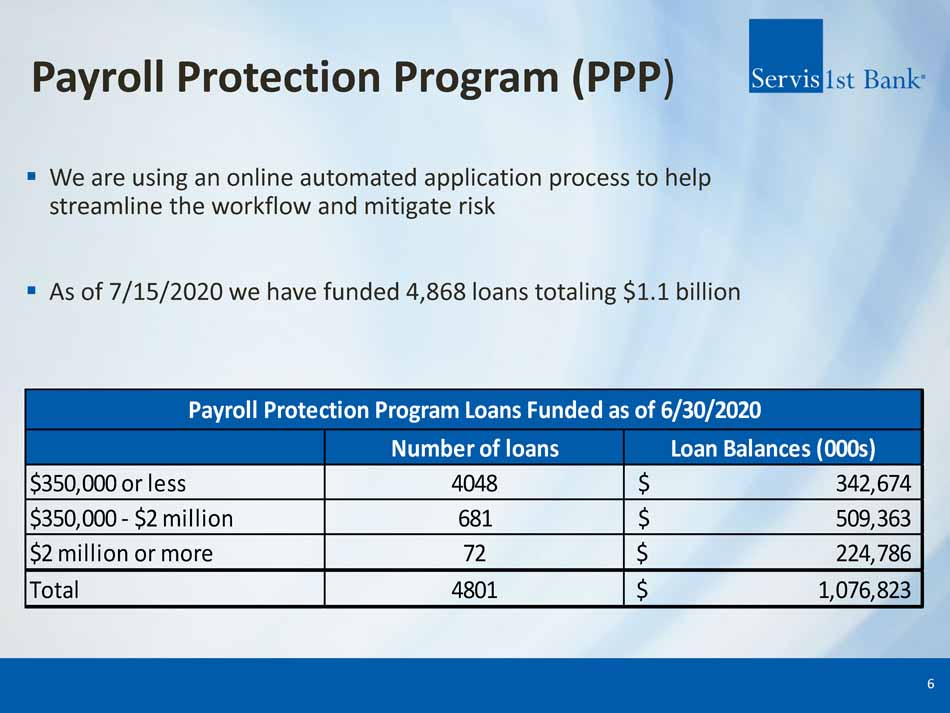

Payroll Protection Program (PPP ) 6 ▪ We are using an online automated application process to help streamline the workflow and mitigate risk ▪ As of 7/15/2020 we have funded 4,868 loans totaling $1.1 billion Payroll Protection Program Loans Funded as of 6/30/2020 Number of loans Loan Balances (000s) $350,000 or less 4048 $ 342,674 $350,000 - $2 million 681 $ 509,363 $2 million or more 72 $ 224,786 Total 4801 $ 1,076,823

Low Rate Environment 7 ▪ Focused on strengthening loan pricing over time ▪ Net Interest Margin – The NIM decreased 26 basis points from 1 st quarter to 2 nd quarter – The impact of PPP negatively impacted the margin by 15 basis points quarter over quarter ▪ Average PPP loan balances of $ 886 million ▪ PPP loan fees and interest of $ 4 . 1 million – Average fed funds sold and due from banks increased $ 358 million quarter over quarter, at an average rate of . 17 % , negatively impacting the margin by 12 basis points ▪ Investment Portfolio is only 7.6% of total assets; primary purpose is to provide liquidity – Sector Allocation: MBS 59%, Bank Senior/Sub - debt 28%, Treasuries/Agencies 7%, Alabama Municipals 5% – Average life of 3.46 – Effective duration of 2.13 – Cumulative principal cash flow 2 years out of 49% and 35% in a +100 environment

Digital Banking Opportunities 8 ▪ Commercial customers who had previously not adopted digital banking options such as Remote Deposit Capture, Mobile Deposits, and Purchase Cards are doing so now in large numbers – Payment Collection – Digital accounts receivables eliminate the need to make in - person or remote deposits of physical checks. – Businesses that historically did not accept credit cards are engaging our merchant services to now accept card payments. – Deposit Processing – We are seeing a large increase from 2019 , when approximately 63 % of deposits were made through a customer’s desktop check scanner or through our mobile app . – Check issuance – Bill Pay and ACH Origination are providing an alternative to manual check issuance. Additionally, business credit cards and business purchase cards are being used as an accounts payable tool.

Member FDIC | Equal Housing Lender