Attached files

| file | filename |

|---|---|

| EX-99.3 - EMPLOYEE COMMUNICATION - Majesco | ea124370ex99-3_majesco.htm |

| EX-99.2 - CUSTOMER COMMUNICATION - Majesco | ea124370ex99-2_majesco.htm |

| EX-99.1 - PRESS RELEASE DATED JULY 20, 2020 - Majesco | ea124370ex99-1_majesco.htm |

| 8-K - CURRENT REPORT - Majesco | ea124370-8k_majesco.htm |

Exhibit 99.4

InvestorPresentation Update July 20.2020

© 2020 Majesco. Allrights reserved 2 Disclaimer: Thematerialinthispresentationisgiveninsummaryformanddoesnotpurporttobecomplete.Informationinthispresentation,includingforecastfinancial information,shouldnotbeconsideredasadviceorarecommendationtoinvestorsorpotentialinvestorsinrelationtoholding,purchasingorsellingsecurities. Thispresentationmaycontainforwardlookingstatementsandunduerelianceshouldnotbeplacedontheseforwardlookingstatements. ImportantInformation: Inconnectionwiththeproposedmerger,Majescowillfileaconsentsolicitationstatementandotherrelevantdocumentsconcerningtheproposedmergerwith theSEC.TheconsentsolicitationstatementandothermaterialsfiledwiththeSECwillcontainimportantinformationregardingthemerger,including, among otherthings,therecommendationofMajesco'sboardofdirectorswithrespecttothemerger.SHAREHOLDERSAREURGEDTOREADTHECONSENT SOLICITATIONSTATEMENTANDOTHERCONSENTMATERIALSTHATMAJESCOFILESWITHTHESECWHENTHEYBECOMEAVAILABLEBECAUSETHEYWILL CONTAINIMPORTANTINFORMATIONABOUTTHEMERGERANDRELATEDMATTERS.Youwillbeabletoobtaintheconsentsolicitationstatement,aswellas otherfilingscontaininginformationaboutMajesco,freeofcharge,atthewebsitemaintainedbytheSECatwww.sec.gov.Copiesoftheconsentsolicitation statementandotherfilingsmadebyMajescowiththeSECcanalsobeobtained,freeofcharge,bydirectingarequesttoMajesco,412MountKembleAve., Suite110C,Morristown,NJ07960,Attention:CorporateSecretary. ParticipantsintheSolicitation: Majescoanditsexecutiveofficersanddirectorsmaybedeemed,underSECrules,tobeparticipantsinthesolicitationofconsentsfromMajesco’sshareholders withrespecttotheproposedmerger.InformationregardingtheexecutiveofficersanddirectorsofMajescoandtheirrespectiveownershipofMajescocommon stockisincludedintheProxyStatementforMajesco’s2019AnnualMeetingofStockholders(the“2019ProxyStatement”),filedwiththeSEConJuly26,2019, andinCurrentReportsonForm8-KfiledwiththeSEConSeptember10,2019andonJuly13,2020.Totheextentthatholdingsof Majesco’ssecuritieshave changedsincetheamountsprintedinthe2019ProxyStatement,suchchangeshavebeenorwillbereflectedonStatementsofChangeinOwnershiponForm4 filedwiththeSEC.Moredetailedinformationregardingtheidentityofthepotentialparticipants,andtheirdirectorindirectinterests,bysecurityholdingsor otherwise,willbesetforthintheconsentsolicitationstatementandothermaterialstobefiledwithSECinconnectionwiththeproposedmerger.

© 2020 Majesco. Allrights reserved 3 CautionaryLanguageConcerningForward-LookingStatements Thispresentationcontainsforward-lookingstatementswithinthemeaningofthe“safeharbor”provisionsofthePrivateSecuritiesLitigationReformAct. Theseforward-lookingstatementsaremadeonthebasisofthecurrentbeliefs,expectationsandassumptionsofmanagement,arenotguaranteesof performanceandaresubjecttosignificantrisksanduncertainty.Theseforward-lookingstatementsshould,therefore,beconsideredinlightofvarious importantfactors,includingthosesetforthinMajesco’sreportsthatitfilesfromtimetotimewiththeSecuritiesandExchangeCommissionandwhich youshouldreview,includingthosestatementsunder“Item1A–RiskFactors”inMajesco’sAnnualReportonForm10-K,asamendedbyitsQuarterly ReportsonForm10-Q. Importantfactorsthatcouldcauseactualresultstodiffermateriallyfromthosedescribedinforward-lookingstatementscontainedinthispressrelease include,butarenotlimitedto:theincurrenceofunexpectedcosts,liabilitiesordelaysrelatingtothemerger;thefailuretosatisfytheconditionstothe mergerandincludingregulatoryapprovals;thefailuretoobtainapprovalofthemergerbytheshareholdersofMajesco’sparentcompanyMajesco Limited;and These forward-looking statements should not be relied upon as predictions of future events and Majesco cannot assure you that the events or circumstances discussed or reflected in these statements will be achieved or will occur. If such forward-looking statements prove to be inaccurate, the inaccuracy may be material. You should not regard these statements as a representation or warranty by Majesco or any other person that we will achieve our objectives and plans in any specified timeframe, or at all. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Majesco disclaims any obligation to publicly update or release any revisions to these forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this press release or to reflect the occurrence of unanticipated events, except as required bylaw

1. TransactionSummary 2. MajescoGroupLegalStructure 3. Current MarketCapitalization 4. TransactionValue 5. ValuerealizationtoMajescoLtdShareholders 6. UseofProceeds,ApprovalsandTimelines AGENDA

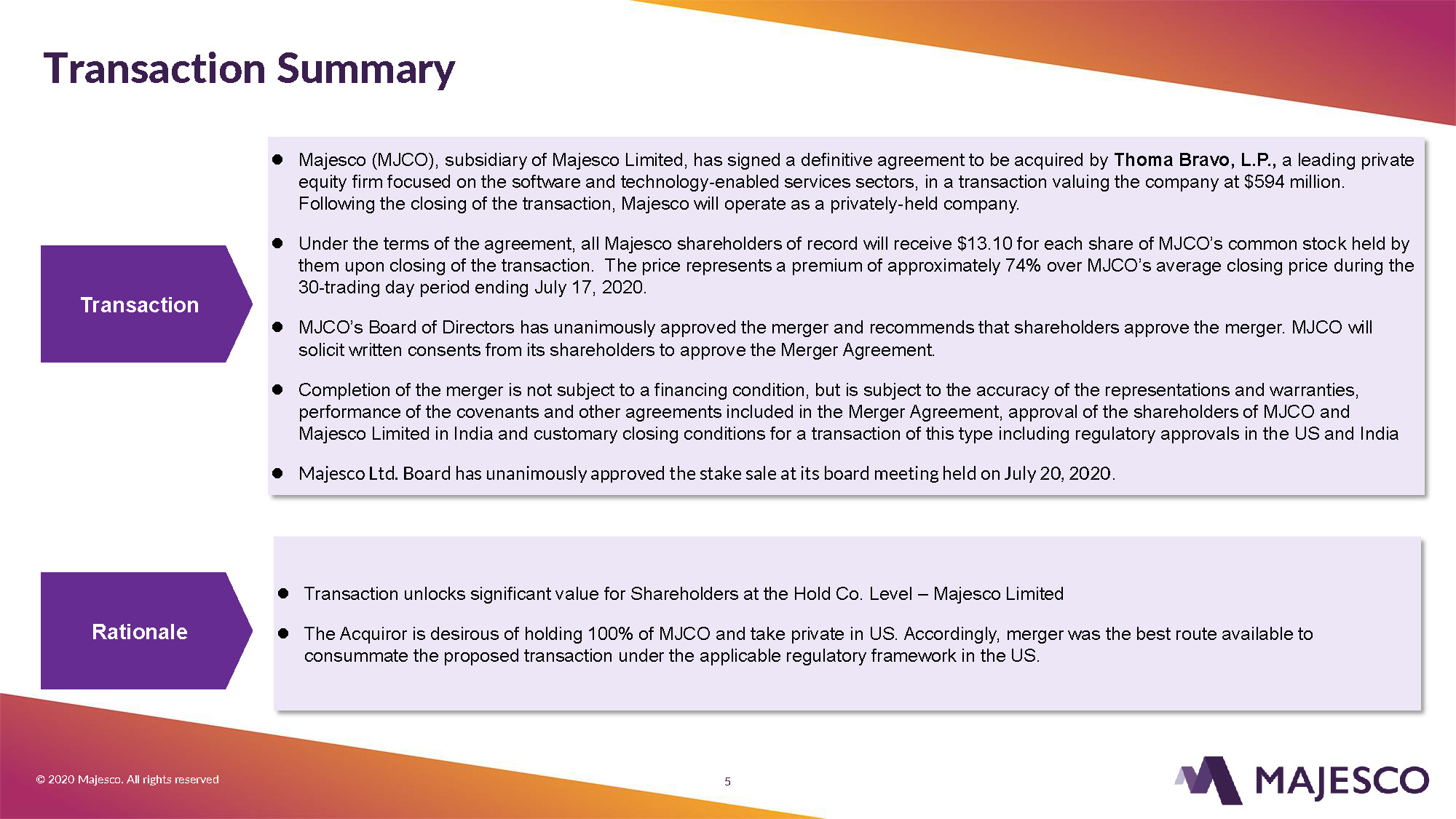

© 2020 Majesco. Allrights reserved TransactionSummary 5 Majesco (MJCO), subsidiary of Majesco Limited, has signed a definitive agreement to be acquired by Thoma Bravo, L.P., a leading private equity firm focused on the software and technology-enabled services sectors, in a transaction valuing the company at $594 million. Following the closing of the transaction, Majesco will operate as a privately-heldcompany. Underthetermsoftheagreement,allMajescoshareholdersofrecordwillreceive$13.10foreachshareofMJCO’scommonstockheldby themuponclosingofthetransaction.Thepricerepresentsapremiumofapproximately74%overMJCO’saverageclosingpriceduringthe 30-tradingdayperiodendingJuly17,2020. Transaction MJCO’s Board of Directors has unanimously approved the merger and recommends that shareholders approve the merger. MJCO will solicit written consents from its shareholders to approve the MergerAgreement. Completion of the merger is not subject to a financing condition, but is subject to the accuracy of the representations and warranties, performance of the covenants and other agreements included in the Merger Agreement, approval of the shareholders of MJCO and Majesco Limited in India and customary closing conditions for a transaction of this type including regulatory approvals in the US andIndia MajescoLtd.BoardhasunanimouslyapprovedthestakesaleatitsboardmeetingheldonJuly20,2020. Rationale Transaction unlocks significant value for Shareholders at the Hold Co. Level –MajescoLimited The Acquiror is desirous of holding 100% of MJCO and take private in US. Accordingly, merger was the best route availableto consummate the proposed transaction under the applicable regulatory framework in theUS.

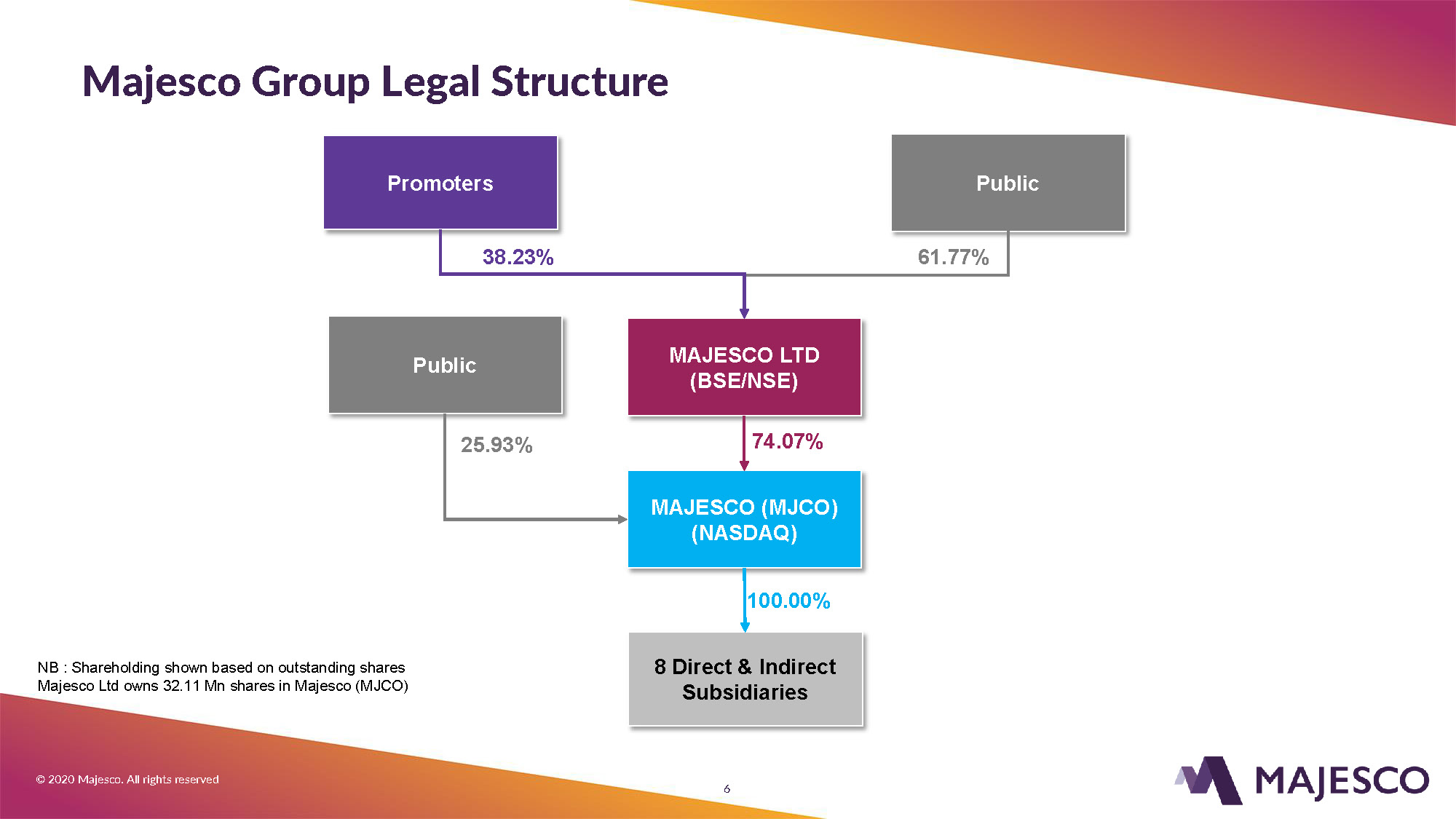

© 2020 Majesco. Allrights reserved Majesco Group LegalStructure 6 MAJESCOLTD (BSE/NSE) 74.07% Promoters Public 61.77%38.23% Public 25.93% 8 Direct &Indirect Subsidiaries MAJESCO(MJCO) (NASDAQ) 100.00% NB : Shareholding shown based on outstandingshares Majesco Ltd owns 32.11 Mn shares in Majesco(MJCO)

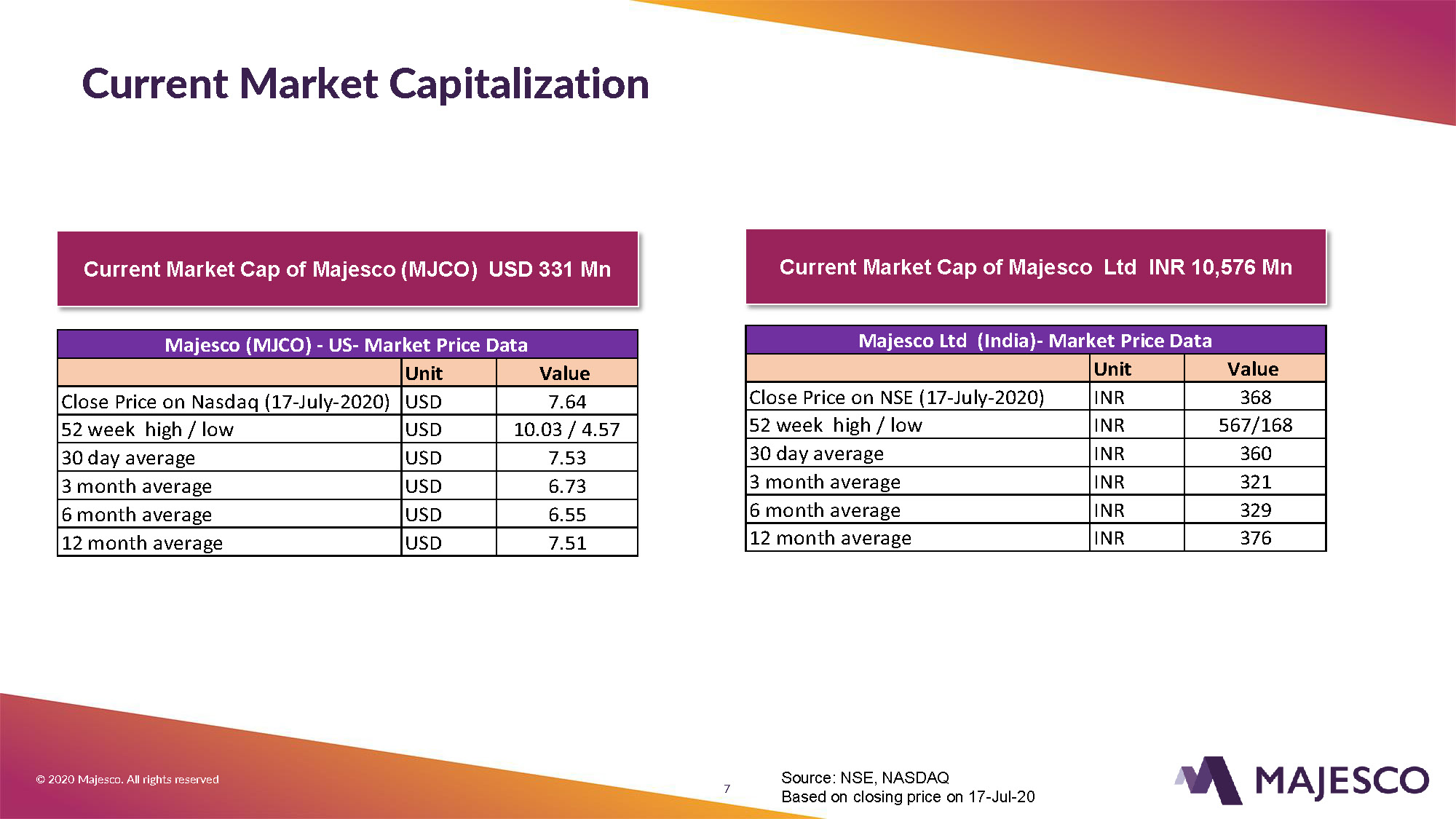

© 2020 Majesco. Allrights reserved Current MarketCapitalization 7 Current Market Cap of Majesco (MJCO) USD 331Mn Source: NSE,NASDAQ Based on closing price on17-Jul-20 Majesco (MJCO) -US-Market PriceData Unit Value Close Price on Nasdaq(17-July-2020) USD 7.64 52 week high /low USD 10.03 /4.57 30 dayaverage USD 7.53 3 monthaverage USD 6.73 6 monthaverage USD 6.55 12 monthaverage USD 7.51 Current Market Cap of Majesco Ltd INR 10,576Mn Majesco Ltd (India)-Market PriceData Unit Value Close Price on NSE(17-July-2020) INR 368 52 week high /low INR 567/168 30 dayaverage INR 360 3 monthaverage INR 321 6 monthaverage INR 329 12 monthaverage INR 376

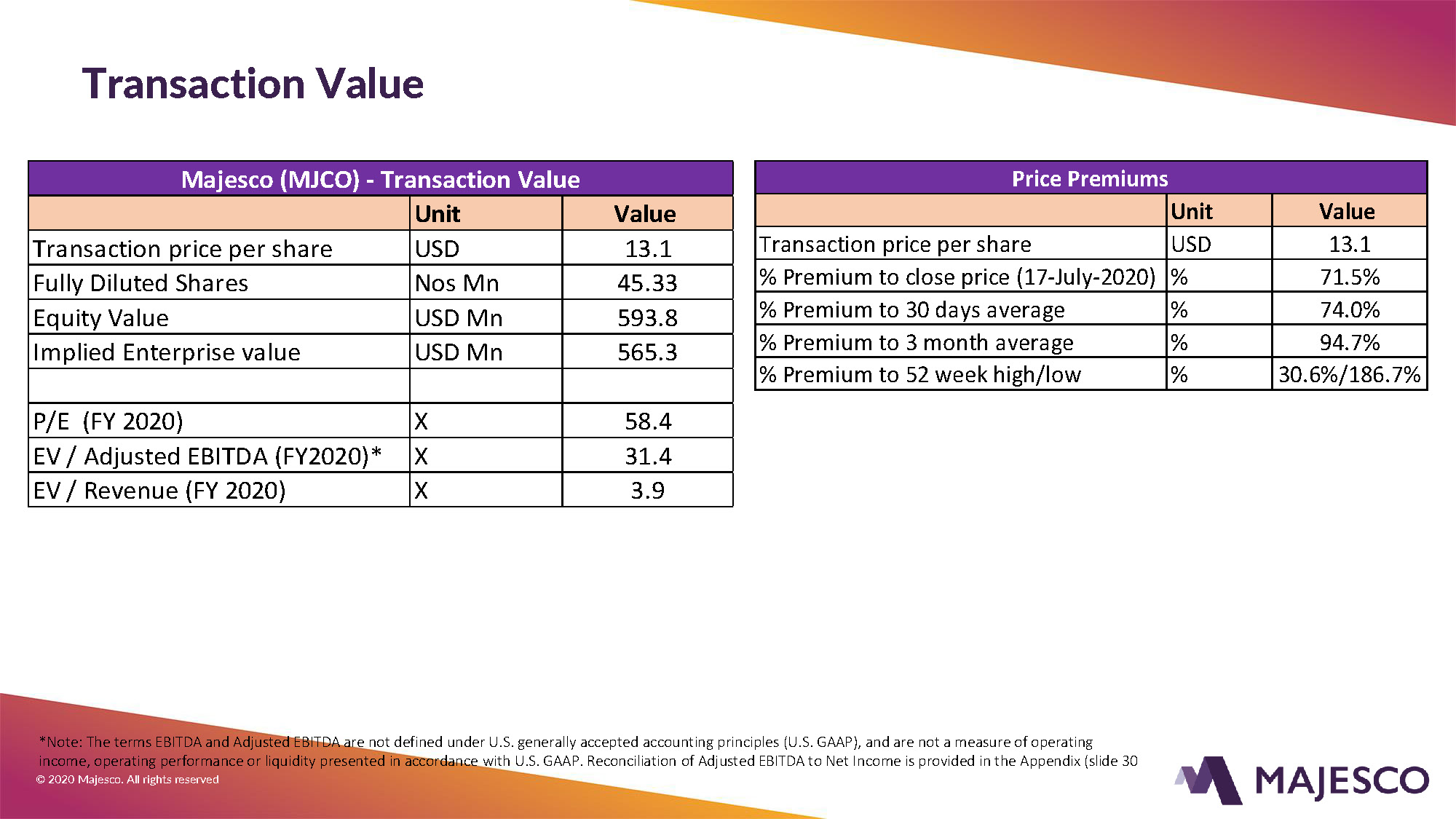

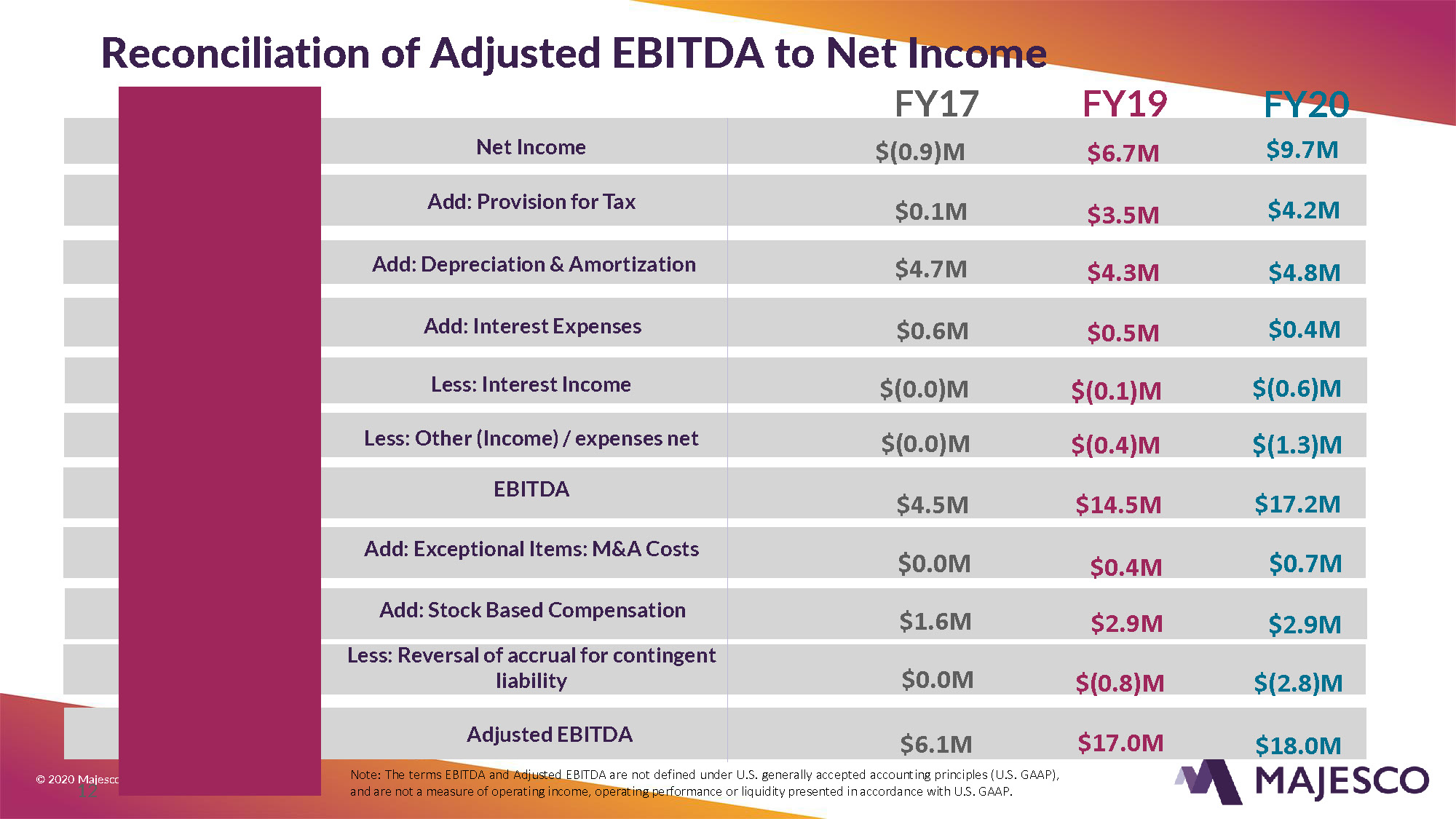

TransactionValue PricePremiums Unit Value Transaction price pershare USD 13.1 % Premium to close price(17-July-2020) % 71.5% % Premium to 30 daysaverage % 74.0% % Premium to 3 monthaverage % 94.7% % Premium to 52 weekhigh/low % 30.6%/186.7% *Note: The terms EBITDA and Adjusted EBITDA are not defined under U.S. generally accepted accounting principles (U.S. GAAP), and are not a measure of operating income,operatingperformanceorliquiditypresentedinaccordancewithU.S.GAAP.ReconciliationofAdjustedEBITDAtoNetIncome isprovidedintheAppendix (slide 30 © 2020 Majesco. All rightsreserved Majesco (MJCO) -TransactionValue Unit Value Transaction price pershare USD 13.1 Fully DilutedShares NosMn 45.33 EquityValue USDMn 593.8 Implied Enterprisevalue USDMn 565.3 P/E (FY2020) X 58.4 EV / Adjusted EBITDA(FY2020)* X 31.4 EV / Revenue (FY2020) X 3.9

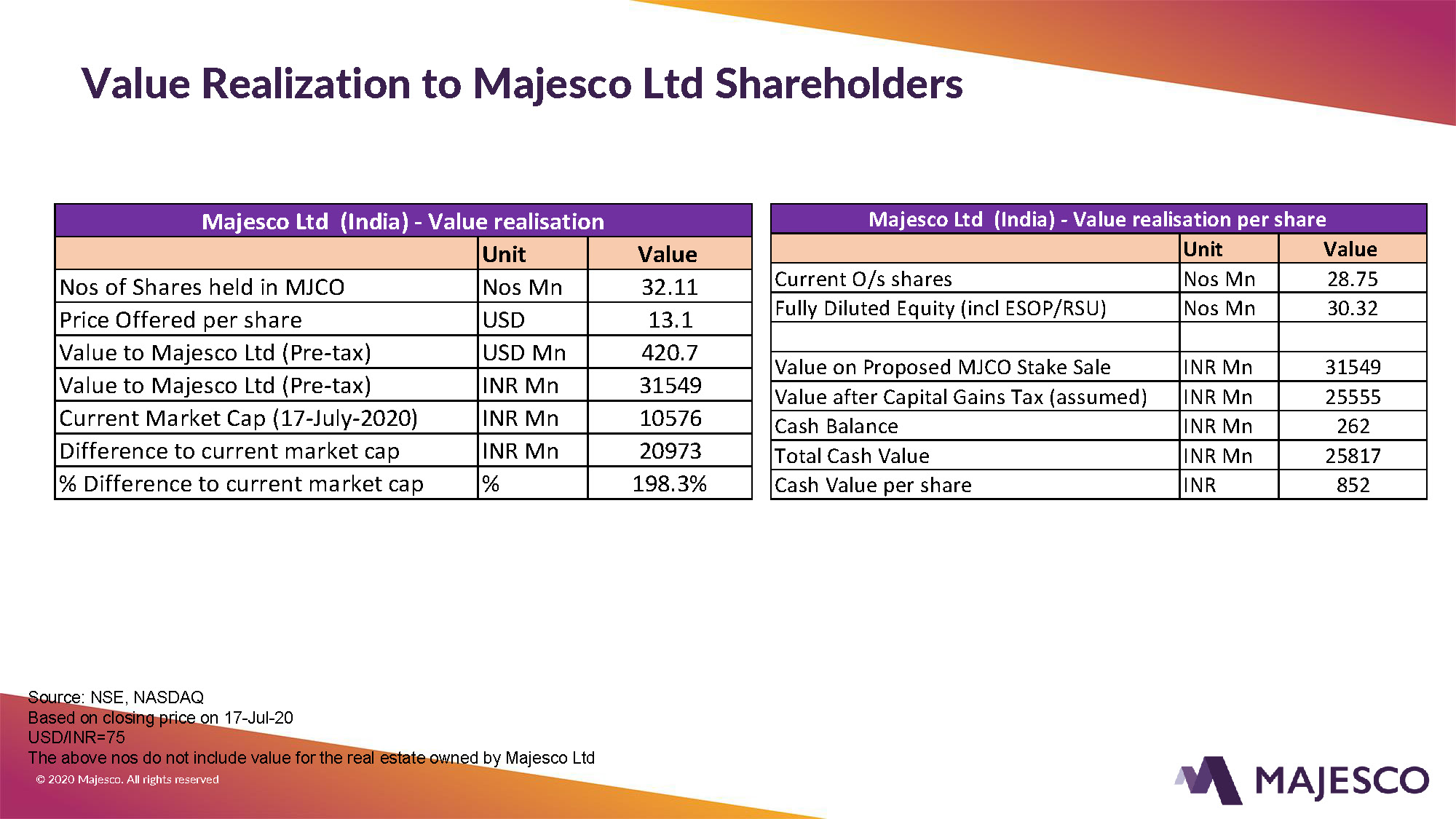

Value Realization to Majesco LtdShareholders Majesco Ltd (India) -Valuerealisation Unit Value Nos of Shares held inMJCO NosMn 32.11 Price Offered pershare USD 13.1 Value to Majesco Ltd(Pre-tax) USDMn 420.7 Value to Majesco Ltd(Pre-tax) INRMn 31549 Current Market Cap(17-July-2020) INRMn 10576 Difference to current marketcap INRMn 20973 % Difference to current marketcap % 198.3% Source: NSE,NASDAQ Based on closing price on17-Jul-20 USD/INR=75 The above nos do not include value for the real estate owned by MajescoLtd © 2020 Majesco. All rightsreserved Majesco Ltd (India) -Value realisation pershare Unit Value Current O/sshares NosMn 28.75 Fully Diluted Equity (inclESOP/RSU) NosMn 30.32 Value on Proposed MJCO StakeSale INRMn 31549 Value after Capital Gains Tax(assumed) INRMn 25555 CashBalance INRMn 262 Total CashValue INRMn 25817 Cash Value pershare INR 852

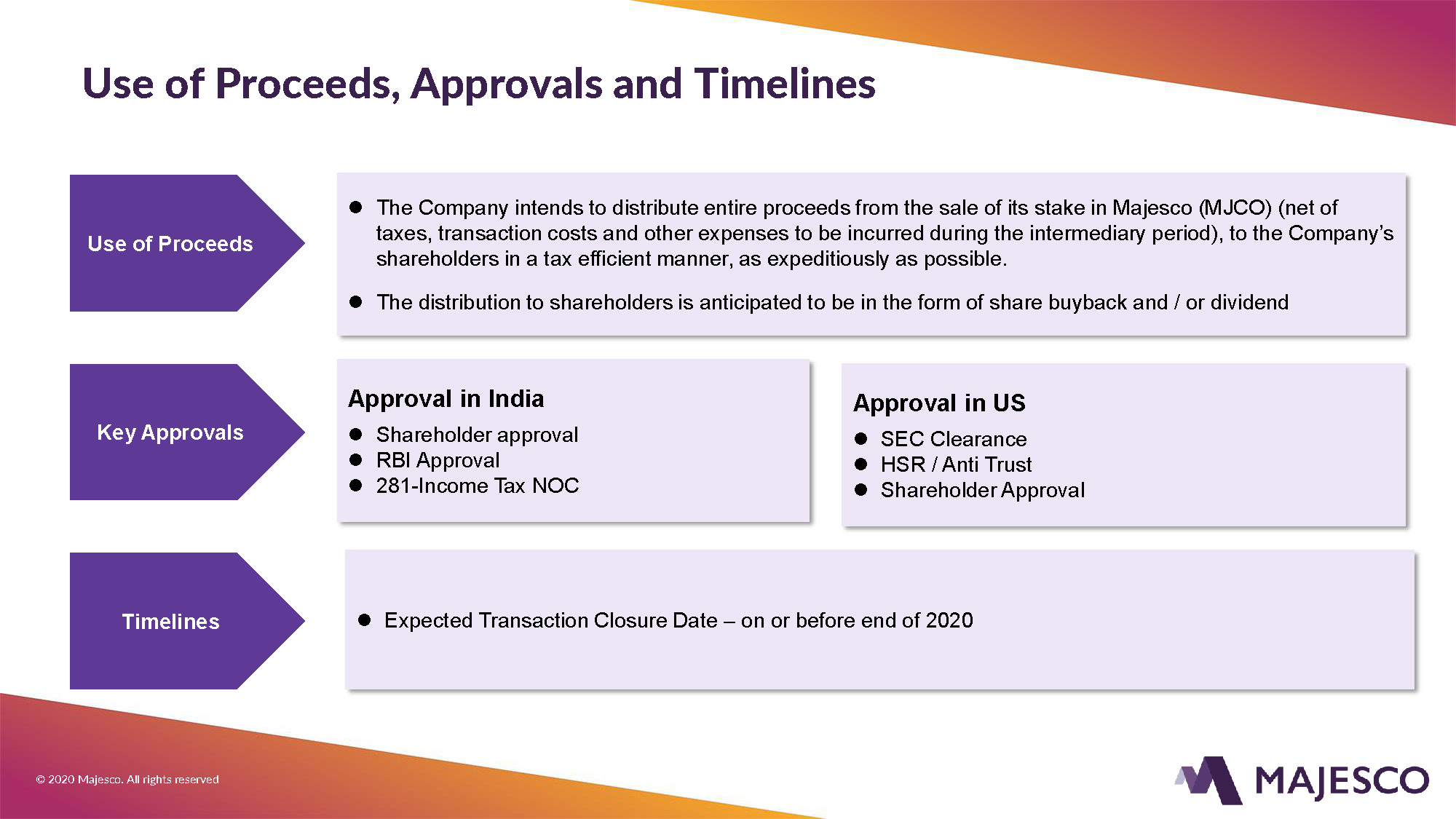

© 2020 Majesco. Allrights reserved Use of Proceeds, Approvals andTimelines Use ofProceeds KeyApprovals The Company intends to distribute entire proceeds from the sale of its stake in Majesco (MJCO) (net of taxes, transaction costs and other expenses to be incurred during the intermediary period), to the Company’s shareholders in a tax efficient manner, as expeditiously aspossible. Thedistributiontoshareholdersis anticipatedtobeintheformofsharebuybackand/ordividend Timelines Expected Transaction Closure Date –on or before end of2020 Approval inIndia Shareholderapproval RBIApproval 281-Income TaxNOC Approval inUS SEC Clearance HSR / AntiTrust ShareholderApproval

© 2020 Majesco. Allrights reserved Appendix 11

© 2020Majesco. All rightsreserved Reconciliation of Adjusted EBITDA to NetIncome FY19 NET NET CAS CAS H/ H (DEBT) P OSITI TI ON ON 12 FY20 Add:ExceptionalItems:M&ACosts $0.4M $0.0M $0.7M Add: StockBased Compensation $2.9M $1.6M $2.9M Less:Reversalofaccrualforcontingent liability $(0.8)M $0.0M $(2.8)M NetIncome Add:ProvisionforTax Add:Depreciation&Amortization Add: InterestExpenses Less: InterestIncome Less:Other(Income)/expensesnet EBITDA $14.5M $(0.9)M $0.1M $3.5M $4.7M $0.6M $(0.0)M $(0.0)M $4.5M $6.1M $4.3M $0.5M $(0.1)M $(0.4)M $6.7M $17.0M $9.7M $4.2M $4.8M $(1.3)M $17.2M $18.0M Note: The terms EBITDA and Adjusted EBITDA are not defined under U.S. generally accepted accounting principles (U.S. GAAP), and are not a measure of operating income, operating performance or liquidity presented in accordance with U.S.GAAP. FY17 AdjustedEBITDA $0.4M $(0.6)M

© 2020 Majesco. Allrights reserved ThankYou 13