Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Celanese Corp | tm2024680d2_ex99-1.htm |

| EX-10.1 - EXHIBIT 10.1 - Celanese Corp | tm2024680d2_ex10-1.htm |

| 8-K - FORM 8-K - Celanese Corp | tm2024680d2_8k.htm |

Exhibit 99.2

Celanese Unlocks Shareholder Value Through Monetization of Polyplastics Joint Venture Engineered Materials Well - Positioned to Continue Growth Trajectory July 2020

1

Disclosures Forward - Looking Statements This presentation contains "forward - looking statements," which include information concerning the Company's plans, objectives, g oals, strategies, future revenues, synergies, performance, capital expenditures, financing needs and other information that is not historical information. All forward - looking statements are based upon current expectations and beliefs and various assumptions. There can be no assurance that the Company will realize these expectations or that these beliefs will prove correct. There are a number of ri sks and uncertainties that could cause actual results to differ materially from the results expressed or implied in the forward - looking statements contained in this presentation. These risks and uncertainties inc lude, among other things: changes in general economic, business, political and regulatory conditions in the countries or regions in which we operate; the length and depth of product and industry business cyc les, particularly in the automotive, electrical, mobility, textiles, medical, electronics and construction industries; changes in the price and availability of raw materials, particularly changes in the dem and for, supply of, and market prices of ethylene, methanol, natural gas, wood pulp and fuel oil and the prices for electricity and other energy sources; the ability to pass increases in raw material prices on to customers or otherwise improve margins through price increases; the ability to maintain plant utilization rates and to implement planned capacity additions and expansions; the ability to reduce or maintai n c urrent levels of production costs and to improve productivity by implementing technological improvements to existing plants; the ability to identify desirable potential acquisition targets and to consumm ate acquisition or investment transactions consistent with the Company's strategy; the ability to identify and execute on other attractive investment opportunities towards which to deploy capital; increased p ric e competition and the introduction of competing products by other companies; market acceptance of our products and technology; the ability to obtain governmental approvals and to construct facilities on te rms and schedules acceptable to the Company; changes in the degree of intellectual property and other legal protection afforded to our products or technologies, or the theft of such intellectual pro perty; compliance and other costs and potential disruption or interruption of production or operations due to accidents, interruptions in sources of raw materials, cyber security incidents, terrorism or pol itical unrest or other unforeseen events or delays in construction or operation of facilities, including as a result of geopolitical conditions or as a result of weather or natural disasters; potential liabil ity for remedial actions and increased costs under existing or future environmental regulations, including those relating to climate change; potential liability resulting from pending or future litigation, or fro m changes in the laws, regulations or policies of governments or other governmental activities in the countries in which we operate; changes in currency exchange rates and interest rates; our level of indebted nes s, which could diminish our ability to raise additional capital to fund operations or limit our ability to react to changes in the economy or the chemicals industry; tax rates and changes thereto; our ability to ob tain regulatory approval for, and satisfy closing conditions to, any transactions described herein; and various other factors discussed from time to time in the Company's filings with the Securities and Exch ang e Commission. Any forward - looking statement speaks only as of the date on which it is made, and the Company undertakes no obligation to update any forward - looking statements to reflect events or circums tances after the date on which it is made or to reflect the occurrence of anticipated or unanticipated events or circumstances. Results Unaudited The results in this document, together with the adjustments made to present the results on a comparable basis, have not been aud ited and are based on internal financial data furnished to management. Historical results should not be taken as an indication of the results of operations to be reported for any future period. Non - GAAP Financial Measures This presentation, and statements made in connection with this presentation, refer to non - GAAP financial measures. For more info rmation on the non - GAAP financial measures used by the Company, including the most directly comparable GAAP financial measure for each non - GAAP financial measures used, including definitions and reconci liations of the differences between such non - GAAP financial measures and the comparable GAAP financial measures, please refer to the slides in the appendix to this presentation and to Non - US GAAP Finan cial Measures and Supplemental Information document available on our website, investors.celanese.com, under Financial Information/Non - GAAP Financial Measures. 2

2

1 Base business excludes affiliate earnings 1 Committed to a multi - year value creation strategy in Engineered Materials (EM), which is more diverse, solutions - oriented, and customer - focused. 2 Celanese investment in local Asia capabilities in our base business 1 has driven double - digit annual sales growth in Asia over the last decade. 3 4 5 Unlocking value from 45% passive stake in Polyplastics for $1.575 billion, at 36x our share of 2019 results. Expected to close in the second half, following customary regulatory review. Global EM capabilities remain intact, with active influence over virtually all earnings. Share repurchases of approximately $0.5 billion in the near - term will ensure the deal is immediately accretive to adjusted earnings per share. Reinvestment of >$1.3 billion in estimated total net proceeds to higher return uses in the midterm. Capital allocation strategy remains focused on organic investment, high - return M&A, and share repurchases. Continued consideration of all opportunities that generate shareholder value. Summary Highlights 3

3

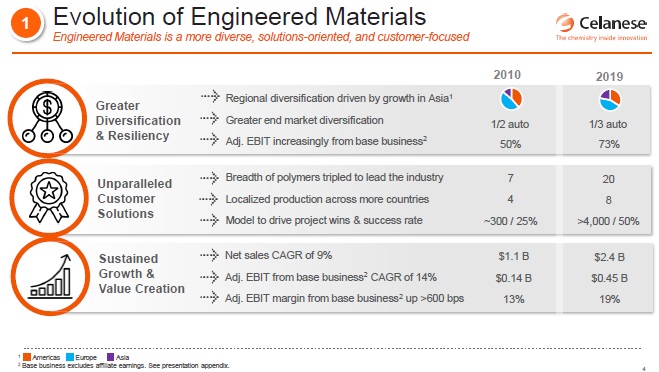

Greater Diversification & Resiliency Regional diversification driven by growth in Asia 1 Greater end market diversification Adj. EBIT increasingly from base business 2 Unparalleled Customer Solutions Breadth of polymers tripled to lead the industry Localized production across more countries Model to drive project wins & success rate Sustained Growth & Value Creation Net sales CAGR of 9% Adj. EBIT from base business 2 CAGR of 14% Adj. EBIT margin from base business 2 up >600 bps 2010 2019 7 4 ~300 / 25% 20 8 >4,000 / 50% $2.4 B $0.45 B 19% $1.1 B $0.14 B 13% 50% 73% 1 Americas Europe Asia 2 Base business excludes affiliate earnings. See presentation appendix. 1/2 auto 1/3 auto 1 Evolution of Engineered Materials Engineered Materials is a more diverse, solutions - oriented, and customer - focused 4

4

2 Engineered Materials Growth in Asia Investment in local capabilities to drive continued growth EM Base Business Growth in Asia (2010 – 2019) 2019 2010 Joint Venture Led Presence (1960 – 2009) 22% 14% 10% or less Asia Percentage of EM Net Sales EM Asia Net Sales 1 $533 M $152 M ~$100 M or less Net sales CAGR of 15%, nearly double the US or Europe Three production facilities in China and India Technical centers in China, South Korea, and Japan Organization with local leadership, talent, and know - how Organic and M&A investment in base business Specialty applications rivaling the US and Europe Asia presence established via JVs: - Polyplastics (Japan) 1964 - KEPCO (South Korea) 1999 Limited local know - how or capabilities Business mostly with multinationals Primarily standard applications Limited base business or JV growth Future Growth Strategy 2020 - Double - digit sales CAGR Scale existing assets to meet demand Enhance product dev capabilities Scale key programs in lithium - ion batteries, electric vehicles, and 5G More direct engagement with OEMs More direct participation in key markets outside China 1 Engineered Materials net sales excludes affiliates 5

5

• Polyplastics Co., Ltd. (PPC) formed in Japan in 1964 is Celanese’s oldest joint venture (JV) • Established by Celanese (45%) and Daicel Corporation (55%) • Originally established to create a Celanese presence in Asia • Production and marketing capabilities with facilities in Asia Limited Celanese Influence Relative to Other Engineered Materials JVs Celanese minority ownership Limited minority protection rights Business decisions controlled by partner Inability to implement EM commercial model Polyplastics Performance Relative to Engineered Materials Base Business 2008 2019 EM Base Business 1 Polyplastics 2 1 Adjusted EBIT excluding affiliate earnings 2 Celanese share of Polyplastics earnings 2 Polyplastics Background and Performance Focus over many years to restructure Polyplastics JV to drive improved performance 6

6

Immediate Unlocking of Full Value $1.575 billion in Exchange for Celanese 45% Stake in Polyplastics Monetization at 36x 2019 Polyplastics equity earnings 1 Stronger Engineered Materials Application of EM commercial model on vast majority of adjusted EBIT Enables improved focus on Engineered Materials base business No change in competitive dynamics with Polyplastics in overlapping product lines Disciplined Redeployment of Capital Redeployment of capital to higher return uses Accretive to adjusted earnings per share via initial share repurchases Series of new or more attractive organic investment opportunities available in EM 1 Celanese share of Polyplastics earnings 3 Transaction to Create Significant Value Unlocking passive investment in Polyplastics to redeploy at greater returns 7

7

Gross proceeds of $1.575 billion Post - tax net proceeds of >$1.3 billion Second half close after necessary regulatory approvals and customary closing conditions Phase I Deployment (near - term) Monetization Phase II Deployment (midterm) >$1.3 B ~$0.5 B >$0.8 B Adjusted earnings per share accretion on ~$0.5 billion in share repurchases >$0.8 billion deployed to M&A and/or share repurchases M&A return thresholds remain in excess of share repurchases Current repurchase authorization increased by $500 million 2 1 3 4 Accretive Deployment of Proceeds Full net proceeds of ~$1.3 billion to be deployed to share repurchases or higher return M&A 8

8

RETURNS Organic Growth Acquisitions > 12% >20 % Share Repurchases W ACC + Current W ACC Repay Debt 3 - 5% Keep Excess Cash 1 - 2% Disciplined consideration of bolt - on and transformational opportunities Pursue highly synergistic acquisitions with attractive regional, polymer formulation, or application enhancements Complementary spaces to leverage a solutions - oriented pipeline model Enhance capabilities to leverage key trends in 5G, mobility, medical & pharma, electric vehicles, and sustainability Investments in technology and production of high - value polymers Continued localization in Asia for greater customer intimacy and speed Organic Growth Acquisitions 5 High - return Capital Allocation Strategy We consider all capital allocation opportunities that create outsized shareholder value 9

9

Appendix

Non - GAAP Definitions Adjusted EBIT is a performance measure used by the Company and is defined by the Company as net earnings (loss) attributable to Celanese Co rpo ration, plus (earnings) loss from discontinued operations, less interest income, plus interest expense, plus refinancing expense and taxes, and further adjuste d f or Certain Items. We believe that adjusted EBIT provides transparent and useful information to management, investors, analysts and other parties in evaluating and assessing our prima ry operating results from period - to - period after removing the impact of unusual, non - operational or restructuring - related activities that affect comparability. Our management recognizes that adjusted EBIT has inherent limitations because of the excluded items. Adjusted EBIT is one of the measures management uses for planning and budgeting, monitoring and evaluating financial a nd operating results and as a performance metric in the Company's incentive compensation plan. We do not provide reconciliations for adjusted EBIT on a forward - looking basis (including those contained in this document) when we are unable to provide a meaningful or accurate calculation or estimation of reconciling items and the information is not available without unr easonable effort. This is due to the inherent difficulty of forecasting the timing and amount of Certain Items, such as mark - to - market pension gains and losses, that have not yet occurred, are out of our control and/or cannot be reasonably predicted. For the same reasons, we are unable to address the probable significance of the unavailable information. Adjusted EBIT margin is defined by the Company as adjusted EBIT divided by net sales. Adjusted EBIT margin has the same uses and limitations as Adjusted EBIT. 11

11

Reconciliation to U.S. GAAP 12 Engineered Materials Supplemental Segment Data and Reconciliation of Non - GAAP Measures – Unaudited Source: Non - GAAP Financial Measures – available in the ‘Financial Information’ section of Celanese Investor Relations website. Note: Adjusted EBIT and Adjusted EBIT Margin are non - GAAP measures. 1 Engineered Materials net sales of $1.1 billion and $2.4 billion for the years ended December 31, 2010 and 2019, respectively. FY 2010 FY 2019 (In $ millions, except percentages) Operating Profit (Loss) / Operating Margin 1 182 16.4% 446 18.7% Other Income (Expense) Attributable to Celanese Corporation (1) - Certain Items Attributable to Celanese Corporation (38) 7 Adjusted EBIT / Adjusted EBIT Margin 1 143 12.9% 453 19.0%

12