Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NETFLIX INC | nflx-20200716.htm |

Exhibit 99.1

July 16, 2020

Fellow shareholders,

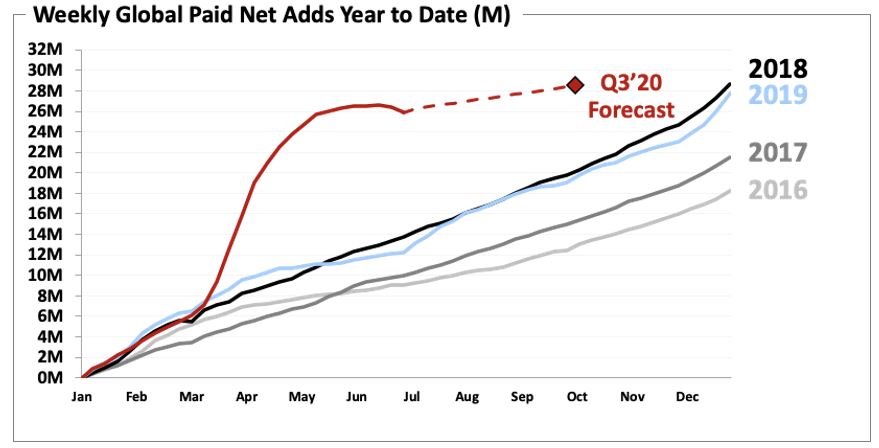

We live in uncertain times with restrictions on what we can do socially and many people are turning to entertainment for relaxation, connection, comfort and stimulation. In Q1 and Q2, we saw significant pull-forward of our underlying adoption leading to huge growth in the first half of this year (26 million paid net adds vs. prior year of 12 million). As a result, we expect less growth for the second half of 2020 compared to the prior year. As we navigate these turbulent circumstances, we’re focused on our members by continuing to improve the quality of our service and bringing new films and shows to people's screens. Our Q2 summary results and forecast for Q3 are in the table below.

| (in millions except per share data and Streaming Content Obligations) | Q2'19 | Q3'19 | Q4'19 | Q1'20 | Q2'20 | Q3'20 Forecast | ||||||||||||||

| Revenue | $ | 4,923 | $ | 5,245 | $ | 5,467 | $ | 5,768 | $ | 6,148 | $ | 6,327 | ||||||||

| Y/Y % Growth | 26.0 | % | 31.1 | % | 30.6 | % | 27.6 | % | 24.9 | % | 20.6 | % | ||||||||

| Operating Income | $ | 706 | $ | 980 | $ | 459 | $ | 958 | $ | 1,358 | $ | 1,245 | ||||||||

| Operating Margin | 14.3 | % | 18.7 | % | 8.4 | % | 16.6 | % | 22.1 | % | 19.7 | % | ||||||||

| Net Income | $ | 271 | $ | 665 | $ | 587 | $ | 709 | $ | 720 | $ | 954 | ||||||||

| Diluted EPS | $ | 0.60 | $ | 1.47 | $ | 1.30 | $ | 1.57 | $ | 1.59 | $ | 2.09 | ||||||||

| Global Streaming Paid Memberships | 151.56 | 158.33 | 167.09 | 182.86 | 192.95 | 195.45 | ||||||||||||||

| Y/Y % Growth | 21.9 | % | 21.4 | % | 20.0 | % | 22.8 | % | 27.3 | % | 23.4 | % | ||||||||

| Global Streaming Paid Net Additions | 2.70 | 6.77 | 8.76 | 15.77 | 10.09 | 2.50 | ||||||||||||||

| Net cash provided by (used in) operating activities | $ | (544) | $ | (502) | $ | (1,462) | $ | 260 | $ | 1,041 | ||||||||||

| Free Cash Flow* | $ | (594) | $ | (551) | $ | (1,670) | $ | 162 | $ | 899 | ||||||||||

| Adjusted EBITDA** | $ | 836 | $ | 1,107 | $ | 586 | $ | 1,084 | $ | 1,489 | ||||||||||

| Shares (FD) | 452.2 | 451.6 | 451.4 | 452.5 | 453.9 | |||||||||||||||

| Streaming Content Obligations*** ($B) | 18.5 | 19.1 | 19.5 | 19.2 | 19.1 | |||||||||||||||

| Note: Figures are consolidated, including DVD. | ||||||||||||||||||||

| * Free cash flow represents Net Cash provided by (used in) operating and investing activities | ||||||||||||||||||||

| ** Adjusted EBITDA represents net income before interest expense and other income/expense, income taxes, depreciation and amortization of property and equipment and further adjusted to exclude other non-cash charges or non-recurring items | ||||||||||||||||||||

| *** Corresponds to our total known streaming content obligations as defined in our financial statements and related notes in our most recently filed SEC Form 10-K | ||||||||||||||||||||

Ted Sarandos appointed co-CEO and elected to Board of Directors

Ted joined Netflix over 20 years ago, and we are thrilled to appoint him to be co-CEO with Reed. “Ted has been my partner for decades. This change makes formal what was already informal -- that Ted and I share the leadership of Netflix,” says Hastings. Lead Independent director Jay Hoag says “Having watched Reed and Ted work together for so long, the board and I are confident this is the right step to evolve Netflix’s management structure so that we can continue to best serve our members and shareholders for years to come.”

Ted will also continue to serve as Chief Content Officer. In addition, Greg Peters has been appointed COO adding to his Chief Product Officer role. “We want Greg to help us stay aligned and effective as we grow so quickly around the world,” said Hastings.

| 1 | ||||

Q2 Results and Q3 Forecast

In Q2, revenue grew 25% year over year, while quarterly operating income exceeded $1 billion. Average streaming paid memberships in Q2 rose 25% year over year while streaming ARPU increased 0.4% year over year. Excluding a -$289m impact from foreign exchange (F/X), streaming ARPU grew 5% year over year. Operating margin expanded 770 basis points year over year to 22.1%, above our guidance forecast due to higher than expected membership and revenue growth. In addition, content and marketing expenses were lower than we expected, as the pandemic delayed some planned spend. EPS of $1.59 vs. $0.60 a year ago included a $119m non-cash unrealized loss from F/X remeasurement on our Euro denominated debt and a $220m non-cash valuation allowance for deferred tax assets (due to recent legislation limiting the use of California R&D credits). Our Q2 effective tax rate of 30.5% includes about a 21% point negative impact due to the valuation allowance.

We added a Q2-record 10.1m paid memberships vs. 2.7m in last year’s Q2. The positive variance relative to our 7.5m forecast was due to better-than-forecast acquisition and retention. In the first half of this year, we’ve added 26m paid memberships, nearly on par with the 28m we achieved in all of 2019. However, as we expected (and can be seen in the graph below), growth is slowing as consumers get through the initial shock of Covid and social restrictions. Our paid net additions for the month of June also included the subscriptions we cancelled1 for the small percentage of members who had not used the service recently.

The quarterly guidance we provide is our actual internal forecast at the time we report and we strive for accuracy. We forecast 2.5m paid net adds for Q3’20 vs. 6.8m in the prior year quarter. As we indicated in our Q1’20 letter, we’re expecting paid net adds will be down year over year in the second half as our strong first half performance likely pulled forward some demand from the second half of the year. In addition, Q3’19 included the positive impact of new seasons of both Stranger Things and La Casa de Papel (aka Money Heist). We continue to view the quarter-to-quarter fluctuations in paid net adds as not that meaningful in the context of the long run adoption of internet entertainment which we believe provides us with many years of strong growth ahead.

__________________________________

1 https://media.netflix.com/en/company-blog/helping-members-who-havent-been-watching-cancel

| 2 | ||||

For the full year 2020, we’re still targeting a 16% operating margin. We’re currently on track to exceed 16% although F/X (and the relative strength of the US dollar) remains a wildcard. As always, our intention is to grow our annual operating margin year over year - we’re currently targeting 19% for 2021.

Content

As the world slowly re-opens, our main business priority is to restart our productions safely and in a manner consistent with local health and safety standards to ensure that our members can enjoy a diverse range of high quality new content. Given the significant differences between countries (e.g., incidence of new Covid-19 cases, availability of testing, government and industry regulations), there is no one-size-fits-all approach, and we’re adapting to local circumstances.

Today, we’re slowly resuming productions in many parts of the world. We are furthest along in Asia Pacific (where we never fully shut down in Korea, for example) and are now shooting live action series like season 2 of our Japanese original The Naked Director. In EMEA, we are now back in production in many countries, including Germany, France, Spain, Poland, Italy, and the UK. While we recently resumed production on two films in California and two stop-motion animation projects in Oregon and expect some more of our US productions to get going this quarter, current infection trends create more uncertainty for our productions in the US. Parts of the world like India and some of Latin America are also more challenging and we are hoping to restart later in the year in these regions.

Since our content production lead time is long, our 2020 plans for launching original shows and films continue to be largely intact. For 2021, based on our current plan, we expect the paused productions will lead to a more second half weighted content slate in terms of our big titles, although we anticipate the total number of originals for the full year will still be higher than 2020. We’ll also round out our content offering with film acquisitions like The Trial of the Chicago 7 from Aaron Sorkin and The Spongebob Movie: Sponge on the Run (global excluding US and China). We also acquired nearly completed seasons of unreleased original series like Cobra Kai (seasons 1, 2 and a brand new season 3) and Emily in Paris starring Lily Collins.

The pandemic and pauses in production are impacting our competitors and suppliers similarly. With our large library of thousands of titles and strong recommendations, we believe our member satisfaction will remain high.

In Q2, we notched successes in many of our key content verticals. In English scripted TV, Never Have I Ever, a fun, young adult dramedy from Mindy Kaling, broke through with 40m households choosing to watch this show in its first four weeks, and 40m households for our new comedy Space Force (starring Steve Carell). On the heels of Love is Blind, Too Hot to Handle and Floor is Lava are the latest in our line of buzzy unscripted shows (51m and a projected 37m households, respectively, in the first four weeks).

In original films, 27 million households chose to watch Spike Lee’s Da 5 Bloods, which was celebrated as a “soul stirring film for the ages.2” Extraction (starring Chris Hemsworth) and The Wrong Missy, a comedy starring David Spade and Lauren Lapkus, were also big hits with audiences (99m and 59m households, respectively, choosing to watch in their first 28 days). In addition, The Willoughbys3 (38m households in the first four weeks) is an example of the level of animated feature film we are ramping towards to bolster our offering for kids and families.

___________________________________

2 https://www.rollingstone.com/movies/movie-reviews/da-5-bloods-movie-review-spike-lee-netflix-997311/

3 https://variety.com/2020/film/news/netflix-the-willoughbys-ratings-1234614384/

| 3 | ||||

We also saw increased viewing for some older titles like 13th, American Son and Dear White People - all part of our Black Lives Matter Collection4 - as our members sought out stories that speak to racial injustice and the Black experience in America.

Our local language originals - like Dark in Germany, Control Z in Mexico, Extracurricular in Korea, The Woods in Poland, or Blood & Water in South Africa - continue to be highly impactful, driving large viewing, buzz and sign-ups in their home countries. We continue to see these stories find audiences all over the world. The best example of this was La Casa de Papel (aka Money Heist): Part 4, which we launched on April 3; through its first 28 days, 65m households chose to watch this hit show.

For Q3, we recently released The Old Guard (starring Charlize Theron), which continues our recent string of adrenaline-filled action movies. Later in July, we’re looking forward to launching season 2 of The Umbrella Academy5, followed by The Kissing Booth 26 (the sequel to our hit romantic comedy), Project Power7 (an action movie starring Jamie Foxx) and Enola Holmes (featuring Millie Bobbie Brown as the sister of Sherlock Holmes, played by Henry Cavill) later in the quarter.

Product and Partnerships

We continue to test different pricing approaches in some countries including lower priced, mobile-only plans and our bundled offerings with MVPDs and ISPs. While some of these carry lower ARPU, the goal is to accelerate membership growth on neutral-to-better short term revenue (with incremental acquisition and improved retention offsetting the lower price). We think this strategy will increase long term revenue as a larger membership base can generate more word-of-mouth around our content and help us better understand peoples’ needs in that country - so that we can more quickly improve our catalog and product experience, which would then lead to higher member satisfaction and growth as well as improved long term retention.

A very small percentage of our members have not watched anything for the last two years and although we make it easy for people to cancel their subscriptions with just a few clicks, they have not taken advantage of that ability. So we decided to stop billing them and will do so for members meeting the same criteria going forward. Like all of our former members, they can easily restart their membership in the future. While this change resulted in a slight hit to revenue, we believe that pro-consumer policies like this are the right thing to do and that the long term benefits will outweigh the short term costs. In a world where consumers have many subscriptions, auto-pause on billing after an extended period of non-use should be how leading services operate.

Competition

All of the major entertainment companies like WarnerMedia, Disney and NBCUniversal are pushing their own streaming services and two of the most valuable companies in the world, Apple and Amazon, are growing their investment in premium content. In addition, TikTok’s growth is astounding, showing the fluidity of internet entertainment. Instead of worrying about all these competitors, we continue to stick to our strategy of trying to improve our service and content every quarter faster than our peers. Our continued strong growth is a testament to this approach and the size of the entertainment market.

___________________________________

4 https://variety.com/2020/digital/news/netflix-black-lives-matter-collection-1234630160/

5 https://www.youtube.com/watch?v=QGAlNkI3mJQ&feature=youtu.be

6 https://www.youtube.com/watch?v=fjVonI2oVeM

7 https://www.youtube.com/watch?v=xw1vQgVaYNQ&feature=youtu.be

| 4 | ||||

Cash Flow and Capital Structure

Net cash generated in operating activities in Q2 was +$1 billion vs. -$544 million in the prior year period. Free cash flow8 was positive for a second consecutive quarter at +$899m vs. -$594 million. Free cash flow was higher than net income due primarily to the loss on FX remeasurement and the valuation allowance for deferred tax assets, both of which were non-cash items that reduced net income.

Our FCF profile is continuing to improve, which is being driven in part by our growing operating margin and the digestion of our big move into the production of Netflix originals that requires more cash upfront vs. licensed content. In addition, the pause in production has also pushed out cash spending on content into the second half of 2020 and into 2021.

Due to the pause in production from the pandemic combined with higher-than-forecast paid net adds year to date, we now expect free cash flow for the full year 2020 to be breakeven to positive, compared with our prior expectation for -$1 billion or better. As we indicated last quarter, in 2021 we project that full year free cash flow will dip back to being negative again, although we believe the FCF deficit will be materially better than our peak deficit level of -$3.3 billion in 2019. There has been no material change in our overall estimated timetable to reach consistent annual positive FCF within the next few years.

We’re often asked by investors what our FCF profile would be at “steady state” or when our cash content spending matches our content amortization. The pandemic and the resulting pause in productions provides one early snapshot of what that may look like. In Q2’20, our cash spending on content was $2.6 billion, equivalent to our content amortization of $2.6 billion, or a 1x cash content-to-content amortization ratio9. This resulted in a FCF margin of +15% in Q2. Of course, our plan is to continue to grow our content spend (as we don’t believe we are anywhere near maturity), but the above analysis may prove illustrative. And by the time our cash content-to-content amortization ratio reaches 1x on a sustained basis (which is still many years away), we hope to have many more members and much greater revenue, operating margin and FCF.

In April, we raised $1 billion of debt at a blended rate of ~3.3% across both US dollar and Euro tranches. We ended Q2 with more than $7 billion of cash and cash equivalents on our balance sheet.

As part of our commitment to racial equity, we allocated about two percent of our cash holdings - initially up to $100 million - into financial institutions and organizations that directly support Black communities10 in the US. We hope other US large-caps will also consider taking this small and relatively easy step to bolster US racial economic equity.

With our cash balance, $750 million credit facility (which remains undrawn) and improving FCF profile, we have sufficient liquidity to fund our operations for over 12 months. As a result, we don’t expect to access the debt markets for the remainder of 2020 and we believe our need for external financing is diminishing.

___________________________________

8 For a reconciliation of free cash flow to net cash provided by (used in) operating activities, please refer to the reconciliation in tabular form on the attached unaudited financial statements and the footnotes thereto.

9 For additional details on these concepts, please refer to our Content Accounting Overview slide deck on our investor relations site - https://www.netflixinvestor.com/ir-overview/profile/default.aspx

10 https://media.netflix.com/en/company-blog/building-economic-opportunity-for-black-communities

| 5 | ||||

Reference

For quick reference, our eight most recent investor letters are: April 2020,11 January 2020,12 October 2019,13 July 2019,14 April 2019,15 January 2019,16 October 2018,17 July 2018.18

Regional Breakdown

| (in millions) | Q2'19 | Q3'19 | Q4'19 | Q1'20 | Q2'20 | ||||||||||||

| UCAN Streaming: | |||||||||||||||||

| Revenue | $ | 2,501 | $ | 2,621 | $ | 2,672 | $ | 2,703 | $ | 2,840 | |||||||

| Paid Memberships | 66.50 | 67.11 | 67.66 | 69.97 | 72.90 | ||||||||||||

| Paid Net Additions | (0.13) | 0.61 | 0.55 | 2.31 | 2.94 | ||||||||||||

| ARPU | $ | 12.52 | $ | 13.08 | $ | 13.22 | $ | 13.09 | $ | 13.25 | |||||||

| Y/Y % Growth | 12 | % | 17 | % | 17 | % | 14 | % | 6 | % | |||||||

| F/X Neutral Y/Y % ARPU Growth | 13 | % | 17 | % | 17 | % | 14 | % | 6 | % | |||||||

| EMEA: | |||||||||||||||||

| Revenue | $ | 1,319 | $ | 1,428 | $ | 1,563 | $ | 1,723 | $ | 1,893 | |||||||

| Paid Memberships | 44.23 | 47.36 | 51.78 | 58.73 | 61.48 | ||||||||||||

| Paid Net Additions | 1.69 | 3.13 | 4.42 | 6.96 | 2.75 | ||||||||||||

| ARPU | $ | 10.13 | $ | 10.40 | $ | 10.51 | $ | 10.40 | $ | 10.50 | |||||||

| Y/Y % Growth | (6) | % | 1 | % | 3 | % | 2 | % | 4 | % | |||||||

| F/X Neutral Y/Y % ARPU Growth | 3 | % | 6 | % | 7 | % | 4 | % | 8 | % | |||||||

| LATAM: | |||||||||||||||||

| Revenue | $ | 677 | $ | 741 | $ | 746 | $ | 793 | $ | 785 | |||||||

| Paid Memberships | 27.89 | 29.38 | 31.42 | 34.32 | 36.07 | ||||||||||||

| Paid Net Additions | 0.34 | 1.49 | 2.04 | 2.90 | 1.75 | ||||||||||||

| ARPU | $ | 8.14 | $ | 8.63 | $ | 8.18 | $ | 8.05 | $ | 7.44 | |||||||

| Y/Y % Growth | (5) | % | 8 | % | 9 | % | 3 | % | (9) | % | |||||||

| F/X Neutral Y/Y % ARPU Growth | 12 | % | 17 | % | 18 | % | 12 | % | 13 | % | |||||||

| APAC: | |||||||||||||||||

| Revenue | $ | 349 | $ | 382 | $ | 418 | $ | 484 | $ | 569 | |||||||

| Paid Memberships | 12.94 | 14.49 | 16.23 | 19.84 | 22.49 | ||||||||||||

| Paid Net Additions | 0.80 | 1.54 | 1.75 | 3.60 | 2.66 | ||||||||||||

| ARPU | $ | 9.29 | $ | 9.29 | $ | 9.07 | $ | 8.94 | $ | 8.96 | |||||||

| Y/Y % Growth | (1) | % | — | % | (1) | % | (5) | % | (4) | % | |||||||

| F/X Neutral Y/Y % ARPU Growth | 5 | % | 3 | % | — | % | (3) | % | 1 | % | |||||||

___________________________________

11 https://s22.q4cdn.com/959853165/files/doc_financials/2020/q1/updated/FINAL-Q1-20-Shareholder-Letter.pdf

12 https://s22.q4cdn.com/959853165/files/doc_financials/2019/q4/FINAL-Q4-19-Shareholder-Letter.pdf

13 https://s22.q4cdn.com/959853165/files/doc_financials/quarterly_reports/2019/q3/FINAL-Q3-19-Shareholder-Letter.pdf

14 https://s22.q4cdn.com/959853165/files/doc_financials/quarterly_reports/2019/q2/Q2-19-Shareholder-Letter-FINAL.pdf

15 https://s22.q4cdn.com/959853165/files/doc_financials/quarterly_reports/2019/q1/FINAL-Q1-19-Shareholder-Letter.pdf

16 https://s22.q4cdn.com/959853165/files/doc_financials/quarterly_reports/2018/q4/01/FINAL-Q4-18-Shareholder-Letter.pdf

17 https://s22.q4cdn.com/959853165/files/doc_financials/quarterly_reports/2018/q3/FINAL-Q3-18-Shareholder-Letter.pdf

18 https://s22.q4cdn.com/959853165/files/doc_financials/quarterly_reports/2018/q2/FINAL-Q2-18-Shareholder-Letter.pdf

| 6 | ||||

July 16, 2020 Earnings Interview, 3pm PT

Our video interview with Kannan Venkateshwar of Barclays Capital will be on youtube/netflixir at 3pm PT today. Questions that investors would like to see asked should be sent to kannan.venkateshwar@barclayscapital.com. Reed Hastings, co-CEO, Spence Neumann, CFO, Ted Sarandos, co-CEO and Chief Content Officer, Greg Peters, COO and Chief Product Officer and Spencer Wang, VP of IR/Corporate Development will all be on the video to answer Kannan’s questions.

IR Contact: | PR Contact: | ||||

Spencer Wang | Richard Siklos | ||||

VP, Finance/IR & Corporate Development | VP, Communications | ||||

408 809-5360 | 408 540-2629 | ||||

| 7 | ||||

Use of Non-GAAP Measures

This shareholder letter and its attachments include reference to the non-GAAP financial measure of free cash flow and adjusted EBITDA. Management believes that free cash flow and adjusted EBITDA are important liquidity metrics because they measure, during a given period, the amount of cash generated that is available to repay debt obligations, make investments and for certain other activities or the amount of cash used in operations, including investments in global streaming content. However, these non-GAAP measures should be considered in addition to, not as a substitute for or superior to, net income, operating income, diluted earnings per share and net cash provided by operating activities, or other financial measures prepared in accordance with GAAP. Reconciliation to the GAAP equivalent of these non-GAAP measures are contained in tabular form on the attached unaudited financial statements.

Forward-Looking Statements

This shareholder letter contains certain forward-looking statements within the meaning of the federal

securities laws, including statements regarding future content offerings and the timing of such offerings, including the uncertainty introduced by the Coronavirus pandemic; restarting productions; watch metrics for certain titles; product tests, including those around pricing, and the anticipated impact of such tests; impact of competition; future capital raises and external financing needs; global streaming paid members, paid net additions and membership growth; paid net additions, consolidated revenue, revenue growth, operating income, operating margin, net income, and earnings per share; and free cash flow, including future free cash flow profile and margin. The forward-looking statements in this letter are subject to risks and uncertainties that could cause actual results and events to differ, including, without limitation: our ability to attract new members and retain existing members; our ability to compete effectively; maintenance and expansion of device platforms for streaming; fluctuations in consumer usage of our service; service disruptions; production risks, including those related to the Coronavirus pandemic; and, competition, including consumer adoption of different modes of viewing in-home filmed entertainment. A detailed discussion of these and other risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K, filed with the Securities and Exchange Commission (“SEC”) on January 29, 2020, as updated in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020. The Company provides internal forecast numbers. Investors should anticipate that actual performance will vary from these forecast numbers based on risks and uncertainties discussed above and in our Annual Report on Form 10-K, as updated by Form 10-Q for the quarter ended March 31, 2020. We undertake no obligation to update forward-looking statements to reflect events or circumstances occurring after the date of this shareholder letter.

| 8 | ||||

Netflix, Inc.

Consolidated Statements of Operations

(unaudited)

(in thousands, except per share data)

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||

| June 30, 2020 | March 31, 2020 | June 30, 2019 | June 30, 2020 | June 30, 2019 | |||||||||||||||||||||||||

| Revenues | $ | 6,148,286 | $ | 5,767,691 | $ | 4,923,116 | $ | 11,915,977 | $ | 9,444,108 | |||||||||||||||||||

Cost of revenues | 3,643,707 | 3,599,701 | 3,005,657 | 7,243,408 | 5,876,271 | ||||||||||||||||||||||||

Marketing | 434,370 | 503,830 | 603,150 | 938,200 | 1,219,728 | ||||||||||||||||||||||||

Technology and development | 435,045 | 453,817 | 383,233 | 888,862 | 755,997 | ||||||||||||||||||||||||

General and administrative | 277,236 | 252,087 | 224,657 | 529,323 | 426,609 | ||||||||||||||||||||||||

| Operating income | 1,357,928 | 958,256 | 706,419 | 2,316,184 | 1,165,503 | ||||||||||||||||||||||||

| Other income (expense): | |||||||||||||||||||||||||||||

| Interest expense | (189,151) | (184,083) | (152,033) | (373,234) | (287,562) | ||||||||||||||||||||||||

| Interest and other income (expense) | (133,175) | 21,697 | (53,470) | (111,478) | 22,634 | ||||||||||||||||||||||||

| Income before income taxes | 1,035,602 | 795,870 | 500,916 | 1,831,472 | 900,575 | ||||||||||||||||||||||||

| Provision for income taxes | 315,406 | 86,803 | 230,266 | 402,209 | 285,873 | ||||||||||||||||||||||||

| Net income | $ | 720,196 | $ | 709,067 | $ | 270,650 | $ | 1,429,263 | $ | 614,702 | |||||||||||||||||||

| Earnings per share: | |||||||||||||||||||||||||||||

| Basic | $ | 1.63 | $ | 1.61 | $ | 0.62 | $ | 3.25 | $ | 1.41 | |||||||||||||||||||

| Diluted | $ | 1.59 | $ | 1.57 | $ | 0.60 | $ | 3.15 | $ | 1.36 | |||||||||||||||||||

| Weighted-average common shares outstanding: | |||||||||||||||||||||||||||||

| Basic | 440,569 | 439,352 | 437,587 | 439,961 | 437,271 | ||||||||||||||||||||||||

| Diluted | 453,945 | 452,494 | 452,195 | 453,220 | 452,063 | ||||||||||||||||||||||||

| 9 | ||||

Netflix, Inc.

Consolidated Balance Sheets

(in thousands)

| As of | |||||||||||

| June 30, 2020 | December 31, 2019 | ||||||||||

| (unaudited) | |||||||||||

| Assets | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 7,153,248 | $ | 5,018,437 | |||||||

| Other current assets | 1,410,891 | 1,160,067 | |||||||||

| Total current assets | 8,564,139 | 6,178,504 | |||||||||

| Content assets, net | 25,155,117 | 24,504,567 | |||||||||

| Property and equipment, net | 751,941 | 565,221 | |||||||||

| Other non-current assets | 2,704,084 | 2,727,420 | |||||||||

| Total assets | $ | 37,175,281 | $ | 33,975,712 | |||||||

| Liabilities and Stockholders' Equity | |||||||||||

| Current liabilities: | |||||||||||

| Current content liabilities | $ | 4,664,733 | $ | 4,413,561 | |||||||

| Accounts payable | 446,668 | 674,347 | |||||||||

| Accrued expenses and other liabilities | 986,595 | 843,043 | |||||||||

| Deferred revenue | 1,029,261 | 924,745 | |||||||||

| Short-term debt | 499,161 | — | |||||||||

| Total current liabilities | 7,626,418 | 6,855,696 | |||||||||

| Non-current content liabilities | 3,208,164 | 3,334,323 | |||||||||

| Long-term debt | 15,294,998 | 14,759,260 | |||||||||

| Other non-current liabilities | 1,710,948 | 1,444,276 | |||||||||

| Total liabilities | 27,840,528 | 26,393,555 | |||||||||

| Stockholders' equity: | |||||||||||

| Common stock | 3,127,813 | 2,793,929 | |||||||||

| Accumulated other comprehensive loss | (34,072) | (23,521) | |||||||||

| Retained earnings | 6,241,012 | 4,811,749 | |||||||||

| Total stockholders' equity | 9,334,753 | 7,582,157 | |||||||||

| Total liabilities and stockholders' equity | $ | 37,175,281 | $ | 33,975,712 | |||||||

| 10 | ||||

Netflix, Inc.

Consolidated Statements of Cash Flows

(unaudited)

(in thousands)

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||

| June 30, 2020 | March 31, 2020 | June 30, 2019 | June 30, 2020 | June 30, 2019 | |||||||||||||||||||||||||

| Cash flows from operating activities: | |||||||||||||||||||||||||||||

| Net income | $ | 720,196 | $ | 709,067 | $ | 270,650 | $ | 1,429,263 | $ | 614,702 | |||||||||||||||||||

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | |||||||||||||||||||||||||||||

| Additions to content assets | (2,510,782) | (3,294,275) | (3,325,103) | (5,805,057) | (6,322,849) | ||||||||||||||||||||||||

| Change in content liabilities | (108,432) | 258,945 | (12,414) | 150,513 | (27,112) | ||||||||||||||||||||||||

| Amortization of content assets | 2,607,159 | 2,483,385 | 2,231,915 | 5,090,544 | 4,356,601 | ||||||||||||||||||||||||

| Depreciation and amortization of property, equipment and intangibles | 26,661 | 28,517 | 25,496 | 55,178 | 49,057 | ||||||||||||||||||||||||

| Stock-based compensation expense | 104,210 | 97,019 | 103,848 | 201,229 | 205,048 | ||||||||||||||||||||||||

| Other non-cash items | 70,301 | 65,448 | 60,695 | 135,749 | 106,403 | ||||||||||||||||||||||||

| Foreign currency remeasurement loss (gain) on debt | 119,161 | (93,060) | 61,284 | 26,101 | 3,684 | ||||||||||||||||||||||||

| Deferred taxes | 223,308 | 46,619 | 35,519 | 269,927 | 42,146 | ||||||||||||||||||||||||

| Changes in operating assets and liabilities: | |||||||||||||||||||||||||||||

| Other current assets | 3,066 | (127,353) | (24,231) | (124,287) | (56,307) | ||||||||||||||||||||||||

| Accounts payable | (112,027) | (149,153) | (2,674) | (261,180) | (127,141) | ||||||||||||||||||||||||

| Accrued expenses and other liabilities | (105,450) | 214,191 | (26,705) | 108,741 | 130,942 | ||||||||||||||||||||||||

| Deferred revenue | 42,508 | 62,008 | 84,085 | 104,516 | 131,878 | ||||||||||||||||||||||||

| Other non-current assets and liabilities | (38,803) | (41,446) | (26,119) | (80,249) | (30,605) | ||||||||||||||||||||||||

| Net cash provided by (used in) operating activities | 1,041,076 | 259,912 | (543,754) | 1,300,988 | (923,553) | ||||||||||||||||||||||||

| Cash flows from investing activities: | |||||||||||||||||||||||||||||

| Purchases of property and equipment | (141,741) | (98,015) | (39,584) | (239,756) | (99,965) | ||||||||||||||||||||||||

| Change in other assets | (260) | (288) | (10,452) | (548) | (30,174) | ||||||||||||||||||||||||

| Net cash used in investing activities | (142,001) | (98,303) | (50,036) | (240,304) | (130,139) | ||||||||||||||||||||||||

| Cash flows from financing activities: | |||||||||||||||||||||||||||||

| Proceeds from issuance of debt | 1,009,464 | — | 2,243,196 | 1,009,464 | 2,243,196 | ||||||||||||||||||||||||

| Debt issuance costs | (7,559) | — | (18,192) | (7,559) | (18,192) | ||||||||||||||||||||||||

| Proceeds from issuance of common stock | 89,060 | 43,694 | 21,896 | 132,754 | 44,868 | ||||||||||||||||||||||||

| Net cash provided by financing activities | 1,090,965 | 43,694 | 2,246,900 | 1,134,659 | 2,269,872 | ||||||||||||||||||||||||

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash | 11,819 | (70,902) | 4,998 | (59,083) | (16) | ||||||||||||||||||||||||

| Net increase in cash, cash equivalents, and restricted cash | 2,001,859 | 134,401 | 1,658,108 | 2,136,260 | 1,216,164 | ||||||||||||||||||||||||

| Cash, cash equivalents and restricted cash at beginning of period | 5,178,187 | 5,043,786 | 3,370,097 | 5,043,786 | 3,812,041 | ||||||||||||||||||||||||

| Cash, cash equivalents and restricted cash at end of period | $ | 7,180,046 | $ | 5,178,187 | $ | 5,028,205 | $ | 7,180,046 | $ | 5,028,205 | |||||||||||||||||||

| Three Months Ended | Six Months Ended | ||||||||||||||||||||||||||||

| June 30, 2020 | March 31, 2020 | June 30, 2019 | June 30, 2020 | June 30, 2019 | |||||||||||||||||||||||||

| Non-GAAP free cash flow reconciliation: | |||||||||||||||||||||||||||||

| Net cash provided by (used in) operating activities | $ | 1,041,076 | $ | 259,912 | $ | (543,754) | $ | 1,300,988 | $ | (923,553) | |||||||||||||||||||

| Net cash used in investing activities | (142,001) | (98,303) | (50,036) | (240,304) | (130,139) | ||||||||||||||||||||||||

| Non-GAAP free cash flow | $ | 899,075 | $ | 161,609 | $ | (593,790) | $ | 1,060,684 | $ | (1,053,692) | |||||||||||||||||||

| 11 | ||||

Netflix, Inc.

Non-GAAP Information

(unaudited)

(in thousands)

| June 30, 2019 | September 30, 2019 | December 31, 2019 | March 31, 2020 | June 30, 2020 | |||||||||||||||||||||||||

| Non-GAAP Adjusted EBITDA reconciliation: | |||||||||||||||||||||||||||||

| GAAP net income | $ | 270,650 | $ | 665,244 | $ | 586,970 | $ | 709,067 | $ | 720,196 | |||||||||||||||||||

| Add: | |||||||||||||||||||||||||||||

| Other expense (income) | 205,503 | (32,084) | 309,179 | 162,386 | 322,326 | ||||||||||||||||||||||||

| Provision for (benefit from) income taxes | 230,266 | 347,079 | (437,637) | 86,803 | 315,406 | ||||||||||||||||||||||||

| Depreciation and amortization of property, equipment and intangibles | 25,496 | 26,704 | 27,818 | 28,517 | 26,661 | ||||||||||||||||||||||||

| Stock-based compensation expense | 103,848 | 100,262 | 100,066 | 97,019 | 104,210 | ||||||||||||||||||||||||

| Adjusted EBITDA | $ | 835,763 | $ | 1,107,205 | $ | 586,396 | $ | 1,083,792 | $ | 1,488,799 | |||||||||||||||||||

| 12 | ||||