Attached files

| file | filename |

|---|---|

| EX-23.2 - Clean Energy Technologies, Inc. | ex23-2.htm |

| EX-10.114 - Clean Energy Technologies, Inc. | ex10-114.htm |

| EX-5.1 - Clean Energy Technologies, Inc. | ex5-1.htm |

As filed with the Securities and Exchange Commission on July 14, 2020

Registration No. 333-______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

CLEAN ENERGY TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 3990 | 20-2675800 | ||

(State or Other Jurisdiction of Incorporation) |

(Primary Standard Classification Code) |

(IRS Employer Identification No.) |

2990 Redhill Ave,

Costa Mesa, California 92626

Telephone: (949) 273-4990

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Kambiz Mahdi

Chief Executive Officer

Clean Energy Technologies, Inc.

2990 Redhill Ave,

Costa Mesa, California 92626

Telephone: (949) 273-4990

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

The Newman Law Firm, PLLC

1872 Pleasantville Road, Suite 177

Briarcliff Manor, NY 10510

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [X]

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | [ ] | Accelerated filer | [ ] | |

| Non-accelerated filer | [X] | Smaller reporting company | [X] | |

| Emerging growth company | [ ] | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. [ ]

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered | Amount To Be Registered(1) | Proposed Maximum Offering Price Per Share(2) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee(3) | ||||||||||||

| Common Stock, $0.001 par value | 74,720,000 | $ | $ | 1,298,633 | $ | 168.56 | ||||||||||

| Total: | $ | $ | ||||||||||||||

| (1) | In accordance with Rule 416(a), this registration statement shall also cover an indeterminate number of shares that may be issued and resold resulting from stock splits, stock dividends or similar transactions. |

| (2) | Estimated pursuant to Rule 457(c) under the Securities Act of 1933, as amended (the “Securities Act”), based on the average of the closing prices as reported on the OTCQB within 5 business days prior to the date of the filing of this Registration Statement. |

| (3) | The fee is calculated at a rate of $129.80 per million dollars, pursuant to Section 6(b) of the Securities Act of 1933. |

| The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said section 8(a), may determine. | |

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion. Dated July 14, 2020. |

PRELIMINARY PROSPECTUS

CLEAN ENERGY TECHNOLOGIES, INC.

74,720,000 Shares of Common Stock

The selling stockholder identified in this prospectus may offer an indeterminate number of shares of its common stock, which will consist of up to 74,720,000 shares of common stock to be sold by GHS Investments LLC (“GHS”) pursuant to an Equity Financing Agreement (the “Financing Agreement”) dated June 8, 2020. If issued presently, the 74,720,000 shares of common stock registered for resale by GHS would represent 10% of our issued and outstanding shares of common stock as of July 14, 2020. Additionally, the 74,720,000shares of our common stock registered for resale herein would represent approximately 30% of the Company’s public float which would not include 764,562 shares of our common stock currently held by GHS.

The selling stockholder may sell all or a portion of the shares being offered pursuant to this prospectus at fixed prices and prevailing market prices at the time of sale, at varying prices, or at negotiated prices. See the section of this prospectus entitled “Plan of Distribution” for additional information.

We will not receive any proceeds from the sale of the shares of our common stock by GHS. We will sell shares to GHS at a price equal to 80% of the two day average lowest closing price of our common stock during the ten (10) consecutive trading day period beginning on the date on which we deliver a put notice to GHS (the “Market Price”). There will be a minimum of ten (10) trading days between purchases.

GHS is an underwriter within the meaning of the Securities Act of 1933, and any broker-dealers or agents that are involved in selling the shares may be deemed to be “underwriters” within the meaning of the Securities Act of 1933 in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act of 1933.

Our common stock is traded on OTCQB Markets under the symbol “CETY”. On July 1, 2020, the reported closing price for our common stock was $0.018 per share.

This offering is highly speculative, and these securities involve a high degree of risk and should be considered only by persons who can afford the loss of their entire investment. See “Risk Factors” beginning on page [●]. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is July 14, 2020.

| 2 |

TABLE OF CONTENTS

You may only rely on the information contained in this prospectus or that we have referred you to. We have not authorized any person to give you any supplemental information or to make any representations for us. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the Common Stock offered by this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any Common Stock in any circumstances in which such offer or solicitation is unlawful. Neither the delivery of this prospectus nor any sale made in connection with this prospectus shall, under any circumstances, create any implication that there has been no change in our affairs since the date of this prospectus is correct as of any time after its date. You should not rely upon any information about our company that is not contained in this prospectus. Information contained in this prospectus may become stale. You should not assume the information contained in this prospectus or any prospectus supplement is accurate as of any date other than their respective dates, regardless of the time of delivery of this prospectus, any prospectus supplement or of any sale of the shares. Our business, financial condition, results of operations, and prospects may have changed since those dates. The selling stockholders are offering to sell and seeking offers to buy shares of our common stock only in jurisdictions where offers and sales are permitted.

| 3 |

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our financial statements and the related notes and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in each case included elsewhere in this prospectus.

Unless the context otherwise requires, references to “we,” “our,” “us,” or the “Company” in this prospectus mean Clean Energy Technologies, Inc. on a consolidated basis with its wholly-owned subsidiaries.

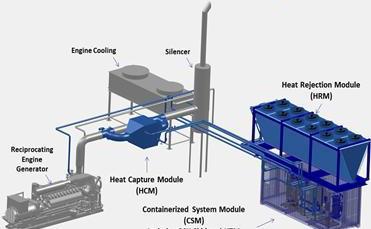

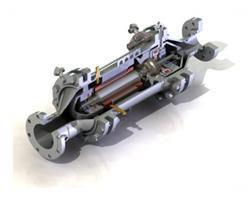

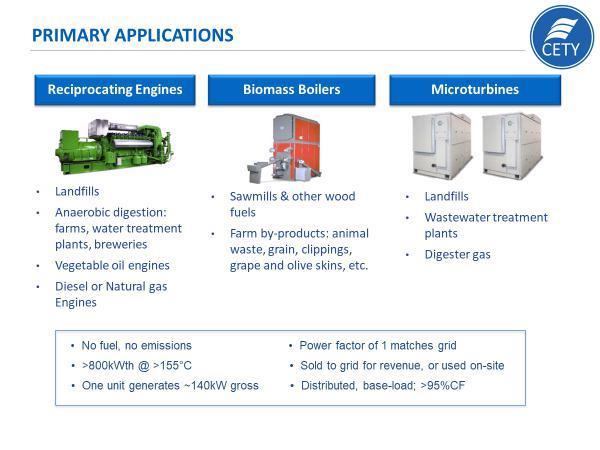

We design, produce and market clean energy products and integrated solutions focused on energy efficiency and renewables. Our initial principal product is the Clean CycleTM heat generator, offered through our wholly owned subsidiary Heat Recovery Solutions, (HRS). The Clean CycleTM generator captures waste heat from a variety of sources and turns it into electricity. By using our Clean CycleTM generator commercial and industrial heat generators boost their overall energy efficiency and the savings created provide our customers with a fast return on their investment. The Clean CycleTM generator saves fuel, reduces pollution and requires little maintenance. We also use our Clean CycleTM generator to manufacture Biomass Power Plants and Co-generation Distribution Power Plants that produce clean energy.

Industrial facilities, power plants, high rise buildings and waste to energy plants currently waste heat and energy during their production processes. Our Clean Cycle TM generators are used in commercial and industrial heat generators to boost their overall energy efficiency. Our products save fuel, reduce pollution, require little maintenance and provide an attractive return on investment.

|

| |

| Clean Cycle II Heat Generator | Containerized Clean Cycle II Heat Generator |

We compete based on efficiency, maintenance and our customer’s return on investment. We have an exclusive license from Calnetix to use their magnetic turbine for heat waste recovery applications. We believe that the magnetic turbine technology is more efficient than our competitor’s turbines which allows our systems to generate more electricity at lower heat ranges. Because our generator is magnetic, it requires far less maintenance than our competitors who use oil, gearbox and rubber seals in their turbines. We have the advantage of selling a system that was originally manufactured and sold by General Electric International so our Clean CycleTM generator has a substantial market base and we believe has a reputation as one of the defacto standards in the market.

| 4 |

Our greatest advantage is that the Clean CycleTM generator is a product that can be delivered on a turnkey basis, not a major project that needs to be designed, manufactured and installed. We believe that this is one of the most distinguishing features of our Clean Cycle™ generator, as it significantly reduces the time our customers spend on installation, improves the speed with which we can deliver our product and reduces startup costs.

Over 123 Clean CycleTM generators are installed to date with 88 units used in biomass/landfill projects, 4 with diesel electric generators, 3 with turbine electric generators and 26 in industrial electric production applications.

The Clean CycleTM generator is delivered on a turnkey basis and does not require major planning for design, manufacturing and installation. In addition to attractive returns on capital investment, we believe that the ease of installation distinguishes our Clean Cycle™ generators by significantly reducing installation time, improving delivery times and lowering costs.

A Complete ORC System

We estimate that one clean system using our Clean CycleTM generator can generate 1 GWh of electricity per year from waste heat and avoid more than 350 metric tons of CO2 per year which we estimate is the annual equivalent of the CO2 emissions of approximately 200 cars.

Our goal is to become a leading provider of renewable and energy efficiency products and solutions by helping commercial companies and municipalities eliminate energy waste, reduce emissions, lower cost and generate incremental revenue.

Company Information and History

We were incorporated in California in July 1995 under the name Probe Manufacturing Industries, Inc. We redomiciled to Nevada in April 2005 under the name Probe Manufacturing, Inc. We manufactured electronics and provided services to original equipment manufacturers (OEMs) of industrial, automotive, semiconductor, medical, communication, military, and high technology products. On September 11, 2015 Clean Energy HRS, or “CE HRS”, our wholly owned subsidiary acquired the assets of Heat Recovery Solutions from General Electric International. In November 2015, we changed our name to Clean Energy Technologies, Inc.

Our principal executive offices are located at 2990 Redhill Avenue, Costa Mesa, CA 92626. Our telephone number is (949) 273-4990. Our common stock is listed on the OTCQB Markets under the symbol “CETY.”

Our internet website address is www.cetyinc.com and our subsidiary’s web site is www.heatrecoverysolutions.com.

The Company has three reportable segments: Clean Energy HRS (HRS), Cety Europe and the legacy electronic contract manufacturing services (Electronic Assembly) division.

| 5 |

Employees

We presently have 12 employees, including production, program management, materials management, engineering, sales, quality, and administrative and management personnel. We have never experienced work stoppages and we are not a party to any collective bargaining agreement. We have one employee that works full time in CETY Europe and 1 full time employee in our Electronics Assembly segment.

GHS Equity Financing Agreement and Registration Rights Agreement

On June 8, 2020, we entered into an Equity Financing Agreement (“Equity Financing Agreement”) and Registration Rights Agreement (“Registration Rights Agreement”) with GHS Investments LLC, a Nevada limited liability company (“GHS”). Under the terms of the Equity Financing Agreement, GHS agreed to provide the Company with up to $2,000,000 upon effectiveness of a registration statement on Form S-1 (the “Registration Statement”) filed with the U.S. Securities and Exchange Commission (the “Commission”)

Following effectiveness of the Registration Statement, the Company shall have the discretion to deliver puts (each, a “Put”) to GHS and GHS will be obligated to purchase shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”) based on the investment amount specified in each Put notice. The maximum amount that the Company shall be entitled to put to GHS in each Put notice shall not be less than $10,000 nor exceed two hundred percent (200%) of the average daily trading dollar volume of the Company’s Common Stock during the ten (10) trading days preceding the put, or $400,000. Pursuant to the Equity Financing Agreement, GHS and its affiliates will not be permitted to purchase shares, and the Company may not request Puts from GHS, that would result in GHS’s beneficial ownership equaling more than 4.99% of the Company’s outstanding Common Stock. The price of each share in a Put shall be equal to eighty percent (80%) of the average of the lowest two closing prices for the 10 days prior to the Put notice from the Company (the “Purchase Price”). Puts may be delivered by the Company to GHS until (i) the earlier of thirty-six (36) months after the date of the Equity Financing Agreement, (ii) the date on which GHS has purchased an aggregate of $2,000,000 worth of Common Stock under the terms of the Equity Financing Agreement or (iii) such time the Registration Statement is no longer in effect. In accordance with the Equity Financing Agreement, the Company issued GHS 764,526 shares of its Common Stock which was equal to the Purchase Price as of the execution date of the Equity Financing Agreement and is obligated to issue $5,000 of Common Stock upon delivery of the second and third Puts at the then applicable Purchase Price.

The Registration Rights Agreement provides that the Company shall (i) use its best efforts to file with the Commission the Registration Statement within 30 days of the date of the Registration Rights Agreement; and (ii) use reasonable commercial efforts to have the Registration Statement declared effective by the Commission within 30 days after the date the Registration Statement is filed with the Commission, but in no event more than 90 days after the Registration Statement is filed.

| Shares currently outstanding (1): | 762,895,515 | |

| Shares being offered: | 74,720,000 | |

| Offering Price per share: | The selling stockholders may sell all or a portion of the shares being offered pursuant to this prospectus at fixed prices and prevailing market prices at the time of sale, at varying prices or at negotiated prices. | |

| Use of Proceeds: | We will not receive any proceeds from the sale of the shares of our common stock by the selling stockholder. | |

| Trading Symbol: | CETY | |

| Risk Factors: | See “Risk Factors” beginning on page [●] herein and the other information in this prospectus for a discussion of the factors you should consider before deciding to invest in shares of our common stock. |

(1)

The number of shares of our Common Stock outstanding prior to and to be outstanding immediately after this offering, as set forth in the table above, is based on 762,895,515 shares outstanding as of July 10, 2020, and excluding 74,720,000 shares of Common Stock issuable in this offering

| 6 |

| Clean Energy Technologies, Inc. | ||||||||

| Consolidated Statement of Operations | ||||||||

| for the three months ended March 31, | ||||||||

| 2020 | 2019 | |||||||

| Sales | $ | 858,816 | $ | 224,363 | ||||

| Cost of Goods Sold | 343,277 | 149,177 | ||||||

| Gross Profit | 515,539 | 75,186 | ||||||

| General and Administrative | ||||||||

| General and Administrative expense | 95,720 | 60,642 | ||||||

| Salaries | 209,547 | 203,303 | ||||||

| Travel | 29,158 | 40,117 | ||||||

| Professional Fees | 21,887 | 4,019 | ||||||

| Facility lease and Maintenance | 110,455 | 82,034 | ||||||

| Depreciation and Amortization | 9,443 | 11,763 | ||||||

| Total Expenses | 476,210 | 401,878 | ||||||

| Net Profit / (Loss) From Operations | 39,329 | (326,692 | ) | |||||

| Change in derivative liability | (130,994 | ) | (159,733 | ) | ||||

| Gain / (Loss) on debt settlement’ | 22,221 | - | ||||||

| Interest and Financing fees | (244,130 | ) | (240,352 | ) | ||||

| Net Profit / (Loss) Before Income Taxes | (313,574 | ) | (726,777 | ) | ||||

| Income Tax Expense | - | - | ||||||

| Net Profit / (Loss) | $ | (313,574 | ) | $ | (726,777 | ) | ||

| Per Share Information: | ||||||||

| Basic and diluted weighted average number of common shares outstanding | 758,170,513 | 566,027,100 | ||||||

| Net Profit / (Loss) per common share basic and diluted | $ | (0.00 | ) | $ | (0.00 | ) | ||

The accompanying footnotes are in integral part of these condensed consolidated financial statements.

| 7 |

| Clean Energy Technologies, Inc. | ||||||||

| Consolidated Statement of Operations | ||||||||

| For the years ended December 31, | ||||||||

| 2019 | 2018 | |||||||

| Sales | $ | 1,610,008 | $ | 1,331,171 | ||||

| Cost of Goods Sold | 952,782 | 810,489 | ||||||

| Gross Profit | 657,226 | 520,682 | ||||||

| General and Administrative | ||||||||

| General and Administrative expense | 382,871 | 232,571 | ||||||

| Salaries | 802,951 | 740,146 | ||||||

| Professional fees | 130,709 | 142,234 | ||||||

| Travel | 246,078 | 114,534 | ||||||

| Consulting | 73,443 | 79,084 | ||||||

| Bad Debt Expense | 128,463 | 50,000 | ||||||

| Facility lease | 305,883 | 280,239 | ||||||

| Depreciation and Amortization | 41,437 | 52,444 | ||||||

| Share Based Expense | - | 353,140 | ||||||

| Total Expenses | 2,111,835 | 2,044,392 | ||||||

| Net Profit / (Loss) From Operations | (1,454,609 | ) | (1,523,710 | ) | ||||

| Change in derivative liability | 216,269 | 116,259 | ||||||

| Gain / (Loss) on disposition of assets | 2,389 | |||||||

| Interest and Financing fees | (1,317,643 | ) | (1,404,955 | ) | ||||

| Net Profit / (Loss) Before Income Taxes | (2,555,983 | ) | (2,810,017 | ) | ||||

| Income Tax Expense | - | - | ||||||

| Net Profit / (Loss) | $ | (2,555,983 | ) | $ | (2,810,017 | ) | ||

| Per Share Information: | ||||||||

| Basic and diluted weighted average number of common shares outstanding | 641,349,437 | 553,354,983 | ||||||

| Net Profit / (Loss) per common share basic and diluted | $ | (0.00 | ) | $ | (0.01 | ) | ||

The accompanying notes are an integral part of these consolidated financial statements.

| 8 |

Risks About Our Business

OUR INDEPENDENT ACCOUNTANTS HAVE ISSUED A GOING CONCERN OPINION AND IF WE CANNOT OBTAIN ADDITIONAL FINANCING AND/OR REDUCE OUR OPERATING COSTS SUFFICIENTLY, WE MAY HAVE TO CURTAIL OPERATIONS AND MAY ULTIMATELY CEASE TO EXIST.

Going Concern

The financial statements have been prepared on a going concern basis, which contemplates continuity of operations, realization of assets and liquidation of liabilities in the normal course of business. The Company had a total stockholder’s deficit of $5,252,478 and a working capital deficit of $6,785,689 and a net loss of $2,555,983 for the year ended December 31, 2019. The company also had an accumulated deficit of $14,215,718 as of December 31, 2019 and used $2,224,168 in net cash from operating activities for the year ended December 31, 2019. Therefore, there is substantial doubt about the ability of the Company to continue as a going concern. There can be no assurance that the Company will achieve its goals and reach profitable operations and is still dependent upon its ability (1) to obtain sufficient debt and/or equity capital and/or (2) to generate positive cash flow from operations.

WE HAVE AN ACCUMULATED DEFICIT AND MAY INCUR ADDITIONAL LOSSES; THEREFORE, WE MAY NOT BE ABLE TO OBTAIN THE ADDITIONAL FINANCING NEEDED FOR WORKING CAPITAL, CAPITAL EXPENDITURES AND TO MEET OUR DEBT SERVICE OBLIGATIONS.

As of December 31, 2019, we had current liabilities of $8,929,141. Our debt could limit our ability to obtain additional financing for working capital, capital expenditures, debt service requirements, or other purposes in the future, as needed; to plan for, or react to, changes in technology and in our business and competition; and to react in the event of an economic downturn.

We may not be able to meet our debt service obligations. If we are unable to generate sufficient cash flow or obtain funds for required payments, or if we fail to comply with covenants in our revolving lines of credit, we will be in default.

WE ARE IN DEFAULT IN OUR OBLIGATIONS TO OUR MAJOR CREDITORS

We are currently in default on the payment of $1,200,000 and accrued interest of approximately 241,961 as of the date of this filing. This is the balance of the purchase price pursuant to our asset purchase agreement with General Electric International, due to a combination of our inability to raise sufficient capital as expected and our belief that we are entitled to a reduction in purchase price we paid as reflected in the principal amount of the outstanding note. In addition, we are in default in the amount of $972,233 in accrued transitional fees, we may use some of the proceeds to settle this obligation.

We are also in default of $258,325 payments of principal and interest on our notes payable to Cybernaut Zfounder Ventures.

We are in discussions with both General Electric International and Cybernaut Zfounder Ventures.

Our business, results of operations and financial condition may be adversely affected by public health epidemics, including the coronavirus or COVID-19.

Our business, results of operations and financial condition may be adversely affected if a public health epidemic, including the coronavirus or COVID-19 interferes with the ability of us, our employees, workers, contractors, suppliers, customers and other business partners to perform our and their respective responsibilities and obligations relative to the conduct of our business. We maintain offices in HaiXi with employees and workers upon whom we rely to, among other things, identify sources of supply in China, conduct factory inspections, place orders for merchandise, perform factory monitoring with respect to production, quality control and other requirements, and arrange shipping. A public health epidemic, including the coronavirus, poses the risk that we or our employees, workers, contractors, suppliers, customers and other business partners may be prevented from conducting business activities for an indefinite period of time, including due to shutdowns that may be requested or mandated by governmental authorities. We face similar risks if a public health epidemic, including the coronavirus, affects other geographic areas where our employees, workers, contractors, suppliers, customers and other business partners are located.

| 9 |

IF DEMAND FOR THE PRODUCTS AND SERVICES THAT THE COMPANY OFFERS SLOWS, OUR BUSINESS WOULD BE MATERIALLY AFFECTED.

Demand for products which it intends to sell depends on many factors, including:

| ● | the economy, and in periods of rapidly declining economic conditions, customers may defer purchases or may choose alternate products; |

| ● | the cost of oil, gas and solar energy; |

| ● | the competitive environment in the heat to power sectors may force us to reduce prices below our desired pricing level or increase promotional spending; |

| ● | our ability to maintain efficient, timely and cost-effective production and delivery of the products and services; and, |

| ● | All of these factors could result in immediate and longer term declines in the demand for the products and services that we offer, which could adversely affect our sales, cash flows and overall financial condition. |

WE OPERATE IN A HIGHLY COMPETITIVE MARKET. IF WE DO NOT COMPETE EFFECTIVELY, OUR PROSPECTS, OPERATING RESULTS, AND FINANCIAL CONDITION COULD BE ADVERSELY AFFECTED.

The markets for our products and services are highly competitive, with companies offering a variety of competitive products and services. We expect competition in our markets to intensify in the future as new and existing competitors introduce new or enhanced products and services that are potentially more competitive than our products and services. We believe many of our competitors and potential competitors have significant competitive advantages, including longer operating histories, ability to leverage their sales efforts and marketing expenditures across a broader portfolio of products and services, larger and broader customer bases, more established relationships with a larger number of suppliers, contract manufacturers, and channel partners, greater brand recognition, and greater financial, research and development, marketing, distribution, and other resources than we do and the ability to offer financing for projects. Our competitors and potential competitors may also be able to develop products or services that are equal or superior to ours, achieve greater market acceptance of their products and services, and increase sales by utilizing different distribution channels than we do. Some of our competitors may aggressively discount their products and services in order to gain market share, which could result in pricing pressures, reduced profit margins, lost market share, or a failure to grow market share for us. If we are not able to compete effectively against our current or potential competitors, our prospects, operating results, and financial condition could be adversely affected.

WE MAY LOSE OUT TO LARGER AND BETTER-ESTABLISHED COMPETITORS.

The alternative power industry is intensely competitive. Most of our competitors have significantly greater financial, technical, marketing and distribution resources as well as greater experience in the industry than we have. Our products may not be competitive with other technologies, both existing at the current time and in the future. If this happens, our sales and revenues will decline, or fail to develop at all. In addition, our current and potential competitors may establish cooperative relationships with larger companies to gain access to greater development or marketing resources. Competition may result in price reductions, reduced gross margins and loss of market share.

| 10 |

OUR INTERNATIONAL OPERATIONS SUBJECT US TO RISKS, WHICH COULD ADVERSELY AFFECT OUR OPERATING RESULTS.

Our international operations are exposed to the following risks, several of which are out of our control:

political and economic instability, international terrorism and anti-American sentiment, particularly in emerging markets;

| ● | preference for locally branded products, and laws and business practices favoring local competition; | |

| ● | unusual or burdensome foreign laws or regulations, and unexpected changes to those laws or regulations; | |

| ● | |import and export license requirements, tariffs, taxes and other barriers; | |

| ● | costs of customizing products for foreign countries; | |

| ● | increased difficulty in managing inventory; | |

| ● | less effective protection of intellectual property; and | |

| ● | difficulties and costs of staffing and managing foreign operations. |

Any or all of these factors could adversely affect our ability to execute any geographic expansion strategies or have a material adverse effect on our business and results of operations.

OUR PRODUCTS MAY BE DISPLACED BY NEWER TECHNOLOGY.

The alternative power industry is undergoing rapid and significant technological change. Third parties may succeed in developing or marketing technologies and products that are more effective than those developed or marketed by us, or that would make our technology obsolete or non-competitive. Accordingly, our success will depend, in part, on our ability to respond quickly to technological changes. We may not have the resources to do this.

WE MUST HIRE QUALIFIED ENGINEERING, DEVELOPMENT AND PROFESSIONAL SERVICES PERSONNEL.

We cannot be certain that we can attract or retain a sufficient number of highly qualified mechanical engineers, industrial technology and manufacturing process developers and professional services personnel. To deploy our products quickly and efficiently, and effectively maintain and enhance them, we will require an increasing number of technology developers. We expect customers that license our technology will typically engage our professional engineering staff to assist with support, training, consulting and implementation. We believe that growth in sales depends on our ability to provide our customers with these services and to attract and educate third-party consultants to provide similar services. As a result, we plan to hire professional services personnel to meet these needs. New technical and professional services personnel will require training and education and it will take time for them to reach full productivity. To meet our needs for engineers and professional services personnel, we also may use costlier third-party contractors and consultants to supplement our own staff. Competition for qualified personnel is intense, particularly because our technology is specialized and only a limited number of individuals have acquired the needed skills. Additionally, we will rely on third-party implementation providers for these services. Our business may be harmed if we are unable to establish and maintain relationships with third-party implementation providers.

WE MAY BE ADVERSELY AFFECTED BY SHORTAGES OF REQUIRED COMPONENTS. IN ADDITION, WE DEPEND ON A LIMITED NUMBER OF SUPPLIERS TO PROCURE OUR PARTS FOR PRODUCTION WHICH IF AVAILABILITY OF PRODUCTS BECOMES COMPROMISED IT COULD ADD TO OUR COST OF GOODS SOLD AND AFFECT OUR REVENUE GROWTH.

At various times, there have been shortages of some of the components that we use, as a result of strong demand for those components or problems experienced by suppliers. These unanticipated component shortages have resulted in curtailed production or delays in production, which prevented us from making scheduled shipments to customers in the past and may do so in the future. Our inability to make scheduled shipments could cause us to experience a reduction in our sales and an increase in our costs and could adversely affect our relationship with existing customers as well as prospective customers. Component shortages may also increase our cost of goods sold because we may be required to pay higher prices for components in short supply and redesign or reconfigure products to accommodate substitute components.

| 11 |

OUR PRINCIPAL SHAREHOLDERS, DIRECTORS AND EXECUTIVE OFFICERS, IN THE AGGREGATE, BENEFICIALLY OWN MORE THAN 50% OF OUR OUTSTANDING COMMON STOCK AND THESE SHAREHOLDERS, IF ACTING TOGETHER, WILL BE ABLE TO EXERT SUBSTANTIAL INFLUENCE OVER ALL MATTERS REQUIRING APPROVAL OF OUR SHAREHOLDERS.

Our principal shareholders, directors and executive officers in the aggregate, beneficially own more than 50% our outstanding common stock on a fully diluted basis. These shareholders, if acting together, will be able to exert substantial influence over all matters requiring approval of our shareholders, including amendments to our Articles of Incorporation, fundamental corporate transactions such as mergers, acquisitions, the sale of the company, and other matters involving the direction of our business and affairs and specifically the ability to determine the members of our board of directors. (See “Security Ownership of Certain Beneficial Owners and Managements”).

IF WE LOSE KEY SENIOR MANAGEMENT PERSONNEL OUR BUSINESS COULD BE NEGATIVELY AFFECTED. FURTHER, WE WILL NEED TO RECRUIT AND RETAIN ADDITIONAL SKILLED MANAGEMENT PERSONNEL AND IF WE ARE NOT ABLE TO DO SO, OUR BUSINESS AND OUR ABILITY TO CONTINUE TO GROW COULD BE HARMED.

Our success depends to a large extent upon the continued services of our executive officers. We could be seriously harmed by the loss of any of our executive officers. In order to manage our growth, we will need to recruit and retain additional skilled management personnel and if we are not able to do so, our business and our ability to continue to grow could be harmed. We are presently dependent to a great extent upon the experience, abilities and continued services of Kambiz Mahdi, our Chief Executive Officer. The loss of his services would delay our business operations substantially. Although a number of companies in our industry have implemented workforce reductions, there remains substantial competition for highly skilled employees.

WE ARE SUBJECT TO ENVIRONMENTAL COMPLIANCE RISKS AND UNEXPECTED COSTS THAT WE MAY INCUR WITH RESPECT TO ENVIRONMENTAL MATTERS MAY RESULT IN ADDITIONAL LOSS CONTINGENCIES, THE QUANTIFICATION OF WHICH CANNOT BE DETERMINED AT THIS TIME.

We are subject to various federal, state, local and foreign environmental laws and regulations, including those governing the use, storage, discharge and disposal of hazardous substances in the ordinary course of our manufacturing process. If more stringent compliance or cleanup standards under environmental laws or regulations are imposed, or the results of future testing and analyses at our current or former operating facilities indicate that we are responsible for the release of hazardous substances, we may be subject to additional remediation liability. Further, additional environmental matters may arise in the future at sites where no problem is currently known or at sites that we may acquire in the future. Currently unexpected costs that we may incur with respect to environmental matters may result in additional loss contingencies, the quantification of which cannot be determined at this time.

OUR SALES AND CONTRACT FULFILLMENT CYCLES CAN BE LONG, UNPREDICTABLE AND VARY SEASONALLY, WHICH CAN CAUSE SIGNIFICANT VARIATION IN REVENUES AND PROFITABILITY IN A PARTICULAR QUARTER.

The timing of our sales and related customer contract fulfillment is difficult to predict. Many of our customers are large enterprises, whose purchasing decisions, budget cycles and constraints and evaluation processes are unpredictable and out of our control. Further, the timing of our sales is difficult to predict. The length of our sales cycle, from initial evaluation to payment for our products and services, can range from several months to well over a year and can vary substantially from customer to customer. Our sales efforts involve significant investment in resources in field sales, marketing and educating our customers about the use, technical capabilities and benefits of our products and services. Customers often undertake a prolonged evaluation process. As a result, it is difficult to predict exactly when, or even if, we will make a sale to a potential customer or if we can increase sales to our existing customers. Large individual sales have, in some cases, occurred in quarters subsequent to those we anticipated, or have not occurred at all. In addition, the fulfillment of our customer contracts is partially dependent on other factors related to our customers’ businesses that are not in our control. as with the sales cycle, this can also cause revenues and earnings to fluctuate from quarter to quarter. If our sales and/or contract fulfillment cycles lengthen or our substantial upfront investments do not result in sufficient revenue to justify our investments, our operating results could be adversely affected.

We have experienced seasonal and end-of-quarter concentration of our transactions and variations in the number and size of transactions that close in a particular quarter, which impacts our ability to grow revenue over the long term and plan and manage cash flows and other aspects of our business and cost structure. Our transactions vary by quarter, with the fourth quarter typically being our largest. If expectations for our business turn out to be inaccurate, our revenue growth may be adversely affected over time and we may not be able to adjust our cost structure on a timely basis and our cash flows may suffer.

| 12 |

OUR OPERATING MARGINS MAY DECLINE AS A RESULT OF INCREASING PRODUCT COSTS.

Our business is subject to significant pressure on pricing and costs caused by many factors, including competition, the cost of components used in our products, labor costs, constrained sourcing capacity, inflationary pressure, pressure from customers to reduce the prices we charge for our products and services, and changes in consumer demand. Costs for the raw materials used in the manufacture of our products are affected by, among other things, energy prices, consumer demand, fluctuations in commodity prices and currency, and other factors that are generally unpredictable and beyond our control. Increases in the cost of raw materials used to manufacture our products or in the cost of labor and other costs of doing business in the United States and internationally could have an adverse effect on, among other things, the cost of our products, gross margins, operating results, financial condition, and cash flows.

WE MAY NEED TO RAISE ADDITIONAL CAPITAL REQUIRED TO GROW OUR BUSINESS, AND WE MAY NOT BE ABLE TO RAISE CAPITAL ON TERMS ACCEPTABLE TO US OR AT ALL.

Growing and operating our business will require significant cash outlays and capital expenditures and commitments. We have utilized cash on hand and cash generated from operations as sources of liquidity. If cash on hand and cash generated from operations are not sufficient to meet our cash requirements, we will need to seek additional capital, potentially through equity or debt financing, to fund our growth. Our ability to access the credit and capital markets in the future as a source of liquidity, and the borrowing costs associated with such financing, are dependent upon market conditions.

In addition, any equity securities we issue, including any preferred stock, may be on terms that are dilutive or potentially dilutive to our stockholders, and the prices at which new investors would be willing to purchase our securities may be lower than the offering price per share of our Common Stock. The holders of any equity securities we issue, including any preferred stock, may also have rights, preferences or privileges which are senior to those of existing holders of Common Stock. If new sources of financing are required, but are insufficient or unavailable, we will be required to modify our growth and operating plans based on available funding, if any, which would harm our ability to grow our business.

NATURAL DISASTERS AND OTHER CATASTROPHIC EVENTS BEYOND OUR CONTROL COULD ADVERSELY AFFECT OUR BUSINESS OPERATIONS AND FINANCIAL PERFORMANCE.

The occurrence of one or more natural disasters, such as fires, hurricanes, tornados, tsunamis, floods and earthquakes; geo-political events, such as civil unrest in a country in which our suppliers are located or terrorist or military activities disrupting transportation, communication or utility systems; or other highly disruptive events, such as nuclear accidents, pandemics, unusual weather conditions or cyber-attacks, could adversely affect our operations and financial performance. Such events could result, among other things, in operational disruptions, physical damage to or destruction or disruption of one or more of our properties or properties used by third parties in connection with the supply of products or services to us, the lack of an adequate workforce in parts or all of our operations and communications and transportation disruptions. These factors could also cause consumer confidence and spending to decrease or result in increased volatility in the United States and global financial markets and economy. Such occurrences could have a material adverse effect on us and could also have indirect consequences such as increases in the costs of insurance if they result in significant loss of property or other insurable damage.

WE HAVE ISSUED A SUBSTANTIAL AMOUNT OF CONVERTIBLE SECURITIES WHICH IF CONVERTED WILL SUBSTANTIALLY DILUTE ALL OF OUR STOCKHOLDERS.

We have issued a substantial amount of convertible securities which, if converted, would result in substantial dilution to our stockholders. As of the date of this Offing Circular we have outstanding the convertible notes, warrants and preferred stock as set forth below:

| Convertible Notes - and Approximate common share equivalents | 507,650,818 | |||

| Convertible Preferred series D and approximate common share equivalents | 8,739,000 | |||

| Warrants a and Common Stock equivalent’s | 174,250,000 | |||

| Total Convertible Common Stock equivalents | 690,639,818 |

| 13 |

MGW Investments I Limited (“MGWI”) holds two notes, the interest and principal of which may be converted into shares of our common stock at a fixed conversion price of $.003 per share which, at the time of this filing, equal approximately 65,946,000 shares and 391,458,333 shares respectively, or an aggregate of 457,404,333 shares. In addition, MGWI holds a warrant to purchase 168,000,000 shares of our common stock. Calvin Pang, our director, is a beneficial owner of the securities held by MGWI. We have also issued warrants to purchase 6,250,000 shares of our common stock to other investors and convertible notes to other investors convertible into an additional 65,235,485 shares.

OUR ISSUANCE OF ADDITIONAL CAPITAL STOCK IN CONNECTION WITH FINANCINGS, ACQUISITIONS, INVESTMENTS, OUR EQUITY INCENTIVE PLANS, OR OTHERWISE WILL DILUTE ALL OTHER STOCKHOLDERS.

We expect to issue additional capital stock in the future that will result in dilution to all other stockholders. We expect to grant equity awards to employees, directors, and consultants under our equity incentive plans. We may also raise capital through equity financings in the future. As part of our business strategy, we may acquire or make investments in complementary companies, products, or technologies, and issue equity securities to pay for any such acquisition or investment. Any such issuances of additional capital stock may cause stockholders to experience significant dilution of their ownership interests and the per share value of our common stock to decline.

WE MAY MAKE ACQUISITIONS THAT ARE DILUTIVE TO EXISTING STOCKHOLDERS. IN ADDITION, OUR LIMITED EXPERIENCE IN ACQUIRING OTHER BUSINESSES, PRODUCT LINES AND TECHNOLOGIES MAY MAKE IT DIFFICULT FOR US TO OVERCOME PROBLEMS ENCOUNTERED IN CONNECTION WITH ANY ACQUISITIONS WE MAY UNDERTAKE.

We intend to evaluate and explore strategic opportunities as they arise, including business combinations, strategic partnerships, and the purchase, licensing or sale of assets. In connection with any such future transaction, we could issue dilutive equity securities, incur substantial debt, reduce our cash reserves or assume contingent liabilities.

Our experience in acquiring other businesses, product lines and technologies is limited. Our inability to overcome problems encountered in connection with any acquisitions could divert the attention of management, utilize scarce corporate resources and otherwise harm our business. Any potential future acquisitions also involve numerous risks, including:

| ● | problems assimilating the purchased operations, technologies or products; | |

| ● | costs associated with the acquisition; | |

| ● | adverse effects on existing business relationships with suppliers and customers; | |

| ● | risks associated with entering markets in which we have no or limited prior experience; | |

| ● | potential loss of key employees of purchased organizations; and | |

| ● | potential litigation arising from the acquired company’s operations before the acquisition. |

Furthermore, acquisitions may require material charges and could result in adverse tax consequences, substantial depreciation, deferred compensation charges, in-process research and development charges, the amortization of amounts related to deferred compensation and identifiable purchased intangible assets or impairment of goodwill, any of which could negatively affect our results of operations.

| 14 |

WE MAY BE SUBJECT TO GOVERNMENT LAWS AND REGULATIONS PARTICULAR TO OUR OPERATIONS WITH WHICH WE MAY BE UNABLE TO COMPLY.

We may not be able to comply with all current and future government regulations which are applicable to our business. Our business operations are subject to all government regulations normally incident to conducting business (e.g., occupational safety and health acts, workmen’s compensation statutes, unemployment insurance legislation, income tax, and social security laws and regulations, environmental laws and regulations, consumer safety laws and regulations, etc.) as well as to governmental laws and regulations applicable to small public companies and their capital formation efforts. Although we will make every effort to comply with applicable laws and regulations, we can provide no assurance of our ability to do so, nor can we predict the effect of those regulations on our proposed business activities. Our failure to comply with material regulatory requirements would likely have an adverse effect on our ability to conduct our business and could result in our cessation of active business operations.

COMPLIANCE WITH CHANGING REGULATION OF CORPORATE GOVERNANCE AND PUBLIC DISCLOSURE WILL RESULT IN ADDITIONAL EXPENSES.

Changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002 and related SEC regulations, have created uncertainty for public companies and significantly increased the costs and risks associated with accessing the public markets and public reporting. Our management team will need to invest significant management time and financial resources to comply with both existing and evolving standards for public companies, which will lead to increased general and administrative expenses and a diversion of management time and attention from revenue generating activities to compliance activities.

OUR REVENUE GROWTH RATE DEPENDS PRIMARILY ON OUR ABILITY TO EXECUTE OUR BUSINESS PLAN.

We may not be able to identify and maintain the necessary relationships within our industry. Our ability to execute our business plan also depends on other factors, including the ability to:

1. Negotiate and maintain contracts and agreements with acceptable terms;

2. Hire and train qualified personnel;

3. Maintain marketing and development costs at affordable rates; and,

4. Maintain an affordable labor force.

Risks About Our Stock

OUR COMMON STOCK MAY BE DEEMED A “PENNY STOCK,” WHICH WOULD MAKE IT MORE DIFFICULT FOR OUR INVESTORS TO SELL THEIR SHARES.

Our common stock is currently subject to the “penny stock” rules adopted under Section 15(g) of the Exchange Act. The penny stock rules generally apply to companies whose common stock is not listed on The Nasdaq Stock Market or another national securities exchange and trades at less than $4.00 per share, other than companies that have had average revenues of at least $6,000,000 for the last three years or that have tangible net worth of at least $5,000,000 ($2,000,000 if the company has been operating for three or more years). These rules require, among other things, that brokers who trade penny stock to persons other than “established customers” complete certain documentation, make suitability inquiries of investors and provide investors with certain information concerning trading in the security, including a risk disclosure document and quote information under certain circumstances. Many brokers have decided not to trade penny stocks because of the requirements of the penny stock rules and, as a result, the number of broker-dealers willing to act as market makers in these securities is limited. If we remain subject to the penny stock rules for any significant period, it could have an adverse effect on the market, if any, for our securities. If our securities are subject to the penny stock rules, investors will find it more difficult to dispose of our securities.

WE MAY IN THE FUTURE ISSUE ADDITIONAL SHARES OF OUR COMMON STOCK, WHICH MAY HAVE A DILUTIVE EFFECT ON OUR STOCKHOLDERS.

Our Certificate of Incorporation authorizes the issuance of 2,000,000,000 shares of common stock of which 762,895,515 are issued and outstanding and 20,000,000 shares of preferred stock, of which 7,500 shares are issued and 5,700 shares are outstanding as of July 10, 2020. The future issuance of our common stock may result in substantial dilution in the percentage of our common shares held by our then existing stockholders. We may value any Common Stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors and might have an adverse effect on any trading market for our common stock.

| 15 |

OUR BOARD OF DIRECTORS HAS AUTHORIZED A REVERSE STOCK SPLIT OF UP TO 50 SHARES OF OUR COMMON STOCK INTO ONE SHARE OF OUR COMMON STOCK WHICH MAY HAVE A DILUTIVE EFFECT ON OUR STOCKHOLDERS.

If implemented by our Board of Directors, a reverse stock split will reduce the number of outstanding shares of our Common Stock without reducing the number of shares of available but unissued Common Stock, which will also have the effect of increasing the number of authorized but unissued shares. The issuance of additional shares of our Common Stock may have a dilutive effect on the ownership of existing shareholders. The liquidity of the shares of our common stock may be adversely affected by a reverse stock split given the reduced number of shares that will be outstanding following a reverse stock split, especially if the market price of our common stock does not increase as a result of the reverse stock split. Although we believe that a higher market price of our common stock may help generate greater or broader investor interest, we cannot assure you that a reverse stock split will result in a share price that will attract new investors.

OUR SECURITIES ARE THINLY TRADED WHICH DOES NOT PROVIDE LIQUIDITY FOR OUR INVESTORS.

Our securities are quoted on the OTCQB Market. The OTCQB Market is an inter-dealer, over-the-counter market that provides significantly less liquidity than the NASDAQ Stock Market or national or regional exchanges. Securities traded on the OTCQB Market are usually thinly traded, highly volatile, have fewer market makers and are not followed by analysts. The Securities and Exchange Commission’s order handling rules, which apply to NASDAQ-listed securities, do not apply to securities quoted on the OTCQB Market. Quotes for stocks included on the OTCQB Market are not listed in newspapers. Therefore, prices for securities traded solely on the OTCQB Market may be difficult to obtain and holders of our securities may be unable to resell their securities at or near their original acquisition price, or at any price.

Investors must contact a broker-dealer to trade on the OTCQB Market. As a result, you may not be able to buy or sell our securities at the times that you may wish. Furthermore, when investors place market orders to buy or sell a specific number of shares at the current market price it is possible for the price of a stock to go up or down significantly during the lapse of time between placing a market order and its execution.

THE MARKET PRICE AND TRADING VOLUME OF SHARES OF OUR COMMON STOCK MAY BE VOLATILE.

The market price of our common stock could fluctuate significantly for many reasons, including for reasons unrelated to our specific performance, such as reports by industry analysts, investor perceptions, or negative announcements by customers, or competitors regarding their own performance, as well as general economic and industry conditions. In addition, when the market price of a company’s shares drops significantly, stockholders could institute securities class action lawsuits against the company. A lawsuit against us could cause us to incur substantial costs and could divert the time and attention of our management and other resources.

IF WE FAIL TO MAINTAIN EFFECTIVE INTERNAL CONTROLS OVER FINANCIAL REPORTING, THE PRICE OF OUR COMMON STOCK MAY BE ADVERSELY AFFECTED.

As a public reporting company, we are required to establish and maintain appropriate internal controls over financial reporting. Failure to establish those controls, or any failure of those controls once established, could adversely impact our public disclosures regarding our business, financial condition or results of operations. Any failure of these controls could also prevent us from maintaining accurate accounting records and discovering accounting errors and financial frauds. Rules adopted by the SEC pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 require annual assessment of our internal control over financial reporting and may require attestation of this assessment by our independent registered public accountants. The standards that must be met for management to assess the internal control over financial reporting as effective are complex, and require significant documentation, testing and possible remediation to meet the detailed standards. We may encounter problems or delays in completing activities necessary to make an assessment of our internal control over financial reporting. In addition, the attestation process by our independent registered public accountants is new and we may encounter problems or delays in completing the implementation of any requested improvements and receiving an attestation of our assessment by our independent registered public accountants.

| 16 |

COMPLIANCE WITH CHANGING REGULATION OF CORPORATE GOVERNANCE AND PUBLIC DISCLOSURE WILL RESULT IN ADDITIONAL EXPENSES.

Changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002 and related SEC regulations, have significantly increased the costs and risks associated with accessing the public markets and public reporting. Our management team will need to invest significant management time and financial resources to comply with both existing and evolving standards for public companies, which will lead to increased general and administrative expenses and a diversion of management time and attention from revenue generating activities to compliance activities.

WE DO NOT INTEND TO PAY DIVIDENDS IN THE FORESEEABLE FUTURE; THEREFORE, YOU MAY NEVER SEE A RETURN ON YOUR INVESTMENT.

We do not anticipate the payment of cash dividends on our common stock in the foreseeable future. We anticipate that any profits from our operations will be devoted to our future operations. Any decision to pay dividends will depend upon our profitability at the time, cash available and other factors

OUR OPERATING RESULTS AND SHARE PRICE MAY BE VOLATILE AND THE MARKET PRICE OF OUR COMMON STOCK AFTER THIS OFFERING MAY DROP BELOW THE PRICE YOU PAY.

Our quarterly operating results have in the past fluctuated and are likely to do so in the future. As a result, the trading price of the shares of our common stock following this offering is likely to be highly volatile and could be subject to wide fluctuations in response to various factors, some of which are beyond our control. In addition to the factors discussed in this “Risk Factors” section and elsewhere in this Prospectus, these factors include:

| ● | the success of competitive products or technologies; |

| ● | actual or anticipated changes in our growth rate relative to our competitors; |

| ● | announcements by us or our competitors of significant acquisitions, strategic partnerships, joint ventures, collaborations or capital commitments; |

| ● | regulatory or legal developments in the United States and other countries; |

| ● | the recruitment or departure of key personnel; |

| ● | the level of expenses; |

| ● | changes in our backlog in a given period; |

| ● | actual or anticipated changes in estimates as to financial results, development timelines or recommendations by securities analysts; |

| ● | variations in our financial results or those of companies that are perceived to be similar to us; |

| ● | fluctuations in the valuation of companies perceived by investors to be comparable to us; |

| ● | inconsistent trading volume levels of our shares; |

| ● | announcement or expectation of additional financing efforts; |

| ● | sales of our common stock by us, our insiders or our other stockholders; |

| ● | market conditions in the clean energy sector; and |

| ● | general economic, industry and market conditions. |

These and other factors, many of which are beyond our control, may cause our operating results and the market price and demand for our shares to fluctuate substantially. While we believe that operating results for any particular quarter are not necessarily a meaningful indication of future results, fluctuations in our quarterly operating results could limit or prevent investors from readily selling their shares and may otherwise negatively affect the market price and liquidity of our shares. In addition, the stock market in general, and companies in our markets in particular, have experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of these companies. Broad market and industry factors may negatively affect the market price of our common stock, regardless of our actual operating performance. The realization of any of these risks or any of a broad range of other risks, including those described in these “Risk Factors,” could have a dramatic and material adverse impact on the market price of the shares of our common stock.

| 17 |

WE MAY BE SUBJECT TO SECURITIES LITIGATION, WHICH IS EXPENSIVE AND COULD DIVERT MANAGEMENT ATTENTION.

The market price of the shares of our common stock may be volatile, and in the past companies that have experienced volatility in the market price of their securities have been subject to securities class action litigation. We may be the target of this type of litigation in the future. Securities litigation against us could result in substantial costs and divert our management’s attention from other business concerns, which could seriously harm our business.

WE HAVE BROAD DISCRETION IN THE USE OF THE NET PROCEEDS FROM THIS OFFERING AND MAY NOT USE THEM EFFECTIVELY.

Our management will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways that do not improve our results of operations or enhance the value of our common stock. The failure by our management to apply these funds effectively could result in financial losses that could have a material adverse effect on our business and cause the market price of our shares of common stock to decline. Pending their use, we may invest the net proceeds from this offering in a manner that does not produce income or that loses value. If we do not invest the net proceeds from this offering in ways that enhance stockholder value, we may fail to achieve expected financial results, which could cause the price of our shares of common stock to decline.

Risks Related to the Offering

Our existing stockholders may experience significant dilution from the sale of our common stock pursuant to the GHS financing agreement.

The sale of our common stock to GHS Investments LLC in accordance with the Financing Agreement may have a dilutive impact on our shareholders. As a result, the market price of our common stock could decline. In addition, the lower our stock price is at the time we exercise our put options, the more shares of our common stock we will have to issue to GHS in order to exercise a put under the Financing Agreement. If our stock price decreases, then our existing shareholders would experience greater dilution for any given dollar amount raised through the offering.

The perceived risk of dilution may cause our stockholders to sell their shares, which may cause a decline in the price of our common stock. Moreover, the perceived risk of dilution and the resulting downward pressure on our stock price could encourage investors to engage in short sales of our common stock. By increasing the number of shares offered for sale, material amounts of short selling could further contribute to progressive price declines in our common stock.

The issuance of shares pursuant to the GHS financing agreement may have a significant dilutive effect.

Depending on the number of shares we issue pursuant to the GHS Financing Agreement, it could have a significant dilutive effect upon our existing shareholders. Although the number of shares that we may issue pursuant to the Financing Agreement will vary based on our stock price (the higher our stock price, the less shares we have to issue), there may be a potential dilutive effect to our shareholders, based on different potential future stock prices, if the full amount of the Financing Agreement is realized. Dilution is based upon common stock put to GHS and the stock price discounted to GHS’s purchase price of 80% of the lowest trading price during the pricing period.

GHS Investments LLC will pay less than the then-prevailing market price of our common stock which could cause the price of our common stock to decline.

Our common stock to be issued under the GHS Financing Agreement will be purchased at a twenty percent (20%) discount, or eighty percent (80%) of the lowest closing price for the Company’s common stock during the ten (10) consecutive trading days immediately preceding the Purchase Date (as defined in the GHS Financing Agreement).

GHS has a financial incentive to sell our shares immediately upon receiving them to realize the profit between the discounted price and the market price. If GHS sells our shares, the price of our common stock may decrease. If our stock price decreases, GHS may have further incentive to sell such shares. Accordingly, the discounted sales price in the Financing Agreement may cause the price of our common stock to decline.

We may not have access to the full amount under the financing agreement.

The lowest two closing prices for the 10 days ended July 10, 2020 was approximately $0.0166. At that price we would be able to sell shares to GHS under the Financing Agreement at the discounted price of $0.01328. At that discounted price, the 74,720,000 shares would only represent approximately $992,282, which is far below the full amount of the Financing Agreement. In addition, any single drawdown may not exceed two hundred percent (200%) of the average daily trading dollar volume of the Company’s Common Stock during the ten (10) trading days preceding the put, which is approximately $7,162 on the date of this Registration Statement, and cannot exceed $400,000.

| 18 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements under “Summary”, “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, “Description of Our Business” and elsewhere in this Prospectus constitute forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar matters that are not historical facts. In some cases, you can identify forward-looking statements by terms such as “anticipate”, “believe”, “could”, “estimate”, “expect”, “intend”, “may”, “plan”, “potential”, “should”, “will” and “would” or the negatives of these terms or other comparable terminology.

You should not place undue reliance on forward looking statements. The cautionary statements set forth in this Prospectus, including in “Risk Factors” and elsewhere, identify important factors which you should consider in evaluating our forward-looking statements. These factors include, among other things:

| ● | Our independent accountants have issued a going concern opinion, | |

| ● | Intense competition, which may reduce our sales, operating profits, or both, | |

| ● | Our ability to obtain future financing, | |

| ● | Our ability to execute our strategic plan, | |

| ● | Dilution due to exercise of Convertible notes | |

| ● | We are in default of our agreements with General Electric and Cybernaut Zfounder Ventures , | |

| ● | Our products may be displaced by newer technology, | |

| ● | Majority ownership by our principal shareholders, directors and executive officers, | |

| ● | Concentration of customers, | |

| ● | We are a Penny Stock and lack of liquidity in trading our common stock, | |

| ● | Failure to maintain effective internal controls, | |

| ● | Our highly competitive market, | |

| ● | Limited human resources and ability manage our growth, and | |

| ● | Dependence on our management, senior professionals and other key personnel. |

Although the forward-looking statements in this Prospectus are based on our beliefs, assumptions and expectations, taking into account all information currently available to us, we cannot guarantee future transactions, results, performance, achievements or outcomes. No assurance can be made to any investor by anyone that the expectations reflected in our forward-looking statements will be attained, or that deviations from them will not be material and adverse. We undertake no obligation, other than as maybe be required by law, to re-issue this Prospectus or otherwise make public statements updating our forward-looking statements.

| 19 |

The selling stockholder identified in this prospectus, GHS, may offer and sell up to 74,720,000 shares of our common stock, which consists of shares of common stock to be initially purchased by GHS pursuant to the Financing Agreement. If issued presently, the shares of common stock registered for resale by GHS would represent approximately 10% of our issued and outstanding shares of common stock, based on the 762,895,515 shares of our issued and outstanding shares as of July 10, 2020. Additionally, the 74,720,000 shares of our common stock registered for resale herein would represent approximately 30% of the Company’s public float which would not include 764,562 shares of our common stock currently held by GHS.

We may require the selling stockholder to suspend the sales of the shares of our common stock being offered pursuant to this prospectus upon the occurrence of any event that makes any statement in this prospectus or the related registration statement untrue in any material respect or that requires the changing of statements in those documents in order to make statements in those documents not misleading.

The selling stockholder identified in the table below may from time to time offer and sell under this prospectus any or all of the shares of common stock described under the column “Shares of Common Stock Being Offered” in the table below.

GHS will be deemed to be an underwriter within the meaning of the Securities Act. Any profits realized by the selling stockholder may be deemed to be underwriting commissions.

We cannot give an estimate as to the number of shares of common stock that will actually be held by the selling stockholder upon termination of this offering, because the selling stockholder may offer some or all of the common stock under the offering contemplated by this prospectus or acquire additional shares of common stock. The total number of shares that may be sold hereunder will not exceed the number of shares offered hereby. Please read the section entitled “Plan of Distribution” in this prospectus.

The manner in which the selling stockholder acquired or will acquire shares of our common stock is discussed below under “The Offering.”

The following table sets forth the name of the selling stockholder, the number of shares of our common stock beneficially owned by such stockholder before this offering, the number of shares to be offered for such stockholder’s account and the number and (if one percent or more) the percentage of the class to be beneficially owned by such stockholder after completion of the offering. The number of shares owned are those beneficially owned, as determined under the rules of the SEC, and such information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares of our common stock as to which a person has sole or shared voting power or investment power and any shares of common stock which the person has the right to acquire within 60 days of July 10, 2020, through the exercise of any option, warrant or right, through conversion of any security or pursuant to the automatic termination of a power of attorney or revocation of a trust, discretionary account or similar arrangement, and such shares are deemed to be beneficially owned and outstanding for computing the share ownership and percentage of the person holding such options, warrants or other rights, but are not deemed outstanding for computing the percentage of any other person. Beneficial ownership percentages are calculated based on 762,895,515 shares of our common stock outstanding as of July 10, 2020.

Unless otherwise set forth below, (a) the persons and entities named in the table below have sole voting and sole investment power with respect to the shares set forth opposite the selling stockholder’s name, subject to community property laws, where applicable, and (b) no selling stockholder had any position, office or other material relationship within the past three years, with us or with any of our predecessors or affiliates. The number of shares of common stock shown as beneficially owned before the offering is based on information furnished to us or otherwise based on information available to us at the timing of the filing of the registration statement of which this prospectus forms a part.

| 20 |

| Shares Owned by the Selling Stockholder before the | Shares of Common Stock Being | Number of Shares to be Owned by Selling Stockholder After the Offering and Percent of Total Issued and Outstanding Shares | ||||||||||||||

| Name of Selling Stockholder | Offering (1) | Offered | # of Shares(2) | % of Class (2) | ||||||||||||

| GHS Investments LLC (3) | 764,526 | 74,720,000 | (4) | 764,526 | 0.01 | % | ||||||||||

Notes:

| (1) | The shares currently owned by GHS consist entirely of shares received upon shares issued by the Company to GHS upon execution of the Equity Financing Agreement. |

| (2) | Because the selling stockholder may offer and sell all or only some portion of the 74,720,000 shares of our common stock being offered pursuant to this prospectus and may acquire additional shares of our common stock in the future, we can only estimate the number and percentage of shares of our common stock that the selling stockholder will hold upon termination of the offering based on the shares currently held. |

| (3) | Mark Grober exercises voting and dispositive power with respect to the shares of our common stock that are beneficially owned by GHS. |

| (4) | Consists of up to 74,720,000 shares of common stock to be sold by GHS pursuant to the Financing Agreement. |

The selling stockholder may, from time to time, sell any or all of its shares of Company common stock through the OTC Link or any other stock exchange, quotation board, market or trading facility on which the shares of our common stock are quoted or traded, or in private transactions. These sales may be at fixed prices, prevailing market prices at the time of sale, at varying prices, or at negotiated prices. The selling stockholder may use any one or more of the following methods when selling shares:

| ● | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| ● | block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| ● | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| ● | privately negotiated transactions; |

| ● | broker-dealers may agree with the selling stockholders to sell a specified number of such shares at a stipulated price per share; or |

| ● | a combination of any such methods of sale. |

Additionally, broker-dealers engaged by the selling stockholder may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling stockholder (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a customary brokerage commissions in compliance with FINRA Rule 2440; and in the case of a principal transaction, a markup or markdown in compliance with FINRA IM-2440.

GHS is an underwriter within the meaning of the Securities Act of 1933, and any broker-dealers or agents that are involved in selling the shares may be deemed to be “underwriters” within the meaning of the Securities Act of 1933 in connection with such sales. Any commissions received by such broker-dealers or agents, and any profit on the resale of the shares purchased by them, may be deemed to be underwriting commissions or discounts under the Securities Act of 1933. GHS has informed us that it does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute the Company’s common stock. Pursuant to a requirement by FINRA, the maximum commission or discount to be received by any FINRA member or independent broker-dealer may not be greater than 8% of the gross proceeds received by us for the sale of any securities being registered pursuant to Rule 415 promulgated under the Securities Act of 1933.

| 21 |

Discounts, concessions, commissions and similar selling expenses, if any, attributable to the sale of shares will be borne by the selling stockholder. The selling stockholder may agree to indemnify any agent, dealer, or broker-dealer that participates in transactions involving sales of the shares if liabilities are imposed on that person under the Securities Act of 1933.