Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF INDEPENDENT PUBLICLY REGISTERED ACCOUNTING FIRM, BDO CHINA SHU LUN PA - CHINA JO-JO DRUGSTORES, INC. | ea124107ex23-1_chinajojo.htm |

| EX-5.1 - OPINION OF FLANGAS LAW GROUP - CHINA JO-JO DRUGSTORES, INC. | ea124107ex5-1_chinajojo.htm |

As filed with the Securities and Exchange Commission on July 14, 2020

File No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CHINA JO-JO DRUGSTORES, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 5912 | 98-0557852 | ||

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

Hai Wai Hai Tongxin Mansion Floor 6

Gong Shu District, Hangzhou City

People’s Republic of China 310008

+86-571-88219579

(Address, including zip code, and telephone number, including area code, of registrant’s principal place of business)

Lei Liu, Chief Executive Officer

China Jo-Jo Drugstores, Inc.

Hai Wai Hai Tongxin Mansion Floor 6

Gong Shu District, Hangzhou City

People’s Republic of China 310008

+86-571-88219579

(Name, address, including zip code, and telephone number, including area code, of registrant’s agent for service)

Copies to:

Elizabeth F. Chen, Esq.

Pryor Cashman LLP

7 Times Square

New York, New York 10036

(212) 326-0199

Approximate date of commencement of proposed sale to the public. As soon as practicable after the effective date of this registration statement.

If any of the Securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering: ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, please check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering: ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering: ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to section 7(a)(2)(B) of the Securities Act: ☐

CALCULATION OF REGISTRATION FEE

Title Of Each Class Of Securities To Be Registered | Amount to be Registered(1) | Proposed Maximum Offering Price Per Share(3) | Proposed Maximum Aggregate Offering Price(3) | Amount Of Registration Fee | ||||||||||||

| Common Stock, without par value per share | 4,050,003 | (2) | $ | 1.32 | $ | 5,346,003.96 | $ | 693.91 | ||||||||

| (1) | Pursuant to Rule 416(a) of the Securities Act of 1933, as amended, this registration statement also covers such additional shares as may hereafter be offered or issued to prevent dilution resulting from stock splits, stock dividends, recapitalizations or similar transactions. |

| (2) | Consists of 4,050,003 shares of common stock issuable upon exercise of warrants that were issued to the Selling Shareholders named herein. |

| (3) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(c) under the Securities Act of 1933, as amended, based on the average of the high and low prices per share of the registrant’s common stock on the Nasdaq Capital Market on July 13, 2020. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the commission, acting pursuant to section 8(a) may determine.

The information contained in this prospectus is not complete and may be changed. The selling shareholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated July 14, 2020

CHINA JO-JO DRUGSTORES, INC.

4,050,003 Shares of Common Stock Issuable upon Exercise of Warrants

This prospectus relates to the resale of up to 4,050,003 shares of the common stock of China Jo-Jo Drugstores, Inc., a Nevada corporation (the “Company”), that may be sold from time to time by the selling shareholders named in this prospectus (the “Selling Shareholders”).

The shares of common stock offered under this prospectus consist of 4,050,003 shares of common stock issuable upon the exercise of (i) certain warrants (the “2020 Warrants”), that we issued to certain Selling Shareholders, each of whom is an accredited investor, on June 3, 2020, in a private placement pursuant to a Securities Purchase Agreement dated as of June 1, 2020, by and among the Company and the purchasers named therein and (ii) certain warrants (the “PA Warrants”, and together with the 2020 Warrants, the “Warrants”) that we issued to the placement agent’s designees, in a registered direct offering pursuant to a Securities Purchase Agreement dated as of June 1, 2020, by and among the Company and the purchasers named therein. The issuance of the 2020 Warrants was made in reliance on the exemptions from registration afforded by Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), and Rule 506(b) promulgated thereunder.

We will not receive any proceeds from the sale of any of the shares of common stock offered hereby by the Selling Shareholders. To the extent that any of the Warrants are exercised for cash, if at all, we will receive the exercise price for those Warrants.

The Selling Shareholders or their pledgees, assignees or successors-in-interest may offer and sell or otherwise dispose of the shares of common stock described in this prospectus from time to time through underwriters, broker-dealers or agents, in public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices. The Selling Shareholders will bear all commissions and discounts, if any, attributable to the sales of shares. We will bear all other costs, expenses and fees in connection with the registration of the shares. See “Plan of Distribution” beginning on page 10 of this prospectus for more information about how the Selling Shareholders may sell or dispose of their shares of common stock.

Our common stock is listed on the Nasdaq Capital Market under the symbol “CJJD”. On July 13, 2020, the last reported sale price for our common stock as reported on the Nasdaq Capital Market was $1.30 per share.

INVESTING IN OUR COMMON STOCK INVOLVES SUBSTANTIAL RISKS. SEE THE SECTION TITLED “RISK FACTORS” BEGINNING ON PAGE 5 OF THIS PROSPECTUS TO READ ABOUT FACTORS YOU SHOULD CONSIDER BEFORE BUYING SHARES OF OUR COMMON STOCK.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is _______, 2020

TABLE OF CONTENTS

i

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 that we have filed with the Securities and Exchange Commission (the “SEC”) pursuant to which the Selling Shareholders named herein may, from time to time, offer and sell or otherwise dispose of the shares of our common stock covered by this prospectus. You should rely only on the information contained in this prospectus or any related prospectus supplement. We have not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. The information contained in this prospectus is accurate only on the date of this prospectus. Our business, financial condition, results of operations and prospects may have changed since such date. Other than as required under the federal securities laws, we undertake no obligation to publicly update or revise such information, whether as a result of new information, future events or any other reason.

This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any of our shares of common stock other than the shares of our common stock covered hereby, nor does this prospectus constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about, and to observe, any restrictions as to the offering and the distribution of this prospectus applicable to those jurisdictions.

Some of the industry data contained in this prospectus is derived from data from various third-party sources. We have not independently verified any of this information and cannot assure you of its accuracy or completeness. Such data is subject to change based on various factors, including those discussed under the “Risk Factors” section beginning on page 5 of this prospectus.

ii

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before making an investment decision with respect to our securities. You should read the entire prospectus carefully, especially any risk factors contained herein and our financial statements and related notes contained in this prospectus before making an investment decision with respect to our securities. You should carefully read the information described under the heading “Where You Can Find More Information.” We have not authorized anyone to provide you with information different from that contained in this prospectus supplement.

Unless the context otherwise requires, the terms “CJJD,” “the Company,” “we,” “us,” and “our” in this prospectus supplement each refer to China Jo-Jo Drugstores, Inc., our subsidiaries, and our consolidated entities. “China” and the “PRC” refer to the People’s Republic of China.

Overview

We were incorporated in Nevada on December 19, 2006, under the name “Kerrisdale Mining Corporation.” On September 24, 2009, the Company changed its name to “China Jo-Jo Drugstores, Inc.” We are a retailer and distributor of pharmaceutical and other healthcare products typically found in retail pharmacies in the People’s Republic of China (“PRC” or “China”). Prior to acquiring Zhejiang Jiuxin Medicine Co., Ltd. (“Jiuxin Medicine”) in August 2011, we were primarily a retail pharmacy operator. We currently have one hundred and eighteen (118) store locations under the store brand “Jiuzhou Grand Pharmacy” in Hangzhou city and its adjacent town Lin’an. During the year ended March 31, 2020, the Company dissolved eight independent pharmacies. Among the eight dissolved pharmacies, two stores had merged into Jiuzhou Pharmacy, as defined below, and became Jiuzhou Pharmacy stores in Hangzhou. The other six stores’ licenses of government medical insurance, which qualify the stores for reimbursement from government, were transferred to six Jiuzhou Pharmacy stores in Hangzhou City. Additionally, we acquired a local drugstore chain with ten stores in January 2020. Then we dissolved the chain, closed five stores and changed the other five stores to be Jiuzhou Pharmacy stores. Furthermore, we closed three stores in calendar 2019 due to their underperformance and opened a new store in April 2020. Amidst the COVID-19 outbreak, we experienced a decline in the number of customer visits during the first three months of calendar 2020 due to the implementation of the lockdown policy in China. However, as China is gradually controlling the spread of COVID-19, we believe these negative impacts are temporary.

We currently operate in four business segments in China: (1) retail drugstores, (2) online pharmacy, (3) wholesale business selling products similar to those we carry in our pharmacies, and (4) farming and selling herbs used for traditional Chinese medicine (“TCM”). All of the above business are performed in China with no other international sales.

Our stores provide customers with a wide variety of pharmaceutical products, including prescription and over-the-counter (“OTC”) drugs, nutritional supplements, TCM, personal and family care products, and medical devices, as well as convenience products, including consumable, seasonal, and promotional items. Additionally, we have doctors licensed in both western medicine and TCM on site for consultation, examination and treatment of common ailments at scheduled hours. Three (3) stores have adjacent medical clinics offering urgent care (to provide treatment for minor ailments such as sprains, minor lacerations, and dizziness that can be treated on an outpatient basis), TCM (including acupuncture, therapeutic massage, and cupping) and minor outpatient surgical treatments (such as suturing). Our stores vary in size, but presently average close to 200 square meters per store. We attempt to tailor each store’s product offerings, physician access, and operating hours to suit the community where the store is located.

1

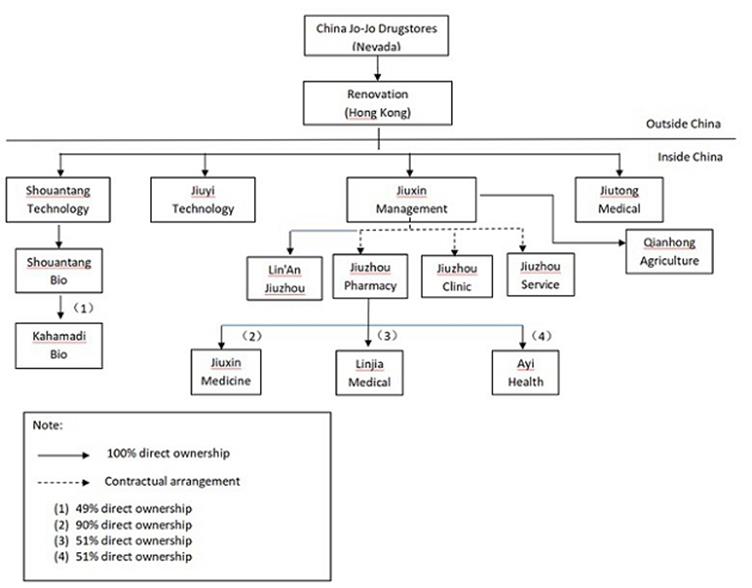

We operate our pharmacies (including the medical clinics) through the following companies in China that we control through contractual arrangements:

| ● | Hangzhou Jiuzhou Grand Pharmacy Chain Co., Ltd. (“Jiuzhou Pharmacy”), which we control contractually, operates our “Jiuzhou Grand Pharmacy” stores; |

| ● | Hangzhou Jiuzhou Clinic of Integrated Traditional and Western Medicine (General Partnership) (“Jiuzhou Clinic”), which we control contractually, operates one (1) of our three (3) medical clinics; and |

| ● | Hangzhou Jiuzhou Medical & Public Health Service Co., Ltd. (“Jiuzhou Service”), which we control contractually, operates our other medical clinics. |

In addition, we operate pharmacies through Lin’An Jiuzhou Pharmacy Co., Ltd (“Lin’An Jiuzhou”), which are directly held by Jiuxin Investments Management Co. Ltd. We have also opened two clinics adjacent to our drugstores under Zhejiang Jiuzhou Linjia Medical Investment and Management Co. Ltd. (“Linjia Medical”), which are controlled by Jiuzhou Pharmacy. The Company, through Jiuzhou Pharmacy, holds 51% of the equity of Zhejiang AyiGe Medical Health Management Co., Ltd.(“Ayi Health”), which is intended to provide technical support such as IT and customer support to our health management business in the future.

We also offer OTC drugs and nutritional supplements for sale through a website (www.dada360.com) operated by Jiuzhou Pharmacy. For the fiscal year ended March 31, 2020, retail revenue, including pharmacies, medical clinics accounted for approximately 63.1% of our total revenue, while online pharmacy revenue accounted for 11.6% of our total revenue.

Since August 2011, we have operated a wholesale business through Zhejiang Jiuxin Medicine Co., Ltd. (“Jiuxin Medicine”), distributing third-party pharmaceutical products (similar to those carried by our pharmacies) primarily to trading companies throughout China. Jiuxin Medicine is wholly owned by Jiuzhou Pharmacy. For the fiscal year March 31, 2020, wholesale revenue accounted for approximately 25.3% of our total revenue.

We also have an herb farming business cultivating and wholesaling herbs used for TCM. This business is conducted through Hangzhou Qianhong Agriculture Development Co., Ltd. (“Qianhong Agriculture”), a wholly-owned subsidiary. During the fiscal year ended March 31, 2020, we generated no revenue from our herb farming business.

2

Corporate Structure

Our current corporate structure as of June 28, 2020 is set forth in the diagram below:

Corporate Information

We are headquartered in Hangzhou, China. Our principal executive office is located at 6th Floor, Hai Wai Hai Tongxin Mansion, Gong Shu District, Hangzhou City, Zhejiang Province, China, Zip Code 310008. Our main telephone number is +86-571-8821-9579, and fax number is +86-571-8807-7108.

Our website address is www.jiuzhou360.com. Information contained on our website is not incorporated by reference into this prospectus and you should not consider information on our website to be part of this prospectus, other than those specifically indicated so in this prospectus. Our shares of common stock are traded on the NASDAQ Capital Market under the symbol “CJJD.”

3

| Common Stock offered by the Selling Shareholders: | 4,050,003 shares of common stock issuable upon exercise of the Warrants. |

| Common stock outstanding prior to this offering: | 37,961,790 shares as of July 8, 2020 |

| Use of proceeds: | The Selling Shareholders will receive the proceeds from the sale of the shares of common stock offered hereby. We will not receive any proceeds from the sale of the shares of common stock. See “Use of Proceeds” on page 5 of this prospectus. |

| Risk Factors: | The purchase of our securities involves a high degree of risk. See under the caption “Risk Factors” in our annual report on Form 10-K that is incorporated by reference in this prospectus, as updated by our subsequent filings under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our securities. |

| NASDAQ Capital Market Symbol: | “CJJD” |

The number of shares of our common stock outstanding, as set forth in the table above, is based on 37,961,790 shares outstanding as of July 8, 2020, and excludes, as of such date:

| ● | 4,854,006 shares being held in reserve by us for future issuance of shares underlying the warrants and/or options that were outstanding immediately prior to the date hereto other than the shares underlying the Warrants; | |

| ● | 4,050,003 shares of common stock issuable upon exercise of the Warrants; and | |

| ● | 3,840,546 shares available for future issuance under our equity incentive plans, excluding the shares reserved for the options issued under the Company’s 2010 Equity Incentive Plan that was included in the first footnote above. |

4

An investment in our securities involves a high degree of risk. Before making any investment decision, you should carefully consider the risk factors set forth below, the information under the caption “Risk Factors” in any applicable prospectus supplement, any related free writing prospectus that we may authorize to be provided to you and the information under the caption “Risk Factors” in our annual report on Form 10-K that is incorporated by reference in this prospectus, as updated by our subsequent filings under the Exchange Act.

These risks could materially affect our business, results of operation or financial condition and affect the value of our securities. Additional risks and uncertainties that are not yet identified may also materially harm our business, operating results and financial condition and could result in a complete loss of your investment. You could lose all or part of your investment. For more information, see “Where You Can Find More Information.”

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements contained or incorporated by reference in this prospectus may be “forward-looking statements” within the meaning of Section 27A of the Securities Act, and Section 21E of the Exchange Act and may involve material risks, assumptions and uncertainties. Forward-looking statements typically are identified by the use of terms such as “may,” “will,” “should,” “believe,” “might,” “expect,” “anticipate,” “intend,” “plan,” “estimate” and similar words, although some forward-looking statements are expressed differently.

Although we believe that the expectations reflected in such forward-looking statements are reasonable, these statements are not guarantees of future performance and involve certain risks and uncertainties that are difficult to predict and which may cause actual outcomes and results to differ materially from what is expressed or forecasted in such forward-looking statements. These forward-looking statements speak only as of the date on which they are made and except as required by law, we undertake no obligation to publicly release the results of any revision or update of these forward-looking statements, whether as a result of new information, future events or otherwise. If we do update or correct one or more forward-looking statements, you should not conclude that we will make additional updates or corrections with respect thereto or with respect to other forward-looking statements. A detailed discussion of risks and uncertainties that could cause actual results and events to differ materially from our forward-looking statements is included in our periodic reports filed with the SEC and in the “Risk Factors” section of this prospectus.

We will not receive any proceeds from the sale of our common stock offered by this prospectus. The Selling Shareholders will receive all of the proceeds. We will pay all costs, fees and expenses incurred in connection with the registration of the shares of our common stock covered by this prospectus.

The following is a summary of our capital stock and certain provisions of our articles of incorporation and bylaws. This summary does not purport to be complete and is qualified in its entirety by the provisions of our articles of incorporation, as amended, our bylaws and applicable provisions of the laws of the State of Nevada.

See “Where You Can Find More Information” elsewhere in this prospectus for information on where you can obtain copies of our articles of incorporation and our bylaws, which have been filed with and are publicly available from the SEC.

Our authorized capital stock consists of 250,000,000 shares of common stock, par value $0.001 per share, and 10,000,000 shares of preferred stock, par value $0.001 per share. As of July 8, 2020, (i) 37,961,790 shares of common stock were issued and outstanding, (ii) no shares of preferred stock were issued and outstanding, (iii) an incentive stock option plan for our directors, officers, and employees to purchase 3,840,546 shares of common stock, (iv) warrants and options to purchase 4,854,006 shares of common stock upon the exercise of the warrants and/or options that were outstanding other than the Warrants and (v) the Warrants for 4,050,003 shares of common stock were issued and outstanding. As of July 14, 2020, the Warrants had not been exercised.

5

DESCRIPTION OF COMMON STOCK

As of July 8, 2020, there were 37,961,790 shares of our common stock issued and outstanding.

Our common stock is currently traded on the NASDAQ Capital Market under the symbol “CJJD.”

The holders of our common stock are entitled to one vote per share on all matters submitted to a vote of our stockholders and do not have cumulative voting rights. Accordingly, holders of a majority of the shares of common stock entitled to vote in any election of directors may elect all of the directors standing for election. The holders of outstanding shares of common stock are entitled to receive ratably any dividends declared by our board of directors out of assets legally available. Upon our liquidation, dissolution or winding up, holders of our common stock are entitled to share ratably in all assets remaining after payment of liabilities and the liquidation preference of any then outstanding shares of preferred stock. Holders of common stock have no preemptive or conversion rights or other subscription rights. There are no redemption or sinking fund provisions applicable to our common stock. The transfer agent and registrar for our common stock is American Stock Transfer & Trust Company, LLC, 6201 15th Avenue, Brooklyn, New York 11219, and its telephone number is (718) 921-8206.

All issued and outstanding shares of common stock are fully paid and non-assessable. Shares of our common stock that may be offered, from time to time, under this prospectus will be fully paid and non-assessable.

DESCRIPTION OF PREFERRED STOCK

As of July 8, 2020, no shares of preferred stock had been issued or were outstanding.

Our board of directors has the authority to issue up to 10,000,000 shares of preferred stock in one or more series and to determine the rights and preferences of the shares of any such series without stockholder approval. Our board of directors may issue preferred stock in one or more series and has the authority to fix the designation and powers, rights and preferences and the qualifications, limitations or restrictions with respect to each class or series of such class without further vote or action by the stockholders, unless action is required by applicable law or the rules of any stock exchange on which our securities may be listed. The ability of our board of directors to issue preferred stock without stockholder approval could have the effect of delaying, deferring or preventing a change of control of us or the removal of existing management. Further, our board of director may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights of the holders of our common stock. Additionally, the issuance of preferred stock may have the effect of decreasing the market price of our common stock.

We will file as an exhibit to the registration statement of which this prospectus is a part, or will incorporate by reference from reports that we file with the SEC, the form of any certificate of designation that describes the terms of the series of preferred stock we are offering before the issuance of that series of preferred stock. This description will include, but not be limited to, the following:

| ● | the title and stated value; | |

| ● | the number of shares we are offering; | |

| ● | the liquidation preference per share; | |

| ● | the purchase price; | |

| ● | the dividend rate, period and payment date and method of calculation for dividends; | |

| ● | whether dividends will be cumulative or non-cumulative and, if cumulative, the date from which dividends will accumulate; | |

| ● | the provisions for a sinking fund, if any; | |

| ● | the provisions for redemption or repurchase, if applicable, and any restrictions on our ability to exercise those redemption and repurchase rights; |

6

| ● | whether the preferred stock will be convertible into our common stock, and, if applicable, the conversion price, or how it will be calculated, and the conversion period; | |

| ● | whether the preferred stock will be exchangeable into debt securities, and, if applicable, the exchange price, or how it will be calculated, and the exchange period; | |

| ● | voting rights, if any, of the preferred stock; | |

| ● | preemptive rights, if any; |

| ● | restrictions on transfer, sale or other assignment, if any; | |

| ● | a discussion of any material United States federal income tax considerations applicable to the preferred stock; | |

| ● | any limitations on the issuance of any class or series of preferred stock ranking senior to or on a parity with the series of preferred stock as to dividend rights and rights if we liquidate, dissolve or wind up our affairs; and | |

| ● | any other specific terms, preferences, rights or limitations of, or restrictions on, the preferred stock. |

DESCRIPTION OF WARRANTS

The material terms and provisions of the Warrants are summarized below. The summary is subject to, and qualified in its entirety by, the form of each warrant is attached as an exhibit to this registration statement.

The 2020 Warrants

The unregistered warrants issued on June 3, 2020 are issued to the investors in a concurrent private placement to a registered direct offering pursuant to a Securities Purchase Agreement dated June 1, 2020 (the “2020 Securities Purchase Agreement”), by and among the Company and the purchasers named therein, to purchase up to an aggregate of 3,750,003 shares of Common Stock at an exercise price of $2.60 per share (the “2020 Warrants”). The 2020 Warrants shall be initially exercisable six months following issuance and expire five and one-half years from the issuance date. The exercise price and the number of shares of Common Stock issuable upon exercise of the 2020 Warrants (the “2020 Warrant Shares”) are subject to adjustment in the event of stock splits or dividends, or other similar transactions. Within 30 business days from the date of the 2020 Securities Purchase Agreement, the Company shall file a registration statement on Form S-1 for the resale by the investors of the 2020 Warrant Shares and use commercially reasonable best efforts to cause such registration to become effective no later than 90 business days from the date of the 2020 Securities Purchase Agreement.

The 2020 Warrants provide that, if at any time while the 2020 Warrants are outstanding, the Company consummates a fundamental transaction, as described in the 2020 Warrants, and which term generally includes, but is not limited to: (i) any consolidation or merger into another corporation, (ii) the consummation of a transaction whereby another person or entity acquires more than 50% of our outstanding voting stock, or (iii) the sale of all or substantially all of our assets, then each holder, concurrently with or within 30 calendar days after the consummation of the fundamental transaction, will have the right to require the Company (or any successor thereto) to repurchase such holder’s 2020 Warrants for an amount of cash equal to the Black-Scholes value of the remaining unexercised portion of such holder’s 2020 Warrants.

H.C. Wainwright& Co., LLC (the “Placement Agent”) acted as exclusive placement agent in connection with the registered direct offering and the concurrent private placement of the 2020 Warrants (the “Offering”) pursuant to an engagement agreement between the Company and the Placement Agent dated May 31, 2020 (the “Engagement Agreement”). The Engagement Agreement provides that the Placement Agent will receive a commission equal to 6.5% of the aggregate gross proceeds of the Offering. The Placement Agent (or its designees) shall also receive warrants to purchase such number of shares of common stock as is equal to 6.0% of the aggregate number of shares of common stock sold in the Offering, or 300,000 warrants, with substantially the same terms as the 2020 Warrants being issued to the investors with certain exceptions, including but not limited to that the Placement Agent’s warrants will expire on June 1, 2025 and the exercise price shall be $2.57.

7

The following table sets forth the name of each Selling Shareholder and the number of shares of common stock that each Selling Shareholder may offer from time to time pursuant to this prospectus. The shares of common stock that may be offered by the Selling Shareholders hereunder may be acquired by the Selling Shareholders upon the exercise by the Selling Shareholders of the Warrants that are held by the Selling Shareholders. The shares of common stock that may be offered by the Selling Shareholders hereunder consist of (i) 3,750,003 shares of common stock issuable upon the exercise of the 2020 Warrants that were issued to certain of the Selling Shareholders on June 3, 2020 pursuant to the 2020 Securities Purchase Agreement and (ii) 300,000 shares of common stock issuable upon the exercise of the PA Warrants pursuant to the Engagement Agreement. Except as otherwise indicated, we believe that each of the beneficial owners and Selling Shareholders listed below has sole voting and investment power with respect to such shares of common stock, subject to community property laws, where applicable.

Except as noted in the table below, none of the Selling Shareholders has had a material relationship with us other than as a stockholder at any time within the past three years or has ever been one of our or our affiliates’ officers or directors. Each of the Selling Shareholders has acquired the Warrants (and the shares of common stock issuable upon the exercise thereof) in the ordinary course of business and, at the time of acquisition of the Warrants, none of the Selling Shareholders was a party to any agreement or understanding, directly or indirectly, with any person to distribute the shares of common stock to be resold by such Selling Shareholders under the registration statement of which this prospectus forms a part.

Because a Selling Shareholder may sell all, some or none of the shares of common stock that it holds that are covered by this prospectus, and because the offering contemplated by this prospectus is not underwritten, no estimate can be given as to the number of shares of our common stock that will be held by a Selling Shareholder upon termination of the offering. The information set forth in the following table regarding the beneficial ownership after resale of shares is based upon the assumption that the Selling Shareholders will sell all of the shares of common stock covered by this prospectus.

In accordance with the rules and regulations of the SEC, in computing the number of shares of common stock beneficially owned by a person and the percentage ownership of that person, shares issuable through the exercise of any option, warrant or right, through conversion of any security held by that person that are currently exercisable or that are exercisable within sixty (60) days are included. These shares are not, however, deemed outstanding for the purpose of computing the percentage ownership of any other person.

| Shares Owned Prior to the Offering | Number of Shares Offered | Shares Owned After the Offering | ||||||||||||||||||

| Name | Number (1) | Percent (2) | Shares (3) | Number | Percent | |||||||||||||||

| Anson Investments Master Fund LP (4) | 2,250,003 | 4.99 | % | 1,250,001 | 1,000,002 | 2.63 | % | |||||||||||||

| Armistice Capital Master Fund, Ltd. (5) | 1,250,001 | 3.29 | % | 1,250,001 | -0- | N/A | ||||||||||||||

| Intracoastal Capital, LLC (6) | 1,250,001 | 3.29 | % | 1,250,001 | -0- | N/A | ||||||||||||||

| Charles Worthman (7) | 6,120 | * | 3,000 | 3,120 | * | |||||||||||||||

| Noam Rubinstein (7) | 184,572 | * | 94,500 | 90,072 | * | |||||||||||||||

| Michael Vasinkevich (7) | 238,815 | * | 192,375 | 46,440 | * | |||||||||||||||

| Craig Schwabe (7) | 10,125 | * | 10,125 | -0- | N/A | |||||||||||||||

| * | Less than 1%. |

| (1) | Assumes the Warrants held by the Selling Shareholders are exercised in full solely for the purpose of this section. |

8

| (2) | Based on 37,961,790 shares issued and outstanding as of July 8, 2020. Shares of our common stock underlying the Warrants are not counted for the purposes of this calculation. |

| (3) | Assumes sale of all shares available for sale under this prospectus and no further acquisitions of shares by the Selling Shareholders. |

| (4) | Represents 1,250,001 shares of our common stock underlying the Warrants and 1,000,002 shares of our common stock underlying other warrants previously issued by the Company to Anson Investments Master Fund LP (“Anson”). The Warrants held by Anson are subject to a beneficial ownership limitation of 4.99%, which does not permit Anson to exercise that portion of the Warrants that would result in Anson and its affiliates owning, after exercise, a number of shares of common stock in excess of the beneficial ownership limitation. Anson Advisors Inc. and Anson Funds Management LP, the Co-Investment Advisers of Anson, hold voting and dispositive power over the common shares held by Anson. Bruce Winson is the managing member of Anson Management GP LLC, which is the general partner of Anson Funds Management LP. Moez Kassam and Amin Nathoo are directors of Anson Advisors Inc. Mr. Winson, Mr. Kassam and Mr. Nathoo each disclaim beneficial ownership of these shares of common stock except to the extent of their pecuniary interest therein. The business address of Mr. Winson, Mr. Kassam and Mr. Nathoo is c/o Anson Advisors Inc., 155 University Ave., Suite 207, Toronto, ON CANADA M5H 3B7. |

| (5) | Represents 1,250,001 shares of our common stock underlying the Warrants held by Armistice Capital Master Fund, Ltd. (“Armistice Fund”). The Warrants held by Armistice Fund are subject to a beneficial ownership limitation of 4.99%, which does not permit Armistice Fund to exercise that portion of the warrants that would result in Armistice Fund and its affiliates owning, after exercise, a number of shares of common stock in excess of the beneficial ownership limitation. The amounts and percentages in the table do not give effect to the beneficial ownership limitation. Steven Boyd is the Managing Member of Armistice Capital, LLC, which acts as the investment manager of Armistice Fund. As a result, Mr. Boyd and Armistice Capital, LLC may be deemed to hold shared voting and dispositive power over the securities held by Armistice Fund. Each of Mr. Boyd and Armistice Capital, LLC disclaims beneficial ownership of these shares of common stock except to the extent of his or its pecuniary interest therein. The business address of Mr. Boyd is c/o Armistice Capital, LLC, 510 Madison Avenue, 7th Floor, New York, NY 10022. |

| (6) | Represents 1,250,001 shares of our common stock underlying the Warrants held by Intracoastal Capital, LLC (“Intracoastal”). The Warrants held by Intracoastal are subject to a beneficial ownership limitation of 4.99%, which does not permit Intracoastal to exercise that portion of the Warrants that would result in Intracoastal and its affiliates owning, after exercise, a number of shares of common stock in excess of the beneficial ownership limitation. Mitchell P. Kopin and Daniel B. Asher, each of whom are managers of Intracoastal, have shared voting control and investment discretion over the securities reported herein that are held by Intracoastal. As a result, each of Mr. Kopin and Mr. Asher may be deemed to have beneficial ownership of the securities reported herein that are held by Intracoastal. Mr. Kopin and Mr. Asher each disclaim beneficial ownership of these shares of common stock except to the extent of their pecuniary interest therein. The address of Mr. Kopin and Mr. Asher is 2211A Lakeside Drive, Bannockburn, Illinois 60015. |

| (7) | Each of these individuals is an affiliate of H.C. Wainwright & Co., LLC (“HCW”). As compensation for the aforementioned registered direct offering that was closed on June 3, 2020, the Warrants were issued to HCW, who then designated the Warrants to these individuals in the following amount: (i) Warrants to purchase up to 3,000 shares of our common stock to Charles Worthman, (ii) 94,500 shares to Noam Rubinstein, (iii) 192,375 shares to Michael Vasinkevich and (iv) 10,125 shares to Craig Schwabe. At the time the Warrants were received, such individuals had no understanding in place to redistribute the shares. The address of HCW is 430 Park Avenue, Third Floor, New York, NY 10022. |

9

The common stock covered by this prospectus may be offered and sold from time to time by the Selling Shareholders. The term “Selling Shareholder” includes pledgees, donees, transferees or other successors in interest selling shares received after the date of this prospectus from each of the Selling Shareholder as a pledge, gift, partnership distribution or other non-sale related transfer. The number of shares beneficially owned by Selling Shareholders will decrease as and when they effect any such transfers. The plan of distribution for the Selling Shareholders’ shares sold hereunder will otherwise remain unchanged, except that the transferees, pledgees, donees or other successors will be Selling Shareholders hereunder. To the extent required, we may amend and supplement this prospectus from time to time to describe a specific plan of distribution. The Selling Shareholders will act independently of us in making decisions with respect to the timing, manner and size of each sale. Once sold under this registration statement, of which this prospectus forms a part, the shares of common stock will be freely tradable in the hands of persons other than our affiliates.

We will not receive any of the proceeds from the sale by the Selling Shareholders of the shares of common stock. We will bear all fees and expenses incident to our obligation to register the shares of common stock.

The Selling Shareholders may make these sales at prices and under terms then prevailing or at prices related to the then current market price. The Selling Shareholders may also make sales in negotiated transactions. The Selling Shareholders may offer their shares from time to time pursuant to one or more of the following methods:

| ● | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| ● | one or more block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| ● | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| ● | an exchange distribution in accordance with the rules of the applicable exchange; |

| ● | public or privately negotiated transactions; |

| ● | on the NASDAQ Capital Market (or through the facilities of any national securities exchange or U.S. inter- dealer quotation system of a registered national securities association, on which the shares are then listed, admitted to unlisted trading privileges or included for quotation); |

| ● | through underwriters, brokers or dealers (who may act as agents or principals) or directly to one or more purchasers; |

| ● | a combination of any such methods of sale; and |

| ● | any other method permitted pursuant to applicable law. |

In connection with distributions of the shares or otherwise, the Selling Shareholders may:

| ● | enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the shares in the course of hedging the positions they assume; |

| ● | sell the shares short after the effective date of the registration statement of which this prospectus forms a part and redeliver the shares to close out such short positions; |

| ● | enter into option or other transactions with broker-dealers or other financial institutions which require the delivery to them of shares offered by this prospectus, which they may in turn resell; and |

| ● | pledge shares to a broker-dealer or other financial institution, which, upon a default, they may in turn resell. |

10

In addition to the foregoing methods, the Selling Shareholders may offer their shares from time to time in transactions involving principals or brokers not otherwise contemplated above, in a combination of such methods as described above or any other lawful methods. The Selling Shareholders may also transfer, donate or assign their shares to lenders, family members and others and each of such persons will be deemed to be a Selling Shareholder for purposes of this prospectus. The Selling Shareholders or their successors in interest may from time to time pledge or grant a security interest in some or all of the shares of common stock, and if any Selling Shareholder defaults in the performance of its secured obligations, the pledgees or secured parties of such Selling Shareholder may offer and sell the shares of common stock from time to time under this prospectus; provided, however in the event of a pledge or then default on a secured obligation by a Selling Shareholder, in order for the shares to be sold under this registration statement, unless permitted by law, we must distribute a prospectus supplement and/or amendment to this registration statement amending the list of Selling Shareholders to include the pledgee, secured party or other successors in interest of such Selling Shareholder under this prospectus.

The Selling Shareholders may also sell their shares pursuant to Rule 144 under the Securities Act, provided the applicable Selling Shareholder meets the criteria and conforms to the requirements of such rule.

The Selling Shareholders may effect such transactions directly or indirectly through underwriters, broker-dealers or agents acting on their behalf. Broker-dealers or agents may receive commissions, discounts or concessions from the Selling Shareholders, in amounts to be negotiated immediately prior to the sale (which compensation as to a particular broker-dealer might be in excess of customary commissions for routine market transactions). If the shares of common stock are sold through underwriters or broker-dealers, the applicable Selling Shareholder will be responsible for underwriting discounts or commissions or agent’s commissions. Neither we, nor the Selling Shareholders, can presently estimate the amount of that compensation. If any Selling Shareholder notifies us that a material arrangement has been entered into with a broker- dealer for the sale of shares through a block trade, special offering, exchange, distribution or secondary distribution or a purchase by a broker or dealer, we will file a prospectus supplement, if required by Rule 424 under the Securities Act, setting forth: (i) the name of each of the selling shareholders and the participating broker-dealers; (ii) the number of shares involved; (iii) the price at which the shares were sold; (iv) the commissions paid or discounts or concessions allowed to the broker-dealers, where applicable; (v) a statement to the effect that the broker-dealers did not conduct any investigation to verify the information set out or incorporated by reference in this prospectus; and any other fact material to the transaction.

The Selling Shareholders and any other person participating in a distribution of the shares covered by this prospectus will be subject to applicable provisions of the Exchange Act, including, without limitation, Regulation M, which may limit the timing of purchases and sales of any of the shares by the Selling Shareholders and any other such person. Furthermore, under Regulation M, any person engaged in the distribution of the shares may not simultaneously engage in market-making activities with respect to the particular shares being distributed for certain periods prior to the commencement of, or during, that distribution. All of the above may affect the marketability of the shares and the ability of any person or entity to engage in market-making activities with respect to the shares. We have advised the Selling Shareholders that the anti-manipulation rules of Regulation M under the Exchange Act may apply.

In offering the shares covered by this prospectus, the Selling Shareholders, and any broker-dealers and any other participating broker-dealers who execute sales for the Selling Shareholders, may be deemed to be “underwriters” within the meaning of the Securities Act in connection with these sales. Any profits realized by the Selling Shareholders and the compensation of such broker-dealers may be deemed to be underwriting discounts and commissions. We are not aware that any Selling Shareholder has entered into any arrangements with any underwriters or broker-dealers regarding the sale of its shares of our common stock.

The validity of the common stock registered for resale hereby will be passed upon for us by Flangas Law Group.

11

Our consolidated financial statements as of March 31, 2020 and 2019, and for each of the years in the two-year period ended March 31, 2020, have incorporated by reference in the registration statement in reliance on the report of BDO China Shu Lun Pan Certified Public Accountants LLP, an independent registered public accounting firm, and upon the authority of said firm as experts in accounting and auditing.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” the information we file with them into this prospectus. This means that we can disclose important information about us and our financial condition to you by referring you to another document filed separately with the SEC instead of having to repeat the information in this prospectus. The information incorporated by reference is considered to be part of this prospectus and later information that we file with the SEC will automatically update and supersede this information. This prospectus incorporates by reference any future filings made with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act, between the date of the initial registration statement and prior to effectiveness of the registration statement and the documents listed below that we have previously filed with the SEC:

| ● | our Current Reports on Form 8-K, filed with the SEC on June 2, 2020, June 15, 2020 and June 26, 2020, respectively; and | |

| ● | our Annual Report on Form 10-K for the year ended March 31, 2020, filed with the SEC on July 10, 2020 |

We also incorporate by reference all documents that we file with the SEC on or after the effective time of this prospectus pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act and prior to the sale of all the securities registered hereunder or the termination of the registration statement. Nothing in this prospectus shall be deemed to incorporate information furnished but not filed with the SEC.

Any statement contained in this prospectus or in a document incorporated or deemed to be incorporated by reference in this prospectus shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained herein or in the applicable prospectus supplement or in any other subsequently filed document that also is or is deemed to be incorporated by reference modifies or supersedes the statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

You may request a copy of the filings incorporated herein by reference, including exhibits to such documents that are specifically incorporated by reference, at no cost, by writing or calling us at the following address or telephone number:

China Jo-Jo Drugstores, Inc.

Hai Wai Hai Tongxin Mansion Floor 6

Gong Shu District, Hangzhou City

People’s Republic of China 310008

+86-571-88219579

Statements contained in this prospectus as to the contents of any contract or other documents are not necessarily complete, and in each instance you are referred to the copy of the contract or other document filed as an exhibit to the registration statement or incorporated herein, each such statement being qualified in all respects by such reference and the exhibits and schedules thereto.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus is part of a registration statement on Form S-1 that we filed with the SEC registering the securities that may be offered and sold hereunder. The registration statement, including exhibits thereto, contains additional relevant information about us and these securities, as permitted by the rules and regulations of the SEC, we have not included in this prospectus. A copy of the registration statement can be obtained at the address set forth below or at the SEC’s website as noted below. You should read the registration statement, including any applicable prospectus supplement, for further information about us and these securities.

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at http:/www.sec.gov. You may also read and copy any document we file at the SEC’s public reference room, 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference room. Because our common stock is listed on the NASDAQ Capital Market, you may also inspect reports, proxy statements and other information at the offices of the NASDAQ Capital Market.

Copies of certain information filed by us with the SEC are also available on our website at http://www.jiuzhou360.com. Our website is not a part of this prospectus and is not incorporated by reference in this prospectus.

12

PART II - INFORMATION NOT REQUIRED IN PROSPECTUS

| Item 13. | Other Expenses of Issuance and Distribution. |

The following table sets forth the costs and expenses, other than underwriting discounts and placement agent fees, if applicable, payable by the registrant in connection with the sale of the shares of common stock being registered. All amounts are estimates except the fees payable to the SEC.

| SEC registration fee | $ | 693.91 | ||

| Legal fees and expenses | $ | * | ||

| Accounting fees and expenses | $ | * | ||

| Miscellaneous fees and expenses | $ | * | ||

| Total | $ | * |

| * | Estimated expenses are presently not known and cannot be estimated. |

| Item 14. | Indemnification of Directors and Officers. |

Under Sections 78.7502 and 78.751 of the Nevada Revised Statutes, the Company has broad powers to indemnify and insure its directors and officers against liabilities they may incur in their capacities as such. These indemnification provisions may be sufficiently broad to permit indemnification of the Company’s directors and officers for liabilities, including reimbursement of expenses incurred, arising under the Securities Act.

Insofar as indemnification for liabilities arising under the Securities Act, is permitted for our directors, officers or controlling persons, pursuant to the above mentioned statutes or otherwise, we understand that the SEC is of the opinion that such indemnification may contravene federal public policy, as expressed in the Securities Act, and therefore, is unenforceable. Accordingly, in the event that a claim for such indemnification is asserted by any of our directors, officers or controlling persons, and the SEC is still of the same opinion, we (except insofar as such claim seeks reimbursement from us of expenses paid or incurred by a director, officer of controlling person in successful defense of any action, suit or proceeding) will, unless the matter has theretofore been adjudicated by precedent deemed by our counsel to be controlling, submit to a court of appropriate jurisdiction the question whether or not indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

At present, there is no pending litigation or proceeding involving any of our directors, officers or employees as to which indemnification is sought, nor are we aware of any threatened litigation or proceeding that may result in claims for indemnification.

| Item 15. | Recent Sales of Unregistered Securities. |

During the last three years, the registrant has not issued unregistered securities to any person, except as described below. None of these transactions involved any underwriters, underwriting discounts or commissions, except as specified below, or any public offering, and, unless otherwise indicated below, the registrant believes that each transaction was exempt from the registration requirements of the Securities Act of 1933 by virtue of Section 4(a)(2) thereof and/or Regulation D promulgated thereunder. All recipients had adequate access, though their relationships with the registrant, to information about the registrant.

On April 15, 2019, the registrant issued warrants to purchase up to 3,240,006 shares of common stock to certain accredited investors and the placement agent in a private placement. These shares underlying the warrants have been later registered under the Securities Act of 1933 in 2019. The issuance of the warrants was in reliance upon the exemption afforded by Regulation D under the Securities Act.

On June 3, 2020, the registrant issued Warrants to purchase up to 4,050,003 shares of common stock to certain accredited investors and the placement agent’s affiliates in a private placement, which was discussed in details under DESCRIPTION OF WARRANTS and incorporated herein by reference. The issuance of the Warrants was in reliance upon the exemption afforded by Regulation D under the Securities Act.

II-1

| Item 16. | Exhibits and Financial Statement Schedules. |

The exhibits listed on the Index to Exhibits of this Registration Statement are filed herewith or are incorporated herein by reference to other filings.

(a) Exhibits. The following exhibits are included herein or incorporated herein by reference.

II-2

| * | Filed herewith |

| (1) | Incorporated by reference from the registrant’s Registration Statement on Form SB-2 filed on November 28, 2007 |

| (2) | Incorporated by reference from the registrant’s Current Report on Form 8-K filed on July 15, 2008 |

| (3) | Incorporated by reference from the registrant’s Current Report on Form 8-K filed on September 24, 2009 |

| (4) | Incorporated by reference from the registrant’s Current Report on Form 8-K filed on October 30, 2009 |

| (5) | Incorporated by reference from the registrant’s Current Report on Form 8-K filed on March 16, 2010 |

| (6) | Incorporated by reference from the registrant’s Current Report on Form 8-K filed on April 14, 2010 |

| (7) | Incorporated by reference from the registrant’s Annual Report on Form 10-K filed on June 29, 2010 |

| (8) | Incorporated by reference from the registrant’s Current Report on Form 8-K filed on June 2, 2020 |

| (9) | Incorporated by reference from the registrant’s Quarterly Report on Form 10-Q filed on February 14, 2011 |

| (10) | Incorporated by reference from the registrant’s Current Report on Form 8-K filed on May 17, 2012 |

| (11) | Incorporated by reference from the registrant’s Current Report on Form 8-K filed on November 30, 2012 |

| (12) | Incorporated by reference from the registrant’s Current Report on Form 8-K filed on January 4, 2013 |

| (13) | Incorporated by reference from the registrant’s Current Report on Form 8-K filed on December 12, 2013 |

| (14) | Incorporated by reference from the registrant’s Current Report on Form 8-K filed on April 11, 2019 |

| (15) | Incorporated by reference from the registrant’s Current Report on Form 8-K filed on October 26, 2018 |

| (16) | Incorporated by reference from the registrant’s Current Report on Form 8-K filed on November 24, 2014 |

| (17) | Incorporated by reference from the registrant’s Current Report on Form 8-K filed on July 21, 2015 |

| (18) | Incorporated by reference from the registrant’s Current Report on Form 8-K filed on December 2, 2015 |

| (19) | Incorporated by reference from the registrant’s Current Report on Form 8-K filed on January 4, 2017 |

| (20) | Incorporated by reference from the registrant’s Exhibit A to the proxy statement on Schedule 14A filed on January 21, 2020 |

| (21) | Incorporated by reference from Exhibit 10.33 of the registrant’s Annual Report on Form 10-K filed on June 29, 2017 |

| (22) | Incorporated by reference from the registrant’s Current Report on Form 8-K filed on September 6, 2018 |

| (23) | Incorporated by reference from the registrant’s Annual Report on Form 10-K filed on July 10, 2020 |

(b) Financial Statement Schedules. No financial statement schedules have been submitted because they are not required or are not applicable or because the information required is included in the consolidated financial statements or the notes thereto.

II-3

| Item 17. | Undertakings. |

| (a) | The undersigned Registrant hereby undertakes: |

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) to include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) to reflect in the prospectus any facts or events arising after the effective date of this registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in this registration statement. Notwithstanding the foregoing, any increase or decrease in the volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) to include any material information with respect to the plan of distribution not previously disclosed in this registration statement or any material change to such information in this registration statement;

provided, however, that paragraphs (1)(i), (1)(ii) and (1)(iii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act, that are incorporated by reference in this registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of this registration statement.

(2) That, for the purposes of determining any liability under the Securities Act, each post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at the time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser, each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness; provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use.

| (b) | The Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in this Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. | |

| (c) | Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the indemnification provisions described herein, or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue. |

II-4

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized in the city of Hangzhou, the People’s Republic of China, on July 14, 2020.

| CHINA JO-JO DRUGSTORES, INC. | ||

| By: | /s/ Lei Liu | |

| Name: | Lei Liu | |

| Title: |

Chief Executive Officer (Principal Executive Officer) | |

Pursuant to the requirements of the Securities Act, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

| Signature | Title | Date | ||

| /s/ Lei Liu | Chief Executive Officer and Director | July 14, 2020 | ||

| Lei Liu | (Principal Executive Officer) | |||

| /s/ Ming Zhao | Chief Financial Officer | July 14, 2020 | ||

| Ming Zhao | (Principal Financial Officer and Principal Accounting Officer) | |||

| * | ||||

| Li Qi | Director | July 14, 2020 | ||

| * | ||||

| Caroline Wang | Director | July 14, 2020 | ||

| * | ||||

| Jiangliang He | Director | July 14, 2020 | ||

| * | ||||

| Genghua Gu | Director | July 14, 2020 | ||

| * | ||||

| Pingfan Wu | Director | July 14, 2020 |

| *By: | /s/ Lei Liu | |

| Lei Liu

Attorney-in-fact |

||

| *By: | /s/ Ming Zhao | |

| Ming Zhao

Attorney-in-fact |

II-5