Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Digital Media Solutions, Inc. | d947542d8k.htm |

Sector Trading Update July 6, 2020 Exhibit 99.1

Disclaimer This investor presentation (“Investor Presentation”) is for informational purposes only to assist interested parties in making their own evaluation with respect to the proposed business combination (the “Business Combination”) between Leo Holdings Corp. (“Leo”) and Digital Media Solutions, LLC (“DMS” or the “Company”). The information contained herein does not purport to be all-inclusive and none of Leo and DMS nor their respective affiliates makes any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this Investor Presentation. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein, and, by accepting this presentation, you confirm that you are not relying upon the information contained herein to make any decision. Forward-Looking Statements. Certain statements in this presentation may be considered forward-looking statements. Forward-looking statements generally relate to future events or Leo’s or the Company’s future financial or operating performance. For example, projections of future EBITDA, Adjusted EBITDA, EBITDA Growth, EBITDA Margin, Pro Forma Adjusted EBITDA, Unlevered Free Cash Flow, Revenue, Revenue Growth, Sales Growth, Capital Expenditures and other metrics are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expect”, “intend”, “will”, “estimate”, “anticipate”, “believe”, “predict”, “potential” or “continue”, or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Leo and its management, and DMS and its management, as the case may be, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to, various factors beyond management's control including competition and general economic conditions for the Company and its management, and other risks, uncertainties and factors set forth in the section entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in Leo’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019. Nothing in this presentation should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. Neither Leo nor the Company undertakes any duty to update these forward-looking statements. Use of Projections. This Investor Presentation contains financial forecasts of the Company. Neither the Company’s independent auditors, nor the independent registered public accounting firm of Leo, audited, reviewed, compiled, or performed any procedures with respect to the projections for the purpose of their inclusion in this Investor Presentation, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this Investor Presentation. These projections should not be relied upon as being necessarily indicative of future results. Additional Information. In connection with the Business Combination, Leo intends to file with the SEC a Registration Statement on Form S-4 (the “Registration Statement”), which will include a preliminary prospectus and preliminary proxy statement. Leo will mail a definitive proxy statement/prospectus and other relevant documents to its shareholders. This Investor Presentation is not a substitute for the Registration Statement, the definitive proxy statement/prospectus or any other document that Leo will send to its shareholders in connection with the Business Combination. Investors and security holders of Leo are advised to read, when available, the proxy statement/prospectus in connection with Leo’s solicitation of proxies for its extraordinary general meeting of shareholders to be held to approve the Business Combination (and related matters) because the proxy statement/prospectus will contain important information about the Business Combination and the parties to the Business Combination. The definitive proxy statement/prospectus will be mailed to shareholders of Leo as of a record date to be established for voting on the Business Combination. Shareholders will also be able to obtain copies of the proxy statement/prospectus, without charge, once available, at the SEC’s website at www.sec.gov or by directing a request to: Leo Holdings Corp., 21 Grosvenor Place, London SW1X 7HF, United Kingdom. Participants in the Solicitation. Leo and its directors, executive officers, other members of management, and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies of Leo’s shareholders in connection with the Business Combination. Investors and security holders may obtain more detailed information regarding the names and interests in the Business Combination of Leo’s directors and officers in Leo’s filings with the SEC, including Leo’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, which was filed with the SEC on March 13, 2020, as well as in the Registration Statement, which will include the proxy statement of Leo for the Business Combination. Shareholders can obtain copies of Leo’s filings with the SEC, without charge, at the SEC’s website at www.sec.gov. No Offer or Solicitation. This Investor Presentation is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities or the solicitation of any vote in any jurisdiction pursuant to the Business Combination or otherwise, nor shall there be any sale, issuance or transfer or securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933 and otherwise in accordance with applicable law. The historical financial information is based on financials prepared pursuant to generally accepted accounting principles under standards established by the AICPA Auditing Standards Board. When the proxy statement/registration statement is filed with the SEC public company standards set by the Public Company Accounting Oversight Board will be applied which could lead to different financial results. In addition, certain historical financial information is based on unaudited estimates for certain periods, and the Company's actual historical financial information for those periods could differ materially from such estimates. Non-GAAP Financial Measure and Related Information. The disclosure herein references EBITDA, EBITDA margin, and Unlevered Free Cash Flow which are financial measures that are not prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). These non-GAAP financial measures do not have a standardized meaning, and the definition of EBITDA used by DMS may be different from other, similarly named non-GAAP measures used by others operating in the target’s industry. In addition, such financial information is unaudited and/or does not conform to SEC Regulation S-X and as a result such information may be presented differently in future filings by the Company with the SEC. 1

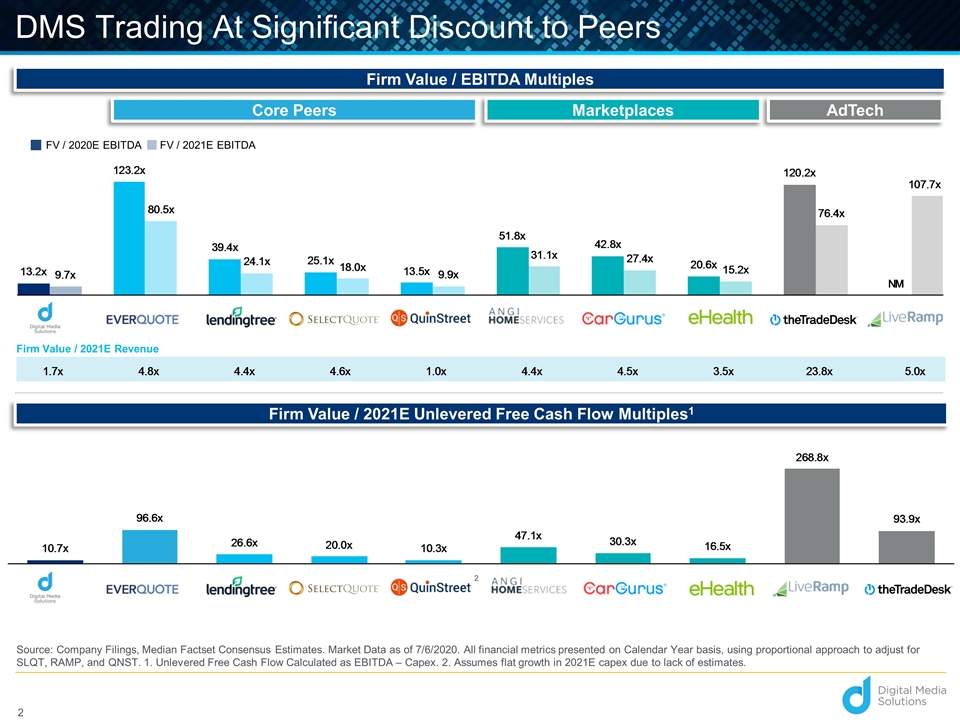

FV / 2020E EBITDA FV / 2021E EBITDA DMS Trading At Significant Discount to Peers Source: Company Filings, Median Factset Consensus Estimates. Market Data as of 7/6/2020. All financial metrics presented on Calendar Year basis, using proportional approach to adjust for SLQT, RAMP, and QNST. 1. Unlevered Free Cash Flow Calculated as EBITDA – Capex. 2. Assumes flat growth in 2021E capex due to lack of estimates. Firm Value / EBITDA Multiples Firm Value / 2021E Unlevered Free Cash Flow Multiples1 Marketplaces Core Peers AdTech Firm Value / 2021E Revenue 2 2

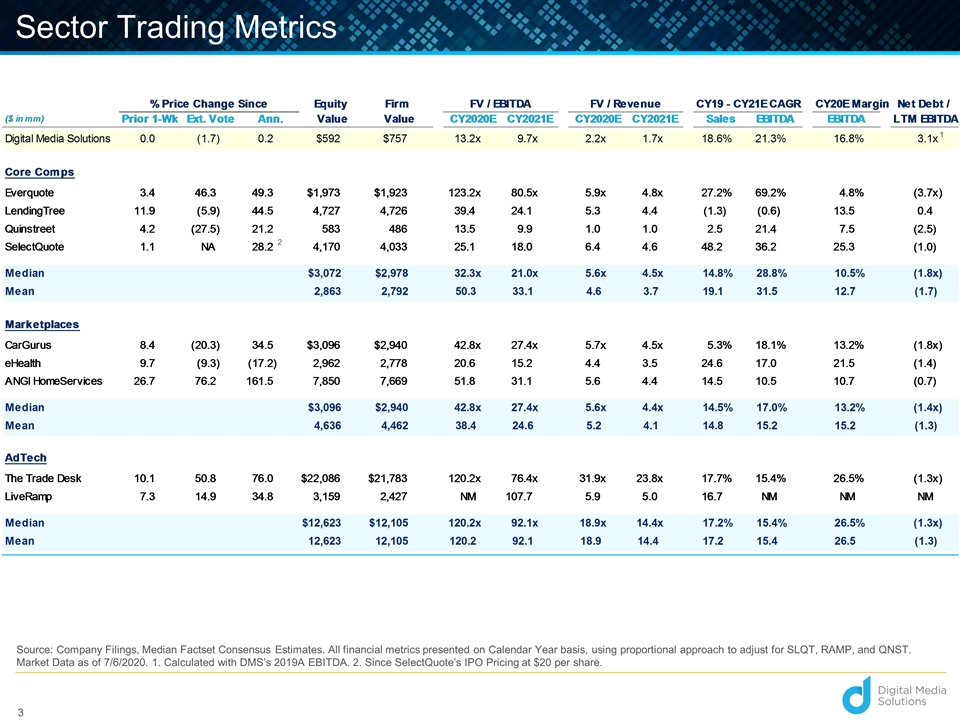

Sector Trading Metrics Source: Company Filings, Median Factset Consensus Estimates. All financial metrics presented on Calendar Year basis, using proportional approach to adjust for SLQT, RAMP, and QNST. Market Data as of 7/6/2020. 1. Calculated with DMS’s 2019A EBITDA. 2. Since SelectQuote’s IPO Pricing at $20 per share. 2 3 1