Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - BED BATH & BEYOND INC | exhibit991-pressreleas.htm |

| 8-K - 8-K - BED BATH & BEYOND INC | form8-k7820q1fy20.htm |

July 8, 2020 BED BATH & BEYOND

This presentation contains forward-looking statements, including, but not limited to, the Company’s progress and anticipated progress towards its long-term objectives and the success of its plans in response to the novel coronavirus (COVID-19), as well as the status of its future liquidity and financial condition and potential impact and success of its strategic restructuring program. Many of these forward-looking statements can be identified by use of words such as may, will, expect, anticipate, approximate, estimate, assume, continue, model, project, plan, goal, and similar words and phrases, although the absence of those words does not necessarily mean that statements are not forward-looking. The Company’s actual results and future financial condition may differ materially from those expressed in any such forward-looking statements as a result of many factors. Such factors include, without limitation: general economic conditions including the housing market, a challenging overall macroeconomic environment and related changes in the retailing environment; risks associated with COVID-19 and the governmental responses to it, including its impacts across the Company's businesses on demand and operations, as well as on the operations of the Company's suppliers and other business partners, and the effectiveness of the Company's actions taken in response to these risks; consumer preferences, spending habits and adoption of new technologies; demographics and other macroeconomic factors that may impact the level of spending for the types of merchandise sold by the Company; civil disturbances and terrorist acts; unusual weather patterns and natural disasters; competition from existing and potential competitors across all channels; pricing pressures; liquidity; the ability to achieve anticipated cost savings, and to not exceed anticipated costs, associated with organizational changes and investments, including the Company's strategic restructuring program; the ability to attract and retain qualified employees in all areas of the organization; the cost of labor, merchandise and other costs and expenses; potential supply chain disruption due to trade restrictions, and other factors such as natural disasters, such as pandemics, including the COVID-19 pandemic, political instability, labor disturbances, product recalls, financial or operational instability of suppliers or carriers, and other items; the ability to find suitable locations at acceptable occupancy costs and other terms to support the Company’s plans for new stores; the ability to establish and profitably maintain the appropriate mix of digital and physical presence in the markets it serves; the ability to assess and implement technologies in support of the Company’s development of its omnichannel capabilities; the ability to effectively and timely adjust the Company's plans in the face of the rapidly changing retail and economic environment, including in response to the COVID-19 pandemic; uncertainty in financial markets; volatility in the price of the Company’s common stock and its effect, and the effect of other factors, including the COVID-19 pandemic, on the Company’s capital allocation strategy; risks associated with the ability to achieve a successful outcome for its business concepts and to otherwise achieve its business strategies; the impact of intangible asset and other impairments; disruptions to the Company’s information technology systems including but not limited to security breaches of systems protecting consumer and employee information or other types of cybercrimes or cybersecurity attacks; reputational risk arising from challenges to the Company’s or a third party product or service supplier’s compliance with various laws, regulations or standards, including those related to labor, health, safety, privacy or the environment; reputational risk arising from third-party merchandise or service vendor performance in direct home delivery or assembly of product for customers; changes to statutory, regulatory and legal requirements, including without limitation proposed changes affecting international trade; changes to, or new, tax laws or interpretation of existing tax laws; new, or developments in existing, litigation, claims or assessments; changes to, or new, accounting standards; and foreign currency exchange rate fluctuations. The Company does not undertake any obligation to update its forward- looking statements. BED BATH & BEYOND 2

Mark Tritton Gustavo Arnal President & CEO CFO & Treasurer John Hartmann Joe Hartsig COO; President, buybuy BABY CMO; President, Harmon Stores Inc. BED BATH & BEYOND 3

1) COVID-19 Response / Strategic Update 2) FY 2020 Q1 Results (March 1st – May 30th) 3) Operations Update 4) Commercial Update 5) Q&A BED BATH & BEYOND 4

BED BATH & BEYOND 5

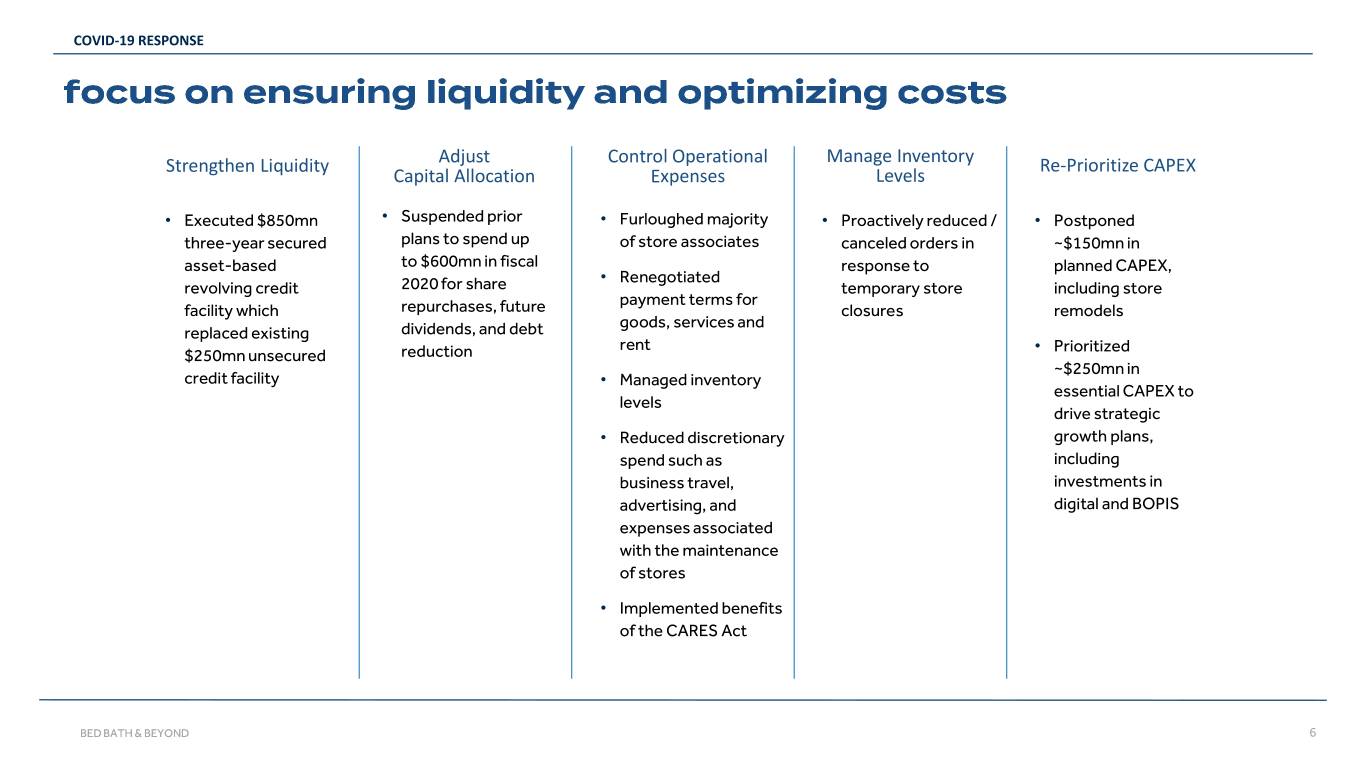

COVID-19 RESPONSE Strengthen Liquidity Adjust Control Operational Manage Inventory Re-Prioritize CAPEX Capital Allocation Expenses Levels • Executed $850mn • Suspended prior • Furloughed majority • Proactively reduced / • Postponed three-year secured plans to spend up of store associates canceled orders in ~$150mn in asset-based to $600mn in fiscal response to planned CAPEX, • Renegotiated revolving credit 2020 for share temporary store including store payment terms for facility which repurchases, future closures remodels goods, services and replaced existing dividends, and debt rent • Prioritized $250mn unsecured reduction ~$250mn in credit facility • Managed inventory essential CAPEX to levels drive strategic • Reduced discretionary growth plans, spend such as including business travel, investments in advertising, and digital and BOPIS expenses associated with the maintenance of stores • Implemented benefits of the CARES Act BED BATH & BEYOND 6

COVID-19 RESPONSE Protecting Associates and Customers During Q1 (March 1 – May 30): • Closed all retail banner stores on March 23rd across the US and Canada excluding most buybuy BABY and Harmon Face Values stores • Majority of stores remained closed for the rest of FY20 Q1 Enhancing Omni-Fulfillment Capabilities • Converted ~25% of Bed Bath & Beyond and buybuy BABY stores in the US/Canada into regional fulfillment centers to assign orders locally and deliver quickly • Accelerated launch of BOPIS and Curbside Pickup fulfillment services BED BATH & BEYOND 7

COVID-19 RESPONSE BED BATH & BEYOND 8

COVID-19 RESPONSE Post Q1 (June 1- July 8): • Nearly all stores open • Favorable response to store re-openings; Digital demand remains strong Early June Mid-June Mid-July % of Stores Open to the Public : >60% >80% ~100% Open to Curbside: ~93% ~95% ~100% BED BATH & BEYOND 9

BED BATH & BEYOND 10

STRATEGIC UPDATE ▪ Former EVP and Chief Merchandising Officer at Target Corporation Mark J. Tritton ▪ 30+ years of experience in end-to-end retail industry experience President and Chief Executive Officer ▪ Previous experience at Nordstrom, Inc., Timberland LLC and Nike, Inc. ▪ Currently serves on the board of Nordstrom, Inc. ▪ Former EVP and CFO at Avon, where Mr. Arnal helped lead a successful business turnaround Gustavo Arnal ▪ A global leader with experience managing teams across the US, EMEA, APAC and LATAM Chief Financial Officer and Treasurer ▪ Previously, CFO of International Divisions and Global Functions at Walgreens Boots Alliance; Senior positions at P&G, including CFO of India, Middle East and Africa, CFO Global Fabric and Home Care, and CFO Global Personal Beauty ▪ Former President and CEO of True Value Company, a leading hardware wholesaler John Hartmann ▪ Led True Value through a significant business transformation of its supply chain Chief Operating Officer and President, buybuy BABY (BABY) ▪ Previously, CEO of leading home improvement company Mitre 10 and COO at HD Supply; Senior positions at The Home Depot, Cardinal Health and the Federal Bureau of Investigation Joe Hartsig ▪ Former SVP & Chief Merchandising Officer at Walgreens Boots Alliance, managing the front of store Retail Products division Executive Vice President, ▪ Led Walgreens owned brand organization and e-commerce and digital merchandising strategies Chief Merchandising Officer and ▪ 30+ years of experience in consumer brand development and retail merchandising; Senior leadership positions at Walmart, Motorola and SC President, Harmon Stores, Inc. Johnson; Currently serves on the board of Acosta Cindy Davis ▪ Former EVP, Chief Digital Marketing Officer L Brands Executive Vice President, ▪ Prior to L Brands, Ms. Davis held strategic leadership positions at other leading retail and leisure brands, including Disney/ABC Television, Chief Brand Officer and Walmart, Inc., Sam’s Club, Yum! Brands, Starwood Hotels and Hilton Hotels President, Decorist ▪ 30+ years building strong brands and loyal, profitable customer relationships Rafeh Masood ▪ Former Chief Digital Officer of BJ’s Wholesale Club, driving digital strategy for e-commerce and omni-channel efforts Executive Vice President, ▪ Previous senior positions at Dick’s Sporting Goods and at Sears Holdings Chief Digital Officer ▪ RIS magazine named Masood as one of the “Top 10 Movers and Shakers” in retail in 2017 and a “Pacesetter” in retail technology in 2012 Gregg Melnick ▪ Former Chief Operations Officer, Digital and Chief Digital Officer at Bed Bath & Beyond Executive Vice President, ▪ Previously President Party City Holdings and President of Party City Retail Group Chief Stores Officer ▪ Held senior positions at Dow Jones Inc. Arlene Hong ▪ Former Chief Legal Officer and Corporate Secretary at FULLBEAUTY Brands, where she managed legal affairs for the $1 billion multi-channel retailer Executive Vice President, Chief Legal Officer and ▪ Previously led Amazon’s legal team responsible for the North America Softlines business Corporate Secretary ▪ Served as General Counsel at Quidsi (an Amazon subsidiary), Ideeli, Inc. and J.Crew BED BATH & BEYOND 11

STRATEGIC UPDATE BED BATH & BEYOND 12

STRATEGIC UPDATE • Reduce cost of goods and drive supply chain transformation to address current gross margin pressures related to the substantial shift of sales from store to digital channels • Close ~200 mostly Bed Bath & Beyond stores over the next two years under Store Network Optimization Project • Focus on other SG&A expense reductions • Further investments in Digital Transformation to accelerate and support growth BED BATH & BEYOND 13

BED BATH & BEYOND 14

Q1 2020 RESULTS • Fiscal Q1 spanned the most critical months to date of the COVID-19 pandemic – March, April and May • Maintained strong liquidity and financial flexibility driven by proactive actions to control cash burn • Strong balance sheet, ending quarter with ~$1.2bn in cash and investments; Post Q1: Secured new $850mn ABL Facility for additional liquidity if needed • Net Sales impacted by store closures; ~90% of total stores remained closed during the majority of the quarter; Operated mainly as a digital business during Q1 • Gross margin impacted by channel and product mix related to substantial shift in sales to digital channels BED BATH & BEYOND 15

Q1 2020 RESULTS • Started FY20 Q1 with a healthy cash position FY19 Q4 vs FY20 Q1 – liquidity & cash activity bridge (~$1.4bn as of year-end FY19) $1.6bn • Drew down available $236mn from unsecured $1.8bn revolving credit facility (March) $0.2bn $236mn • Actively controlled monthly cash burn $0.6bn ~neutral $1.2bn (~$1.2bn as of quarter-end FY20 Q1) >$200mn <$200mn • Post Q1, executed new $850mn secured $1.4bn asset-based revolving credit facility, $1.2bn strengthening liquidity if needed FY19 YE FY20 Q1 Post FY20 Q1 Balance Revolver March Cash April Cash May Cash Cash Cash Balance with Revolver Cash Draw Burn Burn Burn Balance with ABL Cash & Investments Credit Facility Availability BED BATH & BEYOND 16

Q1 2020 RESULTS Three Months Ended • Net sales impacted by temporary store closures during COVID-19 pandemic, decreased 49% vs. FY19 Q1 (in millions, except per share data) Q1 2020 Q1 2019 Diff • Gross Margin impacted by channel and product mix related to substantial shift in sales to digital channels, decreased Net Sales $1,307 $2,573 -49% ~780 bps to 26.7% Gross Margin 26.7% 34.5% -780 bps 1 • Adjusted SG&A expense decreased ~15% driven by cost SG&A Expense $723 $846 -15% reduction interventions and COVID-19 impacts EBITDA1 ($291) $125 nm • Adjusted EBITDA loss of (~$291mn); EPS - Diluted1 ($1.96) $0.12 nm • Adjusted EPS loss of ($1.96) vs. $0.12 in FY19 Q1 1 Adjusted BED BATH & BEYOND 17

Q1 2020 RESULTS • Explosive growth in Digital sales, ~82%; Sales by Channel Digital Sales Growth by Month Digital sales growth each month, supported by rollout of BOPIS and Curbside Pickup fulfillment services +>100% Stores, ~1/3 • COVID-19 events and temporary store closures for Digital, majority of quarter led to (~77%) in Store sales +17% ~2/3 March April/May BED BATH & BEYOND 18

Q1 2020 RESULTS • Gross Margin impacted by channel and product mix FY19 Q1 vs FY20 Q1 – gross margin bridge created by the COVID moment related to substantial shift in sales to digital channels, 26.7% vs 34.5% in FY19 Q1 34.5% - Digital sales ~2/3 of total net sales - Higher direct-to-customer shipping costs -450bps - Higher sales of lower margin, COVID-essential 26.7% product / Promotions -330bps -780bps Q1’19 Q1’20 Gross Margin Channel Mix Product Mix Gross Margin BED BATH & BEYOND 19

Q1 2020 RESULTS • SG&A expense decreased $169 million or 19% vs FY19 Q1, FY19 Q1 vs FY20 Q1 – adj. sg&a bridge driven by cost reduction interventions and COVID-19 impacts. $846mn • Adjusted SG&A expense declined ~$123mn (~15%) to $723mn vs $846mn in FY 19 Q1 $723mn ‐ Initiated cost reduction interventions at end of FY 19 and early in FY 20 Q1 in response to COVID 19 ($123mn) Payroll / Q1’19 Advertising / Q1’20A Adj. SG&A CARES Act Adj. SG&A BED BATH & BEYOND 20

BED BATH & BEYOND 21

OPERATIONS UPDATE • Converted ~25% of Bed Bath & Beyond and buybuy BABY stores in the US/Canada into regional fulfillment centers to assign orders locally and deliver quickly ‐ Nearly doubled digital fulfillment capacity ‐ Enabled online orders to ship in 2 days or less (average) • Accelerated launch of BOPIS and Curbside Pickup fulfillment services ‐ Expanded to ~60% of total stores by end of Q1 ‐ Strong customer adoption; weekly growth in BOPIS orders ‐ Further expansion of BOPIS and Curbside Pickup as stores re-open BED BATH & BEYOND 22

OPERATIONS UPDATE • Deep analysis of both individual store and • Plan to close ~200 mostly Bed Bath & Beyond market data stores over the next 2 yrs. • Right-size real estate portfolio to reduce • Expect unfavorable impact to topline; upside redundant stores and support digital-first opportunity on EBITDA platform • Drive cost productivity and continuous • Lean into store closures / leverage significant lease improvement efforts expirations coming due Optimal demand- driven omni-channel store network by market and banner BED BATH & BEYOND 23

OPERATIONS UPDATE Product / Assortment End to End Supply Chain Stores Customers Vendors Product / Assortment BED BATH & BEYOND 24

OPERATIONS UPDATE • BABY teams excelled in creating a positive customer experience and providing the essential items customers need to care for their families • Quickly shifted marketing approach to support the growing online demand • Led the Company’s pilot and standup of BOPIS / Curbside Pickup services • Strong online demand in categories such as: toddler food, safety equipment, playroom items, and sleepwear BED BATH & BEYOND 25

BED BATH & BEYOND 26 26

COMMERCIAL UPDATE • Partnered with vendors to increase and expedite products that met customers’ changing needs • Re-routed product from stores to web warehouses, and converted stores into regional fulfillment centers in order to support web orders • Adjusted marketing spend that was focused on driving store-only traffic • Modified product purchase orders in order to reduce exposure and manage costs BED BATH & BEYOND 27

COMMERCIAL UPDATE • Increased investments in search, paid social and affiliate marketing to reach new customers online • Focused attention on website, modernizing the look, feel and voice to align more closely with new branding • Built out more robust reporting to identify inventory challenges, and stood up working teams to pivot in real time • Incorporated key learnings about customer behavior through detailed site metrics from partners like Pinterest to optimize merchandising and messaging • Engaged new and current customers through digital marketing, and delivered on promise by accelerating the rollout of BOPIS and Curbside delivery • Customers responded to categories that make it easy to feel at home, particularly in the areas of Kitchen, Bed, Baby, Home Cleaning and Outdoor BED BATH & BEYOND 28

COMMERICAL UPDATE Start in Destination categories (Bed, Bath, Kitchen) with Category Experience Resets Create an Owned Brand Portfolio that drives differentiation, consumer delight and value Fund growth through assortment optimization reviews and supplier profitability actions across omni-channel portfolio Enhance in-stock levels and working capital savings by improved inventory balancing across our networks BED BATH & BEYOND 29

COMMERICAL UPDATE Deliver on price/value equation Leverage sales pattern analytics to optimize for margin opportunities Keep select digital assortment competitively priced and on strategy Develop end-to-end processes, analytics and tools to optimize investments and drive profitable sales-driving promotions BED BATH & BEYOND 30

BED BATH & BEYOND 31

WRAP UP 2 Strong liquidity position including recent initiatives around FY 2020 cash preservation and new ABL Facility 1 3 5 Transformation underway with cost interventions and investments in capabilities Strategic growth agenda Leading home furnishings to re-establish authority in Home space; that is customer inspired, retailer with significant scale Expect to generate future annualized savings omni always, designed to deliver and market share - make it of between $250 and $350mn, excluding future market share and easy to feel at home related one-time costs margin growth 4 ` New management team with extensive retail transformation expertise BED BATH & BEYOND 32

q&a BED BATH & BEYOND 33

BED BATH & BEYOND JULY 8, 2020 34

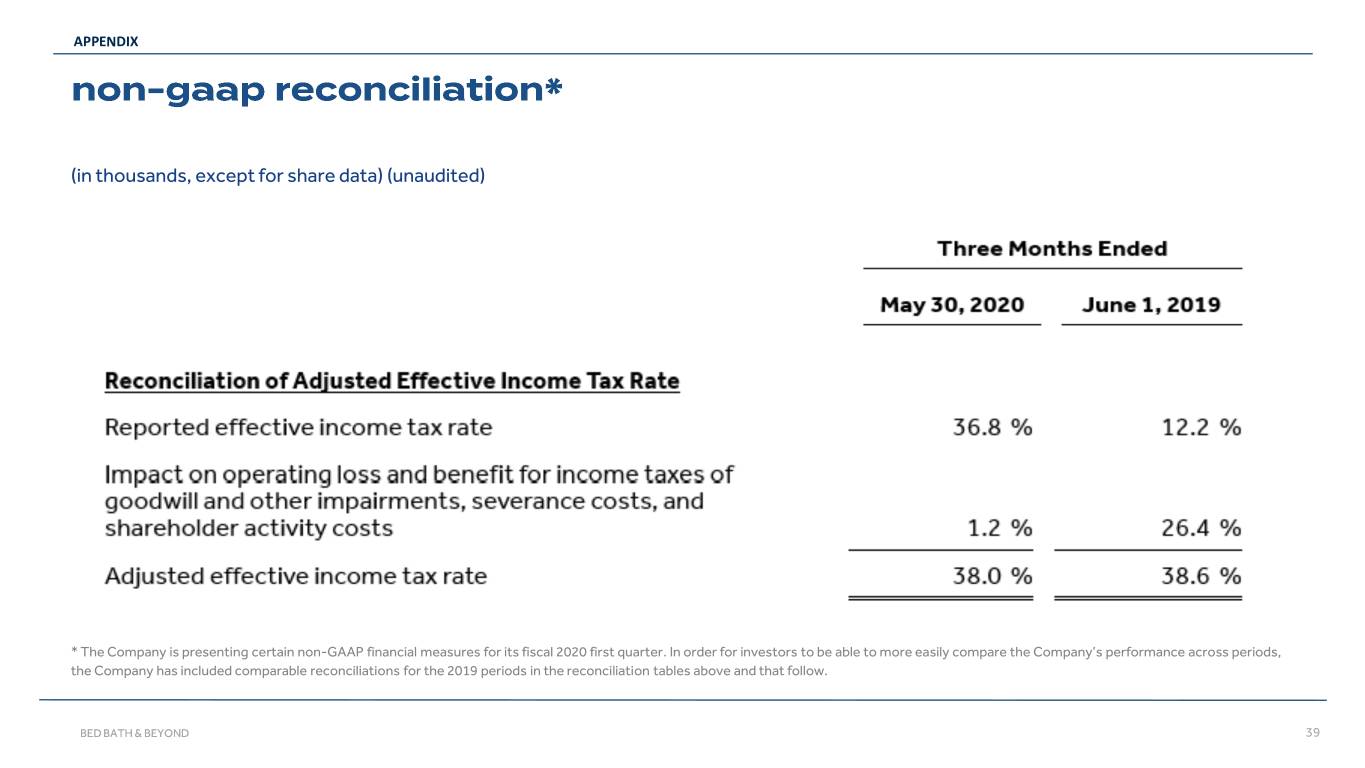

APPENDIX (in thousands, except for share data) (unaudited) * The Company is presenting certain non-GAAP financial measures for its fiscal 2020 first quarter. In order for investors to be able to more easily compare the Company’s performance across periods, the Company has included comparable reconciliations for the 2019 periods in the reconciliation tables above and that follow. BED BATH & BEYOND 35

APPENDIX (in thousands, except for share data) (unaudited) * The Company is presenting certain non-GAAP financial measures for its fiscal 2020 first quarter. In order for investors to be able to more easily compare the Company’s performance across periods, the Company has included comparable reconciliations for the 2019 periods in the reconciliation tables above and that follow. BED BATH & BEYOND 36

APPENDIX (in thousands, except for share data) (unaudited) * The Company is presenting certain non-GAAP financial measures for its fiscal 2020 first quarter. In order for investors to be able to more easily compare the Company’s performance across periods, the Company has included comparable reconciliations for the 2019 periods in the reconciliation tables above and that follow. BED BATH & BEYOND 37

APPENDIX (in thousands, except for share data) (unaudited) * The Company is presenting certain non-GAAP financial measures for its fiscal 2020 first quarter. In order for investors to be able to more easily compare the Company’s performance across periods, the Company has included comparable reconciliations for the 2019 periods in the reconciliation tables above and that follow. BED BATH & BEYOND 38

APPENDIX (in thousands, except for share data) (unaudited) * The Company is presenting certain non-GAAP financial measures for its fiscal 2020 first quarter. In order for investors to be able to more easily compare the Company’s performance across periods, the Company has included comparable reconciliations for the 2019 periods in the reconciliation tables above and that follow. BED BATH & BEYOND 39

APPENDIX (in thousands, except for share data) (unaudited) * The Company is presenting certain non-GAAP financial measures for its fiscal 2020 first quarter. In order for investors to be able to more easily compare the Company’s performance across periods, the Company has included comparable reconciliations for the 2019 periods in the reconciliation tables above and that follow. BED BATH & BEYOND 40

BED BATH & BEYOND 41