Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Vivint Solar, Inc. | d936830d8k.htm |

| EX-99.1 - EX-99.1 - Vivint Solar, Inc. | d936830dex991.htm |

Announcement of Definitive Agreement to Acquire Vivint Solar July 6, 2020 Exhibit 99.2

Safe Harbor & Forward Looking Statements Forward-Looking Statements This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, but not limited to, statements based upon or relating to Sunrun Inc.’s, a Delaware corporation (“Sunrun”), and Vivint Solar, Inc.’s, a Delaware corporation (“Vivint Solar”), expectations or predictions of future financial or business performance or conditions. Forward-looking statements generally relate to future events or future financial or operating performance. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “would,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” “will be,” “will likely result” or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions. Forward-looking statements may include, but are not limited to, statements concerning the expected benefits of the transaction; cost synergies and opportunities resulting from the transaction; Sunrun’s leadership position in the industry; the availability of rebates, tax credits and other financial incentives including solar renewable energy certificates, or SRECs, and federal and state incentives; regulations and policies related to net metering and interconnection limits or caps and decreases to federal solar tax credits; determinations by the Internal Revenue Service of the fair market value of Sunrun’s and Vivint Solar’s solar energy systems; changes in regulations, tariffs and other trade barriers and tax policy; the retail price of utility-generated electricity or electricity from other energy sources; federal, state and local regulations and policies governing the electric utility industry and developments or changes with respect to such regulations and policies; the ability of Sunrun and Vivint Solar to manage their supply chains (including the availability and price of solar panels and other system components and raw materials) and distribution channels and the impact of natural disasters and other events beyond their control; the ability of Sunrun and Vivint Solar and their industry to manage recent and future growth, product offering mix, and costs (including, but not limited to, equipment costs) effectively, including attracting, training and retaining sales personnel and solar energy system installers; Sunrun’s and Vivint Solar’s strategic partnerships and expected benefits of such partnerships; the sufficiency of Sunrun’s and Vivint Solar’s cash, investment fund commitments and available borrowings to meet anticipated cash needs; the need and ability of Sunrun and Vivint Solar to raise capital, refinance existing debt and finance their respective obligations and solar energy systems from new and existing investors; the potential impact of interest rates on Sunrun’s and Vivint Solar’s interest expense; the course and outcome of litigation and investigations and the ability of Sunrun and Vivint Solar to consummate the transactions contemplated by the definitive transaction agreement in a timely manner or at all. These statements are not guarantees of future performance; they reflect Sunrun’s and Vivint Solar’s current views with respect to future events and are based on assumptions and estimates and subject to known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from expectations or results projected or implied by forward-looking statements. These risks include, but are not limited to: the occurrence of any event, change or other circumstances that could give rise to the termination of the definitive transaction agreement or the failure to satisfy the closing conditions; the possibility that the consummation of the proposed transactions is delayed or does not occur, including the failure of the parties’ stockholders to approve the proposed transactions; uncertainty regarding the timing of the receipt of required regulatory approvals for the merger and the possibility that the parties may be required to accept conditions that could reduce or eliminate the anticipated benefits of the merger as a condition to obtaining regulatory approvals or that the required regulatory approvals might not be obtained at all; the outcome of any legal proceedings that have been or may be instituted against the parties or others following announcement of the transactions contemplated by the definitive transaction agreement; challenges, disruptions and costs of closing, integrating and achieving anticipated synergies, or that such synergies will take longer to realize than expected; risks that the merger and other transactions contemplated by the definitive transaction agreement disrupt current plans and operations that may harm the parties’ businesses; the amount of any costs, fees, expenses, impairments and charges related to the merger; uncertainty as to the effects of the announcement or pendency of the merger on the market price of the parties’ respective common stock and/or on their respective financial performance; uncertainty as to the long-term value of Sunrun’s and Vivint Solar’s common stock; the ability of Sunrun and Vivint Solar to raise capital from third parties to grow their business; any rise in interest rates which would increase the cost of capital; the ability to meet covenants in investment funds and debt facilities; the potential inaccuracy of the assumptions employed in calculating operating metrics; the failure of the energy industry to develop to the size or at the rate Sunrun and Vivint Solar expect; and the inability of Sunrun and Vivint Solar to finance their solar service offerings to customers on an economically viable basis. These risks and uncertainties may be amplified by the ongoing COVID-19 pandemic, which has caused significant economic uncertainty and negative impacts on capital and credit markets. The extent to which the COVID-19 pandemic impacts Sunrun’s and Vivint Solar’s businesses, operations, and financial results, including the duration and magnitude of such effects, will depend on numerous factors, many of which are unpredictable, including, but not limited to, the duration and spread of the pandemic, its severity, the actions to contain the pandemic or treat its impact, and how quickly and to what extent normal economic and operating conditions can resume.

Safe Harbor & Forward Looking Statements (continued) Any financial projections in this filing are forward-looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond Sunrun’s and Vivint Solar’s control. While all projections are necessarily speculative, Sunrun and Vivint Solar believe that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection extends from the date of preparation. The assumptions and estimates underlying the projected results are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the projections. The inclusion of projections in this filing should not be regarded as an indication that Sunrun and Vivint Solar, or their representatives, considered or consider the projections to be a reliable prediction of future events. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included herein and elsewhere, including the risk factors included in Sunrun’s and Vivint Solar’s most recent reports on Form 10-K, Form 10-Q, Form 8-K and other documents on file with the United States Securities and Exchange Commission (“SEC”). These forward-looking statements represent estimates and assumptions only as of the date made. Unless required by federal securities laws, Sunrun and Vivint Solar assume no obligation to update any of these forward-looking statements, or to update the reasons actual results could differ materially from those anticipated, to reflect circumstances or events that occur after the statements are made. Given these uncertainties, investors should not place undue reliance on these forward-looking statements. Investors should read this document with the understanding that Sunrun’s and Vivint Solar’s actual future results may be materially different from what Sunrun and Vivint Solar expect. Sunrun and Vivint Solar qualify all of their forward-looking statements by these cautionary statements. Additional Information and Where to Find It In connection with the proposed merger, Sunrun intends to file with the SEC a registration statement on Form S-4, which will include a document that serves as a prospectus of Sunrun and a joint proxy statement of Sunrun and Vivint Solar (the “joint proxy statement/prospectus”). After the registration statement has been declared effective by the SEC, the joint proxy statement/prospectus will be delivered to stockholders of Sunrun and Vivint Solar. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, SECURITY HOLDERS OF SUNRUN AND VIVINT SOLAR ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS RELATING TO THE MERGER THAT WILL BE FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. Investors and security holders will be able to obtain copies of the joint proxy statement/prospectus (when available) and other documents filed by Sunrun and Vivint Solar with the SEC, without charge, through the website maintained by the SEC at http://www.sec.gov. Copies of documents filed with the SEC by Sunrun will be made available free of charge on Sunrun’s website at http://investors.sunrun.com/ under the heading “Filings & Financials” and then under the subheading “SEC Filings.” Copies of documents filed with the SEC by Vivint Solar will be made available free of charge on Vivint Solar’s website at http://investors.vivintsolar.com/ under the link “Financial Information” and then under the heading “SEC Filings.” Participants in the Solicitation Sunrun and Vivint Solar and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the holders of Sunrun common stock and Vivint Solar common stock in respect of the proposed transaction. Information about Sunrun’s directors and executive officers is set forth in Sunrun’s Form 10-K for the year ended December 31, 2019 and the proxy statement for Sunrun’s 2020 Annual Meeting of Stockholders, which were filed with the SEC on February 27, 2020 and April 17, 2020, respectively. Information about Vivint Solar’s directors and executive officers is set forth in Vivint Solar’s Form 10-K for the year ended December 31, 2019 and the proxy statement for Vivint Solar’s 2020 Annual Meeting of Stockholders, which were filed with the SEC on March 10, 2020 and April 24, 2020, respectively. Stockholders may obtain additional information regarding the interests of such participants by reading the registration statement and the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed merger when they become available. Investors should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. No Offer or Solicitation This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

LYNN JURICH Sunrun’s CEO & Co-Founder Announcement of Definitive Agreement for Sunrun to Acquire Vivint Solar in an All-Stock Transaction EDWARD FENSTER Sunrun’s Executive Chairman & Co-Founder DAVID BYWATER Vivint Solar’s CEO CALL PARTICIPANTS TOM VONREICHBAUER Sunrun’s CFO

This is a transformational opportunity to generate consumer, shareholder, and societal value as we bring clean, affordable energy to more homes.

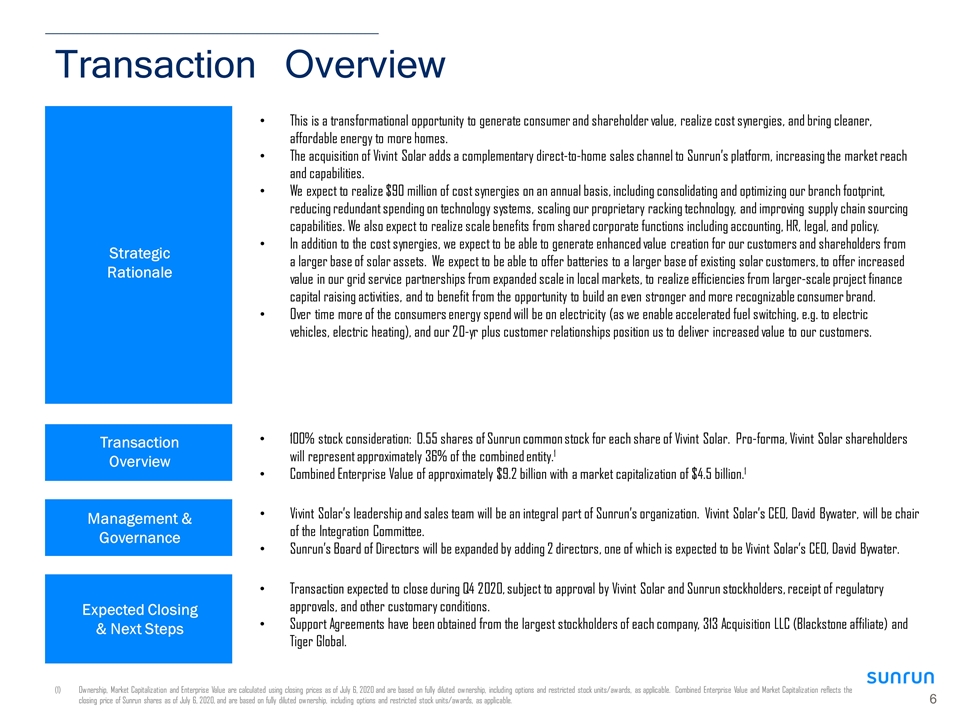

Transaction Overview Strategic Rationale This is a transformational opportunity to generate consumer and shareholder value, realize cost synergies, and bring cleaner, affordable energy to more homes. The acquisition of Vivint Solar adds a complementary direct-to-home sales channel to Sunrun’s platform, increasing the market reach and capabilities. We expect to realize $90 million of cost synergies on an annual basis, including consolidating and optimizing our branch footprint, reducing redundant spending on technology systems, scaling our proprietary racking technology, and improving supply chain sourcing capabilities. We also expect to realize scale benefits from shared corporate functions including accounting, HR, legal, and policy. In addition to the cost synergies, we expect to be able to generate enhanced value creation for our customers and shareholders from a larger base of solar assets. We expect to be able to offer batteries to a larger base of existing solar customers, to offer increased value in our grid service partnerships from expanded scale in local markets, to realize efficiencies from larger-scale project finance capital raising activities, and to benefit from the opportunity to build an even stronger and more recognizable consumer brand. Over time more of the consumers energy spend will be on electricity (as we enable accelerated fuel switching, e.g. to electric vehicles, electric heating), and our 20-yr plus customer relationships position us to deliver increased value to our customers. Transaction Overview Management & Governance Expected Closing & Next Steps 100% stock consideration: 0.55 shares of Sunrun common stock for each share of Vivint Solar. Pro-forma, Vivint Solar shareholders will represent approximately 36% of the combined entity.1 Combined Enterprise Value of approximately $9.2 billion with a market capitalization of $4.5 billion.1 Vivint Solar’s leadership and sales team will be an integral part of Sunrun’s organization. Vivint Solar’s CEO, David Bywater, will be chair of the Integration Committee. Sunrun’s Board of Directors will be expanded by adding 2 directors, one of which is expected to be Vivint Solar’s CEO, David Bywater. Transaction expected to close during Q4 2020, subject to approval by Vivint Solar and Sunrun stockholders, receipt of regulatory approvals, and other customary conditions. Support Agreements have been obtained from the largest stockholders of each company, 313 Acquisition LLC (Blackstone affiliate) and Tiger Global. Ownership, Market Capitalization and Enterprise Value are calculated using closing prices as of July 6, 2020 and are based on fully diluted ownership, including options and restricted stock units/awards, as applicable. Combined Enterprise Value and Market Capitalization reflects the closing price of Sunrun shares as of July 6, 2020, and are based on fully diluted ownership, including options and restricted stock units/awards, as applicable.

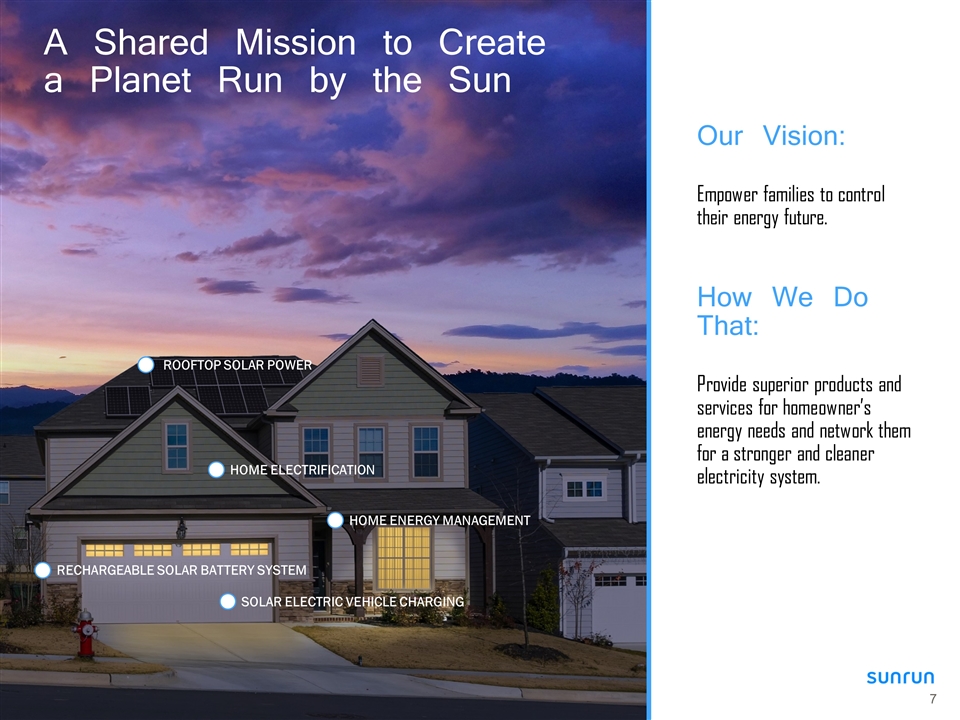

A Shared Mission to Create a Planet Run by the Sun Our Vision: Empower families to control their energy future. How We Do That: Provide superior products and services for homeowner’s energy needs and network them for a stronger and cleaner electricity system. ROOFTOP SOLAR POWER RECHARGEABLE SOLAR BATTERY SYSTEM SOLAR ELECTRIC VEHICLE CHARGING HOME ENERGY MANAGEMENT HOME ELECTRIFICATION

OUR CUSTOMERS Most energy consumers are currently beholden to a single power company that provides electricity to them based on household location. Sunrun will give home solar and battery consumers access to better, more affordable products - enabling greater energy choice. A lower cost structure from greater scale can open more markets and allow lower pricing for customers, accelerating renewable energy adoption. Combining R&D resources and focusing efforts will allow us to accelerate product and service development and offering advanced solutions to more customers in more markets. OUR INVESTORS The acquisition of Vivint Solar adds a complementary direct-to-home sales channel to Sunrun’s platform, increasing the market reach and capabilities. We expect to deliver meaningful cost synergies, estimated at $90 million dollars on an annual basis: including consolidating and optimizing our branch footprint, reducing redundant spending on technology systems, scaling our proprietary racking technology, and through improved supply chain sourcing. We also expect to realize scale benefits from shared corporate functions including accounting, HR, legal and policy. OUR COMMUNITIES Extreme weather due to climate change is increasing, putting immense strain on our energy system. Fossil fuel power plants produce over 30% of carbon pollution in the US. 1 There is an urgent need to decarbonize our energy system. With a combined customer base of nearly 500,000, Sunrun will ultimately be able to network even more systems in more locations to provide greater benefits to the grid and helping to shut down carbon-producing power plants. The combined company’s increased scale, operating efficiency and combined R&D efforts will help the company accelerate the adoption of renewable energy and benefit more customers. Energy Information Agency website, last updated February 27, 2020. A winning combination for our customers, our investors and our communities.

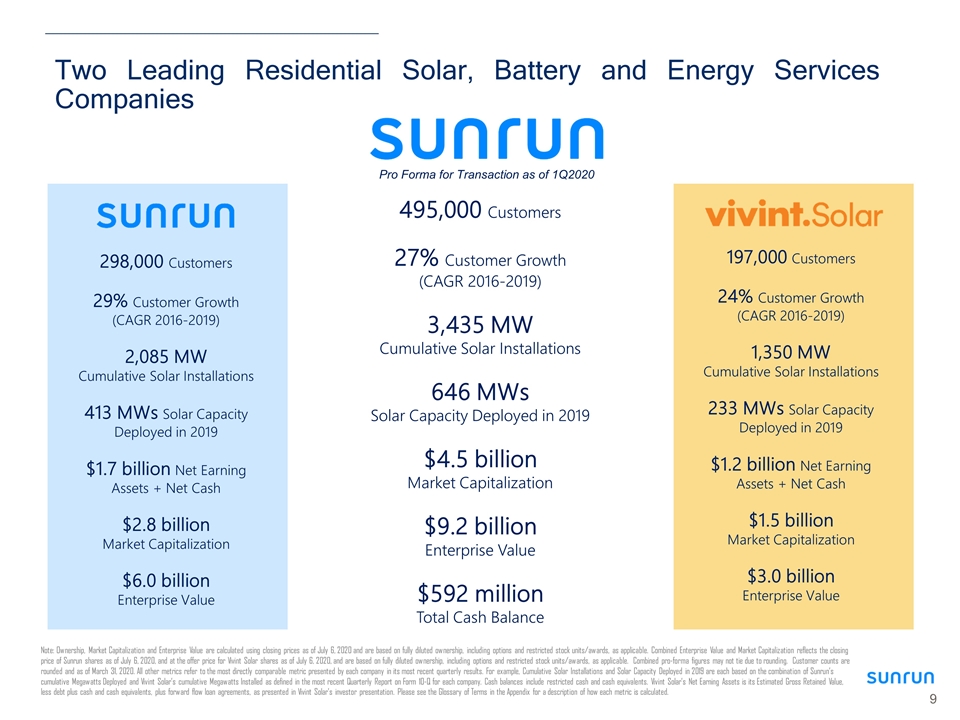

Two Leading Residential Solar, Battery and Energy Services Companies 298,000 Customers 29% Customer Growth (CAGR 2016-2019) 2,085 MW Cumulative Solar Installations 413 MWs Solar Capacity Deployed in 2019 $1.7 billion Net Earning Assets + Net Cash $2.8 billion Market Capitalization $6.0 billion Enterprise Value Note: Ownership, Market Capitalization and Enterprise Value are calculated using closing prices as of July 6, 2020 and are based on fully diluted ownership, including options and restricted stock units/awards, as applicable. Combined Enterprise Value and Market Capitalization reflects the closing price of Sunrun shares as of July 6, 2020, and at the offer price for Vivint Solar shares as of July 6, 2020, and are based on fully diluted ownership, including options and restricted stock units/awards, as applicable. Combined pro-forma figures may not tie due to rounding. Customer counts are rounded and as of March 31, 2020. All other metrics refer to the most directly comparable metric presented by each company in its most recent quarterly results. For example, Cumulative Solar Installations and Solar Capacity Deployed in 2019 are each based on the combination of Sunrun’s cumulative Megawatts Deployed and Vivint Solar’s cumulative Megawatts Installed as defined in the most recent Quarterly Report on Form 10-Q for each company. Cash balances include restricted cash and cash equivalents. Vivint Solar’s Net Earning Assets is its Estimated Gross Retained Value, less debt plus cash and cash equivalents, plus forward flow loan agreements, as presented in Vivint Solar’s investor presentation. Please see the Glossary of Terms in the Appendix for a description of how each metric is calculated. 495,000 Customers 27% Customer Growth (CAGR 2016-2019) 3,435 MW Cumulative Solar Installations 646 MWs Solar Capacity Deployed in 2019 $4.5 billion Market Capitalization $9.2 billion Enterprise Value $592 million Total Cash Balance 197,000 Customers 24% Customer Growth (CAGR 2016-2019) 1,350 MW Cumulative Solar Installations 233 MWs Solar Capacity Deployed in 2019 $1.2 billion Net Earning Assets + Net Cash $1.5 billion Market Capitalization $3.0 billion Enterprise Value Pro Forma for Transaction as of 1Q2020

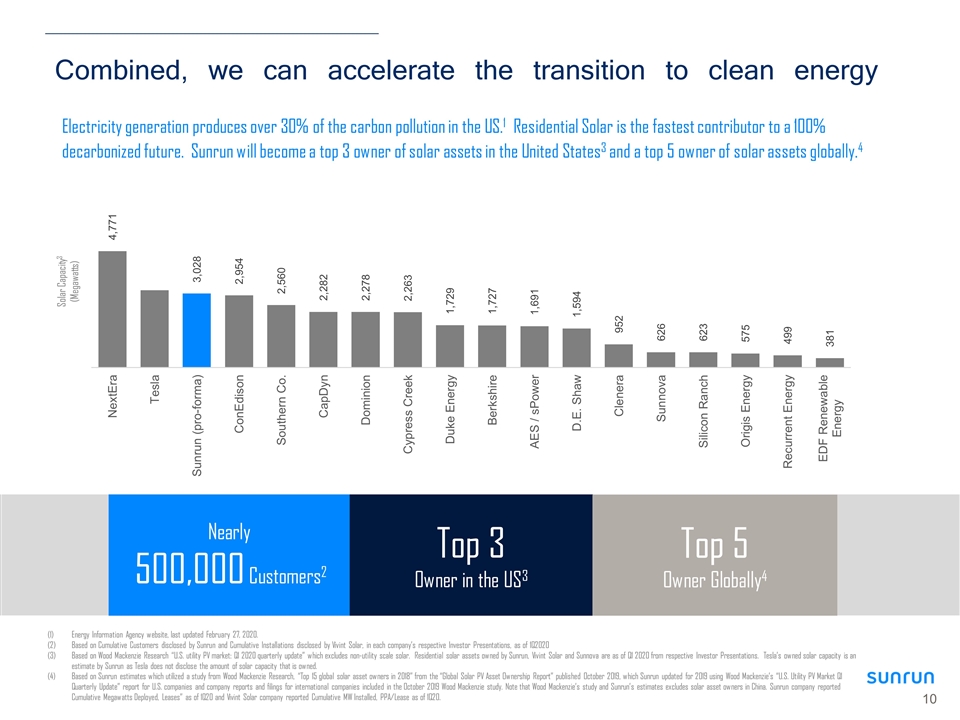

Combined, we can accelerate the transition to clean energy Energy Information Agency website, last updated February 27, 2020. Based on Cumulative Customers disclosed by Sunrun and Cumulative Installations disclosed by Vivint Solar, in each company’s respective Investor Presentations, as of 1Q2020 Based on Wood Mackenzie Research “U.S. utility PV market: Q1 2020 quarterly update” which excludes non-utility scale solar. Residential solar assets owned by Sunrun, Vivint Solar and Sunnova are as of Q1 2020 from respective Investor Presentations. Tesla’s owned solar capacity is an estimate by Sunrun as Tesla does not disclose the amount of solar capacity that is owned. Based on Sunrun estimates which utilized a study from Wood Mackenzie Research, “Top 15 global solar asset owners in 2018” from the “Global Solar PV Asset Ownership Report” published October 2019, which Sunrun updated for 2019 using Wood Mackenzie’s “U.S. Utility PV Market Q1 Quarterly Update” report for U.S. companies and company reports and filings for international companies included in the October 2019 Wood Mackenzie study. Note that Wood Mackenzie’s study and Sunrun’s estimates excludes solar asset owners in China. Sunrun company reported Cumulative Megawatts Deployed, Leases” as of 1Q20 and Vivint Solar company reported Cumulative MW Installed, PPA/Lease as of 1Q20. Solar Capacity3 (Megawatts) Electricity generation produces over 30% of the carbon pollution in the US.1 Residential Solar is the fastest contributor to a 100% decarbonized future. Sunrun will become a top 3 owner of solar assets in the United States3 and a top 5 owner of solar assets globally.4 Nearly 500,000 Customers2 Top 3 Owner in the US3 Top 5 Owner Globally4

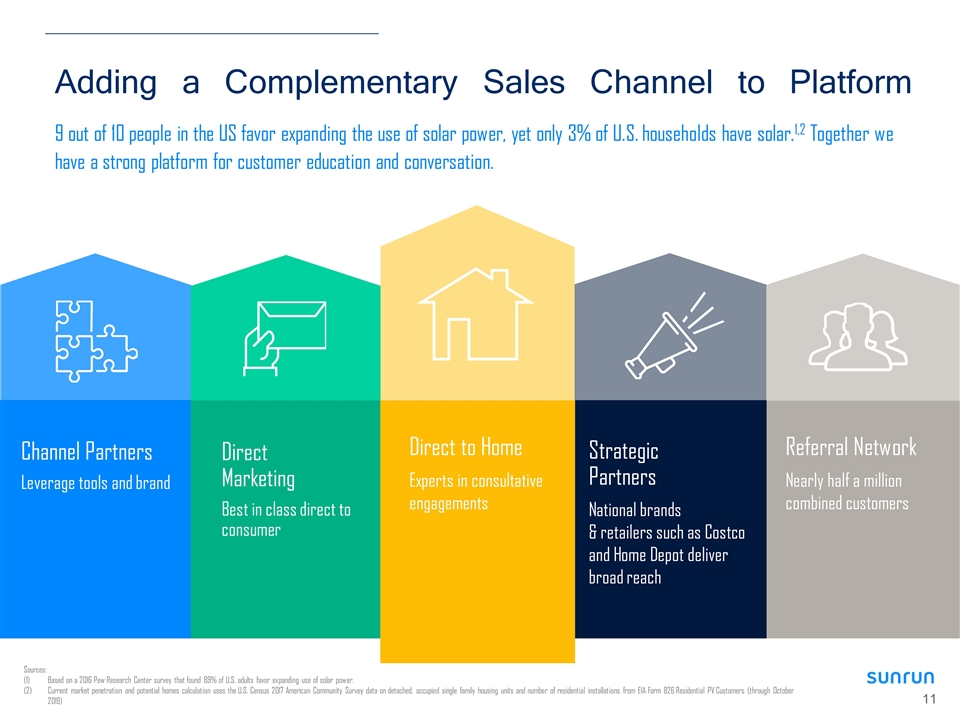

9 out of 10 people in the US favor expanding the use of solar power, yet only 3% of U.S. households have solar.1,2 Together we have a strong platform for customer education and conversation. Adding a Complementary Sales Channel to Platform Channel Partners Leverage tools and brand Strategic Partners National brands & retailers such as Costco and Home Depot deliver broad reach Direct Marketing Best in class direct to consumer Referral Network Nearly half a million combined customers Direct to Home Experts in consultative engagements Sources: Based on a 2016 Pew Research Center survey that found 89% of U.S. adults favor expanding use of solar power. Current market penetration and potential homes calculation uses the U.S. Census 2017 American Community Survey data on detached, occupied single family housing units and number of residential installations from EIA Form 826 Residential PV Customers (through October 2019)

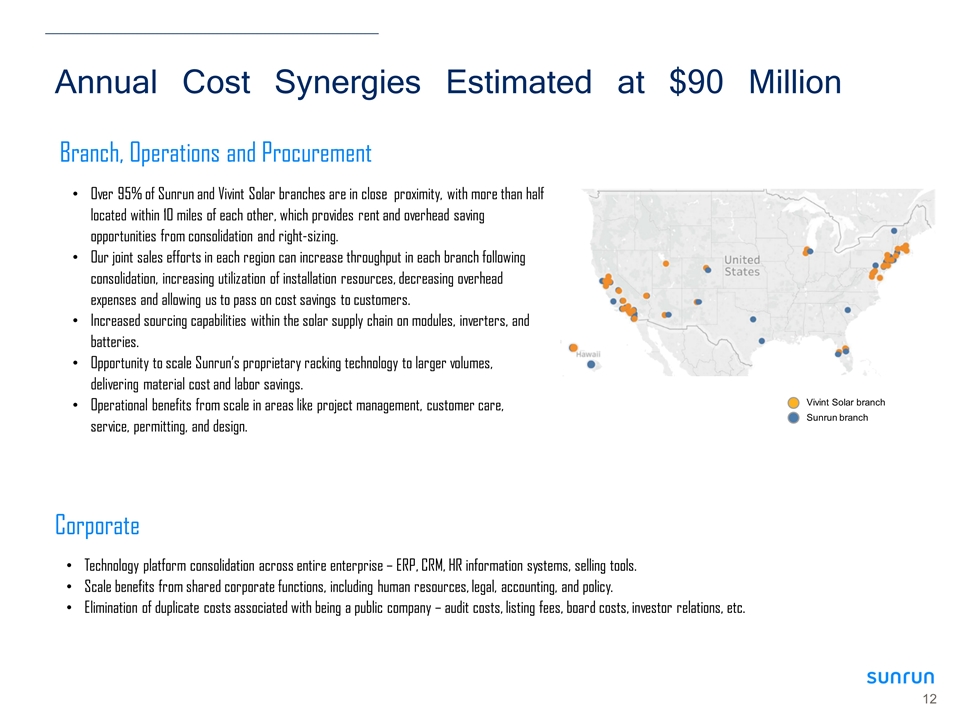

Annual Cost Synergies Estimated at $90 Million Over 95% of Sunrun and Vivint Solar branches are in close proximity, with more than half located within 10 miles of each other, which provides rent and overhead saving opportunities from consolidation and right-sizing. Our joint sales efforts in each region can increase throughput in each branch following consolidation, increasing utilization of installation resources, decreasing overhead expenses and allowing us to pass on cost savings to customers. Increased sourcing capabilities within the solar supply chain on modules, inverters, and batteries. Opportunity to scale Sunrun’s proprietary racking technology to larger volumes, delivering material cost and labor savings. Operational benefits from scale in areas like project management, customer care, service, permitting, and design. Vivint Solar branch Sunrun branch Corporate Technology platform consolidation across entire enterprise – ERP, CRM, HR information systems, selling tools. Scale benefits from shared corporate functions, including human resources, legal, accounting, and policy. Elimination of duplicate costs associated with being a public company – audit costs, listing fees, board costs, investor relations, etc. Branch, Operations and Procurement

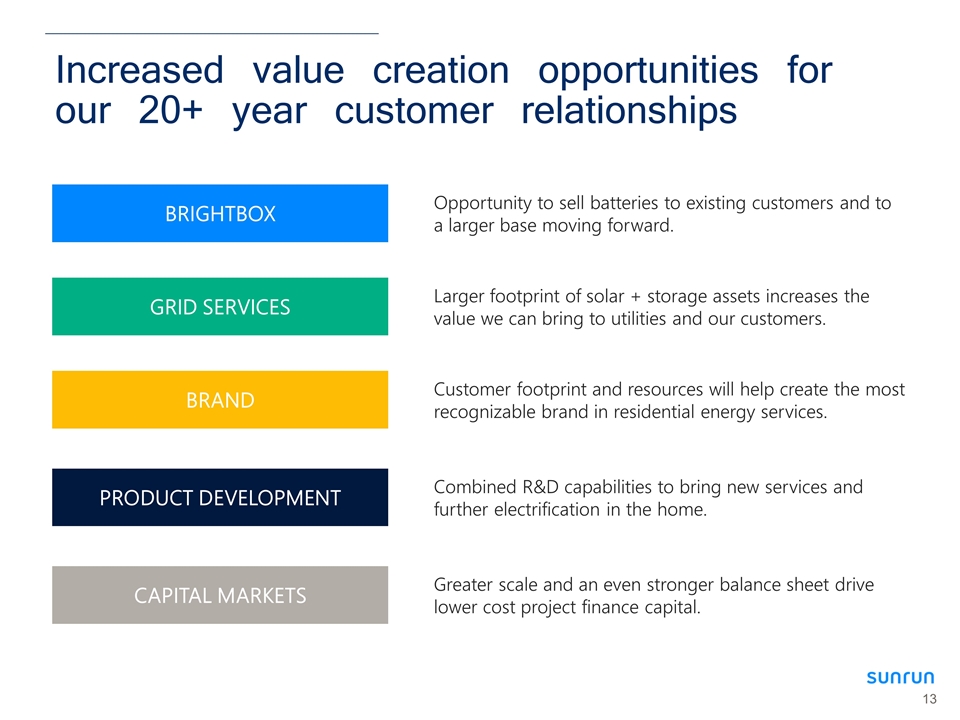

Increased value creation opportunities for our 20+ year customer relationships BRIGHTBOX GRID SERVICES PRODUCT DEVELOPMENT CAPITAL MARKETS BRAND Opportunity to sell batteries to existing customers and to a larger base moving forward. Larger footprint of solar + storage assets increases the value we can bring to utilities and our customers. Customer footprint and resources will help create the most recognizable brand in residential energy services. Combined R&D capabilities to bring new services and further electrification in the home. Greater scale and an even stronger balance sheet drive lower cost project finance capital.

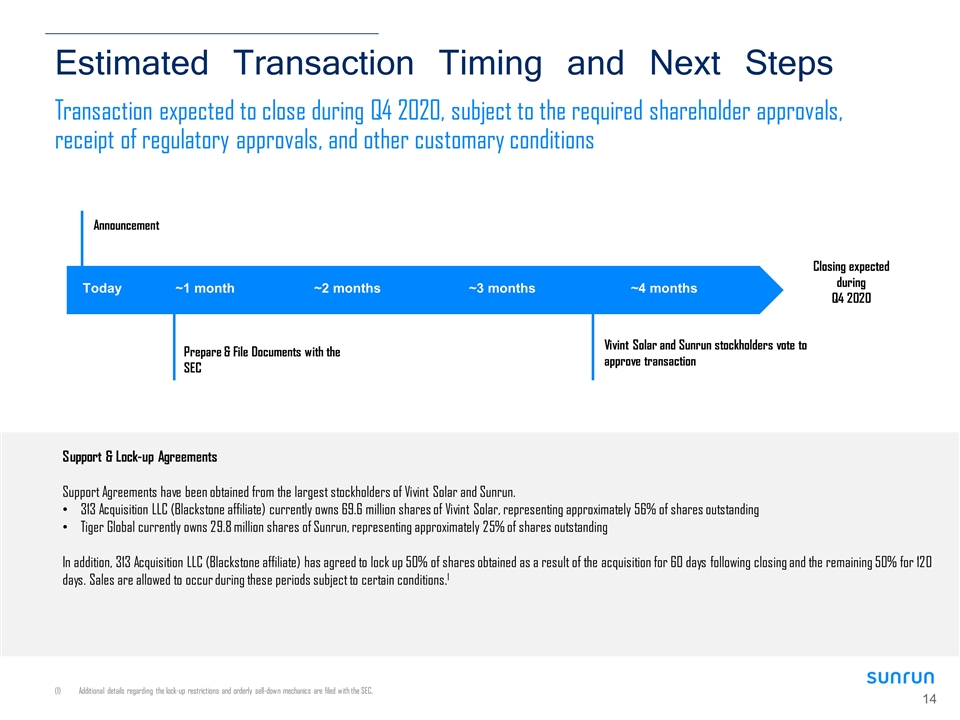

Transaction expected to close during Q4 2020, subject to the required shareholder approvals, receipt of regulatory approvals, and other customary conditions Estimated Transaction Timing and Next Steps Support & Lock-up Agreements Support Agreements have been obtained from the largest stockholders of Vivint Solar and Sunrun. 313 Acquisition LLC (Blackstone affiliate) currently owns 69.6 million shares of Vivint Solar, representing approximately 56% of shares outstanding Tiger Global currently owns 29.8 million shares of Sunrun, representing approximately 25% of shares outstanding In addition, 313 Acquisition LLC (Blackstone affiliate) has agreed to lock up 50% of shares obtained as a result of the acquisition for 60 days following closing and the remaining 50% for 120 days. Sales are allowed to occur during these periods subject to certain conditions.1 Today ~1 month ~2 months ~3 months ~4 months Announcement Prepare & File Documents with the SEC Vivint Solar and Sunrun stockholders vote to approve transaction Closing expected during Q4 2020 Additional details regarding the lock-up restrictions and orderly sell-down mechanics are filed with the SEC.

Glossary of Terms Glossary of Sunrun Terms Customers refers to all parties (i) who have executed Customer Agreements or cash sales agreements with us and (ii) for whom we have internal confirmation that the applicable solar energy system has reached notice to proceed or “NTP”, net of cancellations. Customer Agreements refers to, collectively, solar power purchase agreements and solar leases. Gross Earning Assets represent the remaining net cash flows (discounted at 6%) we expect to receive during the initial term of our Customer Agreements (typically 20 or 25 years) for systems that have been deployed as of the measurement date, plus a discounted estimate of the value of the Customer Agreement renewal term or solar energy system purchase at the end of the initial term. Gross Earning Assets deducts estimated cash distributions to investors in consolidated joint ventures and estimated operating, maintenance and administrative expenses for systems deployed as of the measurement date. In calculating Gross Earning Assets, we deduct estimated cash distributions to our project equity financing providers. In calculating Gross Earning Assets, we do not deduct customer payments we are obligated to pass through to investors in pass-through financing obligations as these amounts are reflected on our balance sheet as long-term and short-term pass-through financing obligations, similar to the way that debt obligations are presented. In determining our finance strategy, we use pass-through financing obligations and long-term debt in an equivalent fashion as the schedule of payments of distributions to pass-through financing investors is more similar to the payment of interest to lenders than the internal rates of return (IRRs) paid to investors in other tax equity structures. We calculate the Gross Earning Assets value of the purchase or renewal amount at the expiration of the initial contract term assuming either a system purchase or a five year renewal (for our 25-year Customer Agreements) or a 10-year renewal (for our 20-year Customer Agreements), in each case forecasting only a 30-year customer relationship (although the customer may renew for additional years, or purchase the system), at a contract rate equal to 90% of the customer’s contractual rate in effect at the end of the initial contract term. After the initial contract term, our Customer Agreements typically automatically renew on an annual basis and the rate is initially set at up to a 10% discount to then-prevailing power prices. Gross Earning Assets Under Energy Contract represents the remaining net cash flows during the initial term of our Customer Agreements (less substantially all value from SRECs prior to July 1, 2015), for systems deployed as of the measurement date. Gross Earning Assets Under Energy Contract represents the remaining net cash flows during the initial term of our Customer Agreements (less substantially all value from SRECs prior to July 1, 2015), for systems deployed as of the measurement date. Gross Earning Assets Value of Purchase or Renewal is the forecasted net present value we would receive upon or following the expiration of the initial Customer Agreement term (either in the form of cash payments during any applicable renewal period or a system purchase at the end of the initial term), for systems deployed as of the measurement date. Megawatts Deployed represents the aggregate megawatt production capacity of our solar energy systems, whether sold directly to customers or subject to executed Customer Agreements (i) for which we have confirmation that the systems are installed on the roof, subject to final inspection, (ii) in the case of certain system installations by our partners, for which we have accrued at least 80% of the expected project cost, or (iii) for multi-family and any other systems that have reached NTP, measured on the percentage of the project that has been completed based on expected project cost. Net Earning Assets represents Gross Earning Assets less both project level debt and pass-through financing obligations, as of the same measurement date. Because estimated cash distributions to our project equity financing partners are deducted from Gross Earning Assets, a proportional share of the corresponding project level debt is deducted from Net Earning Assets. NTP or Notice to Proceed refers to our internal confirmation that a solar energy system has met our installation requirements for size, equipment and design. Glossary of Vivint Solar Terms Installations represents the number of solar energy systems installed on customer premises. Megawatts (MWs) represents the DC nameplate megawatt production capacity. MW Installed represents the aggregate megawatt nameplate capacity of solar energy systems for which panels, inverters, and mounting and racking hardware have been installed on customer premises in the period. Estimated Gross Retained Value represents the net cash flows, discounted at 6%, that Vivint Solar expects to receive from customers pursuant to long-term customer contracts plus the value of contracted SRECs net of estimated cash distributions to fund investors, debt associated with forward flow facilities, and estimated operating expenses for systems installed as of the measurement date. For purposes of the calculation, Vivint Solar aggregates the estimated retained value from the solar energy systems during the typical 20 to 25-year term of Vivint Solar’s contracts, which Vivint Solar refers to as estimated retained value under energy contracts, and the estimated retained value associated with an assumed 5 to 10-year renewal term following the expiration of the initial contract term, which Vivint Solar refers to as estimated retained value of renewal. To calculate estimated retained value of renewal, Vivint Solar assumes all contracts are renewed at 90% of the contractual price in effect at the expiration of the initial term.

Sunrun Investor Relations investors.sunrun.com 415-373-5206 investors@sunrun.com