Attached files

| file | filename |

|---|---|

| EX-99.1 - NEWS RELEASE - VALVOLINE INC | juneupdatenewsrelease.htm |

| 8-K - 8-K - VALVOLINE INC | vvv-20200707.htm |

Exhibit 99.2 June Business Update – Supplemental Materials July 7, 2020

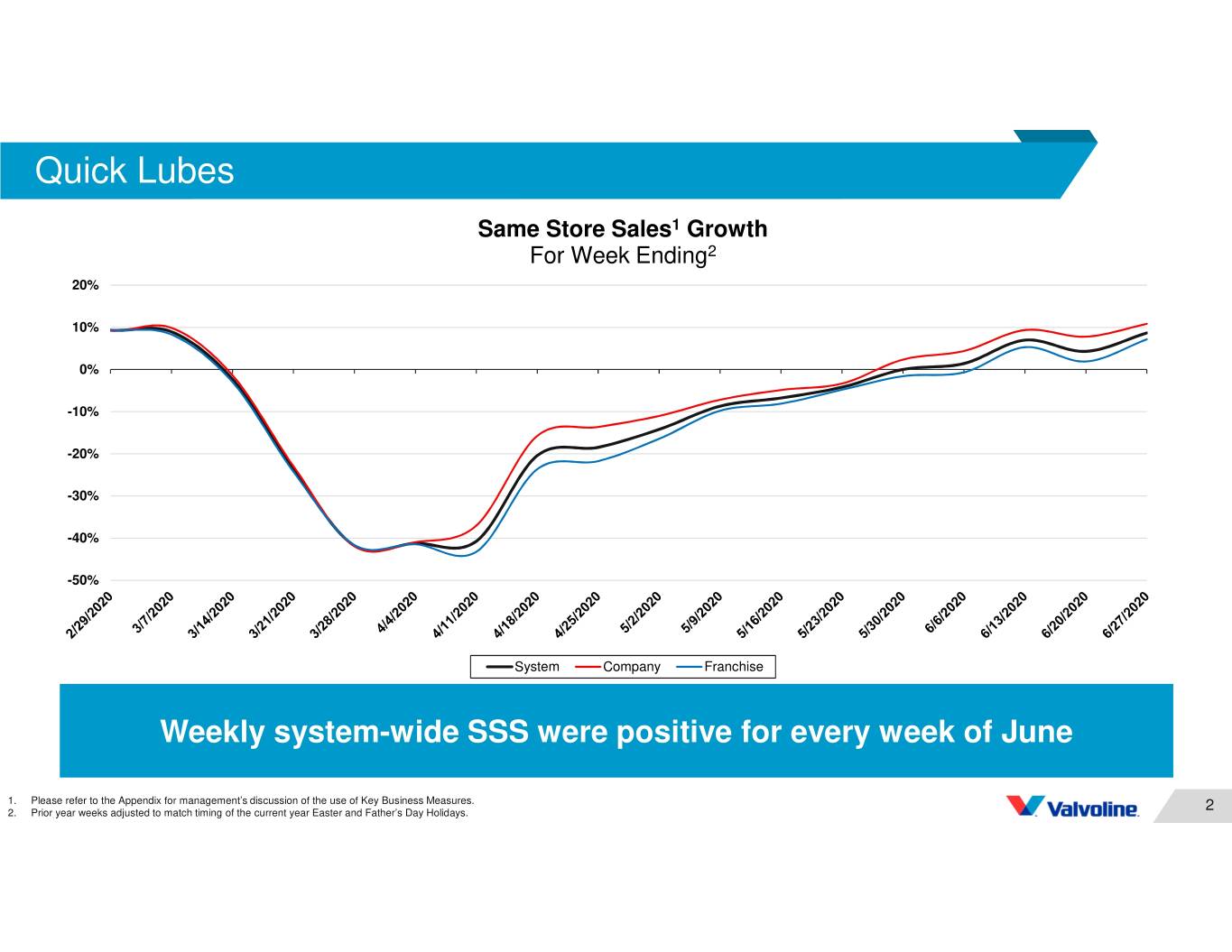

Quick Lubes Same Store Sales 1 Growth For Week Ending 2 20% 10% 0% -10% -20% -30% -40% -50% System Company Franchise Weekly system-wide SSS were positive for every week of June 1. Please refer to the Appendix for management’s discussion of the use of Key Business Measures. 2. Prior year weeks adjusted to match timing of the current year Easter and Father’s Day Holidays. 2

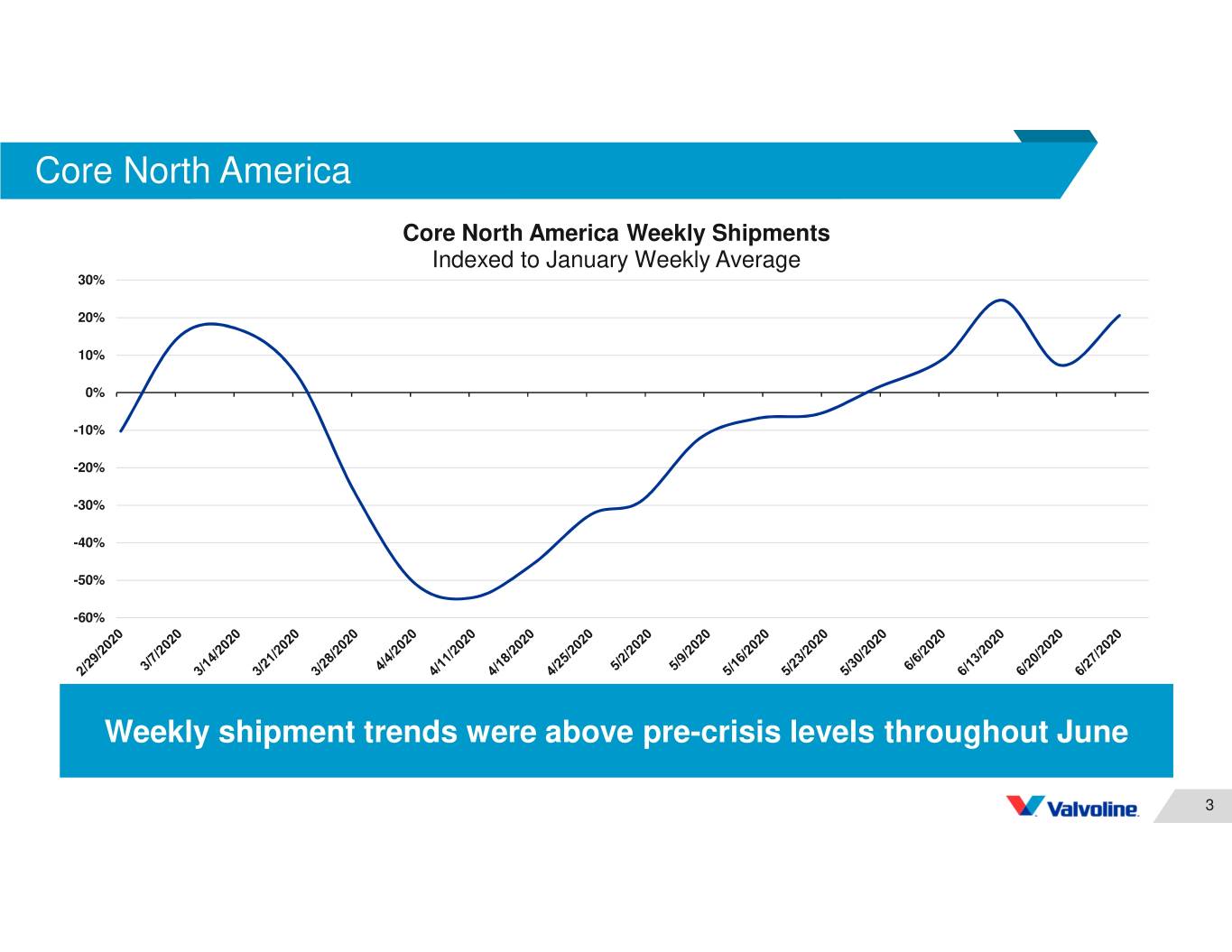

Core North America Core North America Weekly Shipments Indexed to January Weekly Average 30% 20% 10% 0% -10% -20% -30% -40% -50% -60% Weekly shipment trends were above pre-crisis levels throughout June 3

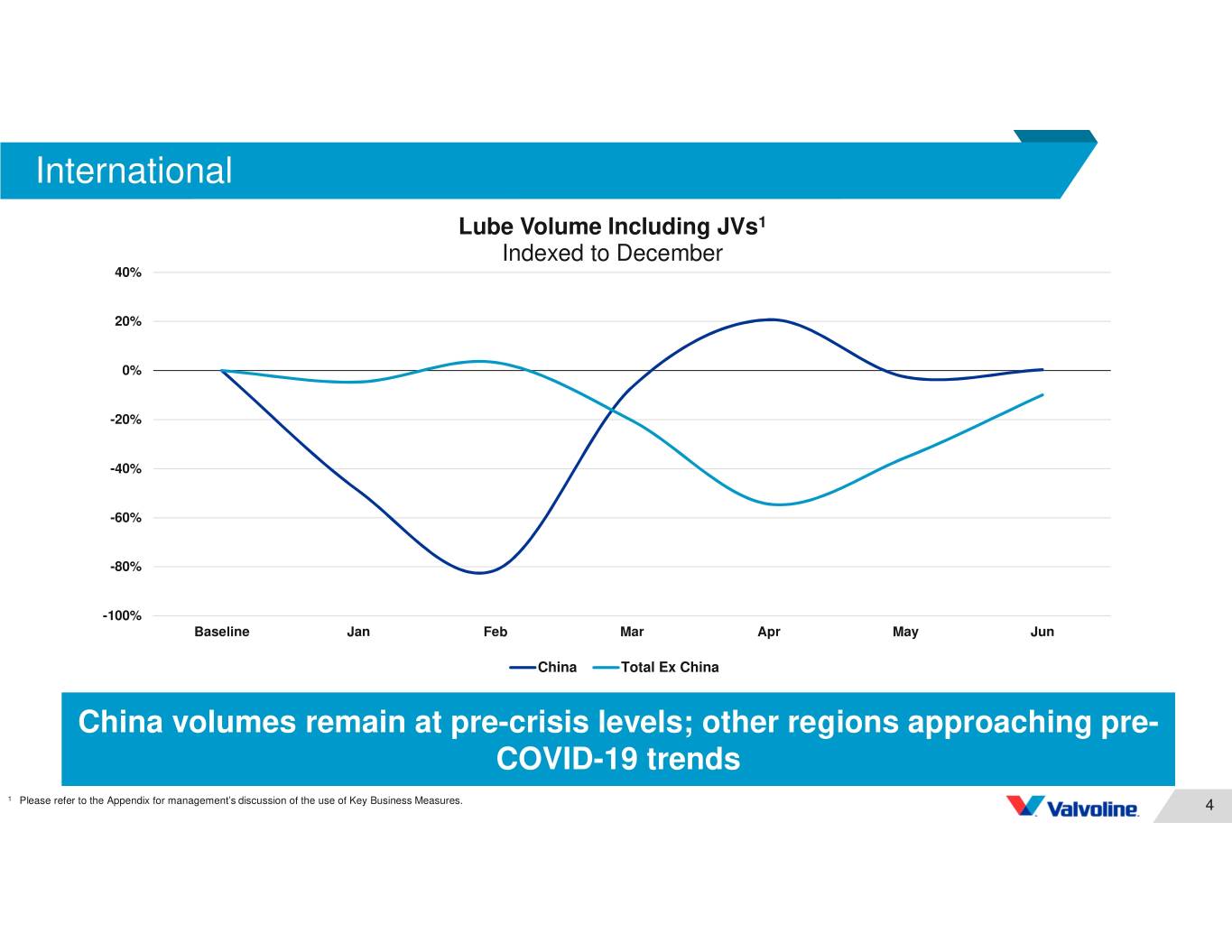

International Lube Volume Including JVs 1 Indexed to December 40% 20% 0% -20% -40% -60% -80% -100% Baseline Jan Feb Mar Apr May Jun China Total Ex China China volumes remain at pre-crisis levels; other regions approaching pre- COVID-19 trends 1 Please refer to the Appendix for management’s discussion of the use of Key Business Measures. 4

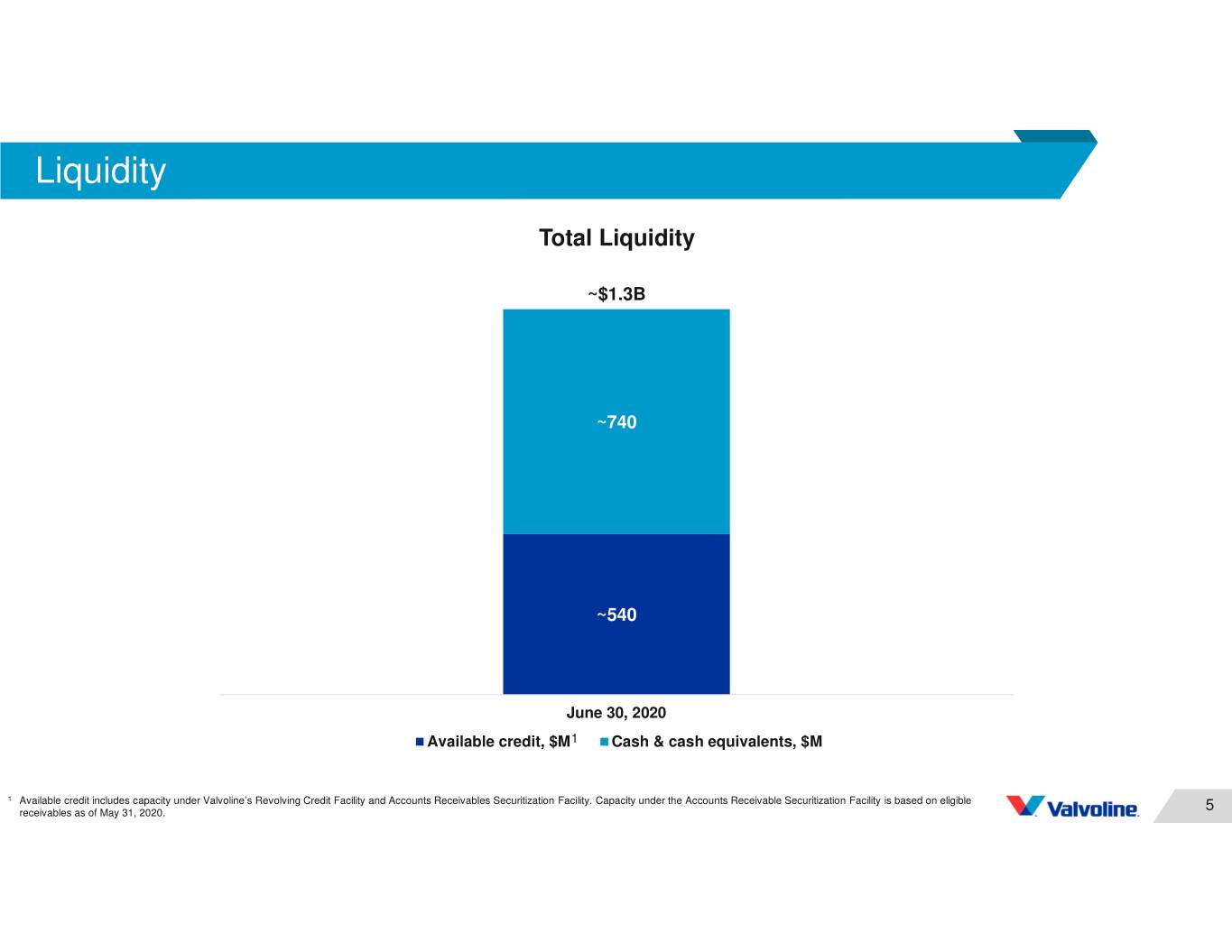

Liquidity Total Liquidity ~$1.3B ~740 ~540 June 30, 2020 Available credit, $M 1 Cash & cash equivalents, $M 1 Available credit includes capacity under Valvoline’s Revolving Credit Facility and Accounts Receivables Securitization Facility. Capacity under the Accounts Receivable Securitization Facility is based on eligible receivables as of May 31, 2020. 5

Appendix – Key Business Measures Valvoline tracks its operating performance and manages its business using certain key measures, including system-wide, company-owned and franchised store counts and same-store sales; Express Care store counts; lubricant volumes sold by unconsolidated joint ventures; and total lubricant volumes sold and percentage of premium lubricants sold. Management believes these measures are useful to evaluating and understanding Valvoline’s operating performance and should be considered as supplements to, not substitutes for, Valvoline's sales and operating income, as determined in accordance with U.S. GAAP. Sales in the Quick Lubes reportable segment are influenced by the number of service center stores and the business performance of those stores. Stores are considered open upon acquisition or opening for business. Temporary store closings remain in the respective store counts with only permanent store closures reflected in the end of period store counts and activity. SSS is defined as sales by Quick Lubes service center stores (company-owned, franchised and the combination of these for system-wide SSS), with new stores excluded from the metric until the completion of their first full fiscal year in operation as this period is generally required for new store sales levels to begin to normalize. Differences in SSS are calculated to determine the percentage change between comparative periods. Quick Lubes revenue is limited to sales at company-owned stores, sales of lubricants and other products to independent franchisees and Express Care operators and royalties and other fees from franchised stores. Although Valvoline does not recognize store-level sales from franchised or Express Care stores as revenue in its Statements of Consolidated Income, management believes system-wide and franchised SSS comparisons and store counts, in addition to Express Care store counts, are useful to assess the operating performance of the Quick Lubes reportable segment and the operating performance of an average Quick Lubes store. Lubricant volumes sold by unconsolidated joint ventures are used to measure the operating performance of the International operating segment. Valvoline does not record lubricant sales from unconsolidated joint venture as International reportable segment revenue. International revenue is limited to sales by Valvoline's consolidated affiliates. Although Valvoline does not record sales by unconsolidated joint ventures as revenue in its Condensed Consolidated Statements of Comprehensive Income, management believes lubricant volumes including and sold by unconsolidated joint ventures is useful to assess the operating performance of its investments in joint ventures. Management also evaluates lubricant volumes sold in gallons by each of its reportable segments and premium lubricant percentage, defined as premium lubricant gallons sold as a percentage of U.S. branded lubricant volumes for the Quick Lubes and Core North America segments and as a percentage of total segment lubricant volume for the International segment. Premium lubricant products generally provide a higher contribution to segment profitability and the percentage of premium volumes is useful to evaluating and understanding Valvoline’s operating performance. 6