Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - CORELOGIC, INC. | d936979dex993.htm |

| EX-99.1 - EX-99.1 - CORELOGIC, INC. | d936979dex991.htm |

| EX-4.1 - EX-4.1 - CORELOGIC, INC. | d936979dex41.htm |

| EX-3.2 - EX-3.2 - CORELOGIC, INC. | d936979dex32.htm |

| EX-3.1 - EX-3.1 - CORELOGIC, INC. | d936979dex31.htm |

| 8-K - 8-K - CORELOGIC, INC. | d936979d8k.htm |

Investor Update July 2020 Exhibit 99.2

Safe Harbor / Forward Looking Statements Certain statements made in this presentation are forward-looking statements within the meaning of the federal securities laws, including but not limited to those statements related to CoreLogic, Inc.’s (“CoreLogic”, the “Company” or “us”) expected financial results in 2020, 2021 and 2022; overall mortgage market volumes; market opportunities; shareholder value creation; statements regarding our strategic plans or growth strategy; and the near and long-term consequences of the unsolicited proposal we received from Cannae Holdings, Inc. (“Cannae”) and Senator Investment Group, LP (“Senator”) on June 26, 2020 (the “Unsolicited Proposal”). Risks and uncertainties exist that may cause the results to differ materially from those set forth in these forward-looking statements. Factors that could cause the anticipated results to differ from those described in the forward-looking statements include the risks and uncertainties set forth in Part I, Item 1A of our most recent Annual Report on Form 10-K, as such risk factors may be amended, supplemented, or superseded from time to time by other reports we file with the SEC. These risks and uncertainties include but are not limited to: any potential developments related to the Unsolicited Proposal; any impact resulting from COVID-19; our ability to protect our information systems against data corruption, cyber-based attacks or network security breaches; limitations on access to or increase in prices for data from external sources, including government and public record sources; systems interruptions that may impair the delivery of our products and services; changes in applicable government legislation, regulations and the level of regulatory scrutiny affecting our customers or us, including with respect to consumer financial services and the use of public records and consumer data; difficult conditions in the mortgage and consumer lending industries and the economy generally; risks related to the outsourcing of services and international operations; our ability to realize the anticipated benefits of certain acquisitions and/or divestitures and the timing thereof; impairments in our goodwill or other intangible assets; and our ability to generate sufficient cash to service our debt. The forward-looking statements speak only as of the date they are made. The Company does not undertake to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made. In the event that Senator and Cannae file a consent solicitation statement or a proxy statement with the U.S. Securities and Exchange Commission (the “SEC”) in connection with a solicitation to, among other things, possibly remove directors in furtherance of the Unsolicited Proposal (the “Solicitation”), the Company plans to file a proxy statement or a consent revocation statement, as applicable (each, a “Solicitation Statement”), with the SEC, together with a WHITE proxy card or consent revocation card, as applicable. SHAREHOLDERS ARE URGED TO READ THE APPLICABLE SOLICITATION STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT THE COMPANY WILL FILE WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Shareholders will be able to obtain, free of charge, copies of the Solicitation Statement, any amendments or supplements thereto and any other documents (including the WHITE proxy card or consent revocation card, as applicable) when filed by the Company with the SEC in connection with the Solicitation at the SEC’s website (http://www.sec.gov), at the Company’s website (https://investor.corelogic.com), or by contacting Innisfree M&A Incorporated by phone toll-free at 1 (877) 750-9498 (from the U.S. and Canada) or +1 (412) 232-3651 (from other locations), or by mail at Innisfree M&A Incorporated, 501 Madison Avenue, 20th Floor, New York, New York, 10022. Important Additional Information and Where to Find It Participants in the Solicitation The Company, its directors and certain of its executive officers and other employees may be deemed to be participants in the solicitation of proxies from shareholders in connection with the Solicitation. Additional information regarding the identity of these potential participants, none of whom owns in excess of one percent (1%) of the Company’s shares, and their direct or indirect interests, by security holdings or otherwise, will be set forth in the applicable Solicitation Statement and other materials to be filed with the SEC in connection with the Solicitation. Information relating to the foregoing can also be found in the Company’s definitive proxy statement for its 2020 annual meeting of shareholders (the “2020 Proxy Statement”), filed with the SEC on March 19, 2020. To the extent holdings of the Company’s securities by such potential participants (or the identity of such participants) have changed since the information printed in the 2020 Proxy Statement, such information has been or will be reflected on Statements of Change in Ownership on Forms 3 and 4 filed with the SEC. You may obtain free copies of these documents using the sources indicated above. This presentation contains certain non-GAAP financial measures, such as adjusted EBITDA and adjusted EPS, which are provided only as supplemental information. These non-GAAP measures are not in accordance with, or a substitute for, U.S. GAAP. The Company believes that its presentation of these non-GAAP measures provides useful supplemental information to investors and management regarding the Company’s financial condition and results of operations. Adjusted EBITDA is defined as net income from continuing operations adjusted for interest, taxes, depreciation and amortization, share-based compensation, non-operating gains/losses, and other adjustments. Adjusted EPS is defined as diluted income from continuing operations, net of tax per share, adjusted for share-based compensation, amortization of acquisition-related intangibles, non-operating gains/losses, and other adjustments; and assumes an effective tax rate of 26% for 2020. Other firms may calculate non-GAAP measures differently than the Company, which limits comparability between companies. Because the non-GAAP measures included herein are forward-looking, the Company is not able to provide a reconciliation, without unreasonable efforts, of its forward-looking guidance of adjusted EBITDA or adjusted EPS to the most directly comparable GAAP financial measure due to the unknown effect, timing, and potential significance of special charges or gains that are material to the comparable GAAP financial measure. Use of Non-GAAP (Generally Accepted Accounting Principles) Financial Measures 1

Introduction Our business momentum and growth trajectory are evident, accelerating and sustainable The $65.00 per share proposal by Cannae Holdings and Senator Investment Group significantly undervalues the potential of CoreLogic’s multi-faceted value creation strategy – hostile proposal launched with stock at $57.80(1) and rising Unsolicited proposal is opportunistic and press statements are replete with inaccuracies CoreLogic is the information currency for the residential property ecosystem – market leadership in housing finance, real estate and insurance CoreLogic is open to all viable paths to create value and is willing to meet with Senator/Cannae Serious regulatory concerns given significant overlaps between CoreLogic and the network of companies associated with Cannae’s Chairman, Bill Foley – Black Knight and Fidelity National 2 Based on 6/25/2020 after hours trading price

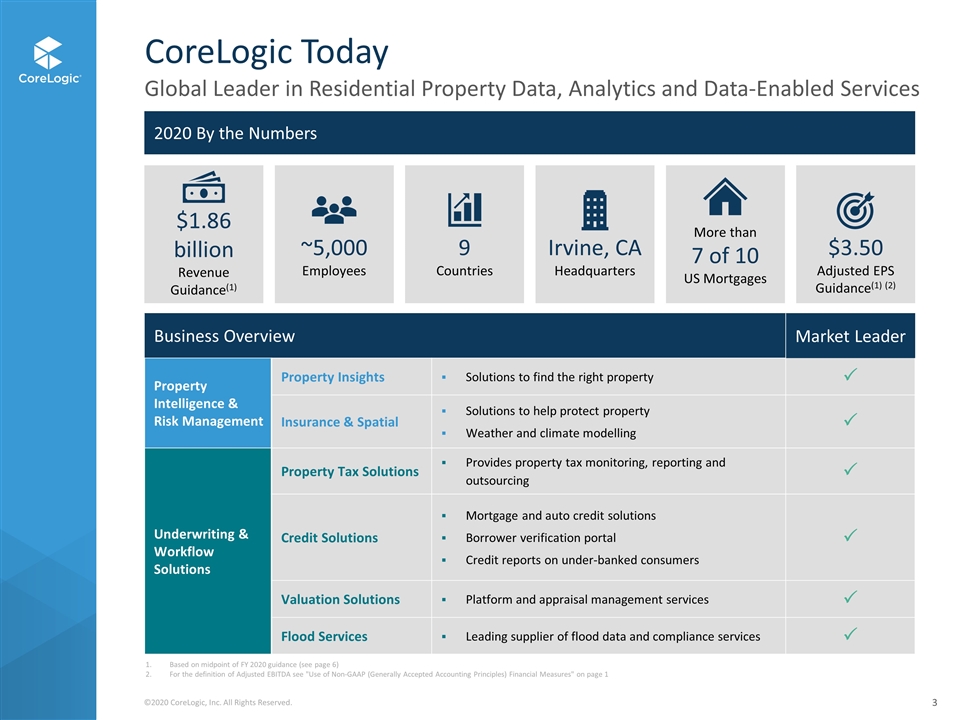

CoreLogic Today Global Leader in Residential Property Data, Analytics and Data-Enabled Services 2020 By the Numbers $1.86 billion Revenue Guidance(1) ~5,000 Employees Irvine, CA Headquarters 9 Countries Business Overview Market Leader Property Intelligence & Risk Management Property Insights Solutions to find the right property P Insurance & Spatial Solutions to help protect property Weather and climate modelling P Underwriting & Workflow Solutions Property Tax Solutions Provides property tax monitoring, reporting and outsourcing P Credit Solutions Mortgage and auto credit solutions Borrower verification portal Credit reports on under-banked consumers P Valuation Solutions Platform and appraisal management services P Flood Services Leading supplier of flood data and compliance services P $3.50 Adjusted EPS Guidance(1) (2) More than 7 of 10 US Mortgages Based on midpoint of FY 2020 guidance (see page 6) For the definition of Adjusted EBITDA see "Use of Non-GAAP (Generally Accepted Accounting Principles) Financial Measures" on page 1 3

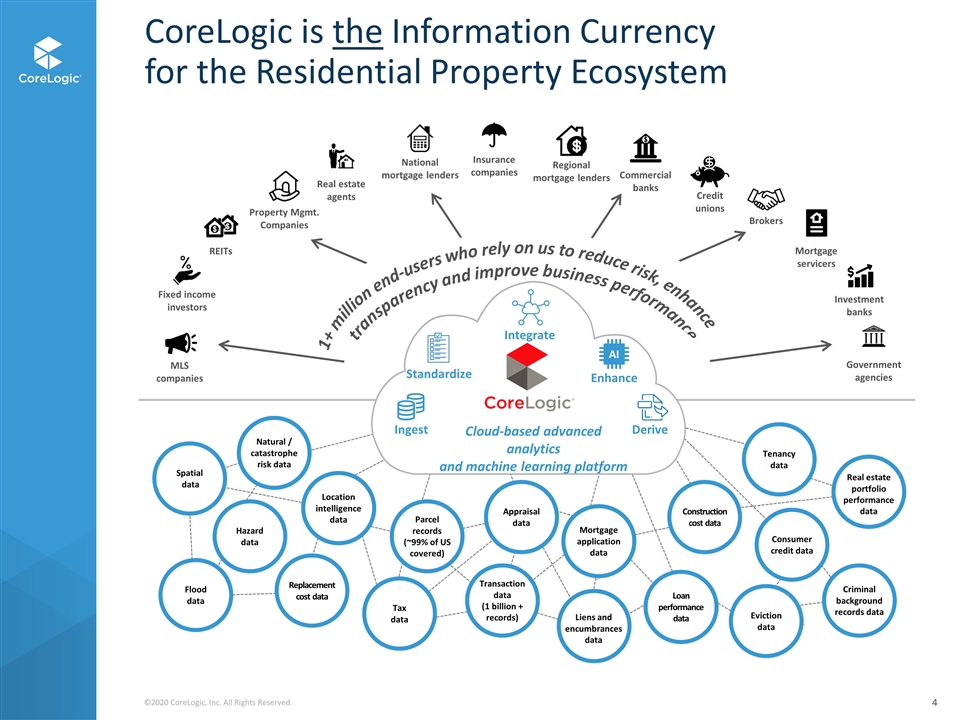

CoreLogic is the Information Currency for the Residential Property Ecosystem 1+ million end-users who rely on us to reduce risk, enhance transparency and improve business performance National mortgage lenders Hazard data Natural / catastrophe risk data Appraisal data Tenancy data Parcel records (~99% of US covered) Tax data Spatial data Location intelligence data Transaction data (1 billion + records) Eviction data Mortgage application data Flood data Replacement cost data Liens and encumbrances data Construction cost data Loan performance data Consumer credit data Criminal background records data Real estate portfolio performance data Government agencies Insurance companies REITs Property Mgmt. Companies MLS companies Real estate agents Fixed income investors Regional mortgage lenders Mortgage servicers Brokers Credit unions Commercial banks Investment banks Ingest Integrate Enhance AI Standardize Derive Cloud-based advanced analytics and machine learning platform 4

CoreLogic’s Accelerating Business Momentum

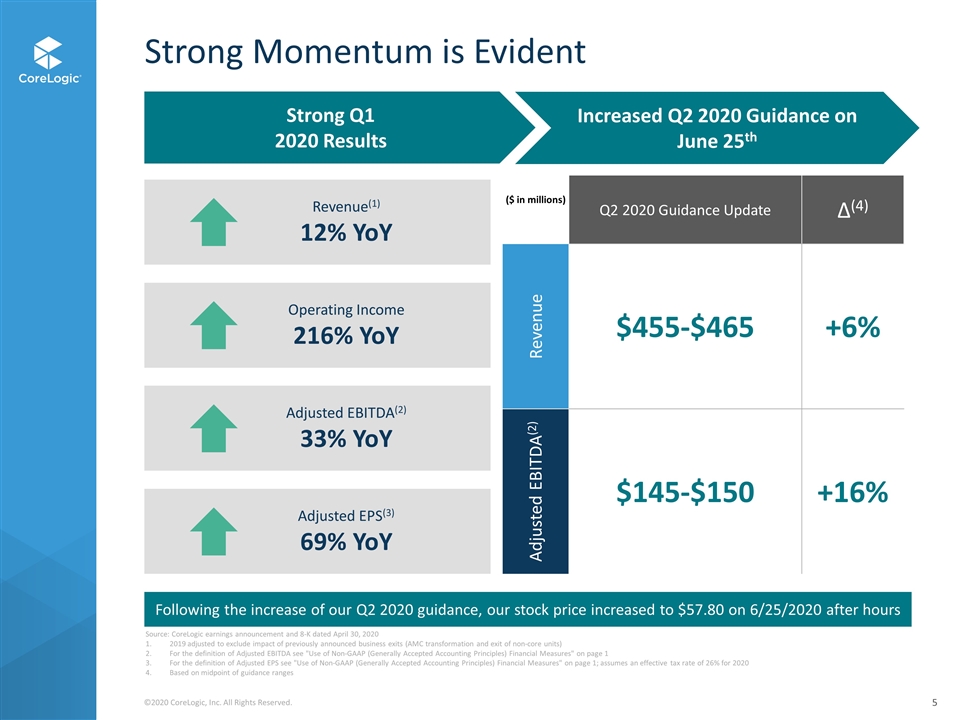

Strong Momentum is Evident Strong Q1 2020 Results Increased Q2 2020 Guidance on June 25th Revenue(1) 12% YoY Operating Income 216% YoY Adjusted EBITDA(2) 33% YoY Adjusted EPS(3) 69% YoY Q2 2020 Guidance Update Δ(4) Revenue $455-$465 +6% Adjusted EBITDA(2) $145-$150 +16% Following the increase of our Q2 2020 guidance, our stock price increased to $57.80 on 6/25/2020 after hours Reconciliation to GAAP Source: CoreLogic earnings announcement and 8-K dated April 30, 2020 2019 adjusted to exclude impact of previously announced business exits (AMC transformation and exit of non-core units) For the definition of Adjusted EBITDA see "Use of Non-GAAP (Generally Accepted Accounting Principles) Financial Measures" on page 1 For the definition of Adjusted EPS see "Use of Non-GAAP (Generally Accepted Accounting Principles) Financial Measures" on page 1; assumes an effective tax rate of 26% for 2020 Based on midpoint of guidance ranges ($ in millions) 5

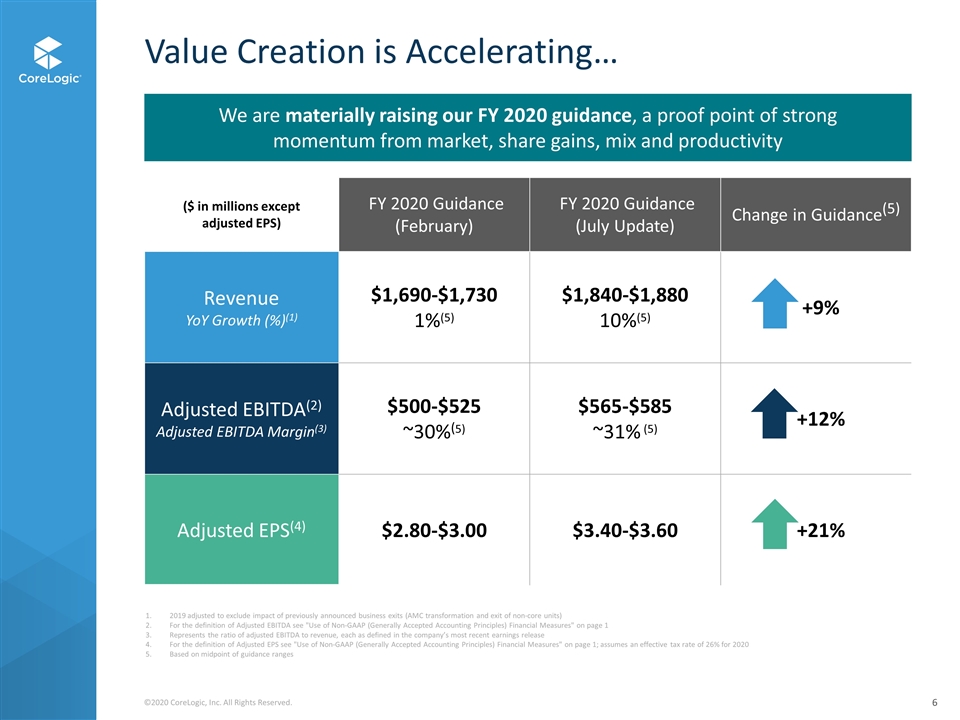

($ in millions except adjusted EPS) FY 2020 Guidance (February) FY 2020 Guidance (July Update) Change in Guidance(5) Revenue YoY Growth (%)(1) $1,690-$1,730 1%(5) $1,840-$1,880 10%(5) +9% Adjusted EBITDA(2) Adjusted EBITDA Margin(3) $500-$525 ~30%(5) $565-$585 ~31% (5) +12% Adjusted EPS(4) $2.80-$3.00 $3.40-$3.60 +21% Value Creation is Accelerating… We are materially raising our FY 2020 guidance, a proof point of strong momentum from market, share gains, mix and productivity FY 2020 revenue growth – want to show it as pro forma, footnote it for AMC restructure impact First bullet under assumptions from prior guidance releases GAAP reconciliation Confirm revenue growth rates based off Pro Forma #s Confirm Guidance ranges Strategic initiatives Confirm new business wins descriptions Confirm wording bottom of p13 2019 adjusted to exclude impact of previously announced business exits (AMC transformation and exit of non-core units) For the definition of Adjusted EBITDA see "Use of Non-GAAP (Generally Accepted Accounting Principles) Financial Measures" on page 1 Represents the ratio of adjusted EBITDA to revenue, each as defined in the company’s most recent earnings release For the definition of Adjusted EPS see "Use of Non-GAAP (Generally Accepted Accounting Principles) Financial Measures" on page 1; assumes an effective tax rate of 26% for 2020 Based on midpoint of guidance ranges 6

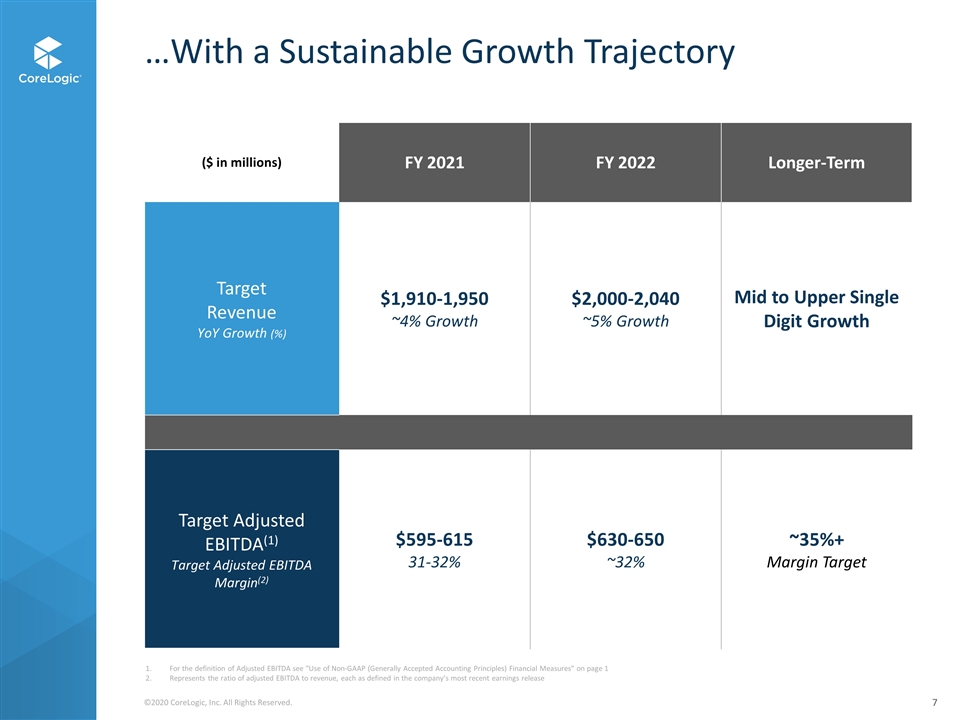

…With a Sustainable Growth Trajectory ($ in millions) FY 2021 FY 2022 Longer-Term Target Revenue YoY Growth (%) $1,910-1,950 ~4% Growth $2,000-2,040 ~5% Growth Mid to Upper Single Digit Growth Target Adjusted EBITDA(1) Target Adjusted EBITDA Margin(2) $595-615 31-32% $630-650 ~32% ~35%+ Margin Target For the definition of Adjusted EBITDA see "Use of Non-GAAP (Generally Accepted Accounting Principles) Financial Measures" on page 1 Represents the ratio of adjusted EBITDA to revenue, each as defined in the company’s most recent earnings release 7

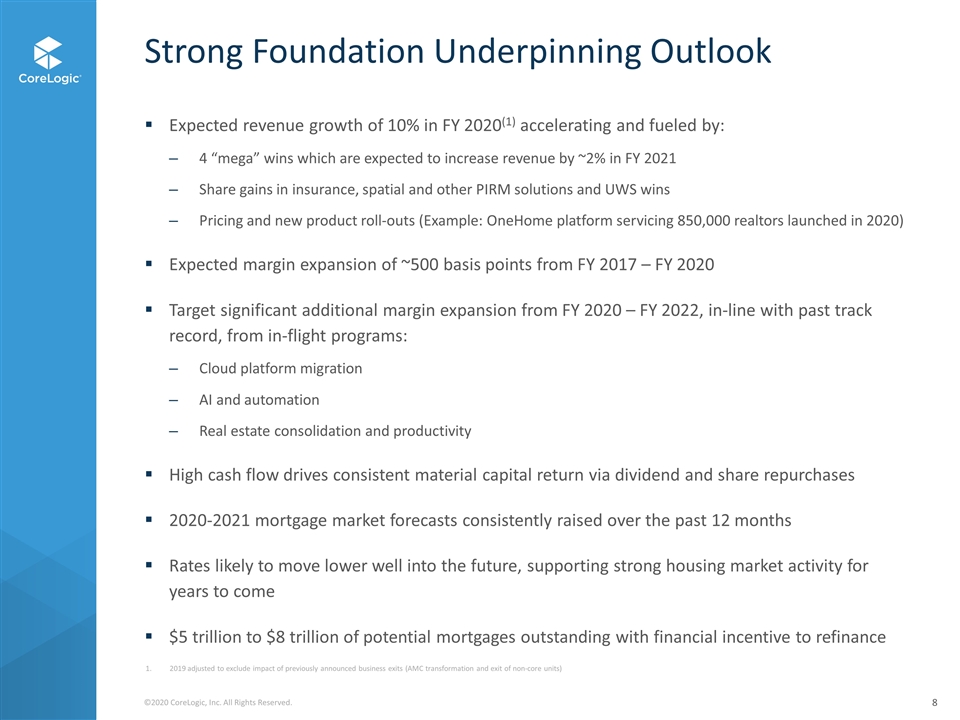

Strong Foundation Underpinning Outlook Expected revenue growth of 10% in FY 2020(1) accelerating and fueled by: 4 “mega” wins which are expected to increase revenue by ~2% in FY 2021 Share gains in insurance, spatial and other PIRM solutions and UWS wins Pricing and new product roll-outs (Example: OneHome platform servicing 850,000 realtors launched in 2020) Expected margin expansion of ~500 basis points from FY 2017 – FY 2020 Target significant additional margin expansion from FY 2020 – FY 2022, in-line with past track record, from in-flight programs: Cloud platform migration AI and automation Real estate consolidation and productivity High cash flow drives consistent material capital return via dividend and share repurchases 2020-2021 mortgage market forecasts consistently raised over the past 12 months Rates likely to move lower well into the future, supporting strong housing market activity for years to come $5 trillion to $8 trillion of potential mortgages outstanding with financial incentive to refinance 8 2019 adjusted to exclude impact of previously announced business exits (AMC transformation and exit of non-core units)

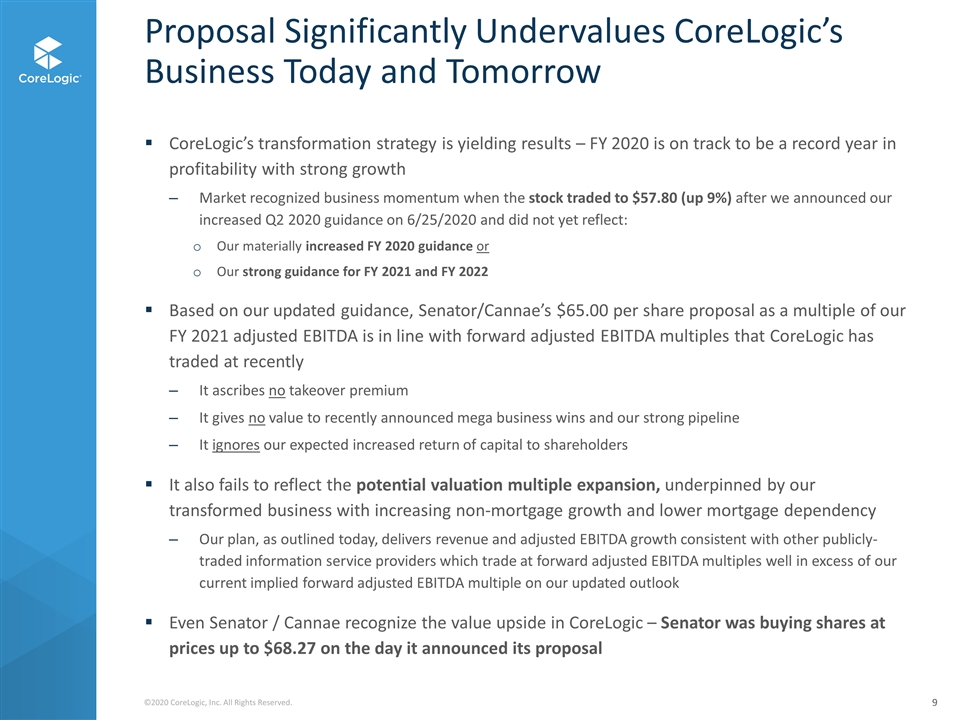

Proposal Significantly Undervalues CoreLogic’s Business Today and Tomorrow CoreLogic’s transformation strategy is yielding results – FY 2020 is on track to be a record year in profitability with strong growth Market recognized business momentum when the stock traded to $57.80 (up 9%) after we announced our increased Q2 2020 guidance on 6/25/2020 and did not yet reflect: Our materially increased FY 2020 guidance or Our strong guidance for FY 2021 and FY 2022 Based on our updated guidance, Senator/Cannae’s $65.00 per share proposal as a multiple of our FY 2021 adjusted EBITDA is in line with forward adjusted EBITDA multiples that CoreLogic has traded at recently It ascribes no takeover premium It gives no value to recently announced mega business wins and our strong pipeline It ignores our expected increased return of capital to shareholders It also fails to reflect the potential valuation multiple expansion, underpinned by our transformed business with increasing non-mortgage growth and lower mortgage dependency Our plan, as outlined today, delivers revenue and adjusted EBITDA growth consistent with other publicly-traded information service providers which trade at forward adjusted EBITDA multiples well in excess of our current implied forward adjusted EBITDA multiple on our updated outlook Even Senator / Cannae recognize the value upside in CoreLogic – Senator was buying shares at prices up to $68.27 on the day it announced its proposal 9

CoreLogic’s Strategy to Deliver Future Value

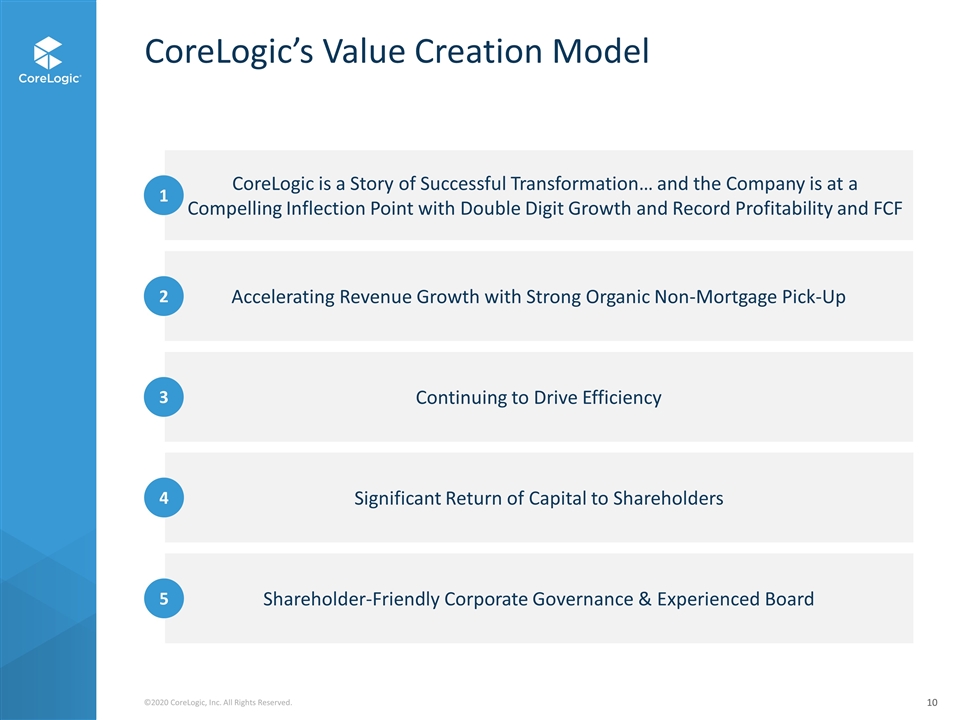

CoreLogic’s Value Creation Model Continuing to Drive Efficiency 3 Accelerating Revenue Growth with Strong Organic Non-Mortgage Pick-Up 2 CoreLogic is a Story of Successful Transformation… and the Company is at a Compelling Inflection Point with Double Digit Growth and Record Profitability and FCF 1 Significant Return of Capital to Shareholders 4 Shareholder-Friendly Corporate Governance & Experienced Board 5 10

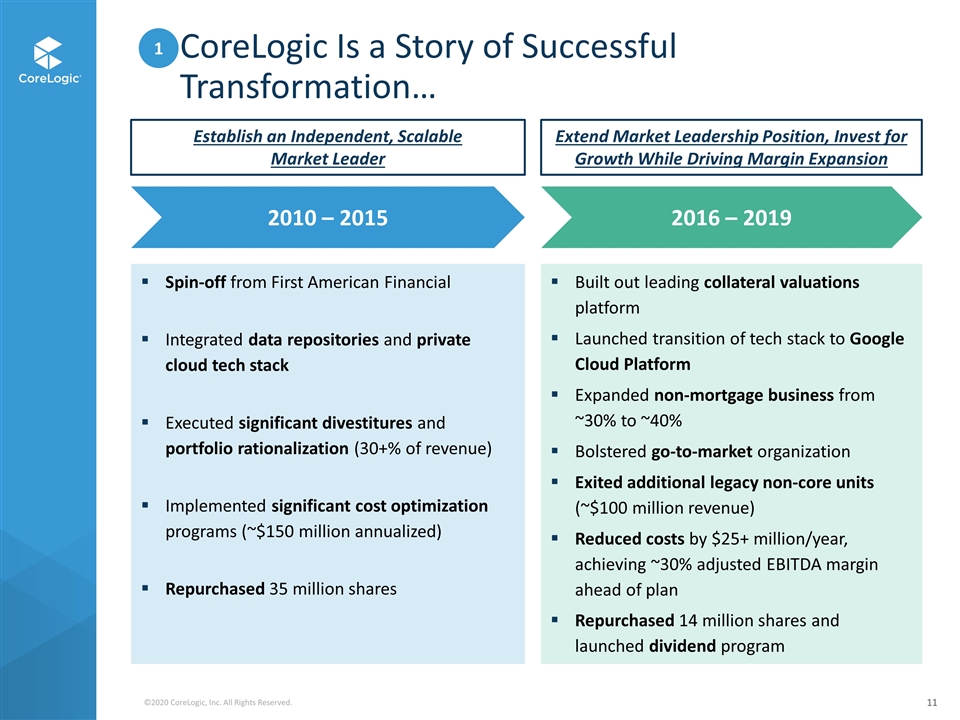

2010 – 2015 CoreLogic Is a Story of Successful Transformation… Spin-off from First American Financial 2016 – 2019 Built out leading collateral valuations platform Extend Market Leadership Position, Invest for Growth While Driving Margin Expansion Establish an Independent, Scalable Market Leader Launched transition of tech stack to Google Cloud Platform Expanded non-mortgage business from ~25% to ~40% Reinvigorated go-to-market organization 1 Executed significant divestitures and portfolio rationalization (30+% of revenue) Implemented significant cost optimization programs (~$200 million annualized) Reimagined data repositories and private cloud tech stack Repurchased 35 million shares Exited additional non-core units (~$125 million revenue) Reduced costs by $25+ million/year, achieving ~30% adjusted EBITDA margin ahead of plan Repurchased 14 million shares and launched dividend program 11 Spin-off from First American Financial Integrated data repositories and private cloud tech stack Executed significant divestitures and portfolio rationalization (30+% of revenue) Implemented significant cost optimization programs (~$150 million annualized) Repurchased 35 million shares Built out leading collateral valuations platform Launched transition of tech stack to Google Cloud Platform Expanded non-mortgage business from ~30% to ~40% Bolstered go-to-market organization Exited additional legacy non-core units (~$100 million revenue) Reduced costs by $25+ million/year, achieving ~30% adjusted EBITDA margin ahead of plan Repurchased 14 million shares and launched dividend program

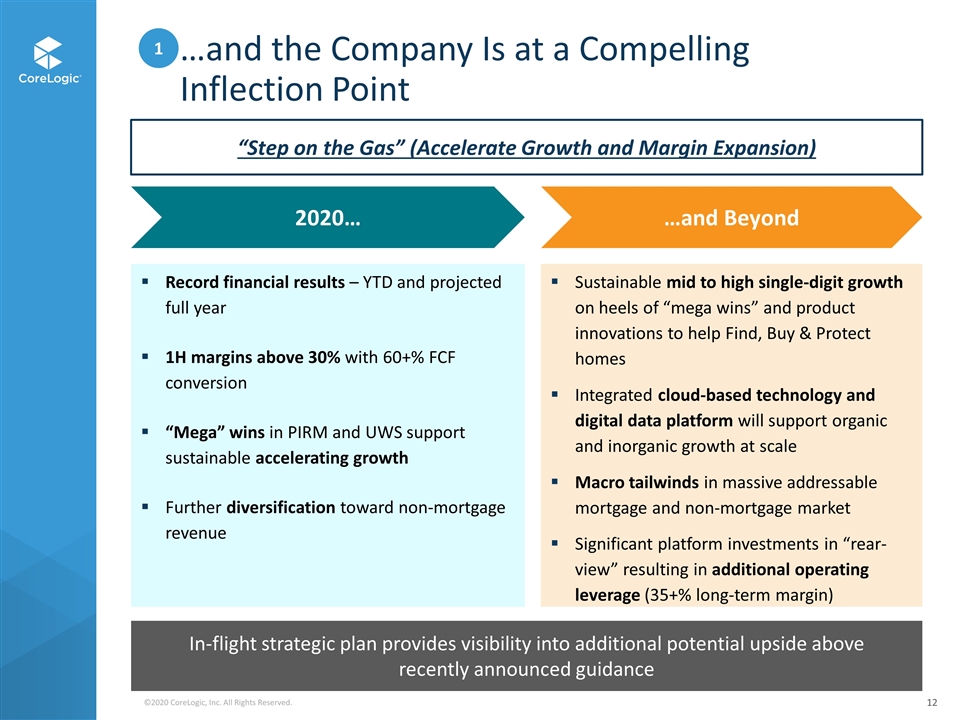

…and the Company Is at a Compelling Inflection Point 1 2020… Record financial results – YTD and projected full year …and Beyond Sustainable mid to high single-digit organic growth on heels of “mega wins” and product innovations to help Find, Buy & Protect homes Efficient cloud-based platform ripe for our inorganic growth initiatives underway Macro tailwinds in massive addressable mortgage and non-mortgage market Significant platform investments in “rear-view” resulting in massive operating leverage (35+% long-term margin) 1H margins above 30% with 60+% FCF conversion “Mega” wins in PIRM and UWS support sustainable accelerating growth Further diversification toward non-mortgage revenue “Step on the Gas” (Accelerate Growth and Margin Expansion) 12 Record financial results – YTD and projected full year 1H margins above 30% with 60+% FCF conversion “Mega” wins in PIRM and UWS support sustainable accelerating growth Further diversification toward non-mortgage revenue Sustainable mid to high single-digit growth on heels of “mega wins” and product innovations to help Find, Buy & Protect homes Integrated cloud-based technology and digital data platform will support organic and inorganic growth at scale Macro tailwinds in massive addressable mortgage and non-mortgage market Significant platform investments in “rear-view” resulting in additional operating leverage (35+% long-term margin) In-flight strategic plan provides visibility into additional potential upside above recently announced guidance

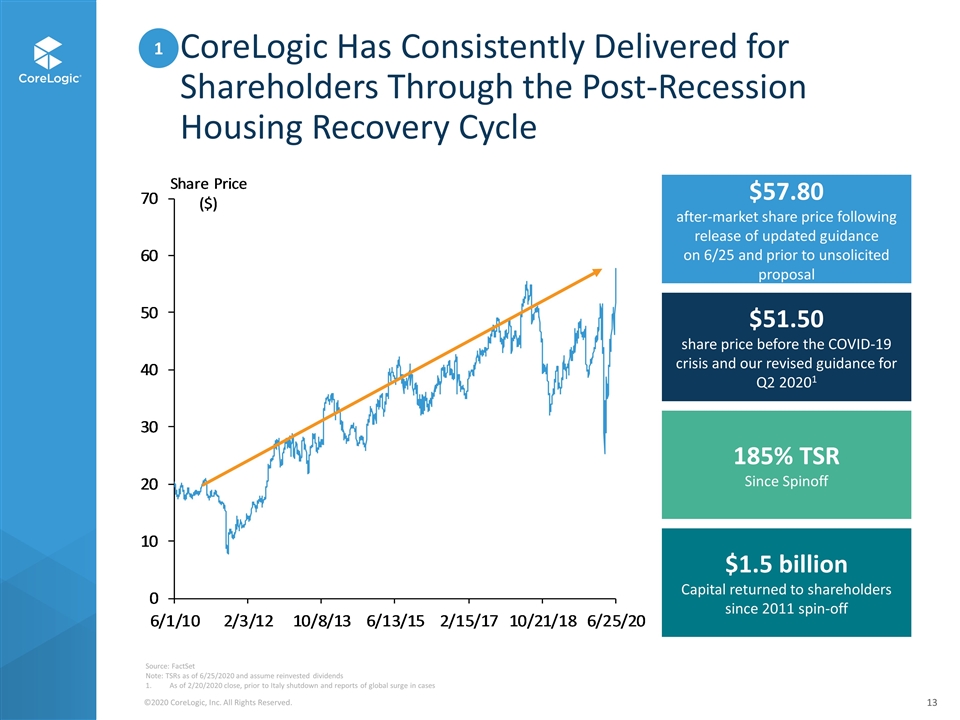

CoreLogic Has Consistently Delivered for Shareholders Through the Post-Recession Housing Recovery Cycle 185% TSR Since Spinoff $51.50 share price before the COVID-19 crisis and our revised guidance for Q2 20201 $57.80 after-market share price following release of updated guidance on 6/25 and prior to unsolicited proposal Source: FactSet Note: TSRs as of 6/25/2020 and assume reinvested dividends As of 2/20/2020 close, prior to Italy shutdown and reports of global surge in cases $1.5 billion Capital returned to shareholders since 2011 spin-off 1 13

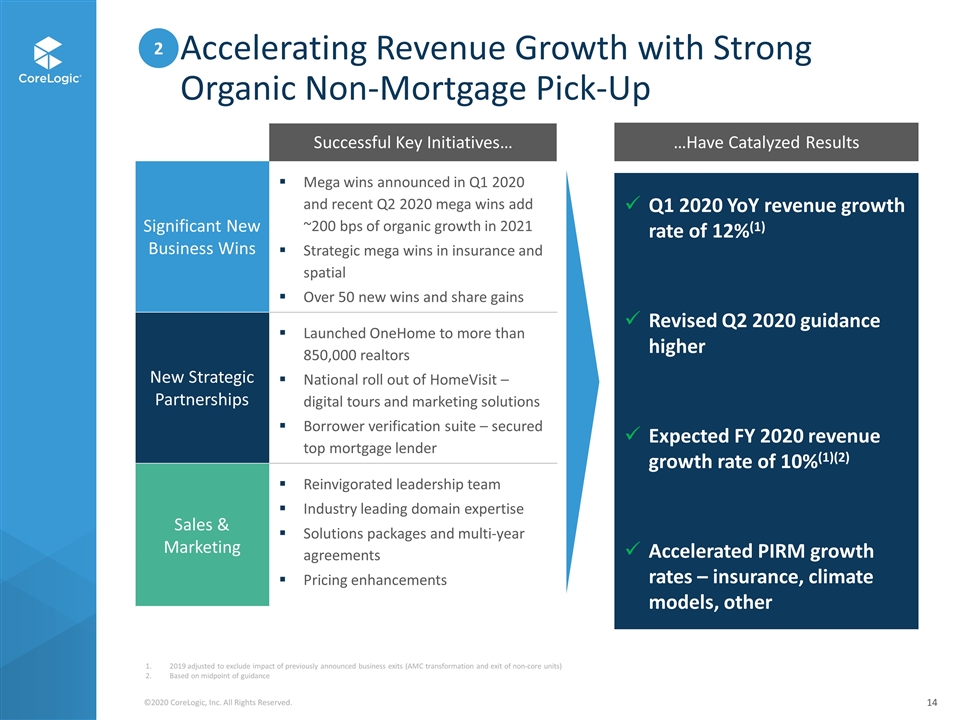

Accelerating Revenue Growth with Strong Organic Non-Mortgage Pick-Up Successful Key Initiatives… Significant New Business Wins Mega wins announced in Q1 2020 and recent Q2 2020 mega wins add ~200 bps of organic growth in 2021 Strategic mega wins in insurance and spatial Over 50 new wins and share gains New Strategic Partnerships Launched OneHome to more than 850,000 realtors National roll out of HomeVisit – digital tours and marketing solutions Borrower verification suite – secured top mortgage lender Sales & Marketing Reinvigorated leadership team Industry leading domain expertise Solutions packages and multi-year agreements Pricing enhancements Q1 2020 YoY revenue growth rate of 12%(1) Revised Q2 2020 guidance higher Expected FY 2020 revenue growth rate of 10%(1)(2) Accelerated PIRM growth rates – insurance, climate models, other …Have Catalyzed Results 2 2019 adjusted to exclude impact of previously announced business exits (AMC transformation and exit of non-core units) Based on midpoint of guidance 14

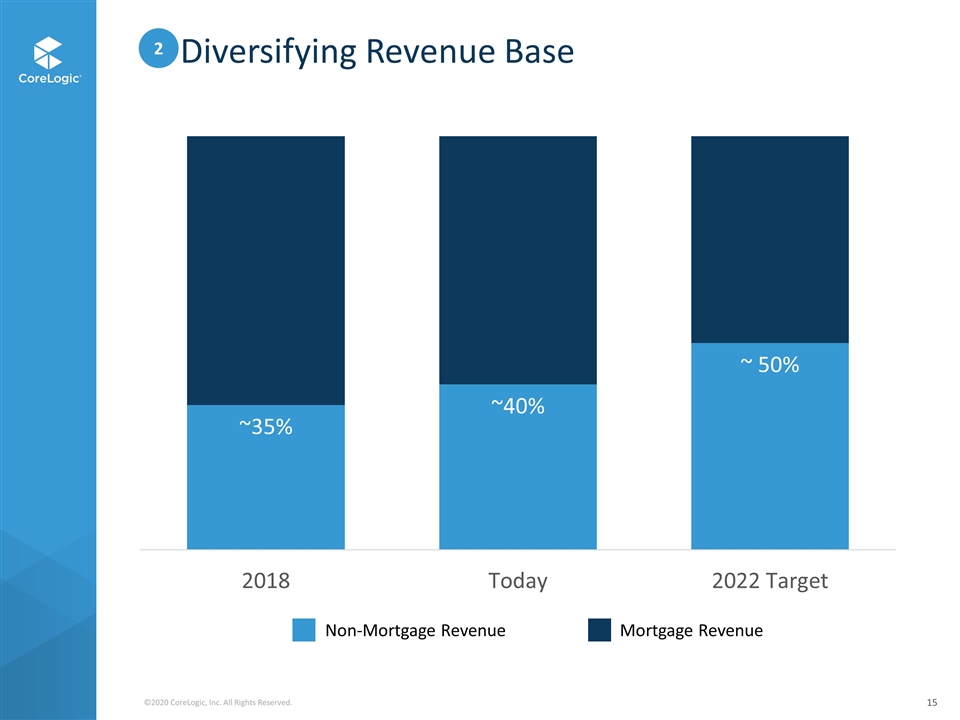

Diversifying Revenue Base CONFIRM 2011 breakdown Non-Mortgage Revenue Mortgage Revenue 2 15

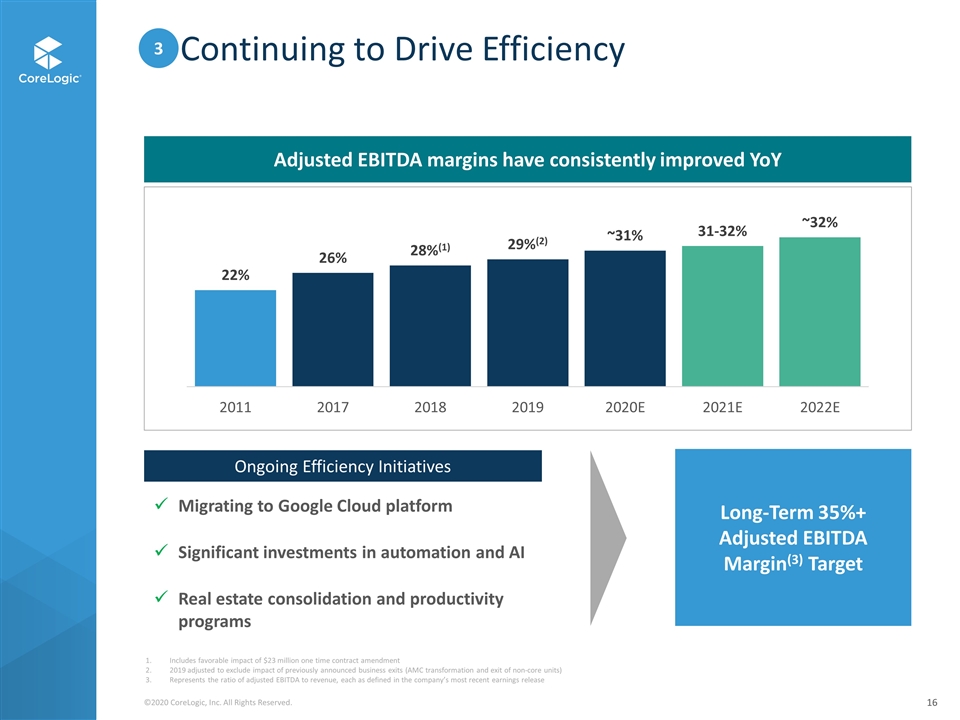

Continuing to Drive Efficiency Long-Term 35%+ Adjusted EBITDA Margin(3) Target Ongoing Efficiency Initiatives Migrating to Google Cloud platform Significant investments in automation and AI Real estate consolidation and productivity programs Adjusted EBITDA margins have consistently improved YoY Includes favorable impact of $23 million one time contract amendment 2019 adjusted to exclude impact of previously announced business exits (AMC transformation and exit of non-core units) Represents the ratio of adjusted EBITDA to revenue, each as defined in the company’s most recent earnings release 3 16

A Track Record of Operational Excellence Adjusted EPS 21% CAGR Adjusted EBITDA Margin ~900bps Revenue 6% CAGR Adjusted EBITDA 10% CAGR Growth in share and market leadership in key operating units Building out high margin growth drivers – insurance, spatial/hazard, valuation, marketing and realtor solutions Scaling of core mortgage operations Bundled solution packages leveraging our efficient and integrated technology and back-office infrastructure Successful cost productivity initiatives Over 30% margin on trailing 12-month basis(2) with additional margin expansion expected Technology and data capture transformations Investment in automation and AI Organization efficiencies / managing headcount Revenue mix shift toward platform and higher profit solutions driving predictability and margins Expanded platform offerings related to mortgage underwriting, home purchase-related marketing services and insurance and spatial solutions Durable cash-generative business model Generation of $315 million in free cash flow, representing a conversion rate of 59% of our adjusted EBITDA on a trailing 12-month basis(2) Operating Performance FY 2011 – FY 2020E(1) Based on midpoint of FY 2020 Guidance As of Q1 2020; 2019 adjusted to exclude impact of previously announced business exits (AMC transformation and exit non-core units) 3 17

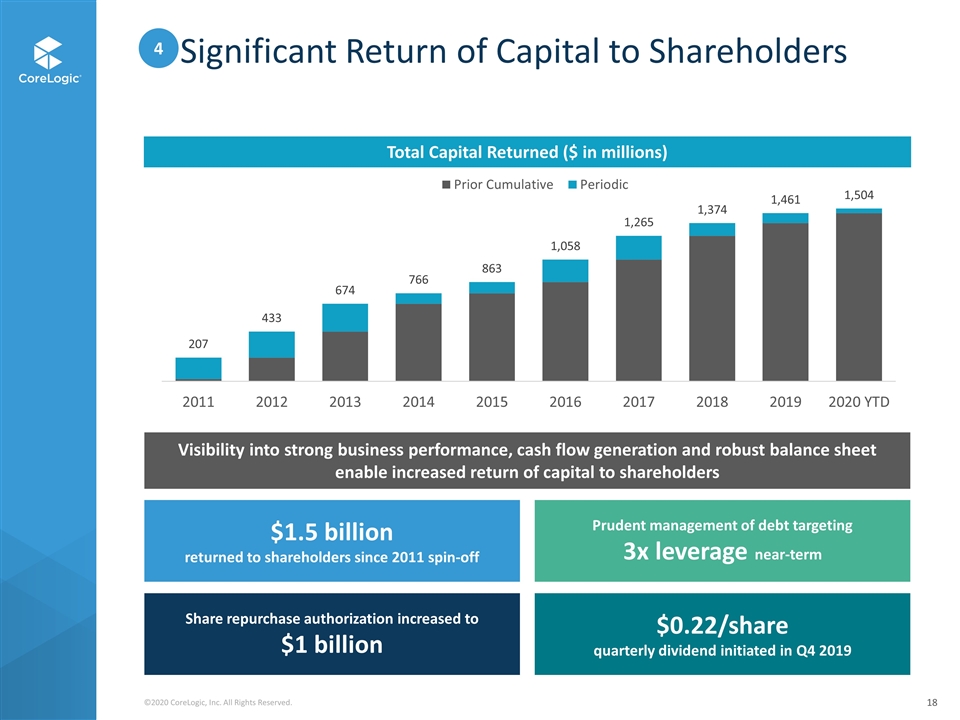

Significant Return of Capital to Shareholders Visibility into strong business performance, cash flow generation and robust balance sheet enable increased return of capital to shareholders Total Capital Returned ($ in millions) Share repurchase authorization increased to $1 billion Prudent management of debt targeting 3x leverage near-term $0.22/share quarterly dividend initiated in Q4 2019 $1.5 billion returned to shareholders since 2011 spin-off 4 18

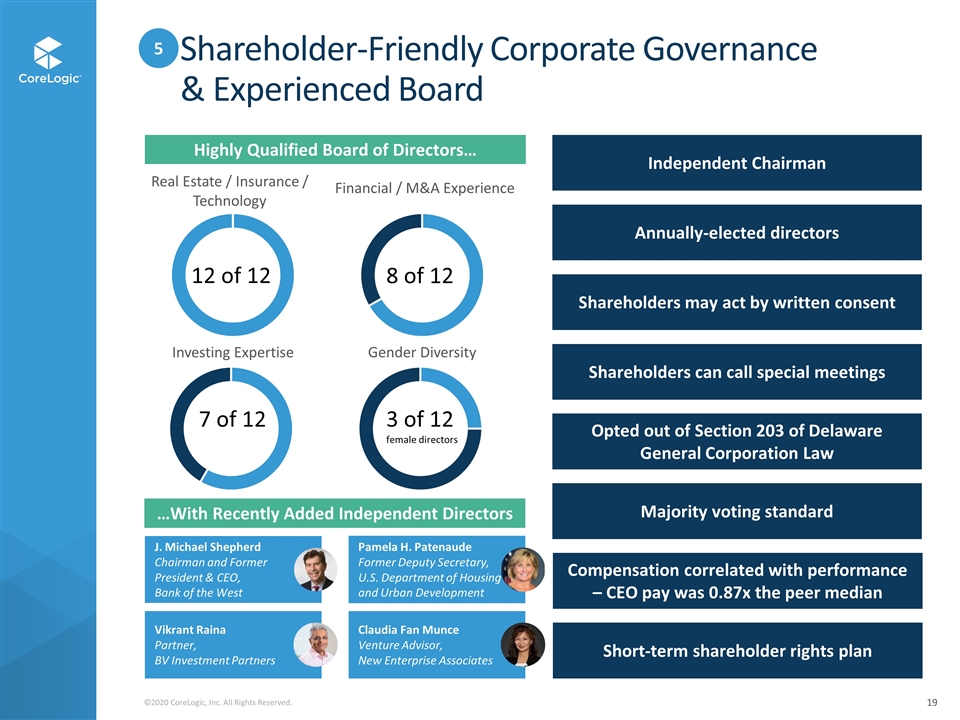

Shareholder-Friendly Corporate Governance & Experienced Board Pamela H. Patenaude Former Deputy Secretary, U.S. Department of Housing and Urban Development J. Michael Shepherd Chairman and Former President & CEO, Bank of the West Annually-elected directors Shareholders can call special meetings Opted out of Section 203 of Delaware General Corporation Law Independent Chairman Majority voting standard Shareholders may act by written consent Compensation correlated with performance – CEO pay was 0.87x the peer median 12 of 12 8 of 12 7 of 12 3 of 12 female directors …With Recently Added Independent Directors Highly Qualified Board of Directors… Short-term shareholder rights plan Claudia Fan Munce Venture Advisor, New Enterprise Associates Vikrant Raina Partner, BV Investment Partners 5 19

Senator & Cannae’s Proposal Is Opportunistic, Significantly Undervalues CoreLogic, and Poses Serious Regulatory Concerns

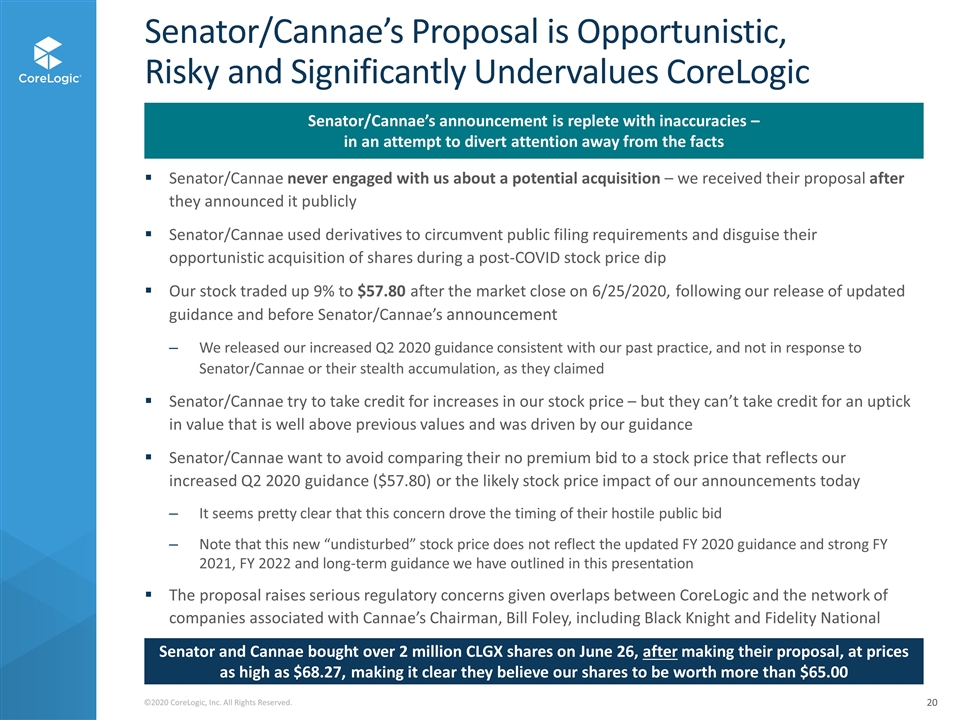

Senator/Cannae’s Proposal is Opportunistic, Risky and Significantly Undervalues CoreLogic Senator/Cannae never engaged with us about a potential acquisition – we received their proposal after they announced it publicly Senator/Cannae used derivatives to circumvent public filing requirements and disguise their opportunistic acquisition of shares during a post-COVID stock price dip Our stock traded up 9% to $57.80 after the market close on 6/25/2020, following our release of updated guidance and before Senator/Cannae’s announcement We released our increased Q2 2020 guidance consistent with our past practice, and not in response to Senator/Cannae or their stealth accumulation, as they claimed Senator/Cannae try to take credit for increases in our stock price – but they can’t take credit for an uptick in value that is well above previous values and was driven by our guidance Senator/Cannae want to avoid comparing their no premium bid to a stock price that reflects our increased Q2 2020 guidance ($57.80) or the likely stock price impact of our announcements today It seems pretty clear that this concern drove the timing of their hostile public bid Note that this new “undisturbed” stock price does not reflect the updated FY 2020 guidance and strong FY 2021, FY 2022 and long-term guidance we have outlined in this presentation The proposal raises serious regulatory concerns given overlaps between CoreLogic and the network of companies associated with Cannae’s Chairman, Bill Foley, including Black Knight and Fidelity National Senator/Cannae’s announcement is replete with inaccuracies – in an attempt to divert attention away from the facts Senator and Cannae bought over 2 million CLGX shares on June 26, after making their proposal, at prices as high as $68.27, making it clear they believe our shares to be worth more than $65.00 Contrary to Senator/Cannae’s false statements, they never engaged with us about a potential acquisition – we received their proposal after they announced it publicly 20

CoreLogic’s Highly Qualified Board Thoroughly Evaluated the Proposal Following Senator and Cannae’s public proposal, CoreLogic engaged Evercore to serve as financial advisor and Skadden, Arps, Slate, Meagher & Flom LLP to serve as legal counsel in order to assist with the thorough evaluation of the proposal CoreLogic’s Board is comprised of directors with track records of successfully evaluating and executing public M&A transactions 8 directors with public M&A experience, including at Actel, Ameristar, Pinnacle Entertainment, LifeLock, aQuantitative Over $20 billion of public M&A experience among CoreLogic’s directors After a careful and thorough review conducted in consultation with its independent financial and legal advisors, CoreLogic’s Board concluded that Senator and Cannae’s unsolicited proposal significantly undervalues the Company and is not in the best interest of shareholders The Board is focused on generating shareholder value and will consider any viable path that would reasonably be expected to enhance the value of the Company for our shareholders We are willing to meet with Senator and Cannae to learn more details about their proposal and position on a number of important matters, including ability to deliver appropriate value and plans to address regulatory and other concerns 21

CoreLogic is Well Positioned to Deliver Substantial Shareholder Value Near-term revenue growth is substantial, including significant customer wins which are driving record revenues and EPS 12%(1) YoY revenue growth in Q1 2020; 10%(1)(2) YoY revenue growth expected for FY 2020; ~4%(3) revenue CAGR forecasted from FY 2020 – FY2022 Visibility into increasing near-term profitability outlook Adjusted EBITDA guidance of $565 – $585 million for FY 2020 (+15.6% YoY) and $595 – $615 million for FY 2021 Operating leverage and adjusted EBITDA margin expansion from stronger mix shift, efficiency initiatives Increased adjusted EBITDA margins by ~500 bps YoY during Q1 2020(1), and expected to increase adjusted EBITDA margins by ~80 bps(3) from FY 2020 – FY 2022 Aggressive repositioning – from the vast majority of our revenue being mortgage-dependent in 2011 to ~60% today and targeting ~50% by FY 2022 Increasing our share repurchase authorization to $1 billion We are committed to acting in the best interests of shareholders, as reflected by our shareholder-friendly governance policies including annually elected directors and allowing for shareholders to call special meetings and act by written consent We are open to all paths to creating value including meeting with Senator/Cannae Our plan is poised to deliver value significantly in excess of Senator/Cannae’s $65.00 per share proposal, which is not in the best interest of shareholders 2019 adjusted to exclude impact of previously announced business exits (AMC transformation and exit of non-core units) Based on midpoint of guidance Based on midpoint of FY 2022 guidance compared against midpoint of FY 2020 guidance 22