Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Vir Biotechnology, Inc. | d945110dex991.htm |

| EX-23.1 - EX-23.1 - Vir Biotechnology, Inc. | d945110dex231.htm |

| EX-10.59 - EX-10.59 - Vir Biotechnology, Inc. | d945110dex1059.htm |

| EX-10.58 - EX-10.58 - Vir Biotechnology, Inc. | d945110dex1058.htm |

| EX-10.57 - EX-10.57 - Vir Biotechnology, Inc. | d945110dex1057.htm |

| EX-10.56 - EX-10.56 - Vir Biotechnology, Inc. | d945110dex1056.htm |

| EX-10.55 - EX-10.55 - Vir Biotechnology, Inc. | d945110dex1055.htm |

| EX-10.54 - EX-10.54 - Vir Biotechnology, Inc. | d945110dex1054.htm |

| EX-10.53 - EX-10.53 - Vir Biotechnology, Inc. | d945110dex1053.htm |

| EX-10.21 - EX-10.21 - Vir Biotechnology, Inc. | d945110dex1021.htm |

| EX-5.1 - EX-5.1 - Vir Biotechnology, Inc. | d945110dex51.htm |

| EX-1.1 - EX-1.1 - Vir Biotechnology, Inc. | d945110dex11.htm |

Table of Contents

As filed with the Securities and Exchange Commission on July 6, 2020.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Vir Biotechnology, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 2836 | 81-2730369 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) 499 Illinois Street, Suite 500 San Francisco, California 94158 (415) 906-4324 |

(I.R.S. Employer Identification Number) |

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

George Scangos, Ph.D.

President and Chief Executive Officer

Vir Biotechnology, Inc.

499 Illinois Street, Suite 500

San Francisco, California 94158

(415) 906-4324

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Laura A. Berezin Charles S. Kim Kristin VanderPas Cooley LLP 3175 Hanover Street Palo Alto, California 94304 (650) 843-5000 |

Brian J. Cuneo B. Shayne Kennedy Drew Capurro Latham & Watkins LLP 140 Scott Drive Menlo Park, California 94025 (650) 328-4600 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, check the following box. ☐

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of securities being registered |

Proposed maximum aggregate offering price(1)(2) |

Amount of registration fee (2) | ||

| Common Stock, $0.0001 par value per share |

$287,500,000 | $37,317.50 | ||

|

| ||||

|

| ||||

| (1) | Includes additional shares that the underwriters have the option to purchase. |

| (2) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JULY 6, 2020

PRELIMINARY PROSPECTUS

6,200,000 Shares

Common Stock

We are offering 6,200,000 shares of our common stock.

Our common stock is listed on The Nasdaq Global Select Market under the trading symbol “VIR.” The last reported sale price of our common stock on The Nasdaq Global Select Market on July 2, 2020 was $40.32 per share.

We are an “emerging growth company” as defined under the federal securities laws and, as such, have elected to comply with certain reduced public company reporting requirements.

Investing in our common stock involves a high degree of risk. See the section titled “Risk Factors” beginning on page 17.

| Per Share |

Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds to us before expenses |

$ | $ | ||||||

| (1) | See the section titled “Underwriting” for additional information regarding compensation payable to the underwriters. |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

We have granted the underwriters an option for a period of 30 days to purchase up to 930,000 additional shares of common stock at the public offering price, less the underwriting discounts and commissions.

The underwriters expect to deliver the shares against payment in New York, New York on , 2020.

| Goldman Sachs & Co. LLC | BofA Securities | Cowen | Barclays | |||

| Needham & Company | ||||||

Prospectus dated , 2020

Table of Contents

| Page | ||||

| 1 | ||||

| 17 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 24 | ||||

| 25 | ||||

| 27 | ||||

| 29 | ||||

| 33 | ||||

| Material U.S. Federal Income Tax Consequences to Non-U.S. Holders |

38 | |||

| 42 | ||||

| 48 | ||||

| 48 | ||||

| 48 | ||||

| 49 | ||||

Neither we nor the underwriters have authorized anyone to provide any information or to make any representations other than those contained or incorporated by reference in this prospectus or in any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained or incorporated by reference in this prospectus or in any applicable free writing prospectus is current only as of its date, regardless of its time of delivery or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: Neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus and any such free writing prospectus outside the United States.

Unless the context otherwise requires, the terms “Vir,” “the company,” “we,” “us,” “our” and similar references in this prospectus refer to Vir Biotechnology, Inc. and its consolidated subsidiaries.

i

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus or incorporated by reference herein. Before investing in our common stock, you should carefully read this entire prospectus, including the information incorporated by reference herein, especially the matters discussed in the information set forth under the sections titled “Risk Factors” in this prospectus and in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, and the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2019 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, each of which are incorporated by reference herein.

Business Summary

Our mission is to create a world without infectious disease

We are a clinical-stage immunology company focused on combining immunologic insights with cutting-edge technologies to treat and prevent serious infectious diseases. Infectious diseases are one of the leading causes of death worldwide and can cause trillions of dollars of direct and indirect economic burden each year – as evidenced by the current coronavirus disease 2019, or COVID-19, pandemic. We believe that now is the time to apply the recent and remarkable advances in immunology to combat infectious diseases. Our approach begins with identifying the limitations of the immune system in combating a particular pathogen, the vulnerabilities of that pathogen and the reasons why previous approaches have failed. We then bring to bear powerful technologies that we believe, individually or in combination, will lead to effective therapies.

We have assembled four technology platforms, focused on antibodies, T cells, innate immunity and small interfering ribonucleic acid, or siRNA, through internal development, collaborations and acquisitions. Our current development pipeline consists of product candidates targeting severe acute respiratory syndrome coronavirus 2, or SARS-CoV-2, the virus that causes COVID-19, hepatitis B virus, or HBV, influenza A, human immunodeficiency virus, or HIV, and tuberculosis, or TB. For SARS-CoV-2, VIR-7831, a SARS-CoV-2- neutralizing monoclonal antibody, or mAb, is planned to start a Phase 2/3 clinical trial program in August 2020 and we anticipate initial clinical data to be available before the end of the year. VIR-7832, a vaccinal SARS-CoV-2-neutralizing mAb, is planned to initiate a Phase 2 clinical trial later this year. VIR-2703, a SARS-CoV-2-targeting siRNA, is in preclinical studies. For HBV, VIR-2218, an HBV-targeting siRNA, is currently in an ongoing Phase 2 clinical trial. Initial Phase 2 data have demonstrated substantial, durable, and dose dependent reduction of hepatitis B virus surface antigen, or HBsAg, and VIR-2218 has been generally well-tolerated. We recently initiated a Phase 2 clinical trial to combine VIR-2218 with pegylated interferon-alpha, or PEG-IFN-α, an approved immune modulatory agent. In addition, we recently initiated a Phase 1 clinical trial for VIR-3434, an HBV-neutralizing mAb. For influenza A, VIR-2482, a mAb designed for the prevention of influenza A, is currently in a Phase 1/2 clinical trial and has been generally well-tolerated. For HIV, VIR-1111, an HIV T cell vaccine based on HCMV, is planned to initiate a Phase 1 trial in the second half of this year. We have built an industry-leading team that has deep experience in immunology, infectious diseases and product development. Given the global impact of infectious diseases, we are committed to developing cost-effective treatments that can be delivered at scale.

Our Technology Platforms

Our four current technology platforms are designed to stimulate and enhance the immune system by exploiting critical observations of natural immune processes. We are using our platforms to advance our current product candidates and generate additional product candidates for multiple indications.

1

Table of Contents

Antibody Platform: We have established a robust method for capitalizing on unusually successful immune responses naturally occurring in people who are protected from, or have recovered from, infectious diseases. We identify rare antibodies from survivors that have the potential to treat and prevent rapidly evolving and/or previously untreatable pathogens via direct pathogen neutralization and immune system stimulation. The fully-human antibodies that we discover may also be modified to enhance their therapeutic potential. We have applied these methods to identify mAbs for a range of pathogens including Ebola, HBV, influenza A and influenza B virus, SARS-CoV-2, RSV and malaria, and bacterial pathogens, including clostridium difficile, Staphylococcus aureus, Klebsiella pneumoniae, and Acinetobacter spp.

T Cell Platform: We are exploiting the unique immunology of human cytomegalovirus, or HCMV, a commonly occurring virus in humans, as a vaccine vector to potentially treat and prevent infection by pathogens refractory to current vaccine technologies. This approach is based on fundamental observations made in non-human primates, or NHPs, with rhesus cytomegalovirus, or RhCMV. We believe that this platform may also have applicability beyond infectious diseases, to areas such as cancer.

Innate Immunity Platform: Moving beyond more traditional approaches that are used to evoke adaptive immunity or that directly target pathogens, where the development of resistance can occur, we plan to target host proteins as a means of creating host-directed therapies with high barriers to resistance. We believe that by leveraging the power of innate immunity, we can create medicines that break the “one-drug-for-one-bug” paradigm to produce “one-drug-for-multiple-bugs.”

siRNA Platform: We are harnessing the power of siRNA to inhibit pathogen replication, eliminate key host factors necessary for pathogen survival and remove microbial immune countermeasures. Our collaboration with Alnylam Pharmaceuticals, Inc., or Alnylam, includes VIR-2218 for HBV, VIR-2703 for SARS-CoV-2 and up to seven additional programs for infectious diseases.

Our Development Pipeline

Our current product candidates are summarized in the chart below:

| * | VIR-1111 is a vaccine designed to establish proof of concept in Phase (Ph) 1 clinical trial to determine whether unique immune response observed in NHPs can be replicated in humans; ultimately, any candidates we advance as a potential HIV vaccine will require modifications to VIR-1111 before further clinical development. |

2

Table of Contents

SARS-CoV-2: The substantial impact of viral outbreaks and the need for global preparedness have been highlighted by the current COVID-19 pandemic. As of June 19, 2020, the virus had spread to 188 countries, there were over 8.5 million recorded infections and over 450,000 recorded deaths. We have moved rapidly to address this global health challenge. Our focus is on treating and preventing SARS-CoV-2, as well as potential future coronavirus outbreaks. To do so, we are taking multiple approaches: antibodies (VIR-7831 and VIR-7832), siRNA (VIR-2703), applying our innate immunity platform to identify cellular host genes necessary for virus replication, and vaccines. We anticipate that the initial registration populations for our product candidates will include those at high risk of contracting COVID-19 and those in need of treatment for COVID-19.

VIR-7831 and VIR-7832 are SARS-CoV-2-neutralizing mAbs. For VIR-7831, we plan to submit an Investigational New Drug Application, or IND, and thereafter commence a Phase 2/3 clinical trial program in August 2020. VIR-7832 is planned to initiate a Phase 2 clinical trial later this year. Both VIR-7831 and VIR-7832 are based on a parent antibody, S309, which was derived from samples previously gathered for research on pan-coronavirus-neutralizing mAbs. S309 has demonstrated high affinity and avidity for the SARS-CoV-2 spike protein and the ability to potently neutralize SARS-CoV-2 in multiple live-virus cellular assays. S309 binds to an epitope on SARS-CoV-2 that is shared with SARS-CoV-1 (also commonly known as ‘SARS’), indicating that the epitope is highly conserved. We believe the conservation of this epitope will make it more difficult for escape mutants to develop and result in a high barrier to resistance. S309 also exhibits potent effector function in vitro, potentially allowing the engagement and recruitment of immune cells to kill off already infected cells. VIR-7831 and VIR-7832 have both been engineered with “LS” mutations within the Fc region of the mAbs, for the purpose of increasing lung tissue bioavailability and extending their half-life. VIR-7832 has been further engineered with “XX2” mutations in the Fc region of the mAb to potentially allow it to function as a T cell vaccine. We anticipate initial clinical data from our Phase 2/3 trial of VIR-7831 to be available before the end of the year.

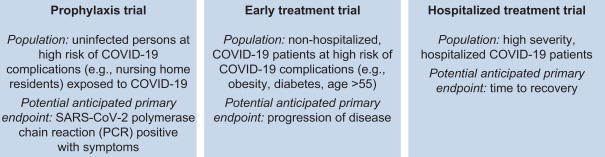

Our Phase 2/3 trial program for VIR-7831 will be comprised of the following:

To accelerate the progress of VIR-7831 and VIR-7832, we have signed a number of collaboration agreements to aid in their manufacture and potential commercialization. Specifically, we are collaborating on clinical manufacturing with WuXi Biologics (Hong Kong) Limited, or WuXi, and Biogen Inc., or Biogen. We are collaborating on commercial manufacturing with WuXi and Samsung Biologics Co., Ltd., or Samsung, and we anticipate commercial supply of approximately 10-15 million doses in 2021, depending on titer, yield and dose amount. And we are collaborating on potential commercialization with WuXi for greater China and GlaxoSmithKline plc, or GSK, for all other countries. See the section titled “Recent SARS-CoV-2 Activities” for a description of these and other collaborations.

VIR-2703 is an inhaled SARS-CoV-2-targeting siRNA for which we are conducting preclinical studies that are expected to be completed by the end of 2020. In vitro, VIR-2703 has demonstrated the ability to significantly reduce SARS-CoV-2 live virus replication. It is designed to degrade the viral genome, leading to inhibition of viral protein synthesis and blocking the production of infectious virus. It targets a nucleic acid sequence in the SARS-CoV-2 genome that is highly conserved amongst currently available viral sequences and is also conserved in SARS-CoV-1. VIR-2703 leverages Alnylam’s latest advances in lung delivery of siRNAs and is the first development candidate selected in our expanded collaboration with Alnylam for SARS-CoV-2 and other coronaviruses.

3

Table of Contents

HBV: Approximately 290 million people globally are chronically infected with HBV and approximately 900,000 of them die from HBV-associated complications each year. There is a significant unmet medical need for more effective therapies that lead to life-long control of the virus after a finite duration of therapy, which is the definition of a functional cure. For a registrational trial to demonstrate a functional cure, the formal endpoint accepted by the U.S. Food and Drug Administration, or the FDA, is undetectable HBsAg, defined as less than 0.05 international units per milliliter, or IU/ml, as well as HBV DNA less than the lower limit of quantification, in the blood six months after the end of therapy.

We are developing VIR-2218 and VIR-3434 for the functional cure of HBV. Each of these product candidates has the potential to stimulate an effective immune response and also has direct antiviral activity against HBV. We believe that a functional cure for HBV will require an effective immune response, in addition to antiviral activity, based on the observation that severe immunosuppression can reactivate HBV disease. While monotherapy with VIR-2218 and VIR-3434 may provide a functional cure in some patients, we believe combination therapy will be necessary for a functional cure in many patients. We are planning trials that combine VIR-2218 and VIR-3434, which we believe have the potential to act in concert by removing potentially tolerogenic HBV proteins and stimulating new HBV specific T cells. We also recently initiated a trial that combines VIR-2218 with PEG-IFN-α and are evaluating additional combinations with other immunotherapy agents and direct acting antiviral agents. We anticipate that the initial registration population for these product candidates will be patients chronically infected with HBV.

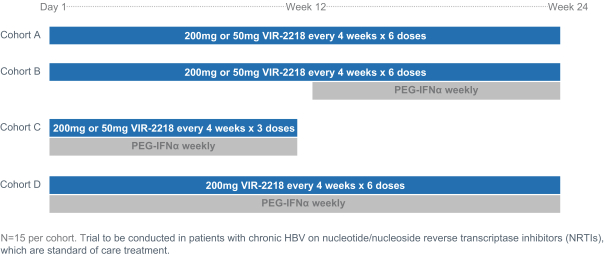

VIR-2218 is a subcutaneously administered HBV-targeting siRNA that is currently in a Phase 2 clinical trial. By targeting a conserved region of the HBV genome, it is designed to inhibit the production of all HBV proteins: X, polymerase, S, and core. Suppression of HBV proteins, particularly HBsAg, is hypothesized to remove the inhibition of T cell and B cell activity directed against HBV, allowing VIR-2218 to potentially result in a functional cure. VIR-2218 was the first siRNA in the clinic to include Alnylam’s ESC+ technology, which has the potential to enhance the therapeutic index. In total, 37 healthy volunteers have received VIR-2218 and 12 healthy volunteers have received placebo. In addition, 24 patients with chronic HBV on nucleotide/nucleoside reverse transcriptase inhibitors, or NRTIs, have received VIR-2218, and eight patients with chronic HBV on NRTIs have received placebo. The data suggest that VIR-2218 is generally well-tolerated in healthy volunteers given as a single dose up to 900 mg and in patients given as two doses of 20 mg, 50 mg, 100 mg or 200 mg each dose. The data also demonstrate substantial, dose dependent reductions in HBsAg in patients at doses ranging from 20 mg to 200 mg, which are durable at the higher doses for at least six months. We recently initiated a Phase 2 combination trial of VIR-2218 and PEG-IFN-α, and anticipate initial clinical data to be available in 2021.

The trial design for the Phase 2 combination trial of VIR-2218 and PEG-IFN-α is shown below:

4

Table of Contents

VIR-3434 is a subcutaneously administered HBV-neutralizing mAb currently in a Phase 1 clinical trial. By targeting a conserved region of HBsAg, it is designed to block entry of all 10 genotypes of HBV into liver cells called hepatocytes and reduce the level of virions and subviral particles in the blood. We have also engineered VIR-3434 to have an extended half-life and to potentially function as a therapeutic T cell vaccine for chronic HBV infection. These modifications are intended to enhance its potential to result in an HBV functional cure. We anticipate clinical data from our Phase 1 trial will enable us to initiate a Phase 2 clinical trial of VIR-3434 in combination with VIR-2218 in 2021.

Influenza: On average, each year the influenza virus infects 5% to 10% of the world’s population and results in an estimated 500,000 deaths. In the 2017-2018 flu season, it is now estimated that 61,000 people died from influenza in the United States alone. Influenza vaccines have historically had limited success, with an average efficacy of 40%. This limited efficacy results from incomplete coverage against seasonal strains and the lack of an effective immune response in many individuals after receiving the vaccine. We are developing VIR-2482 as a universal prophylactic for influenza A and have designed it to overcome both limitations of flu vaccines, which we believe will lead to meaningfully higher levels of protection. We anticipate that the initial registration population for VIR-2482 will be individuals at high risk of influenza A complications, such as the elderly with chronic lung disease or congestive heart failure.

VIR-2482 is an intramuscularly administered influenza A-neutralizing mAb currently in a Phase 1/2 clinical trial. In vitro, VIR-2482 has been shown to cover all major strains of influenza A that have arisen since the 1918 Spanish flu pandemic. We believe that VIR-2482 has the potential to provide superior protection to flu vaccines and be able to be used year after year because it has broad strain coverage as opposed to the limited strain coverage generated by vaccines. We also believe that it provides passive immunity rather than relying on a person to generate active immunity via a functional immune response, an ability that is known to decline with age. VIR-2482 has been engineered to increase lung tissue bioavailability and to extend its half-life so that a single intramuscular dose has the potential to last the entire flu season, which is typically five to six months long. VIR-2482 is estimated to have a half-life of 58 days based on preliminary data. VIR-2482 has been generally well-tolerated in the approximately 100 healthy volunteers dosed in the Phase 1 portion of the clinical trial. We anticipate initiating the Phase 2 portion of the clinical trial in the northern hemisphere in the fourth quarter of 2020, followed by a second northern hemisphere season if necessary. Data from an interim analysis of the first flu season of the Phase 2 clinical trial are anticipated to be available in the first half of 2021.

HIV: Each year there are approximately 1.8 million new cases of HIV and approximately 1.0 million HIV-related deaths globally. Current prevention approaches such as behavioral modification and pharmacological intervention have had only a modest effect on HIV transmission globally, leaving a high unmet medical need for a safe and effective vaccine for the billions of individuals who are or may become sexually active. VIR-1111 is a proof of concept HIV vaccine designed to elicit a type of immune response that is different from other vaccines. We anticipate the initial registration population for our eventual HIV vaccine will be individuals at high risk of contracting HIV.

VIR-1111 is a subcutaneously administered HIV T cell vaccine based on HCMV for which we plan to submit an IND in the second half of 2020 and thereafter commence a Phase 1 clinical trial. VIR-1111 has been designed to elicit T cells that recognize HIV epitopes that are different from those recognized by prior HIV vaccines and to stimulate a different and specific type of T cell immune response to HIV, known as an HLA-E restricted immune response. An HLA-E restricted immune response has been shown to be associated with protection of NHPs from simian immunodeficiency virus, or SIV, the NHP equivalent of HIV. VIR-1111 is a vaccine designed solely to establish proof of concept in a Phase 1 clinical trial to determine whether the unique immune response observed in NHPs can be replicated in humans.

5

Table of Contents

TB: Globally, nearly two billion people are latently infected with TB, and each year there are approximately 10 million new active cases of TB and approximately 1.6 million TB-related deaths. There is a high unmet medical need for a safe and effective vaccine that prevents active pulmonary TB in adolescents and adults, as they represent the key sources of TB transmission and are the primary contributors to overall disease burden. VIR-2020 is a vaccine designed to provide a type of immune response that is different from other vaccines and lead to meaningful levels of protection from active TB. We anticipate that the initial registration population for VIR-2020 will be people at high risk of developing active TB, such as those who have latent TB infection.

VIR-2020 is a subcutaneously administered TB T cell vaccine based on HCMV for which we plan to submit an IND in 2023 and thereafter commence a Phase 1 clinical trial. VIR-2020 is designed to stimulate T cells that reside in the lung and to recognize TB epitopes that are different from those recognized by prior TB vaccines. In preclinical studies, a T cell vaccine based on RhCMV has been shown to provide protection of NHPs from TB.

Recent SARS-CoV-2 Activities

Since February 2020, we have entered into a number of collaboration agreements to accelerate the development, manufacture, and potential commercialization of therapies to treat and prevent SARS-CoV-2 and other coronaviruses. We have also made substantial efforts to protect our intellectual property in this area, as evidenced by our recent expansion of our patent portfolio.

Development and Commercialization

GSK Collaboration Agreement

In June 2020, we entered into a definitive collaboration agreement with Glaxo Wellcome UK Limited and Beecham S.A. of GSK (and collectively referred to as GSK), pursuant to which we agreed to collaborate to research, develop and commercialize products for the prevention, treatment and prophylaxis of diseases caused by SARS-CoV-2 and potentially other coronaviruses. The collaboration is focused on the development and commercialization of three types of collaboration products under three programs: (1) antibodies targeting SARS-CoV-2, and potentially other coronaviruses, or the Antibody Program; (2) vaccines targeting SARS-CoV-2, and potentially other coronaviruses, or the Vaccine Program, and (3) products based on genome-wide CRISPR screening of host targets expressed in connection with exposure to SARS-CoV-2, or the Functional Genomics Program. The initial antibodies under the Antibody Program will be VIR-7831 and VIR-7832, which have demonstrated high affinity for the SARS-CoV-2 spike protein and are highly potent in neutralizing SARS-CoV-2 in live-virus cellular assays.

We are primarily responsible for the development and clinical manufacturing activities for the Antibody Program, and for conducting the initial development activities directed to a vaccine in the Vaccine Program. GSK will be primarily responsible for the commercialization activities for the Antibody Program (except in connection with sales of antibody products licensed to WuXi in greater China), the later-stage development, manufacturing and commercialization activities for the Vaccine Program and the development, manufacturing and commercialization activities for the Functional Genomics Program. We and GSK are required to use commercially reasonable efforts to conduct the activities assigned to each party under each development plan and to seek and obtain regulatory approval for collaboration products that arise from such activities in the United States and specified major markets. Subject to an opt-out mechanism, we and GSK will share all development costs, manufacturing costs and costs and expenses for the commercialization of the collaboration products, with us bearing 72.5% of such costs for the antibody products, 27.5% of such costs for the vaccine products, and we and GSK sharing equally all such costs for the functional genomics products, and all profits will be shared in the same ratios. If we and GSK elect to conduct a technology transfer of manufacturing technology under our agreements with WuXi (as further described below) and Biogen, we will bear 72.5% of the costs related to such

6

Table of Contents

manufacturing technology transfer and for commercial manufacturing of the antibody products under such agreements with WuXi and Biogen, and GSK will bear 27.5% of such costs. The parties will also share the committed costs for the reservation of manufacturing capacity for the drug substance for antibody products in the foregoing ratio under our agreement with Samsung as well as such costs relating to committed manufacturing capacity for antibody products as are approved by the joint steering committee from time to time.

On an antibody product-by-antibody product basis, we have a co-promotion right with respect to such antibody product in the United States, pursuant to which we will have the right to perform up to 20% of details in connection with such antibody product. GSK will lead commercialization and book all sales and is required to use commercially reasonable efforts to commercialize each collaboration product following regulatory approval in the United States and specified major markets. This definitive agreement superseded and replaced the April 2020 preliminary agreement with GSK. In connection with the GSK collaboration, we also entered into a stock purchase agreement in April 2020, pursuant to which we issued 6,626,027 shares of our common stock to an affiliate of GSK at a price per share of $37.73, for an aggregate purchase price of approximately $250.0 million.

Expansion of Alnylam Collaboration and License Agreement

In March and April 2020, we entered into two further amendments to our collaboration and license agreement with Alnylam, dated October 16, 2017, to expand our existing collaboration of five infectious disease targets to nine, including one targeting SARS-CoV-2 and potentially other coronaviruses, and up to three targeting human host factors for SARS-CoV-2.

Pursuant to both recent amendments, we and Alnylam will each be responsible for pre-clinical development costs incurred by such party in performing its allocated responsibilities under an agreed-upon initial pre-clinical development plan for each of the four new targets. We and Alnylam will equally share costs incurred in connection with the manufacture of non-GMP drug product required for pre-clinical development prior to filing of an IND. Following the completion of initial pre-clinical development activities, if we exercise our option to progress one or more candidates arising from the coronavirus program into further development, we will be responsible for conducting all development, manufacturing and commercialization activities at our sole expense, subject to Alnylam’s right to opt-in, during a specified period, to share equally with us the profits and losses in connection with development and commercialization of a coronavirus product.

Manufacturing

Consistent with our corporate manufacturing strategy of building internal capabilities in chemistry, manufacturing and control, or CMC, and working with contract development and manufacturing organizations, or CDMOs, to supply clinical and commercial batches of our product candidates, we have entered into the following agreements to date in support of our SARS-CoV-2 program:

WuXi Manufacturing Agreements

In February 2020, we entered into a development and manufacturing collaboration agreement with WuXi, for the clinical development, manufacturing, and commercialization of our proprietary antibodies developed for SARS-CoV-2. Under the agreement, WuXi will conduct cell-line development, process and formulation development, and initial manufacturing for clinical development. WuXi will have the right to commercialize products incorporating such antibodies in greater China pursuant to an exclusive license granted for the selected antibodies that have been developed. We will have the right to commercialize such products in all other markets worldwide.

7

Table of Contents

WuXi will perform mutually agreed development and manufacturing activities, under individual statements of work. In addition, the parties agreed that WuXi will pay us tiered royalties at percentages ranging from the high single-digits to mid-teens on annual net sales of all products sold by WuXi in greater China.

On June 15, 2020, we entered into a binding letter of intent with WuXi, pursuant to which WuXi will perform certain development and manufacturing services for our SARS-CoV-2 antibody program. Under the terms of the letter of intent, we have committed to purchase a firm and binding capacity reservation for the manufacture of a specified number of batches of drug substance of our SARS-CoV-2 antibody in 2020 and 2021. In addition, we have the right to order an additional specified number of batches of drug substance, provided we make such election by a specified date in the fourth calendar quarter in 2020. WuXi is obligated to reserve such manufacturing slots on a non-cancellable basis, and will manufacture the agreed number of batches of drug substance in accordance with an agreed manufacturing schedule. We are obligated to pay a total of approximately $130.0 million for such capacity reservation, if all batches are manufactured, inclusive of estimated raw material costs, with between 70% and 80% of the batch production fees owed to WuXi on a take-or-pay basis regardless of whether we utilize such manufacturing slots. The amounts will be payable during 2020 and 2021 and invoiced on a per-batch basis. The SARS-CoV-2 antibody drug substance contemplated to be manufactured in accordance with the terms of the letter of intent will be utilized in connection with progressing the development and commercialization of the SARS-CoV-2 antibody product under our collaboration with GSK.

We and WuXi will continue to negotiate additional terms in a definitive commercial manufacturing and supply agreement and will use commercially reasonable efforts to execute such definitive agreement before July 30, 2020.

We will bear 72.5% of the costs under the development and manufacturing collaboration agreement and letter of intent with WuXi and GSK will bear 27.5% of such costs pursuant to our collaboration agreement with GSK, subject to certain conditions and exceptions.

Biogen Clinical Development and Manufacturing Agreement

In May 2020, we entered into a clinical development and manufacturing agreement with Biogen pursuant to which Biogen will perform process development activities and specified manufacturing services under agreed statements of work for certain pre-commercial and clinical supply of our SARS-CoV-2 mAbs. We also agreed to collaborate with Biogen to develop highly productive clonal cell lines and clinical and commercial manufacturing processes for our SARS-CoV-2 mAbs. These processes are designed to be transferrable to global biomanufacturing facilities designed for advanced biologics production. Under the agreement, Biogen will conduct cGMP clinical manufacturing in the United States and provide technical support to facilitate process transfer to Samsung, and potentially other large-scale biomanufacturing facilities in the United States and other regions of the world to enable us to obtain reliable supply of a potential commercial product.

Under the terms of the Biogen agreement, we have agreed to pay fees for Biogen’s performance of services as provided in each applicable statement of work, including costs to third parties on a pass-through basis. We entered into three statements of work with Biogen for the process development and certain clinical manufacturing services simultaneously with the execution of the agreement, with the cost of activities under such agreed statements of work totaling approximately $13.8 million.

The Biogen agreement provides us the right to request a technology transfer of all manufacturing technology and processes developed under the agreement to us or any third party designated by us to conduct manufacturing of a SARS-CoV-2 antibody using such technology, including applicable licenses to us under Biogen’s relevant intellectual property rights. In connection with any such technology transfer, we have also agreed to pay an “access fee” to Biogen for each successful batch of SARS-CoV-2 antibody drug substance manufactured using

8

Table of Contents

certain improvements relating to increases in batch yield developed under the agreement, whether such manufacturing is performed by us, our affiliates, or third parties. If we successfully manufacture all batches of SARS-CoV-2 antibody drug substance for which we are currently committed under the Samsung letter agreement, based on our current working assumptions of manufacturing yield per batch, the access fee payable to Biogen in connection with the Samsung manufacturing will total approximately $100.0 million.

We will bear 72.5% of the costs under the Biogen agreement and GSK will bear 27.5% of such costs pursuant to our collaboration agreement with GSK, subject to certain conditions and exceptions.

Samsung Manufacturing Agreement

In April 2020, we entered into a binding letter agreement with Samsung pursuant to which Samsung will perform development and manufacturing services for our SARS-CoV-2 mAbs. Under the terms of the letter agreement, we have committed to purchase a firm and binding capacity reservation for a specified number of drug substance manufacturing slots in 2021 and 2022. Samsung will reserve such manufacturing slots on a non-cancellable, non-adjustable basis and will not offer such manufacturing slots under our capacity reservation to third parties. We are obligated to pay a total of approximately $362.0 million for such capacity reservation on a take-or-pay basis regardless of whether such manufacturing slots are utilized by us. The amounts will be payable during 2021 and 2022 and invoiced on a per-batch basis, with shortfalls invoiced at the end of the year in which such shortfall occurs. Samsung began performing services for us upon execution of the letter agreement, and we agreed to pay fees and out-of-pocket costs for the services performed thereunder. Samsung is expected to commence manufacturing on our behalf as early as October 2020 with the first engineering run.

We will bear 72.5% of the costs under the Samsung letter agreement and GSK will bear 27.5% of such costs pursuant to our collaboration agreement with GSK, subject to certain conditions and exceptions.

We continue to negotiate a definitive agreement with Samsung, to expand upon the letter agreement, and agreed to use best efforts to execute such definitive agreement before July 31, 2020.

Intellectual Property

VIR-7831

Our VIR-7831 intellectual property portfolio includes multiple United States provisional patent applications. These applications include composition of matter claims, pharmaceutical composition claims, and method of treatment claims. The 20-year term of any patents issuing from these provisional patent applications is presently estimated to expire in 2041, absent any available patent term adjustments or extensions.

Licensed Patents

Our VIR-7831 intellectual property portfolio also includes patents and patent applications that we have non- exclusively licensed from Xencor, Inc., or Xencor. As of February 15, 2020, these patents and applications include seven issued patents in the United States directed to composition of matter claims, methods of extending antibody serum half-life claims, pharmaceutical composition claims and process (methods of producing) claims. The 20-year term of these patents is presently estimated to expire between 2021 and 2025, absent any available patent term adjustments or extensions. Additionally, as of February 15, 2020, these patents and applications include 70 issued patents in Australia, Austria, Belgium, Canada, China, Croatia, Czech Republic, Estonia, Finland, France, Germany, Hungary, Iceland, India, Ireland, Israel, Italy, Japan, South Korea, Lithuania, Luxembourg, Malta, Monaco, Netherlands, Poland, Russia, Slovenia, Spain, Sweden, Switzerland, Turkey and the United Kingdom directed to composition of matter claims, pharmaceutical composition claims, method of

9

Table of Contents

treatment claims, composition for use in treatment claims and process (methods of producing) claims. The 20-year term of these patents is presently estimated to expire between 2021 and 2028, absent any available patent term adjustments or extensions.

The patents and applications we have non-exclusively licensed from Xencor also include, as of February 15, 2020, a pending patent application in the United States and five patent applications pending in Brazil, Canada, China, Europe and Russia directed to composition of matter claims, pharmaceutical composition claims, composition for use in treatment claims, and process (methods of producing) claims. The 20-year term of any patents issuing from these patent applications is presently estimated to expire between 2021 and 2028, absent any available patent term adjustments or extensions.

VIR-7832

Our VIR-7832 intellectual property portfolio includes multiple United States provisional patent applications. These applications include composition of matter claims, pharmaceutical composition claims, and method of treatment claims. The 20-year term of any patents issuing from these provisional patent applications is presently estimated to expire in 2041, absent any available patent term adjustments or extensions.

Licensed Patents

Our VIR-7832 intellectual property portfolio includes a patent family that we have exclusively licensed from Rockefeller, which includes, as of February 15, 2020, one pending patent application in the United States, one pending PCT patent application and one pending patent application in Europe. The applications in this family include composition of matter claims, pharmaceutical composition claims, method of treatment claims, composition for use in treatment claims and process (methods of producing) claims. The 20-year term of any patents issuing from the application in this family is presently estimated to expire in 2038, absent any available patent term adjustments or extensions.

Our VIR-7832 intellectual property portfolio also includes patents and patent applications that we have non- exclusively licensed from Xencor. As of February 15, 2020, these patents and applications include seven issued patents in the United States directed to composition of matter claims, methods of extending antibody serum half-life claims, pharmaceutical composition claims and process (methods of producing) claims. The 20-year term of these patents is presently estimated to expire between 2021 and 2025, absent any available patent term adjustments or extensions. Additionally, as of February 15, 2020, these patents and applications include 70 issued patents in Australia, Austria, Belgium, Canada, China, Croatia, Czech Republic, Estonia, Finland, France, Germany, Hungary, Iceland, India, Ireland, Israel, Italy, Japan, South Korea, Lithuania, Luxembourg, Malta, Monaco, Netherlands, Poland, Russia, Slovenia, Spain, Sweden, Switzerland, Turkey and the United Kingdom directed to composition of matter claims, pharmaceutical composition claims, method of treatment claims, composition for use in treatment claims and process (methods of producing) claims. The 20-year term of these patents is presently estimated to expire between 2021 and 2028, absent any available patent term adjustments or extensions.

The patents and applications we have non-exclusively licensed from Xencor also include, as of February 15, 2020, a pending patent application in the United States and five patent applications pending in Brazil, Canada, China, Europe and Russia directed to composition of matter claims, pharmaceutical composition claims, composition for use in treatment claims, and process (methods of producing) claims. The 20-year term of any patents issuing from these patent applications is presently estimated to expire between 2021 and 2028, absent any available patent term adjustments or extensions.

10

Table of Contents

VIR-2703

Licensed Patents

Our VIR-2703 intellectual property portfolio includes multiple United States provisional patent applications that we have exclusively licensed from Alnylam. These applications include composition of matter claims, pharmaceutical composition claims, and method of treatment claims. The 20-year term of any patents issuing from these provisional patent applications is presently estimated to expire in 2041, absent any available patent term adjustments or extensions.

Risks Associated with Our Business

Our business is subject to a number of risks of which you should be aware before making a decision to invest in our common stock. These risks are more fully described in the section titled “Risk Factors” immediately following this prospectus summary. These risks include, among others, the following:

| • | We have incurred significant net losses since inception and anticipate that we will continue to incur substantial net losses for the foreseeable future and may never achieve or maintain profitability. |

| • | Our limited operating history may make it difficult for you to evaluate the success of our business to date and to assess our future viability. |

| • | Even after this offering, we will require substantial additional funding to finance our operations. If we are unable to raise capital when needed, we could be forced to delay, reduce or terminate certain of our development programs or other operations. |

| • | Our pursuit of a potential therapy for COVID-19, the disease caused by the virus SARS-CoV-2, is at an early stage, and we are committing substantial financial resources and personnel and making substantial capital commitments with third parties in furtherance thereof. |

| • | Our future success is substantially dependent on the successful clinical development, regulatory approval and commercialization of our product candidates in a timely manner. If we are not able to obtain required regulatory approvals, we will not be able to commercialize our product candidates and our ability to generate product revenue will be adversely affected. |

| • | We are a party to strategic collaboration and license agreements pursuant to which we are obligated to make substantial payments upon achievement of milestone events and, in certain cases, have relinquished important rights over the development and commercialization of certain current and future product candidates. We also intend to explore additional strategic collaborations, which may never materialize or may require that we relinquish rights to and control over the development and commercialization of our product candidates. |

| • | Success in preclinical studies or earlier clinical trials may not be indicative of results in future clinical trials and we cannot assure you that any ongoing, planned or future clinical trials will lead to results sufficient for the necessary regulatory approvals. |

| • | Clinical product development involves a lengthy and expensive process. We may incur additional costs and encounter substantial delays or difficulties in our clinical trials. |

| • | Our business could be materially adversely affected by the effects of health pandemics or epidemics, including the current COVID-19 pandemic and future outbreaks of the disease. |

| • | We intend to rely on third parties to produce clinical and commercial supplies of our product candidates. |

11

Table of Contents

| • | If we are unable to obtain and maintain patent protection for our product candidates and technology, or if the scope of the patent protection obtained is not sufficiently broad or robust, our competitors could develop and commercialize products and technology similar or identical to ours, and our ability to successfully commercialize our product candidates and technology may be adversely affected. |

| • | We are highly dependent on our key personnel, and if we are not able to retain these members of our management team or recruit and retain additional management, clinical and scientific personnel, our business will be harmed. |

Our Corporate Information

We were incorporated under the laws of the State of Delaware on April 7, 2016. Our principal executive offices are located at 499 Illinois Street, Suite 500, San Francisco, California 94158, and our telephone number is (415) 906-4324. Our corporate website address is www.vir.bio. Information contained on or accessible through our website is not a part of this prospectus or the registration statement of which it forms a part, and the inclusion of our website address in this prospectus is an inactive textual reference only.

“Vir Biotechnology,” “Vir Bio,” “Vir.Bio,” the Vir logo and other trademarks, trade names or service marks of Vir Biotechnology, Inc. appearing in this prospectus or the documents incorporated by reference herein are the property of Vir Biotechnology, Inc. All other trademarks, trade names and service marks appearing in this prospectus or incorporated by reference herein are the property of their respective owners. Solely for convenience, the trademarks and trade names in this prospectus or the documents incorporated by reference herein may be referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert their rights thereto.

Implications of Being an Emerging Growth Company

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or the JOBS Act, enacted in April 2012. For so long as we remain an emerging growth company, we are permitted and intend to rely on certain exemptions from various public company reporting requirements, including not being required to have our internal control over financial reporting audited by our independent registered public accounting firm pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and any golden parachute payments not previously approved. In particular, in this prospectus, we have provided only two years of audited consolidated financial statements and have not included all of the executive compensation-related information that would be required if we were not an emerging growth company. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

We would cease to be an “emerging growth company” upon the earliest to occur of: (i) December 31, 2024; (ii) the last day of the fiscal year in which we have $1.07 billion or more in annual revenue; (ii) the date on which we first qualify as a large accelerated filer under the rules of the U.S. Securities and Exchange Commission, or the SEC; and (iii) the date on which we have, in any three-year period, issued more than $1.0 billion in non-convertible debt securities. We may choose to take advantage of some but not all of these reduced reporting burdens.

In addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. This provision allows an emerging growth company to delay the adoption of some accounting standards until those standards would otherwise apply to private companies. We have elected to avail ourselves of this exemption from new or revised accounting standards, and therefore we will not be subject to the same requirements to adopt new or revised accounting standards as other public companies that are not emerging growth companies.

12

Table of Contents

The Offering

| Common stock to be offered by us |

6,200,000 shares |

| Underwriters’ option to purchase additional shares |

930,000 shares |

| Common stock to be outstanding immediately after this offering |

122,499,280 shares (or approximately 123,429,280 shares if the underwriters exercise in full their option to purchase additional shares of common stock) |

| Use of proceeds |

We estimate that the net proceeds from this offering will be approximately $234.0 million (or approximately $269.2 million if the underwriters exercise in full their option to purchase up to 930,000 additional shares of common stock), based on the assumed public offering price of $40.32 per share, which was the last reported sale price of our common stock on The Nasdaq Global Select Market on July 2, 2020, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| We currently intend to use the net proceeds from this offering, together with our existing cash, cash equivalents and short-term investments, to fund the research and development of our product candidates and development programs, including VIR-7831, VIR-7832, VIR-2703, VIR-2218, VIR-2218 with PEG-IFN-α, VIR-3434 and VIR-2482, and the remainder for commercial manufacturing and launch preparation for our SARS-CoV-2 antibodies, our other clinical trials and preclinical programs, as well as for working capital and other general corporate purposes. |

| The intended uses set forth above include any related milestone payments that may be due from us under the applicable license and collaboration agreements. In addition, we expect that the current grants from the Bill & Melinda Gates Foundation will fund the manufacture and early clinical development of VIR-1111 and VIR-2020. |

See the section titled “Use of Proceeds” for additional information.

| Risk factors |

You should read the section titled “Risk Factors” for a discussion of factors to consider carefully, together with all the other information included in this prospectus and incorporated by reference herein, before deciding to invest in our common stock. |

| Nasdaq Global Select Market symbol |

“VIR” |

13

Table of Contents

The number of shares of our common stock to be outstanding after this offering is based on 116,299,280 shares of common stock (excluding 1,457,432 shares of unvested restricted common stock) outstanding as of March 31, 2020 on a pro forma basis, and after giving effect to the subsequent issuances after March 31, 2020 of an aggregate of 7,948,912 shares of our common stock as described below, and excludes:

| • | 7,959,416 shares of our common stock issuable upon the exercise of outstanding stock options as of March 31, 2020, with a weighted-average exercise price of $7.30 per share; |

| • | 1,884,693 shares of our common stock issuable upon the exercise of outstanding stock options granted subsequent to March 31, 2020, with a weighted-average exercise price of $30.36 per share; |

| • | 7,611,513 shares of our common stock reserved for future issuance under our 2019 Equity Incentive Plan, or the 2019 Plan, as of March 31, 2020; and |

| • | 2,377,244 shares of our common stock reserved for future issuance under our 2019 Employee Stock Purchase Plan, or ESPP, as of March 31, 2020. |

Unless otherwise indicated, all information contained in this prospectus, including the number of shares of common stock that will be outstanding after this offering, assumes or gives effect to:

| • | the issuance of 6,626,027 shares of our common stock to Glaxo Group Limited, or GGL, on April 29, 2020 at a purchase price per share of $37.73, or approximately $250.0 million; |

| • | the issuance of 1,111,111 shares of our common stock to Alnylam on May 6, 2020 upon the achievement of a development milestone pursuant to a collaboration and license agreement; |

| • | the issuance of 211,774 shares of common stock to Takeda Ventures, Inc., or Takeda, on May 26, 2020 upon the cashless exercise of a warrant to purchase 244,444 shares; |

| • | no exercise of the outstanding options after March 31, 2020; and |

| • | no exercise by the underwriters of their option to purchase up to 930,000 additional shares of our common stock. |

14

Table of Contents

Summary Consolidated Financial Data

The following tables summarize our consolidated financial data for the periods and as of the dates set forth below. You should read the following summary consolidated financial data together with the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2019 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, each of which are incorporated by reference herein. We have derived the summary consolidated statements of operations data for the years ended December 31, 2018 and 2019 from our audited consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2019, which are incorporated by reference herein. We derived the summary consolidated statements of operations data for the three months ended March 31, 2019 and 2020, and the summary consolidated balance sheet data as of March 31, 2020, from our unaudited interim condensed consolidated financial statements included in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, which are incorporated by reference herein. Our unaudited consolidated interim financial statements were prepared on a basis consistent with our audited consolidated financial statements and include, in management’s opinion, all adjustments, consisting of normal recurring adjustments, that we consider necessary for a fair presentation of the financial information set forth in those financial statements. Our historical results are not necessarily indicative of the results that may be expected in the future and our results for the three months ended March 31, 2020 are not necessarily indicative of results to be expected for the full fiscal year or any other period.

| Year Ended December 31, |

Three Months Ended March 31, |

|||||||||||||||

| 2018 | 2019 | 2019 | 2020 | |||||||||||||

| (in thousands, except share and per share data) |

||||||||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||||||

| Revenue: |

||||||||||||||||

| Grant revenue |

$ | 9,800 | $ | 7,380 | $ | 3,644 | $ | 5,231 | ||||||||

| Contract revenue |

868 | 711 | 17 | 487 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenue |

10,668 | 8,091 | 3,661 | 5,718 | ||||||||||||

| Operating expenses: |

||||||||||||||||

| Research and development |

100,229 | 148,472 | 25,872 | 64,979 | ||||||||||||

| General and administrative |

29,131 | 37,598 | 8,559 | 12,649 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

129,360 | 186,070 | 34,431 | 77,628 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(118,692 | ) | (177,979 | ) | (30,770 | ) | (71,910 | ) | ||||||||

| Other income (expense): |

||||||||||||||||

| Interest income |

2,540 | 8,511 | 2,245 | 1,755 | ||||||||||||

| Other income (expense), net |

(212 | ) | (5,061 | ) | (145 | ) | (7,069 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other income (expense) |

2,328 | 3,450 | 2,100 | (5,314 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss before benefit from (provision for) income taxes |

(116,364 | ) | (174,529 | ) | (28,670 | ) | (77,224 | ) | ||||||||

| Benefit from (provision for) income taxes |

480 | (154 | ) | — | (16 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

$ | (115,884 | ) | $ | (174,683 | ) | $ | (28,670 | ) | $ | (77,240) | |||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss per share, basic and diluted(1) |

$ | (15.12) | $ | (5.76) | $ | (3.19) | $ | (0.71) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted-average shares outstanding, basic and diluted(1) |

7,666,463 | 30,349,920 | 9,001,158 | 108,387,913 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | See Notes 2 and 13 to our audited consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2019 and Note 12 to our unaudited condensed consolidated financial statements included in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, each of which are incorporated by reference herein, for explanations of the |

15

Table of Contents

| calculations of our basic and diluted net loss per share and the weighted-average number of shares outstanding used in the computation of the per share amounts. |

| As of March 31, 2020 | ||||||||||||

| Actual | Pro Forma(1) | Pro Forma As Adjusted(2)(3) |

||||||||||

| (in thousands) | ||||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||

| Cash, cash equivalents and short-term investments |

$ | 355,611 | $ | 605,611 | $839,596 | |||||||

| Working capital(4) |

321,145 | 571,145 | 805,130 | |||||||||

| Total assets |

477,114 | 727,114 | 961,099 | |||||||||

| Accumulated deficit |

(445,759 | ) | (445,759 | ) | (445,759) | |||||||

| Total stockholders’ equity |

380,333 | 630,333 | 864,318 | |||||||||

| (1) | The pro forma column reflects: (i) the issuance of 6,626,027 shares of our common stock to GGL on April 29, 2020 at a purchase price per share of $37.73, or approximately $250.0 million; (ii) the issuance of 1,111,111 shares of our common stock to Alnylam on May 6, 2020 upon the achievement of a development milestone pursuant to a collaboration and license agreement; and (iii) the issuance of 211,774 shares of common stock to Takeda on May 26, 2020 upon the cashless exercise of a warrant to purchase 244,444 shares. |

| (2) | The pro forma as adjusted column reflects (i) the pro forma adjustments set forth in footnote (1) above and (ii) the sale of 6,200,000 shares of our common stock in this offering at the assumed public offering price of $40.32 per share, which was the last reported sale price of our common stock on The Nasdaq Global Select Market on July 2, 2020, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| (3) | The pro forma as adjusted information discussed above is illustrative only and will depend on the actual public offering price and other terms of this offering determined at pricing. Each $1.00 increase or decrease in the assumed public offering price of $40.32 per share, which was the last reported sale price of our common stock on The Nasdaq Global Select Market on July 2, 2020, would increase or decrease, as applicable, each of our pro forma as adjusted cash, cash equivalents and short-term investments, working capital, total assets and total stockholders’ equity by approximately $5.8 million, assuming the number of shares of common stock offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, each increase or decrease of 1.0 million shares of common stock offered by us would increase or decrease, as applicable, each of our pro forma as adjusted cash, cash equivalents and short-term investments, working capital, total assets and total stockholders’ equity by approximately $37.9 million, assuming the assumed public offering price of $40.32 per share remains the same, and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| (4) | We define working capital as current assets less current liabilities. See our unaudited condensed consolidated financial statements and the related notes included in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, which is incorporated by reference herein, for further details regarding our current assets and current liabilities. |

16

Table of Contents

Investing in our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below, as well as the risks and uncertainties set forth under the heading “Risk Factors” in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, which is incorporated by reference herein, and all of the other information in this prospectus and the documents incorporated by reference herein before deciding whether to purchase shares of our common stock. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that affect us. If any of the following risks are realized, our business, financial condition, results of operations and prospects could be materially and adversely affected. In that event, the price of our common stock could decline, and you could lose part or all of your investment.

Risks Related to This Offering

We have broad discretion in the use of our cash, cash equivalents and short-term investments, including the net proceeds from this offering, and may use them ineffectively, in ways with which you do not agree or in ways that do not increase the value of your investment.

Our management will have broad discretion in the application of our cash, cash equivalents and short-term investments, including the net proceeds from this offering, and could spend the proceeds in ways that do not improve our results of operations or enhance the value of our common stock. The failure by our management to apply these funds effectively could result in additional operating losses that could have a negative impact on our business, cause the price of our common stock to decline and delay the development of our product candidates. Pending their use, we may invest our cash, cash equivalents and short-term investments, including the net proceeds from this offering, in a manner that does not produce income or that loses value. See the section titled “Use of Proceeds” for additional information.

We will require substantial additional funding to finance our operations. If we are unable to raise additional capital when needed, we could be forced to delay, reduce or terminate certain of our development programs or other operations.

Based on our current operating plan, we expect our operating expenses to increase in future periods relative to our historical spend, and we believe that the net proceeds from this offering, together with our existing cash, cash equivalents and short-term investments, will fund our operations through at least the next 12 months. However, our operating plan may change as a result of many factors currently unknown to us, and we may need to seek additional funds sooner than planned. Moreover, it is particularly difficult to estimate with certainty our future expenses given the dynamic and rapidly evolving nature of our business and the COVID-19 pandemic environment generally. The expected net proceeds from this offering, together with our cash, cash equivalents and short-term investments, will not be sufficient for us to fund any of our product candidates through regulatory approval, and we will need to raise additional capital to complete the development and commercialization of our product candidates and fund certain of our existing manufacturing and other commitments. We expect to finance our cash needs through public or private equity or debt financings, third-party (including government) funding and marketing and distribution arrangements, as well as other collaborations, strategic alliances and licensing arrangements, or any combination of these approaches. Our future capital requirements will depend on many factors, including:

| • | the timing, progress and results of our ongoing preclinical studies and clinical trials of our product candidates; |

| • | the scope, progress, results and costs of preclinical development, laboratory testing and clinical trials of other product candidates that we may pursue; |

17

Table of Contents

| • | our ability to establish and maintain collaboration, license, grant and other similar arrangements, and the financial terms of any such arrangements, including timing and amount of any future milestones, royalty or other payments due thereunder; |

| • | the costs, timing and outcome of regulatory review of our product candidates; |

| • | the costs and timing of future commercialization activities, including product manufacturing, marketing, sales and distribution, for any of our product candidates for which we receive marketing approval; |

| • | the revenue, if any, received from commercial sales of our product candidates for which we receive marketing approval; |

| • | the costs and timing of preparing, filing and prosecuting patent applications, maintaining and enforcing our intellectual property rights and defending any intellectual property-related claims; |

| • | any expenses needed to attract, hire and retain skilled personnel; |

| • | the costs of operating as a public company; and |

| • | the extent to which we acquire or in-license other companies’ product candidates and technologies. |

Identifying potential product candidates and conducting preclinical testing and clinical trials is a time-consuming, expensive and uncertain process that takes years to complete, and we may never generate the necessary data or results required to obtain regulatory approval and achieve product sales. In addition, our product candidates, if approved, may not achieve commercial success. Our commercial revenue, if any, will be derived from sales of products that we do not expect to be commercially available for several years, if at all. Accordingly, we will need to continue to rely on additional financing to achieve our business objectives.

The COVID-19 pandemic continues to rapidly evolve and has already resulted in a significant disruption of global financial markets. If the disruption persists and deepens, we could experience an inability to access additional capital, which could in the future negatively affect our capacity for certain corporate development transactions or our ability to make other important, opportunistic investments. Adequate additional financing may not be available to us on acceptable terms, or at all. If we are unable to raise capital when needed or on attractive terms, we could be forced to delay, reduce or altogether terminate our research and development programs or future commercialization efforts, which may adversely affect our business, financial condition, results of operations and prospects. In addition, we may seek additional capital due to favorable market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans.

If you purchase shares of common stock in this offering, you will suffer immediate dilution of your investment.

The public offering price of our common stock will be substantially higher than the pro forma, as adjusted net tangible book value per share of our common stock as of March 31, 2020. Therefore, if you purchase shares of our common stock in this offering, you will pay a price per share that substantially exceeds our pro forma, as adjusted net tangible book value per share immediately after this offering. Based on the assumed public offering price of $40.32 per share, which was the last reported sale price of our common stock on The Nasdaq Global Select Market on July 2, 2020, and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us, you will experience immediate dilution of $33.69 per share, representing the difference between our pro forma, as adjusted net tangible book value per share after this offering and the public offering price per share. After this offering, we will also have outstanding options to purchase common stock. To the extent these outstanding options are exercised, there will be further dilution to investors in this offering. See the section titled “Dilution” for additional information.

18

Table of Contents

Future sales and issuances of our capital stock or rights to purchase capital stock could result in additional dilution of the percentage ownership of our stockholders and could cause the price of our common stock to decline.

We may issue additional securities following the closing of this offering. Future sales and issuances of our capital stock or rights to purchase our capital stock could result in substantial dilution to our existing stockholders. We may sell common stock, convertible securities, and other equity securities in one or more transactions at prices and in a manner as we may determine from time to time. If we sell any such securities in subsequent transactions, investors may be materially diluted. New investors in such subsequent transactions could gain rights, preferences, and privileges senior to those of holders of our common stock.

Future sales of our common stock in the public market could cause the market price of our common stock to decline.