Attached files

| file | filename |

|---|---|

| 8-K - 8-K - JPMORGAN CHASE & CO | jpmc2020dfastform8k.htm |

2020 Annual Stress Test Disclosure Dodd-Frank Act Stress Test Results Supervisory Severely Adverse Scenario June 29, 2020

Overview This 2020 Annual Stress Test Disclosure presents the results of the annual stress test conducted by JPMorgan Chase & Co. (“JPMorgan Chase” or the “Firm”) as required under the rules of the Board of Governors of the Federal Reserve System (the “Federal Reserve”) that implement the Dodd-Frank Act Stress Test (“DFAST”) requirements (“DFAST Rule”). The results reflect certain forecasted financial measures for the nine-quarter projection period (1Q20 through 1Q22) under the Supervisory Severely Adverse scenario prescribed by the Federal Reserve. The stress test has been conducted in accordance with the Comprehensive Capital Analysis and Review (“CCAR”) 2020 Summary Instructions published by the Federal Reserve on March 4, 2020 (“2020 CCAR Instructions”). The results represent hypothetical estimates under the Supervisory Severely Adverse scenario prescribed by the Federal Reserve on February 6, 2020 and do not represent JPMorgan Chase's forecasts of actual expected gains, losses, pre-provision net revenue ("PPNR"), net income before taxes, capital, risk-weighted assets (“RWA”), or capital ratios. The results were calculated using forecasting models and methodologies developed by JPMorgan Chase, and reflect capital action assumptions set forth in the DFAST Rule as of April 6, 2020. The Federal Reserve conducts its own stress tests of covered companies, including JPMorgan Chase, based on forecasting models and methodologies developed by the Federal Reserve, and uses the capital action assumptions set forth in the DFAST Rule as of May 18, 2020, which reflects changes made to those assumptions by the Stress Capital Buffer rule. Because the models and methodologies, as well as capital action assumptions, utilized by the Firm and the Federal Reserve are different, the results separately published by the Federal Reserve may vary from those disclosed in this report. JPMorgan Chase may not be able to explain the differences between the results published in this report and the results published by the Federal Reserve. JPMorgan Chase's results reflect the following required assumptions under the DFAST Rule as of April 6, 2020 for each of the second through ninth quarters of the projection period (“DFAST Capital Actions”)1: Common stock dividend payments continue at the same dollar amount as the average of the prior-four quarters (2Q19 – 1Q20) and include common stock dividends attributable to issuances related to employee compensation Scheduled dividend, interest, or principal payments for other capital instruments are paid Repurchases of common stock and redemptions of other capital instruments are zero Issuances of new preferred, or common stock, other than issuances of common stock related to employee compensation, are zero A strong capital position is essential to the Firm's business strategy and competitive position. Maintaining a strong balance sheet to manage through economic volatility is considered a strategic imperative of the Firm’s Board of Directors, Chief Executive Officer and Operating Committee. Capital adequacy and stress testing is subject to oversight at the most senior levels of the Firm, including the Firm’s Board of Directors. The annual DFAST stress test is subject to a governance framework, which includes oversight by the Board of Directors, the Firmwide Asset and Liability Committee, Capital & Liquidity Management, the Firmwide and line of business (“LOB”) Chief Financial Officers and Chief Risk Officers, Model Risk Governance and Review, and Internal Audit. 1 The first quarter of the projection period (1Q20) reflects actual capital actions (e.g., actual common stock dividends and repurchases net of issuances, and issuances and redemptions of other capital instruments) 1

2020 DFAST Stress Test Supervisory Severely Adverse scenario The Supervisory Severely Adverse scenario is characterized by a severe global recession, accompanied by heightened stress in commercial real estate markets and corporate debt markets Key economic variables in the Supervisory Severely Adverse scenario prescribed by the Federal Reserve1 U.S. real GDP – GDP declines 8.5% between the fourth quarter of 2019 and its trough in the third quarter of 2021 U.S. inflation – The annualized rate of change in the Consumer Price Index (“CPI”) drops from 2.6% in the fourth quarter of 2019 to 1.0% in the third quarter of 2020 U.S. unemployment rate – Unemployment rate increases by 6.5 percentage points from its level in the fourth quarter of 2019, peaking at 10% in the third quarter of 2021 Real estate prices – House prices decline 28% through the first quarter of 2022 relative to their level in the fourth quarter of 2019; commercial real estate prices decline by 35% through the first quarter of 2022 relative to their level in the fourth quarter of 2019 Equity markets – Equity prices decline by 50% between the fourth quarter of 2019 and their trough in the fourth quarter of 2020; equity market volatility peaks in the second quarter of 2020 Short-term and long-term rates – Short-term Treasury rates drop from 1.60% in the fourth quarter of 2019 to 0.10% in the first quarter of 2020, where they remain for the duration of the forecast horizon; long-term Treasury rates drop from 1.80% in the fourth quarter of 2019 to 0.70% in the first quarter of 2020, gradually recovering to 1.60% by the first quarter of 2022 Mortgage rates – 30-year mortgage rates rise from 3.70% in the fourth quarter of 2019 to a peak of 4.40% in the third quarter of 2020 before returning to 4.00% by the first quarter of 2022 Credit spreads – The spread between yields on investment-grade corporate bonds and yields on long-term Treasury securities widens from approximately 150 basis points in the fourth quarter of 2019 to a peak of 550 basis points in the third quarter of 2020 International – The scenario features severe recessions in the Euro area, United Kingdom, Japan and a pronounced deceleration of activity in developing Asia 1 For the full scenario description and a complete set of economic variables provided by the Federal Reserve, see Board of Governors of the Federal Reserve System “2020 Supervisory Scenarios for Annual Stress Tests Required under the Dodd-Frank Act Stress Testing Rules and the Capital Plan Rule” (February 6th, 2020) 2

Agenda Page 1 2020 Supervisory Severely Adverse scenario results 1 JPMorgan Chase & Co. 3 JPMorgan Chase Bank, N.A. 8 2 Risks and methodologies 10

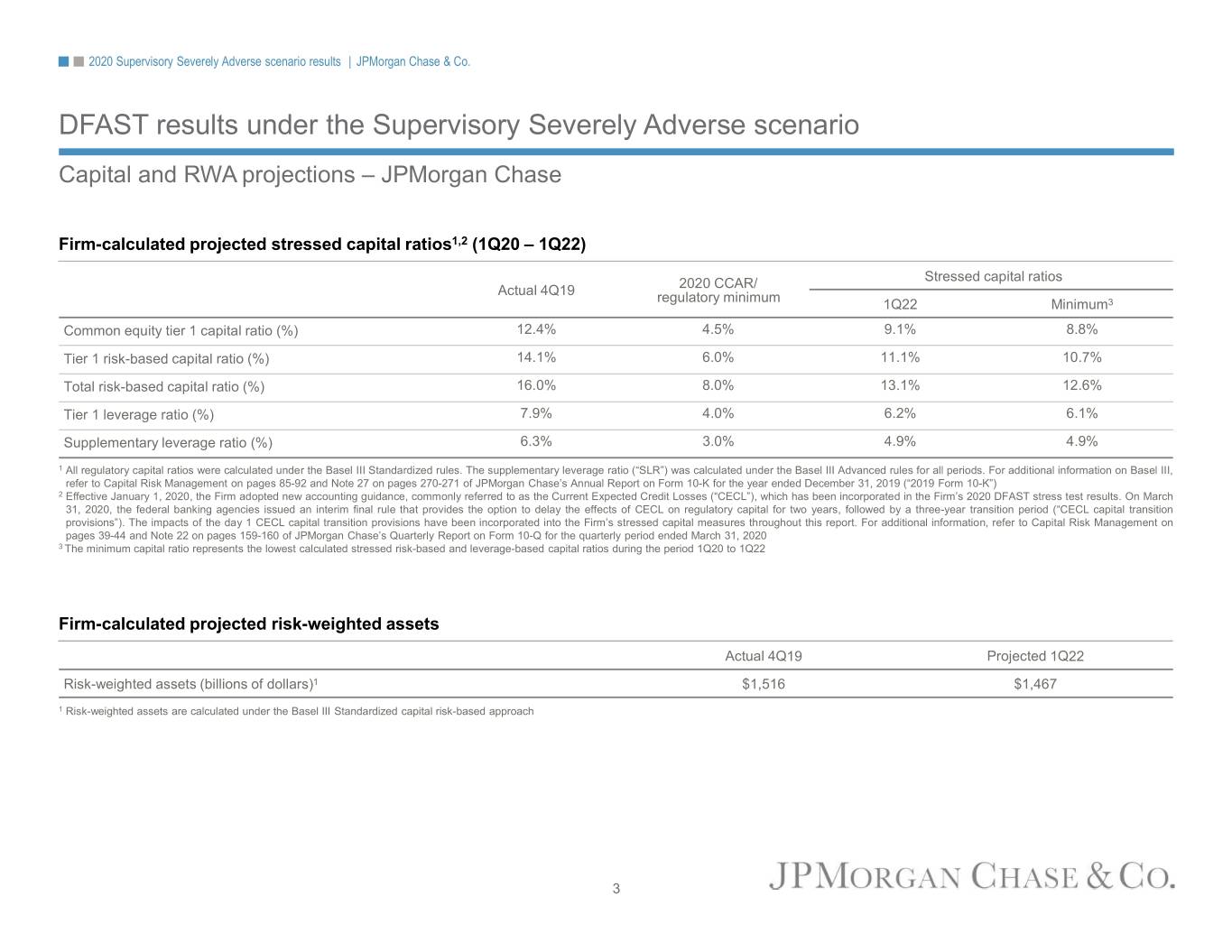

2020 Supervisory Severely Adverse scenario results | JPMorgan Chase & Co. DFAST results under the Supervisory Severely Adverse scenario Capital and RWA projections – JPMorgan Chase Firm-calculated projected stressed capital ratios1,2 (1Q20 – 1Q22) 2020 CCAR/ Stressed capital ratios Actual 4Q19 regulatory minimum 1Q22 Minimum3 Common equity tier 1 capital ratio (%) 12.4% 4.5% 9.1% 8.8% Tier 1 risk-based capital ratio (%) 14.1% 6.0% 11.1% 10.7% Total risk-based capital ratio (%) 16.0% 8.0% 13.1% 12.6% Tier 1 leverage ratio (%) 7.9% 4.0% 6.2% 6.1% Supplementary leverage ratio (%) 6.3% 3.0% 4.9% 4.9% 1 All regulatory capital ratios were calculated under the Basel III Standardized rules. The supplementary leverage ratio (“SLR”) was calculated under the Basel III Advanced rules for all periods. For additional information on Basel III, refer to Capital Risk Management on pages 85-92 and Note 27 on pages 270-271 of JPMorgan Chase’s Annual Report on Form 10-K for the year ended December 31, 2019 (“2019 Form 10-K”) 2 Effective January 1, 2020, the Firm adopted new accounting guidance, commonly referred to as the Current Expected Credit Losses (“CECL”), which has been incorporated in the Firm’s 2020 DFAST stress test results. On March 31, 2020, the federal banking agencies issued an interim final rule that provides the option to delay the effects of CECL on regulatory capital for two years, followed by a three-year transition period (“CECL capital transition provisions”). The impacts of the day 1 CECL capital transition provisions have been incorporated into the Firm’s stressed capital measures throughout this report. For additional information, refer to Capital Risk Management on pages 39-44 and Note 22 on pages 159-160 of JPMorgan Chase’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2020 3 The minimum capital ratio represents the lowest calculated stressed risk-based and leverage-based capital ratios during the period 1Q20 to 1Q22 Firm-calculated projected risk-weighted assets Actual 4Q19 Projected 1Q22 Risk-weighted assets (billions of dollars)1 $1,516 $1,467 1 Risk-weighted assets are calculated under the Basel III Standardized capital risk-based approach 3

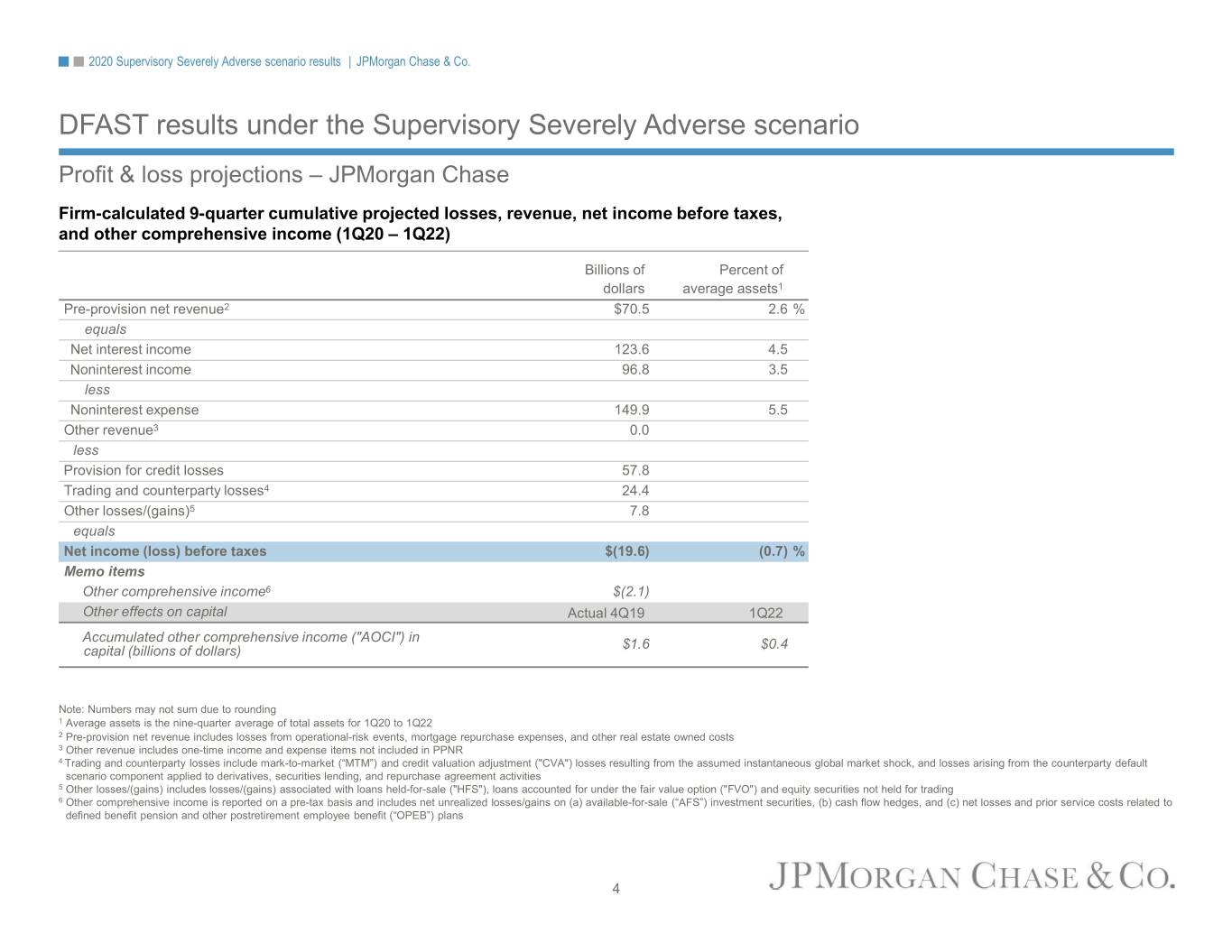

2020 Supervisory Severely Adverse scenario results | JPMorgan Chase & Co. DFAST results under the Supervisory Severely Adverse scenario Profit & loss projections – JPMorgan Chase Firm-calculated 9-quarter cumulative projected losses, revenue, net income before taxes, and other comprehensive income (1Q20 – 1Q22) Billions of Percent of dollars average assets1 Pre-provision net revenue2 $70.5 2.6 % equals Net interest income 123.6 4.5 Noninterest income 96.8 3.5 less Noninterest expense 149.9 5.5 Other revenue3 0.0 less Provision for credit losses 57.8 Trading and counterparty losses4 24.4 Other losses/(gains)5 7.8 equals Net income (loss) before taxes $(19.6) (0.7) % Memo items Other comprehensive income6 $(2.1) Other effects on capital Actual 4Q19 1Q22 Accumulated other comprehensive income ("AOCI") in $1.6 $0.4 capital (billions of dollars) Note: Numbers may not sum due to rounding 1 Average assets is the nine-quarter average of total assets for 1Q20 to 1Q22 2 Pre-provision net revenue includes losses from operational-risk events, mortgage repurchase expenses, and other real estate owned costs 3 Other revenue includes one-time income and expense items not included in PPNR 4 Trading and counterparty losses include mark-to-market (“MTM”) and credit valuation adjustment ("CVA") losses resulting from the assumed instantaneous global market shock, and losses arising from the counterparty default scenario component applied to derivatives, securities lending, and repurchase agreement activities 5 Other losses/(gains) includes losses/(gains) associated with loans held-for-sale ("HFS"), loans accounted for under the fair value option ("FVO") and equity securities not held for trading 6 Other comprehensive income is reported on a pre-tax basis and includes net unrealized losses/gains on (a) available-for-sale (“AFS”) investment securities, (b) cash flow hedges, and (c) net losses and prior service costs related to defined benefit pension and other postretirement employee benefit (“OPEB”) plans 4

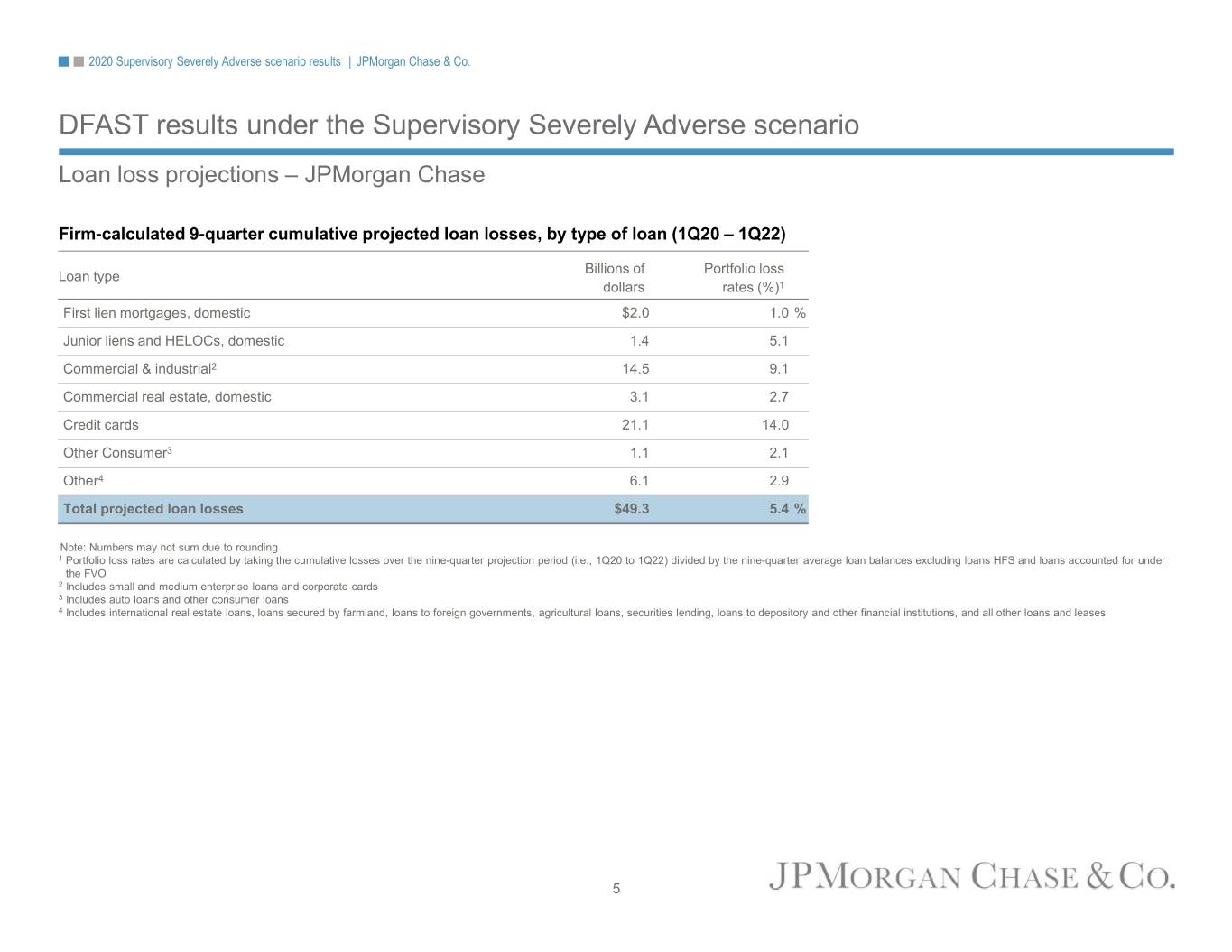

2020 Supervisory Severely Adverse scenario results | JPMorgan Chase & Co. DFAST results under the Supervisory Severely Adverse scenario Loan loss projections – JPMorgan Chase Firm-calculated 9-quarter cumulative projected loan losses, by type of loan (1Q20 – 1Q22) Billions of Portfolio loss Loan type dollars rates (%)1 First lien mortgages, domestic $2.0 1.0 % Junior liens and HELOCs, domestic 1.4 5.1 Commercial & industrial2 14.5 9.1 Commercial real estate, domestic 3.1 2.7 Credit cards 21.1 14.0 Other Consumer3 1.1 2.1 Other4 6.1 2.9 Total projected loan losses $49.3 5.4 % Note: Numbers may not sum due to rounding 1 Portfolio loss rates are calculated by taking the cumulative losses over the nine-quarter projection period (i.e., 1Q20 to 1Q22) divided by the nine-quarter average loan balances excluding loans HFS and loans accounted for under the FVO 2 Includes small and medium enterprise loans and corporate cards 3 Includes auto loans and other consumer loans 4 Includes international real estate loans, loans secured by farmland, loans to foreign governments, agricultural loans, securities lending, loans to depository and other financial institutions, and all other loans and leases 5

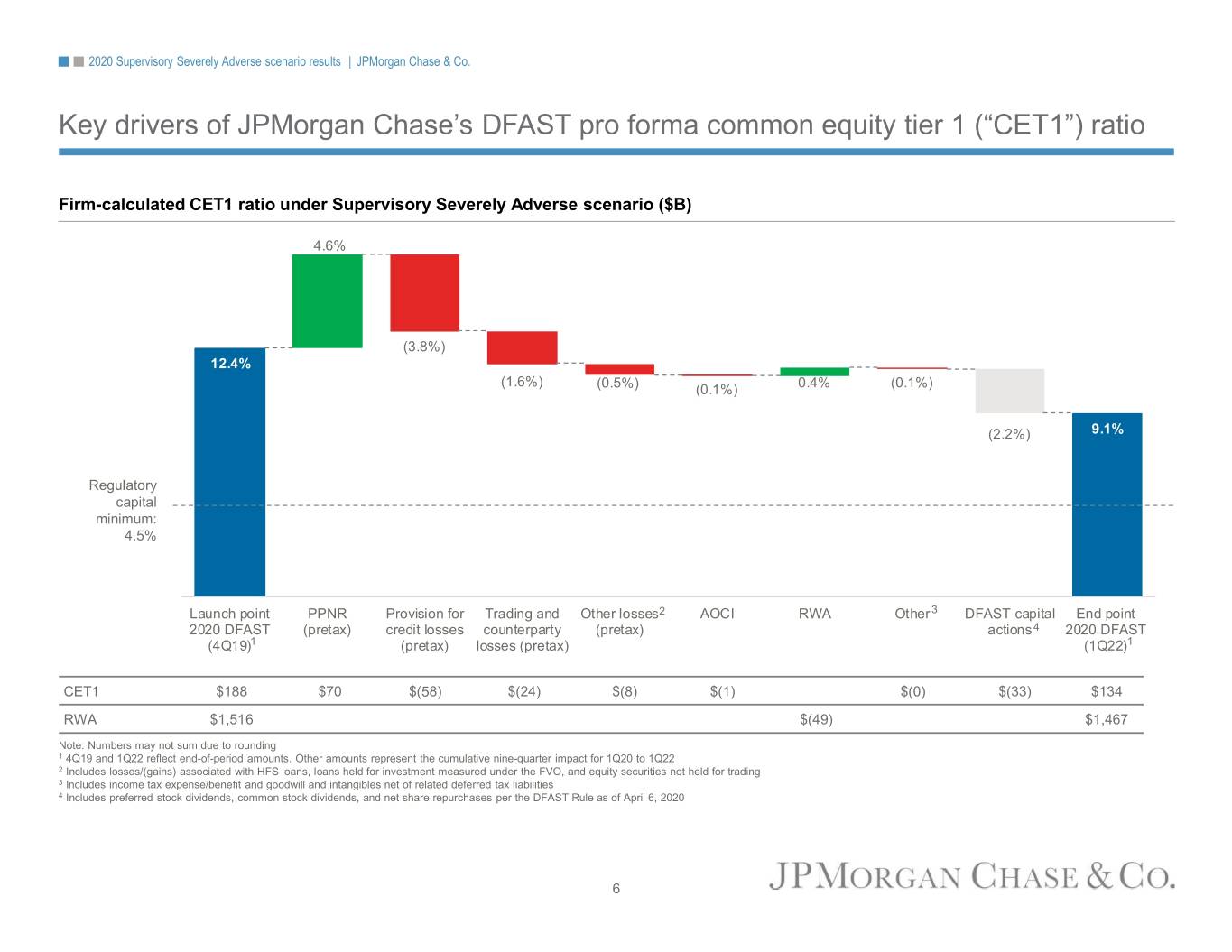

2020 Supervisory Severely Adverse scenario results | JPMorgan Chase & Co. Key drivers of JPMorgan Chase’s DFAST pro forma common equity tier 1 (“CET1”) ratio Firm-calculated CET1 ratio under Supervisory Severely Adverse scenario ($B) 4.6% (3.8%) 12.4% (1.6%) (0.5%) (0.1%) 0.4% (0.1%) (2.2%) 9.1% Regulatory capital minimum: 4.5% Launch point PPNR Provision for Trading and Other losses2 AOCI RWA Other3 DFAST capital End point 2020 DFAST (pretax) credit losses counterparty (pretax) actions4 2020 DFAST (4Q19)1 (pretax) losses (pretax) (1Q22)1 CET1 $188 $70 $(58) $(24) $(8) $(1) $(0) $(33) $134 RWA $1,516 $(49) $1,467 Note: Numbers may not sum due to rounding 1 4Q19 and 1Q22 reflect end-of-period amounts. Other amounts represent the cumulative nine-quarter impact for 1Q20 to 1Q22 2 Includes losses/(gains) associated with HFS loans, loans held for investment measured under the FVO, and equity securities not held for trading 3 Includes income tax expense/benefit and goodwill and intangibles net of related deferred tax liabilities 4 Includes preferred stock dividends, common stock dividends, and net share repurchases per the DFAST Rule as of April 6, 2020 6

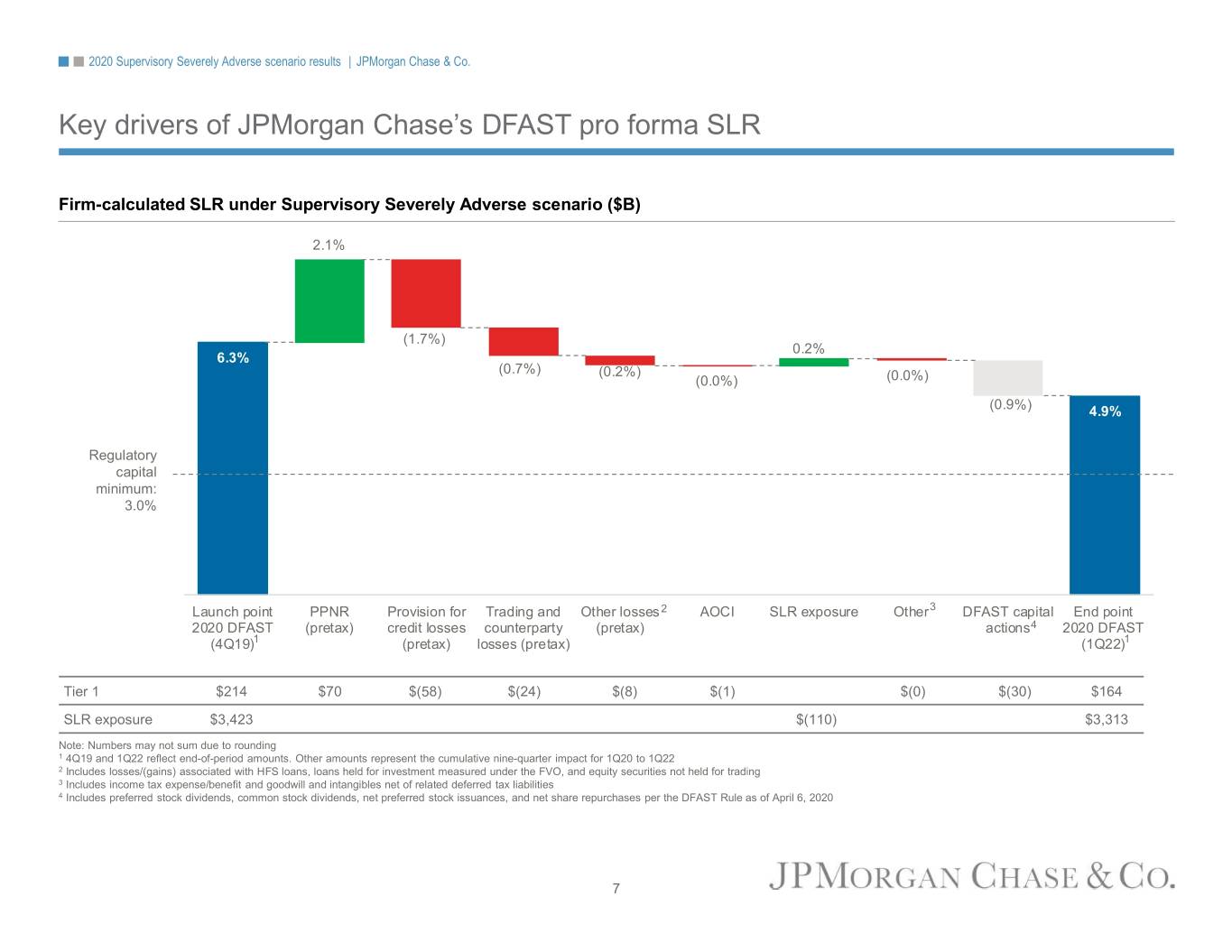

2020 Supervisory Severely Adverse scenario results | JPMorgan Chase & Co. Key drivers of JPMorgan Chase’s DFAST pro forma SLR Firm-calculated SLR under Supervisory Severely Adverse scenario ($B) 2.1% (1.7%) 0.2% 6.3% (0.7%) (0.2%) (0.0%) (0.0%) (0.9%) 4.9% Regulatory capital minimum: 3.0% Launch point PPNR Provision for Trading and Other losses 2 AOCI SLR exposure Other3 DFAST capital End point 2020 DFAST (pretax) credit losses counterparty (pretax) actions4 2020 DFAST (4Q19)1 (pretax) losses (pretax) (1Q22)1 Tier 1 $214 $70 $(58) $(24) $(8) $(1) $(0) $(30) $164 SLR exposure $3,423 $(110) $3,313 Note: Numbers may not sum due to rounding 1 4Q19 and 1Q22 reflect end-of-period amounts. Other amounts represent the cumulative nine-quarter impact for 1Q20 to 1Q22 2 Includes losses/(gains) associated with HFS loans, loans held for investment measured under the FVO, and equity securities not held for trading 3 Includes income tax expense/benefit and goodwill and intangibles net of related deferred tax liabilities 4 Includes preferred stock dividends, common stock dividends, net preferred stock issuances, and net share repurchases per the DFAST Rule as of April 6, 2020 7

Agenda Page 1 2020 Supervisory Severely Adverse scenario results 1 JPMorgan Chase & Co. 3 JPMorgan Chase Bank, N.A. 8 2 Risks and methodologies 10

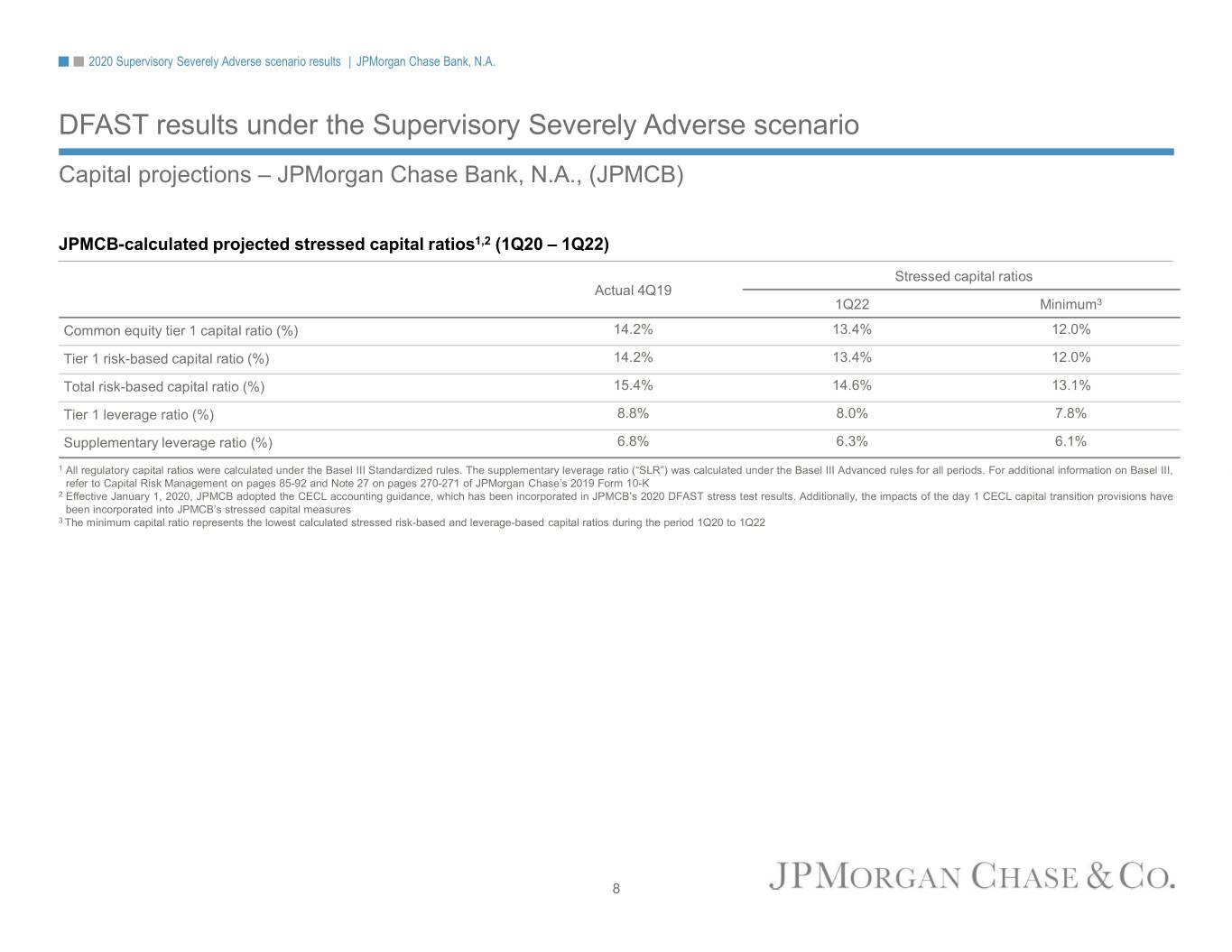

2020 Supervisory Severely Adverse scenario results | JPMorgan Chase Bank, N.A. DFAST results under the Supervisory Severely Adverse scenario Capital projections – JPMorgan Chase Bank, N.A., (JPMCB) JPMCB-calculated projected stressed capital ratios1,2 (1Q20 – 1Q22) Stressed capital ratios Actual 4Q19 1Q22 Minimum3 Common equity tier 1 capital ratio (%) 14.2% 13.4% 12.0% Tier 1 risk-based capital ratio (%) 14.2% 13.4% 12.0% Total risk-based capital ratio (%) 15.4% 14.6% 13.1% Tier 1 leverage ratio (%) 8.8% 8.0% 7.8% Supplementary leverage ratio (%) 6.8% 6.3% 6.1% 1 All regulatory capital ratios were calculated under the Basel III Standardized rules. The supplementary leverage ratio (“SLR”) was calculated under the Basel III Advanced rules for all periods. For additional information on Basel III, refer to Capital Risk Management on pages 85-92 and Note 27 on pages 270-271 of JPMorgan Chase’s 2019 Form 10-K 2 Effective January 1, 2020, JPMCB adopted the CECL accounting guidance, which has been incorporated in JPMCB’s 2020 DFAST stress test results. Additionally, the impacts of the day 1 CECL capital transition provisions have been incorporated into JPMCB’s stressed capital measures 3 The minimum capital ratio represents the lowest calculated stressed risk-based and leverage-based capital ratios during the period 1Q20 to 1Q22 8

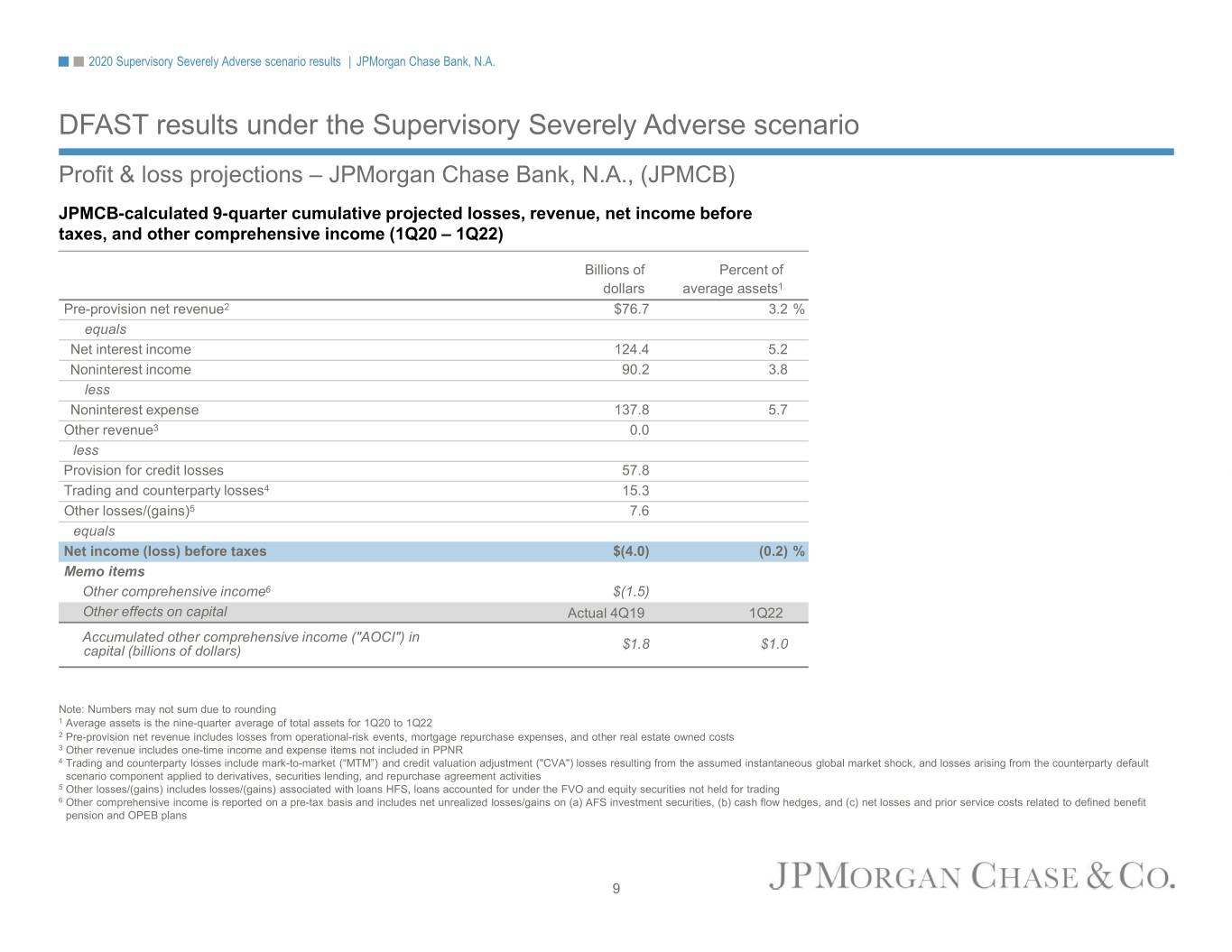

2020 Supervisory Severely Adverse scenario results | JPMorgan Chase Bank, N.A. DFAST results under the Supervisory Severely Adverse scenario Profit & loss projections – JPMorgan Chase Bank, N.A., (JPMCB) JPMCB-calculated 9-quarter cumulative projected losses, revenue, net income before taxes, and other comprehensive income (1Q20 – 1Q22) Billions of Percent of dollars average assets1 Pre-provision net revenue2 $76.7 3.2 % equals Net interest income 124.4 5.2 Noninterest income 90.2 3.8 less Noninterest expense 137.8 5.7 Other revenue3 0.0 less Provision for credit losses 57.8 Trading and counterparty losses4 15.3 Other losses/(gains)5 7.6 equals Net income (loss) before taxes $(4.0) (0.2) % Memo items Other comprehensive income6 $(1.5) Other effects on capital Actual 4Q19 1Q22 Accumulated other comprehensive income ("AOCI") in $1.8 $1.0 capital (billions of dollars) Note: Numbers may not sum due to rounding 1 Average assets is the nine-quarter average of total assets for 1Q20 to 1Q22 2 Pre-provision net revenue includes losses from operational-risk events, mortgage repurchase expenses, and other real estate owned costs 3 Other revenue includes one-time income and expense items not included in PPNR 4 Trading and counterparty losses include mark-to-market (“MTM”) and credit valuation adjustment ("CVA") losses resulting from the assumed instantaneous global market shock, and losses arising from the counterparty default scenario component applied to derivatives, securities lending, and repurchase agreement activities 5 Other losses/(gains) includes losses/(gains) associated with loans HFS, loans accounted for under the FVO and equity securities not held for trading 6 Other comprehensive income is reported on a pre-tax basis and includes net unrealized losses/gains on (a) AFS investment securities, (b) cash flow hedges, and (c) net losses and prior service costs related to defined benefit pension and OPEB plans 9

Agenda Page 1 2020 Supervisory Severely Adverse scenario results 1 2Risks and methodologies 10

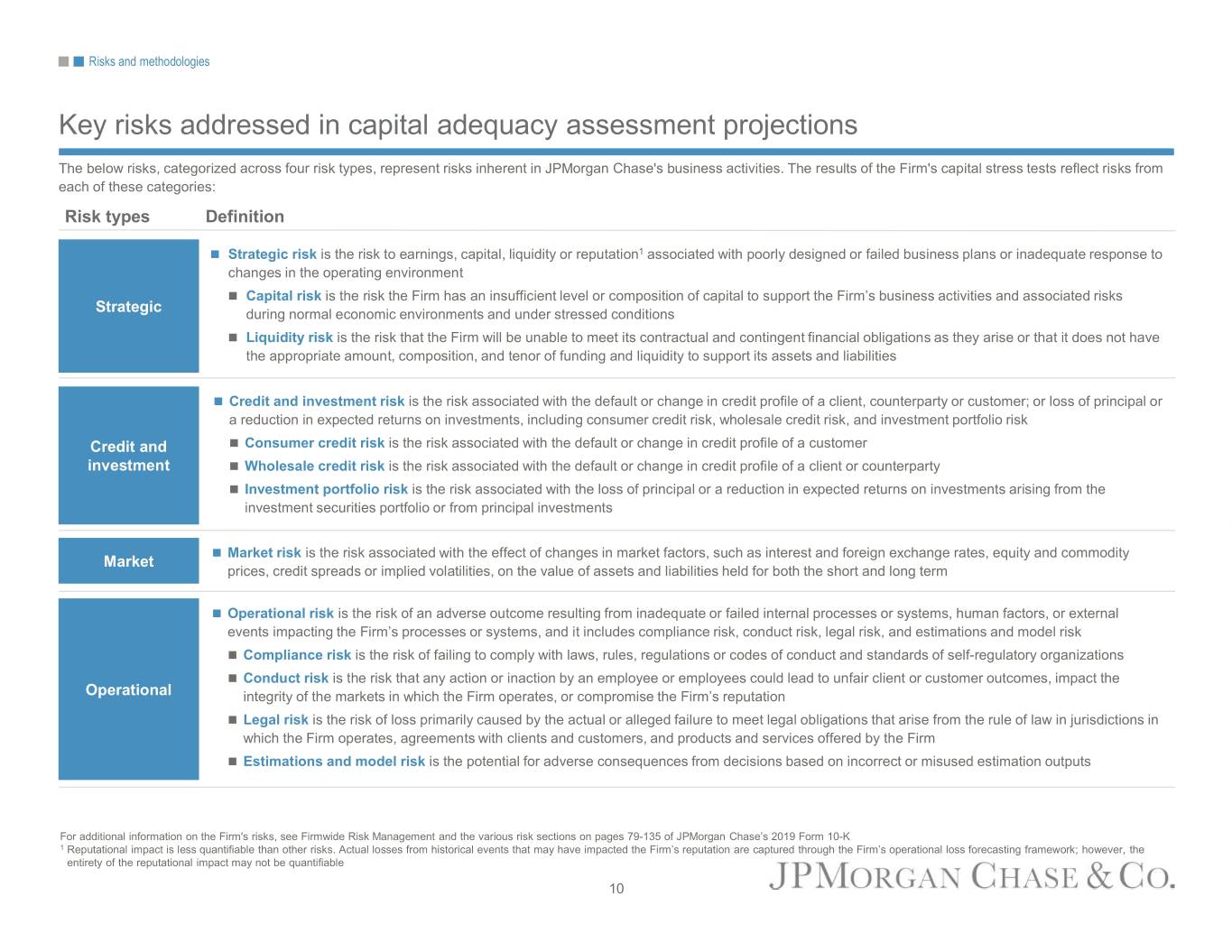

Risks and methodologies Key risks addressed in capital adequacy assessment projections The below risks, categorized across four risk types, represent risks inherent in JPMorgan Chase's business activities. The results of the Firm's capital stress tests reflect risks from each of these categories: Risk types Definition Strategic risk is the risk to earnings, capital, liquidity or reputation1 associated with poorly designed or failed business plans or inadequate response to changes in the operating environment Capital risk is the risk the Firm has an insufficient level or composition of capital to support the Firm’s business activities and associated risks Strategic during normal economic environments and under stressed conditions Liquidity risk is the risk that the Firm will be unable to meet its contractual and contingent financial obligations as they arise or that it does not have the appropriate amount, composition, and tenor of funding and liquidity to support its assets and liabilities Credit and investment risk is the risk associated with the default or change in credit profile of a client, counterparty or customer; or loss of principal or a reduction in expected returns on investments, including consumer credit risk, wholesale credit risk, and investment portfolio risk Credit and Consumer credit risk is the risk associated with the default or change in credit profile of a customer investment Wholesale credit risk is the risk associated with the default or change in credit profile of a client or counterparty Investment portfolio risk is the risk associated with the loss of principal or a reduction in expected returns on investments arising from the investment securities portfolio or from principal investments Market risk is the risk associated with the effect of changes in market factors, such as interest and foreign exchange rates, equity and commodity Market prices, credit spreads or implied volatilities, on the value of assets and liabilities held for both the short and long term Operational risk is the risk of an adverse outcome resulting from inadequate or failed internal processes or systems, human factors, or external events impacting the Firm’s processes or systems, and it includes compliance risk, conduct risk, legal risk, and estimations and model risk Compliance risk is the risk of failing to comply with laws, rules, regulations or codes of conduct and standards of self-regulatory organizations Conduct risk is the risk that any action or inaction by an employee or employees could lead to unfair client or customer outcomes, impact the Operational integrity of the markets in which the Firm operates, or compromise the Firm’s reputation Legal risk is the risk of loss primarily caused by the actual or alleged failure to meet legal obligations that arise from the rule of law in jurisdictions in which the Firm operates, agreements with clients and customers, and products and services offered by the Firm Estimations and model risk is the potential for adverse consequences from decisions based on incorrect or misused estimation outputs For additional information on the Firm's risks, see Firmwide Risk Management and the various risk sections on pages 79-135 of JPMorgan Chase’s 2019 Form 10-K 1 Reputational impact is less quantifiable than other risks. Actual losses from historical events that may have impacted the Firm’s reputation are captured through the Firm’s operational loss forecasting framework; however, the entirety of the reputational impact may not be quantifiable 10

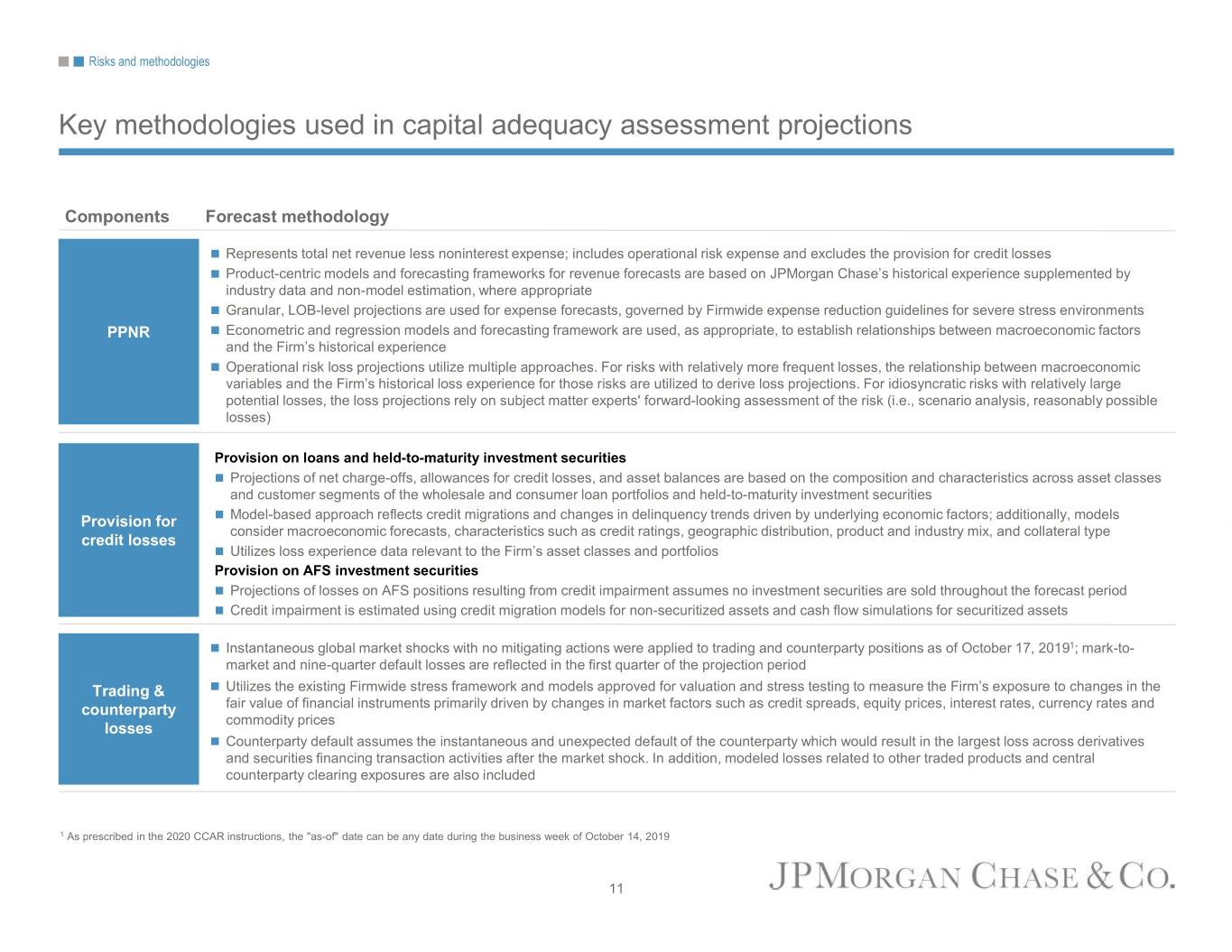

Risks and methodologies Key methodologies used in capital adequacy assessment projections Components Forecast methodology Represents total net revenue less noninterest expense; includes operational risk expense and excludes the provision for credit losses Product-centric models and forecasting frameworks for revenue forecasts are based on JPMorgan Chase’s historical experience supplemented by industry data and non-model estimation, where appropriate Granular, LOB-level projections are used for expense forecasts, governed by Firmwide expense reduction guidelines for severe stress environments PPNR Econometric and regression models and forecasting framework are used, as appropriate, to establish relationships between macroeconomic factors and the Firm’s historical experience Operational risk loss projections utilize multiple approaches. For risks with relatively more frequent losses, the relationship between macroeconomic variables and the Firm’s historical loss experience for those risks are utilized to derive loss projections. For idiosyncratic risks with relatively large potential losses, the loss projections rely on subject matter experts' forward-looking assessment of the risk (i.e., scenario analysis, reasonably possible losses) Provision on loans and held-to-maturity investment securities Projections of net charge-offs, allowances for credit losses, and asset balances are based on the composition and characteristics across asset classes and customer segments of the wholesale and consumer loan portfolios and held-to-maturity investment securities Provision for Model-based approach reflects credit migrations and changes in delinquency trends driven by underlying economic factors; additionally, models consider macroeconomic forecasts, characteristics such as credit ratings, geographic distribution, product and industry mix, and collateral type credit losses Utilizes loss experience data relevant to the Firm’s asset classes and portfolios Provision on AFS investment securities Projections of losses on AFS positions resulting from credit impairment assumes no investment securities are sold throughout the forecast period Credit impairment is estimated using credit migration models for non-securitized assets and cash flow simulations for securitized assets Instantaneous global market shocks with no mitigating actions were applied to trading and counterparty positions as of October 17, 20191; mark-to- market and nine-quarter default losses are reflected in the first quarter of the projection period Trading & Utilizes the existing Firmwide stress framework and models approved for valuation and stress testing to measure the Firm’s exposure to changes in the counterparty fair value of financial instruments primarily driven by changes in market factors such as credit spreads, equity prices, interest rates, currency rates and commodity prices losses Counterparty default assumes the instantaneous and unexpected default of the counterparty which would result in the largest loss across derivatives and securities financing transaction activities after the market shock. In addition, modeled losses related to other traded products and central counterparty clearing exposures are also included 1 As prescribed in the 2020 CCAR instructions, the "as-of" date can be any date during the business week of October 14, 2019 11

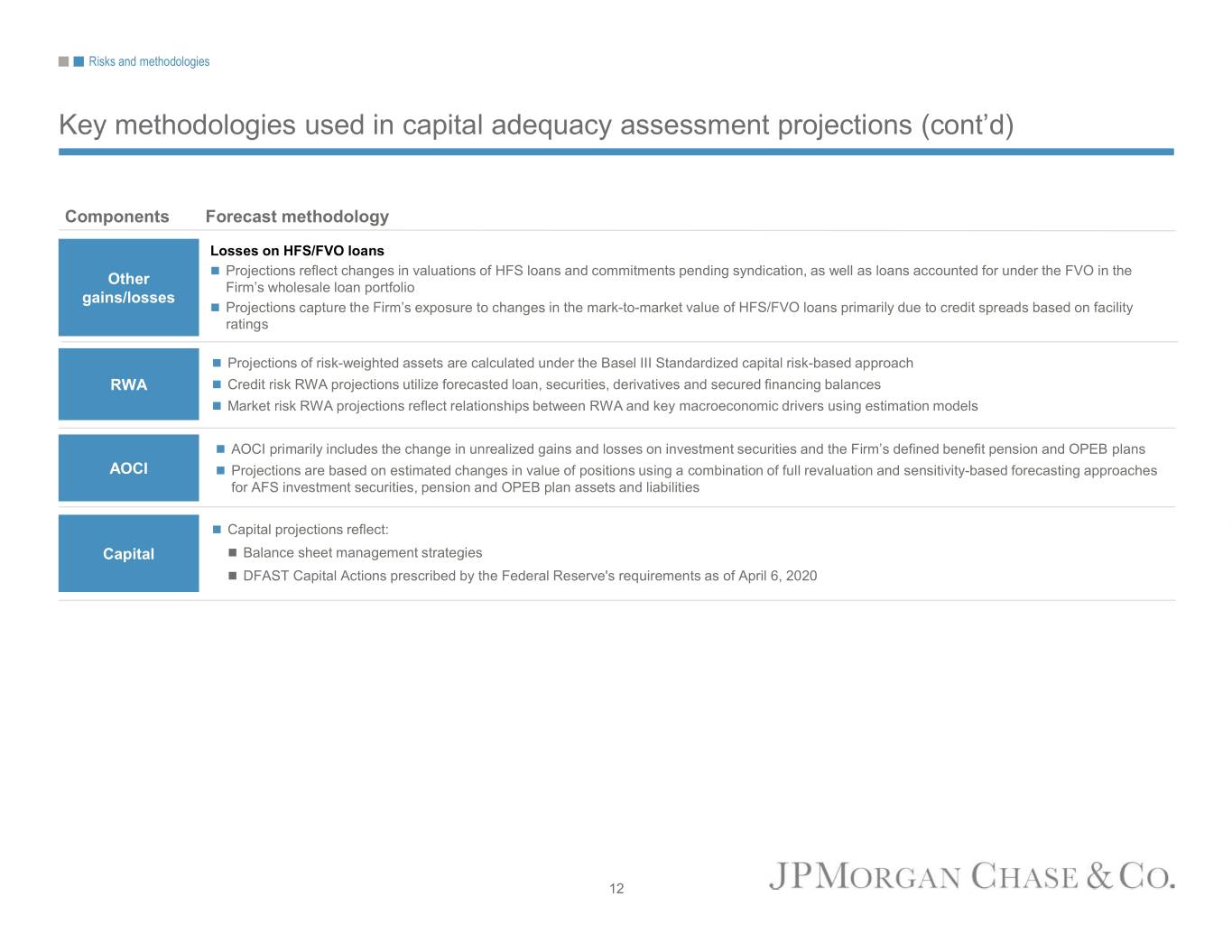

Risks and methodologies Key methodologies used in capital adequacy assessment projections (cont’d) Components Forecast methodology Losses on HFS/FVO loans Projections reflect changes in valuations of HFS loans and commitments pending syndication, as well as loans accounted for under the FVO in the Other Firm’s wholesale loan portfolio gains/losses Projections capture the Firm’s exposure to changes in the mark-to-market value of HFS/FVO loans primarily due to credit spreads based on facility ratings Projections of risk-weighted assets are calculated under the Basel III Standardized capital risk-based approach RWA Credit risk RWA projections utilize forecasted loan, securities, derivatives and secured financing balances Market risk RWA projections reflect relationships between RWA and key macroeconomic drivers using estimation models AOCI primarily includes the change in unrealized gains and losses on investment securities and the Firm’s defined benefit pension and OPEB plans AOCI Projections are based on estimated changes in value of positions using a combination of full revaluation and sensitivity-based forecasting approaches for AFS investment securities, pension and OPEB plan assets and liabilities Capital projections reflect: Capital Balance sheet management strategies DFAST Capital Actions prescribed by the Federal Reserve's requirements as of April 6, 2020 12

Forward-looking statements The results presented here contain forward-looking projections that represent estimates based on the hypothetical, severely adverse economic and market scenarios and assumptions under the Supervisory Severely Adverse scenario prescribed by the Federal Reserve. The stress test results do not represent JPMorgan Chase's forecasts of actual expected gains, losses, pre-provision net revenue, net income before taxes, capital, risk-weighted assets, or capital and leverage ratios. Actual results may differ from those set forth in the forward-looking statements. Factors that could cause JPMorgan Chase & Co.’s actual results to differ materially from those described in the forward-looking statements can be found in JPMorgan Chase & Co.’s Annual Report on Form 10- K for the year ended December 31, 2019, and Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2020, which have been filed with the Securities and Exchange Commission and is available on JPMorgan Chase & Co.’s website (https://jpmorganchaseco.gcs-web.com/financial-information/sec-filings), and on the Securities and Exchange Commission’s website (www.sec.gov). JPMorgan Chase & Co. does not undertake to update any forward-looking statements.