Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - II-VI INC | d53753dex992.htm |

| EX-23.1 - EX-23.1 - II-VI INC | d53753dex231.htm |

| 8-K - 8-K - II-VI INC | d53753d8k.htm |

Exhibit 99.1

PART I

| Item 1. | BUSINESS |

Definitions

II-VI Incorporated (“II-VI,” the “Company,” “we,” “us,” or “our”) was incorporated in Pennsylvania in 1971. Our headquarters are located at 375 Saxonburg Boulevard, Saxonburg, Pennsylvania 16056. Our telephone number is 724-352-4455. Reference to “II-VI,” the “Company,” “we,” “us,” or “our” in this Exhibit 99.1 to our Current Report on Form 8-K, unless the context requires otherwise, refers to II-VI Incorporated and its wholly owned subsidiaries. The Company’s name is pronounced “Two Six Incorporated.” The name II-VI refers to Groups II and VI on the periodic table of elements from which II-VI originally designed and produced infrared optics for high-power CO2 lasers used in materials processing. We address seven major markets. The majority of our revenues are attributable to the sale of engineered materials and optoelectronic components, devices, and subsystems for the industrial materials processing, optical communications, and aerospace and defense markets. Reference to “fiscal” or “fiscal year” means our fiscal year ended June 30 for the year referenced.

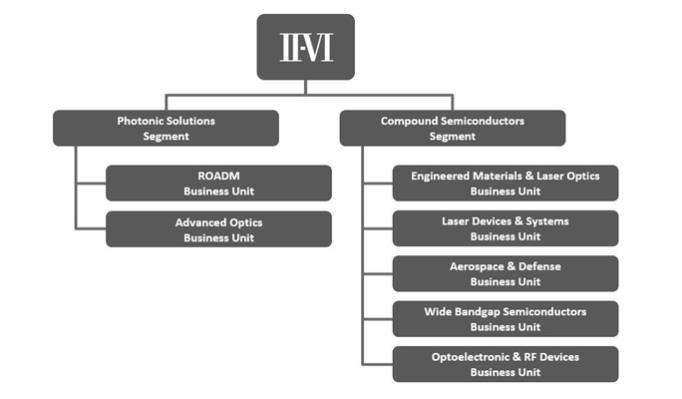

As of June 30, 2019, the Company’s operations were organized into two reporting segments: (i) Compound Semiconductors and (ii) Photonic Solutions. The Company combined II-VI Laser Solutions and II-VI Performance Products and renamed the combined segment Compound Semiconductors. All applicable segment information has been restated to reflect this change. Additionally, the Company changed the name of II-VI Photonics to Photonic Solutions. See below for a more detailed description of each of these segments.

The following terms are defined for reference: bismuth telluride (“Bi2Te3”); cadmium telluride (“CdTe”); carbon dioxide (“CO2”); carbon monoxide (“CO”); chemical vapor deposited (“CVD”) materials including diamond; dense wavelength division multiplexing (“DWDM”); extreme-ultraviolet (“EUV”) lithography; 5th-generation (“5G”) wireless; 4th-generation (“4G”) wireless; gallium arsenide (“GaAs”); gallium nitride (“GaN”); gigabit Ethernet (“GbE”); gigabit per second (“Gb/s”); high-definition multimedia interface (“HDMI”); indium phosphide (“InP”); infrared (“IR”); intellectual property (“IP”); light detection and ranging (“LiDAR”); liquid crystal (“LC”); liquid crystal on silicon (“LCOS”); nanometers (“nm”); near-infrared (“NIR”); organic light-emitting diode (“OLED”); original equipment manufacturer (“OEM”); optical time domain reflectometer (“OTDR”); radio frequency (“RF”); reconfigurable optical add/drop multiplexer (“ROADM”); research, development, and engineering (“RD&E”); silicon carbide (“SiC”); three-dimensional (“3D”); ultraviolet (“UV”); vertical cavity surface-emitting laser (“VCSEL”); wavelength division multiplexing (“WDM”); wavelength selective switching (“WSS”); zinc selenide (“ZnSe”); and zinc sulfide (“ZnS”).

Pending Acquisition of Finisar Corporation

II-VI and Finisar have entered into an Agreement and Plan of Merger, dated as of November 8, 2018 (the “Merger Agreement”). Pursuant to the terms of the Merger Agreement, Mutation Merger Sub Inc., a Delaware corporation and wholly owned subsidiary of II-VI, will be merged with and into Finisar, and Finisar will continue as the surviving corporation in the merger and a wholly owned subsidiary of II-VI (the “Merger”).

If the Merger is consummated, Finisar stockholders will be entitled to receive, at their election, consideration per share of common stock of Finisar (the “Finisar Common Stock”) consisting of (i) $26.00 in cash, without interest (the “Cash Consideration”), (ii) 0.5546 shares of II-VI common stock (the shares, the “II-VI Common Stock,” and the consideration, the “Stock Consideration”), or (iii) a combination of $15.60 in cash, without interest, and 0.2218 shares of II-VI Common Stock (the “Mixed Consideration,” and, together with the Cash Consideration and the Stock Consideration, the “Merger Consideration”). The Cash Consideration and the Stock Consideration are subject to proration adjustment pursuant to the terms of the Merger Agreement such that the aggregate Merger Consideration will consist of approximately 60% cash and approximately 40% II-VI Common Stock assuming a per share price of II-VI common stock equal to the price when the Merger Agreement was signed on November 8, 2018, which was $46.88 per share.

At the effective time of the Merger (the “Effective Time”), each option granted pursuant to Finisar’s 2005 Stock Incentive Plan, as such plan has been further amended and restated (each, a “Finisar Stock Option”), or portion thereof, that is outstanding and unexercised as of immediately prior to the Effective Time (whether vested or unvested) will be cancelled, terminated and converted into the right to receive an amount of Mixed Consideration that would be payable to a holder of such number of shares of Finisar Common Stock equal to the quotient of (i) the product of (a) the excess, if any, of $26.00 over the exercise price per share of such Finisar Stock Option multiplied by (b) the number of shares of Finisar Common Stock subject to such Finisar Stock Option, divided by (ii) $26.00.

At the Effective Time, each restricted stock unit granted pursuant to Finisar’s 2005 Stock Incentive Plan, as such plan has been further amended and restated (each, a “Finisar Restricted Stock Unit”), or portion thereof , that is outstanding and subject to a

performance-based vesting condition that relates solely to the value of Finisar Common Stock will, to the extent such Finisar Restricted Stock Unit vests in accordance with its terms in connection with the Merger (the “Participating RSUs”), be cancelled and extinguished and converted into the right to receive the Cash Consideration, the Stock Consideration or the Mixed Consideration at the election of the holder of such Participating RSUs, subject to proration adjustment.

At the Effective Time, each Finisar Restricted Stock Unit (or portion thereof) that is outstanding and unvested, does not vest in accordance with its terms in connection with the Merger and is either (x) subject to time-based vesting requirements only or (y) subject to a performance-based vesting condition other than the value of Finisar Common Stock will be assumed by II-VI (each, an “Assumed RSU”). Each Assumed RSU will be subject to substantially the same terms and conditions as applied to the related Finisar Restricted Stock Unit immediately prior to the Effective Time, including the vesting schedule (and the applicable performance-vesting conditions in the case of a grant contemplated by clause (y) of the preceding sentence) and any provisions for accelerated vesting applicable thereto, except that the number of shares of II-VI Common Stock subject to each Assumed RSU will be equal to the product of (i) the number of shares of Finisar Common Stock underlying such unvested Finisar Restricted Stock Unit award as of immediately prior to the Effective Time multiplied by (ii) the sum of (a) 0.2218 plus (b) the quotient obtained by dividing (1) $15.60 by (2) the volume weighted average price per share of II-VI Common Stock (rounded to the nearest cent) on the Nasdaq Global Select Market for the ten consecutive trading days ending on (and including) the third trading day immediately prior to the Effective Time (with the resulting number rounded down to the nearest whole share).

II-VI filed with the SEC a registration statement on Form S-4 relating to the Merger, and that registration statement became effective in accordance with the provisions of Section 8(a) of the Securities Act of 1933, as amended, on February 7, 2019. Shareholders of II-VI and stockholders of Finisar voted to approve proposals related to the Merger at special meetings held on March 26, 2019 by the respective companies.

The waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, with respect to the Merger has expired without a request for additional information. Other regulatory approvals applicable to the Merger have been obtained in Germany, Mexico and Romania.

The completion of the Merger is subject to the satisfaction or waiver of certain additional customary closing conditions, including review and approval of the Merger by the State Administration for Market Regulation in China. The Company is planning to refile with the State Administration for Market Regulation in China, extending the approval period. Subject to the satisfaction or waiver of each of the closing conditions, II-VI and Finisar expect that the Merger will be completed in the second half of calendar 2019. However, it is possible that factors outside the control of both companies could result in the Merger being completed at a different time or not at all.

On November 8, 2018, in connection with its entry into the Merger Agreement, II-VI entered into a commitment letter (together with a related fee letter) with Bank of America, N.A., which was subsequently amended and restated on December 7, 2018 and on December 14, 2018 (together with one or more related fee letters, the “Commitment Letter”). Subject to the terms and conditions set forth in the Commitment Letter, the lender parties thereto severally committed to provide 100% of up to $2.425 billion in aggregate principal amount of senior secured credit facilities of II-VI.

On March 4, 2019, II-VI entered into a Credit Agreement, dated as of March 4, 2019 (as amended, the “New Credit Agreement”), by and among the Company, Bank of America, N.A., as Administrative Agent, Swing Line Lender and an L/C Issuer, and the other lenders party thereto. II-VI also entered into Amendment No. 1 to Credit Agreement, dated as of May 24, 2019, by and among the Company, Bank of America, N.A., as Administrative Agent, and the other lenders party thereto, which includes the final results of the syndication of the Term A Facility (as defined below). Pursuant to the terms and subject to the conditions therein, the New Credit Agreement provides for senior secured financing of $1.705 billion in the aggregate, consisting of (i) a five-year senior secured first-lien term A loan facility in an aggregate principal amount of $1.255 billion (the “Term A Facility”) and (ii) a five-year senior secured first-lien revolving credit facility in an aggregate principal amount of $450.0 million (the “Revolving Credit Facility” and together with the Term A Facility, the “New Senior Credit Facilities”). The New Credit Agreement also provides for a letter of credit sub-facility not to exceed $25.0 million and a swing loan sub-facility initially not to exceed $20.0 million, subject to adjustment in accordance with the terms of the New Credit Agreement. II-VI anticipates using the proceeds from the Term A Facility, together with a separately committed term B loan facility in an aggregate principal amount of up to $720.0 million (the “Term B Facility”) and cash and short-term investments of II-VI and Finisar, to pay the cash portion of the merger consideration payable in connection with the Merger and related fees and expenses. II-VI currently does not intend to draw on the Revolving Credit Facility in order to fund the cash portion of the merger consideration payable in connection with the Merger.

The funding obligations of the lenders under the New Senior Credit Facilities are subject to certain currently unsatisfied conditions, including the consummation of the Merger. Accordingly, no borrowings are currently outstanding under the New Senior Credit Facilities, and II-VI currently is not able to borrow under the New Senior Credit Facilities. Further, II-VI expects that the New Credit Agreement will be amended prior to the consummation of the Merger to reflect syndication of the Term B Facility and to finalize certain other terms in the New Credit Agreement. Upon the consummation of the Merger, the New Senior Credit Facilities, governed by the New Credit Agreement as it may be amended as of such time, will be used (i) to refinance in full the Amended Credit Facility (as defined in Note 9 to the Company’s Consolidated Financial Statements included in Item 8 of this Exhibit 99.1 to our Current Report on Form 8-K) and (ii) on or after the date of the consummation of the Merger, to repay amounts owed in connection with Finisar’s outstanding convertible notes, currently in an aggregate principal amount outstanding of $575.0 million, including with the proceeds of a portion of the Term A Facility which will be available to II-VI for a certain period after the initial funding under the New Senior Credit Facilities.

Unless and until the Merger is consummated and the other currently unsatisfied conditions to the funding obligations of the lenders under the New Senior Credit Facilities are satisfied or waived, the Amended Credit Facility remains in effect in accordance with its terms.

General Description of Business

We develop, manufacture, and market engineered materials, optoelectronic components, and devices for precision use in industrial materials processing, optical communications, aerospace and defense, consumer electronics, semiconductor capital equipment, life sciences, and automotive applications and markets. We use advanced engineered materials growth technologies coupled with proprietary high-precision fabrication, microassembly, optical thin-film coating, and electronic integration to manufacture complex optoelectronic devices and modules. Our products are deployed in a variety of applications, including (i) laser cutting, welding, and marking operations; (ii) 3D sensing consumer applications; (iii) optical, data, and wireless communications products; (iv) strategic aerospace and defense applications including intelligence, surveillance, and reconnaissance; (v) semiconductor processing and tooling; and (vi) thermoelectric cooling and power-generation solutions.

Through RD&E and acquisitions, II-VI has expanded its portfolio of materials. We believe that the materials we grow and fabricate are differentiated by one or a combination of unique optical, electrical, thermal, and mechanical properties. II-VI’s optics are shaped by precision surfacing techniques to meet the most stringent requirements for flat or curved geometries, functionalized with smooth or structured surfaces, or with patterned metallization. Proprietary processes developed at our global optical coating centers differentiate our products’ durability against high-energy lasers and extreme operating environments. Optical coatings also provide the desired spectral characteristics ranging from the ultraviolet to the far-infrared. II-VI leverages these capabilities to deliver miniature- to large-scale precision optical assemblies, including those in combination with thermal management components, integrated electronics, and/or software.

II-VI also offers a broad portfolio of compound semiconductor lasers that are used in a variety of applications in most of our end markets. These compound semiconductor lasers enable high-power lasers for materials processing; optical signal amplification in terrestrial and submarine communications networks; high-bit-rate server connectivity between and within datacenters; and fast and accurate measurements in biomedical instruments, consumer electronics, and optical communications network monitoring.

II-VI continues to work to perfect its operational capabilities, develop next-generation products, and invest in new technology platforms. With a strategic focus on fast-growing and sustainable markets, II-VI pursues its vision of enabling the world to be safer, healthier, closer, and more efficient.

Information Regarding Market Segments and Foreign Operations

Financial data regarding our revenues, results of operations, industry segments, and international sales for the three years ended June 30, 2019, are set forth in the Consolidated Statements of Earnings and in Note 14 to the Company’s Consolidated Financial Statements included in Item 8 of this Exhibit 99.1 to our Current Report on Form 8-K and are incorporated herein by reference. We also discuss certain Risk Factors set forth in Item 1A – Risk Factors of our Annual Report on Form 10-K filed August 16, 2019 related to our foreign operations, which are incorporated herein by reference.

Bookings and Backlog

We define our bookings as customer orders received that are expected to be converted to revenues over the next 12 months. The Company records only those orders which are expected to be converted into revenues within 12 months from the end of the reporting period. Bookings are adjusted if changes in customer demands or production schedules cause the expected time of a delivery to extend beyond 12 months. For the fiscal year ended June 30, 2019, our bookings were approximately $1.4 billion, compared with bookings of approximately $1.2 billion for the fiscal year ended June 30, 2018.

We define our backlog as bookings that have not been converted to revenues by the end of the reporting period. As of June 30, 2019, our backlog was approximately $500 million, compared with approximately $450 million as of June 30, 2018.

Global Operations

II-VI is headquartered in Saxonburg, PA, with RD&E, manufacturing, and sales facilities worldwide. Our U.S. production and research and development operations are located in Pennsylvania, California, New Jersey, Texas, Mississippi, Massachusetts, Connecticut, Delaware, New York, Florida, Ohio, Arizona, Colorado, and Illinois, and our non-U.S. production operations are based in China, Singapore, Vietnam, the Philippines, Germany, Switzerland, and the United Kingdom. We also utilize contract manufacturers and strategic suppliers. In addition to sales offices at most of our manufacturing sites, we have sales and marketing subsidiaries in Hong Kong, Japan, Germany, China, Switzerland, Belgium, the United Kingdom, Italy, South Korea, and Taiwan. Approximately 70% of our revenues for the fiscal year ended June 30, 2019, were generated from sales to customers outside of the United States.

Employees

The table below summarizes the number of our employees as of June 30, 2019, in the main functions. We have a long-standing practice of encouraging active employee participation in areas of operations and quality management. We believe our relations with our employees are good. We reward substantially all our employees with some form of variable compensation based on achievement of performance goals. There are approximately 236 employees located in the United States and the Philippines who are covered under collective bargaining agreements. The Company’s collective bargaining agreement in the Philippines expired in June 2019, and the Company is in the process of negotiating a new collective bargaining agreement. The collective bargaining agreement covering certain U.S.-based employees expires in January 2021. There are 735 employees of II-VI Photop in China who work under contract manufacturing arrangements for customers of the Company.

| Number of employees |

Percent of total |

|||||||

| Direct production |

9,778 | 78 | % | |||||

| Research, development, and engineering |

1,707 | 14 | % | |||||

| Sales, marketing, administration, finance, and supporting services |

1,002 | 8 | % | |||||

|

|

|

|

|

|||||

| Total: |

12,487 | 100 | % | |||||

|

|

|

|

|

|||||

Manufacturing Processes

Our success in developing and manufacturing many of our products depends on our ability to manufacture and to tailor the optical and physical properties of technically challenging materials and components. The ability to produce, process, and refine these complex materials and to control their quality and in-process yields is an expertise of the Company that is critical to the performance of our customers’ subsystems and systems. In the markets we serve, there are a limited number of high-quality suppliers of many of the components we manufacture, and there are very few industry-standard products.

Our network of worldwide manufacturing sites allows us to manufacture our products in regions that provide cost-effective and risk management advantages. We employ numerous advanced manufacturing technologies and systems at our manufacturing facilities. These include metal–organic chemical vapor deposition and molecular beam epitaxy reactors, automated computer numeric control optical fabrication, high-throughput thin-film coaters, nanoprecision metrology, and custom-engineered automated furnace controls for crystal growth processes. Manufacturing products for use across the electromagnetic spectrum requires the capability to repeatedly produce products with high yields to atomic tolerances. II-VI continuously updates its comprehensive quality management systems that feature manufacturing quality best practices. II-VI is committed to delivering products within specification, on time, and with high quality, with a goal of fully satisfying customers and continually improving.

Sources of Supply

Among the major feed stock and raw materials we use are zinc, selenium, ZnSe, ZnS, hydrogen selenide, hydrogen sulfide, arsine, phosphine, hydrogen, silon, tellurium, yttrium oxide, aluminum oxide, iridium, platinum, bismuth, silicon, thorium fluoride, antimony, carbon, graphite, GaAs, InP, copper, germanium, molybdenum, quartz, optical glass, and diamond.

The continued high quality of and access to these materials is critical to the stability and predictability of our manufacturing yields. We test materials at the onset and throughout the production process. Additional research and capital investment may be needed to better define future material specifications. We have not experienced significant production delays due to shortages of materials. However, we do occasionally experience problems associated with vendor-supplied materials not meeting contract specifications for quality or purity. As discussed in greater detail in Item 1A – Risk Factors of this Exhibit 99.1 to our Current Report on Form 8-K, significant failure of our suppliers to deliver sufficient quantities of necessary high-quality materials to our specifications on a timely basis could have a materially adverse effect on our results of our operations.

Business Units

As of June 30, 2019, the Company’s organizational structure is divided into two reporting segments for the purpose of making operational decisions and assessing financial performance: (i) Compound Semiconductors and (ii) Photonic Solutions. These segments, and the business units within the segments, are reflected in the organizational chart below:

Compound Semiconductors designs, manufactures, and markets: (i) optical and electro-optical components and materials sold under the II-VI Infrared brand name that are used primarily in high-power CO2 lasers, fiber-delivered beam delivery systems, and processing tools; direct-diode lasers for industrial use sold under the II-VI HIGHYAG brand name; (ii) infrared optical components and high-precision optical assemblies for aerospace and defense, medical, and commercial laser imaging applications; and (iii) unique silicon carbide engineered materials for thermoelectric devices and subsystems for SiC applications servicing the semiconductor equipment, aerospace and defense, communications, automotive, and life science markets. Compound Semiconductors also manufactures compound semiconductor epitaxial wafers under the II-VI EpiWorks brand name for applications in optical components, wireless devices, and high-speed communications systems; and 6-inch gallium arsenide wafers allowing for the production of high-performance lasers, optoelectronics, and integrated circuits in high volume under the II-VI Laser Enterprise, II-VI EpiWorks, II-VI Compound Semiconductor Ltd., and II-VI OptoElectronic Devices brand names.

Photonic Solutions manufactures crystal materials, optics, microchip lasers, and optoelectronic modules for use in optical communications networks and other diverse consumer, life sciences, and commercial applications. In addition, the segment also manufactures pump lasers, optical isolators, optical amplifiers, and micro-optics for optical amplifiers for both terrestrial and

submarine applications within the optical communications market; direct-diode laser modules, subsystems, and systems sold under the II-VI Suwtech and II-VI DIRECTPHOTONICS brand names; and super-hard materials processing laser systems sold under the II-VI LASERTECH brand name.

II-VI’s segments are organized by business unit at the group or division level. Each of these business units develops and markets products as described below.

| Segment |

Business Unit |

Our Products | ||

| Photonic Solutions | ROADM | • Products and solutions that enable high-bit-rate interconnects for datacenters and communications service providers, datacenter interconnects, ROADM systems, and undersea fiber-optic transmission

| ||

| Advanced Optics | • Fiber optics and precision optics used in projection and displays; crystal materials and components for optical communications; high-power UV, visible, and NIR optics for industrial lasers; filters and assemblies for life sciences as well as for sensors, instrumentation, and semiconductor equipment |

| Segment |

Business Unit |

Our Products | ||

| Compound Semiconductors | Engineered Materials & Laser Optics | • Laser optics and accessories for CO2 lasers used in materials processing, semiconductors, and life sciences

• High-power fiber and direct-diode laser optics

• Infrared thermal imaging optics and assemblies

• II-VI compound crystalline materials production including ZnSe, ZnS, ZnS multispectral, and CVD diamond

• Thermoelectric components, subassemblies, and systems for heating, cooling, temperature tuning, thermal cycling, and power generation in aerospace and defense, medical, industrial, automotive, consumer, telecommunications, and energy-production markets

• Specialty refining, recycling, and materials recovery services for high-purity rare metals such as selenium and tellurium, as well as related chemical products such as tellurium dioxide, for optics, photovoltaics, semiconductors, thermoelectric coolers, metallurgy, agriculture, and industrial applications

• Advanced ceramic and metal-matrix composite products for semiconductor capital equipment, flat-panel displays, industrial and optical equipment, and defense applications

| ||

| Laser Devices & Systems | • High-power semiconductor lasers and laser bars enabling fiber and direct-diode lasers for materials processing, medical, defense, consumer, and printing applications

• Laser heads and modules; Q-switched laser modules; high-power, uncooled pump laser modules; laser solutions for super-hard materials processing; high-brightness direct-diode laser engines

• Laser processing heads and beam delivery systems for laser materials processing with industrial lasers

|

| Segment |

Business Unit |

Our Products | ||

| Aerospace & Defense | • Precision optical assemblies, objectives, infrared optics, thin-film coatings, and optical materials

• Optical solutions for critical and complex design, engineering, and production challenges in defense, aerospace, and commercial industries

| |||

| Wide Bandgap Semiconductors | • SiC and advanced semiconductor materials for high-frequency and high-power electronic device applications in defense, telecommunications, automotive, and industrial markets

| |||

| Optoelectronic & RF Devices | • VCSELs for optical interconnects and sensing

• VCSELs for 3D sensing in consumer electronics and automotive applications

• RF devices for communications

• GaAs-based RF electronic devices

• II-IV epitaxial wafers to enable higher-performance photonic and RF components for consumer, communications, network, and mobile applications |

Our Markets

Our market-focused businesses are organized by technology and products. Our businesses are composed of the following primary markets: communications, materials processing, aerospace and defense, semiconductor capital equipment, life sciences, consumer electronics, and automotive.

Communications Market

II-VI’s optical communications products and technologies enable the next generation of high-speed optical transmission systems, networks, and datacenter solutions necessary to meet the accelerating global bandwidth demand. At the core of both terrestrial and undersea optical networks, our market-leading 980 nm pump lasers boost the power of the optical signal in the fiber optic cable at intervals along the way to enable a larger number of high-speed signals to be transmitted over longer distances. Our latest generation of 980 nm pump lasers along with miniature tunable filters and hybrid passives is part of our ultracompact family of components critical to a new generation of small-size, long-reach DWDM transmission modules operating at 100, 200, and 400 Gb/s.

Customers continue to rely on us for our industry-leading optical amplification and embedded monitoring solutions for their next-generation ROADM systems to compensate for inherent signal loss and to monitor signal integrity. Our proprietary OTDR modules allow systems to automatically detect and pinpoint issues along the transmission path in real time. The accelerating adoption of applications such as cloud computing is driving the rapid growth of datacenter buildouts. Our high-speed 25 Gb/s VCSELs enable intra-datacenter transceivers to transmit and receive signals. Our miniature WDM thin-film filter assemblies are used to increase the bandwidth within 100 GbE transceivers by combining wavelengths at the transmitter end and separating them out at the receiver end.

In mobile wireless applications, II-VI supplies base SiC substrates to customers who manufacture RF power amplifier devices that are embedded in remote radio heads in 4G wireless base stations to boost the power of the RF signal before it reaches the antenna. These devices are also widely expected to be embedded in next-generation active antennas for 5G wireless, where multiple devices per antenna will be required to enable higher bandwidth. SiC has a high number of intrinsic physical and electronic advantages, such as high thermal conductivity, that enables it to operate at high power levels and still dissipate the excess heat generated.

Materials Processing Market

Our industrial laser optics and solutions for the materials processing market remain in strong demand. There continues to be a steady global demand to support existing installations and new deployments of CO2 and fiber laser systems. Our vertically integrated and market-leading ZnSe optics and components, due to their inherent low loss at around 10-micron wavelength, have enabled high-power CO2 laser systems for many decades and remain critical to the steady stream of new deployments as well as to continued operation, serving as replacement optics for the installed base of CO2 lasers. II-VI continues to introduce products that address new and growing applications for low-power CO2 lasers, such as cutting textiles, leather, wood, and other organic materials, for which the CO2 laser’s 10-micron wavelength is ideally suited. CO2 lasers are also at the core of EUV lithography systems, which are now emerging on the market to enable a new generation of smaller and more powerful personal integrated circuits for internet of things computing devices.

Over the past several years, fiber laser-based systems operating at 1-micron wavelength in pulsed or continuous mode have taken a central role in nearly all materials processing segments, especially for precision machining such as marking and micro-drilling. From the laser chips that generate the input optical power to the beam delivery systems that direct the output optical power to the target, II-VI supplies a broad set of laser optics and fused fiber products that enable many functions within these systems. The same set of II-VI products is also at the core of existing and emerging direct-diode laser systems. II-VI is also driving innovation with a direct-diode laser engine small enough to be mounted on a robotic arm so that the end user can apply square beams directly to the workpiece at wavelengths optimized for aluminum processing.

II-VI’s broad portfolio of coated optics and crystal materials serve all of these growing laser markets.

Aerospace and Defense Market

II-VI aerospace and defense optical products and technologies enable targeting, night vision, and navigation as well as intelligence, surveillance, and reconnaissance systems. Moreover, our recently acquired optical beam combining and directing technologies, along with our fiber laser components, are enabling High Energy Laser (HEL) systems and applications.

Multiple fighter jets are equipped with our large-area sapphire windows that surround advanced electro-optical targeting and imaging systems. Infrared domes are used on missiles with infrared guidance systems ranging from small human-portable designs to larger designs mounted on helicopters, fixed-wing aircraft, and ground vehicles. High-precision domes are an integral component of a missile’s targeting system, providing efficient tactical capability while serving as a multi-functional protective cover for its internal components.

Rotary and fixed-wing aircraft also use missile warning systems to protect against the threat of shoulder-fired human-portable missiles. Our competencies in materials growth for UV crystals and our optical assembly capabilities provide significant support to these common missile warning systems. A key attribute of several of these systems is the ability to filter electromagnetic interference using microfine conductive mesh patterns. This technology is also applied to non-optical applications for absorbing and transmitting energy from the surfaces of aircraft and missiles.

Many aerospace and defense systems employ laser designation and range-finding capabilities supported by our semiconductor laser bars and solid state laser host crystals and laser optics, all manufactured in-house, and benefit from our competency in short-wave infrared and visible optics. Our thermoelectric coolers are used to increase thermal imaging sensitivity or to maintain a constant window temperature in various visible and infrared applications for night vision and sighting applications.

We provide a range of battlefield-ready technologies for soldier equipment and specifically designed variants for law enforcement. Our precision patterned reticles can be embedded in rifle scopes. Our reaction-bonded boron carbide materials are shaped into torso plates and employed as in-aircraft cabin and protective body armor. Our thermoelectric coolers are used to regulate the soldier’s body heat. They are also used to convert heat produced by battlefield fuel burners into electrical power, for example, to extend battery life on the battlefield.

We maintain engineering and manufacturing facilities in the United States with strictly controlled access that are dedicated to our U.S. government supported contracts.

Semiconductor Capital Equipment Market

Semiconductor capital equipment requires advanced materials to meet the need for tighter tolerances, enhanced thermal stability, faster wafer transfer speeds, and reduced stage settling times. Our metal-matrix composites and reaction-bonded ceramics enable these applications, thanks to their optimum combination of light weight, strength, hardness, and coefficient of thermal expansion. Our reaction-bonded SiC materials are used to manufacture wafer chucks, lightweight scanning stages, and high-temperature corrosion-resistant wafer support systems. Our cooled SiC mirrors and precision patterned reticles are used in the illumination systems of lithography tools.

In the emerging market of EUV lithography systems, CO2 lasers are used to generate extreme-ultraviolet light. These CO2 lasers and beam delivery systems leverage our broad portfolio of CO2 laser optics, CdTe modulators, and high-power damage-resistant polycrystalline CVD diamond windows to route the powerful laser beam to a tin droplet from which EUV light will emanate. Due to its very high mechanical and thermal performance characteristics, our reaction-bonded SiC is used in structural support systems that are integral to EUV lithography optics to meet critical requirements for optical system stability.

Life Sciences Market

The majority of our business in the life sciences end market is in analytical tools. Many analytical tools found in modern biotech laboratories are based on some form of interaction with light. This applies to flow cytometry, cell sorting, confocal microscopy, DNA genome sequencing, Raman spectroscopy, fluorescence spectroscopy, and particle sizing, to name a few. Our multicolored laser engines along with our broad portfolio of application-specific optics, filters, and gratings are embedded in these analytical tools. We also supply objective lenses, precision patterned reticles, and assemblies for microscopes.

Genome sequencing involves temperature-cycling DNA in flow cells with a high degree of temperature uniformity and precision. We believe that our thermal engines are the state of the art in chiller technology, and they achieve what we believe to be industry-leading temperature control and uniformity across large areas. Our green lasers are used to excite the fluorescence of DNA to reveal its structure. Our flow cells are micromachined with a high degree of precision to ensure the smooth flow of sample fluids undergoing analysis. Our thermal engines are also used in a multitude of other biomedical applications, for example, to measure substance concentration in complex mixtures, protect blood supplies, and perform heating- and cooling-based physical therapy.

Clinical procedures are increasingly performed with tools that embed our lasers and optics. For example, our semiconductor laser bars are used in hair and wrinkle removal procedures, and our custom-designed lens assemblies are used for laser eye surgery. We continue to leverage our core laser, optics, and temperature-control expertise into new applications to grow our business in the life sciences.

Consumer Electronics Market

II-VI manufactures low-cost VCSELs, VCSEL arrays, and filters for the consumer electronics market. Our VCSEL products leverage our world-class 6-inch GaAs platform, combining our epitaxial wafer growth and wafer fabrication capabilities.

Our VCSELs, unlike many on the market, have already been designed into consumer products such as the computer mouse as well as for menu navigation in smart phones and vehicle steering wheels. Our VCSELs are also widely deployed in datacenters and in the emerging market for HDMI optical cables. This expertise in VCSEL technology is being leveraged for the emerging 3D sensing market. With our acquisitions of 6-inch epitaxy and wafer capabilities, we have invested significantly to round out our capacity expansion.

Automotive Market

Power-conversion electronics for high-efficiency electric vehicles need a combination of high power density, high efficiency, and high-temperature operation that is only afforded by advanced materials systems based on SiC substrates. Our SiC substrates are available in large diameters and have what we believe to be best-in-class quality and low defect levels.

Our thermoelectric modules are used to cool batteries to extend their operating life. They are also more efficient than resistive heaters when used in heated car seats and extend an electric vehicle’s range of travel in cold environments.

To operate safely, self-driving cars will rely on control systems that are informed by a comprehensive number of sensors. One such sensor is based on LiDAR, which employs semiconductor lasers to properly identify and measure the distance to obstacles ahead. Our GaAs-based semiconductor laser platform, which already enables a broad portfolio of products in communications and materials processing, is now being scaled further for consumer electronics and will be leveraged to deliver a highly reliable and cost-effective laser product for this emerging market.

Marketing and Sales

We market our products through a direct sales force and through representatives and distributors around the world. Our market strategy is focused on understanding our customers’ requirements and building market awareness and acceptance of our products. New products are continually being developed and introduced to our new and established customers in all markets.

The Company has centralized its worldwide marketing and sales functions across the Company’s business units. Sales offices have been strategically established to best serve and distribute products to our worldwide customer base. There are significant cooperation, coordination, and synergies among our business units, which capitalize on the most efficient and appropriate marketing channels to address diverse applications within our markets.

Our sales force develops effective communications with our OEM and end-user customers worldwide. Products are actively marketed through targeted mailings, telemarketing, select advertising, attendance at trade shows, and customer partnerships. Our sales force includes a highly trained team of applications engineers to assist customers in designing, testing, and qualifying our products as key components of our customers’ systems. As of June 30, 2019, we employed approximately 273 individuals in sales, marketing, and support.

We do business with a number of customers in the defense industry, who in turn generally contract with a governmental entity, typically a U.S. government agency. Most governmental programs are subject to funding approval and can be modified or terminated without warning by a legislative or administrative body.

Customers

The representative groups of customers by segments are as follows:

| Segment: |

Group/Division: |

Our Customers Are: |

Representative Customers: | |||

| Photonic Solutions | ROADM | Worldwide network system and subsystem providers of telecommunications, data communications, and CATV | • Ciena Corporation

• Fujitsu Network Communications

• Nokia Solutions and Networks | |||

| Advanced Optics | Global manufacturers of industrial and medical laser optics and crystals including commercial and consumer products used in a wide array of instruments, sensors, fiber lasers, displays, and projection devices | • Corning Incorporated

• Coherent Inc.

• Han’s Laser Technology Industry Group Co. Ltd. | ||||

| Compound Semiconductors | Engineered Materials & Laser Optics |

OEM and system integrators of industrial, medical, personal comfort, and aerospace and defense laser systems; laser end users who require replacement optics for their existing laser systems | • TRUMPF GmbH + Co. KG

• Bystronic Laser AG

• Coherent Inc. | |||

| Manufacturers and developers of integrated-circuit capital equipment for the semiconductor capital equipment industry | • ASML Holding NV

• Carl Zeiss AG

• Nikon Corporation

• KLA-Tencore Corporation | |||||

| Primary mineral processors, refiners, and providers of specialized materials used in laser optics, photovoltaics, semiconductors, thermoelectric coolers, metallurgy, and industrial products | • Aurubis AG | |||||

| Laser Devices & Systems |

Manufacturers of industrial laser components, optical communications equipment, and consumer technology applications; automotive manufacturers | • Ford Motor Company

• Laserline GmbH

• Wuhan Raycus Fiber Laser Technologies Co. Ltd. | ||||

| OEM and subsystem integrators of aiming, machine vision, biomedical instruments, and fiber lasers; laser cutting machines for super-hard materials | • BGI Complete Genomics, Shenzhen Co. Ltd.

• TRUMPF GmbH + Co. KG | |||||

| Segment: |

Group/Division: |

Our Customers Are: |

Representative Customers: | |||

| Aerospace & Defense | Manufacturers of equipment and devices for aerospace, defense, and commercial markets | • Lockheed Martin Corporation | ||||

| Wide Bandgap Semiconductors | Manufacturers and developers of equipment and devices for high-power RF electronics and high-power, voltage-switching, and power-conversion systems for both commercial and aerospace and defense applications | • Sumitomo Electric Device Innovations Inc.

• Showa Denko KK

• STMicroelectronics

• IQE PLC

• Infineon Technologies AG | ||||

| Optoelectronic & RF Devices | Manufacturers of consumer electronics and transceivers | • Sumitomo Electric Device Innovations Inc. | ||||

Competition

II-VI is a global leader in many of its product families. We compete partly on the basis of our reputation for offering highly engineered products, product and technology roadmaps, intellectual property, ability to scale, quality, on-time delivery, technical support, and pricing. We believe that we compete favorably with respect to these factors and that our vertical integration, manufacturing facilities and equipment, experienced technical and manufacturing employees, and worldwide marketing and distribution channels provide us with competitive advantages. The representative groups of our competitors by segment are as follows:

| Segment: |

Areas of Competition: |

Competitors: | ||

| Compound Semiconductors | Infrared laser optics |

• Sumitomo Electric Industries Ltd.

• MKS Instruments Inc.

• Wavelength Opto-Electronic Pte. Ltd.

• Sigma Koki Co. Ltd. | ||

|

Automated equipment and laser materials processing tools to deliver high-power 1-micron laser systems |

• Optoskand AB

• Precitec GmbH & Co. KG

• Mitsubishi Cable Industries Ltd. | |||

|

Biomedical instruments for flow cytometry, DNA sequencing, and fluorescence microscopy |

• Coherent Inc.

• Pavilion Integration Corporation

• Shimadzu Corporation | |||

|

Semiconductor laser diodes for the industrial and consumer markets |

• Lumentum Operations LLC

• Finisar Corporation

• Broadcom Ltd.

• ams AG

• Jenoptik AG

• OSRAM Licht AG

• Sony Corporation

• Hamamatsu Photonics KK | |||

|

Infrared optics for aerospace and defense applications |

• In-house fabrication and thin-film coating capabilities of major aerospace and defense customers | |||

|

Thermoelectric components, subassemblies, and systems |

• Komatsu Ltd.

• Laird PLC

• Ferrotec Corporation | |||

|

Metal-matrix composites and reaction-bonded ceramic products |

• Berliner Glas KGaA Herbert Kubatz GmbH & Co.

• CoorsTek Inc.

• Japan Fine Ceramics Co. Ltd. | |||

|

Single-crystal SiC substrates |

• Cree Inc.

• Dow Corning Corporation

• SICC Co. Ltd.

• TankeBlue Semiconductor Co. Ltd.

• ROHM Co. Ltd. |

| Segment: |

Areas of Competition: |

Competitors: | ||

| Refining and materials-recovery services for high-purity rare metals | • Vital Materials Co. Ltd.

• 5N Plus Inc.

• RETORTE GmbH Selenium Chemicals & Metals | |||

|

Photonic Solutions |

Optics, optical components, modules, and subsystems for optical communications |

• Molex LLC

• Lumentum Operations LLC | ||

|

Optical and crystal components, thin-film coatings, and subassemblies for lasers and metrology instruments |

• Casix Inc.

• CASTECH Inc.

• Hellma GmbH & Co. KG

• Research Electro-Optics Inc.

• IDEX Corporation |

In addition to competitors who manufacture products similar to those we produce, there are other technologies and products available that may compete with our technologies and products.

Our Strategy

Our strategy is to grow businesses with world-class engineered materials capabilities to advance our current customers’ strategies, penetrate new markets through innovative technologies and platforms, and enable new applications in large and growing markets. A key strategy of ours is to develop and manufacture high-performance materials and, in certain cases, components from those materials that are differentiated from those produced by our competitors. We focus on providing components that are critical to the heart of our customers’ products serving the applications mentioned above.

We have grown the number and size of our key accounts substantially. Now, a significant portion of our business is based on sales orders with market leaders, which enable our forward planning and production efficiencies. We intend to continue capitalizing and executing on this proven model, participating effectively in the growth of the markets discussed above, and continuing our focus on operational excellence as we execute our primary business strategies:

| Key Business Strategies: |

Our Plan to Execute: | |

| Identify New Products and Markets | Identify new technologies, products, and markets to meet evolving customer requirements for high-performance engineered materials through our dedicated RD&E programs to increase new product revenue and maximize return on investment. | |

|

Balanced Approach to Research and Development |

Internally and externally funded RD&E expenditures, targeting an overall investment of between 10–15% of revenues depending on the nature of the investment in terms of technology platforms or products. | |

|

Leverage Vertical Integration |

Combine RD&E and manufacturing expertise, operating with a bias toward components and production machines, reducing cost and lead time to enhance competitiveness, time to market, profitability, and quality, and enabling our customers to offer competitive products. | |

|

Investment in Scalable Manufacturing |

Strategically invest in, evaluate, and identify opportunities to consolidate and automate manufacturing operations worldwide to increase production capacity, capabilities, and cost-effectiveness. | |

|

Enhance Our Performance and Reputation as a Quality and Customer Service Leader |

Continue to improve upon our established reputation as a consistent, high-quality supplier of engineered materials and optoelectrical components that are built into our customers’ products. | |

|

Execute our global quality transformation process, eliminating costs of nonconforming materials and processes. | ||

|

Identify and Complete Strategic Acquisitions and Alliances |

Identify acquisition opportunities that accelerate our access to emerging, high-growth segments of the markets we serve and further leverage our competencies and economies of scale. | |

Research, Development, and Engineering

During the fiscal year ended June 30, 2019, the Company continued to identify, invest in, and focus our research and development on new products and platform technologies in an effort to accelerate our organic growth. This approach is managed under a disciplined innovation program that we refer to as the “II-VI Phase Gate Process.”

From time to time, the ratio of externally funded contract activity to internally funded contract activity varies due to the unevenness of government-funded research programs and changes in the focus of our internally funded research programs. We are committed to having the right mix of internally and externally funded research that ties closely to our long-term strategic objectives.

We devote significant resources to RD&E programs directed at the continuous improvement of our existing products and processes and to the timely development of new materials, technologies, and products. We believe that our RD&E activities are essential to establishing and maintaining a leadership position in each of the markets we serve. As of June 30, 2019, we employed 1,707 people in RD&E functions. In addition, certain manufacturing personnel support or participate in our research and development efforts on an ongoing basis. We believe this interaction between the development and manufacturing functions enhances the direction of our projects, reducing costs and accelerating technology transfers.

During the fiscal year ended June 30, 2019, we focused our RD&E investments in the following areas:

| Segment: |

Area of Development: |

Our RD&E Investments: | ||

| Compound Semiconductors | High-power laser diodes and high-volume manufacturing | Focusing on increasing fiber coupled optical output power of multi-emitter modules. | ||

|

Developing high-power VCSELs for consumer devices and next-generation, high-speed VCSELs for 3D sensing and datacom applications. | ||||

|

High power beam delivery |

Developing multi-kW beam delivery systems and cables for welding and cutting. | |||

|

CVD diamond technology |

Developing CVD diamond for EUV applications. | |||

|

Broadening our portfolio beyond infrared window applications. | ||||

|

SiC technology |

Developing advanced SiC substrate growth technologies to support emerging markets in GaN RF and SiC power electronics. | |||

|

Continuous improvement to maintain world-class, high-quality, large-diameter substrates and epitaxial wafers. | ||||

|

Thermoelectric materials and devices |

Continuing to develop leading Bi2Te3 materials for thermoelectric cooling/heating. | |||

|

Focusing on thermoelectric power-generation capability in order to introduce new products to the market. | ||||

|

Metal-matrix composites and reaction-bonded ceramics |

Support industrial customers in developing application-specific wear and thermal-management solutions. | |||

|

Fiber laser technologies |

Developing high-power fiber laser technologies for aerospace and defense and commercial applications. | |||

|

Photonic Solutions |

Photonics design |

Continuing to develop and improve crystal materials, precision optical parts, and laser device components for photonics applications. | ||

|

Pump lasers |

Continuing to invest in our next-generation GaAs pump laser portfolio and flexible manufacturing footprint to address evolving terrestrial and undersea markets. | |||

|

Developing InP growth and processing capability together with associated packaging technology. | ||||

|

Optical amplifiers and subsystems |

Investing and broadening the range of amplifiers and integrated subsystems including ROADMs. | |||

|

Wavelength selective switching |

Developing LC and LCOS technologies and associated module designs for WSS; investing in manufacturing equipment and the automation platform. | |||

|

Optical monitoring |

Continuing optical channel monitoring investment. | |||

|

Developing OTDRs to monitor the health of the fiber plant. | ||||

|

Micro-optics manufacturing |

Shifting toward smaller, more compact optics and automated assembly platforms and packages. | |||

|

Investing in manufacturing equipment for computerized processes. |

The development of our products and manufacturing processes is largely based on proprietary technical know-how and expertise. We rely on a combination of contract provisions, trade secret laws, invention disclosures, and patents to protect our proprietary rights. We have entered into selective intellectual property licensing agreements. We have asserted in the past, and expect that we will continue to assert, as well as vigorously protect, our intellectual property rights. We have a total of approximately 800 patents globally.

Internally funded research and development expenditures were $139.2 million, $116.9 million, and $96.8 million for the fiscal years 2019, 2018, and 2017, respectively. For these same periods, externally funded research and development expenditures were $14.7 million, $12.7 million, and $8.7 million, respectively, and were included in cost of goods sold in the Consolidated Statements of Earnings.

Export and Import Compliance

We are required to comply with various export/import control and economic sanction laws, including:

| • | The International Traffic in Arms Regulations administered by the U.S. Department of State, Directorate of Defense Trade Controls, which among other things impose licensing requirements on the export from the United States of certain defense articles and defense services, generally including items that are specially designed or adapted for a military application and/or listed on the United States Munitions List; |

| • | The Export Administration Regulations administered by the U.S. Department of Commerce, Bureau of Industry and Security, which among other things impose licensing requirements on certain dual-use goods, technology, and software, i.e., items that potentially have both commercial and military applications; |

| • | The regulations administered by the U.S. Department of the Treasury, Office of Foreign Assets Control, which implement economic sanctions imposed against designated countries, governments, and persons based on U.S. foreign policy and national security considerations; and |

| • | The import regulations administered by U.S. Customs and Border Protection. |

Foreign governments have also implemented similar export and import control regulations, which may affect our operations or transactions subject to their jurisdiction. For additional discussions regarding our import and export compliance, see the discussion set forth in Item 1A – Risk Factors of our Annual Report Form on Form 10-K filed August 16, 2019.

Trade Secrets, Patents, and Trademarks

Our use of trade secrets, proprietary know-how, trademarks, copyrights, patents, contractual confidentiality, and IP ownership provisions help us develop and maintain our competitive position with respect to our products and manufacturing processes. We aggressively pursue process and product patents in certain areas of our businesses, and in certain jurisdictions across the globe. We have entered into selective intellectual property licensing agreements. We have confidentiality and noncompetition agreements with certain personnel. We require that our U.S. employees sign a confidentiality and noncompetition agreement upon commencement of their employment with us.

The design, processes, and specialized equipment utilized in our engineered materials, advanced components, and subsystems are innovative, complex, and difficult to duplicate. However, there can be no assurance that others will not develop or patent similar technology, or that all aspects of our proprietary technology will be protected. Others have obtained patents covering a variety of materials, devices, equipment, configurations, and processes, and others could obtain patents covering technology similar to ours. We may be required to obtain licenses under such patents, and there can be no assurance that we would be able to obtain such licenses, if required, on commercially reasonable terms, or that claims regarding rights to technology will not be asserted that may adversely affect our results of operations. In addition, our research and development contracts with agencies of the U.S. government present a risk that project-specific technology could be disclosed to competitors as contract reporting requirements are fulfilled.

Executive Officers of the Registrant

The executive officers of the Company and their respective ages and positions as of June 30, 2019, are set forth below. Each executive officer listed has been appointed by the Board of Directors to serve until removed or until such person’s successor is appointed and qualified.

| Name | Age | Position | ||

| Vincent D. Mattera, Jr. |

63 | President and Chief Executive Officer; Director | ||

| Mary Jane Raymond |

58 | Chief Financial Officer and Treasurer and Assistant Secretary | ||

| Giovanni Barbarossa |

57 | Chief Technology Officer and President, Compound Semiconductors | ||

| Name | Age | Position | ||

| Gary A. Kapusta |

59 | Chief Operating Officer | ||

| Jo Anne Schwendinger |

63 | Chief Legal and Compliance Officer and Secretary | ||

| David G. Wagner |

56 | Vice President, Human Resources | ||

Vincent D. Mattera, Jr. Dr. Mattera initially served as a member of the II-VI Board of Directors from 2000 to 2002. Dr. Mattera joined the Company as a Vice President in 2004 and served as Executive Vice President from January 2010 to November 2013, when he became the Chief Operating Officer. In November 2014, Dr. Mattera became the President and Chief Operating Officer and was reappointed to the Board of Directors. In November 2015, he became the President of II-VI. In September 2016, Dr. Mattera became the Company’s third President and Chief Executive Officer in 45 years. During his career at II-VI, he has assumed successively broader management roles, including as a lead architect of the Company’s diversification strategy. He has provided vision, energy, and dispatch to the Company’s growth initiatives, including overseeing the acquisition-related integration activities in the United States, Europe, and Asia—especially in China—thereby establishing additional platforms. These have contributed to a new positioning of the Company into large and transformative global growth markets while increasing considerably the global reach of the Company, deepening the technology and IP portfolio, broadening the product roadmap and customer base, and increasing the potential of II-VI.

Prior to joining II-VI as an executive, Dr. Mattera had a continuous 20-year career in the Optoelectronic Device Division of AT&T Bell Laboratories, Lucent Technologies, and Agere Systems, during which he led the development and manufacturing of semiconductor laser-based materials and devices for optical and data communications networks. Dr. Mattera has 34 years of leadership experience in the compound semiconductor materials, device technology, operations, and markets that are core to II-VI’s business and strategy. Dr. Mattera holds a B.S. degree in chemistry from the University of Rhode Island (1979) and a Ph.D. in chemistry from Brown University (1984). He completed the Stanford University Executive Program (1996).

Mary Jane Raymond has been Chief Financial Officer and Treasurer of the Company since March 2014. Previously, Ms. Raymond was Executive Vice President and Chief Financial Officer of Hudson Global Inc. (Nasdaq:HSON) from 2005 to 2013. Ms. Raymond was the Chief Risk Officer and Vice President and Corporate Controller at Dun and Bradstreet Inc. from 2002 to 2005. Additionally, she was the Vice President, Merger Integration, at Lucent Technologies from 1997 to 2002 and held several management positions at Cummins Engine Company from 1988 to 1997. Ms. Raymond holds a B.A. degree in Public Management from St. Joseph’s University, and an MBA from Stanford University.

Giovanni Barbarossa joined II-VI in 2012, served as the Chief Technology Officer from 2012 through June 30, 2019 and as the President, II-VI Laser Solutions, from 2014 to 2019, and has served as the President, Compound Semiconductors, since 2019. Dr. Barbarossa was employed at Avanex Corporation from 2000 through 2009, serving in various executive positions in product development and general management, and ultimately serving as President and Chief Executive Officer. When Avanex merged with Bookham Technology, forming Oclaro, Dr. Barbarossa became a member of the Board of Directors of Oclaro and served as such from 2009 to 2011. Previously, he had management responsibilities at British Telecom, AT&T Bell Labs, Lucent Technologies, and Hewlett-Packard. Dr. Barbarossa graduated from the University of Bari, Italy, with a B.S. degree in Electrical Engineering and holds a Ph.D. in Photonics from the University of Glasgow, U.K.

Gary A. Kapusta joined II-VI in February 2016 and served from then through June 30, 2019 as the Company’s Chief Operating Officer. Prior to his employment with the Company, Mr. Kapusta served in various roles at Coca-Cola, including as President and Chief Executive Officer, Coca-Cola Bottlers’ Sales & Services LLC; President, Customer Business Solutions; and Vice President, Procurement Transformation, Coca-Cola Refreshments. He joined Coca-Cola following a 19-year career at Agere Systems, Lucent Technologies, and AT&T. Mr. Kapusta graduated from the University of Pittsburgh with B.S. and M.S. degrees in Industrial Engineering and holds an MBA from Lehigh University.

Jo Anne Schwendinger has served as the Company’s Chief Legal and Compliance Officer and Secretary since March 2017. Ms. Schwendinger also served as the Company’s General Counsel and Secretary from when she joined the Company in March 2017 until November 2017. Prior to her employment with the Company, Ms. Schwendinger practiced law with the firm Blank Rome LLP from August 2016 until February 2017. Previously, Ms. Schwendinger served in various legal roles at Deere & Company from February 2000 until August 2016, including Regional General Counsel–Asia-Pacific and Sub-Saharan Africa and Assistant General Counsel. Ms. Schwendinger holds a bachelor’s degree from the Université d’Avignon et des Pays de Vaucluse, a master’s degree from the Université de Strasbourg, and a Juris Doctor degree from the University of Pittsburgh Law School.

David G. Wagner has been employed by the Company since 2008 and has been Vice President, Human Resources, since 2011. Prior to his employment with the Company, Mr. Wagner was employed with Owens Corning (NYSE:OC) from 1985 through 2008, serving in various human resource management positions, ultimately becoming Vice President, Human Resources, for Owen Corning’s global sales force. Mr. Wagner graduated with a B.S. degree in Human Resources Management from Juniata College in 1985. Mr. Wagner has announced his intention to retire from the Company, to be effective in 2019, at a date to be determined.

Appointment of Walter R. Bashaw II as President Effective July 1, 2019

On June 27, 2019, the Board of Directors of the Company appointed Walter R. Bashaw II as the Company’s President, effective July 1, 2019. Dr. Mattera remains the Company’s Chief Executive Officer and a member of the Company’s Board of Directors.

Mr. Bashaw, 54, has served as the Company’s Senior Vice President, Corporate Strategy and Development, Administration since October 2018 and previously served as the Company’s Interim General Counsel and Secretary from December 2015 until March 2017. Mr. Bashaw also previously was the Managing Shareholder and a Director of the law firm of Sherrard, German & Kelly, P.C. (“SGK”) in Pittsburgh, Pennsylvania, until October 2018 and has been Of Counsel at SGK since October 2018. Mr. Bashaw graduated from The Pennsylvania State University with a B.S. degree in Logistics and also holds a J.D. degree from the University of Pittsburgh School of Law.

Changes in Management Roles Effective July 1, 2019

The Company’s Board of Directors also determined on June 27, 2019 that Dr. Barbarossa would be reassigned to the position of Chief Strategy Officer and President of the Compound Semiconductor segment, effective July 1, 2019. The Company’s Board of Directors appointed Christopher Koeppen, who most recently served as the Company’s Vice President, Laser Systems Group, as the Company’s Chief Technology Officer, effective July 1, 2019. Mr. Kapusta, who most recently served as the Company’s Chief Operating Officer, was reassigned by the Company’s Board of Directors to the position of Chief Procurement Officer, effective July 1, 2019.

Availability of Information

Our internet address is www.ii-vi.com. Information contained on our website is not part of, and should not be construed as being incorporated by reference into, this Exhibit 99.1 to our Current Report on Form 8-K. We post the following reports on our website as soon as reasonably practical after they are electronically filed with or furnished to the Securities and Exchange Commission (“SEC”): our Annual Reports on Form 10-K, our Quarterly Reports on Form 10-Q, our Current Reports on Form 8-K, and any amendments to those reports or statements filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act. In addition, we post our proxy statements on Schedule 14A related to our annual shareholders’ meetings as well as reports filed by our directors, officers, and 10% beneficial owners pursuant to Section 16 of the Exchange Act. In addition, all filings are available via the SEC’s website (www.sec.gov). We also make our corporate governance documents available on our website, including the Company’s Code of Business Conduct and Ethics, governance guidelines, and the charters for our Board committees. All such documents are located on the Investors page of our website and are available free of charge.

PART II

| Item 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Forward-Looking Statements

Certain statements contained in this Management’s Discussion and Analysis of Financial Condition and Results of Operations are forward-looking statements. Forward-looking statements are also identified by words such as “expects,” “anticipates,” “believes,” “intends,” “plans,” “projects” or similar expressions. Actual results could differ materially from those anticipated in these forward-looking statements for many reasons, including those potential risks set forth in Item 1A, of our Annual Report on Form 10-K filed on August 16, 2019, which are incorporated herein by reference.

Overview

II-VI Incorporated (“II-VI,” the “Company,” “we,” “us” or “our”), a worldwide leader in engineered materials and optoelectronic components, is a vertically integrated manufacturing company that develops innovative products for diversified applications in the industrial materials processing, optical communications, aerospace and defense, consumer electronics, semiconductor capital equipment, life science and automotive applications and markets. The Company produces a wide variety of application-specific photonic and electronic materials and components, and deploys them in various forms, including integration with advanced software.

The Company generates revenues, earnings and cash flows from developing, manufacturing and marketing engineered materials and optoelectronic components and devices for precision use in industrial materials processing, optical communications, consumer electronics, semiconductor capital equipment, life sciences and automotive applications. We also generate revenue, earnings and cash flows from government funded research and development contracts relating to the development and manufacture of new technologies, materials and products.

Our customer base includes OEMs, laser end-users, system integrators of high-power lasers, manufacturers of equipment and devices for the industrial, optical communications, aerospace and defense, semiconductor, medical and life science markets, consumer, U.S. government prime contractors, various U.S. Government agencies and thermoelectric integrators. `

In September 2018, November 2018, and March 2019, the Company completed its acquisitions of CoAdna Holdings, Inc. (“CoAdna”), an additional product line, and Redstone Aerospace Corporation (“Redstone”), respectively. See Note 3, Acquisitions, to our Consolidated Financial Statements contained in Item 8 of this Exhibit 99.1 to our Current Report on Form 8-K. The operating results of these acquisitions have been reflected in the selected financial information of the Company’s Photonic Solutions segment since the respective dates of the acquisitions, with the exclusion of Redstone which is reflected in the Compound Semiconductors segment.

As we grow, we are focused on scaling our Company and deriving the continued benefits of vertical integration as we strive to be a best in class competitor in all of our highly competitive markets. The Company may elect to change the way in which the Company operates or is organized in the future to enable the most efficient implementation of its strategy.

Pending Acquisition of Finisar Corporation

II-VI and Finisar have entered into an Agreement and Plan of Merger, dated as of November 8, 2018 (the “Merger Agreement”). Pursuant to the terms of the Merger Agreement, Mutation Merger Sub Inc., a Delaware corporation and wholly owned subsidiary of II-VI, will be merged with and into Finisar, and Finisar will continue as the surviving corporation in the merger and a wholly owned subsidiary of II-VI (the “Merger”).

If the Merger is consummated, Finisar stockholders will be entitled to receive, at their election, consideration per share of common stock of Finisar (the “Finisar Common Stock”) consisting of (i) $26.00 in cash, without interest (the “Cash Consideration”), (ii) 0.5546 shares of II-VI common stock (the shares, the “II-VI Common Stock,” and the consideration, the “Stock Consideration”), or (iii) a combination of $15.60 in cash, without interest, and 0.2218 shares of II-VI Common Stock (the “Mixed Consideration,” and, together with the Cash Consideration and the Stock Consideration, the “Merger Consideration”). The Cash Consideration and the Stock Consideration are subject to proration adjustment pursuant to the terms of the Merger Agreement such that the aggregate Merger Consideration will consist of approximately 60% cash and approximately 40% II-VI Common Stock assuming a per share price of II-VI common stock equal to the price when the Merger Agreement was signed on November 8, 2018, which was $46.88 per share.

At the effective time of the Merger (the “Effective Time”), each option granted pursuant to Finisar’s 2005 Stock Incentive Plan, as such plan has been further amended and restated (each, a “Finisar Stock Option”), or portion thereof, that is outstanding and unexercised as of immediately prior to the Effective Time (whether vested or unvested) will be cancelled, terminated and converted into the right to receive an amount of Mixed Consideration that would be payable to a holder of such number of shares of Finisar Common Stock equal to the quotient of (i) the product of (a) the excess, if any, of $26.00 over the exercise price per share of such Finisar Stock Option multiplied by (b) the number of shares of Finisar Common Stock subject to such Finisar Stock Option, divided by (ii) $26.00.

At the Effective Time, each restricted stock unit granted pursuant to Finisar’s 2005 Stock Incentive Plan, as such plan has been further amended and restated (each, a “Finisar Restricted Stock Unit”), or portion thereof , that is outstanding and subject to a performance-based vesting condition that relates solely to the value of Finisar Common Stock will, to the extent such Finisar Restricted Stock Unit vests in accordance with its terms in connection with the Merger (the “Participating RSUs”), be cancelled and extinguished and converted into the right to receive the Cash Consideration, the Stock Consideration or the Mixed Consideration at the election of the holder of such Participating RSUs, subject to proration adjustment.

At the Effective Time, each Finisar Restricted Stock Unit (or portion thereof) that is outstanding and unvested, does not vest in accordance with its terms in connection with the Merger and is either (x) subject to time-based vesting requirements only or (y) subject to a performance-based vesting condition other than the value of Finisar Common Stock will be assumed by II-VI (each, an “Assumed RSU”). Each Assumed RSU will be subject to substantially the same terms and conditions as applied to the related Finisar Restricted Stock Unit immediately prior to the Effective Time, including the vesting schedule (and the applicable performance-vesting conditions in the case of a grant contemplated by clause (y) of the preceding sentence) and any provisions for accelerated vesting applicable thereto, except that the number of shares of II-VI Common Stock subject to each Assumed RSU will be equal to the product of (i) the number of shares of Finisar Common Stock underlying such unvested Finisar Restricted Stock Unit award as of immediately prior to the Effective Time multiplied by (ii) the sum of (a) 0.2218 plus (b) the quotient obtained by dividing (1) $15.60 by (2) the volume weighted average price per share of II-VI Common Stock (rounded to the nearest cent) on the Nasdaq Global Select Market for the ten consecutive trading days ending on (and including) the third trading day immediately prior to the Effective Time (with the resulting number rounded down to the nearest whole share).

II-VI filed with the SEC a registration statement on Form S-4 relating to the Merger, and that registration statement became effective in accordance with the provisions of Section 8(a) of the Securities Act of 1933, as amended, on February 7, 2019. Shareholders of II-VI and stockholders of Finisar voted to approve proposals related to the Merger at special meetings held on March 26, 2019 by the respective companies.

The waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, with respect to the Merger has expired without a request for additional information. Other regulatory approvals applicable to the Merger have been obtained in Germany, Mexico and Romania.

The completion of the Merger is subject to the satisfaction or waiver of certain additional customary closing conditions, including review and approval of the Merger by the State Administration for Market Regulation in China. The Company is planning to refile with the State Administration for Market Regulation in China, extending the approval period. Subject to the satisfaction or waiver of each of the closing conditions, II-VI and Finisar expect that the Merger will be completed in the second half of calendar 2019. However, it is possible that factors outside the control of both companies could result in the Merger being completed at a different time or not at all.