Attached files

| file | filename |

|---|---|

| EX-23 - EX-23.2 - Sunnova Energy International Inc. | d875054dex232.htm |

| EX-21 - EX-21.1 - Sunnova Energy International Inc. | d875054dex211.htm |

| EX-10 - EX-10.8 - Sunnova Energy International Inc. | d875054dex108.htm |

| EX-10 - EX-10.7 - Sunnova Energy International Inc. | d875054dex107.htm |

| EX-10 - EX-10.6 - Sunnova Energy International Inc. | d875054dex106.htm |

| EX-10 - EX-10.3.1 - Sunnova Energy International Inc. | d875054dex1031.htm |

| EX-10 - EX-10.2.7 - Sunnova Energy International Inc. | d875054dex1027.htm |

| EX-10 - EX-10.2.6 - Sunnova Energy International Inc. | d875054dex1026.htm |

| EX-5 - EX-5.1 - Sunnova Energy International Inc. | d875054dex51.htm |

| EX-4 - EX-4.12 - Sunnova Energy International Inc. | d875054dex412.htm |

| EX-4 - EX-4.11 - Sunnova Energy International Inc. | d875054dex411.htm |

| EX-4 - EX-4.4 - Sunnova Energy International Inc. | d875054dex44.htm |

| EX-4 - EX-4.2.1 - Sunnova Energy International Inc. | d875054dex421.htm |

| EX-1 - EX-1.1 - Sunnova Energy International Inc. | d875054dex11.htm |

Table of Contents

As filed with the Securities and Exchange Commission on June 29, 2020.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

Sunnova Energy International Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 4931 | 30-1192746 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

20 East Greenway Plaza, Suite 540

Houston, Texas 77046

(281) 985-9904

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Walter A. Baker

Executive Vice President, General Counsel and Secretary

Sunnova Energy International Inc.

20 East Greenway Plaza, Suite 540

Houston, Texas 77046

(281) 985-9904

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Joshua Davidson Travis J. Wofford Baker Botts L.L.P. 910 Louisiana Street Houston, TX 77002 (713) 229-1234 |

David P. Oelman E. Ramey Layne Vinson & Elkins L.L.P. 1001 Fannin Street Houston, TX 77002 (713) 758-2222 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of each Class of Securities to be Registered |

Shares to be Registered |

Proposed Offering Price |

Maximum Offering Price(2) |

Amount of Registration Fee | ||||

| Common Stock, $0.0001 per share |

9,200,000(1) | $19.57 | $180,044,000(1) | $23,369.71 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes (i) 6,847,975 in outstanding shares of common stock offered by certain of the selling stockholders, (ii) 1,152,025 shares of common stock to be issued pursuant to the conversion of $15.4 million aggregate principal amount of convertible notes held by certain of the selling stockholders and (iii) an additional 1,200,000 shares of our common stock that the underwriters have the option to purchase from certain of the selling stockholders. |

| (2) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(c) of the Securities Act of 1933, as amended. The proposed maximum offering price per share and proposed maximum aggregate offering price are based on the average high and low sales prices of the Registrant’s common stock on June 22, 2020 as reported on the New York Stock Exchange. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the Registration Statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated June 29, 2020.

8,000,000 Shares of Common Stock

This prospectus covers the offer and resale of 8,000,000 shares of common stock of Sunnova Energy International Inc. (“SEI”) by the selling stockholders identified on page 136 of this prospectus. A portion of these shares are issuable upon conversion of our 9.75% convertible senior notes due 2025 (“9.75% convertible senior notes”) that we previously issued to certain of the selling stockholders. We will not receive any proceeds from the sale of the shares offered by this prospectus or upon the conversion of the 9.75% convertible senior notes.

Our common stock is listed on the New York Stock Exchange (the “NYSE”) under the symbol “NOVA.” On June 26, 2020, the last reported sale price of our common stock on the NYSE was $18.85.

To the extent that the underwriters sell more than 8,000,000 shares of common stock, the underwriters have a 30-day option to purchase up to an additional 1,200,000 shares of common stock from certain of the selling stockholders at the public offering price less underwriting discounts and commissions. We are not offering any shares of our common stock under this prospectus and we will not receive any proceeds from the sale of shares of our common stock by the selling stockholders.

See the section titled “Risk Factors” beginning on page 17 of this prospectus to read about risks you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Price to Public |

Underwriting Discounts and Commissions (1) |

Proceeds to Selling Stockholders (2) |

||||||||||

| Per share |

$ | $ | $ | |||||||||

| Total |

$ | $ | $ | |||||||||

| (1) | See the section titled “Underwriting” for additional information regarding compensation payable to the underwriters. |

| (2) | We have agreed to pay all offering expenses, other than underwriting discounts and commissions, for the selling stockholders incurred in connection with the sale by the selling stockholders. |

The underwriters expect to deliver the shares of common stock against payment therefor on or about , 2020.

| J.P. Morgan | BofA Securities | Credit Suisse | Goldman Sachs & Co. LLC |

The date of this prospectus is , 2020

Table of Contents

| Page | ||||

| 1 | ||||

| 17 | ||||

| 69 | ||||

| 71 | ||||

| 72 | ||||

| 73 | ||||

| 74 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

80 | |||

| 119 | ||||

| 135 | ||||

| 136 | ||||

| 139 | ||||

| 146 | ||||

| MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES TO NON-U.S. HOLDERS OF OUR COMMON STOCK |

148 | |||

| INVESTMENT IN SUNNOVA ENERGY INTERNATIONAL INC. BY EMPLOYEE BENEFIT PLANS |

153 | |||

| 155 | ||||

| 164 | ||||

| 165 | ||||

| 166 | ||||

We have not, and the selling stockholders and the underwriters have not, authorized anyone to provide any information or make any representations other than those contained in this prospectus or in any free writing prospectus prepared by or on behalf of us. We, the selling stockholders and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The selling stockholders are offering to sell, and seeking offers to buy, shares of our common stock only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock.

For investors outside of the United States: Neither we nor any of the selling stockholders or the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, this offering and the distribution of this prospectus outside of the United States.

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. Please read the section titled “Risk Factors” on page 17 and the section titled “Cautionary Language Regarding Forward-Looking Statements” in this prospectus.

i

Table of Contents

This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, including the sections titled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Cautionary Language Regarding Forward-Looking Statements” and read our consolidated financial statements and the related notes included in our Annual Report on Form 10-K for the year ended December 31, 2019 and Quarterly Report on Form 10-Q for the quarter ended March 31, 2020 before making an investment decision. The information presented in this prospectus assumes, unless otherwise indicated, that the underwriters do not exercise their option to purchase additional shares of common stock from certain of the selling stockholders. Unless the context otherwise requires, the terms “Registrant,” “Sunnova,” the “company,” “we,” “us” and “our” or like terms in this prospectus refer to Sunnova Energy Corporation and its subsidiaries, our predecessor for accounting purposes, when used in a historical context (periods prior to July 29, 2019, the closing date of our initial public offering), and to SEI and its subsidiaries when used in the present tense or prospectively (on or after July 29, 2019, the closing date of our initial public offering).

Sunnova Energy International Inc.

Our Business

We are a leading residential solar and energy storage service provider, serving more than 85,000 customers in more than 20 United States (“U.S.”) states and territories. Our goal is to be the leading provider of clean, affordable and reliable energy for consumers, and we operate with a simple mission: to power energy independence so that homeowners have the freedom to live life uninterrupted. We were founded to deliver customers a better energy service at a better price; and, through our solar and solar plus energy storage service offerings, we are disrupting the traditional energy landscape and the way the 21st century customer generates and consumes electricity.

We have a differentiated residential solar dealer model in which we partner with local dealers who originate, design and install our customers’ solar energy systems and energy storage systems on our behalf. Our focus on our dealer model enables us to leverage our dealers’ specialized knowledge, connections and experience in local markets to drive customer origination while providing our dealers with access to high quality products at competitive prices as well as technical oversight and expertise. We believe this structure provides operational flexibility, reduced exposure to labor shortages and lower fixed costs relative to our peers, furthering our competitive advantage.

We offer customers products to power their homes with affordable solar energy. We are able to offer savings and storage opportunities to most customers compared to utility-based retail rates with little to no up-front expense to the customer, and we are able to provide energy resiliency and reliability to our solar plus energy storage customers. Our solar service agreements take the form of a lease, power purchase agreement (a “PPA”) or loan. The initial term of our solar service agreements is typically either 10 or 25 years. Service is an integral part of our agreements and includes operations and maintenance, monitoring, repairs and replacements, equipment upgrades, on-site power optimization for the customer (for both supply and demand), the ability to efficiently switch power sources among the solar panel, grid and energy storage system, as appropriate, and diagnostics. During the life of the contract we have the opportunity to integrate related and evolving home servicing and monitoring technologies to upgrade the flexibility and reduce the cost of our customers’ energy supply.

In the case of leases and PPAs, we also currently receive tax benefits and other incentives from federal, state and local governments, a portion of which we finance through tax equity, non-recourse

1

Table of Contents

debt structures and hedging arrangements in order to fund our upfront costs, overhead and growth investments. We have an established track record of attracting capital from diverse sources. From our inception through March 31, 2020, we have raised more than $5.5 billion in total capital commitments from equity, debt and tax equity investors.

In addition to providing ongoing service as a standard component of our solar service agreements, we also offer Sunnova Protect Services, which provides ongoing energy services to customers who purchased their solar energy system through unaffiliated third parties. Under these arrangements, we agree to provide monitoring, maintenance and repair services to these customers for the life of the service contract they sign with us. We believe the quality and scope of our comprehensive energy service offerings, whether to customers that obtained their solar energy system through us or through another party, is a key differentiator between us and our competitors.

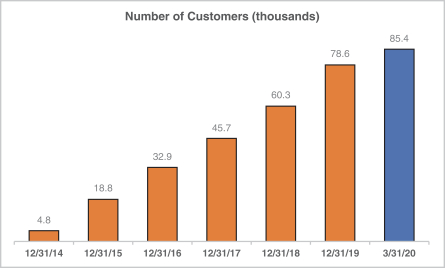

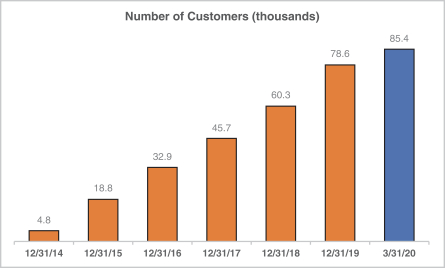

We commenced operations in January 2013 and began providing solar energy services under our first solar energy system in April 2013. Since then, our brand, innovation and focused execution have driven significant growth in our market share and in the number of customers on our platform. We operate one of the largest fleets of residential solar energy systems in the U.S., comprising more than 625 megawatts of generation capacity and serving more than 85,000 customers. We define number of customers to include each customer that is party to an in-service solar service agreement. The following chart illustrates the growth in our number of customers from December 31, 2015 through March 31, 2020.

Our Customer Value Proposition

Our customer value proposition includes:

| • | A better energy service at a better price. Our residential solar service agreements offer customers low-cost, clean solar energy along with comprehensive customer service and system maintenance over the lifetime of their contract with us. We generally price our solar service agreements lower than utility-provided electricity, offering customers the opportunity to reduce their overall electric utility bill. The initial price or energy rate is fixed (often coupled with a price escalator at the customer’s option), providing predictable prices over the entire 10 or |

2

Table of Contents

| 25-year term of the solar service agreements. We believe this provides the customer valuable protection against unpredictable increases in utility rates. We also offer energy storage solutions to those customers who are looking for energy resiliency and reliability. In addition, we monitor, maintain and service the system over the life of the contract, ensuring that customers benefit from a better energy service, generally at a better price over the life of their relationship with us. |

| • | Best-in-class customer service. All Sunnova solar service agreements include comprehensive servicing solutions designed to ensure maximum performance and a high-quality customer experience. Our solar service agreements provide remote monitoring, maintenance and warranty coverage and services for the entire contract term. The majority of our solar service agreements contain a production guarantee to help customers capture the savings they expect. Our digital monitoring platforms allow customers to monitor the performance of their systems, and we have a staff of bilingual, well-trained professionals on-call to respond to customer questions and concerns. We believe that our customer service is a critical component of our value proposition and we pride ourselves on the experience we provide. In addition to the customers that we service and finance through lease, loans and PPAs, we also offer service-only contracts to customers who have non-Sunnova solar energy systems installed, but do not have the benefit of a comprehensive service relationship. We believe this focus on service differentiates us from other solar providers and facilitates long-term, active relationships with our customers. |

| • | Greater resiliency and independence from the grid. Our energy storage systems increase customers’ independence from the centralized utility and provide on-site backup power when there is a grid outage due to storms, wildfires, other natural disasters and other power failures. In addition, variable electricity prices, known as time-of-use rates, can make it more profitable to sell solar energy to the grid rather than consume it, allowing customers to save money. This combination of increased energy resilience and independence from the grid is a strong incentive for customers to adopt solar and energy storage. |

| • | Reliable, clean power. Our solar and energy storage services allow customers to reduce their environmental footprint by buying clean, affordable and reliable energy. In addition to being a more sustainable energy option than centralized grid-provided energy predominantly powered by fossil fuels, our service offerings are also well-positioned to meet the evolving needs of energy consumers. |

| • | Flexible financing solutions. We offer an array of financing solutions to provide solar and storage services to customers at minimal or no upfront cost. Our solar and solar plus energy storage contracts include leases, PPAs and loans. These flexible solutions allow us to tailor our offerings to meet customers’ needs: we can offer them a fixed payment plan per month to provide predictability, or a contract where monthly payments vary with solar production levels. All of our financing options are Sunnova-branded, and we manage all billing and collections in-house. |

Our Competitive Strengths

Our key competitive strengths include:

| • | Focus on long-term customer relationships. We serve as the primary point of contact for our customers over the duration of their solar service agreements. This direct, long-term relationship with customers drives our focused efforts to provide excellent customer service both directly and through our dealers by providing them with access to high quality components |

3

Table of Contents

| and system designs. We believe that by providing an excellent customer experience from the outset, we are well-positioned to meet the evolving needs of our energy consumers, including energy storage systems today and the potential ability to integrate home automation, electric vehicle charging and other home technology solutions in the future. |

| • | Local dealer model provides operational flexibility and lower fixed costs. We believe our network of approximately 190 local, independent dealers and sub-dealers as of March 31, 2020 provides us with competitive advantages in originating new customer contracts and servicing systems. Our dealer model facilitates our entry into new markets by enabling us to develop relationships with existing local businesses and leveraging their local knowledge and sourcing new sales leads. Similarly, we can quickly refocus our origination efforts and capital deployment strategy to different markets in response to changing dynamics and regulatory developments. We believe our differentiated dealer model enables us to have lower fixed costs and reduced fixed overhead expenses relative to our peers who bear the burden of local market origination, as well as sales, marketing and installation costs, although use of our dealer model means we do not have direct control over certain costs related to our business. |

| • | Mutually beneficial partnership with our dealers. Attracting the best dealers in the business to partner with us has been one of our principal goals since we began operating. We have successfully developed and built our dealer network by offering a compelling value proposition. We have a suite of branding, marketing and technology tools and products to support our dealers’ origination efforts at attractive unit economics. In turn, our dealers benefit from being able to sell a Sunnova-branded solar service agreement that is backed by our best-in-class customer service and proven financing track record. We also have multi-year exclusivity arrangements with several key dealers, under which these dealers will generally not sell solar energy systems for any other company. For certain other dealers, substantially all of the solar service agreements originated by such dealers are Sunnova agreements, although they are under no exclusivity arrangement. We instill trust in our dealers and do not compete with them in their local markets. |

| • | Stable and diversified business model. Our business model is underpinned by contracted cash flows, geographic diversification and proven technology. Our assets are supported by long-term contracted cash flows, with most of our solar service agreements having an initial term of either 10 or 25 years with an opportunity for customers to renew for up to an additional 10 years via two five-year renewal periods. Our stringent customer credit approval policies have resulted in limited defaults in customer payments on our solar service agreements. As of March 31, 2020, our customers had, at the time of signing the solar service agreement, an average FICO score of 739. In addition, we believe our diversification across geographies and equipment manufacturers contributes to the overall stability of our business. As of March 31, 2020, approximately 25%, 25% and 13% of our solar energy systems were located in New Jersey, California, and Puerto Rico, respectively, with our total reach spanning more than 20 U.S. states and territories, reducing the adverse impact on our business of adverse climate, regulatory or economic conditions in any one jurisdiction. Additionally, we have a broad range of suppliers for our solar energy and energy storage system components, which tends to reduce warranty concentration and component and supply risk. |

| • | Demonstrated access to diversified funding sources. We have financed the capital investment required for solar energy system and energy storage system installations from a broad range of sources and investors, including large institutional investors, private equity sponsors and limited foreign investment. Our relationships with, and access to, these investors have allowed us to raise more than $5.5 billion in total capital commitments from equity, debt and tax equity investors. Our diversified access to capital and long-term relationships with |

4

Table of Contents

| multiple funding sources have enabled us to retain significant assets on our balance sheet, without the need to sell assets to raise cash. We believe that our strong balance sheet and access to capital provides us with a competitive advantage. However, we may not be able to access sources of capital due to general market conditions, market perception of our business or the renewable energy industry as a whole. |

| • | Focused and experienced management team. Our CEO and founder has always led our company with a focused and consistent goal of providing reliable and affordable solar energy through best-in-class customer service. Our management team’s long-term focus and commitment underpin everything we do. In addition, our management team has substantial experience in the renewable energy and power sectors and was among the pioneers of the distributed solar industry, providing the team a strong understanding of dealer networks and the associated benefits of the dealer network model. Our CEO and founder has founded two prior successful residential solar businesses, and our management team has multi-disciplinary experience in sales, marketing, legal and project finance with an average of over 20 years in management roles across a variety of both public and private companies. We believe that our combination of experience and focus on our mission and customers provides us with a lasting competitive advantage. |

Our Growth Strategies

Our chief objective is to be a primary provider of clean, affordable and reliable energy for consumers. In order to accomplish this objective, we intend to:

| • | Accelerate growth in underpenetrated markets and expand our geographic footprint. We believe the total market opportunity for residential solar services remains significantly under-penetrated, reaching less than 3% of the 84 million single-family, detached homes in the U.S. The flexibility and reach of our dealer model, coupled with our scalable technology platform, allow us to increase market penetration and enter new markets quickly and efficiently. We plan to strengthen our existing relationships and identify new dealers to accelerate our growth. We will seek to enter new markets and geographies over time, both in the U.S. and internationally, where climate, demand for residential solar energy, and regulatory policies position solar energy as an economically compelling alternative to centralized electric utilities. |

| • | Further strengthen our dealer relationships with support platform and technology suite. Our operations department supports our dealer network and is used to sell additional complementary services to our customer base and directly facilitate sales for our dealers. Additionally, our cloud-based technology suite standardizes and simplifies the design, installation and customer contract processes, and ongoing training and field support provides cost-efficient operations. Finally, dealers are able to leverage our economies of scale to procure equipment through our supply chain relationships. |

| • | Continued deployment of energy storage systems to customers. We believe that integrated energy storage systems enhance the reliability, resiliency and predictability of home solar energy in certain markets, increasing the overall value proposition to consumers. We expect customer demand for Sunnova SunSafe, our solar plus energy storage product, to increase over time. We also expect increased requests by our customers that we retrofit their existing solar energy systems with energy storage arising out of a demand for greater resiliency. In addition, we expect that customers will continue to look for holistic solutions to their solar and storage needs and, as a result, we have partnered with Generac, a leading global designer and manufacturer of energy technology solutions, to provide our customers |

5

Table of Contents

| with greater flexibility to install and size their storage capacity, empowering our customers to power their energy independence. |

| • | Broaden and enhance service offerings. In addition to providing ongoing monitoring and service as a standard component of our solar service agreements, we also offer our service-only product, Sunnova Protect, as a standalone product to consumers who have obtained their solar energy systems through unaffiliated third parties. Of the approximate 2.4 million homes that utilize solar energy systems, we estimate that approximately 900,000 are not covered by a service plan. We believe there is significant market demand for long-term protection plans for customers who have chosen to finance or purchase systems rather than lease them, and we will strive to capture a significant share of this market. We believe the quality and scope of our service offerings through Sunnova Protect fulfill the need for active, comprehensive management to monitor system function and optimize performance. We plan to expand our energy product and industry-leading service offerings in the home to provide further cost savings to our customers and optimize the performance of existing solar energy systems. |

Recent Developments

In May 2020, we amended the revolving credit facility associated with one of our financing subsidiaries that owns certain tax equity funds to, among other things, (a) increase the aggregate commitment amount from $200.0 million to $390.0 million and (b) increase the unused line fee on such committed amounts. In June 2020, we further amended that facility to, among other things, (a) increase the aggregate commitment amount from $390.0 million to $437.5 million and (b) increase the unused line fee on such committed amounts. In May 2020, we admitted a tax equity investor with a total capital commitment of $75.0 million.

In May 2020, we issued and sold an aggregate principal amount of $130.0 million of our 9.75% convertible senior notes in a private placement at an issue price of 95%, for an aggregate purchase price of $123.5 million. The 9.75% convertible senior notes mature in April 2025 unless earlier redeemed, repurchased or converted. We granted the investors of the 9.75% convertible senior notes an option to purchase up to an additional $60.0 million aggregate principal amount of 9.75% convertible senior notes on the same terms and conditions, and the investors exercised this option and completed the purchase of such additional notes on June 12, 2020. We also entered into privately negotiated exchanges with a small number of institutional investors in our 7.75% convertible senior notes due January 2027 (“7.75% convertible senior notes”) whereby such investors exchanged all $55.0 million aggregate principal amount outstanding of our 7.75% convertible senior notes for an equal principal amount of our 9.75% convertible senior notes.

In June 2020, one of our subsidiaries issued $135.9 million in aggregate principal amount of Series 2020-A Class A solar loan-backed notes and $22.6 million in aggregate principal amount of Series 2020-A Class B solar loan-backed notes. The notes bear interest at an annual rate of 2.98% and 7.25% for the Class A and Class B notes, respectively.

Market Opportunity

The number of residential solar energy systems in the U.S. is expected to increase from approximately 2.2 million in 2018 to an estimated 5.4 million in 2024, representing a 16% compounded annual growth rate. Even in light of this rapid growth, the residential solar market remains significantly under-penetrated, reaching less than 3% of the 84 million single-family, detached homes in the U.S.

6

Table of Contents

The following trends have increased solar energy demand from homeowners in a growing number of markets, and are expected to continue to do so:

| • | Rising utility-based electricity rates; |

| • | Declining cost of a residential solar system; |

| • | Availability of financing for residential solar service providers at an attractive cost of capital; |

| • | Declining cost of energy storage due to improvements in technology; |

| • | Increasing consumer demand for energy storage systems to provide temporary power during power outages due to natural disasters; |

| • | Increasing consumer demand for environmentally-friendly products, including power sourced from renewable energy; and |

| • | Governmental policies and incentives, such as net metering, federal tax credits, accelerated depreciation, renewable portfolio standards (“RPS”) on utilities and solar renewable energy certificates (“SRECs”). |

Key Financial and Operational Metrics

We regularly review a number of metrics, including the following key operational and financial metrics, to evaluate our business, measure our performance and liquidity, identify trends affecting our business, formulate our financial projections and make strategic decisions.

| As of March 31, 2020 |

As of December 31, | |||||||||||||||||||

| 2019 | 2018 | 2017 | ||||||||||||||||||

| Number of customers |

|

85,400 | 78,600 | 60,300 | 45,700 | |||||||||||||||

| Three Months Ended March 31, |

Year Ended December 31, | |||||||||||||||||||

| 2020 | 2019 | 2019 | 2018 | 2017 | ||||||||||||||||

| Weighted average number of customers |

81,900 | 62,000 | 68,500 | 53,400 | 38,800 | |||||||||||||||

| Three Months Ended March 31, |

Year Ended December 31, | |||||||||||||||||||

| 2020 | 2019 | 2019 | 2018 | 2017 | ||||||||||||||||

| (in thousands) |

||||||||||||||||||||

| Net loss |

$ | (77,004 | ) | $ | (35,496 | ) | $ | (133,434 | ) | $ | (68,409 | ) | $ | (90,182 | ) | |||||

| Adjusted EBITDA(1) |

$ | 6,190 | $ | 8,068 | $ | 48,297 | $ | 41,119 | $ | 23,404 | ||||||||||

| Interest income from customer notes receivable |

$ | 4,372 | $ | 2,328 | $ | 11,588 | $ | 6,147 | $ | 3,003 | ||||||||||

| Principal proceeds from customer notes receivable, net of related revenue |

$ | 6,378 | $ | 3,429 | $ | 20,044 | $ | 6,812 | $ | 2,360 | ||||||||||

| (1) | Adjusted EBITDA is a financial measure that is not calculated or presented in accordance with generally accepted accounting principles in the U.S. (“GAAP”). See “—Summary Consolidated Financial and Operational Data—Non-GAAP Reconciliation” for information regarding our use of this non-GAAP financial measure and reconciliation of such measure to its most directly comparable GAAP equivalent. |

7

Table of Contents

Risk Factors

Investing in our common stock involves risks that relate to, among other things, our business, our dealers, market factors, governmental policies and regulation, competition, the pace of technological innovations, the credit risk of our customers, our ability to raise financing and the level of our indebtedness. You should carefully consider the risks described under the section titled “Risk Factors” on page 17 in evaluating an investment in our common stock.

Corporate Information

Our principal executive offices are located at 20 East Greenway Plaza, Suite 540, Houston, TX 77046, and our telephone number is (281) 985-9904. Our website address is www.sunnova.com. Information contained on, or that can be accessed through, our website does not constitute part of this prospectus and inclusions of our website address in this prospectus are inactive textual references only.

The Sunnova design logo, “Sunnova” and our other registered or common law trademarks, service marks or trade names appearing in this prospectus are the property of Sunnova Energy Corporation. Other trademarks and trade names referred to in this prospectus are the property of their respective owners. This prospectus contains references to our trademarks and service marks and to those belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus, including logos, artwork and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate in any way that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other entities’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other entity.

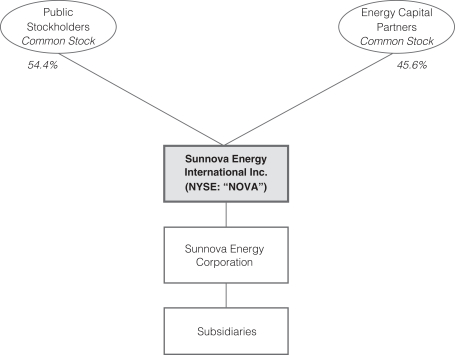

Our Corporate Structure

Sunnova Energy Corporation was incorporated in Delaware on October 22, 2012. SEI, the issuer in this offering, was incorporated in Delaware on April 1, 2019 to enable Sunnova Energy Corporation to implement a holding company organizational structure, to be effected by a merger conducted pursuant to Section 251(g) of the General Corporation Law of the State of Delaware (the “DGCL”) that occurred simultaneously with the closing of our initial public offering (the “IPO”).

On July 24, 2019, SEI priced its IPO of 14,000,000 shares of its common stock at a public offering price of $12.00 per share and on July 25, 2019 SEI’s shares of common stock began trading on the NYSE under the symbol “NOVA”. The IPO closed on July 29, 2019. On August 19, 2019, we issued and sold an additional 865,267 shares of our common stock at a public offering price of $12.00 per share pursuant to the underwriters’ option to purchase additional shares.

In connection with our IPO we decreased the total number of outstanding shares with a 1 for 2.333 reverse stock split effective July 29, 2019 (the “Reverse Stock Split”). All current and past period amounts stated herein have given effect to the Reverse Stock Split.

8

Table of Contents

The following chart summarizes our organizational structure and equity ownership immediately prior to this offering, including by Energy Capital Partners. This chart is provided for illustrative purposes only and does not represent all legal entities affiliated with, or obligations of, our company. See the section titled “Initial Public Offering and Recapitalization Transactions” in our Annual Report on Form 10-K for the year ended December 31, 2019 for more information regarding our recapitalization and reorganization in connection with our IPO. See “—Principal and Selling Stockholders” for additional information regarding beneficial ownership of our common stock.

9

Table of Contents

THE OFFERING

| Common stock offered to the public by the selling stockholders |

8,000,000 shares (9,200,000 shares, if the underwriters exercise in full their option to purchase additional shares of our common stock from certain of the selling stockholders). |

| Underwriters’ option |

To the extent that the underwriters sell more than 8,000,000 shares of common stock, the underwriters have a 30-day option to purchase up to an additional 1,200,000 shares of common stock from certain of the selling stockholders at the public offering price less underwriting discounts and commissions. |

| Common stock to be outstanding immediately after this offering(1)(2) |

85,192,457 shares. |

| Use of proceeds |

We will not receive any of the proceeds from the sale of our common stock by the selling stockholders. See the sections titled “Use of Proceeds” and “Principal and Selling Stockholders” for additional information. |

| NYSE trading symbol |

“NOVA” |

| Risk Factors |

Please read the section titled “Risk Factors” on page 17 for a discussion of risks that you should consider before investing in our common stock. |

(1) Includes 1,152,025 shares of our common stock that will be issued upon conversion of approximately $15.4 million aggregate principal amount of our 9.75% convertible senior notes for resale in this offering by certain of the selling stockholders.

(2) Excludes the following:

| • | 4,143,604 shares of our common stock issuable upon the exercise of outstanding options to purchase shares of our common stock; and |

| • | 5,209,158 shares of our common stock reserved for future issuance under our 2019 Long-Term Incentive Plan. |

| • | 17,010,296 shares of our common stock issuable upon the conversion of approximately $229.6 million aggregate principal amount of our 9.75% convertible senior notes that will remain outstanding after this offering. |

Except as otherwise indicated and except as set forth in our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2019, our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020 and information derived therefrom, all information in this prospectus assumes:

| • | the conversion of approximately $15.4 million aggregate principal amount of our 9.75% convertible senior notes into 1,152,025 shares of common stock for resale by certain of the selling stockholders in this offering; |

| • | there will be no exercise of outstanding stock options subsequent to the date hereof; and |

| • | there will be no exercise by the underwriters of their option to purchase up to 1,200,000 additional shares of our common stock from certain of the selling stockholders. |

10

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL AND OPERATIONAL DATA

The following summary consolidated financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus and our consolidated financial statements and related notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2019 and Quarterly Report on Form 10-Q for the quarter ended March 31, 2020. Our historical results are not necessarily indicative of our future results. The summary consolidated financial data in this section are not intended to replace our consolidated financial statements and related notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2019 and Quarterly Report on Form 10-Q for the quarter ended March 31, 2020 and are qualified in their entirety by our consolidated financial statements and related notes thereto included elsewhere therein.

Sunnova Energy International Inc. was incorporated on April 1, 2019 and had limited historical financial operating results prior to the IPO. Following the IPO, SEI became the sole stockholder of Sunnova Energy Corporation. As a result, SEI consolidates the financial results of Sunnova Energy Corporation and its subsidiaries. For periods prior to the completion of the IPO, the following table shows selected consolidated historical financial data of our accounting predecessor, Sunnova Energy Corporation and its subsidiaries, including SEI.

| Three Months Ended March 31, |

Year Ended December 31, | |||||||||||||||||||

| 2020 | 2019 | 2019 | 2018 | 2017 | ||||||||||||||||

| (Unaudited) | ||||||||||||||||||||

| (in thousands, except share and per share amounts) | ||||||||||||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||||||||||

| Revenue |

$ | 29,829 | $ | 26,715 | $ | 131,556 | $ | 104,382 | $ | 76,856 | ||||||||||

| Operating expenses: |

||||||||||||||||||||

| Cost of revenue—depreciation |

12,986 | 9,653 | 43,536 | 34,710 | 25,896 | |||||||||||||||

| Cost of revenue—other |

1,043 | 652 | 3,877 | 2,007 | 1,444 | |||||||||||||||

| Operations and maintenance |

2,219 | 2,254 | 8,588 | 14,035 | 4,994 | |||||||||||||||

| General and administrative |

27,893 | 18,681 | 97,986 | 67,430 | 54,863 | |||||||||||||||

| Other operating expense (income) |

(6 | ) | (18 | ) | (161 | ) | (70 | ) | 14 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses, net |

44,135 | 31,222 | 153,826 | 118,112 | 87,211 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating loss |

(14,306 | ) | (4,507 | ) | (22,270 | ) | (13,730 | ) | (10,355 | ) | ||||||||||

| Interest expense, net |

67,318 | 31,661 | 108,024 | 51,582 | 59,847 | |||||||||||||||

| Interest expense, net—affiliates |

— | 1,822 | 4,098 | 9,548 | 23,177 | |||||||||||||||

| Interest income |

(4,620 | ) | (2,494 | ) | (12,483 | ) | (6,450 | ) | (3,197 | ) | ||||||||||

| Loss on extinguishment of long-term debt, net—affiliates |

— | — | 10,645 | — | — | |||||||||||||||

| Other (income) expense |

— | — | 880 | (1 | ) | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss before income tax |

(77,004 | ) | (35,496 | ) | (133,434 | ) | (68,409 | ) | (90,182 | ) | ||||||||||

| Income tax |

— | — | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss |

(77,004 | ) | (35,496 | ) | (133,434 | ) | (68,409 | ) | (90,182 | ) | ||||||||||

| Net income (loss) attributable to redeemable noncontrolling interests |

(5,929 | ) | 3,018 | 10,917 | 5,837 | 903 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss attributable to stockholders |

$ | (71,075 | ) | $ | (38,514 | ) | $ | (144,351 | ) | $ | (74,246 | ) | $ | (91,085 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss per share attributable to stockholders—basic and diluted |

$ | (0.85 | ) | $ | (5.87 | ) | $ | (4.14 | ) | $ | (15.74 | ) | $ | (14.05 | ) | |||||

| Weighted average common shares outstanding—basic and diluted |

84,001,151 | 8,635,527 | 40,797,976 | 8,634,477 | 8,632,936 | |||||||||||||||

11

Table of Contents

| Three Months Ended March 31, |

Year Ended December 31, | |||||||||||||||||||

| 2020 | 2019 | 2019 | 2018 | 2017 | ||||||||||||||||

| (Unaudited, in thousands, except per customer amounts) |

||||||||||||||||||||

| Cash Flow Data: |

||||||||||||||||||||

| Net cash used in operating activities |

$ | (58,112 | ) | (24,430 | ) | $ | (170,262 | ) | $ | (11,570 | ) | $ | (48,967 | ) | ||||||

| Net cash used in investing activities |

(184,315 | ) | (92,680 | ) | $ | (568,316 | ) | $ | (348,849 | ) | $ | (289,133 | ) | |||||||

| Net cash provided by financing activities |

261,372 | 109,351 | $ | 801,823 | $ | 365,687 | $ | 369,893 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net increase (decrease) in cash and restricted cash |

$ | 18,945 | $ | (7,759 | ) | $ | 63,245 | $ | 5,268 | $ | 31,793 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Other Financial Data:(1) |

||||||||||||||||||||

| Adjusted EBITDA |

$ | 6,190 | $ | 8,068 | $ | 48,297 | $ | 41,119 | $ | 23,404 | ||||||||||

| Interest income from customer notes receivable |

$ | 4,372 | $ | 2,328 | $ | 11,588 | $ | 6,147 | $ | 3,003 | ||||||||||

| Principal proceeds from customer notes receivable, net of related revenue |

$ | 6,378 | $ | 3,429 | $ | 20,044 | $ | 6,812 | $ | 2,360 | ||||||||||

| Adjusted Operating Cash Flow |

$ | (20,070 | ) | $ | (15,930 | ) | $ | 6,417 | $ | (10,565 | ) | $ | (41,710 | ) | ||||||

| Adjusted Operating Expense |

$ | 23,639 | $ | 18,647 | $ | 83,259 | $ | 63,264 | $ | 53,452 | ||||||||||

| Adjusted Operating Expense per weighted average customer |

$ | 289 | $ | 301 | $ | 1,215 | $ | 1,185 | $ | 1,378 | ||||||||||

| (1) | Adjusted EBITDA, Adjusted Operating Cash Flow, Adjusted Operating Expense and Adjusted Operating Expense per weighted average customer are not financial measures calculated or presented in accordance with GAAP. See “—Non-GAAP Reconciliation” for information regarding our use of these non-GAAP financial measures and reconciliations of each such measure to its most directly comparable GAAP equivalent. |

| As of March 31, 2020 |

As of December 31, | |||||||||||||||

| 2019 | 2018 | 2017 | ||||||||||||||

| (Unaudited) | ||||||||||||||||

| (in thousands) |

||||||||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||||||

| Total current assets |

$ | 279,956 | $ | 274,320 | $ | 89,533 | $ | 81,277 | ||||||||

| Property and equipment, net |

$ | 1,884,576 | $ | 1,745,060 | $ | 1,328,457 | $ | 1,113,073 | ||||||||

| Total assets |

$ | 2,682,180 | $ | 2,487,067 | $ | 1,665,085 | $ | 1,328,788 | ||||||||

| Long-term debt, net (excluding debt with affiliates) |

$ | 1,511,555 | $ | 1,346,419 | $ | 872,249 | $ | 723,697 | ||||||||

| Total liabilities |

$ | 1,847,733 | $ | 1,668,827 | $ | 1,078,287 | $ | 919,015 | ||||||||

| Total stockholders’ equity |

$ | 592,020 | $ | 645,935 | $ | 501,118 | $ | 371,183 | ||||||||

Non-GAAP Reconciliation:

Adjusted EBITDA. We define Adjusted EBITDA as net income (loss) plus net interest expense, depreciation and amortization expense, income tax expense, financing deal costs, natural disaster losses and related charges, net, amortization of payments to dealers for exclusivity and other bonus arrangements, legal settlements and excluding the effect of certain non-recurring items we do not consider to be indicative of our ongoing operating performance such as, but not limited to, costs of our IPO, losses on unenforceable contracts, losses on extinguishment of long-term debt, realized and unrealized gains and losses on fair value option instruments and other non-cash items such as non-cash compensation expense, asset retirement obligation (“ARO”) accretion expense and provision for current expected credit losses. We began recognizing current expected credit losses in the first quarter of 2020 as a result of the adoption of Accounting Standards Update No. 2016-13. Financial Statements—Credit Losses.

12

Table of Contents

Adjusted EBITDA is a non-GAAP financial measure we use as a performance measure. We believe investors and securities analysts also use Adjusted EBITDA in evaluating our operating performance. This measurement is not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance. The GAAP measure most directly comparable to Adjusted EBITDA is net income (loss). The presentation of Adjusted EBITDA should not be construed to suggest our future results will be unaffected by non-cash or non-recurring items. In addition, our calculation of Adjusted EBITDA is not necessarily comparable to Adjusted EBITDA as calculated by other companies.

We believe Adjusted EBITDA is useful to management, investors and analysts in providing a measure of core financial performance adjusted to allow for comparisons of results of operations across reporting periods on a consistent basis. These adjustments are intended to exclude items that are not indicative of the ongoing operating performance of the business. Adjusted EBITDA is also used by our management for internal planning purposes, including our consolidated operating budget, and by our board of directors in setting performance-based compensation targets. Adjusted EBITDA should not be considered an alternative to but viewed in conjunction with GAAP results, as we believe it provides a more complete understanding of ongoing business performance and trends than GAAP measures alone. Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP.

| Three Months Ended March 31, |

Year Ended December 31, | |||||||||||||||||||

| 2020 | 2019 | 2019 | 2018 | 2017 | ||||||||||||||||

| (Unaudited, in thousands) |

||||||||||||||||||||

| Reconciliation of Net Loss to Adjusted EBITDA: |

||||||||||||||||||||

| Net loss |

$ | (77,004 | ) | $ | (35,496 | ) | $ | (133,434 | ) | $ | (68,409 | ) | $ | (90,182 | ) | |||||

| Interest expense, net |

67,318 | 31,661 | 108,024 | 51,582 | 59,847 | |||||||||||||||

| Interest expense, net—affiliates |

— | 1,822 | 4,098 | 9,548 | 23,177 | |||||||||||||||

| Interest income |

(4,620 | ) | (2,494 | ) | (12,483 | ) | (6,450 | ) | (3,197 | ) | ||||||||||

| Depreciation expense |

14,946 | 11,012 | 49,340 | 39,290 | 29,482 | |||||||||||||||

| Amortization expense |

9 | 5 | 29 | 133 | 133 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA |

649 | 6,510 | 15,574 | 25,694 | 19,260 | |||||||||||||||

| Non-cash compensation expense |

2,690 | 387 | 10,512 | 3,410 | 1,495 | |||||||||||||||

| ARO accretion expense |

489 | 313 | 1,443 | 1,183 | 704 | |||||||||||||||

| Financing deal costs |

116 | 119 | 1,161 | 1,902 | 336 | |||||||||||||||

| Natural disaster losses and related charges, net |

31 | — | 54 | 8,217 | 1,034 | |||||||||||||||

| IPO costs |

— | 739 | 3,804 | 563 | — | |||||||||||||||

| Loss on unenforceable contracts |

— | — | 2,381 | — | — | |||||||||||||||

| Loss on extinguishment of long-term debt, net—affiliates |

— | — | 10,645 | — | — | |||||||||||||||

| Unrealized loss on fair value option instruments |

— | — | 150 | — | — | |||||||||||||||

| Realized loss on fair value option instruments |

— | — | 730 | — | — | |||||||||||||||

| Amortization of payments to dealers for exclusivity and other bonus arrangements |

351 | — | 583 | — | — | |||||||||||||||

| Legal settlements |

— | — | 1,260 | 150 | 575 | |||||||||||||||

| Provision for current expected credit losses |

1,864 | — | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

$ | 6,190 | $ | 8,068 | $ | 48,297 | $ | 41,119 | $ | 23,404 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

13

Table of Contents

Adjusted Operating Cash Flow. We define Adjusted Operating Cash Flow as net cash used in operating activities plus principal proceeds from customer notes receivable, financed insurance payments and distributions to redeemable noncontrolling interests less derivative breakage fees from financing structure changes, payments to dealers for exclusivity and other bonus arrangements, net inventory and prepaid inventory (sales) purchases and payments of non-capitalized costs related to our IPO. Adjusted Operating Cash Flow is a non-GAAP financial measure we use as a liquidity measure. This measurement is not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of liquidity. The GAAP measure most directly comparable to Adjusted Operating Cash Flow is net cash used in operating activities. We believe Adjusted Operating Cash Flow is a supplemental financial measure useful to management, analysts, investors, lenders and rating agencies as an indicator of our ability to internally fund origination activities, service or incur additional debt and service our contractual obligations. We believe investors and analysts will use Adjusted Operating Cash Flow to evaluate our liquidity and ability to service our contractual obligations. However, Adjusted Operating Cash Flow has limitations as an analytical tool because it does not account for all future expenditures and financial obligations of the business or reflect unforeseen circumstances that may impact our future cash flows, all of which could have a material effect on our financial condition and results from operations. In addition, our calculations of Adjusted Operating Cash Flow are not necessarily comparable to liquidity measures presented by other companies. Investors should not rely on these measures as a substitute for any GAAP measure, including net cash used in operating activities.

| Three Months Ended March 31, |

Year Ended December 31, | |||||||||||||||||||

| 2020 | 2019 | 2019 | 2018 | 2017 | ||||||||||||||||

| (Unaudited, in thousands) |

||||||||||||||||||||

| Reconciliation of Net Cash Used in Operating Activities to Adjusted Operating Cash Flow: |

||||||||||||||||||||

| Net cash used in operating activities |

$ | (58,112 | ) | $ | (24,430 | ) | $ | (170,262 | ) | $ | (11,570 | ) | $ | (48,967 | ) | |||||

| Principal proceeds from customer notes receivable |

6,940 | 3,757 | 21,604 | 7,715 | 2,816 | |||||||||||||||

| Financed insurance payments |

(2,398 | ) | — | (4,672 | ) | — | — | |||||||||||||

| Derivative breakage fees from financing structure changes |

31,122 | 3,428 | 12,080 | (17,793 | ) | 2,833 | ||||||||||||||

| Distributions to redeemable noncontrolling interests |

(1,373 | ) | (3,652 | ) | (7,559 | ) | (2,017 | ) | (294 | ) | ||||||||||

| Payments to dealers for exclusivity and other bonus arrangements |

5,344 | 2,000 | 31,733 | — | — | |||||||||||||||

| Net Inventory and prepaid inventory (sales) purchases |

(1,593 | ) | 2,967 | 118,549 | 13,100 | 1,902 | ||||||||||||||

| Payments of non-capitalized costs related to IPO |

— | — | 4,944 | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted Operating Cash Flow |

$ | (20,070 | ) | $ | (15,930 | ) | $ | 6,417 | $ | 10,565 | $ | (41,710 | ) | |||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

14

Table of Contents

Adjusted Operating Expense. We define Adjusted Operating Expense as total operating expense less depreciation and amortization expense, financing deal costs, natural disaster losses and related charges, net, amortization of payments to dealers for exclusivity and other bonus arrangements, legal settlements and excluding the effect of certain non-recurring items we do not consider to be indicative of our ongoing operating performance such as, but not limited to, costs of our IPO, losses on unenforceable contracts and other non-cash items such as non-cash compensation expense, ARO accretion expense and provision for current expected credit losses. Adjusted Operating Expense is a non-GAAP financial measure we use as a performance measure. We believe investors and securities analysts will also use Adjusted Operating Expense in evaluating our performance. This measurement is not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance. The GAAP measure most directly comparable to Adjusted Operating Expense is total operating expense. We believe Adjusted Operating Expense is a supplemental financial measure useful to management, analysts, investors, lenders and rating agencies as an indicator of the efficiency of our operations between reporting periods. Adjusted Operating Expense should not be considered an alternative to but viewed in conjunction with GAAP total operating expense, as we believe it provides a more complete understanding of our performance than GAAP measures alone. Adjusted Operating Expense has limitations as an analytical tool and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP, including total operating expense.

| Three Months Ended March 31, |

Year Ended December 31, | |||||||||||||||||||

| 2020 | 2019 | 2019 | 2018 | 2017 | ||||||||||||||||

| (Unaudited, in thousands, except per customer data) |

||||||||||||||||||||

| Reconciliation of Total Operating Expense, Net to Adjusted Operating Expense: |

||||||||||||||||||||

| Total operating expense, net |

$ | 44,135 | $ | 31,222 | $ | 153,826 | $ | 118,112 | $ | 87,211 | ||||||||||

| Depreciation expense |

(14,946 | ) | (11,012 | ) | (49,340 | ) | (39,290 | ) | (29,482 | ) | ||||||||||

| Amortization expense |

(9 | ) | (5 | ) | (29 | ) | (133 | ) | (133 | ) | ||||||||||

| Non-cash compensation expense |

(2,690 | ) | (387 | ) | (10,512 | ) | (3,410 | ) | (1,495 | ) | ||||||||||

| ARO accretion expense |

(489 | ) | (313 | ) | (1,443 | ) | (1,183 | ) | (704 | ) | ||||||||||

| Financing deal costs |

(116 | ) | (119 | ) | (1,161 | ) | (1,902 | ) | (336 | ) | ||||||||||

| Natural disaster losses and related charges, net |

(31 | ) | — | (54 | ) | (8,217 | ) | (1,034 | ) | |||||||||||

| IPO costs |

— | (739 | ) | (3,804 | ) | (563 | ) | — | ||||||||||||

| Loss on unenforceable contracts |

— | — | (2,381 | ) | — | — | ||||||||||||||

| Amortization of payments to dealers for exclusivity and other bonus arrangements |

(351 | ) | — | (583 | ) | — | — | |||||||||||||

| Legal settlements |

— | — | (1,260 | ) | (150 | ) | (575 | ) | ||||||||||||

| Provision for current expected credit losses |

(1,864 | ) | — | — | — | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted Operating Expense |

$ | 23,639 | $ | 18,647 | $ | 83,259 | $ | 63,264 | $ | 53,452 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted Operating Expense per weighted average customer |

$ | 289 | $ | 301 | $ | 1,215 | $ | 1,185 | $ | 1,378 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

15

Table of Contents

Operational Metrics

We regularly review a number of metrics, including the following key operational and financial metrics, to evaluate our business, measure our performance and liquidity, identify trends affecting our business, formulate our financial projections and make strategic decisions. For additional information about our key operational metrics, including their definitions, calculation and limitations, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Financial and Operational Metrics.”

| As of March 31, 2020 |

As of December 31, | |||||||||||||||

| 2019 | 2018 | 2017 | ||||||||||||||

| Number of customers |

85,400 | 78,600 | 60,300 | 45,700 | ||||||||||||

| Three Months Ended March 31, |

Year Ended December 31, |

|||||||||||||||||||

| 2020 | 2019 | 2019 | 2018 | 2017 | ||||||||||||||||

| Weighted average number of customers (excluding loan agreements) |

70,100 | 55,300 | 60,100 | 49,200 | 37,000 | |||||||||||||||

| Weighted average number of customers with loan agreements |

11,800 | 6,700 | 8,400 | 4,200 | 1,800 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted average number of customers |

81,900 | 62,000 | 68,500 | 53,400 | 38,800 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| As of March 31, 2020 |

As of December 31, | |||||||||||||||

| 2019 | 2018 | 2017 | ||||||||||||||

| (Unaudited, in millions) |

||||||||||||||||

| Estimated gross contracted customer value |

$ | 2,035 | $ | 1,879 | $ | 1,476 | $ | 1,127 | ||||||||

16

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below together with all of the other information included in this prospectus before deciding to invest in our common stock. If any of the following risks actually occur, they may materially and adversely affect our business, financial condition, cash flows and results of operations. In this event, the trading price of our common stock could decline, and you could lose all or part of your investment in us. We may experience additional risks and uncertainties not currently known to us; or, as a result of developments occurring in the future, conditions that we currently deem to be immaterial may also materially and adversely affect our business, financial condition, cash flows and results of operations.

Risks Related to Our Business

Historically, we have incurred operating and net losses and we may be unable to achieve or sustain profitability in the future.

We incurred operating losses of $14.3 million, $22.3 million and $13.7 million and net losses of $77.0 million, $133.4 million and $68.4 million for the three months ended March 31, 2020 and the years ended December 31, 2019 and 2018, respectively. These historical operating and net losses were due to a number of factors, including increased expenses to fund our growth and related financing needs. We expect to incur significant expenses as we finance the expansion of our operations and implement additional internal systems and infrastructure to support our growth. In addition, as a public company, we incur significant additional legal, accounting and other expenses we did not incur as a private company. We do not know whether our revenue will grow rapidly enough to absorb these costs. Our ability to achieve profitability depends on a number of factors, including:

| • | growing our customer base and originating new solar service agreements on economic terms; |

| • | maintaining or lowering our cost of capital; |

| • | reducing operating costs by optimizing our operations and maintenance processes; |

| • | maximizing the benefits of our dealer network; |

| • | finding additional tax equity investors and other sources of institutional capital; and |

| • | the continued availability of various governmental incentives for the solar industry. |

Even if we do achieve profitability, we may be unable to sustain or increase our profitability in the future.

The ongoing Coronavirus Disease (“COVID-19”) pandemic could adversely affect our business, financial condition and results of operations.

The ongoing COVID-19 pandemic continues to be a rapidly evolving situation. The COVID-19 pandemic and efforts to respond to it have resulted in widespread adverse impacts on the global economy and on our employees, customers, dealers and other parties with whom we have business relations. We have experienced some resulting disruptions to our business operations as the COVID-19 pandemic has continued to spread through the states and U.S. territories in which we operate. For example, social distancing guidelines, stay-at-home orders and similar government measures associated with the COVID-19 pandemic, as well as actions by individuals to reduce their potential exposure to the virus, contributed to a decline in origination, with new contract origination, net of cancellations, declining in each of March and April 2020. This decline reflects an inability by our dealers to perform in-person sales calls based on the stay-at-home orders in some locations. A significant or extended decline in new contract origination may have a material adverse effect on our business, cash flows, liquidity, financial condition and results of operations.

17

Table of Contents

We and our dealers have modified certain business and workforce practices (including those related to new contract origination, installation and servicing of solar energy systems and employee work locations) to conform to government restrictions and best practices encouraged by governmental and regulatory authorities. Such modifications have allowed our dealers to continue to install and us to continue to service solar energy systems, but may also disrupt our operations, impede productivity or otherwise be ineffective in the future. If there are additional outbreaks of the COVID-19 virus or other viruses or more stringent health and safety guidelines are adopted, our and our dealers’ ability to continue performing installations and service calls may be adversely impacted.

Our future success also depends on our ability to raise capital from third-party investors and commercial sources. In the initial weeks of the COVID-19 pandemic we saw access to capital markets reduced generally. If we are unable to regain access to the capital markets or are unable to raise funds through our tax equity and warehouse financing transactions at competitive terms, it would adversely impact both our ability to finance the deployment of our solar energy systems and energy storage systems and may have a material adverse effect on our business, cash flows, liquidity, financial condition and results of operations.

There is considerable uncertainty regarding the extent to which the COVID-19 virus will continue to spread and the extent and duration of governmental and other measures implemented to try to slow the spread of the COVID-19 virus, such as large-scale travel bans and restrictions, border closures, quarantines, shelter-in-place orders and business and government shutdowns. Restrictions of this nature have caused, and may continue to cause, us and our dealers to experience operational delays and may cause milestones or deadlines relating to our exclusivity arrangements to be missed. To date, we have not received notices from our dealers regarding performance delays resulting from the COVID-19 pandemic. However, worsening economic conditions could result in such outcomes over time, which would impact our future financial performance. Further, the effects of the economic downturn associated with the COVID-19 pandemic, and other economic factors, may increase unemployment and reduce consumer credit ratings and credit availability, which may adversely affect new customer origination and our existing customers’ ability to make payments on their solar service agreements. Periods of high unemployment and a lack of availability of credit may lead to increased delinquency and default rates. If existing economic conditions continue for a prolonged period of time or worsen, delinquencies on solar service agreements could increase, which would also negatively impact our future financial performance and the price of our common stock. Finally, if supply chains become significantly disrupted due to additional outbreaks of the COVID-19 virus or other viruses or more stringent health and safety guidelines are implemented, our ability to install and service solar energy systems could become adversely impacted.

We cannot predict the full impact the COVID-19 pandemic or the significant disruption and volatility currently being experienced in the capital markets will have on our business, cash flows, liquidity, financial condition and results of operations at this time due to numerous uncertainties. The ultimate impact will depend on future developments, including, among other things, the ultimate geographic spread and duration of the COVID-19 virus, the depth and duration of the economic downturn and other economic effects of the COVID-19 pandemic, the consequences of governmental and other measures designed to prevent the spread of the COVID-19 virus, actions taken by governmental authorities, customers, dealers and other third parties, our ability and the ability of our customers, potential customers and dealers to adapt to operating in a changed environment and the timing and extent to which normal economic and operating conditions resume.

18

Table of Contents

Certain of our key operational metrics, including estimated gross contracted customer value, are based on various assumptions and estimates we make over an extended period of time. Actual experience may vary materially from these estimates and assumptions and therefore undue reliance should not be placed on these metrics.

Our key operational metrics include a number of assumptions and estimates we make over an extended period of time (up to 35 years) and may not prove accurate. In calculating estimated gross contracted customer value, we estimate projected monthly customer payments over the remaining life of our solar service agreements, which are typically 25 years in length with an opportunity for customers to renew for up to an additional 10 years, and from the future sale of related SRECs. These estimated future cash flows depend on various factors including but not limited to solar service agreement type, contracted rates, customer loss rates, expected sun hours and the projected production capacity of the solar equipment installed. Additionally, in calculating estimated gross contracted customer value we also estimate cash distributions to tax equity fund investors and operating, maintenance and administrative expenses associated with the solar service agreements, including expenses related to accounting, reporting, audit, insurance, maintenance and repairs over the remaining life of our solar service agreements.

Furthermore, in calculating estimated gross contracted customer value, we discount our future net cash flows at 6% based on industry practice and the interest rate on certain recent securitizations. This discount rate might not be the most appropriate discount rate based on interest rates in effect from time to time and industry or company-specific risks associated with these cash flows and the appropriate discount rate for these estimates may change in the future due to the level of inflation, rising interest rates, our cost of capital, customer default rates and consumer demand for solar energy systems, among other things. We also assume customer losses of 0% in calculating these metrics even though we expect to have some minimal level of customer losses over the life of our contracts. To illustrate the way in which actual results may change, we present sensitivities around the discount rate and the rate of customer losses, although these sensitivities may not capture the most appropriate discount rate or the rate of customer losses we will experience. For a discussion of estimated gross contracted customer value and the related discount rate, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Financial and Operational Metrics—Estimated Gross Contracted Customer Value”.

PricewaterhouseCoopers LLP has not audited, reviewed, examined, compiled nor applied agreed-upon procedures with respect to these operational metrics or their components. The estimates discussed above are based on a combination of assumptions that may prove to be inaccurate over time. Such inaccuracies could be material, particularly given the estimates relate to cash flows up to 35 years in the future.

If our allowance for credit losses is not enough to cover actual credit losses from our customer notes receivable portfolio, our results of operations and financial condition could be negatively affected.

We maintain an allowance for credit losses, which is a reserve that represents our best estimate of actual credit losses we may experience in our existing customer notes receivable portfolio. The level of the allowance reflects our continuing evaluation of factors including the financial asset type, customer credit rating, contractual term, vintage, volume and trends in delinquencies, nonaccruals, write-offs and present economic, political and regulatory conditions. The determination of the appropriate level of the allowance for credit losses inherently involves subjectivity in our modeling and requires us to make estimates of current credit risks and future trends, all of which may undergo material changes or vary from our historical experience. Deterioration in economic conditions affecting our customers, new information regarding existing loans and other factors, both within and outside of

19

Table of Contents

our control, may require an increase in the allowance for credit losses. Furthermore, if write-offs in future periods exceed the allowance for credit losses, we will need to increase the allowance for credit losses in future periods. Any increases in the allowance for credit losses will result in an increase in net loss and could have a material adverse effect on our business, financial condition and results of operations.