Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Old COPPER Company, Inc. | d930433d8k.htm |

Exhibit 99.1

J. C. PENNEY COMPANY, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| Month Ended | Four Months Ended | |||||||||||||||

| June 6, | June 8, | June 6, | June 8, | |||||||||||||

| (In millions, except per share data) | 2020 | 2019 | 2020 | 2019 | ||||||||||||

| Total net sales |

$ | 266 | $ | 1,003 | $ | 1,348 | $ | 3,442 | ||||||||

| Credit income and other |

7 | 32 | 121 | 148 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenues |

273 | 1,035 | 1,469 | 3,590 | ||||||||||||

| Costs and expenses/(income): |

||||||||||||||||

| Cost of goods sold (exclusive of depreciation and amortization shown separately below) |

166 | 645 | 979 | 2,275 | ||||||||||||

| Selling, general and administrative (SG&A) |

113 | 313 | 685 | 1,169 | ||||||||||||

| Depreciation and amortization |

50 | 56 | 185 | 203 | ||||||||||||

| Real estate and other, net |

(3 | ) | 6 | (5 | ) | 1 | ||||||||||

| Restructuring and management transition |

7 | 2 | 162 | 22 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total costs and expenses |

333 | 1,022 | 2,006 | 3,670 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating income/(loss) |

(60 | ) | 13 | (537 | ) | (80 | ) | |||||||||

| Other components of net periodic pension cost/(income) |

(8 | ) | (4 | ) | (31 | ) | (18 | ) | ||||||||

| Net interest expense |

25 | 27 | 100 | 100 | ||||||||||||

| Loss due to discontinuance of hedge accounting |

— | — | 77 | — | ||||||||||||

| Reorganization items, net |

72 | — | 72 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income/(loss) before income taxes |

(149 | ) | (10 | ) | (755 | ) | (162 | ) | ||||||||

| Income tax expense/(benefit) |

(1 | ) | 1 | (61 | ) | 3 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income/(loss) |

$ | (148 | ) | $ | (11 | ) | $ | (694 | ) | $ | (165 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings/(loss) per share - basic |

$ | (0.46 | ) | $ | (0.03 | ) | $ | (2.14 | ) | $ | (0.52 | ) | ||||

| Earnings/(loss) per share - diluted |

$ | (0.46 | ) | $ | (0.03 | ) | $ | (2.14 | ) | $ | (0.52 | ) | ||||

J. C. PENNEY COMPANY, INC.

CONSOLIDATED BALANCE SHEETS

(Unaudited)

| June 6, | June 8, | |||||||

| 2020 | 2019 | |||||||

| (In millions) |

||||||||

| Assets |

||||||||

| Current assets: |

||||||||

| Cash in banks and in transit |

$ | 154 | $ | 148 | ||||

| Cash short-term investments |

583 | 7 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents |

737 | 155 | ||||||

| Merchandise inventory |

2,124 | 2,398 | ||||||

| Prepaid expenses and other |

300 | 297 | ||||||

|

|

|

|

|

|||||

| Total current assets |

3,161 | 2,850 | ||||||

| Property and equipment, net |

3,306 | 3,626 | ||||||

| Operating lease assets |

929 | 912 | ||||||

| Prepaid pension |

144 | 159 | ||||||

| Other assets |

626 | 662 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 8,166 | $ | 8,209 | ||||

|

|

|

|

|

|||||

| Liabilities and stockholders’ equity |

||||||||

| Current liabilities: |

||||||||

| Merchandise accounts payable |

$ | 583 | $ | 807 | ||||

| Other accounts payable and accrued expenses |

919 | 881 | ||||||

| Current operating lease liabilities |

101 | 83 | ||||||

| Current portion of finance leases and note payable |

— | 2 | ||||||

| Current portion of long-term debt, net |

4,884 | 92 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

6,487 | 1,865 | ||||||

| Noncurrent operating lease liabilities |

1,080 | 1,076 | ||||||

| Long-term debt |

— | 3,793 | ||||||

| Deferred taxes |

47 | 119 | ||||||

| Other liabilities |

355 | 330 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

7,969 | 7,183 | ||||||

| Stockholders’ equity |

||||||||

| Common stock |

161 | 159 | ||||||

| Additional paid-in capital |

4,721 | 4,719 | ||||||

| Reinvested earnings/(accumulated deficit) |

(4,363 | ) | (3,566 | ) | ||||

| Accumulated other comprehensive income/(loss) |

(322 | ) | (286 | ) | ||||

|

|

|

|

|

|||||

| Total stockholders’ equity |

197 | 1,026 | ||||||

|

|

|

|

|

|||||

| Total liabilities and stockholders’ equity |

$ | 8,166 | $ | 8,209 | ||||

|

|

|

|

|

|||||

J. C. PENNEY COMPANY, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(Unaudited)

| Reinvested | Accumulated | |||||||||||||||||||||||

| Number of | Additional | Earnings/ | Other | |||||||||||||||||||||

| Common | Common | Paid-in | (Accumulated | Comprehensive | Total Stockholders’ | |||||||||||||||||||

| (In millions) | Shares | Stock | Capital | Deficit) | Income/(Loss) | Equity | ||||||||||||||||||

| February 1, 2020 |

320.5 | $ | 160 | $ | 4,723 | $ | (3,667 | ) | $ | (387 | ) | $ | 829 | |||||||||||

| Net income/(loss) |

— | — | — | (546 | ) | — | (546 | ) | ||||||||||||||||

| Discontinuance of hedge accounting |

— | — | — | — | 63 | 63 | ||||||||||||||||||

| Other comprehensive income/(loss) |

— | — | — | — | 1 | 1 | ||||||||||||||||||

| Stock-based compensation and other |

1.4 | 1 | 2 | (2 | ) | — | 1 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| May 2, 2020 |

321.9 | 161 | 4,725 | (4,215 | ) | (323 | ) | 348 | ||||||||||||||||

| Net income/(loss) |

— | — | — | (148 | ) | — | (148 | ) | ||||||||||||||||

| Other comprehensive income/(loss) |

— | — | — | — | 1 | 1 | ||||||||||||||||||

| Stock-based compensation and other |

— | — | (4 | ) | — | — | (4 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| June 6, 2020 |

321.9 | $ | 161 | $ | 4,721 | $ | (4,363 | ) | $ | (322 | ) | $ | 196 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Reinvested | Accumulated | |||||||||||||||||||||||

| Number of | Additional | Earnings/ | Other | |||||||||||||||||||||

| Common | Common | Paid-in | (Accumulated | Comprehensive | Total Stockholders’ | |||||||||||||||||||

| (In millions) | Shares | Stock | Capital | Deficit) | Income/(Loss) | Equity | ||||||||||||||||||

| February 2, 2019 |

316.1 | $ | 158 | $ | 4,713 | $ | (3,373 | ) | $ | (328 | ) | $ | 1,170 | |||||||||||

| ASC 842 (Leases) and ASU 2018-02 (Stranded Taxes) adoption |

— | — | — | (26 | ) | 53 | 27 | |||||||||||||||||

| Net income/(loss) |

— | — | — | (154 | ) | — | (154 | ) | ||||||||||||||||

| Other comprehensive income/(loss) |

— | — | — | — | (11 | ) | (11 | ) | ||||||||||||||||

| Stock-based compensation and other |

0.7 | — | 2 | — | — | 2 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| May 4, 2019 |

316.8 | 158 | 4,715 | (3,553 | ) | (286 | ) | 1,034 | ||||||||||||||||

| Net income/(loss) |

— | — | — | (11 | ) | — | (11 | ) | ||||||||||||||||

| Stock-based compensation and other |

0.3 | 1 | 4 | (2 | ) | — | 3 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| June 8, 2019 |

317.1 | $ | 159 | $ | 4,719 | $ | (3,566 | ) | $ | (286 | ) | $ | 1,026 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

J. C. PENNEY COMPANY, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| Month Ended | Four Months Ended | |||||||||||||||

| June 6, | June 8, | June 6, | June 8, | |||||||||||||

| (In millions) | 2020 | 2019 | 2020 | 2019 | ||||||||||||

| Cash flows from operating activities: |

||||||||||||||||

| Net income/(loss) |

$ | (148 | ) | $ | (11 | ) | $ | (694 | ) | $ | (165 | ) | ||||

| Adjustments to reconcile net income/(loss) to net cash provided by/(used in) operating activities: |

||||||||||||||||

| Restructuring and management transition |

— | — | 139 | 15 | ||||||||||||

| Net gain on sale of operating assets |

— | 7 | — | 3 | ||||||||||||

| Discontinuance of hedge accounting |

— | — | 77 | — | ||||||||||||

| Depreciation and amortization |

50 | 56 | 185 | 203 | ||||||||||||

| Benefit plans |

(5 | ) | (9 | ) | (27 | ) | (23 | ) | ||||||||

| Stock-based compensation |

(5 | ) | 3 | (3 | ) | 5 | ||||||||||

| Deferred taxes |

— | — | (60 | ) | (3 | ) | ||||||||||

| Change in cash from: |

||||||||||||||||

| Inventory |

97 | 79 | 42 | 39 | ||||||||||||

| Prepaid expenses and other assets |

(28 | ) | (10 | ) | (126 | ) | (108 | ) | ||||||||

| Merchandise accounts payable |

4 | (35 | ) | (203 | ) | (40 | ) | |||||||||

| Income taxes |

— | (4 | ) | (1 | ) | (1 | ) | |||||||||

| Accrued expenses and other |

124 | (44 | ) | (54 | ) | (98 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net cash provided by/(used in) operating activities |

89 | 32 | (725 | ) | (173 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Cash flows from investing activities: |

||||||||||||||||

| Capital expenditures |

— | (18 | ) | (33 | ) | (89 | ) | |||||||||

| Proceeds from sale of operating assets |

— | 4 | — | 12 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net cash provided by/(used in) investing activities |

— | (14 | ) | (33 | ) | (77 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Cash flows from financing activities: |

||||||||||||||||

| Proceeds from borrowings under the credit facility |

— | 221 | 1,950 | 629 | ||||||||||||

| Payments of borrowings under the credit facility |

— | (255 | ) | (771 | ) | (545 | ) | |||||||||

| Payments of finance leases and note payable |

— | — | (1 | ) | (1 | ) | ||||||||||

| Payments of long-term debt |

— | — | (19 | ) | (11 | ) | ||||||||||

|

Debtor-in-possession financing costs |

(50 | ) | — | (50 | ) | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net cash provided by/(used in) financing activities |

(50 | ) | (34 | ) | 1,109 | 72 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase/(decrease) in cash and cash equivalents |

39 | (16 | ) | 351 | (178 | ) | ||||||||||

| Cash and cash equivalents at beginning of period |

698 | 171 | 386 | 333 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Cash and cash equivalents at end of period |

$ | 737 | $ | 155 | $ | 737 | $ | 155 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

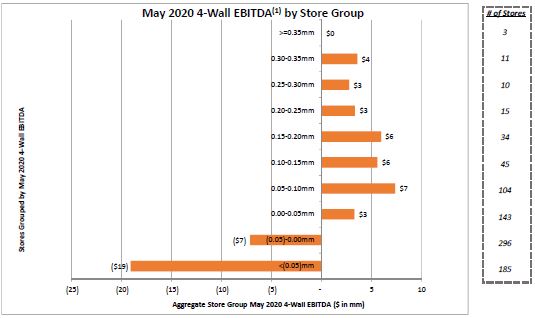

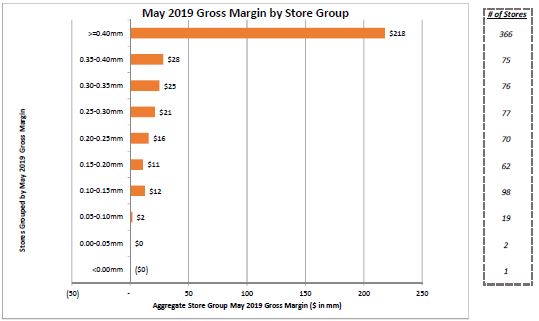

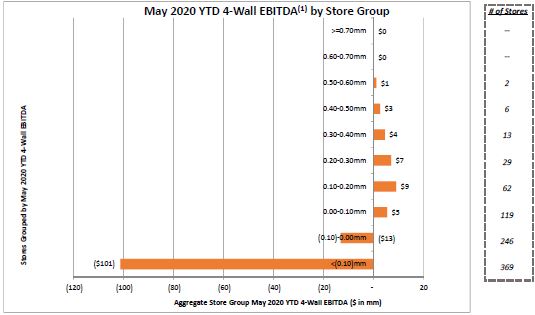

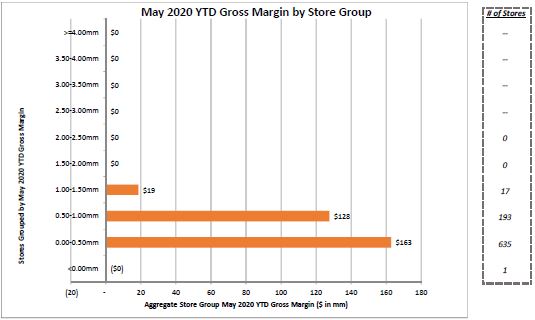

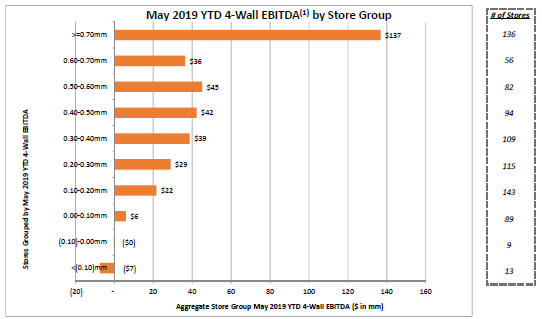

| (1) | 4-Wall EBITDA is an internal store performance metric, which excludes most corporate overhead and other fixed allocated costs. Monthly 4-Wall EBITDA numbers do not reflect certain allocations made only on an annual basis. |

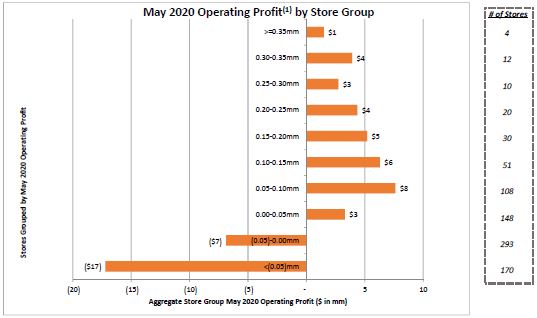

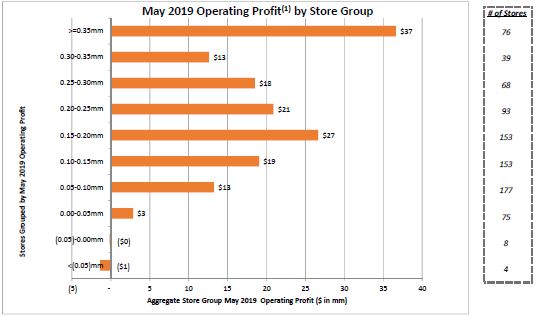

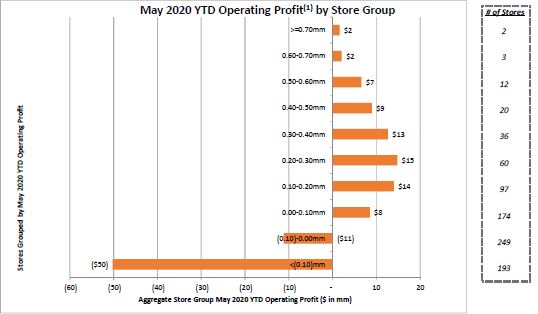

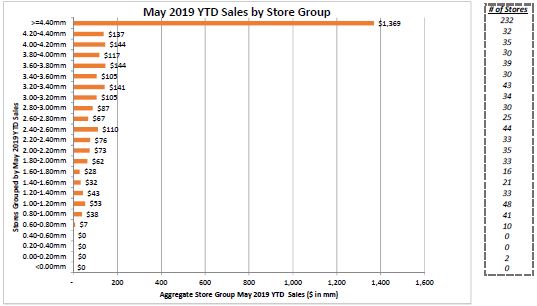

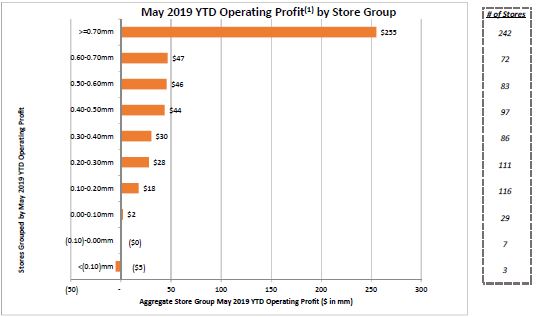

| (1) | Operating Profit is an internal store performance metric, which excludes most corporate overhead and other fixed allocated costs. |

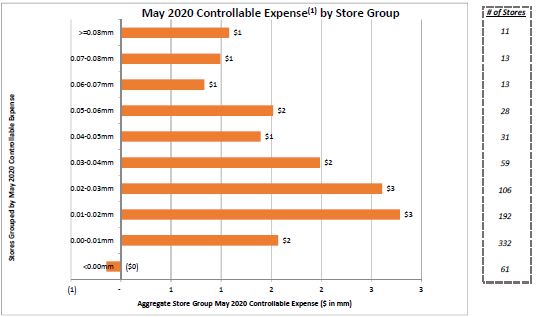

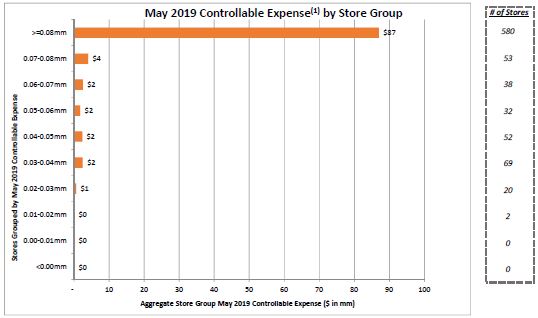

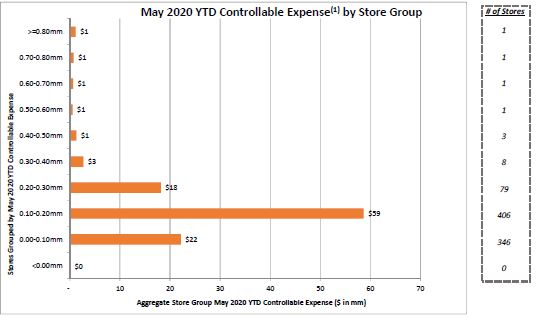

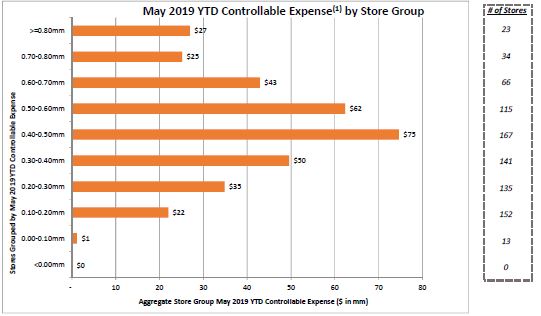

| (1) | Controllable expenses include store salaries, facilities expenses and utilities expenses, among others. |

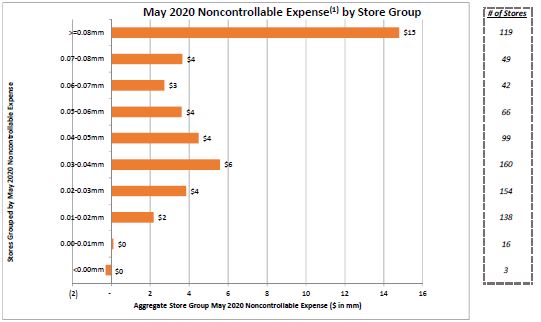

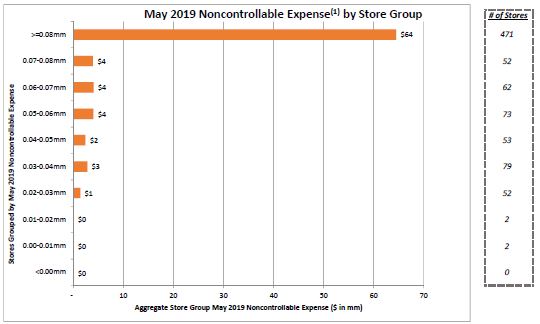

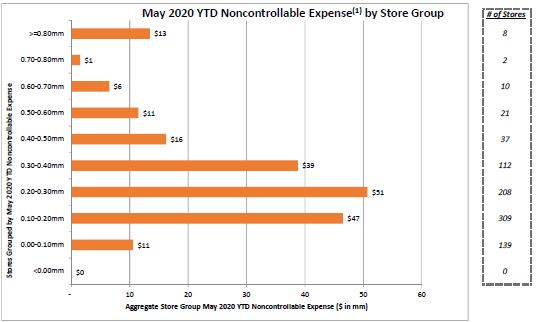

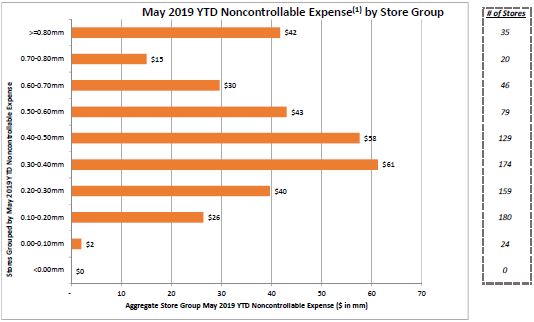

| (1) | Noncontrollable expenses include expenses relating to marketing, display, maintenance and repairs, among others. |

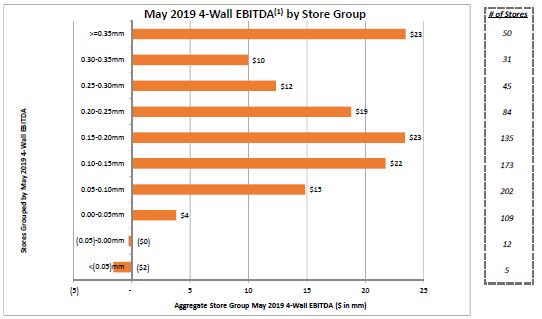

| (1) | 4-Wall EBITDA is an internal store performance metric, which excludes most corporate overhead and other fixed allocated costs. Monthly 4-Wall EBITDA numbers do not reflect certain allocations made only on an annual basis. |

| (1) | Operating Profit is an internal store performance metric, which excludes most corporate overhead and other fixed allocated costs. |

| (1) | Controllable expenses include store salaries, facilities expenses and utilities expenses, among others. |

| (1) | Noncontrollable expenses include expenses relating to marketing, display, maintenance and repairs, among others. |

| (1) | 4-Wall EBITDA is an internal store performance metric, which excludes most corporate overhead and other fixed allocated costs. Monthly 4-Wall EBITDA numbers do not reflect certain allocations made only on an annual basis. |

| (1) | Operating Profit is an internal store performance metric, which excludes most corporate overhead and other fixed allocated costs. |

| (1) | Controllable expenses include store salaries, facilities expenses and utilities expenses, among others. |

| (1) | Noncontrollable expenses include expenses relating to marketing, display, maintenance and repairs, among others. |

| (1) | 4-Wall EBITDA is an internal store performance metric, which excludes most corporate overhead and other fixed allocated costs. Monthly 4-Wall EBITDA numbers do not reflect certain allocations made only on an annual basis. |

| (1) | Operating Profit is an internal store performance metric, which excludes most corporate overhead and other fixed allocated costs. |

| (1) | Controllable expenses include store salaries, facilities expenses and utilities expenses, among others. |

| (1) | Noncontrollable expenses include expenses relating to marketing, display, maintenance and repairs, among others. |