Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Repare Therapeutics Inc. | d920931dex991.htm |

| EX-3.2 - EX-3.2 - Repare Therapeutics Inc. | d920931dex32.htm |

| 8-K - 8-K - Repare Therapeutics Inc. | d920931d8k.htm |

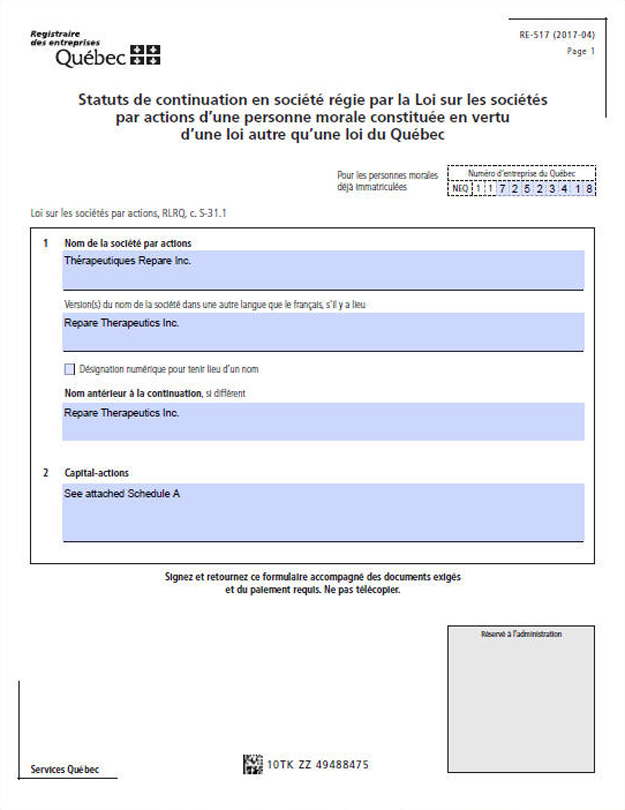

Exhibit 3.1

RE-517 (2017-04)

Pa g e 1

Statuts de continuation en société régie par la Loi sur les sociétés par actions d’une personne morale constituée en vertu d’une loi autre

qu’une loi du Québec

Pour les personnes morales Numéro d’entreprise du Québec déjà immatriculées NEQ 1 1

Loi sur les sociétés par actions, RLRQ, c. S-31.1

1 Nom de la société par

actions

Version(s) du nom de la société dans une autre langue que le français, s’il y a lieu

Désignation numérique pour tenir lieu d’un nom

Nom antérieur à la

continuation, si différent

2 Capital-actions

Signez et retournez ce

formulaire accompagné des documents exigés et du paiement requis. Ne pas télécopier.

Réservé à l’administration

10TK ZZ 49488475

Services Québec

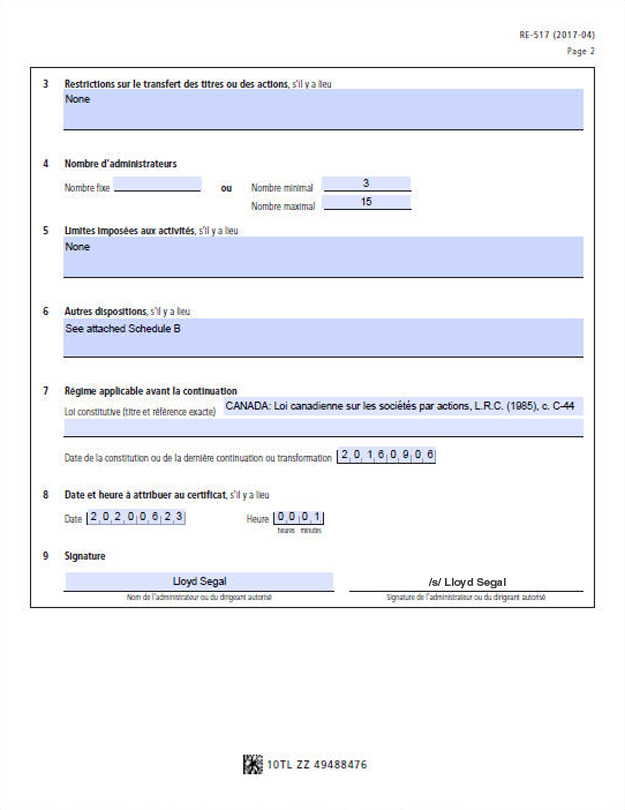

RE-517 (2017-04)

Pa g e 2

3 Restrictions sur le transfert des titres ou des actions, s’il y a lieu

4 Nombre

d’administrateurs

Nombre fixe ou Nombre minimal Nombre maximal

5 Limites

imposées aux activités, s’il y a lieu

6 Autres dispositions, s’il y a lieu

7 Régime applicable avant la continuation

Loi constitutive (titre et référence

exacte)

Date de la constitution ou de la dernière continuation ou transformation

8 Date et heure à attribuer au certificat, s’il y a lieu

Date Heure

heures minutes

9 Signature

Nom de l’administrateur ou du dirigeant autorisé Signature de l’administrateur ou du dirigeant autorisé

10TL ZZ 49488476

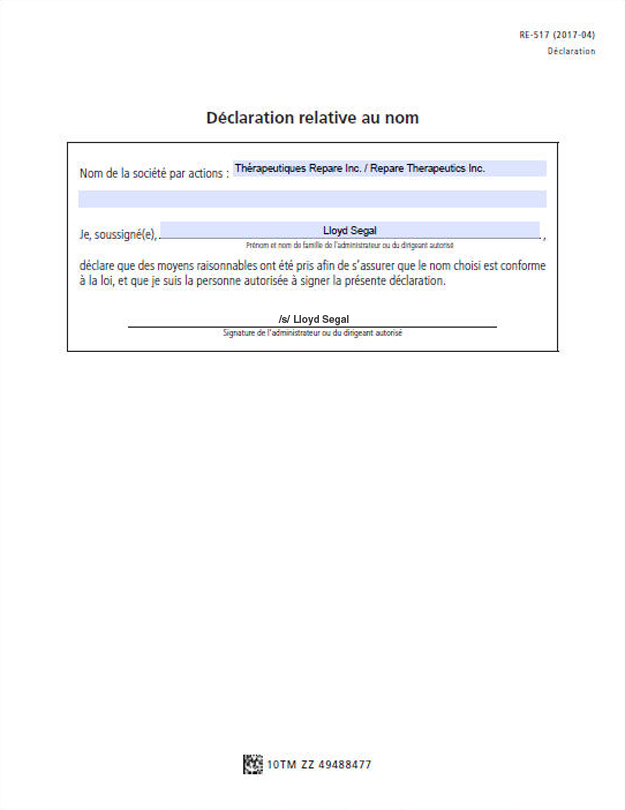

RE-517 (2017-04)

D é c l a ra t i o n

Déclaration relative au nom

Nom de la société par actions :

Je, soussigné(e), ,

Prénom et nom de famille de

l’administrateur ou du dirigeant autorisé

déclare que des moyens raisonnables ont été pris afin de s’assurer que le nom choisi est

conforme à la loi, et que je suis la personne autorisée à signer la présente déclaration.

Signature de l’administrateur ou du

dirigeant autorisé

10TM ZZ 49488477

SCHEDULE A

Description of share capital

Unlimited number of common shares; and

Unlimited number of preferred shares, issuable in series.

| 1. | The common shares shall have attached thereto the following rights and restrictions: |

| 1.1. | Voting. Each common share shall entitle the holder thereof to one (1) vote at all meetings of the shareholders of the Corporation (except meetings at which only holders of another specified class of shares are entitled to vote pursuant to the provisions hereof or pursuant to the provisions of the Business Corporations Act (Quebec) (hereinafter referred to as the “Act”)). |

| 1.2. | Dividends. The holders of the common shares shall be entitled to receive, as and when declared by the board of directors of the Corporation (the “Board”), subject to and subordinate to the rights, privileges, conditions and restrictions attaching to the preferred shares and the shares of any other class ranking senior to the common shares, dividends payable in money, property or by the issue of fully paid shares of the share capital of the Corporation or options or right to acquire fully paid shares of the Corporation. |

| 1.3. | Liquidation, etc. In the event of the liquidation, dissolution or winding-up of the Corporation, whether voluntary or involuntary, or other distribution of property of the Corporation among shareholders for the purpose of winding up its affairs, subject to and subordinate to the rights, privileges, conditions and restrictions attaching to the preferred shares and the shares of any other class ranking senior to the common shares, the holders of the common shares shall be entitled to receive the remaining property of the Corporation. |

| 2. | The preferred shares shall have attached thereto the following rights and restrictions: |

| 2.1. | Series. The Board may, at any time and from time to time, issue the preferred shares in one or more series, each series to consist of such number of shares as may, before issuance thereof, be determined by the Board. |

| 2.2. | Terms of Each Series. The Board may, in the manner hereinafter provided, from time to time fix, before issuance, the designation, rights, privileges, restrictions and limitations attaching to the preferred shares of each series, including, without limiting the generality of the foregoing, the rate, amount or method of calculation of preferential dividends (whether cumulative or non-cumulative or partially cumulative, and whether such rate, amount or method of calculation shall be subject to change or adjustment in the future), the currency or currencies of payment, the date or dates and place or places of payment thereof and the date or dates from which such preferential dividends shall accrue, the |

| redemption price and terms and conditions of redemption, if any, the rights of retraction, if any, vested in the holders of preferred shares of such series and the prices and the other terms and conditions of any rights of retraction, and any additional rights of retraction which may be vested in such holders in the future, voting rights and conversion, exchange or reclassification rights, if any, any sinking fund, purchase fund or other provisions attaching to the preferred shares of such series, and any other terms not inconsistent with these provisions, the whole subject to the issuance of a certificate of amendment in respect of articles of amendment in the prescribed form to designate a series of shares. |

| 2.3. | Ranking of Preferred Shares of Each Series. The preferred shares of each series shall with respect to the payment of dividends, the return of capital and the distribution of the assets of the Corporation in the event of the liquidation, dissolution or winding-up of the Corporation, whether voluntary or involuntary, or any other distribution of the assets of the Corporation for the purpose of winding up its affairs, rank (i) on a parity with the preferred shares of every other series and (ii) senior to the common shares and the shares of any other class ranking junior to the preferred shares. The preferred shares of any series shall also be entitled to such other preferences, not inconsistent with these provisions, over the common shares and the shares of any other class ranking junior to the preferred shares as may be fixed in accordance with subsection 2.2 above. |

| 2.4. | Voting Rights. Except as hereinafter specifically provided, as required by the Act, by law or as may be required by an order of a court of competent jurisdiction or in accordance with any voting rights which may be attached to any series of preferred shares, the holders of preferred shares shall not be entitled as such to receive notice of, or attend, any meeting of shareholders of the Corporation and shall not be entitled to vote at any meeting. |

SCHEDULE B

Other provisions

| 1. | Annual meetings and special meetings of the shareholders of the Corporation may be held outside the Province of Quebec. |

| 2. | The directors of a Corporation that is a reporting issuer or that has 50 or more shareholders may appoint one or more additional directors who shall hold office for a term expiring no later than the close of the next annual meeting of shareholders, but the total number of directors so appointed may not exceed one third of the number of directors elected at the previous annual meeting of shareholders. |