Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Casper Sleep Inc. | form8-k62320investorpr.htm |

June 2020 Confidential 1

Forward-Looking Statements Disclaimer This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this presentation that do not relate to matters of historical fact should be considered forward-looking statements, including without limitation statements regarding our expectations surrounding our market opportunity; our expectation to achieve positive EBITDA by mid-2021; our expectations surrounding the timing of the wind-down of our European operations; our competitive position; our expectations regarding consumer and corporate behavior, including as a result of the COVID-19 pandemic; our future results of operations and financial position; our business strategy and plans, and objectives of management for future operations and creating long-term value. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to, the following: the COVID-19 pandemic could adversely impact our business, financial condition and results of operations; our ability to compete successfully in the highly competitive industries in which we operate; our ability to maintain and enhance our brand; the success of our retail store expansion plans; our ability to successfully implement our growth strategies related to launching new products; the effectiveness and efficiency of our marketing programs; our ability to manage our current operations and to manage future growth effectively; our past results may not be indicative of our future operating performance; our ability to attract new customers or retain existing customers; the growth of the market for sleep as a retail category and our ability to become a leader or maintain our leadership in the category; the impact of social media and influencers on our reputation; our ability to protect and maintain our intellectual property; our exclusive reliance on third- party contract manufacturers whose efforts we are unable to fully control; our ability to effectively implement strategic initiatives; our ability to transfer our supply chain and other business processes to a global scale; risks relating to our international operations and expansion; we are dependent on our retail partners; general economic and business conditions; we could be subject to system failures or interruptions and security breaches; risks relating to changing legal and regulatory requirements, and any failure to comply with applicable laws and regulations; we may be subject to product liability claims and other litigation; we may experience fluctuations in our quarterly operating results; we have and expect to continue to incur significant losses; risks relating to our indebtedness; our need for additional funding, which may not be available; risks relating to taxes; future sales by us our stockholders may cause the market price of our stock to decline; and risks and additional costs relating to our status as a new public company. These and other important factors discussed under the caption “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2019, as updated by the “Risk Factors” section of our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, and our other filings with the Securities and Exchange Commission could cause actual results to differ materially from those indicated by the forward-looking statements made in this presentation. Any such forward-looking statements represent management’s estimates as of the date of this presentation. While we may elect to update such forward-looking statements at some point in the future, we disclaim any obligation to do so, even if subsequent events cause our views to change. Confidential 2

Agenda 1. Introduction and Our Opportunity 2. What Makes Casper Special 3. 1Q20 Update 4. Appendix Confidential 3

Our Vision The World’s Most Loved & Largest Sleep Company Sleeping Bedtime Wake-Up We Believe Casper is the Only Company Thinking Holistically About Sleep Confidential 4

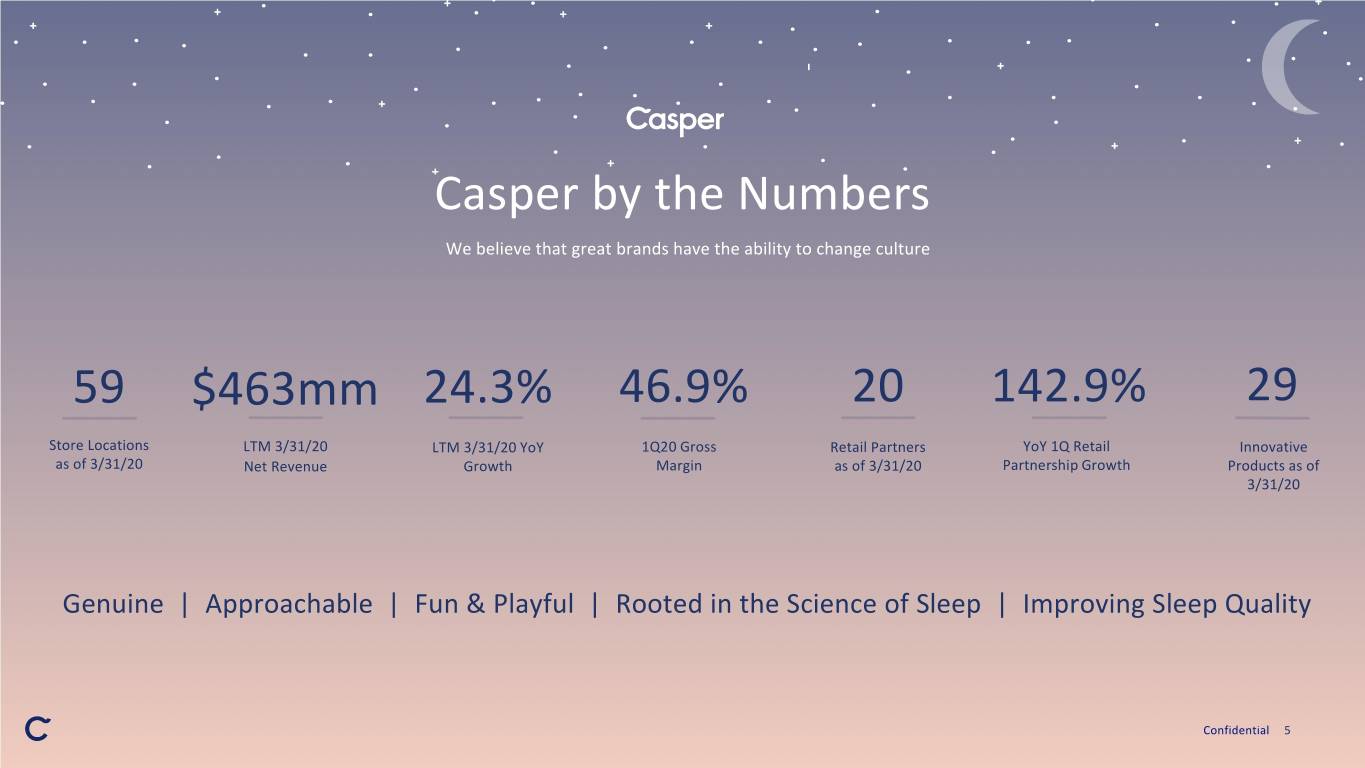

Casper by the Numbers We believe that great brands have the ability to change culture 59 $463mm 24.3% 46.9% 20 142.9% 29 Store Locations LTM 3/31/20 LTM 3/31/20 YoY 1Q20 Gross Retail Partners YoY 1Q Retail Innovative as of 3/31/20 Net Revenue Growth Margin as of 3/31/20 Partnership Growth Products as of 3/31/20 Genuine | Approachable | Fun & Playful | Rooted in the Science of Sleep | Improving Sleep Quality Confidential 5

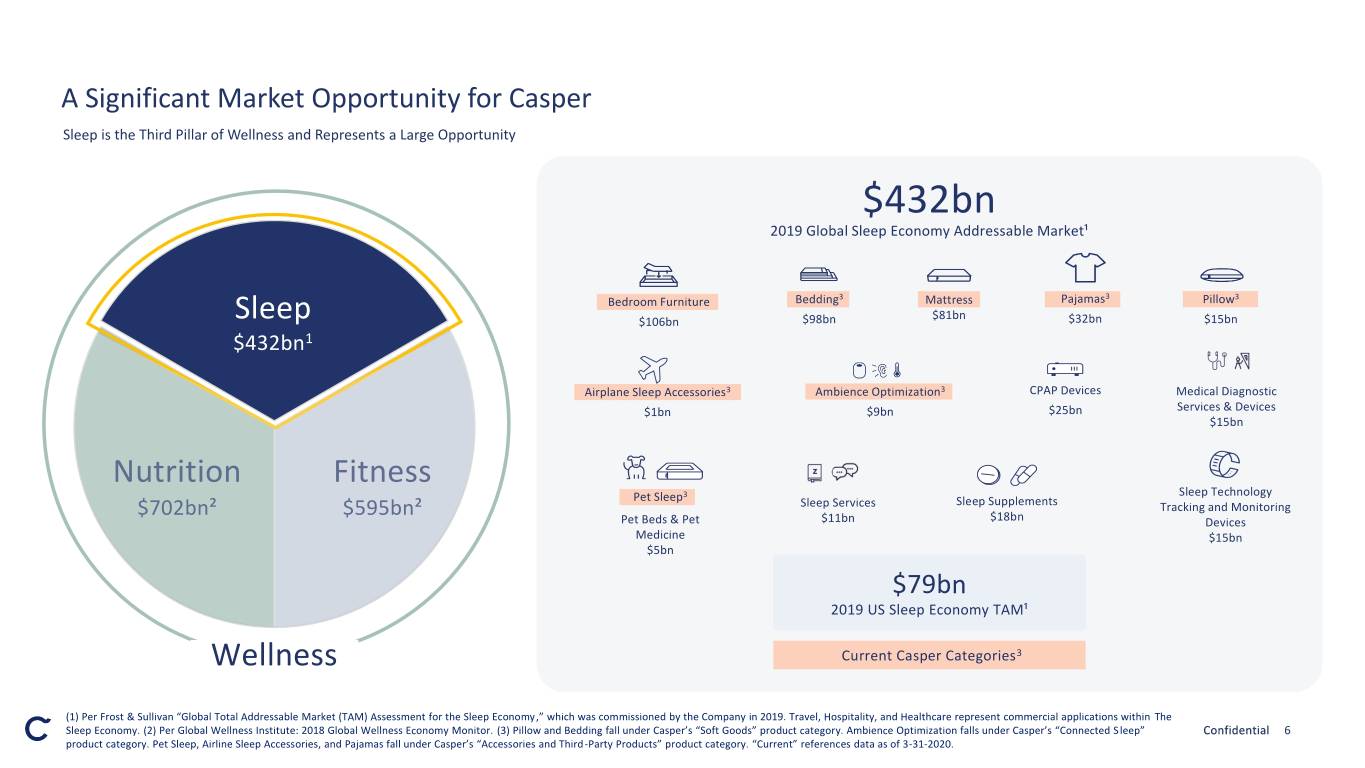

A Significant Market Opportunity for Casper Sleep is the Third Pillar of Wellness and Represents a Large Opportunity $432bn 2019 Global Sleep Economy Addressable Market¹ Bedroom Furniture Bedding3 Mattress Pajamas3 Pillow3 $81bn Sleep $106bn $98bn $32bn $15bn $432bn1 Airplane Sleep Accessories3 Ambience Optimization3 CPAP Devices Medical Diagnostic $1bn $9bn $25bn Services & Devices $15bn Nutrition Fitness Pet Sleep3 Sleep Technology $702bn² $595bn² Sleep Services Sleep Supplements Tracking and Monitoring Pet Beds & Pet $11bn $18bn Devices Medicine $15bn $5bn $79bn 2019 US Sleep Economy TAM¹ Wellness Current Casper Categories3 (1) Per Frost & Sullivan “Global Total Addressable Market (TAM) Assessment for the Sleep Economy,” which was commissioned by the Company in 2019. Travel, Hospitality, and Healthcare represent commercial applications within The Sleep Economy. (2) Per Global Wellness Institute: 2018 Global Wellness Economy Monitor. (3) Pillow and Bedding fall under Casper’s “Soft Goods” product category. Ambience Optimization falls under Casper’s “Connected Sleep” Confidential 6 product category. Pet Sleep, Airline Sleep Accessories, and Pajamas fall under Casper’s “Accessories and Third-Party Products” product category. “Current” references data as of 3-31-2020.

What Makes Casper Special 1 A Differentiated Approach to a Tired Industry 2 Innovative Products and Services Platforms Powered by Casper Labs 3 Re-Inventing a Go-to-Market Strategy with the Customer at the Center 4 Transformational Brand 5 Technology-Based, Data Driven and Agile Business Drive Margin Expansion 6 Expected Positive EBITDA Profitability by Mid-2021 Confidential 7

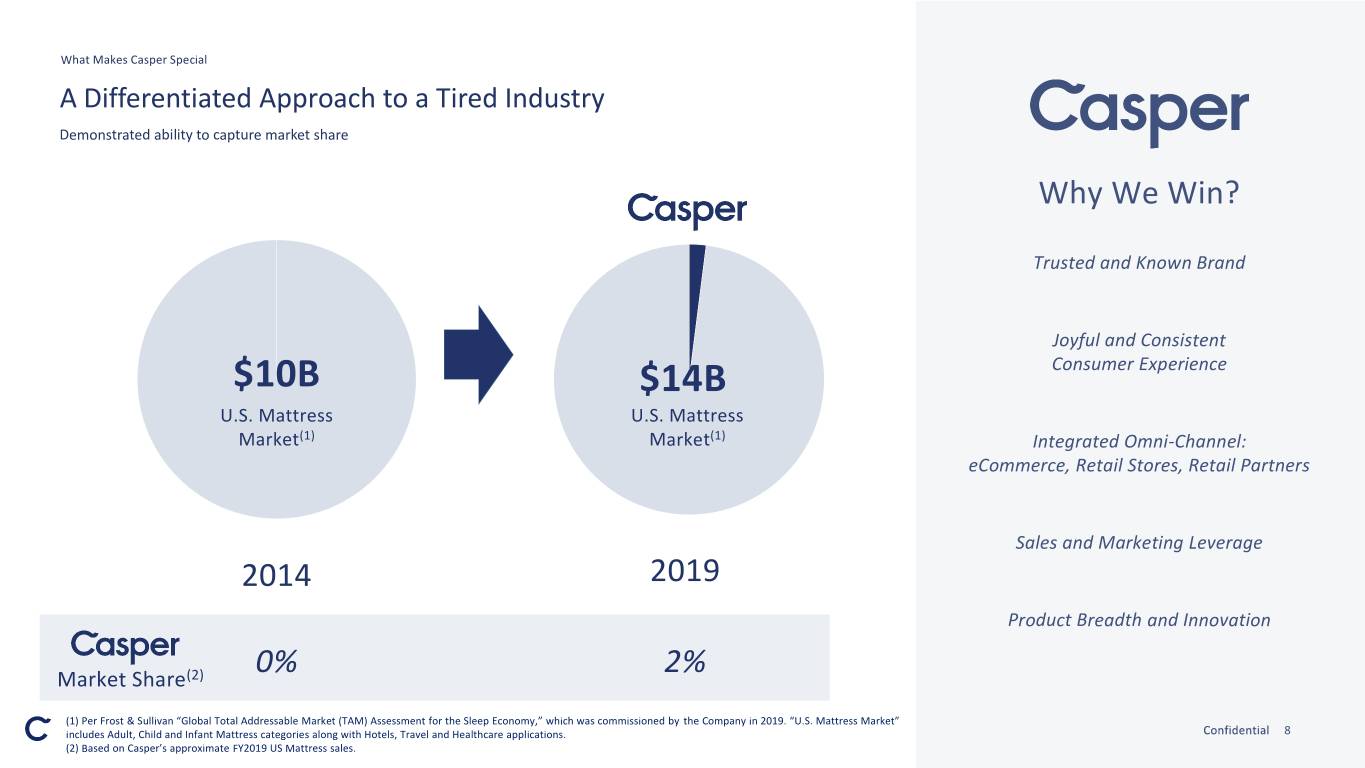

What Makes Casper Special A Differentiated Approach to a Tired Industry Demonstrated ability to capture market share Why We Win? Trusted and Known Brand Joyful and Consistent $10B $14B Consumer Experience U.S. Mattress U.S. Mattress Market(1) Market(1) Integrated Omni-Channel: eCommerce, Retail Stores, Retail Partners Sales and Marketing Leverage 2014 2019 Product Breadth and Innovation 0% 2% Market Share(2) (1) Per Frost & Sullivan “Global Total Addressable Market (TAM) Assessment for the Sleep Economy,” which was commissioned by the Company in 2019. “U.S. Mattress Market” includes Adult, Child and Infant Mattress categories along with Hotels, Travel and Healthcare applications. Confidential 8 (2) Based on Casper’s approximate FY2019 US Mattress sales.

What Makes Casper Special A Differentiated Approach to a Tired Industry Boasting an average of +2 million site visits per month(1) Trailing Twelve Months Web Search Interest(2) Why We Win? 120 Trusted and Known Brand 100 Joyful and Consistent 80 Consumer Experience 60 Integrated Omni-Channel: eCommerce, Retail Stores, Retail Partners 40 Sales and Marketing Leverage 20 Product Breadth and Innovation 0 6/9/2019 7/9/2019 8/9/2019 9/9/2019 10/9/2019 11/9/2019 12/9/2019 1/9/2020 2/9/2020 3/9/2020 4/9/2020 5/9/2020 Casper Mattress Tempur Pedic Mattress Serta Mattress Sealy Mattress Simmons Mattress (1) 1Q20 monthly average sessions based on Casper’s internal data analytics. Confidential 9 (2) Google Trends web search interest as of 6/3/2020. Search results included “Casper Mattress,” “Tempur Pedic Mattress,” “Serta Mattress,” “Sealy Mattress” and “Simmons Mattress.”

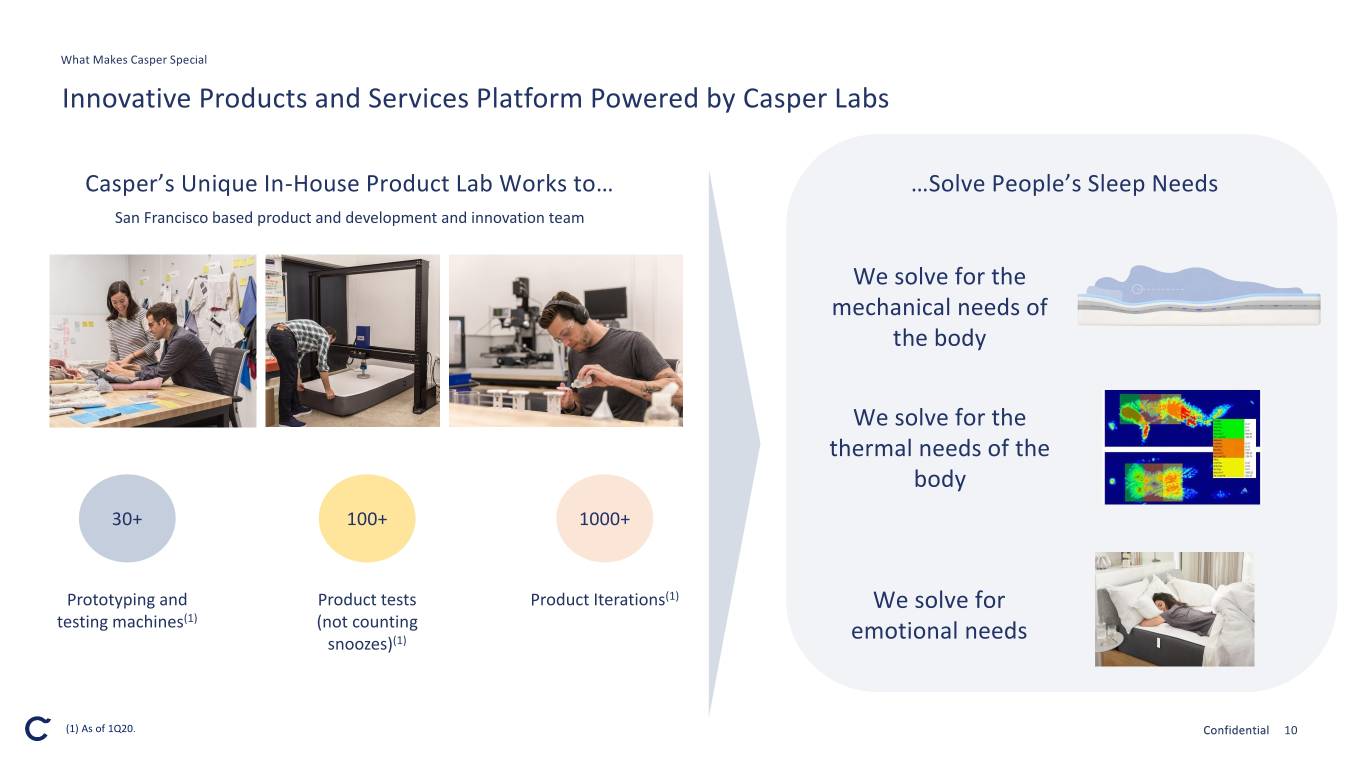

What Makes Casper Special Innovative Products and Services Platform Powered by Casper Labs Casper’s Unique In-House Product Lab Works to… …Solve People’s Sleep Needs San Francisco based product and development and innovation team We solve for the mechanical needs of the body We solve for the thermal needs of the body 30+ 100+ 1000+ Prototyping and Product tests Product Iterations(1) We solve for testing machines(1) (not counting snoozes)(1) emotional needs (1) As of 1Q20. Confidential 10

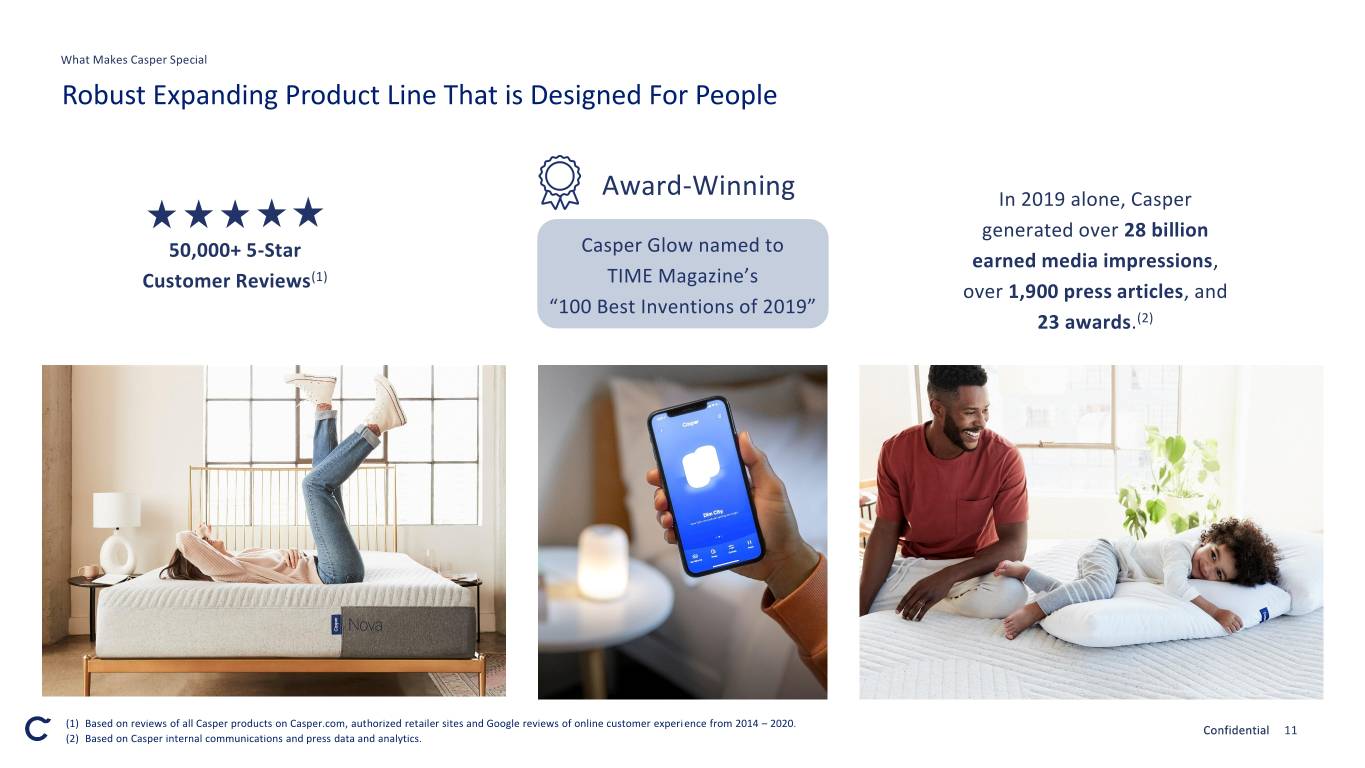

What Makes Casper Special Robust Expanding Product Line That is Designed For People Award-Winning In 2019 alone, Casper generated over 28 billion Casper Glow named to 50,000+ 5-Star earned media impressions, (1) TIME Magazine’s Customer Reviews over 1,900 press articles, and “100 Best Inventions of 2019” 23 awards.(2) (1) Based on reviews of all Casper products on Casper.com, authorized retailer sites and Google reviews of online customer experience from 2014 – 2020. Confidential 11 (2) Based on Casper internal communications and press data and analytics.

What Makes Casper Special Re-Inventing a Go to Market Strategy with the Customer at the Center… We make the science of sleep simple, Our prices are clear and consistent helping customers rest easy across channels, removing stress Great & Consistent Consumer Experience 100-night mattress trial period, Consultative, individualized support and complimentary delivery and removal1 education offered across channels (1) 100-night trial offered on all Casper mattresses, pillows, and bedding. 30-night trial offered on all other products. All products come with complimentary delivery via common carrier delivery or in-home setup. In- home set-up and removal provided complimentary on the Wave Mattress delivered within the contiguous U.S. and offered for purchase on other orders. Confidential 12

What Makes Casper Special …Generating Real Growth and Powerful Synergies Direct-to-Consumer (DTC) Channel eCommerce Retail Retail Partnerships Channel • Best-in-class guided user experience • Intimate trial and purchasing • Enhances brand awareness and experience credibility • Sleep Specialists available across channels • Full product offerings available • Enables reach into new geographies and demographics • Experimentation and data collection • Rich brand experience: sleep, fun, experiential • Increased transaction opportunities • 59 stores as of 3/31/20 • 20 retail partnerships as of 3/31/20 Confidential 13

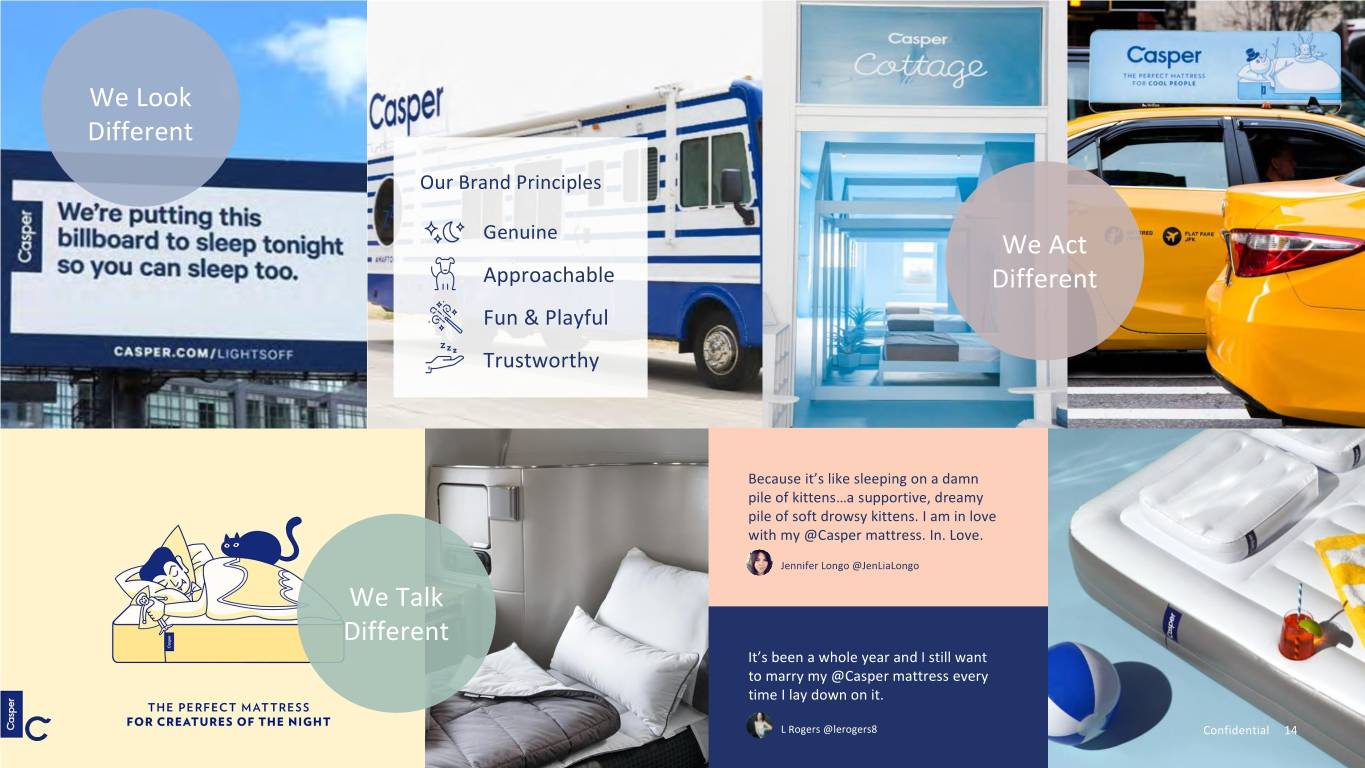

We Look Different Our Brand Principles Genuine We Act Approachable Different Fun & Playful Trustworthy Because it’s like sleeping on a damn pile of kittens…a supportive, dreamy pile of soft drowsy kittens. I am in love with my @Casper mattress. In. Love. Jennifer Longo @JenLiaLongo We Talk Different It’s been a whole year and I still want to marry my @Casper mattress every time I lay down on it. L Rogers @lerogers8 Confidential 14

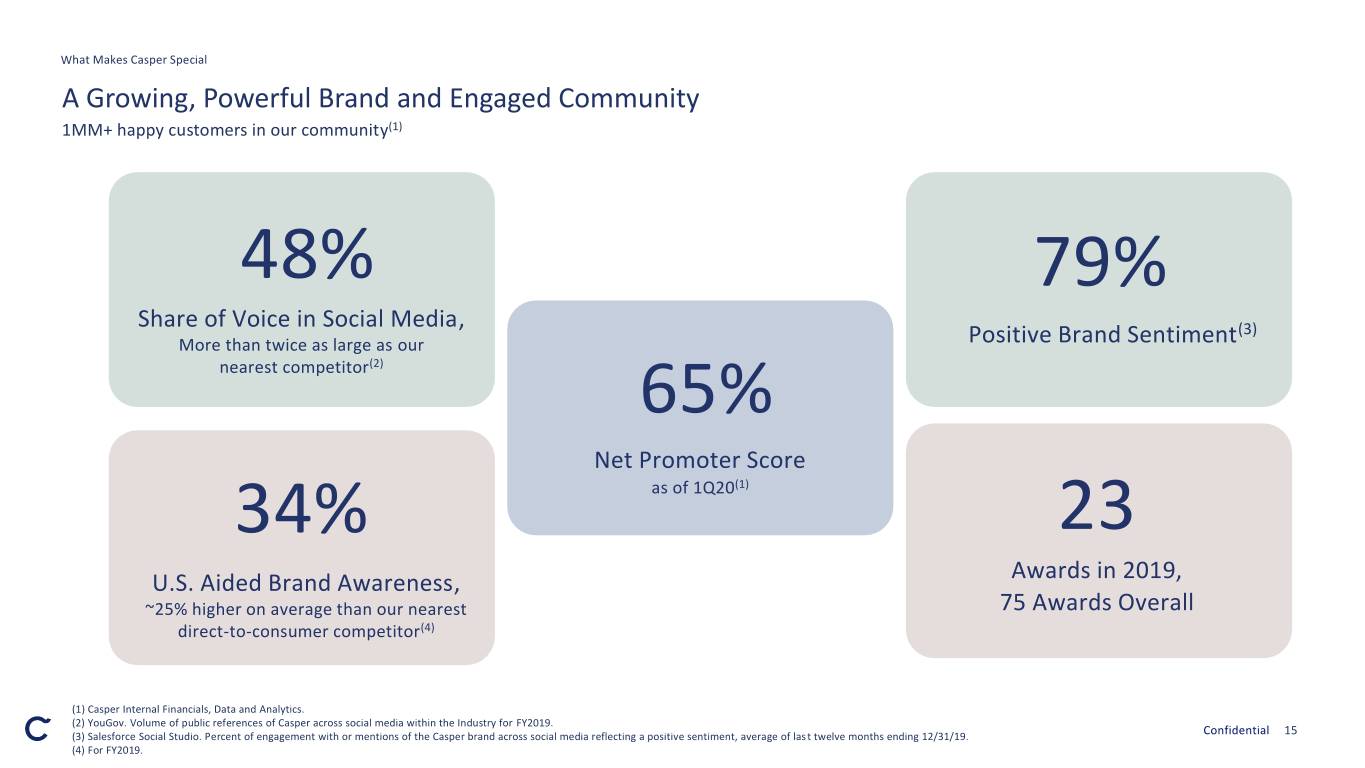

What Makes Casper Special A Growing, Powerful Brand and Engaged Community 1MM+ happy customers in our community(1) 48% 79% Share of Voice in Social Media, (3) More than twice as large as our Positive Brand Sentiment nearest competitor(2) 65% Net Promoter Score 34% as of 1Q20(1) 23 U.S. Aided Brand Awareness, Awards in 2019, ~25% higher on average than our nearest 75 Awards Overall direct-to-consumer competitor(4) (1) Casper Internal Financials, Data and Analytics. (2) YouGov. Volume of public references of Casper across social media within the Industry for FY2019. (3) Salesforce Social Studio. Percent of engagement with or mentions of the Casper brand across social media reflecting a positive sentiment, average of last twelve months ending 12/31/19. Confidential 15 (4) For FY2019.

What Makes Casper Special Technology Based, Data-Driven and Agile Business Drive Margin Expansion We constantly capture data from multiple sources and apply actionable insights to improve our business Casper.com Product Customer Social Reviews Data Customer Casper Facebook Research Labs Data Advanced Glow Analytics Brand & Consumer App Experience Competitive Insights Retail Data is in our DNA Store Data Retail Go-to-market Partner Data Strategy We Believe We Know More About the Business of Sleep Than Any Other Company Confidential 16

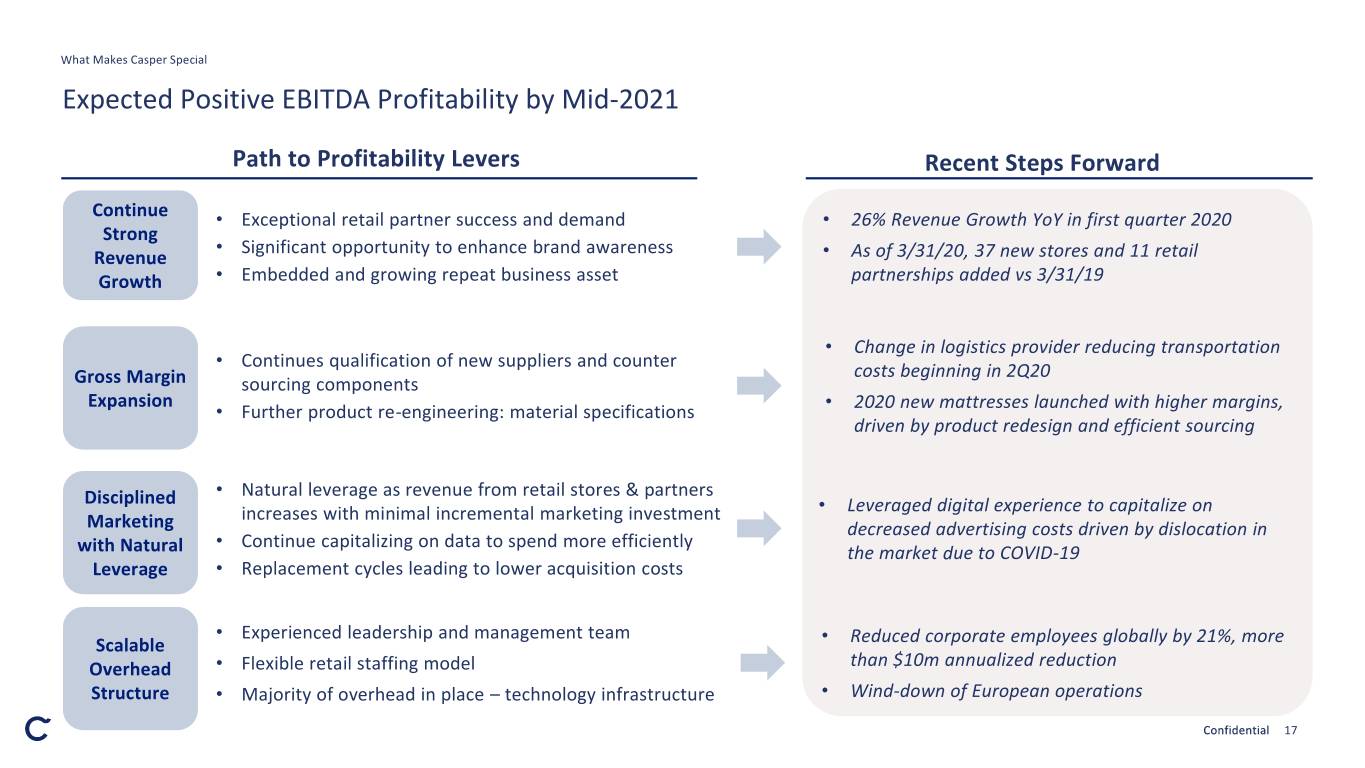

What Makes Casper Special Expected Positive EBITDA Profitability by Mid-2021 Path to Profitability Levers Recent Steps Forward Continue • Exceptional retail partner success and demand • 26% Revenue Growth YoY in first quarter 2020 Strong • Significant opportunity to enhance brand awareness Revenue • As of 3/31/20, 37 new stores and 11 retail Growth • Embedded and growing repeat business asset partnerships added vs 3/31/19 • Change in logistics provider reducing transportation • Continues qualification of new suppliers and counter costs beginning in 2Q20 Gross Margin sourcing components Expansion • 2020 new mattresses launched with higher margins, • Further product re-engineering: material specifications driven by product redesign and efficient sourcing Disciplined • Natural leverage as revenue from retail stores & partners increases with minimal incremental marketing investment • Leveraged digital experience to capitalize on Marketing decreased advertising costs driven by dislocation in • Continue capitalizing on data to spend more efficiently with Natural the market due to COVID-19 Leverage • Replacement cycles leading to lower acquisition costs • Experienced leadership and management team • Scalable Reduced corporate employees globally by 21%, more Overhead • Flexible retail staffing model than $10m annualized reduction Structure • Majority of overhead in place – technology infrastructure • Wind-down of European operations Confidential 17

What Makes Casper Special Why Invest in Casper? ✓ Trusted & Known Brand ✓ Demonstrated Ability to Capture Market Share from Traditional Players ✓ Innovate Products & Services ✓ Integrated Omni-Channel Approach ✓ Data Driven Approach to Drive Margin Expansion ✓ Expected Positive EBITDA Profitability by Mid-2021 Confidential 18

ConfidentialConfidential 19

1Q Update Q1 and April 2020 Update Strong Revenue Growth • Net Revenue increased 26.4% from 1Q19 to $113.0 million • Direct-to-Consumer Revenues increased 12.8% from 1Q19 to $90.3 million • Retail Partnership Revenues increased 142.9% from 1Q19 to $22.7 million Well-Positioned for Current Dynamic Environment: Multi-Channel Platform E-Commerce Strength Accelerating into 2Q20 • April-20 Results: o Net Revenue grew over 15% from April-19 o eCommerce growth of over 35% compared to April-19; DTC growth of over 15% despite the closure of all retail stores throughout April-20 o Retail partnership growth of over 20% compared to April-19 Successful Launch of 2020 Mattress Collection • New line resonating in marketplace and positioned to drive future gross margin expansion Closed IPO, raising $88 million • Strong cash position of $116.1 million as of 3/31/20 Confidential 20

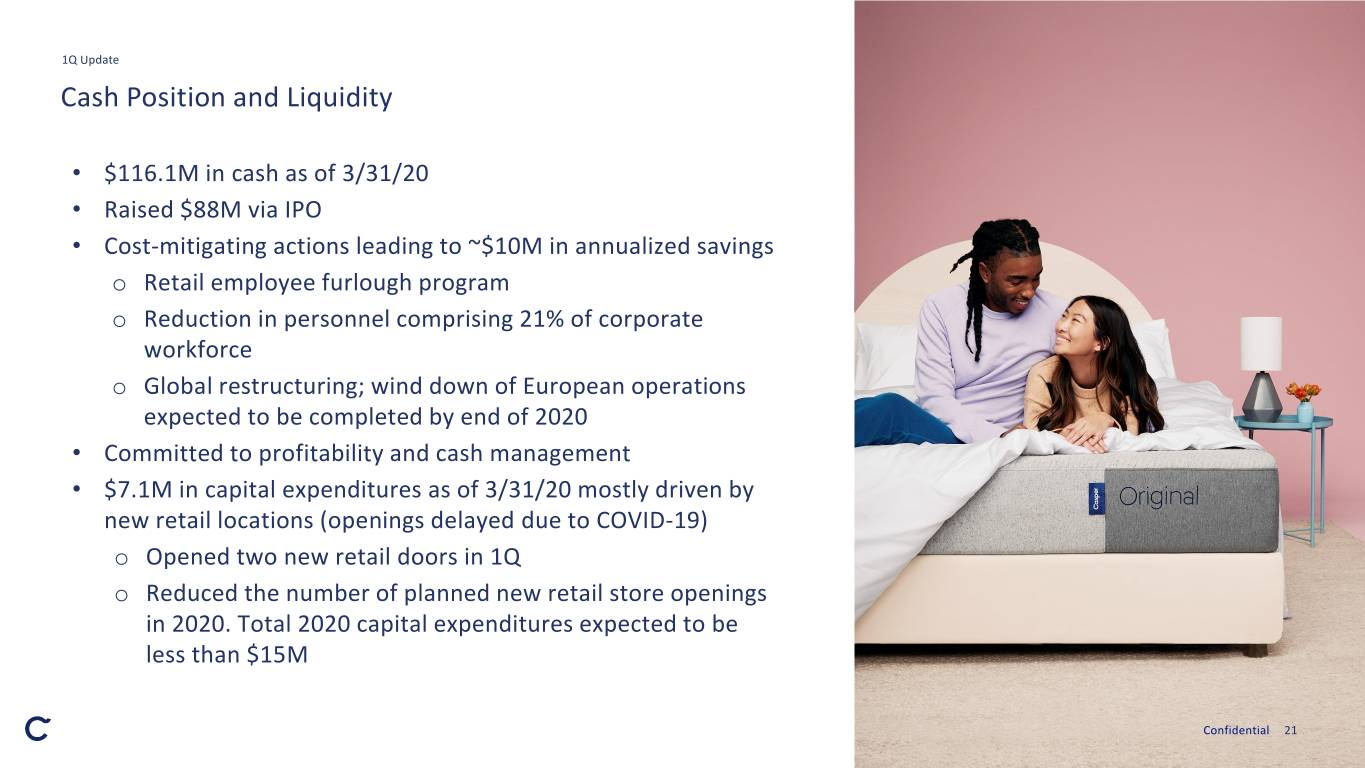

1Q Update Cash Position and Liquidity • $116.1M in cash as of 3/31/20 • Raised $88M via IPO • Cost-mitigating actions leading to ~$10M in annualized savings o Retail employee furlough program o Reduction in personnel comprising 21% of corporate workforce o Global restructuring; wind down of European operations expected to be completed by end of 2020 • Committed to profitability and cash management • $7.1M in capital expenditures as of 3/31/20 mostly driven by new retail locations (openings delayed due to COVID-19) o Opened two new retail doors in 1Q o Reduced the number of planned new retail store openings in 2020. Total 2020 capital expenditures expected to be less than $15M Confidential 21

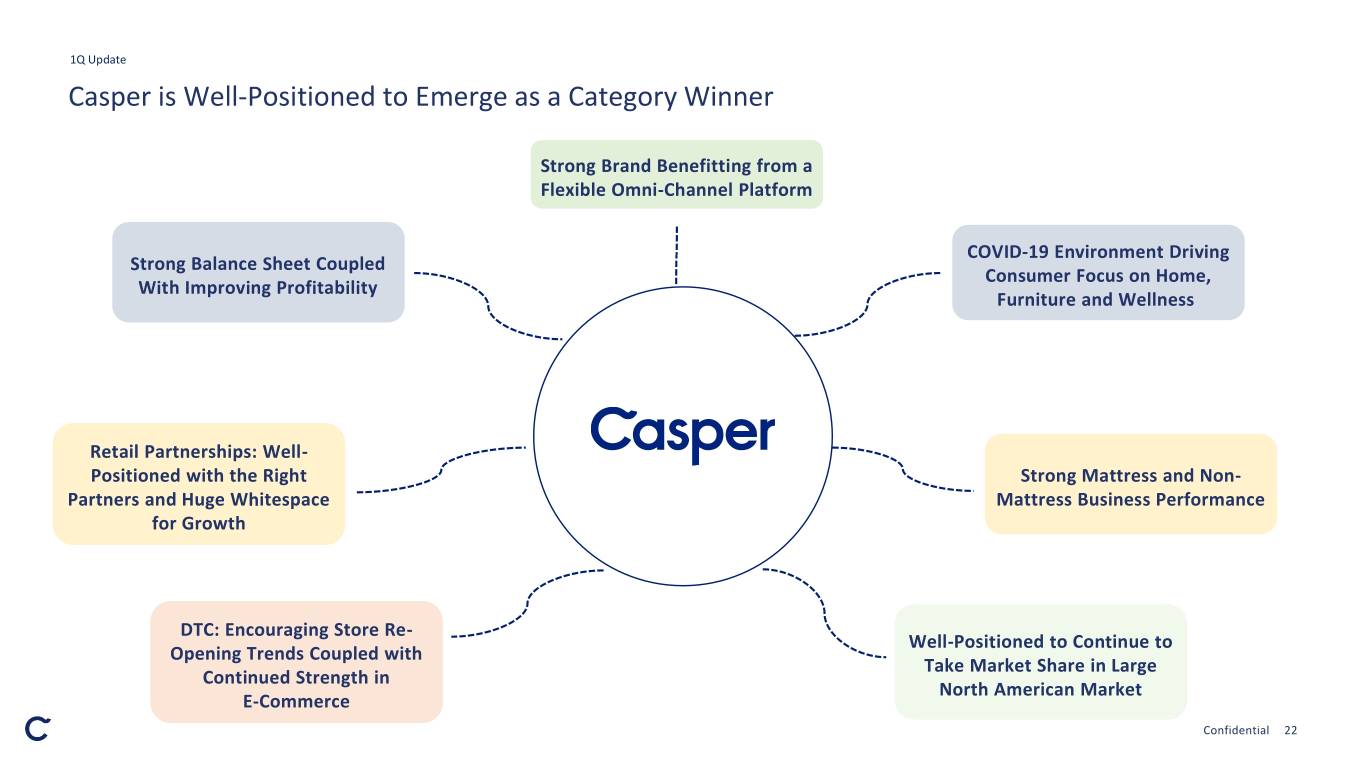

1Q Update Casper is Well-Positioned to Emerge as a Category Winner Strong Brand Benefitting from a Flexible Omni-Channel Platform COVID-19 Environment Driving Strong Balance Sheet Coupled Consumer Focus on Home, With Improving Profitability Furniture and Wellness Retail Partnerships: Well- Positioned with the Right Strong Mattress and Non- Partners and Huge Whitespace Mattress Business Performance for Growth DTC: Encouraging Store Re- Well-Positioned to Continue to Opening Trends Coupled with Take Market Share in Large Continued Strength in North American Market E-Commerce Confidential 22

1Q Update Post-COVID 19 Macro Environment Providing Tailwinds to Casper Changes in consumer behavior that have the potential to benefit Casper 1 2 3 4 5 6 Cocooning Wellness Wallet Share Shifts Home Improvements Suburbanization Purchasing Platform Optionality Feeling Comfy, Safe, Health and Wellness Changes in Time at Home Desire for Suburb vs. E-Commerce Secure and Cozy is Focus Includes Sleep Consumer Spending Driving Increased City Living Leading Benefits vs. In- Core to the Casper as a Focal Point Driving More Investment in Home to Increased Moving Person Shopping Brand Household & Household Concerns Consumer Purchases Creation Confidential 23

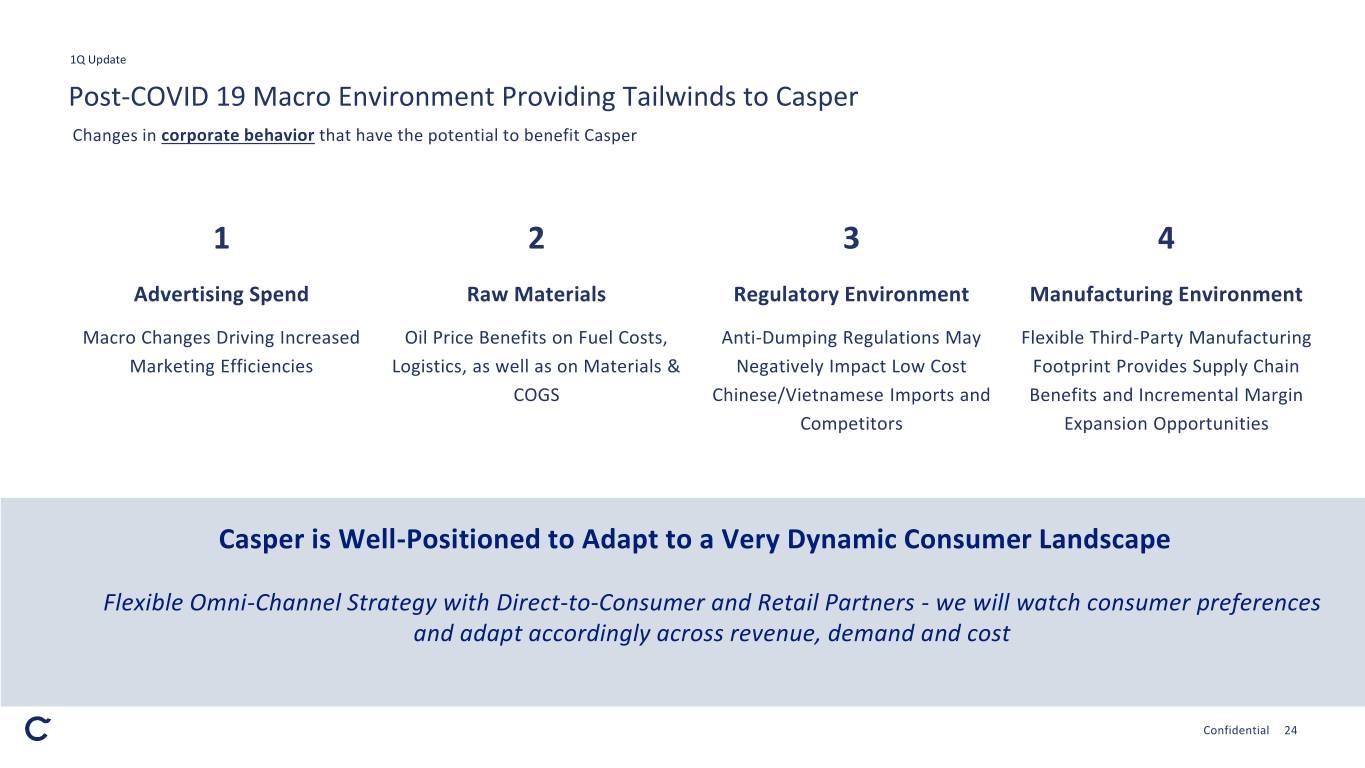

1Q Update Post-COVID 19 Macro Environment Providing Tailwinds to Casper Changes in corporate behavior that have the potential to benefit Casper 1 2 3 4 Advertising Spend Raw Materials Regulatory Environment Manufacturing Environment Macro Changes Driving Increased Oil Price Benefits on Fuel Costs, Anti-Dumping Regulations May Flexible Third-Party Manufacturing Marketing Efficiencies Logistics, as well as on Materials & Negatively Impact Low Cost Footprint Provides Supply Chain COGS Chinese/Vietnamese Imports and Benefits and Incremental Margin Competitors Expansion Opportunities Casper is Well-Positioned to Adapt to a Very Dynamic Consumer Landscape Flexible Omni-Channel Strategy with Direct-to-Consumer and Retail Partners - we will watch consumer preferences and adapt accordingly across revenue, demand and cost Confidential 24

Confidential 25

Confidential 26

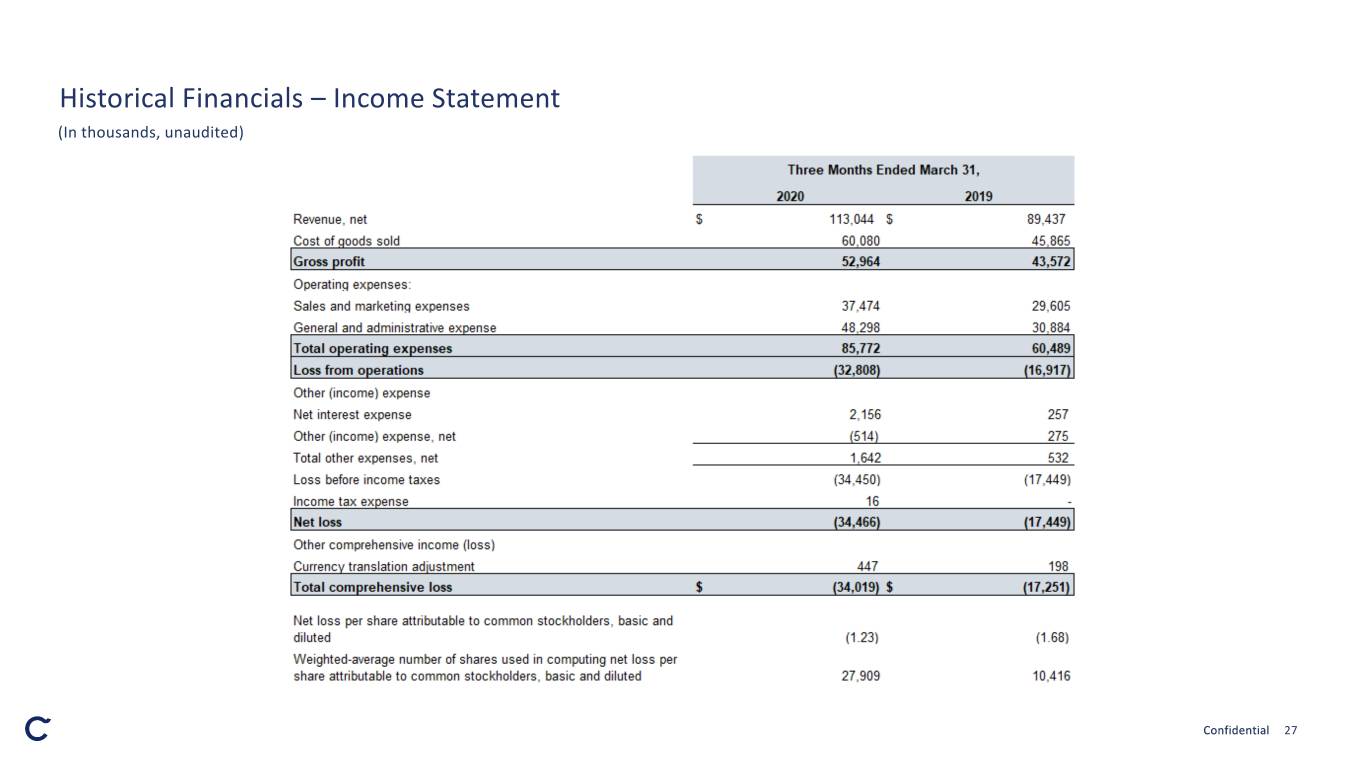

Historical Financials – Income Statement (In thousands, unaudited) Confidential 27

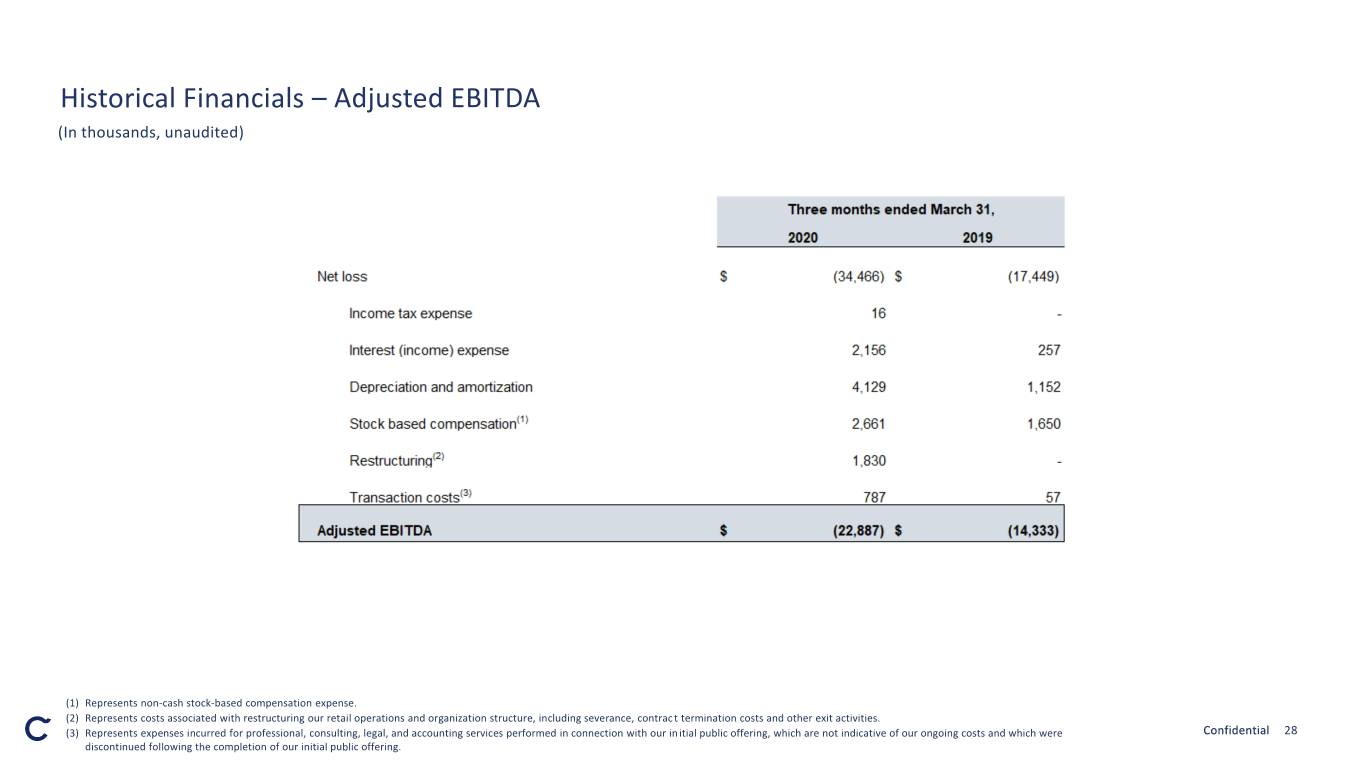

Historical Financials – Adjusted EBITDA (In thousands, unaudited) (1) Represents non-cash stock-based compensation expense. (2) Represents costs associated with restructuring our retail operations and organization structure, including severance, contract termination costs and other exit activities. (3) Represents expenses incurred for professional, consulting, legal, and accounting services performed in connection with our initial public offering, which are not indicative of our ongoing costs and which were Confidential 28 discontinued following the completion of our initial public offering.

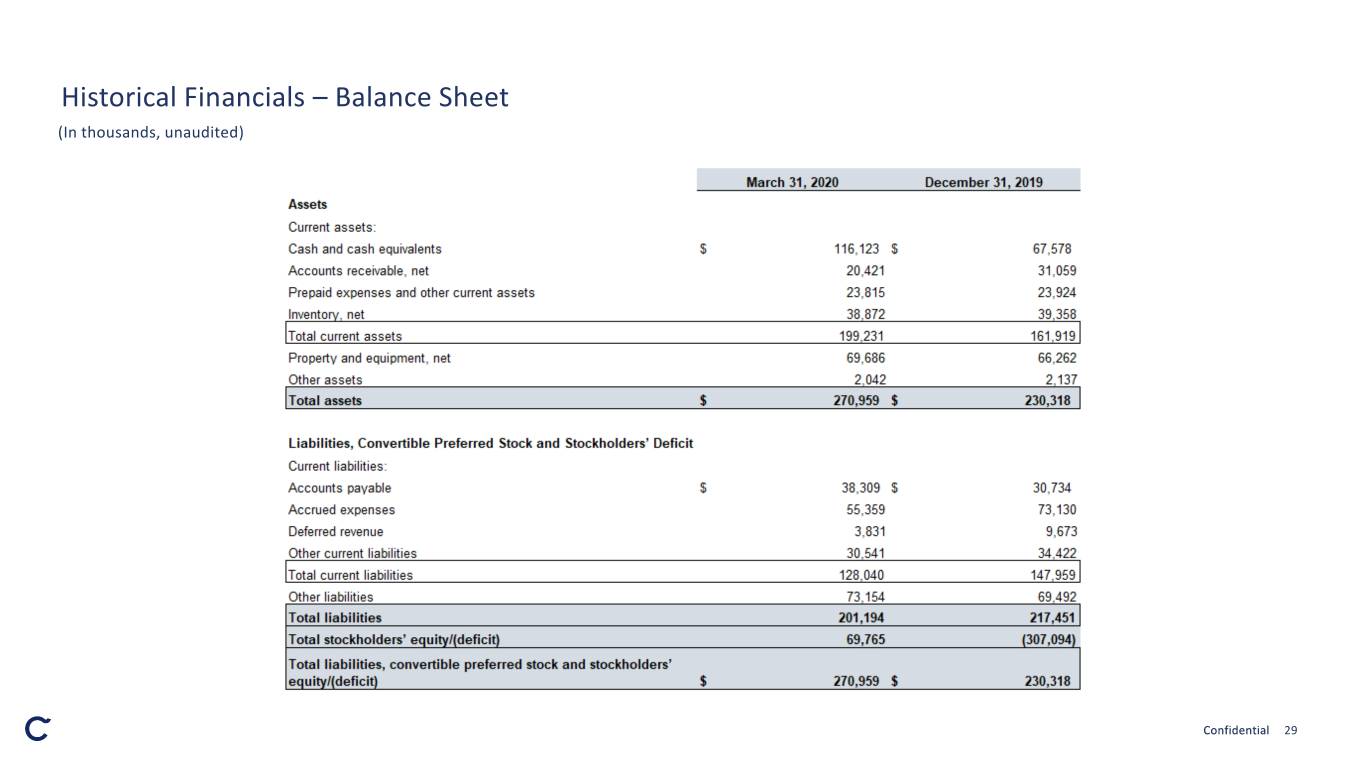

Historical Financials – Balance Sheet (In thousands, unaudited) Confidential 29

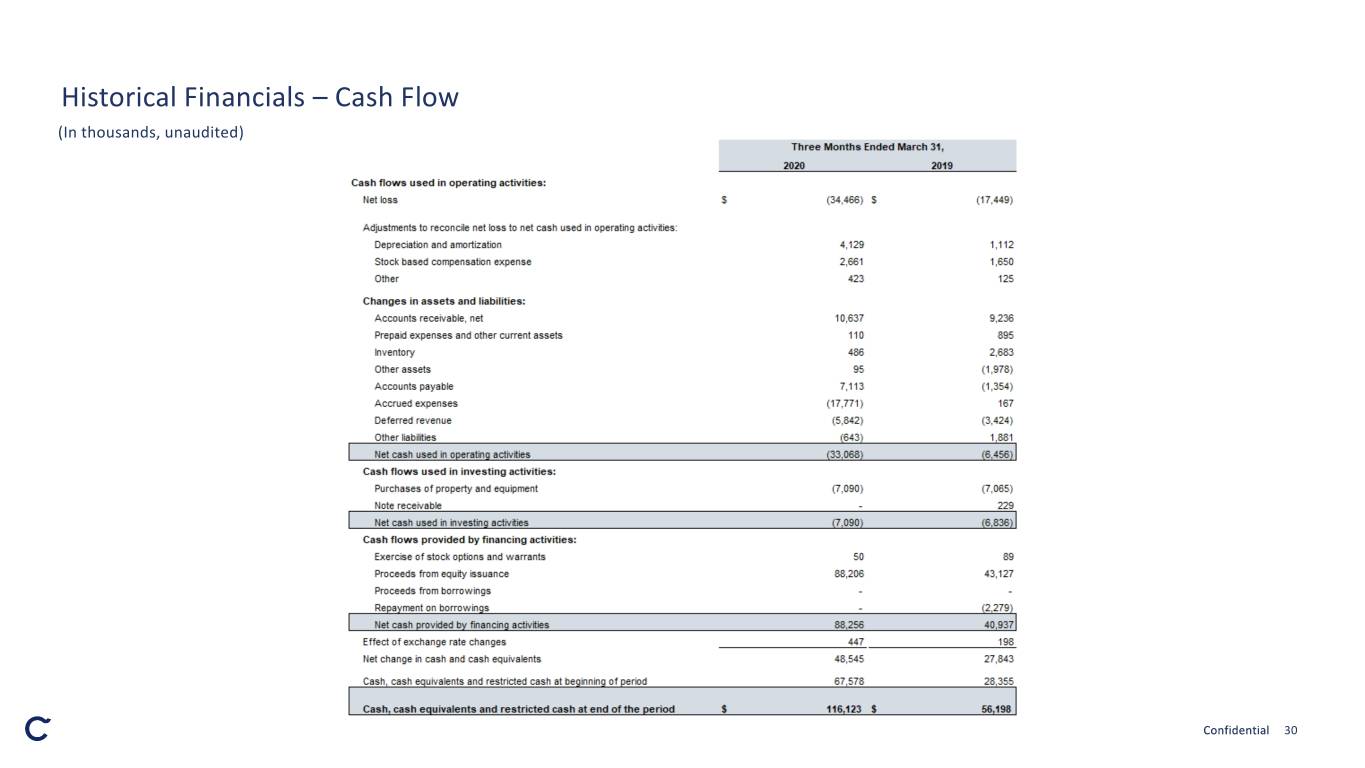

Historical Financials – Cash Flow (In thousands, unaudited) Confidential 30