Attached files

| file | filename |

|---|---|

| EX-99.4 - EX-99.4 - Invitae Corp | d948897dex994.htm |

| EX-99.3 - EX-99.3 - Invitae Corp | d948897dex993.htm |

| EX-99.1 - EX-99.1 - Invitae Corp | d948897dex991.htm |

| 8-K - 8-K - Invitae Corp | d948897d8k.htm |

Transforming medical genetics worldwide 06 | 22 | 2020 Exhibit 99.2

Safe Harbor Statement This presentation contains statements, including statements regarding the proposed acquisition of ArcherDX, Inc. (“Archer”) by Invitae Corporation (“Invitae”) that are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are intended to be covered by the “safe harbor” created by those sections. Forward-looking statements, which are based on certain assumptions and describe future plans, strategies, expectations and events, can generally be identified by the use of forward-looking terms such as “believe,” “expect,” “may,” “will,” “should,” “would,” “could,” “seek,” “intend,” “plan,” “goal,” “project,” “estimate,” “anticipate” or other comparable terms. All statements other than statements of historical facts included in this presentation regarding strategies, synergies, prospects, financial results, operations, costs, plans, objectives and the proposed acquisition of Archer by Invitae are forward-looking statements. Examples of forward-looking statements include, but are not limited to, statements regarding expected future operating results, including forward cash burn, future products and services and customers served, regulatory submissions, anticipated results of product development efforts, potential addressable markets, the impact of Covid-19, the anticipated benefits of the proposed acquisition of Archer, including expected synergies, opportunities and financial and other impacts, the transaction structure and financing plans, and the expected timing of completion of the proposed transaction. Forward-looking statements are neither historical facts nor assurances of future performance or events. Instead, they are based only on current beliefs, expectations and assumptions regarding future business developments, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Forward-looking statements are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Actual results, conditions and events may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause actual results, conditions and events to differ materially from those indicated in the forward-looking statements include, but are not limited to: the ability to successfully and profitably market our products and services; the acceptance of our products and services by patients and healthcare providers; the ability to meet demand for our products and services; the availability and sufficiency of reimbursement; the amount and nature of competition; the effects of the adoption, modification or repeal of any law, rule, order, interpretation or policy relating to the healthcare system, including without limitation as a result of any judicial, executive or legislative action; the impact of Covid-19 on the business of Invitae and Archer; Invitae’s ability to manage its growth effectively; the ability of Invitae and Archer to successfully develop new products and services; the ability to effectively utilize strategic partnerships and acquisitions; the ability of Invitae and Archer to obtain and maintain regulatory approvals and comply with applicable regulations; the ability of Invitae and Archer to obtain the required regulatory approvals for the proposed merger and the approval of Invitae’s and Archer’s stockholders, and to satisfy the other conditions to the closing of the acquisition and related financing transactions on a timely basis or at all; the occurrence of events that may give rise to a right of one or both of Invitae and Archer to terminate the merger agreement; negative effects of the announcement or the consummation of the acquisition on the market price of Invitae’s common stock and/or on the companies’ respective businesses, financial conditions, results of operations and financial performance; significant transaction costs and/or unknown liabilities; the possibility that the anticipated benefits from the proposed acquisition of Archer cannot be realized in full or at all or may take longer to realize than expected; risks associated with contracts containing consent and/or other provisions that may be triggered by the proposed acquisition of Archer; risks associated with transaction-related litigation; the possibility that costs or difficulties related to the integration of Archer’s operations with those of Invitae will be greater than expected; the ability of companies individually and the combined company to retain and hire key personnel; and the risks and uncertainties set forth in Invitae’s reports on Forms 10-K, 10-Q and 8-K filed with or furnished to the Securities and Exchange Commission (the “SEC”) and other written statements made by Invitae from time to time. There can be no assurance that the proposed acquisition of Archer will in fact be consummated in the manner described or at all. Forward -looking statements speak only as of the date hereof, and Invitae disclaims any obligation to update any forward-looking statements. NOTE: Invitae and the Invitae logo are trademarks of Invitae Corporation. All other trademarks and service marks are the property of their respective owners.

Additional Information In connection with the proposed transaction, Invitae will file with the SEC a registration statement on Form S-4, which will include a document that serves as a proxy statement/prospectus of Invitae (the “proxy statement/prospectus”), and will file other documents regarding the proposed transaction with the SEC. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. A definitive proxy statement/prospectus will be sent to Invitae’s stockholders when it becomes available. Investors and security holders will be able to obtain the registration statement and the proxy statement/prospectus free of charge from the SEC’s website or from Invitae when it becomes available. The documents filed by Invitae with the SEC may be obtained free of charge at Invitae’s website at www.invitae.com or at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from Invitae by requesting them by mail at Invitae Corporation, 1400 16th Street, San Francisco, California 94103, or by telephone at (415) 374-7782. Participants in the Solicitation Invitae and its directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about Invitae’s directors and executive officers is available in Invitae’s proxy statement dated April 29, 2020 for its 2020 Annual Meeting of Stockholders. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the registration statement, the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when they become available. Stockholders, potential investors and other readers should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from Invitae as indicated above. No Offer or Solicitation This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

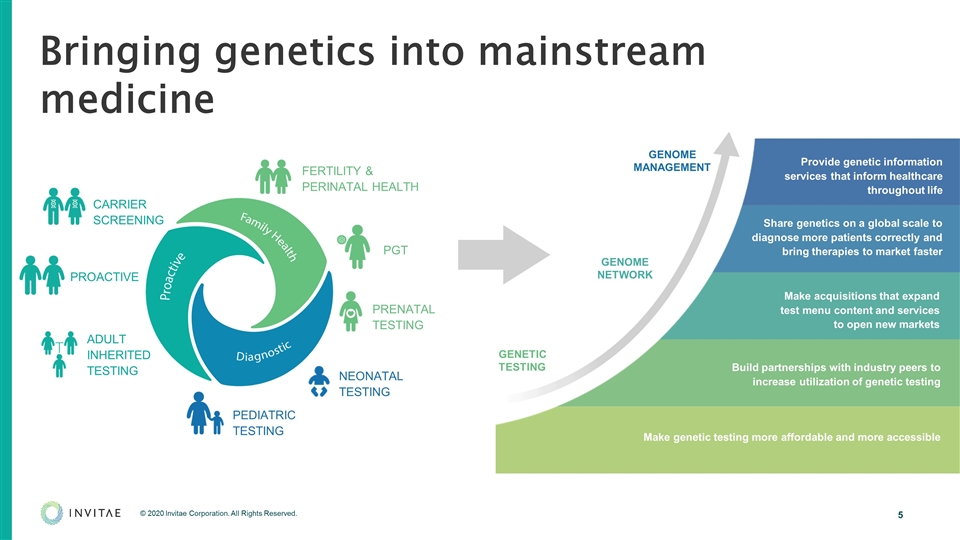

Invitae’s mission is to bring comprehensive genetics into mainstream medicine to improve healthcare for billions of people. By aggregating the world’s genetic tests into a single service, we are making genetic information accessible to all who can benefit.

Bringing genetics into mainstream medicine Build partnerships with industry peers to increase utilization of genetic testing Make acquisitions that expand test menu content and services to open new markets Share genetics on a global scale to diagnose more patients correctly and bring therapies to market faster Provide genetic information services that inform healthcare throughout life GENOME NETWORK GENETIC TESTING GENOME MANAGEMENT Make genetic testing more affordable and more accessible FERTILITY & PERINATAL HEALTH PGT PRENATAL TESTING NEONATAL TESTING PEDIATRIC TESTING CARRIER SCREENING ADULT INHERITED TESTING PROACTIVE

Today we take another step forward toward our mission.

The future of precision oncology and cancer care

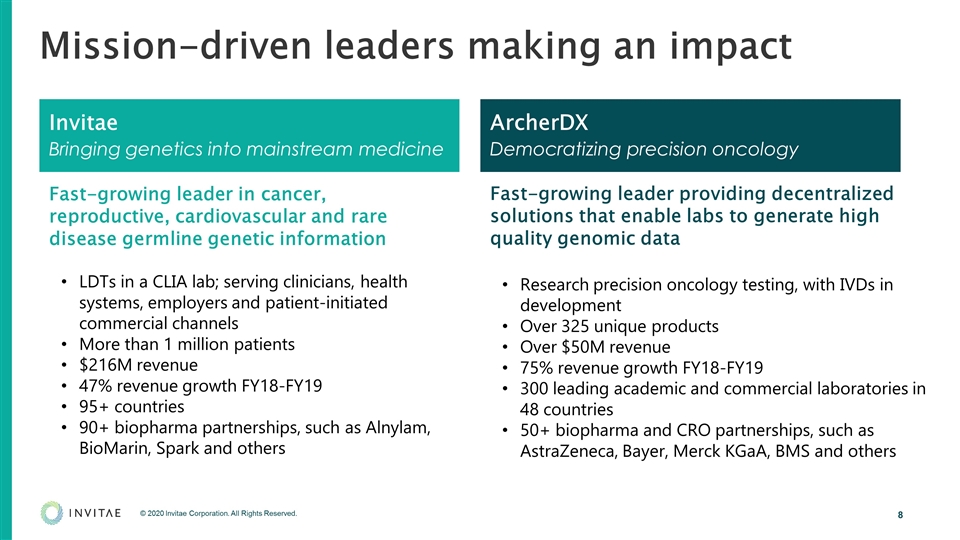

Mission-driven leaders making an impact Invitae Bringing genetics into mainstream medicine ArcherDX Democratizing precision oncology Fast-growing leader in cancer, reproductive, cardiovascular and rare disease germline genetic information LDTs in a CLIA lab; serving clinicians, health systems, employers and patient-initiated commercial channels More than 1 million patients $216M revenue 47% revenue growth FY18-FY19 95+ countries 90+ biopharma partnerships, such as Alnylam, BioMarin, Spark and others Fast-growing leader providing decentralized solutions that enable labs to generate high quality genomic data Research precision oncology testing, with IVDs in development Over 325 unique products Over $50M revenue 75% revenue growth FY18-FY19 300 leading academic and commercial laboratories in 48 countries 50+ biopharma and CRO partnerships, such as AstraZeneca, Bayer, Merck KGaA, BMS and others

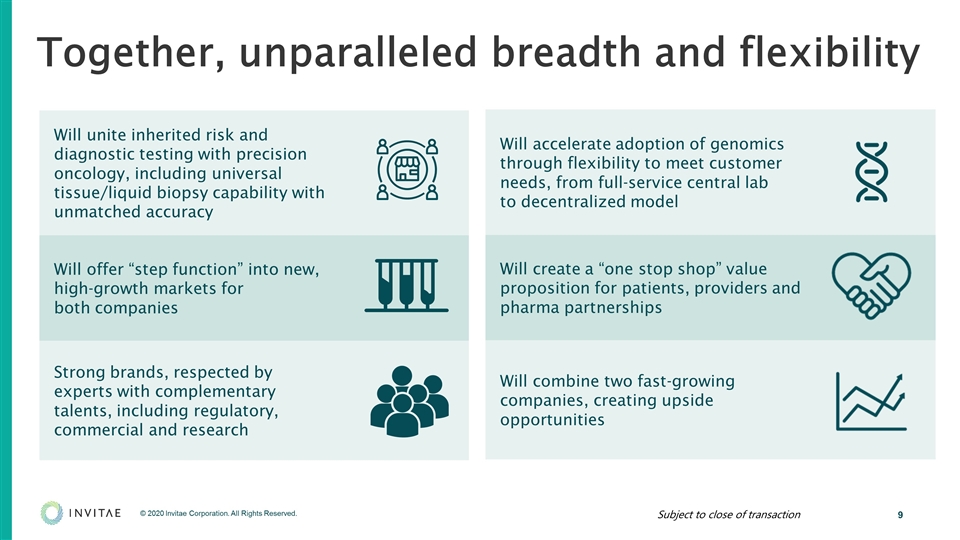

Will unite inherited risk and diagnostic testing with precision oncology, including universal tissue/liquid biopsy capability with unmatched accuracy Will offer “step function” into new, high-growth markets for both companies Strong brands, respected by experts with complementary talents, including regulatory, commercial and research Together, unparalleled breadth and flexibility Will accelerate adoption of genomics through flexibility to meet customer needs, from full-service central lab to decentralized model Will create a “one stop shop” value proposition for patients, providers and pharma partnerships Will combine two fast-growing companies, creating upside opportunities Subject to close of transaction

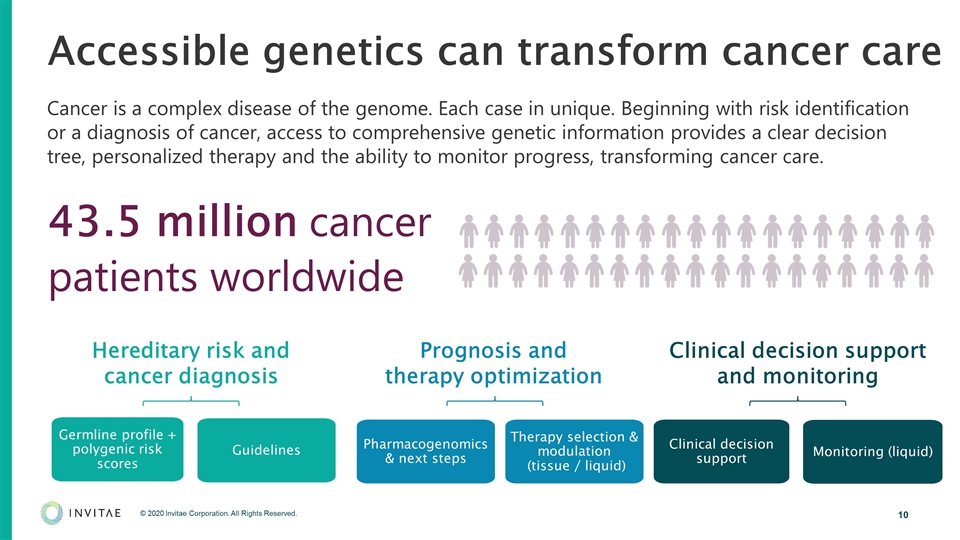

Accessible genetics can transform cancer care Cancer is a complex disease of the genome. Each case in unique. Beginning with risk identification or a diagnosis of cancer, access to comprehensive genetic information provides a clear decision tree, personalized therapy and the ability to monitor progress, transforming cancer care. Hereditary risk and cancer diagnosis Prognosis and therapy optimization Clinical decision support and monitoring Guidelines Germline profile + polygenic risk scores Therapy selection & modulation (tissue / liquid) Pharmacogenomics & next steps Clinical decision support Monitoring (liquid) 43.5 million cancer patients worldwide

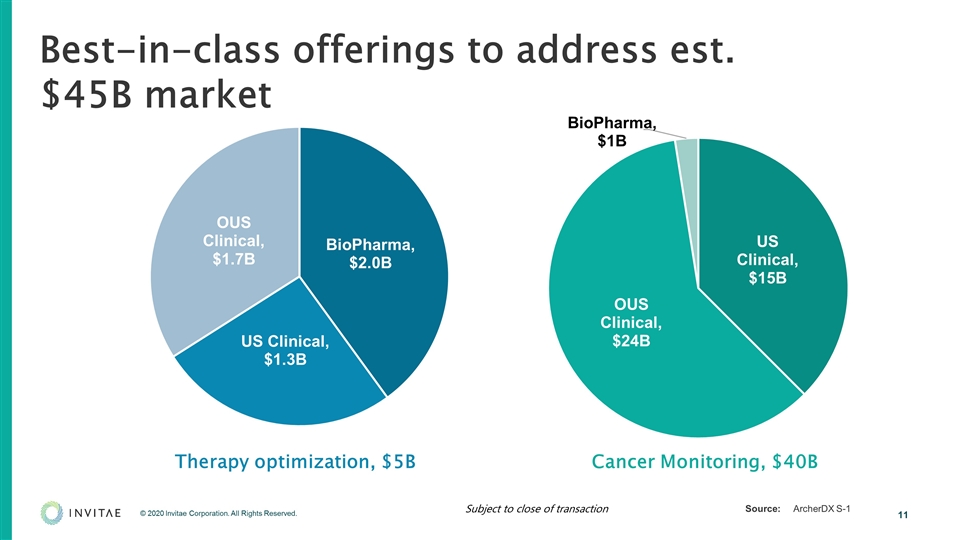

Best-in-class offerings to address est. $45B market Source:ArcherDX S-1 Therapy optimization, $5B Cancer Monitoring, $40B Subject to close of transaction

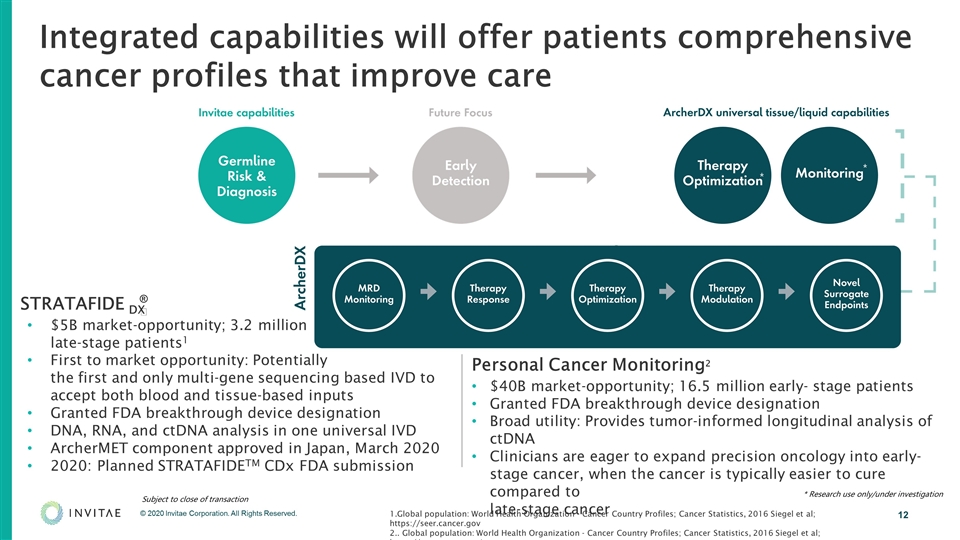

Integrated capabilities will offer patients comprehensive cancer profiles that improve care STRATAFIDE DX $5B market-opportunity; 3.2 million late-stage patients1 First to market opportunity: Potentially the first and only multi-gene sequencing based IVD to accept both blood and tissue-based inputs Granted FDA breakthrough device designation DNA, RNA, and ctDNA analysis in one universal IVD ArcherMET component approved in Japan, March 2020 2020: Planned STRATAFIDETM CDx FDA submission Personal Cancer Monitoring2 $40B market-opportunity; 16.5 million early- stage patients Granted FDA breakthrough device designation Broad utility: Provides tumor-informed longitudinal analysis of ctDNA Clinicians are eager to expand precision oncology into early-stage cancer, when the cancer is typically easier to cure compared to late-stage cancer 1.Global population: World Health Organization - Cancer Country Profiles; Cancer Statistics, 2016 Siegel et al; https://seer.cancer.gov 2.. Global population: World Health Organization - Cancer Country Profiles; Cancer Statistics, 2016 Siegel et al; https://seer.cancer.gov) Subject to close of transaction * * Research use only/under investigation ®️ *

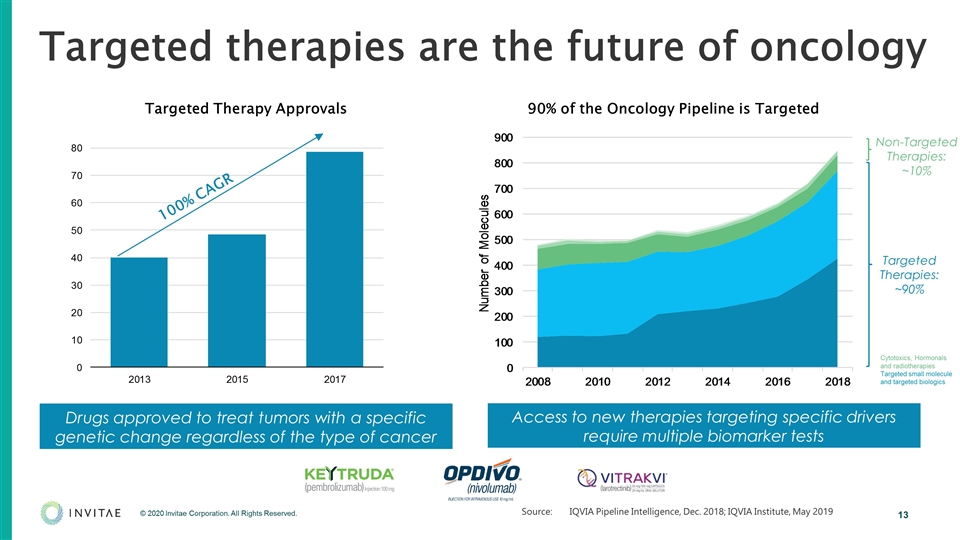

Targeted therapies are the future of oncology Drugs approved to treat tumors with a specific genetic change regardless of the type of cancer 100% CAGR Targeted Therapy Approvals 90% of the Oncology Pipeline is Targeted Access to new therapies targeting specific drivers require multiple biomarker tests Targeted Therapies: ~90% Non-Targeted Therapies: ~10% Source:IQVIA Pipeline Intelligence, Dec. 2018; IQVIA Institute, May 2019 Cytotoxics, Hormonals and radiotherapies Targeted small molecule and targeted biologics

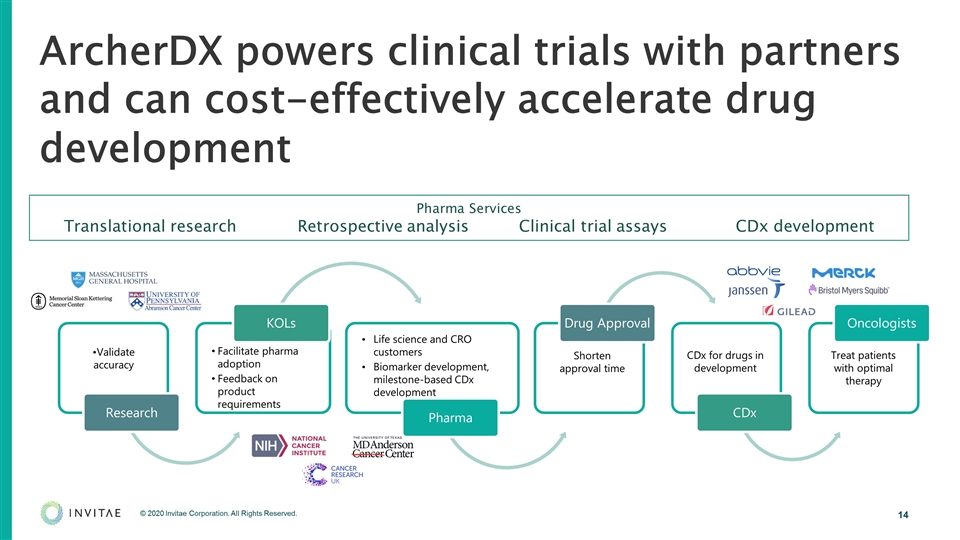

ArcherDX powers clinical trials with partners and can cost-effectively accelerate drug development Shorten approval time CDx for drugs in development Treat patients with optimal therapy Pharma Services Translational research Retrospective analysis Clinical trial assays CDx development Research Validate accuracy KOLs Facilitate pharma adoption Pharma Life science and CRO customers Biomarker development, milestone-based CDx development Drug Approval CDx Oncologists Feedback on product requirements

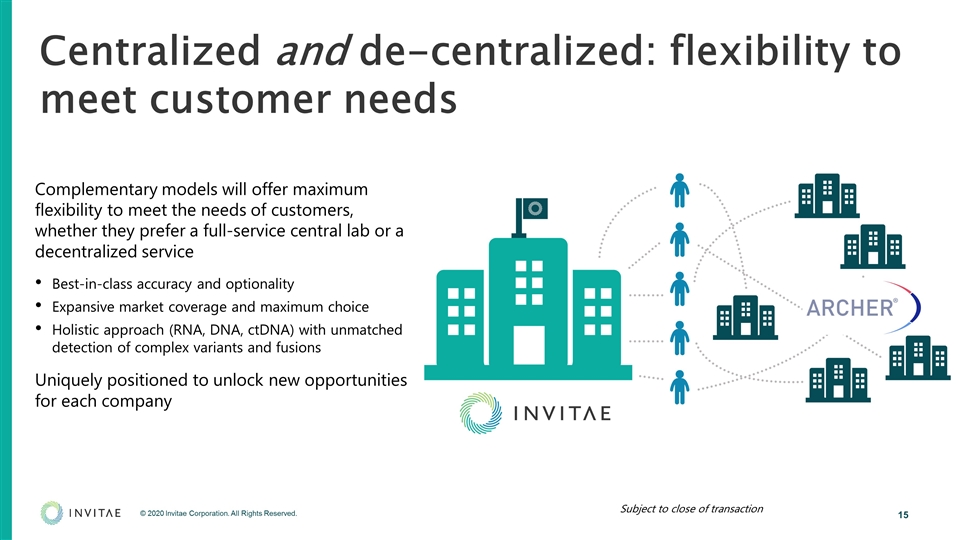

Centralized and de-centralized: flexibility to meet customer needs Complementary models will offer maximum flexibility to meet the needs of customers, whether they prefer a full-service central lab or a decentralized service Best-in-class accuracy and optionality Expansive market coverage and maximum choice Holistic approach (RNA, DNA, ctDNA) with unmatched detection of complex variants and fusions Uniquely positioned to unlock new opportunities for each company Subject to close of transaction

Deal structure & financing

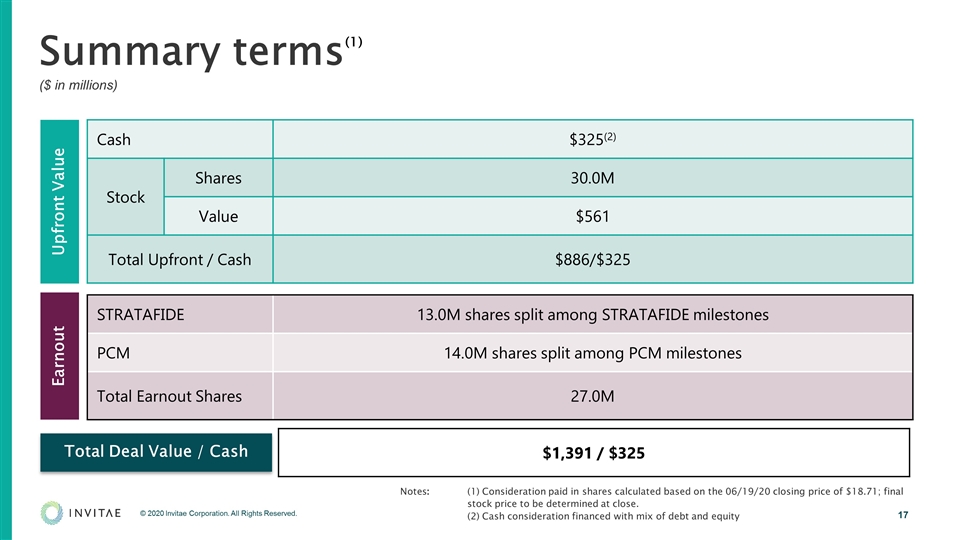

Summary terms ($ in millions) Cash $325(2) Stock Shares 30.0M Value $561 Total Upfront / Cash $886/$325 STRATAFIDE 13.0M shares split among STRATAFIDE milestones PCM 14.0M shares split among PCM milestones Total Earnout Shares 27.0M Upfront Value Earnout $1,391 / $325 Total Deal Value / Cash Notes: (1) Consideration paid in shares calculated based on the 06/19/20 closing price of $18.71; final stock price to be determined at close. (2) Cash consideration financed with mix of debt and equity (1)

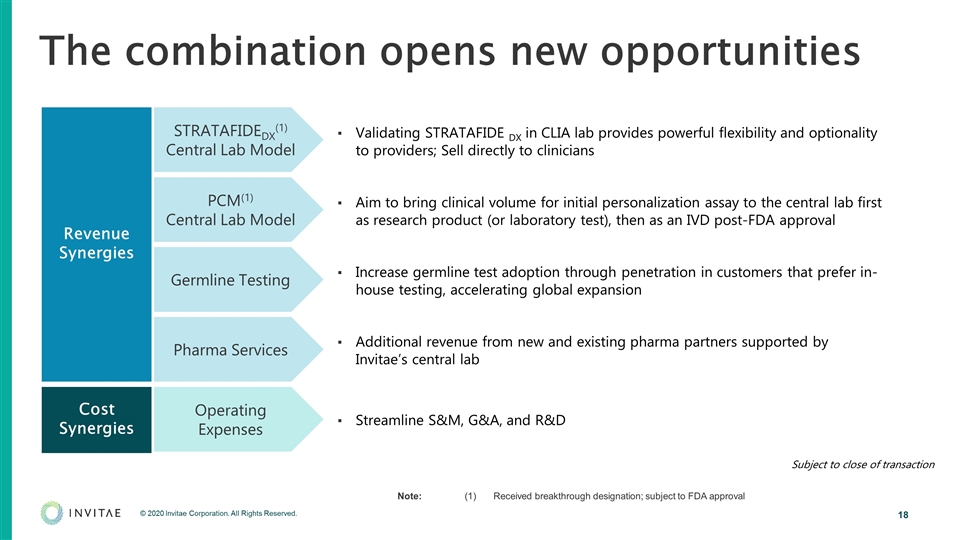

The combination opens new opportunities Validating STRATAFIDE DX in CLIA lab provides powerful flexibility and optionality to providers; Sell directly to clinicians Aim to bring clinical volume for initial personalization assay to the central lab first as research product (or laboratory test), then as an IVD post-FDA approval Increase germline test adoption through penetration in customers that prefer in-house testing, accelerating global expansion Additional revenue from new and existing pharma partners supported by Invitae’s central lab Streamline S&M, G&A, and R&D Note:(1)Received breakthrough designation; subject to FDA approval Revenue Synergies Cost Synergies STRATAFIDEDX(1) Central Lab Model PCM(1) Central Lab Model Germline Testing Pharma Services Operating Expenses Subject to close of transaction

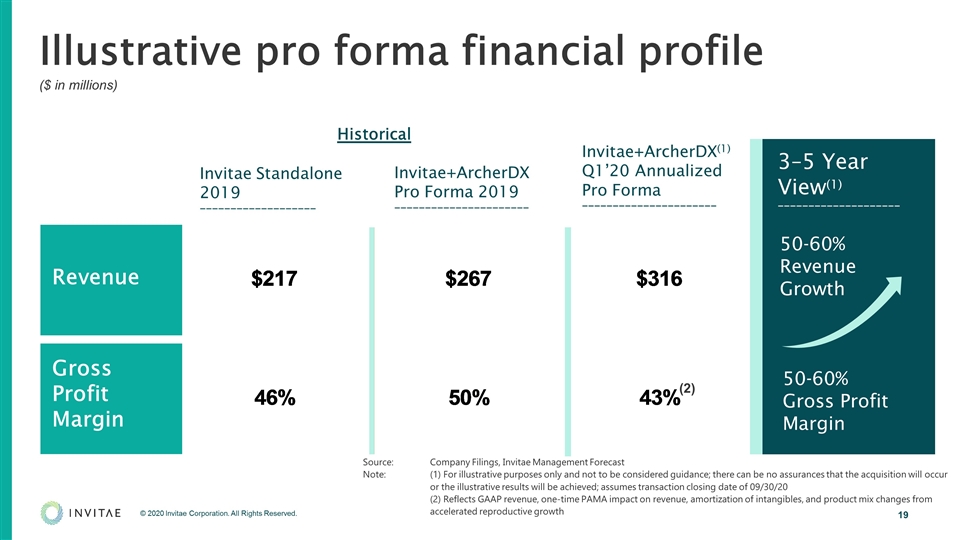

Illustrative pro forma financial profile ($ in millions) (1) (2) Revenue Gross Profit Margin 50-60% Revenue Growth 50-60% Gross Profit Margin 3–5 Year View(1) ____________________ Source:Company Filings, Invitae Management Forecast Note: (1) For illustrative purposes only and not to be considered guidance; there can be no assurances that the acquisition will occur or the illustrative results will be achieved; assumes transaction closing date of 09/30/20 (2) Reflects GAAP revenue, one-time PAMA impact on revenue, amortization of intangibles, and product mix changes from accelerated reproductive growth Historical Invitae Standalone 2019 ___________________ Invitae+ArcherDX Pro Forma 2019 ______________________ Invitae+ArcherDX(1) Q1’20 Annualized Pro Forma ______________________

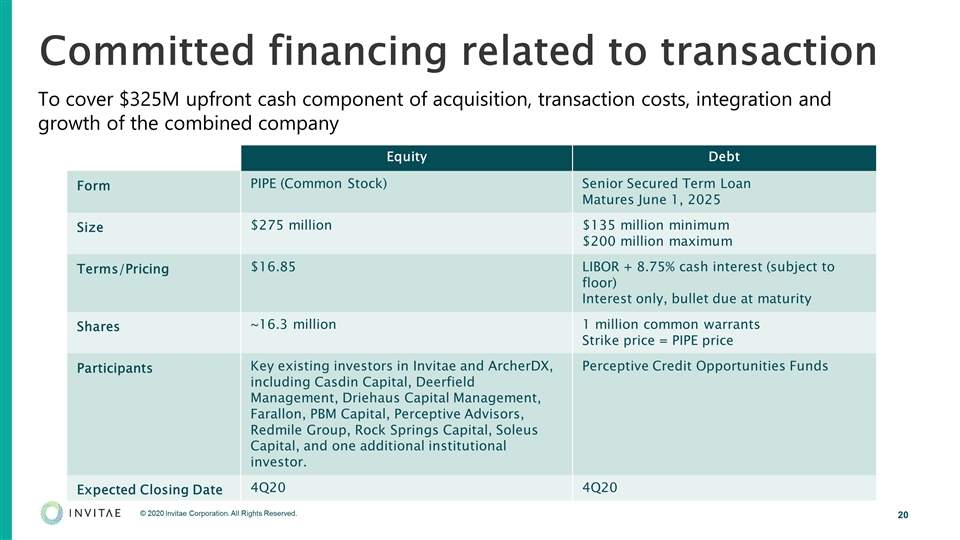

Committed financing related to transaction To cover $325M upfront cash component of acquisition, transaction costs, integration and growth of the combined company Equity Debt Form PIPE (Common Stock) Senior Secured Term Loan Matures June 1, 2025 Size $275 million $135 million minimum $200 million maximum Terms/Pricing $16.85 LIBOR + 8.75% cash interest (subject to floor) Interest only, bullet due at maturity Shares ~16.3 million 1 million common warrants Strike price = PIPE price Participants Key existing investors in Invitae and ArcherDX, including Casdin Capital, Deerfield Management, Driehaus Capital Management, Farallon, PBM Capital, Perceptive Advisors, Redmile Group, Rock Springs Capital, Soleus Capital, and one additional institutional investor. Perceptive Credit Opportunities Funds Expected Closing Date 4Q20 4Q20

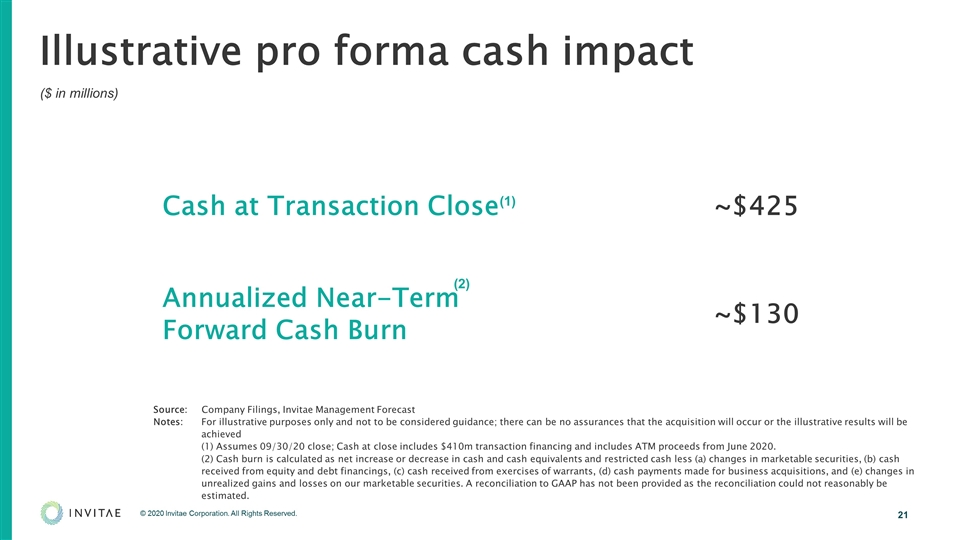

Illustrative pro forma cash impact ($ in millions) Cash at Transaction Close ~$425 Annualized Near-Term Forward Cash Burn ~$130 (1) (2) Source: Company Filings, Invitae Management Forecast Notes: For illustrative purposes only and not to be considered guidance; there can be no assurances that the acquisition will occur or the illustrative results will be achieved (1) Assumes 09/30/20 close; Cash at close includes $410m transaction financing and includes ATM proceeds from June 2020. (2) Cash burn is calculated as net increase or decrease in cash and cash equivalents and restricted cash less (a) changes in marketable securities, (b) cash received from equity and debt financings, (c) cash received from exercises of warrants, (d) cash payments made for business acquisitions, and (e) changes in unrealized gains and losses on our marketable securities. A reconciliation to GAAP has not been provided as the reconciliation could not reasonably be estimated.

The team to build the runaway leader in genetics

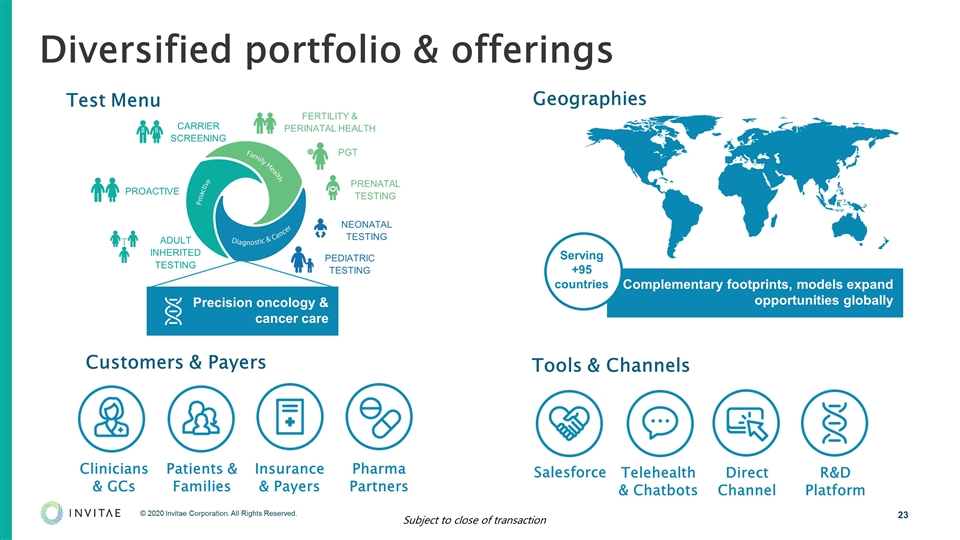

Complementary footprints, models expand opportunities globally Diversified portfolio & offerings FERTILITY & PERINATAL HEALTH PGT PRENATAL TESTING NEONATAL TESTING PEDIATRIC TESTING CARRIER SCREENING ADULT INHERITED TESTING PROACTIVE Serving +95 countries Clinicians & GCs Patients & Families Insurance & Payers Customers & Payers Tools & Channels Telehealth & Chatbots Pharma Partners Direct Channel R&D Platform Geographies Test Menu Salesforce Precision oncology & cancer care Subject to close of transaction

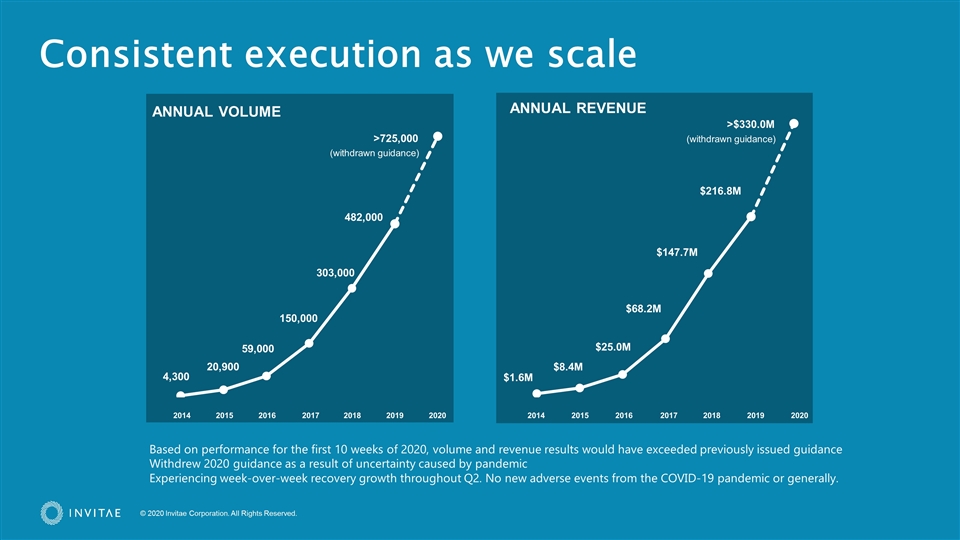

4,300 482,000 20,900 59,000 150,000 303,000 $1.6M $216.8M $8.4M $25.0M $68.2M $147.7M ANNUAL REVENUE ANNUAL VOLUME 2014 2015 2016 2017 2018 2019 2020 2014 2015 2016 2017 2018 2019 2020 Consistent execution as we scale >725,000 >$330.0M Based on performance for the first 10 weeks of 2020, volume and revenue results would have exceeded previously issued guidance Withdrew 2020 guidance as a result of uncertainty caused by pandemic Experiencing week-over-week recovery growth throughout Q2. No new adverse events from the COVID-19 pandemic or generally. (withdrawn guidance) (withdrawn guidance)

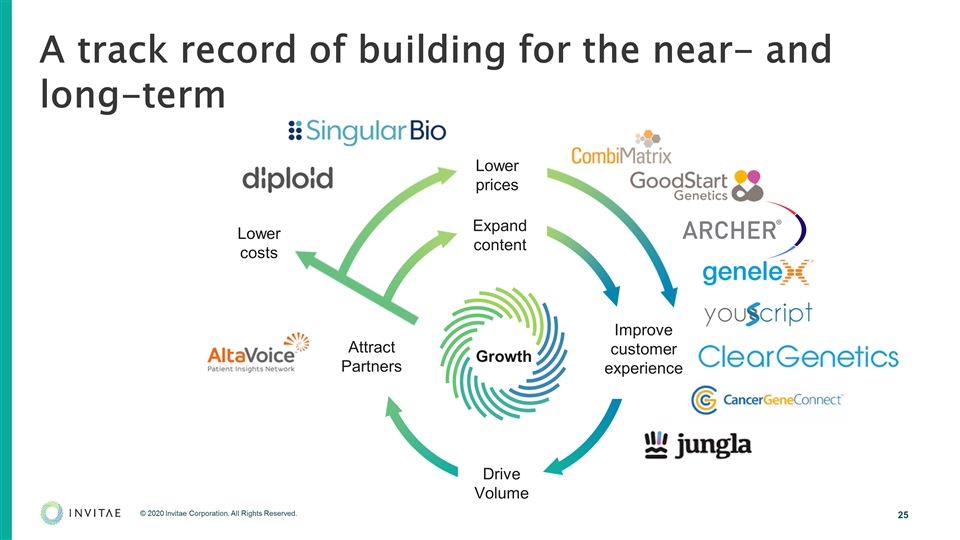

A track record of building for the near- and long-term Expand content Improve customer experience Drive Volume Attract Partners Growth Lower costs Lower prices

Together, we are uniting the right companies with the right capabilities at the right time to transform care for patients worldwide.