Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HOME BANCSHARES INC | homb-8k_20200618.htm |

HOMB Hotel Portfolio COVID-19 Update

Forward Looking Statement This presentation may contain forward-looking statements regarding the Company’s plans, expectations, goals and outlook for the future. Statements in this presentation that are not historical facts should be considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements of this type speak only as of the date of this presentation. By nature, forward-looking statements involve inherent risk and uncertainties. Various factors could cause actual results to differ materially from those contemplated by the forward-looking statements. These factors include, but are not limited to, the following: economic conditions, credit quality, interest rates, loan demand, disruptions and uncertainties in our business and operations as a result of the ongoing coronavirus pandemic, the ability to successfully integrate new acquisitions, legislative and regulatory changes and risks associated with current and future regulations, technological changes and cybersecurity risks, competition from other financial institutions, changes in the assumptions used in making the forward-looking statements, and other factors described in reports we file with the Securities and Exchange Commission (the “SEC”), including those factors set forth in our Annual Report on Form 10-K for the year ended December 31, 2019 filed with the SEC on February 26, 2020

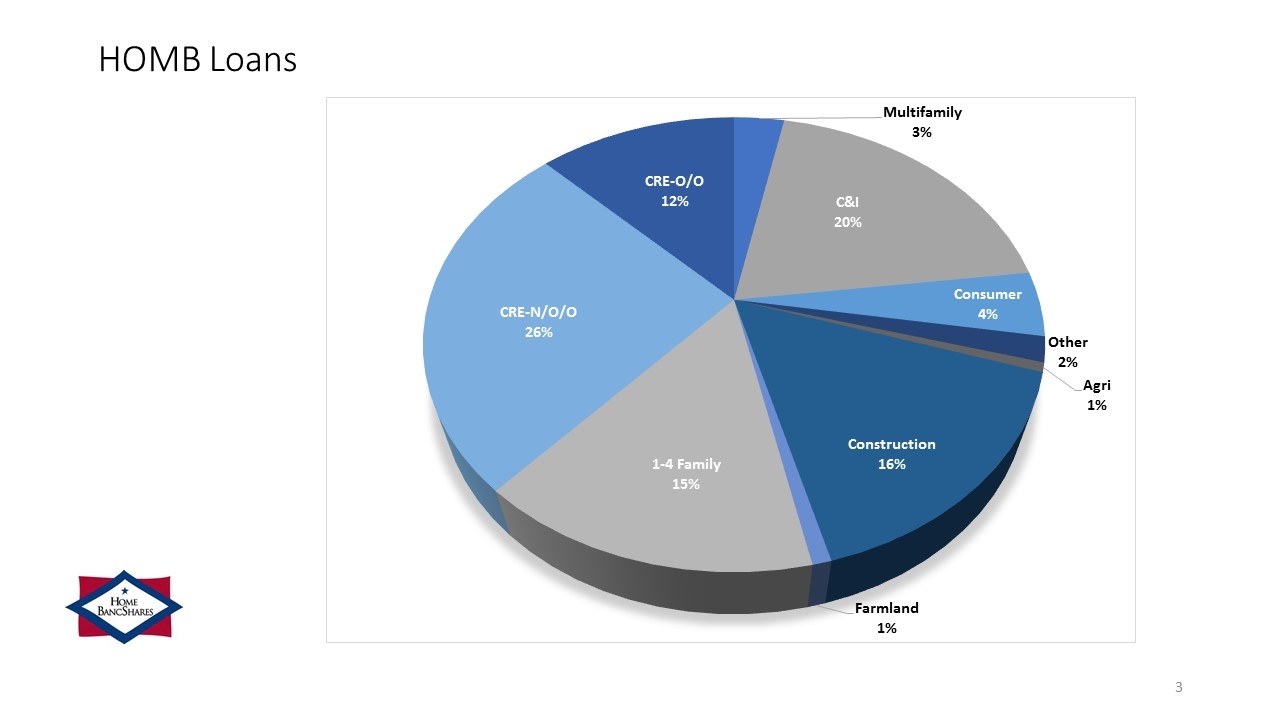

HOMB Loans

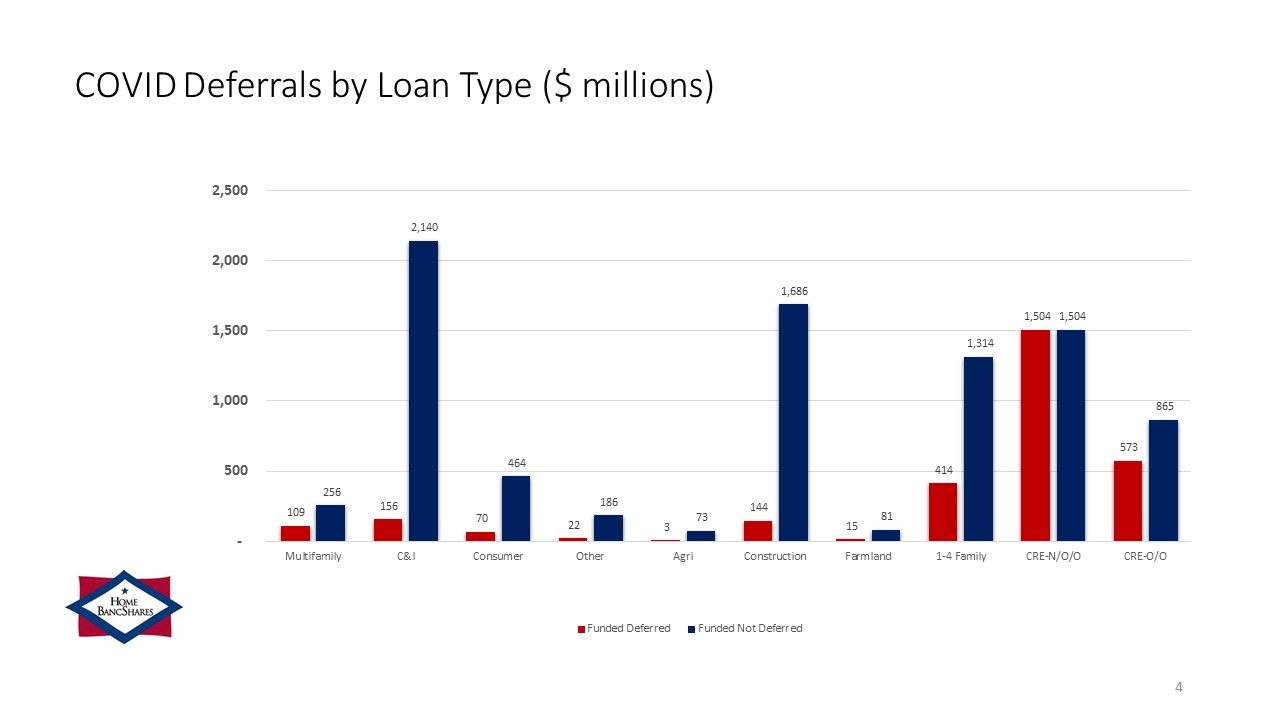

COVID Deferrals by Loan Type ($ millions)

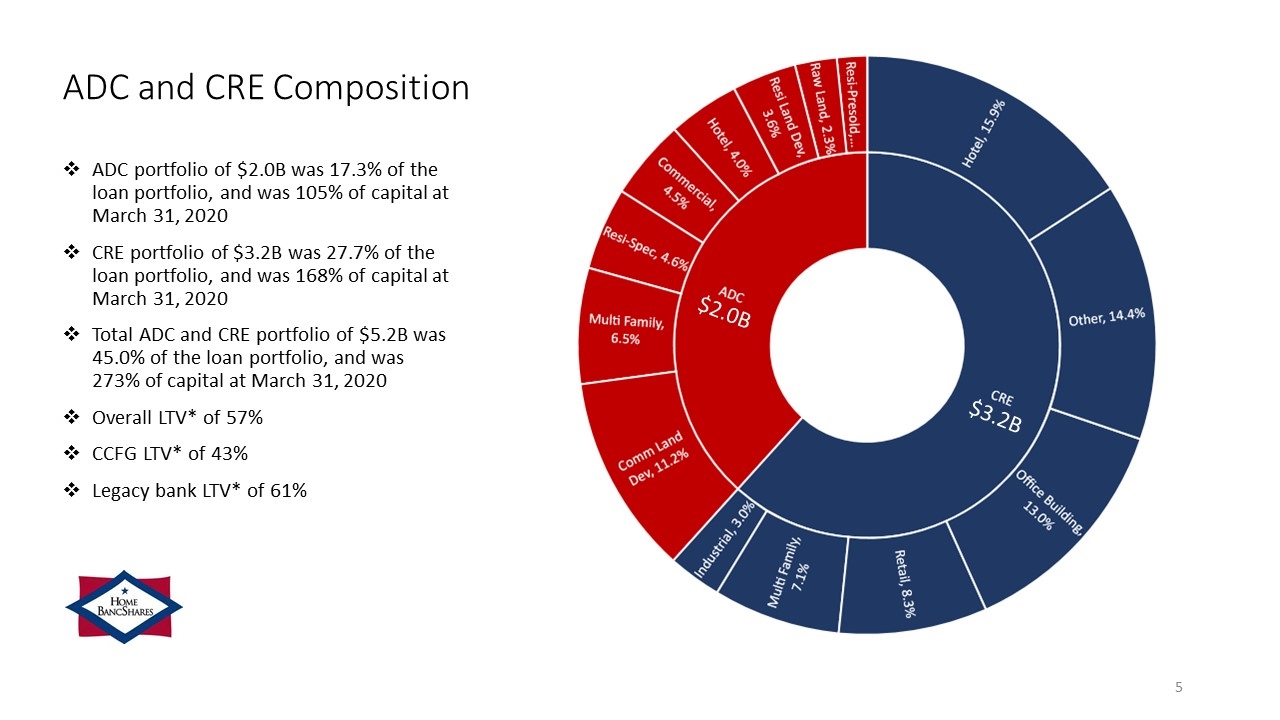

ADC and CRE Composition ADC portfolio of $2.0B was 17.3% of the loan portfolio, and was 105% of capital at March 31, 2020 CRE portfolio of $3.2B was 27.7% of the loan portfolio, and was 168% of capital at March 31, 2020 Total ADC and CRE portfolio of $5.2B was 45.0% of the loan portfolio, and was 273% of capital at March 31, 2020 Overall LTV* of 57% CCFG LTV* of 43% Legacy bank LTV* of 61% $3.2B $2.0B

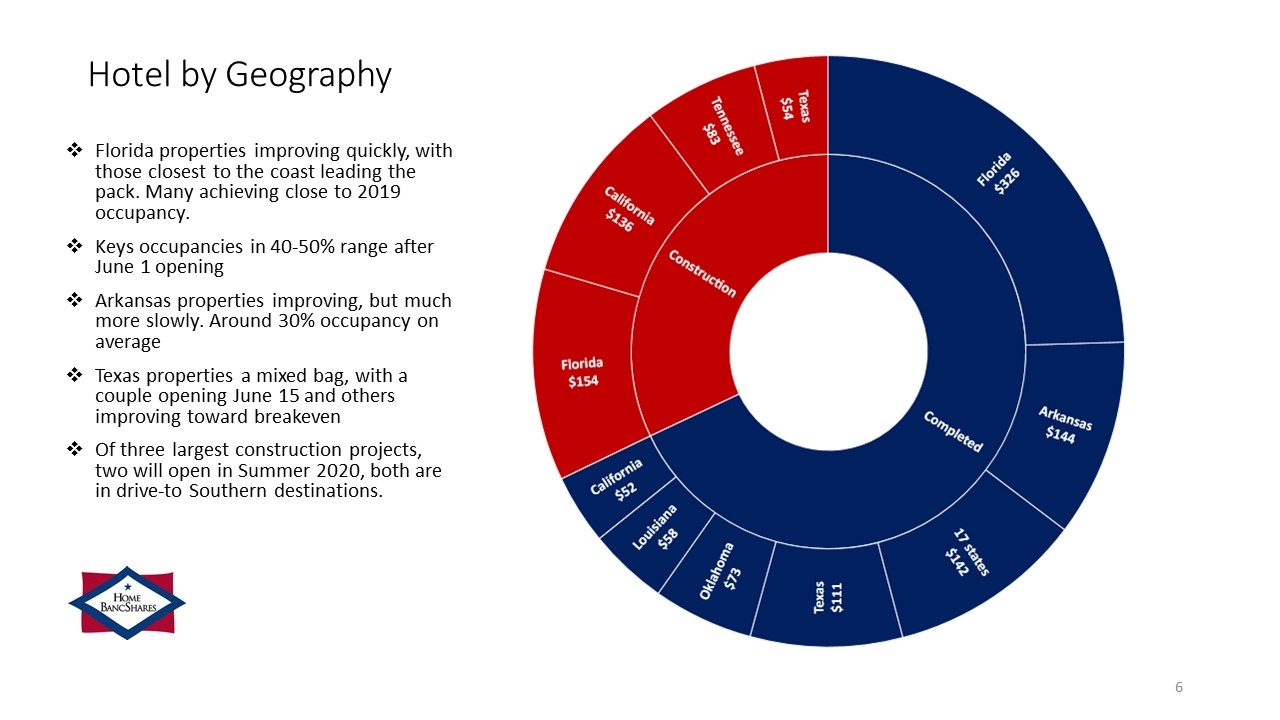

Hotel by Geography Florida properties improving quickly, with those closest to the coast leading the pack. Many achieving close to 2019 occupancy. Keys occupancies in 40-50% range after June 1 opening Arkansas properties improving, but much more slowly. Around 30% occupancy on average Texas properties a mixed bag, with a couple opening June 15 and others improving toward breakeven Of three largest construction projects, two will open in Summer 2020, both are in drive-to Southern destinations. $427 $906

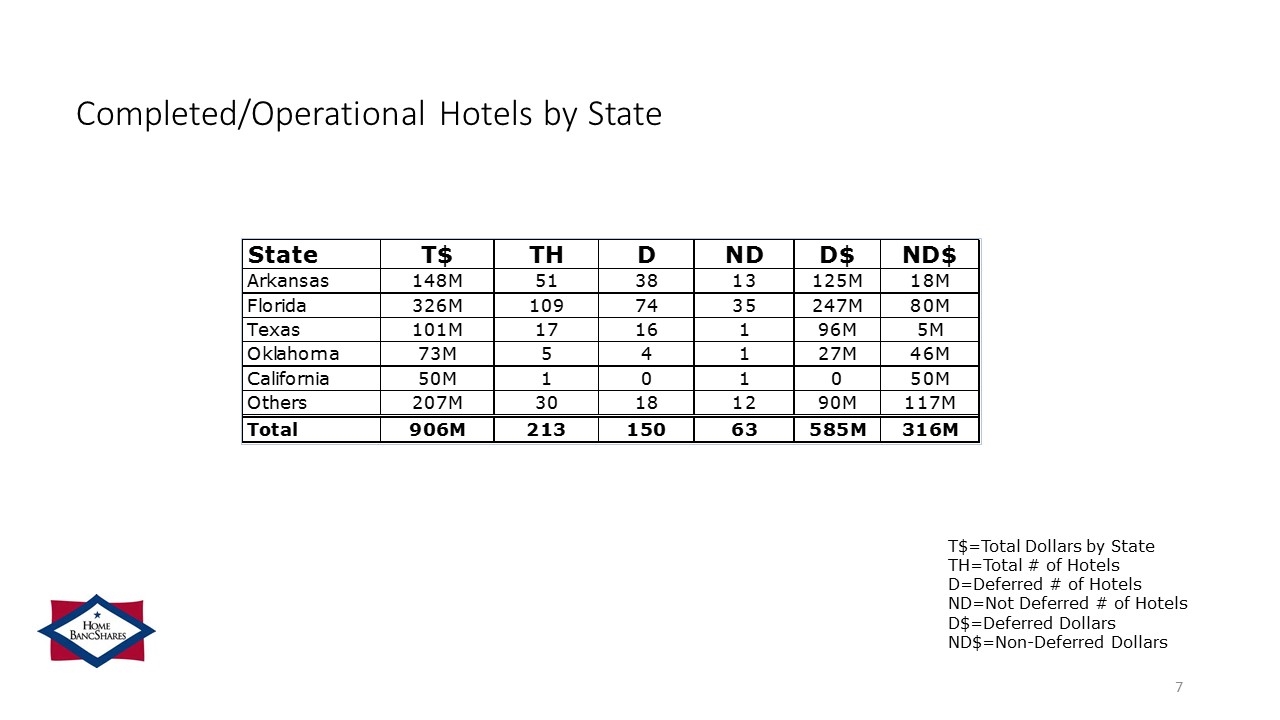

T$=Total Dollars by State TH=Total # of Hotels D=Deferred # of Hotels ND=Not Deferred # of Hotels D$=Deferred Dollars ND$=Non-Deferred Dollars Completed/Operational Hotels by State State T$ TH D ND D$ ND$ Arkansas 148M 51 38 13 125M 18M Florida 326M 109 74 35 247M 80M Texas 101M 17 16 1 96M 5M Oklahoma 73M 5 4 1 27M 46M California 50M 1 0 1 0 50M Others 207M 30 18 12 90M 117M Total 906M 213 150 63 585M 316M

Comments From the Field “Since the beginning of the pandemic I have had regular follow ups with hotel owner/operators up and down the gulf coast from owners of single 40 key properties to owners with 2,000+ keys under ownership/management. Largely properties along the gulf have been experiencing for the past 3-4 weeks 80%+ capacity weekends with the weekly travel still being a little soft in most markets. Expectations looking forward with bookings seem to point towards weekly occupancy greatly improving over next 2 weeks as well. ADR’s for those weekends reported seem to either mirror same periods last year or exceeding. The summer season appears to be salvageable and many will take advantage of driving to the Gulf vs traveling abroad so hopes are high”. ~ Jim Haynes, Regional President North Florida

“Relative to the global hotel industry, our hotel portfolio, which is comprised of – for the most part – transient, drive-to destinations, was in much better shape as the COVID-19 crisis unfolded. We claim that most of our assets are “recession resistant” in that we offer an affordable beach vacation to millions of people within driving distance. When macro economic conditions deteriorate, our portfolio experiences a fraction of the global decline in occupancy. Prior to the sweep of stay at home orders, our portfolio’s occupancy was solidly in the 60s while the balance of the lodging industry was seeing much larger decreases. Unfortunately, regardless of our economically sheltered locations, our occupancies dropped below 10 percent when the beaches were closed via civil authority. It was shocking to see our recession resistant portfolio actually underperform the industry, where roadside suburban and extended stay hotels were reported to maintain occupancy in the low 20s. Coming out of the COVID crisis, we are once again the envy of the industry, experiencing weekends with 100% occupancy and strong room rates. Our weekday business can be described as solid (mid 50s to mid 60s) but still down year over year. We attribute this to a lack of occupancy compression from the continued decrease in business, group and government travel. While we don’t lean heavily on these segments to fill our hotels, there is no denying that these groups play an incremental role in “shrinking the size” of available room count, thus providing an easier path to filling a hotel at strong ADRs. We expect a gradual increase in travel for these segments through the balance of the year. Finally, our cash flow is in stable condition. Our primary tools for managing cash through the crisis were utilization of the SBA’s PPP and obtaining 90 day forbearance from our balance sheet lenders. We did not find it necessary to locate additional liquidity through LOCs and/or disposition of assets. In fact, we did not make a single draw on our existing seasonal line of credit during the crisis. We moved quickly to reduce expenses and sharpen our tools for sustainable operating efficiencies. While we expect modestly lower revenue this summer, we also expect meaningful increases in our gross operating profit margin, such that the balance of 2020 should realize NOIs comparable to last year at many of our beachfront hotels”. ~ Brooks Moore, Innisfreehotels

“Peachtree’s portfolio performance bottomed out in late April/early May. Since that time, we have seen considerable weekly RevPAR growth across our portfolio. While we continue to maintain the heightened expense controls that we implemented during the early stages of the pandemic, we have turned our focus towards capturing market share and re-staffing for the rebound. The majority of our assets reside within suburban markets that have fared better than CBD located hotels. Several of our Florida hotels have performed well recently. For instance, our Springhill Suites in Navarre Beach and our Hampton Inn in Vero Beach have outperformed macro market trends over the last month as they have benefitted from being in a drive to location coupled with the pent-up demand for travel. Despite the university closure, our Gainesville hotels are maintaining stable RevPAR growth. However, our Miami hotel assets are experiencing a much slower turnaround due to the lack of international travel. Overall, there is still a long road ahead, and we anticipate a rebound to pre-COVID topline performance within the next 18-months”. ~Greg Friedman – CEO Peachtree Hotel Group “Our hotel portfolio in Southeast Florida is conservatively leveraged across the board. Although our clients have had a few difficult months amid the pandemic, they are already seeing an increase in bookings for the remainder of the summer. We are confident in our borrowers’ abilities to navigate through these challenging times. With a position of low leverage, experienced operators, and sufficient guarantor liquidity, we feel good about our hotel portfolio in Southeast Florida”. ~J.C. de Ona, Division President Southeast Florida

“The Arkansas hotel industry experienced the fastest drop in revenue ever at the end of March and beginning of April. Hoteliers responded by cutting back quickly and drastically. Revenues fell by over 90%, and labor costs were cut by two thirds. Since that time, hotels have seen a steady improvement. Revenue in May was double April’s revenue, and occupancies have improved every week. June is pacing to outperform May. Leisure travel is leading the way, but hoteliers hope that businesses will begin to allow their teams to travel as the summer begins”. ~Blair Allen, Beechwood Hospitality and Centennial Bank Little Rock Advisory Board Member “The Little Rock Region’s customer base which is experiencing challenges due to COVID-19 has been largely limited to the hospitality, food service and retail sectors. Other industries with whom we interact daily report minimal impact, while others report they have benefited substantially and unexpectedly from the Pandemic. This Pandemic has been different than the last economic slow-down in that it came on quickly with little or no bow wave. Fortunately, business owners have been reacting differently as well. This is especially true in the hospitality sector as our customers took quick and decisive action to cut direct costs and minimize overhead. Years of prosperity has positioned the sector with manageable leverage and sufficient liquidity to sustain them through this relatively short-term business interruption. Thankfully the COVID-19 shutdown in Arkansas has been limited in scope and short in duration. Enterprises dependent upon business travel, education and athletics continue to feel the biggest impact, but all metrics appear favorable for a return to normal, or near normal, by summer’s end”. ~Gordon Silaski, Division President Little Rock, Arkansas

“While we have very limited exposure in the local hotel market with approximately $8MM in total exposure, we are confident our three borrowers are navigating these abrupt economics changes and unprecedented times as well as anyone in the industry. The have owned and operated numerous properties for years, have diversified investment groups, and have built reserves to utilize for operational and capital needs. With the bank’s assistance of deferring loan payments combined with their concentration and focus on customer service and safety, they feel they are positioned well for the continued increase in occupancy as restrictions and bans are lifted and economic conditions improve”. ~Scott Hancock, Division President, Northwest Arkansas “Hilton weekly reservations from business travel is still slow but seeing some increase. Weekend stays are starting to pick up as travel related sports started again June 1st”. ~Raju Vyas, Hilton properties in Central Arkansas “Major flags and boutique hotels in my portfolio have hit bottom and are ramping back up. While some ran sub 10% occupancy and some closed, all are opened back up and ramping back up. Many speak of a goal of getting back to fixed cost coverage by October. Competition for transient business and medical / essential workers has helped increase occupancy but lower their typical RevPar. Low leverage in the portfolio with seasoned borrowers with strong access to liquidity continue to provide confidence in the portfolio. A bright spot in the portfolio is extended stay economy class. This portfolio is only off 4% occupancy and 6% RevPar and by stripping out additional costs they have been able to meet their operating budget and are requesting no deferrals. Property locations include Dallas, Tx, Boston, MA and New Jersey”. ~Kevin Rose, Market President Batesville, Arkansas

“At CCFG we currently have three hotel development loans. Each of these loans are destination resorts; Napa, CA, Santa Fe, New Mexico and Lake Conroe, TX. All three are primarily drive-to destination locations. Napa pulls from San Francisco, New Mexico pulls from Texas and the Lake Conroe property draws from Houston and central Texas Delivery of the projects is expected over the next year to two years”. ~Chris Poulton, President of Centennial Commercial Finance Group, New York “Destination locations on both east and west coast are showing sign of strong resiliency and high occupancy for the weekend rentals. Weekday rentals continue to be soft, but expectations are as travel continue to open up that will change to normal levels by end of the summer”. ~David Druey, Regional President South Florida “We have four hotels in the Foley and Mobile area. Three have superior locations near major interstates or close proximity to entertainment. Only one property is more reliant on business travel. People are flocking back to Alabama beaches”. ~Lyndsay Job, Market President Alabama

“We have been in the hospitality business in Southwest Florida for over 25 years and have experienced severe downturns before including 9/11 and the Gulf Oil spill. Each time we managed through the difficulties by adjusting expenses and managing towards a stabilization/rebound of our markets. The current COVID 19 downturn, while difficult to manage through because of the dramatic drop in revenue, has been softened by the Government Stimulus Program (PPP). This program has allowed us to bridge the gap in lost revenue and manage towards stabilization. The current crisis began in Mid-March with our low point being in April with approximately 10% of normal revenue, increasing to approximately 47% in May. We project that our revenue for the next four months should increase to the 65-75% range when compared to the previous year, with a 90% rebound in late fall/early winter. This is a similar pattern that we have experienced in the previous severe downturns without the stimulus to bridge the gap”. ~Tom Longe, Trianon Hotels- Naples and Bonita Springs, Florida Olde Florida Chop House – Bonita Springs, Florida Lake House Bar & Grill – Bonita Springs, Florida Home BancShares Director

“We believe destination driving-distance leisure travel will lead recovery. Less people are traveling via air, so this makes sense given what we observed after 9/11/2001. - First to recover - resort/beach hotels for weekend transient travel only. - Second to recover - select service hotels for leisure and corporate travel. - Third to recover - urban select service and mid-scale hotels for corporate travel. - Last to recover - large convention/group full service properties and “air-only” destination/resort hotels. January to March 14 were ahead of budget and best performance over the past 10 years. Since March 14, we have seen the worst portfolio occupancy in April, with improvement in May, and continued improvement in June (9 days data only). However, we’re still 70% down to budget because of both occupancy and rate. Fortunately for us as well, our portfolio consists of smaller room-counts, so we can build RevPar faster. Also good news for the majority of our portfolio: FL occupancy tends to be down in Summer anyways, so we are fortunate to have secured the majority of peak business prior to March 14, and should rebound 75% by October/November when peak season arrives again”. ~Punit Shah, Liberty Group Tampa, Florida

“We are in a better position now than before. The market is much stronger, people are relocating from hard hit COVID areas, to FL.- the beach, and vacationers are staying local – in the U.S., not traveling abroad, not on cruises, and not the Caribbean, THEY ARE COMING TO THE BEACHES OF FLORIDA!” Proof is in the numbers, look at AMI Locals. My weekly rental property management company, “AMI Locals had its 1st $1MM week in bookings June 5th and Bali Hai is at 118% YTD over last year with ADR at 140% over last year.” ~Shawn Kaleta, Bali Hai Resort & AMI Locals, Anna Maria Island, Florida

Contact Information Corporate Headquarters Home BancShares, Inc. 719 Harkrider Street, Suite 100 P.O. Box 966 Conway, AR 72033 Financial Information Donna Townsell Director of Investor Relations (501) 328-4625 Website www.homebancshares.com

NASDAQ: HOMB | June 2020 www.homebancshares.com