Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Embassy Bancorp, Inc. | emyb-20200618x8k.htm |

Exhibit 99.1

Embassy Bank for the Lehigh Valley

Embassy Bank.com

Member FDIC Equal Housing Lender

Exhibit 99.1

2020 Annual Meeting of Shareholders

June 18, 2020

2

Exhibit 99.1

Welcome-Lynne Neel

3

Embassy Bank For the Lehigh Valley EmbassyBank.com

Member FDIC Equal Housing Lender

Exhibit 99.1

Caution on Forward Looking Statements

This presentation may contain forward-looking statements, including statements of goals, intentions, and expectations as to future trends, plans, events or results of Embassy Bancorp, Inc.’s (“Company”) operations and policies and regarding general economic conditions. These forward-looking statements are intended to be covered by the safe harbor for forward-looking statements provided by the Private Securities Litigation Reform Act of 1995.These statements are based upon current and anticipated economic conditions, nationally and in the Company’s market, interest rates and interest rate policy, competitive factors and other conditions that, by their nature, are not susceptible to accurate forecast, and are subject to significant uncertainty.

Such forward-looking statements can be identified by the use of forward-looking terminology such as “believes”, “expects”, “may”, “intends”, “will”, “should”, “anticipates”, or the negative of any of the foregoing or other variations thereon or comparable terminology, or by discussion of strategy.

No assurance can be given that the future results covered by forward-looking statements will be achieved. Such statements are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Important factors that could impact the Company’s operating results include, but are not limited to,(i) the effects of changing economic conditions in the Company’s market areas and nationally, (ii) credit risks of commercial, real estate, consumer and other lending activities, (iii) significant changes in interest rates, (iv) changes in federal and state banking laws and regulations which could impact the Company’s operations, (v) changes in accounting policies or procedures as may be required by FASB or regulatory agencies,(vi) risks and uncertainties related to the COVID-19 pandemic and resulting governmental and societal responses,and (vii) other external developments which could materially affect the Company’s business and operations, as well as the risks described in the Company’s Form 10-K for the year ended December 31, 2019, the March 31, 2020 Quarterly Report on Form 10-Q,and subsequent filings with the SEC.

4

Exhibit 99.1

Introductions

5

Embassy Bank For the Lehigh Valley EmbassyBank.com

Member FDIC Equal Housing Lender

Exhibit 99.1

Board of Directors

Frank Banko III

Geoffrey F. Boyer

John G. Englesson

Bernard M. Lesavoy

David M. Lobach, Jr.

John C. Pittman

Patti Gates Smith

John T. Yurconic

6

Exhibit 99.1

Strategic Leadership Team

Dave Lobach

Judy Hunsicker

Jim Bartholomew

Lynne Neel

Diane Cunningham

Mark Casciano

7

Exhibit 99.1

Presentation Agenda

•

Call to Order and Business Meeting

•

Key Drivers of Performance

•

Financial Results

•

Who We Are

•

COVID-19 Pandemic Response

•

Shareholder Value

Please:

No Video / Audio Recording

No Photography

8

Exhibit 99.1

Call to Order

-David Lobach

9

Exhibit 99.1

Business Meeting

-Judith Hunsicker

10

Exhibit 99.1

Business Meeting

|

|

Proposals Proposal No. 1 -Election of Directors Frank “Chip” Banko III |

|

|

Geoffrey Boyer |

|

|

|

|

|

Proposal No. 2 –Ratification of Independent Registered Public Accounting Firm Baker Tilly Virchow Krause, LLP |

|

|

|

|

|

|

11

Exhibit 99.1

Key Drivers of Performance

-David Lobach

12

Exhibit 99.1

Key Drivers of Performance

|

|

Organic Growth |

|

|

Low Cost Deposits |

|

|

Asset Quality |

|

|

Efficiency |

13

Exhibit 99.1

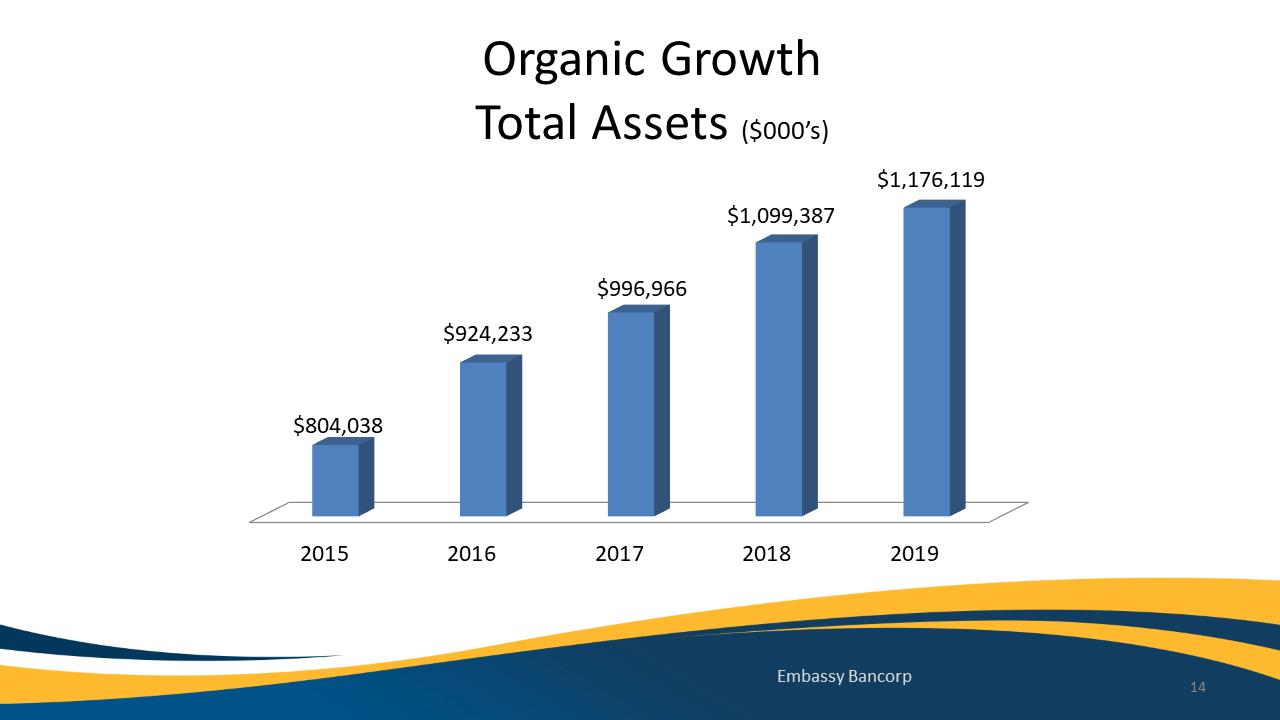

Organic Growth Total Assets ($000’s)

2015

2016

2017

2018

2019

$804,038

$924,233

$996,966

$1,099,387

$1,176,119

Embassy Bancorp

14

Exhibit 99.1

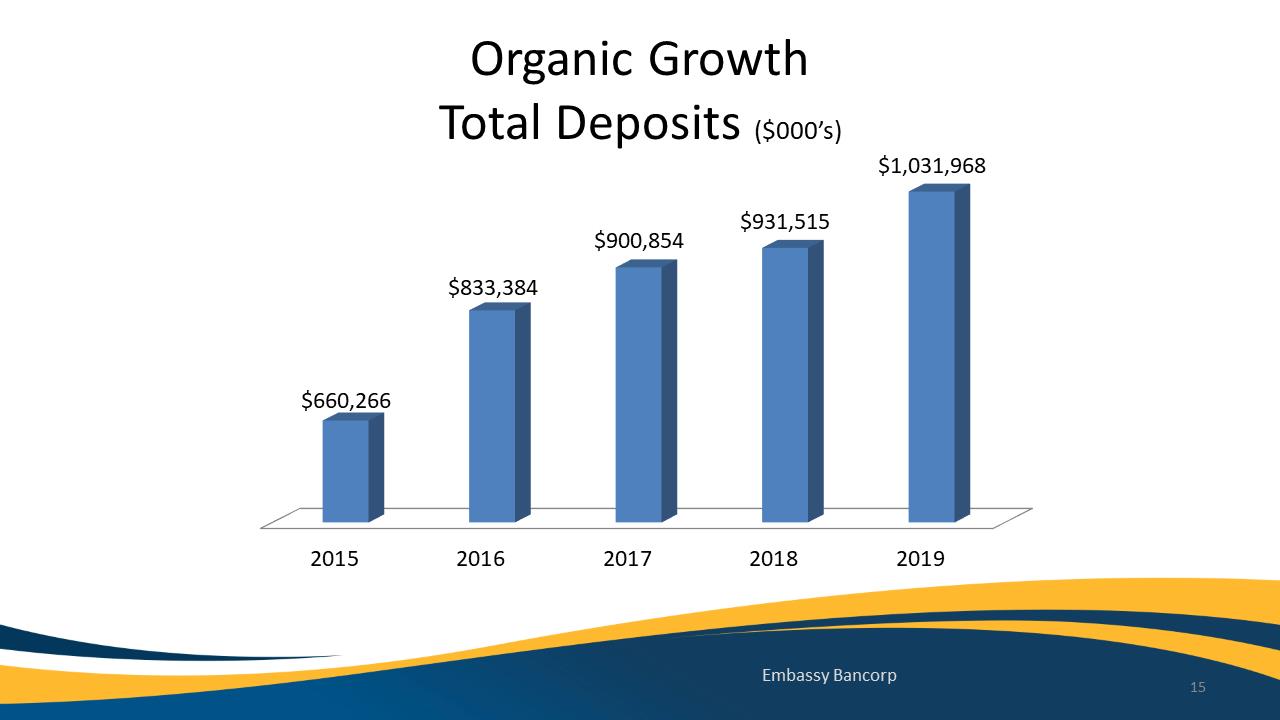

Organic Growth Total Deposits ($000’s)

2015

2016

2017

2018

2019

$660,266

$833,384

$900,854

$931,515

$1,031,968

Embassy Bancorp

15

Exhibit 99.1

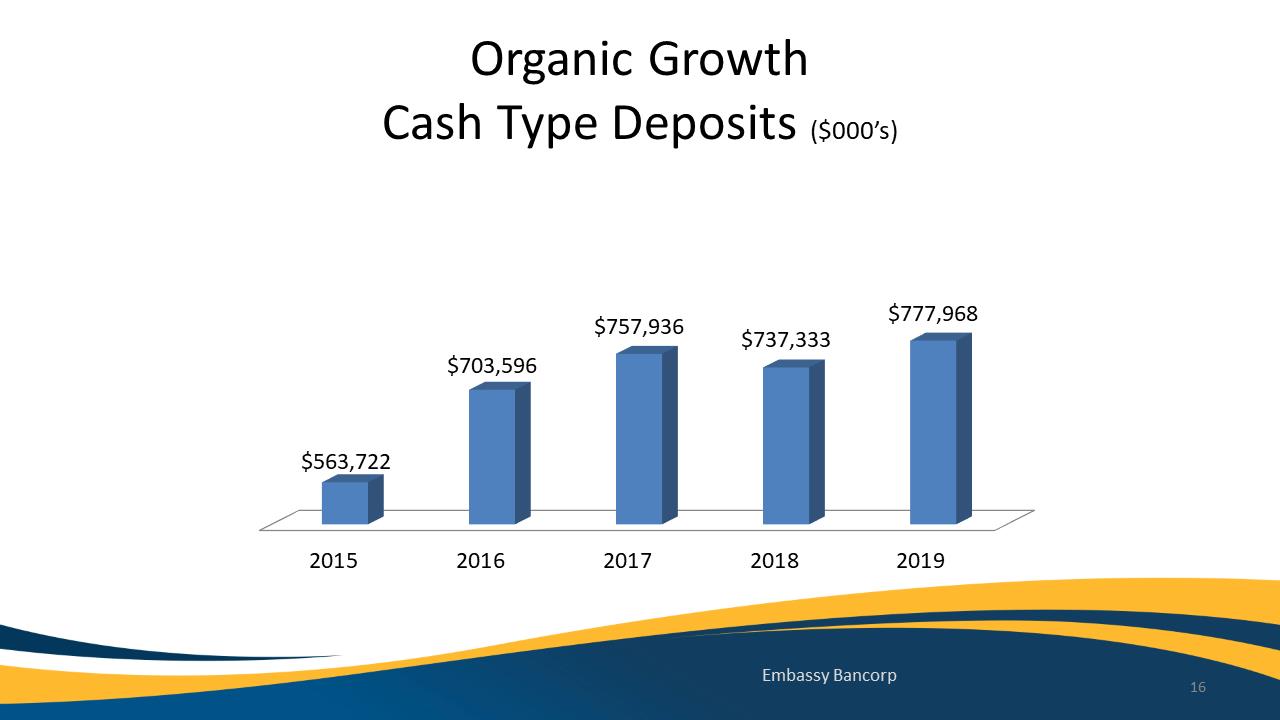

Organic Growth Cash Type Deposits ($000’s)

2015

2016

2017

2018

2019

$563,722

$703,596

$757,936

$737,333

$777,968

Embassy Bancorp

16

Exhibit 99.1

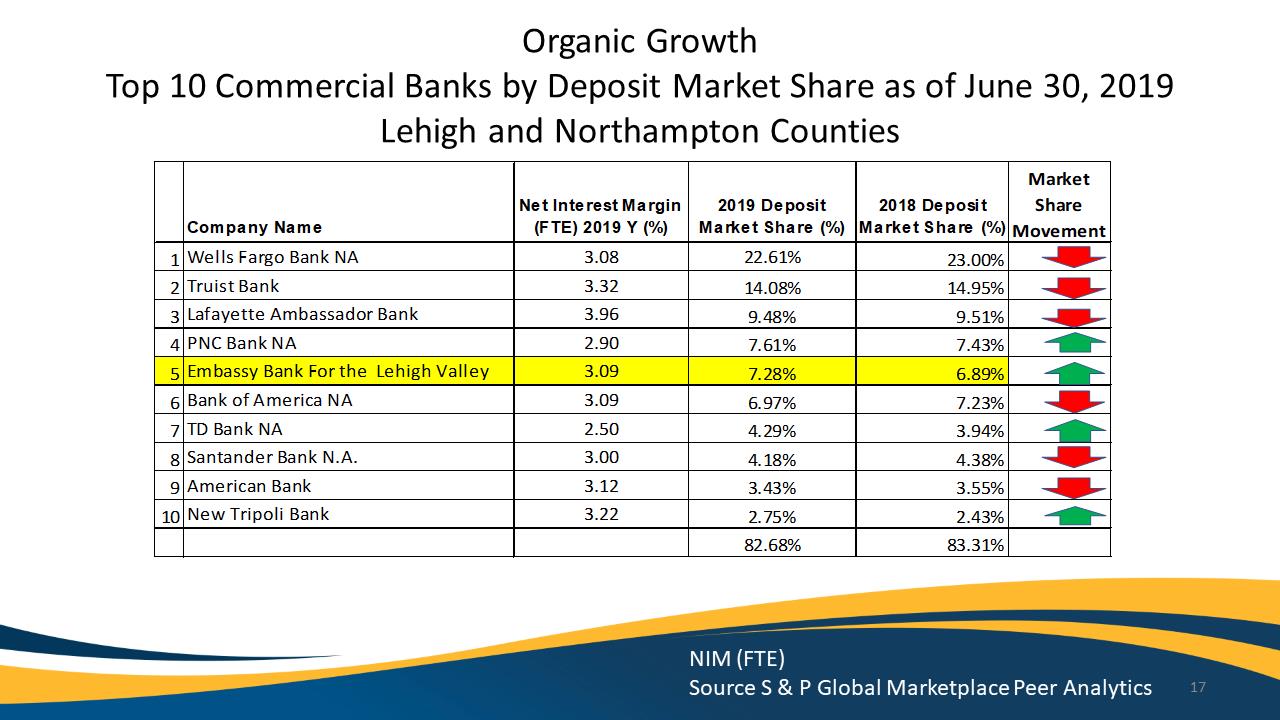

Organic Growth Top 10 Commercial Banks by Deposit Market Share as of June 30, 2019Lehigh and Northampton Counties

NIM (FTE)

Source S & P Global Marketplace Peer Analytics Company Name Net Interest Margin (FTE) 2019 Y (%)2019 Deposit Market Share (%)2018 Deposit Market Share (%)Market Share Movement1Wells Fargo Bank NA3.0822.61%23.00%2Truist Bank3.3214.08%14.95%3Lafayette Ambassador Bank3.969.48%9.51%4PNC Bank NA2.907.61%7.43%5Embassy Bank For the Lehigh Valley3.097.28%6.89%6Bank of America NA3.096.97%7.23%7TD Bank NA2.504.29%3.94%8Santander Bank N.A.3.004.18%4.38%9American Bank3.123.43%3.55%10New Tripoli Bank3.222.75%2.43%82.68%83.31%17

Exhibit 99.1

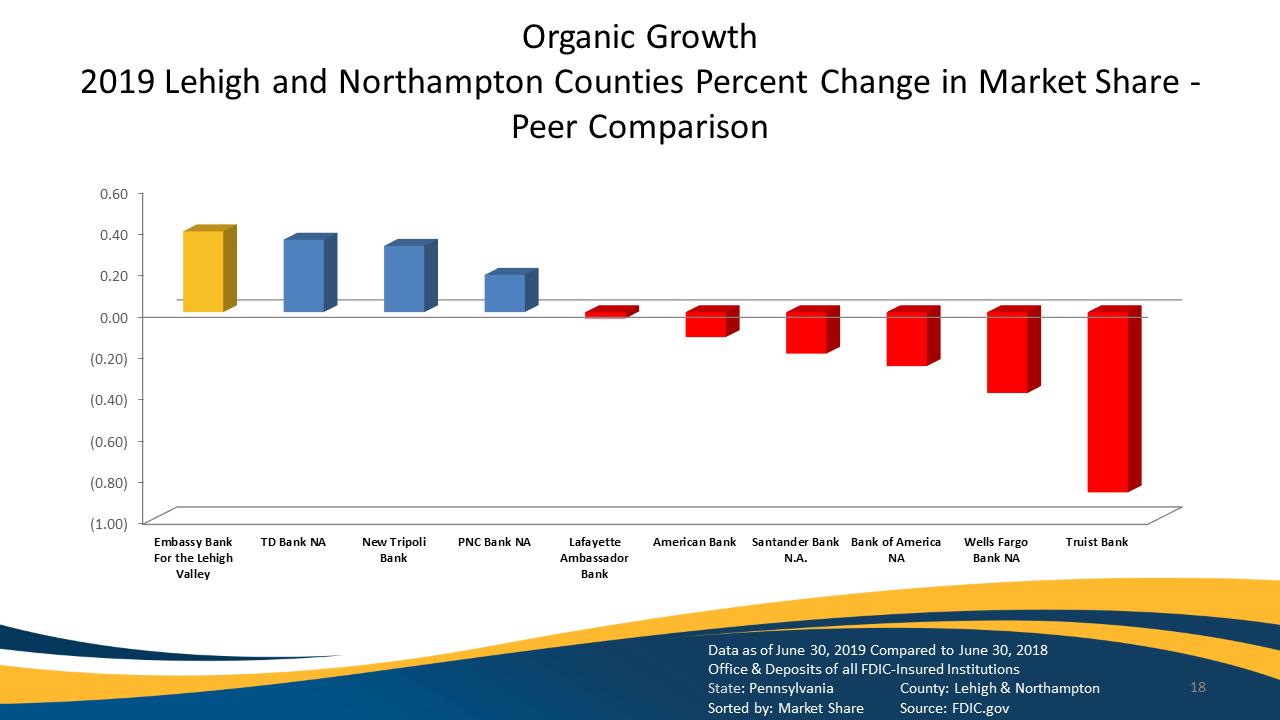

Organic Growth2019 Lehigh and Northampton Counties Percent Change in Market Share -Peer Comparison

Data as of June 30, 2019 Compared to June 30, 2018

Office & Deposits of all FDIC-Insured Institutions

State: Pennsylvania County: Lehigh & Northampton

Sorted by: Market Share Source: FDIC.gov

(1.00)

(0.80)

(0.60)

(0.40)

(0.20)

0.00

0.20

0.40

0.60

Embassy Bank For the Lehigh Valley

TD Bank NA

New Tripoli Bank

PNC Bank NA

LafayetteAmbassadorBank

American Bank

Santander BankN.A.

Bank of AmericaNA

Wells Fargo Bank NA

Truist Bank

18

Exhibit 99.1

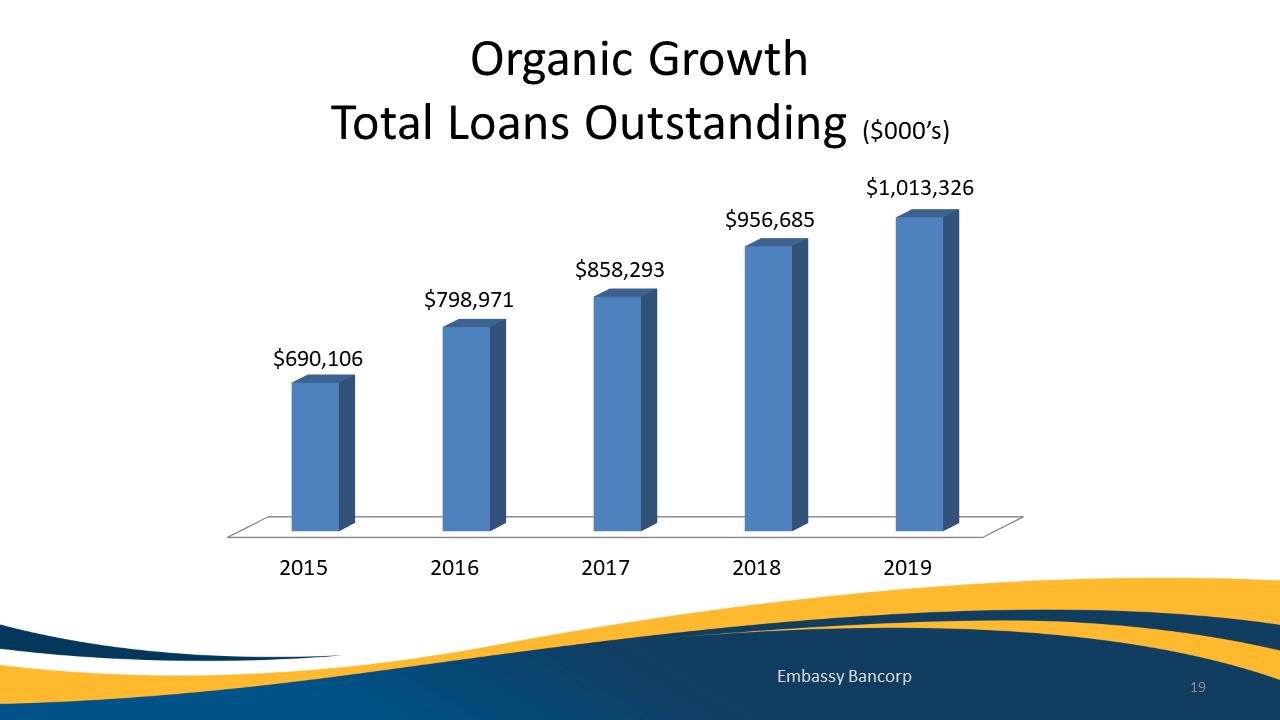

Organic Growth Total Loans Outstanding ($000’s)

2015

2016

2017

2018

2019

$690,106

$798,971

$858,293

$956,685

$1,013,326

Embassy Bancorp 19

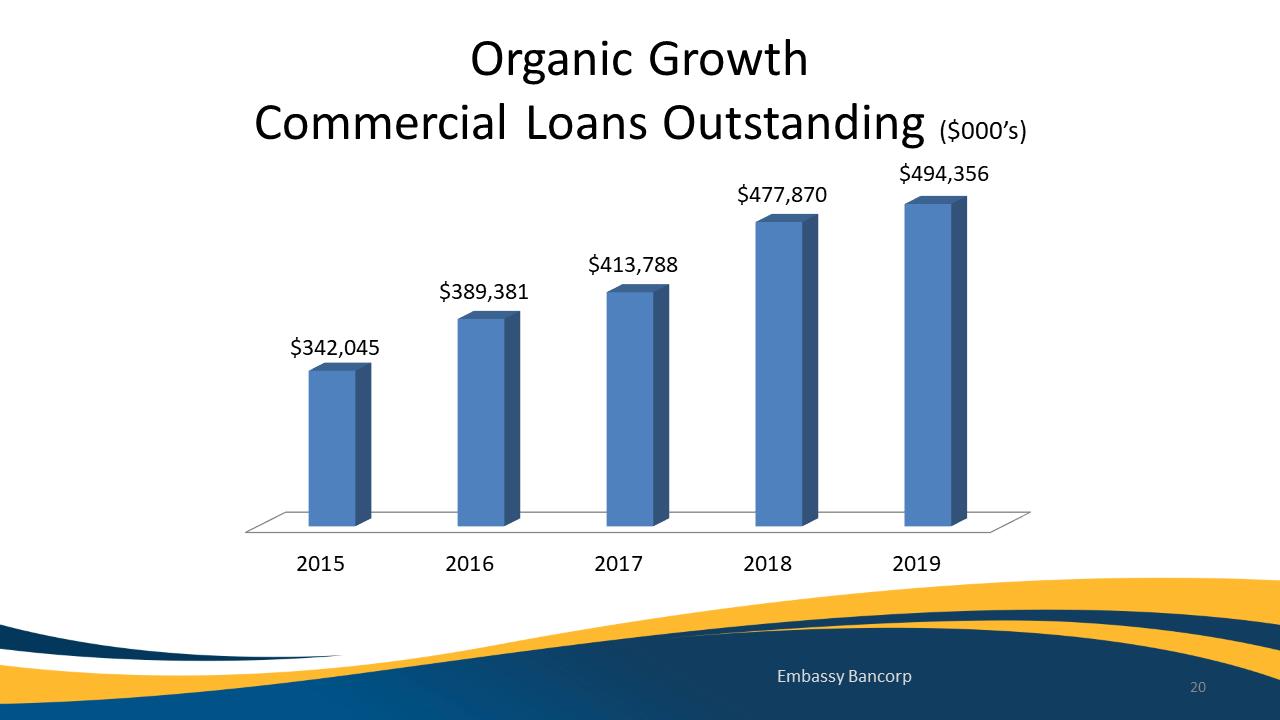

Exhibit 99.1

Organic Growth Commercial Loans Outstanding ($000’s)

2015

2016

2017

2018

2019

$342,045

$389,381

$413,788

$477,870

$494,356

Embassy Bancorp 20

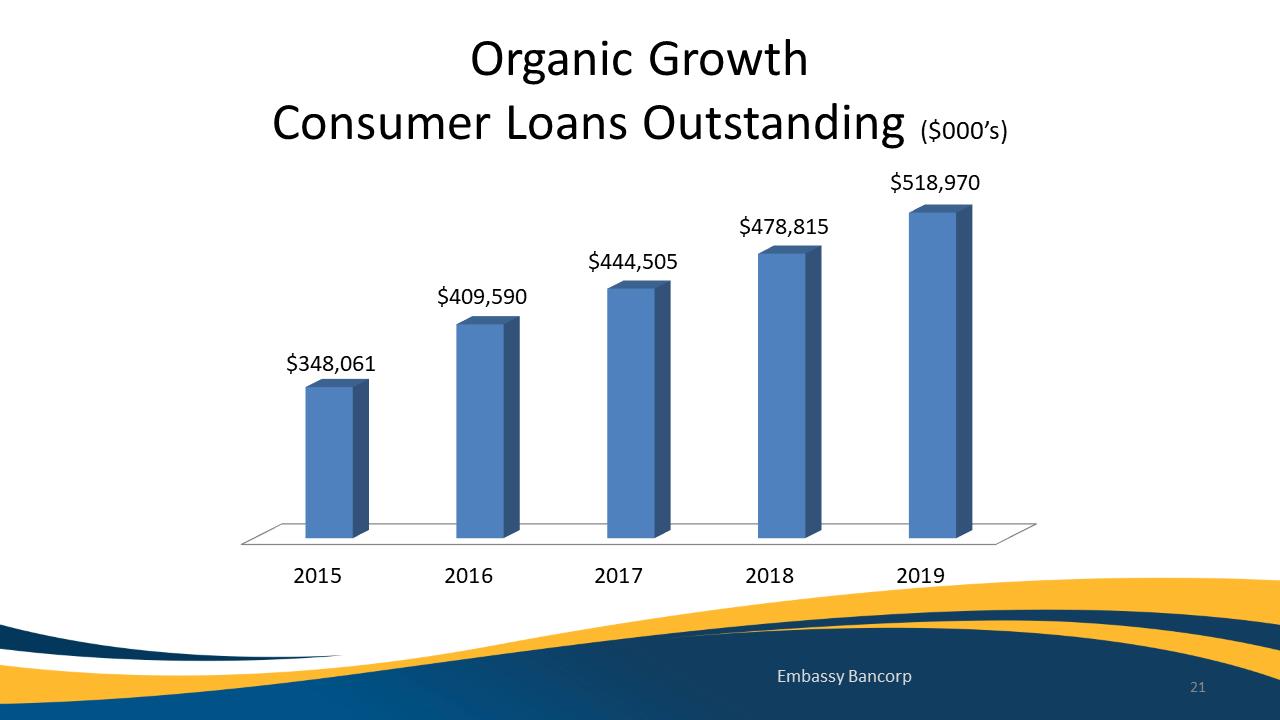

Exhibit 99.1

Organic Growth Consumer Loans Outstanding ($000’s)

2015

2016

2017

2018

2019

$348,061

$409,590

$444,505

$478,815

$518,970

Embassy Bancorp 21

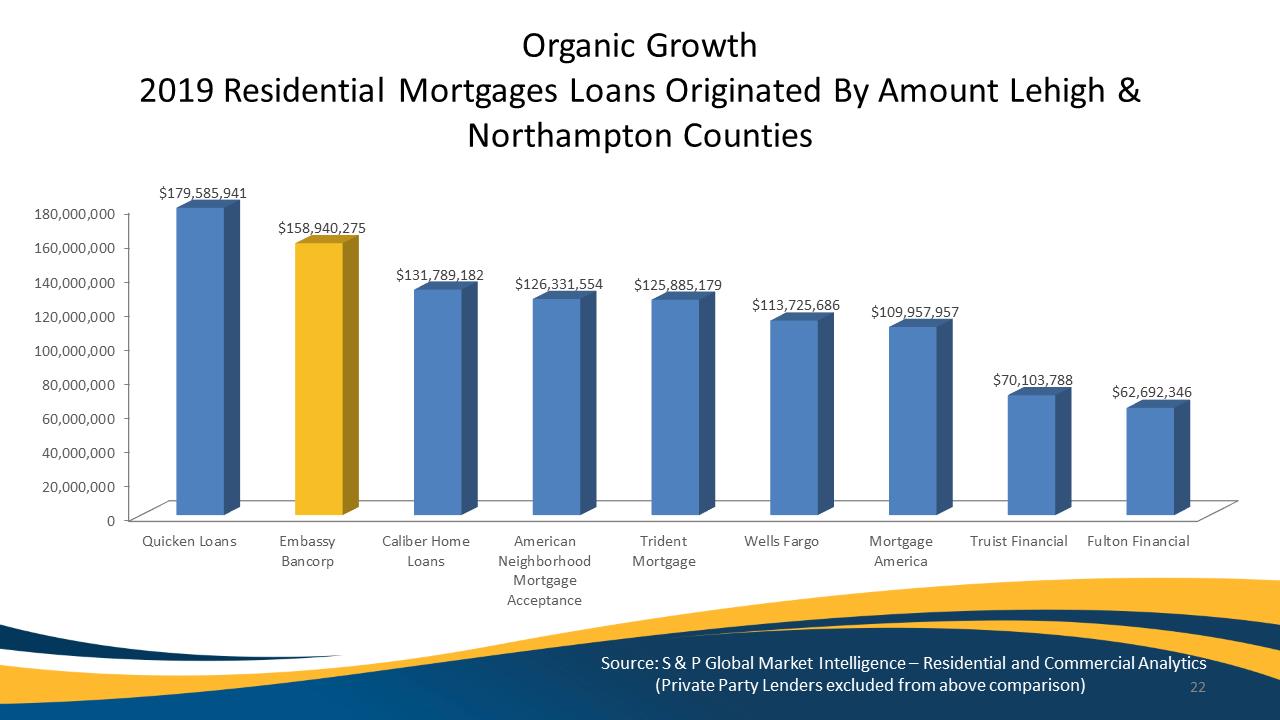

Exhibit 99.1

Organic Growth2019 Residential Mortgages Loans Originated By Amount Lehigh & Northampton Counties

Source: S & P Global Market Intelligence –Residential and Commercial Analytics

(Private Party Lenders excluded from above comparison)

0

20,000,000

40,000,000

60,000,000

80,000,000

100,000,000

120,000,000

140,000,000

160,000,000

180,000,000

Quicken Loans

Embassy Bancorp

Caliber Home Loans

AmericanNeighborhoodMortgageAcceptance

Trident Mortgage

Wells Fargo

Mortgage America

Truist Financial

Fulton Financial

$179,585,941

$158,940,275

$131,789,182

$126,331,554

$125,885,179

$113,725,686

$109,957,957

$70,103,788

$62,692,346 22

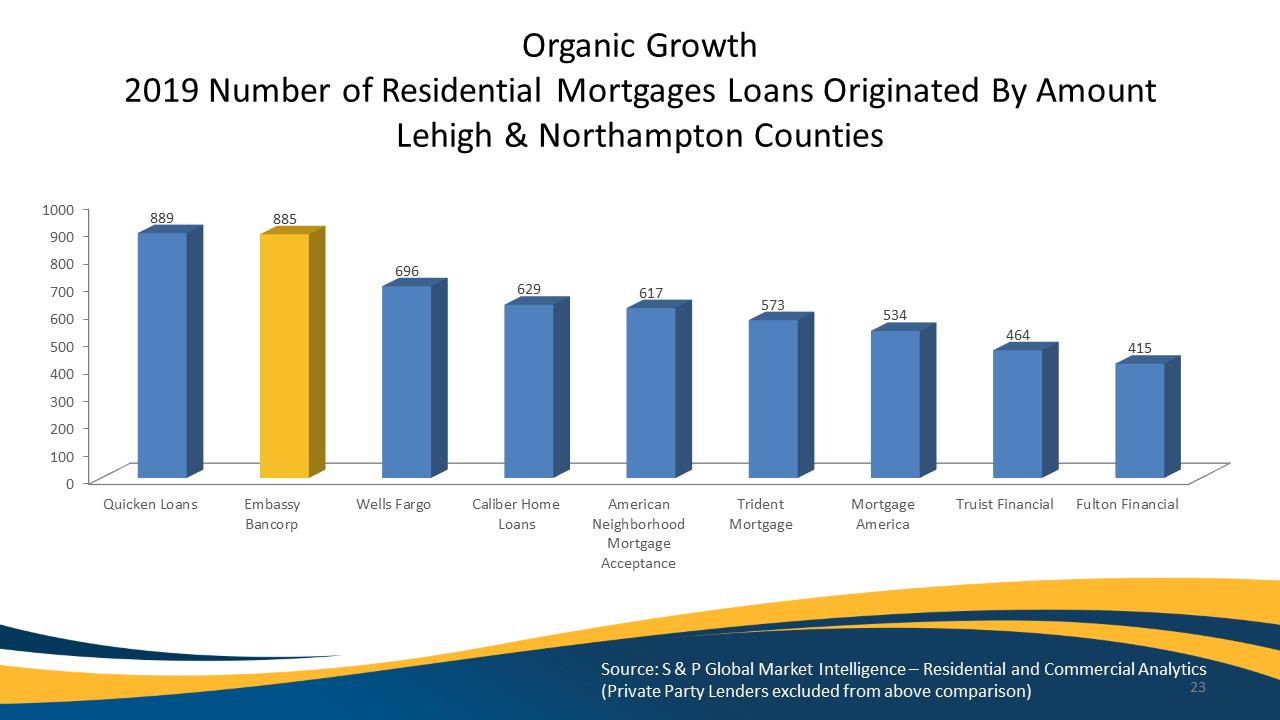

Exhibit 99.1

Organic Growth2019 Number of Residential Mortgages Loans Originated By Amount Lehigh & Northampton Counties

Source: S & P Global Market Intelligence –Residential and Commercial Analytics

(Private Party Lenders excluded from above comparison)

0

100

200

300

400

500

600

700

800

900

1000

Quicken Loans

Embassy Bancorp

Wells Fargo

Caliber Home Loans

AmericanNeighborhoodMortgageAcceptance

Trident Mortgage

Mortgage America

Truist Financial

Fulton Financial

889

885

696

629

617

573

534

464

415

23

Exhibit 99.1

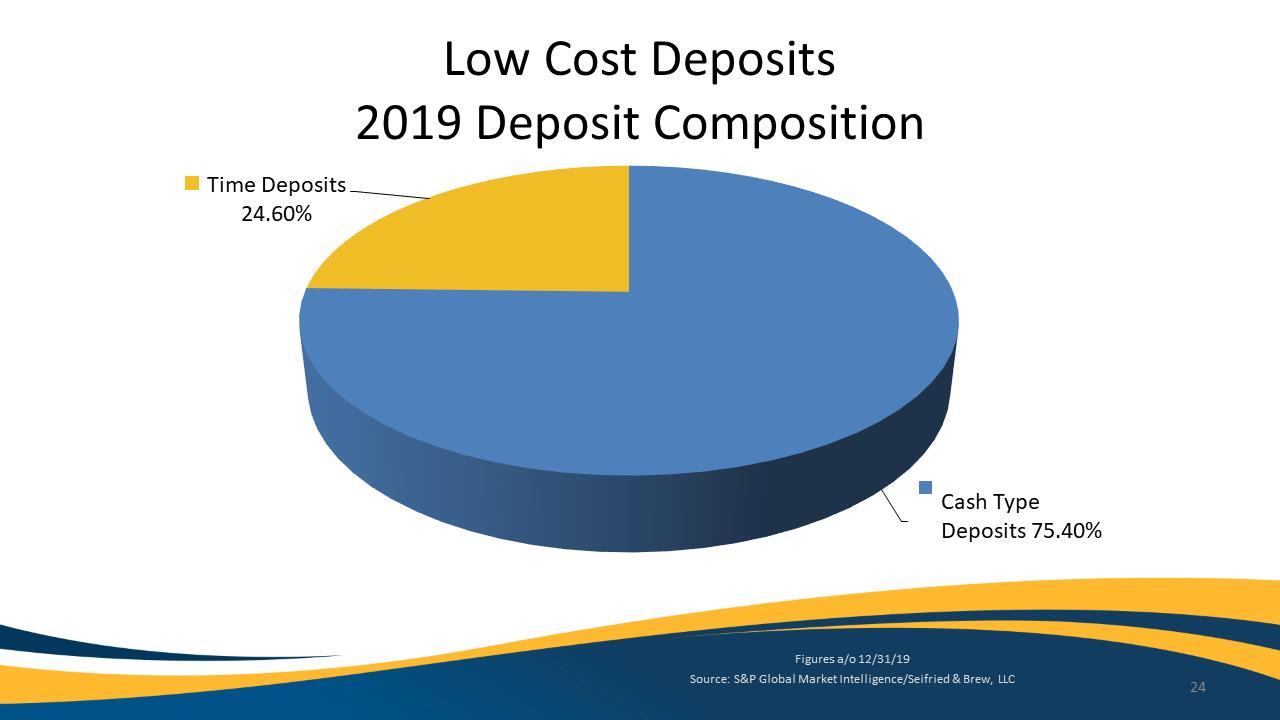

Low Cost Deposits2019 Deposit Composition

Cash Type Deposits75.40%

Time Deposits24.60%

Figures a/o 12/31/19

Source: S&P Global Market Intelligence/Seifried & Brew, LLC 24

Exhibit 99.1

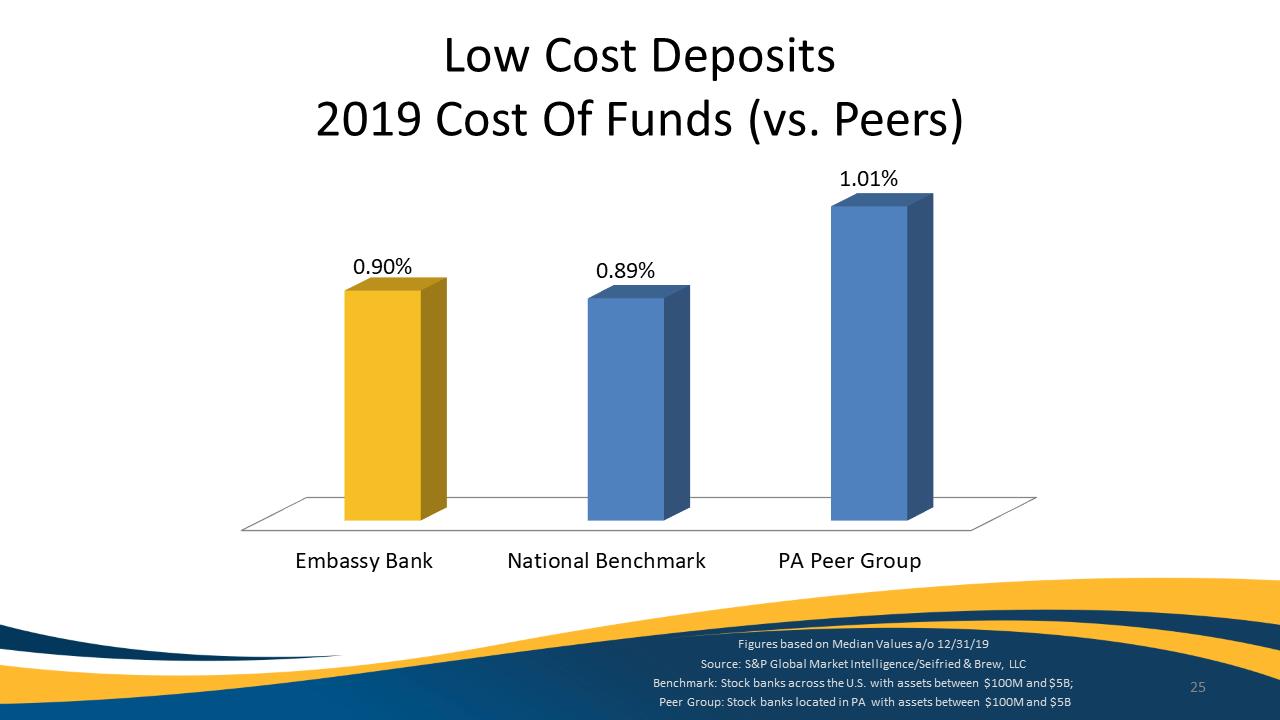

Low Cost Deposits2019 Cost Of Funds (vs. Peers)

Embassy Bank

National Benchmark

PA Peer Group

0.90%

0.89%

1.01%

Figures based on Median Values a/o 12/31/19

Source: S&P Global Market Intelligence/Seifried & Brew, LLC

Benchmark: Stock banks across the U.S. with assets between $100M and $5B;

Peer Group: Stock banks located in PA with assets between $100M and $5B

25

Exhibit 99.1

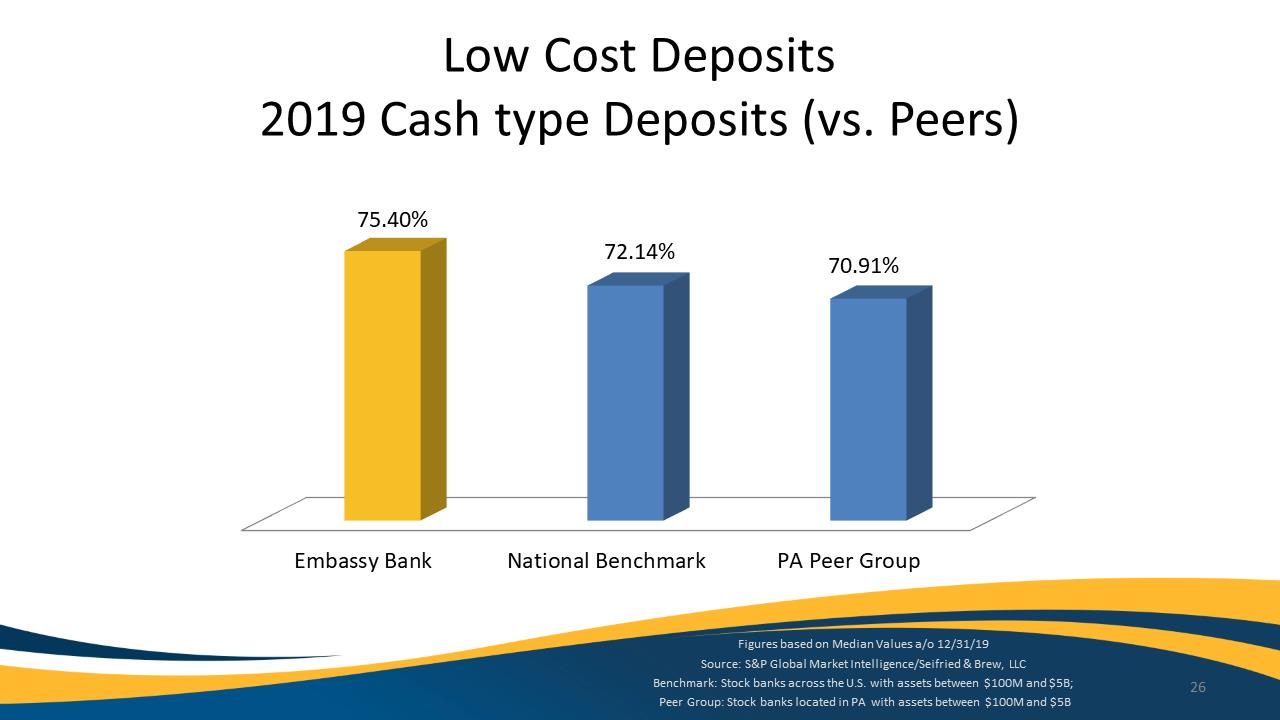

Low Cost Deposits2019 Cash type Deposits (vs. Peers)

Embassy Bank

National Benchmark

PA Peer Group

75.40%

72.14%

70.91%

Figures based on Median Values a/o 12/31/19

Source: S&P Global Market Intelligence/Seifried & Brew, LLC

Benchmark: Stock banks across the U.S. with assets between $100M and $5B;

Peer Group: Stock banks located in PA with assets between $100M and $5B

26

Exhibit 99.1

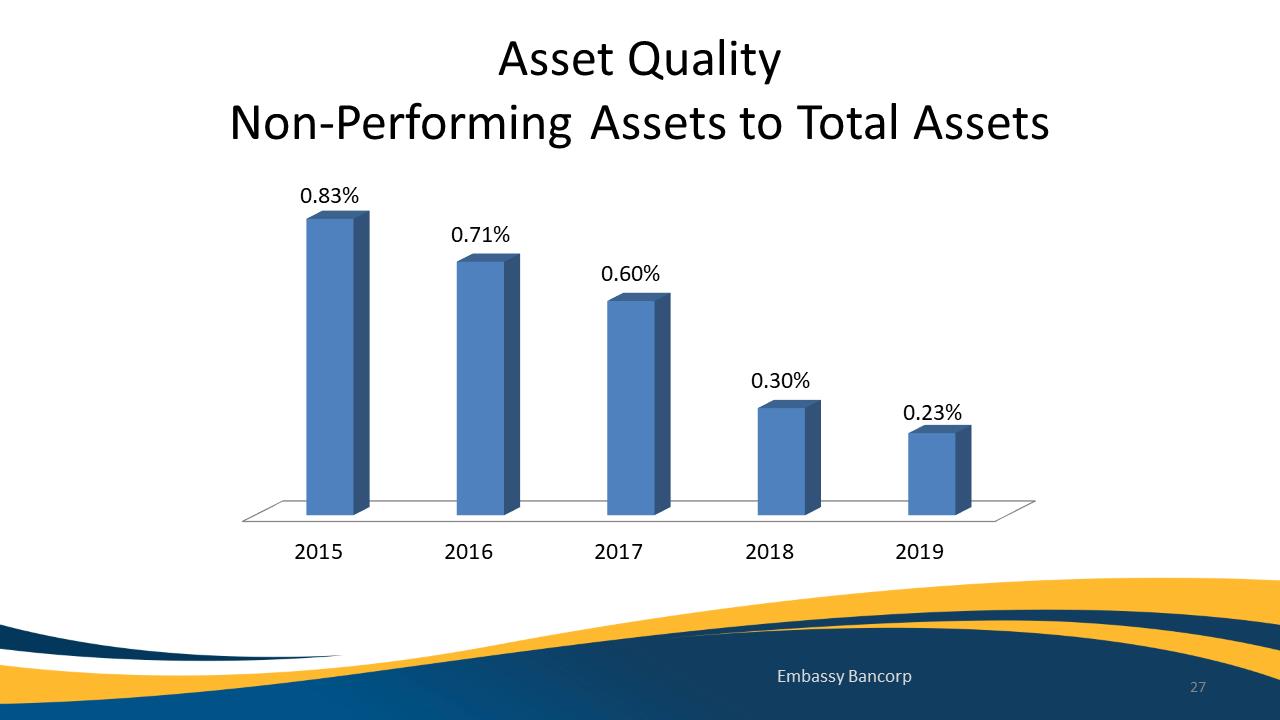

Asset QualityNon-Performing Assets to Total Assets

2015

2016

2017

2018

2019

0.83%

0.71%

0.60%

0.30%

0.23%

Embassy Bancorp 27

Exhibit 99.1

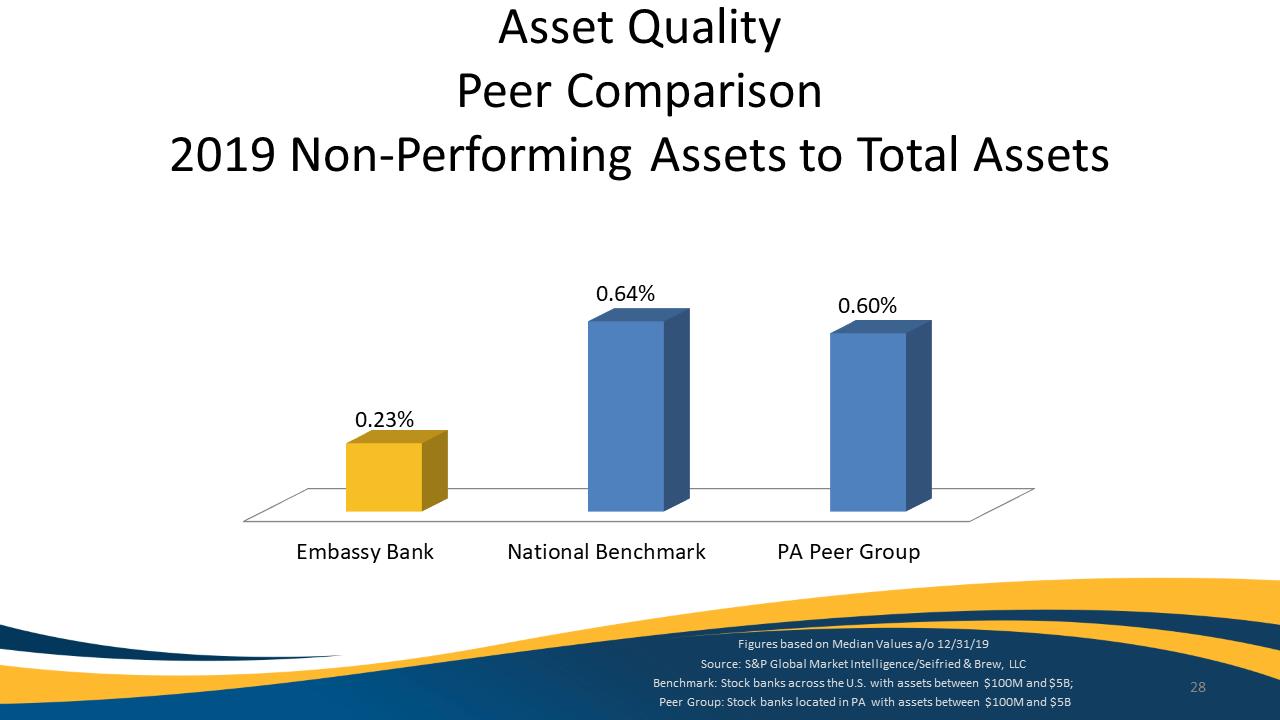

Asset Quality Peer Comparison2019 Non-Performing Assets to Total Assets

Embassy Bank

National Benchmark

PA Peer Group

0.23%

0.64%

0.60%

Figures based on Median Values a/o 12/31/19

Source: S&P Global Market Intelligence/Seifried & Brew, LLC

Benchmark: Stock banks across the U.S. with assets between $100M and $5B;

Peer Group: Stock banks located in PA with assets between $100M and $5B

28

Exhibit 99.1

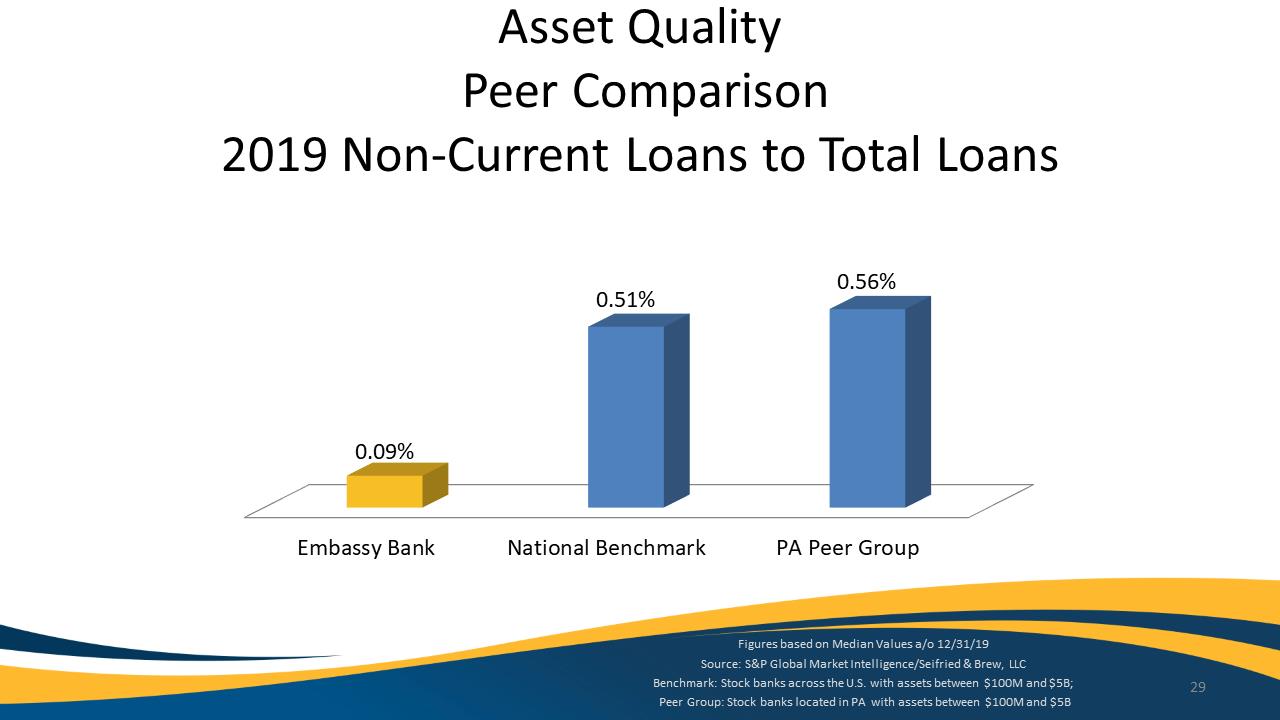

Asset Quality Peer Comparison2019 Non-Current Loans to Total Loans

Embassy Bank

National Benchmark

PA Peer Group

0.09%

0.51%

0.56%

Figures based on Median Values a/o 12/31/19

Source: S&P Global Market Intelligence/Seifried & Brew, LLC

Benchmark: Stock banks across the U.S. with assets between $100M and $5B;

Peer Group: Stock banks located in PA with assets between $100M and $5B

29

Exhibit 99.1

Asset Quality Number of Bank-Owned Properties

ZERO

30

Exhibit 99.1

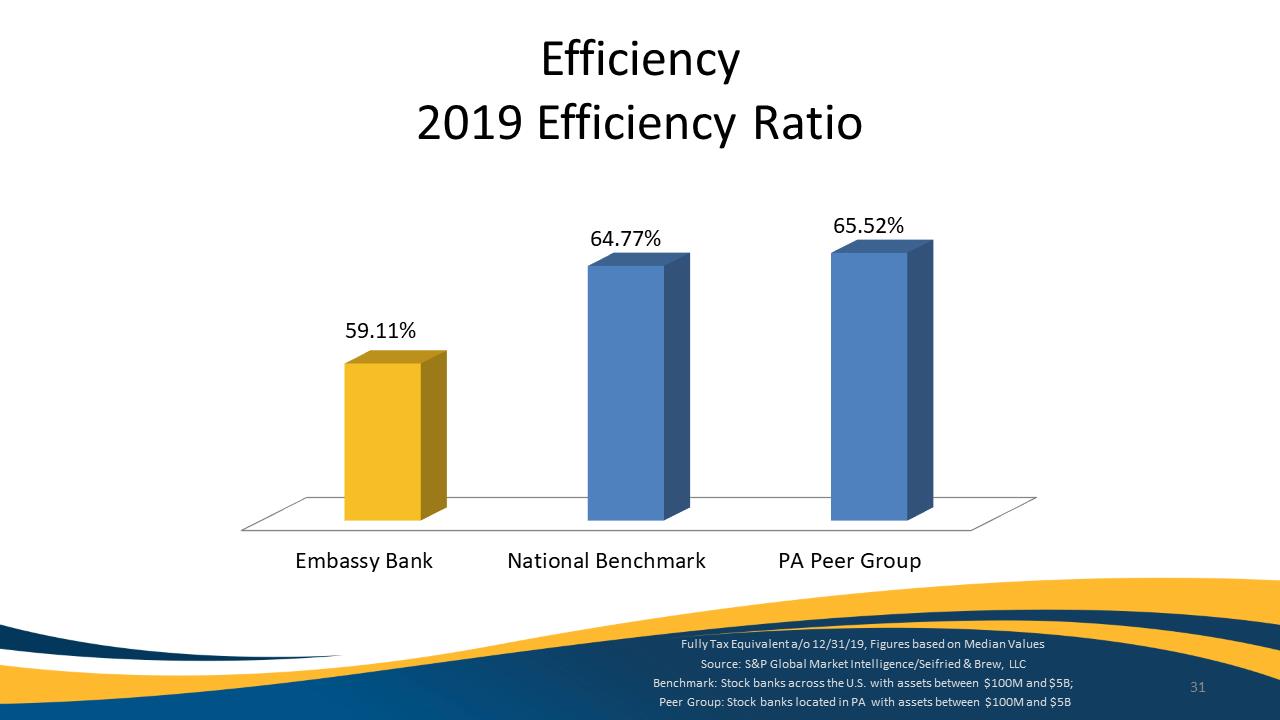

Efficiency2019 Efficiency Ratio

Embassy Bank

National Benchmark

PA Peer Group

59.11%

64.77%

65.52%

Fully Tax Equivalent a/o 12/31/19, Figures based on Median Values

Source: S&P Global Market Intelligence/Seifried & Brew, LLC

Benchmark: Stock banks across the U.S. with assets between $100M and $5B;

Peer Group: Stock banks located in PA with assets between $100M and $5B

31

Exhibit 99.1

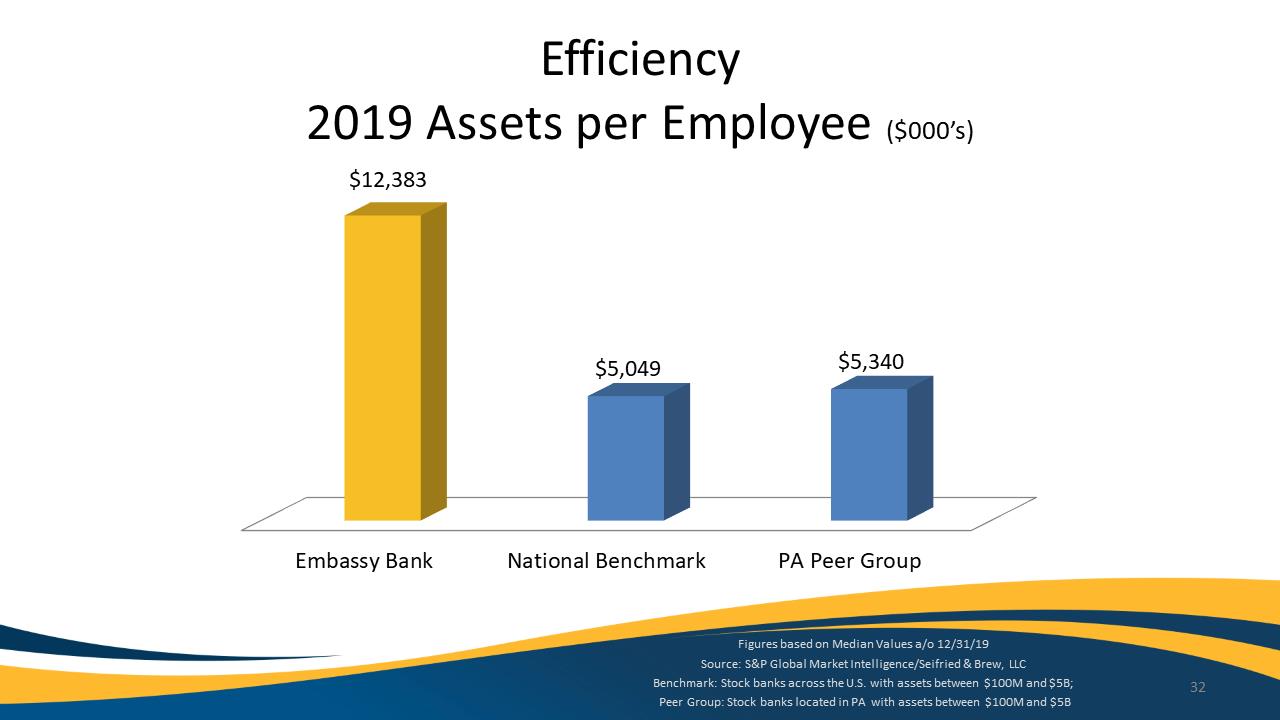

Efficiency2019 Assets per Employee ($000’s)

Embassy Bank

National Benchmark

PA Peer Group

$12,383

$5,049

$5,340

Figures based on Median Values a/o 12/31/19

Source: S&P Global Market Intelligence/Seifried & Brew, LLC

Benchmark: Stock banks across the U.S. with assets between $100M and $5B;

Peer Group: Stock banks located in PA with assets between $100M and $5B

32

Exhibit 99.1

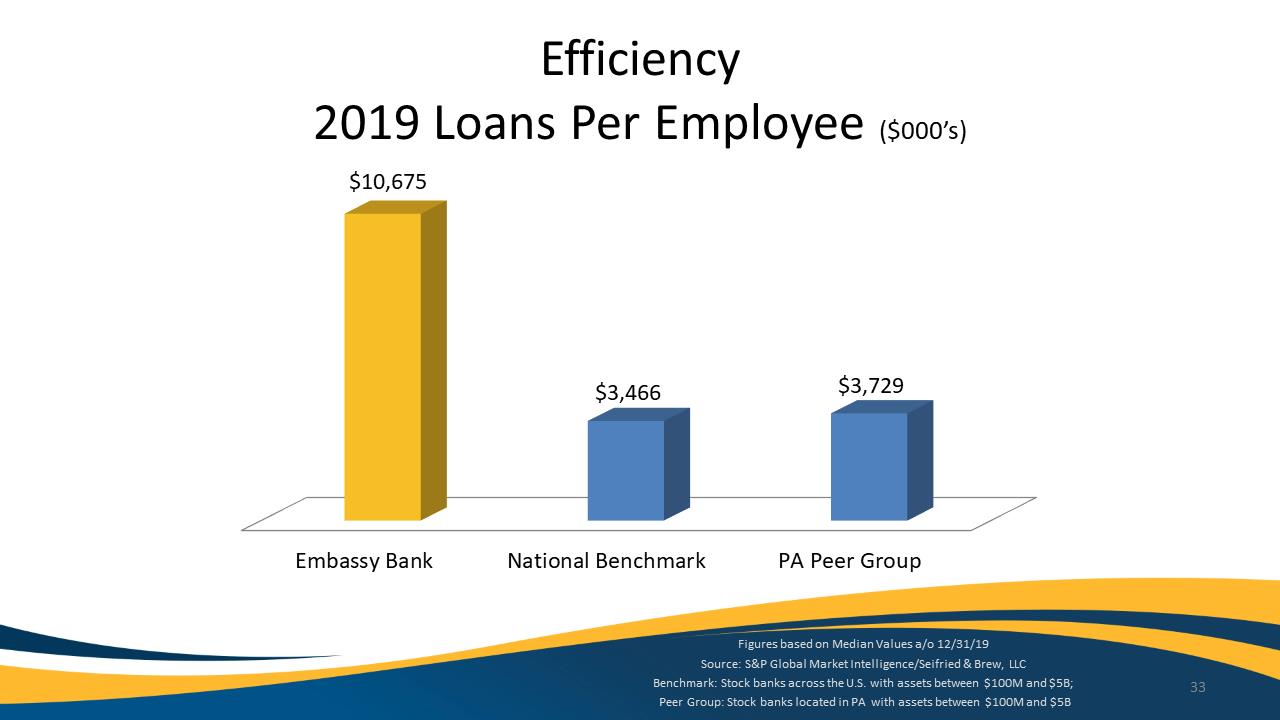

Efficiency2019 Loans Per Employee ($000’s)

Embassy Bank

National Benchmark

PA Peer Group

$10,675

$3,466

$3,729

Figures based on Median Values a/o 12/31/19

Source: S&P Global Market Intelligence/Seifried & Brew, LLC

Benchmark: Stock banks across the U.S. with assets between $100M and $5B;

Peer Group: Stock banks located in PA with assets between $100M and $5B

33

Exhibit 99.1

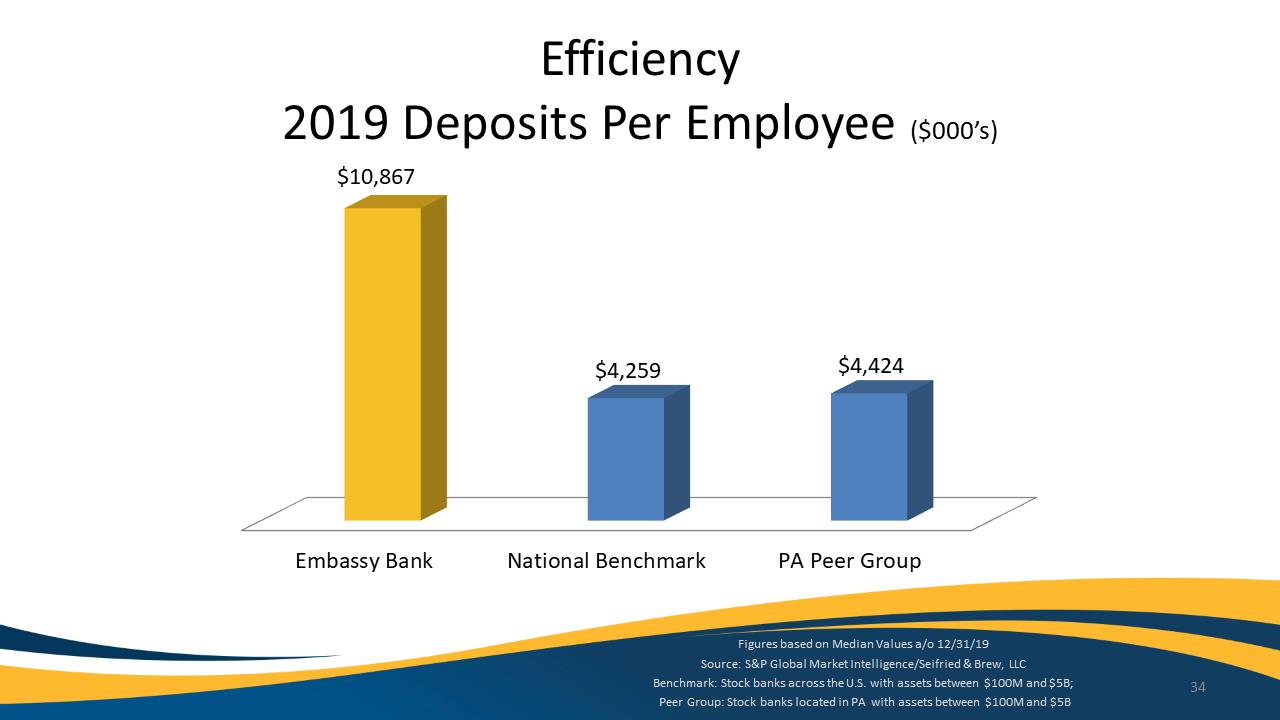

Efficiency2019 Deposits Per Employee ($000’s)

Embassy Bank

National Benchmark

PA Peer Group

$10,867

$4,259

$4,424

Figures based on Median Values a/o 12/31/19

Source: S&P Global Market Intelligence/Seifried & Brew, LLC

Benchmark: Stock banks across the U.S. with assets between $100M and $5B;

Peer Group: Stock banks located in PA with assets between $100M and $5B

34

Exhibit 99.1

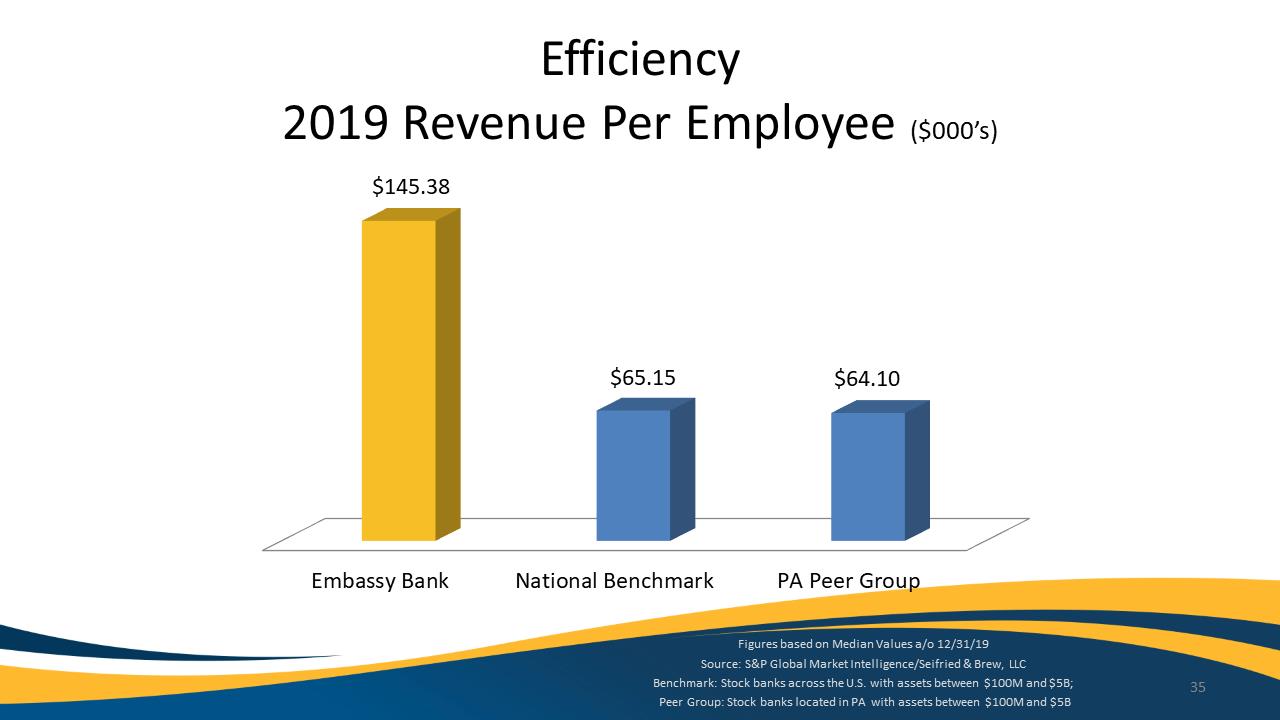

Efficiency2019 Revenue Per Employee ($000’s)

Embassy Bank

National Benchmark

PA Peer Group

$145.38

$65.15

$64.10

Figures based on Median Values a/o 12/31/19

Source: S&P Global Market Intelligence/Seifried & Brew, LLC

Benchmark: Stock banks across the U.S. with assets between $100M and $5B;

Peer Group: Stock banks located in PA with assets between $100M and $5B

35

Exhibit 99.1

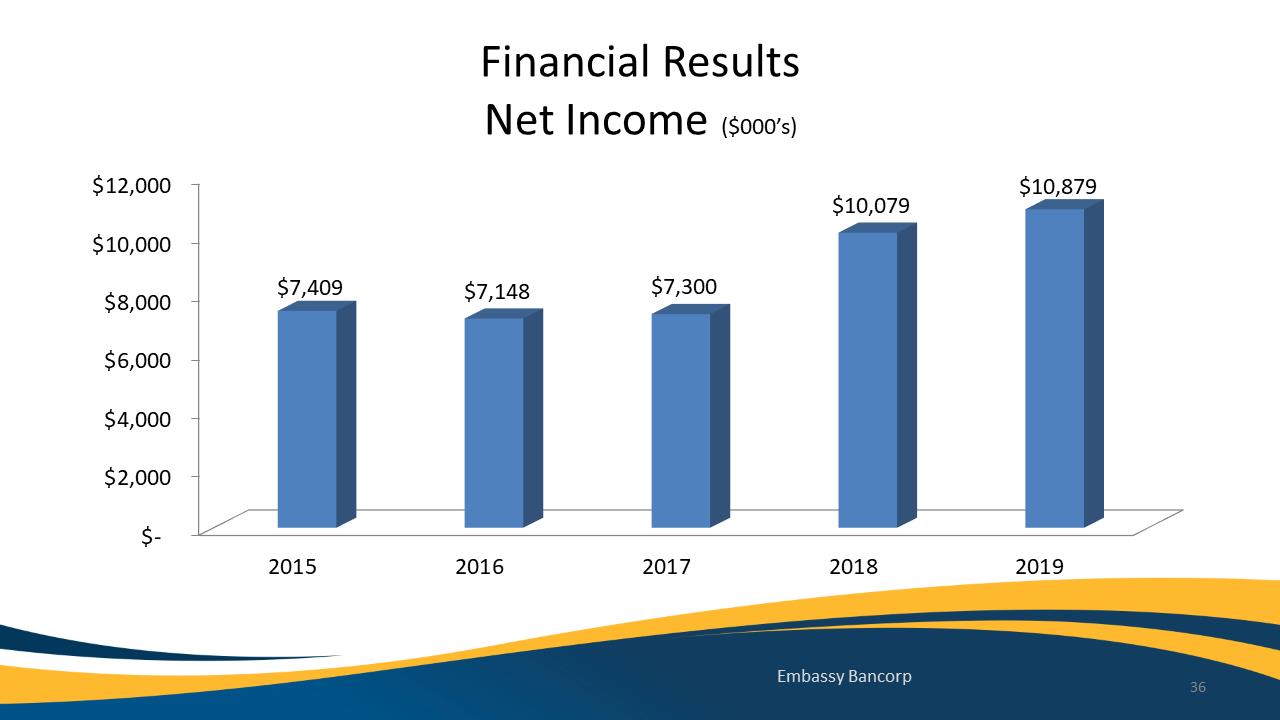

Financial Results Net Income ($000’s)

$-

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

2015

2016

2017

2018

2019

$7,409

$7,148

$7,300

$10,079

$10,879

Embassy Bancorp 36

Exhibit 99.1

Overhead

Cost of Funds

Efficiency

Asset Growth & Quality

Productivity

Net Interest Margin

Return on Equity

37

Exhibit 99.1

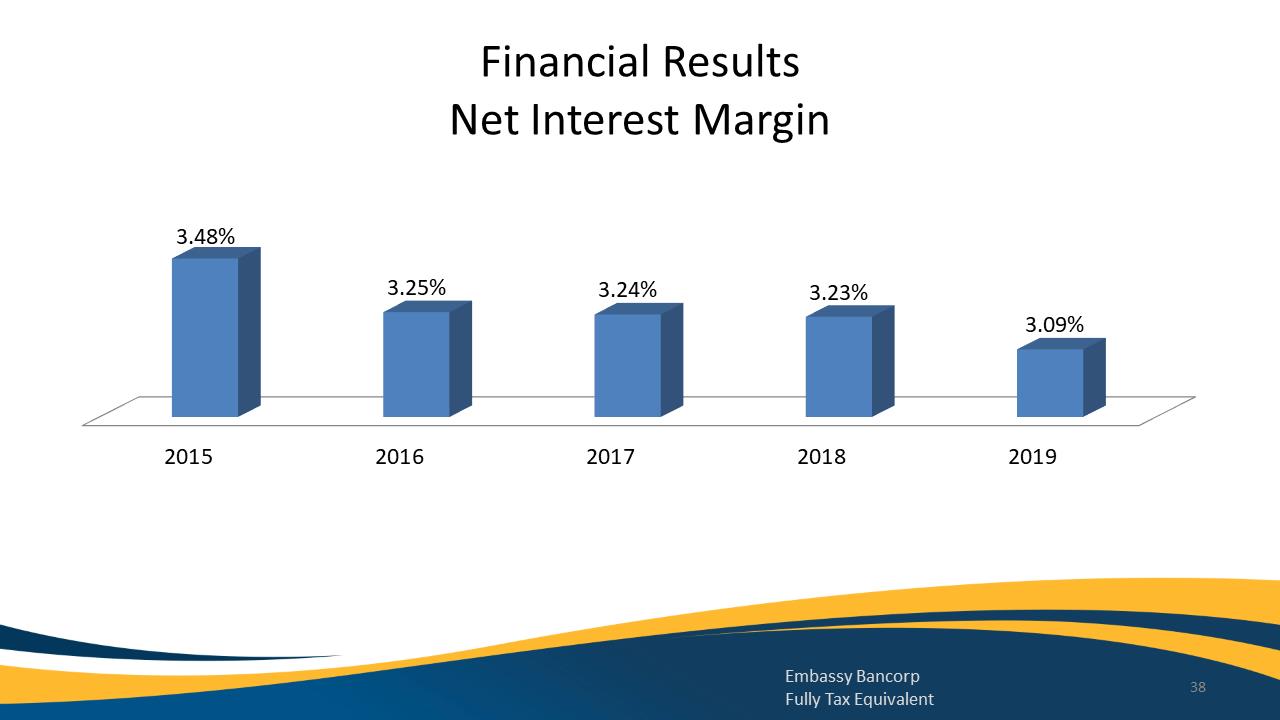

Financial Results Net Interest Margin

2015

2016

2017

2018

2019

3.48%

3.25%

3.24%

3.23%

3.09%

Embassy Bancorp

Fully Tax Equivalent 38

Exhibit 99.1

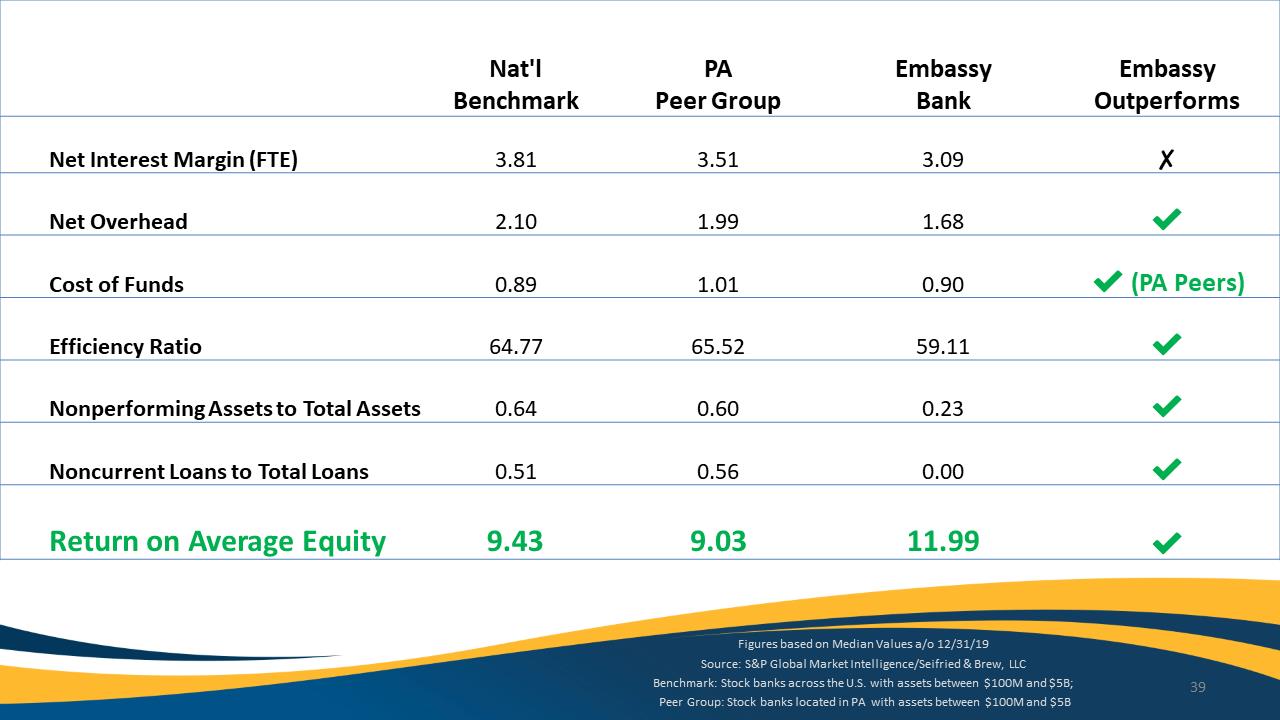

Nat’l Benchmark

PAPeer Group

Embassy Bank

Embassy Outperforms

Net Interest Margin (FTE)

3.81

3.51

3.09

✘

Net Overhead

2.10

1.99

1.68

✔

Cost of Funds

0.89

1.01

0.90

✔(PA Peers)

Efficiency Ratio

64.77

65.52

59.11

✔

Nonperforming Assets to Total Assets

0.64

0.60

0.23

✔

Noncurrent Loans to Total Loans

0.51

0.56

0.00

✔

Return on Average Equity

9.43

9.03

11.99

✔

Figures based on Median Values a/o 12/31/19

Source: S&P Global Market Intelligence/Seifried & Brew, LLC

Benchmark: Stock banks across the U.S. with assets between $100M and $5B;

Peer Group: Stock banks located in PA with assets between $100M and $5B

39

Exhibit 99.1

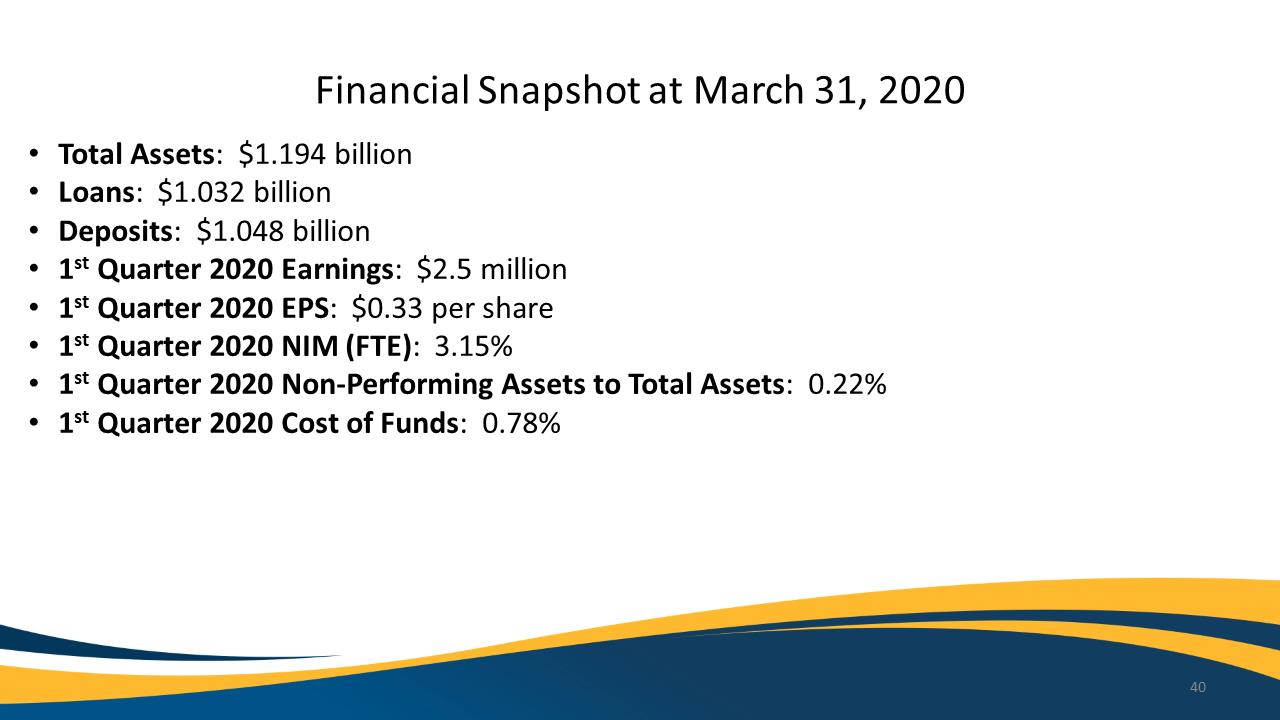

Financial Snapshot at March 31, 2020

•

Total Assets: $1.194 billion

•

Loans: $1.032 billion

•

Deposits: $1.048 billion

•

1stQuarter 2020 Earnings: $2.5 million

•

1stQuarter 2020 EPS: $0.33 per share

•

1stQuarter 2020 NIM (FTE):3.15%

•

1stQuarter 2020 Non-Performing Assets to Total Assets: 0.22%

•

1stQuarter 2020 Cost of Funds: 0.78%

40

Exhibit 99.1

2020

A Position of Strength

-

Diane Cunningham

Embassy Bank For the Lehigh Valley

EmbassyBank.com

Member FDIC

Equal Housing Lender

41

Exhibit 99.1

Our Vision

Embassy Bank Vision Statement

Embassy Bank is a happy, team-oriented, entrepreneurial group of local professionals with significant financial services experience. We possess an unmatched level of dedication to providing our future valued customers with exceptional service. Our total focus on customer satisfaction is the catalyst, continuously driving us to be able to provide the best financial products, services, technology and solutions. As a team, we will strive to exceed customer expectations while setting the standard for relationship banking in the Lehigh Valley. By regularly soliciting feedback from all Embassy Bank stakeholders – customers, employees, management, shareholders, directors and the Lehigh Valley community – we will constantly improve these attributes, contributing to stakeholder value and generating exceptional performance.

42

Exhibit 99.1

Financial Strength

Key Drivers of Performance

•

Asset Quality

•

Continued Market Expansion

•

The Right Mix of Deposits

•

Efficiency

43

Exhibit 99.1

Foundational Strength

•

Independent

•

Culture

•

Community Based

•

2019 Giving

–

$1,105,886 Charitable Contributions / Sponsorships

–

103 Organizations

44

Exhibit 99.1

Reputational Strength

Lehigh Valley Business Reader Rankings Lehigh Valley Business 2019 Reader Banking Awards Top Winner

Readers’ 2019 Choice The Morning Call

45

Exhibit 99.1

Reputational Strength

We Analyze Banks & Credit Unions… Very Carefully Bauer Financial www.bauerfinancial.com 4 stars

American Banker Top 200 Community Banks

46

Exhibit 99.1

•

Pricing

•

Products

•

Branch Network

Brand

Competitive Strength

47

Exhibit 99.1

Google Pay & Apple Pay

•

Online Home Loan Applications

•

Online Account Opening

•

Fraud Protection Tools

Competitive Strength

Brand Fintech 48

Exhibit 99.1

Continuing Our Financial Investment

Embassy Bank Online smart secure local support

Embassy Online Services Banking On Your Terms

Manage Your Accounts Pay Your Bills Make a Purchase Deposit Your Checks Pay Your Friends Protect Your Money Open Account

49

Exhibit 99.1

COVID-19 Pandemic Response

-James Bartholomew

50

Embassy Bank For the Lehigh Valley EmbassyBank.com

Member FDIC Equal Housing Lender

50

Exhibit 99.1

Safeguarding Our Community & Team Branch Offices

•

Agile and ready

•

Amended operating hours locations

•

Banking at drive-up and by-appointment

•

Online banking and ATMs available 24/7

•

Multi-phase re-opening plan

51

Exhibit 99.1

Safeguarding Our Community & Team Personnel

•

Established work from home teams

•

Employee assistance programs

•

Staffing rotations

52

Exhibit 99.1

Helping Our Community Overdraft Fees

•

Worked with deposit customers in need.

•

Immediately implemented a policy of waiving all overdraft fees. 53

Exhibit 99.1

Helping Our Community Loan Payment Accommodations

54

• As of the March 31, 2020 Form 10-Q, through April 29,

2020 provided loan payment accommodations:

- Approximately 275 loans totaling $170 million

- Short term principal and/or interest deferrals

Exhibit 99.1

Helping Our Community PPP Lending

•

500 Paycheck Protection Program (“PPP”) loans

•

Totaling approximately $66 million

•

Average loan size of $133 thousand

•

Over $2 million in SBA fees anticipated to be collected

55

Exhibit 99.1

Helping Our CommunityPPP Lending

•

Forgiveness period to begin in third quarter 2020

•

Software to program participants with forgiveness

•

Federal Reserve Board Paycheck Protection Program Liquidity Facility 56

Exhibit 99.1

Shareholder Value-David Lobach

Embassy Bank For the Lehigh Valley

EmbassyBank.com

Member FDIC Equal Housing Lender

Exhibit 99.1

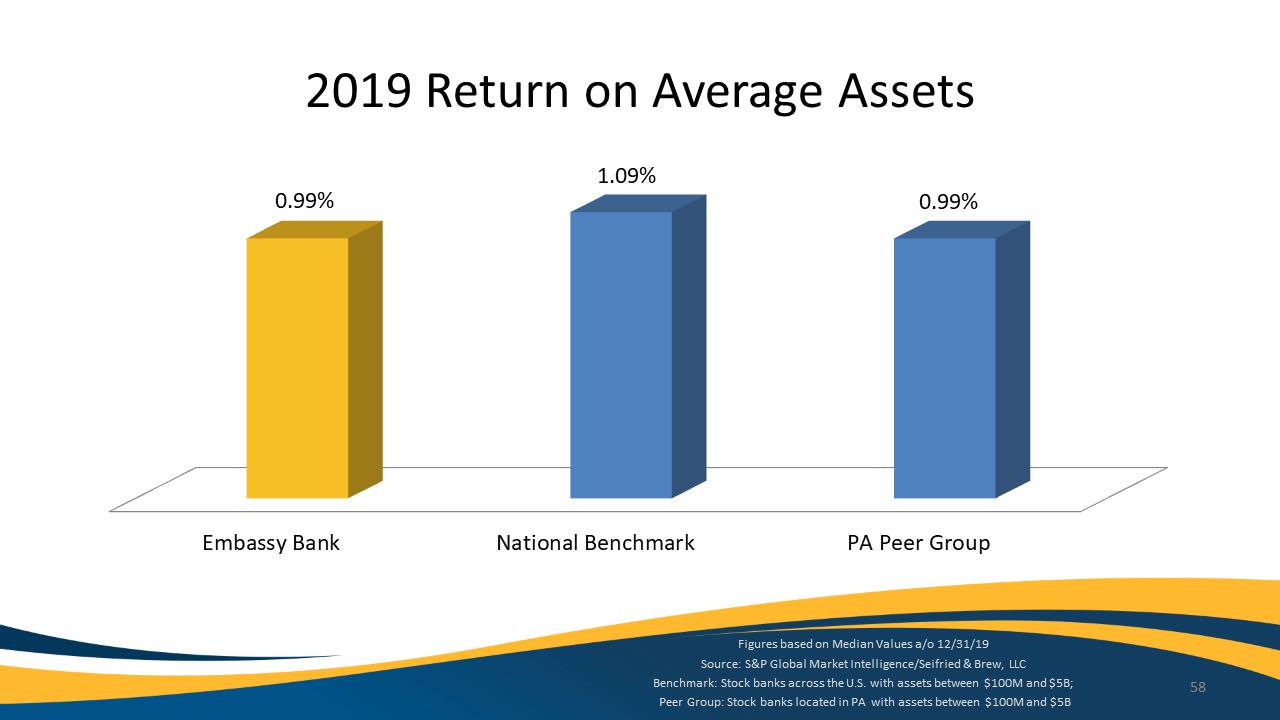

2019 Return on Average Assets

Embassy Bank

National Benchmark

PA Peer Group

0.99%

1.09%

0.99%

Figures based on Median Values a/o 12/31/19

Source: S&P Global Market Intelligence/Seifried & Brew, LLC

Benchmark: Stock banks across the U.S. with assets between $100M and $5B;

Peer Group: Stock banks located in PA with assets between $100M and $5B

58

Exhibit 99.1

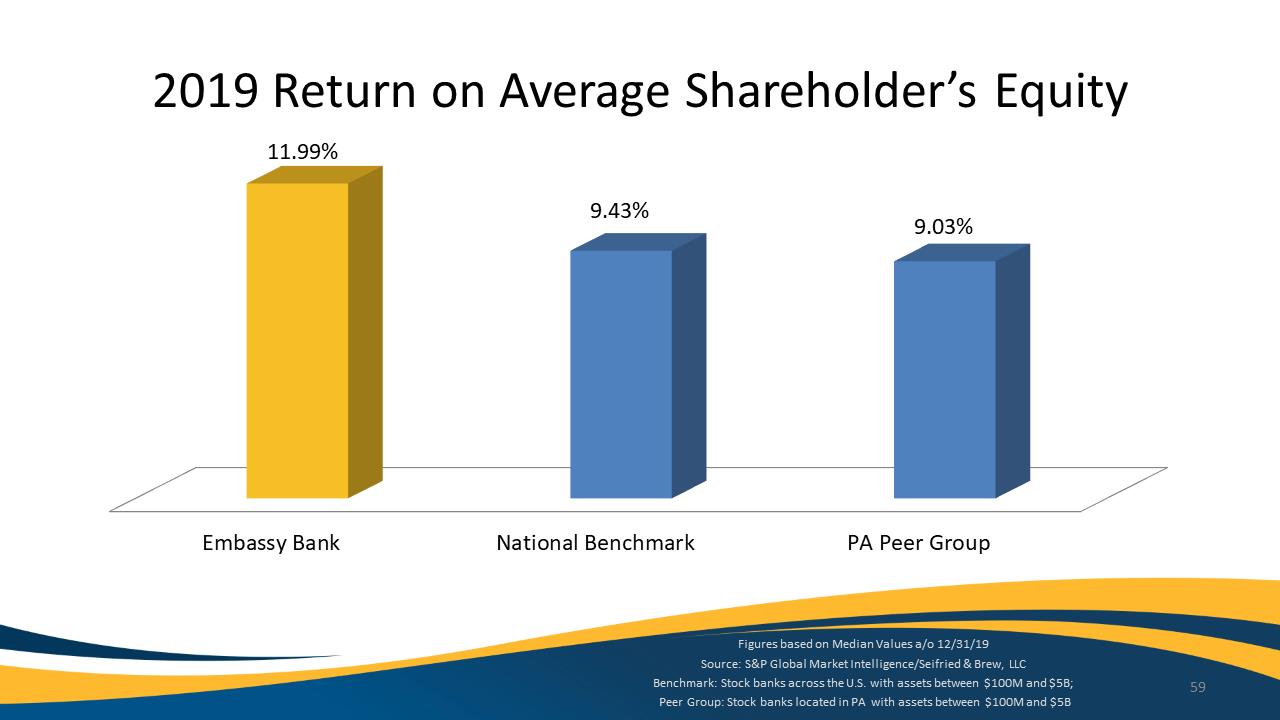

2019 Return on Average Shareholder’s Equity

Embassy Bank

National Benchmark

PA Peer Group

11.99%

9.43%

9.03%

Figures based on Median Values a/o 12/31/19

Source: S&P Global Market Intelligence/Seifried & Brew, LLC

Benchmark: Stock banks across the U.S. with assets between $100M and $5B;

Peer Group: Stock banks located in PA with assets between $100M and $5B

59

Exhibit 99.1

Earnings Per Share

2015

2016

2017

2018

2019

$1.01

$0.96

$0.97

$1.34

$1.44

Embassy Bancorp

Amounts above reflects diluted EPS 60

Exhibit 99.1

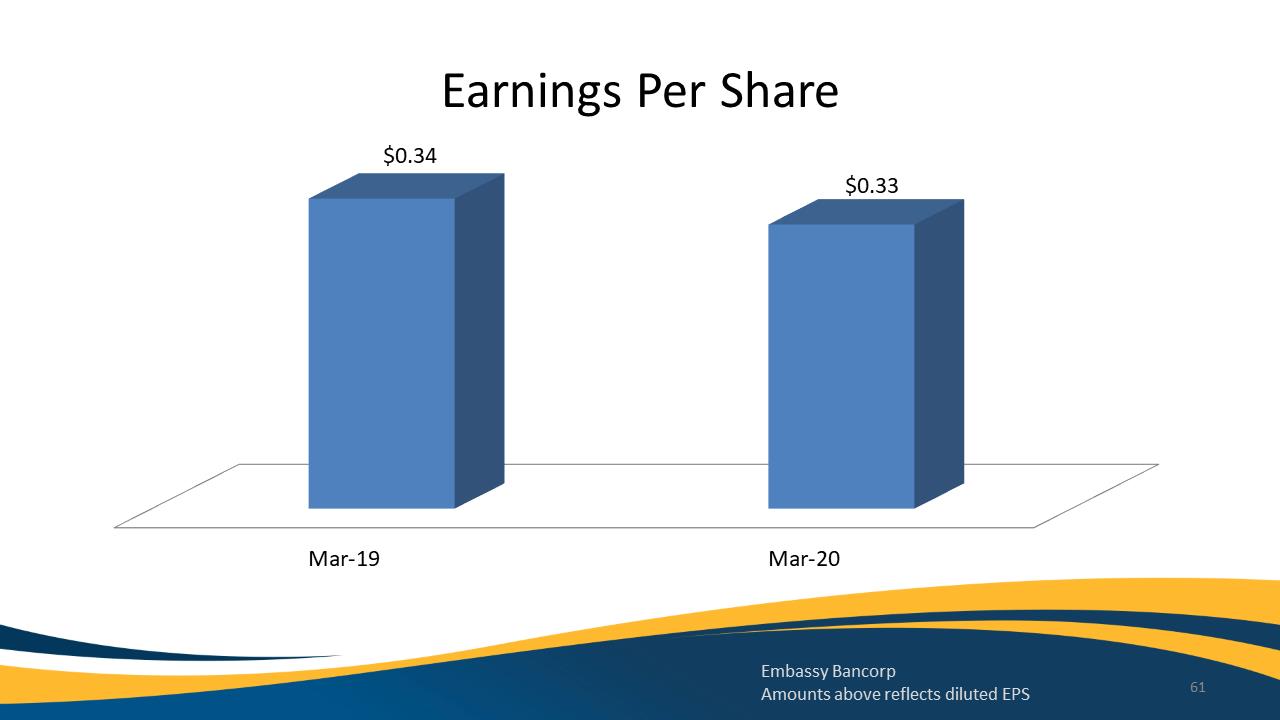

Earnings Per Share

Mar-19

Mar-20

$0.34

$0.33

Embassy Bancorp

Amounts above reflects diluted EPS 61

Exhibit 99.1

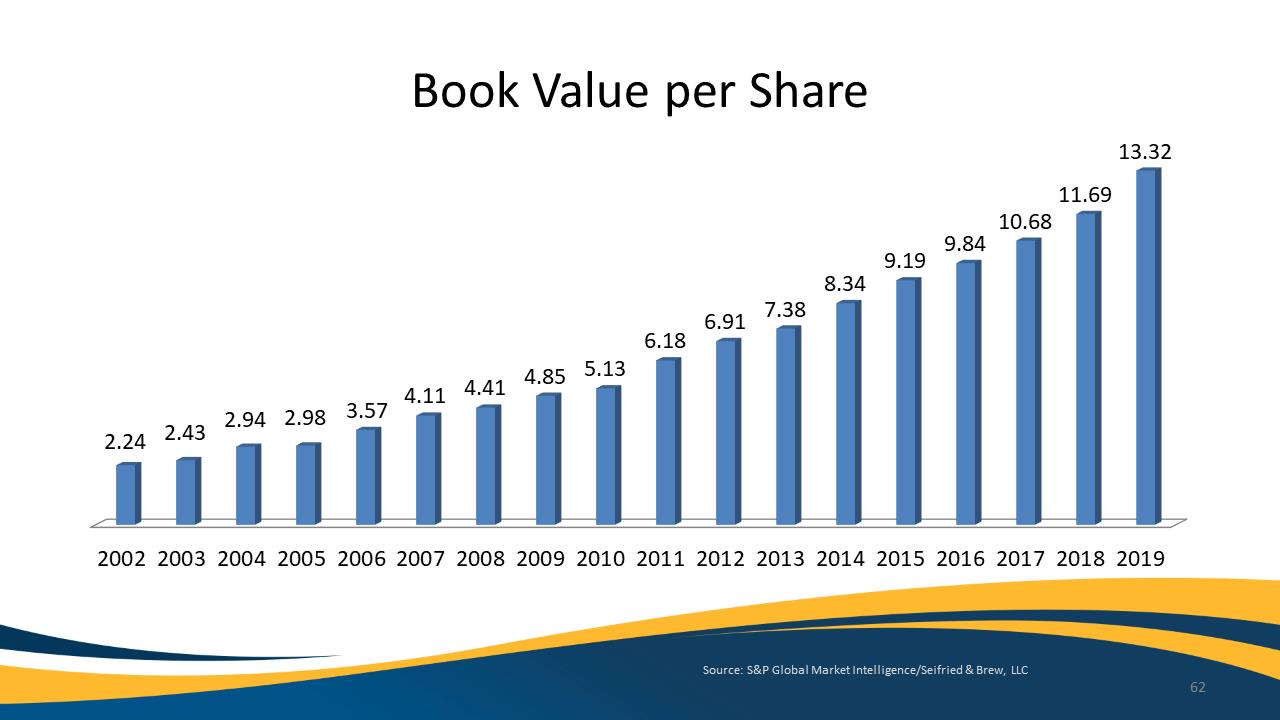

Book Value per Share

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2.24

2.43

2.94

2.98

3.57

4.11

4.41

4.85

5.13

6.18

6.91

7.38

8.34

9.19

9.84

10.68

11.69

13.32

Source: S&P Global Market Intelligence/Seifried & Brew, LLC

62

Exhibit 99.1

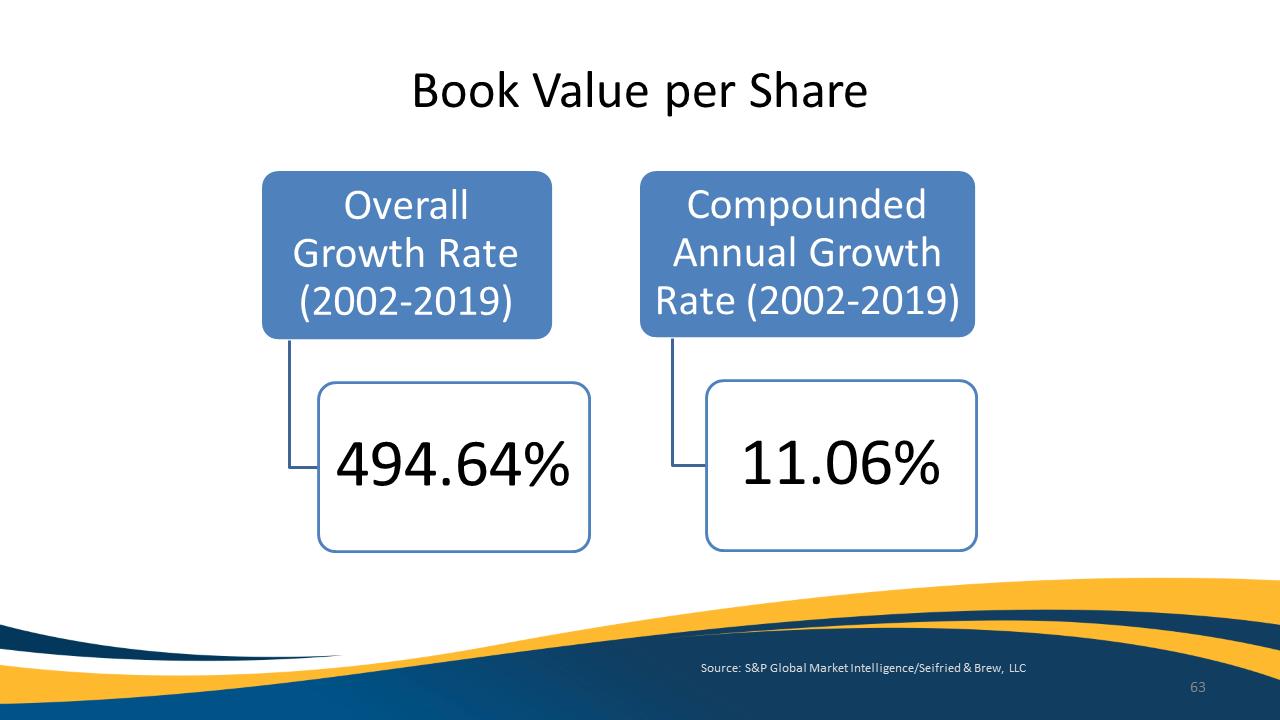

Book Value per Share

Overall Growth Rate (2002-2019)

494.64%

Compounded Annual Growth Rate (2002-2019)

11.06%

Source: S&P Global Market Intelligence/Seifried & Brew, LLC

63

Exhibit 99.1

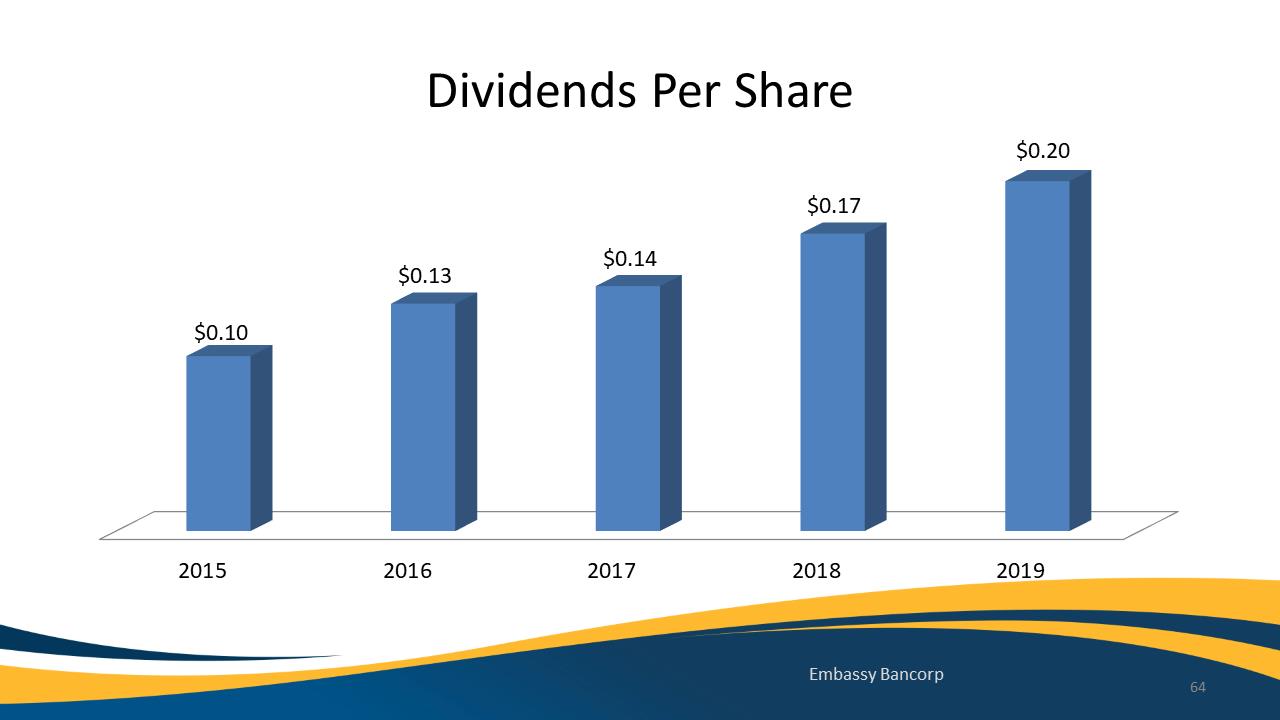

Dividends Per Share

2015

2016

2017

2018

2019

$0.10

$0.13

$0.14

$0.17

$0.20

Embassy Bancorp 64

Exhibit 99.1

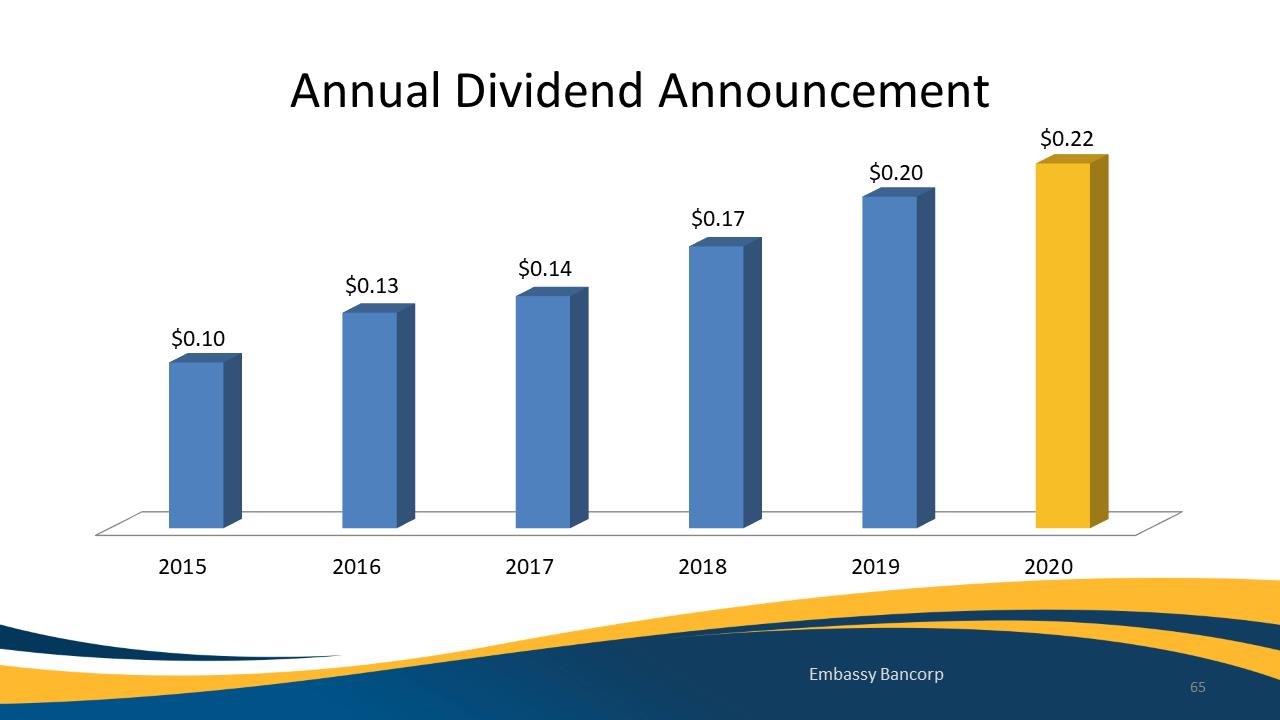

Annual Dividend Announcement

2015

2016

2017

2018

2019

2020

$0.10

$0.13

$0.14

$0.17

$0.20

$0.22

Embassy Bancorp 65

Exhibit 99.1

Closing Items

•

Q&A

•

Results of Voting

•

Conclusion of Meeting

66

Exhibit 99.1

Thank You Shareholders!

67

Embassy Bank For the Lehigh Valley