Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K DATED JUNE 17, 2020 - COMMUNICATIONS SYSTEMS INC | csi200976_8k.htm |

Exhibit 99.1

Communications Systems, Inc. (NASDAQ: JCS) The new CSI….. evolving into an IoT Intelligent Edge Product & Services Company

Meeting Agenda 2 1. Opening Remarks 2. Open Business Meeting 3. Vote on Matters Presented in Proxy 4. Adjourn Business Meeting 5. Company Update 6. Shareholder Questions 7. Adjourn Meeting

Vote on Matters Presented in Proxy 3 Proposal No. 1 Election of Directors Proposal No. 2 Ratifying and approving appointment of Baker Tilly Virchow Krause, LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2020 Other Business

Other Business Announcements 4

Other Business Meeting Adjourned 5

Communications Systems, Inc. (NASDAQ: JCS) The new CSI….. evolving into an IoT Intelligent Edge Product & Services Company Management Report

Forward Looking Statement This presentation includes certain forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding future financial performance, future growth and future acquisitions. These statements are based on Communications Systems’ current expectations or beliefs and are subject to uncertainty and changes in circumstances. Actual results may vary materially from those expressed or implied by the statements here due to changes in economic, business, competitive or regulatory factors, and other risks and uncertainties affecting the operation of Communications Systems’ business. These risks, uncertainties and contingencies are presented in the Company’s Annual Report on Form 10 - K and, from time to time, in the Company’s other filings with the Securities and Exchange Commission. The information set forth herein should be read in light of such risks. Further, investors should keep in mind that the Company’s financial results in any particular period may not be indicative of future results. Communications Systems is under no obligation to, and expressly disclaims any obligation to, update or alter its forward - looking statements, whether as a result of new information, future events, changes in assumptions or otherwise. 7

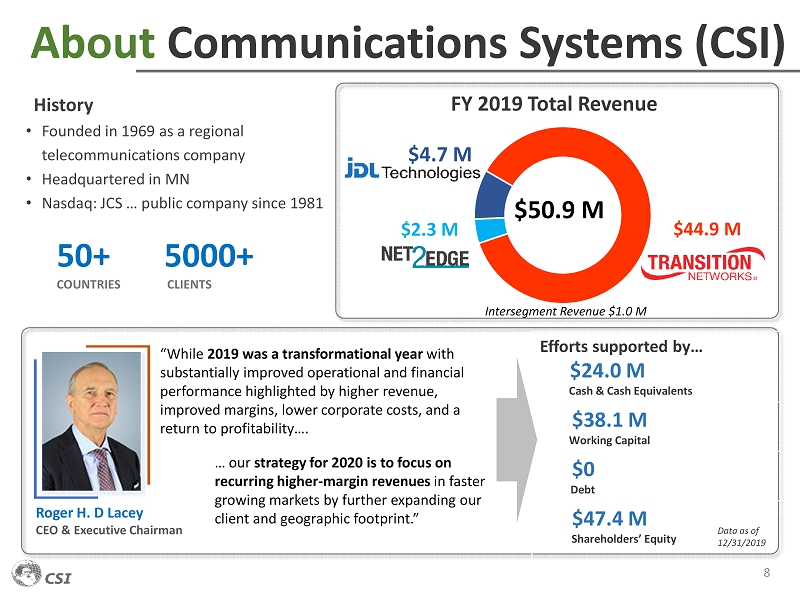

$44.9 M $2.3 M FY 2019 Total Revenue About Communications Systems (CSI) History • Founded in 1969 as a regional telecommunications company • Headquartered in MN • Nasdaq: JCS … public company since 1981 8 50+ COUNTRIES 5000+ CLIENTS “While 2019 was a transformational year with substantially improved operational and financial performance highlighted by higher revenue, improved margins, lower corporate costs, and a return to profitability…. Roger H. D Lacey CEO & Executive Chairman Efforts supported by… $24.0 M Cash & Cash Equivalents $38.1 M Working Capital $0 Debt $47.4 M Shareholders’ Equity … our strategy for 2020 is to focus on recurring higher - margin revenues in faster growing markets by further expanding our client and geographic footprint.” $50.9 M $4.7 M Data as of 12/31/2019 Intersegment Revenue $1.0 M

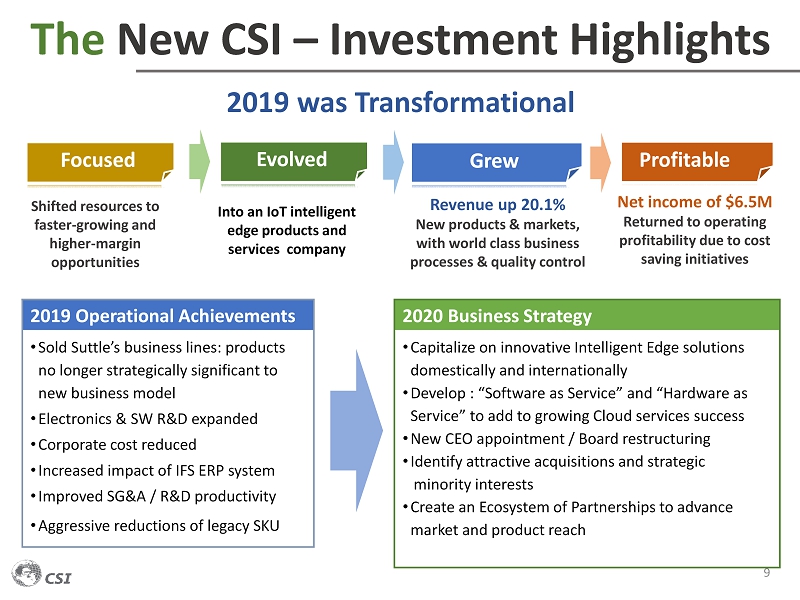

The New CSI – Investment Highlights 9 Profitable Shifted resources to faster - growing and higher - margin opportunities Into an IoT intelligent edge products and services company Focused Grew 2019 was Transformational Evolved 2019 Operational Achievements • Sold Suttle’s business lines: products no longer strategically significant to new business model • Electronics & SW R&D expanded • Corporate cost reduced • Increased impact of IFS ERP system • Improved SG&A / R&D productivity • Aggressive reductions of legacy SKU 2020 Business Strategy • Capitalize on innovative Intelligent Edge solutions domestically and internationally • Develop : “Software as Service” and “Hardware as Service” to add to growing Cloud services success • New CEO appointment / Board restructuring • Identify attractive acquisitions and strategic minority interests • Create an Ecosystem of Partnerships to advance market and product reach Revenue up 20.1% New products & markets, with world class business processes & quality control Net income of $6.5M Returned to operating profitability due to cost saving initiatives

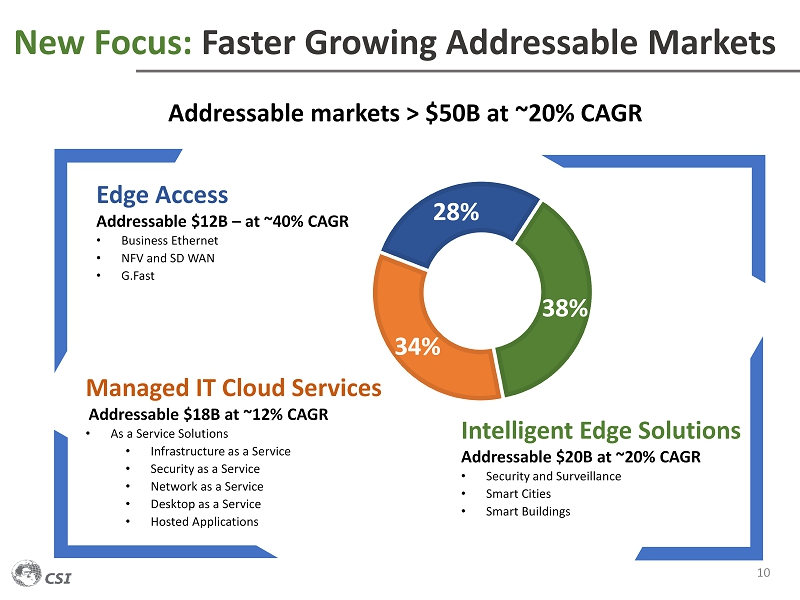

New Focus: Faster Growing Addressable Markets 10 Managed IT Cloud Services Addressable $18B at ~12% CAGR • As a Service Solutions • Infrastructure as a Service • Security as a Service • Network as a Service • Desktop as a Service • Hosted Applications Edge Access Addressable $12B – at ~40% CAGR • Business Ethernet • NFV and SD WAN • G.Fast Intelligent Edge Solutions Addressable $20B at ~20% CAGR • Security and Surveillance • Smart Cities • Smart Buildings Addressable markets > $50B at ~20% CAGR 38% 34% 28%

Substantial Global Footprint 11 5 Sales Offices 50+ Countries 5000+ Customers

World Class Customer Base 12 North America International

Business Units 13

Business Units: 14 Transforming Networks ECOSYSTEM OF PARTNERS STRONG FOUNDATION IN NETWORK CONVERTERS o Brand equity with blue chip customer list o Market reputation o Superior customer experience o Actionable Intelligence at the Edge o Partnerships and software APIs to integrate into IoT ecosystem o Alternate Connectivity Solutions o Network Management Software to ease deployment o Elevate brand with global integration partners USER FRIENDLY TECHNOLOGIES & PARTNERSHIPS ADDRESSABLE MARKETS AND VERTICALS Intelligent Transportation Systems o Traffic and pedestrian monitoring o Connected Vehicles o Smart Parking Security and Surveillance o Financial institutions o Government agencies o Universities Smart Buildings o Building automation o Networked utilities o LED lighting and access control

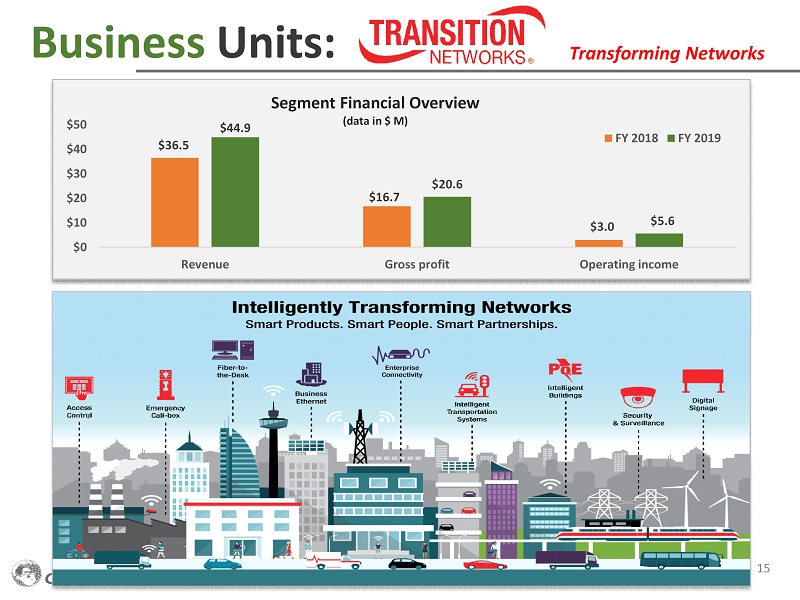

Business Units: 15 Transforming Networks $36.5 $16.7 $3.0 $44.9 $20.6 $5.6 $0 $10 $20 $30 $40 $50 Revenue Gross profit Operating income Segment Financial Overview (data in $ M) FY 2018 FY 2019

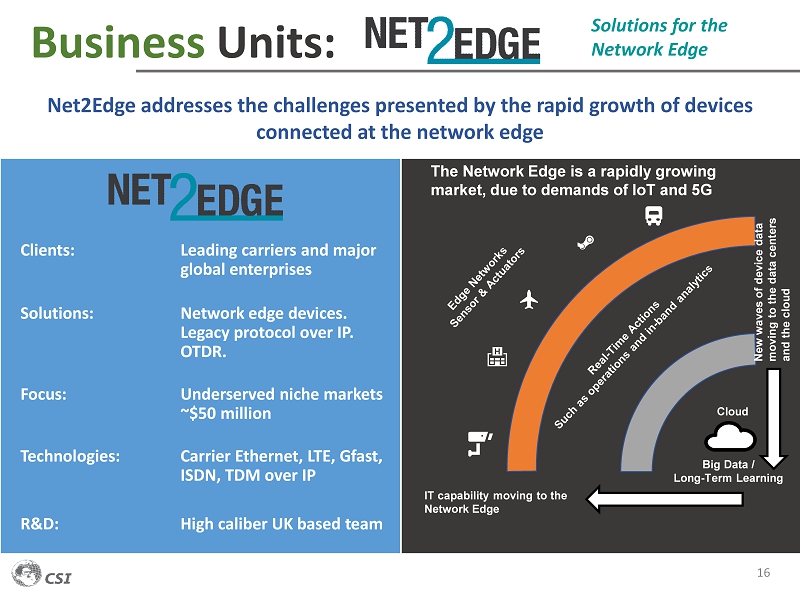

Business Units: 16 Clients: Leading carriers and major global enterprises Solutions: Network edge devices. Legacy protocol over IP. OTDR. Focus: Underserved niche markets ~$50 million Technologies: Carrier Ethernet, LTE, Gfast, ISDN, TDM over IP R&D: High caliber UK based team Net2Edge addresses the challenges presented by the rapid growth of devices connected at the network edge Solutions for the Network Edge Cloud IT capability moving to the Network Edge New waves of device data moving to the data centers and the cloud Big Data / Long - Term Learning The Network Edge is a rapidly growing market, due to demands of IoT and 5G

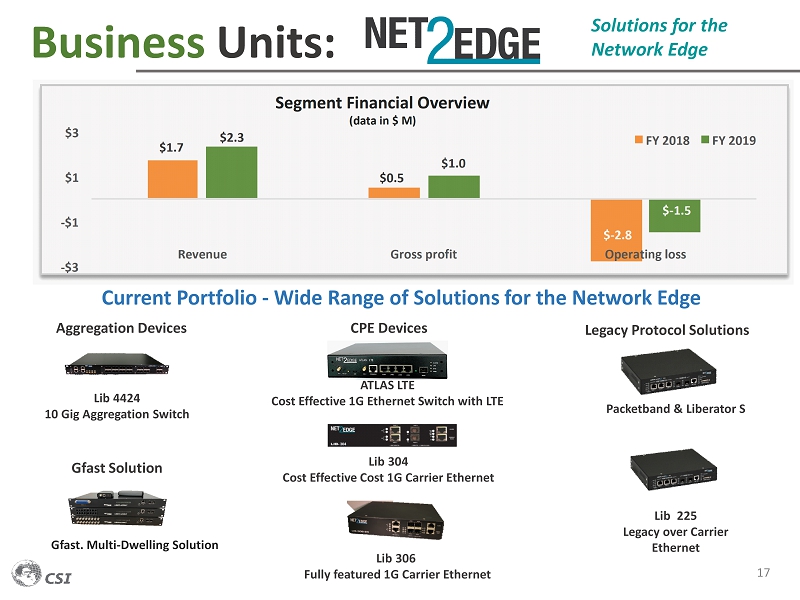

Business Units: 17 Current Portfolio - Wide Range of Solutions for the Network Edge Lib 304 Cost Effective Cost 1G Carrier Ethernet ATLAS LTE Cost Effective 1G Ethernet Switch with LTE Lib 4424 10 Gig Aggregation Switch Lib 225 Legacy over Carrier Ethernet Gfast . Multi - Dwelling Solution Packetband & Liberator S Solutions for the Network Edge Aggregation Devices CPE Devices Legacy Protocol Solutions Lib 306 Fully featured 1G Carrier Ethernet Gfast Solution

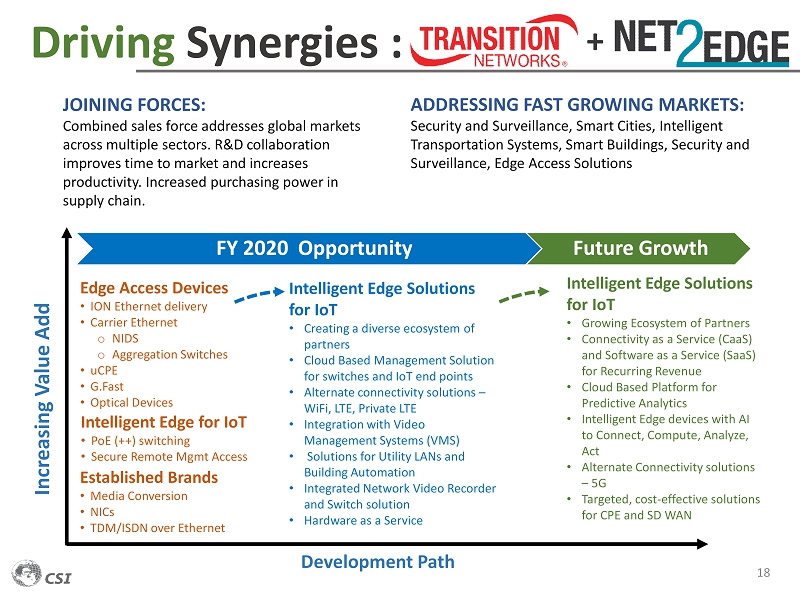

Edge Access Devices • ION Ethernet delivery • Carrier Ethernet o NIDS o Aggregation Switches • uCPE • G.Fast • Optical Devices Driving Synergies : 18 Packetband & Liberator S Development Path Increasing Value Add Established Brands • Media Conversion • NICs • TDM/ISDN over Ethernet Intelligent Edge Solutions for IoT • Creating a diverse ecosystem of partners • Cloud Based Management Solution for switches and IoT end points • Alternate connectivity solutions – WiFi , LTE, Private LTE • Integration with Video Management Systems (VMS) • Solutions for Utility LANs and Building Automation • Integrated Network Video Recorder and Switch solution • Hardware as a Service Intelligent Edge Solutions for IoT • Growing Ecosystem of Partners • Connectivity as a Service (CaaS) and Software as a Service (SaaS) for Recurring Revenue • Cloud Based Platform for Predictive Analytics • Intelligent Edge devices with AI to Connect, Compute, Analyze, Act • Alternate Connectivity solutions – 5G • Targeted, cost - effective solutions for CPE and SD WAN FY 2020 Opportunity Future Growth JOINING FORCES : Combined sales force addresses global markets across multiple sectors. R&D collaboration improves time to market and increases productivity. Increased purchasing power in supply chain. ADDRESSING FAST GROWING MARKETS : Security and Surveillance, Smart Cities, Intelligent Transportation Systems, Smart Buildings, Security and Surveillance, Edge Access Solutions + Intelligent Edge for IoT • PoE (++) switching • Secure Remote Mgmt Access

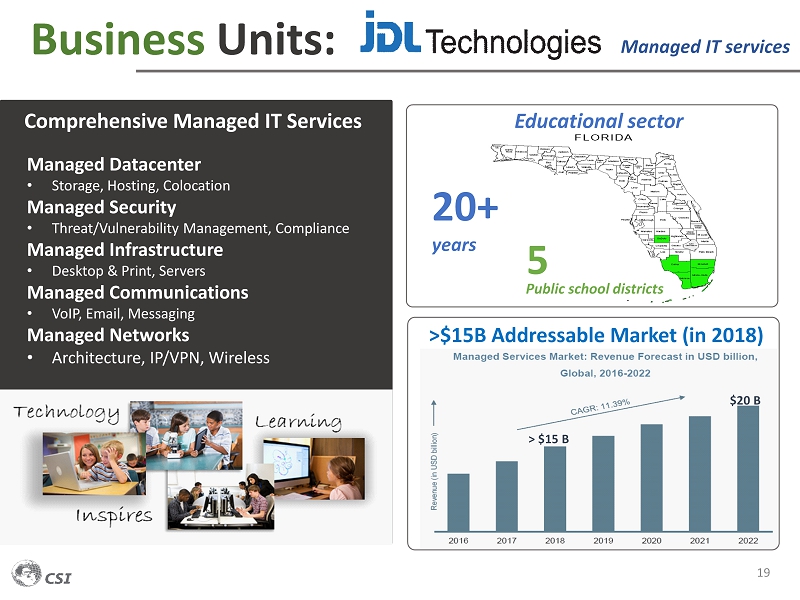

Business Units: 19 > $15 B $20 B Managed Datacenter • Storage, Hosting, Colocation Managed Security • Threat/Vulnerability Management, Compliance Managed Infrastructure • Desktop & Print, Servers Managed Communications • VoIP, Email, Messaging Managed Networks • Architecture, IP/VPN, Wireless Managed IT services >$15B Addressable Market (in 2018) Comprehensive Managed IT Services 20+ years 5 Public school districts Educational sector

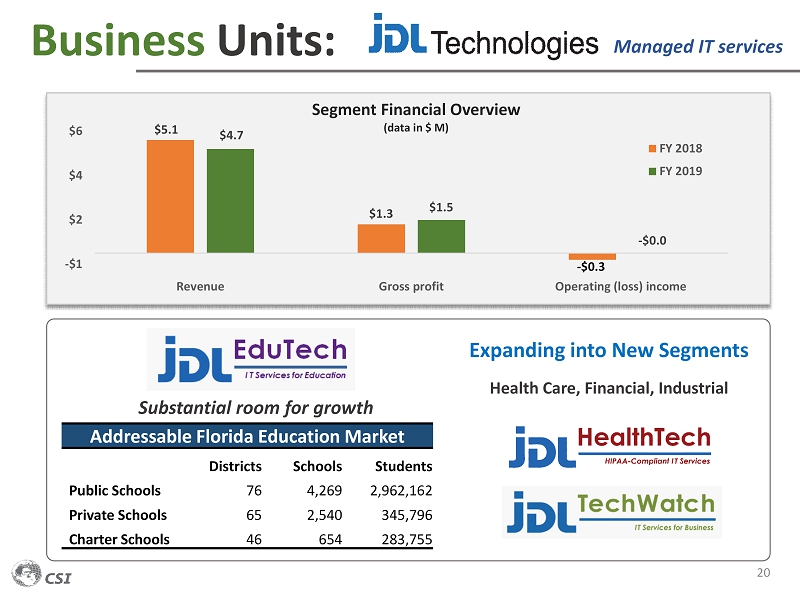

Business Units: 20 Addressable Florida Education Market Districts Schools Students Public Schools 76 4,269 2,962,162 Private Schools 65 2,540 345,796 Charter Schools 46 654 283,755 Substantial room for growth $5.1 $1.3 - $0.3 $4.7 $1.5 - $0.0 -$1 $2 $4 $6 Revenue Gross profit Operating (loss) income Segment Financial Overview (data in $ M) FY 2018 FY 2019 Managed IT services Expanding into New Segments Health Care, Financial, Industrial

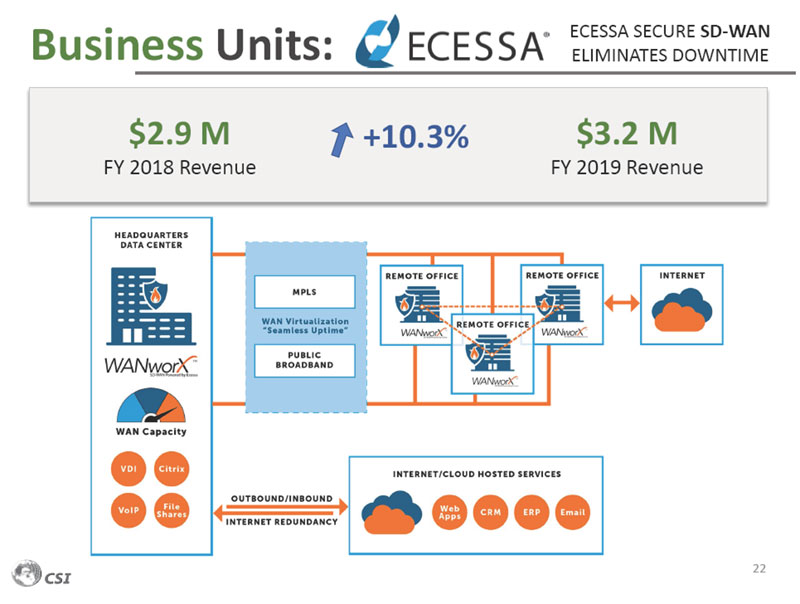

Business Units: 21 18 - YEAR TRACK RECORD OF SUCCESS o Fully Managed SD - WAN solution for all customers o 99% Customer Satisfaction o Over 10,000 solutions worldwide o All - In - One, Self Contained SW Stack - Deploy Anywhere o No Need To Change IP Addresses o Carrier Agnostic (Any Technology, Any ISP, Globally) o Supports High Bandwidth (20Gbps) o DataCenter Class Products (Fiber, HA, HWFO) FLEXIBLE, GUIDED SD - WAN DEPLOYMENTS ECESSA SECURE SD - WAN ELIMINATES DOWNTIME ADDRESSABLE MARKETS AND VERTICALS Banking o Never Down virtual branch operations o Secure, reliable WAN infrastructure o Enhanced remote customer experience Healthcare o HIPAA compliant private networks o Remote, virtual visits and data sharing o Cost - effective private WAN Government & Municipalities o All - in - One Secure, private networks o Self - contained edge solutions o Easy integration into existing infrastructure

Business Units: 22 ECESSA SECURE SD - WAN ELIMINATES DOWNTIME $2.9 M FY 2018 Revenue $3.2 M FY 2019 Revenue +10.3%

Product Segmentation Intelligent Edge devices such as PoE switches and converters, uCPE , with embedded actionable intelligence and compute for decision making at the edge Products On premise and Cloud based software solutions to provide ubiquitous, proactive management and predictive analytics Software Recurring revenue from Software as a Service (SaaS) and Hardware as a Service ( HaaS ), Professional Services Services Segment with double digit growth, Strategic direction for company Intelligent Edge Solutions (IES) Segment with minimum focus or investment, Harvest Strategy for revenue, look for opportunistic growth Traditional 23

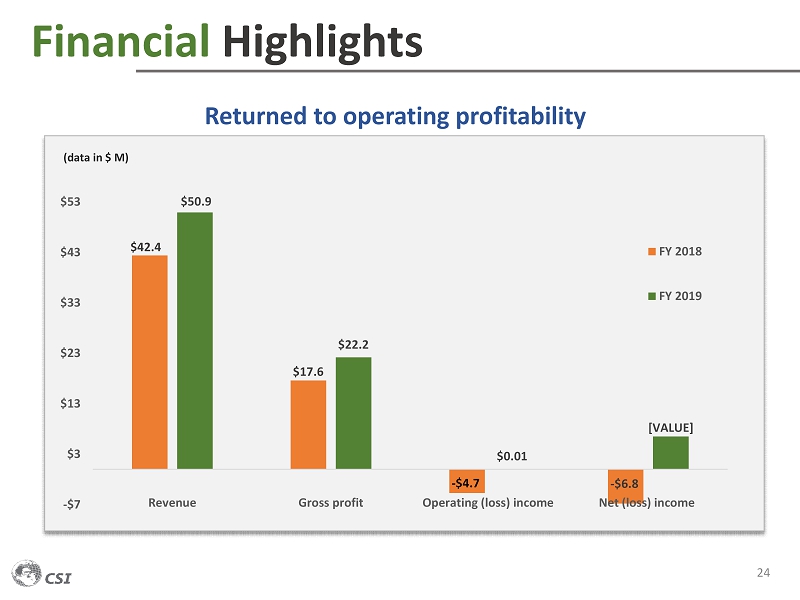

24 $42.4 $17.6 - $4.7 - $6.8 $50.9 $22.2 $0.01 [VALUE] -$7 $3 $13 $23 $33 $43 $53 Revenue Gross profit Operating (loss) income Net (loss) income (data in $ M) FY 2018 FY 2019 Returned to operating profitability Financial Highlights

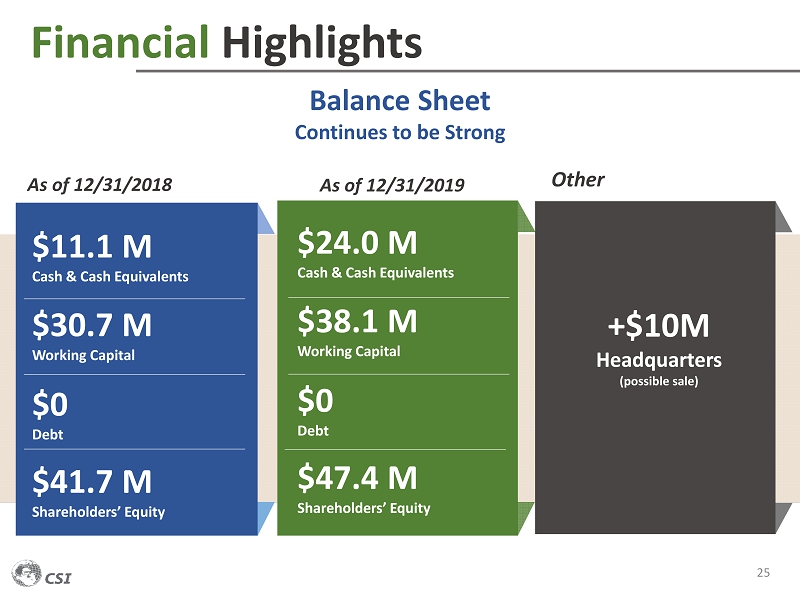

Financial Highlights 25 As of 12/31/2018 Balance Sheet Continues to be Strong As of 12/31/2019 $11.1 M Cash & Cash Equivalents $30.7 M Working Capital $0 Debt $41.7 M Shareholders’ Equity $24.0 M Cash & Cash Equivalents $38.1 M Working Capital $0 Debt $47.4 M Shareholders’ Equity +$10M Headquarters (possible sale) Other

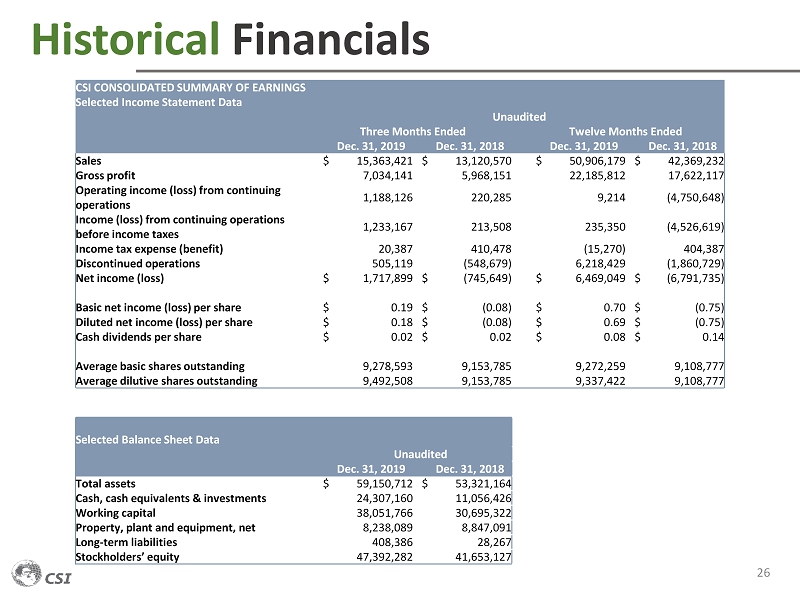

Historical Financials 26 CSI CONSOLIDATED SUMMARY OF EARNINGS Selected Income Statement Data Unaudited Three Months Ended Twelve Months Ended Dec. 31, 2019 Dec. 31, 2018 Dec. 31, 2019 Dec. 31, 2018 Sales $ 15,363,421 $ 13,120,570 $ 50,906,179 $ 42,369,232 Gross profit 7,034,141 5,968,151 22,185,812 17,622,117 Operating income (loss) from continuing operations 1,188,126 220,285 9,214 (4,750,648) Income (loss) from continuing operations before income taxes 1,233,167 213,508 235,350 (4,526,619) Income tax expense (benefit) 20,387 410,478 (15,270) 404,387 Discontinued operations 505,119 (548,679) 6,218,429 (1,860,729) Net income (loss) $ 1,717,899 $ (745,649) $ 6,469,049 $ (6,791,735) Basic net income (loss) per share $ 0.19 $ (0.08) $ 0.70 $ (0.75) Diluted net income (loss) per share $ 0.18 $ (0.08) $ 0.69 $ (0.75) Cash dividends per share $ 0.02 $ 0.02 $ 0.08 $ 0.14 Average basic shares outstanding 9,278,593 9,153,785 9,272,259 9,108,777 Average dilutive shares outstanding 9,492,508 9,153,785 9,337,422 9,108,777 Selected Balance Sheet Data Unaudited Dec. 31, 2019 Dec. 31, 2018 Total assets $ 59,150,712 $ 53,321,164 Cash, cash equivalents & investments 24,307,160 11,056,426 Working capital 38,051,766 30,695,322 Property, plant and equipment, net 8,238,089 8,847,091 Long - term liabilities 408,386 28,267 Stockholders’ equity 47,392,282 41,653,127

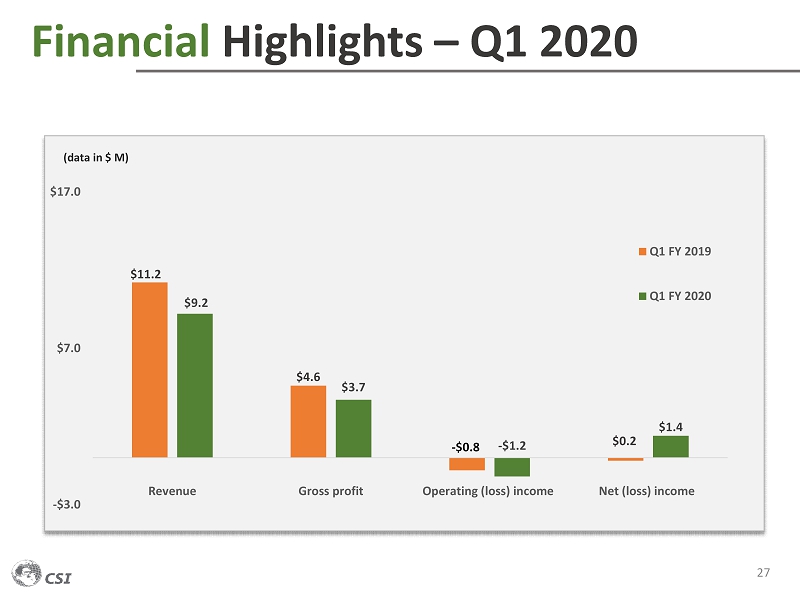

27 $11.2 $4.6 - $0.8 $0.2 $9.2 $3.7 - $1.2 $1.4 -$3.0 $7.0 $17.0 Revenue Gross profit Operating (loss) income Net (loss) income (data in $ M) Q1 FY 2019 Q1 FY 2020 Financial Highlights – Q1 2020

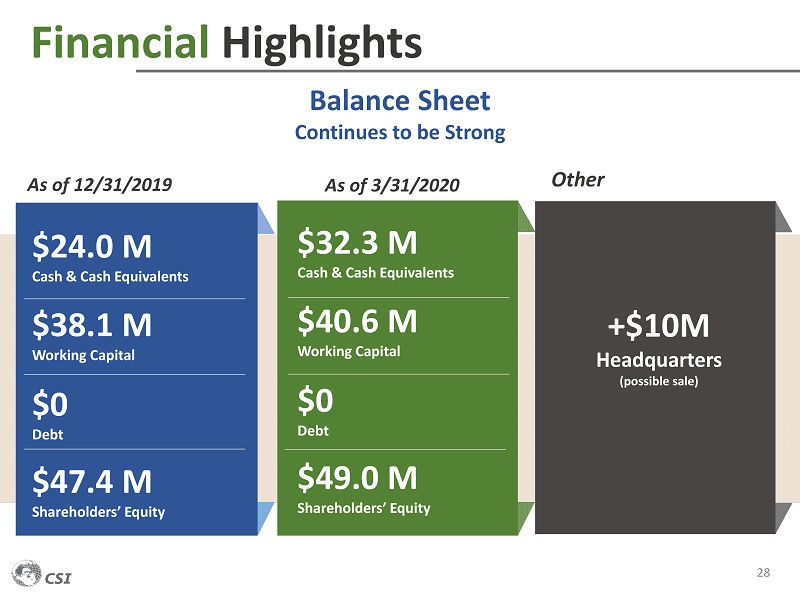

Financial Highlights 28 As of 12/31/2019 Balance Sheet Continues to be Strong As of 3/31/2020 $24.0 M Cash & Cash Equivalents $38.1 M Working Capital $0 Debt $47.4 M Shareholders’ Equity $32.3 M Cash & Cash Equivalents $40.6 M Working Capital $0 Debt $49.0 M Shareholders’ Equity +$10M Headquarters (possible sale) Other

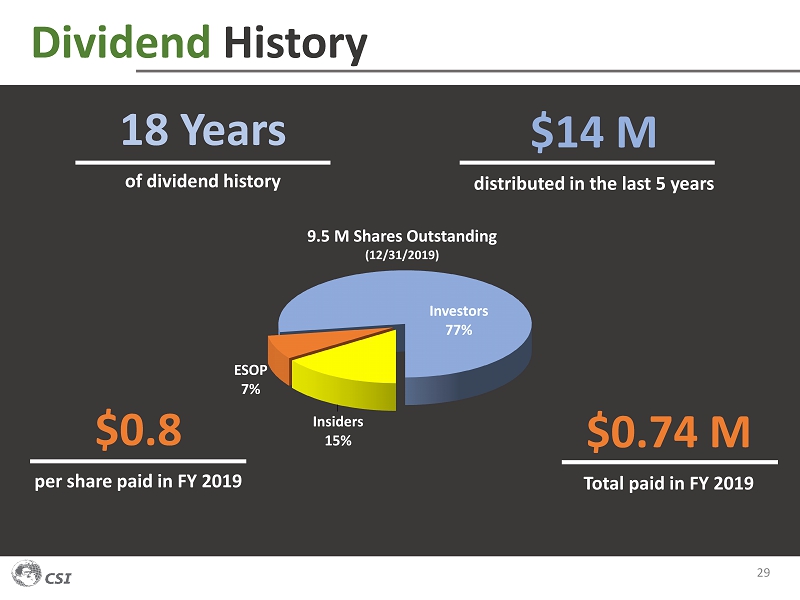

Dividend History 29 $14 M distributed in the last 5 years $0.8 per share paid in FY 2019 18 Years of dividend history $0.74 M Total paid in FY 2019 Insiders 15% ESOP 7% Investors 77% 9.5 M Shares Outstanding (12/31/2019)

Communications Systems, Inc. (NASDAQ: JCS) The new CSI….. evolving into an IoT Intelligent Edge Product & Services Company

Contact Us 31 Lena Cati (212) 836 - 9611 lcati@equityny.com Devin Sullivan (212) 836 - 9608 dsullivan@equityny.com Mark D. Fandrich Chief Financial Officer 952 - 582 - 6416 mark.fandrich@commsysinc.com Roger H. D. Lacey Chief Executive Officer 952 - 996 - 1674