Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - PYXUS INTERNATIONAL, INC. | d944528dex991.htm |

| EX-10.1 - EX-10.1 - PYXUS INTERNATIONAL, INC. | d944528dex101.htm |

| 8-K - 8-K - PYXUS INTERNATIONAL, INC. | d944528d8k.htm |

Exhibit 99.2

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

|

|

§ | |||

| In re: | § | Chapter 11 | ||

| § | ||||

| PYXUS INTERNATIONAL, INC., et al.,1 | § | |||

| § | Case No. 20-_______(__) | |||

| Debtors. | § | |||

| § | (Joint Administration Requested) | |||

| § | ||||

|

|

§ |

DISCLOSURE STATEMENT FOR THE JOINT PREPACKAGED CHAPTER 11 PLAN OF

REORGANIZATION OF PYXUS INTERNATIONAL, INC. AND ITS AFFILIATED DEBTORS

| SIMPSON THACHER & BARTLETT LLP | YOUNG CONAWAY STARGATT & TAYLOR, LLP | |||||

| Sandeep Qusba (pro hac vice pending) | Pauline K. Morgan (No. 3650) | |||||

| Michael H. Torkin (pro hac vice pending) | Kara Hammond Coyle (No. 4410) | |||||

| Kathrine A. McLendon (pro hac vice pending) | Ashley E. Jacobs (No. 5635) | |||||

| Nicholas E. Baker (pro hac vice pending) | Tara C. Pakrouh (No. 6192) | |||||

| 425 Lexington Avenue | 1000 North King Street | |||||

| New York, New York 10017 | Wilmington, Delaware 19801 | |||||

| Telephone: | (212) 455-2000 | Telephone: | (302) 571-6600 | |||

| Facsimile: | (212) 455-2502 | Facsimile: | (302) 571-1253 | |||

| Email: | squsba@stblaw.com | Email: | pmorgan@ycst.com | |||

| michael.torkin@stblaw.com | kcoyle@ycst.com | |||||

| kmclendon@stblaw.com | ajacobs@ycst.com | |||||

| nbaker@stblaw.com | tpakrouh@ycst.com | |||||

Proposed Counsel to Debtors and Debtors in Possession

Dated: June 14, 2020

| 1 | The Debtors in the Chapter 11 Cases, along with the last four digits of each Debtor’s United States federal tax identification number, are: Pyxus International, Inc. (6567), Alliance One International, LLC (3302), Alliance One North America, LLC (7908), Alliance One Specialty Products, LLC (0115) and GSP Properties, LLC (5603). The Debtors’ mailing address is 8001 Aerial Center Parkway, Morrisville, NC 27560-8417. |

THIS IS A SOLICITATION OF VOTES TO ACCEPT OR REJECT THE PLAN IN ACCORDANCE WITH BANKRUPTCY CODE SECTION 1125 AND WITHIN THE MEANING OF BANKRUPTCY CODE SECTION 1126, 11 U.S.C. §§ 1125, 1126. THIS DISCLOSURE STATEMENT HAS NOT BEEN APPROVED BY THE BANKRUPTCY COURT. THE DEBTORS INTEND TO SUBMIT THIS DISCLOSURE STATEMENT TO THE BANKRUPTCY COURT FOR APPROVAL FOLLOWING COMMENCEMENT OF SOLICITATION AND THE DEBTORS’ FILING FOR RELIEF UNDER CHAPTER 11 OF THE BANKRUPTCY CODE. THE INFORMATION IN THIS DISCLOSURE STATEMENT IS SUBJECT TO CHANGE. THIS DISCLOSURE STATEMENT IS NOT AN OFFER TO SELL ANY SECURITIES AND IS NOT SOLICITING AN OFFER TO BUY ANY SECURITIES.

2

IMPORTANT INFORMATION REGARDING THIS DISCLOSURE STATEMENT

DISCLOSURE STATEMENT, DATED JUNE 14, 2020

SOLICITATION OF VOTES TO ACCEPT OR REJECT

THE JOINT PREPACKAGED CHAPTER 11 PLAN OF REORGANIZATION OF PYXUS

INTERNATIONAL, INC. AND ITS AFFILIATED DEBTORS FROM THE HOLDERS OF

OUTSTANDING CLAIMS

IF YOU ARE IN CLASSES 3 OR 4 YOU ARE RECEIVING THIS DOCUMENT AND THE

ACCOMPANYING MATERIALS BECAUSE YOU ARE ENTITLED TO VOTE ON THE PLAN.

| VOTING CLASS | NAME OF CLASS UNDER THE PLAN | |

| CLASS 3 | FIRST LIEN NOTES CLAIMS | |

| CLASS 4 | SECOND LIEN NOTES CLAIMS | |

HOLDERS OF CLASS 4 – SECOND LIEN NOTES CLAIMS ARE ALSO ENTITLED TO ELECT THE

SECOND LIEN NOTES CASH OPTION OR THE SECOND LIEN NOTES STOCK OPTION

HOLDERS OF CLASS 4 – SECOND LIEN NOTES CLAIMS THAT ARE NOT PARTY TO THE RESTRUCTURING SUPPORT AGREEMENT MAY ELECT TO RECEIVE (I) THEIR PRO RATA SHARE OF THE NEW COMMON STOCK FROM THE SECOND LIEN NOTES COMMON STOCK POOL OR (II) CASH IN AN AMOUNT EQUAL TO 2.00% OF THE AGGREGATE PRINCIPAL AMOUNT OF SECOND LIEN NOTES HELD BY SUCH HOLDER.

IN ORDER TO ELECT THE SECOND LIEN NOTES STOCK OPTION, A HOLDER OF SECOND LIEN NOTES CLAIMS MUST COMPLETE A SECOND LIEN NOTES STOCK ELECTION FORM NO LATER THAN THE SECOND LIEN NOTES STOCK OPTION DEADLINE. SEE SECTION V.B.6 OF THIS DISCLOSURE STATEMENT FOR A SUMMARY OF THE SECOND LIEN NOTES STOCK OPTION AND THE SECOND LIEN NOTES CASH OPTION AND SECTION VII.F OF THIS DISCLOSURE STATEMENT FOR ADDITIONAL DETAILS ON COMPLETING A SECOND LIEN NOTES STOCK ELECTION FORM.

HOLDERS OF CLASS 10 – EXISTING PYXUS INTERESTS

ARE NOT ENTITLED TO VOTE ON THE PLAN

HOLDERS OF CLASS 10 – EXISTING PYXUS INTERESTS WILL RECEIVE AN EQUITYHOLDER OPTOUT FORM BECAUSE THEIR RIGHTS ARE AFFECTED BY THE PLAN. SPECIFICALLY, HOLDERS OF CLASS 10 – EXISTING PYXUS INTERESTS ARE ENTITLED TO OPT OUT OF THE RELEASES IN ARTICLE VIII OF THE PLAN.

ANY HOLDER OF CLASS 10 – EXISTING PYXUS INTERESTS THAT SUBMITS A DULY EXECUTED EQUITYHOLDER OPT-OUT FORM BY THE EQUITYHOLDER OPT-OUT DEADLINE WILL NOT BE A RELEASING PARTY OR A RELEASED PARTY UNDER THE PLAN.

ANY HOLDER OF PYXUS COMMON STOCK THAT (I) SUBMITS A DULY EXECUTED EQUITYHOLDER OPT-OUT FORM BY THE EQUITYHOLDER OPT-OUT DEADLINE OR (II) OBJECTS TO, OPPOSES, OR SEEKS TO IMPEDE OR DELAY CONFIRMATION OF THE PLAN WILL NOT BE A RELEASING PARTY OR A RELEASED PARTY UNDER THE PLAN AND WILL NOT RECEIVE ANY DISTRIBUTION FROM THE EXISTING EQUITY CASH POOL.

HOLDERS OF EXISTING PYXUS INTERESTS SHOULD NOT SUBMIT AN EQUITYHOLDER OPT-OUT FORM IF THEY WISH TO (X) RECEIVE THEIR PRO RATA SHARE OF THE EXISTING EQUITY CASH POOL (IF APPLICABLE) AND (Y) BE SUBJECT TO AND BENEFIT FROM THE RELEASES IN ARTICLE VIII.F OF THE PLAN.

DELIVERY OF BALLOTS, SECOND LIEN NOTES STOCK ELECTION FORM

AND EQUITYHOLDER OPT-OUT FORM

| 1. | Ballots or master ballots (each, a “Ballot”) must be actually received by the Solicitation Agent before 5:00 p.m. prevailing Eastern Time, on July 20, 2020 (the “Voting Deadline”). |

| 2. | Ballots must be completed following the instructions received with the Ballot, so that such Holder’s Ballot including their vote is actually received by the Voting Deadline. |

| 3. | The Second Lien Notes Stock Election Form must be completed following the instructions contained therein and must actually be received by the Second Lien Notes Stock Option Deadline (which is anticipated to be the same date as the Voting Deadline). |

| 4. | The Equityholder Opt-Out Form must be completed following the instructions contained therein and must actually be received by the Equityholder Opt-Out Deadline (which is anticipated to be the same date as the Voting Deadline). |

If you have any questions on the procedures for voting on the Plan, please contact the Solicitation Agent by emailing pyxusballots@primeclerk.com and referencing “Pyxus Ballot Processing” in the subject line, or by calling 1-(844)-974-2130 (toll-free) or 1-(929)-955-3418 (international), and asking for the solicitation group.

This disclosure statement (as may be amended, supplemented, or otherwise modified from time to time in accordance with its terms, this “Disclosure Statement”) provides information regarding the Joint Prepackaged Chapter 11 Plan of Reorganization of Pyxus International, Inc. and its Affiliated Debtors (as may be amended, supplemented, or otherwise modified from time to time in accordance with its terms, the “Plan”),2 which the Debtors are seeking to have confirmed by the Bankruptcy Court. A copy of the Plan is attached hereto as Exhibit A. The Debtors are providing the information in this Disclosure Statement to certain Holders of Claims for the purpose of soliciting votes to accept or reject the Plan (the “Solicitation”).

This Disclosure Statement contains, among other things, descriptions and summaries of provisions of the Plan being proposed by the Debtors. The Debtors reserve the right to modify the Plan consistent with section 1127 of title 11 of the United States Code (as now in effect or hereafter amended, the “Bankruptcy Code”), Rule 3019 of the Federal Rules of Bankruptcy Procedure (together with the local rules of the Bankruptcy Court, as now in effect or hereafter amended, the “Bankruptcy Rules”).

Pursuant to the Restructuring Support Agreement, the Plan is currently supported by the Debtors, the Consenting First Lien Noteholders, who hold greater than 92% of the First Lien Notes Claims, and the Consenting Second Lien Noteholders, who hold greater than 67% of the Second Lien Notes Claims.

The consummation and effectiveness of the Plan are subject to certain material conditions precedent described herein and set forth in Article IX of the Plan. There is no assurance that the Bankruptcy Court will confirm the Plan or, if the Bankruptcy Court does confirm the Plan, that the conditions necessary for the Plan to become effective will be satisfied or, in the alternative, waived.

The Debtors urge each Holder of a Claim to consult with its own advisors with respect to any legal, financial, securities, tax, or business advice in reviewing this Disclosure Statement, the Plan, and each proposed transaction contemplated by the Plan.

Holders of Claims should not construe the content of this Disclosure Statement as providing legal, business, financial, or tax advice. The Debtors strongly encourage Holders of Claims in Classes 3 and 4 to read this Disclosure Statement (including the Risk Factors described in Section VIII hereof) and the Plan in their entirety before voting to accept or reject the Plan. Assuming the requisite acceptances to the Plan are obtained, the Debtors will seek the Bankruptcy Court’s approval of the Plan at the Confirmation Hearing.

| 2 | Capitalized terms used but not otherwise defined herein have the meanings ascribed to them in the Plan. |

ii

RECOMMENDATION BY THE DEBTORS

EACH OF THE DEBTORS STRONGLY RECOMMENDS THAT ALL HOLDERS OF CLAIMS WHOSE VOTES ARE BEING SOLICITED SUBMIT BALLOTS TO ACCEPT THE PLAN BY RETURNING THEIR BALLOTS SO AS TO BE ACTUALLY RECEIVED BY THE SOLICITATION AGENT NO LATER THAN JULY 20, 2020 AT 5:00 P.M. (PREVAILING EASTERN TIME) PURSUANT TO THE INSTRUCTIONS SET FORTH HEREIN AND ON THE BALLOTS.

THE BOARD OF DIRECTORS OR MANAGERS, AS APPLICABLE, FOR EACH DEBTOR HAS APPROVED THE TRANSACTIONS CONTEMPLATED BY THE PLAN AND DESCRIBED IN THIS DISCLOSURE STATEMENT, AND EACH DEBTOR BELIEVES THAT THE COMPROMISES CONTEMPLATED UNDER THE PLAN ARE FAIR AND EQUITABLE, MAXIMIZE THE VALUE OF EACH OF THE DEBTOR’S ESTATES, AND PROVIDE THE BEST RECOVERY TO CLAIM AND INTEREST HOLDERS.

AT THIS TIME, EACH DEBTOR BELIEVES THAT THE PLAN AND RELATED TRANSACTIONS REPRESENT THE BEST ALTERNATIVE FOR ACCOMPLISHING THE DEBTORS’ OVERALL RESTRUCTURING OBJECTIVES.

iii

SPECIAL NOTICE REGARDING FEDERAL AND STATE SECURITIES LAWS

The Bankruptcy Court has not reviewed this Disclosure Statement or the Plan, and the Securities to be issued on or after the Effective Date will not have been the subject of a registration statement filed with the U.S. Securities and Exchange Commission (the “SEC”) under the U.S. Securities Act of 1933, as amended (the “Securities Act”), or any securities regulatory authority of any state under any state securities law (“Blue Sky Laws”). The Plan has not been approved or disapproved by the SEC or any state regulatory authority and neither the SEC nor any state regulatory authority has passed upon the accuracy or adequacy of the information contained in this Disclosure Statement or the Plan. Any representation to the contrary is a criminal offense. The Debtors are relying on section 4(a)(2) and/or Regulation D of the Securities Act, and similar Blue Sky Laws provisions, to exempt from registration under the Securities Act and Blue Sky Laws the offer to certain Holders of First Lien Notes Claims and Second Lien Notes Claims that are “accredited investors” as defined in Rule 501 of the Securities Act (“Accredited Investors”), respectively, of new securities prior to the Petition Date, including in connection with the Solicitation.

After the Petition Date, the Debtors will rely on section 1145(a) of the Bankruptcy Code or, to the extent not available, Section 4(a)(2) and/or Regulation D of the Securities Act and similar Blue Sky Laws provisions, to exempt from registration under the Securities Act and Blue Sky Laws the issuance of Securities, including the New Common Stock and the Exit Secured Notes, in connection with the Plan. Neither the Solicitation nor this Disclosure Statement constitutes an offer to sell or the solicitation of an offer to buy Securities in any state or jurisdiction in which such offer or solicitation is not authorized.

iv

DISCLAIMER

This Disclosure Statement contains summaries of certain provisions of the Plan and certain other documents and financial information. The information included in this Disclosure Statement is provided solely for the purpose of soliciting acceptances of the Plan and should not be relied upon for any purpose other than to determine whether and how to vote on the Plan. All Holders of Claims entitled to vote to accept or reject the Plan are advised and encouraged to read this Disclosure Statement and the Plan in their entirety before voting to accept or reject the Plan. The Debtors believe that these summaries are fair and accurate. The summaries of the financial information and the documents that are attached to, or incorporated by reference in, this Disclosure Statement are qualified in their entirety by reference to such information and documents. In the event of any inconsistency or discrepancy between a description in this Disclosure Statement, on the one hand, and the terms and provisions of the Plan or the financial information and documents incorporated in this Disclosure Statement by reference, on the other hand, the Plan or the financial information and documents, as applicable, shall govern for all purposes.

Except as otherwise provided in the Plan or in accordance with applicable law, the Debtors are under no duty to update or supplement this Disclosure Statement. The Bankruptcy Court’s approval of this Disclosure Statement does not constitute a guarantee of the accuracy or completeness of the information contained herein or the Bankruptcy Court’s endorsement of the merits of the Plan. The statements and financial information contained in this Disclosure Statement have been made as of the date hereof unless otherwise specified. Holders of Claims or Interests reviewing the Disclosure Statement should not assume at the time of such review that there have been no changes in the facts set forth in this Disclosure Statement since the date of this Disclosure Statement. No Holder of a Claim or Interest should rely on any information, representations, or inducements that are not contained in or are inconsistent with the information contained in this Disclosure Statement, the documents attached to this Disclosure Statement, and the Plan. This Disclosure Statement does not constitute legal, business, financial, or tax advice. Any Person or Entity desiring any such advice should consult with their own advisors. Additionally, this Disclosure Statement has not been approved or disapproved by the Bankruptcy Court, the SEC, or any securities regulatory authority of any state under Blue Sky Laws. The Debtors are soliciting acceptances to the Plan prior to commencing any cases under chapter 11 of the Bankruptcy Code.

FORWARD LOOKING STATEMENTS

The financial information contained in or incorporated by reference into this Disclosure Statement has not been audited, except as specifically indicated otherwise. The Debtors’ management, in consultation with the Debtors’ advisors, has prepared the financial projections attached hereto as Exhibit D and described in this Disclosure Statement (the “Financial Projections”). The Financial Projections, while presented with numerical specificity, necessarily were based on a variety of estimates and assumptions that are inherently uncertain and may be beyond the control of the Debtors’ management. Important factors that may affect actual results and cause the management forecasts not to be achieved include, but are not limited to, risks and uncertainties relating to the Debtors’ businesses (including their ability to achieve strategic goals, objectives, and targets over applicable periods), industry performance, the regulatory environment, general business and economic conditions, and other factors. The Debtors caution that no representations can be made as to the accuracy of these projections or to their ultimate performance compared to the information contained in the forecasts or that the forecasted results will be achieved. Therefore, the Financial Projections may not be relied upon as a guarantee or other assurance that the actual results will occur.

Regarding contested matters, adversary proceedings, and other pending, threatened, or potential litigation or other actions, this Disclosure Statement does not constitute, and may not be construed as, an admission of fact, liability, stipulation, or waiver by the Debtors or any other party, but rather as a statement made in the context of settlement negotiations in accordance with Rule 408 of the Federal Rules of Evidence and any analogous state or foreign laws or rules. As such, this Disclosure Statement shall not be admissible in any non-bankruptcy proceeding involving the Debtors or any other party in interest, nor shall it be construed to be conclusive advice on the tax, Securities, financial or other effects of the Plan to Holders of Claims against the Debtors or any other party in interest. Please refer to Section VIII of this Disclosure Statement, entitled “Risk Factors” for a discussion of certain risk factors that Holders of Claims voting on the Plan should consider.

v

Except as otherwise expressly set forth herein, all information, representations, or statements contained herein have been provided by the Debtors. No Person is authorized by the Debtors in connection with this Disclosure Statement, the Plan, or the Solicitation to give any information or to make any representation or statement regarding this Disclosure Statement, the Plan, or the Solicitation, in each case, other than as contained in this Disclosure Statement and the exhibits attached hereto or as otherwise incorporated herein by reference or referred to herein. If any such information, representation, or statement is given or made, it may not be relied upon as having been authorized by the Debtors.

This Disclosure Statement contains certain forward-looking statements, all of which are based on various estimates and assumptions. Such forward-looking statements are subject to inherent uncertainties and to a wide variety of significant regulatory, business, economic, and competitive risks and contingencies, which are difficult or impossible to predict accurately and may be beyond the control of the Debtors, including, but not limited to, those summarized herein. When used in this Disclosure Statement, the words “anticipate,” “believe,” “estimate,” “think,” “will,” “may,” “intend,” and “expect” and similar expressions generally identify forward-looking statements. Although the Debtors believe that their plans, intentions, and expectations reflected in the forward-looking statements are reasonable, they cannot be sure that they will be achieved. These statements are only predictions and are not guarantees of future performance or results. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that could cause actual results and performance to differ materially from any future results or performance contemplated by a forward-looking statement, including under the heading “Risk Factors” below and other factors described in the Debtors’ SEC filings. Accordingly, the Debtors cannot give any assurance that their expectations will in fact occur and caution that actual results may differ materially from those in the forward- looking statements. All forward-looking statements attributable to the Debtors or Persons or Entities acting on their behalf are expressly qualified in their entirety by the cautionary statements set forth in this Disclosure Statement. Forward-looking statements speak only as of the date on which they are made. Except as required by law, the Debtors expressly disclaim any obligation to revise or update any forward-looking statement, or to make any other forward- looking statements, whether as a result of new information, future events, or otherwise.

[Remainder of Page Intentionally Left Blank]

vi

TABLE OF CONTENTS

| I. |

Executive Summary |

1 | ||||||||

| A. | Purpose of this Disclosure Statement and the Plan | 1 | ||||||||

| B. | Overview of the Transactions Contemplated by the Plan | 1 | ||||||||

| C. | Summary of Treatment of Claims and Interests and Description of Recoveries under the Plan | 2 | ||||||||

| D. | Voting on the Plan | 4 | ||||||||

| E. | Confirmation and Consummation of the Plan | 5 | ||||||||

| 1. | Confirmation Hearing. |

5 | ||||||||

| 2. | Effect of Confirmation and Consummation of the Plan |

6 | ||||||||

| F. | Additional Plan-Related Documents | 6 | ||||||||

| II. |

The Debtors’ Business Operations and Capital Structure |

6 | ||||||||

| A. | Corporate History | 6 | ||||||||

| B. | The Company’s Business | 7 | ||||||||

| C. | The Debtors’ Operations. | 8 | ||||||||

| D. | The Debtors’ Prepetition Capital Structure | 8 | ||||||||

| 1. | ABL Facility |

9 | ||||||||

| 2. | First Lien Notes |

9 | ||||||||

| 3. | Second Lien Notes |

10 | ||||||||

| 4. | Foreign Credit Lines |

10 | ||||||||

| 5. | Receivables Facilities |

11 | ||||||||

| 6. | Intercompany Financing |

12 | ||||||||

| III. |

Key Events Leading to Chapter 11 |

12 | ||||||||

| A. | Excess Leverage and the Failed Canadian IPO | 12 | ||||||||

| B. | Delayed Sales and COVID-19 | 13 | ||||||||

| C. | Negotiations with Key Stakeholders | 13 | ||||||||

| IV. |

The Debtors’ Proposed Restructuring: Key Components |

14 | ||||||||

| A. | The Restructuring Support Agreement and the Plan | 14 | ||||||||

| B. | The Debtors’ Proposed Disclosure Statement and Solicitation Process | 17 | ||||||||

| C. | New MIP | 17 | ||||||||

| D. | The Debtors’ First-Day Motions and Certain Related Relief | 18 | ||||||||

| 1. | Operational First-Day Pleadings |

18 | ||||||||

| 2. | Postpetition Financing |

18 | ||||||||

| 3. | Motion To Approve Solicitation Procedures and Confirm the Plan |

18 | ||||||||

| E. | Other Requested First-Day Relief and Retention Applications | 18 | ||||||||

| V. |

Summary of the Plan |

19 | ||||||||

| A. | Treatment of Unclassified Claims | 19 | ||||||||

| 1. | DIP Facility Claims |

19 | ||||||||

| 2. | Administrative Claims |

19 | ||||||||

| 3. | Professional Fee Claims |

20 | ||||||||

| 4. | Priority Tax Claims |

21 | ||||||||

| 5. | Statutory Fees |

21 | ||||||||

| B. | Classification and Treatment of Claims and Interests | 21 | ||||||||

| 1. | Classification of Claims and Interests |

21 | ||||||||

| 2. | Treatment of Classes of Claims and Interests |

22 | ||||||||

| 3. | Class 1 — Other Secured Claims |

22 | ||||||||

i

| 4. | Class 2 — Other Priority Claims |

22 | ||||||||

| 5. | Class 3 — First Lien Notes Claims |

23 | ||||||||

| 6. | Class 4 — Second Lien Notes Claims |

23 | ||||||||

| 7. | Class 5 — Foreign Credit Line Claims |

24 | ||||||||

| 8. | Class 6 — General Unsecured Claims |

24 | ||||||||

| 9. | Class 7 — Debtor Intercompany Claims |

25 | ||||||||

| 10. | Class 8 — Non-Debtor Intercompany Claims |

25 | ||||||||

| 11. | Class 9 — Intercompany Interests |

25 | ||||||||

| 12. | Class 10 — Existing Pyxus Interests |

26 | ||||||||

| C. | Means for Implementation of the Plan | 26 | ||||||||

| 1. | General Settlement of Claims and Interests |

26 | ||||||||

| 2. | Restructuring Transactions |

26 | ||||||||

| 3. | Sources of Consideration for Plan Distributions |

27 | ||||||||

| 4. | New Shareholders Agreement |

29 | ||||||||

| 5. | Exemption from Registration Requirements |

29 | ||||||||

| 6. | Corporate Existence |

30 | ||||||||

| 7. | Corporate Action |

30 | ||||||||

| 8. | Vesting of Assets in the Reorganized Debtors |

31 | ||||||||

| 9. | Cancellation of Facilities, Notes, Instruments, Certificates, and Other Documents |

31 | ||||||||

| 10. | Effectuating Documents; Further Transactions |

32 | ||||||||

| 11. | Exemptions from Certain Taxes and Fees. |

32 | ||||||||

| 12. | New Pyxus Constituent Documents |

32 | ||||||||

| 13. | Directors and Officers |

32 | ||||||||

| 14. | New MIP |

33 | ||||||||

| 15. | Preservation of Causes of Action |

33 | ||||||||

| 16. | Executory Contracts and Expired Leases |

33 | ||||||||

| D. | Conditions to Consummation of the Plan | 37 | ||||||||

| 1. | Conditions Precedent to the Effective Date |

37 | ||||||||

| 2. | Waiver of Conditions Precedent to Confirmation or the Effective Date |

38 | ||||||||

| 3. | Substantial Consummation |

38 | ||||||||

| 4. | Effect of Non-Occurrence of Conditions to Consummation |

38 | ||||||||

| E. | Settlement, Release, Injunction, and Related Provisions | 38 | ||||||||

| 1. | Compromise and Settlement of Claims, Interests, and Controversies |

38 | ||||||||

| 2. | Binding Effect |

39 | ||||||||

| 3. | Discharge of Claims |

39 | ||||||||

| 4. | Release of Liens |

39 | ||||||||

| 5. | Debtor Release |

39 | ||||||||

| 6. | Third-Party Release |

40 | ||||||||

| 7. | Exculpation |

41 | ||||||||

| 8. | Injunction |

41 | ||||||||

| VI. |

Confirmation of the Plan |

42 | ||||||||

| A. | The Confirmation Hearing | 42 | ||||||||

| B. | Deadline to Object to Approval of the Disclosure Statement and Confirmation of the Plan | 42 | ||||||||

| C. | Requirements for Approval of the Disclosure Statement | 42 | ||||||||

| D. | Requirements for Confirmation of the Plan | 42 | ||||||||

| 1. | Requirements of Section 1129(a) of the Bankruptcy Code |

42 | ||||||||

| 2. | The Debtor Release, Third-Party Release, Exculpation, and Injunction Provisions |

43 | ||||||||

| 3. | Best Interests of Creditors—Liquidation Analysis |

44 | ||||||||

ii

| 4. | Feasibility/Financial Projections | 45 | ||||||||

| 5. | Acceptance by Impaired Classes | 45 | ||||||||

| 6. | Confirmation Without Acceptance by All Impaired Classes | 45 | ||||||||

| 7. | Valuation of the Debtors | 47 | ||||||||

| VII. | Voting Instructions | 47 | ||||||||

| A. | Overview | 47 | ||||||||

| B. | Solicitation Procedures | 47 | ||||||||

| 1. | Solicitation Agent | 47 | ||||||||

| 2. | Solicitation Package | 47 | ||||||||

| 3. | Voting Deadline | 47 | ||||||||

| 4. | Distribution of the Solicitation Package and Plan Supplement | 48 | ||||||||

| C. | Voting Procedures | 48 | ||||||||

| D. | Voting Tabulation | 49 | ||||||||

| E. | Equityholder Opt-Out Forms | 50 | ||||||||

| F. | Second Lien Notes Stock Election Forms | 51 | ||||||||

| VIII. | Risk Factors | 51 | ||||||||

| A. | Risks Related to the Restructuring | 52 | ||||||||

| 1. | The Restructuring May Take Longer Than Anticipated | 52 | ||||||||

| 2. | The Debtors Will Consider All Available Restructuring Alternatives if the Restructuring Transactions are not Implemented, and Such Alternatives May Result in Lower Recoveries for Holders of Claims Against the Debtors | 52 | ||||||||

| 3. | Even if the Restructuring Transactions are Successful, the Debtors Will Continue to Face Risks | 52 | ||||||||

| 4. | Risks Related to Confirmation and Consummation of the Plan | 53 | ||||||||

| B. | Risks Related to Recoveries Under the Plan | 55 | ||||||||

| 1. | The Debtors May Not Be Able to Achieve Their Projected Financial Results or Meet Their Post-Restructuring Debt Obligations | 55 | ||||||||

| 2. | Estimated Valuations of the Debtors, the New Common Stock and the Exit Secured Notes and Estimated Recoveries to Holders of Allowed Claims and Interests Are Not Intended to Represent Potential Market Values | 56 | ||||||||

| 3. | Certain Tax Implications of the Debtors’ Bankruptcy and Reorganization May Increase the Tax Liability of the Reorganized Debtors | 56 | ||||||||

| C. | Risks Related to the Offer and Issuance of Securities Under the Plan | 56 | ||||||||

| 1. | The Consideration Under the Plan Does Not Reflect any Independent Valuation of Claims against or Interests in the Debtors | 56 | ||||||||

| 2. | A Decline in the Reorganized Debtors’ Credit Ratings Could Negatively Affect the Reorganized Debtors’ Ability to Access the Capital Markets in the Future | 56 | ||||||||

| 3. | Risks Related to the Exit Term Facility | 57 | ||||||||

| 4. | The Debtors Do Not Intend to Register or to Offer to Exchange the New Common Stock or the Exit Secured Notes in a Registered Exchange Offer | 57 | ||||||||

| 5. | Implied Valuation of New Common Stock and Exit Secured Notes Not Intended to Represent Trading Value of New Common Stock Exit Secured Notes, as Applicable | 58 | ||||||||

| 6. | Risks Related to the New Common Stock | 58 | ||||||||

| 7. | The Debtors May Not Be Able to Secure A Commitment for the Exit ABL Facility | 59 | ||||||||

| 8. | Risks Related to the Exit Secured Notes | 60 | ||||||||

| D. | Risk Factors Related to the Business Operations of the Company and Reorganized Debtors | 63 | ||||||||

iii

| 1. | Global or regional health pandemics or epidemics, including COVID-19, could negatively impact the Company’s business operations, financial performance and results of operations | 63 | ||||||||

| 2. | The Company’s reliance on a small number of significant customers may adversely affect its financial statements | 65 | ||||||||

| 3. | The Company may not have access to available capital to finance our local operations in non-U.S. jurisdictions | 65 | ||||||||

| 4. | Failure of foreign banks in which the Company’s subsidiaries deposit funds or the failure to transfer funds or honor withdrawals may affect its results of operations | 65 | ||||||||

| 5. | Continued vertical integration by the Company’s customers could materially adversely affect its financial statements | 65 | ||||||||

| 6. | Suppliers who have historically grown tobacco and from whom the Company has purchased tobacco may elect to grow other crops instead of tobacco, which affects the world supply of tobacco and may impact the Debtors’ quarterly and annual financial performance | 66 | ||||||||

| 7. | The Company faces increased risks of doing business due to the extent of its international operations | 66 | ||||||||

| 8. | The Company’s investments in new business lines as part of its transformational business strategy have been in companies with limited histories that are operating in newly developing markets and are subject to numerous risks and uncertainties | 66 | ||||||||

| 9. | The Company expects to incur significant ongoing costs and obligations related to its investment in infrastructure, growth, regulatory compliance, and operations of the new business lines | 67 | ||||||||

| 10. | Changing consumer preferences may adversely affect consumer retention and results of operations | 67 | ||||||||

| 11. | The industries in which the new business lines operate are highly regulated, require regulatory approvals or licensing and the Company may not always succeed in complying fully with applicable regulatory requirements and obtaining required approvals and licenses in all jurisdictions where the Company carries on business | 67 | ||||||||

| 12. | The Company and its U.S. subsidiaries may be unable to receive any funds generated by the Company’s Canadian cannabis subsidiaries and such funds may not be used to fund the payment of obligations of our U.S. based operations | 68 | ||||||||

| E. | Miscellaneous Risks and Disclaimers | 69 | ||||||||

| 1. | The Financial Information Is Based on the Debtors’ Books and Records and, Unless Otherwise Stated, No Audit Was Performed | 69 | ||||||||

| 2. | No Legal or Tax Advice Is Provided By This Disclosure Statement | 69 | ||||||||

| 3. | No Admissions Made | 69 | ||||||||

| 4. | Failure to Identify Litigation Claims or Projected Objections | 69 | ||||||||

| 5. | Information Was Provided by the Debtors and Was Relied Upon by the Debtors’ Advisors | 69 | ||||||||

| 6. | No Representations Outside This Disclosure Statement Are Authorized | 70 | ||||||||

| IX. | Important Securities Laws Disclosures | 70 | ||||||||

| A. | Plan Consideration | 70 | ||||||||

| B. | Exemption from Registration Requirements; Issuance and Resale of New Common Stock, and Exit Secured Notes; Definition of “Underwriter” Under Section 1145(b) of the Bankruptcy Code | 70 | ||||||||

| 1. | Exemption from Registration Requirements; Issuance and Resale of New Common Stock, and Exit Secured Notes | 70 | ||||||||

| 2. | Definition of “Underwriter” Under Section 1145(b) of the Bankruptcy Code; Implications for Resale of New Common Stock and Exit Secured Notes | 71 | ||||||||

iv

| C. | Private Placement Exemptions | 72 | ||||||||

| X. | Certain United States Federal Tax Consequences of the Plan | 74 | ||||||||

| A. | Introduction | 74 | ||||||||

| B. | Certain U.S. Federal Income Tax Consequences of the Plan to the Debtors and the Reorganized Pyxus | 75 | ||||||||

| 1. | Cancellation of Debt and Reduction of Tax Attributes | 75 | ||||||||

| 2. | Limitation of NOL Carryforwards and Other Tax Attributes | 76 | ||||||||

| C. | Certain U.S. Federal Income Tax Consequences of the Plan to U.S. Holders of Allowed Second Lien Notes Claims, Allowed First Lien Notes Claims and Existing Pyxus Interests | 78 | ||||||||

| 1. | U.S. Federal Income Tax Consequences of the Consummation of the Plan | 78 | ||||||||

| 2. | U.S. Federal Income Tax Consequences of Owning and Disposing of the New Common Stock | 83 | ||||||||

| 3. | U.S. Federal Income Tax Consequences of Owning and Disposing of the Exit Secured Notes | 83 | ||||||||

| 4. | Limitation of Use of Capital Losses | 84 | ||||||||

| D. | Certain U.S. Federal Income Tax Consequences of the Plan to Non-U.S. Holders of Allowed Second Lien Notes Claims, Allowed First Lien Notes Claims and Existing Pyxus Interests | 85 | ||||||||

| 1. | U.S. Federal Income Tax Consequences to Non-U.S. Holders of Allowed Second Lien Notes Claims and Allowed First Lien Notes Claims | 85 | ||||||||

| 2. | U.S. Federal Income Tax Consequences to Non-U.S. Holders of Existing Pyxus Interests | 87 | ||||||||

| 3. | U.S. Federal Income Tax Consequences to Non-U.S. Holders of Owning and Disposing of New Common Stock | 87 | ||||||||

| 4. | U.S. Federal Income Tax Consequences to Non-U.S. Holders of Payments of Interest and Owning and Disposing of Exit Secured Notes | 89 | ||||||||

| E. | Information Reporting and Backup Withholding | 89 | ||||||||

| F. | FATCA | 89 | ||||||||

| XI. | Recommendation | 90 | ||||||||

v

EXHIBITS

| Exhibit A | Plan of Reorganization | |

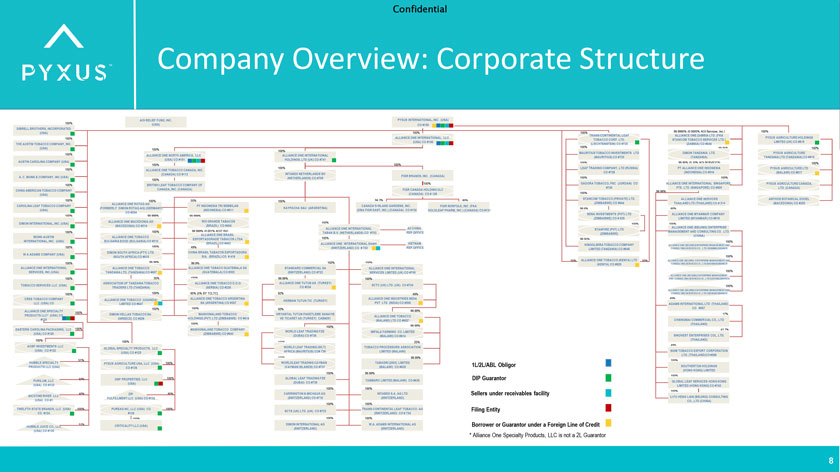

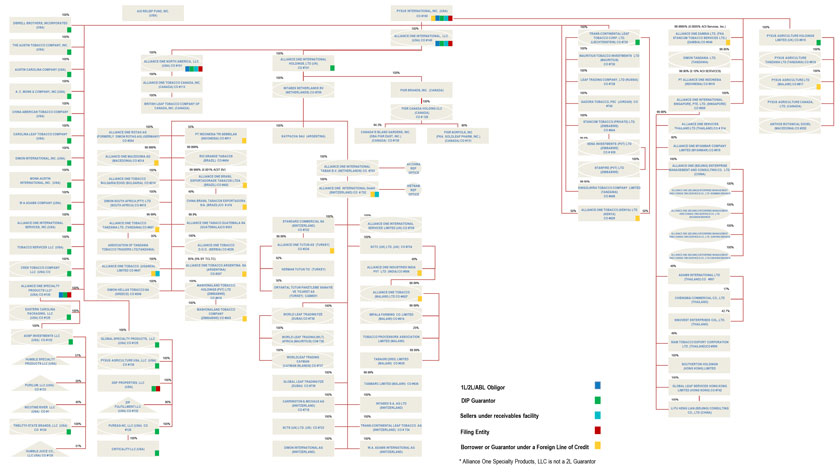

| Exhibit B | Corporate Structure of the Debtors | |

| Exhibit C | Restructuring Support Agreement | |

| Exhibit D | Financial Projections | |

| Exhibit E | Valuation Analysis | |

| Exhibit F | Liquidation Analysis | |

vi

I. Executive Summary

A. Purpose of this Disclosure Statement and the Plan.

Pyxus International, Inc. (“Pyxus”) and certain of its direct and indirect subsidiaries, as debtors and debtors- in-possession (collectively, with Pyxus, the “Debtors”, and together with their non-Debtor subsidiaries and affiliates, the “Company”), submit this Disclosure Statement pursuant to sections 1125 and 1126 of the Bankruptcy Code to Holders of Class 3 First Lien Notes Claims and Class 4 Second Lien Notes Claims against certain of the Debtors in connection with the Solicitation of the Plan. A copy of the Plan is attached hereto as Exhibit A and incorporated herein by reference.1 The Plan constitutes a separate chapter 11 plan for each of the Debtors.

THE DEBTORS BELIEVE THAT THE COMPROMISES AND SETTLEMENTS CONTEMPLATED BY THE PLAN ARE FAIR AND EQUITABLE, MAXIMIZE THE VALUE OF THE DEBTORS’ ESTATES, AND MAXIMIZE RECOVERIES TO HOLDERS OF CLAIMS. THE DEBTORS BELIEVE THE PLAN IS THE BEST AVAILABLE ALTERNATIVE FOR IMPLEMENTING A RESTRUCTURING OF THE DEBTORS’ BALANCE SHEET. THE DEBTORS STRONGLY RECOMMEND THAT YOU VOTE TO ACCEPT THE PLAN.

B. Overview of the Transactions Contemplated by the Plan.

The Debtors will commence chapter 11 cases (the “Chapter 11 Cases”) in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”) in order to implement financial restructuring transactions (the “Restructuring Transactions”) that will eliminate approximately $440 million of net indebtedness from their balance sheet and provide the Debtors and Reorganized Debtors at least $260 million of new working capital. Critically, the Restructuring Transactions and the Plan will not impair any of the lenders to the Company’s foreign operating subsidiaries, none of which are debtors in the Chapter 11 Cases, nor will the Company’s global workforce, vendors or customers be impaired under the Plan.

The Debtors will seek joint administration of the Chapter 11 Cases for procedural purposes and, upon commencement of the Chapter 11 Cases, will file the Plan, this Disclosure Statement, a motion seeking to approve the Disclosure Statement and proposed Solicitation process, and motions seeking first-day relief.

On June 14, 2020, the Debtors, certain Holders of greater than 92% of the First Lien Notes Claims (the “Consenting First Lien Noteholders”) and certain Holders of greater than 67% of the Second Lien Notes Claims (the “Consenting Second Lien Noteholders”) entered into the Restructuring Support Agreement attached hereto as Exhibit C (as may be amended, supplemented, or otherwise modified from time to time in accordance with its terms, the “Restructuring Support Agreement”), that sets forth the principal terms of the Restructuring Transactions and requires the Consenting First Lien Noteholders and the Consenting Second Lien Noteholders to support the Plan.

As set forth in the Plan, the Restructuring Transactions provide for a comprehensive restructuring of a significant portion of the Claims against and Interests in the Debtors by replacing or refinancing in full the First Lien Notes and by equitizing or distributing Cash on account of the Second Lien Notes. Holders of at least 67% of the Second Lien Notes have elected the Second Lien Notes Stock Option. Holders of Second Lien Notes that do not elect the Second Lien Notes Stock Option will receive Cash in an amount equal to 2.00% of the principal amount of their Second Lien Notes.

A lynchpin of the Restructuring Transactions and the Plan, is a $206.7 million debtor-in-possession financing facility (the “DIP Facility”) that provides critical working capital to the Company during the Chapter 11 Cases and that will convert upon emergence (together with certain fees) into the Exit Term Facility. Each Holder of a DIP Facility

| 1 | This Disclosure Statement incorporates the rules of interpretation located in Article I of the Plan. Any summary provided in this Disclosure Statement of any documents attached to this Disclosure Statement, including the Plan, is qualified in its entirety by reference to the Plan, the exhibits, and other materials referenced in the Plan, the Plan Supplement, and the documents being summarized. In the event of any inconsistencies between the terms of this Disclosure Statement and the Plan, the Plan shall govern. |

1

Claim will also receive its ratable portion of the Exit Facility Shares, consisting of approximately 44.44% shares of New Common Stock issued on the Effective Date subject to dilution by New Common Stock issued on account of the New MIP. Eligible Holders of Second Lien Notes Claims can ratably participate in 87.5% of the DIP Facility subject to subscription terms, conditions, and procedures to be distributed following the Petition Date. The subscription period will be held open for ten days following entry of the Interim DIP Order and certain members of the Ad Hoc Crossholder Group (the “Initial Commitment Parties”) have committed to fund the Debtors’ interim borrowings under the DIP Facility and certain of the Initial Commitment Parties (the “Financing Commitment Parties”) have committed to fund any unsubscribed portion of the DIP Facility remaining after the subscription period expires.2

The Debtors’ existing ABL Facility will be refinanced by the DIP Facility, and upon emergence, the Reorganized Debtors will enter into a new exit ABL revolving or term loan facility having commitments of not less than $60 million (the “Exit ABL Facility”). The Exit ABL Facility may be provided by new third party lenders or by the Company’s existing creditors.

Existing Pyxus Interests will be discharged and cancelled on the Effective Date, but Holders of Pyxus Common Stock that (i) do not opt out of the releases contained in Article VIII.F of the Plan pursuant to the Equityholder Opt-Out Form and (ii) do not otherwise oppose, object to, or seek to impede or delay confirmation of the Plan will receive their ratable share of $1,000,000 in Cash on the Effective Date.

The Company recognizes the importance of its business partners around the world, including its joint venture counterparties and lenders under the Foreign Credit Lines, and structured the Restructuring Transactions to have no impact on those critical relationships. Other than the Holders of the First Lien Notes Claims and Second Lien Notes Claims (who overwhelmingly support the Plan pursuant to the Restructuring Support Agreement), the Debtors’ other creditors (including employees, vendors, and general unsecured claim holders) will be paid in full or otherwise receive such treatment to render them unimpaired. The Company’s foreign operations, including the Foreign Credit Lines, are unaffected by these Chapter 11 Cases and will continue uninterrupted.

The Plan and Restructuring Transactions, therefore, implement a significant deleveraging with the overwhelming support of the largest creditors that allows the Company to fully pay its employees and vendors and continue to focus on its traditional business strengths while pursuing new markets.

As described below, you are receiving this Disclosure Statement because you are a Holder of a Claim entitled to vote to accept or reject the Plan. Prior to voting on the Plan, you are encouraged to read this Disclosure Statement and all documents attached to this Disclosure Statement in their entirety. As reflected in this Disclosure Statement, there are risks, uncertainties, and other important factors that could cause the Debtors’ actual performance or achievements to be materially different from those they may project, and the Debtors undertake no obligation to update any such statement. Certain of these risks, uncertainties, and factors are described in Section VIII of this Disclosure Statement, entitled “Risk Factors.”

C. Summary of Treatment of Claims and Interests and Description of Recoveries under the Plan.

The Plan organizes the Debtors’ creditor and equity constituencies into groups called “Classes.” For each Class, the Plan describes: (1) the underlying Claim or Interest; (2) the recovery available to the Holders of Claims or Interests in that Class under the Plan; (3) whether the Class is Impaired or Unimpaired under the Plan; (4) the form of consideration, if any, that Holders in such Class will receive on account of their respective Claims or Interests; and (5) whether the Holders of Claims or Interests in such Class are entitled to vote to accept or reject the Plan.

The proposed distributions under the Plan are based upon a number of factors, including the Debtors’ valuation and liquidation analyses. The valuation of the Reorganized Debtors as a going concern is based upon the value of the Debtors’ assets and liabilities as of an assumed Effective Date of July 31, 2020 and incorporates various assumptions and estimates, as discussed in detail in the Valuation Analysis prepared by the Debtors, and together with their proposed financial advisor, RPA Advisors, LLC (“RPA”), and investment banker, Lazard Ltd. (“Lazard”).

| 2 | Further details regarding these DIP Facility syndication procedures are set forth in Section IV.A.2 below and in the motion to approve the DIP Orders. |

2

The table below provides a summary of the classification, description, treatment, and anticipated recovery of Claims and Interests under the Plan. This information is provided in summary form below for illustrative purposes only and is qualified in its entirety by reference to the provisions of the Plan. Any estimates of Claims or Interests in this Disclosure Statement may vary from the final amounts allowed by the Bankruptcy Court. Your ability to receive distributions under the Plan depends upon the ability of the Debtors to obtain Confirmation and meet the conditions necessary to consummate the Plan. The recoveries available to Holders of Claims are estimates and actual recoveries may materially differ based on, among other things, whether the amount of Claims actually Allowed exceeds the estimates provided below. In such an instance, the recoveries available to Holders of Allowed Claims could be materially lower when compared to the estimates provided below. To the extent that any inconsistency exists between the summaries contained in this Disclosure Statement and the Plan, the terms of the Plan shall govern.

For a more detailed description of the treatment of Claims and Interests under the Plan and the sources of satisfaction for Claims and Interests, see Section V of this Disclosure Statement, entitled “Summary of the Plan.”

3

| SUMMARY OF ESTIMATED RECOVERIES3 |

||||||||||

| Class |

Claim/Interest |

Plan Treatment |

Voting Rights |

Projected4 Amount |

Projected | |||||

| 1 | Other Secured Claims | Unimpaired | Not Entitled to Vote (Presumed to Accept) |

$200,000 | 100% | |||||

| 2 | Other Priority Claims | Unimpaired | Not Entitled to Vote (Presumed to Accept) |

$12,300,000 | 100% | |||||

| 3 | First Lien Notes Claims |

Impaired | Entitled to Vote | $275,000,000 | 100% | |||||

| 4 | Second Lien Notes Claims | Impaired | Entitled to Vote | $635,686,000 | 30.3% | |||||

| 5 | Foreign Credit Line Claims | Unimpaired | Not Entitled to Vote (Presumed to Accept) | $523,000,000 | 100% | |||||

| 6 | General Unsecured Claims | Unimpaired | Not Entitled to Vote (Presumed to Accept) | $21,700,000 | 100% | |||||

| 7 | Debtor Intercompany Claims | Unimpaired/Impaired | Not Entitled to Vote (Presumed to Accept or Deemed to Reject) | $280,000,0005 | N/A | |||||

| 8 | Non-Debtor Intercompany Claims | Unimpaired/Impaired | Not Entitled to Vote (Presumed to Accept or Deemed to Reject) | $315,000,0006 | N/A | |||||

| 9 | Intercompany Interests | Unimpaired/Impaired | Not Entitled to Vote (Presumed to Accept or Deemed to Reject) | N/A | N/A | |||||

| 10 | Existing Pyxus Interests | Impaired | Not Entitled to Vote (Deemed to Reject) | N/A | 0% | |||||

D. Voting on the Plan.

Certain procedures will be used to collect and tabulate votes on the Plan, as summarized in Section VII of this Disclosure Statement, entitled “Voting Instructions.” Readers should carefully read the voting instructions in Section VII herein.

Only Holders of First Lien Notes Claims and Second Lien Notes Claims, which are classified in Classes 3 and 4 under the Plan, are entitled to vote on the Plan (the “Voting Classes”). Holders of Claims in Classes 1, 2, 5, and 6 are conclusively presumed to accept the Plan because they are Unimpaired by the Plan. Holders of Interests in Class 10 are Impaired and deemed to reject. Holders of Claims or Interests in Classes 7, 8, or 9 are deemed to reject or presumed to accept the Plan because they are (1) Unimpaired under the Plan and presumed to accept the Plan, or (2) Impaired and entitled to no recovery under the Plan and deemed to reject the Plan.

| 3 | The estimated recoveries presented for Holders of First Lien Notes Claims and Second Lien Notes Claims are estimated recoveries to such Holders solely on account of their First Lien Notes Claims and Second Lien Notes Claims, respectively, and do not reflect consideration received by such Holders for any other Claims or in any other capacity, including in their capacity as a party to the Restructuring Support Agreement or as a Holder of DIP Facility Claims. The recovery of Holders of Second Lien Notes Claims reflects the mid-point of total enterprise value of Reorganized Pyxus as set forth in the Valuation Analysis. The recovery for Holders making the Second Lien Notes Cash Option will be 2.00%. |

| 4 | Unless otherwise indicated, all Claim amounts in this Disclosure Statement and accompanying exhibits are estimates as of the Petition Date, Classes 3 and 4 reflect outstanding principal only, and Class 5 reflects the approximate principal amount of the Foreign Credit Lines that is guaranteed by Pyxus. |

| 5 | As of March 31, 2020. |

| 6 | As of March 31, 2020. |

4

The Voting Deadline is 5:00 p.m., prevailing Eastern Time, on July 20, 2020. To be counted as votes to accept or reject the Plan, a Ballot must be actually received on or before the Voting Deadline by Prime Clerk LLC (“Prime Clerk” or the “Solicitation Agent”) as follows:

DELIVERY OF BALLOTS

1. Ballots must be actually received by the Solicitation Agent before the Voting Deadline (5:00 p.m. prevailing Eastern Time, on July 20, 2020).

2. Ballots must be completed following the instructions received with the Ballot, so that such Holder’s Ballot including their vote is actually received by the Voting Deadline.

If you have any questions on the procedures for voting on the Plan, please contact the Solicitation Agent by emailing pyxusballots@primeclerk.com and referencing “Pyxus Ballot Processing” in the subject line, or by calling 1-(844)- 974-2130 (toll-free) or 1-(929)-955-3418 (international), and asking for the solicitation group.

IF YOU HAVE ANY QUESTIONS ABOUT THE SOLICITATION OR VOTING PROCESS, PLEASE CONTACT THE SOLICITATION AGENT. ANY BALLOT RECEIVED AFTER THE VOTING DEADLINE OR OTHERWISE NOT IN COMPLIANCE WITH THE VOTING INSTRUCTIONS WILL NOT BE COUNTED EXCEPT AS DETERMINED BY THE DEBTORS.

E. Confirmation and Consummation of the Plan.

Under section 1128(a) of the Bankruptcy Code, the Bankruptcy Court, after notice, may hold a hearing to confirm a plan of reorganization. If the Debtors file the Chapter 11 Cases, they will file a motion on the Petition Date requesting that the Bankruptcy Court set a date and time as soon as practicable after the Petition Date for a hearing (such hearing, the “Confirmation Hearing”) for the Bankruptcy Court to determine whether the Disclosure Statement contains adequate information under section 1125(a) of the Bankruptcy Code, whether the Debtors’ prepetition solicitation of acceptances in support of the Plan complied with section 1126(b) of the Bankruptcy Code, and whether the Plan should be confirmed in light of both the affirmative requirements of the Bankruptcy Code and objections, if any, that are timely filed, as permitted by section 105(d)(2)(B)(2)(v) of the Bankruptcy Code. The Confirmation Hearing, once set, may be continued from time to time without further notice other than an adjournment announced in open court or a notice of adjournment filed with the Bankruptcy Court and served on those parties who have requested notice under Bankruptcy Rule 2002 and the Entities who have filed an objection to the Plan, if any, without further notice to parties in interest. The Bankruptcy Court, in its discretion and prior to the Confirmation Hearing, may put in place additional procedures governing the Confirmation Hearing. Subject to section 1127 of the Bankruptcy Code, the Plan may be modified, if necessary, prior to, during, or as a result of the Confirmation Hearing, without further notice to parties in interest.

Additionally, section 1128(b) of the Bankruptcy Code provides that any party in interest may object to Confirmation. The Debtors, in the same motion requesting a date for Confirmation of the Plan, will request that the Bankruptcy Court set a date and time for parties in interest to file objections to the adequacy of the Disclosure Statement, the Debtors’ prepetition Solicitation of acceptances in support of the Plan, and Confirmation of the Plan. All such objections must be filed with the Bankruptcy Court and served on the Debtors and certain other parties in interest in accordance with the applicable order of the Bankruptcy Court so that they are received before the deadline to file such objections.

1. Confirmation Hearing.

At the Confirmation Hearing, the Bankruptcy Court will determine whether the Disclosure Statement contains adequate information under section 1125(a) of the Bankruptcy Code, whether the Debtors’ prepetition solicitation of acceptances in support of the Plan complied with section 1126(b) of the Bankruptcy Code, and whether the Plan should be confirmed in light of both the affirmative requirements of the Bankruptcy Code and objections, if any, that are timely filed, and subject to satisfaction or waiver of each condition precedent in Article IX of the Plan.

5

For a more detailed discussion of the Confirmation Hearing, see Section VI of this Disclosure Statement, entitled “Confirmation of the Plan.”

2. Effect of Confirmation and Consummation of the Plan.

Following Confirmation, and subject to satisfaction or waiver of each condition precedent in Article IX of the Plan, the Plan will be consummated on the Effective Date. Among other things, on the Effective Date, certain release, injunction, exculpation, and discharge provisions set forth in Article VIII of the Plan will become effective. Accordingly, it is important to read the provisions contained in Article VIII of the Plan very carefully so that you understand how Confirmation and Consummation—which effectuates such release, injunction, exculpation, and discharge provisions—will affect you and any Claim or Interest you may hold with respect to the Debtors so that you may cast your vote accordingly. These provisions are described in Section V of this Disclosure Statement.

F. Additional Plan-Related Documents.

The Debtors will file certain documents that provide more details about implementation of the Plan in the Plan Supplement, which will be filed with the Bankruptcy Court no later than seven calendar days before the Confirmation Objection Deadline and otherwise in accordance with the Restructuring Support Agreement. The Debtors will serve a notice that will inform all parties that the initial Plan Supplement was filed, list the information included therein, and explain how copies of the Plan Supplement may be obtained. Eligible Holders of Claims entitled to vote to accept or reject the Plan shall not be entitled to change their vote based on the contents of the Plan Supplement after the Voting Deadline. The Plan Supplement will include:

| • | the New Shareholders Agreement; |

| • | the New Pyxus Constituent Documents; |

| • | the identity of the members of the Reorganized Pyxus Board and the officers of Reorganized Pyxus; |

| • | the Rejected Executory Contract and Unexpired Lease List, if any; |

| • | the Exit Term Facility Agreement; |

| • | the Exit ABL Credit Agreement; |

| • | the Exit Secured Notes Indenture or, if applicable, the Replacement First Lien Financing Agreement; and |

| • | any other necessary documentation related to the Restructuring Transactions. |

THE FOREGOING EXECUTIVE SUMMARY IS ONLY A GENERAL OVERVIEW OF THIS DISCLOSURE STATEMENT AND THE MATERIAL TERMS OF, AND TRANSACTIONS PROPOSED BY, THE PLAN AND IS QUALIFIED IN ITS ENTIRETY BY REFERENCE TO, AND SHOULD BE READ IN CONJUNCTION WITH, THE MORE DETAILED DISCUSSIONS APPEARING ELSEWHERE IN THIS DISCLOSURE STATEMENT AND THE EXHIBITS ATTACHED TO THIS DISCLOSURE STATEMENT, INCLUDING THE PLAN.

II. The Debtors’ Business Operations and Capital Structure

A. Corporate History.

In 2005, DIMON Incorporated and Standard Commercial Corporation merged to create Alliance One International, Inc., which later changed its name to Pyxus International, Inc. Its primary business has historically been as a tobacco leaf merchant, purchasing, processing, packing, storing and shipping tobacco to manufacturers of cigarettes and other consumer tobacco products throughout the world. Through its predecessors, the Company has a long operating history in the leaf tobacco industry with some customer relationships beginning in the early 1900s. Alliance One’s common stock was listed on The New York Stock Exchange in 1995.

6

In 2018, the Company began a transformation process designed to diversify its products and services by leveraging its core strengths in agronomy and traceability. This process included diversification into the production and sale of “e-liquids” for vapable products and CBD oil, which is a non-intoxicating extract from industrial hemp. Pyxus, through certain non-Debtor Affiliates, also took controlling stakes in two Canadian cannabis producers producing cannabis exclusively for sale in the Canadian market, where production for medicinal use has been legal since 2001 and recreational use has been federally legal since 2018. The Company operates its federally cannabis business lines primarily through joint ventures and Company-owned subsidiaries, none of which are Debtors in these Chapter 11 Cases.

B. The Company’s Business.

As of the date of Solicitation (the “Solicitation Date”), the Company purchases tobacco in more than 35 countries and ships to approximately 90 countries. The Company has approximately 3,564 employees, excluding approximately 4,710 seasonal employees as of the Solicitation Date. Most seasonal employees, as well as approximately 125 full-time factory personnel in the United States, are members of unions and covered by collective bargaining agreements.

The Company’s operations are organized by product category and geographic area and aggregated into three segments: (i) Leaf – North America, (ii) Leaf – Other Regions, and (iii) Other Products and Services (also known as the Global Specialty Products). The Company has approximately 100 direct and indirect subsidiaries, including joint ventures which are consolidated on an equity basis in the Company’s financial statements.

The “Leaf” segments cover the Company’s core business of purchasing, processing, packing, storing and shipping tobacco to manufacturers of cigarettes and other consumer tobacco products throughout the world. The Company’s leaf tobacco operations deal primarily in flue-cured, burley, and oriental tobaccos that are used in international brand cigarettes. The Company purchases tobacco directly from suppliers and assumes the risk of matching the quantities and grades required by its customers to the entire crop it must purchase under contract.

In some markets, the Company buys tobacco from local entities that have purchased tobacco from their own suppliers and, in some cases, it also processes tobacco at its facilities for customers who need this service. The Company also supplies seeds, fertilizer, pesticides and other products related to growing tobacco to farmers on a short- term basis to assist in crop production. In an increasing number of markets, the Company also provides agronomy expertise to its contracted tobacco grower base for growing leaf tobacco, hemp, groundnuts and sunflower seeds.

A substantial portion of the Company’s inventory is sourced abroad. Once purchased, the Company processes tobacco to meet each customer’s specifications as to quality, yield, chemistry, particle size, moisture content and other characteristics. The processing of leaf tobacco facilitates shipping, prevents spoilage, and is an essential service to the Company’s customers, because the quality of processed leaf tobacco substantially affects the quality of the manufacturer’s end product. The Company processes tobacco in company-owned and third-party facilities around the world, including the United States, Argentina, Brazil, China, Zimbabwe, Jordan, Guatemala, India, Tanzania, Malawi, Thailand, Indonesia, Macedonia, Kenya and Turkey.

The “Other Products and Services” (also known as Global Specialty Products) segment is comprised of the new business lines, including hemp-derived CBD, flavors for multiple uses, “e-liquids” for electronic cigarettes and, in the Canadian market, federally legal cannabis. These business lines are primarily operated through various joint ventures and Company-owned subsidiaries, none of which are Debtors. The revenue from these product lines represent approximately 2% of total revenue for the fiscal year ending 2020.

7

C. The Debtors’ Operations.

The Company operates its businesses through the Debtors, other domestic and international subsidiaries and affiliates (collectively, the “Non-Debtor Affiliates”) and domestic and international joint ventures. In addition to housing certain domestic operations and assets, certain of the Debtors provide critical financial, logistical and administrative support to non-Debtor Affiliates.

Debtor Pyxus is the publicly-listed parent of the Company and employs senior management. One of its primary functions is distributing funds to its various subsidiaries, including from borrowings under the ABL Facility. Pyxus does not directly own or operate any factories or facilities. Debtor Alliance One International, LLC (“AOI”) imports processed tobacco from foreign suppliers which it then sells to domestic customers. It also acquires domestic processed tobacco through an intercompany arrangement with Debtor Alliance One North America, LLC (“AONA”), which it exports to foreign customers. A portion of the receivables that AOI generates are sold to certain financial institutions through certain receivables facilities (the “Receivables Facilities”). Debtor GSP Properties leases office space in New York.

AONA purchases, processes, packs, stores, and ships tobacco to domestic manufacturers of cigarettes and other consumer tobacco products. Processing begins first by classifying flue-cured and burley tobacco according to grade. Tobacco is then blended to meet customer specifications regarding color, body and chemistry, threshed to remove the stem from the leaf and further processed to produce strips of tobacco and sieve out small scrap. AONA processes domestic tobacco, excluding both “cut rag” (described below) and cut-rolled expanded stem tobaccos. AONA’s tobacco processing activities are comprised of (i) the purchase of U.S.-origin green tobacco from U.S. suppliers and (ii) the sale of U.S.-origin tobacco to U.S. customers or to AOI for export to non-U.S. customers. Debtor Alliance One Specialty Products LLC (“AOSP”) houses the Company’s cut rag operations, by which it turns strips of leaf tobacco into cut rag tobacco, the type used in traditional, cigarettes, cigars, roll your own products and pipe products. AOSP also indirectly holds the Company’s interests in the North American non-Debtor joint ventures for “e-liquids” and vaping products.

D. The Debtors’ Prepetition Capital Structure.

As of the Solicitation Date, the Debtors’ long-term debt obligations total in excess of $1.5 billion. The primary components of the Debtors’ consolidated funded debt obligations outstanding as of the Solicitation Date are as follows:

| Type of Debt |

Description |

Maturity |

Principal | |||

| ABL Facility |

Revolving credit facility based on eligible accounts receivable and eligible inventory |

January 2021 | $ 44,900,000 | |||

| First Lien Notes |

8.5% senior secured first lien notes due 2021 |

April 2021 | $275,000,000 | |||

| Second Lien Notes |

9.875% senior secured second lien notes due 2021 |

July 2021 | $635,686,000 | |||

| Foreign Credit Lines |

Uncommitted short-term seasonal lines of credit at the local level |

Various | $557,000,000 |

The ABL Facility and the First Lien Notes share pari passu crossing liens on substantially all of the Debtor Obligors’ (as defined below) assets. The ABL Facility has priority in respect of the ABL Priority Collateral and the First Lien Notes have priority in respect of the Notes Priority Collateral (each as defined below). The Second Lien Notes are secured by second priority liens on a portion of the ABL Priority Collateral and First Lien Notes Collateral, junior in each case to the liens securing the ABL Facility and First Lien Notes.

In addition, many of the Company’s foreign subsidiaries (none of which are Debtors) borrow under seasonal lines of credit from local financial institutions (the “Foreign Credit Lines”) to fund local operations, including the local purchase of tobacco. Pyxus guarantees a significant portion of the Foreign Credit Lines.

8

1. ABL Facility.

On October 14, 2016, Pyxus entered into the ABL Credit Agreement (as amended, supplemented or otherwise modified from time to time, the “ABL Credit Agreement”) with certain lenders (the “ABL Lenders”) and Deutsche Bank AG New York Branch, as Administrative Agent and Collateral Agent (the “ABL Collateral Agent”), establishing a senior secured revolving asset-based lending facility (the “ABL Facility”) of $60 million subject to a borrowing base composed of its eligible accounts receivable and inventory.

The borrowing base is subject to customary reserves, which are established by the ABL Collateral Agent in its permitted discretion as set forth in the ABL Credit Agreement. As of the Petition Date, although the borrowing base is $77.9 million, only $44.9 million in principal amount of loans is currently outstanding. If Pyxus were to borrow more than $45 million, the ABL Collateral Agent would be permitted to impose cash dominion and sweep the Debtors’ cash in its deposit accounts on a daily basis to repay the ABL Facility.

Pyxus’ obligations as the borrower under the ABL Facility are (a) guaranteed by AOSP, AONA and AOI (collectively with Pyxus, the “Debtor Obligors”) and (b) secured by substantially all of the Debtor Obligors’ tangible and intangible assets, subject to certain exceptions and permitted liens (the “Collateral”).

The ABL Collateral Agent, on behalf of the ABL Lenders, and the First Lien Indenture Trustee (as defined below), on behalf of the First Lien Noteholders, and Pyxus are party to the Senior Lien Intercreditor Agreement, dated as of October 14, 2016 (as amended, the “Senior Lien Intercreditor Agreement”) which governs the respective rights and remedies of the ABL Lenders and First Lien Noteholders in respect of the Collateral. The Senior Lien Intercreditor Agreement gives the ABL Facility priority over the First Lien Notes in respect of Collateral consisting of accounts receivable, certain chattel paper, inventory, payment intangibles, certain investment property, cash (other than identifiable cash proceeds of the Notes Priority Collateral), deposit accounts, related general intangibles and instruments and proceeds of the foregoing (collectively, the “ABL Priority Collateral”).

The ABL Facility is junior in priority to the First Lien Notes in respect of the remaining Collateral, including material owned real property in the United States, capital stock of subsidiaries owned directly by a Debtor Obligor (but only 65% of the voting capital stock of direct foreign subsidiaries), intellectual property rights, equipment, related general intangibles and instruments and proceeds of the foregoing (collectively, the “Notes Priority Collateral”).

The ABL Facility matures on January 14, 2021 and bears interest at LIBOR plus 2.50% or Base Rate plus 1.50% (each such term as defined in the ABL Credit Agreement), exclusive of default interest of 2.00%.

Given the over-collateralization of the ABL Facility and its senior position regarding the Debtor Obligors’ working capital assets, the Debtors are requesting authorization to use a portion of the DIP Facility to repay the ABL Facility in full.

2. First Lien Notes.

On October 14, 2016, Pyxus issued $275 million in aggregate principal amount of 8.500% Senior Secured First Lien Notes due 2021 (the “First Lien Notes” and the holders thereof, the “First Lien Noteholders”) pursuant to an Indenture (as amended, the “First Lien Indenture”) between Pyxus and the Bank of New York Mellon Trust Company, N.A., as the indenture trustee and collateral agent (the “First Lien Indenture Trustee”). As of the Petition Date, there was approximately $275 million in principal amount outstanding under the First Lien Notes. Like the ABL Facility, the First Lien Notes are guaranteed by the Debtor Obligors and are secured by liens on the Collateral (see “ABL Facility” above for a discussion on the Collateral as shared between the ABL Facility and the First Lien Notes).

Pursuant to the Senior Lien Intercreditor Agreement, the First Lien Noteholders are deemed to consent to any debtor-in-possession financing that the ABL Collateral Agent consents (or otherwise does not object) to, even if such financing is secured by priming liens on the ABL Priority Collateral, so long as (among other conditions) such financing does not have senior priority to the First Lien Notes as to the Notes Priority Collateral.

The First Lien Notes bear interest at a rate of 8.50% per annum payable semi-annually in arrears in cash on April 15 and October 15 of each year, subject to an additional 1.00% of default interest, on demand, following the occurrence of a payment default.

9

The First Lien Notes mature on April 15, 2021. If the First Lien Notes are voluntarily redeemed by Pyxus prior to October 15, 2020, they are subject to a redemption premium equal to 2.125% of the principal amount of the redeemed notes. Thereafter, the First Lien Notes can be redeemed with no premium.

3. Second Lien Notes.

On August 1, 2013, Pyxus issued $735 million in aggregate principal amount of 9.875% senior secured second lien notes due 2021 (the “Second Lien Notes” and the holders thereof, the “Second Lien Noteholders”) pursuant to an Indenture (as amended, supplemented or otherwise modified from time to time, the “Second Lien Indenture”) between Pyxus and Wilmington Trust, National Association as the successor trustee and collateral trustee (the “Second Lien Indenture Trustee”). As of the Petition Date, there was $635,686,000 in principal amount outstanding under the Second Lien Notes.

The Second Lien Notes are guaranteed by AONA and AOI (together with Pyxus, the “Debtor Second Lien Notes Obligors”). The Second Lien Notes are secured by liens on the ABL Priority Collateral of the Debtor Second Lien Notes Obligors as well as certain capital stock of subsidiaries and the “cut rag” processing facility located in North Carolina, which facility is part of the Notes Priority Collateral. The ABL Collateral Agent, on behalf of the ABL Lenders, and the First Lien Indenture Trustee, on behalf of the First Lien Noteholders, and the Second Lien Indenture Trustee, on behalf of the Second Lien Noteholders are party to the Junior Lien Intercreditor Agreement, dated as of August 1, 2013 (as amended, the “Junior Lien Intercreditor Agreement”), which governs the rights and remedies of the ABL Lenders, First Lien Noteholders and Second Lien Noteholders in respect of the Collateral. Under the Junior Lien Intercreditor Agreement, the liens securing the Second Lien Notes are junior to the liens securing both the ABL Facility and the First Lien Notes.7

The Second Lien Notes bear interest at a rate of 9.875% per annum, payable semi-annually in arrears in cash on January 15 and July 15 of each year. The Second Lien Notes are subject to an additional 1.00% of default interest following the occurrence of a payment default. The Second Lien Notes mature on July 15, 2021.

4. Foreign Credit Lines.

Certain of the Company’s foreign Non-Debtor Affiliates (the “Foreign Borrowers”) borrow under the Foreign Credit Lines. The Company uses the proceeds from these facilities to purchase tobacco from local farmers and run operations including production facilities in Africa, Europe and South America. The Foreign Borrowers occasionally purchase seeds, fertilizers, pesticides and other products related to growing tobacco, and provide them to farmers in these regions with which the Foreign Borrowers have contracts to purchase the resulting tobacco crop. The resulting crop is then purchased and marketed by the Company. The Foreign Credit Lines are typically seasonal in nature, normally extending for a term of 180 to 270 days corresponding to the tobacco crop cycle in the applicable location.

| 7 | The Junior Lien Intercreditor Agreement provides that Second Lien Noteholders are deemed to consent to any debtor- in-possession financing that the ABL Collateral Agent consents (or otherwise does not object) to, even if such financing is secured by priming liens on the ABL Priority Collateral and/or Notes Priority Collateral. |

10

As of May 31, 2020, approximately $557 million is drawn and outstanding under the Foreign Credit Lines. Approximately 35 Foreign Credit Lines are currently available, spread among approximately 30 lenders, the four largest of which are identified in the following table:

| Lender |

Amount Outstanding as of the Solicitation Date (in millions) |

|||

| Eastern & Southern African Trade & Development Bank (TDB) |

$ | 269.6 | ||

| Banco do Brasil SA |

$ | 106.3 | ||

| Industrial and Commercial Bank of China (ICBC) |

$ | 56.0 | ||

| Standard Bank of South Africa Limited |

$ | 33.0 | ||

The Foreign Credit Lines may be unsecured or secured by certain assets of the Foreign Borrowers, consisting primarily of receivables and tobacco inventory on hand. Although none of the Foreign Borrowers are Debtors, Pyxus guaranties approximately 95% of the outstanding principal of the Foreign Credit Lines.

Many of the Foreign Credit Lines are uncommitted, demand facilities. This gives Foreign Credit Line lenders the right to stop making loans or require payment on demand at any time. The Company customarily renews the Foreign Credit Lines at the start of the tobacco crop season in the relevant country.

Certain of the lenders under the Foreign Credit Lines renewed their commitments prior to the Solicitation Date but included covenants in respect of these Chapter 11 Cases, while others entered into limited waiver agreements or amendments in respect of termination events that may be caused by the commencement of these cases and related consequences. However, a protracted bankruptcy proceeding could nonetheless trigger events of defaults that would permit those lenders to terminate their facilities and exercise remedies against collateral that is crucial to the Company’s ongoing operations.

5. Receivables Facilities.

The Company relies on certain facilities to monetize accounts receivables given the delay between shipping its products and receiving payments from customers. Pyxus, AOI and AONA, all of whom are Debtors, are sellers under that certain Third Amended and Restated Receivables Purchase Agreement, dated as of December 21, 2018, and Alliance One International GmbH (“AOI GmbH”), a Non-Debtor Affiliate, is a seller under that certain Fourth Amended and Restated Receivables Purchase Agreement, dated as of December 21, 2018 (as amended, supplemented or otherwise modified from time to time, collectively, “Finacity RPAs”). Finacity Receivables 2006-2, LLC (the “Finacity Purchaser”) purchases all right, title and interest to the receivables sold by Pyxus, AOI, AONA and AOI GmbH under the Finacity RPAs and then enters into back-to-back sales with certain financial institutions. The Finacity Purchaser purchases the receivables under the Finacity RPAs for a discount to the face amount, of which a portion is paid up front with the balance deferred. The sale of receivables under the Finacity RPAs have been structured as a true sale and are non-recourse to the sellers, subject to certain customary repurchase obligations for (among other things) breaches of representations and warranties by the Company sellers. As of the week of June 8, 2020, approximately $80 million was outstanding under the Finacity RPAs.

Pyxus and AOI GmbH are also sellers under that certain Amendment and Restatement Agreement, dated December 2, 2016 (as amended, supplemented or otherwise modified from time to time, the “Standard Bank RPA” together with the Finacity RPAs, the “Securitization Facilities”), with Standard Bank of South Africa Limited (“Standard Bank”). The Standard Bank RPA is a $125 million uncommitted receivables facility. As of the week of June 8, 2020, approximately $20 million was outstanding under the Standard Bank RPA. Similar to the Finacity RPAs, these purchases are structured as true sales, without recourse to Pyxus or AOI GmbH, subject to certain customary repurchase obligations for (among other things) failure by either of the Company sellers to perform their obligations under the applicable sales contract. The receivables are purchased at a discount to the invoiced amount less any

11

applicable fees and discounts. Upon payment of the invoice by the customer to Standard Bank, the sellers are entitled to receive agreed-upon additional amounts paid by the customer to Standard Bank in respect of such invoice. In general, the Company financed approximately 5% of all receivables through the Standard Bank RPA in fiscal year 2020. The Standard Bank RPA expires by its terms on December 6, 2020.