Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SRP & DRP SUSPENSION - InvenTrust Properties Corp. | ivt-8xksrpdrpsuspensionfin.htm |

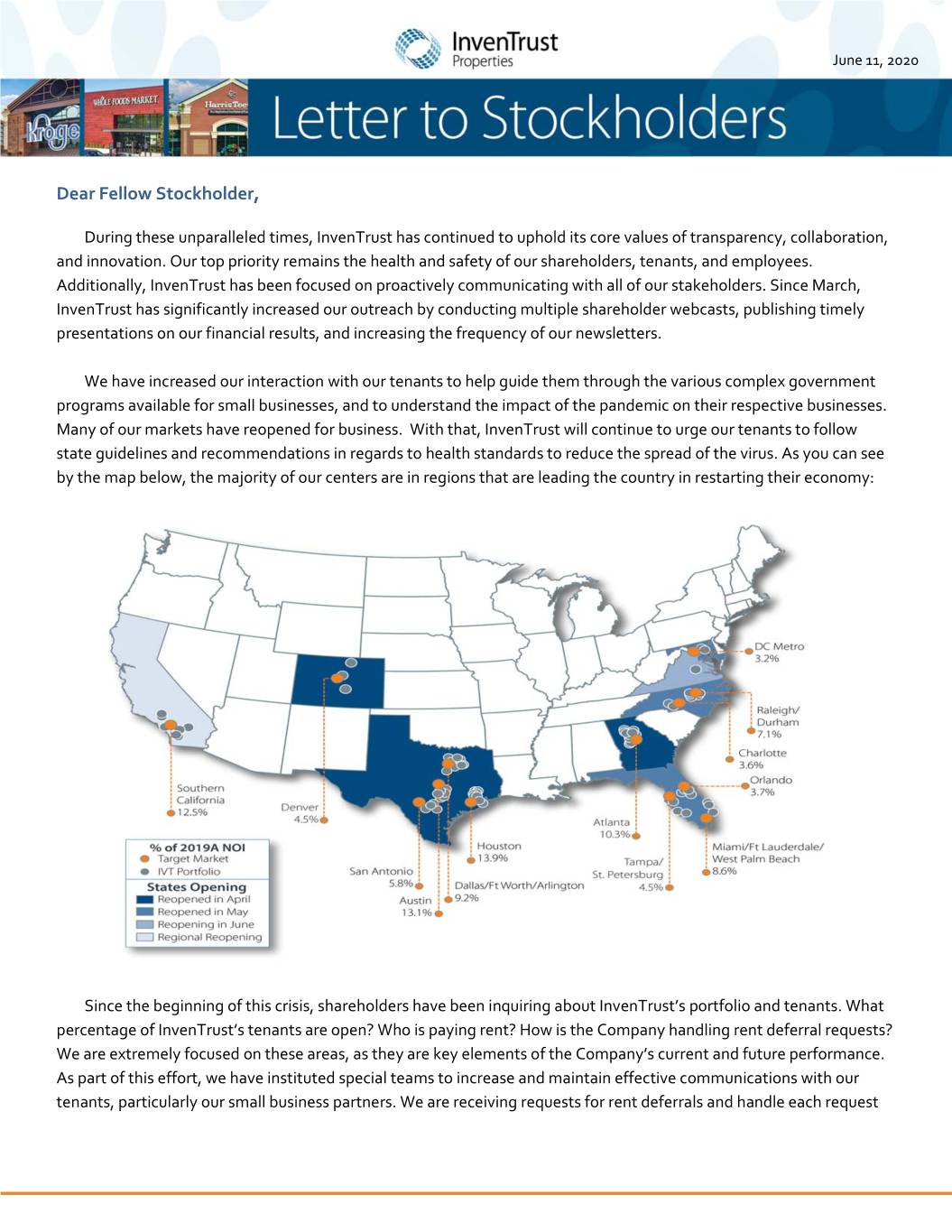

June 11, 2020 Dear Fellow Stockholder, During these unparalleled times, InvenTrust has continued to uphold its core values of transparency, collaboration, and innovation. Our top priority remains the health and safety of our shareholders, tenants, and employees. Additionally, InvenTrust has been focused on proactively communicating with all of our stakeholders. Since March, InvenTrust has significantly increased our outreach by conducting multiple shareholder webcasts, publishing timely presentations on our financial results, and increasing the frequency of our newsletters. We have increased our interaction with our tenants to help guide them through the various complex government programs available for small businesses, and to understand the impact of the pandemic on their respective businesses. Many of our markets have reopened for business. With that, InvenTrust will continue to urge our tenants to follow state guidelines and recommendations in regards to health standards to reduce the spread of the virus. As you can see by the map below, the majority of our centers are in regions that are leading the country in restarting their economy: Since the beginning of this crisis, shareholders have been inquiring about InvenTrust’s portfolio and tenants. What percentage of InvenTrust’s tenants are open? Who is paying rent? How is the Company handling rent deferral requests? We are extremely focused on these areas, as they are key elements of the Company’s current and future performance. As part of this effort, we have instituted special teams to increase and maintain effective communications with our tenants, particularly our small business partners. We are receiving requests for rent deferrals and handle each request

on a case‐by‐case basis with a goal to receive the full rental payments required by the term of the lease in an effort to minimize disruption to our cash flow. As of June 1, we collected over 72% of our rent owed for April and about 64% for May. June collections should be similar to May. Currently, over 90% of our tenants (by square footage) are cleared by the government to open for business. We believe the essential nature of our portfolio and tenants will lead to improved rent collections over the next several months. Despite our efforts, the consequences of COVID‐19 will be significant and prolonged. We expect our portfolio and our financial performance to be affected. To prepare for this impact, the Board and management team are evaluating our corporate policies including the distribution rate, the share repurchase program and the dividend reinvestment plan. In April, the Company paid its quarterly distribution at the previously announced 3% increase. The Board, as of now, has elected to maintain InvenTrust’s current dividend rate. However, on June 9, the Board decided to suspend the share repurchase program (“SRP”) and dividend reinvestment plan (“DRP”) for the time being. This was not an easy decision for the Board and management. We understand this is a source of liquidity for many shareholders, but with the heightened uncertainty around the economy and the low participation level in the DRP, which funds the SRP, the Board decided it was the most prudent course of action. We do not discount the importance of these programs to our investors, and therefore will continue to periodically evaluate their potential reinstatement. For shareholders currently in queue, the Company will be redeeming shares on June 27, 2020, as the program states. As mentioned above, the DRP funds collected, which in turn will be used to repurchase shares in the SRP, is limited. We do not anticipate sufficient funds to redeem shareholders from the “General” category. All SRP requests will remain in the queue in the event InvenTrust reinstates the SRP. For shareholders in the DRP, all distributions will be paid in the form of a check or ACH wire to their account starting with the July distribution payment. Please review the Current Report filed June 11, 2020 for all of the details related to the Board’s actions. These continue to be unprecedented times. At InvenTrust, we will continue to work hard for our shareholders and our focus is on the long‐term success of our company despite the short‐term disruption we may experience. As always, if you have any questions, please call 855‐377‐0510 or send an email to investorrelations@inventrustproperties.com. Stay safe and healthy. Sincerely, INVENTRUST PROPERTIES CORP. Thomas P. McGuinness President, CEO Forward-Looking Statements in this letter, which are not historical facts, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 Forward-looking statements are statements that are not historical, including statements regarding management’s intentions, beliefs, expectations, plans or predictions of the future and are typically identified by words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “likely,” “will,” “would” and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Such forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by the Company and its management, are inherently uncertain and involve known and unknown risks that are difficult to predict. For a discussion of factors that could materially affect the outcome of the Company’s forward- looking statements and our future results and financial condition, see the Risk Factors included in the Company’s most recent Annual Report on Form 10-K, as updated by any subsequent Quarterly Report on Form 10-Q, in each case as filed with the Securities and Exchange Commission. The Company intends that such forward-looking statements be subject to the safe harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, except as may be required by applicable law. You are cautioned not to place undue

reliance on any forward-looking statements, which are made as of the date of this letter. The Company undertakes no obligation to update publicly any of these forward-looking statements to reflect actual results, new information, future events, changes in assumptions, or changes in other factors affecting forward-looking statements, except to the extent required by applicable law. If the Company updates one or more forward-looking statements, no inference should be drawn that it will make additional updates with respect to those or other forward looking statements. This letter does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor there any sale of securities referred to in this letter, in any jurisdiction in which any such offer, solicitation or sale is not permitted. Furthermore, nothing in this letter is intended to provide tax, legal or investment advice. You should consult your business advisor, attorney and/or tax and accounting advisor regarding your specific business, legal or tax situation. During a given Redemption period, IVT may reach its repurchase limit for such period equal to 5% of the weighted-average number of shares outstanding, meaning your repurchase request may not be processed for redemption or you will only receive a proration of your request redeemed.