Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST UNITED CORP/MD/ | tm2022322d1_8k.htm |

Exhibit 99.1

FIRST UNITED CORPORATION

2020 Annual Meeting of Shareholders’ Presentation

June 11, 2020

CARISSA RODEHEAVER

Slide 2: Management Presentation

Good morning fellow shareholders, and welcome to First United’s 2020 Shareholders’ Meeting. I appreciate your interest in attending and for your flexibility with the virtual format this year.

Slide 3: Forward Looking Statements

Before we begin our presentation, I would like to direct your attention to the Forward-Looking Statements Disclosure, which is displayed on the screen for your review.

Slide 4: Current Environment

The past few months have been unprecedented for our bank, our region and our country as we have all faced the onslaught of the COVID-19 pandemic and its impact on our daily lives and business operations. As a financial institution, we have a Business Continuity Plan that is prepared and frequently tested. The plan is designed with its primary focus being the health, safety and financial well-being of our associates and our customers. Proactive communication is at the heart of the plan and we practiced it regularly through our participation in the Paycheck Protection Program, as we implemented various programs and as we took steps to ease the financial pressure on our customers.

| [1] |

All steps were taken with an eye towards risk management. We have been diligent in evaluating our operational procedures and modifying as necessary as we quickly transitioned to a remote workforce and telephonic and digital communication with customers. We closely monitored this risk through our cyber security protocol to ensure the safety of our customer information. In addition, we stress tested our capital and liquidity and evaluated the higher risk industries where we have balance sheet exposure. We entered this health crisis, which quickly turned into a financial crisis, in a strong financial position.

Slide 5: Delivering for Stakeholders

As our customers and associates are integral to executing on our long-term strategy, we quickly implemented processes to protect these valuable assets. As part of its plan to protect the financial well-being of its customers, the Corporation chose to participate and educate its customers on the government sponsored plans established to provide financial assistance to businesses. The U.S. Government’s Coronavirus Aid, Relief, and Economic Security Act, better known as the CARES Act, established the Small Business Administration Paycheck Protection Program, better known as the SBA PPP Program, which provides small businesses with resources to maintain payroll, hire back employees who may have been laid off, and to cover applicable overhead expenses. Your Company acted expeditiously to prepare our associates so they could guide our customers on the proper procedures necessary to enable them to take advantage of this program. We developed an SBA PPP specific information site within our website that provided detailed information, links and materials for eligible customers to access. Internally, we reallocated resources to review, process and enter customer applications, working tirelessly over extended hours to provide access to as many local business owners as possible. We proudly funded over 1,063 loans, for approximately $147 million, protecting 16,700 jobs in our local communities.

| [2] |

During this same time period we worked with our commercial and consumer borrowers to waive fees and penalties, modify loans and to temporarily cease any foreclosure activity. Our business ties to our customers and communities will withstand the crisis, support our market presence and enhance our competitive positioning long-term. Our customers are not just “stakeholders” but are a key value driver for our shareholders.

While positioning the Company to help our customers, we were also protecting our associates. We quickly introduced a Pandemic Pay Policy to give our associates the peace of mind that they could care for themselves and their family members. We established comprehensive protocols for cleaning, adjusted lobby access at our branch network and accommodated a remote work environment. We believe that enduring associate engagement will further strengthen our culture and organization well beyond this crisis.

| [3] |

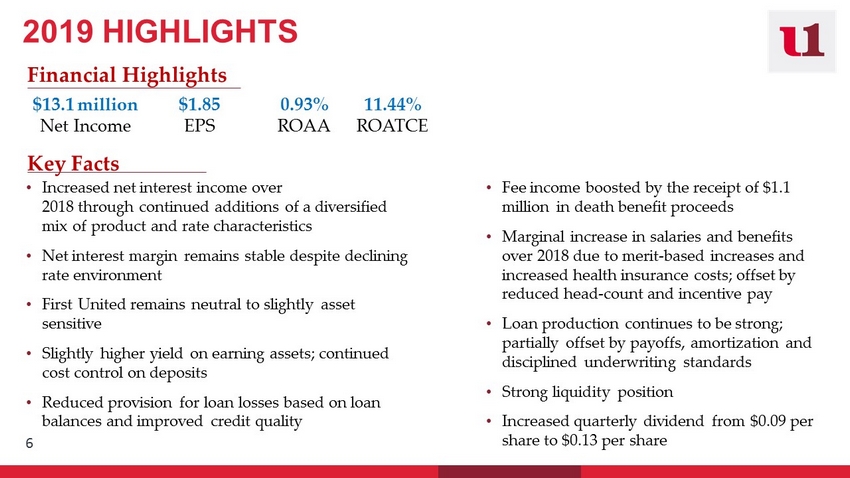

Slide 6: 2019 Highlights

While many were sequestered for COVID reasons, we released our 2019 financial reporting, highlighting another profitable year for our shareholders. Our diversified mix of loans and deposits and disciplined pricing produced net income of $13.1 million resulting in earnings per share of $1.85 along with increasing return on assets and return on equity ratios. Increased fee income from our wealth division and heightened cost control contributed to our successful year. Given our increased net income, your board of directors increased the quarterly dividend by 40% in the fourth quarter of 2019 from $.09 per share to $.13 per share. During the last quarter of 2019, the board of directors authorized a stock repurchase of up to 500,000 outstanding shares of the Company’s common stock.

Slide 7: First Quarter 2020

Our solid financial performance continued in the first quarter of 2020 as our pre-tax, pre-provision income increased by 11% over the same time period in 2018 to $4.9 million. This was attributable to a stable net interest margin, an improved efficiency ratio and our continued focus on increasing fee income. Due to the uncertainties of the impact of COVID-19 on the economic environment and our borrowers, we felt that it was prudent to increase our allowance for loan losses, and through qualitative factor adjustments we recorded a precautionary provision of $2.7 million, partially offsetting pre-tax income for the quarter. This resulted in net income for the quarter of $1.8 million or $.25 per share. Prior to the onset of COVID-19, the Company repurchased 145,219 outstanding shares, or approximately $2.7 million of our common stock as part of the repurchase plan discussed previously.

| [4] |

Slide 8: Reliable Growth

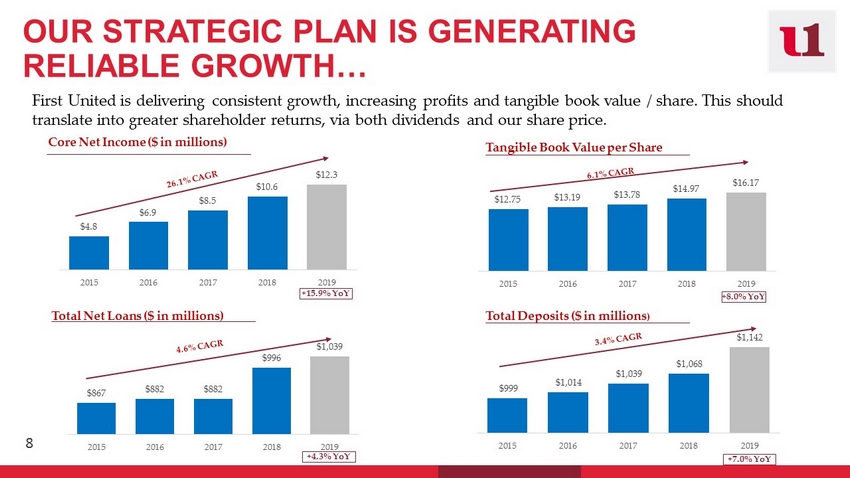

Over the past five years, the management team has delivered consistent growth, increasing profits and tangible book value per share. We expect that this will translate into greater shareholder returns through both dividends and share price. Over that time period, net loans and deposits have produced a compound annual growth rate of 4.6% and 3.4%, respectively. We believe in profitable growth, not growth for the sake of growth alone. As a result, we have recognized a 26.1% compound annual growth rate in our core net income and a 6.1% compound annual growth rate in tangible book value per share.

Slide 9: Improved Profitability

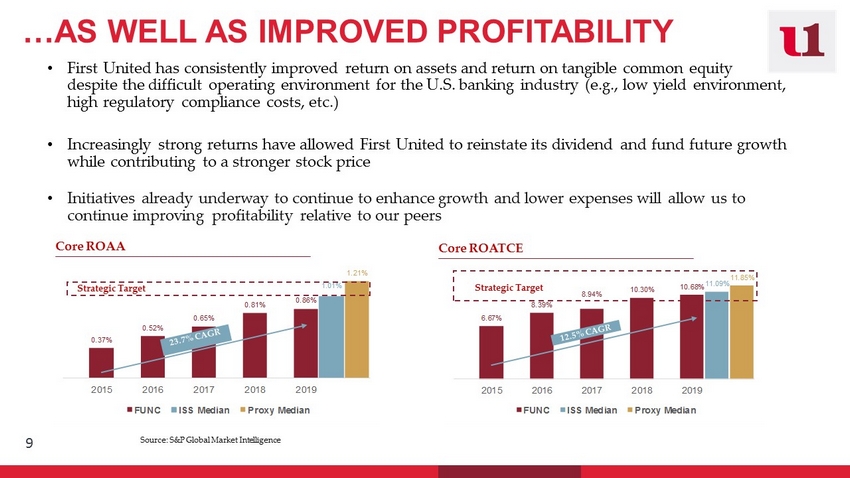

First United has experienced consistently improved return on average assets and return on tangible common equity over the past five years. This growth in profitability has positioned us well to fund our future growth and allowed us to increase our common stock dividend by 40% in the fourth quarter of 2019. We have set long-term strategic targets and we have plans in place to continue to enhance our growth and to lower expenses over the next several years to position us to achieve these targets. Of course, the impact of the current COVID pandemic will likely impact 2020 results, as it will for most businesses and companies. As mentioned earlier, we proactively added to our allowance for loan losses in the first quarter given the uncertainty of the economic environment of the near future.

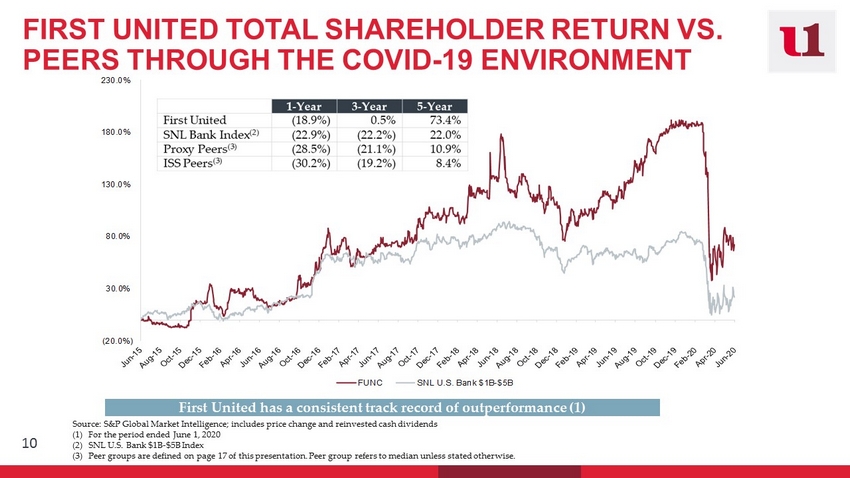

Slide 10: Total Shareholder Return

Even through the current COVID-19 environment, First United has consistently outperformed the SNL Bank Index and its peer groups by as much as 50% over the last five years, returning a 73.4% total shareholder return, which includes both share price appreciation and reinvested dividends. Our stock price was significantly impacted in March as the pandemic jolted the economy, the banking industry and the stock market as a whole. From the March 23rd market bottom through June 1st, First United shares have returned 25%, outpacing the SNL US Bank $1-$5 billion index by over 8 percentage points.

| [5] |

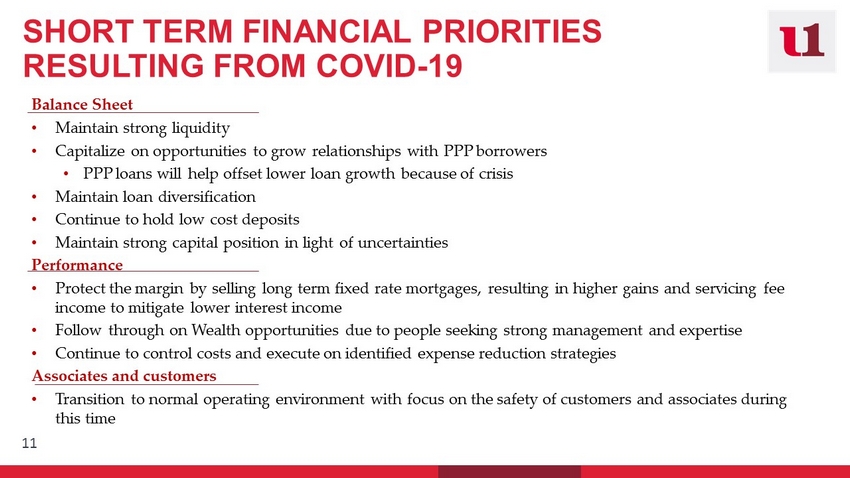

Slide 11: Short Term Priorities

As a result of and in response to the pandemic, First United quickly adapted and shifted our 2020 strategic focus. As in all economic downturns, strong capital and liquidity, maintaining loan diversification and assisting our customers through the uncertainty have now become priorities. We are implementing strategies to protect our margin, promoting the expertise of our wealth management professionals and continuing to control costs and execute on expense reduction strategies. As the economy and our local markets re-open, we intend to likewise transition to a normal operating environment, all while ensuring the safety of our associates and customers. We recognize there could be a new normal and we are prepared and ready to adapt our operations to continue to maximize shareholder value.

Slide 12: Short-Term Priorities

While the short-term focus has shifted, our long-term initiatives and strategic priorities remain the same. We are executing on our plans to leverage technology, refine our operating structure, and ultimately enhance efficiency. We are leveraging our branding initiative by further penetrating our customer base, attracting new customers with our upgraded technology and continuing to expand the productivity and profitability in our branch network through consumer and small business lending and growth in low-cost deposits. Greater efficiencies and improved technology combined with our uncommon commitment to service and customized approach to providing financial solutions equates to an enhanced customer experience and bottom-line profitability. As we return to a more normalized environment, we will continue to identify strategic growth opportunities in existing and new markets, hire banking talent, and evaluate acquisition opportunities when appropriate.

| [6] |

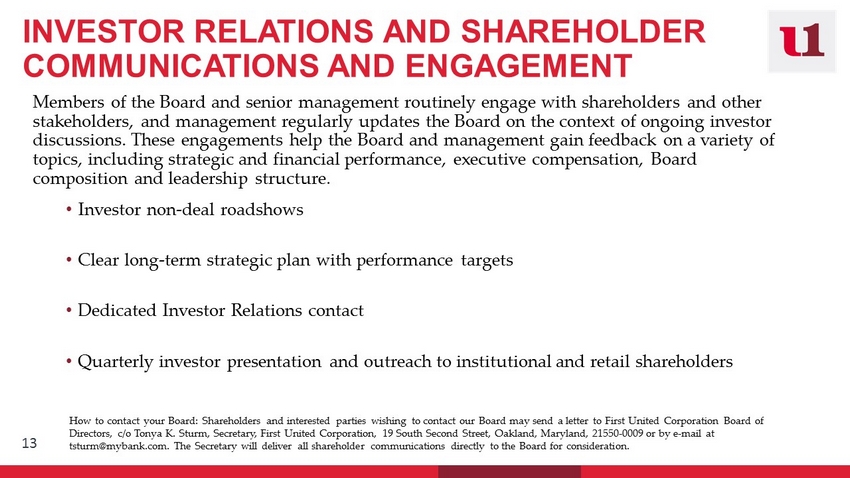

Slide 13: Investor Relations

Your senior management team and board are routinely engaging with shareholders and prospective investors, as well as continuing our involvement in our local communities. These engagements are invaluable to us and we are using the constructive feedback provided to enhance our performance and our governance profile.

Slide 14: Thank You for Your Service

At this time, I want to recognize Mr. Robert Kurtz, who will be retiring at the next Board meeting. We want to thank him for his contribution to the banking industry and to First United Bank & Trust. Congratulations and thank you for your service. Bob, we wish you the best in your retirement.

Slide 15: Board and Management

I also want to thank our Board of Directors for your guidance and the leadership that you provide to First United Corporation. On behalf of the Board, I would like to thank the management team and all our associates for your dedication and strong commitment to our customers, particularly as we stand strong and face the COVID environment together.

Slide 16: Thank You

Thank you for your attendance today and your investment and confidence in First United Corporation!

| [7] |

First United Corporation Annual Shareholders’ Meeting June 11, 2020

Carissa Rodeheaver 2 Chief Executive Officer and Chairman of the Board MANAGEMENT PRESENTATION

3 FORWARD LOOKING STATEMENTS This presentation contains “forward - looking statements” within the meaning of The Private Securities Litigation Reform Act of 1995 relating to, among other things, First United Corporation’s plans, strategies, objectives, expectations, intentions and adequacy of resources. You should be aware of the speculative nature of forward - looking statements. Statements that are not historical in nature, including those that include the words “anticipate”, “estimate”, “will”, “should”, “expect”, “believe”, “intend”, and similar expressions, are based on current expectations, estimates and projections about, among other things, the industry and the markets in which we operate, and they are not guarantees of future performance. Whether actual results will conform to expectations and predictions is subject to known and unknown risks and uncertainties. Actual results could be materially different from management’s expectations. This presentation should be read in conjunction with our Annual Report on Form 10 - K for the year ended December 31, 2019 and our Quarterly Report on Form 10 - Q for the quarter ended March 31, 2020, including the sections of those reports entitled “Risk Factors”, as well as the reports and other documents that we subsequently file with the Securities and Exchange Commission (“SEC”), which are available on the SEC’s website at www.sec.gov or at our website at www.mybank.com . Except as required by law, we do not intend to publish updates or revisions of any forward - looking statements we make to reflect new information, future events or otherwise.

4 CURRENT ENVIRONMENT COVID - 19 Response Enterprise Risk Management • Quickly responded to COVID - 19 through our well - designed and tested Business Continuity Plan, focusing on the health, safety, and financial well - being of our associates and customers • Proactive communication with shareholders, customers and associates regarding enhanced measures and procedures • Excellent delivery for customers on the Paycheck Protection Program, protecting over 16,800 local jobs • Relieved financial pressures for customers through various measures, including loan modifications, waiving early withdrawal penalties and overdraft fees, and temporarily suspending repossession and foreclosure activity • Activated Business Continuity Plan • Evaluated and modified, as necessary, operational processes for adaptation to remote workforce and customer contact • Ensured backup personnel for critical functions • Considered cyber security risk – virus software, encrypted data, insurance, vulnerability testing • Identified industries at risk and stress tested key segments of loan and investment portfolios • Increased allowance for loan losses (ALL) due to economic uncertainties • Stress tested liquidity from all sources • Reviewed and updated budget and strategic initiatives given current environment

5 DELIVERING FOR STAKEHOLDERS AMIDST THE COVID - 19 CRISIS Our customers and associates are integral to our long - term strategy, and we are going the extra mile for these key stakeholders while we all navigate the crisis together Customers • Processed 1,063 Paycheck Protection Program loans for 16,700 employees, totaling $147 million (1) • Waived certificates of deposit early withdrawal penalties, overdraft fees for insufficient funds; loan modifications provided for 606 loans totaling $222.2 million (2) • Our business ties to our customers and communities will withstand the crisis, support our market presence and enhance our competitive positioning long term. Our customers and communities are not just “stakeholders,” but also a key value driver for our shareholders Associates • 96% of associates with VPN access are logging in remotely each week • Pandemic Pay Policy for associates who are unable to work, such as those who need to care for family members during the crisis • Comprehensive protocols including suspension of travel, daily updates and enhanced branch cleaning • Enduring associate engagement will strengthen our culture and organization well beyond the crisis. First United understands the long - term impact of our stewardship of human capital (1) As of May 28, 2020 (2) As of June 4, 2020

6 Financial Highlights $13.1 million Net Income $1.85 EPS 0.93% ROAA 11.44% ROATCE Key Facts 2019 HIGHLIGHTS • Increased net interest income over 2018 through continued additions of a diversified mix of product and rate characteristics • Net interest margin remains stable despite declining rate environment • First United remains neutral to slightly asset sensitive • Slightly higher yield on earning assets; continued cost control on deposits • Reduced provision for loan losses based on loan balances and improved credit quality • Fee income boosted by the receipt of $1.1 million in death benefit proceeds • Marginal increase in salaries and benefits over 2018 due to merit - based increases and increased health insurance costs; offset by reduced head - count and incentive pay • Loan production continues to be strong; partially offset by payoffs, amortization and disciplined underwriting standards • Strong liquidity position • Increased quarterly dividend from $0.09 per share to $0.13 per share

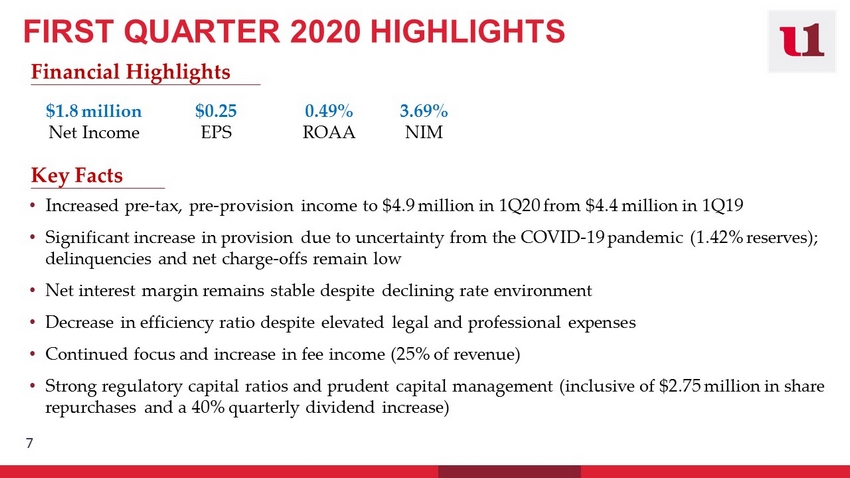

7 Financial Highlights • Increased pre - tax, pre - provision income to $4.9 million in 1Q20 from $4.4 million in 1Q19 • Significant increase in provision due to uncertainty from the COVID - 19 pandemic (1.42% reserves); delinquencies and net charge - offs remain low • Net interest margin remains stable despite declining rate environment • Decrease in efficiency ratio despite elevated legal and professional expenses • Continued focus and increase in fee income (25% of revenue) • Strong regulatory capital ratios and prudent capital management (inclusive of $2.75 million in share repurchases and a 40% quarterly dividend increase) $1.8 million Net Income $0.25 EPS 0.49% ROAA 3.69% NIM Key Facts FIRST QUARTER 2020 HIGHLIGHTS

$999 $1,014 $1,039 $1,068 $1,142 2015 2016 2017 2018 2019 $4.8 $6.9 $8.5 $10.6 $12.3 2015 2016 2017 2018 2019 8 OUR STRATEGIC PLAN IS GENERATING RELIABLE GROWTH… First United is delivering consistent growth, increasing profits and tangible book value / share. This should translate into greater shareholder returns, via both dividends and our share price. Core Net Income ($ in millions) +7.0% YoY $12.75 $13.19 $13.78 $14.97 $16.17 2015 2016 2017 2018 2019 Tangible Book Value per Share +8.0% YoY Total Net Loans ($ in millions) Total Deposits ($ in millions ) $867 $882 $882 $996 $1,039 2015 2016 2017 2018 2019 +15.9% YoY +4.3% YoY

6.67% 8.39% 8.94% 10.30% 10.68% 11.09% 11.85% 2015 2016 2017 2018 2019 FUNC ISS Median Proxy Median 0.37% 0.52% 0.65% 0.81% 0.86% 1.01% 1.21% 2015 2016 2017 2018 2019 FUNC ISS Median Proxy Median 9 …AS WELL AS IMPROVED PROFITABILITY • First United has consistently improved return on assets and return on tangible common equity despite the difficult operating environment for the U.S. banking industry (e.g., low yield environment, high regulatory compliance costs, etc.) • Increasingly strong returns have allowed First United to reinstate its dividend and fund future growth while contributing to a stronger stock price • Initiatives already underway to continue to enhance growth and lower expenses will allow us to continue improving profitability relative to our peers Core ROAA Strategic Target Core ROATCE Strategic Target Source: S&P Global Market Intelligence

(20.0%) 30.0% 80.0% 130.0% 180.0% 230.0% FUNC SNL U.S. Bank $1B-$5B 10 FIRST UNITED TOTAL SHAREHOLDER RETURN VS. PEERS THROUGH THE COVID - 19 ENVIRONMENT First United has a consistent track record of outperformance (1) Source: S&P Global Market Intelligence; includes price change and reinvested cash dividends (1) For the period ended June 1, 2020 (2) SNL U.S. Bank $1B - $5B Index (3) Peer groups are defined on page 17 of this presentation. Peer group refers to median unless stated otherwise.

11 SHORT TERM FINANCIAL PRIORITIES RESULTING FROM COVID - 19 Balance Sheet • Maintain strong liquidity • Capitalize on opportunities to grow relationships with PPP borrowers • PPP loans will help offset lower loan growth because of crisis • Maintain loan diversification • Continue to hold low cost deposits • Maintain strong capital position in light of uncertainties Performance • Protect the margin by selling long term fixed rate mortgages, resulting in higher gains and servicing fee income to mitigate lower interest income • Follow through on Wealth opportunities due to people seeking strong management and expertise • Continue to control costs and execute on identified expense reduction strategies Associates and customers • Transition to normal operating environment with focus on the safety of customers and associates during this time

12 KEY INITIATIVES AND STRATEGIC PRIORITIES Focus on increasing core earnings through regionalized plans to enhance efficiency and grow revenue Enhance Efficiency • Head - count reduction opportunities identified and enacted • Restructuring and consolidation of regional operating structure • Leverage technology to improve processes and procedures • Negotiating key contracts Enhance Customer Experience • Utilize relationship advisor model to provide a seamless customer experience across our business lines • Implement regionalized approach with team - based incentives • Serve clients with uncommon commitment to service and customized financial solutions Strategic Growth • Identify and expand into new markets through our efficient financial center model • Opportunistically identify and hire banking talent • Evaluate strategic acquisition opportunities, including banking and wealth management companies • Enhance consumer and small business lending via branch network and focus on Community Oriented Business Owner Leverage Branding Initiative • Leverage branch transformation, branding initiatives and investments in technology to further penetrate customer base • Present imagery of being current and relevant for changing banking preferences • Grow revenue through improved branch productivity and profitability Shareholder Relations - Continue to improve governance practices

13 INVESTOR RELATIONS AND SHAREHOLDER COMMUNICATIONS AND ENGAGEMENT Members of the Board and senior management routinely engage with shareholders and other stakeholders, and management regularly updates the Board on the context of ongoing investor discussions. These engagements help the Board and management gain feedback on a variety of topics, including strategic and financial performance, executive compensation, Board composition and leadership structure. • Clear long - term strategic plan with performance targets • Dedicated Investor Relations contact • Investor non - deal roadshows • Quarterly investor presentation and outreach to institutional and retail shareholders How to contact your Board: Shareholders and interested parties wishing to contact our Board may send a letter to First United Co rporation Board of Directors, c/o Tonya K. Sturm, Secretary, First United Corporation, 19 South Second Street, Oakland, Maryland, 21550 - 0009 or by e - mail at tsturm@mybank.com. The Secretary will deliver all shareholder communications directly to the Board for consideration.

THANK YOU FOR YOUR SERVICE! 14 Robert Kurtz Director

15 BOARD OF DIRECTORS & MANAGEMENT Note: Excludes Robert Kurtz who is retiring from the Board in June 2020 Directors Directors Management Team & Associates Carissa Rodeheaver Chief Executive Officer & Chair Elaine McDonald Independent Director R.L. Fisher SVP & Chief Revenue Officer John McCullough Lead Director (Nom/ Gov Chair) Gary Ruddell Independent Director Jason Rush SVP & Chief Operations Officer John Barr Independent Director Irvin Robert Rudy Independent Director Keith Sanders SVP & Chief Wealth Officer Brian Boal Independent Director (Audit Chair) Marisa Shockley Independent Director Tonya Sturm SVP & Chief Financial Officer M Kathryn Burkey Independent Director (Comp Chair) Hoye Andrew Walls III Independent Director First United Associates

“My bank is First United!” 16 Thank You!

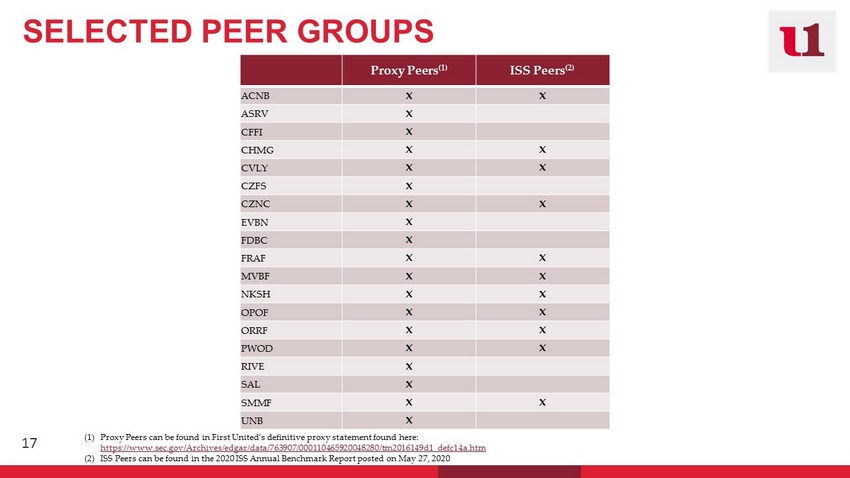

17 SELECTED PEER GROUPS (1) Proxy Peers can be found in First United’s definitive proxy statement found here: https://www.sec.gov/Archives/edgar/data/763907/000110465920048280/tm2016149d1_defc14a.htm (2) ISS Peers can be found in the 2020 ISS Annual Benchmark Report posted on May 27, 2020 Proxy Peers (1) ISS Peers (2) ACNB X X ASRV X CFFI X CHMG X X CVLY X X CZFS X CZNC X X EVBN X FDBC X FRAF X X MVBF X X NKSH X X OPOF X X ORRF X X PWOD X X RIVE X SAL X SMMF X X UNB X