Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DANA INC | d937880d8k.htm |

Deutsche Bank Global Automotive Industry Conference June 10, 2020 James Kamsickas Chairman and Chief Executive Officer Jonathan Collins Executive Vice President and Chief Financial Officer Exhibit 99.1

Certain statements and projections contained in this presentation are, by their nature, forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on our current expectations, estimates and projections about our industry and business, management’s beliefs, and certain assumptions made by us, all of which are subject to change. Forward-looking statements can often be identified by words such as “anticipates,” “expects,” “intends,” “plans,” “predicts,” “believes,” “seeks,” “estimates,” “may,” “will,” “should,” “would,” “could,” “potential,” “continue,” “ongoing,” similar expressions, and variations or negatives of these words. These forward-looking statements are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause our actual results to differ materially and adversely from those expressed in any forward-looking statement. Dana’s Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q, recent Current Reports on Form 8-K, and other Securities and Exchange Commission filings discuss important risk factors that could affect our business, results of operations and financial condition. The forward-looking statements in this presentation speak only as of this date. Dana does not undertake any obligation to revise or update publicly any forward-looking statement for any reason. Safe Harbor Statement

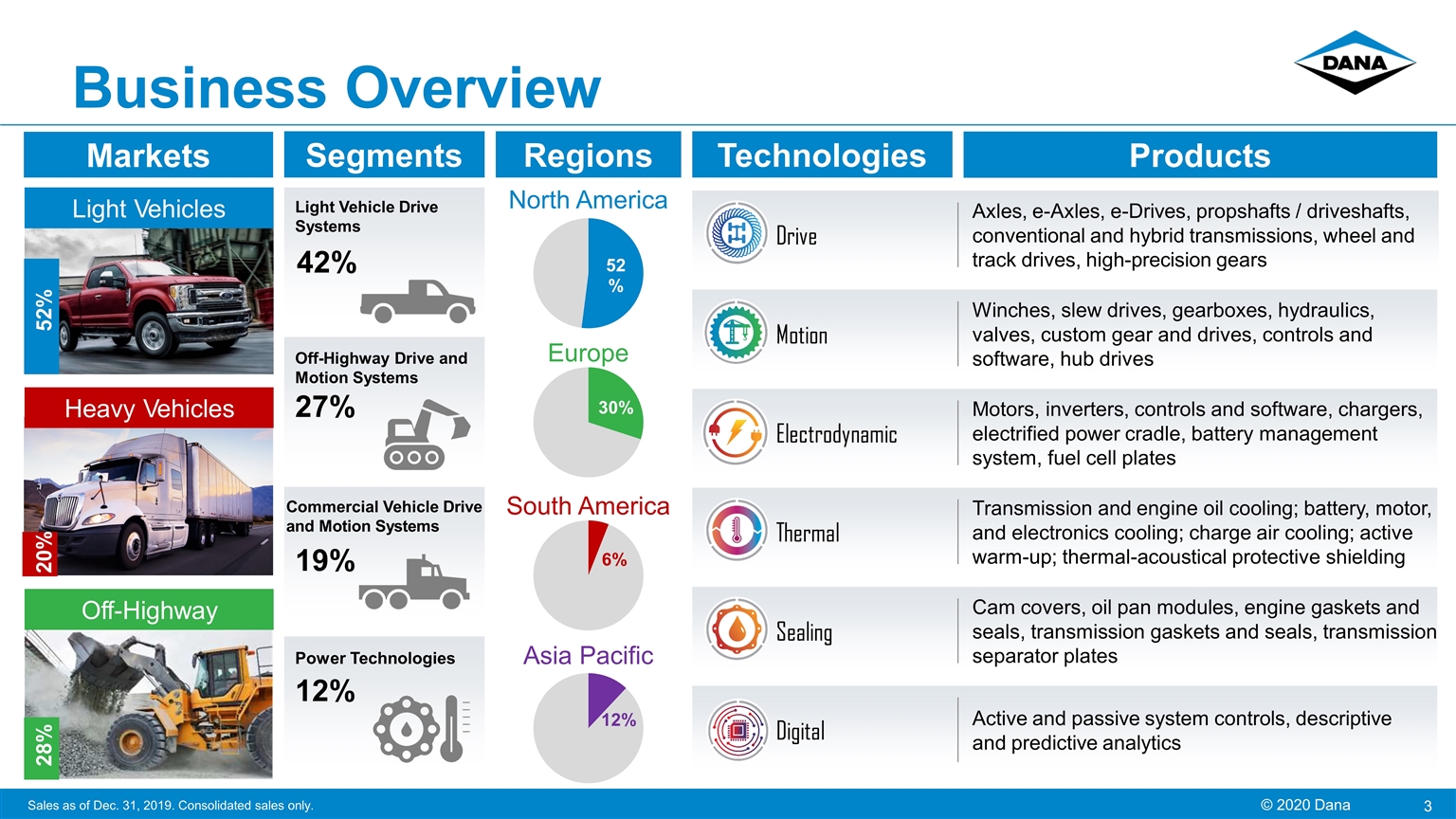

Business Overview Technologies Drive Axles, e-Axles, e-Drives, propshafts / driveshafts, conventional and hybrid transmissions, wheel and track drives, high-precision gears Motion Winches, slew drives, gearboxes, hydraulics, valves, custom gear and drives, controls and software, hub drives Sealing Cam covers, oil pan modules, engine gaskets and seals, transmission gaskets and seals, transmission separator plates Thermal Transmission and engine oil cooling; battery, motor, and electronics cooling; charge air cooling; active warm-up; thermal-acoustical protective shielding Digital Active and passive system controls, descriptive and predictive analytics Electrodynamic Motors, inverters, controls and software, chargers, electrified power cradle, battery management system, fuel cell plates Products Segments 19% Light Vehicle Drive Systems 42% Power Technologies 12% 27% Off-Highway Drive and Motion Systems Regions North America South America Europe Asia Pacific Markets Heavy Vehicles Light Vehicles Off-Highway 52% 20% 28% Sales as of Dec. 31, 2019. Consolidated sales only. Commercial Vehicle Drive and Motion Systems

Pandemic Response Priorities Employees Communities Customers Future Protecting our…

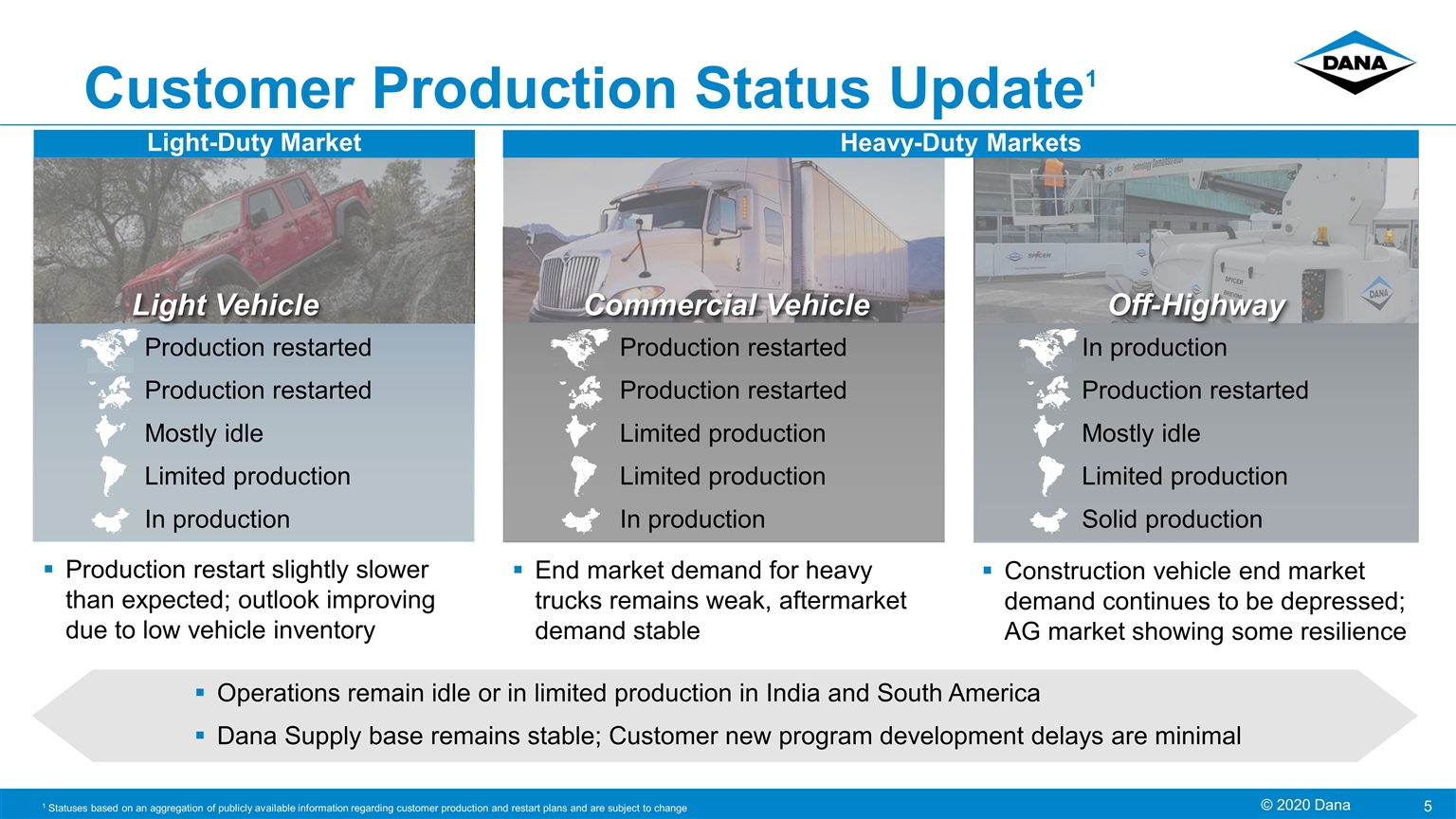

Customer Production Status Update1 Light Vehicle Off-Highway Commercial Vehicle Heavy-Duty Markets 1 Statuses based on an aggregation of publicly available information regarding customer production and restart plans and are subject to change Light-Duty Market Production restarted Production restarted Mostly idle Limited production In production Production restarted Production restarted Limited production Limited production In production In production Production restarted Mostly idle Limited production Solid production Operations remain idle or in limited production in India and South America Dana Supply base remains stable; Customer new program development delays are minimal Production restart slightly slower than expected; outlook improving due to low vehicle inventory End market demand for heavy trucks remains weak, aftermarket demand stable Construction vehicle end market demand continues to be depressed; AG market showing some resilience

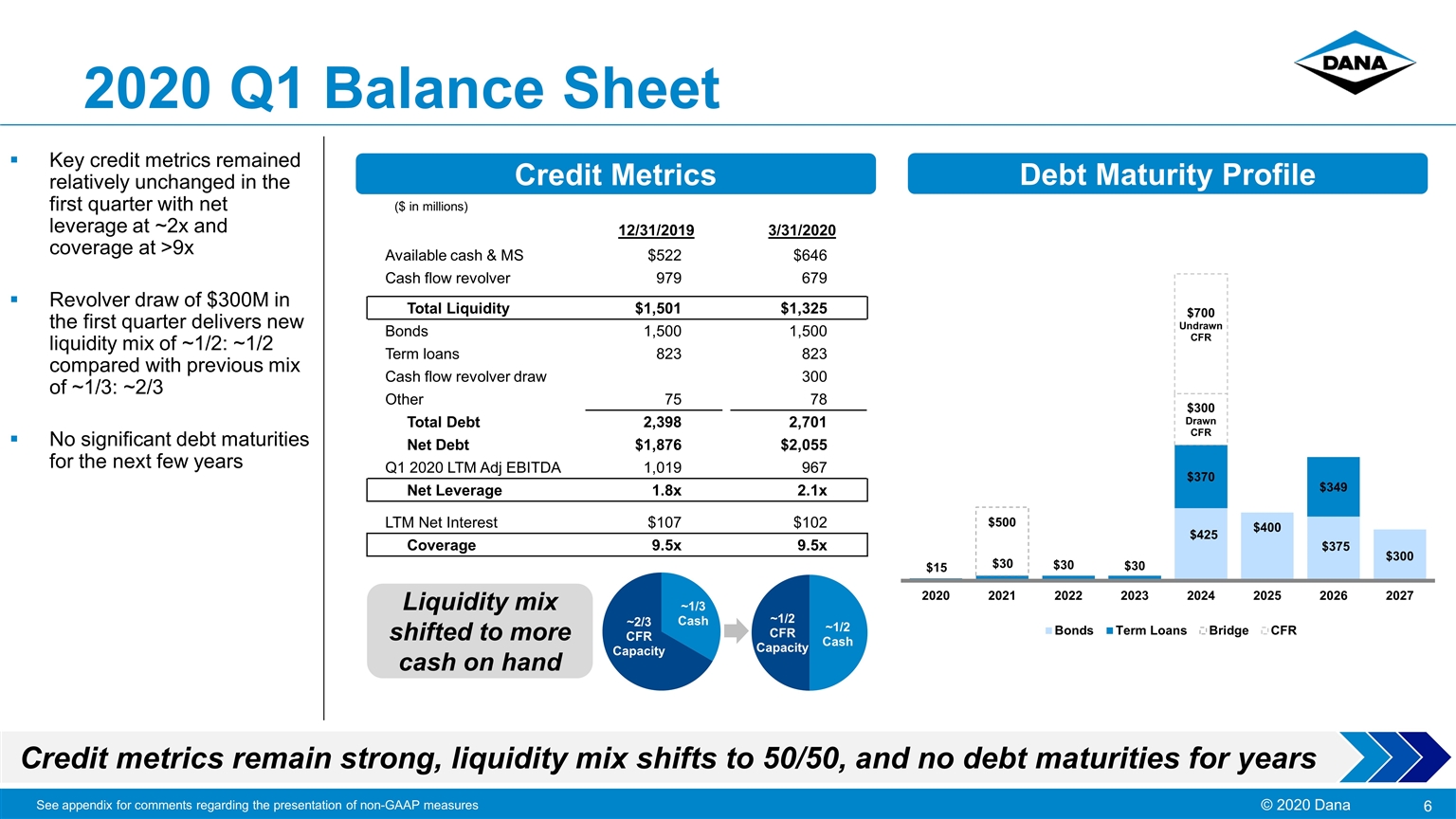

2020 Q1 Balance Sheet Key credit metrics remained relatively unchanged in the first quarter with net leverage at ~2x and coverage at >9x Revolver draw of $300M in the first quarter delivers new liquidity mix of ~1/2: ~1/2 compared with previous mix of ~1/3: ~2/3 No significant debt maturities for the next few years Credit metrics remain strong, liquidity mix shifts to 50/50, and no debt maturities for years 12/31/2019 3/31/2020 Available cash & MS $522 $646 Cash flow revolver 979 679 Total Liquidity $1,501 $1,325 Bonds 1,500 1,500 Term loans 823 823 Cash flow revolver draw 300 Other 75 78 Total Debt 2,398 2,701 Net Debt $1,876 $2,055 Q1 2020 LTM Adj EBITDA 1,019 967 Net Leverage 1.8x 2.1x LTM Net Interest $107 $102 Coverage 9.5x 9.5x See appendix for comments regarding the presentation of non-GAAP measures Credit Metrics Debt Maturity Profile Liquidity mix shifted to more cash on hand ($ in millions)

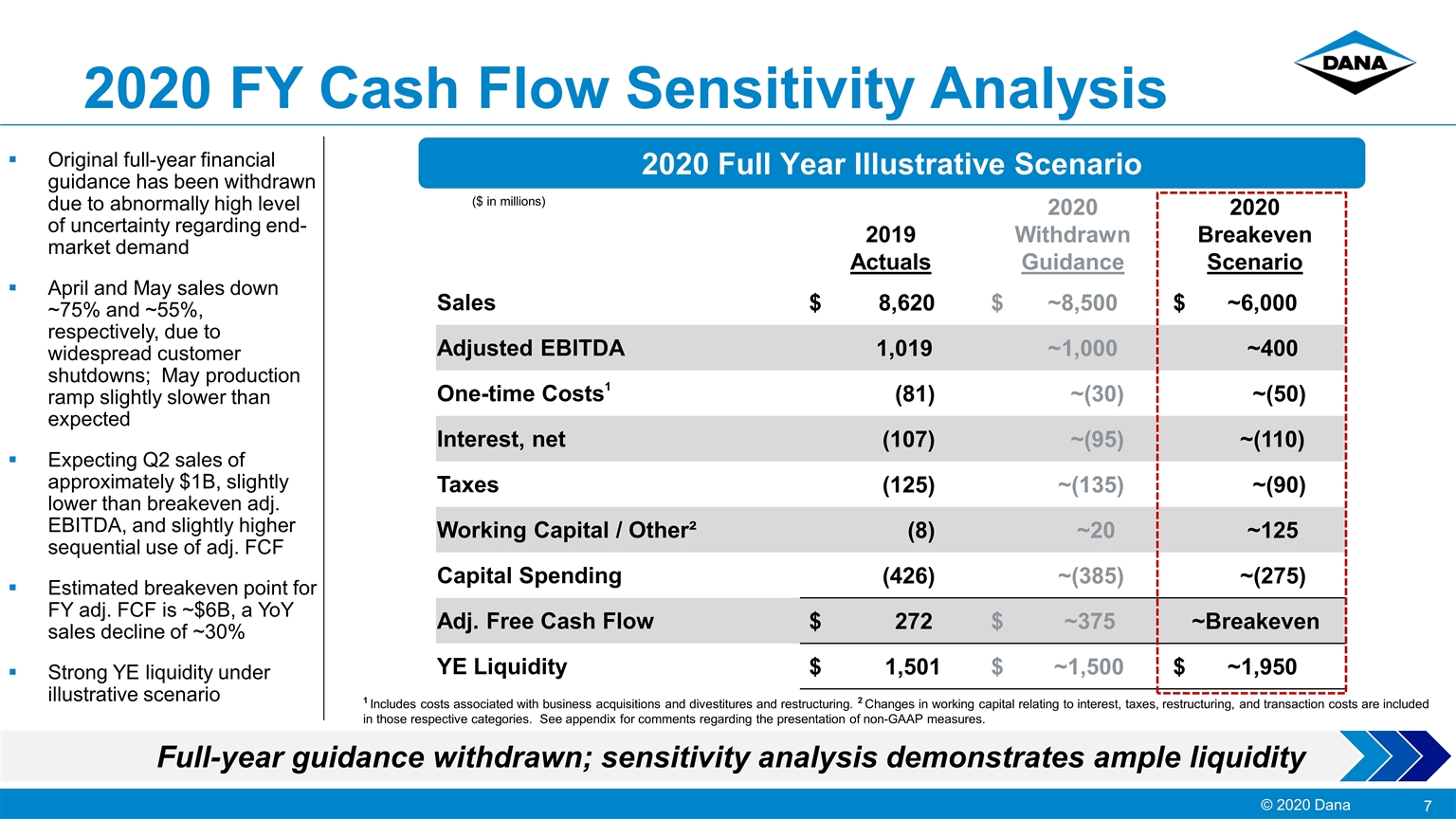

2020 FY Cash Flow Sensitivity Analysis Original full-year financial guidance has been withdrawn due to abnormally high level of uncertainty regarding end- market demand April and May sales down ~75% and ~55%, respectively, due to widespread customer shutdowns; May production ramp slightly slower than expected Expecting Q2 sales of approximately $1B, slightly lower than breakeven adj. EBITDA, and slightly higher sequential use of adj. FCF Estimated breakeven point for FY adj. FCF is ~$6B, a YoY sales decline of ~30% Strong YE liquidity under illustrative scenario 2020 Full Year Illustrative Scenario Full-year guidance withdrawn; sensitivity analysis demonstrates ample liquidity 1 Includes costs associated with business acquisitions and divestitures and restructuring. 2 Changes in working capital relating to interest, taxes, restructuring, and transaction costs are included in those respective categories. See appendix for comments regarding the presentation of non-GAAP measures. 2019 Actuals 2020 Withdrawn Guidance 2020 Breakeven Scenario Sales $ 8,620 $ ~8,500 $ ~6,000 Adjusted EBITDA 1,019 ~1,000 ~400 One-time Costs1 (81) ~(30) ~(50) Interest, net (107) ~(95) ~(110) Taxes (125) ~(135) ~(90) Working Capital / Other² (8) ~20 ~125 Capital Spending (426) ~(385) ~(275) Adj. Free Cash Flow $ 272 $ ~375 ~Breakeven YE Liquidity $ 1,501 $ ~1,500 $ ~1,950 ($ in millions)

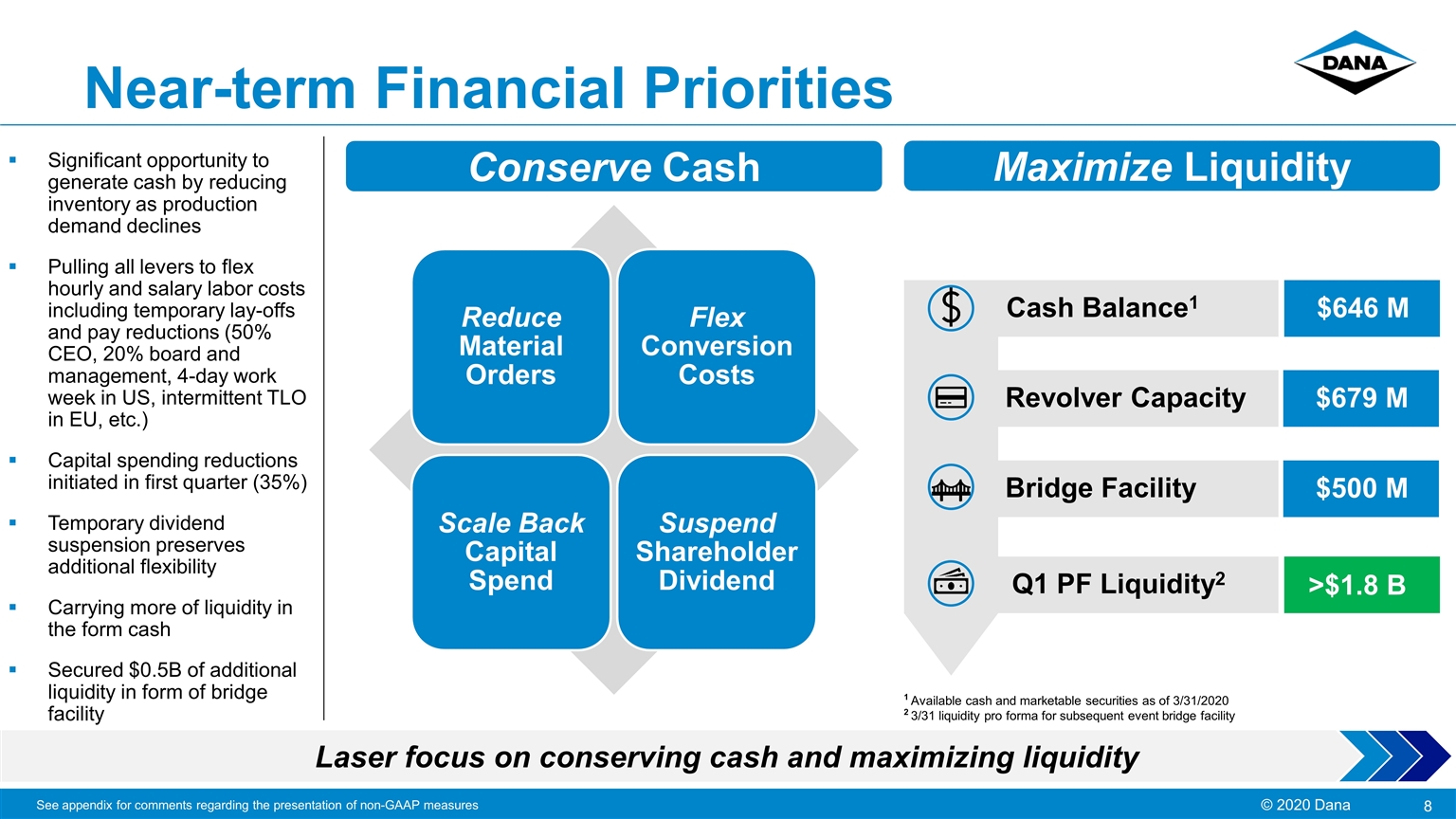

Near-term Financial Priorities See appendix for comments regarding the presentation of non-GAAP measures Significant opportunity to generate cash by reducing inventory as production demand declines Pulling all levers to flex hourly and salary labor costs including temporary lay-offs and pay reductions (50% CEO, 20% board and management, 4-day work week in US, intermittent TLO in EU, etc.) Capital spending reductions initiated in first quarter (35%) Temporary dividend suspension preserves additional flexibility Carrying more of liquidity in the form cash Secured $0.5B of additional liquidity in form of bridge facility Laser focus on conserving cash and maximizing liquidity Maximize Liquidity Cash Balance1 $646 M Revolver Capacity $679 M Bridge Facility $500 M Q1 PF Liquidity2 >$1.8 B 1 Available cash and marketable securities as of 3/31/2020 2 3/31 liquidity pro forma for subsequent event bridge facility Conserve Cash Reduce Material Orders Flex Conversion Costs Scale Back Capital Spend Suspend Shareholder Dividend

Adjusted EBITDA is a non-GAAP financial measure which we have defined as net income before interest, income taxes, depreciation, amortization, equity grant expense, restructuring expense, non-service cost components of pension and other postretirement benefit costs and other adjustments not related to our core operations (gain/loss on debt extinguishment, pension settlements, divestitures, impairment, etc.). Adjusted EBITDA is a measure of our ability to maintain and continue to invest in our operations and provide shareholder returns. We use adjusted EBITDA in assessing the effectiveness of our business strategies, evaluating and pricing potential acquisitions and as a factor in making incentive compensation decisions. In addition to its use by management, we also believe adjusted EBITDA is a measure widely used by securities analysts, investors and others to evaluate financial performance of our company relative to other Tier 1 automotive suppliers. Adjusted EBITDA should not be considered a substitute for earnings before income taxes, net income or other results reported in accordance with GAAP. Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies. Diluted adjusted EPS is a non-GAAP financial measure which we have defined as adjusted net income divided by adjusted diluted shares. We define adjusted net income as net income attributable to the parent company, excluding any nonrecurring income tax items, restructuring charges, amortization expense and other adjustments not related to our core operations (as used in adjusted EBITDA), net of any associated income tax effects. We define adjusted diluted shares as diluted shares as determined in accordance with GAAP based on adjusted net income. This measure is considered useful for purposes of providing investors, analysts and other interested parties with an indicator of ongoing financial performance that provides enhanced comparability to EPS reported by other companies. Diluted adjusted EPS is neither intended to represent nor be an alternative measure to diluted EPS reported in accordance with GAAP. Free cash flow is a non-GAAP financial measure which we have defined as net cash provided by (used in) operating activities less purchases of property, plant and equipment. Adjusted free cash flow is a non-GAAP financial measure which we have defined as net cash provided by (used in) operating activities excluding discretionary pension contributions less purchases of property, plant and equipment. We believe these measures are useful to investors in evaluating the operational cash flow of the company inclusive of the spending required to maintain the operations. Free cash flow and adjusted free cash flow are not intended to represent nor be an alternative to the measure of net cash provided by (used in) operating activities reported in accordance with GAAP. Free cash flow and adjusted free cash flow may not be comparable to similarly titled measures reported by other companies. The accompanying financial information provides reconciliations of adjusted EBITDA, diluted adjusted EPS, free cash flow and adjusted free cash flow to the most directly comparable financial measures calculated and presented in accordance with GAAP. We have not provided a reconciliation of our adjusted EBITDA and diluted adjusted EPS outlook to the most comparable GAAP measures of net income (loss) and diluted EPS. Providing net income (loss) and diluted EPS guidance is potentially misleading and not practical given the difficulty of projecting event driven transactional and other non-core operating items that are included in net income (loss) and diluted EPS, including restructuring actions, asset impairments and certain income tax adjustments. The accompanying reconciliations of these non-GAAP measures with the most comparable GAAP measures for the historical periods presented are indicative of the reconciliations that will be prepared upon completion of the periods covered by the non-GAAP guidance. Non-GAAP Financial Information