Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CENTRAL PACIFIC FINANCIAL CORP | cpf-20200609.htm |

PAUL YONAMINE A. CATHERINEChief Executive Officer NGO President & Chief Executive Officer CATHERINE NGO DAVIDPresident S. MORIMOTO Executive Vice President & Chief FinancialDAVID Officer MORIMOTO Chief Financial Officer AUGUST 2018 ANNA HU Chief Credit Officer JUNE 2020

FORWARD LOOKING STATEMENTS This document may contain forward-looking statements concerning: projections of revenues, expenses, income or loss, earnings or loss per share, capital expenditures, the payment or nonpayment of dividends, capital position, net interest margin or other financial items; statements of plans, objectives and expectations of Central Pacific Financial Corp. or its management or Board of Directors, including those relating to business plans, use of capital resources, products or services and regulatory developments and regulatory actions; statements of future economic performance including anticipated performance results from our RISE2020 initiative; or any statements of the assumptions underlying or relating to any of the foregoing. Words such as "believes," "plans," "anticipates," "expects," "intends," "forecasts," "hopes," "targeting," "continue," "remain," "will," "should," "estimates," "may" and other similar expressions are intended to identify forward- looking statements but are not the exclusive means of identifying such statements. While we believe that our forward-looking statements and the assumptions underlying them are reasonably based, such statements and assumptions are by their nature subject to risks and uncertainties, and thus could later prove to be inaccurate or incorrect. Accordingly, actual results could differ materially from those statements or projections for a variety of reasons, including, but not limited to: the adverse effects of the COVID-19 pandemic virus on local, national and international economies, including, but not limited to, the adverse impact on tourism and construction in the State of Hawaii, our borrowers, customers, third-party contractors, vendors and employees as well as the effects of government programs and initiatives in response to COVID-19; the increase in inventory or adverse conditions in the real estate market and deterioration in the construction industry; adverse changes in the financial performance and/or condition of our borrowers and, as a result, increased loan delinquency rates, deterioration in asset quality, and losses in our loan portfolio; our ability to successfully implement our RISE2020 initiative; the impact of local, national, and international economies and events (including natural disasters such as wildfires, volcanic eruptions, hurricanes, tsunamis, storms, earthquakes and pandemic virus and disease, including COVID-19) on the Company's business and operations and on tourism, the military, and other major industries operating within the Hawaii market and any other markets in which the Company does business; deterioration or malaise in domestic economic conditions, including any destabilization in the financial industry and deterioration of the real estate market, as well as the impact of declining levels of consumer and business confidence in the state of the economy in general and in financial institutions in particular; changes in estimates of future reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements; the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act"), changes in capital standards, other regulatory reform and federal and state legislation, including but not limited to regulations promulgated by the Consumer Financial Protection Bureau (the "CFPB"), government-sponsored enterprise reform, and any related rules and regulations which affect our business operations and competitiveness; the costs and effects of legal and regulatory developments, including legal proceedings or regulatory or other governmental inquiries and proceedings and the resolution thereof, the results of regulatory examinations or reviews and the effect of, and our ability to comply with, any regulatory orders or actions we are or may become subject to; ability to successfully implement our initiatives to lower our efficiency ratio; the effects of and changes in trade, monetary and fiscal policies and laws, including the interest rate policies of the Board of Governors of the Federal Reserve System (the "FRB" or the "Federal Reserve"); inflation, interest rate, securities market and monetary fluctuations, including the anticipated replacement of the London Interbank Offered Rate ("LIBOR") Index and the impact on our loans and debt which are tied to that index; negative trends in our market capitalization and adverse changes in the price of the Company's common stock; political instability; acts of war or terrorism; pandemic virus and disease, including COVID-19; changes in consumer spending, borrowings and savings habits; failure to maintain effective internal control over financial reporting or disclosure controls and procedures; cybersecurity and data privacy breaches and the consequence therefrom; the ability to address deficiencies in our internal controls over financial reporting or disclosure controls and procedures; technological changes and developments; changes in the competitive environment among financial holding companies and other financial service providers; the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight Board, the Financial Accounting Standards Board ("FASB") and other accounting standard setters and the cost and resources required to implement such changes; our ability to attract and retain key personnel; changes in our organization, compensation and benefit plans; and our success at managing the risks involved in the foregoing items. For further information with respect to factors that could cause actual results to materially differ from the expectations or projections stated in the forward-looking statements, please see the Company's publicly available Securities and Exchange Commission filings, including the Company's Form 10-K for the last fiscal year and, in particular, the discussion of "Risk Factors" set forth therein. We urge investors to consider all of these factors carefully in evaluating the forward-looking statements contained in this Form 8-K. Forward-looking statements speak only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which such statement is made, or to reflect the occurrence of unanticipated events except as required by law. 2

COVID-19 SUPPORT EMPLOYEES CUSTOMERS COMMUNITY • Work from home with • Loan payment • CPB Foundation is 70% of all employees deferrals and supporting the setup on VPN mortgage community with forbearance successful initiatives • Temporarily closed including: smaller footprint • ~6,800 PPP loans branches for totaling over $530 • “Keep Hawaii increased social million* Cooking” initiative distancing donated $300,000 to • Active outreach to subsidize 10,000 • Employees larger borrowers to meals from local redeployed to assist help them through restaurants with high volume the COVID lockdown areas • “Mahalo Meals” is • Increased daily limits providing meals to • Plan to re-open on mobile deposits frontline heroes closed branches and debit cards during the pandemic starting in June 2020 3 * Data as of May 27, 2020

EXPERIENCED & PREPARED LEADERSHIP Paul Yonamine Catherine Ngo Chairman & CEO President • Over 40 years of executive • Over 27 years of banking management experience experience • As President of IBM Japan, led the • Joined CPF/CPB in 2010 and Company through the 2011 helped lead the Company through Tohoku earthquake, tsunami and its financial turnaround following radiation after-effects. the Great Recession. • Led Bearing Point Asia Pacific through the SARS outbreak in 2002-2004. David Morimoto Anna Hu Executive Vice President & Executive Vice President & Chief Financial Officer Chief Credit Officer • Over 28 years of banking • Over 28 years of banking experience with CPF/CPB experience • Helped lead the Company through • Extensive credit risk and lending its financial turnaround following experience, including the the Great Recession. management of special credits at CPB and another large local bank. 4

Paul Yonamine, CREATING VALUE BEYOND BANKING CEO, advocating to the HI State Senate for a “Travel Safety Bubble” with Japan 5

FIRST QUARTER 2020 HIGHLIGHTS • Quarterly results impacted by Net Income $8 Million new CECL accounting standard and declining economic conditions Diluted EPS $0.29 • Pre-tax, Pre-provision earnings remained strong Pre-Tax, $21 Million Pre-Provision • Solid liquidity and capital; Earnings balance sheet well-positioned • Committed to supporting our Loan Growth +$63 Million +1.4% employees, customers and community Net Interest 3.43% Margin 6

SHAREHOLDER VALUE DRIVERS 1 RISE2020 STRENGTH IN HAWAII SOLID CAPITAL, INVESTING TARGET NICHE MARKET & LIQUIDITY AND FOR THE MARKETS & KEY POSITION CREDIT FUTURE PRODUCT OFFERINGS 7

• Best-in-class online and • Best-in-class small mobile banking business and cash platforms 1 management products DIGITAL • cpb.bank website REVENUE • Japan business BANKING ENHANCEMENTS development • Digital marketing, data 2 analytics and mining • Enterprise-wide sales management tools • Co-working areas and • End-to-end commercial community meeting loan origination system space • Outsourced residential • Transformed branches BRANCH OPERATIONAL mortgage loan servicing and ATMs TRANSFORMATION EXCELLENCE • Operational efficiencies • CPB Lab for innovation leveraging technology and testing 8

COVID-19 IMPACT ON CUSTOMER BEHAVIOR . COVID-19 accelerated the migration to digital banking COVID-19 Impact 1/3 . Strong momentum and ideal timing branches closed for the RISE2020 digital banking strategy new product launch in Summer 2020 9

SHAREHOLDER VALUE DRIVERS 1 RISE2020 STRENGTH IN HAWAII SOLID CAPITAL, INVESTING TARGET NICHE MARKET & LIQUIDITY AND FOR THE MARKETS & KEY POSITION CREDIT FUTURE PRODUCT OFFERINGS 10

TARGET NICHE MARKET OPPORTUNITIES . SBA Lender of the Year Category II, 7 years SMALL in a row, with more loans originated than the BUSINESSES 3 other large Hawaii banks combined CPB leads the Hawaii . Relationships with physician and dental Small Business market organizations and schools have been successful in growing market share . CPB’s timely and successful support of local businesses with PPP lending brought many new business relationships and growth opportunities JAPAN BUSINESS . Agreements with Hokuyo Bank and TSUBASA DEVELOPMENT Alliance of Japan for relationship development and two-way referral of business Relationships with significant Japanese banks . Japan Bank Advisors assist in identifying, provides unique developing and growing business opportunities opportunity between Hawaii and Japan 11

SMALL BUSINESS ONLINE BANKING PRODUCT . Valuable tool for small businesses to automate banking transactions and processing . Multi-user logins . Mobile functionality . No monthly fees . Strong and consistent client enrollments since product launch in July 2016 12

FLAGSHIP DEPOSIT PRODUCT- EXCEPTIONAL PLAN Plan links personal deposit accounts with a combined minimum balance of $10,000 and offers numerous free benefits and services to the customer. PRODUCT SUMMARY* CUSTOMER BENEFITS Total Balances $1.4 Billion ATM fees waived Wtd Avg Rate 0.06% Free checks Free notary Free safe deposit box No wire fees Preferred Platinum Debit MasterCard Mobile banking Online Bill Pay 13 * Balances and rates as of May 27, 2020

SHAREHOLDER VALUE DRIVERS 1 RISE2020 STRENGTH IN HAWAII SOLID CAPITAL, INVESTING TARGET NICHE MARKET & LIQUIDITY AND FOR THE MARKETS & KEY CPF POSITION CREDIT FUTURE PRODUCT OFFERINGS 14

RESILIENT HAWAII MARKET $789K STRENGTHS AND RECOVERY FACTORS • 2nd lowest COVID-19 infection rate in • While tourism drives ~20% of GDP, the US with only 644 confirmed government/defense and real estate makes cases*; a safe place to travel up another ~40% of GDP • Restarting tourism in summer with • Construction and development in Hawaii potential “travel bubbles” between continues through the pandemic certain Asian countries • Housing prices remained strong through past downturns 15 * As of May 27, 2020

ATTRACTIVE POSITION IN HAWAII MARKET LARGE SMALL INSTITUTIONS INSTITUTIONS . First Hawaiian Bank . Territorial Savings . $21B total assets . $2B total assets . . 58 branches $6.1B total assets . 30 branches . 35 branches . Bank of Hawaii . Hawaii National Bank . $19B total assets . $0.7B total assets . 66 branches Large enough to serve . 14 branches most Hawai'i customers. . American Savings . Finance Factors Bank Small enough to provide . $0.6B total assets . $7B total assets differentiated service. . 13 branches . 50 branches Note: Peer Bank data as of March 31, 2020, source: S&P Global. 16

SHAREHOLDER VALUE DRIVERS 1 RISE2020 STRENGTH IN HAWAII SOLID CAPITAL, INVESTING TARGET NICHE MARKET & LIQUIDITY AND FOR THE MARKETS & KEY POSITION CREDIT FUTURE PRODUCT OFFERINGS 17

SOLID CAPITAL & LIQUIDITY POSITION Regulatory Capital Ratios As of March 31, 2020 STRONG CAPITAL . $150 million capital cushion to the 16.0% 13.4% Total well-capitalized Total RBC minimum of 14.0% RBC 10% at 3/31/20 Tier 2 1.1% 12.0% 1.0% . 1Q2020 PTPP earnings of $21 million Tier 1 10.0% . 8.0% Estimated PPP fee income of $21 million CET1 6.0% 11.3% 9.5% AMPLE LIQUIDITY 4.0% 8.9% . At 3/31/20, over $2 billion in 2.0% alternative sources of liquidity from 0.0% the FHLB/FRB and $0.6 billion in Risk-based Tier 1 TCE Capital Leverage unpledged investment securities 18

STRONG CREDIT METRICS Allowance for Credit Losses Delinquencies (ACL) Past Due 90+ Days $65 1.90% CECL 0.50% $5 $60 1.70% $55 0.40% $4 Incurred Loss Method 1.50% $50 0.30% $3 1.30% $45 $40 1.10% 0.20% $2 $35 0.90% $30 0.10% $1 0.70% $25 0.00% $0 0.50% $20 1Q19 2Q19 3Q19 4Q19 1Q20 1Q19 2Q19 3Q19 4Q19 1Q20 Delinquencies in $ Millions (right) ACL in $ Millions (right) ACL/Total Loans (left) Delinquency Ratio (left) Non-Performing Loans Net Charge-Offs 0.50% $5 0.50% $5 0.40% $4 0.40% $4 0.30% $3 0.30% $3 0.20% $2 0.20% $2 0.10% $1 0.10% $1 0.00% $0 0.00% $0 1Q19 2Q19 3Q19 4Q19 1Q20 1Q19 2Q19 3Q19 4Q19 1Q20 Net Charge-offs in $ Millions (right) NPLs in $ Millions (right) NPL ratio (left) NCO/Avg Loans (left) 19

SHAREHOLDER VALUE DRIVERS 1 RISE2020 STRENGTH IN HAWAII SOLID CAPITAL, INVESTING TARGET NICHE MARKET & LIQUIDITY AND FOR THE MARKETS & KEY POSITION CREDIT FUTURE PRODUCT OFFERINGS 20

A. CATHERINE NGO President & Chief Executive Officer DAVIDAPPENDIX S. MORIMOTO Executive Vice President & Chief Financial Officer AUGUST 2018 21

TOTAL LOAN PORTFOLIO Total Loan Portfolio of $4,512MM Outstanding Balance as of 3/31/20 Loan Portfolio Highlights $ in Millions • Diversified Loan Portfolio Commercial & – 40% Commercial Consumer Industrial – 60% Consumer $560 / 13% $575 / 13% Construction • Predominantly Hawaii $101 / 2% CRE - Investor Focused $903 / 20% – 88% Hawaii – 12% Mainland • 75% Real Estate Secured • Conservative Loan Portfolio CRE - Owner Occupied $236 / 5% Residential Home Equity $1,632 / 36% $505 / 11% 22

COMMERCIAL & INDUSTRIAL – INDUSTRY COMPOSITION Healthcare Loan Portfolio Details $107 / 19% • Strong borrowers; many are Other essential businesses Industries • Well established, locally $173 / 30% owned and operated by strong management • Borrowers have access to $575MM Retail Trade capital with good liquidity $67 / 12% 13% • Long term relationships averaging 12 years • Granular with average Wholesale Trade outstanding loan amount of $29 / 5% $146,000 Transportation and • Criticized loan exposure of Real Estate and Warehousing 1.3%; majority COVID-19 Rental & Leasing $62 / 11% related $42 / 7% Accommodation Manufacturing $48 / 8% • Total undrawn commitments and Foodservice of $317MM $47 / 8% Other Industries include: Other Services; Professional, Scientific and Technical; Construction; Utilities; Finance and Insurance; Information 23

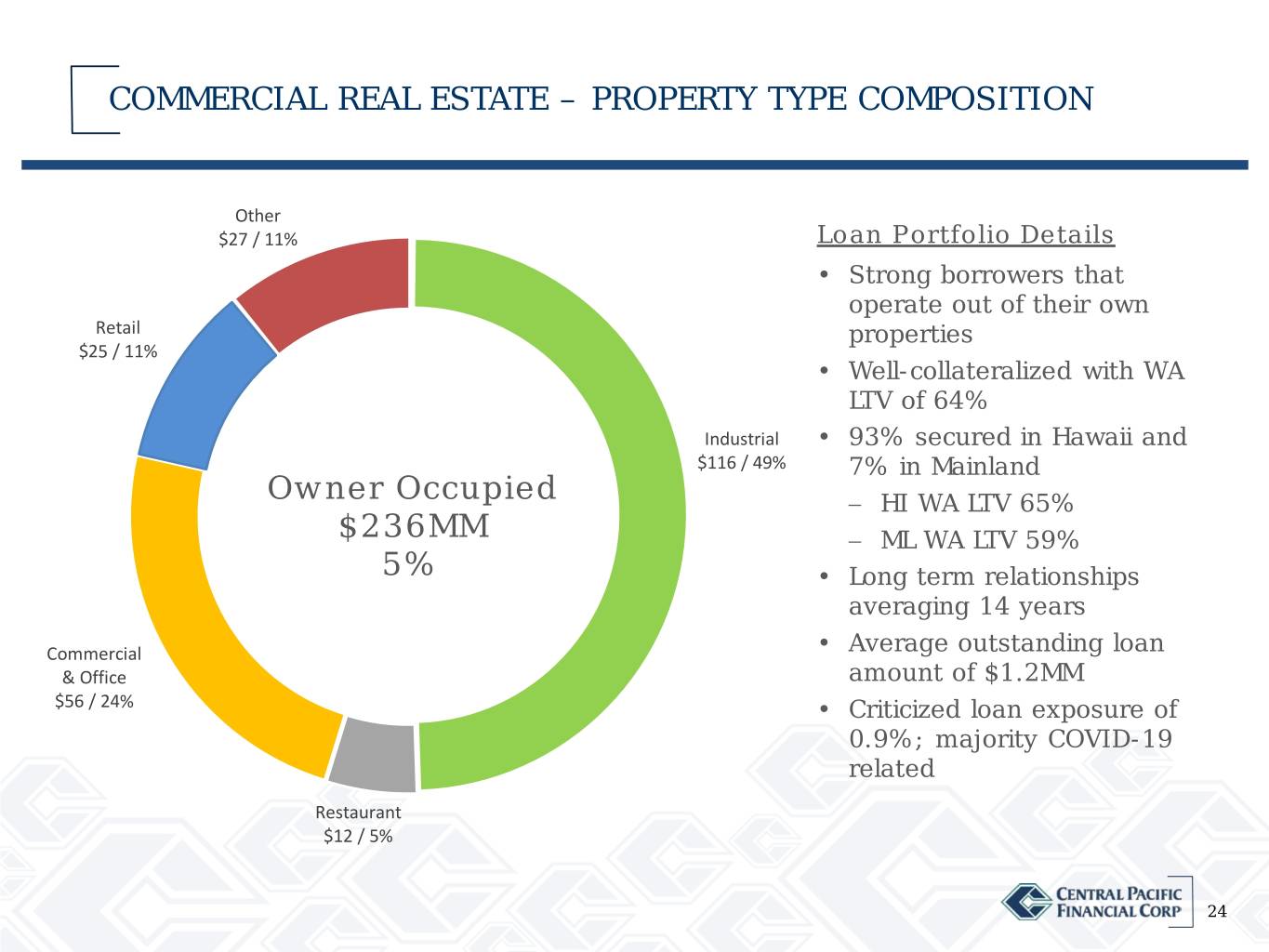

COMMERCIAL REAL ESTATE – PROPERTY TYPE COMPOSITION Other $27 / 11% Loan Portfolio Details • Strong borrowers that operate out of their own Retail properties $25 / 11% • Well-collateralized with WA LTV of 64% Industrial • 93% secured in Hawaii and $116 / 49% 7% in Mainland Owner Occupied − HI WA LTV 65% $236MM − ML WA LTV 59% 5% • Long term relationships averaging 14 years Commercial • Average outstanding loan & Office amount of $1.2MM $56 / 24% • Criticized loan exposure of 0.9%; majority COVID-19 related Restaurant $12 / 5% 24

COMMERCIAL REAL ESTATE – PROPERTY TYPE COMPOSITION Self Storage Other $25 / 3% $23 / 2% Loan Portfolio Details Hotel $59 / 7% • Seasoned real estate investors • Well-collateralized with WA Multi-Family $305 / 34% LTV of 55% • 77% secured in Hawaii and 23% in Mainland/Guam − HI WA LTV 57% Retail Investor − ML/Guam WA LTV 50% $218 / 24% $903MM • Long term relationships 20% averaging 11 years • Average outstanding loan amount of $2.5MM • Criticized loan exposure of 0.7%; majority is COVID-19 related Commercial & Office Industrial $100 / 11% $151 / 17% Restaurant $22 / 2% 25

HIGH RISK INDUSTRIES As of March 31, 2020 $ Millions Outstanding % of total Criticized as a % Balance loans of total loans C&I CRE Healthcare $ 122 2.7% 0.1% $ 107 $ 15 Retail Trade $ 90 2.0% 0.3% $ 67 $ 23 Manufacturing $ 71 1.6% 0.4% $ 48 $ 23 Food Service $ 61 1.3% 0.3% $ 47 $ 14 Accommodation $ 59 1.3% 0.2% $ 0 $ 59 Wholesale Trade $ 38 0.8% 0.1% $ 29 $ 9 Total $ 441 9.8% 1.5% $ 298 $ 143 Loan Portfolio Details • Well established, locally owned and operated by strong management • Borrowers have access to capital with good liquidity • Long term relationships averaging 11 years • Granular with average outstanding loan amount of $269,000 • Criticized loan exposure of 1.5%; majority COVID-19 related • Total undrawn commitments of $121MM 26

RESIDENTIAL MORTGAGE Investor & Second Home $318 / 20% Loan Portfolio Details • 100% in Hawaii; 89% on Oahu • 84% of loan balance are loans <$1.0MM • Average outstanding loan amount of $434,000 $1,632MM • WA LTV 60% 36% • WA FICO 779 Owner Occupied $1,314 / 80% 27

HOME EQUITY Investor & Second Home $64 / 13% Loan Portfolio Details • 100% in Hawaii; 85% on Oahu • 54% of loan balance are lines/loans <$250,000 • Average outstanding loan amount of $90,000 52% are 1st mortgages $505MM • • 23% are 2nd mortgages 11% behind CPB 1st mortgage • WA CLTV 58% • WA FICO 786 • Total undrawn commitments of $503MM Owner Occupied $441 / 87% 28

CONSUMER As of March 31, 2020 Loan Portfolio Details $ Millions Outstanding % of total • Hawaii Consumer Balance loans − WA FICO 737 Auto (Hawaii) $ 218 5% Auto (Mainland) 71 2% • Mainland Consumer Total Auto 289 7% − WA FICO 758 Private Banking (Hawaii) 54 1% • Total undrawn commitments Other Consumer (Hawaii) 97 2% of $96MM Other Consumer (Mainland) 120 3% Total Consumer 271 6% Total Auto & Consumer $ 560 13% 29

COVID-19 LOAN DEFERRALS & FORBEARANCE Central Pacific has implemented borrower relief programs to provide assistance to our customers. COML RE AND C&I RESIDENTIAL MORTGAGE • Principal or Principal & Interest • Principal & Interest payment deferrals for 3-6 months are forbearance provided for 3 months. being granted on a case-by-case • $223MM/431 loans were granted basis. deferrals (10% of $2.1B • $300MM/771 loans granted outstanding, including home deferrals (17% of $1.8B equity). outstanding). TOTAL $MM COUNT DEFERRALS CONSUMER Booked $590 5,155 • Principal & Interest payment deferral for 3 months. • $67MM/3,953 loans were Deferrals have been made on granted deferrals (12% of $0.6B approximately 13% of the total loan outstanding). portfolio Note: Deferral data as of May 27, 2020. 30

CORPORATE PROFILE Founded in 1954 by Japanese-American veterans of World War II MARKET INFORMATION NYSE TICKER CPF Over 65 years later, Central Pacific continues Assets $6.1B to work for our customers, shareholders, employees and the community. Market Cap $490 Mil Share Price $17.40 Dividend Yield 5.3% HAWAII FRANCHISE • 35 Central Pacific Bank (CPB) Branches in Hawaii only • 4th largest financial institution in Hawaii 31 Note: Assets as of March 31, 2020. Market cap, share price and dividend yield as of May 27, 2020.

FINANCIAL HIGHLIGHTS QTD YEAR ENDED DECEMBER 31, ($ in millions) 1Q20 2019 2018 2017 2016 2015 Balance Sheet (period end data) Loans and leases $4,512.0 $4,449.5 $4,078.4 $3,770.6 $3,524.9 $3,211.5 Total assets 6,108.5 6,012.7 5,807.0 5,623.7 5,384.2 5,131.3 Total deposits 5,136.1 5,120.0 4,946.5 4,956.4 4,608.2 4,433.4 Total shareholders' equity 533.8 528.5 491.7 500.0 504.7 494.6 Income Statement Net interest income $47.8 $184.1 $173.0 $167.7 $158.0 $149.5 Provision (credit) for credit losses 9.3 6.3 (1.1) (2.7) (5.5) (15.7) Other operating income 8.9 41.8 38.8 36.5 42.3 34.8 Other operating expense 36.2 141.6 134.6 131.1 ** 132.5 ** 126.0 ** Income taxes (benefit) 2.8 19.6 18.8 34.6 *, ** 26.3 ** 28.1 ** Net income 8.3 58.3 59.5 41.2 * 47.0 45.9 Profitability Return on average assets 0.55% 0.99% 1.05% 0.75%* 0.90% 0.92% Return on avg shareholders' equity 6.21% 11.36% 12.22% 8.03%* 9.16% 8.91% Efficiency ratio 63.90% 62.70% 63.59% 64.19%** 66.17% ** 68.34% ** Net interest margin 3.43% 3.35% 3.22% 3.28% 3.27% 3.30% Capital Adequacy (period end data) Leverage capital ratio 9.5% 9.5% 9.9% 10.4% 10.6% 10.7% Total risk-based capital ratio 13.4% 13.6% 14.7% 15.9% 15.5% 15.7% Asset Quality Net loan charge-offs/average loans (annualized) 0.11% 0.15% 0.02% 0.11% 0.03% -0.16% Nonaccrual loans/total loans (period end) 0.08% 0.03% 0.06% 0.07% 0.24% 0.44% * Results were negatively impacted by a one-time $7.4 M charge for the revaluation of our net DTA due to Tax Reform. ** Results have been restated for an accounting policy change for low-income housing tax credit partnerships from the 32 cost method to the proportional amortization method

LOAN PORTFOLIO TREND (2011- Balances Outstanding 1Q 2020) $5,000 8.25 Yr. $4,449$4,512 CAGR $4,500 $4,078 $4,000 $3,771 $3,525 $3,500 $3,212 +11.1% $3,042 $2,932 $3,000 $2,631 $2,500 $2,169 $2,204 $2,064 +19.7% Millions $2,000 $1,500 +15.0% -5.5% $1,000 +6.1% $500 $0 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 1Q20 Comml Mtg Construction C&I Consumer/Other Resi Mtg/Home Equity 33

HAWAII DEPOSIT PRICING ADVANTAGE Total Deposit Cost 2.50% 2.35% 2.00% 1.63% 1.59% 1.50% 1.05% 0.89% 0.94% 1.00% 0.78% 0.81% 1.09% 0.54% 0.52% 0.48% 0.40% 0.36% 0.39% 0.36% 0.50% 0.30% 0.34% 0.33% 0.64% 0.23% 0.14% 0.11% 0.09% 0.09% 0.12% 0.00% 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 1Q20 CPF Peer Note: National peer group is comprised of publicly traded U.S. banks with total assets between $3 and $7 billion (79 banks). Source: S&P Global 34

Non-GAAP Financial Measures- Pre-Tax, Pre-Provision Earnings Three-Months Ended $ Millions % Change Mar. 31, Dec. 31, Mar. 31, 2020 2019 2019 QoQ YoY Net Interest Income $ 47.8 $ 47.9 $ 45.1 0% 6% Other Operating Income 8.9 9.8 11.7 -9% -24% Total Revenue 56.7 57.7 56.8 -2% 0% Other Operating Expense 36.2 36.2 34.4 0% 6% Pre-tax, Pre-provision Earnings 20.5 21.5 22.4 -5% -9% GAAP Net Income 8.3 14.2 16.0 -41% -48% We believe that pre-tax, pre-provision earnings, a non-GAAP financial measure, is useful as a tool to help evaluate the ability to provide for credit costs through operations. 35