Attached files

| file | filename |

|---|---|

| 8-K - 8-K - INVESTOR PRESENTATION JUNE 2020 - Clearwater Paper Corp | a8kinvestordeck.htm |

InvestorInvestor PresentationPresentation JuneJune 2020 2020

FORWARD LOOKING STATEMENTS Cautionary Statement Regarding Forward Looking Statements This presentation of supplemental information contains, in addition to historical information, certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding industry trends and market conditions; near term strategic focus and positioning; our liquidity, capital structure and allocation; our operations; our sustainability efforts; consumer demand projections; the potential and forecasted impact of the Shelby expansion; our transportation and production costs; and paperboard demand. These forward-looking statements are based on management’s current expectations, estimates, assumptions and projections that are subject to change. Our actual results of operations may differ materially from those expressed or implied by the forward-looking statements contained in this presentation. Important factors that could cause or contribute to such differences include the risks and uncertainties described from time to time in the company's public filings with the Securities and Exchange Commission, including but not limited to the following: impact of COVID-19 on our operations and our supplier’s operations and on customer demand; competitive pricing pressures for our products, including as a result of increased capacity as additional manufacturing facilities are operated by our competitors and the impact of foreign currency fluctuations on the pricing of products globally; the loss of, changes in prices in regard to, or reduction in, orders from a significant customer; changes in the cost and availability of wood fiber and wood pulp; changes in transportation costs and disruptions in transportation services; changes in customer product preferences and competitors' product offerings; larger competitors having operational and other advantages; customer acceptance and timing and quantity of purchases of our tissue products, including the existence of sufficient demand for and the quality of tissue produced by our expanded Shelby, North Carolina operations; consolidation and vertical integration of converting operations in the paperboard industry; our ability to successfully implement our operational efficiencies and cost savings strategies, along with related capital projects, and achieve the expected operational or financial results of those projects, including from the continuous digester at our Lewiston, Idaho facility; changes in the U.S. and international economies and in general economic conditions in the regions and industries in which we operate; manufacturing or operating disruptions, including IT system and IT system implementation failures, equipment malfunctions and damage to our manufacturing facilities; cyber-security risks; changes in costs for and availability of packaging supplies, chemicals, energy and maintenance and repairs; labor disruptions; cyclical industry conditions; changes in expenses, required contributions and potential withdrawal costs associated with our pension plans; environmental liabilities or expenditures; reliance on a limited number of third- party suppliers for raw materials; our ability to attract, motivate, train and retain qualified and key personnel; our substantial indebtedness and ability to service our debt obligations; restrictions on our business from debt covenants and terms; negative changes in our credit agency ratings; and changes in laws, regulations or industry standards affecting our business. Forward-looking statements contained in this presentation present management’s views only as of the date of this presentation. We undertake no obligation to publicly update forward-looking statements, to retract future revisions of management's views based on events or circumstances occurring after the date of this presentation. Non-GAAP Financial Measures This presentation includes certain financial measures that exclude or adjust for charges or income associated with special charges or income. The Company’s management believes that the presentation of these financial measures provides useful information to investors because these measures are regularly used by management in assessing the Company’s performance. These financial measures are not calculated in accordance with generally accepted accounting principles in the United States (“GAAP”) and should be considered in addition to results prepared in accordance with GAAP but should not be considered substitutes for or superior to GAAP results. In addition, these non-GAAP financial measures may not be comparable to similarly-titled measures utilized by other companies, since such other companies may not calculate such measure in the same manner as we do. A reconciliation of these measures to the most relevant GAAP measure is available in our latest earnings press release which can be found in the Investors section on the Clearwater Paper website at www.clearwaterpaper.com. Page 2 © Clearwater Paper Corporation 2020

CLEARWATER PAPER – AT A GLANCE TRUSTED PRODUCTS THAT ARE ESSENTIAL IN EVERYDAY LIFE Key Highlights Two Well-Positioned Businesses $1,761M $167M 2019 NET SALES 2019 ADJUSTED EBITDA Adjusted SALES1 44% 47% $478M $55M 56% EBITDA1 53% Q1 2020 NET SALES Q1 2020 ADJUSTED EBITDA National Footprint Supporting Strong Customer Service Consumer Products WA ND MT MN MI ME Tissue manufacturing facilities – 435,000 tons capacity2 ID SD WI OR VT Tissue converting facilities – 432,000 tons capacity2 MI NH WY NY MA IA NE CT RI PA OH Paperboard IL IN NJ NV UT CO WV MDDE KS MO Pulp mills – 904,000 tons capacity2 KY VA CA Bleached paperboard mills – 840,000 tons capacity2 OK TN NC AR AZ NM Sheeted paperboard facilities – 193,000 tons capacity2 SC MS AL GA TX LA Corporate FL Corporate 1 Page 3 Based upon Clearwater Paper Financial Information for Q1 2020, excluding corporate expenses including impact of COVID-19 in results © Clearwater Paper Corporation 2020 2 Capacities listed are as reported in Clearwater Paper Form 10-K for the year ended December 31, 2020

CLEARWATER PAPER VALUE PROPOSITION Well positioned across two attractive businesses Consumer Products: . Leading private brand provider with national scale & superior supply chain performance . Shift to private-branded over branded product continues with long runway . Tissue is need-based and economically resilient Paperboard: . Diversified range of end-markets, well-invested national footprint . Focused on non-integrated customers, with strong service and quality commitment . Well positioned for trends towards sustainable packaging and food service products Near term strategy is to prioritize free cash flow, reduce debt . Deliver benefits from Shelby expansion . Operational improvements . Aggressively manage working capital . Prudent capital allocation Page 4 © Clearwater Paper Corporation 2020

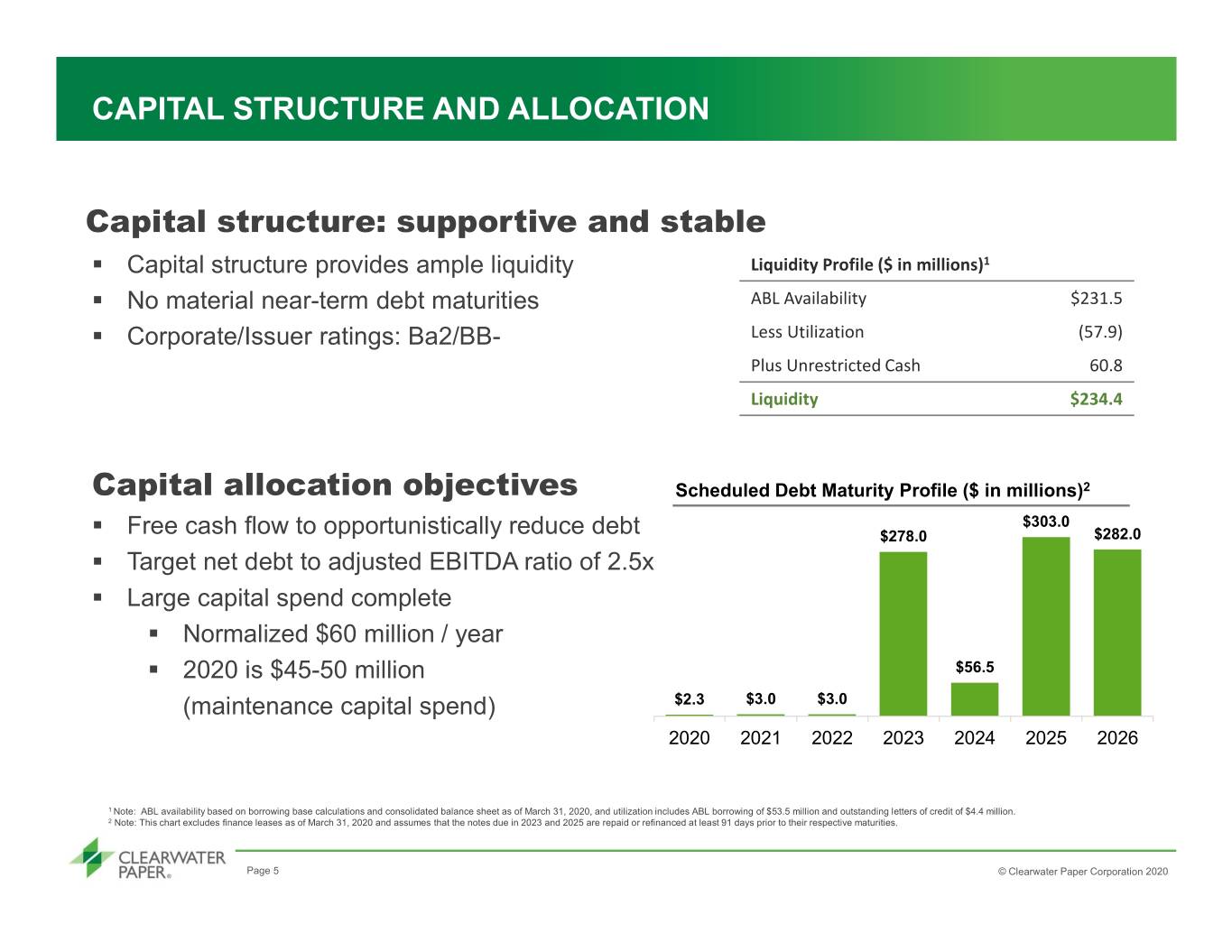

CAPITAL STRUCTURE AND ALLOCATION Capital structure: supportive and stable . Capital structure provides ample liquidity Liquidity Profile ($ in millions)1 . No material near-term debt maturities ABL Availability $231.5 . Corporate/Issuer ratings: Ba2/BB- Less Utilization (57.9) Plus Unrestricted Cash 60.8 Liquidity $234.4 Capital allocation objectives Scheduled Debt Maturity Profile ($ in millions)2 $303.0 . Free cash flow to opportunistically reduce debt $278.0 $282.0 . Target net debt to adjusted EBITDA ratio of 2.5x . Large capital spend complete . Normalized $60 million / year . 2020 is $45-50 million $56.5 (maintenance capital spend) $2.3 $3.0 $3.0 2020 2021 2022 2023 2024 2025 2026 1 Note: ABL availability based on borrowing base calculations and consolidated balance sheet as of March 31, 2020, and utilization includes ABL borrowing of $53.5 million and outstanding letters of credit of $4.4 million. 2 Note: This chart excludes finance leases as of March 31, 2020 and assumes that the notes due in 2023 and 2025 are repaid or refinanced at least 91 days prior to their respective maturities. Page 5 © Clearwater Paper Corporation 2020

SUSTAINABILITY . We have a strong legacy of prioritizing the sustainability of both the products we make and the way we make them. . This positive impact is possible with the commitment of our employees, who continue to take our company to new levels of sustainability performance. . We are committed to using resources efficiently and generating energy from renewable sources. . From our baseline, we have reduced: . Greenhouse gas emissions by 9% . Purchased energy by 10% . Reduced waste-to-landfill by 74% . Water consumption by 13% Please see our Corporate Sustainability report at www.clearwaterpaper.com/sustainability Page 6 © Clearwater Paper Corporation 2020

Consumer Products Division Page 7 © Clearwater Paper Corporation 2020

CLW: CONSUMER PRODUCTS OVERVIEW . Manufactures and sells a complete line of at-home products for retailers . Leader in growing North American private brand tissue segment . Approximately 1/3 of overall tissue market is private brand1 . National footprint allowing for appropriate scale and partnership with major retailers versus competitors who are primarily regional Business Business Description $266M 5 4 1 Q1 2020 NET SALES TISSUE CONVERTING TISSUE MANUFACTURING FACILITIES FACILITIES Metrics 12% 435K 17% Key Operational Operational Key Q1 2020 ADJ. EBITDA TONS OF ANNUAL TISSUE PRIVATE BRAND TONS MARGIN PAPER CAPACITY MARKET SHARE2 Products Parent Rolls Other Consumer Products business produces AFH 4% 1% superior tissue products that match the 5% quality of the leading national brands Clearwater across a wide variety of categories and Tissue retail channels Shipments Overview Retail Q1’20 End-market Q1’20 93% Page 8 1 As reported in Q1, 2020 10Q 2 IRI Panel, Total US All Outlets, Latest 52 weeks ended 4/19/20 © Clearwater Paper Corporation 2020

CONSUMER PRODUCTS INDUSTRY OVERVIEW Industry Overview . U.S. tissue market is comprised of at-home and the away- from-home (AFH) segments Napkins Facial Tissue 4% − At-home segment: bath, paper towels, facial and napkin 9% AFH product categories, purchased by consumers in grocery, 33% North American Tissue U.S. At-Home Tissue Market1 Industry Product dollar, mass merchandisers and club stores Mix2 − AFH segment: tissue for use in commercial locations such Paper Towels as restaurants, hotels and office buildings 33% Bath Tissue At-Home 54% 67% Private Brand Space First Quality . The consumer tissue market is characterized by two types of Others 19% offerings: brand name products and cost-effective private Private Brand Brands 30% 32% 68% brand products U.S. Retail Tissue U.S. Retail Capacity1 Clearwater . Medium and smaller players focus on private brand offerings Tissue Excluding the “Big 16% Market2 3” and offer equivalent products without brand name costs Kruger* 5% . RISI anticipates the private brand share to grow from 32% to APP* 5% Sofidel Cascades 36% of the U.S. retail market by 2026 8% 16% . North American market has room for private brand growth when compared to some European countries, where private brand * Also have branded presence share is over 50% 1 2 Page 9 Based upon RISI Outlook for World Tissue Business Apr 2020 IRI Panel, Total US All Outlets, Latest 52 Weeks Ending 4-19-20 © Clearwater Paper Corporation 2020

DEMAND TRENDS: CONSUMER PRODUCTS Tissue demand grows with population North American Tissue Demand and U.S. Population Growth North American Tissue Demand (Thousands of Tons)1 U.S. Population (mm)2 North American Change in Capacity (Thousands of Tons)3 2003 – 2020E CAGR: 1.7% 2003 – 2020E CAGR: 0.8% 11,000 400 9,817 9,479 9,643 380 10,000 9,087 9,264 8,628 8,804 360 9,000 8,280 8,400 8,515 8,015 8,173 8,015 8,185 340 8,000 320 7,000 300 280 6,000 225 39 171 124 160 260 5,000 197 70 87 68 (14) 90 (114) 240 213 4,000 57 220 3,000 200 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Customer demand continues to shift to private brand Private Brand Market Share Penetration1 50% Quality-driven impact 45% Financial crisis impact 40% 35% 30% 25% 20% 15% % of At-Home Tissue Volume Tissue At-Home % of 10% 5% 0% 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 YTD 2020 ’19&YTD’20 Based on IRI 1 RISI estimates as of Mar of 2020; 2 U.S. Population per U.S. Census December 2010 and latest U.S. Census estimates; 3 RISI US Tissue Monthly Data as of Mar 2020; 4 Equity research Panel Total US MULO Page 10 © Clearwater Paper Corporation 2020

INVESTMENT IN SHELBY, NC Investment Overview . Installation of tissue machine and corresponding converting equipment and warehousing . Located in Shelby, NC, adjacent to existing tissue plant . Completed investment of $420M Investment Benefit Summary Investment Highlights & Progress . More effectively meet customers' growth and execute ultra-quality consumer tissue growth APRIL 2019 2021 plan PRODUCTION STARTUP EXPECTED FULL SHIPMENT RUN-RATE . Helps to geographically overlap various 70 – 75k 50% TONS/YEAR EXPECTED INCREMENTAL CAPACITY quality categories with customers' needs ADDITIONAL CAPACITY FOR GROWTH . Paper machine selected for its technology to $55 - $65M facilitate production of ultra-quality products EXPECTED ANNUAL ADJ. EBITDA BENEFIT and conventional premium products in the East . Fortify East Coast presence and reduce transportation costs of conventional parent rolls from the West Page 11 © Clearwater Paper Corporation 2020

Paperboard Products Division Page 12 © Clearwater Paper Corporation 2020

CLW: PAPERBOARD SEGMENT OVERVIEW . Manufactures and markets premium white SBS paperboard; offers services including custom sheeting and slitting, as well as converting solutions consulting . Focused on diverse North American SBS high-end packaging segments . Top 5 SBS manufacturer in North America Other Business Business Description . Valued by customers for our independent status 2% Clearwater $212M 5 2 Cup and Plate Folding Q1 2020 NET SALES PAPERBOARD SHEETING PULP AND PAPERBOARD 1 Paperboard MILLS MILLS 32% Carton Overview Shipments 59% Metrics 17% 840K 14%* Q1’20 End-market Key Operational Operational Key 2020 ADJ. EBITDA TONS OF ANNUAL SBS NORTH AMERICAN MARGIN PAPER CAPACITY MARKET SHARE Liquid Packaging 7% Award winning innovative brand of multi-layer cupstock, designed to meet customer demand for sustainability and high definition graphics Up to 35% post consumer recycled fiber Forest Stewardship Council® (FSC) Chain of Product Innovation Product Custody certification Paperboard Applications Paperboard Page 13 1 As reported in Q1, 2020 10Q * 2020 RISI Capacity does not include competitor machine curtailments © Clearwater Paper Corporation 2020

PAPERBOARD INDUSTRY OVERVIEW Industry Overview Other . Clearwater Paper operates within the Solid Bleached 4% Liquid Cup and Sulfate (“SBS”) or premium white paperboard segment Packaging Plate SBS of the broader paperboard industry Unbleached 24% 25% 55% Kraft − SBS is a high-performance paperboard grade 26% traditionally manufactured using virgin fiber combined U.S. North American Boxboard 5.3 M Tons Bleached with the kraft bleaching process, resulting in superior Industry* Paperboard Production by cleanliness, print surface, brightness and converting Type* performance Recycled − End uses for SBS are well-established and the most 19% diverse of all boxboard markets Folding Carton 47% Diversified Applications for SBS Paperboard *RISI NA Capacity Report Liquid Packaging & Folding Carton Cup and Plate Specialty . Largest portion of the SBS category within . Clay coated cupstock is converted into . Liquid packaging segment for rigid the U.S. paperboard industry and includes round food containers for packaging containers including juice, milk, wine and some commercial print applications premium ice cream sold in the sake sold in supermarket retail channels supermarket retail channels . Encompasses varying qualities of SBS . Bleached bristols (premium printing paperboard. High-end segment generally . Drink cupstock is converted into hot and heavyweight paper grades serviced with requires a premium print surface to cold cups used in the Quick Serve quick turn in small volumes) for use in package pharmaceuticals, cosmetics and channels postcards, signage and promotional other premium retail goods literature . Traditionally commodity focused, plate . Applications also include frozen foods, segment is the highest growth and . Carded packaging consisting of blister beverages and baked goods diversifying into value-added niches board alternatives typically hung on retail store racks (i.e. batteries and lipstick) Page 14 © Clearwater Paper Corporation 2020

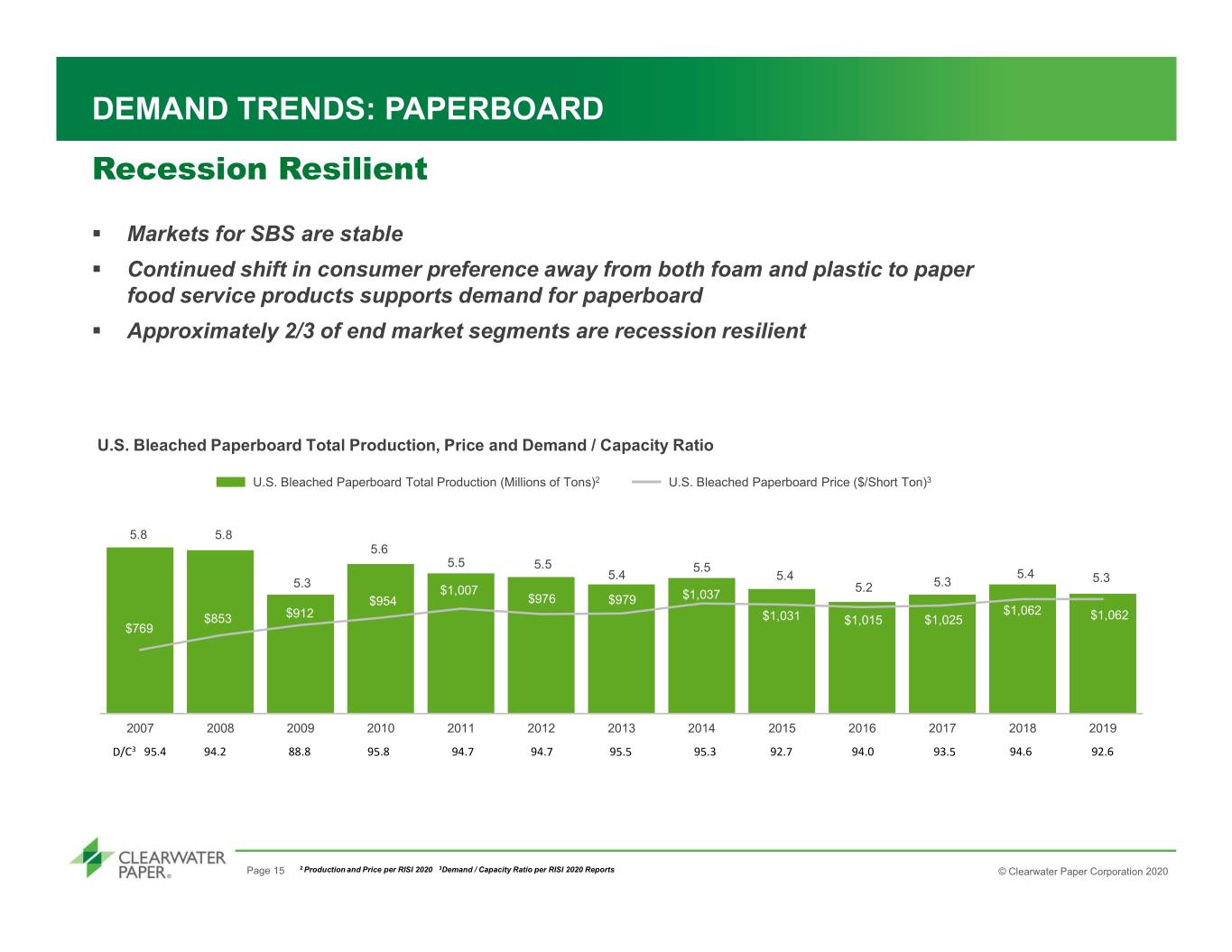

DEMAND TRENDS: PAPERBOARD Recession Resilient . Markets for SBS are stable . Continued shift in consumer preference away from both foam and plastic to paper food service products supports demand for paperboard . Approximately 2/3 of end market segments are recession resilient U.S. Bleached Paperboard Total Production, Price and Demand / Capacity Ratio U.S. Bleached Paperboard Total Production (Millions of Tons)2 U.S. Bleached Paperboard Price ($/Short Ton)3 5.8 5.8 5.6 5.5 5.5 5.5 5.4 5.4 5.4 5.3 5.3 5.2 5.3 $1,007 $1,037 $954 $976 $979 $912 $1,062 $853 $1,031 $1,015 $1,025 $1,062 $769 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 D/C3 95.4 94.2 88.8 95.8 94.7 94.7 95.5 95.3 92.7 94.0 93.5 94.6 92.6 Page 15 2 Production and Price per RISI 2020 3Demand / Capacity Ratio per RISI 2020 Reports © Clearwater Paper Corporation 2020

Summary Investor Presentation June 2020

Clearwater Paper Value Proposition . New executive management team . Well positioned across two attractive businesses . Economically resilient market segments . Completed major capital expenditures . Focusing on cash generation to reduce debt by . Delivering benefits from Shelby investment . Continued operational improvements . Aggressively managing working capital . Prudently allocating capital . Taking decisive actions to adjust operations to changing market conditions Page 17 © Clearwater Paper Corporation 2020