Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Benefitfocus, Inc. | d938676d8k.htm |

| EX-99.1 - EX-99.1 - Benefitfocus, Inc. | d938676dex991.htm |

| EX-10.2 - EX-10.2 - Benefitfocus, Inc. | d938676dex102.htm |

| EX-10.1 - EX-10.1 - Benefitfocus, Inc. | d938676dex101.htm |

Exhibit 3.1

Benefitfocus, Inc.

Certificate of Designations

Series A Convertible Preferred Stock

On May 21, 2020, the Board of Directors of Benefitfocus, Inc., a Delaware corporation (the “Company”), adopted the following resolution designating and creating, out of the authorized and unissued shares of preferred stock of the Company, one million seven hundred seventy seven thousand seven hundred seventy eight (1,777,778) authorized shares of a series of preferred stock of the Company titled the “Series A Convertible Preferred Stock”:

RESOLVED that, pursuant to the Company’s Certificate of Incorporation and Bylaws each as currently in effect, and applicable law, a series of preferred stock of the Company titled the “Series A Convertible Preferred Stock,” and having a par value of $0.001 per share and an initial number of authorized shares equal to one million seven hundred seventy seven thousand seven hundred seventy eight (1,777,778), is hereby designated and created out of the authorized and unissued shares of preferred stock of the Company, which series has the rights, designations, preferences, voting powers and other provisions set forth below:

SECTION 1. DEFINITIONS.

“Affiliate” of any Person means any Person, directly or indirectly, Controlling, Controlled by or under common Control with such Person.

“Business Day” means any day on which the Principal Market is open for trading during normal trading hours (i.e., 9:30 a.m. to 4:00 p.m. Eastern Time), including any day on which the Principal Market is open for trading for a period of time less than the customary time.

“Capital Stock” of any Person means any and all shares of, interests in, rights to purchase, warrants or options for, participations in, or other equivalents of, in each case however designated, the equity of such Person, but excluding any debt securities convertible into such equity.

“Certificate” means any Physical Certificate or Electronic Certificate.

“Certificate of Designations” means this Certificate of Designations, as amended or supplemented from time to time.

“Certificate of Incorporation” means the Company’s Restated Certificate of Incorporation, as the same may be further amended, supplemented or restated.

“Change of Control” means any of the following events:

| (a) | a “person” or “group” (within the meaning of Section 13(d)(3) of the Exchange Act), other than the Company, its wholly owned Subsidiaries or a Holder (together with its Affiliates), has become the direct or indirect “beneficial owner” (as defined below) of shares of the Company’s Capital Stock representing more than fifty percent (50%) of the voting power of all of the Company’s then-outstanding Capital Stock; or |

| (b) | the consummation of (i) any sale, lease or other transfer, in one transaction or a series of transactions, of all or substantially all of the assets of the Company and its Subsidiaries, taken as a whole, to any Person; or (ii) any transaction or series of related transactions in connection with which (whether by means of merger, consolidation, share exchange, combination, reclassification, recapitalization, acquisition, liquidation or otherwise) all of the Capital Stock is exchanged for, converted into, acquired for, or constitutes solely the right to receive, other securities, cash or other property; provided, however, that any merger, consolidation, share exchange or combination of the Company pursuant to which the Persons that directly or indirectly “beneficially owned” (as defined below) shares of the Company’s Capital Stock representing more than fifty percent (50%) of the voting power of all of the Company’s then-outstanding Capital Stock immediately before such transaction directly or indirectly “beneficially own,” immediately after such transaction, more than fifty percent (50%) of the voting power of the surviving, continuing or acquiring company or other transferee, as applicable, or the parent thereof, in substantially the same proportions vis-à-vis each other as immediately before such transaction will be deemed not to be a Change of Control pursuant to this clause (b). |

For the purposes of this definition, (x) any transaction or event described in both clause (a) and in clause (b)(i) or (ii) above (without regard to the proviso in clause (b)) will be deemed to occur solely pursuant to clause (b) above (subject to such proviso); and (y) whether a Person is a “beneficial owner” and whether shares are “beneficially owned” will be determined in accordance with Rule 13d-3 under the Exchange Act.

“Change of Control Redemption” means the redemption of any share of Convertible Preferred Stock by the Company pursuant to Section 6(h).

“Change of Control Redemption Date” means the date fixed, pursuant to Section 6(h), for the redemption of any share of Convertible Preferred Stock by the Company pursuant to a Change of Control Redemption.

“Change of Control Redemption Notice” has the meaning set forth in Section 6(i).

“Change of Control Redemption Notice Date” means the date on which the Change of Control Redemption Notice is delivered.

2

“Change of Control Redemption Price” means the cash price payable by the Company to redeem any share of Convertible Preferred Stock upon its Change of Control Redemption, calculated pursuant to Section 6(h).

“Close of Business” means 5:00 p.m., Charleston, South Carolina time.

“Common Stock” means the common stock, $0.001 par value per share, of the Company.

“Common Stock Participating Dividend” has the meaning set forth in Section 4(b).

“Company” has the meaning set forth in the preamble.

“Company Redemption” has the meaning set forth in Section 6(a).

“Company Redemption Date” means the date fixed, pursuant to Section 6(c), for the settlement of the redemption of the Convertible Preferred Stock by the Company pursuant to a Company Redemption.

“Company Redemption Notice” has the meaning set forth in Section 6(e).

“Company Redemption Notice Date” means, with respect to a Company Redemption of the Convertible Preferred Stock, the date on which the Company sends the related Company Redemption Notice pursuant to Section 6(e).

“Company Redemption Price” means the consideration payable by the Company to redeem any share of Convertible Preferred Stock upon its Redemption, calculated pursuant to Section 6(d).

“Company Redemption Price Premium” means One Hundred Five Percent (105%).

“Control” (including its correlative meanings “under common Control with” and “Controlled by”) means, with respect to any Person, the possession, directly or indirectly, of the power to direct or cause the direction of the management or policies of such Person, whether through ownership of securities or partnership or other interests, by contract or otherwise.

“Conversion” means the conversion of the Convertible Preferred Stock pursuant to Section 8 hereof.

“Conversion Consideration” means, with respect to the conversion of any share of Convertible Preferred Stock, the type and amount of consideration payable to settle such conversion, determined in accordance with Section 8.

“Conversion Date” means, with respect to the Conversion of any share of Convertible Preferred Stock, the first Business Day on which the requirements set forth in Section 8(c)(i) for such conversion are satisfied.

3

“Conversion Price” means $15.00 per share, subject to adjustment for stock splits, recapitalizations and the like as set forth in Section 8(e).

“Convertible Preferred Stock” has the meaning set forth in Section 3(a).

“Conversion Share” means any share of Common Stock issued or issuable upon conversion of any share of Convertible Preferred Stock.

“Depositary” means The Depository Trust Company or its successor.

“Dividend” means any Regular Dividend or Participating Dividend.

“Dividend Payment Date” means each Regular Dividend Payment Date with respect to a Regular Dividend and each date on which any declared Participating Dividend is scheduled to be paid on the Convertible Preferred Stock.

“Electronic Certificate” means any electronic book-entry maintained by the Transfer Agent that represents any share(s) of Convertible Preferred Stock.

“Ex-Dividend Date” means, with respect to an issuance, dividend or distribution on the Common Stock, the first date on which shares of Common Stock trade on the applicable exchange or in the applicable market, regular way, without the right to receive such issuance, dividend or distribution (including pursuant to due bills or similar arrangements required by the relevant stock exchange). For the avoidance of doubt, any alternative trading convention on the applicable exchange or market in respect of the Common Stock under a separate ticker symbol or CUSIP number will not be considered “regular way” for this purpose.

“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended.

“Holder” means a person in whose name any share of Convertible Preferred Stock is registered in the Register.

“Initial Issue Date” means June 4, 2020.

“Initial Stated Value” means forty-five dollars ($45.00) per share of Convertible Preferred Stock.

“Last Reported Sale Price” of the Common Stock for any Trading Day means the closing sale price per share (or, if no closing sale price is reported, the average of the last bid price and the last ask price per share or, if more than one in either case, the average of the average last bid prices and the average last ask prices per share) of the Common Stock on such Trading Day as reported in composite transactions for the principal U.S. national or regional securities exchange on which the Common Stock is then listed. If the Common Stock is not listed on a U.S. national or regional securities exchange on such Trading Day, then the Last Reported Sale Price will be the last quoted bid price per share of Common Stock on such

4

Trading Day in the over-the-counter market as reported by OTC Markets Group Inc. or a similar organization. If the Common Stock is not so quoted on such Trading Day, then the Last Reported Sale Price will be the average of the mid-point of the last bid price and the last ask price per share of Common Stock on such Trading Day from each of at least three nationally recognized independent investment banking firms the Company selects in good faith.

“Market Disruption Event” means, with respect to any date, the occurrence or existence, during the one-half hour period ending at the scheduled close of trading on such date on the principal U.S. national or regional securities exchange or other market on which the Common Stock is listed for trading or trades, of any material suspension or limitation imposed on trading (by reason of movements in price exceeding limits permitted by the relevant exchange or otherwise) in the Common Stock or in any options contracts or futures contracts relating to the Common Stock.

“Officer” means the Chief Executive Officer, the President, the Chief Financial Officer, the Treasurer, any Assistant Treasurer, the Controller or the Secretary of the Company.

“Open of Business” means 9:00 a.m., Charleston, South Carolina time.

“Ownership Limitation” has the meaning set forth in Section 8(f)(i).

“Participating Dividend” has the meaning set forth in Section 4(b).

“Person” or “person” means any individual, corporation, partnership, limited liability company, joint venture, association, joint-stock company, trust, unincorporated organization or government or other agency or political subdivision thereof. Any division or series of a limited liability company, limited partnership or trust will constitute a separate “person” under this Certificate of Designations.

“Physical Certificate” means any certificate (other than an Electronic Certificate) representing any share(s) of Convertible Preferred Stock registered in the name of the Holder of such share(s) and duly executed by the Company and countersigned by the Transfer Agent.

“Preferred Stock Directors” has the meaning set forth in Section 7(a)(i).

“Preferred Stock Director Designation Right Condition” has the meaning set forth in Section 7(a)(i).

“Principal Market” means the Nasdaq Global Market; provided, however, that in the event the Company’s Common Stock is ever listed or traded on the New York Stock Exchange, the NYSE MKT, the Nasdaq Global Select Market, the Nasdaq Capital Market, the OTC Bulletin Board or either of the OTCQB Marketplace or the OTCQX marketplace of the OTC Markets Group, then the “Principal Market” shall mean such other market or exchange on which the Company’s Common Stock is then listed or traded.

5

“Record Date” means, with respect to any dividend or distribution on, or issuance to holders of, Convertible Preferred Stock or Common Stock, the date fixed (whether by law, contract or the Board of Directors or otherwise) to determine the Holders or the holders of Common Stock, as applicable, that are entitled to such dividend, distribution or issuance.

“Redemption” means a Company Redemption or a Change of Control Redemption.

“Redemption Notice Date” means a Change of Control Redemption Date or Company Redemption Date, as applicable.

“Register” has the meaning set forth in Section 3(e).

“Regular Dividend Payment Date” means, with respect to any share of Convertible Preferred Stock, each March 31st, June 30th, September 30th, and December 31st of each year, beginning on June 30, 2020 (or beginning on such other date specified in the Certificate representing such share).

“Regular Dividend Period” means each period from, and including, a Regular Dividend Payment Date (or, in the case of the first Regular Dividend Period, from, and including, the Initial Issue Date) to, but excluding, the next Regular Dividend Payment Date.

“Regular Dividend Rate” means eight percent (8.0%) per annum.

“Regular Dividends” has the meaning set forth in Section 4(a)(i).

“Requisite Stockholder Approval” means any stockholder approval contemplated by NASDAQ Listing Standard Rule 5635 with respect to the issuance of shares of Common Stock upon conversion of the Convertible Preferred Stock in contravention of the limitations imposed by such rule; provided, however, that the Requisite Stockholder Approval will be deemed to be obtained if, due to any amendment or binding change in the interpretation of the applicable listing standards of The NASDAQ Stock Market, any such stockholder approval is no longer required for the Company to settle all conversions of the Convertible Preferred Stock in shares of Common Stock without regard to Section 8(f).

“Stated Value” means, with respect to the Convertible Preferred Stock, an amount initially equal to the Initial Stated Value per share of Convertible Preferred Stock as adjusted for any stock splits, stock dividends, recapitalizations or similar transactions with respect to the Convertible Preferred Stock as set forth in Section 8(e) and, if applicable, as adjusted pursuant to Section 4.

“Trading Day” means any day on which (a) trading in the Common Stock generally occurs on the principal U.S. national or regional securities exchange on which the Common Stock is then listed or, if the Common Stock is not then listed on a U.S. national or regional securities exchange, on the principal other market on which the Common Stock is then traded; and (b) there is no Market Disruption Event. If the Common Stock is not so listed or traded, then “Trading Day” means a Business Day.

6

“Transfer Agent” means the Company or its successor or assignee in that capacity.

SECTION 2. RULES OF CONSTRUCTION. For purposes of this Certificate of Designations:

(a) “or” is not exclusive;

(b) “will” expresses a command;

(c) the “average” of a set of numerical values refers to the arithmetic average of such numerical values;

(d) a merger involving, or a transfer of assets by, a limited liability company, limited partnership or trust will be deemed to include any division of or by, or an allocation of assets to a series of, such limited liability company, limited partnership or trust, or any unwinding of any such division or allocation;

(e) words in the singular include the plural and in the plural include the singular, unless the context requires otherwise;

(f) “herein,” “hereof” and other words of similar import refer to this Certificate of Designations as a whole and not to any particular Section or other subdivision of this Certificate of Designations, unless the context requires otherwise; and

(g) references to currency mean the lawful currency of the United States of America, unless the context requires otherwise.

SECTION 3. THE CONVERTIBLE PREFERRED STOCK.

(a) Designation; Par Value. A series of stock of the Company titled the “Series A Convertible Preferred Stock” (the “Convertible Preferred Stock”) is hereby designated and created out of the authorized and unissued shares of preferred stock of the Company. The par value of the Convertible Preferred Stock is $0.001 per share.

(b) Number of Authorized Shares. The total authorized number of shares of Convertible Preferred Stock is one million seven hundred seventy seven thousand seven hundred seventy eight (1,777,778).

(c) Form, Dating and Certificates.

(i) Form and Date of Certificates Representing Convertible Preferred Stock. Each Certificate representing any share of Convertible Preferred Stock may bear notations, legends or endorsements required by law, stock exchange rule or usage or the Depositary.

7

(ii) Certificates.

(1) Generally. The Convertible Preferred Stock will be originally issued initially in the form of one or more Physical Certificates. Physical Certificates may be exchanged for Electronic Certificates, and Electronic Certificates may be exchanged for Physical Certificates upon request by the Holder thereof pursuant to customary procedures.

(2) Electronic Certificates; Interpretation. For purposes of this Certificate of Designations, (A) any reference in this Certificate of Designations to the “delivery” of any Electronic Certificate will be deemed to be satisfied upon the registration of the electronic book-entry representing such Electronic Certificate in the name of the applicable Holder; and (B) upon satisfaction of any applicable requirements of the Delaware General Corporation Law, the Certificate of Incorporation and the Bylaws of the Company, and any related requirements of the Transfer Agent, in each case for the issuance of Convertible Preferred Stock in the form of one or more Electronic Certificates, such Electronic Certificates will be deemed to be executed by the Company and countersigned by the Transfer Agent.

(iii) No Bearer Certificates. The Convertible Preferred Stock will be issued only in registered form.

(d) Method of Payment; Delay When Payment Date is Not a Business Day.

(i) Method of Payment. The Company will pay all cash amounts due on any share of Convertible Preferred Stock (whether by reason of an accrued dividend, as a result of a liquidation, by reason of the Ownership Limitation, or otherwise) by check issued in the name of the Holder thereof; provided, however, that if such Holder has delivered to the Company, no later than the time set forth in the next sentence, a written request to receive payment by wire transfer to an account of such Holder within the United States, then the Company will pay all such cash amounts by wire transfer of immediately available funds to such account. To be timely, such written request must be delivered no later than the Close of Business on the following date: (x) with respect to the payment of any declared cash Dividend due on a Dividend Payment Date for the Convertible Preferred Stock, the date that is fifteen (15) calendar days immediately prior to the Regular Dividend Payment Date in the case of Regular Dividends, and the related Record Date with respect to Participating Dividends; and (y) with respect to any other payment, the date that is fifteen (15) calendar days immediately before the date such payment is due. For the avoidance of doubt, any wire instructions provided by a Holder to the Company pursuant to this Section 3(d)(i) shall remain in full force and effect for any future payments to be made to such Holder until a revocation notice of such wire instructions is provided by such Holder to the Company in writing.

8

(ii) Delay of Payment when Payment Date is Not a Business Day. If the due date for a payment on any share of Convertible Preferred Stock as provided in this Certificate of Designations is not a Business Day, then, notwithstanding anything to the contrary in this Certificate of Designations, such payment may be made on the immediately following Business Day and no additional interest, dividend or other amount will accrue or accumulate on such payment as a result of the related delay. Solely for purposes of the immediately preceding sentence, a day on which the applicable place of payment is authorized or required by law or executive order to close or be closed will be deemed not to be a “Business Day.”

(e) Transfer Agent; Register. The Company or any of its Subsidiaries may act as the Transfer Agent. The Company will, or will retain another Person (who may be the Transfer Agent) to act as registrar, who will keep a record (the “Register”) of the names and addresses of the Holders, the number of shares of Convertible Preferred Stock held by each Holder and the transfer, exchange, repurchase, Redemption and Conversion of the Convertible Preferred Stock. Absent manifest error, the entries in the Register will be conclusive and the Company and the Transfer Agent may treat each Person whose name is recorded as a Holder in the Register as a Holder for all purposes. The Register will be in written form or in any form capable of being converted into written form reasonably promptly. The Company will promptly provide a copy of the Register to any Holder upon its request.

(f) Transfers and Exchanges; Transfer Taxes; Certain Transfer Restrictions.

(i) Provisions Applicable to All Transfers and Exchanges.

(1) Generally. Subject to this Section 3(f), shares of Convertible Preferred Stock represented by any Certificate may be transferred or exchanged from time to time, and the Company, or any other Person retained by the Company to act as registrar, will cause each such transfer or exchange to be recorded in the Register.

(2) No Services Charge; Transfer Taxes. The Company will not impose any service charge on any Holder for any transfer, exchange or conversion of any share of Convertible Preferred Stock, but the Company may require payment of a sum sufficient to cover any transfer tax or similar governmental charge that may be imposed in connection with any transfer or exchange of shares of Convertible Preferred Stock, provided, that for the avoidance of doubt, any transfer tax or similar governmental charge that may be imposed with any conversion of .shares of Convertible Preferred Stock shall be governed pursuant to Section 9(d) herein.

(3) Settlement of Transfers and Exchanges. Upon satisfaction of the requirements of this Certificate of Designations to effect a transfer or exchange of any share of Convertible Preferred Stock as well as the delivery of all documentation reasonably required by the Transfer Agent or the Company in order to effect any transfer or exchange, the Company will cause such transfer or exchange to be effected as soon as reasonably practicable but in no event later than the fifth (5th) Business Day after the date of such satisfaction.

9

(ii) Transfers of Shares Subject to Redemption or Conversion. Notwithstanding anything to the contrary in this Certificate of Designations, the Company will not be required to register the transfer of or exchange any share of Convertible Preferred Stock:

| (1) | that has been surrendered for Conversion; or |

| (2) | that has been called for Redemption pursuant to a Redemption Notice, except to the extent that the Company fails to pay the related Redemption Price, as applicable, when due. |

(g) Outstanding Shares.

(i) Generally. The shares of Convertible Preferred Stock that are outstanding at any time will be deemed to be those shares of Convertible Preferred Stock that, at such time, have been duly executed by the Company and countersigned by the Transfer Agent, excluding those shares of Convertible Preferred Stock that have theretofore been (1) cancelled by the Transfer Agent or delivered to the Transfer Agent for cancellation; (2) paid in full upon their conversion or redemption in accordance with this Certificate of Designations; or (3) deemed to cease to be outstanding to the extent provided in, and subject to Section 3(g)(ii).

(ii) Shares to Be Converted. If any share of Convertible Preferred Stock is to be converted, then, at the Close of Business on the Conversion Date for such conversion (unless there occurs a default in the delivery of the Conversion Consideration due pursuant to Section 8 upon such conversion): (1) such Convertible Preferred Stock will be deemed to cease to be outstanding (without limiting the Company’s obligations pursuant to Section 4(c)); (2) Regular Dividends will cease to accumulate on such Convertible Preferred Stock from and after such Conversion Date; and (3) the rights of the Holders of such Convertible Preferred Stock, as such, will terminate with respect to such Convertible Preferred Stock, other than the right to receive such Conversion Consideration as provided in Section 8 (and, if applicable, declared Dividends as provided in Section 4(c)).

Section 4. DIVIDENDS.

(a) Generally.

(i) Regular Dividends.

(1) Accumulation and Payment of Regular Dividends. Each share of Convertible Preferred Stock will accrue dividends quarterly in arrears at a rate per annum equal to the Regular Dividend Rate on the Stated Value with respect to such share deemed to be in effect commencing on the day immediately following the most recent Regular Dividend Payment Date, regardless of whether or not declared or funds are legally available for their payment (such dividends that accumulate on the Convertible Preferred Stock pursuant to this sentence, “Regular Dividends”). Subject to the other provisions of this Section 4, such Regular Dividends will be payable in cash on each Regular Dividend Payment Date, provided, that if not paid in cash by the respective Regular Dividend

10

Payment Date, such accrued Regular Dividends will be deemed to have been paid in kind, and the Stated Value with respect to each share of Preferred Stock shall be increased as of the applicable Regular Dividend Payment Date by an amount equal to the accrued but unpaid Regular Dividend with respect thereto for the immediately prior Regular Dividend Period (or, if there is not a preceding Regular Dividend Payment Date as to which such share of Convertible Preferred Stock was outstanding, on the Initial Stated Value of each such share of Convertible Preferred Stock). Accrued Regular Dividends will be computed on the basis of a 360-day year.

(b) Participating Dividends. No dividend or other distribution on the Common Stock (whether in cash, securities or other property, or any combination of the foregoing) will be declared or paid on the Common Stock unless, at the time of such declaration and payment, an equivalent dividend or distribution is declared and paid, respectively, on each outstanding share of Convertible Preferred Stock (such a dividend or distribution on such share of Convertible Preferred Stock, a “Participating Dividend,” and such corresponding dividend or distribution on the Common Stock, the “Common Stock Participating Dividend”), such that (1) the Record Date and the payment date for such Participating Dividend occur on the same dates as the Record Date and payment date, respectively, for such Common Stock Participating Dividend; and (2) the kind and amount of consideration payable per share of Convertible Preferred Stock in such Participating Dividend is the same kind and amount of consideration that would be payable in the Common Stock Participating Dividend in respect of a number of shares of Common Stock equal to the number of shares of Common Stock that would be issuable (determined in accordance with Section 8 but without regard to Section 8(d)(ii) and Section 8(f)) in respect of one (1) share of Convertible Preferred Stock that is converted with a Conversion Date occurring on such Record Date (subject to the same arrangements, if any, in such Common Stock Participating Dividend not to issue or deliver a fractional portion of any security or other property, but with such arrangement applying separately to each Holder and computed based on the total number of shares of Convertible Preferred Stock held by such Holder on such Record Date).

(c) Treatment of Dividends Upon Redemption or Conversion. If the Redemption Date or Conversion Date of any share of Convertible Preferred Stock is after a Record Date for a declared Dividend on the Convertible Preferred Stock and on or before the next Dividend Payment Date, then the Holder of such share at the Close of Business on such Record Date will be entitled, notwithstanding the related Redemption or Conversion, as applicable, to receive, on or, at the Company’s election, before such Dividend Payment Date, such declared Dividend on such share in cash; provided, that to the extent such dividend is not paid in cash, the amount of such dividend shall be added to the Stated Value with respect to such share in effect on such Redemption Date or Conversion Date. Except as provided in this Section 4(c) or Section 6(d), Regular Dividends on any share of Convertible Preferred Stock will cease to accumulate from and after the Redemption Date or Conversion Date, as applicable, for such share, unless the Company defaults in the payment of the related Redemption Price or Conversion Consideration, as applicable.

11

Section 5. RIGHTS UPON LIQUIDATION, DISSOLUTION OR WINDING UP.

(a) Generally. If the Company liquidates, dissolves or winds up, whether voluntarily or involuntarily, then, subject to the rights of any of the Company’s creditors and the Change of Control Redemption required by Section 6(g) below, each share, or fraction thereof, of Convertible Preferred Stock, as applicable, will entitle the Holder thereof to receive payment for the greater of the amounts set forth in clause (i) and (ii) below out of the Company’s assets or funds legally available for distribution to the Company’s stockholders, before any such assets or funds are distributed to, or set aside for the benefit of, the Common Stock:

(i) the sum of:

(1) the Stated Value per share (or fraction thereof) of Convertible Preferred Stock; and

(2) all unpaid Regular Dividends that will have accumulated on such share (or fraction thereof) from the immediately preceding Regular Dividend Payment Date to, but excluding, the date of such payment; or

(ii) the amount such Holder would have received in respect of the number of shares of Common Stock that would be issuable (determined in accordance with Section 8 but without regard to Section 8(d)(ii) and Section 8(f)) upon conversion of such share (or fraction thereof) of Convertible Preferred Stock assuming the Conversion Date of such conversion occurs on the date of such payment.

Upon payment of such amount in full on the outstanding Convertible Preferred Stock, Holders of the Convertible Preferred Stock will have no rights to the Company’s remaining assets or funds, if any. If such assets or funds are insufficient to fully pay such amount on all outstanding shares of Convertible Preferred Stock, then, subject to the rights of any of the Company’s creditors, such assets or funds will be distributed ratably on the outstanding shares of Convertible Preferred Stock in proportion to the full respective distributions to which such shares would otherwise be entitled.

(b) Certain Business Combination Transactions Deemed to Be a Liquidation. For purposes of Section 5(a), the Company’s consolidation or combination with, or merger with or into, or the sale, lease or other transfer of all or substantially all of the Company’s assets (other than a sale, lease or other transfer in connection with the Company’s liquidation, dissolution or winding up) to, another Person will constitute the Company’s liquidation, dissolution or winding up.

SECTION 6. RIGHT OF THE COMPANY TO REDEEM THE CONVERTIBLE PREFERRED STOCK.

(a) Right to Redeem. Subject to the terms of this Section 6, the Company has the right, at its election, to redeem, subject to the right of the Holders to convert the Convertible Preferred Stock pursuant to Section 8 after receipt of the Company Redemption Notice but prior to such redemption, all, or any number of shares or fraction thereof that is less than all, of the Convertible Preferred Stock, at any time and from time to time, on a Company Redemption Date, for a cash purchase price equal to the Company Redemption Price (such redemption, a “Company Redemption”).

12

(b) Redemption Prohibited in Certain Circumstances. The Company will not call for Company Redemption, or otherwise send a Company Redemption Notice in respect of the Company Redemption of, any share of Convertible Preferred Stock pursuant to this Section 6 unless (i) the Company has sufficient funds legally available, and is permitted under the terms of its indebtedness for borrowed money, to fully pay the Company Redemption Price in cash in respect of all shares of Convertible Preferred Stock called for Company Redemption and (ii) the Last Reported Sale Price of the Common Stock has been at least 150% of the Conversion Price then in effect for at least 20 Trading Days (whether or not consecutive) during any 30 consecutive Trading Day period (including the last Trading Day of such period) ending on, and including, the Trading Day immediately preceding the date on which the Company provides a Company Redemption Notice in accordance with Section 6(e).

(c) Company Redemption Date. The Company Redemption Date for any Company Redemption will be a Business Day of the Company’s choosing that is no less than thirty (30) calendar days after the Company Redemption Notice Date for such Company Redemption, but in no event prior to the fourth year anniversary of the Initial Issue Date.

(d) Company Redemption Price. The Company Redemption Price for any share of Convertible Preferred Stock to be repurchased pursuant to a Company Redemption is an amount in cash equal to (1) the product of (x) the Company Redemption Price Premium and (y) the Initial Stated Value of such share at the Close of Business on the Company Redemption Date for such Redemption plus (2) the difference between the Stated Value then in effect with respect to such share and the Initial Stated Value, if any, plus (3) accumulated and unpaid Regular Dividends on such share from the immediately preceding Regular Dividend Payment Date to, but excluding, such Company Redemption Date (to the extent such accumulated and unpaid Regular Dividends are not included in the Stated Value set forth in subclause (2) above). In the event of any fractional shares, the Company Redemption Price shall be calculated on a pro rata basis.

(e) Company Redemption Notice. To call any share of Convertible Preferred Stock for Company Redemption, the Company must send to the Holder of such share a notice of such Company Redemption (a “Company Redemption Notice”). Such Company Redemption Notice must state:

(1) that such share has been called for Company Redemption, briefly describing the Company’s Company Redemption right under this Certificate of Designations;

(2) the Company Redemption Date for such Company Redemption;

(3) the Company Redemption Price per share of Convertible Preferred Stock;

(4) if the Company Redemption Date is after a Record Date and on or before the next Dividend Payment Date, that such Dividend will be paid in accordance with Section 4(c);

13

(5) that such share of Convertible Preferred Stock called for Company Redemption may be converted at any time before the Close of Business on the Business Day immediately before the Company Redemption Date (or, if the Company fails to pay the Company Redemption Price due on such Company Redemption Date in full, at any time until such time as the Company pays such Company Redemption Price in full);

(6) the Conversion Price in effect with respect to such share on the Company Redemption Notice Date for such Company Redemption; and

(7) the CUSIP numbers, if any, of the Convertible Preferred Stock.

(f) Selection and Conversion of Convertible Preferred Stock Subject to Partial Redemption. If less than all shares of Convertible Preferred Stock then outstanding are called for Company Redemption, then:

(1) the shares of Convertible Preferred Stock to be subject to such Company Redemption will be redeemed by the Company pro rata; and

(2) if only a portion of the Convertible Preferred Stock is called for Company Redemption and a portion of such Convertible Preferred Stock is converted, then the converted portion of such Convertible Preferred Stock will be deemed to be from the portion of such Convertible Preferred Stock that was called for Company Redemption.

(g) Payment of the Company Redemption Price. Subject to Section 4(c), the Company will cause the Company Redemption Price for each share of Convertible Preferred Stock subject to Company Redemption to be paid to the Holder thereof on or before the applicable Company Redemption Date.

(h) Redemption of Convertible Preferred Stock upon a Change of Control. Subject to the other terms of this Section 6, if a Change of Control occurs, then the Company will redeem, contingent upon and contemporaneously with the consummation of the Change of Control, but subject to the right of the Holders to convert the Convertible Preferred Stock pursuant to Section 8 after receipt of the Change of Control Redemption Notice but prior to such redemption, all of the Convertible Preferred Stock on the Change of Control Redemption Date for such Change of Control for a cash purchase price equal to the Change of Control Redemption Price. The Change of Control Redemption Date for any Change of Control will be the effective date of the Change of Control and Change of Control Redemption Price for any share of Convertible Preferred Stock to be redeemed upon a Change of Control Redemption following a Change of Control is an amount in cash equal to the greater of (x) the sum of (1) One Hundred and Five Percent (105%) of the Initial Stated Value of such share at the Close of Business on the Change of Control Redemption Date for such Change of Control plus (2) the difference between the Stated Value then in effect with respect to such share and the Initial Stated Value, if any, plus (3) accumulated and unpaid Regular Dividends on such share from the immediately preceding Regular Dividend Payment Date to, but excluding, such Change of Control Redemption Date (to the extent such accumulated and unpaid Regular Dividends are not included in the Stated Value set forth in subclause (2) above) and (y) the amount such Holder would have received in respect of the number of shares of Common Stock that would be issuable upon conversion of such share of

14

Convertible Preferred Stock (determined in accordance with Section 8 but without regard to Section 8(d)(ii) and Section 8(f)) assuming the Conversion Date of such conversion occurs on the date of such payment. The Company will cause the Change of Control Redemption Price for each share of Convertible Preferred Stock to be redeemed pursuant to a Change of Control Redemption to be paid to the Holder thereof on or before the later of (i) the applicable Change of Control Redemption Date and (ii) the date such share is tendered to the Transfer Agent or the Company.

| (i) | Change of Control Redemption Notice. On or before the twentieth (20th) Business Day before the effective date of a Change of Control, the Company shall send to each Holder a notice of such Change of Control (a “Change of Control Redemption Notice”) containing the information set forth in this Section 6(i). Such Change of Control Redemption Notice must state: (1) a brief description of the events causing such Change of Control; (2) the effective date of such Change of Control; (3) the Change of Control Redemption Date for such Change of Control; (4) the Change of Control Redemption Price per share of Convertible Preferred Stock; (5) if the Change of Control Redemption Date is after a Record Date for a declared Dividend on the Convertible Preferred Stock and on or before the next Dividend Payment Date, that such Dividend will be paid in accordance with Section 4(c); (6) the Conversion Price in effect on the date of such Change of Control Redemption Notice and a description and quantification of any adjustments to the Conversion Price that may result from such Change of Control; and (7) that shares of Convertible Preferred Stock for which a Change of Control Redemption Notice has been duly tendered and not duly withdrawn must be delivered to the Company for the Holder thereof to be entitled to receive the Change of Control Redemption Price. If the underlying Change of Control has been terminated or cancelled and the Company has delivered a Change of Control Redemption Notice with respect to any share(s) of the Convertible Preferred Stock, the Company shall withdraw such Change of Control Redemption Notice by delivering a written notice of withdrawal to the Holders at any time before the Close of Business on Change of Control Redemption Date. Such withdrawal notice must state: (1) if such share(s) are represented by one or more Physical Certificates, the certificate number(s) of such Physical Certificates(s); and (2) the number of shares of Convertible Preferred Stock to be withdrawn, which, for the avoidance of doubt, shall be no less than all of the outstanding shares of Convertible Preferred Stock. |

SECTION 7. VOTING RIGHTS. The Convertible Preferred Stock will have no voting rights except as set forth in this Section 7 or as provided in the Certificate of Incorporation or required by the Delaware General Corporation Law.

(a) Right to Designate Directors.

(i) Generally. For so long as not less than 60% of the shares of Convertible Preferred Stock originally issued remain outstanding (the “Preferred Stock Director Designation Right Condition”), the holders of a majority of the then outstanding shares of Convertible Preferred Stock, voting together as a single class, shall have the right at any election of directors to elect (A) two (2) of the

15

authorized directors on the Board of Directors of the corporation if the authorized number of directors on the Board of Directors is nine (9) directors or fewer, or (B) three (3) of the authorized directors on the Board of Directors if the authorized number of directors on the Board of Directors is ten (10) directors (the “Preferred Stock Directors”).

(ii) Removal of the Preferred Stock Directors. At any time, a Preferred Stock Director may be removed with or without cause only by the affirmative vote or written consent of a majority of the holders of Convertible Preferred Stock entitled to elect such director.

(iii) The Right to Call A Special Meeting to Elect Preferred Stock Directors. At all times when the Preferred Stock Director Designation Right Condition is satisfied, the Holders representing at least twenty five percent (25%) of the voting power of the Convertible Preferred Stock will have the right to call a special meeting of stockholders for the election of Preferred Stock Directors (including an election to fill any vacancy in the office of Preferred Stock Directors). Such right may be exercised by written notice, executed by such Holders delivered to the Company at its principal executive offices. Notwithstanding anything to the contrary in this Section 7(a)(iii), if the Company’s next annual or special meeting of stockholders is scheduled to occur within ninety (90) days after such right is exercised, and the Company is otherwise permitted to conduct such election at such next annual or special meeting, then such election will instead be included in the agenda for, and conducted at, such next annual or special meeting.

(b) Voting.

(i) Generally. The Holders will have the right to vote together as a single class with the holders of the Common Stock on each matter submitted for a vote or consent by the holders of the Common Stock, and, for these purposes, (i) the Convertible Preferred Stock of each Holder will entitle such Holder to be treated as if such Holder were the holder of record, as of the record or other relevant date for such matter, of a number of shares of Common Stock equal to the number of shares of Common Stock that would be issuable (determined in accordance with Section 8(d), including Section 8(d)(ii)) upon conversion of such Convertible Preferred Stock assuming such Convertible Preferred Stock were converted with a Conversion Date occurring on such record or other relevant date; and (ii) the Holders will be entitled to notice of all matters to be submitted to a vote of the stockholders in accordance with the Certificate of Incorporation, the Bylaws of the Company, and the Delaware General Corporation Law as if the Holders were holders of Common Stock. For the avoidance of doubt, the voting rights set forth in this Section 7(b) will be limited or eliminated, as applicable, to the same extent to which the right to convert the Convertible Preferred Stock is limited or eliminated pursuant to Section 8(f).

(ii) As a Separate Class. While any share of Convertible Preferred Stock is outstanding, each following event by the Company will require, and cannot be effected without, the affirmative vote or consent of Holders, representing a majority of the outstanding shares of Convertible Preferred Stock, if any:

16

(1) effect any authorization, creation, or issuance of (or any obligation to authorize, create, or issue) any securities of the Company having rights, preferences, or privileges senior to or on a parity with any of the rights, preferences, or privileges of the Convertible Preferred Stock, whether by merger, reclassification or otherwise;

(2) effect any alteration, repeal, change, or amendment of the rights, privileges, or preferences of the Convertible Preferred Stock;

(3) amend, modify, or repeal any provision of the Company’s Certificate of Incorporation (including this Certificate of Designations) or bylaws in a manner adverse to the Convertible Preferred Stock;

(4) effect any change in the authorized number of directors of the Company to a number greater than ten (10);

(5) effect any transactions between the Company, on the one hand, and any of its Affiliates, on the other hand (excluding (A) any transaction between the Company and any of its Subsidiaries, (B) any compensation that has been approved by the Compensation Committee (or any successor committee) of the Board of Directors, or (C) any transaction approved by either the Audit Committee (or any successor committee) of the Board of Directors or by a majority of the directors who do not have an interest adverse to the Company in the relevant transaction);

(6) except as provided herein, declare or pay dividends or make any distribution with respect to any Capital Stock of the Company at any time the Company has any indebtedness outstanding;

(7) incur any indebtedness (including any existing indebtedness as of the filing date of this Certificate of Designations) in excess of $500 million (it being understood that lease obligations are not considered indebtedness for purposes hereof), or encumber or grant a security interest in all or substantially all of the assets of the Company in connection with any such indebtedness of the Company, excepting such security interests existing on the date of the filing of this Certificate of Designations; or

(8) agree or consent to any of the actions prohibited by this Section 7(b)(ii);

Section 8. CONVERSION.

(a) Generally. The Convertible Preferred Stock may be converted only pursuant to the provisions of this Section 8.

17

(b) Conversion at the Option of the Holders.

(i) Conversion Right; When Shares May Be Submitted for Conversion. Holders will have the right to submit all, or any number of shares or fraction thereof that is less than all, of their shares of Convertible Preferred Stock for Conversion at any time; provided, however, that, notwithstanding anything to the contrary in this Certificate of Designations, shares of Convertible Preferred Stock that are called for (a) Company Redemption may not be submitted for Conversion after the Close of Business on the Business Day immediately before the related Company Redemption Date or (b) Change of Control Redemption may not be submitted for Conversion after the Close of Business on the Business Day immediately before the related Change of Control Redemption Date; provided, that, in either case, if the Company fails to pay the Company Redemption Price or the Change of Control Redemption Price (as applicable) due on such Company Redemption Date or Change of Control Redemption Date (as applicable) in full, Holders shall have the right to submit such shares of Convertible Preferred Stock called for Company redemption for Conversion at any time until such time as the Company pays such Company Redemption Price or Change of Control Redemption Price (as applicable) in full.

(ii) A Holder delivering a conversion notice hereunder may specify in such conversion notice that its election to effect such conversion is contingent upon the consummation of a Change of Control, in which case such Conversion shall not occur until such time as such Change of Control has been consummated, and if such Change of Control is terminated or cancelled, such conversion notice shall be deemed to be duly withdrawn. For the avoidance of doubt, any such contingent Conversion shall occur prior to the Change of Control Redemption that would have otherwise been effected in connection with such Change of Control.

(c) Conversion Procedures.

(i) Requirements for Holders to Exercise Conversion Right.

(1) Generally. To convert any share or fraction thereof of Convertible Preferred Stock, the Holder of such share must (w) complete, sign and deliver to the Company a conversion notice; (x) deliver any Physical Certificate(s) representing such Convertible Preferred Stock to the Company (at which time, subject to Section 8(b)(ii), such Conversion will become irrevocable); (y) furnish any endorsements and transfer documents that the Company may require; and (z) if applicable, pay any documentary or other taxes required pursuant to Section 9(d).

(2) Conversion Permitted only During Business Hours. Convertible Preferred Stock may be surrendered for Conversion only after the Open of Business and before the Close of Business on a day that is a Business Day.

(ii) Treatment of Accumulated Regular Dividends upon Conversion.

(1) No Adjustments for Accumulated Regular Dividends. Without limiting the operation of Sections 4(a) and 8(d)(i), the Conversion Price will not be adjusted to account for any accumulated and unpaid Regular Dividends on any share of Convertible Preferred Stock being converted.

18

(2) Conversions Between A Record Date and a Dividend Payment Date. If the Conversion Date of any share of Convertible Preferred Stock to be converted is after a Record Date for a declared Dividend on the Convertible Preferred Stock and on or before the next Dividend Payment Date, then such Dividend will be paid pursuant to Section 4(c) notwithstanding such conversion. In the event of any fractional shares, such Dividends shall be calculated on a pro rata basis.

(iii) When Holders Become Stockholders of Record of the Shares of Common Stock Issuable Upon Conversion. The Person in whose name any share of Common Stock is issuable upon conversion of any share of Convertible Preferred Stock will be deemed to become the holder of record of such share as of the Close of Business on the Conversion Date for such conversion.

(d) Settlement upon Conversion.

(i) Generally. Subject to Section 4(c), Section 8(d)(ii), Section 8(f) and Section 10(b), the number of shares due upon settlement of the conversion of each share (or fraction thereof) of Convertible Preferred Stock will consist of a number of shares of Common Stock equal to the quotient obtained by dividing (I) the sum of (x) the Stated Value of such share (or fraction thereof) of Convertible Preferred Stock immediately before the Close of Business on the Conversion Date for such conversion and (y) an amount equal to accumulated and unpaid Regular Dividends on such share (or fraction thereof) of Convertible Preferred Stock to, but excluding, such Conversion Date (but only to the extent such accumulated and unpaid Regular Dividends are not included in the Stated Value referred to in the preceding clause (x)); by (II) the Conversion Price. By way of example, on the Initial Issue Date, each share of Convertible Preferred Stock shall convert into three (3) shares of Common Stock.

(ii) Payment of Cash in Lieu of any Fractional Share of Common Stock. Subject to Section 10(b), in lieu of delivering any fractional share of Common Stock otherwise due upon conversion of any share of Convertible Preferred Stock, the Company will, to the extent it is legally able to do so and permitted under the terms of its indebtedness for borrowed money, pay cash in lieu of any fractional shares of Common Stock resulting from the calculation described in clause (d)(i) above.

(iii) Delivery of Conversion Consideration. The Company will pay or deliver, as applicable, the cash or Conversion Shares due upon conversion of any share of Convertible Preferred Stock on or before the fifth (5th Business Day immediately after the Conversion Date for such conversion.

19

(e) Conversion Price Adjustments.

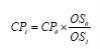

(i) Events Requiring an Adjustment to the Conversion Price. The Conversion Price will be adjusted from time to time if the Company issues solely shares of Common Stock as a dividend or distribution on all or substantially all shares of the Common Stock, or if the Company effects a stock split or a stock combination of the Common Stock, then the Conversion Price will be adjusted based on the following formula:

where:

| CP0 | = | the Conversion Price in effect immediately before the Close of Business on the Record Date for such dividend or distribution, or immediately before the Close of Business on the effective date of such stock split or stock combination, as applicable; | ||

| CP1 | = | the Conversion Price in effect immediately after the Close of Business on such Record Date or effective date, as applicable; | ||

| OS0 | = | the number of shares of Common Stock outstanding immediately before the Close of Business on such Record Date or effective date, as applicable, without giving effect to such dividend, distribution, stock split or stock combination; and | ||

| OS1 | = | the number of shares of Common Stock outstanding immediately after giving effect to such dividend, distribution, stock split or stock combination. | ||

If any dividend, distribution, stock split or stock combination of the type described in this Section 8(e)(i) is declared or announced, but not so paid or made, then the Conversion Price will be readjusted, effective as of the date the Board of Directors, or any Officer acting pursuant to authority conferred by the Board of Directors, determines not to pay such dividend or distribution or to effect such stock split or stock combination, to the Conversion Price that would then be in effect had such dividend, distribution, stock split or stock combination not been declared or announced.

(ii) Stockholder Rights Plans. If any shares of Common Stock are to be issued upon conversion of any share of Convertible Preferred Stock and, at the time of such conversion, the Company has in effect any stockholder rights plan, then the Holder of such share of Convertible Preferred Stock will be entitled to receive, in addition to, and concurrently with the delivery of, the consideration otherwise due upon such conversion, the rights set forth in such stockholder rights plan.

(iii) Determination of the Number of Outstanding Shares of Common Stock. For purposes of Section 8(e)(i), the number of shares of Common Stock outstanding at any time will (1) include shares issuable in respect of scrip certificates issued in lieu of fractions of shares of Common Stock; and (2) exclude shares of Common Stock held in the Company’s treasury (unless the Company pays any dividend or makes any distribution on shares of Common Stock held in its treasury).

20

(iv) Notice of Conversion Price Adjustments. Upon the effectiveness of any adjustment to the Conversion Price pursuant to Section 8(e)(i), the Company will, as soon as reasonably practicable, but in no event later than ten (10) Business Days after the date of such effectiveness, send notice to the Holders containing (1) a brief description of the transaction or other event on account of which such adjustment was made; (2) the Conversion Price in effect immediately after such adjustment; and (3) the effective time of such adjustment.

(f) Restriction on Conversions.

| (i) | Limitation on Conversion Right. Notwithstanding anything to the contrary in this Certificate of Designations, unless and until the Requisite Stockholder Approval is obtained, or is not, in the opinion of counsel to the corporation, required, no shares of Common Stock will be issued or delivered upon conversion of any share of Convertible Preferred Stock of any Holder, and no share of Convertible Preferred Stock of any Holder will be convertible, in each case to the extent, and only to the extent, that such issuance, delivery, conversion or convertibility would result in such Holder or a “person” or “group” (within the meaning of Section 13(d)(3) of the Exchange Act) beneficially owning in excess of nineteen and nine-tenths percent (19.9%) of the then-outstanding shares of Common Stock (the restrictions set forth in this sentence, the “Ownership Limitation”). For these purposes, beneficial ownership and calculations of percentage ownership will be determined in accordance with Rule 13d-3 under the Exchange Act. If any Conversion Consideration otherwise due upon the conversion of any share of Convertible Preferred Stock is not delivered as a result of the Ownership Limitation, then the Company shall pay all such amounts in cash to the Holder in accordance with the procedures set forth in Section 3(d) above. Any purported delivery of shares of Common Stock upon conversion of any share of Convertible Preferred Stock will be void and have no effect to the extent, and only to the extent, that such delivery would contravene the Ownership Limitation. The satisfaction, by a Holder of any share of Convertible Preferred Stock, of the requirements set forth in Section 8(c)(i) to convert such Convertible Preferred Stock will be deemed to be a representation, by such Holder to the Company, that the settlement of such conversion in full and without regard to this Section 8(f)(i) will not contravene the Ownership Limitation. |

| (ii) | Covenant to Seek the Requisite Stockholder Approval. The Company will use its reasonable best efforts to obtain, at the next meeting of its stockholders held following its Annual Meeting of Stockholders in 2020, but in no event later than July 1, 2021, the Requisite Stockholder Approval, including by endorsing its approval in the related proxy materials. The Company will promptly notify the Holders if the Requisite Stockholder Approval is obtained. |

21

SECTION 9. CERTAIN PROVISIONS RELATING TO THE ISSUANCE OF COMMON STOCK.

(a) Equitable Adjustments to Prices. Whenever this Certificate of Designations requires the Company to calculate the average of the Last Reported Sale Prices, or any function thereof, over a period of multiple days (including to calculate an adjustment to the Conversion Price), the Company will make appropriate adjustments, if any, to those calculations to account for any adjustment to the Conversion Price pursuant to Section 8(e)(i) that becomes effective, or any event requiring such an adjustment to the Conversion Price where the Ex-Dividend Date, effective date or Expiration Date, as applicable, of such event occurs, at any time during such period.

(b) Reservation of Shares of Common Stock. The Company will reserve, out of its authorized, unreserved and not outstanding shares of Common Stock, for delivery upon conversion of the Convertible Preferred Stock, a number of shares of Common Stock that would be sufficient to settle the conversion of all shares of Convertible Preferred Stock then outstanding, if any. To the extent the Company delivers shares of Common Stock held in the Company’s treasury in settlement of any obligation under this Certificate of Designations to deliver shares of Common Stock, each reference in this Certificate of Designations to the issuance of shares of Common Stock in connection therewith will be deemed to include such delivery.

(c) Status of Shares of Common Stock. Each share of Common Stock delivered upon conversion of any share of Convertible Preferred Stock will be a newly issued or treasury share and will be duly and validly issued, fully paid, non-assessable, free from preemptive rights and free of any lien or adverse claim (except to the extent of any lien or adverse claim created by the action or inaction of such Holder or the Person to whom such share of Common Stock will be delivered). If the Common Stock is then listed on any securities exchange, or quoted on any inter-dealer quotation system, then the Company will cause each such share of Common Stock, when so delivered, to be admitted for listing on such exchange or quotation on such system.

(d) Taxes Upon Issuance of Common Stock. The Company will pay any documentary, stamp or similar issue or transfer tax or duty due on the issue of any shares of Common Stock upon conversion of the Convertible Preferred Stock of any Holder, except any tax or duty that is due because such Holder requests those shares to be registered in a name other than such Holder’s name.

SECTION 10. CALCULATIONS.

(a) Responsibility; Schedule of Calculations. Except as otherwise provided in this Certificate of Designations, the Company will be responsible for making all calculations called for under this Certificate of Designations or the Convertible Preferred Stock, including determinations of the Conversion Price, Stated Value and accumulated Regular Dividends on the Convertible Preferred Stock. The Company will make all calculations in good faith, and, absent manifest error, its calculations will be final and binding on all Holders. The Company will provide a schedule of such calculations to any Holder upon written request.

22

(b) Calculations Aggregated for Each Holder. The composition of the Conversion Consideration due upon conversion of the Convertible Preferred Stock of any Holder will be computed based on the total number of shares of Convertible Preferred Stock of such Holder being converted with the same Conversion Date. For these purposes, any cash amounts due to such Holder in respect thereof will be rounded to the nearest cent.

(c) Fractional Shares. Any calculation with respect to Dividends on, Redemption of or Conversion of any fractional shares shall be made on a pro rata basis.

SECTION 11. NOTICES. The Company will send all notices or communications to Holders pursuant to this Certificate of Designations in writing and delivered personally, by facsimile or e-mail (with confirmation of receipt from the recipient, in the case of e-mail), or sent by nationally recognized overnight courier service to the Holder’s respective addresses shown on the Register. Notwithstanding anything in the Certificate of Designations to the contrary, any defect in the delivery of any such notice or communication will not impair or affect the validity of such notice or communication and the failure to give any such notice or communication to all the Holders will not impair or affect the validity of such notice or communication to whom such notice is sent.

SECTION 12. NO OTHER RIGHTS. The Convertible Preferred Stock will have no rights, preferences or voting powers except as provided in this Certificate of Designations or the Certificate of Incorporation or as required by applicable law.

[The Remainder of This Page Intentionally Left Blank; Signature Page Follows]

23

IN WITNESS WHEREOF, the Company has caused this Certificate of Designations to be duly executed as of the date first written above.

| BENEFITFOCUS, INC. | ||

| By: | /s/ Stephen M. Swad | |

| Name: Stephen M. Swad | ||

| Title: Chief Financial Officer | ||

[Signature Page to Certificate of Designations]