Attached files

| file | filename |

|---|---|

| EX-31.4 - EX-31.4 - ULTRA PETROLEUM CORP | upl-ex314_54.htm |

| EX-31.3 - EX-31.3 - ULTRA PETROLEUM CORP | upl-ex313_55.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

(Amendment No. 1)

|

☑ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-33614

ULTRA PETROLEUM CORP.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Yukon, Canada |

|

N/A |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. employer identification number) |

|

|

|

|

|

116 Inverness Drive East, Suite 400 |

|

80112 |

|

(Address of principal executive offices) |

|

(Zip code) |

(303) 708-9740

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ☐ NO ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☑ NO ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (Section 232.405) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). YES ☑ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

Non-accelerated filer |

☑ |

Smaller reporting company |

☑ |

Emerging Growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ☐ NO ☑

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was $28,438,541 as of June 28, 2019 (based on the last reported sales price of $0.18 of such stock on the NASDAQ on such date).

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13, or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. YES ☑ NO ☐

The number of common shares, without par value, of Ultra Petroleum Corp., outstanding as of May 31, 2020 was 199,665,509.

Documents incorporated by reference: None.

Ultra Petroleum Corp. (“we,” “us,” “our,” “Ultra,” “Ultra Petroleum,” or the “Company”) filed its Annual Report on Form 10-K for its fiscal year ended December 31, 2019 (the “Original Filing”) with the Securities and Exchange Commission (the “SEC”) on April 15, 2020. In the Original Filing, the Company indicated its intention to incorporate by reference the information required by Part III in Form 10-K from the definitive proxy statement it anticipated filing with the Commission prior to the annual meeting of shareholders it anticipated holding at that time. The Company no longer anticipates filing a definitive proxy statement with the Commission before 120 days after the end of the fiscal year covered by the Original Filing. Accordingly, the Company is now filing this Amendment No. 1 on Form 10-K/A (this “Amended Filing”) solely to disclose the Part III information and update Item 15 of Part IV.

Pursuant to the rules of the SEC, Part IV, Item 15 has also been amended to contain the currently dated certifications from the Company’s principal executive officer and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. The certifications of the Company’s principal executive officer and principal financial officer are attached to this Amended Filing as Exhibits 31.3 and 31.4. Because no financial statements have been included in this Amended Filing and this Amended Filing does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4 and 5 of the certifications have been omitted.

We are currently considered a “smaller reporting company” for purposes of the SEC’s executive compensation and other disclosures. As such, we have opted to take advantage of the scaled disclosure requirements afforded to smaller reporting companies and, as such, have provided more limited disclosures.

Except to the extent expressly set forth herein, this Amended Filing does not change, update, or supplement the previously reported financial statements or any of the other disclosures presented in Part I and Part II of the Original Filing and this Amended Filing, does not reflect events occurring after the filing of the Original Filing. In particular, on May 14, 2020, the Company and certain of its subsidiaries, including Ultra Resources, Inc., Keystone Gas Gathering, LLC, Ultra Wyoming, LLC, Ultra Wyoming LGS, LLC, UPL Pinedale, LLC, UP Energy Corporation and UPL Three Rivers Holdings, LLC (collectively, the “Filing Subsidiaries” and, together with the Company, the “Debtors”), filed voluntary petitions for reorganization (the “Chapter 11 Cases”) under chapter 11 of the United States Bankruptcy Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the Southern District of Texas, Houston Division (the “Court”). Except to the extent expressly set forth herein, this Amended Filing does not reflect the corporate governance arrangements discussed in the Debtors’ proposed Joint Prepackaged Plan of Reorganization under the Bankruptcy Code.

|

|

|

|

|

Page |

|

|

Item 10. |

|

|

|

1 |

|

|

Item 11. |

|

|

|

7 |

|

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

|

24 |

|

Item 13. |

|

Certain Relationships, Related Transactions and Director Independence |

|

|

26 |

|

Item 14. |

|

|

|

27 |

|

|

|

|||||

|

Item 15. |

|

|

|

29 |

|

|

|

|

|

|

34 |

|

Item 10. Directors, Executive Officers, and Corporate Governance

The names, ages and positions of the members of the Company’s board of directors (the “Board”) and the Company’s executive officers, together with certain information concerning each of them as of June 1, 2020 is set forth below.

Please refer to the “Beneficial Ownership of Securities – Security Ownership of Certain Beneficial Owners and Management” table for a summary of the number of common shares owned by those of our current directors and executive officers who held their positions as of June 1, 2020.

Our Board consists of the eight members described below, who are one class of directors.

With respect to our executive officers, each executive officer has been appointed to serve based on their respective employment agreements with the Company. See Compensation Discussion and Analysis for additional details.

There are no family relationships among any of our directors and executive officers. Certain of our executive officers and directors served as officers or directors of the Company, as applicable, prior to and during its previous chapter 11 proceedings of 2016 through 2017.

On May 14, 2020, the Chapter 11 Cases commenced. The Chapter 11 Cases are being jointly administered under the caption In re Ultra Petroleum Corp., et al., Case No. 20-32631. The Company will continue to operate its businesses as a “debtor in possession” under the jurisdiction of the Court and in accordance with the applicable provisions of the Bankruptcy Code and the orders of the Court. On the same date, the Company entered into a restructuring support agreement with certain creditors (the “RSA”) pursuant to which the Company and those creditors agreed to support a plan of reorganization consistent with the terms set forth in the RSA. The Company’s plan of reorganization provides for, among other things, that in connection with the consummation of the plan of reorganization and emergence of the Company from bankruptcy, the term of the current members of the Board shall expire and new directors shall be appointed to the Company’s Board. It is expected that the current directors and officers will continue in their roles during the Chapter 11 proceedings.

|

Name |

|

Age |

|

|

Position with Company |

|

Position Since |

|

|

Evan S. Lederman |

|

|

40 |

|

|

Chairman of the Board |

|

2018 |

|

Sylvia K. Barnes |

|

|

63 |

|

|

Director |

|

2019 |

|

Neal P. Goldman |

|

|

50 |

|

|

Director |

|

2017 |

|

Michael J. Keeffe |

|

|

68 |

|

|

Director |

|

2012 |

|

Stephen J. McDaniel |

|

|

58 |

|

|

Director |

|

2006 |

|

Alan J. Mintz |

|

|

59 |

|

|

Director |

|

2017 |

|

Edward A. Scoggins, Jr. |

|

|

40 |

|

|

Director |

|

2018 |

|

Brad Johnson |

|

|

48 |

|

|

President, Chief Executive Officer and Director |

|

2018 |

|

David W. Honeyfield |

|

|

52 |

|

|

Senior Vice President and Chief Financial Officer |

|

2018 |

|

Jerald J. Stratton, Jr. |

|

|

58 |

|

|

Senior Vice President and Chief Operating Officer |

|

2018 |

|

James N. Whyte |

|

|

61 |

|

|

Senior Vice President and Chief Human Resources Officer |

|

2019 |

|

Kason D. Kerr |

|

|

36 |

|

|

Vice President, General Counsel and Corporate Secretary |

|

2019 |

|

Mark T. Solomon |

|

|

51 |

|

|

Vice President and Chief Accounting Officer and Controller |

|

2019 |

Current Directors and Officers

Mr. Evan S. Lederman was appointed Chairman of our Board in 2018. Mr. Lederman is a Managing Director, Co- Head of Restructuring, and a Partner on the Investment Team at Fir Tree Partners. Mr. Lederman focuses on the funds distressed credit and special situation investment strategies, including co-managing its energy restructuring initiatives. Prior to joining Fir Tree Partners in 2011, Mr. Lederman worked in the Business Finance and Restructuring groups at Weil, Gotshal & Manges LLP and Cravath, Swaine & Moore LLP. In addition to Ultra Petroleum, Mr. Lederman is currently a member of the board, in his capacity as a Fir Tree Partners employee, of Riviera Resources, Inc. (Chairman), Amplify Energy Corp. (formally Memorial Production Partners) and Deer Finance, LLC. Mr. Lederman received a J.D. degree with honors from New York University School of Law and a B.A., magna cum laude, from New York University. The Board believes Mr. Lederman is a valuable member of the Board and that he is highly qualified to be our Chairman because of the strategic and analytical experience and expertise he has developed as a result of his extensive directorship, finance, and investment experience with oil and gas exploration and production companies.

Ms. Sylvia Barnes has been a director on our Board since 2019. Ms. Barnes is a Principal and owner of Tanda Resources LLC, a privately held oil & gas investment and consulting company. She also is a member of the Board of Directors of Pure Acquisition Corp., and serves as the Chairperson of the Audit Committee and on the Compensation Committee and the Nominating Committee,

1

and is a member of the Board of Directors of Teekay LNG Partners L.P. and serves as Chairperson of the Governance Committee and is a member of the Audit Committee. Previously, Ms. Barnes served on the Board of Directors of SandRidge Energy, Inc. as Chairperson of the Compensation Committee, and a member of the Audit Committee and also on the Board of Directors of Halcon Resources Corporation and as a member of its Audit Committee and Reserves Committee. Ms. Barnes has over 30 years of oil and gas financial experience and a background in engineering. While working in senior roles in investment banking she successfully executed a variety of mergers, acquisitions, and divestiture transactions, and advised on public and private equity offerings and private debt and equity placements. She is experienced in advising boards of directors, special committees, and executive management on financial decisions with strategic and governance considerations and being responsible for strategic growth initiatives, budgets and P&L. Ms. Barnes began her career as a reservoir engineer for Esso Resources. She graduated from the University of Manitoba with a Bachelor of Science in Engineering (Dean’s List), was a licensed professional engineer in Alberta and earned a Masters of Business Administration in Finance from York University.

Mr. Neal P. Goldman has been a director on our Board since 2017. Mr. Goldman is currently the Managing Member of SAGE Capital Investments, LLC, a consulting firm specializing in independent board of director services, turnaround consulting, strategic planning, and special situation investments. Mr. Goldman was a Managing Director at Och Ziff Capital Management, L.P. from 2014 to 2016 and a Founding Partner of Brigade Capital Management, LLC from July 2007 to 2012, which he helped build to over $12 billion in assets under management. Prior to this, Mr. Goldman was a Portfolio Manager at Mackay Shields, LLC and also held various positions at Salomon Brothers Inc., both as a mergers and acquisitions banker and as an investor in the high yield trading group. Throughout his career, Mr. Goldman has held numerous board representations including roles as an independent member of the boards of directors of Lightsquared, Inc., Pimco Income Strategy Fund I & II, and Catalyst Paper Corporation as well as a member of the boards of directors of Jacuzzi Brands and NII Holdings, Inc. Mr. Goldman currently serves as Chairman of the Board of Talos Energy, and is a member of the Board of Weatherford International. Mr. Goldman received a B.A. from the University of Michigan and a M.B.A. from the University of Illinois. We believe Mr. Goldman’s extensive financial expertise and experience in representing public and private companies in complex financial situations brings important experience and skill to our Board of Directors and makes him highly qualified to chair our Compensation Committee.

Mr. Michael J. Keeffe has been a director on our Board since 2012. Prior to his retirement in 2011, Mr. Keeffe was a Senior Audit Partner with Deloitte & Touche LLP. He has 35 years of public accounting experience at Deloitte & Touche directing financial statement audits of public companies, principally in the oil field service and engineering and construction industries, most with significant international operations. He also served as a senior risk management and quality assurance partner in the firm’s consultation network. He is a Certified Public Accountant and holds a Bachelor of Arts and a Master of Business Administration from Tulane University. Mr. Keeffe currently serves on the Board of Gulf Island Fabrication, Inc. (NASDAQ: GIFI) and its Audit and Compensation Committees. The Board believes Mr. Keeffe is a valuable member of the Board and that he is highly qualified to chair our Audit Committee because of his extensive accounting and financial expertise in our industry and related industries.

Stephen J. McDaniel has been a director of the Company since 2006. Additionally, Mr. McDaniel serves as Chairman of the Board of Sundance Energy, Inc. a NASDAQ-listed exploration and production company. He also serves on the board of Encino Energy, a private exploration and production company. Mr. McDaniel also previously served as a director of Midstates Petroleum Company (NYSE:MPO), where he was previously President and Chief Executive Officer and, later, non-executive Chairman. Since 2013, Mr. McDaniel has served on the Executive Board of the Lone Star Chapter of Big Brothers Big Sisters. His previous experience included approximately ten years of oil and gas investment banking, the majority of which was with Merrill Lynch where he held the position of Managing Director. He began his career with Conoco in 1983 where he held a variety of engineering, operations, and business development positions.

Mr. Alan J. Mintz has been a director of the Company since 2017. Mr. Mintz is a Managing Principal of Stone Lion. Mr. Mintz co-founded Stone Lion in August 2008 and launched the Stone Lion Funds in November 2008. Prior to Stone Lion, Mr. Mintz was employed by Bear Stearns (1997-2008) where he served as a Senior Managing Director, a Global Co-Head of Distressed Debt Trading and Proprietary Investments and the Director of Distressed Research. Mr. Mintz also served as a board member of various Bear Stearns’ portfolio companies. Prior to his employment with Bear Stearns, Mr. Mintz worked at Policano & Manzo (1990-1997) as a Restructuring Advisor, advising creditors and debtors of financially troubled companies. For several years prior to that, he worked in public accounting, beginning his career at Arthur Andersen & Company where he was employed from 1983 until 1989 and was a Senior Manager in the Tax Division. Mr. Mintz received a Bachelor of Science from Boston University in 1983.

Mr. Edward A. Scoggins has been a director of the Company since 2018. Mr. Scoggins is Managing Partner & Chief Executive Officer of Millennial Energy Partners. Under his leadership, the firm has invested more than $500 million to build a portfolio of operated, non-operated and financial assets in the oil and gas upstream and midstream sectors. Prior to founding Millennial in 2012, Mr. Scoggins led BG Group plc’s commercial and operations teams on upstream, midstream and LNG investments in the United States, Canada, Chile, Equatorial Guinea and Trinidad and Tobago from 2008 to 2012. Prior to joining BG, Mr. Scoggins was Strategic Planning Manager and Community and Public Relations Manager with Marathon Oil from 2005 - 2008. He began his oil and gas career in 2004 with Bechtel Corporation as Project Controls Engineer residing in Equatorial Guinea, West Africa. Mr. Scoggins

2

currently serves as a member of the York Tactical Energy Fund (“YTEF”) Investment Committee. He previously served as Director on the Board of Amplify Energy Corp., where he was Chairman of the Audit Committee, until its merger with Midstates Petroleum Company, Inc. in August 2019. Mr. Scoggins is a member of Vanderbilt University’s College of Arts & Sciences Campaign Cabinet and an Advisory Board member of Georgetown University’s Master of Science in Foreign Service (MSFS) program. Mr. Scoggins received his B.S. in economics and history from Vanderbilt, where he graduated Phi Beta Kappa and magna cum laude. He earned his MSFS degree with a focus on international business and development from Georgetown. We value Mr. Scoggins’ participation on our Board because of his significant financial and investment expertise as well as his operational and managerial experience in the upstream oil and gas exploration and production business.

Mr. Brad Johnson joined Ultra Petroleum in 2008 as Director, Reservoir Engineering and Planning, before being named Vice President, Reservoir Engineering and Development in 2011 and Senior Vice President of Operations in 2014. Effective February 28, 2018, he was promoted to Interim Chief Executive Officer and appointed to our Board. Effective March 1, 2019, he was promoted to President and Chief Executive Officer. Prior to joining Ultra Petroleum, Mr. Johnson was employed by Anadarko Petroleum for 13 years where he served in various engineering and leadership roles in several assets located in onshore North America, shelf, and deep-water Gulf of Mexico and in Algeria. Mr. Johnson earned a Bachelor of Science in Petroleum Engineering from Texas A&M University and an M.S. in Petroleum Engineering from the University of Texas. He is a member of the Society of Petroleum Engineers and is a licensed professional engineer in Texas, Colorado, Wyoming, and Pennsylvania. The Board believes Mr. Johnson is a valuable member of the Board because of his deep expertise, experience and knowledge including his work and management of the exploration and development of our Pinedale field assets over the past decade.

Mr. David Honeyfield joined Ultra Petroleum in November 2018 and is currently a Senior Vice President and Chief Financial Officer. He most recently served as Senior Vice President and Chief Financial Officer of PDC Energy, Inc. from December 2016 to January 2018, and as Chief Financial Officer of Jonah Energy LLC from August 2014 to December 2016. Also, his previous experience includes six years at Intrepid Potash, Inc., including most recently as President and Chief Financial Officer. Prior to that, he served in various leadership roles including Senior Vice President and Chief Financial Officer of SM Energy, and Controller and Chief Accounting Officer of Cimarex Energy Co. Prior to that, Mr. Honeyfield was a Senior Audit Manager with Arthur Andersen LLP in Denver, where he focused on clients in the oil and gas exploration and production, manufacturing, and mining sectors. Mr. Honeyfield holds a Bachelor of Arts degree in Economics from the University of Colorado and is a Certified Public Accountant.

Mr. Jerald J. “Jay” Stratton, Jr. joined Ultra Petroleum in June 2018 as Chief Operating Officer. He most recently served as Executive Vice President and Chief Operating Officer of Jagged Peak Energy Inc. from August 2017 through February 2018. Prior to that, he served as Chief Operating Officer of Permian Resources LLC from April 2014 until the sale of all of its assets in May 2017. Prior to Permian Resources LLC, he was a District Manager for Permian Basin and Mid-Continent assets for Chesapeake Energy Corporation from January 2011 to March 2014. He began his career with Atlantic Richfield Company, with increasing levels of responsibility at Occidental Petroleum Corporation, and Anadarko Petroleum Corporation in various engineering roles. Mr. Stratton earned a Bachelor of Science in Petroleum Engineering from Texas A&M University.

Mr. James N. Whyte joined Ultra Petroleum as Senior Vice President and Chief Human Resources Officer in April 2019. He previously served as Executive Vice President for Intrepid Potash, Inc. from August 2016 – 2018, and prior to that, he served as the Executive Vice President of Human Resources and Risk Management from 2007 to August 2016. Mr. Whyte joined Intrepid Mining LLC as Vice President of Human Resources and Risk Management in 2004. Prior to joining Intrepid, Mr. Whyte spent 17 years in the property and casualty insurance industry including roles with Marsh and McLennan, Incorporated, American Re-Insurance, and a private insurance brokerage firm he founded. Mr. Whyte was a director of American Eagle Energy Corporation from November 2013 to October 2016. Mr. Whyte earned a Bachelors of Business Administration from Southern Methodist University and a Masters of Business Administration from the University of Denver.

Mr. Kason D. Kerr joined Ultra Petroleum in April 2019 as Vice President, General Counsel and Corporate Secretary. Previously, Mr. Kerr served as Deputy General Counsel, Corporate of Halcón Resources Corporation, a publicly traded exploration and production company, working primarily on the company’s capital markets transactions, acquisitions and divestitures and upstream and midstream activities. Prior to that, he was an associate attorney at Latham & Watkins LLP and Bracewell LLP in the capital markets and corporate practice groups. Mr. Kerr holds a B.B.A. degree in finance, with honors, from the University of Texas at Austin and a J.D. from the University of Houston Law Center where he graduated magna cum laude and served as the Executive Editor of the Houston Law Review.

Mr. Mark T. Solomon joined Ultra Petroleum in June 2019 as Vice President – Controller and Chief Accounting Officer. Mr. Solomon most recently served as Vice President - Controller and Assistant Secretary of SM Energy Company from May 2011 to October 2018. Prior to that, he served in various roles at SM Energy Company, including Controller, Assistant Vice President – Financial Reporting and Assistant Vice President – Assistant Controller. Mr. Solomon was an auditor with Ernst & Young prior to joining SM Energy Company. Mr. Solomon holds a Bachelor of Science in Accounting from Lipscomb University and is a Certified Public Accountant.

3

SECTION 16(a) – BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires our directors and executive officers, and persons who own more than 10% of a registered class of our equity securities, to file with the SEC and any exchange or other system on which such securities are traded or quoted, initial reports of ownership and reports of changes in ownership of our common shares and other equity securities.

Delinquent Section 16(a) Reports

To our knowledge, based solely on a review of the copies of such Section 16(a) reports furnished to us and written representations that no other reports were required, we believe all reporting obligations of our officers, directors and greater-than-10% shareholders under Section 16(a) were satisfied during the year ended December 31, 2019, except that with respect to Mr. Stratton, a Form 4 reporting two delinquent Form 4 filings involving three transactions for 2019 was filed on October 7, 2019.

CORPORATE GOVERNANCE

Statement of Corporate Governance Practices

We believe that good corporate governance is important to ensure our business is managed for the overall benefit of our shareholders. We periodically review our corporate governance policies and practices and compare them to those suggested by various authorities in corporate governance and to the practices of other public companies. We also continuously review the rules and regulations promulgated under the Sarbanes-Oxley Act of 2002 and all new and proposed rules of the SEC. Although our common shares were delisted from the NASDAQ Global Select Market (“NASDAQ”) and now trade on the OTC Bulletin Board, our Corporate Governance Principles incorporate many of the governance standards utilized by NASDAQ and we continue to review all new and proposed listing and compliance standards of the NASDAQ, and we do and will continuously review the NASDAQ compliance standards.

Corporate Governance Principles. Our Board has adopted Corporate Governance Principles to assist the Board in the exercise of its responsibilities. These Principles are interpreted in the context of all applicable laws and our Certificate of Continuance, Articles of Reorganization (the “Articles”), bylaw and other corporate governance documents. The Principles are intended to serve as a flexible framework within which the Board may conduct its business and not as a set of legally binding obligations. The Principles are available free of charge to the public on our website at http://www.ultrapetroleum.com. You may also request a copy of the Principles at no cost by making a written or telephone request for copies to Ultra Petroleum Corp., Corporate Secretary, 116 East Inverness Drive, Suite 400, Englewood, CO 80112, (303) 708-9740.

Code of Ethics and Business Conduct. Our Board has adopted a Code of Ethics and Business Conduct which applies to all of our directors, officers, and employees. The Code of Ethics and Business Conduct is available free of charge on our website at http://www.ultrapetroleum.com. You may also request a copy of the Code of Ethics and Business Conduct at no cost by making a written or telephone request for copies to Ultra Petroleum Corp., Corporate Secretary, 116 East Inverness Drive, Suite 400, Englewood, CO 80112, (303) 708-9740. Any amendments to or waivers of the Code of Ethics and Business Conduct will also be posted on our website as required by applicable rules or regulations. As of the date of this Amended Filing, our Board has not granted any waivers to the Code of Ethics and Business Conduct.

Mandate of the Board and Role in Risk Oversight

Our Board has explicitly acknowledged its responsibility for the management of our business and affairs, and to act with a view to our best interests. The mandate of the Board includes, among other matters: the monitoring of senior management’s conduct of our business operations and affairs; the review and approval of our fundamental financial and business objectives and major corporate actions; the assessment of major risks facing the Company; the selecting and evaluation of the Chief Executive Officer, including the approval of the Chief Executive Officer’s compensation; the planning for succession for senior executives; and the overseeing of policies and procedures regarding corporate governance, ethical conduct and maintenance of financial accounting controls.

While our full Board, with input from each of its committees, oversees our management of risks, our management team is responsible for our day-to-day risk management process. Our Audit Committee reviews, with management as well as our internal and external auditors, our business risk management process, including the adequacy of our overall control environment and controls in selected areas representing significant financial and business risk. Our Audit Committee receives reports from management at least quarterly regarding management’s assessment of various risks and considers the impact of risk on our financial position and the adequacy of our risk-related internal controls. In addition, each of the committees of our Board as well as senior management reports regularly to our full Board regarding risks we face and the steps taken to mitigate those risks.

4

Our Board met formally thirteen times during the fiscal year ended December 31, 2019. No current director attended fewer than 75% of the aggregate number of formal meetings of the Board during the period in which he or she served on the Board.

All of our directors attended our annual meeting, either in person or telephonically, in 2019. We believe that there are benefits to having members of the Board attend annual meetings, and we will strongly encourage all of the directors and director nominees to attend the annual meetings; however, attendance is not mandatory.

Board of Directors’ Leadership Structure

The Board of Directors currently has separate roles for the non-executive Chairman of the Board and the Chief Executive Officer. The Company believes the separation of the two roles allows the Chief Executive Officer to focus on the day-to-day business and operations while allowing the independent Chairman of the Board to lead the board in its fundamental role of providing guidance to and oversight of management. Further, we believe the separate roles will better align the interests of shareholders and the management team in the Company’s strategic plan going forward.

Communication with the Board of Directors

We have provided our shareholders and other interested parties a direct and open line of communication to our Board. Shareholders and other interested persons may communicate with the Chairman of our Audit Committee or with our non-management directors as a group by written communications addressed in care of Corporate Secretary, Ultra Petroleum Corp., 116 East Inverness Drive, Suite 400, Englewood, CO 80112, (303) 708-9740.

Communications received in accordance with these procedures will be reviewed initially by our senior management and relayed to the appropriate director or directors unless it is determined the communication: (i) does not relate to our business or affairs or the functioning or constitution of our Board or any of its committees; (ii) relates to routine or insignificant matters that do not warrant the attention of the Board; (iii) is an advertisement or other commercial solicitation or communication; (iv) is frivolous or offensive; or (v) is otherwise inappropriate for delivery to the Board.

Any director who receives such a communication will have discretion to determine whether the subject matter should be brought to the attention of the full Board or one or more of its committees and whether any response to the person sending the communication is appropriate. Any such response will be made only in accordance with applicable law and regulations relating to the disclosure of information.

Our Corporate Secretary will retain copies of all communications received pursuant to these procedures for a period of at least one year. The Board will review the effectiveness of these procedures from time to time and, if appropriate, recommend changes.

Board Committees

Our Board has three committees: the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. The Board may add new committees or remove existing committees as it deems advisable for purposes of fulfilling its primary responsibilities. Each committee will perform its duties as assigned by the Board in compliance with our bylaws. The committees and their mandates are outlined below. In 2019, the Board formed two additional committees (Strategic Alternatives Committee and Liability Management Committee) to assist the Board in fulfilling its responsibilities in evaluating all options available to the Company throughout 2019 and early 2020.

Audit Committee. The purpose of the Audit Committee is to assist the Board with its oversight of: the quality and integrity of our financial statements and accounting and financial reporting processes; our compliance with legal and regulatory requirements; the qualifications, independence and performance of our independent registered public accounting firm; and the performance of our internal audit function. The principal function of the Audit Committee is to assist our Board in the areas of financial reporting and accounting integrity. As such, it meets periodically with the independent registered public accounting firm and management, including each in executive session. Management is solely responsible for our financial statements and the financial reporting process, including the system of internal controls. Our independent registered public accounting firm is responsible for expressing an opinion on the conformity of these financial statements, in all material respects, with accounting principles generally accepted in the United States of America.

Our Audit Committee is responsible for retaining and compensating our independent registered public accounting firm. The Audit Committee annually reviews and pre-approves the audit, review, attestation and permitted non-audit services to be provided during the next audit cycle by our independent registered public accounting firm. To the extent practicable, at the same meeting the Audit Committee also reviews and approves a budget for each of such services. Services proposed to be provided by the independent registered public accounting firm that have not been pre-approved during the annual review and the fees for such proposed services must be pre-approved by the Audit Committee. The Audit Committee has delegated to the Chairman of the Audit Committee authority to approve permitted services provided that the Chairman reports any decisions to the Audit Committee at its next scheduled meeting.

5

All requests or applications for the independent auditor to provide services to us must be submitted to the Audit Committee by the independent auditor and management and must state whether, in the view of the submitting party, the request or application is consistent with applicable laws, rules and regulations relating to auditor independence. In the event that any member of management or the independent auditor becomes aware that any services are being, or have been, provided to us by the independent auditor without the requisite pre-approval, such individual must immediately notify the Chief Financial Officer, who must promptly notify the Chairman of the Audit Committee and appropriate management so that prompt action may be taken to the extent deemed necessary or advisable.

The Audit Committee is currently comprised of Messrs. Keeffe (Chairman), McDaniel, and Mintz. The Board has affirmatively determined that each of the members is able to read and understand fundamental financial statements, and is “independent” under applicable SEC rules and regulations and for purposes of NASDAQ rules applicable to members of the Audit Committee. Additionally, our Board of Directors has determined that Messrs. Keeffe, McDaniel and Mintz are each an “audit committee financial expert.”

Our Audit Committee met formally five times during the fiscal year ended December 31, 2019. No current director who was a member of the Audit Committee in 2019 attended fewer than 75% of the aggregate number of formal meetings of the Audit Committee during the period in which he served on such committee. The Audit Committee Charter is available free of charge to the public on our website at http://www.ultrapetroleum.com. You may also request a copy of the Audit Committee Charter at no cost by making a written or telephone request for copies to Ultra Petroleum Corp., Corporate Secretary, 116 East Inverness Drive, Suite 400, Englewood, CO 80112, (303) 708-9740.

Compensation Committee. The purpose of our Compensation Committee is to carry out the responsibilities delegated by the Board relating to the review and determination of executive compensation. The Compensation Committee has the authority and responsibility to, among other things: annually review and approve the corporate goals and objectives applicable to the compensation of the executive officers; review and discuss with management our “Compensation Discussion and Analysis” and related executive compensation information to be included in our annual proxy statement (or, in lieu of such filing, our Annual Report on Form 10-K); review and, when appropriate, recommend to the Board for approval, incentive compensation plans and equity-based plans; and consider the results of the most recent shareholder advisory vote on executive compensation as required by Section 14A of the Exchange Act.

The Compensation Committee is currently comprised of Messrs. Goldman (Chairman), Keeffe, and Lederman and Ms. Barnes. Each of these members is “independent” under applicable SEC rules and regulations and for purposes of NASDAQ rules applicable to members of the Compensation Committee. Mr. Scoggins was a member of the Compensation Committee until May 2019 when Ms. Barnes was elected to our Board of Directors. Following Ms. Barnes’ election, she joined the Compensation Committee and Mr. Scoggins joined the Nominating and Corporate Governance Committee.

Our Compensation Committee met formally seven times during the fiscal year ended December 31, 2019. No current director who was a member of the Compensation Committee in 2019 attended fewer than 75% of the aggregate number of formal meetings of the Compensation Committee during the period in which he or she served on such committee. The Compensation Committee Charter is available free of charge to the public on our website at http://www.ultrapetroleum.com. You may also request a copy of the Compensation Committee Charter at no cost by making a written or telephone request for copies to Ultra Petroleum Corp., Corporate Secretary, 116 East Inverness Drive, Suite 400, Englewood, CO 80112, (303) 708-9740.

Nominating and Corporate Governance Committee. The purpose of the Nominating and Corporate Governance Committee (the “Nominating Committee”) is to: develop and recommend qualification standards and other criteria for selecting new directors; oversee evaluations of the Board, individual Board members and the Board committees; and periodically review and assess our Corporate Governance Principles and Code of Ethics and Business Conduct and our compliance therewith, and make recommendations for changes thereto to the Board.

The Nominating Committee is currently comprised of Messrs. Mintz (Chairman), Goldman, Scoggins, and Lederman. Each of these members is “independent” under applicable SEC rules and regulations and for purposes of NASDAQ rules applicable to members of the Nominating Committee.

Our Nominating Committee met formally seven times during the fiscal year ended December 31, 2019. No current director who was a member of the Nominating Committee in 2019 attended fewer than 75% of the aggregate number of formal meetings of the Nominating Committee during the period in which he served on such committee. In accordance with our Corporate Governance Principles and with the Nominating Committee’s Charter, the Nominating Committee performs the functions listed above, which includes an assessment of whether our Board has the necessary diversity of skills, backgrounds, and experiences to meet our ongoing needs. The Nominating Committee Charter is available free of charge to the public on our website at http://www.ultrapetroleum.com. You may also request a copy of the Nominating Committee Charter at no cost by making a written or telephone request for copies to Ultra Petroleum Corp., Corporate Secretary, 116 East Inverness Drive, Suite 400, Englewood, CO 80112, (303) 708-9740.

6

Identifying and Evaluating Director Nominees

The Board has established certain criteria that it and the Nominating Committee use as guidelines in considering nominations to our Board. The criteria include: personal characteristics, including such matters as integrity, age, education, financial independence, diversity of background, gender and ethnic diversity, skills and experience, absence of potential conflicts of interest with us and our operations, willingness to exercise independent judgment, and the availability and willingness to devote sufficient time to the duties as one of our directors; experience in corporate management; experience as a board member of another company; practical and mature business judgment; and in the case of an incumbent director, past performance on our Board. The criteria are not exhaustive, and the Board and the Nominating Committee may consider other qualifications and attributes which they believe are appropriate in evaluating the ability of an individual to serve on our Board. Our goal is to assemble a board of directors with a variety of perspectives and skills derived from high quality business and professional experience. In doing so, the Board and the Nominating Committee also consider candidates with appropriate non-business backgrounds.

The Board and our Nominating Committee believe that, based on their knowledge of our corporate governance principles and the needs and qualifications of the Board at any given time, the Board, with the help of the Nominating Committee, is best equipped to select nominees that will result in a well-qualified and well-rounded board of directors. Accordingly, it is the policy of the Board not to accept unsolicited nominations from shareholders.

In making its nominations, the Board and the Nominating Committee identify nominees by first evaluating the current members of the Board willing to continue their service. Current members with qualifications and skills that are consistent with the criteria for Board service are re-nominated. As to new candidates, the Board and the Nominating Committee members discuss among themselves and members of management their respective recommendations. The Board and the Nominating Committee may also review the composition and qualification of the boards of directors of our competitors, seek input from industry experts or analysts and commission a formal director search to help identify qualified candidates. The Board and the Nominating Committee review the qualifications, experience, and background of the candidates. Final candidates are interviewed by the independent directors and executive management. In making determinations, the Board and the Nominating Committee evaluate each individual in the context of the Board as a whole, with the objective of assembling a group that can best represent shareholder interests through the exercise of sound judgment. After review and deliberation of all feedback and data, the Board of Directors slates the nominees.

In addition, as previously disclosed, we entered into a director nomination agreement dated December 21, 2018 (the “Director Nomination Agreement”) with certain holders of our 9.00% Cash / 2.00% PIK Senior Secured Second Lien Notes, pursuant to which a majority of such holders may designate an independent director for nomination to the Board. On January 30, 2019, pursuant to the terms of the Director Nomination Agreement, Sylvia K. Barnes became a non-voting observer of the Board and was thereafter duly elected by our shareholders to serve as a director of the Company at our annual meeting on May 22, 2019.

Procedures and Processes for Determining Director and Executive Officer Compensation

Information about our Compensation Committee’s procedures and processes for making compensation determinations is provided in the “Executive Compensation” section of this Amended Filing.

Compensation Committee Interlocks and Insider Participation

There were no Compensation Committee interlocks nor insider (employee) participation during 2019.

Item 11. Executive Compensation

Compensation Discussion and Analysis

This section discusses our compensation objectives and outlines the decisions regarding 2019 compensation for our named executive officers. We are currently considered a “smaller reporting company” for purposes of the SEC’s executive compensation and other disclosures.

Our Named Executive Officers as of December 31, 2019

|

Name |

|

Title |

|

Brad Johnson |

|

President, Chief Executive Officer and Director |

|

David W. Honeyfield |

|

Senior Vice President and Chief Financial Officer |

|

Jerald J. Stratton, Jr. |

|

Senior Vice President and Chief Operating Officer |

7

Our compensation program is designed to attract, retain, and motivate our employees in order to effectively execute our business strategy.

|

|

||

|

✓ Pay for performance — We link pay to performance. We set clear financial and operational goals for corporate performance, and we differentiate based on individual achievements so that a substantial component of our executive compensation is not guaranteed.

✓ Mitigate incentives to take undue risk — We mitigate the chance that our named executive officers may have incentive to take undue risk by using multiple performance measures and targets, different performance measures in our short-term and long-term incentive programs, and by engaging both the Board and management in our internal processes to identify circumstances that may create unnecessary risk.

✓ Share ownership guidelines — We have adopted share ownership guidelines for our executive officers and directors, which we believe serve to align the interests of our executive officers and directors with those of our shareholders by requiring them to acquire and maintain a meaningful equity position in the Company, which further encourages our executives to support our objective of building long-term shareholder value.

✓ Reasonable post-employment/change in control provisions — We believe we have reasonable postemployment and change in control provisions that generally apply to our named executive officers in the same manner as the applicable broader employee population.

✓ Independent compensation firm — Our Compensation Committee regularly solicits the guidance of an independent compensation consulting firm which provides no other services to us or our named executive officers.

|

|

✗ No excise tax gross-ups

✗ No repricing of underwater stock options without shareholder approval

✗ No cash buyout of underwater options without shareholder approval

✗ Prohibition on named executive officers or directors from entering into short sales, puts or calls |

Process for Determining Named Executive Officer Compensation

Compensation Committee Consideration of 2019 Shareholder Advisory Vote on Our Compensation Program.

At our 2019 annual meeting, we asked our shareholders to approve, in an advisory vote, the compensation of our named executive officers. Our shareholders broadly endorsed the compensation of our named executive officers, with approval by 76.6% of the votes cast on our “Say on Pay” proposal (excluding broker non-votes and abstentions). Further, also at our 2019 annual meeting, we asked shareholders to vote on the frequency with which we should hold a vote on Say on Pay. Our shareholders also endorsed holding a vote every year, with 97.9% voting in favor of holding annual Say on Pay advisory votes. We engage in regular discussions with our shareholders on many aspects of our business, and to the extent that during those discussions we receive shareholder feedback on our compensation practices, our Compensation Committee takes that feedback into account, along with the advice and guidance of our independent compensation consultants, as our Compensation Committee endeavors to ensure that our executive compensation programs are consistent with our objective of ensuring we are able to recruit, motivate and retain the executive talent required to successfully manage and grow our business. For a further analysis of our named executive officer compensation please refer to the section entitled “2019 Compensation Program” below.

8

We will continue to consider the outcome for our “Say on Pay” votes and shareholder views annually when making future compensation decisions for our executive officers.

Participants in the Decision-Making Process

|

Participant |

Role |

|

Compensation Committee |

• Composed entirely of independent (non-executive) members of our Board; • Oversees executive compensation programs, policies, and practices; • Reviews and approves the corporate goals and objectives for the Chief Executive Officer; • Evaluates the Chief Executive Officer’s performance based on the approved goals and objectives; • Determines competitive compensation of our named executive officers, including base salary, performance targets for incentive compensation, and any resulting awards predicated on performance achievement; and • Maintains exclusive authority to retain an independent compensation consultant.

|

|

Chief Executive Officer |

• Provides the Compensation Committee preliminary recommendations for executive compensation decisions related to our named executive officers (other than for the Chief Executive Officer); • Provides the Compensation Committee performance assessments on each named executive officer (other than the Chief Executive Officer); and • Provides the Compensation Committee information on short and long-term business strategy for consideration in establishing appropriate metrics and goals for the short-term and long-term incentive plans.

|

|

Independent Compensation Consultant |

• Retained by, and performs work at the direction of, the Compensation Committee; and • Provides research and analytical services on subjects such as trends in executive compensation, director compensation and corporate governance, peer, and industry data, including data on short-term and long-term performance measures, and executive officer compensation levels.

|

Compensation Philosophy and Considerations

Our executive compensation programs are designed to attract, retain, and motivate the technical, operational, professional, and executive talent needed to efficiently and effectively execute our business strategy. Our programs are designed to align executive compensation with the short- and long-term interests of our shareholders in the following ways:

|

|

• |

Our compensation is directly linked to our operational and financial performance and the performance of each named executive officer; |

|

|

• |

Our compensation program is designed to retain and motivate our named executive officers in the current industry environment, as well as to reward them for contributing to the achievement of our performance objectives; and |

|

|

• |

Our compensation program provides competitive pay levels commensurate with our named executive officers’ qualifications, skills, experience, and responsibilities. |

Compensation Practices and Enterprise Risk

We do not believe our compensation policies and practices create risks that are reasonably likely to have a material adverse effect on the Company or our business. In addition, we believe that the mix and design of the elements of compensation do not encourage our named executive officers to assume excessive risks.

9

Benchmarking Process and Competitive Positioning

In 2019, our Compensation Committee retained Lyons, Benenson & Company Inc. (“LB&C”) to advise the Compensation Committee with respect to executive officer compensation. Specifically, LB&C is engaged to review the current Peer Group and compensation structure for our executive officers, develop a benchmark for executive compensation by analyzing the executive compensation structure of our current Peer Group and current market trends, and provide advice to the Compensation Committee on the 2019 executive compensation structure and program based on their analysis. LB&C is also engaged to review the compensation arrangements applicable to the non-employee, independent directors of the Board.

Peer Group for 2019 Compensation

The Compensation Committee, in consultation with LB&C, considered several factors in selecting an industry-specific Peer Group for external benchmarking. Considerations included the following:

|

|

• |

Market capitalization between one-half and two times the size of the Company; |

|

|

• |

Revenue between one-half and two times the size of the Company; |

|

|

• |

Assets between approximately one-third and three times the size of the Company; and |

|

|

• |

Companies with substantial gas production (greater than 50% of production). |

Our compensation Peer Group for 2019 included the following companies:

|

• Cabot Oil & Gas Corp. |

• Gulfport Energy Corporation |

• Northern Oil and Gas, Inc. |

|

• Carrizo Oil & Gas Inc. |

• HighPoint Resources Corporation |

• Oasis Petroleum, Inc. |

|

• Denbury Resources Inc. |

• Laredo Petroleum, Inc. |

• PDC Energy, Inc. |

|

• EP Energy Corp. |

• Matador Resources Co. |

• QEP Resources, Inc. |

|

• Extraction Oil & Gas Inc. |

• Montage Resources Corporation |

• SRC Energy, Inc |

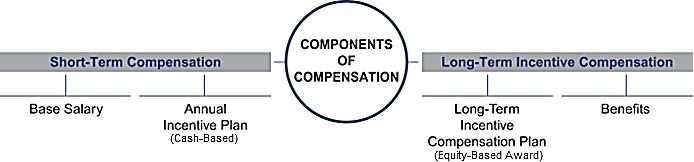

Elements of the 2019 Compensation Program

The compensation program for our named executive officers is comprised of base salary, cash-based annual incentive compensation, long-term equity-based incentive compensation and benefits. Our program is designed to deliver the majority of an executive’s compensation in performance-based awards dependent on both Company and individual performance.

10

|

Purpose |

Competitive Positioning |

|

|

|

|

|

|

Base Salary |

• Recognize responsibilities, experience, and contributions • Provide competitive, regular-paid income |

• Competitive with peers |

|

|

|

|

|

|

|

|

|

Annual Incentive Plan Grants (Cash-Based Award) |

• Reward the achievement of key shorter-term corporate objectives • Align our named executive officers’ interests with shareholder interests |

• Target opportunity set at competitive levels relative to peers, subject to Compensation Committee discretion • Actual payouts determined based on annual performance relative to annual goals |

|

|

|

|

|

|

|

|

|

Stock Incentive Plan Grants (Equity-Based Award) |

• Align executives’ interests with the interests of shareholders over the long term • Motivate superior performance by means of long-term performance-related incentives • Encourage retention through time-based requirements • Enable our executives to share in the long-term growth and success of the Company |

• Actual value earned dependent on performance relative to specific stock price appreciation performance goals • Tiered vesting based on the overall performance and total enterprise value of the Company |

|

|

|

|

|

|

|

|

|

Benefits |

• Provide savings and security through matching 401(k) contributions, discretionary supplemental contributions to the Company’s 401(k) plan, medical, dental, life, and long-term disability insurance

|

• Competitive with market practice |

Base Salary

The base salary for our named executive officers is based on the responsibilities, experience, and contributions of each such executive. We consider how the current base salary for each of our named executive officers aligns with market trends and conditions and the median of our Peer Group.

We believe the base salaries for our named executive officers are generally competitive within the market but are moderate relative to base salaries paid by companies with which we compete for similar executive talent across the broad spectrum of the energy industry.

We review the base salaries on an annual basis and may make adjustments as necessary to maintain a competitive executive compensation structure. As part of our review, we may examine the compensation of executive officers in similar positions with similar responsibilities at peer companies identified by our Board or Compensation Committee or at companies within the oil and gas industry with which we generally compete for executive talent.

Our Compensation Committee determines base salaries for our named executive officers based on individual performance and the peer group and market condition factors referenced above.

Executive Employment Agreements

Executive Employment Agreements: Brad Johnson

As previously disclosed, Brad Johnson, our then-Senior Vice President of Operations, was promoted to Interim Chief Executive Officer and appointed to our Board following the retirement of the Company’s former Chief Executive Officer in February 2018. Effective March 1, 2019, Mr. Johnson was appointed President and Chief Executive Officer and in connection with such

11

appointment, we entered into a new employment agreement with Mr. Johnson and on March 10, 2020, we amended the employment agreement to provide for an Additional Incentive Bonus (as defined below) (collectively, the “Johnson Employment Agreement”). The Johnson Employment Agreement provides Mr. Johnson with an initial base salary of $650,000 per year and with eligibility to receive cash-based incentive compensation pursuant to the Company’s Annual Incentive Plan (as defined below) with a target bonus amount equal to 100% of his annual base salary (the “Johnson Cash Incentive”) and pursuant to the amendment, an additional incentive bonus consisting of a one-time, time-based additional bonus in the amount of $411,250, one-third of which would vest and become payable, in a lump sum cash payment, on March 1, 2021 and the remaining two-thirds of which would vest and become payable, in a lump sum cash payment, on September 1, 2021, subject to continued employment on each date (the “Additional Incentive Bonus”). Mr. Johnson is also eligible to receive grants of equity-based incentive compensation in the form of time-based and performance-based restricted stock units (“RSUs”). The Johnson Employment Agreement also provides Mr. Johnson with other benefits, including health insurance and the opportunity to participate in a 401(k) plan, to the same extent as such benefits are available to the Company’s other salaried employees.

The Johnson Employment Agreement provides that either the Company or Mr. Johnson can terminate the employment relationship. The Company’s right to terminate the employment relationship is subject to its obligation to make certain severance payments and provide certain other benefits to Mr. Johnson, depending upon the circumstances under which the employment relationship is terminated. The Company is generally not obligated, under the Johnson Employment Agreement, to provide any severance payments or benefits if Mr. Johnson is terminated for cause or if Mr. Johnson resigns without good reason (each, as defined in the Johnson Employment Agreement). The Company is generally obligated, under the Johnson Employment Agreement, to provide the severance payments and benefits as set forth in the Johnson Employment Agreement if the Company terminates him without cause, or if he resigns with good reason. In the event Mr. Johnson’s employment is terminated by the Company without cause, or in the event Mr. Johnson resigns for good reason, the Company will be obligated (subject to Mr. Johnson’s timely execution and non-revocation of a general release of claims in favor of the Company) to provide him with the following severance benefits: (i) payment of any accrued but unpaid compensation as of the termination date (the “Johnson Accrued Benefits”), (ii) payment of a portion of his annual cash incentive compensation based on his target under the Annual Incentive Plan and the Company’s actual performance at the conclusion of the performance period without pro-ration (the “Johnson Severance Cash Incentive”), (iii) a lump-sum payment equal to 150% of his then-current annual base salary and any Johnson Cash Incentive earned, but not yet paid, for the year prior to the year of termination (the “Johnson Severance Payment”), (iv) any unpaid Additional Incentive Bonus, and (v) continued coverage under the Company’s health and welfare benefits programs for the shorter of (x) 12 months following his termination and (y) the date on which he obtains comparable coverage under a subsequent employer. In the event Mr. Johnson is terminated due to disability (as defined in the Johnson Employment Agreement) or in the event of Mr. Johnson’s death, the Company will be obligated to provide him with the following severance benefits: (i) the Johnson Accrued Benefits, (ii) the Johnson Severance Cash Incentive, and (iii) any unpaid Additional Incentive Bonus.

The Johnson Employment Agreement also contains various other ordinary and customary covenants for the Company’s benefit by Mr. Johnson with respect to inventions, non-competition, non-solicitation, non-disparagement, confidentiality, and cooperation and assistance with respect to litigation or other adjudicatory proceedings.

Executive Employment Agreement: David W. Honeyfield

In November 2018, we entered into an employment agreement with David W. Honeyfield. On March 10, 2020, we amended the employment agreement to provide for an Additional Incentive Bonus (collectively, the “Honeyfield Employment Agreement”). The Honeyfield Employment Agreement provides Mr. Honeyfield with an initial base salary of $500,000 per year; an aggregate sign-on bonus of $100,000 paid in two equal installments in 2019; eligibility to receive cash-based incentive compensation pursuant to the Company’s Annual Incentive Plan with a target bonus amount equal to 90% of his annual base salary (the “Honeyfield Cash Incentive”); pursuant to the amendment, a one-time Additional Incentive Bonus of $375,000 (subject to the same vesting terms as described above with respect to the Johnson Employment Agreement); and eligibility to receive grants of equity-based incentive compensation in the form of time-based and performance-based RSUs. Mr. Honeyfield was subsequently named Senior Vice President and Chief Financial Officer and his base salary was adjusted to $550,000, with each adjustment being effective as of March 1, 2019. The Honeyfield Employment Agreement also provides Mr. Honeyfield with other benefits, including health insurance and the opportunity to participate in a 401(k) plan, to the same extent as such benefits are available to our other salaried employees.

The Honeyfield Employment Agreement provides that either the Company or Mr. Honeyfield can terminate the employment relationship. The Company’s right to terminate the employment relationship is subject to its obligation to make certain severance payments and provide certain other benefits to Mr. Honeyfield, depending upon the circumstances under which the employment relationship is terminated. The Company is generally not obligated, under the Honeyfield Employment Agreement, to provide any severance payments or benefits if Mr. Honeyfield is terminated for cause or if Mr. Honeyfield resigns without good reason (each, as defined in the Honeyfield Employment Agreement). The Company is generally obligated, under the Honeyfield Employment Agreement, to provide the severance payments and benefits as set forth in the Honeyfield Employment Agreement if the Company terminates him without cause, or if he resigns with good reason. In the event Mr. Honeyfield’s employment is terminated without cause, or in the event of a resignation for good reason, we will be obligated (subject to Mr. Honeyfield’s timely execution and non-revocation of a general release of claims in favor of the Company) to provide him with the following severance benefits: (i) payment

12

of any accrued but unpaid compensation as of the termination date (the “Honeyfield Accrued Benefits”), (ii) payment of a pro-rated portion of the annual cash incentive compensation he would have received based on his target under the Annual Incentive Plan and the Company’s actual performance at the conclusion of the performance period for the calendar year in which the termination of employment occurred (the “Honeyfield Severance Cash Incentive”), (iii) a lump-sum payment equal to 100% of his then-current annual base salary and any Honeyfield Cash Incentive earned, but not yet paid, for the year prior to the year of termination (the “Honeyfield Severance Payment”), (iv) any unpaid Additional Incentive Bonus, and (v) continued coverage under the Company’s health and welfare benefits programs for the shorter of (x) 12 months following his termination and (y) the date on which he obtains comparable coverage. In the event Mr. Honeyfield is terminated due to disability (as defined in the Honeyfield Employment Agreement) or in the event of Mr. Honeyfield’s death, the Company will be obligated to provide him with the following severance benefits: (i) the Honeyfield Accrued Benefits, (ii) the Honeyfield Severance Cash Incentive, and (iii) any unpaid Additional Incentive Bonus.

The Honeyfield Employment Agreement also contains various other ordinary and customary covenants for the Company’s benefit by Mr. Honeyfield with respect to inventions, non-competition, non-solicitation, non-disparagement, confidentiality, and cooperation and assistance with respect to litigation or other adjudicatory proceedings.

Executive Employment Agreement: Jerald J. Stratton, Jr.

In May 2018, we entered into an employment agreement with Jerald J. Stratton, Jr. as Chief Operating Officer and on March 10, 2020, we amended the employment agreement to provide for an Additional Incentive Bonus (collectively, the “Stratton Employment Agreement”). Mr. Stratton was subsequently named Senior Vice President and Chief Operating Officer. The Stratton Employment Agreement provides Mr. Stratton with an initial annual base salary of $500,000; an aggregate sign-on bonus of $100,000 payable in two equal installments; eligibility to receive cash-based incentive compensation pursuant to the Company’s Annual Incentive Plan with a target bonus amount equal to 90% of his annual base salary (the “Stratton Cash Incentive”); a one-time Additional Incentive Bonus of $325,000 (subject to the same vesting terms as described above with respect to the Johnson Employment Agreement); and eligibility to receive grants of equity-based incentive compensation in the form of time-based and performance-based RSUs. The Stratton Employment Agreement also provides Mr. Stratton with other benefits, including health insurance and the opportunity to participate in a 401(k) plan, to the same extent as such benefits are available to the Company’s other salaried employees.

The Stratton Employment Agreement provides that either the Company or Mr. Stratton can terminate the employment relationship. The Company’s right to terminate the employment relationship is subject to its obligation to make certain severance payments and provide certain other benefits to Mr. Stratton, depending upon the circumstances under which the employment relationship is terminated. The Company is generally not obligated, under the Stratton Employment Agreement, to provide any severance payments or benefits if Mr. Stratton is terminated for cause or if Mr. Stratton resigns without good reason (each, as defined in the Stratton Employment Agreement). The Company is generally obligated, under the Stratton Employment Agreement, to provide the severance payments and benefits as set forth in the Stratton Employment Agreement if the Company terminates him without cause, or if he resigns with good reason. In the event Mr. Stratton’s employment is terminated without cause, or in the event of a resignation for good reason, we will be obligated (subject to Mr. Stratton’s timely execution and non-revocation of a general release of claims in favor of the Company) to provide him with the following severance benefits: (i) payment of any accrued but unpaid compensation as of the termination date (the “Stratton Accrued Benefits”), (ii) payment of a pro-rated portion of the annual cash incentive compensation he would have received based on his target under the Annual Incentive Plan and the Company’s actual performance at the conclusion of the performance period for the calendar year in which the termination of employment occurred, (iii) a lump-sum payment equal to 100% of his then-current annual base salary and any Stratton Cash Incentive earned, but not yet paid, for the year prior to the year of termination (the “Stratton Severance Payment”), (iv) any unpaid Additional Incentive Bonus, and (v) continued coverage under the Company’s health and welfare benefits programs for the shorter of (x) 12 months following his termination and (y) the date on which he obtains comparable coverage. In addition, Mr. Stratton must repay to the Company (i) the full amount of the sign-on bonus previously paid, if his employment is terminated by the Company for cause, or if he resigns other than for good reason, or (ii) a $50,000 portion of the sign-on bonus previously paid, if his employment is terminated due to death or disability, in each case, for clauses (i) and (ii), if such termination occurs prior to June 4, 2019. In the event Mr. Stratton is terminated due to disability (as defined in the Stratton Employment Agreement) or in the event of Mr. Stratton’s death, the Company will be obligated to provide him with the following severance benefits: (i) the Stratton Accrued Benefits, (ii) the Stratton Severance Cash Incentive, and (iii) any unpaid Additional Incentive Bonus.

The Stratton Employment Agreement also contains various other ordinary and customary covenants for the Company’s benefit by Mr. Stratton with respect to inventions, non-competition, non-solicitation, non-disparagement, confidentiality, and cooperation and assistance with respect to litigation or other adjudicatory proceedings.

13

In July 2018, the Compensation Committee approved the adoption of an annual incentive compensation plan (the “Annual Incentive Plan”), which provides for the payment of short-term, cash-based incentive compensation to certain employees, including the Company’s named executive officers. Pursuant to the Annual Incentive Plan, the Compensation Committee, in its sole discretion, (i) established written corporate performance goals (“Performance Goals”), which were comprised of multiple elements of Company performance, called “key performance indicators” (“KPIs”); (ii) established target awards for each employee, the payment of which were be contingent on achievement of the Performance Goals for the applicable period; and (iii) prescribed a formula for determining the percentage of such target awards that were payable based upon the level of attainment of the Performance Goals for the applicable period.

In March 2019, the Compensation Committee approved, pursuant to the Annual Incentive Plan, KPIs for fiscal year 2019, as well as the Performance Goals applicable to, the relative weighting of, and the funding formula for each KPI. The KPIs for fiscal year 2019, each of which are weighted equally in the formula, were: (i) annual production, (ii) controllable cash costs (consisting of lease operating expenses plus cash general and administrative expenses), (iii) well performance drill bit finding and development (“F&D”) cost, and (iv) execution of the Company’s business plan. The Compensation Committee also established target values under our Annual Incentive Plan for the Company’s executive officers, pursuant to which each executive officer was eligible to earn a bonus under our Annual Incentive Plan in respect of fiscal year 2019 with a target amount equal to a percentage of his annual base salary.

Under our Annual Incentive Plan, the Compensation Committee establishes performance metrics and goals each year, which are designed to measure key deliverables critical to our sustained short and longer-term success. The Compensation Committee, in its discretion, may consider additional factors such as commodity prices and significant corporate transactions in determining the actual amount of any annual incentive award.

Our executive officers have the potential to receive meaningful annual cash incentive compensation under our Annual Incentive Plan. In 2019, the Annual Incentive Plan payout opportunity ranged from 0% to 200% of target with payouts based on actual level of performance achieved and the Compensation Committee’s discretion on overall performance. The threshold performance is 50% of target and the actual performance measurement can exceed 200% of target performance. Actual payouts have been based on the Compensation Committee’s discretion on overall performance; however, the total of all individual incentive awards may not exceed the funded and approved incentive pool.

The table below describes the targets established by the Compensation Committee and the actual performance level achieved during 2019.

|

Performance Metric & Unit |

|

Weight |

|

|

Threshold (50% payout) |

|

|

Target (100% payout) |

|

|

Maximum (200% payout) |

|

|

Actual Performance |

|

|||||

|

Production (Bcfe) |

|

|

25 |

% |

|

|

241.0 |

|

|

|

247.0 |

|

|

|

260.0 |

|

|

|

240.2 |

|

|

Controllable Cash Costs ($/Mcfe) |

|

|

25 |

% |

|

$ |

0.385 |

|

|

$ |

0.355 |

|

|

$ |

0.310 |

|

|

$ |

0.39 |

|

|

Well Performance Drill Bit F&D ($/Mcfe) |

|

|

25 |

% |

|

$ |

1.120 |

|

|

$ |

1.070 |

|

|

$ |

1.010 |

|

|

$ |

1.80 |

|

|

Execution of 2019 Business Plan |

|

|

25 |

% |

|

|

n/a |

|

|

|

n/a |

|

|

|

n/a |

|

|

|

n/a |

|