Attached files

| file | filename |

|---|---|

| 8-K - 8-K INVESTOR PRESENTATION 06 03 20 - U.S. CONCRETE, INC. | a8-kinvestorpresentati.htm |

June 2020 Investor Presentation

Disclaimer CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS Certain statements and information provided in this presentation are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements include, without limitation, statements concerning plans, objectives, goals, projections, outlook, strategies, future events or performance, and underlying assumptions and other statements, which are not statements of historical facts. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “intend,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “outlook,” “predict,” “potential” or “continue,” the negative of such terms or other comparable terminology. These forward- looking statements, which are subject to risks, uncertainties and assumptions about us, may include projections of our future financial performance, our anticipated growth strategies and anticipated trends in our business. These statements are predictions based on our current expectations and projections about future events which we believe are reasonable. Actual events or results may differ materially. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We believe that these risks and uncertainties include, but are not limited to: general economic and business conditions, which will, among other things, affect demand for new residential and commercial construction; our ability to successfully identify, manage, and integrate acquisitions; the cyclical nature of, and changes in, the real estate and construction markets, including pricing changes by our competitors; governmental requirements and initiatives, including those related to mortgage lending, financing or deductions, funding for public or infrastructure construction, land usage, and environmental, health, and safety matters; disruptions, uncertainties or volatility in the credit markets that may limit our, our suppliers’ and our customers’ access to capital; our ability to successfully implement our operating strategy; weather conditions; our substantial indebtedness and the restrictions imposed on us by the terms of our indebtedness; the effects of currency fluctuations on our results of operations and financial condition; our ability to maintain favorable relationships with third parties who supply us with equipment and essential supplies; our ability to retain key personnel and maintain satisfactory labor relations; and product liability, property damage, results of litigation and other claims and insurance coverage issues. These risks and uncertainties also include the effects of COVID-19; the length and severity of the COVID-19 pandemic; the pace of recovery following the COVID-19 pandemic; our ability to implement cost containment strategies; and the adverse effects of COVID-19 on our business, the economy and the markets we serve. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. All written and oral forward-looking statements made in connection with this press release that are attributable to us or persons acting on our behalf are expressly qualified in their entirety by the “Risk Factors” in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission. We are under no duty to update any of the forward-looking statements after the date of this press release to conform such statements to actual results or to changes in our expectations, except as required by federal securities laws. There can be no assurance that other factors will not affect the accuracy of these forward-looking statements or that our actual results will not differ materially from the results anticipated in such forward-looking statements. Unpredictable or unknown factors we have not discussed in this press release also could have material effects on actual results or matters that are the subject of our forward-looking statements. We undertake no obligation to, and do not intend to, update our description of important factors each time a potential important factor arises. Non-GAAP Financial Measures. Included in this presentation are certain non-GAAP financial measures that we believe are useful for investors. These non-GAAP financial measures may not be comparable to similarly titled measures other companies report and are not intended to be used as an alternative to any measure of our performance in accordance with GAAP. Please see the appendix to this presentation reconciliations. Industry and Market Data. This presentation includes industry data that we obtained from various third-party sources, including periodic industry publications, data compiled by the United States Census Bureau, and industry reports produced by consultants and trade associations. These third-party sources generally include a statement that the information contained therein has been obtained from sources believed to be reliable. However, industry and market data is subject to change and cannot always be verified with certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey. Neither we nor the initial purchasers have independently verified any of the data from third-party sources nor have we or the initial purchasers ascertained the underlying economic assumptions relied upon therein. As a result, you should be aware that industry, market and other similar data set forth herein, and estimates and beliefs based on such data, might not be accurate. 2

U.S. Concrete Overview

U.S. Concrete Summary Revenue ($mm)(1) • U.S. Concrete is one of the largest construction materials $1,506 $1,479 companies in North America $1,336 $1,168 • Focused on building defensible vertically integrated $975 market position with an increasing concentration on aggregates to create a unique and value enhancing franchise which is impossible to replicate • Operates in some of the fastest growing and most attractive metropolitan markets in the U.S., including New York City, Philadelphia, Washington, D.C., 2015 2016 2017 2018 2019 Dallas/Fort Worth, and San Francisco Adjusted EBITDA ($mm)(2) • Vertically integrated into aggregates, internally supplying $192 $194 $184 approximately 34% of our aggregate requirements $160 $132 • Our market leadership, vertical integration and logistics expertise provide us with significant competitive advantages that enable us to offer a compelling value proposition for both our customers and suppliers 2015 2016 2017 2018 2019 13.5% 13.7% 14.4% 12.8% 12.5% 2019 Financial Mix Adjusted EBITDA Margin(3) Revenue Mix by Region Ready-Mixed Volume by End Market Reported Segment Adj. EBITDA Other: 2% Infrastructure: 18% Aggregates: 25% West: 30% Commercial & Ready-mixed Central: Residential: Industrial: Concrete: 34% 22% 60% 75% East: 34% 1) Per respective years financial statements. 2) Adjusted EBITDA is a non-GAAP financial measure. See appendix for a reconciliation to the comparable GAAP measure. 3) Adjusted EBITDA Margin is a non-GAAP financial measure. See appendix for a reconciliation to the comparable GAAP measure. 4

U.S. Concrete Plays a Critical Role in the Construction Materials Value Chain Construction Materials Value Chain Ready-Mixed Manufacturing Materials Production Customers and Supplying Commercial (medium-large projects) • High service complexity, scale critical, rigorous quality standard, ability to differentiate on product • A core focus of USCR Infrastructure (medium-large projects) • Service complexity, need scale, ability to differentiate on product • A core focus of USCR Residential (small projects) • Service complexity low • Not a core focus of USCR No single customer accounted for more than 10% of revenue U.S. Concrete’s Value Proposition • Serves as a critical raw material producer and finished good manufacturer to highly fragmented and diverse contractor customer base • Supplying ready-mixed concrete requires a high degree of product, logistics and services expertise due to its unique attributes (short product life span, value-to-weight ratio) • Given the logistical proficiency required in the delivery process, USCR differentiates itself from its competitors based on scale, service and product quality 5

U.S. Concrete Investment Highlights Large, High Quality, Vertically Integrated Asset Base Top 3 Position in Favorable Geographic Markets A Top Supplier to Large and Complex Commercial Projects Increasing Vertical Integration into Aggregates Enhances Value Chain Logistical Expertise with Continued Investments in Technology Multiple Levers to Drive Continued Growth Creating Value through Acquisitions with Demonstrable Track Record of Successful Integrations Well Positioned to Continue to Capitalize on the Construction Cycle Solid Balance Sheet and Ample Liquidity Experienced Management Team with Long-Term Strategic Focus 6

Large, High Quality, Vertically Integrated Asset Base East Region Market Driver: Financial Services / Government West Region Market Driver: 41 Technology 26 4 1 5 2 Company Total 2011 Current 113 196 Central Region Market Driver: 7 19 Diversified 0 7 125 12 Ready-Mixed Concrete Operating Facilities U.S. Virgin Islands Aggregates Producing Facilities Aggregates Distribution Terminals 4 Ready-Mixed Concrete Market 2 Aggregates Market Note: As of December 31, 2019. 7

A Top Supplier to Large and Complex Commercial Projects Project Location Cubic Yards Status LaGuardia Airport Queens, New York 355,000 In Progress Charles Schwab Westlake Campus Westlake, Texas 141,526 In Progress Passport Park DFW Airport, Texas 108,440 In Progress Newark Airport Terminal A - Paving Newark, New Jersey 93,320 Upcoming 66 Hudson Blvd Manhattan, New York 90,000 In Progress Adobe North Tower Office Building San Jose, California 83,000 In Progress The Village Town Center Dallas, Texas 80,000 In Progress Google Caribbean Mt View Mt View, California 75,000 Upcoming Carter Distribution Fort Worth, Texas 65,100 In Progress UTSW BICC, Dallas-Vaughn Dallas, Texas 65,010 In Progress I680 / SR 4 Interchange Martinez, California 65,000 In Progress Goodyear Distribution Center Forney, Texas 62,097 In Progress Note: LaGuardia Airport was a joint venture with other providers As of December 31, 2019 8

Increasing Vertical Integration into Aggregates Enhances Value Chain Strong Base Continued Investment Acquisition Business in Aggregates Growth Leading Player in the Heavy Increasing Share of Segment ◼ History of Successful Acquisitions Building Materials Market EBITDA Derived from Aggregates Deep industry ties assist in sourcing M&A opportunities; well developed 9.2 Ready-Mixed Volume integration processes drive synergy (cubic yards in millions - 2019) realization 11.4 Aggregates Volume (tons in millions - 2019) ◼ Coram Acquisition 25% Coram represents a high-margin 2019 Revenue 25% $1,479 ($ in millions) Share of 2019 opportunity to further expand and Segment Adj. build density in the profitable NY 2019 Adj. EBITDA (1) EBITDA(3) Derived $184 10% market ($ in millions) from Aggregates (2) 12.5% 2019 Adj. EBITDA Margin (% of Revenue) 2015 2019 Long Run Favorable Effects of Favorable Characteristics Key Competitive Highlights Increasing Aggregates Mix of Coram Acquisition Leading Market Positions Improved Margin Profile Increased Vertical Integration in Attractive NY Market Unique Urban Asset Base (350+ acres of land & 49 million tons of sand reserves) Greater Control of Supply Chain Vertical Integration into Aggregates Meaningful Competitive Moat (limited permitted sources in Long Island) Improved Valuation Multiple Logistics and Scheduling Expertise Best-in-Class Operating Capabilities (well maintained equipment and facility footprint) Scale Drives Operating Efficiencies Higher Quality of Earnings Strong Synergy Potential Concrete Mix Design Expertise (footprint overlap / vertical integration) Proven Ability to Drive Value via M&A 1) Adjusted EBITDA is a non-GAAP financial measure. See appendix for a reconciliation to the comparable GAAP measure. 2) Adjusted EBITDA Margin is a non-GAAP financial measure. See appendix for a reconciliation to the comparable GAAP measure. 3) Segment Adjusted EBITDA calculated as the sum of ready-mixed concrete reporting segment Adjusted EBITDA and aggregate products reporting segment Adjusted EBITDA. 9

Acquisition of Coram Materials Company Overview Dual Dredge Operation • Coram Materials Corp. (“Coram”) is a premier provider of high-quality sand and gravel products located on Long Island, Dredge 1 NY • Coram owns and controls approximately 49.4 million tons of in-place reserves and excavates the material using two state- of-the-art floating barges equipped with clam shell buckets that feed conveyor lines to wet and dry processing plants • The $142 million acquisition further vertically integrates U.S. Concrete’s New York ready-mixed operations and position Dredge 2 itself to be one of the largest suppliers of natural sand to the NYC construction materials market Deal Highlights Proximity to our New York Ready-Mixed Operations • $142 million purchase price • ~41.9 million tons of proven and permitted reserves • ~7.5 million tons of proven and unpermitted reserves • Reinforces USCR’s aggregates focused strategy • High quality of earnings enhances overall company margin profile 10

Logistical Expertise with Continued Investments in Technology U.S. Concrete owns and licenses the Where’s My Concrete?™ technology platform providing a distinct competitive advantage in the marketplace Robust Digital Platform Cloud-Based Analytics Secure Mobile • Improves Customer • High Availability • Access Real-Time • Granular Security • Access for Interactions Data Roles Customers, Drivers, • Continuous Sales & Management • Increases Innovation • Actionable Insights • Two-Factor Operational into Operations Authentication • Anywhere, Anytime Efficiencies • Cost Effective Access • Truck Efficiency • Continuous • IoT Enabled with • Open Integration to Monitoring Integration to Truck Various 3rd Party • Driver Performance Solutions • SOX Compliant Sensors & GPS • Sales Analysis Tracking Devices • Financials 11

Environmental and Sustainable Leadership • Pioneered technology for low CO2 concrete • Reduced Levi’s Stadium carbon footprint by an estimated 23 million lbs. of CO2 • First company in the US concrete industry to adopt the 2030 Challenge to develop Environmental Product Declarations (“EPD”) • USCR has over 15,000 EPDs nationwide • Integrating Climate Earth’s EPD tool in our submittal process, thereby delivering on-demand EPDs for every product offering. • Strategic investments in technology to recycle CO2 to reduce carbon footprint while positively affecting product performance, further enhancing value proposition • CarbonCure has been retrofitted into existing concrete plants 12

Multiple Levers to Drive Continued Growth Strong track record of creating value through consistent execution of a profitable growth strategy • Continued market share gains Organic Growth • Further aggregates volume pull through • Strong customer relationships Operating • Increased self-supply of higher margin aggregates • Realization of operating improvements Excellence • Increased use of technology to drive improved logistics, i.e. Where’s My Concrete?™, VERIFI® Strategic • Higher margin aggregates strengthen portfolio • Increase vertical integration into aggregates Acquisitions • Augment existing market positions with bolt-ons Product • National Research Laboratory • Leader in sustainable product development Development • Able to meet stringent specifications • Well diversified end markets with significant room for continued expansion Market Growth • Markets growing faster than the national average 13

Creating Value through Acquisitions with Demonstrable Track Record of Successful Integrations Strengthens Our Business Market consolidation Enhances service capabilities Increases vertical integration Geographic expansion Value Creation Adds relevant scale from Acquisitions Significant Synergy Realization Purchasing scale benefits Overhead leverage Asset optimization / Capex savings Best practices 14

Well Positioned to Continue to Capitalize on the Construction Cycle Strong prospects for an elongated period of cyclical growth Ready-Mixed Concrete Consumption Per Private Construction Investment % of GDP Capita 1.4 7.0% Cubic Yards 6.0% 5.0% 4.0% 3.0% 2011 2017 1997 2001 2013 2015 2019 1999 2007 2003 2005 2009 Private Construction % of GDP 1997-2019 Average Public Construction Investment % of GDP 1.1 2.2% Cubic Yards 2.0% 1.8% 1.6% 1.4% 1997-2007 Average 2019 2011 2017 1997 2001 2013 2015 2019 1999 2007 2003 2005 2009 Public Construction % of GDP 1997-2019 Average 15

Financial Overview

Financial Overview • FY 2019 Financial Results • Consolidated Revenue of $1,479 million • Adj. EBITDA(1) of $184 million • Liquidity • Cash and cash equivalents of approximately $41 million • Availability under the ABL Revolving Credit Facility of approximately $244 million • Financial Profile • No near-term maturities • No financial maintenance covenants • As long as liquidity exceeds $35 million • Ample liquidity • Pro forma 12/31/19 liquidity of $324 million bolstered with new $180 million delayed draw term loan 1) Adjusted EBITDA is a non-GAAP financial measure. See appendix for a reconciliation to the comparable GAAP measure. 17

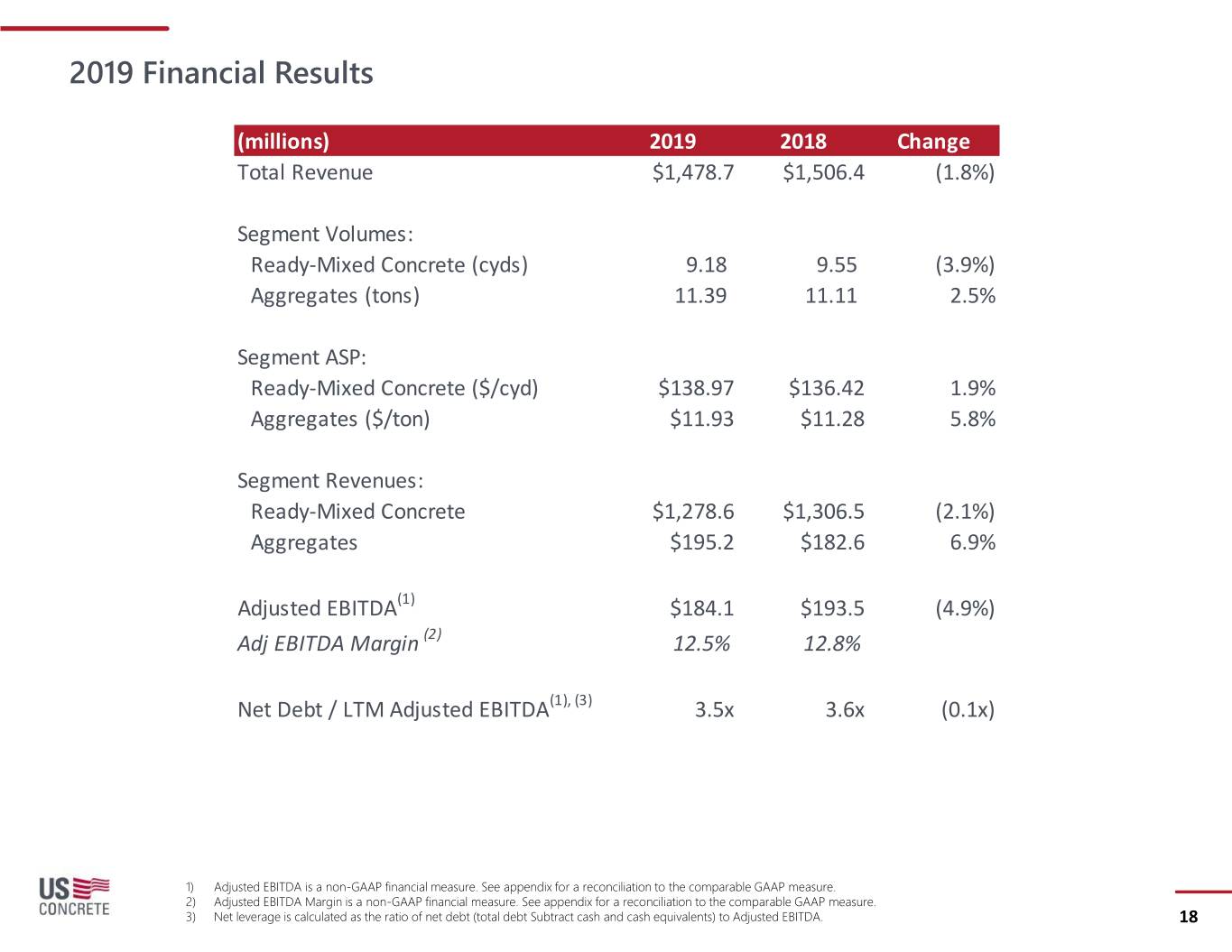

2019 Financial Results (millions) 2019 2018 Change Total Revenue $1,478.7 $1,506.4 (1.8%) Segment Volumes: Ready-Mixed Concrete (cyds) 9.18 9.55 (3.9%) Aggregates (tons) 11.39 11.11 2.5% Segment ASP: Ready-Mixed Concrete ($/cyd) $138.97 $136.42 1.9% Aggregates ($/ton) $11.93 $11.28 5.8% Segment Revenues: Ready-Mixed Concrete $1,278.6 $1,306.5 (2.1%) Aggregates $195.2 $182.6 6.9% Adjusted EBITDA(1) $184.1 $193.5 (4.9%) Adj EBITDA Margin (2) 12.5% 12.8% Net Debt / LTM Adjusted EBITDA(1), (3) 3.5x 3.6x (0.1x) 1) Adjusted EBITDA is a non-GAAP financial measure. See appendix for a reconciliation to the comparable GAAP measure. 2) Adjusted EBITDA Margin is a non-GAAP financial measure. See appendix for a reconciliation to the comparable GAAP measure. 3) Net leverage is calculated as the ratio of net debt (total debt Subtract cash and cash equivalents) to Adjusted EBITDA. 18

Capitalization and Liquidity ($ in millions) Actual Pro Forma Pro Forma Capitalization Maturity 12/31/2019 12/31/2019 Cash & Cash Equivalents $41 $41 ABL Revolving Credit Facility ($350) 8/31/22 -- 140(1) Delayed Draw Term Loan ($180) 4/17/25 -- -- Finance Leases & Promissory Notes Various 88 88 Total Secured Debt $88 $228 6.375% Senior Unsecured Notes(2) 6/1/24 607 607 Less: Unamortized Debt Issuance Costs (7) (7) Total Debt $688 $828 Liquidity USCR Liquidity - 12/31/19 $284 $284 Payment for Coram -- (140) Availability under term loan -- 180 Pro Forma Liquidity $284 $324 Operating Statistics USCR LTM 12/31/19 Adj. EBITDA(3) $184 $184 Coram LTM 12/31/19 Adj. EBITDA(3) -- 15 Pro Forma LTM 12/31/19 Adj. EBITDA (3) $184 $199 Credit Statistics Total Debt / LTM Adj. EBITDA 3.7x 4.2x Net Debt / LTM Adj. EBITDA 3.5x 3.9x Note: Figures in the table above are rounded to the nearest whole number. Total amounts may not foot due to rounding. 1) Represents ABL Revolving Credit Facility borrowings to fund the Coram acquisition 19 2) Includes unamortized premium of $6.8 million on an actual and adjusted basis. 3) Adjusted EBITDA is a non-GAAP financial measure. See appendix for a reconciliation to the comparable GAAP measure.

Appendix

Reconciliation of Non-GAAP Financial Measures Year ended December 31, Coram Pro Forma ($ in millions) 2015 2016 2017 2018 2019 12/31/19 12/31/19 Adjusted EBITDA Reconciliation Add: Income (loss) from continuing operations ($5.1) $9.6 $26.2 $31.3 $16.3 $13.8 $30.1 Add: Income tax expense 0.8 21.2 12.4 16.8 12.3 - 12.3 Add (Subtract): Interest expense (income), net 21.7 27.7 42.1 46.4 46.1 (0.1) 46.0 Add: Loss on extinguishment of debt - 12.0 - - - - - Add: Derivative loss 60.0 19.9 0.8 - - - - Add: Depreciation, depletion and amortization 43.6 54.9 67.8 91.8 93.2 1.6 94.8 Add: Non-cash change in value of contingent consideration 0.9 5.2 7.9 - 2.8 - 2.8 Add: Impairment of assets - - 6.2 1.3 - - - Add (Subtract): Hurricane-related (gains) losses, net - - 3.0 (0.8) (2.1) - (2.1) Add: Quarry dredge costs for specific event - - 3.4 1.1 - - - Add: Purchase accounting adjustments for inventory - - 1.3 0.8 - - - Add: Foreign currency losses resulting from Polaris acquisition - - 1.9 - - - - Add: Non-cash stock compensation expense 5.8 7.1 8.3 10.4 19.1 - 19.1 Add: Acquisition-related costs 3.8 2.3 10.1 6.2 0.1 - 0.1 Add: Officer transition expenses 0.4 - 0.8 - 0.6 - 0.6 Add: Loss on mixer truck fire - - - - 0.7 - 0.7 Add: Litigation settlement costs - - - 2.1 0.3 - 0.3 Add (Subtract): Eminent domain matter - - - 0.7 (5.3) - (5.3) Subtract: Gain on sale of business - - - (14.6) - - - Adjusted EBITDA $131.9 $159.8 $192.2 $193.5 $184.1 $15.3 $199.4 Adjusted EBITDA margin 13.5% 13.7% 14.4% 12.8% 12.5% 70.8% 13.3% Total Adjusted EBITDA and Total Adjusted EBITDA Margin are non-GAAP financial measures. We define Total Adjusted EBITDA as our income (loss) from continuing operations, excluding the impact of income tax expense, depreciation, depletion and amortization, net interest expense and certain other non-cash, non-recurring and/or unusual, non-operating items including, but not limited to: non-cash stock compensation expense, non-cash change in value of contingent consideration, impairment of assets, acquisition-related costs, officer transition expenses, quarry dredge costs for specific event, hurricane-related losses, net of gains and derivative loss. Acquisition-related costs consist of fees and expenses for accountants, lawyers and other professionals incurred during the negotiation and closing of strategic acquisitions and certain acquired entities' management severance costs. Acquisition-related costs do not include fees or expenses associated with post-closing integration of strategic acquisitions. We define Total Adjusted EBITDA Margin as the amount determined by dividing Total Adjusted EBITDA by total revenue. We have included Total Adjusted EBITDA and Total Adjusted EBITDA Margin herein because they are widely used by investors for valuation and comparing our financial performance with the performance of other building material companies. We also use Total Adjusted EBITDA and Total Adjusted EBITDA Margin to monitor and compare the financial performance of our operations. Total Adjusted EBITDA does not give effect to the cash we must use to service our debt or pay our income taxes and thus does not reflect the funds actually available for capital expenditures. In addition, our presentation of Total Adjusted EBITDA may not be comparable to similarly titled measures other companies report. Total Adjusted EBITDA and Total Adjusted EBITDA Margin are not intended to be used as an alternative to any measure of our performance in accordance with GAAP. The table above reconciles Total Adjusted EBITDA to the most directly comparable GAAP financial measure, which is income (loss) from continuing operations and is presented per respective years financial statements. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, our reported operating results or cash flow from operations or any other measure of performance prepared in accordance with GAAP. 21

Thank You 331 N. Main Street Euless, TX 76039 844-828-4774 www.us-concrete.com