Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TANDY LEATHER FACTORY INC | form8k.htm |

Exhibit 99.1

Annual Meeting of Shareholders June 2, 2020Management Presentation

Tandy Strategy Overview Introduction

Long-term strategy to drive sales and earnings growthOur assessment revealed strengths and

opportunities……Leading to key actions we need to take to grow2019: a year of investment – and restatementWe are now also addressing COVID-19 INTRODUCTION Today’s presentation will include statements, other than historical results, that

constitute forward-looking statements within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, each as amended. These statements reflect our expectations or estimates based on the information we have today

but are not guarantees or predictions of future performance. They involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results to differ materially from the

statements contained in this presentation. You are cautioned not to put undue reliance on these forward-looking statements. The Company assumes no obligation to update or otherwise revise these forward-looking statements, except as required

by law.

TANDY STRATEGY StrengthsBrand awareness and strong equityOur stores are a key competitive

advantage100-year old heritage

TANDY STRATEGY OpportunitiesPricing was too high and complicated Consumer perception of inconsistent

quality targeted at beginnersCompetitors have been winning with high-value consumer segmentsCustomers outgrow TandyTalent, process, tools, systems to execute strategic initiatives need rebuilding

Our Core Today Customer Type Hobbyist End Use Hobbyist-Maker Etsy Small/Home Business Medium

Business Large Business/ National Chain Traditional Tooled Leather Bags/SLGs Costumes Books Fetish/BDSM Furniture Shoes Jewelry Art/Sculpture Smaller Bigger Not Our Expertise Gun/Knife Our Expertise TANDY

STRATEGY Future Opportunity Future Opportunity

Strategic ActionsImprove the brand propositionReverse the decline with business customersBuild the

talent, process, tools, systemsPosition for long-term growth TANDY STRATEGY Started in 2019, these actions require multi-year investment

Long-term growthOnlineInternationalChains and institutions TANDY STRATEGY We have already made

significant progress in building our online business

Strategy & Performance 2019 Summary

Improve our brand proposition with key consumer segmentsAssess and build the infrastructure and

operating modelBuild the team 2019 GOALS: FOUNDATION BUILDING

2019

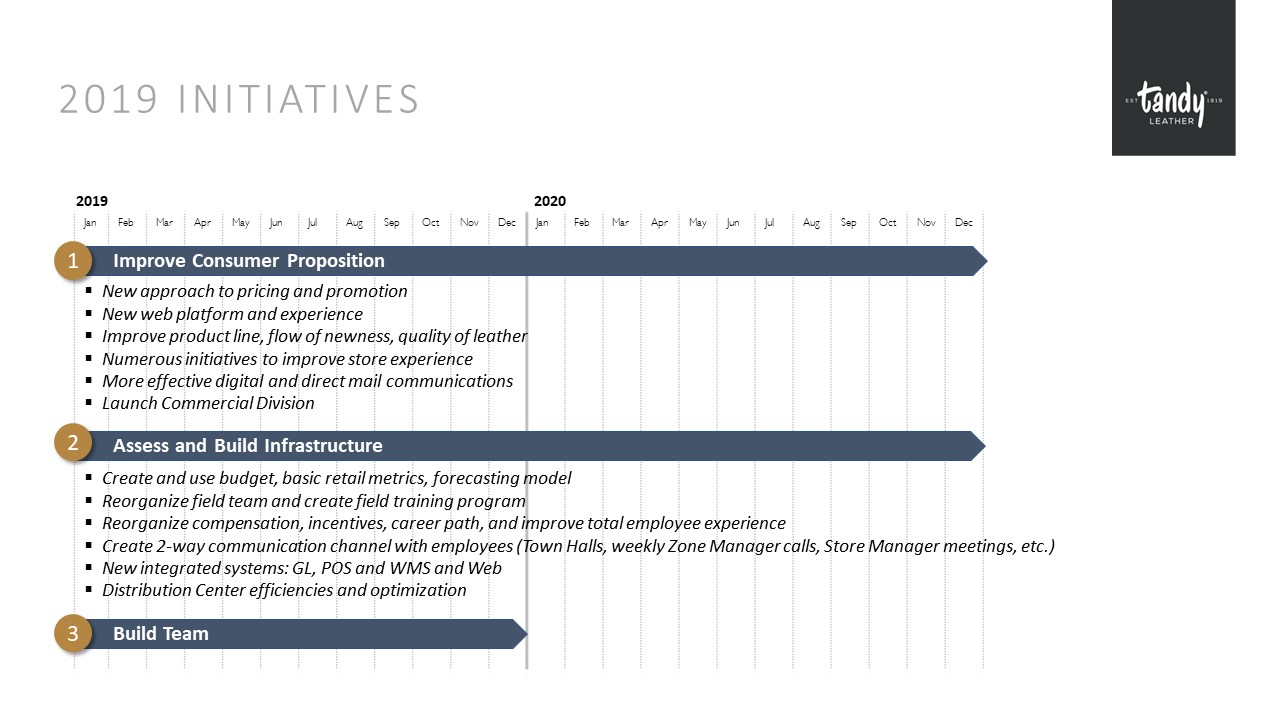

INITIATIVES 2019 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 1 Improve Consumer Proposition 3 Build Team 2 Assess and Build Infrastructure New approach

to pricing and promotionNew web platform and experienceImprove product line, flow of newness, quality of leatherNumerous initiatives to improve store experienceMore effective digital and direct mail communicationsLaunch Commercial

Division Create and use budget, basic retail metrics, forecasting model Reorganize field team and create field training programReorganize compensation, incentives, career path, and improve total employee experienceCreate 2-way communication

channel with employees (Town Halls, weekly Zone Manager calls, Store Manager meetings, etc.)New integrated systems: GL, POS and WMS and WebDistribution Center efficiencies and optimization 2020

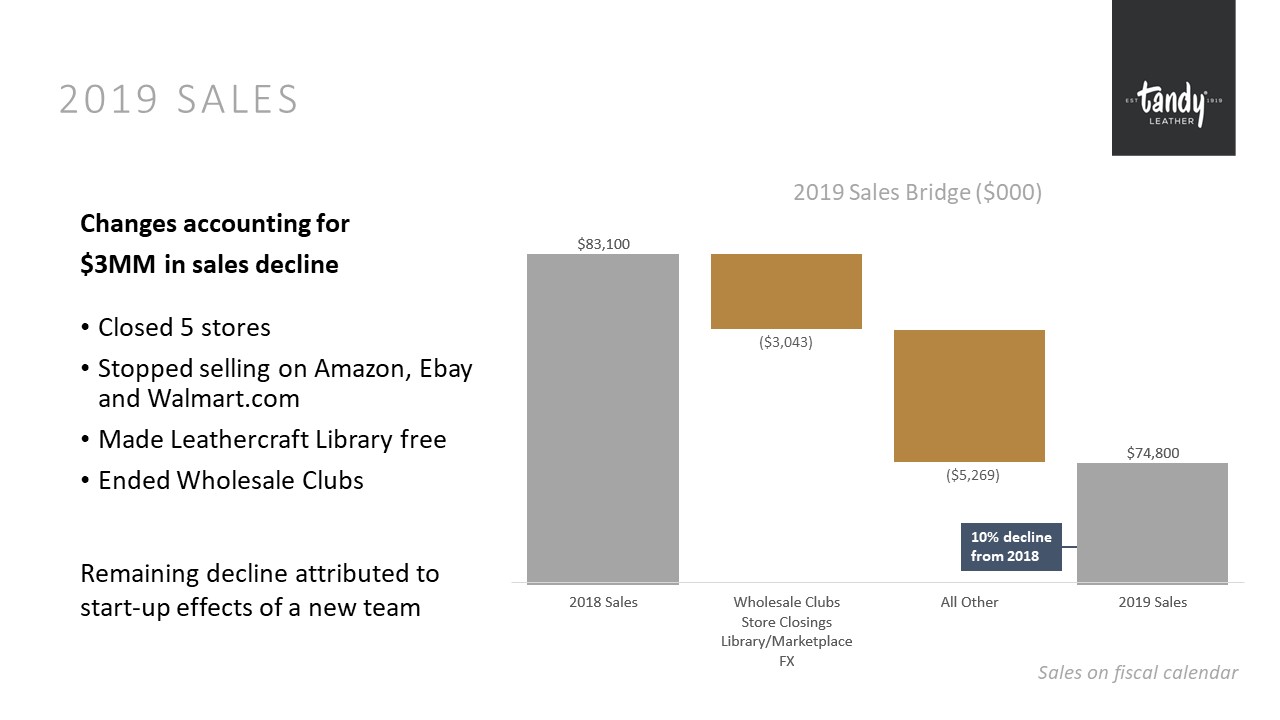

Changes accounting for $3MM in sales declineClosed 5 stores Stopped selling on Amazon, Ebay and

Walmart.comMade Leathercraft Library freeEnded Wholesale Clubs 2019 SALES Remaining decline attributed to start-up effects of a new team 10% decline from 2018 ($3,043) ($5,269) Sales on fiscal calendar 2019 Sales Bridge ($000)

Inventory not correctly stated at FIFOWarehousing and handling not correctly capitalizedWarehousing and

handling incorrectly classified as operating expensesOn track to complete by August 10, 2020 RESTATEMENT

COVID-19 Response & Outlook 2020

Demonstrate success of our consumer-facing strategiesSubstantially complete key infrastructure

initiativesEvaluate and test growth opportunitiesComplete restatement by August 10, 2020 2020 PLAN

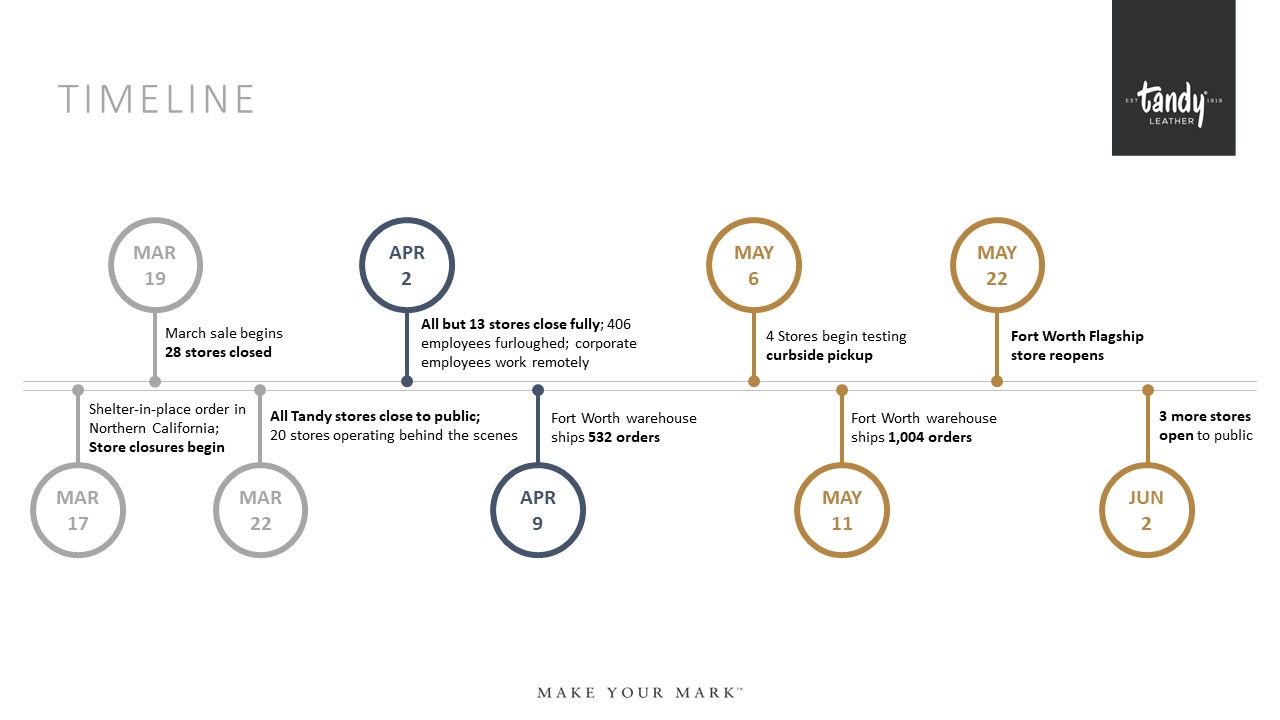

TIMELINE Shelter-in-place order in Northern California;Store closures begin MAR 17 All Tandy stores

close to public; 20 stores operating behind the scenes MAR 22 Fort Worth warehouse ships 532 orders APR 9 All but 13 stores close fully; 406 employees furloughed; corporate employees work remotely APR 2 March sale begins28 stores

closed MAR 19 MAY 6 4 Stores begin testing curbside pickup Fort Worth warehouse ships 1,004 orders MAY 11 MAY 22 Fort Worth Flagship store reopens JUN 2 3 more stores open to public

COVID-19 RESPONSE Focus on web fulfillmentRetooled to drive online business and fulfill all web orders

out of Fort WorthAble to ship over 1,500 direct-to-consumer orders from our warehouse dailyCreated virtual customer service and phone order team

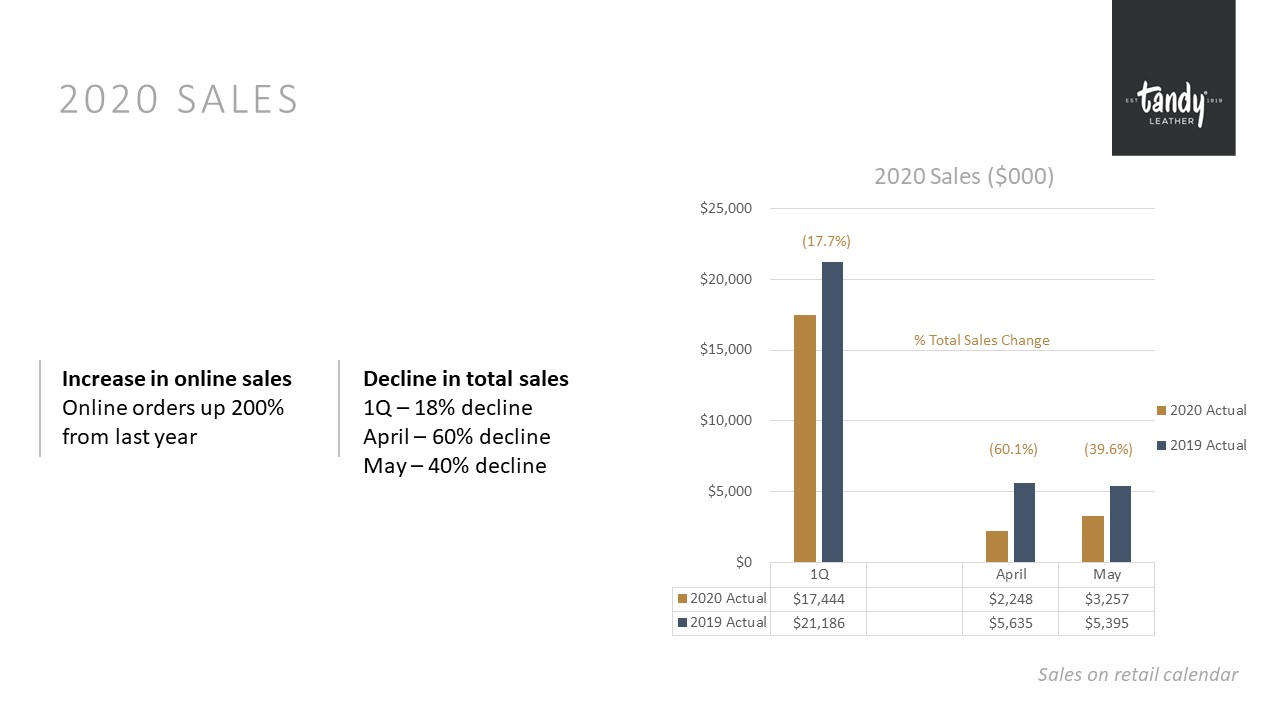

2020 SALES Increase in online sales Online orders up 200% from last year Decline in total sales 1Q –

18% declineApril – 60% declineMay – 40% decline (17.7%) (60.1%) % Total Sales Change (39.6%) Sales on retail calendar

COVID-19 RESPONSE Focus on conserving capital and protecting liquidity406 employees furloughed or laid

off on April 2Reduced SG&A expenses, including salary cutsPaused product purchasesNegotiated abatements, deferrals and longer-term reductions in rent8 stores permanently closed Do we want to put cost savings on the page?

COVID-19 RESPONSE Closed storesPhoenix AZAustin TXDallas TXPeoria ILRichmond VANyack

NYJohnston RISt Leonard QC

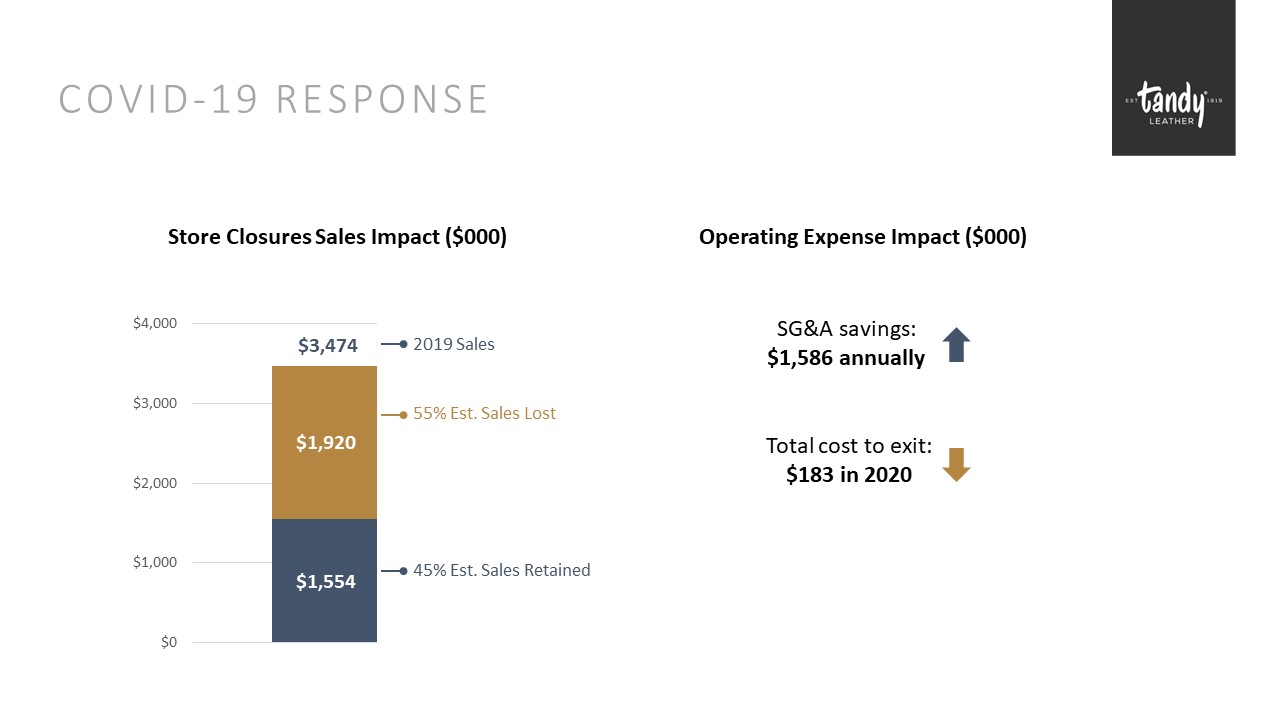

COVID-19 RESPONSE Operating Expense Impact ($000) Total cost to exit: $183 in 2020 SG&A

savings: $1,586 annually approx. +$530 annually Net Cash Impact ($000) Store Closures Sales Impact ($000) 55% Est. Sales Lost 45% Est. Sales Retained $3,474 2019 Sales I’m taking this off the page but leaving in comments?

WHERE WE ARE NOW Reopening stores where possiblePrioritize the safety of our employees, customers and

community10 stores currently offering curbside pickup (plus 2 more by June 5)Fort Worth Flagship location opened to customers This is a gradual process, as we monitor and assess business and environment factors for each store June 2El Paso

TXPortland OROklahoma City OK June 5Columbus OHBillings MTBerlin CT Pittsburgh PADenver COPhoenix AZ 10 total stores will have reopened to the public by June 5

OUTLOOK Protecting long-term valuePositioning to reemerge strongSolid strategy to build on

QUESTIONS To ask a question, please message Daniel Ross in the Zoom chat and he will facilitateIf you

are calling in on a phone line and would like to ask a question, please email Dan Ross at daniel.ross@tandyleather.com