Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Global Net Lease, Inc. | tm2021537d1_ex99-1.htm |

| 8-K - 8-K - Global Net Lease, Inc. | tm2021537d1_8k.htm |

Exhibit 99.2

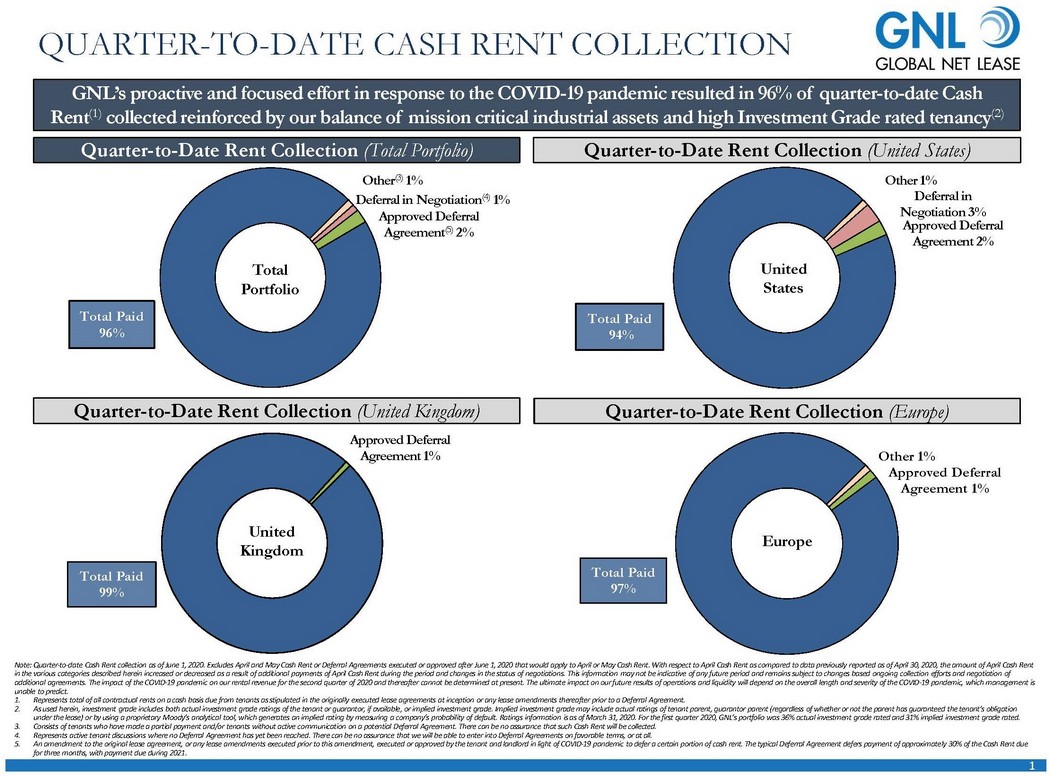

1 Other (3) 1% Deferral in Negotiation (4) 1% Approved Deferral Agreement (5) 2% Total Paid 96% Total Paid 99% Approved Deferral … Other 1% Approved Deferral … Total Paid 97% Other 1% Deferral in Negotiation 3% Approved Deferral Agreement 2% Total Paid 94% QUARTER - TO - DATE CASH RENT COLLECTION GNL’s proactive and focused effort in response to the COVID - 19 pandemic resulted in 96% of quarter - to - date Cash Rent (1) collected reinforced by our balance of mission critical industrial assets and high Investment Grade rated tenancy (2) Quarter - to - Date Rent Collection (Total Portfolio) Quarter - to - Date Rent Collection (United Kingdom) Quarter - to - Date Rent Collection (United States) Quarter - to - Date Rent Collection (Europe) Total Portfolio United States United Kingdom Europe Note: Quarter - to - date Cash Rent collection as of June 1, 2020. Excludes April and May Cash Rent or Deferral Agreements executed or approved after June 1, 2020 that would appl y t o April or May Cash Rent. With respect to April Cash Rent as compared to data previously reported as of April 30, 2020, the a mou nt of April Cash Rent in the various categories described herein increased or decreased as a result of additional payments of April Cash Rent durin g t he period and changes in the status of negotiations. This information may not be indicative of any future period and remains sub ject to changes based ongoing collection efforts and negotiation of additional agreements. The impact of the COVID - 19 pandemic on our rental revenue for the second quarter of 2020 and thereafter cannot be determined at pres ent. The ultimate impact on our future results of operations and liquidity will depend on the overall length and severity of the COVID - 19 pandemic, which management is unable to predict. 1. Represents total of all contractual rents on a cash basis due from tenants as stipulated in the originally executed lease agr eem ents at inception or any lease amendments thereafter prior to a Deferral Agreement. 2. As used herein, investment grade includes both actual investment grade ratings of the tenant or guarantor, if available, or i mpl ied investment grade. Implied investment grade may include actual ratings of tenant parent, guarantor parent (regardless of w het her or not the parent has guaranteed the tenant’s obligation under the lease) or by using a proprietary Moody’s analytical tool, which generates an implied rating by measuring a company’ s p robability of default. Ratings information is as of March 31, 2020. For the first quarter 2020, GNL’s portfolio was 36% actua l i nvestment grade rated and 31% implied investment grade rated. 3. Consists of tenants who have made a partial payment and/or tenants without active communication on a potential Deferral Agree men t. There can be no assurance that such Cash Rent will be collected. 4. Represents active tenant discussions where no Deferral Agreement has yet been reached. There can be no assurance that we will be able to enter into Deferral Agreements on favorable terms, or at all. 5. An amendment to the original lease agreement, or any lease amendments executed prior to this amendment, executed or approved by the tenant and landlord in light of COVID - 19 pandemic to defer a certain portion of cash rent. The typical Deferral Agreement de fers payment of approximately 30% of the Cash Rent due for three months, with payment due during 2021.