Attached files

| file | filename |

|---|---|

| 8-K - 8-K Q1-20 BANK SOFC - BOSTON PRIVATE FINANCIAL HOLDINGS INC | bpfh-20200602.htm |

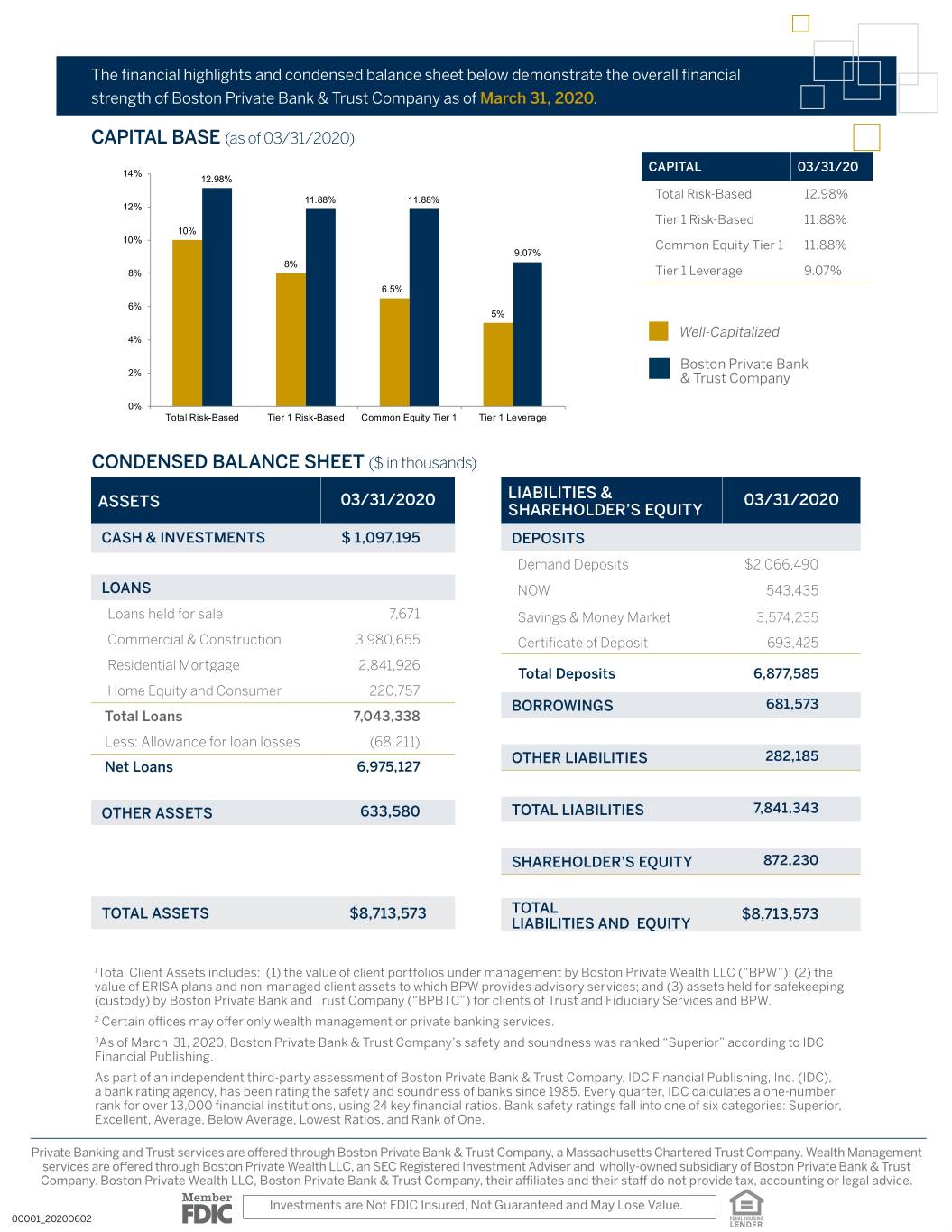

Quarterly Statement of FINANCIAL CONDITION for Boston Private Bank & Trust Company First Quarter 2020 BOSTON PRIVATE offers a full spectrum of wealth, trust, and banking services designed to FINANCIAL HIGHLIGHTS (as of 03/31/2020) give you one trusted resource to help simplify and strengthen your financial life. $6.9 Billion Total Deposits Every individual and organization has a different reason WHY they work so hard. At Boston Private, we strive to understand what drives our clients, so $7.0 Billion Total Loans that we can help them live and work the way they want. Understanding what our clients’ wealth is really for enables us to formulate a custom strategy 9.07% Tier 1 and solution to help them achieve their goals, Leverage Capital Ratio (Above the 5.00% required hopes and dreams for today and tomorrow. by the FDIC to be well-capitalized) Headquartered in Boston, we serve clients from our offices located in the major markets of Greater $13.5 Billion Boston, New York, San Francisco, San Jose, Los Total Client Assets1 Angeles, Miami, and Palm Beach Gardens.2 Asset Low levels of problem loans relative to Capital Capital ratios in excess of levels the industry due to our underwriting banking regulators consider to be Quality standards. Base well-capitalized. Liquidity $2.1 billion of cash (as of March 31, 2020), IDC Superior high-quality unpledged investment 3 Profile securities, and borrowing capacity from Rating the Federal Home Loan Bank. bostonprivate.com

The financial highlights and condensed balance sheet below demonstrate the overall financial strength of Boston Private Bank & Trust Company as of March 31, 2020. CAPITAL BASE (as of 03/31/2020) CAPITAL 03/31/20 14% 12.98% Total Risk-Based 12.98% 11.88% 11.88% 12% Tier 1 Risk-Based 11.88% 10% 10% Common Equity Tier 1 11.88% 9.07% 8% 8% Tier 1 Leverage 9.07% 6.5% 6% 5% Well-Capitalized 4% Boston Private Bank 2% & Trust Company 0% Total Risk-Based Tier 1 Risk-Based Common Equity Tier 1 Tier 1 Leverage CONDENSED BALANCE SHEET ($ in thousands) LIABILITIES & ASSETS 03/31/2020 03/31/2020 SHAREHOLDER’S EQUITY CASH & INVESTMENTS $ 1,097,195 DEPOSITS Demand Deposits $2,066,490 LOANS NOW 543,435 Loans held for sale 7,671 Savings & Money Market 3,574,235 Commercial & Construction 3,980,655 Certificate of Deposit 693,425 Residential Mortgage 2,841,926 Total Deposits 6,877,585 Home Equity and Consumer 220,757 BORROWINGS 681,573 Total Loans 7,043,338 Less: Allowance for loan losses (68,211) OTHER LIABILITIES 282,185 Net Loans 6,975,127 OTHER ASSETS 633,580 TOTAL LIABILITIES 7,841,343 SHAREHOLDER’S EQUITY 872,230 TOTAL ASSETS $8,713,573 TOTAL $8,713,573 LIABILITIES AND EQUITY 1Total Client Assets includes: (1) the value of client portfolios under management by Boston Private Wealth LLC (“BPW”); (2) the value of ERISA plans and non-managed client assets to which BPW provides advisory services; and (3) assets held for safekeeping (custody) by Boston Private Bank and Trust Company (“BPBTC”) for clients of Trust and Fiduciary Services and BPW. 2 Certain offices may offer only wealth management or private banking services. 3As of March 31, 2020, Boston Private Bank & Trust Company’s safety and soundness was ranked “Superior” according to IDC Financial Publishing. As part of an independent third-party assessment of Boston Private Bank & Trust Company, IDC Financial Publishing, Inc. (IDC), a bank rating agency, has been rating the safety and soundness of banks since 1985. Every quarter, IDC calculates a one-number rank for over 13,000 financial institutions, using 24 key financial ratios. Bank safety ratings fall into one of six categories: Superior, Excellent, Average, Below Average, Lowest Ratios, and Rank of One. Private Banking and Trust services are offered through Boston Private Bank & Trust Company, a Massachusetts Chartered Trust Company. Wealth Management services are offered through Boston Private Wealth LLC, an SEC Registered Investment Adviser and wholly-owned subsidiary of Boston Private Bank & Trust Company. Boston Private Wealth LLC, Boston Private Bank & Trust Company, their affiliates and their staff do not provide tax, accounting or legal advice. Investments are Not FDIC Insured, Not Guaranteed and May Lose Value. 00001_20200602