Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CHINOOK THERAPEUTICS, INC. | d933619dex991.htm |

| EX-10.7 - EX-10.7 - CHINOOK THERAPEUTICS, INC. | d933619dex107.htm |

| EX-10.6 - EX-10.6 - CHINOOK THERAPEUTICS, INC. | d933619dex106.htm |

| EX-10.5 - EX-10.5 - CHINOOK THERAPEUTICS, INC. | d933619dex105.htm |

| EX-10.4 - EX-10.4 - CHINOOK THERAPEUTICS, INC. | d933619dex104.htm |

| EX-10.3 - EX-10.3 - CHINOOK THERAPEUTICS, INC. | d933619dex103.htm |

| EX-10.2 - EX-10.2 - CHINOOK THERAPEUTICS, INC. | d933619dex102.htm |

| EX-10.1 - EX-10.1 - CHINOOK THERAPEUTICS, INC. | d933619dex101.htm |

| EX-2.1 - EX-2.1 - CHINOOK THERAPEUTICS, INC. | d933619dex21.htm |

| 8-K - FORM 8-K - CHINOOK THERAPEUTICS, INC. | d933619d8k.htm |

Developing Precision Medicines for Kidney Diseases Merger Announcement June 2, 2020 Exhibit 99.2

Note Regarding Forward-Looking Statements Certain of the statements made in this presentation are forward looking for purposes of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including those relating to the benefits of the merger, future management and the board of directors of the combined company, statements regarding the expected ownership in the combined company of the former Chinook securityholders and securityholders of Aduro as of immediately prior to the Merger, Aduro’s and Chinook’s respective businesses, the strategy of the combined company, future operations, advancement of its product candidates and product pipeline, clinical development of the combined company’s product candidates, including expectations regarding timing of initiation and results of clinical trials of the combined company, cash resources of the combined company following closing of the proposed transaction, the ability of Aduro to remain listed on the Nasdaq Stock Market, strategic options for Aduro’s legacy programs outside of kidney disease, the completion of any financing and the receipt of any payments under the CVRs. In some cases, you can identify these statements by forward-looking words such as “may,” “will,” “continue,” “anticipate,” “intend,” “could,” “project,” “expect” or the negative or plural of these words or similar expressions. Forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties that could cause actual results and events to differ materially from those anticipated, including, but not limited to, the risk that the proposed transaction may not be completed in a timely manner or at all, which may adversely affect Aduro’s business and the price of the common stock of Aduro; the failure of either party to satisfy any of the conditions to the consummation of the proposed transaction, including the adoption of the merger agreement by Aduro’s stockholders and the receipt of certain governmental and regulatory approvals; uncertainties as to the timing of the consummation of the proposed transaction; the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement; the effect of the announcement or pendency of the proposed transaction on Aduro’s business relationships, operating results and business generally; risks that the proposed transaction disrupts current plans and operations and the potential difficulties in employee retention as a result of the proposed transaction; risks related to diverting management’s attention from Aduro’s ongoing business operations; the outcome of any legal proceedings that may be instituted against Aduro related to the merger agreement or the proposed transaction; unexpected costs, charges or expenses resulting from the proposed transaction; Aduro’s history of net operating losses and uncertainty regarding its ability to achieve profitability; Aduro’s ability to develop and commercialize product candidates; Aduro’s ability to use and expand technology platforms to build a pipeline of product candidates; Aduro’s ability to obtain and maintain regulatory approval of product candidates; Aduro’s ability to operate in a competitive industry and compete successfully against competitors that have greater resources; Aduro’s reliance on third parties; Aduro’s ability to obtain and adequately protect intellectual property rights for product candidates; and the effects of COVID-19 on clinical programs and business operations. Aduro discusses many of these risks in greater detail under the heading “Risk Factors” contained in its quarterly report on Form 10-Q for the quarter ended March 31, 2020, filed with the SEC on May 4, 2020, and its other filings with the SEC. Any forward-looking statements in this presentation speak only as of the date of this presentation. Neither Aduro nor Chinook assumes any obligation to update forward-looking statements whether as a result of new information, future events or otherwise, after the date of this presentation.

Transformative & Synergistic Transaction for Aduro Underwent strategic reset in Jan 2019 and corporate restructuring in Jan 2020 to reduce OpEx and extend cash position into 2023 Over the last ~12 months, explored strategic alternatives that would provide value to shareholders With recent increased focus on anti-APRIL antibody BION-1301, began evaluating companies focused on renal disease for potential synergies Chinook merger will provide a Phase 3 lead renal asset, a focused pipeline in kidney disease and seasoned management team Aduro will be focused on closing Chinook transaction and exploring strategic alternatives for our legacy programs outside of kidney disease

Chinook – Precision Medicines for Kidney Diseases Large, underserved markets Building a pipeline of targeted approaches and precision medicines to potentially treat kidney diseases Synergy between Chinook’s and Aduro’s key programs Multiple programs expected to be in clinical development in 2021 Seasoned management team with significant drug development expertise Strong capitalization

The Time is Now for Kidney Disease Drug Development Emerging patient stratification approaches and translational platforms Causal mutations, biomarkers, single-cell sequencing, organoid / podocyte systems Underserved market with >$100B of annual healthcare costs in U.S. Few new drugs approved in past 20 years Recent acceptance of surrogate endpoints based on understanding of pathophysiology Proteinuria, eGFR (vs hard renal outcomes in traditional trials)

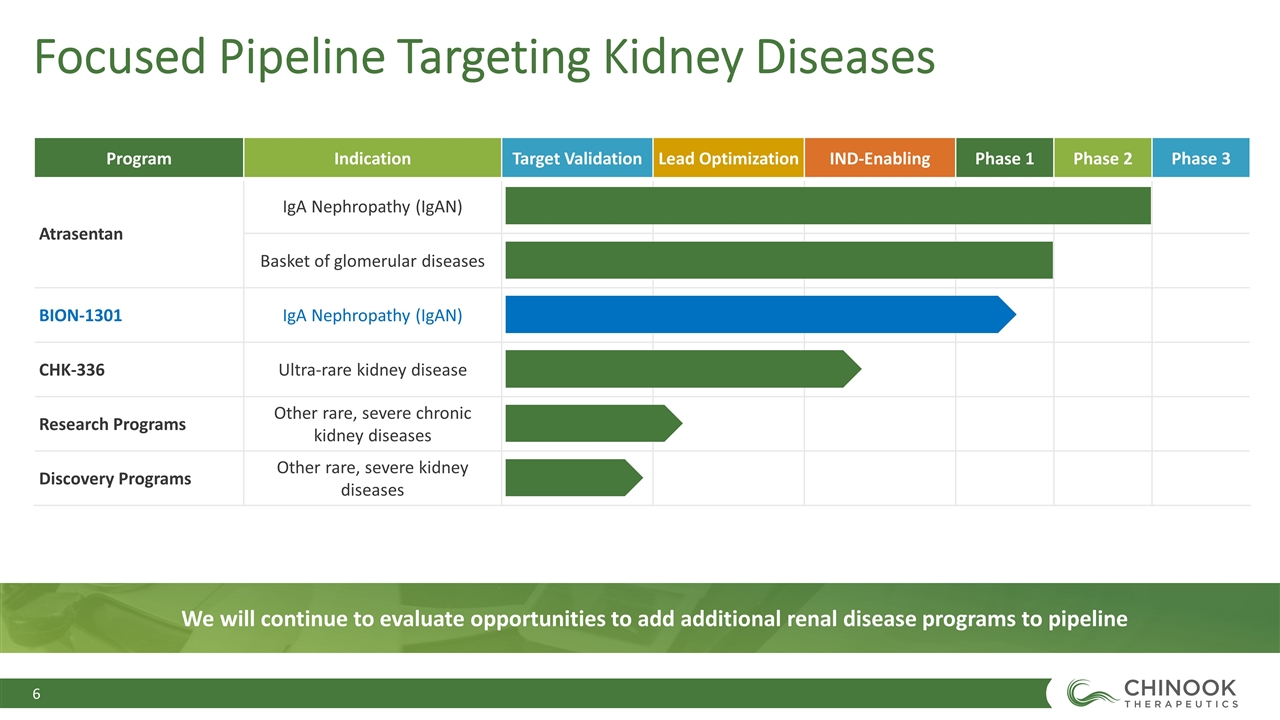

Focused Pipeline Targeting Kidney Diseases Program Indication Target Validation Lead Optimization IND-Enabling Phase 1 Phase 2 Phase 3 Atrasentan IgA Nephropathy (IgAN) Basket of glomerular diseases BION-1301 IgA Nephropathy (IgAN) CHK-336 Ultra-rare kidney disease Research Programs Other rare, severe chronic kidney diseases Discovery Programs Other rare, severe kidney diseases We will continue to evaluate opportunities to add additional renal disease programs to pipeline

Atrasentan Atrasentan is an investigational, potent, selective endothelin A (ETA) receptor antagonist previously developed by AbbVie Extensively studied with clinical data in >5,000 diabetic kidney disease patients Reduced proteinuria and preserved kidney function in clinical trials Well-characterized safety (dosed up to 5 years in trials) Compelling opportunity for atrasentan to potentially benefit IgA nephropathy patients with a faster registration pathway Potential to seek accelerated approval based on surrogate endpoint (proteinuria reduction) and to seek full approval based on renal function (i.e., change in eGFR) Strong endorsement from KOLs supporting the utility of ETA inhibition in IgAN Exclusivity period based on IP and potential for orphan designation Unmet medical need creates strong commercial opportunity Phase 3 Clinical Program

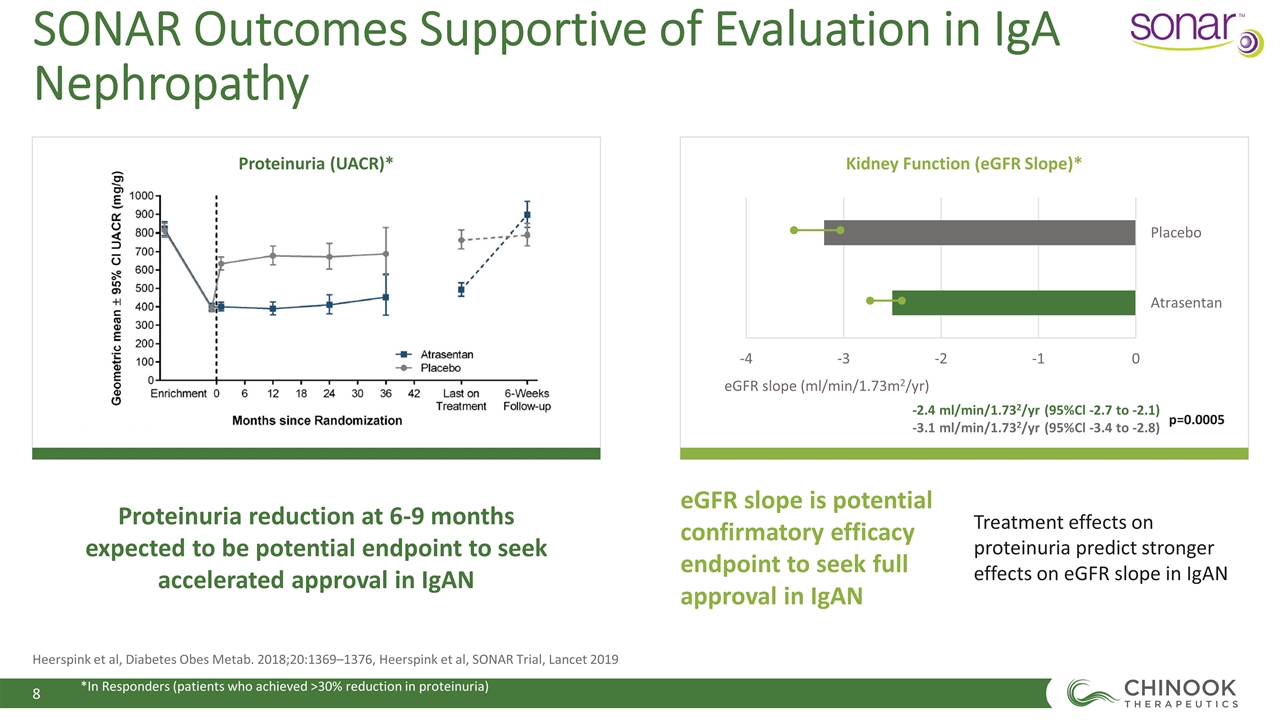

Proteinuria (UACR)* Kidney Function (eGFR Slope)* Proteinuria reduction at 6-9 months expected to be potential endpoint to seek accelerated approval in IgAN eGFR slope is potential confirmatory efficacy endpoint to seek full approval in IgAN Treatment effects on proteinuria predict stronger effects on eGFR slope in IgAN -2.4 ml/min/1.732/yr (95%Cl -2.7 to -2.1) -3.1 ml/min/1.732/yr (95%Cl -3.4 to -2.8) p=0.0005 Heerspink et al, Diabetes Obes Metab. 2018;20:1369–1376, Heerspink et al, SONAR Trial, Lancet 2019 SONAR Outcomes Supportive of Evaluation in IgA Nephropathy *In Responders (patients who achieved >30% reduction in proteinuria)

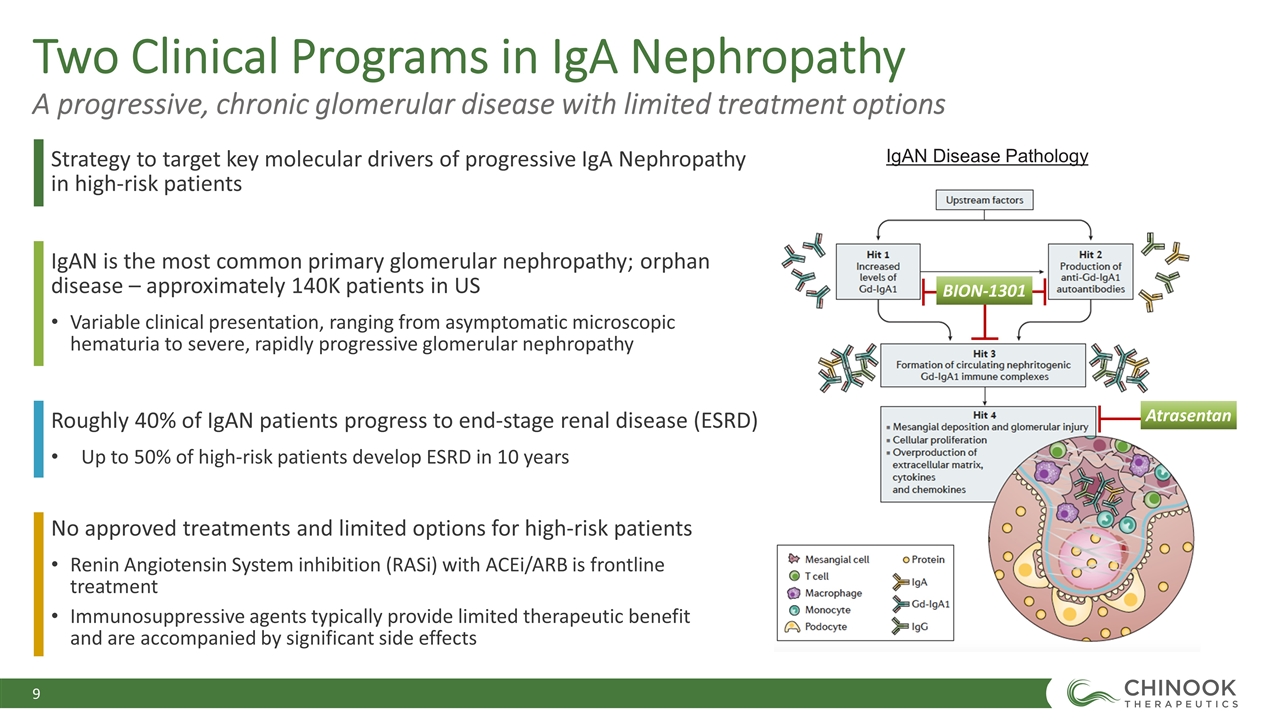

Two Clinical Programs in IgA Nephropathy A progressive, chronic glomerular disease with limited treatment options Strategy to target key molecular drivers of progressive IgA Nephropathy in high-risk patients No approved treatments and limited options for high-risk patients Renin Angiotensin System inhibition (RASi) with ACEi/ARB is frontline treatment Immunosuppressive agents typically provide limited therapeutic benefit and are accompanied by significant side effects Roughly 40% of IgAN patients progress to end-stage renal disease (ESRD) Up to 50% of high-risk patients develop ESRD in 10 years IgAN is the most common primary glomerular nephropathy; orphan disease – approximately 140K patients in US Variable clinical presentation, ranging from asymptomatic microscopic hematuria to severe, rapidly progressive glomerular nephropathy Atrasentan BION-1301 IgAN Disease Pathology

Experienced Leadership Team Executive Team Board Eric Dobmeier President and CEO Tom Frohlich Chief Business Officer Alan Glicklich, MD Chief Medical Officer Renata Oballa, PhD VP, Chemistry and Vancouver Site Head Andrew King, DVM, PhD Head of Renal Discovery and Translational Medicine Jerel Davis, PhD Srini Akkaraju, MD, PhD Ross Haghighat William M. Greenman Eric Dobmeier 2 Independent Directors (to be named)

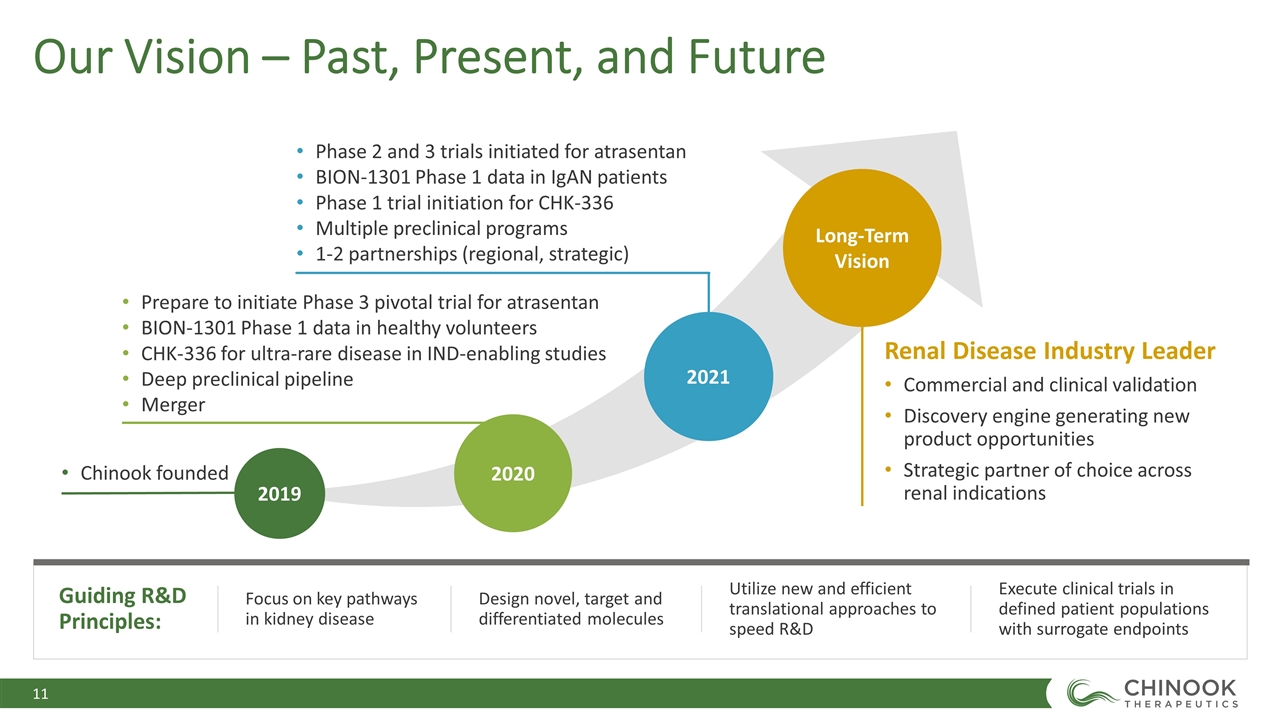

Our Vision – Past, Present, and Future Guiding R&D Principles: Focus on key pathways in kidney disease Design novel, target and differentiated molecules Utilize new and efficient translational approaches to speed R&D Execute clinical trials in defined patient populations with surrogate endpoints 2021 Long-Term Vision 2020 2019 Renal Disease Industry Leader Commercial and clinical validation Discovery engine generating new product opportunities Strategic partner of choice across renal indications Chinook founded Prepare to initiate Phase 3 pivotal trial for atrasentan BION-1301 Phase 1 data in healthy volunteers CHK-336 for ultra-rare disease in IND-enabling studies Deep preclinical pipeline Merger Phase 2 and 3 trials initiated for atrasentan BION-1301 Phase 1 data in IgAN patients Phase 1 trial initiation for CHK-336 Multiple preclinical programs 1-2 partnerships (regional, strategic)

Transaction Summary Structure of the transaction is a ~50:50 merger Strong financial position with ~$200M in cash, cash equivalents and marketable securities expected at closing Includes $25M in additional investment committed by Chinook’s existing investors Organizational and cost efficiencies in merged company, with optimized clinical development for kidney diseases Post-closing, Chinook to trade under ticker symbol “KDNY” Merger expected to close in second half of 2020, subject to customary closing conditions

Why Chinook? Kidney disease is a large underserved market poised to be transformed by recent advances in the understanding of underlying diseases and new approaches to drug development Unique late-stage opportunity with lead asset atrasentan, and clinical program BION-1301 Building a differentiated and proprietary pipeline targeting IgA nephropathy, glomerular diseases, and other rare, severe chronic kidney diseases Seasoned management and scientific team with track record of advancing transformative therapies Potential merger provides for a well-capitalized company to support multiple clinical and preclinical programs Pursuing opportunities for strategic partnerships and attractive profile for long-term value generation

Additional Information and Where to Find It Aduro plans to file a Registration Statement on Form S-4 containing a proxy statement/prospectus of Aduro and other documents concerning the proposed merger with the Securities and Exchange Commission (the “SEC”). BEFORE MAKING ANY VOTING DECISION, ADURO’S STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS IN ITS ENTIRETY WHEN IT BECOMES AVAILABLE AND ANY OTHER DOCUMENTS FILED BY ADURO WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER OR INCORPORATED BY REFERENCE THEREIN BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION. Security holders may obtain a free copy of the proxy statement/prospectus (when it is available) and other documents filed by Aduro with the SEC at the SEC’s website at www.sec.gov. Investors and stockholders will be able to obtain a free copy of the proxy statement/prospectus and other documents containing important information about Aduro and Chinook, once such documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov. Aduro makes available free of charge at www.aduro.com (in the “Investor Relations” section), copies of materials that Aduro files with, or furnishes to, the SEC.

Participants in the Solicitation This document does not constitute a solicitation of proxy, an offer to purchase or a solicitation of an offer to sell any securities. Aduro and Chinook, and each of their respective directors, executive officers and certain employees may be deemed to be participants in the solicitation of proxies from the stockholders of Aduro in connection with the proposed merger. Security holders may obtain information regarding the names, affiliations and interests of Aduro’s directors and officers in Aduro’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, which was filed with the SEC on March 9, 2020, and its definitive proxy statement for the 2020 annual meeting of stockholders, which was filed with the SEC on March 24, 2020. To the extent the holdings of Aduro securities by Aduro’s directors and executive officers have changed since the amounts set forth in Aduro’s proxy statement for its 2020 annual meeting of stockholders, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interests of such individuals in the proposed merger will be included in the proxy statement/prospectus relating to the proposed merger when it is filed with the SEC. These documents (when available) may be obtained free of charge from the SEC’s website at www.sec.gov and Aduro’s website at www.aduro.com.

Developing Precision Medicines for Kidney Diseases Merger Announcement June 2, 2020