Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Xenia Hotels & Resorts, Inc. | xhr20208-kjuneinvestor.htm |

Investor Presentation June 2020

Forward-Looking Statements 1

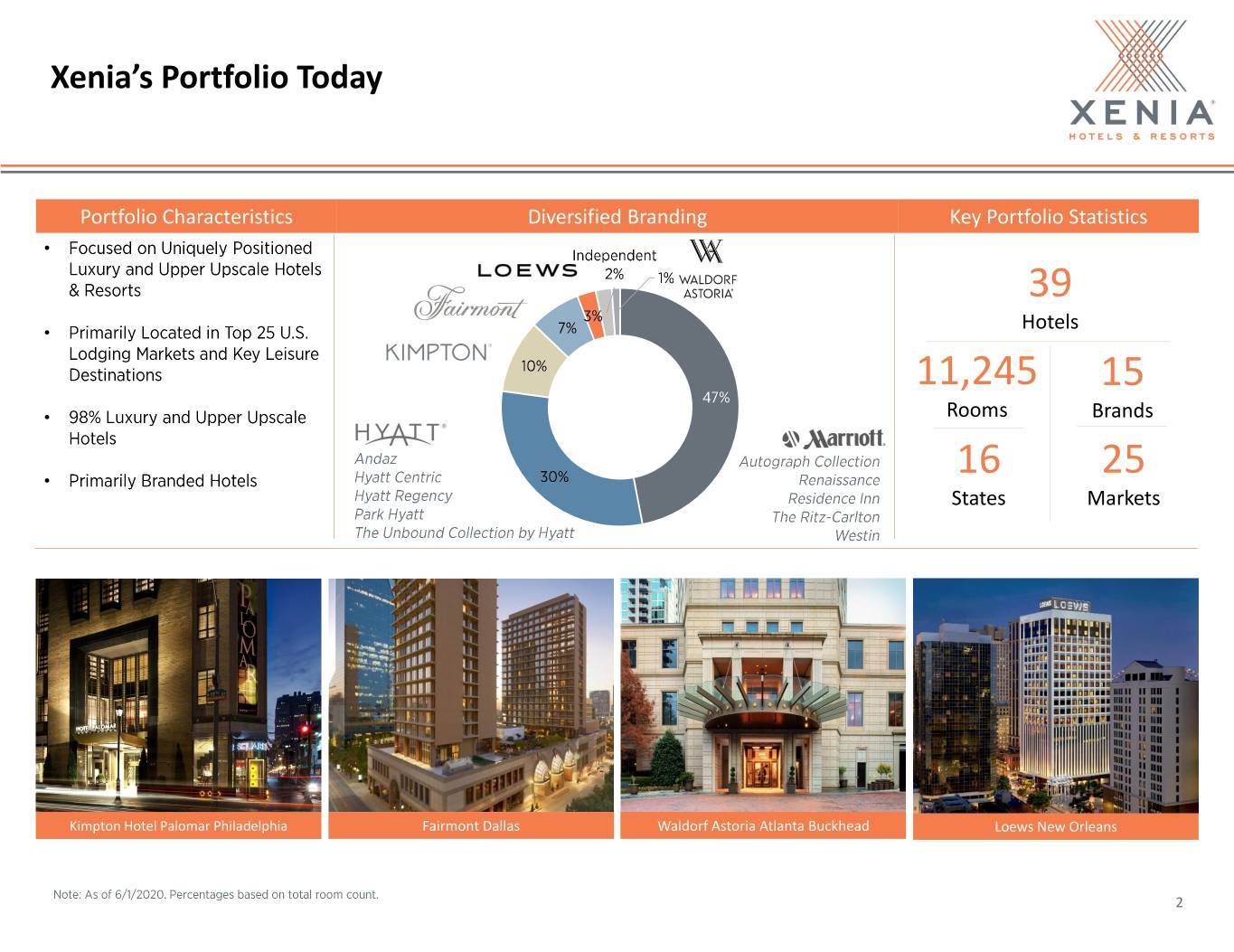

Xenia’s Portfolio Today Portfolio Characteristics Diversified Branding Key Portfolio Statistics • 39 • Hotels 11,245 15 • Rooms Brands • 16 25 States Markets Kimpton Hotel Palomar Philadelphia Fairmont Dallas Waldorf Astoria Atlanta Buckhead Loews New Orleans 2

Geographic Diversification Hotels located across 25 unique lodging markets including the Sunbelt region, various drive-to leisure markets, and several gateway markets. No single market contributed more than 10% of 2019 Hotel EBITDA1 3

Experienced Management Team 4

Business Update

Operations Update • • • • • • • • • • • 6

Corporate Actions • • • • • • • • • • • 7

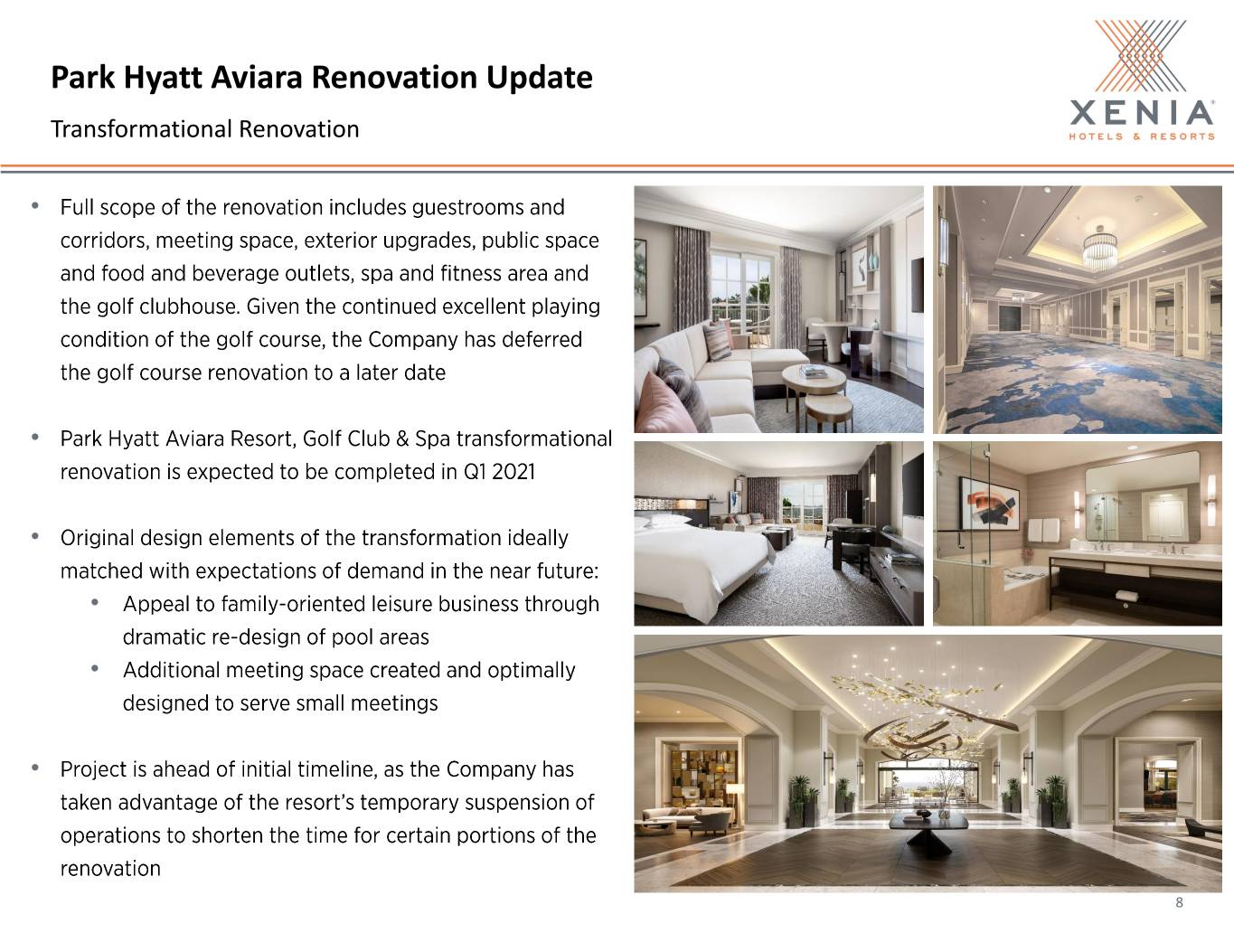

Park Hyatt Aviara Renovation Update Transformational Renovation • • • • • • 8

Park Hyatt Aviara Renovation Update Renovation Timeline Park Hyatt Aviara Resort, Golf Club & Spa transformational renovation is expected to be completed in Q1 2021 9

Liquidity and Balance Sheet Update

Debt Overview $1.6 Billion 5.2x 3.3% Debt Detail Debt Maturity Schedule 11

Monthly Recurring Cash Expenses As of 3/31/2020, Xenia had approximately $397 million of cash and cash equivalents1 12

Competitive Advantages

Seasoned Management Team Management team has an average of 27 years of hotel experience and an average tenure of 8 years with Xenia • • MARCEL VERBAAS, CHAIRMAN AND CHIEF EXECUTIVE OFFICER ✓ ✓ ✓ ✓ BARRY BLOOM, PRESIDENT AND CHIEF OPERATING OFFICER ✓ ✓ ✓ ATISH SHAH, CHIEF FINANCIAL OFFICER ✓ ✓ ✓ 14

Well-Positioned Portfolio 15

High-Quality Portfolio of Hotels & Resorts Strategic capital allocation over past five years delivers superior portfolio Xenia’s Current Portfolio 39 $171.32 $29,599 20142 2015 2016 2017 2018 2019 Since Listing5 16

Advantage of Branded Hotels • • • • • • • • 17

Attributes of Xenia’s Portfolio Key leisure and drive-to destinations expected to have the quickest ramp-up to stabilization in the current environment 18

Key Leisure and Drive-To Market Hotels & Resorts 19

Portfolio in Excellent Condition • • • • • • • • 20

Flexible Meeting Space at Many Properties • • • • • • • • • • 21

✓ ✓ Key ✓ Takeaways ✓ ✓ ✓ ✓ 22

23

Definitions 24

Non-GAAP Financial Measures 25