Attached files

| file | filename |

|---|---|

| EX-99.2 - PRESS RELEASE, DATED JUNE 1, 2020 - Schultze Special Purpose Acquisition Corp. | ea122529ex99-2_schultze.htm |

| 8-K - CURRENT REPORT - Schultze Special Purpose Acquisition Corp. | ea122529-8k_schultzespecial.htm |

Exhibit 99.1

CLEVER LEAVES AND SCHULTZE SPECIAL PURPOSE ACQUISITION CORP. ANNOUNCE PROPOSED BUSINESS COMBINATION June 2020 Investor Presentation

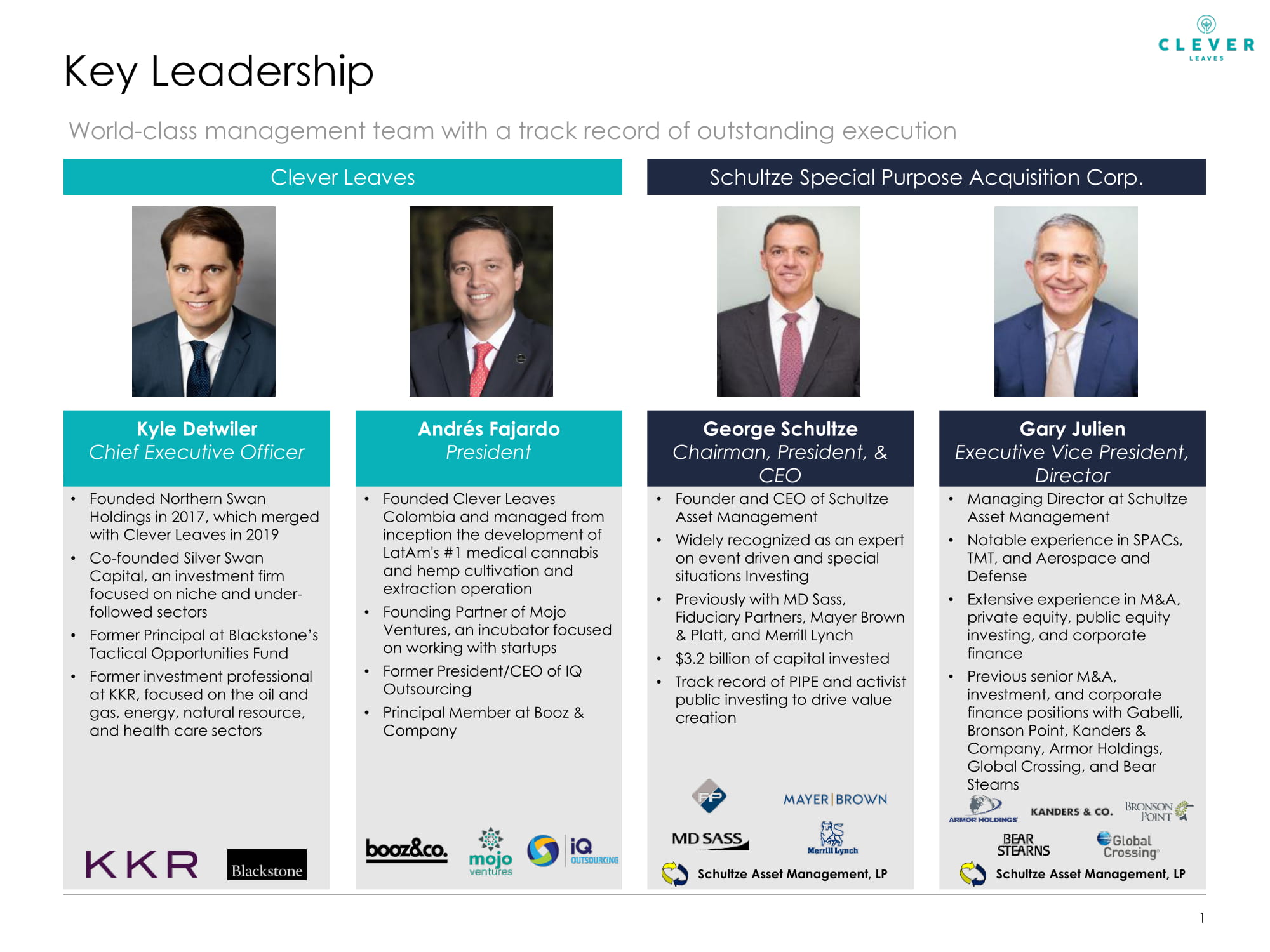

Key Leadership World - class management team with a track record of outstanding execution Clever Leaves Schultze Special Purpose Acquisition Corp. Kyle Detwiler Chief Executive Officer Andrés Fajardo President Gary Julien Executive Vice President, Director George Schultze Chairman, President, & CEO • Founded Northern Swan Holdings in 2017, which merged with Clever Leaves in 2019 • Co - founded Silver Swan Capital, an investment firm focused on niche and under - followed sectors • Former Principal at Blackstone’s Tactical Opportunities Fund • Former investment professional at KKR, focused on the oil and gas, energy, natural resource, and health care sectors • Founded Clever Leaves Colombia and managed from inception the development of LatAm's #1 medical cannabis and hemp cultivation and extraction operation • Founding Partner of Mojo Ventures, an incubator focused on working with startups • Former President/CEO of IQ Outsourcing • Principal Member at Booz & Company • Founder and CEO of Schultze Asset Management • Widely recognized as an expert on event driven and special situations Investing • Previously with MD Sass, Fiduciary Partners, Mayer Brown & Platt, and Merrill Lynch • $3.2 billion of capital invested • Track record of PIPE and activist public investing to drive value creation • Managing Director at Schultze Asset Management • Notable experience in SPACs, TMT, and Aerospace and Defense • Extensive experience in M&A, private equity, public equity investing, and corporate finance • Previous senior M&A, investment, and corporate finance positions with Gabelli, Bronson Point, Kanders & Company, Armor Holdings, Global Crossing, and Bear Stearns Schultze Asset Management, LP Schultze Asset Management, LP 1

Investment Highlights 1 4 5 3 2 2 Pharmaceutical - grade, GMP - certified production authorized for export Thoughtfully constructed, vertically integrated multi - national operator Purpose - built for significant growth, profitability and operating leverage Exceptional operational, regulatory and management talent Global leader in low - cost cannabis cultivation and extraction

Distribution Clever Leaves – Vertically Integrated Platform Genetics Cultivation Ex t racti o n Research & Development Brands NORTH A M ERICA EUROPE LATIN A M ERICA (1) Note: Portugal pre - license approval obtained in Q4 2019; full licensing status expected 2H 2020 At its core, Clever Leaves leverages its low - cost and pharma quality competitive advantages and selectively competes downstream COLOMBIA/LATAM Latin America’s #1 licensed producer of medical cannabis and hemp with 1.8M sq. ft. of cultivation and the region's only GMP - certified extraction operation Licensed producer applicant (1) headquartered in Lisbon, with an 85 ha property in the south of Portugal, 1 ha of Frankfurt – based pharmaceutical brand and importer/distributor of medical cannabis product existing greenhouse and expansion underway, and a vision to construct GMP - certified pharmaceutical and Minority investor in GDP and GMP - certified pharmaceutical company PORTUGAL processing facilities focused on cannabis importation and distribution Manufacturer and distributor of health and wellness products selling in over 10,000 retail locations in the US 3

Global Footprint Supported by Low - Cost, High - Quality Production Office Genetics and Cultivation Locations with B2B Sales (Supply Agreements) German Importer and Distributor (Licensed) Brands & Distribution German Distribution Assets Extraction and Formulation 1 - 10 em ploy e e s 10 - 100 em ploy e e s Beverage manufacturing Chile Argentina Australia Israel Mexico Canada - Portugal - European Union ~500 Total Employees - Colombia - 300+ em ploy e e s Brazil United Kingdom 4 Peru New Zealand

Clever Leaves’ Rapid Progression • Clever Leaves receives initial extraction license 2016 • Clever Leaves receives high - THC cultivation license 2017 • Initial investment by Northern Swan Holdings • First greenhouse constructed and first crop planted 1H 2018 • Investment in Cansativa • Portuguese operation commenced 2H 2018 • Clever Leaves and Northern Swan Holdings combine • Pre - license inspection letter in Portugal • INVIMA (Colombian) GMP certification • First cannabinoid revenue 2H 2019 • LatAm supply agreement with Canopy Growth Corp. announced • Received notice of increased high - THC Colombian extraction quota • Import of THC genetics into Portugal • DEA approved shipment to US • EU GMP inspection nearing completion and certification expected in June • GACP Certification in Colombia 1H 2020 • Acquired Herbal Brands 1H 2019 • Portugal full licensing • Closing of SAMA transaction and public listing 2H 2020 (Expected) 5

Colombia Leading the World Over 70% of all cut flowers imported into the US come from Colombia (1) Bogota 0 ƒ Equator Equatorial location creates ideal 12/12 hour cycle of sunlight for flowers “Given its cost advantages, we believe Colombia is positioned to become a major global export hub for cannabis, particularly if producers pursue EU GMP - compliant operating practices.” – Canaccord Genuity 6 “Colombia looks to become the world’s supplier of legal pot” – Washington Post (March 10, 2018) “Colombia seeks to be a cut above on cannabis” – Financial Times (July 20, 2019) (1) Source: US Customs and Border Protection

Ideally Suited for Industrial Scale Production 20 ƒ F (1) / 6.3 hours of daylight (1) Average cost per gram of $1.71 (2) Licensed cannabis companies: 250+ Average elevation: 567 ft Canadian cannabis Cost Ad vant a ge: VS VS VS Colombian cannabis 3x 65 ƒ F (3) / 12 hours of daylight (4) Average cost per gram of $0.20 (5) Licensed producers: 5 - 30 (5) Average elevation: 8,300 ft 5x 8x Note: 1.38 CAD:1.00 USD as of 05/29/20 Sources: Bureau of Labor Statistics, Health Canada, St. Louis Fed, The Colombian Ministry of Justice, WSJ barrel breakdown (2016), National Bureau of Statistics of China (249 workdays in 2019 via china.workingdays.org) (1) Based on median temperature and hours of daylight for major cities for coldest month of the year (2) Average of Aphria, Aurora, OrganiGram and Tilray; source: Most recent company filings. Refer to filings for more detail on breakdown of costs (3) Average temperature for coldest month of the year (4) Winter statistic (5) Reflects Management’s estimates (US$) 7

EU GMP unlocks higher price points and creates first mover advantage for Clever Leaves as global demand increases and more legal cannabis geograph ies emerge EU GMP Certification Would Set Clever Leaves Apart from Competitors 8 Not EU GMP - Certified (1,000+) EU GMP - Certified Flower Producers (~10) EU GMP - Certified Vertically Integrated Botanical Extractors (4) EU GMP expected June 2020 Clever Leaves is poised to achieve EU GMP certification in June 2020, bolstering its competitive advantage and status as a leader in the global cannabis industry Note: Clever Leaves has completed its EU GMP inspection Sources: Company filings, EudraGMDP database, press releases, MJBiz Daily “More Canadian cannabis…EU GMP certifications” published 03/09/20

Colombia Greenhouse Cultivation Site #1 9 1,800,000 sq. ft. of greenhouse completed. Perpetual harvest cycle operating since November 2018. Note: Facility photos from November 2018 through July 2019 Phase 5 ready for expansion

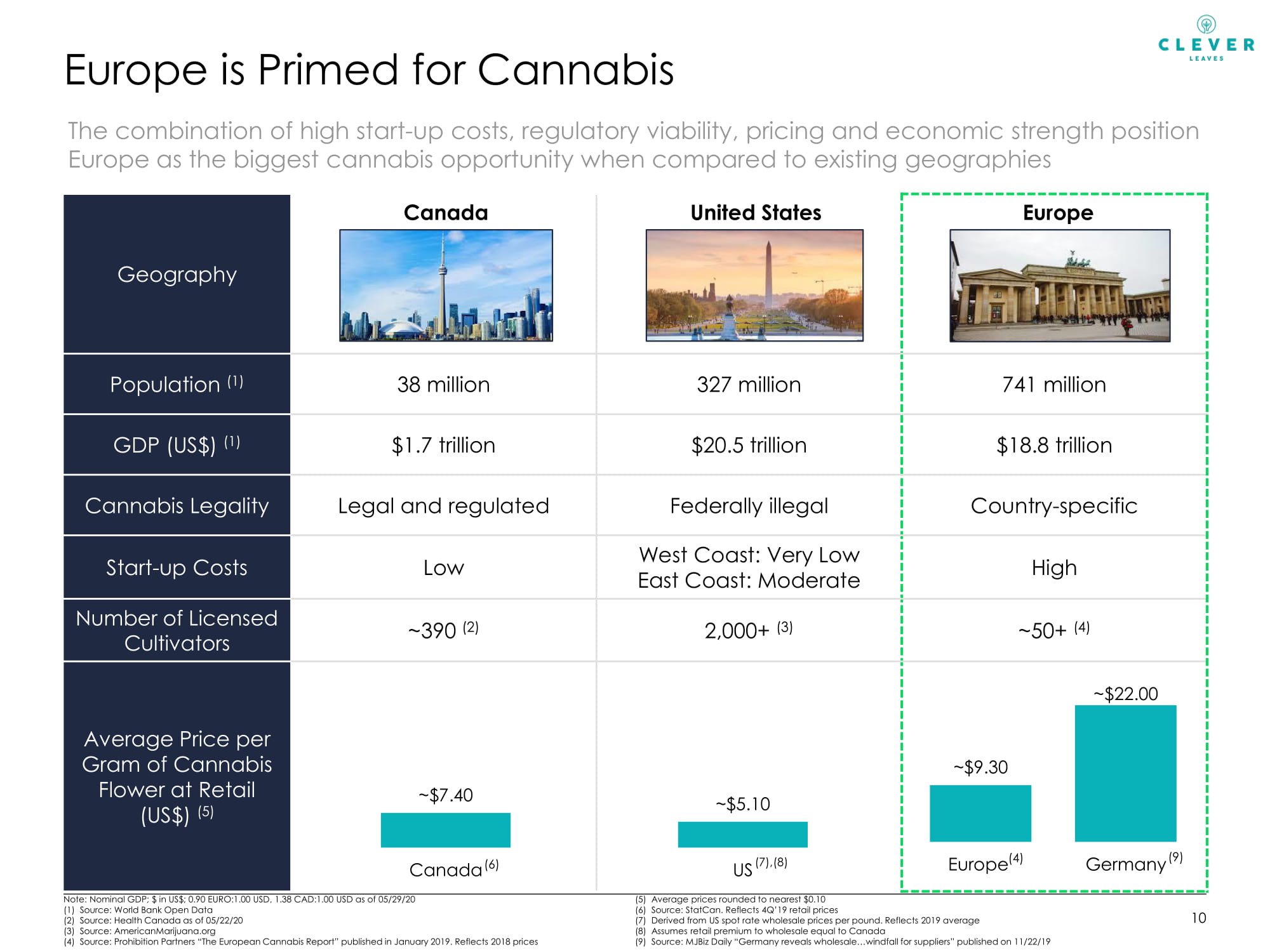

~$ 9 . 30 E urope C a nad a US Geography Canada United States Europe Population (1) 38 million 327 million 741 million GDP (US$) (1) $1.7 trillion $20.5 trillion $18.8 trillion Cannabis Legality Legal and regulated Federally illegal Country - specific Start - up Costs Low West Coast: Very Low East Coast: Moderate High Number of Licensed Cultivators ~390 (2) 2,000+ (3) ~50+ (4) ~$22.00 Average Price per Gram of Cannabis Flower at Retail (US$) (5) ~$7.40 ~$5.10 ~$9.30 Canada (6) US (7),(8) Europe (4) Germany (9) Note: Nominal GDP; $ in US$; 0.90 EURO:1.00 USD, 1.38 CAD:1.00 USD as of 05/29/20 (1) Source: World Bank Open Data (2) Source: Health Canada as of 05/22/20 (3) Source: AmericanMarijuana.org (4) Source: Prohibition Partners “The European Cannabis Report” published in January 2019. Reflects 2018 prices (5) Average prices rounded to nearest $0.10 (6) Source: StatCan. Reflects 4Q’19 retail prices (7) Derived from US spot rate wholesale prices per pound. Reflects 2019 average (8) Assumes retail premium to wholesale equal to Canada (9) Source: MJBiz Daily “Germany reveals wholesale…windfall for suppliers” published on 11/22/19 Europe is Primed for Cannabis The combination of high start - up costs, regulatory viability, pricing and economic strength position Europe as the biggest cannabis opportunity when compared to existing geographies 10

Distribution Asset #1 Distribution Asset #2 Acquired 85 ha property with 100,000 sq. ft. of existing greenhouse south of Lisbon Envisage 10 - 30 ha of greenhouse and 100 ha of outdoor facilities Cultivation European - based regulatory expertise with expected certifications to create significant advantages overcoming various regulatory hurdles Poised for Further International Expansion Germany Strategic investments in a complex cannabis industry securing access to a large and valuable customer base • Largest economy and medical cannabis geography in Europe, with 2019 insurance reimbursements growing nearly 70% over 2018 levels (1) • Clever Leaves' pharmaceutical division centralizing knowledge and interaction with pharma stakeholders in the EU • Influential investor in Cansativa, one of the largest German medical cannabis importers and distributors today , with additional licensing in process under IQANNA (100% owned) for additional paths for importation or commercial partnerships • Favorable public insurance coverage for medical cannabis • Strategically positioned to use Germany as a platform to expand into the European cannabis industry • Favorable importation margins Portugal Subject to full licensing, Clever Leaves plans to commence low - cost cultivation operations in Portugal, providing an important foothold into Europe • Access to flower sales, downstream expansion and product and branding opportunities • Favorable regulatory framework and cannabis laws • Excellent Southern European climate for cultivation purposes • Relatively low cost operations compared to EU peers • Access to high quality facilities and talent • Pre - license inspection letter received Nov. 2019 • First test harvest now completed; full licensing anticipated in 2H 2020 European Regulatory 11 (1) Source: MJBiz Daily “Insurance - covered cannabis…123 million euros” published on 03/27/20

Supply Agreement with Canopy Growth Corp. In December 2019, Clever Leaves finalized a LatAm supply agreement with Canopy Growth Corp., foreshadowing the B2B opportunity for Clever Leaves Agreement Highlights • Clever Leaves is slated to provide its partner with a steady supply of extracted cannabis products • One - year agreement with option to renew for two additional years • First shipment in January 2020 from Clever Leaves’ GMP - certified facilities in Colombia Advantages for Canopy • Allows Canopy to accelerate time to market • Ensures future supply availability via Latin America’s only GMP - certified cannabis facility • Enables asset - light go - to - market strategy Advantages for Clever Leaves • Affirms Clever Leaves’ position as a cannabis industry leader in Latin America • Paves the way for Colombia to become a hub in the global cannabinoid supply chain • Connects Clever Leaves’ large - scale capacity with one of the companies that is best positioned to bring cannabis products to market across LatAm 12

Global Opportunity Driving Outsized Growth 13 Note: US$ in B. Figures may not sum exactly due to rounding. TAM estimates include legal sales only Sources: Prohibition Partners “The Global Cannabis Report” published November 2019; Cowen research “Disruption Junction, The Cannabis Growth Function” published on 11/11/19 2024E Total Legal Addressable Market US Canada L a tAm Euro p e Asia Africa 2024E Total Medical Recreationa l $99B $54B $45B $9B $7B $2 9 B $26B $16B $10B $57B $15B $3B $2B $1B $39B $ $ 6 22 8 B B $17B $57B $7B $6B $1 9 B $13B $11B $2B $15B Ocean i a $3B $2B $1B When combining Europe, LatAm and Australia, Clever Leaves is targeting a global opportunity in excess of $50B

Disclaimer 14 DISCLAIMER This presentation (this “Presentation”) is provided for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to the proposed business combination between Clever Leaves, Inc. (“Clever Leaves” or the “Company”) and Schultze Special Purpose Acquisition Corp. (“SAMA”) and related transactions (the “Proposed Transactions”) and for no other purpose. No representations or warranties, express or implied are given in, or in respect of, this Presentation. To the fullest extent permitted by law in no circumstances will SAMA, Clever Leaves or any of their respective subsidiaries, stockholders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. Industry and market data used in this Presentation have been obtained from third - party industry publications and sources as well as from research reports prepared for other purposes. Neither SAMA nor Clever Leaves has independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. This data is subject to change. In addition, this Presentation does not purport to be all - inclusive or to contain all of the information that may be required to make a full analysis of Clever Leaves or the Proposed Transactions. Viewers of this Presentation should each make their own evaluation of Clever Leaves and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. Important Information and Where to Find It If a definitive agreement is entered into and in connection with the proposed transactions described herein, SAMA and Clever Leaves will prepare a proxy statement/prospectus for SAMA’s stockholders to be filed with the Securities and Exchange Commission (the “SEC”). The proxy statement/prospectus will be mailed to SAMA’s stockholders. SAMA and Clever Leaves urge investors, stockholders and other interested persons to read, when available, the proxy statement/prospectus, as well as other documents filed with the SEC, because these documents will contain important information about the proposed business combination transaction. Such persons can also read SAMA’s Annual Report on Form 10 - K for the fiscal year ended December 31, 2019, for a description of the security holdings of its officers and directors and their respective interests as security holders in the consummation of the transactions described herein. SAMA’s definitive proxy statement/prospectus will be mailed to stockholders of SAMA as of a record date to be established for voting on the transactions described in this report. SAMA’ stockholders will also be able to obtain a copy of such documents, without charge, by directing a request to: Schultze Special Purpose Acquisition Corp, 800 Westchester Avenue, Suite 632, Rye, New York 10573; e - mail: sdu@samco.net. These documents, once available, can also be obtained, without charge, at the SEC’s web site (http://www.sec.gov). Participants in the Solicitation SAMA, Clever Leaves and their respective directors, executive officers and other members of their management and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies of SAMA stockholders in connection with the proposed business combination. Investors and security holders may obtain more detailed information regarding the names, affiliations and interests of SAMA’s directors in its Annual Report on Form 10 - K for the fiscal year ended December 31, 2019, which was filed with the SEC on March 10, 2020. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to SAMA’s stockholders in connection with the proposed business combination will be set forth in the proxy statement/prospectus for the proposed business combination when available. Information concerning the interests of SAMA’s and Clever Leaves’ participants in the solicitation, which may, in some cases, be different than those of SAMA’s and Clever Leaves’ equity holders generally, will be set forth in the proxy statement/prospectus relating to the proposed business combination when it becomes available. SAMA and the Company and their respective directors and certain of their respective executive officers and other members of management and employees may be considered participants in the solicitation of proxies with respect to the Proposed Transactions. Information about the directors and executive officers of SAMA is set forth in the Registration Statement and other relevant materials to be filed with the SEC regarding the Proposed Transactions. Stockholders, potential investors and other interested persons should read the Registration Statement carefully before making any voting or investment decisions. These documents can be obtained free of charge from the sources

indicated above. No Offer or Solicitation This Presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

Disclaimer (cont.) 15 Forward - Looking Statements This Presentation includes certain statements that are not historical facts but are forward - looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward - looking statements generally are accompanied by words such as

“believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward - looking statements and factors that may cause such differences include, without limitation, SAMA’s and Clever Leaves’ inability to enter into a definitive agreement with respect to the proposed business combination transaction or to complete the transactions contemplated by the non - binding letter of intent; matters discovered by the parties as they complete their respective due diligence investigation of the other; the inability to recognize the anticipated benefits of the proposed business combination, which may be affected by, among other things, the amount of cash available following any redemptions by SAMA stockholders; the ability to meet NASDAQ's listing standards following the consummation of the transactions contemplated by the proposed business combination; costs related to the proposed business combination; expectations with respect to future performance and growth; the timing of the completion of the proposed business combination; Clever Leaves’ ability to execute its business plans and strategy and to receive regulatory approvals; potential litigation involving the parties; global economic conditions; geopolitical events and regulatory changes; access to additional financing; and other risks and uncertainties indicated from time to time in filings with the SEC. Other factors include the possibility that the proposed transaction does not close, including due to the failure to receive required security holder approvals, or the failure of other closing conditions. The foregoing list of factors is not exclusive. Additional information concerning certain of these and other risk factors is contained in SAMA’s most recent filings with the SEC and will be contained in the proxy statement/prospectus expected to be filed in connection with the proposed transactions described above. All subsequent written and oral forward - looking statements concerning SAMA or Clever Leaves, the transactions described herein or other matters and attributable to SAMA, Clever Leaves or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Readers are cautioned not to place undue reliance upon any forward - looking statements, which speak only as of the date made. SAMA and Clever Leaves expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward - looking statements contained herein to reflect any change in SAMA’s and Clever Leaves’ expectations with respect thereto or any change in events, conditions or circumstances on which any statement is based. Trademarks This Presentation contains trademarks, service marks, trade names and copyrights of SAMA, Clever Leaves and other companies, which are the property of their respective owners.