Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - HollyFrontier Corp | renewablesstrategyupda.htm |

| 8-K - 8-K - HollyFrontier Corp | hfcform8-kcheyenne06x0.htm |

HOLLYFRONTIER Renewables Update June 2020

Disclosure Statement Statements made during the course of this presentation that are not historical facts are “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are inherently uncertain and necessarily involve risks that may affect the business prospects and performance of HollyFrontier Corporation and/or Holly Energy Partners, L.P., and actual results may differ materially from those discussed during the presentation. Such risks and uncertainties include but are not limited to risks and uncertainties with respect to the extraordinary market environment and effects of the COVID-19 pandemic, including the continuation of a material decline in demand for refined petroleum products in markets HollyFrontier and Holly Energy Partners serve, HollyFrontier’s inability to complete the decommissioning of assets at the Cheyenne Refinery as planned or within the time periods anticipated, whether due to changes in regulations, technology or other factors, changes in preliminary accounting estimates due to the significant judgments and assumptions required, HollyFrontier’s and Holly Energy Partners’ efficiency in carrying out construction projects, including its ability to complete announced capital projects, such as the conversion of the Cheyenne Refinery and construction of the pre-treatment unit, on time and within budget, HollyFrontier’s inability to timely obtain or maintain permits, including those necessary for capital projects, such as the conversion of the Cheyenne Refinery and the construction of the pre-treatment unit; the actions of actual or potential competitive suppliers and transporters of refined petroleum or lubricants products in HollyFrontier’s and Holly Energy Partners’ markets, the demand for and supply of crude oil and refined products, the spread between market prices for refined products and market prices for crude oil, the possibility of constraints on the transportation of refined products or lubricants, the possibility of inefficiencies, curtailments or shutdowns in refinery operations or pipelines, whether due to infection in the workforce or in response to reductions in demand, effects of governmental regulations and policies, including the effects of restrictions on various commercial and economic activities in response to the COVID-19 pandemic, the availability and cost of financing to HollyFrontier and Holly Energy Partners, the effectiveness of HollyFrontier’s and Holly Energy Partners’ capital investments and marketing strategies, HollyFrontier's ability to acquire refined or lubricant product operations or pipeline and terminal operations on acceptable terms and to integrate any existing or future acquired operations, the possibility of terrorist or cyber attacks and the consequences of any such attacks, further deterioration in gross margins or a prolonged economic slowdown due to COVID-19 could result in an impairment of goodwill, and general economic conditions, including uncertainty regarding the timing, pace and extent of an economic recovery in the United States. Additional information on risks and uncertainties that could affect the business prospects and performance of HollyFrontier and Holly Energy Partners is provided in the most recent reports of HollyFrontier and Holly Energy Partners filed with the Securities and Exchange Commission, including those risks and uncertainties included under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results and Operations” in our latest Annual Report on Form 10-K and Quarterly Report on Form 10-Q. All forward-looking statements included in this presentation are expressly qualified in their entirety by the foregoing cautionary statements. The forward-looking statements speak only as of the date hereof and, other than as required by law, HollyFrontier and Holly Energy Partners undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. 2

HollyFrontier Renewables Renewables Business Profile Strategic Rationale Expected capacity to produce over 200 million . Plan to expand the renewables segment to gallons per year of renewable diesel with become a meaningful part of HollyFrontier’s feedstock flexibility cash flow and diversify from traditional petroleum fuels refining . Artesia Renewable Diesel Unit . Consumer preference for low carbon fuels . ~120 million gallons per year capacity co- continues to grow, driving expansion of located at Artesia refinery government renewable fuel programs, requirements and incentives to more states in . Cheyenne Renewable Diesel Unit the US and across the world . ~90 million gallons per year capacity . HollyFrontier can leverage utilities and through conversion of existing refinery infrastructure at existing refineries for renewables production . Pre-Treatment Unit (PTU) . Integrated solution to the Renewable Fuels . Flexibility to process multiple feedstocks for Standard (RFS) both Artesia and Cheyenne . Strengthens ESG profile . Expected total capital spend of approximately $650-$750 million . Expected consolidated IRR 20-30% 3

Cheyenne Conversion Convert Cheyenne Refinery from a traditional fuels refinery into a renewable diesel facility Strategic Considerations Financial Impact . Superior economic returns from renewable One-time charges and costs for ceasing diesel petroleum refining include . Advantaged location close to emerging LCFS . Non-cash impairment and depreciation markets & ability to leverage existing utilities charges of $225-$275 million and infrastructure . Non-cash asset retirement obligations of $3- . Future free cash flow generation at Cheyenne $12 million expected to be challenged due to . Plant decommission costs of $25-$45 million . Lower gross margins resulting from the economic impact of COVID-19 and . Severance obligations of $5-$7 million compressed crude differentials . Forecast uncompetitive operating and Working capital monetization of $50-$70 million maintenance costs as refinery operations wind down in 3Q20 . Anticipated loss of Small Refinery Exemption (SRE) 4

HollyFrontier Renewable Diesel HollyFrontier is expected to produce over 200 million gallons per year of renewable diesel Renewable Diesel Defined . Renewable diesel is a cleaner burning fuel with over 50% lower greenhouse (GHG) emissions than conventional diesel . Renewable diesel is not biodiesel . Same feedstock . Different process . Chemically identical to conventional diesel . No blend limit, existing diesel fleet can run 100% with no risk to engine operation Economics . Increasing renewable diesel demand driven by diesel consumption and low-carbon fuel policy . Renewable diesel margin supported by RIN, Low Carbon Fuel Standard (LCFS) value and Blender’s Tax Credit (BTC) when in effect . Every gallon of renewable diesel generates 1.7 D4 RINs . Renewable diesel production expected to generate >1,000,000 LCFS credits year 1* . Every gallon of renewable diesel earns $1.00 in Blender’s Tax Credit in 2022 *Credit generation declines over time as the Carbon Intensity (CI) standard falls because Credit generation is determined by renewable diesel Carbon Intensity value compared to the standard set by the California Air 5 Resources Board

Artesia Renewable Diesel Unit Expected capacity to produce ~120 million gallons per year of renewable diesel Project Details . HFC to construct greenfield Renewable Diesel Unit (RDU) co-located at the Navajo refinery . Includes rail infrastructure and storage tanks . Existing hydrogen and utilities provided by the refinery . Estimated in-service date: 1Q 2022 Project Economics . Estimated capital costs of $350 million, with approximately $140 million spend in 2020 and the balance in 2021 . Expected IRR of 20-30% . Expected average free cash flow of ~$100mm per year excluding BTC* * Blenders tax credit 6 6

Cheyenne Renewable Diesel Unit Expected capacity to produce ~90 million gallons per year of renewable diesel Project Details . HFC plans to convert existing hardware to produce renewable diesel . Expect to cease current petroleum refining operations at the end of July 2020 . Utilizing existing infrastructure allows for shorter timeline and lower cost than greenfield construction . Estimated in-service date: 1Q 2022 Project Economics . Estimated capital costs of $125 - $175 million, predominantly 2021 spend . Expected IRR of 20-30% . Expected average free cash flow of ~$40mm per year excluding BTC* * Blenders tax credit 7

Pre-Treatment Unit Feedstock Flexibility Pre-treatment capacity allows our renewable diesel plants to process a variety of feedstock Project Details . HFC to construct pre-treatment unit to provide flexibility and upgrade of feedstock . Designed to treat degummed “unrefined” soybean oil, bleachable fancy tallow and distillers corn oil . Feedstock flexibility mitigates single feedstock risk . Lower carbon intensity feedstock (tallow and distillers corn oil) increases LCFS value . Located in Artesia, NM . Expected to cover ~80% of HollyFrontier’s total feedstock requirements . Estimated in-service date: first half of 2022 Economics . Estimated capital costs of $175-$225 million, $25 million in 2020 and the balance in 2021 and 2022 . Expected IRR 10-15% base case, but designed to protect the returns of our renewables business against potential volatility in the feedstock markets . Expected average free cash flow of ~$25mm per year 8

Renewables Capital Guidance Updated 2020 capital spend reflects announced renewables projects : HollyFrontier Capital Expenditures (millions) Range Refining $ 202 $ 221 Renewables 150 180 Lubricants & Specialties Products 30 45 Turnarounds & Catalyst 85 110 Total HollyFrontier 467 556 Total HEP 58 69 Total $ 525 $ 625 Renewable Capital (millions) 2019 2020 2021 2022 Total Consolidated Project Spend $10 $150-$180 $450-$500 $40-$60 $650-$750 We expect to finance these projects with a combination of cash on hand and capital markets activity while maintaining our investment grade rating 9

Executive Summary Positioned for Value Creation Across All Segments REFINING MIDSTREAM SPECIALTY LUBRICANTS RENEWABLES . Inland merchant refiner . Operate crude and product . Integrated 34,000 barrels . Construction of 9,000 BPD pipelines, loading racks, per day of production Renewable Diesel Unit at . 5 refineries in the Mid terminals and tanks in and specialty lubricants producer Artesia, NM Refinery Continent, Southwest and around HFC’s refining with capacity Rockies regions assets expected to be completed in . Sells finished lubricants & Q1 2022 . Flexible refining system with . HFC owns 57% of the LP products in >80 countries fleet wide discount to WTI Interest in HEP and the under Petro-Canada . Construction of 6,000 BPD non-economic GP interest Lubricants, Sonneborn, Red . Premium niche product Giant Oil & HollyFrontier Renewable Diesel Unit at markets versus Gulf Coast . Eliminated IDRs in 2017 to product lines Cheyenne, WY Refinery simplify structure expected to be completed in . Organic initiatives to drive . Production facilities in Q1 2022 growth and enhance returns . Currently, over 70% of Mississauga, Ontario; Tulsa, revenues tied to long term Oklahoma; Petrolia, . Disciplined capital structure contracts and minimum Pennsylvania; & the . Construction of Pre- & allocation volume commitments Netherlands treatment unit providing feedstock flexibility . One of the largest North expected to be completed in American white oil & group the first half of 2022 III base oil producer 10

APPENDIX

Renewable Diesel Demand Today’s Market California is currently the key driver of demand consuming nearly 100% of all U.S. renewable diesel production and imports Current LCFS program in place . California consumes approximately 4 billion gallons of LCFS program passed, 2022 implementation LCFS program under evaluation/not yet passed 2,400 diesel annually 5% . Since LCFS implementation in 2011, the diesel blend rate 0.5% 2,000 has risen from 0.5% to 23% displacing over 60,000 BPD 5% of petroleum diesel 5% 5% 5% 5% 5% . California can absorb 100% of the renewable diesel 5% volumes expected to come online, which would imply 20% a ~50% blend rate 30% Looking Forward Significant potential demand growth from multiple sources . Oregon and Canada have already passed LCFS programs and multiple other states are evaluating similar program . California Air Resources Board (CARB) is in active discussion with at least 10 other states to encourage the adoption of an LCFS program . Additionally, many municipalities and corporations are looking at converting truck fleets to renewable diesel Source: EIA and CARB Data Dashboard: https://www.arb.ca.gov/fuels/lcfs/dashboard/dashboard.htm 12

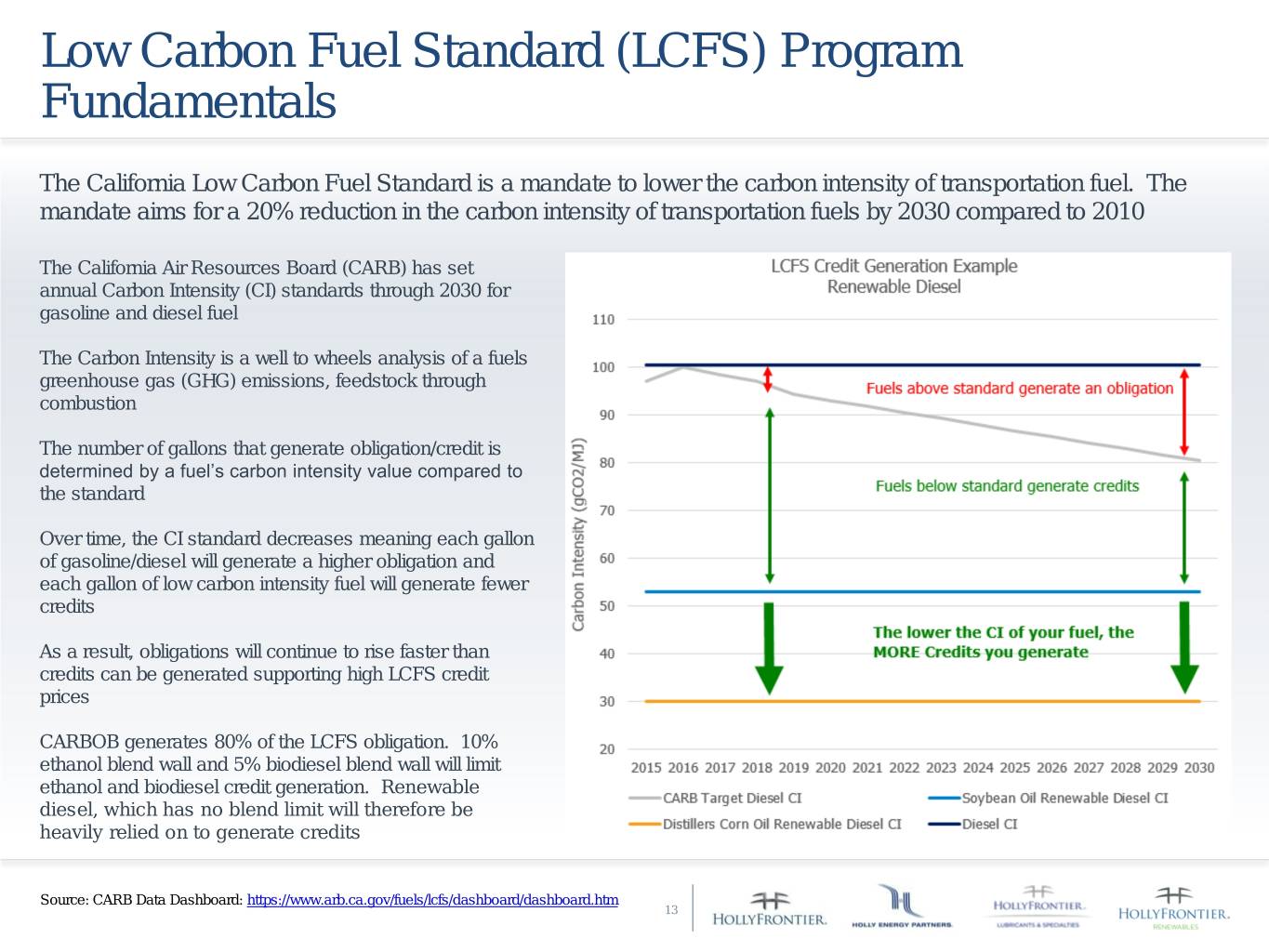

Low Carbon Fuel Standard (LCFS) Program Fundamentals The California Low Carbon Fuel Standard is a mandate to lower the carbon intensity of transportation fuel. The mandate aims for a 20% reduction in the carbon intensity of transportation fuels by 2030 compared to 2010 The California Air Resources Board (CARB) has set annual Carbon Intensity (CI) standards through 2030 for gasoline and diesel fuel The Carbon Intensity is a well to wheels analysis of a fuels greenhouse gas (GHG) emissions, feedstock through combustion The number of gallons that generate obligation/credit is determined by a fuel’s carbon intensity value compared to the standard Over time, the CI standard decreases meaning each gallon of gasoline/diesel will generate a higher obligation and each gallon of low carbon intensity fuel will generate fewer credits As a result, obligations will continue to rise faster than credits can be generated supporting high LCFS credit prices CARBOB generates 80% of the LCFS obligation. 10% ethanol blend wall and 5% biodiesel blend wall will limit ethanol and biodiesel credit generation. Renewable diesel, which has no blend limit will therefore be heavily relied on to generate credits Source: CARB Data Dashboard: https://www.arb.ca.gov/fuels/lcfs/dashboard/dashboard.htm 13

Definitions Blenders Tax Credit (BTC): Federal tax credit where qualified biodiesel blenders are eligible for an income tax credit of $1.00 per gallon of biodiesel or renewable diesel that is blended with petroleum diesel. Biodiesel (FAME): a fuel derived from vegetable oils or animal fats that meet the requirements of ASTM D 6751. Biodiesel is made through a chemical process called transesterification where glycerin is separated from the fat or vegetable oil leaving behind methyl esters (biodiesel) and byproduct glycerin. In the presentation I also refer to this as traditional biodiesel. California’s Low Carbon Fuel Standard (LCFS): California program that mandates the reduction in the carbon intensity of transportation fuels by 20% by 2030 • Carbon Intensity (CI): the amount of carbon emitted per unit of energy consumed, under LCFS it is a “well-to-wheels” analysis of green house gas emissions in transportation fuel, meaning emissions are quantified from feedstock cultivation through combustion. • California Air Resources Board (CARB): California’s clean air agency that administers the LCFS program. • California Reformulated Gasoline Blendstock for Oxygenate Blending (CARBOB): a petroleum-derived liquid which is intended to be, or is represented as, a product that will constitute California gasoline upon the addition of a specified type and percentage (or range of percentages) of oxygenate to the product after the product has been supplied from the production or import facility at which it was produced or imported. Free Cash Flow: calculated by taking operating cash flow and subtracting capital expenditures. Internal Rate of Return (IRR): a metric used in capital budgeting to estimate the profitability of potential investments. The internal rate of return is a discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero. Includes management’s assumptions on future returns. Non GAAP measurements: We report certain financial measures that are not prescribed or authorized by U. S. generally accepted accounting principles ("GAAP"), including free cash flow, which we define as operating cash flow minus capital expenditures. Please be aware that these non-GAAP measures are not alternatives to revenue, operating income, income from continuing operations, net income, or any other comparable operating measure prescribed by GAAP. In addition, these non- GAAP financial measures may be calculated and/or presented differently than measures with the same or similar names that are reported by other companies, and as a result, the non-GAAP measures we report may not be comparable to those reported by others. Also, we have not reconciled to non-GAAP forward-looking measures or guidance to their corresponding GAAP measures because certain items that impact these measures are unavailable or cannot be reasonably predicted without unreasonable effort. Refined Bleached Deodorized Soybean Oil (RBD SBO): primary feedstock for FAME Biodiesel currently in the U.S. accounting for 50% of biodiesel production. Soybean Oil is produced by crushing Soybeans which yield 20% Oil and 80% meal. Crude Soybean Oil is then processed (refined) removing impurities, color and odor. Renewable Diesel (RD): a fuel derived from vegetable oils or animal fats that meets the requirements of ASTM 975. Renewable diesel is distinct from biodiesel. It is produced through various processes, most commonly through hydrotreating, reacting the feedstock with hydrogen under temperatures and pressure in the presence of a catalyst. Renewable Diesel is chemically identical to petroleum based diesel and therefore has no blend limit. Renewable Fuel Standard (RFS): national policy administered by EPA requiring a specified volumes of different renewable fuels (primary categories are ethanol and biodiesel) that must replace petroleum-based transportation fuel. • Renewable Identification Number (RIN): a serial number assigned to each batch of biofuel produced until that gallon is blended with gasoline or diesel resulting in the separation of the RIN to be used for compliance. RIN category (D-code) is assigned for each renewable fuel pathway determined by feedstock, production process and fuel type. • D6 RIN (Renewable Fuel) - corn based ethanol, must reduce lifecycle greenhouse gas emissions by at least 20% • D5 RIN (Advanced Biofuel) – any renewable biomass except corn ethanol that reduces lifecycle greenhouse gas emissions by at least 50% • D4 RIN (Biomass-based Diesel) – biodiesel and renewable diesel, must reduce lifecycle greenhouse gas emissions by at least 50% • Renewable Volume Obligation (RVO): the required volume in gallons of biofuel refiners are obligated to blend into the gasoline and diesel pool. EPA sets volumetric standard which are then converted to percent standards based on EIA’s projected gasoline and diesel consumption. • Equivalence Value (EV): A number used to determine how many RINs can be generated from one gallon of renewable fuel based on the energy content (Btu/gallon) and renewable content of a fuel compared to Ethanol. Ethanol EV is 1.0 RIN per gallon. Biodiesel is 1.5 RINs per gallon and Renewable Diesel is 1.7 RINs per gallon. 14

HollyFrontier Corporation (NYSE: HFC) 2828 N. Harwood, Suite 1300 Dallas, Texas 75201 (214) 954-6510 www.hollyfrontier.com Craig Biery | Director, Investor Relations investors@hollyfrontier.com 214-954-6510 Trey Schonter | Investor Relations investors@hollyfrontier.com 214-954-6510