Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Chatham Lodging Trust | cldt-20200601.htm |

Exhibit 99.1 Investor Presentation June 2020

Safe Harbor Disclosure We make forward-looking statements in this presentation that are subject to risks and uncertainties. These forward-looking statements include information about possible or assumed future results of our business, financial condition, liquidity, results of operations, cash flow and plans and objectives. When we use the words “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,” “may” or similar expressions, we intend to identify forward-looking statements. Statements regarding the following subjects, among others, may be forward-looking: the terms of the proposed financing, market trends in our industry, interest rates, real estate values, the debt financing markets or the general economy or the demand for commercial real estate loans; our business and investment strategy; our projected operating results; actions and initiatives of the U.S. government and changes to U.S. government policies and the execution and impact of these actions, initiatives and policies; the state of the U.S. economy generally or in specific geographic regions; economic trends and economic recoveries; our ability to obtain and maintain financing arrangements; changes in the value of our hotel portfolio; the degree to which our hedging strategies may or may not protect us from interest rate volatility; impact of and changes in governmental regulations, tax law and rates, accounting guidance and similar matters; our ability to satisfy the REIT qualification requirements for U.S. federal income tax purposes; availability of qualified personnel; estimates relating to our ability to make distributions to our shareholders in the future; general volatility of the capital markets and the market price of our common shares; and degree and nature of our competition. The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. Forward-looking statements are not predictions of future events. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to us. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. New risks and uncertainties arise over time, and it is not possible for us to predict those events or how they may affect us. Except as required by law, we are not obligated to, and do not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Included in this presentation are certain “non-GAAP financial measures,” within the meaning of Securities and Exchange Commission (SEC) rules and regulations, that are different from measures calculated and presented in accordance with GAAP (generally accepted accounting principles). The company considers the following non-GAAP financial measures useful to investors as key supplemental measures of its operating performance: (1) FFO, (2) Adjusted FFO, (3) EBITDA, (4) Adjusted EBITDA and (5) Hotel EBITDA. These non-GAAP financial measures could be considered along with, but not as alternatives to, net income or loss, cash flows from operations or any other measures of the company’s operating performance prescribed by GAAP. 2

Business Highlights . Operating performance beginning to show signs of improvement . Relationship with Island Hospitality drives superior sales and cost control . Highest margins of any lodging REIT Profit / cash flow at lower revenue levels than peers . Largest portfolio concentration of extended stay rooms of any lodging REIT Extended stay rooms especially attractive to current lodging demand sources . Outperforming peers in current market environment . Portfolio well suited to capture demand from lodging recovery No big box hotels, limited group exposure and no NYC exposure . Solid liquidity position . Limited cash burn . No material debt maturities until 2023 . Reasonable leverage before Covid-19 pandemic Debt from highly leveraged JVs is non-recourse . Superior portfolio quality with substantial long term value 3

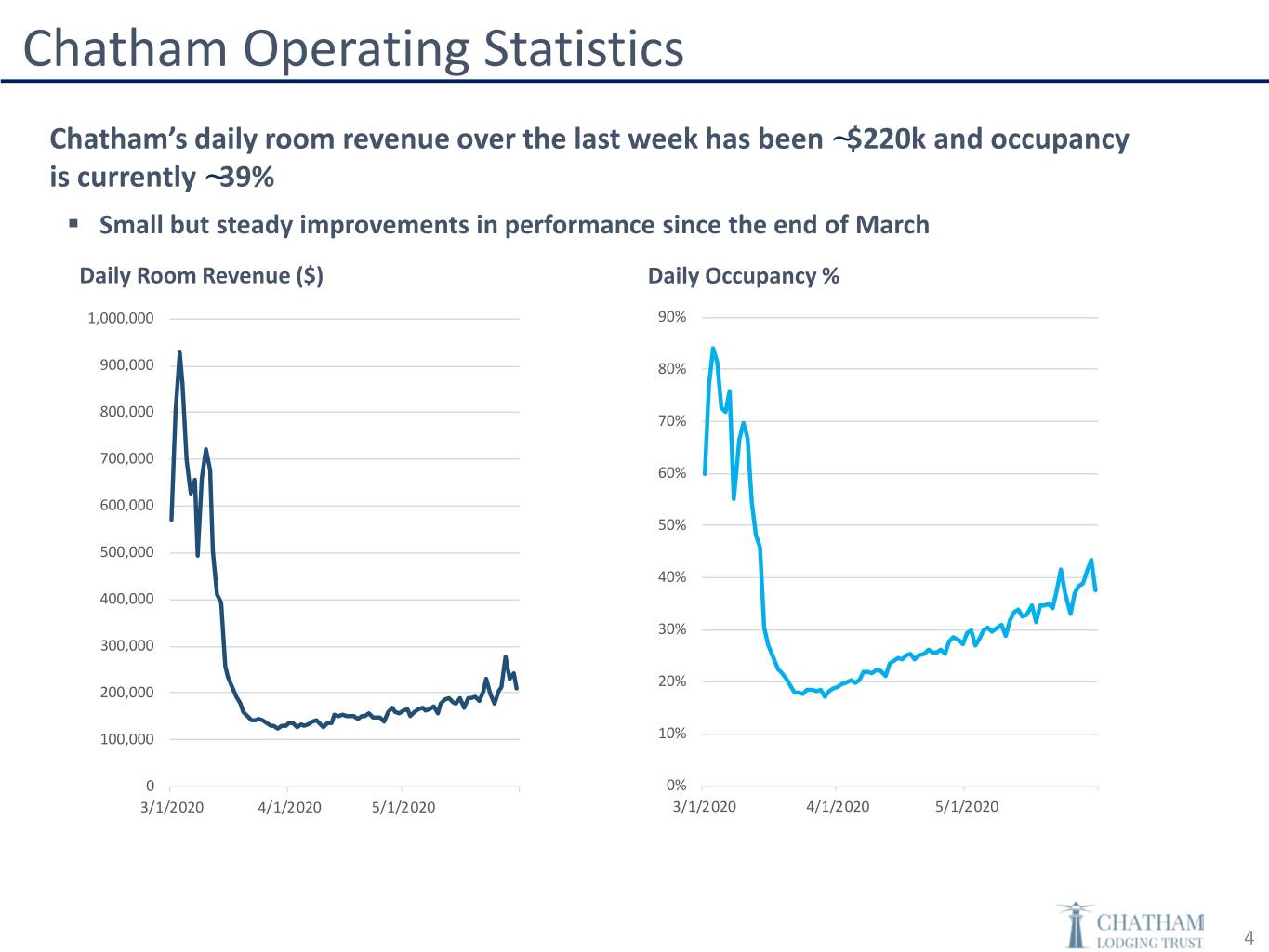

Chatham Operating Statistics Chatham’s daily room revenue over the last week has been ~$220k and occupancy is currently ~39% . Small but steady improvements in performance since the end of March Daily Room Revenue ($) Daily Occupancy % 1,000,000 90% 900,000 80% 800,000 70% 700,000 60% 600,000 50% 500,000 40% 400,000 30% 300,000 20% 200,000 100,000 10% 0 0% 3/1/2020 4/1/2020 5/1/2020 3/1/2020 4/1/2020 5/1/2020 4

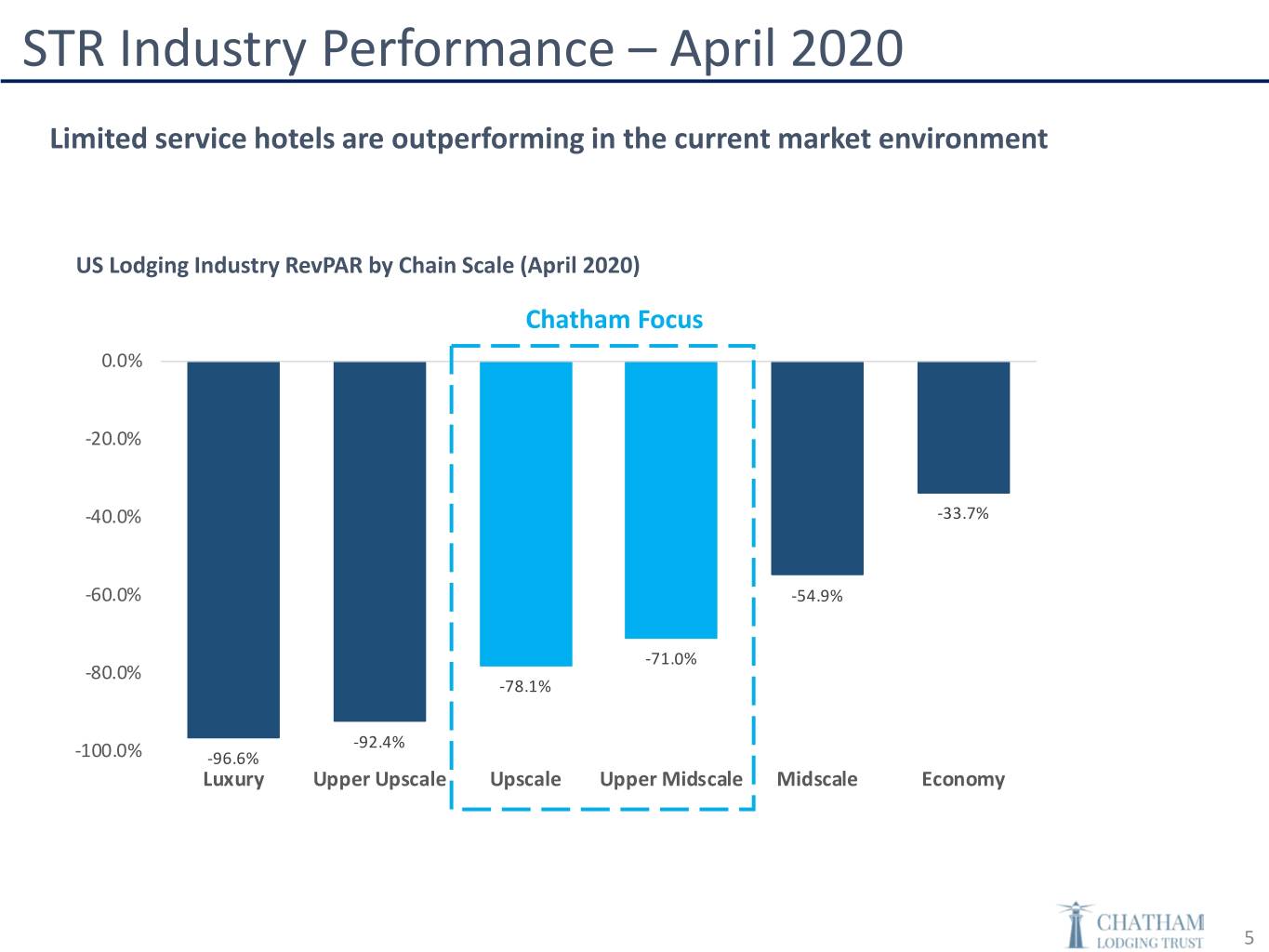

STR Industry Performance – April 2020 Limited service hotels are outperforming in the current market environment US Lodging Industry RevPAR by Chain Scale (April 2020) Chatham Focus 0.0% -20.0% -40.0% -33.7% -60.0% -54.9% -71.0% -80.0% -78.1% -92.4% -100.0% -96.6% Luxury Upper Upscale Upscale Upper Midscale Midscale Economy 5

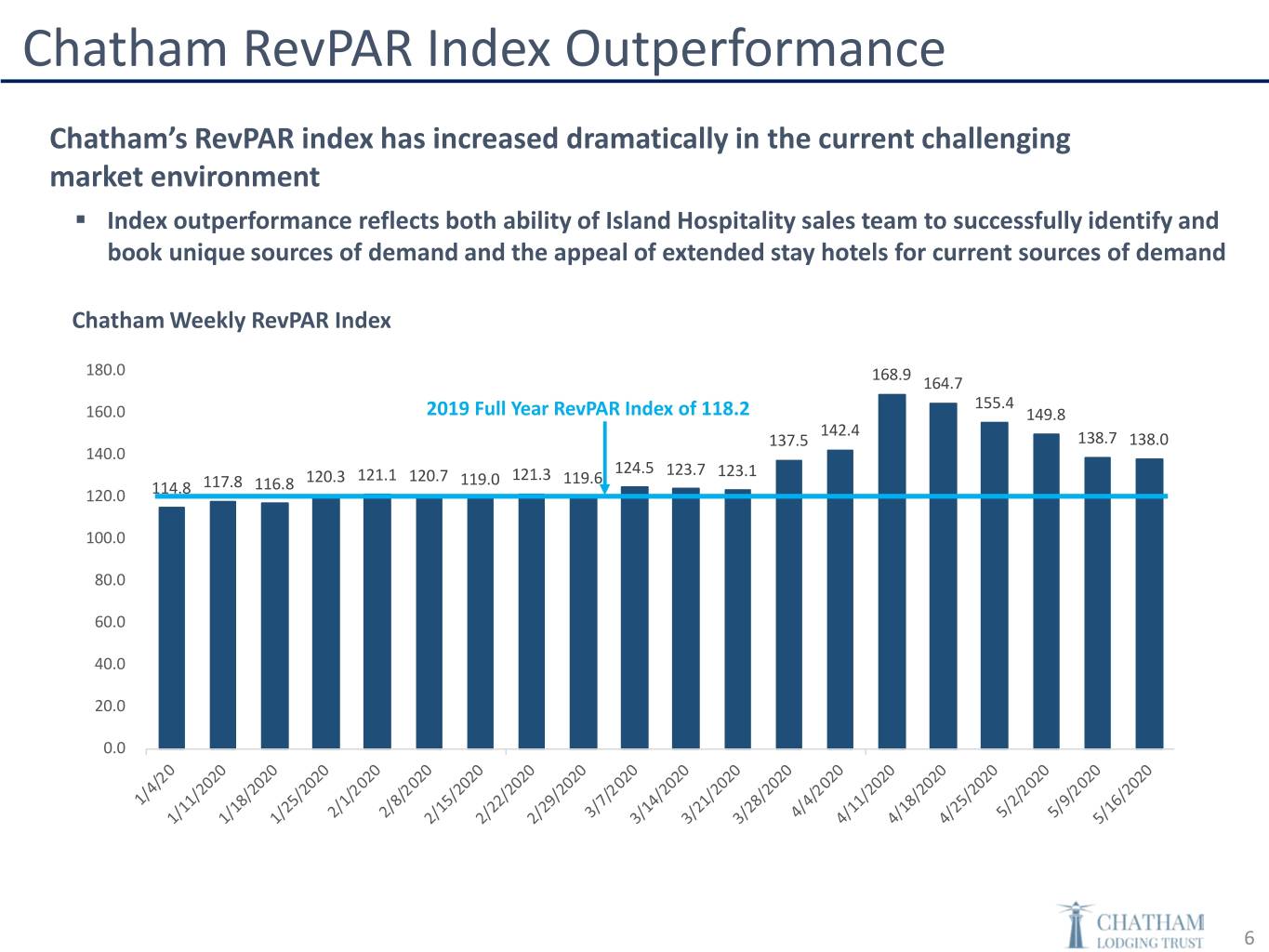

Chatham RevPAR Index Outperformance Chatham’s RevPAR index has increased dramatically in the current challenging market environment . Index outperformance reflects both ability of Island Hospitality sales team to successfully identify and book unique sources of demand and the appeal of extended stay hotels for current sources of demand Chatham Weekly RevPAR Index 180.0 168.9 164.7 155.4 160.0 2019 Full Year RevPAR Index of 118.2 149.8 142.4 137.5 138.7 138.0 140.0 121.1 121.3 124.5 123.7 123.1 117.8 116.8 120.3 120.7 119.0 119.6 120.0 114.8 100.0 80.0 60.0 40.0 20.0 0.0 6

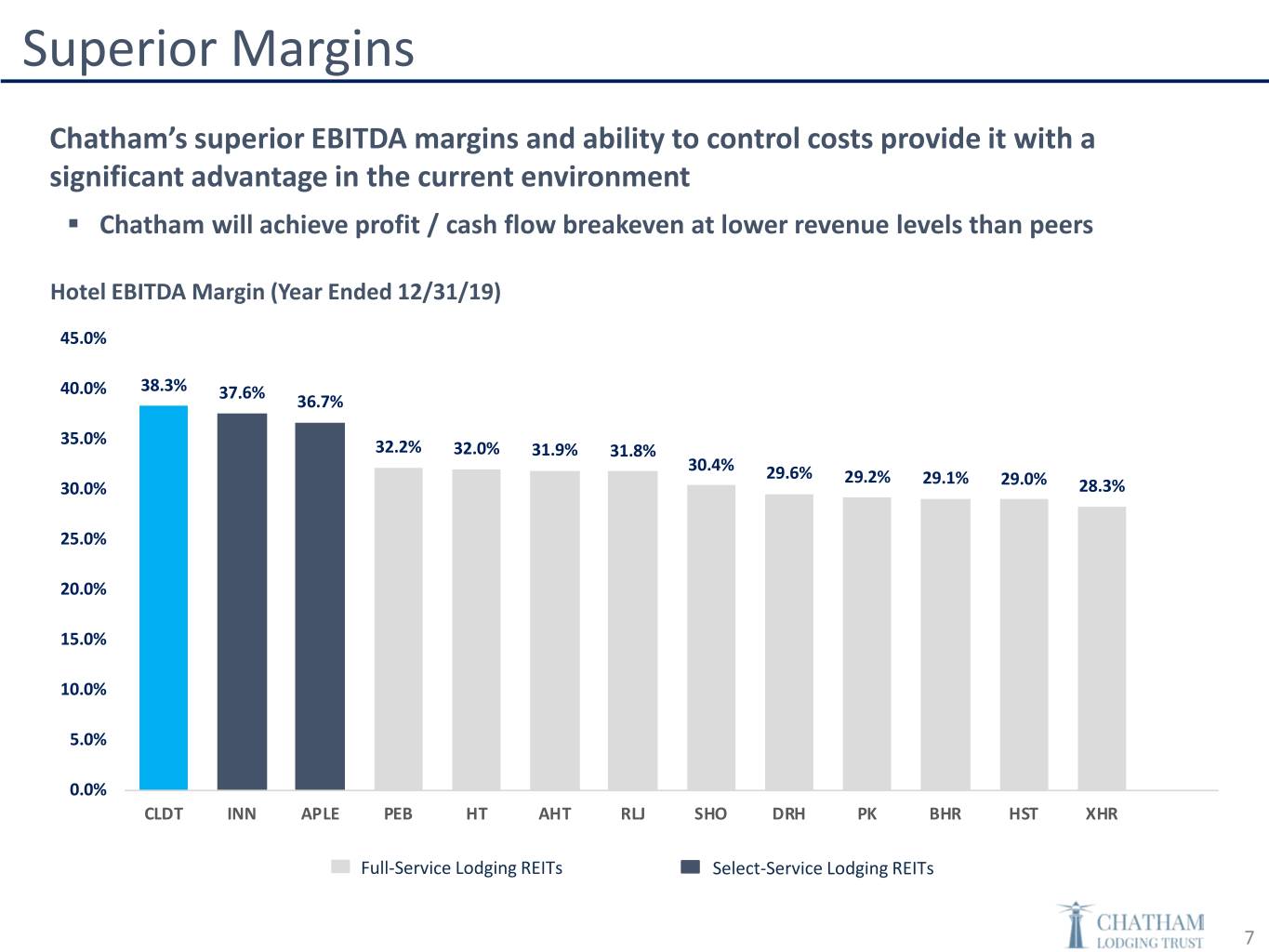

Superior Margins Chatham’s superior EBITDA margins and ability to control costs provide it with a significant advantage in the current environment . Chatham will achieve profit / cash flow breakeven at lower revenue levels than peers Hotel EBITDA Margin (Year Ended 12/31/19) 45.0% 40.0% 38.3% 37.6% 36.7% 35.0% 32.2% 32.0% 31.9% 31.8% 30.4% 29.6% 29.2% 29.1% 29.0% 30.0% 28.3% 25.0% 20.0% 15.0% 10.0% 5.0% 0.0% CLDT INN APLE PEB HT AHT RLJ SHO DRH PK BHR HST XHR Full-Service Lodging REITs Select-Service Lodging REITs 7

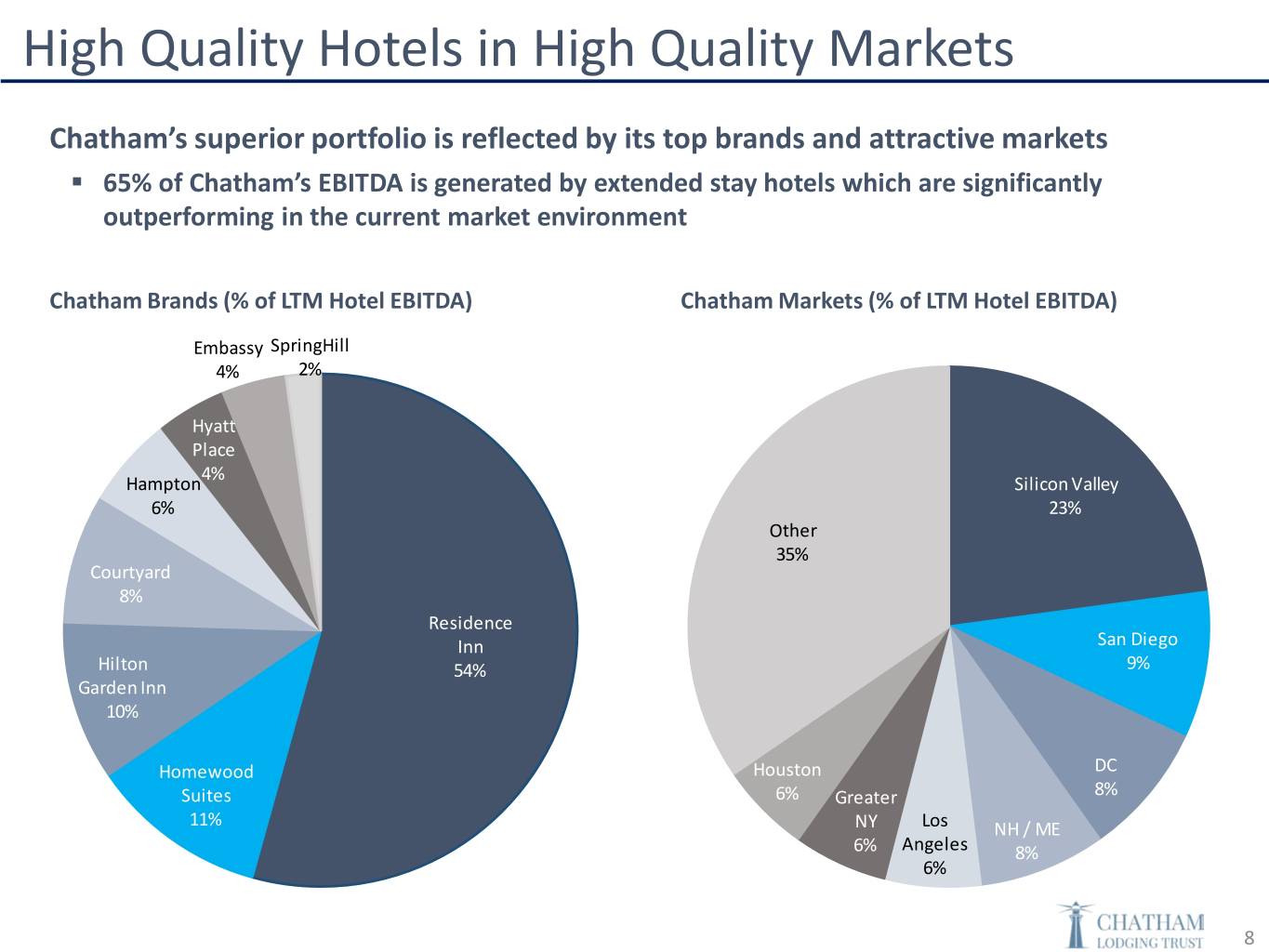

High Quality Hotels in High Quality Markets Chatham’s superior portfolio is reflected by its top brands and attractive markets . 65% of Chatham’s EBITDA is generated by extended stay hotels which are significantly outperforming in the current market environment Chatham Brands (% of LTM Hotel EBITDA) Chatham Markets (% of LTM Hotel EBITDA) Embassy SpringHill 4% 2% Hyatt Place 4% Hampton Silicon Valley 6% 23% Other 35% Courtyard 8% Residence Inn San Diego Hilton 54% 9% Garden Inn 10% Homewood Houston DC Suites 6% Greater 8% 11% NY Los NH / ME 6% Angeles 8% 6% 8

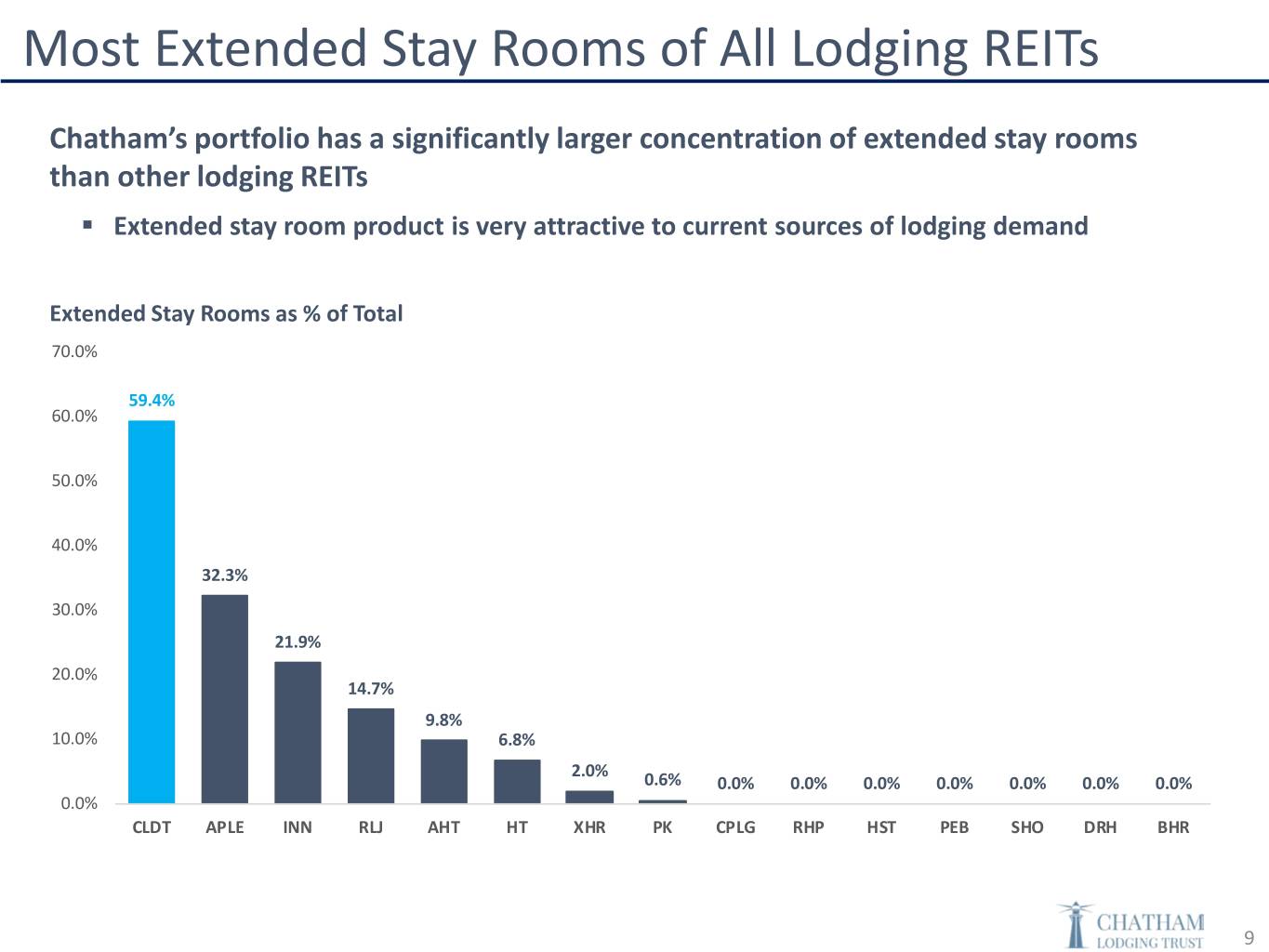

Most Extended Stay Rooms of All Lodging REITs Chatham’s portfolio has a significantly larger concentration of extended stay rooms than other lodging REITs . Extended stay room product is very attractive to current sources of lodging demand Extended Stay Rooms as % of Total 70.0% 59.4% 60.0% 50.0% 40.0% 32.3% 30.0% 21.9% 20.0% 14.7% 9.8% 10.0% 6.8% 2.0% 0.6% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% CLDT APLE INN RLJ AHT HT XHR PK CPLG RHP HST PEB SHO DRH BHR 9

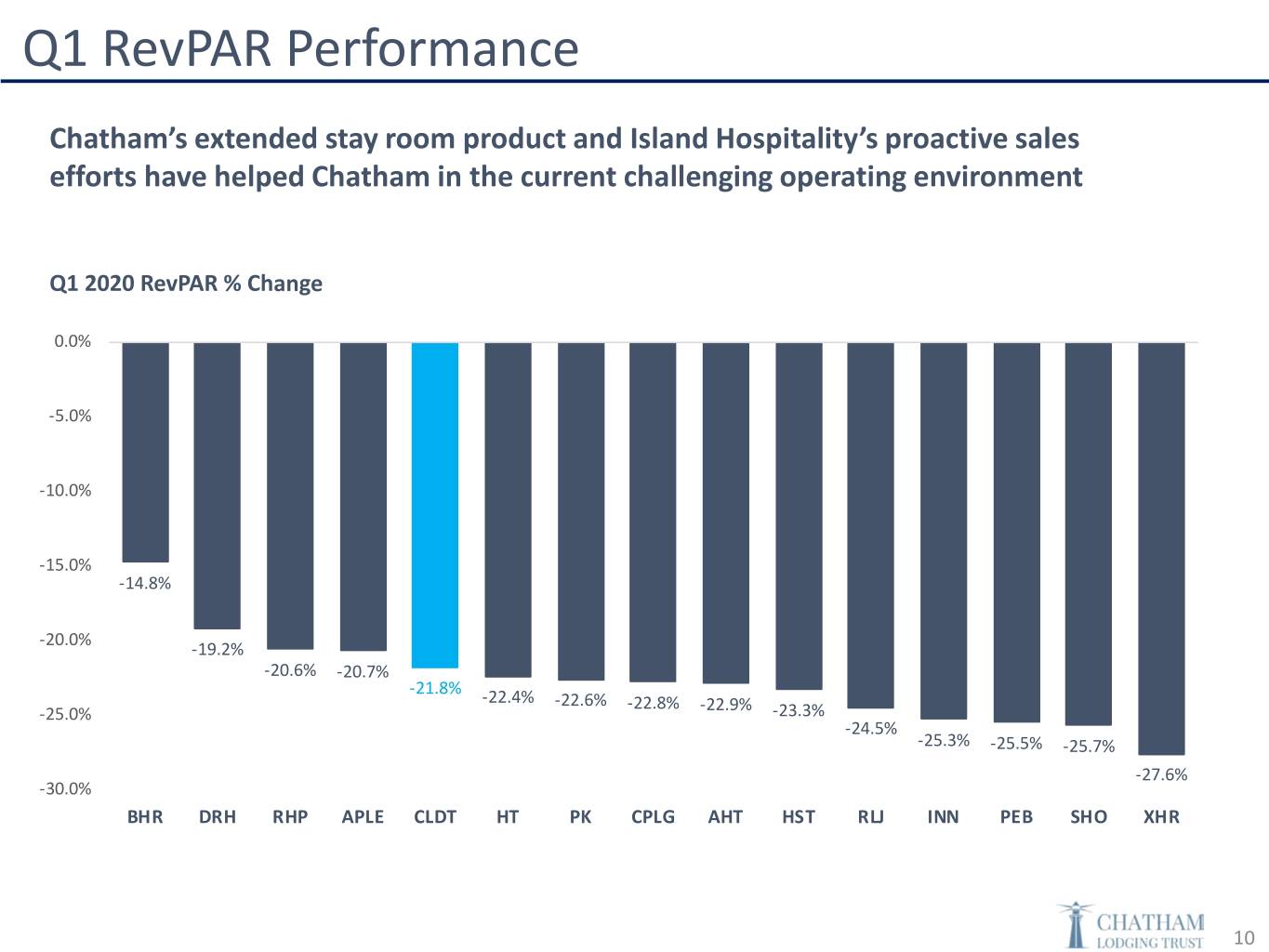

Q1 RevPAR Performance Chatham’s extended stay room product and Island Hospitality’s proactive sales efforts have helped Chatham in the current challenging operating environment Q1 2020 RevPAR % Change 0.0% -5.0% -10.0% -15.0% -14.8% -20.0% -19.2% -20.6% -20.7% -21.8% -22.4% -22.6% -22.8% -22.9% -25.0% -23.3% -24.5% -25.3% -25.5% -25.7% -27.6% -30.0% BHR DRH RHP APLE CLDT HT PK CPLG AHT HST RLJ INN PEB SHO XHR 10

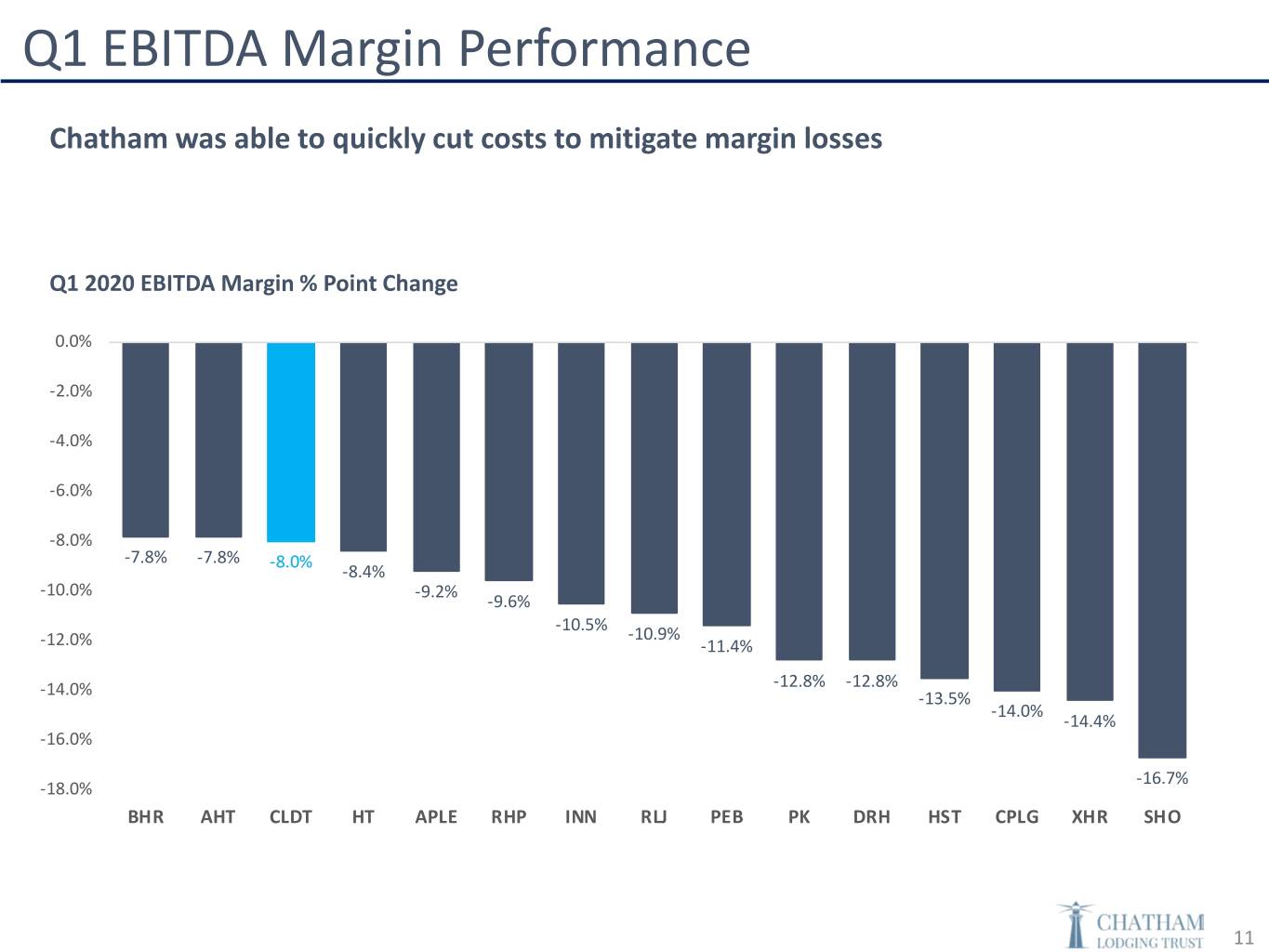

Q1 EBITDA Margin Performance Chatham was able to quickly cut costs to mitigate margin losses Q1 2020 EBITDA Margin % Point Change 0.0% -2.0% -4.0% -6.0% -8.0% -7.8% -7.8% -8.0% -8.4% -10.0% -9.2% -9.6% -10.5% -10.9% -12.0% -11.4% -12.8% -12.8% -14.0% -13.5% -14.0% -14.4% -16.0% -16.7% -18.0% BHR AHT CLDT HT APLE RHP INN RLJ PEB PK DRH HST CPLG XHR SHO 11

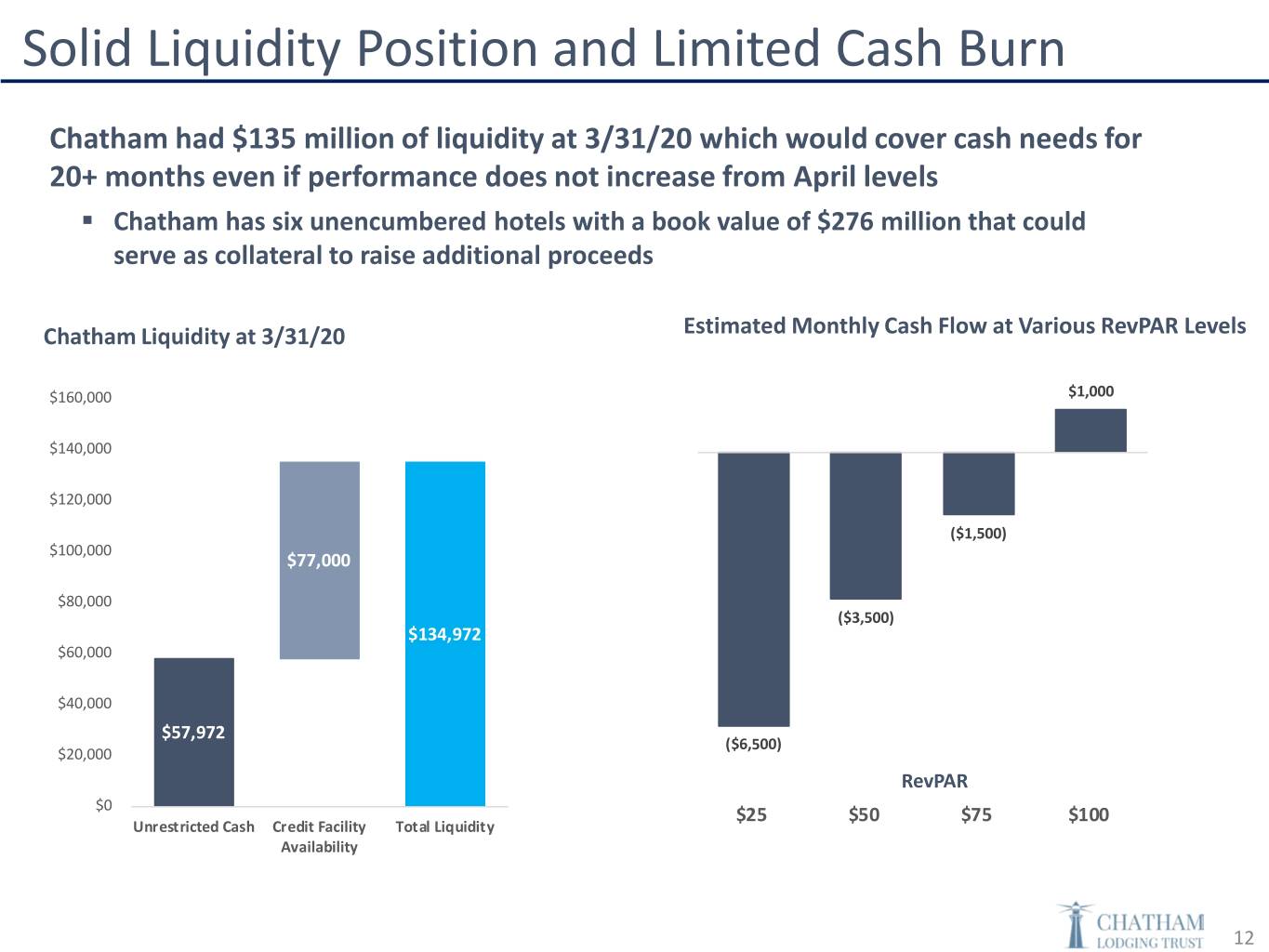

Solid Liquidity Position and Limited Cash Burn Chatham had $135 million of liquidity at 3/31/20 which would cover cash needs for 20+ months even if performance does not increase from April levels . Chatham has six unencumbered hotels with a book value of $276 million that could serve as collateral to raise additional proceeds Chatham Liquidity at 3/31/20 Estimated Monthly Cash Flow at Various RevPAR Levels $160,000 $1,000 $140,000 $120,000 ($1,500) $100,000 $77,000 $80,000 ($3,500) $134,972 $60,000 $40,000 $57,972 $57,972 ($6,500) $20,000 RevPAR $0 $25 $50 $75 $100 Unrestricted Cash Credit Facility Total Liquidity Availability 12

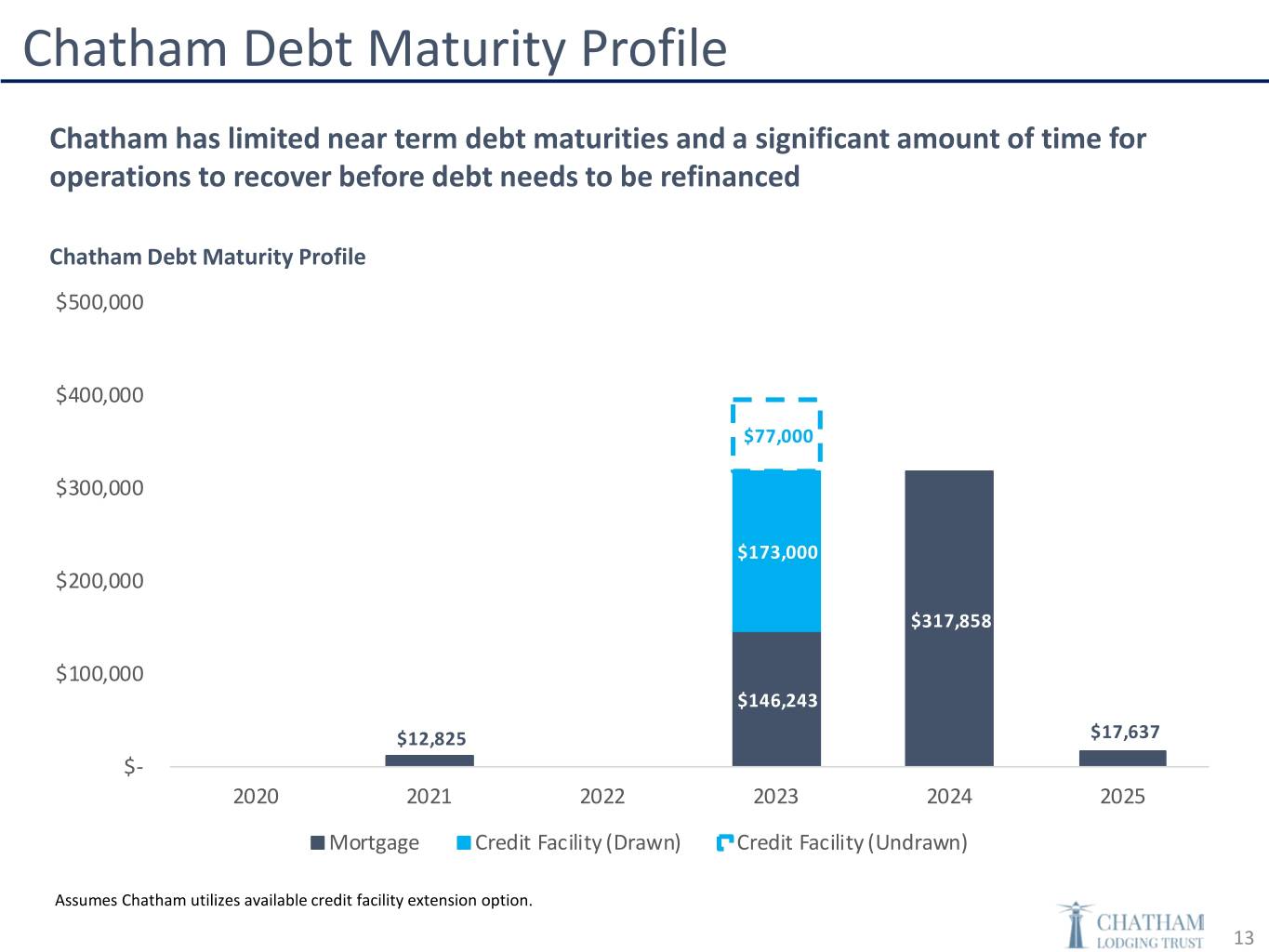

Chatham Debt Maturity Profile Chatham has limited near term debt maturities and a significant amount of time for operations to recover before debt needs to be refinanced Chatham Debt Maturity Profile $500,000 $400,000 $77,000 $300,000 $173,000 $200,000 $317,858 $100,000 $146,243 $12,825 $17,637 $- 2020 2021 2022 2023 2024 2025 Mortgage Credit Facility (Drawn) Credit Facility (Undrawn) Assumes Chatham utilizes available credit facility extension option. 13

High Quality Hotels in Attractive Markets 14

High Quality Hotels in Attractive Markets 15

Recently Renovated Rooms 16