Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Altabancorp | pub-8k_20200527.htm |

People’s Utah Bancorp Annual Shareholders Meeting May 27, 2020 Len Williams, President and Chief Executive Officer Exhibit 99.1

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to risks and uncertainties, including, but not limited to: The duration and impact of the COVID-19 pandemic; Changes in general economic conditions, either nationally or in our market areas; Adequacy of allowance for credit losses and estimation of current expected credit losses; Sufficiency of capital; Impact of changes in overall interest rate environment and other market risks; Fluctuations in demand for loans and other financial services in our market areas; Changes in legislative or regulatory requirements or the results of regulatory examinations; Stability of funding sources and continued availability of borrowings; Changes in accounting policies and practices and the use of estimates in determining fair value of certain of our assets, which estimates may prove to be incorrect and result in significant declines in valuation; and These and other risks as may be detailed from time to time in our filings with the Securities and Exchange Commission. The Company cautions readers not to place undue reliance on any forward-looking statements. Moreover, you should treat these statements as speaking only as of the date they are made and based only on information then actually known to the Company. The Company does not undertake and specifically disclaims any obligation to revise any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements, except as required by law. These risks could cause our actual results in 2020 and beyond to differ materially from those expressed in any forward-looking statements by, or on behalf of, us, and could negatively affect the Company’s operating results, financial condition and stock price performance. Confidential Page

Corporate Vision Page

Board of Directors Confidential Page Richard T. Beard Len E. Williams Paul R. Gunther David G. Anderson R. Brent Anderson Douglas H. Swenson Deborah S. Bayle Jonathan B. Gunther Matthew S. Browning Natalie Gochnour

Executive Management Confidential Page Len E. Williams Chief Executive Officer Mark K. Olson Chief Financial Officer Judd P. Kirkham Chief Credit Officer Judd Austin Chief Banking Officer Ryan H. Jones Chief Lending Officer Chris Linford Chief People Officer

Vision, Purpose, and Values Vision To be the best bank for your business. Purpose We create value and stability for our clients, employees, and other stakeholders by delivering customized financial solutions and expertise to businesses and individuals. Values We care. We are safe. We innovate. We execute. We are professional. Integrity is absolute. Confidential Page

Unified Brand Confidential Page Ticker Symbol: ALTA

Unified Brand Confidential Page

COVID-19 Operational Response and Preparedness Page

COVID-19 Pandemic Response Our first priority is to ensure the health and welfare of our employees; Our second priority is to ensure the safety and soundness of the bank; Our third priority is to provide relief and assistance to our clients and communities; Confidential Page 85% of our administrative staff and 55% of our production staff were able to work from home; We have maintained a fortress balance sheet that should sustain us as we address to consequences associated with closing down the economy; We have funded approximately $80 million in SBA PPP loans; facilitated SBA PPP loans for another 700 borrowers through a third-party; and have provided deferment of payments to approximately 400 borrowers;

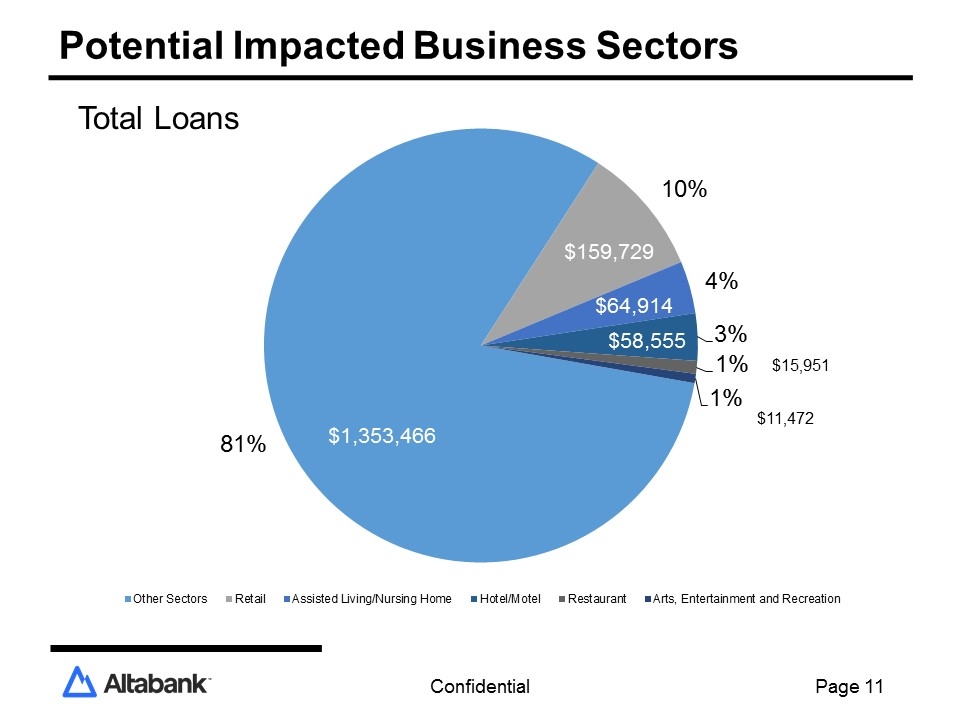

Potential Impacted Business Sectors Confidential Page 6 Total Loans $159,729 $64,914 $58,555 $15,951 $11,472

Next Steps—COVID 19 Pandemic All branches are open and administrative employees are returning to work in our office locations based on state and local guidelines; Evaluate certain job functions to remain permanently at home; Constant contact with commercial and consumer clients to continue assistance as economy rebounds; Continue to enhance technology solutions to improve client experience with mobile application and website; Monitor trends and increase resources to address credit quality issues as they arise; Evaluate all areas of organization to improve efficiencies and leverage platform; Refocus resources to organically grow business, while evaluating opportunities to acquire bank talent, financial portfolios, or banks. Confidential Page

Strong Balance Sheet Page

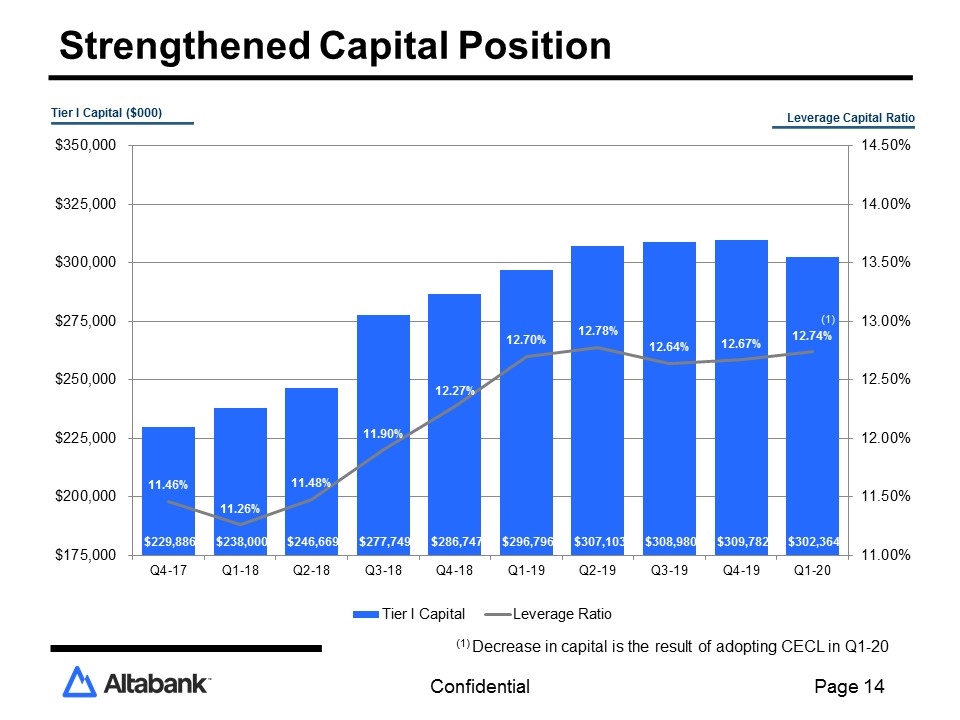

Strengthened Capital Position Confidential Page Tier I Capital ($000) Leverage Capital Ratio (1) Decrease in capital is the result of adopting CECL in Q1-20 (1)

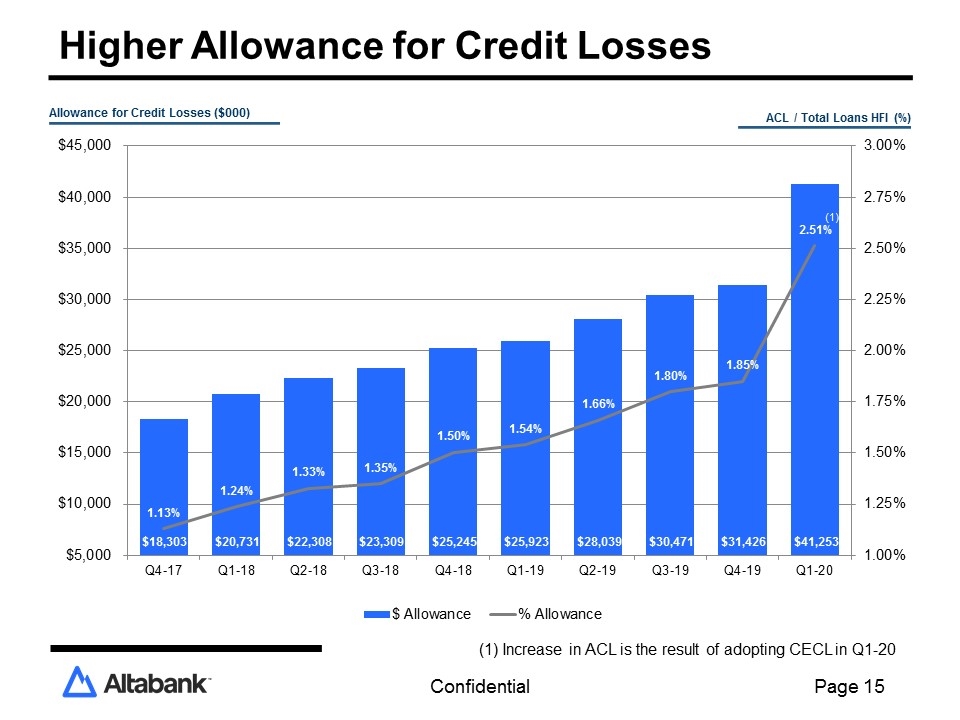

Higher Allowance for Credit Losses Confidential Page Allowance for Credit Losses ($000) ACL / Total Loans HFI (%) (1) Increase in ACL is the result of adopting CECL in Q1-20

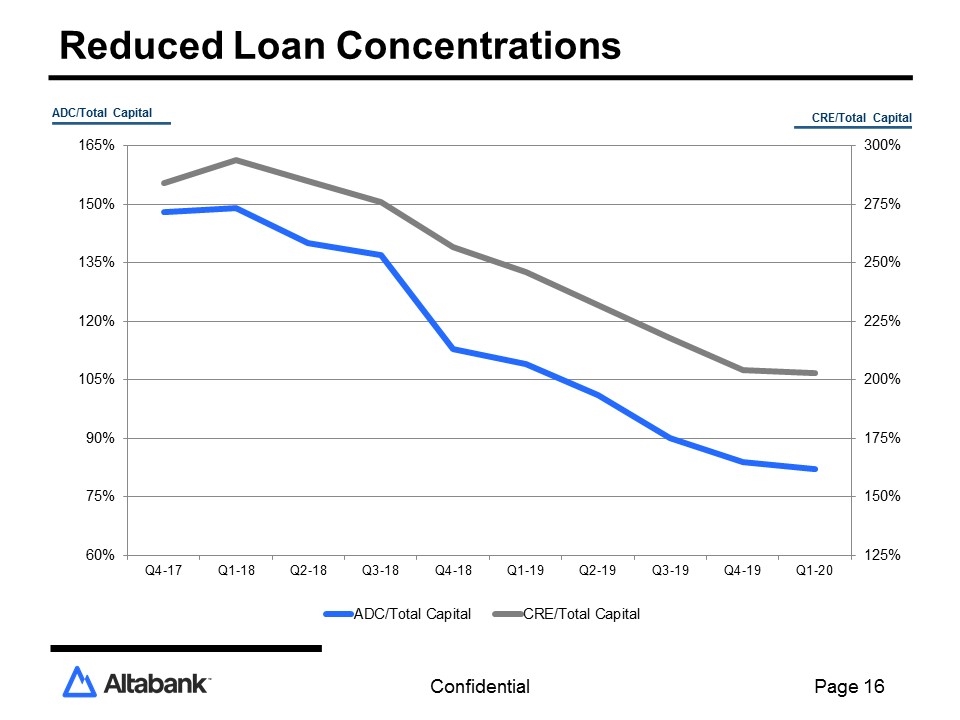

Reduced Loan Concentrations Confidential Page ADC/Total Capital CRE/Total Capital

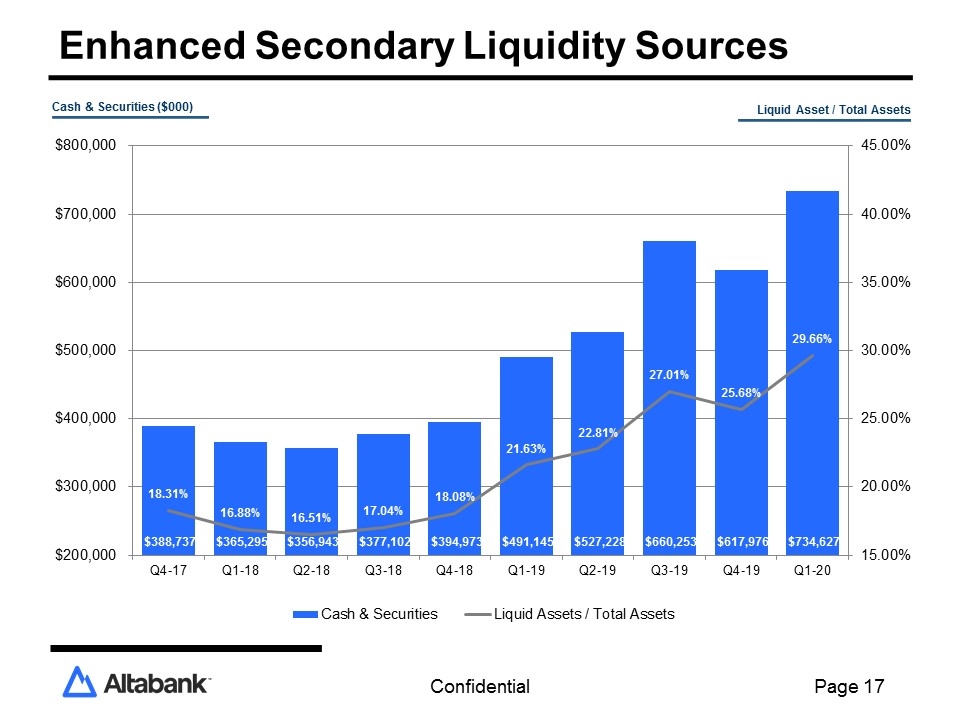

Enhanced Secondary Liquidity Sources Confidential Page Cash & Securities ($000) Liquid Asset / Total Assets

Positive Asset Quality Trends Page

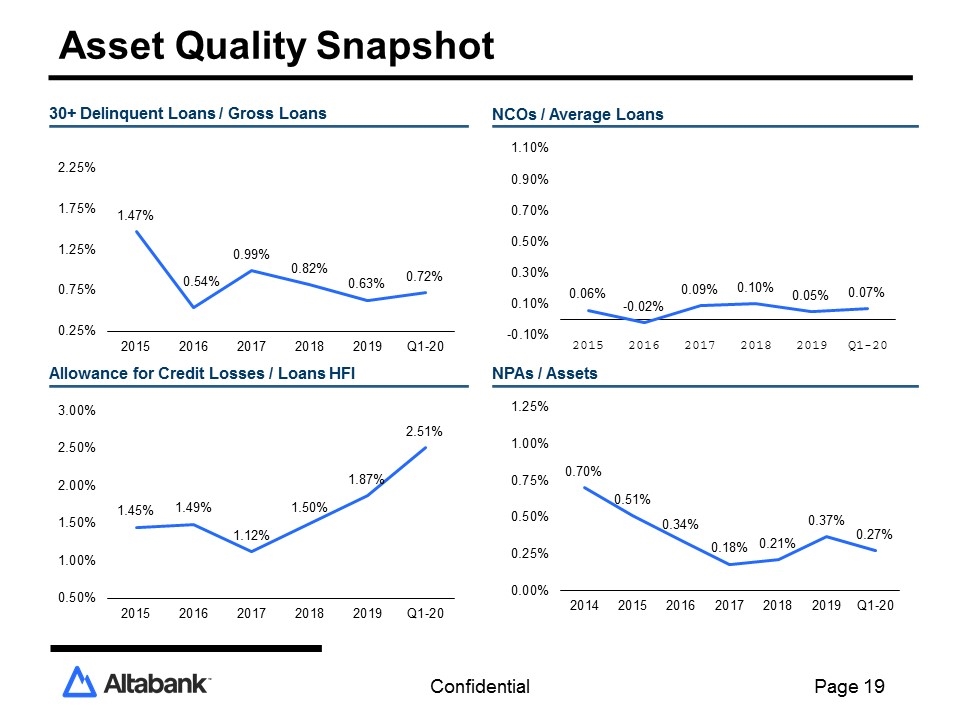

Asset Quality Snapshot Confidential Page 30+ Delinquent Loans / Gross Loans NCOs / Average Loans Allowance for Credit Losses / Loans HFI NPAs / Assets

Robust Financial Performance Page

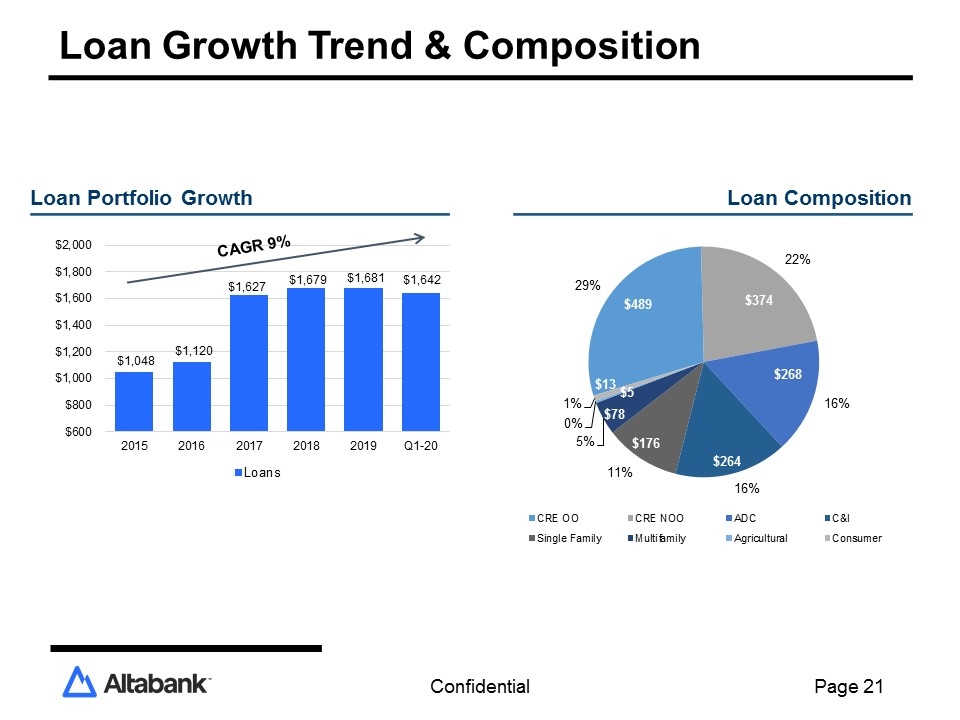

Loan Growth Trend & Composition Confidential Page Loan Portfolio Growth $1,048 $1,120 $1,627 $1,679 CAGR 9% Loan Composition $1,642 $268 $1,681

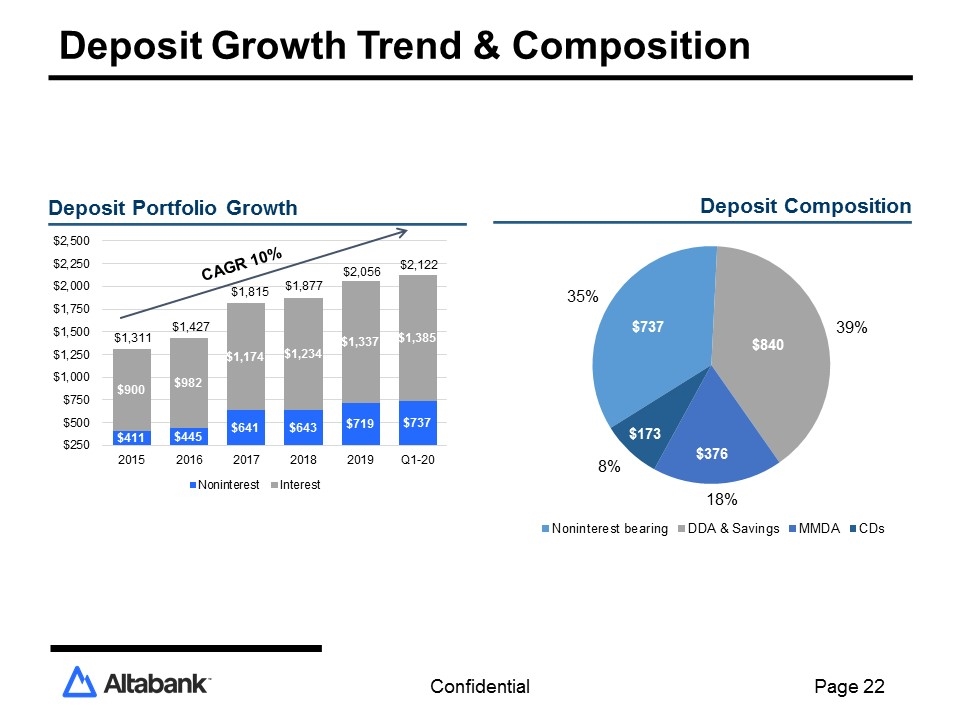

Deposit Growth Trend & Composition Confidential Page Deposit Portfolio Growth CAGR 10% $1,311 $1,427 $1,815 $2,056 Deposit Composition $1,877 $2,122

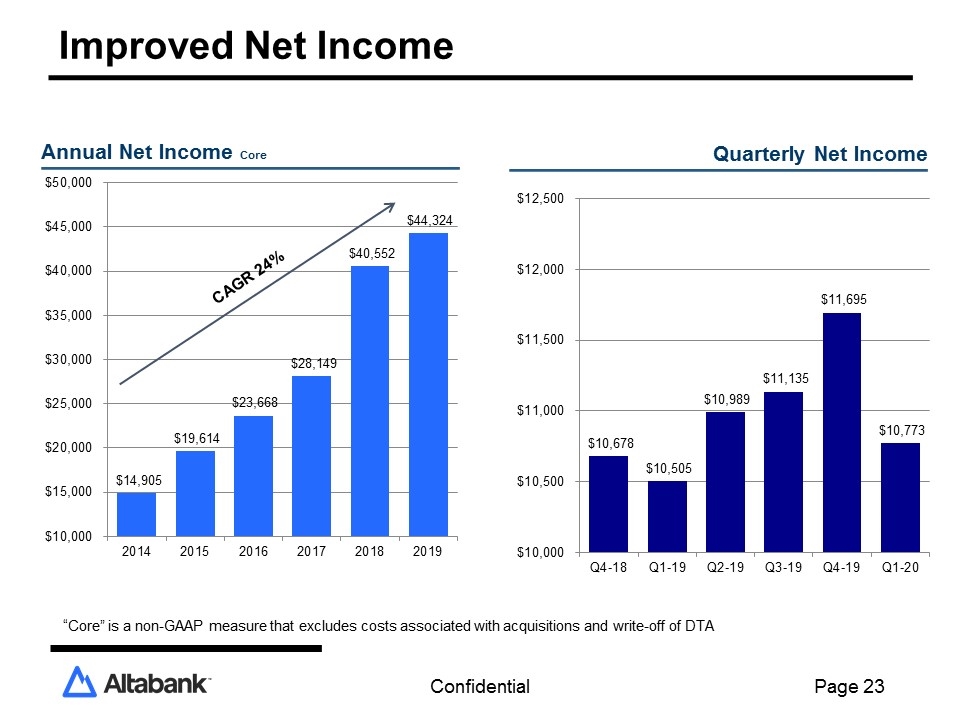

Improved Net Income Confidential Page Annual Net Income Core Quarterly Net Income “Core” is a non-GAAP measure that excludes costs associated with acquisitions and write-off of DTA CAGR 24%

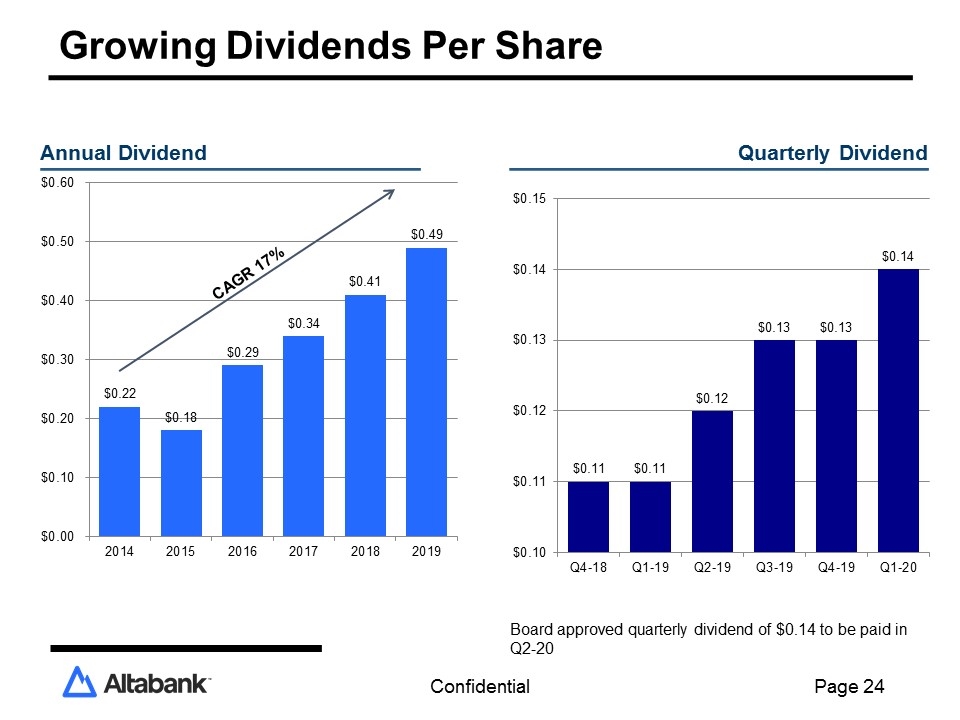

Growing Dividends Per Share Confidential Page Annual Dividend Quarterly Dividend CAGR 17% Board approved quarterly dividend of $0.14 to be paid in Q2-20

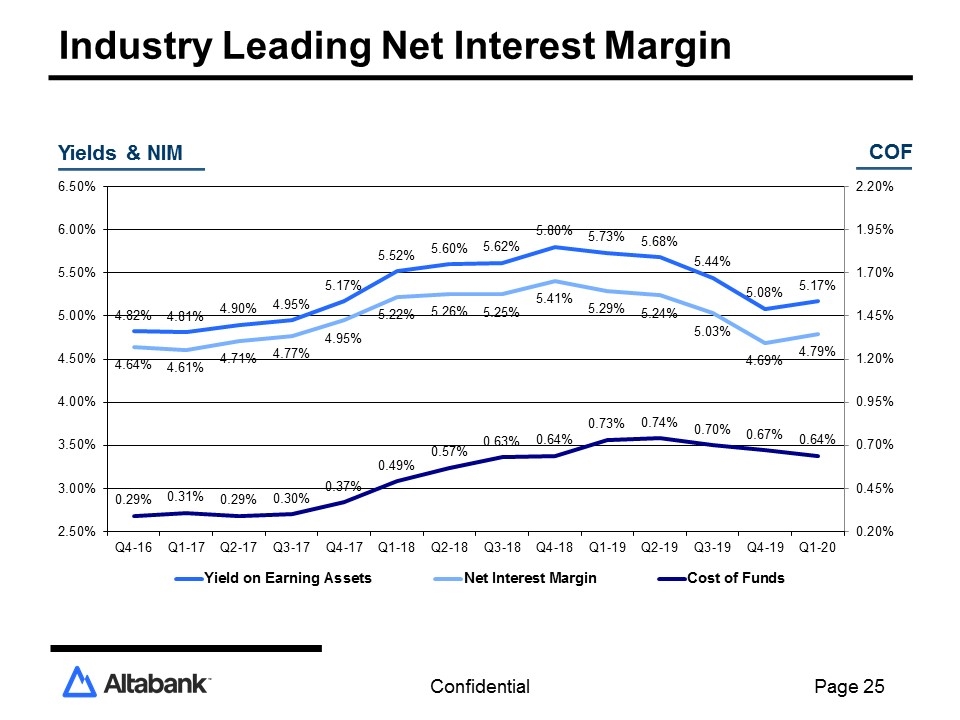

Industry Leading Net Interest Margin Confidential Page Yields & NIM COF

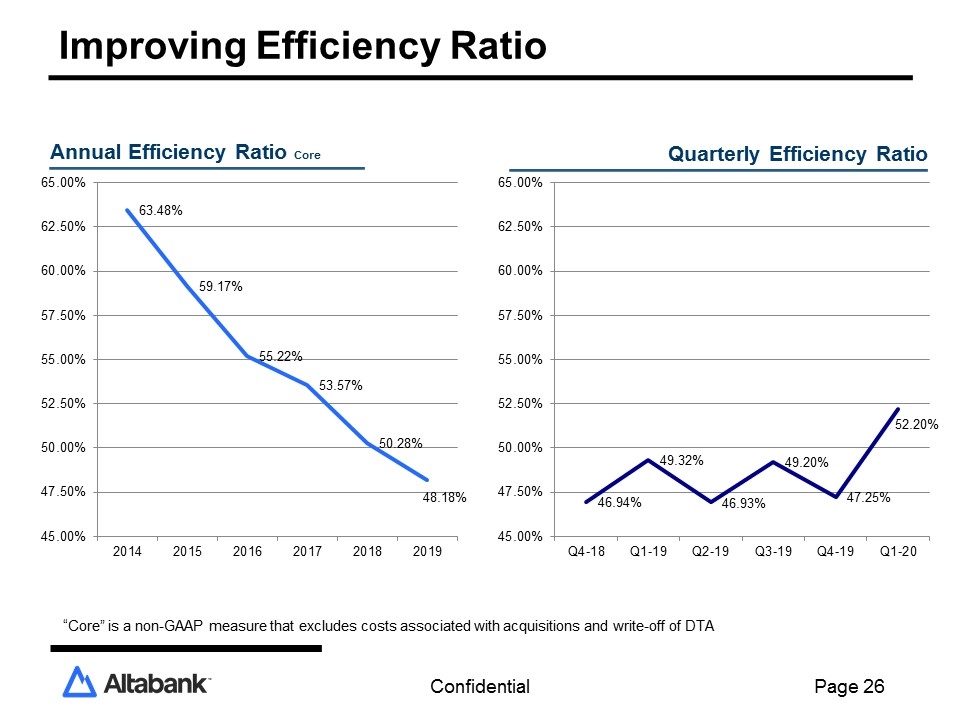

Improving Efficiency Ratio Confidential Page Annual Efficiency Ratio Core Quarterly Efficiency Ratio “Core” is a non-GAAP measure that excludes costs associated with acquisitions and write-off of DTA

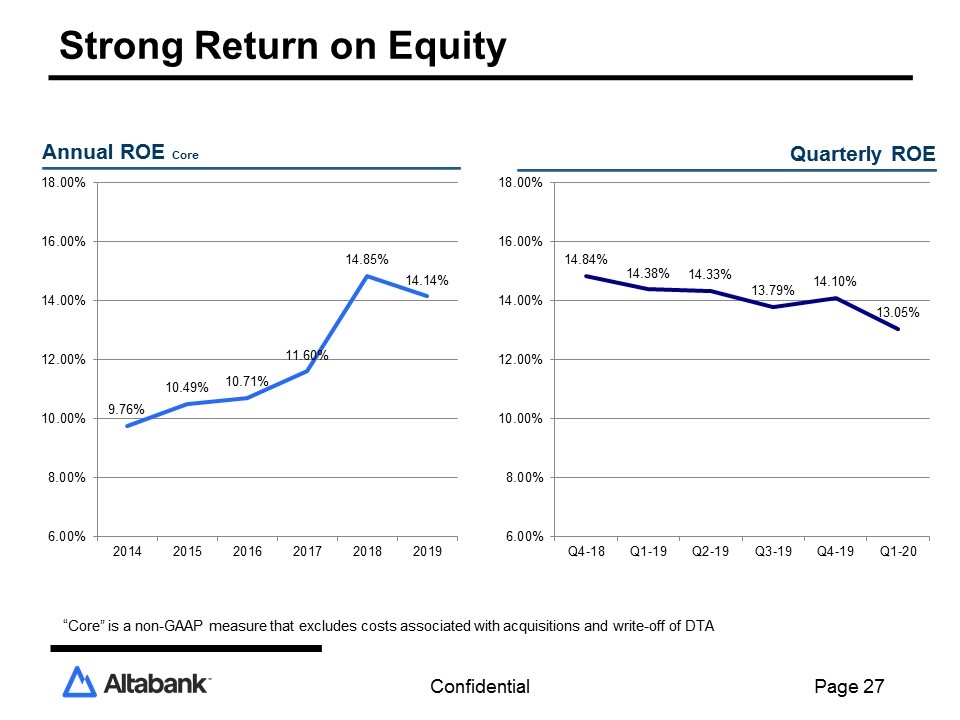

Strong Return on Equity Confidential Page Annual ROE Core Quarterly ROE “Core” is a non-GAAP measure that excludes costs associated with acquisitions and write-off of DTA

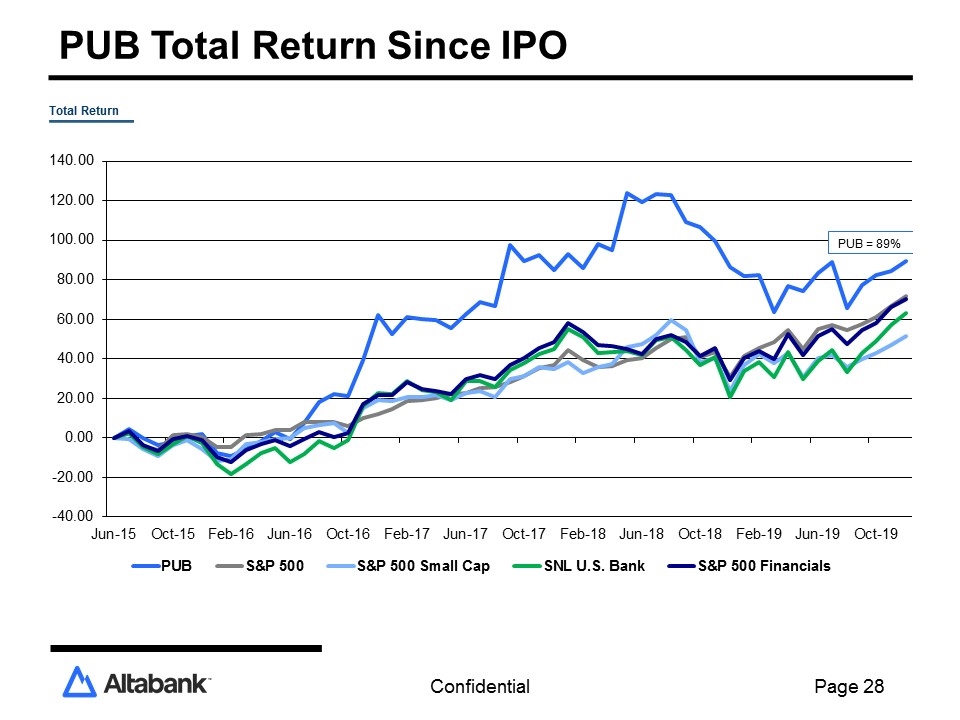

PUB Total Return Since IPO Confidential Page Total Return

Looking Forward Page

Opportunities and Initiatives Drive loan volume through organic growth in specific market sectors and take advantage of market opportunities; Continue investment in technology, while we relentlessly pursue greater efficiencies—Faster, Better, and Cheaper; Enhance sales opportunities and follow-up through Salesforce CRM implementation; Implement comprehensive human resources information systems (“HRIS”); Use our strong balance sheet to be able to play offense as we continue to aggressively focus on M&A. Confidential Page