Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MIDDLEBY CORP | midd5282020-8xk.htm |

Exhibit 99.1 KBCM Virtual Industrials and Basic Materials Conference May 28, 2020

COVID-19 Implemented Action We have implemented the following in response to COVID-19: COVID-19 UPDATE • Employee Safety – Implemented companywide procedures including enhanced workplace sanitation, travel discontinuation, social distancing, staggered shifts and work-at-home protocols for most non-production In response to the COVID-19 pandemic, we employees. implemented swift actions to protect our • Customer Support – Ensured continued access to customer support, technical service and uninterrupted employees, ensure uninterrupted service to shipping of service parts and finished goods. Production continued to meet customer demand. our customers and aggressively adjust our • Cost Initiatives – Initiated an aggressive reduction of all controllable and discretionary costs. This included the business and cost structure for an expected adjustment of global office and production workforces in response to near-term reduced demand levels and revenue decline. Our businesses in all three reduced cash compensation to executives. segments support an essential daily • Supply Chain – Established a task force to identify and mitigate supply chain disruption and ensure continuity requirement, food, and thus have been of business operations and customer support. designated as essential in most global • Liquidity and Cash Flow – Reduced capital expenditures for the remainder of year, enhanced working capital locations. We are proud to continue to reduction initiatives, deferred near-term acquisition and business development related investments, and discontinued the Middleby share repurchase program. support our customers, while adhering to strict employee safety standards at all • COVID-19 Product Introductions – Developed and launched products addressing COVID-19 needs, including sterilization units for N95 masks, mobile and touchless handwashing stations, plexiglass safety shields for worldwide operations. restaurants and retail locations, mobile foodservice stations and hand and cleaning sanitizer produced at our most recent acquired company Deutsche. www.middleby.com 2

Financial Results Q1 2020 FINANCIAL RESULTS 1Q20 1Q19 Change RESULTS COMMENTARY Net Sales $677.5 $686.8 -1.4% • Revenue decline of 5.9% organically Gross Profit 250.2 257.3 -2.8% % of Sales 36.9% 37.5% • Organic growth at Food Processing of 6.1% offset by declines in Commercial Foodservice (8.7%) and Residential Kitchen (5.0%) Operating Income 105.4 101.1 4.3% • Commercial Foodservice impacted by COVID-19, initially on our business in China, but also in North America late in the quarter Net Earnings 73.8 69.0 7.0% • Residential Kitchen reflects weakness in the UK market associated with Adjusted EBITDA 137.8 137.8 0.0% Brexit and Covid-19 impacts globally % of Sales 20.3% 20.1% • Strong EBITDA generation and cash flows LTM Bank EBITDA 682.6 659.7 3.5% • EBITDA margin expansion to 21.3% excluding recent acquisitions as defined in credit agreement • In spite of challenging market conditions, profitability improvements from integration benefits, cost control, and pricing actions, while continuing to invest in R&D across all segments Operating Cash Flow 87.1 33.9 156.9% www.middleby.com 3

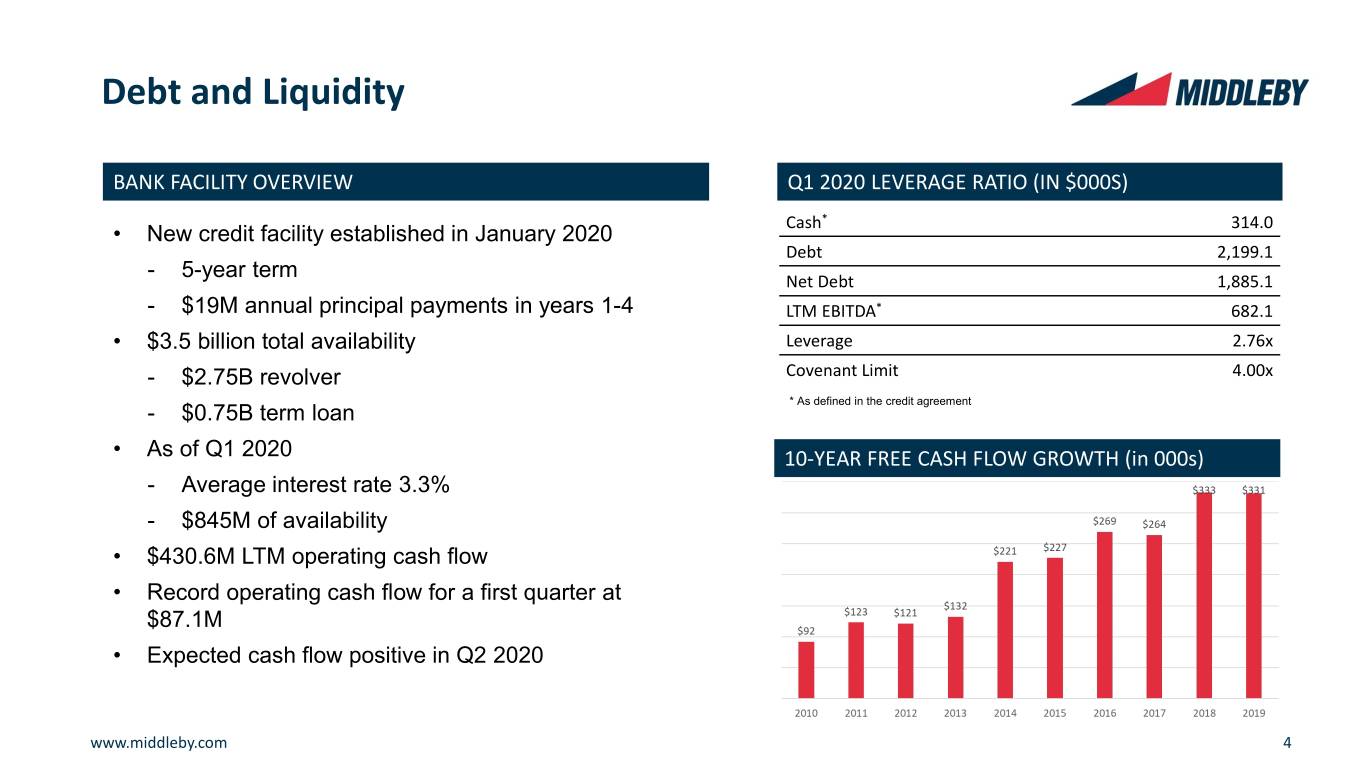

Debt and Liquidity BANK FACILITY OVERVIEW Q1 2020 LEVERAGE RATIO (IN $000S) Cash* 314.0 • New credit facility established in January 2020 Debt 2,199.1 - 5-year term Net Debt 1,885.1 - $19M annual principal payments in years 1-4 LTM EBITDA* 682.1 • $3.5 billion total availability Leverage 2.76x - $2.75B revolver Covenant Limit 4.00x * As defined in the credit agreement - $0.75B term loan • As of Q1 2020 10-YEAR FREE CASH FLOW GROWTH (in 000s) - Average interest rate 3.3% - $845M of availability • $430.6M LTM operating cash flow • Record operating cash flow for a first quarter at $87.1M • Expected cash flow positive in Q2 2020 www.middleby.com 4

Middleby Segment Summary SEGMENT REVENUES Food Processing • Three industry-leading foodservice platforms 13.5% • 100+ highly-respected, leading brands Commercial 67.1% • Global business infrastructure Residential 19.4% • Highly synergistic business segments • Technology and innovation leader SALES BY GEOGRAPHIC REGION Asia • Strong track record of profitability and cash flow 8.7% United States Europe and and Canada Middle East 65.7% 21.9% Latin America 3.7% 5

Near-term Business Conditions Q2 ORDER TRENDS April May April May April May ▼65% ▼55% ▼53% ▼35% ▼28% ▼1% Commercial Food Service Residential Kitchen Food Processing Our foodservice customers are currently focused on At our residential businesses, in both the US and We entered the year with a record backlog of delivery, drive-through and carry-out business and UK markets, the impact of COVID-19 included the approximately $138 million, which grew to the safety of employees and customers. We are able widespread closure of our residential dealers' retail approximately $152 million. In April, customers to support these needs with our existing innovative sales locations and reduction in traffic due to focused on immediate risks to their business products and new technology solutions to address shelter-in-place restrictions. Although demand will and employees thus pulling focus away from workplace safety and continued operating essentials. continue to be adversely impacted and uncertain, new equipment specifications. End-user demand The strategic investments we have made in the past we have seen a positive benefit as dealer retail for our food processing customers has shifted have well-positioned us for current industry trends. locations began to re-open in May. from restaurants to retail grocery stores, We anticipate new restaurant openings will be impacting sales mix. Sales of hot dogs and other impacted, but historically the majority of our sales in meat products in our core equipment markets this segment are equipment replacement and have experienced recent increased demand. We upgrades. are well-positioned to support the demand shift and to support large-scale solutions in this industry. www.middleby.com 6

COVID-19 Restaurant Impacts Restaurant sales are sequentially improving week over week since March MILLERPULSE WEEKLY INDUSTRY SAME STORE SALES, 2020 according to multiple restaurant data resources. 10 5.5 6.2 2.5 3.5 4.2 2.6 3.4 2.9 2.7 3.1 0 Restaurants are rapidly adapting to the -7.9 new the new norm by: -10 • Expanding delivery options, including -19 -17.2 expanding curbside pick-up -20 -23.4 % Decline -25.5 • Adding or improving mobile ordering -27.8 capabilities -30 -33.3 -38.5 • Rapidly adapting menus to support -41.9 -41 -40 limited staffing, dining, and/or carryout options -50 • Restaurants are reopening for dine in • 36 states dine in partially or planned 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 reopening Week Number Source: MillerPulse www.middleby.com 7

Middleby Revenue Composition – Commercial Foodservice SEGMENT IMPACT REVENUE BY DEMAND REQUIREMENT • Quick serve and fast casual fare better as delivery, drive through and carry out support TRAVEL & LEISURE PARTS their business INDEPENDENT 6% 17% • Pizza performs well as delivery is core – large 11% chains to hire 50,000 additional employees • Retail and c-store customers continue to see demand as customers seek alternative CASUAL DINING REVENUE BY DEMAND REQUIREMENT foodservice and avoid dine-in 5% • Institutional Healthcare sectors less impacted MENU DRIVEN PARTS • Casual and fine-dining heavily impacted INSTITUTIONAL QSR 8% 17% • Travel and leisure significantly impacted 7% 20% OPERATOR SPENDING HEALTHCARE 4% • Near-term focus on replacement, capacity and maintenance of equipment C-STORE • Better performing sectors continuing with 7% RETAIL PIZZA FAST CASUAL menu and operational initiatives 8% 7% 8% • Anticipated spending on employee and customer safety modifications • Contract and project activity showing early signs of recovery as expected re-openings NEW BUILD occur 26% REPLACEMENT & UPGRADE 49% www.middleby.com 8

Trends in the Foodservice Industry Click on logo or image to view more information. ACCELERATING TRENDS • Added focus on off-premise (delivery, carryout and drive- through) • Focus on menu simplification, throughput and space utilization • Growth in non-traditional foodservice including retail and c- store • Labor will continue to be a primary challenge • New foodservice models will continue including modular, MIDDLEBY VENTLESS MODULAR AUTOMATED IOT CONNECTED ghost and cloud kitchens SOLUTIONS PICK UP CABINETS KITCHEN • Remote monitoring and automation • Safety protocols for employees and customers • Continued demand trends in healthcare and assisted living MIDDLEBY SOLUTIONS • Middleby ventless kitchens for non-traditional and space savings • Development and launch of Open Kitchen • Middleby modular and ghost kitchens • Data intelligence and automation solutions • Middleby advanced controls • Middleby touchless and automated Pick-Up Cabinets (PUC) MIDDLEBY MODULAR INDUCTION- HEATED MIDDLEBY’S NEW HIGH- • Focus on integrated solutions for targeted segments including AND GHOST KITCHENS DELIVERY SYSTEMS LEVEL USER INTERFACE retail, c-stores, healthcare, and emerging chains Over the past year Middleby has made significant dedicated investments in R&D to focus on technology initiatives, solutions for industry trends and invested in targeted growth segments. As a result we are well positioned with solutions to address these needs that will accelerate as a result of www.middleby.com COVID-19. 9

COVID-19 Products We developed and introduced products addressing needs of the COVID-19 pandemic. N95 MASK UV SAFETY SHIELDS (four off-the-shelf versions and custom STERILIZER options readily available) • UV Sterilizer (more sizes available soon) • Safety Shields • Sanitizer • Mobile Hand Washing Click on logo or image to view more information. HAND SANITIZER (one, two, and five gallon and up to QUALSERV MOBILE truckload quantities available) SANITARY SINK Click to view www.middleby.com 10