Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Argo Group International Holdings, Ltd. | d923879d8k.htm |

Argo Group Investor Presentation May 2020 Exhibit 99.1

This presentation may include forward-looking statements, both with respect to Argo Group and its industry, that reflect our current views with respect to future events and financial performance. These statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that do not relate solely to historical or current facts, and can be identified by the use of words such as "expect," "intend," "plan," "believe," “do not believe,” “aim,” "project," "anticipate," “seek,” "will," “likely,” “assume,” “estimate,” "may," “continue,” “guidance,” “objective,” “outlook,” “trends,” “future,” “could,” “would,” “should,” “target,” “on track” and similar expressions of a future or forward-looking nature. All forward-looking statements address matters that involve risks and uncertainties, many of which are beyond Argo Group's control. Accordingly, there are or will be important factors that could cause actual results to differ materially from those indicated in such statements and, therefore, you should not place undue reliance on any such statements. We believe that these factors include, but are not limited to, the following: 1) unpredictability and severity of catastrophic events; 2) regulatory or rating agency actions; 3) adequacy of our risk management and loss limitation methods; 4) cyclicality of demand and pricing in the insurance and reinsurance markets; 5) statutory or regulatory developments including tax policy, reinsurance and other regulatory matters; 6) our ability to implement our business strategy; 7) adequacy of our loss reserves; 8) continued availability of capital and financing; 9) retention of key personnel; 10) competition; 11) potential loss of business from one or more major insurance or reinsurance brokers; 12) our ability to implement, successfully and on a timely basis, complex infrastructure, distribution capabilities, systems, procedures and internal controls, and to develop accurate actuarial data to support the business and regulatory and reporting requirements; 13) general economic and market conditions (including inflation, volatility in the credit and capital markets, interest rates and foreign currency exchange rates); 14) the integration of businesses we may acquire or new business ventures we may start; 15) the effect on our investment portfolios of changing financial market conditions including inflation, interest rates, liquidity and other factors; 16) acts of terrorism or outbreak of war; 17) availability of reinsurance and retrocessional coverage, as well as management's response to any of the aforementioned factors and; 18) costs associated with shareholder activism and the independent directors’ review of governance and compensation matters. In addition, any estimates relating to loss events involve the exercise of considerable judgment and reflect a combination of ground-up evaluations, information available to date from brokers and cedents, market intelligence, initial tentative loss reports and other sources. The actuarial range of reserves and management’s best estimate is based on our then current state of knowledge including explicit and implicit assumptions relating to the pattern of claim development, the expected ultimate settlement amount, inflation and dependencies between lines of business. Our internal capital model is used to consider the distribution for reserving risk around this best estimate and predict the potential range of outcomes. However, due to the complexity of factors contributing to the losses and the preliminary nature of the information used to prepare these estimates, there can be no assurance that Argo Group’s ultimate losses will remain within the stated amount. The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included herein and elsewhere, including the risk factors included in our most recent reports on Form 10-K and Form 10-Q and other documents of Argo Group on file with or furnished to the U.S. Securities and Exchange Commission (“SEC”). Any forward-looking statements made in this press release are qualified by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by Argo Group will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, Argo Group or its business or operations. Except as required by law, Argo Group undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. Forward-Looking Statements

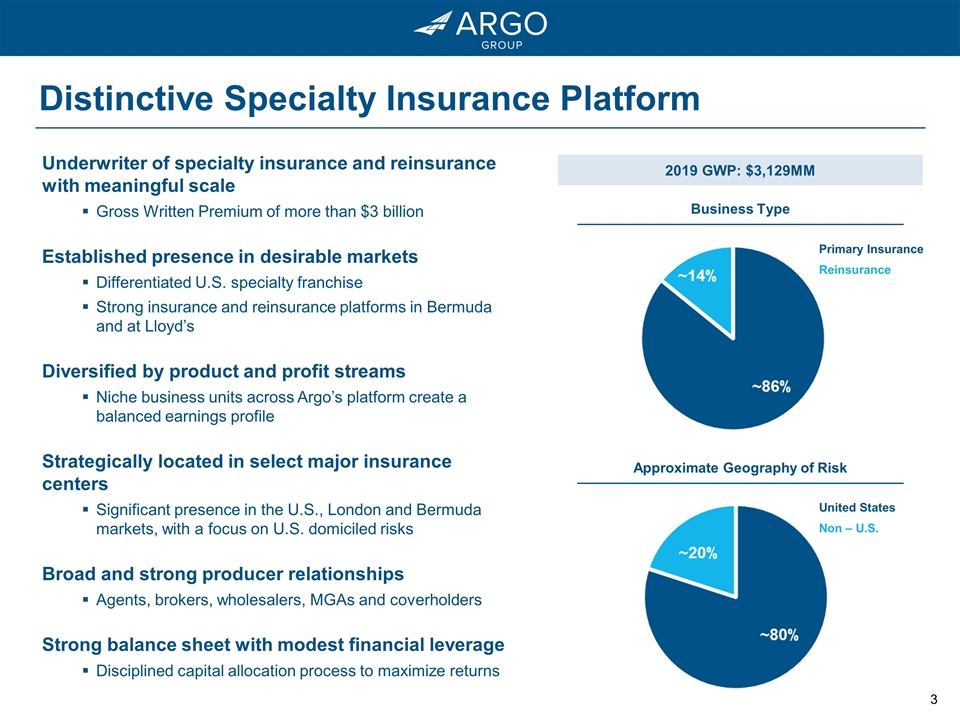

Underwriter of specialty insurance and reinsurance with meaningful scale Gross Written Premium of more than $3 billion Established presence in desirable markets Differentiated U.S. specialty franchise Strong insurance and reinsurance platforms in Bermuda and at Lloyd’s Diversified by product and profit streams Niche business units across Argo’s platform create a balanced earnings profile Strategically located in select major insurance centers Significant presence in the U.S., London and Bermuda markets, with a focus on U.S. domiciled risks Broad and strong producer relationships Agents, brokers, wholesalers, MGAs and coverholders Strong balance sheet with modest financial leverage Disciplined capital allocation process to maximize returns Business Type Primary Insurance Reinsurance United States Non – U.S. Distinctive Specialty Insurance Platform Approximate Geography of Risk 2019 GWP: $3,129MM

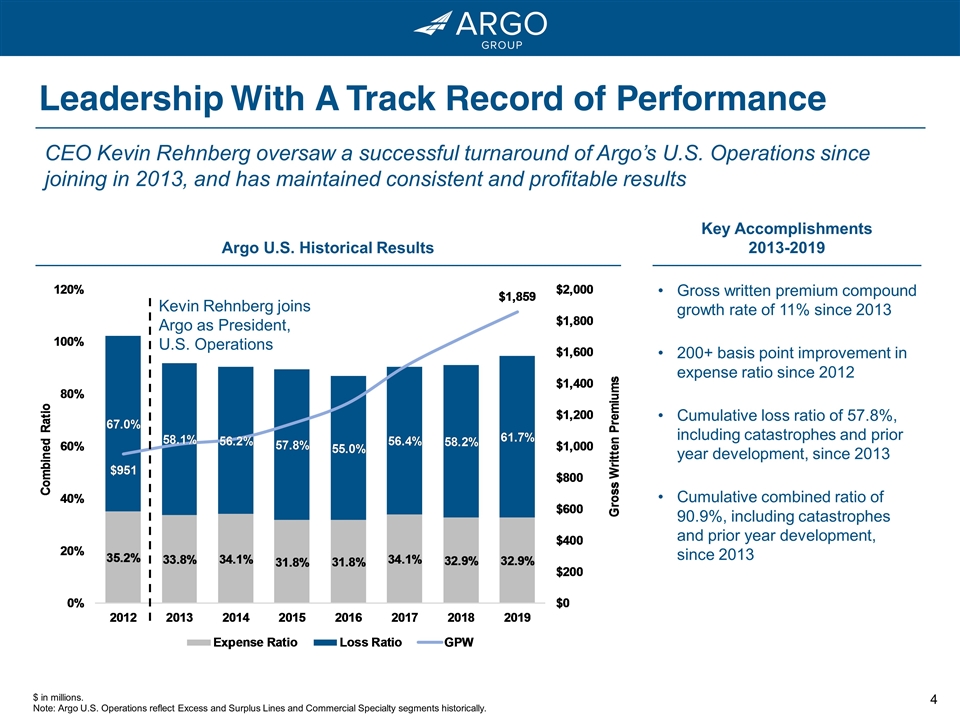

Leadership With A Track Record of Performance CEO Kevin Rehnberg oversaw a successful turnaround of Argo’s U.S. Operations since joining in 2013, and has maintained consistent and profitable results Argo U.S. Historical Results $ in millions. Note: Argo U.S. Operations reflect Excess and Surplus Lines and Commercial Specialty segments historically. Key Accomplishments 2013-2019 Gross written premium compound growth rate of 11% since 2013 200+ basis point improvement in expense ratio since 2012 Cumulative loss ratio of 57.8%, including catastrophes and prior year development, since 2013 Cumulative combined ratio of 90.9%, including catastrophes and prior year development, since 2013 Kevin Rehnberg joins Argo as President, U.S. Operations

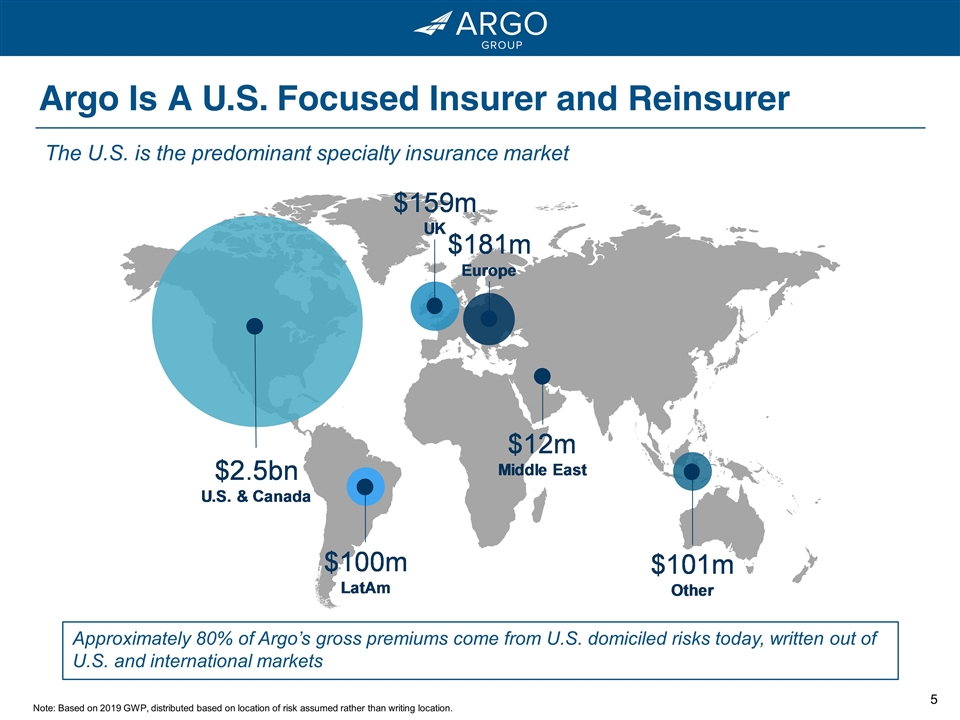

Argo Is A U.S. Focused Insurer and Reinsurer The U.S. is the predominant specialty insurance market Note: Based on 2019 GWP, distributed based on location of risk assumed rather than writing location. Approximately 80% of Argo’s gross premiums come from U.S. domiciled risks today, written out of U.S. and international markets

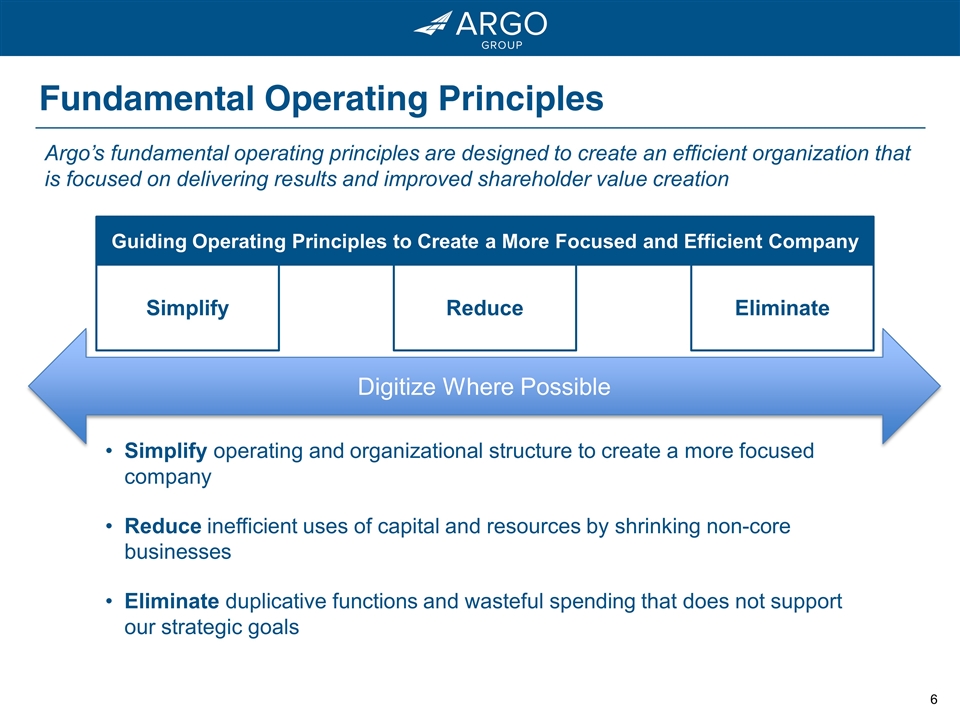

Fundamental Operating Principles Simplify Reduce Eliminate Argo’s fundamental operating principles are designed to create an efficient organization that is focused on delivering results and improved shareholder value creation Guiding Operating Principles to Create a More Focused and Efficient Company Simplify operating and organizational structure to create a more focused company Reduce inefficient uses of capital and resources by shrinking non-core businesses Eliminate duplicative functions and wasteful spending that does not support our strategic goals Digitize Where Possible

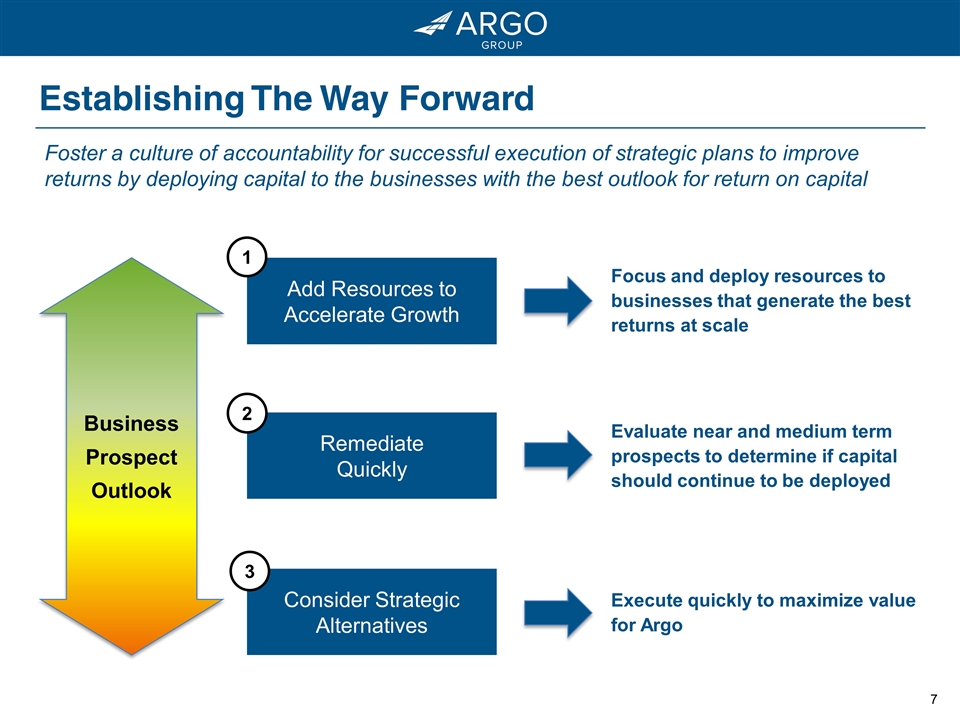

Establishing The Way Forward Focus and deploy resources to businesses that generate the best returns at scale Add Resources to Accelerate Growth Remediate Quickly Consider Strategic Alternatives Foster a culture of accountability for successful execution of strategic plans to improve returns by deploying capital to the businesses with the best outlook for return on capital Execute quickly to maximize value for Argo Evaluate near and medium term prospects to determine if capital should continue to be deployed 1 2 3 Business Prospect Outlook

Recent Actions Taken Exited operations in Asia and most hull business within Syndicate 1200 Eliminated regional underwriting office for Latin America Closed on agreement to sell Trident Public Risk Solutions Exited aircraft lease and put certain corporate real estate up for sale Ended most marketing and sponsorship contracts ü ü ü ü ü Actions taken in recent months to shrink non-core businesses, accelerate growth and reduce our expense base are initial steps aimed at achieving our long-term strategic and financial goals

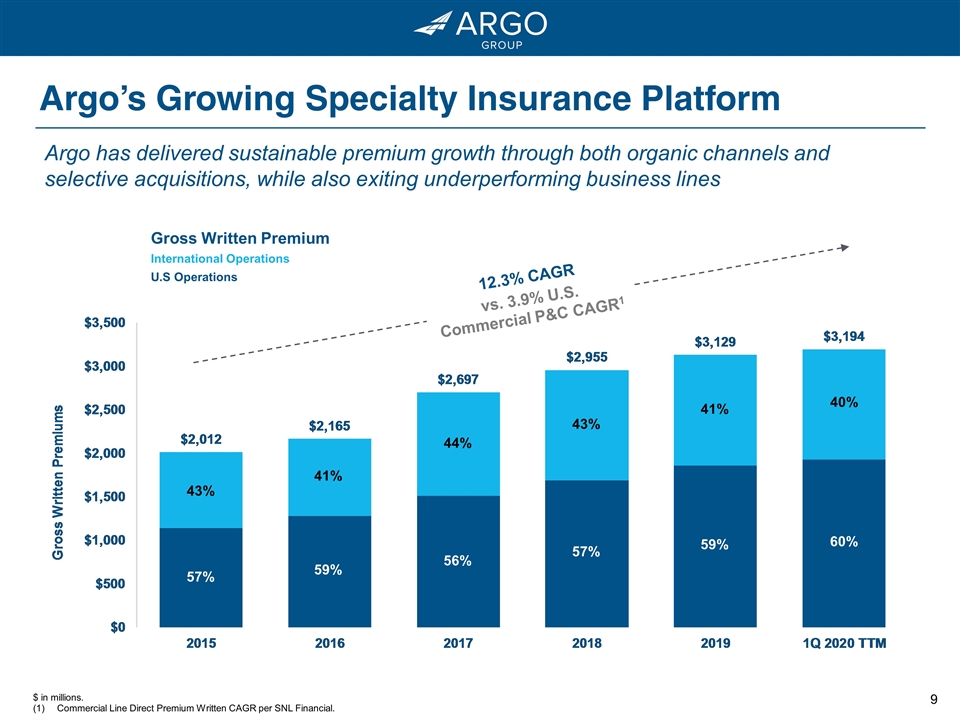

$ in millions. Commercial Line Direct Premium Written CAGR per SNL Financial. 12.3% CAGR vs. 3.9% U.S. Commercial P&C CAGR1 Argo’s Growing Specialty Insurance Platform Argo has delivered sustainable premium growth through both organic channels and selective acquisitions, while also exiting underperforming business lines Gross Written Premium International Operations U.S Operations 60% 59% 57% 56% 59% 57% 43% 41% 44% 43% 41% 40%

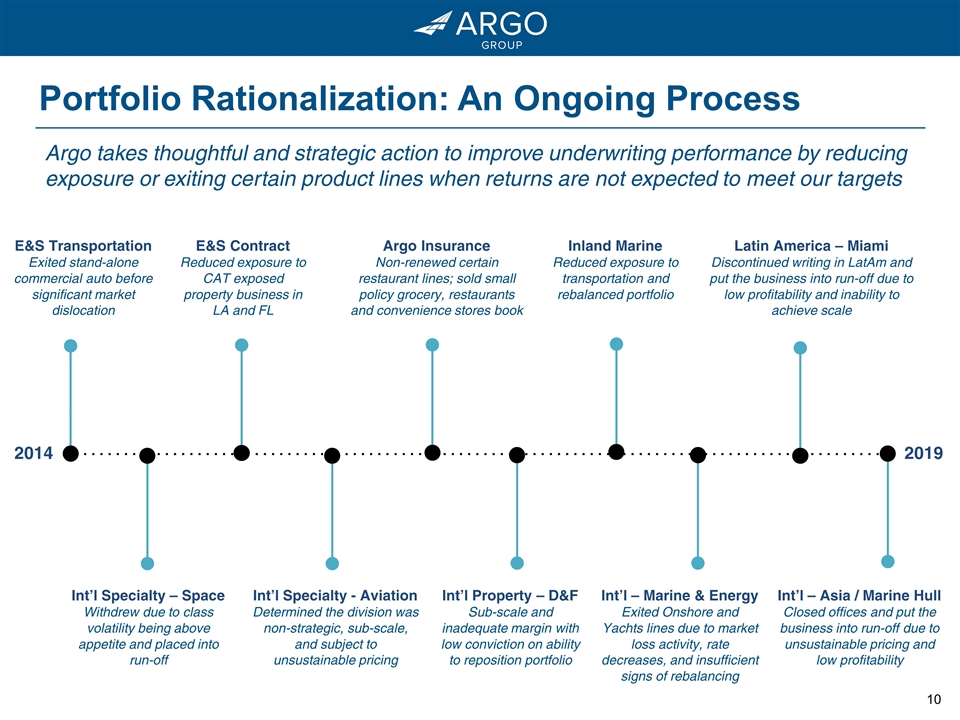

Portfolio Rationalization: An Ongoing Process Argo takes thoughtful and strategic action to improve underwriting performance by reducing exposure or exiting certain product lines when returns are not expected to meet our targets E&S Transportation Exited stand-alone commercial auto before significant market dislocation E&S Contract Reduced exposure to CAT exposed property business in LA and FL Int’l – Marine & Energy Exited Onshore and Yachts lines due to market loss activity, rate decreases, and insufficient signs of rebalancing Int’l Specialty - Aviation Determined the division was non-strategic, sub-scale, and subject to unsustainable pricing Int’l Property – D&F Sub-scale and inadequate margin with low conviction on ability to reposition portfolio Argo Insurance Non-renewed certain restaurant lines; sold small policy grocery, restaurants and convenience stores book Int’l Specialty – Space Withdrew due to class volatility being above appetite and placed into run-off Inland Marine Reduced exposure to transportation and rebalanced portfolio Int’l – Asia / Marine Hull Closed offices and put the business into run-off due to unsustainable pricing and low profitability 2014 2019 Latin America – Miami Discontinued writing in LatAm and put the business into run-off due to low profitability and inability to achieve scale

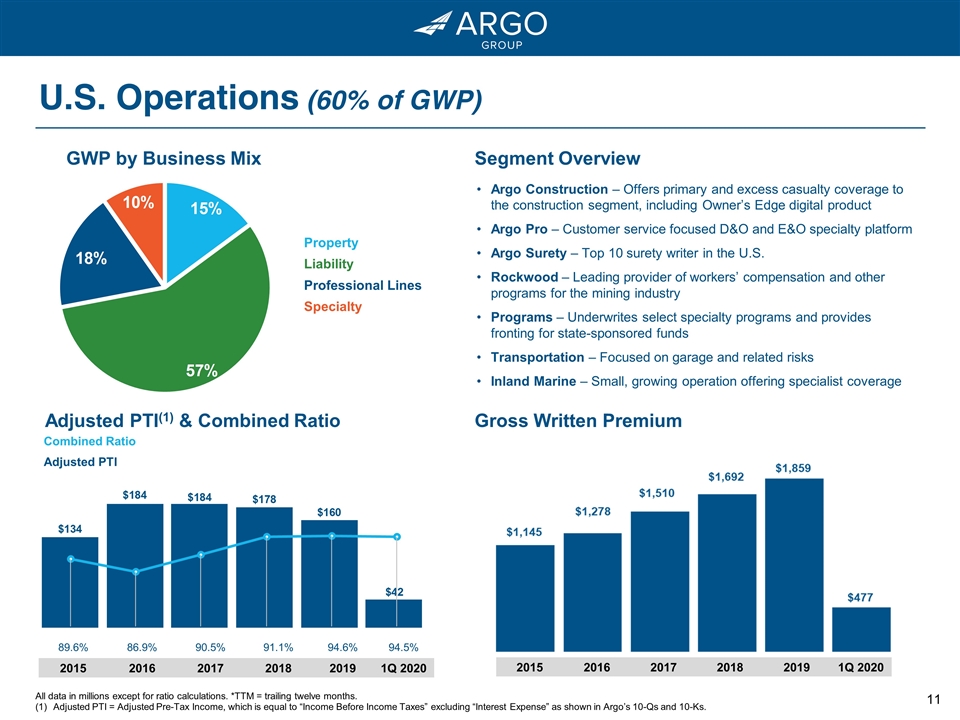

U.S. Operations (60% of GWP) All data in millions except for ratio calculations. *TTM = trailing twelve months. Adjusted PTI = Adjusted Pre-Tax Income, which is equal to “Income Before Income Taxes” excluding “Interest Expense” as shown in Argo’s 10-Qs and 10-Ks. GWP by Business Mix Segment Overview Adjusted PTI(1) & Combined Ratio Gross Written Premium Argo Construction – Offers primary and excess casualty coverage to the construction segment, including Owner’s Edge digital product Argo Pro – Customer service focused D&O and E&O specialty platform Argo Surety – Top 10 surety writer in the U.S. Rockwood – Leading provider of workers’ compensation and other programs for the mining industry Programs – Underwrites select specialty programs and provides fronting for state-sponsored funds Transportation – Focused on garage and related risks Inland Marine – Small, growing operation offering specialist coverage Combined Ratio Adjusted PTI 89.6% 86.9% 90.5% 91.1% 94.6% 94.5% 2015 2016 2017 2018 2019 1Q 2020 Property Liability Professional Lines Specialty 2015 2016 2017 2018 2019 1Q 2020

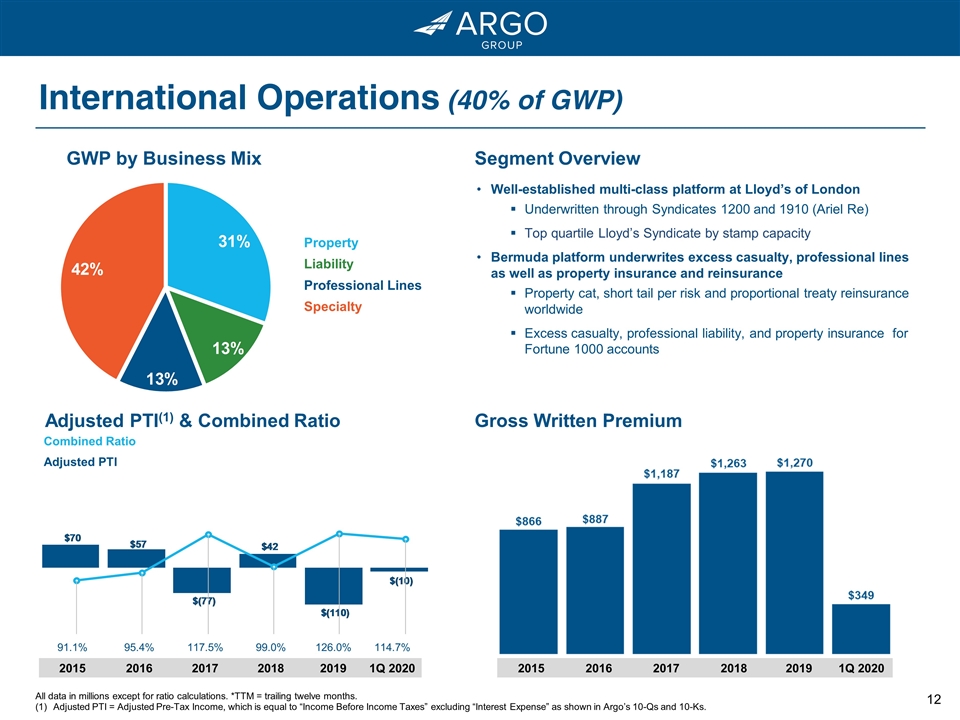

International Operations (40% of GWP) GWP by Business Mix Segment Overview Adjusted PTI(1) & Combined Ratio Gross Written Premium Well-established multi-class platform at Lloyd’s of London Underwritten through Syndicates 1200 and 1910 (Ariel Re) Top quartile Lloyd’s Syndicate by stamp capacity Bermuda platform underwrites excess casualty, professional lines as well as property insurance and reinsurance Property cat, short tail per risk and proportional treaty reinsurance worldwide Excess casualty, professional liability, and property insurance for Fortune 1000 accounts Combined Ratio Adjusted PTI 91.1% 95.4% 117.5% 99.0% 126.0% 114.7% 2015 2016 2017 2018 2019 1Q 2020 2015 2016 2017 2018 2019 1Q 2020 Property Liability Professional Lines Specialty All data in millions except for ratio calculations. *TTM = trailing twelve months. Adjusted PTI = Adjusted Pre-Tax Income, which is equal to “Income Before Income Taxes” excluding “Interest Expense” as shown in Argo’s 10-Qs and 10-Ks.

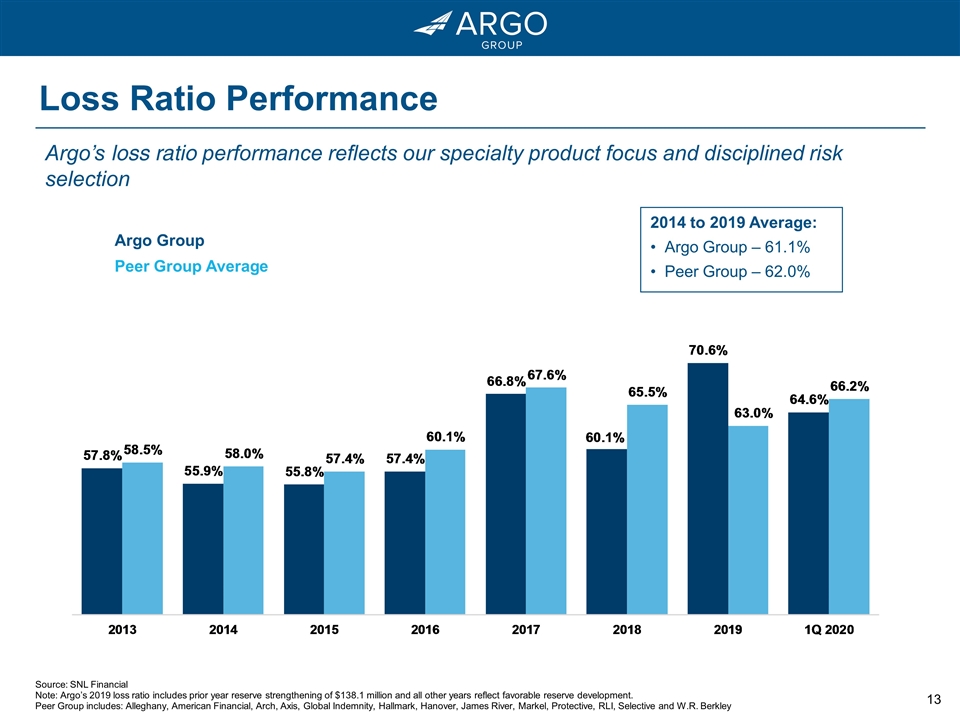

Argo’s loss ratio performance reflects our specialty product focus and disciplined risk selection Argo Group Peer Group Average Source: SNL Financial Note: Argo’s 2019 loss ratio includes prior year reserve strengthening of $138.1 million and all other years reflect favorable reserve development. Peer Group includes: Alleghany, American Financial, Arch, Axis, Global Indemnity, Hallmark, Hanover, James River, Markel, Protective, RLI, Selective and W.R. Berkley Loss Ratio Performance 2014 to 2019 Average: Argo Group – 61.1% Peer Group – 62.0%

$ in millions Duration includes cash & equivalents. Book yield is pre-tax & includes all fixed maturities. Portfolio Characteristics Investment Portfolio Asset Allocation (1Q 2020) Total: $5.0BN Duration of 2.2 years1 – focused on asset-liability management Average rating of ‘Aa3/AA-’ Fixed income book yield of 2.5%2 Liability-driven investment portfolio Short Term & Cash Core Debt High Yield Debt Alternatives Equities Balanced Investment Strategy Net Investment Income Fixed Maturity by Type (1Q 2020) Total: $4.4BN Structured Government Short Term & Cash State / Municipal Corporate

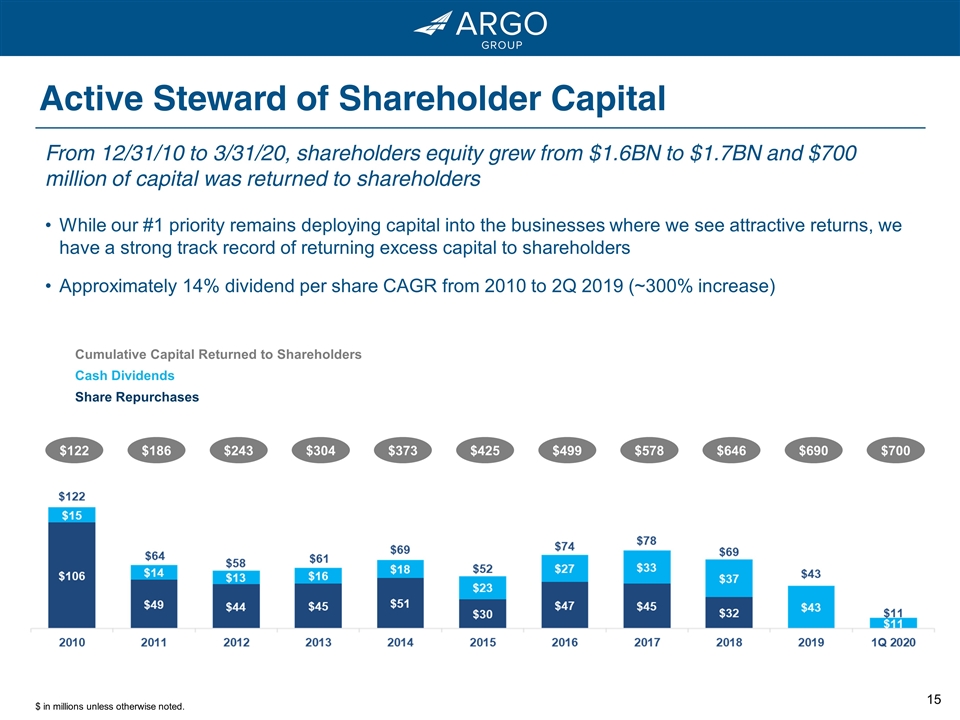

Active Steward of Shareholder Capital $ in millions unless otherwise noted. From 12/31/10 to 3/31/20, shareholders equity grew from $1.6BN to $1.7BN and $700 million of capital was returned to shareholders While our #1 priority remains deploying capital into the businesses where we see attractive returns, we have a strong track record of returning excess capital to shareholders Approximately 14% dividend per share CAGR from 2010 to 2Q 2019 (~300% increase) Cumulative Capital Returned to Shareholders Cash Dividends Share Repurchases $122 $646 $186 $243 $304 $373 $425 $499 $578 $690 $700

Argo is a founding member of ClimateWise, which supports the insurance industry so that it can better communicate, disclose and respond to climate risk management issues Argo has provided its first Greenhouse Gas (GHG) Scope 1 and 2 disclosures, supported by footprint of LEED and EPA Energy Star-certified office locations with electrical conservation programs, recycling efforts and employee bike storage We are an insurer of companies within the clean energy value chain Argo Group’s research and development (R&D) team creates state-of-the-art models to innovate new solutions to risk management challenges Implemented a diversity and inclusion program to ensure staff have the tools and support necessary to address systemic barriers, build a diverse workforce and maintain a positive work environment Recently introduced policies for paid caregiver leave and increased flexible workplace Have responded flexibly to COVID-19 event by adapting flexible working with an emphasis on staff wellbeing Argo is a signatory with the United Nations Principles for Responsible Investments the leading international network of institutional investors committed to including environmental, social and governance factors in their investment decision making Recently underwent a Board refreshment process, adding 9 new directors since 2017 with diverse skills, backgrounds and perspectives Declassified our Board, with Directors standing for annual elections Lengthened the performance period for the company’s long-term incentive program from one to three years, reduced emphasis on individual performance and increased stock ownership guidelines Concluded an extensive review of governance controls, resulting in changes to Argo’s perquisite policy Engaged with largest shareholders in efforts to improve corporate governance and executive compensation practices Argo’s corporate responsibility to stakeholders requires that we hold ourselves to the highest standards by being stewards of the environment, advancing our societal impact and providing transparent corporate governance – see our first Annual ESG Report Environmental Social Governance Argo’s Ongoing Commitment to ESG

Well Positioned to Create Value in 2020 and Beyond Specialty P&C insurer and reinsurer focused on niche products Positioned for growth in attractive markets, primarily U.S. domiciled risks Benefitting from improving market conditions Creating a more focused organization by reducing underperforming businesses Investing in technology to improve operating efficiency and risk selection, while reducing overall expenses Balanced investment portfolio to support our underwriting operations Leveraging third-party capital and reinsurance to manage underwriting volatility ü ü ü ü ü ü ü