Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Warner Music Group Corp. | d833365dex231.htm |

| EX-10.40 - EX-10.40 - Warner Music Group Corp. | d833365dex1040.htm |

| EX-10.2 - EX-10.2 - Warner Music Group Corp. | d833365dex102.htm |

| EX-10.1 - EX-10.1 - Warner Music Group Corp. | d833365dex101.htm |

| EX-5.1 - EX-5.1 - Warner Music Group Corp. | d833365dex51.htm |

| EX-4.1 - EX-4.1 - Warner Music Group Corp. | d833365dex41.htm |

| EX-3.5 - EX-3.5 - Warner Music Group Corp. | d833365dex35.htm |

| EX-3.4 - EX-3.4 - Warner Music Group Corp. | d833365dex34.htm |

| EX-1.1 - EX-1.1 - Warner Music Group Corp. | d833365dex11.htm |

Table of Contents

As filed with the Securities and Exchange Commission on May 26, 2020

Registration No. 333-236298

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 2 TO

FORM S-1

REGISTRATION STATEMENT

UNDER THE

SECURITIES ACT OF 1933

Warner Music Group Corp.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 7900 | 13-4271875 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

1633 Broadway

New York, New York 10019

(212) 275-2000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Paul M. Robinson, Esq.

Executive Vice President and General Counsel and Secretary

Trent N. Tappe, Esq.

Senior Vice President, Deputy General Counsel and Chief Compliance Officer

1633 Broadway

New York, New York 10019

(212) 275-2000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Matthew E. Kaplan, Esq. Eric T. Juergens, Esq. Debevoise & Plimpton LLP 919 Third Avenue New York, New York 10022 (212) 909-6000 |

Michael Kaplan, Esq. Derek Dostal, Esq. Davis

Polk & Wardwell LLP |

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer ☐ | ||

| Non-accelerated filer | ☒ | Smaller reporting company ☐ | ||

| Emerging growth company ☐ | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be |

Proposed Offering Price Per Share |

Proposed Offering Price(1)(2) |

Amount of Registration Fee(3) | ||||

| Class A common stock, par value $0.001 per share |

80,500,000 | $26.00 | $2,093,000,000 | $271,671.40 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes shares/offering price of shares that may be sold upon exercise of the underwriters’ option to purchase additional shares. |

| (2) | This amount represents the proposed maximum aggregate offering price of the securities registered hereunder. These figures are estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(a) under the Securities Act of 1933, as amended. |

| (3) | The registrant previously paid $12,980 of this amount. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the U.S. Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the U.S. Securities and Exchange Commission declares our registration statement effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 26, 2020

70,000,000 Shares

Warner Music Group Corp.

Class A Common Stock

This is the initial public offering of shares of Class A common stock of Warner Music Group Corp.

The selling stockholders identified in this prospectus are offering 70,000,000 shares of Class A common stock in this offering. We will not receive any of the proceeds from the sale of the shares being sold by the selling stockholders in this offering, including any shares they may sell pursuant to the underwriters’ option to purchase additional Class A common stock.

Upon completion of this offering, we will have two classes of common stock, Class A common stock and Class B common stock. Each share of Class A common stock is entitled to one vote per share. Each share of Class B common stock is entitled to 20 votes per share. Holders of our Class A common stock and Class B common stock vote together as a single class on all matters, except as otherwise set forth in this prospectus or as required by applicable law. Each outstanding share of Class B common stock will convert automatically into one share of Class A common stock upon any transfer, except for certain exceptions and permitted transfers described in our amended and restated certificate of incorporation. The Class B common stock, which is held by Access Industries, LLC and certain of its affiliates, will represent approximately 99.2% of the total combined voting power of our outstanding common stock following this offering (or approximately 99.1% of the total combined voting power of our outstanding common stock if the underwriters exercise in full their option to purchase additional shares of our Class A common stock).

Prior to this offering, there has been no public market for our Class A common stock. We have been approved to list our Class A common stock on The Nasdaq Stock Market LLC (“Nasdaq”), under the symbol “WMG”.

We anticipate that the initial public offering price will be between $23.00 and $26.00 per share.

After the completion of this offering, we will be a “controlled company” within the meaning of the corporate governance standards of Nasdaq.

Investing in our Class A common stock involves risks. See “Risk Factors” beginning on page 23 of this prospectus to read about factors you should consider before buying shares of our Class A common stock.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions (1) |

$ | $ | ||||||

| Proceeds, before expenses, to the selling stockholders |

$ | $ | ||||||

| (1) | We have agreed to reimburse the underwriters for certain expenses in connection with this offering. See “Underwriting.” |

The underwriters also may purchase up to 10,500,000 additional shares from the selling stockholders at the initial offering price less the underwriting discounts and commissions, within 30 days from the date of this prospectus.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved the securities described herein or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares to purchasers on or about , 2020.

| Morgan Stanley | Credit Suisse | Goldman Sachs & Co. LLC | BofA Securities | Citigroup | J.P. Morgan |

| Barclays | Evercore ISI | Guggenheim Securities | Macquarie Capital | Nomura | RBC Capital Markets | |||||

| SunTrust Robinson Humphrey | CIBC Capital Markets | HSBC | SOCIETE GENERALE | LionTree | The Raine Group | |||||

| AmeriVet Securities | Bancroft Capital | Blaylock Van, LLC | C.L. King & Associates |

Loop Capital Markets | ||||

| Roberts & Ryan | Ramirez & Co., Inc. | Siebert Williams Shank | Telsey Advisory Group |

Tigress Financial Partners | ||||

Prospectus dated , 2020

Table of Contents

Warner Records wea Sire RHINO REPRISE RECORDS ROADRUNNER Parlophone nonesuch fueled by ramen Elektra music group big Beat atlantic asylum ada

Table of Contents

| i | ||||

| 1 | ||||

| 23 | ||||

| Special Note Regarding Forward-Looking Statements and Information |

47 | |||

| 50 | ||||

| 51 | ||||

| 52 | ||||

| 54 | ||||

| 56 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

57 | |||

| 109 | ||||

| 127 | ||||

| 137 | ||||

| 158 | ||||

| 161 | ||||

| 167 | ||||

| 176 | ||||

| Material U.S. Federal Tax Considerations For Non-U.S. Holders |

178 | |||

| 182 | ||||

| 191 | ||||

| 191 | ||||

| 191 | ||||

| F-1 |

We have not, and the selling stockholders and the underwriters have not, authorized anyone to provide you with information different from, or in addition to, that contained in this prospectus and any related free writing prospectus. We, the selling stockholders and the underwriters take no responsibility for, and can provide no assurances as to the reliability of, any information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is only accurate as of the date of this prospectus, regardless of the time of delivery of this prospectus and any sale of shares of our common stock.

We use the following capitalized terms in this prospectus:

| • | “A&R” means Artists and Repertoire, which is the department at a recorded music company or a music publishing company that is responsible for talent scouting and overseeing the artistic development of recording artists and songwriters. |

| • | “Access” means Access Industries, LLC, a Delaware limited liability company, and its affiliates, certain of which are our controlling stockholders. |

| • | “Acquisition Corp.” means WMG Acquisition Corp., a Delaware corporation, and a direct wholly owned subsidiary of Holdings. |

| • | “common stock” means our Class A common stock and our Class B common stock, collectively. |

| • | “constant currency” refers to information that compares financial metrics between periods as if exchange rates had remained constant period over period. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Operating Measures—Constant Currency.” |

i

Table of Contents

| • | “Holdings” means WMG Holdings Corp., a Delaware corporation, and a direct wholly owned subsidiary of WMG. |

| • | “Merger” means the merger, dated July 20, 2011, of Airplanes Merger Sub, Inc. with and into WMG with WMG surviving as an indirect wholly owned subsidiary of Access, pursuant to the Agreement and Plan of Merger dated as of May 6, 2011, by and among WMG, AI Entertainment Holdings LLC (formerly Airplanes Music LLC), an affiliate of Access, and Airplanes Merger Sub, Inc. |

| • | “Revolving Credit Agreement” means the revolving credit agreement, dated as of January 31, 2018, as amended or supplemented, among Acquisition Corp., Credit Suisse AG, as administrative agent, and the other financial institutions and lenders from time to time party thereto. |

| • | “Secured Notes” means, collectively, the 5.000% Senior Secured Notes due 2023 (the “5.000% Secured Notes”), the 4.125% Senior Secured Notes due 2024 (the “4.125% Secured Notes”), the 4.875% Senior Secured Notes due 2024 (the “4.875% Secured Notes”) and the 3.625% Senior Secured Notes due 2026 (the “3.625% Secured Notes”). |

| • | “Secured Notes Indenture” means the Indenture, dated as of November 1, 2012 (the “Senior Secured Base Indenture”), among Acquisition Corp., the guarantors party thereto, Credit Suisse AG, as Notes Authorized Agent and Collateral Agent, and Wells Fargo Bank, National Association, as trustee (the “Trustee”), as supplemented by the Fifth Supplemental Indenture, dated as of July 27, 2016 (the “5.000% Supplemental Indenture”), as supplemented by the Sixth Supplemental Indenture, dated as of October 18, 2016 (the “4.875% Supplemental Indenture”), as supplemented by the Seventh Supplemental Indenture, dated as of October 18, 2016 (the “4.125% Supplemental Indenture”), as supplemented by the Eighth Supplemental Indenture, dated as of October 9, 2018 (the “3.625% Supplemental Indenture”), and as supplemented by the Ninth Supplemental Indenture, dated as of April 30, 2019 (the “Additional 3.625% Supplemental Indenture”), in each case, among Acquisition Corp., the guarantors party thereto and the Trustee. |

| • | “selling stockholders” means (i) Altep 2012 L.P., WMG Management Holdings, LLC, AI Entertainment Holdings LLC and AI Entertainment Management, LLC (together, the “Firm Selling Stockholders”) and (ii)(a) one or more series of Blavatnik Family Foundation LLC (“BFFLLC”), to the extent that one or more such series receives a contribution of shares of Class B common stock in connection with this offering from Access Industries, LLC and is authorized by its member(s) to sell shares of Class A common stock in this offering, (b) CT/FT Holdings LLC, Blavatnik July 2019-13 Investment Trust and Alex Blavatnik, to the extent that such stockholders decide to sell shares of Class A common stock in this offering (such shares, together with the shares of Class A common stock in clause (ii)(a), “Contingent Sale Shares”) and (c)(1) either or both of Access Industries, LLC and AI Entertainment Holdings LLC, to the extent any series of BFFLLC does not receive a contribution of shares of Class B common stock from Access Industries, LLC or any series of BFFLLC does not sell all of its Contingent Sale Shares and (2) AI Entertainment Holdings LLC, to the extent that any stockholder named in clause (ii)(b) does not sell all of its Contingent Sale Shares. |

| • | “Senior Credit Facilities” means the Senior Term Loan Facility (as defined in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Financial Condition and Liquidity—Liquidity—Senior Term Loan Facility”) together with the Revolving Credit Facility (as defined in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Financial Condition and Liquidity—Liquidity—Revolving Credit Facility”). |

| • | “Senior Notes Indenture” means the Indenture, dated as of April 9, 2014 (the “Senior Notes Base Indenture”), among Acquisition Corp., the guarantors party thereto and the Trustee, as supplemented by the Fifth Supplemental Indenture thereto, dated as of March 14, 2018 (the “Senior Notes Supplemental Indenture”), among Acquisition Corp., the guarantors party thereto and the Trustee. |

| • | “Senior Term Loan Credit Agreement” means the credit agreement, dated November 1, 2012, as amended or supplemented, among Acquisition Corp., Credit Suisse AG, as administrative agent and collateral agent, and the other financial institutions and lenders from time to time party thereto. |

ii

Table of Contents

| • | “Warner Music Group” or “WMG” means Warner Music Group Corp., a Delaware corporation, without its consolidated subsidiaries. |

| • | “we,” “us,” “our” and the “Company” mean Warner Music Group Corp. and its consolidated subsidiaries, unless the context refers only to Warner Music Group Corp. as a corporate entity. |

MARKET AND INDUSTRY DATA

This prospectus includes estimates regarding market and industry data and forecasts, including industry size, share of industry sales, industry position, growth rates and penetration rates, which are based on publicly available information, industry publications and surveys, reports from government agencies, reports by market research firms and our own estimates based on our management’s knowledge of, and experience in, the music entertainment industry and market segments in which we compete. Third-party industry publications and forecasts generally state that the information contained therein has been obtained from sources generally believed to be reliable. The third-party industry sources referenced in this prospectus include, among others, the International Federation of the Phonographic Industry (“IFPI”), Nielsen, Music & Copyright, MIDiA and Billboard. Our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the captions “Risk Factors,” “Special Note Regarding Forward-Looking Statements and Information” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

SERVICE MARKS, TRADEMARKS AND TRADE NAMES

We own various service marks, trademarks and trade names, such as Asylum, Atlantic, Elektra, EMP, Parlophone, Reprise, Rhino, Sire, SPINNIN’ RECORDS, Warner Chappell and WEA, and license various service marks, trademarks and trade names, such as WARNER, WARNER MUSIC, WARNER RECORDS and the “W” logo, that we deem particularly important to our business. This prospectus also contains trademarks, service marks and trade names of other companies which are the property of their respective owners. We do not intend our use or display of such names or marks to imply relationships with, or endorsements of us by, any other company.

PRESENTATION OF FINANCIAL INFORMATION

We have made rounding adjustments to some of the figures included in this prospectus. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that precede them. Unless otherwise indicated, all references to “U.S. dollars,” “dollars,” “U.S. $” and “$” in this prospectus are to the lawful currency of the United States of America.

In this prospectus, we present certain financial measures that are not calculated in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”), such measures referred to herein as “non-U.S. GAAP”. You should review the reconciliation and accompanying disclosures carefully in connection with your consideration of such non-U.S. GAAP measures and note that the way in which we calculate these measures may not be comparable to similarly titled measures employed by other companies.

iii

Table of Contents

The following summary highlights selected information contained in this prospectus. Because this is only a summary, it does not contain all of the information you should consider before investing in our Class A common stock. You should carefully read the entire prospectus, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as our annual and interim financial statements included elsewhere in this prospectus, before making an investment decision. For the definitions of certain capitalized terms used in this prospectus, please refer to “Certain Important Terms.”

Our Company

We are one of the world’s leading music entertainment companies. Our renowned family of iconic record labels, including Atlantic Records, Warner Records, Elektra Records and Parlophone Records, is home to many of the world’s most popular and influential recording artists. In addition, Warner Chappell Music, our global music publishing business, boasts an extraordinary catalog that includes timeless standards and contemporary hits, representing works by over 80,000 songwriters and composers, with a global collection of more than 1.4 million musical compositions. Our entrepreneurial spirit and passion for music has driven our recording artist and songwriter focused innovation for decades.

Our Recorded Music business, home to superstar recording artists such as Ed Sheeran, Bruno Mars and Cardi B, generated $3.840 billion of revenue in fiscal 2019, representing 86% of total revenues. Our Music Publishing business, which includes esteemed songwriters such as Twenty One Pilots, Lizzo and Katy Perry, generated $643 million of revenue in fiscal 2019, representing 14% of total revenues. We benefit from the scale of our global platform and our local focus.

Today, global music entertainment companies such as ours are more important and relevant than ever. The traditional barriers to widespread distribution of music have been erased. The tools to make and distribute music are at every musician’s fingertips, and today’s technology makes it possible for music to travel around the world in an instant. This has resulted in music being ubiquitous and accessible at all times. Against this industry backdrop, the volume of music being released on digital platforms is making it harder for recording artists and songwriters to get noticed. We cut through the noise by identifying, signing, developing and marketing extraordinary talent. Our global A&R experience and marketing strategies are critical ingredients for recording artists or songwriters who want to build long-term global careers. We believe that the music, not the technology, delights fans and drives the business forward.

Our commercial innovation is crucial to maintaining our momentum. We have championed new business models and empowered established players, while protecting and enhancing the value of music. We were the first major music entertainment company to strike landmark deals with important companies such as Apple, YouTube and Tencent Music Entertainment Group, as well as with pure-play music technology companies such as MixCloud, SoundCloud and Audiomack. We adapted to streaming faster than other major music entertainment companies and, in 2016, were the first such company to report that streaming was the largest source of our recorded music revenue. Looking into the future, we believe the universe of opportunities will continue to expand, including through the proliferation of new devices such as smart speakers and the monetization of music on social media and other platforms. We believe advancements in technology will continue to drive consumer engagement and shape a growing and vibrant music entertainment ecosystem.

We have achieved growth and profitability at scale. For the fiscal years ended September 30, 2019, September 30, 2018 and September 30, 2017, we generated $4.5 billion, $4.0 billion and $3.6 billion in revenue, respectively, representing year-over-year growth of 12% and 12%, respectively. For the fiscal years ended

1

Table of Contents

September 30, 2019, September 30, 2018 and September 30, 2017, we reported net income of $258 million, $312 million and $149 million, respectively. For the fiscal years ended September 30, 2019, September 30, 2018 and September 30, 2017, our Adjusted EBITDA was $737 million, $1,033 million (which includes a pre-tax net gain of $389 million related to the sale of Spotify shares acquired in the ordinary course of business) and $604 million, respectively. Adjusted EBITDA is a non-U.S. GAAP measure. For a discussion of Adjusted EBITDA and a reconciliation to the most closely comparable U.S. GAAP measure, see “Summary Historical Consolidated Financial Data.”

Our History

The Company today consists of individual companies that are among the most respected and iconic in the music industry, with a history that dates back to the establishment of Chappell & Co. in 1811 and Parlophone in 1896.

The Company began to take shape in 1967 when Warner-Seven Arts, the parent company of Warner Records (formerly known as Warner Bros. Records) acquired Atlantic Records, which discovered artists such as Led Zeppelin and Aretha Franklin. In 1969, Kinney National Company acquired Warner-Seven Arts, and in 1970, Kinney Services (which was later spun off into Warner Communications) acquired Elektra Records, which was renowned for artists such as The Doors and Judy Collins. In order to harness their collective strength and capabilities, in 1971, Warner Bros., Elektra and Atlantic Records formed a groundbreaking U.S. distribution network commonly known as WEA Corp., or simply WEA, which now stretches across the world.

Throughout this time, the Company’s music publishing division, Warner Bros. Music, built a strong presence. In 1987, the purchase of Chappell & Co. created Warner Chappell Music, one of the industry’s major music publishing forces with a storied history that today connects Ludwig van Beethoven, George Gershwin, Madonna and Lizzo.

The parent company that had grown to become Time Warner completed the sale of the Company to a consortium of private equity investors in 2004, in the process creating the world’s largest independent music company. The Company was taken public the following year, and in 2011, Access acquired the Company.

Since acquiring the Company, Access has focused on revenue growth and increasing operating margins and cash flow combined with financial discipline. Looking past more than a decade of music entertainment industry transitions, Access and the Company foresaw the opportunities that streaming presented for music. Over the last eight years, Access has consistently backed the Company’s bold expansion strategies through organic A&R as well as acquisitions. These strategies include investing more heavily in recording artists and songwriters, growing the Company’s global reach, augmenting its streaming expertise, overhauling its systems and technological infrastructure, and diversifying into other music-based revenue streams.

The purchase of Parlophone Label Group (“PLG”) in 2013 strengthened the Company’s presence in core European territories, with recording artists as diverse as Coldplay, David Bowie, David Guetta and Tinie Tempah. That acquisition was followed by other investments that further strengthened the Company’s footprint in established and emerging markets. Other milestones include the Company’s acquisitions of direct-to-audience businesses such as entertainment specialty e-tailer EMP (as defined in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Factors Affecting Results of Operations and Comparability—Acquisition of EMP”), live music application Songkick and youth culture platform UPROXX.

Our Industry and Market Opportunity

The music entertainment industry is large, global and vibrant. The recorded music and music publishing industries are growing, driven by consumer and demographic trends in the digital consumption of music.

2

Table of Contents

Consumer Trends and Demographics

Consumers today engage with music in more ways than ever. According to IFPI, global consumers spent 18 hours listening to music each week in 2019. Demographic trends and smartphone penetration have been key factors in driving growth in consumer engagement. Younger consumers typically are early adopters of new technologies, including music-enabled devices. According to Nielsen, in 2019, 58% of teens in the United States between the ages of 13 and 17 and 45% of millennials in the United States between the ages of 18 and 34 used their smartphones to listen to music on a weekly basis, as compared to a 40% average for all U.S. consumers. Furthermore, in 2019, U.S. teens and millennials listened to an average of 32.6 and 29.7 hours of music each week, respectively, above the 26.9 hours for all U.S. consumers.

Members of older demographic groups are also increasing their music engagement. According to an IFPI survey of 19 leading geographic markets in 2019, 54% of 35- to 64-year-olds used a streaming service to listen to music in the past month, representing an increase from 46% in 2018, which was the highest rate of growth for use of streaming services across all age groups.

Music permeates our culture across age groups, as evidenced by the footprint that music has across social media. According to the Recording Industry Association of America (“RIAA”), as of September 2019, 7 out of the top 10 most followed accounts on Twitter belong to musicians, and according to YouTube, the majority of videos that have achieved more than one billion lifetime views as well as the top 10 most watched videos of all time, belong to musicians.

Recorded Music

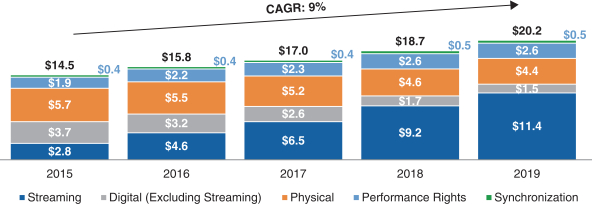

The recorded music industry generated $20.2 billion in global revenue in 2019 and has consistently grown since 2015, according to IFPI. IFPI measures the recorded music industry based on four revenue categories: digital (including streaming), physical, synchronization and performance rights. Digital is the largest, generating $12.9 billion of revenue in 2019, representing 64% of global recorded music revenue. Within digital, streaming generated approximately 88% of revenue, or $11.4 billion, with the remainder of digital revenue coming from other formats such as downloads. Overall, digital grew by 18% in 2019, with streaming increasing by 24%.

Physical represented approximately 22% of global recorded music revenue in 2019, with growth in formats such as vinyl partially offsetting declines in CD sales. Performance rights revenue represents the use of recorded music by broadcasters and public venues, and represented approximately 13% of global recorded music revenue in 2019. Synchronization revenue is generated from the use of recorded music in advertising, film, video games and television content, and represented 2% of global recorded music revenue in 2019. According to IFPI, global recorded music revenue has grown at a 9% CAGR since 2015.

We believe the following secular trends will continue to drive growth in the recorded music industry:

Streaming Still in Early Stages of Global Adoption and Penetration

According to IFPI, global paid music streaming subscribers totaled 341 million at the end of 2019. While this represents an increase of 34% from 255 million in 2018, it still represents less than 11% of the 3.2 billion smartphone users globally, according to Statista. It also represents a small fraction of the user bases for large, globally scaled digital services such as Facebook, which reported 2.6 billion monthly users across its services as of April 2020, and YouTube, which reported over two billion unique monthly users as of May 2020. On-demand streaming (both audio and video) reached 1.15 trillion streams in the United States in 2019, according to Nielsen, and this growth is expected to continue. According to Statista, as of March 16, 2020, 12% of adults (calculated across four demographic cohorts—Generation Z, Millennials, Generation X and Baby Boomers) reported that they are likely to spend more on music streaming due to the COVID-19 pandemic.

3

Table of Contents

The potential of global paid streaming subscriber growth is demonstrated by the penetration rates in early adopter markets. Approximately 30% of the population in Sweden, where Spotify was founded, was estimated to be paid music subscribers in 2018, according to MIDiA. This compares to approximately 25% and 16% for established markets such as the United States and Germany, respectively. Moreover, paid digital music subscribers in Japan, the world’s second-largest recorded music market in 2018 according to IFPI, still only represented approximately 7% of the population, according to MIDiA. There also remains substantial opportunity in emerging markets, such as Brazil and India, where smartphone penetration is low compared to developed markets. For example, according to Statista, smartphone penetration for Brazil and India as of September 2019 was 46% and 25%, respectively, compared to 79% in the United States.

China, in particular, represents a substantial growth market for the recorded music industry. According to IFPI, paid streaming models are at an early stage in China, with an estimated 33 million paid subscribers in 2018, representing only 2% of China’s population of over 1.4 billion. Despite its substantial population, China was the world’s seventh-largest music market in 2019, having only broken into the top 10 in 2017.

Opportunities for Improved Streaming Pricing

In addition to paid subscriber growth, we believe that, over time, streaming revenues will increase due to pricing increases as the broader market further develops. Streaming services are already at the early stages of experimenting with price increases. For example, in 2018, Spotify increased monthly prices for its service in Norway. In addition, in 2019, Amazon launched Amazon Music HD, a high-quality audio streaming offering that is available to customers at a premium price in the United States. We believe the value proposition that streaming provides to consumers supports premium product initiatives.

Technology Enables Innovation and Presents Additional Opportunities

Technological innovation has helped facilitate the penetration of music listening across locations, including homes, offices and cars, as well as across devices, including smartphones, tablets, wearables, digital dashboards, gaming consoles and smart speakers. These technologies represent advancements that are deepening listener engagement and driving further growth in music consumption.

Device Innovation. According to Nielsen, as of August 2019, U.S. consumers listened to music across an average of 4.1 devices per week. We believe that the use of multiple devices is expanding listening hours by bringing music into more moments of consumers’ lives, and the different uses these devices enable are also broadening the base of music to which consumers are exposed. The music that consumers listen to during a commute may be different than the music they listen to while they exercise, and different still than the music they play through a smart speaker while cooking a meal. Smart speakers enable consumers to access music more readily by using their voices. According to PwC, smart speaker ownership is expected to increase at a 38% CAGR from 2018 through 2023, to 440 million devices globally in 2023. The adoption of smart speakers in the United States has been strong, and according to Nielsen, 31% of music listeners today own smart speakers. Smart speakers are fueling further growth in streaming, by converting more casual listeners into paid subscribers, drawn in by music as a critical application for these devices. According to Nielsen, 61% of U.S. consumers who use a smart speaker weekly to listen to music currently pay for a subscription as well.

Format and Monetization Model Innovation. Short-form music and music-based video content has grown rapidly, driven by the growth of global social video applications such as TikTok, which features 15-second videos often set to music. TikTok has reportedly been downloaded more than one billion times since its launch in 2017 and has a global reach of 500 million users, according to Nielsen. Such applications have the potential for mass adoption, illustrating the opportunity for additional platforms of scale to be created to the benefit of the music entertainment industry. These platforms enable incremental consumption of music appealing to varied, and

4

Table of Contents

often younger, audiences. From a recording artist’s perspective, these platforms have the potential to rewrite the path to stardom. For example, our recording artist, Fitz & the Tantrums, an American band, rose to international fame in 2018 as their song “HandClap” went viral in Asia on TikTok. Fitz & the Tantrums quickly topped the international music charts in South Korea and surpassed one billion streams in China. Short-form music and music-based video content have also become increasingly popular on social media platforms such as Facebook and Instagram, further illustrating the growing number of potential pathways through which recording artists may gain consumer exposure.

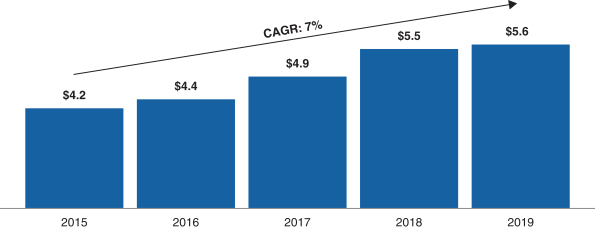

Music Publishing

According to Music & Copyright, the music publishing industry generated $5.6 billion in global revenue in 2019, representing an approximate 2% increase from $5.5 billion in 2018 (following an increase in global music publishing revenues of 11% from 2017 to 2018). Music publishing involves the acquisition of rights to, and the licensing of, musical compositions (as opposed to sound recordings) from songwriters, composers or other rightsholders. Music publishing revenues are derived from four main royalty sources: mechanical, performance, synchronization and digital. In 2019, digital, which accounted for approximately 42% of global revenue, represented the largest and fastest-growing component of industry revenues, while performance, which accounted for approximately 30%, represented the second-largest component of industry revenues. Synchronization accounted for approximately 19% of global revenue in 2019. Mechanical revenues from traditional physical music formats (e.g., CDs, DVDs, downloads), which accounted for approximately 8% of global revenue in 2019, have continued to fall while digital revenues have grown to offset this decline.

Positive Regulatory Trends

The music industry has benefitted from positive regulatory developments in recent years, which are expected to lead to increased revenues for the music entertainment industry in the coming years. These include the 2018 U.S. Music Modernization Act (“MMA”), the 2018 SDARS III and Phonorecords III Copyright Royalty Board (“CRB”) proceedings and the 2019 European Union (“E.U.”) Copyright Directive. See “Business—Our Industry and Market Opportunity—Positive Regulatory Trends” for additional information.

Our Competitive Strengths

Well-Positioned to Benefit from Growth in the Global Music Market Driven by Streaming. The music entertainment industry has undergone a transformation in the consumption and monetization of content towards streaming over the last five years. According to IFPI, from 2015 through 2019, global recorded music revenue grew at a CAGR of 9%, with streaming revenue growing at a CAGR of 42% and increasing as a percentage of global recorded music revenue from 19% to 56% over the same period. By comparison, from fiscal year 2015 to fiscal year 2019, our recorded music streaming revenue grew at a CAGR of 37% and increased as a percentage of our total recorded music revenues from 24% to 55%. We believe our innovation-focused operating strategy with an emphasis on genres that over-index on streaming platforms (e.g., hip-hop and pop) has consistently allowed our digital revenue growth to outpace the market, highlighted by our becoming the first major music entertainment company to report that our streaming revenue was the largest source of recorded music revenue in 2016.

The growth of streaming services has not only improved the discoverability and personalization of music, but has also increased consumer willingness to pay for seamless convenience and access. We believe consumer adoption of paid streaming services still has significant potential for growth. For example, according to MIDiA, in 2018, approximately 30% of the population in Sweden, an early adopter market, was paid music subscribers. This illustrates the opportunity to drive long-term growth by increasing penetration of paid subscriptions throughout the world, including important markets such as the United States, Japan, Germany, the United Kingdom and France, where paid subscriber levels are lower. Our catalog and roster of recording artists and songwriters, including our strengths in hip-hop and pop music, position us to benefit as streaming continues to

5

Table of Contents

grow. We also believe our diversified catalog of evergreen music amassed over many decades will prove advantageous as demographics evolve from younger early adopters to a wider demographic mix and as digital music services target broader audiences.

Established Presence in Growing International Markets, Including China. We believe we will benefit from the growth in international markets due to our local A&R focus, as well as our local and global marketing and distribution infrastructure that includes a network of subsidiaries, affiliates, and non-affiliated licensees and sub-publishers in more than 70 countries. We are developing local talent to achieve regional, national and international success. We have expanded our global footprint over time by acquiring independent recorded music and music publishing businesses, catalogs and recording artist and songwriter rosters in China, Indonesia, Poland, Russia and South Africa, among other markets. In addition, we have increased organic investment in heavily populated emerging markets by, for example, launching Warner Music Middle East, our recorded music affiliate covering 17 markets across the Middle East and North Africa with a total population of 380 million people. We have also strengthened our Warner Music Asia executive team with new appointments and promotions. According to IFPI in 2018, recorded music industry revenues in Asia and Australasia grew 12% year-over-year. Over the same period and on a constant-currency basis, we grew revenues in Asia and Australasia by 21%, again outpacing the industry.

With every region around the world at different stages in transitioning to digital formats, we believe establishing creative hubs by opening new regional offices and partnering with local players will achieve our objective of building local expertise while delivering maximum global impact for our recording artists and songwriters. For example, we recently invested in one of Nigeria’s leading music entertainment companies, Chocolate City, and music from this influential independent company’s recording artists and songwriters will join our repertoire and receive the support of our wide-ranging global expertise, including distribution and artist services.

Differentiated Platform of Scale with Top Industry Position. With over $4 billion in annual revenues, over half of which are generated outside of the United States, we believe our platform is differentiated by the scale, reach and broad appeal of our music. Our collection of owned and controlled recordings and musical compositions, spanning a large variety of genres and geographies over many decades, cannot be replicated. As one of three major music entertainment companies, our industry position remains strong and poised for continued growth. As reported in Music & Copyright, our global recorded music market share has increased approximately 6% from 2011 to 2019, growing from 15.1% to 16.0%. In addition, according to Nielsen, Atlantic Records was the No. 1 record label on the Billboard 200 in the United States in 2017, 2018 and 2019.

Star-Making, Culture-Defining Core Capabilities. For decades, our A&R strategy of identifying and nurturing recording artists and songwriters with the talents to be successful has yielded an extensive catalog of iconic music across a wide breadth of musical genres and marquee brands all over the world. Our marketing and promotion departments provide a comprehensive suite of solutions that are specifically tailored to each of our recording artists and carefully coordinated to create the greatest sales momentum for new and catalog releases alike. The development of our vibrant roster of recording artists has been informed by our significant experience in being able to adapt to changes in consumer trends and sentiment over time. Our creative instincts yield custom strategies for each and every one of our recording artists, including, for example:

| • | Cardi B, whose first Atlantic Records single “Bodak Yellow” was a break-out hit that has been certified nine times Platinum in the United States by the RIAA; |

| • | Twenty One Pilots, whose rise to stardom accelerated with the release of their second Fueled by Ramen studio album, Blurryface; and |

| • | Portugal. The Man, which celebrated its first entry on the Billboard Hot 100 chart after the release of their eighth studio album, Woodstock, featuring the track “Feel It Still.” |

6

Table of Contents

In addition, Warner Chappell Music boasts a diversified catalog of timeless classics together with an ever-growing group of contemporary songwriters who are actively contributing to today’s top hits. We believe our longstanding reputation and relationships in the creative community, as well as our historical success in talent development and management, will continue to attract new recording artists and songwriters with staying power and market potential through the strength and scale of our proprietary capabilities.

Strong Financial Profile with Robust Growth, Operating Leverage and Free Cash Flow Generation. For fiscal year 2017 through fiscal year 2019, we have grown as-reported revenues at a CAGR of 12%, and on a constant-currency basis, at a CAGR of 10%, driven by secular tailwinds, organic reinvestment in A&R and strategic acquisitions. For our fiscal year 2019, our business generated net income and Adjusted EBITDA of $258 million and $737 million, respectively, implying an Adjusted EBITDA margin of approximately 16%. We have an efficient business model as demonstrated by our high Free Cash Flow conversion of Adjusted EBITDA. In fiscal year 2019, we generated $24 million of Free Cash Flow (after taking into account $183 million related to the acquisition of EMP). We believe our financial profile provides a strong foundation for our continued growth.

Experienced Leadership Team and Committed Strategic Investor. Our management team has successfully designed and implemented our business strategy, delivering strong financial results, releasing an increasing flow of new music and establishing a dynamic culture of innovation. At the same time, our management team has driven an increase in operating margins and cash flow through an improved revenue mix to higher-margin digital platforms and overhead cost management, while maintaining financial flexibility to both organically invest in the business and pursue strategic acquisitions to diversify our revenue mix. Our Recorded Music and Music Publishing businesses are led by entrepreneurial and creative individuals with extensive experience in discovering and developing recording artists and songwriters and managing their creative output on a global scale. In addition, we have benefited, and expect to continue to benefit, from our acquisition by Access in July 2011, which has provided us with strategic direction, M&A and capital markets expertise and planning support to help us take full advantage of the ongoing transition in the music entertainment industry.

Expertise in Strategic Acquisitions and Investments That Extend Our Capabilities. Since 2011 when Access became our controlling shareholder, we have completed more than 15 strategic acquisitions. The acquisition of PLG in 2013 significantly strengthened our worldwide roster, global footprint and executive talent, particularly in Europe. In addition, we have made several smaller strategic acquisitions aimed at expanding our artist services capabilities in our Recorded Music business, including EMP, one of Europe’s leading specialty music and entertainment merchandise e-tailers; Sodatone, a premier A&R insight tool; UPROXX, the youth culture and video production powerhouse; Spinnin’ Records, one of the world’s leading independent electronic music companies; and Songkick’s concert discovery application. These transactions showcase the growing breadth of our platform across the music entertainment ecosystem and have increased our direct access to fans of our recording artists and songwriters. In addition to our commercial arrangements with digital music services, we opportunistically invest in some of those services as well as other companies in our industry, including minority equity stakes in Deezer, a French digital music service in which Access owns a controlling equity interest, and Tencent Music Entertainment Group, the leading online music entertainment platform in China. Acquiring and investing in businesses that are highly complementary to our existing portfolio further enables us to potentially derive incremental and new revenue streams from different business models in new markets.

Our Growth Strategies

Attract, Develop and Retain Established and Emerging Recording Artists and Songwriters. A critical component of our global strategy is to produce an increasing flow of new music by finding, developing and retaining recording artists and songwriters who achieve long-term success. Since 2011, our annual new releases have grown significantly and our catalog of musical compositions has increased to over 1.4 million. We expect to

7

Table of Contents

enhance the value of our assets by continuing to attract and develop new recording artists and songwriters with staying power and market potential. Our A&R teams seek to sign talented recording artists and songwriters who will generate meaningful revenues and increase the enduring value of our catalog. We have also made meaningful investments in technology to further expand our A&R capabilities in a rapidly changing music environment. In 2018, we acquired Sodatone, an advanced A&R tool that uses streaming, social and touring data to help track early predictors of success. When combined with the strength of our current ability to identify creative talent, we expect this to further enhance our ability to scout and sign breakthrough recording artists and songwriters. In addition, we anticipate that investment in or commercial relationships with technology companies will enable us to tailor our marketing efforts for established recording artists and songwriters by gaining valuable insight into consumer reactions to new releases. We regularly evaluate our recording artist and songwriter rosters to ensure that we remain focused on developing the most promising and profitable talent and are committed to maintaining financial discipline in the negotiation of our agreements with recording artists and songwriters.

Focus on Growth Markets to Position Us to Realize Upside from Incremental Penetration of Streaming. While the rapid growth of streaming has already transformed the music entertainment industry, streaming is still in relatively early stages, as significant opportunity remains in both developed markets and markets largely untapped by the adoption of paid streaming subscriptions. Some of our largest markets, such as the United States, Germany, United Kingdom and France, still lag Nordic countries in penetration of paid subscriptions and have room for future growth. In these markets, we will continue to increase our output of new releases and use data to more effectively target our marketing efforts. Less mature markets, such as China and Brazil, have large populations with relatively high smartphone penetration, and we are well placed to benefit from streaming tailwinds over the next several years with our local presence and extensive catalog.

Expand Global Presence with Investment in Local Music in Nascent Markets. We recognize that music is inherently local in nature, shaped by people and culture. According to IFPI, in 2018, at least seven of the top-selling singles in Brazil, India, Italy and South Korea were performed by or featured local artists. Similarly, in 2018, at least seven of the top-selling albums in France, Germany, Spain and Turkey were performed by or featured local artists. One of our vital business functions is to help our recording artists and songwriters solve the complexities associated with a fragmented, global market of mixed musical tastes. We have found that investment in local music provides the best opportunity to understand these nuances, and we have made it a strategic priority to seek out investment opportunities in emerging markets. For example, we opened an office in the Middle East and North Africa region to prepare for the forecasted rise in smartphone penetration and projected uptake in digital music. These investments are made with the purpose of increasing our understanding of local market dynamics and popularizing our current roster of recording artists and songwriters around the world. The impact of this local focus is demonstrated by increased revenues. For example, in fiscal year 2019, on a constant-currency basis, our revenues grew by 11% in the United States and Canada, 17% in Latin America, 25% in Asia and Australasia, and 26% in Europe and the rest of the world.

Embrace Commercial Innovation with New Digital Distributors and Partners. We believe the growth of digital formats will continue to create new and powerful ways to distribute and monetize our music. We were the first major music company to strike landmark deals with important companies such as Apple, YouTube, Peloton and Tencent Music Entertainment Group, as well as with pure-play music technology companies such as MixCloud, SoundCloud and Audiomack. We believe that the continued development of new digital channels for the consumption of music and increasing access to digital music services present significant promise and opportunity for the music entertainment industry. We are also focused on investing in emerging music technologies, demonstrated by our launch of WMG Boost, a seed-stage investment fund for start-ups in the music entertainment industry and through partnerships with entrepreneurial incubators such as TechStars. We intend to continue to extend our technological reach by executing deals with new partners and developing optimal business models that will enable us to monetize our music across various platforms, services and devices. We also intend to continue to support and invest in emerging technologies, including artificial intelligence, artificial reality,

8

Table of Contents

virtual reality, high-resolution audio, mobile messaging and other technologies to continue to build new revenue streams and position ourselves for long-term growth.

Pursue Acquisitions to Enhance Asset Portfolio and Long-Term Growth. We have successfully completed a number of strategic acquisitions, particularly in our Recorded Music business. Strengthening and expanding our global footprint provides us with insights on markets in which we can immediately capitalize on favorable industry trends, as evidenced by our acquisition of PLG in 2013. We also build upon our core competencies with additive and ancillary capabilities. For example, our acquisition of UPROXX, one of the most influential media brands for youth culture, not only provides a platform for short-form music and music-based video content production to market and promote our recording artists, but also includes sales capabilities to monetize advertising inventory on digital audio and video platforms. We plan to continue selectively pursuing acquisition opportunities while maintaining financial discipline to further improve our growth trajectory and drive operating efficiencies with increased free cash flow generation. With respect to our Music Publishing business, we have the opportunity to generate significant value by acquiring other music publishers and extracting cost savings (as acquired catalogs can be administered with little incremental cost), as well as by increasing revenues through more aggressive monetization efforts. We will also continue to evaluate opportunities to add to our catalog or acquire or make investments in companies engaged in businesses that we believe will help to advance our strategies.

Our Recording Artist and Songwriter Value Proposition

Over the last five years, we have outperformed in a highly competitive market. For example, from January 2017 through April 2020, our owned and distributed labels have received more U.S. Gold and Platinum certifications from the RIAA for debut albums than those of any other company. Our success is a function of attracting exceptional talent and helping them build long and lucrative careers. In an environment where music entertainment companies often fiercely compete to sign recording artists and songwriters, our ability to differentiate our core capabilities is crucial. We are constantly strengthening our skill sets, as well as evolving and expanding the comprehensive suite of services we provide. Our goal is not to be the biggest music entertainment company, but the best.

In the digital world, consumers have more than 50 million tracks at their fingertips, growing at a rate of approximately 40,000 songs per day. The sheer volume of music being released on digital music services is making it harder for recording artists and songwriters to stand out and get noticed. At the same time, music that is fresh and original is currently what resonates most strongly on digital music services. We believe our Recorded Music and Music Publishing businesses remain not just relevant, but essential to the booming music entertainment economy. Our proven ability to cut through the noise is more necessary and valuable than ever.

Below is an overview of the many creative and commercial services we provide our recording artists and songwriters. Our interests are aligned with theirs. By creating value for our recording artists and songwriters, we create value for ourselves. That philosophy is behind our current momentum, and we believe it will continue to propel our business into the future.

Welcoming Talent

We offer recording artists and songwriters numerous pathways into our ecosystem. Whether it is an up-and-coming songwriter making music in his or her bedroom, a breakout superstar recording artist selling out stadiums or an icon looking to curate a legacy, we offer the necessary support and resources.

We are not just searching for immediate hits. We scout and sign talent with the market potential for longevity and lasting impact. As a result, we are investing in more new music every year without losing our

9

Table of Contents

commitment to each recording artist and songwriter. It is that focus, patience and passion that has built and sustained the reputation that perpetuates our cycle of success.

Creative Partnership

Our A&R executives both champion and challenge the talent they sign, empowering them to realize their visions and evolve over time. Our longstanding relationships within the creative community also provide our recording artists and songwriters with a wide network of collaborators, which is a vital part of helping them to realize their best work. We provide the investment that gives our recording artists and songwriters the requisite time and space to experiment and flourish. This includes access to a multitude of songwriters’ rooms and recording studios around the globe with more to come.

Marketing and Promotional Firepower

We are experts in the art of amplification, with proven specialties in every aspect of marketing and promotion. From every meaningful digital music service and social media network to radio, press, film, television and retail, we are plugged into the most influential people and platforms for music entertainment. At the same time, by combining our collective experience with billions of transactions each and every week, we gather the insights needed to make meaningful commercial decisions grounded in data-based discipline. Most importantly, we quickly adapt to changes in how music is consumed to maximize the opportunities for our recording artists and songwriters. For example, we quickly honed our expertise in securing placement on playlists and other valuable positioning on digital music services.

Global Reach and Local Expertise

As of September 30, 2019, we employed approximately 5,400 persons around the world. This means we can build local fan bases for international recording artists and songwriters, as well as supply the network to deliver worldwide fame. Our local strength fuels our global impact and vice versa. We employ a global priority system to provide as many recording artists as possible a genuine shot at success. Our approach combines a deep understanding of local cultures, with a close-knit, nimble team that is in constant communication around the world.

A Broad Universe of Opportunity

Albums, singles, videos and songs are still the primary drivers for our business. But as the demand for music has grown, music has been woven into the fabric of our daily lives in new and increasingly sophisticated ways. It is our job to help our recording artists and songwriters capitalize on this expanding universe.

In our Recorded Music business, beyond digital and physical revenue streams, we provide a wide array of artist services, including merchandise, e-commerce, VIP ticketing and fan clubs. In our Music Publishing business, we take an active role in expanding the consumption of music, through performance, digital, mechanical, synchronization and, the original music publishing revenue stream, sheet music. Last year, we launched a creative services team that is tasked with finding innovative ways to revitalize catalogs and create new possibilities for our songwriters.

In 2017, we launched a film and television unit and subsequently acquired additional video production capabilities in order to offer greater storytelling possibilities for our recording artists and songwriters.

The centralization of our technology capabilities and data insights has resulted in increased transparency of our royalty reporting to our recording artists and songwriters. We defend and protect our recording artists’ and songwriters’ creative output by remaining vigilant in the collection of different types of royalties around the world and defending against illegitimate and illegal uses of our owned and controlled copyrights.

10

Table of Contents

Representative Sample of Recording Artists and Songwriters

Our Recorded Music business includes music from:

| • | Global superstars such as Ed Sheeran, Bruno Mars, Michael Bublé, Cardi B, Kelly Clarkson, Coldplay, David Guetta, Dua Lipa, Neil Young, Prince, Pink Floyd, David Bowie, Phil Collins, Fleetwood Mac, Tom Petty and The Smiths. |

| • | Next-generation talent including A Boogie wit da Hoodie, Charli XCX, Lizzo and Bebe Rexha. |

| • | International stars such as Anitta, Aya Nakamura, TWICE, Christopher, Udo Lindenberg and Laura Pausini. |

Our Music Publishing business includes musical compositions by:

| • | Superstars such as Stormzy, Twenty One Pilots, Green Day, Katy Perry, George Michael, Chris Stapleton, Damon Albarn, Dave Mustaine and Kacey Musgraves. |

| • | International talent such as Jonathan Lee, Tia Ray, Manuel Medrano, Melendi, Bausa, Shy’m, Tove Lo and Jack & Coke. |

| • | Songwriting icons like Brody Brown, Liz Rose, Justin Tranter, busbee, The-Dream, Dr. Dre, Stephen Sondheim, George & Ira Gershwin and Gamble & Huff. |

Recent Developments

During the one month ended April 30, 2020, we experienced a 12% increase in Recorded Music streaming revenue, our largest and fastest-growing source of revenue, despite the impact of COVID-19 on digital advertising markets. For the one month ended April 30, 2020, Recorded Music streaming revenue was estimated to be $183 million compared to $168 million (or $163 million on a constant-currency basis) for the one month ended April 30, 2019. We also experienced an increase in Music Publishing digital revenue during this period. For the one month ended April 30, 2020, Music Publishing digital revenue was estimated to be $22 million compared to $19 million (or $18 million on a constant-currency basis) for the one month ended April 30, 2019. Total digital revenue increased in the one month ended April 30, 2020 driven by increases in Recorded Music paid streaming revenue and Music Publishing digital revenue, offset by a decrease in Recorded Music ad-supported revenue resulting from the impact of COVID-19 and download revenue due to the continued shift to streaming services. Despite the economic impacts associated with the COVID-19 pandemic, total digital revenue is estimated to have grown 10% year-over-year to $216 million for the one month ended April 30, 2020 compared to $203 million (or $196 million on a constant-currency basis) for the one month ended April 30, 2019. On a constant-currency basis, estimated total digital revenue grew $20 million and represented 73% of total revenue for the one month ended April 30, 2020 compared to 60% for the one month ended April 30, 2019. Our digital revenue trends are consistent with certain published market trends.

For the one month ended April 30, 2020, estimated total revenue was $295 million compared to $335 million (or $329 million on a constant-currency basis) for the one month ended April 30, 2019. On a constant currency basis, this represents a decrease of $34 million, or 10% year-over-year. An increase in total digital revenue, including gains in Recorded Music paid streaming revenue and Music Publishing digital revenue, in April 2020 compared to April 2019 was more than offset by decreases in revenue from artist services and expanded-rights, ad-supported digital and physical revenue in Recorded Music and synchronization revenue in Music Publishing. As the impact of the COVID-19 pandemic subsides, we expect these revenue sources to largely recover. Digital revenue is among our highest margin revenue while some of the revenue sources that have been negatively impacted by the economic effects of the pandemic, such as artist services and physical, are intrinsically lower margin. As a result, we expect the impact on OIBDA of decreased revenue from these sources

11

Table of Contents

to be less than the impact on revenue. We are also taking additional steps to offset the impact of COVID-19 on OIBDA by controlling discretionary spending, initiating cost reduction programs and allocating our resources to areas where they will be most impactful.

For a discussion of the financial impact of the COVID-19 pandemic on our business for the six months ended March 31, 2020, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Business Overview—Factors Affecting Results of Operations and Comparability—COVID-19 Pandemic.” For additional information on the specific risks we face from COVID-19 and the potential future adverse impact that the COVID-19 pandemic and associated government responses could have on our results of operations, cash flows and financial condition, see “Risk Factors—Risks Related to Our Business—Our results of operations, cash flows and financial condition are expected to be adversely impacted by the coronavirus pandemic.”

Cautionary Statement Regarding Estimated Results

The estimated financial information for the Company for the one month ended April 30, 2020 is preliminary, unaudited and subject to completion. This information reflects management’s current views and may change as a result of management’s review of results and other factors, including a wide variety of significant business, economic and competitive risks and uncertainties. Such preliminary financial information is subject to the finalization and closing of the accounting books and records of the Company (which have yet to be performed) and should not be viewed as a substitute for full quarterly financial statements prepared in accordance with U.S. GAAP. The Company cautions you that the estimated financial information for the one month ended April 30, 2020 is not a guarantee of future performance or outcomes and actual results may differ materially from those described above. Factors that could cause actual results to differ from those described above are set forth in “Risk Factors” and “Special Note Regarding Forward-Looking Statements and Information.” The Company assumes no obligation to update any forward-looking statement as a result of new information, future events or other factors. You should read this information together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Company’s audited historical consolidated financial statements appearing elsewhere in this prospectus. No independent registered public accounting firms have audited, reviewed or compiled, examined or performed any procedures with respect to these preliminary results, nor have they expressed any opinion or any other form of assurance on the preliminary results.

The Company maintains a 52-53 week fiscal year ending on the last Friday in each reporting period. Quarters within the fiscal year include 13-week periods, unless a fiscal year includes a 53rd week, in which case the fourth quarter of the fiscal year will be a 14-week period. The one month ended April 30, 2020 consists of four weeks, and therefore, it represents less than one-third of the Company’s fiscal quarter that will end June 30, 2020.

The unaudited preliminary financial information is presented for informational purposes only and does not purport to represent the Company’s financial condition or results of operations for any future date or period. As a result, prospective investors should exercise caution in relying on this information and should not draw any inferences from this information regarding financial or operating data not provided.

Our Controlling Stockholder and Our Status as a Controlled Company

Access Industries is a privately-held industrial group with long-term holdings worldwide. Founded in 1986 by British-American industrialist and philanthropist Len Blavatnik, Access identifies new strategic investment opportunities and invests in both emerging and established industries to create transformative companies and generate significant growth over time. Headquartered in the United States, Access owns strategic and diversified investments around the world in various key sectors including media and telecommunications, natural resources and chemicals, venture capital, real estate and biotechnology.

12

Table of Contents

In the technology, media and entertainment (“TME”) sector, Access has created a media platform for the 21st century built on investments in disruptive technologies, content platforms and production companies. In addition to Warner Music Group, Access’s TME holdings include DAZN, the leading digital sports content streaming company, Deezer, the high-resolution online music streaming service with 14 million active monthly users, Access Entertainment, which invests in premium-quality television, film and theater, and other transformational companies.

Following the completion of this offering, Access will hold an aggregate of 440,000,000 shares of our Class B common stock, representing approximately 99.2% of the total combined voting power of our outstanding common stock (or an aggregate of 429,500,000 shares of our Class B common stock, representing approximately 99.1% of the total combined voting power of our outstanding common stock if the underwriters exercise in full their option to purchase additional shares of our Class A common stock from the selling stockholders) and approximately 86.3% of the economic interest (or approximately 84.2% of the economic interest if the underwriters exercise in full their option to purchase additional shares of our Class A common stock from the selling stockholders). Accordingly, Access will have the ability to control the outcome of matters submitted to our stockholders for approval, including the election of our directors and the approval of any change in control transaction. We believe that this voting structure aligns our interests in creating stockholder value.

Because Access will control a majority of the total combined voting power of our outstanding common stock, we will be a “controlled company” under the corporate governance rules for Nasdaq-listed companies. Therefore, we may elect not to comply with certain corporate governance standards, such as the requirement that our board of directors have a compensation committee and nominating and corporate governance committee composed entirely of independent directors. Following the completion of this offering, we intend to take advantage of these exemptions.

Our Corporate Information

Warner Music Group Corp. is a Delaware corporation. Our principal executive offices are located at 1633 Broadway, New York, New York 10019, and our telephone number is (212) 275-2000. Our website is www.wmg.com. Information on, or accessible through, our website or any other website is not incorporated by reference herein and does not constitute a part of this prospectus.

Summary Risk Factors

Our business is subject to a number of risks, including risks that may prevent us from achieving our business objectives or may adversely affect our business, financial condition, results of operations, cash flows and prospects that you should consider before making a decision to invest in our Class A common stock. These risks are discussed more fully in “Risk Factors” in this prospectus. These risks include, but are not limited to, the following:

| • | our results of operations, cash flows and financial condition are expected to be adversely impacted by the coronavirus pandemic; |

| • | our ability to identify, sign and retain recording artists and songwriters and the existence or absence of superstar releases; |

| • | the ability to further develop a successful business model applicable to a digital environment and to enter into artist services and expanded-rights deals with recording artists in order to broaden our revenue streams in growing segments of the music entertainment business; |

| • | the popular demand for particular recording artists or songwriters and music and the timely delivery to us of music by major recording artists or songwriters; |

13

Table of Contents

| • | the diversity and quality of our recording artists, songwriters and releases; |

| • | slower growth in streaming adoption and revenue; |

| • | our dependence on a limited number of digital music services for the online distribution and marketing of our music and their ability to significantly influence the pricing structure for online music stores; |

| • | risks associated with our non-U.S. operations, including limited legal protections of our intellectual property rights and restrictions on the repatriation of capital; |

| • | the impact of heightened and intensive competition in the recorded music and music publishing industries and our inability to execute our business strategy; |

| • | threats to our business associated with digital piracy, including organized industrial piracy; |

| • | a potential loss of catalog if it is determined that recording artists have a right to recapture U.S. rights in their recordings under the U.S. Copyright Act; |

| • | our substantial leverage; and |

| • | holders of our Class A common stock will have limited or no ability to influence corporate matters due to the dual class structure of our common stock and the existing ownership of Class B common stock by Access, which has the effect of concentrating voting control with Access for the foreseeable future. |

14

Table of Contents

THE OFFERING

| Class A common stock offered by the selling stockholders |

70,000,000 shares. |

| Option to purchase additional shares of Class A common stock offered by the selling stockholders |

The underwriters have a 30-day option to purchase up to an additional 10,500,000 shares of Class A common stock from the selling stockholders at the initial public offering price, less underwriting discounts and commissions. |

| Class A common stock to be outstanding after this offering |

70,000,000 shares (or 80,500,000 if the underwriters exercise in full their option to purchase additional shares of our common stock). |

| Class B common stock to be outstanding after this offering |

440,000,000 shares (or 429,500,000 if the underwriters exercise in full their option to purchase additional shares of our common stock). |

| Total Class A common stock and Class B common stock to be outstanding after this offering |

510,000,000 shares. |

| Use of proceeds |

We will not receive any proceeds from the sale of Class A common stock by the selling stockholders in this offering. |

| Voting rights |

Upon completion of this offering, we will have two classes of voting common stock, Class A common stock and Class B common stock. Each share of Class A common stock is entitled to one vote per share and each share of Class B common stock is entitled to 20 votes per share. |