Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ONESPAWORLD HOLDINGS Ltd | d937331d8k.htm |

Exhibit 99.1

I N V E S TORPRESENTATION| MAY 2020

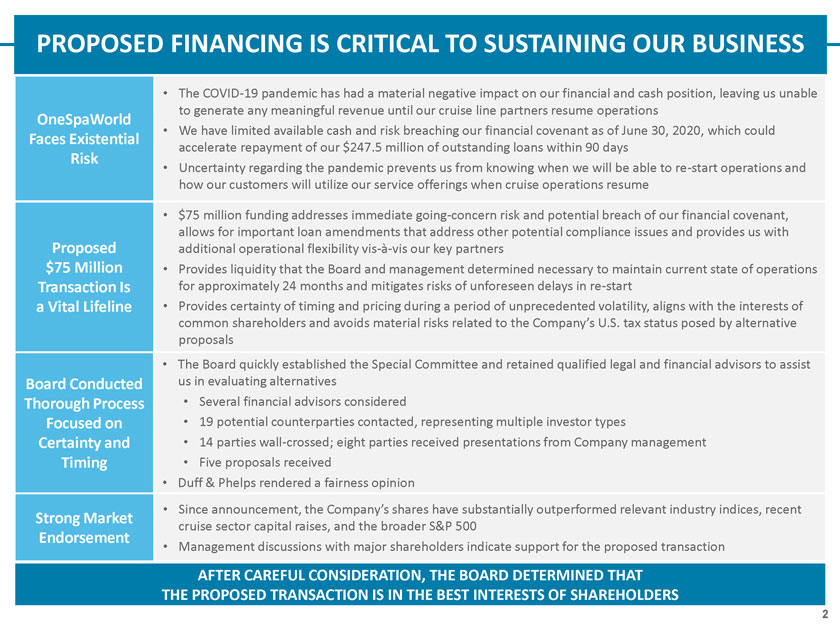

PROPOSED FINANCING IS CRITICAL TO SUSTAINING OUR BUSINESS OneSpaWorld Faces Existential Risk Proposed $75 Million Transaction Is a Vital Lifeline Board Conducted Thorough Process Focused on Certainty and Timing Strong Market Endorsement The COVID-19 pandemic has had a material negative impact on our financial and cash position, leaving us unable to generate any meaningful revenue until our cruise line partners resume operations We have limited available cash and risk breaching our financial covenant as of June 30, 2020, which could accelerate repayment of our $247.5 million of outstanding loans within 90 days Uncertainty regarding the pandemic prevents us from knowing when we will be able to re-start operations and how our customers will utilize our service offerings when cruise operations resume $75 million funding addresses immediate going-concern risk and potential breach of our financial covenant, allows for important loan amendments that address other potential compliance issues and provides us with additional operational flexibility vis-à -vis our key partners Provides liquidity that the Board and management determined necessary to maintain current state of operations for approximately 24 months and mitigates risks of unforeseen delays in re-start Provides certainty of timing and pricing during a period of unprecedented volatility, aligns with the interests of common shareholders and avoids material risks related to the Company’s U.S. tax status posed by alternative proposals The Board quickly established the Special Committee and retained qualified legal and financial advisors to assist us in evaluating alternatives Several financial advisors considered 19 potential counterparties contacted, representing multiple investor types 14 parties wall-crossed; eight parties received presentations from Company management Five proposals received Duff & Phelps rendered a fairness opinion Since announcement, the Company’s shares have substantially outperformed relevant industry indices, recent cruise sector capital raises, and the broader S&P 500 Management discussions with major shareholders indicate support for the proposed transaction AFTER CAREFUL CONSIDERATION, THE BOARD DETERMINED THAT THE PROPOSED TRANSACTION IS IN THE BEST INTERESTS OF SHAREHOLDERS

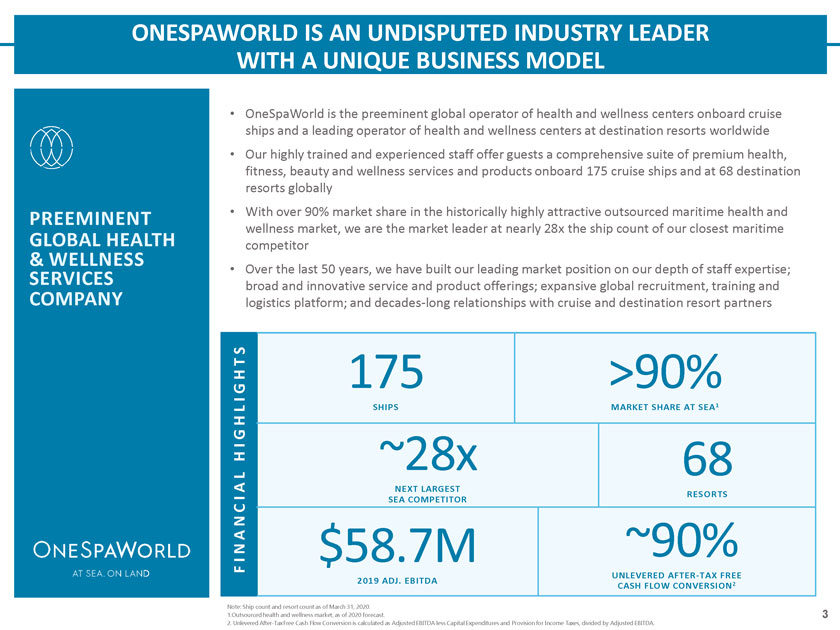

ONESPAWORLD IS AN UNDISPUTED INDUSTRY LEADER WITH A UNIQUE BUSINESS MODEL PREEMINENT GLOBAL HEALTH & WELLNESS SERVICES COMPANY OneSpaWorld is the preeminent global operator of health and wellness centers onboard cruise ships and a leading operator of health and wellness centers at destination resorts worldwide Our highly trained and experienced staff offer guests a comprehensive suite of premium health, fitness, beauty and wellness services and products onboard 175 cruise ships and at 68 destination resorts globally With over 90% market share in the historically highly attractive outsourced maritime health and wellness market, we are the market leader at nearly 28x the ship count of our closest maritime competitor Over the last 50 years, we have built our leading market position on our depth of staff expertise; broad and innovative service and product offerings; expansive global recruitment, training and logistics platform; and decades-long relationships with cruise and destination resort partners S T H 175 >90% G I SHIPS MARKET SHARE AT SEA1 L H G I H ~28x 68 L A NEXT LARGEST RESORTS I SEA COMPETITOR C N A N $58.7M ~90% I F UNLEVERED AFTER-TAX FREE 2019 ADJ. EBITDA CASH FLOW CONVERSION2 Note: Ship count and resort count as of March 31, 2020. 1.Outsourced health and wellness market, as of 2020 forecast. 2. Unlevered After-Tax Free Cash Flow Conversion is calculated as Adjusted EBITDA less Capital Expenditures and Provision for Income Taxes, divided by Adjusted EBITDA.

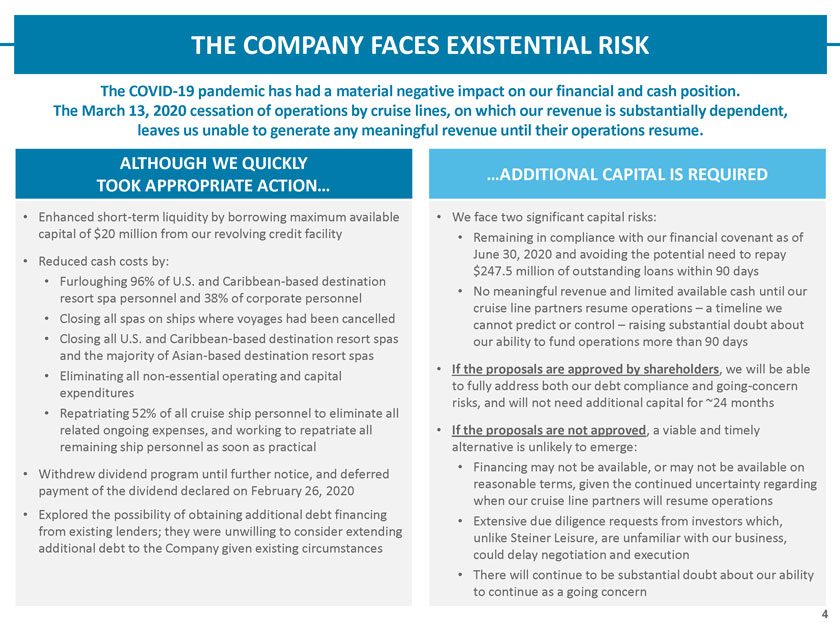

THE COMPANY FACES EXISTENTIAL RISK The COVID-19 pandemic has had a material negative impact on our financial and cash position. The March 13, 2020 cessation of operations by cruise lines, on which our revenue is substantially dependent, leaves us unable to generate any meaningful revenue until their operations resume. ALTHOUGH WE QUICKLY TOOK APPROPRIATE ACTION… Enhanced short-term liquidity by borrowing maximum available capital of $20 million from our revolving credit facility Reduced cash costs by: Furloughing 96% of U.S. and Caribbean-based destination resort spa personnel and 38% of corporate personnel Closing all spas on ships where voyages had been cancelled Closing all U.S. and Caribbean-based destination resort spas and the majority of Asian-based destination resort spas Eliminating all non-essential operating and capital expenditures Repatriating 52% of all cruise ship personnel to eliminate all related ongoing expenses, and working to repatriate all remaining ship personnel as soon as practical Withdrew dividend program until further notice, and deferred payment of the dividend declared on February 26, 2020 Explored the possibility of obtaining additional debt financing from existing lenders; they were unwilling to consider extending additional debt to the Company given existing circumstances …ADDITIONAL CAPITAL IS REQUIRED We face two significant capital risks: Remaining in compliance with our financial covenant as of June 30, 2020 and avoiding the potential need to repay $247.5 million of outstanding loans within 90 days No meaningful revenue and limited available cash until our cruise line partners resume operations – a timeline we cannot predict or control – raising substantial doubt about our ability to fund operations more than 90 days If the proposals are approved by shareholders, we will be able to fully address both our debt compliance and going-concern risks, and will not need additional capital for ~24 months If the proposals are not approved, a viable and timely alternative is unlikely to emerge: Financing may not be available, or may not be available on reasonable terms, given the continued uncertainty regarding when our cruise line partners will resume operations Extensive due diligence requests from investors which, unlike Steiner Leisure, are unfamiliar with our business, could delay negotiation and execution There will continue to be substantial doubt about our ability to continue as a going concern

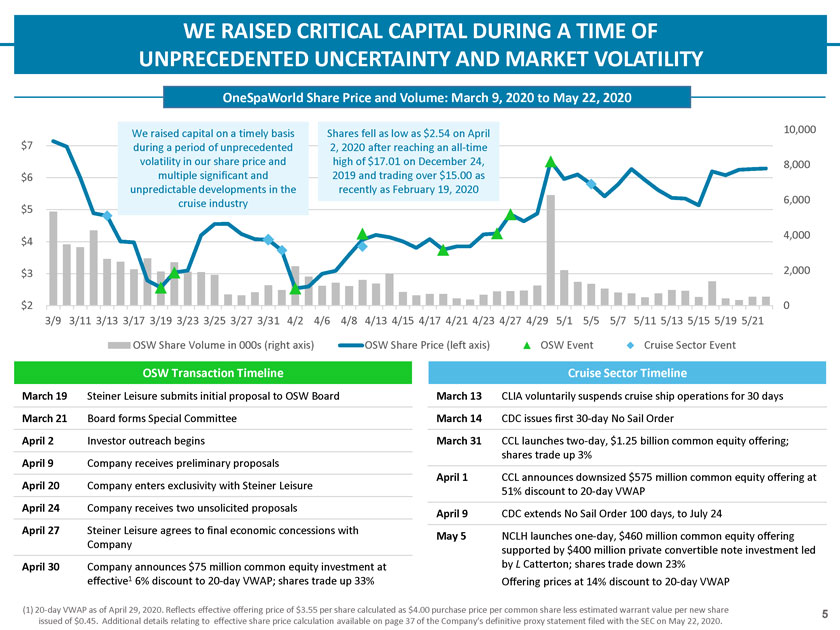

WE RAISED CRITICAL CAPITAL DURING A TIME OF UNPRECEDENTED UNCERTAINTY AND MARKET VOLATILITY OneSpaWorld Share Price and Volume: March 9, 2020 to May 22, 2020 We raised capital on a timely basis Shares fell as low as $2.54 on April 10,000 $7 during a period of unprecedented 2, 2020 after reaching an all-time volatility in our share price and high of $17.01 on December 24, 8,000 $6 multiple significant and 2019 and trading over $15.00 as unpredictable developments in the recently as February 19, 2020 cruise industry 6,000 $5 4,000 $4 $3 2,000 $2 0 3/9 3/11 3/13 3/17 3/19 3/23 3/25 3/27 3/31 4/2 4/6 4/8 4/13 4/15 4/17 4/21 4/23 4/27 4/29 5/1 5/5 5/7 5/11 5/13 5/15 5/19 5/21 OSW Share Volume in 000s (right axis) OSW Share Price (left axis) OSW Event Cruise Sector Event OSW Transaction Timeline March 19 Steiner Leisure submits initial proposal to OSW Board March 21 Board forms Special Committee April 2 Investor outreach begins April 9 Company receives preliminary proposals April 20 Company enters exclusivity with Steiner Leisure April 24 Company receives two unsolicited proposals April 27 Steiner Leisure agrees to final economic concessions with Company April 30 Company announces $75 million common equity investment at effective1 6% discount to 20-day VWAP; shares trade up 33% Cruise Sector Timeline March 13 CLIA voluntarily suspends cruise ship operations for 30 days March 14 CDC issues first 30-day No Sail Order March 31 CCL launches two-day, $1.25 billion common equity offering; shares trade up 3% April 1 CCL announces downsized $575 million common equity offering at 51% discount to 20-day VWAP April 9 CDC extends No Sail Order 100 days, to July 24 May 5 NCLH launches one-day, $460 million common equity offering supported by $400 million private convertible note investment led by L Catterton; shares trade down 23% Offering prices at 14% discount to 20-day VWAP (1) 20-day VWAP as of April 29, 2020. Reflects effective offering price of $3.55 per share calculated as $4.00 purchase price per common share less estimated warrant value per new share issued of $0.45. Additional details relating to effective share price calculation available on page 37 of the Company’s definitive proxy statement filed with the SEC on May 22, 2020.

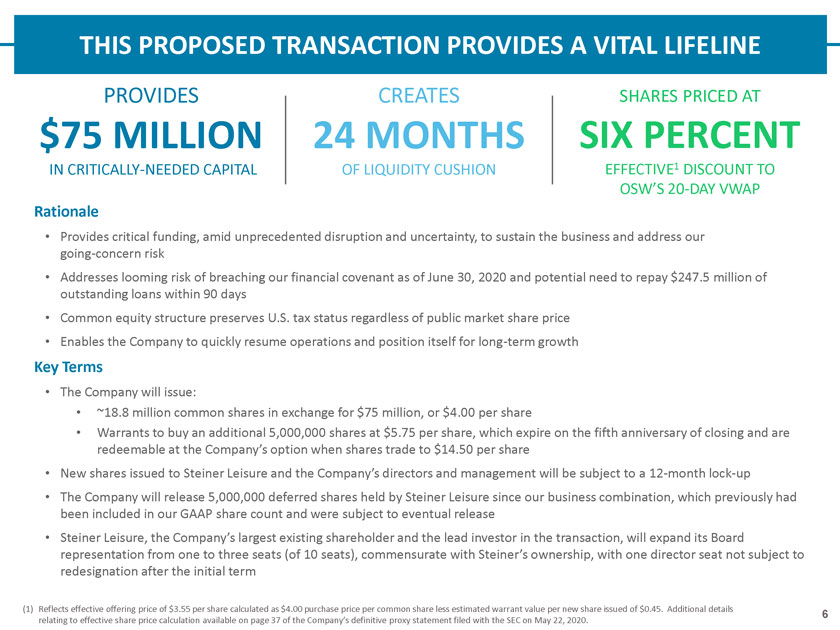

THIS PROPOSED TRANSACTION PROVIDES A VITAL LIFELINE PROVIDES $75 MILLION IN CRITICALLY-NEEDED CAPITAL CREATES 24 MONTHS OF LIQUIDITY CUSHION SHARES PRICED AT SIX PERCENT EFFECTIVE1 DISCOUNT TO OSW’S 20-DAY VWAP Rationale Provides critical funding, amid unprecedented disruption and uncertainty, to sustain the business and address our going-concern risk Addresses looming risk of breaching our financial covenant as of June 30, 2020 and potential need to repay $247.5 million of outstanding loans within 90 days Common equity structure preserves U.S. tax status regardless of public market share price Enables the Company to quickly resume operations and position itself for long-term growth Key Terms The Company will issue: ~18.8 million common shares in exchange for $75 million, or $4.00 per share Warrants to buy an additional 5,000,000 shares at $5.75 per share, which expire on the fifth anniversary of closing and are redeemable at the Company’s option when shares trade to $14.50 per share New shares issued to Steiner Leisure and the Company’s directors and management will be subject to a 12-month lock-up The Company will release 5,000,000 deferred shares held by Steiner Leisure since our business combination, which previously had been included in our GAAP share count and were subject to eventual release Steiner Leisure, the Company’s largest existing shareholder and the lead investor in the transaction, will expand its Board representation from one to three seats (of 10 seats), commensurate with Steiner’s ownership, with one director seat not subject to redesignation after the initial term (1) Reflects effective offering price of $3.55 per share calculated as $4.00 purchase price per common share less estimated warrant value per new share issued of $0.45. Additional details 6 relating to effective share price calculation available on page 37 of the Company’s definitive proxy statement filed with the SEC on May 22, 2020.

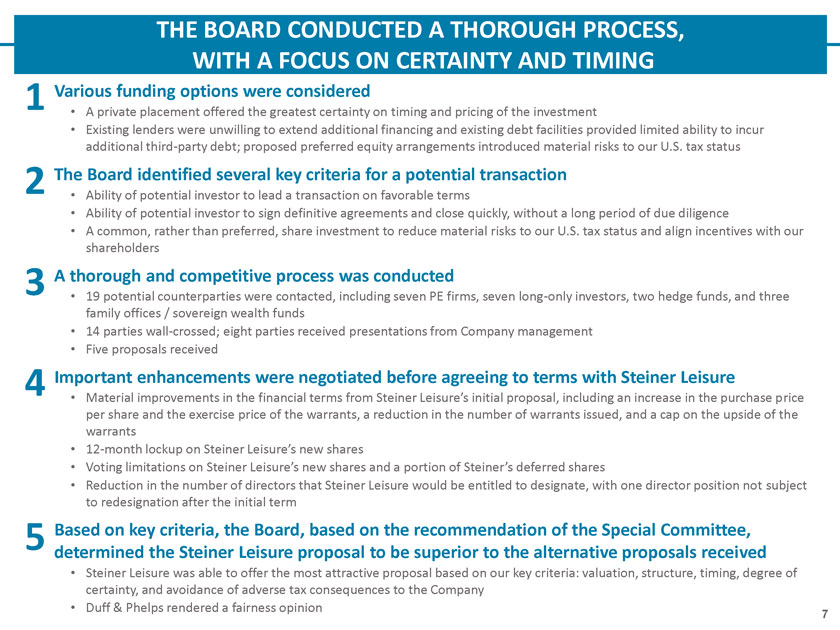

THE BOARD CONDUCTED A THOROUGH PROCESS, WITH A FOCUS ON CERTAINTY AND TIMING 1 Various funding options were considered A private placement offered the greatest certainty on timing and pricing of the investment Existing lenders were unwilling to extend additional financing and existing debt facilities provided limited ability to incur additional third-party debt; proposed preferred equity arrangements introduced material risks to our U.S. tax status 2 The Board identified several key criteria for a potential transaction Ability of potential investor to lead a transaction on favorable terms Ability of potential investor to sign definitive agreements and close quickly, without a long period of due diligence A common, rather than preferred, share investment to reduce material risks to our U.S. tax status and align incentives with our shareholders 3 A thorough and competitive process was conducted 19 potential counterparties were contacted, including seven PE firms, seven long-only investors, two hedge funds, and three family offices / sovereign wealth funds 14 parties wall-crossed; eight parties received presentations from Company management Five proposals received 4 Important enhancements were negotiated before agreeing to terms with Steiner Leisure Material improvements in the financial terms from Steiner Leisure’s initial proposal, including an increase in the purchase price per share and the exercise price of the warrants, a reduction in the number of warrants issued, and a cap on the upside of the warrants 12-month lockup on Steiner Leisure’s new shares Voting limitations on Steiner Leisure’s new shares and a portion of Steiner’s deferred shares Reduction in the number of directors that Steiner Leisure would be entitled to designate, with one director position not subject to redesignation after the initial term 5 Based on key criteria, the Board, based on the recommendation of the Special Committee, determined the Steiner Leisure proposal to be superior to the alternative proposals received Steiner Leisure was able to offer the most attractive proposal based on our key criteria: valuation, structure, timing, degree of certainty, and avoidance of adverse tax consequences to the Company Duff & Phelps rendered a fairness opinion 7

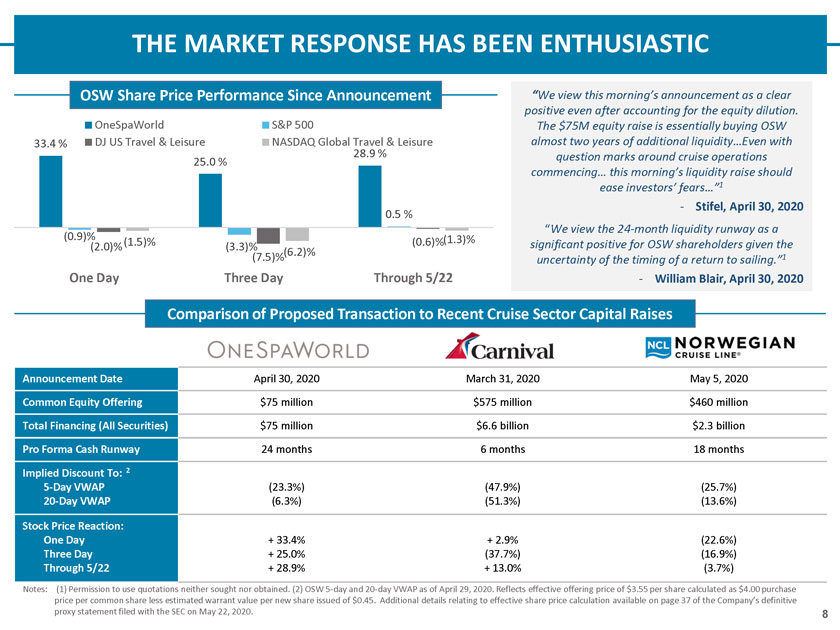

THE MARKET RESPONSE HAS BEEN ENTHUSIASTIC OSW Share Price Performance Since Announcement OneSpaWorld S&P 500 33.4 % DJ US Travel & Leisure NASDAQ Global Travel & Leisure 28.9 % 25.0 % 0.5 % (0.9)% (1.3)% (1.5)% (0.6)% (2.0)% (3.3)% (6.2)% (7.5)% One Day Three Day Through 5/22 “We view this morning’s announcement as a clear positive even after accounting for the equity dilution. The $75M equity raise is essentially buying OSW almost two years of additional liquidity…Even with question marks around cruise operations commencing… this morning’s liquidity raise should ease investors’ fears…”1—Stifel, April 30, 2020 “We view the 24-month liquidity runway as a significant positive for OSW shareholders given the uncertainty of the timing of a return to sailing.”1—William Blair, April 30, 2020 Comparison of Proposed Transaction to Recent Cruise Sector Capital Raises Announcement Date April 30, 2020 March 31, 2020 May 5, 2020 Common Equity Offering $75 million $575 million $460 million Total Financing (All Securities) $75 million $6.6 billion $2.3 billion Pro Forma Cash Runway 24 months 6 months 18 months Implied Discount To: 2 5-Day VWAP (23.3%) (47.9%) (25.7%) 20-Day VWAP (6.3%) (51.3%) (13.6%) Stock Price Reaction: One Day + 33.4% + 2.9% (22.6%) Three Day + 25.0% (37.7%) (16.9%) Through 5/22 + 28.9% + 13.0% (3.7%) Notes: (1) Permission to use quotations neither sought nor obtained. (2) OSW 5-day and 20-day VWAP as of April 29, 2020. Reflects effective offering price of $3.55 per share calculated as $4.00 purchase price per common share less estimated warrant value per new share issued of $0.45. Additional details relating to effective share price calculation available on page 37 of the Company’s definitive proxy statement filed with the SEC on May 22, 2020. 8

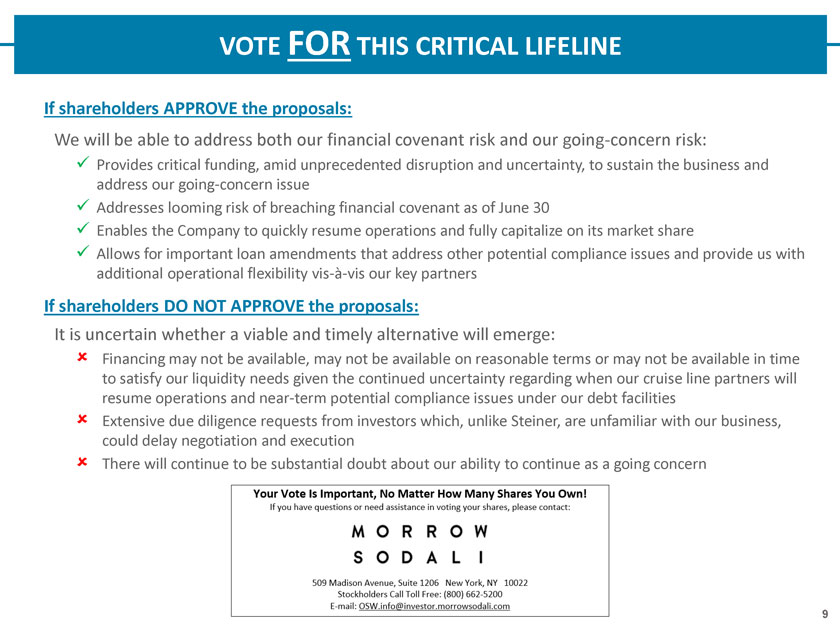

VOTE FOR THIS CRITICAL LIFELINE If shareholders APPROVE the proposals: We will be able to address both our financial covenant risk and our going-concern risk: Provides critical funding, amid unprecedented disruption and uncertainty, to sustain the business and address our going-concern issue Addresses looming risk of breaching financial covenant as of June 30 Enables the Company to quickly resume operations and fully capitalize on its market share Allows for important loan amendments that address other potential compliance issues and provide us with additional operational flexibility vis-à-vis our key partners If shareholders DO NOT APPROVE the proposals: It is uncertain whether a viable and timely alternative will emerge: Financing may not be available, may not be available on reasonable terms or may not be available in time to satisfy our liquidity needs given the continued uncertainty regarding when our cruise line partners will resume operations and near-term potential compliance issues under our debt facilities Extensive due diligence requests from investors which, unlike Steiner, are unfamiliar with our business, could delay negotiation and execution There will continue to be substantial doubt about our ability to continue as a going concern 9

Appendix—Clearing Up the Facts—Non-GAAP Reconciliation

CLEARING UP THE FACTS On Process: Deep Field Asset Management contends the process was “tremendously flawed” Reality: The Board conducted a disciplined and thorough process, with a focus on certainty and timing given the urgency of the situation Established a Special Committee which quickly retained its own advisors Evaluated several potential financial advisors, selecting the one with the deepest knowledge of the Company and ability to conduct investor outreach efforts in a targeted and expeditious manner, and also engaged a second financial advisor to evaluate the fairness of any transaction Assessed multiple funding strategies before proceeding with private placement strategy Contacted 19 potential investors with the scale and experience to lead an investment, ultimately yielding five proposals Negotiated material improvements to Steiner Leisure’s offer before granting exclusivity and also after granting exclusivity in light of additional unsolicited proposals Determined that Steiner Leisure’s proposal was the best alternative based on an assessment of transaction terms, controlled foreign corporation (“CFC”) U.S. tax risks of certain alternative proposals, ability to close quickly, and certainty Deep Field Asset Management contends there is “no reason to believe” alternative financing sources were unavailable Reality: The Board’s process began by investigating various potential structures, and identifying and contacting the most likely potential financing sources Raising additional debt was not possible because the Company’s existing lenders, whose consent would have been required, would neither provide additional funding nor their consent to additional debt given existing circumstances A preferred equity structure introduced unacceptable risk that the Company would become a CFC for U.S. tax purposes if our common shares subsequently fell below a certain value. The Company would then become subject to material taxes in the U.S. for the entirety of the fiscal year in which it was a CFC Public market alternatives, including a rights offering, were considered, but determined to carry unacceptable pricing and timeline risks, particularly in light of the significant pricing discount for Carnival Cruise Line’s equity offering announced during the Board’s deliberations The outreach to potential investors was well-targeted, as evidenced by the fact that eight of the 19 potential investors participated in management meetings over the phone, and the process ultimately yielded five proposals for the Board’s consideration Steiner Leisure’s offer presented the most compelling combination of transaction terms, deal certainty, and timing to close, while also avoiding any CFC risk 11

CLEARING UP THE FACTS On Urgency: Deep Field Asset Management contends the Company “does not need to do this deal, under these terms, at this time” Reality: The Company must raise significant capital quickly to avoid two existential financial risks Wishful thinking is not a strategy: the Company needs to raise capital imminently, and this is the most compelling option available Company faces two key fundamental risks: Remaining in compliance with our financial covenant as of June 30, 2020 and avoiding the potential need to repay $247.5 million of outstanding loans within 90 days No meaningful revenue until our cruise line partners resume operations – a timeline we cannot predict or control – limiting available cash and raising substantial doubt about our ability to fund operations for more than 90 days We already engaged 19 of the most likely potential investors in a thorough, competitive process Having canvassed the market, it is the Board’s judgment that finding another transaction, let alone on reasonable terms, in the time we would have left if shareholders do not approve this proposal, is unlikely Deep Field Asset Management contends the Company could have worked with its “willing lenders” to avoid a capital raise Reality: The Company’s lenders were not willing to let the Company raise debt Again, wishful thinking is not a strategy: the Board engaged with lenders at the start of the process to explore potential alternatives to address the Company’s looming going-concern risks. Raising additional debt was not possible because the Company’s existing lenders, whose consent would have been required, would neither provide additional funding nor their consent to additional debt given existing circumstances On the other hand, if this financing is approved by shareholders, our lenders have agreed to important loan agreement amendments that address other potential compliance issues and provide us with additional operational flexibility vis-a-vis our key partners 12

CLEARING UP THE FACTS On Fairness: Deep Field Asset Management “cannot see any basis … to conclude that this is a fair transaction” Reality: The market disagrees, and our proxy statement explains in great detail why the transaction is fair Our stock gained 33.4% the day the transaction was announced, significantly outperforming relevant industry indices as well as the broader S&P 500, suggesting investors broadly believe this is a compelling transaction That outperformance since announcement has persisted. Since then and through the close of market on May 22, 2020, we have outperformed the S&P 500 Index by 28.4% and the NASDAQ Global Travel & Leisure Index by 30.2% The thoroughness of the process, the competitive bidding that resulted in five proposals and the fairness opinion from a second financial advisor provide strong market-oriented bases in support of a fair process A comparison to the two other recent cruise-industry capital raises also provides a strong indication that the transaction is not just fair, but compelling Deep Field Asset Management contends the process was “compromised” by the choice of financial advisor Reality: The Special Committee evaluated multiple potential financial advisors and determined, before retaining the strongest candidate, that there were no unknown or material conflicts of interest The Special Committee considered several firms, and selected Nomura for its deep knowledge of both the Company and the potential investor pool for this transaction After reviewing Nomura’s prior relationships with Steiner, and mindful that L Catterton, the largest equity holder of Steiner, had relationships with many potential candidates the Special Committee might have considered for this role, the Special Committee determined there was neither an unknown nor a material conflict of interest that should disqualify Nomura As a matter of good governance, however, the Board also engaged Duff & Phelps, another financial advisor, to provide a fairness opinion before the Board approved the transaction 13

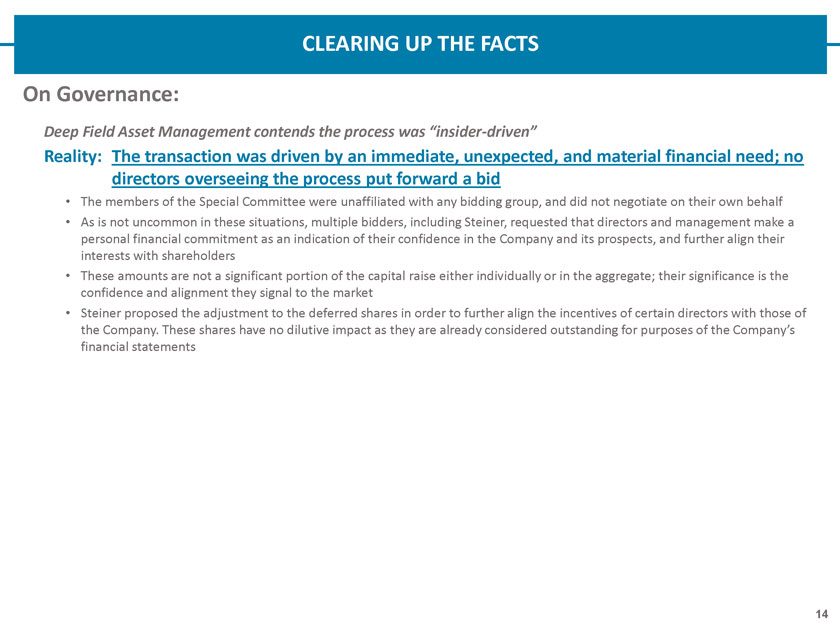

CLEARING UP THE FACTS On Governance: Deep Field Asset Management contends the process was “insider-driven” Reality: The transaction was driven by an immediate, unexpected, and material financial need; no directors overseeing the process put forward a bid The members of the Special Committee were unaffiliated with any bidding group, and did not negotiate on their own behalf As is not uncommon in these situations, multiple bidders, including Steiner, requested that directors and management make a personal financial commitment as an indication of their confidence in the Company and its prospects, and further align their interests with shareholders These amounts are not a significant portion of the capital raise either individually or in the aggregate; their significance is the confidence and alignment they signal to the market Steiner proposed the adjustment to the deferred shares in order to further align the incentives of certain directors with those of the Company. These shares have no dilutive impact as they are already considered outstanding for purposes of the Company’s financial statements 14

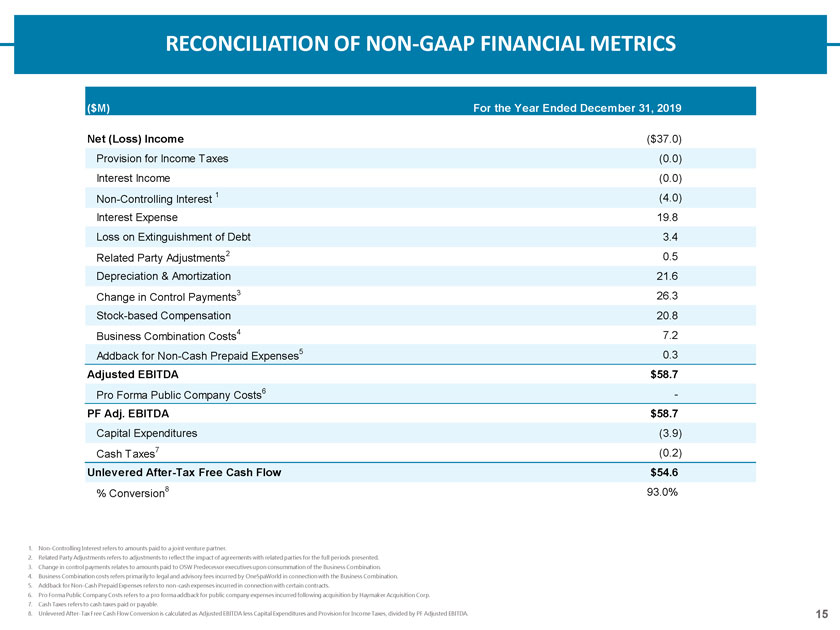

RECONCILIATION OF NON-GAAP FINANCIAL METRICS ($M) For the Year Ended December 31, 2019 Net (Loss) Income ($37.0) Provision for Income Taxes (0.0) Interest Income (0.0) Non-Controlling Interest 1 (4.0) Interest Expense 19.8 Loss on Extinguishment of Debt 3.4 Related Party Adjustments2 0.5 Depreciation & Amortization 21.6 Change in Control Payments3 26.3 Stock-based Compensation 20.8 Business Combination Costs4 7.2 Addback for Non-Cash Prepaid Expenses5 0.3 Adjusted EBITDA $58.7 Pro Forma Public Company Costs6—PF Adj. EBITDA $58.7 Capital Expenditures (3.9) Cash Taxes7 (0.2) Unlevered After-Tax Free Cash Flow $54.6 % Conversion8 93.0% 1. Non-Controlling Interest refers to amounts paid to a joint venture partner. 2. Related Party Adjustments refers to adjustments to reflect the impact of agreements with related parties for the full periods presented. 3. Change in control payments relates to amounts paid to OSW Predecessor executives upon consummation of the Business Combination. 4. Business Combination costs refers primarily to legal and advisory fees incurred by OneSpaWorld in connection with the Business Combination. 5. Addback for Non-Cash Prepaid Expenses refers to non-cash expenses incurred in connection with certain contracts. 6. Pro Forma Public Company Costs refers to a pro forma addback for public company expenses incurred following acquisition by Haymaker Acquisition Corp. 7. Cash Taxes refers to cash taxes paid or payable. 8. Unlevered After-Tax Free Cash Flow Conversion is calculated as Adjusted EBITDA less Capital Expenditures and Provision for Income Taxes, divided by PF Adjusted EBITDA. 15

Forward-Looking Statements These materials include “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may differ from OneSpaWorld Holdings Limited’s (“OSW”) actual results and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” or the negative or other variations thereof and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, expectations with respect to the impact of the private placement on OSW’s liquidity, OSW’s need to seek additional financing, OSW’s compliance with its credit agreements, OSW’s ability to obtain alternative sources of financing, and other statements that are not historical facts. These statements are based on the current expectations of OSW’s management and are not predictions of actual performance. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Factors that may cause such differences include, but are not limited to: the impact of the COVID-19 pandemic on OSW’s business and its results of operations and liquidity for the foreseeable future; the demand for OSW’s services together with the possibility that OSW may be adversely affected by other economic, business, and/or competitive factors or changes in the business environment in which OSW operates; changes in consumer preferences or the market for OSW’s services; changes in applicable laws or regulations; the availability of, or competition for, opportunities for expansion of OSW’s business; difficulties of managing growth profitably; the loss of one or more members of OSW’s management team; loss of a major customer and other risks and uncertainties included from time to time in OSW’s reports (including all amendments to those reports) filed with the SEC. OSW cautions that the foregoing list of factors is not exclusive. You should not place undue reliance upon any forward-looking statements, which speak only as of the date made. OSW does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions, or circumstances on which any such statement is based, except as required by law. These forward-looking statements should not be relied upon as representing OSW’s assessments as of any date subsequent to the date of this communication. Additional Information and Where to Find It In connection with the private placement, OSW filed a definitive proxy statement with the Securities and Exchange Commission (the “SEC”) on May 22, 2020. BEFORE MAKING ANY VOTING DECISION, OSW’S SHAREHOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT IN ITS ENTIRETY AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PRIVATE PLACEMENT OR INCORPORATED BY REFERENCE IN THE DEFINITIVE PROXY STATEMENT (IF ANY) BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PRIVATE PLACEMENT AND THE PARTIES TO THE PRIVATE PLACEMENT. Shareholders may obtain a free copy of documents filed by OSW with the SEC at the SEC’s website at http://www.sec.gov. In addition, shareholders may obtain a free copy of OSW’s filings with the SEC from OSW’s website at https://onespaworld.com/investor-relations/ or by directing a written request to: OSW.info@investor.morrowsodali.com. Participants in the Solicitation OSW and certain of its directors, executive officers, and certain other members of management and employees may be deemed to be participants in the solicitation of proxies from shareholders of OSW in favor of the private placement. Information about directors and executive officers of OSW is set forth in the definitive proxy statement filed by OSW with the SEC on May 22, 2020. Additional information regarding the direct and indirect interests of these individuals and other persons who may be deemed to be participants in the solicitation is included in the definitive proxy statement with respect to the private placement.