Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Independent Bank Group, Inc. | form8-kibtx2020q2inves.htm |

Exhibit 99.1 NASDAQ: IBTX Investor Presentation 2nd Quarter, 2020

Safe Harbor Statement This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding the financial condition, results of operations, business plans and the future performance of Independent Bank Group, Inc. (“IBTX”). Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,” “could,” “may,” “should,” “will” or other similar words and expressions are intended to identify these forward-looking statements. These forward-looking statements are based on IBTX’s current expectations and assumptions regarding IBTX’s business, the economy, and other future conditions. Because forward-looking statements relate to future results and occurrences, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict. Many possible events or factors could affect IBTX’s future financial results and performance and could cause actual results or performance to differ materially from anticipated results or performance. Such risks and uncertainties include, among others, risks relating to the coronavirus (COVID-19) pandemic and its effect on U.S. and world financial markets, potential regulatory actions, changes in consumer behaviors and impacts on and modifications to the operations and business of IBTX relating thereto, and the business, economic and political conditions in the markets in which IBTX operates. Except to the extent required by applicable law or regulation, IBTX disclaims any obligation to update such factors or to publicly announce the results of any revisions to any of the forward-looking statements included herein to reflect future events or developments. Further information regarding IBTX and factors which could affect the forward-looking statements contained herein can be found in IBTX’s Annual Report on Form 10-K, as amended, for the fiscal year ended December 31, 2019, its Quarterly Report on Form 10-Q for the period ended March 31, 2020 and its other filings with the Securities and Exchange Commission. NASDAQ: IBTX 2

Overview - Community bank holding company with $15.6 billion in assets and 93 branches across Texas and Colorado. - Innately conservative credit culture with a demonstrated history of maintaining resilient asset quality through previous downturns. - Highly granular loan portfolio with a small average credit size and low hold limits. - Loan growth driven by block-and-tackle community banking: loans made to relationship borrowers across our footprint in Texas and Colorado. - Large insider ownership (15% of shares outstanding) aligns shareholder interests with day-to-day management and decision-making. - Asset/liability neutral interest rate risk position helps mitigate the impact of a volatile interest rate environment. - Disciplined growth both organically and through strategic acquisitions. NASDAQ: IBTX 3

Company Snapshot Independent Bank Group, Inc. NASDAQ: IBTX Financial Highlights Denver, CO as of and for the Quarter Ended March 31, 2020 Balance Sheet Highlights ($ millions) Total Assets $15,574 Loans Held for Investment, $11,021 Excluding Mortgage Warehouse Mortgage Warehouse Loans $797 Total Deposits $11,883 Total Stockholders’ Equity $2,386 93 HEADQUARTERS BRANCHES Profitability Metrics1 McKinney, TX Adjusted EPS $1.01 1,445 EMPLOYEES Adjusted ROAA 1.17% Adjusted ROTCE 13.66% FOUNDED IN 1988 Adjusted Efficiency Ratio 51.17% Asset Quality Metrics2 NPAs / Assets 0.20% NPLs / Loans Held for Investment 0.26% NCOs (Annualized) 0.05% Capital Ratios Tier 1 Capital / RWA 10.38% Total Capital / RWA 12.05% TCE / Tangible Assets1 8.94% Tier 1 Capital / Avg. Assets 9.67% 1Adjusted (non-GAAP) metrics. See Appendix for reconciliation to the closest applicable GAAP metrics. 2Nonperforming assets, which consist of nonperforming loans, OREO and other repossessed assets, totaled $31,602. Nonperforming loans, which consist of nonaccrual loans, loans delinquent 90 days and still accruing interest, and troubled debt restructurings, and excludes loans acquired with deteriorated credit quality, totaled $28,493. 4

Experienced Leadership Team David R. Brooks Chairman, CEO & President Daniel W. Brooks Vice Chairman, Chief Risk Officer Founder – led the investor group that acquired Independent Bank in 1988. 37 years in financial services; 31 years at the company. Michelle S. Hickox Chief Financial Officer Mark S. Haynie General Counsel 30 years in financial services; 8 years at the company. 37 years of experience representing community banks in corporate, regulatory and securities matters. James C. White Chief Operating Officer 32 years in financial services; 4 years at the company. Michael B. Hobbs Chief Lending Officer 25 years in financial services; joined the company in 2019 with the James P. Tippit Corporate Responsibility acquisition of Guaranty Bank & Trust, where he served as President. 14 years in financial services; 9 years at the company. Strong, Diverse Markets Dallas/Ft. Worth – North Texas 39 Branches Our company was founded in North Texas in 1988, and we have since built a large presence in the Dallas/Fort Worth MSA – one of the fastest-growing MSAs in the country, and one of the strongest markets in Texas. Dallas/Fort Worth boasts a diverse economy that has benefitted from a continued boom of corporate relocation activity to business-friendly Texas. Denver – Colorado Front Range 33 Branches The Colorado Front Range is one of the strongest and fastest-growing areas of the country. In the 2019 U.S. News & World Report ranking of the best places to live in the United States, Denver came in at No. 2, and Colorado Springs came in at No. 3. The confluence of a diverse economy and strong quality of life indicators has drawn a deep talent pool that helps position the Colorado Front Range for continued growth. Austin – Central Texas 8 Branches This market includes the tech hub of Austin, Texas, which U.S. News & World Report rated the No. 1 best place to live in the United States in its 2019 ranking. The market boasts a growing wave of corporate expansions by tech firms into the Austin market, as well as a thriving public sector presence. Greater Houston 13 Branches The Greater Houston MSA serves for a regional center for international trade, energy and manufacturing. The city is regularly ranked as one of the most diverse cities in the United States, and is the home to numerous universities as well as a thriving medical industry. NASDAQ: IBTX 5

Demonstrated Record of Healthy Growth Growth in Total Assets ($ in millions) CAGR Since 2013 (Organic): 32.9% CAGR Since 2013 (Total): 38.0% $14,958 - Established history of growing assets both organically and $3,943 through strategic acquisitions. - Demonstrated expertise in integrating M&A transactions, Entered adding $9.7 billion in acquired assets since our IPO. Colorado Market $9,850 $852 - Track record of building scalable platforms for future growth. $8,684 $2,444 Entered $5,853 Houston Market $5,055 $4,133 $620 $1,671 $2,164 $168 2013 2014 2015 2016 2017 2018 2019 IPO Date: April 3, 2013 Assets Acquired in Fiscal Year NASDAQ: IBTX Note: Acquired assets includes impact of purchase accounting. 6

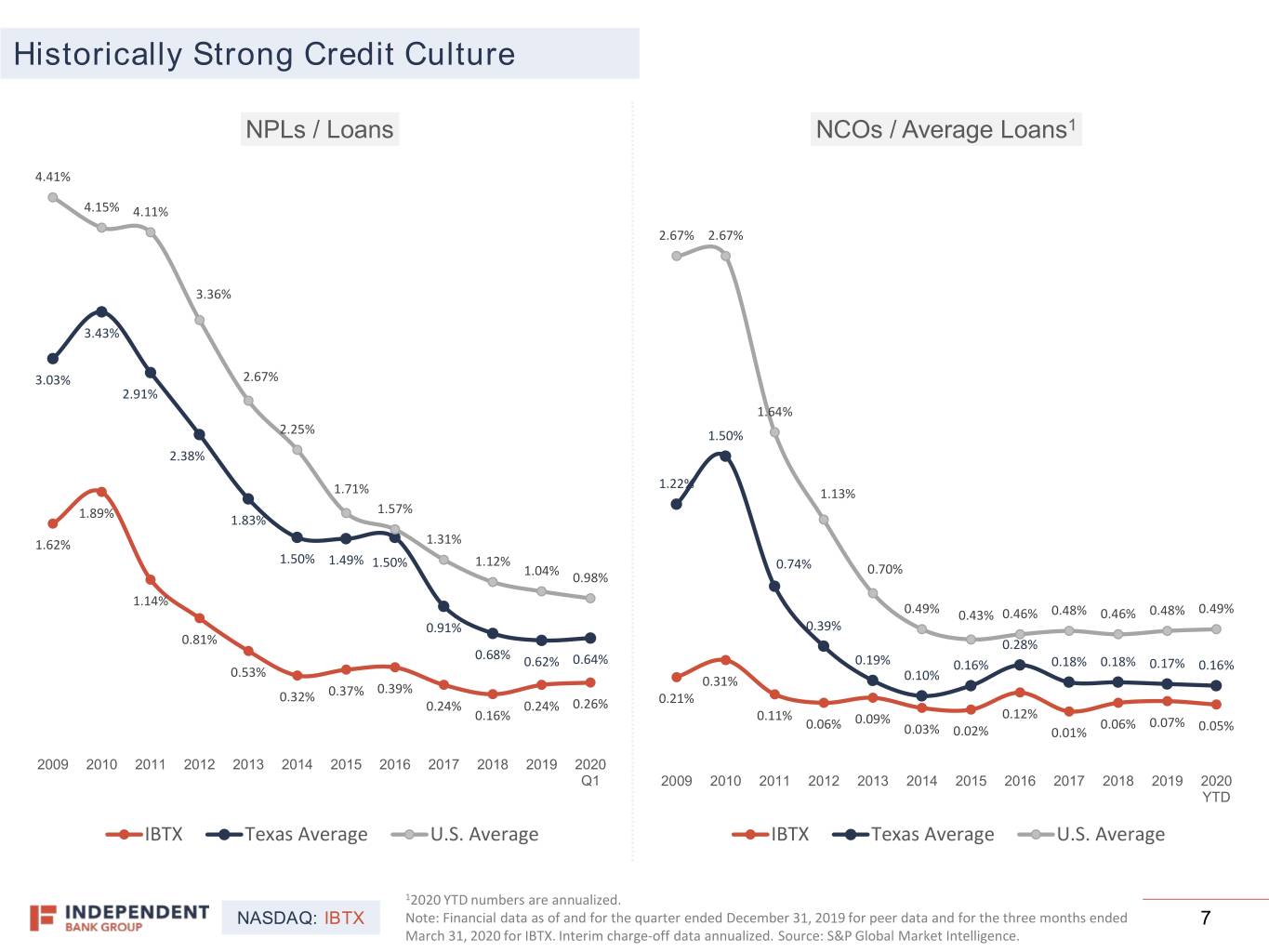

Historically Strong Credit Culture NPLs / Loans NCOs / Average Loans1 4.41% 4.15% 4.11% 2.67% 2.67% 3.36% 3.43% 3.03% 2.67% 2.91% 1.64% 2.25% 1.50% 2.38% 1.22% 1.71% 1.13% 1.57% 1.89% 1.83% 1.62% 1.31% 1.50% 1.49% 1.12% 1.50% 0.74% 0.70% 1.04% 0.98% 1.14% 0.49% 0.43% 0.46% 0.48% 0.46% 0.48% 0.49% 0.91% 0.39% 0.81% 0.28% 0.68% 0.62% 0.64% 0.19% 0.16% 0.18% 0.18% 0.17% 0.16% 0.53% 0.31% 0.10% 0.37% 0.39% 0.32% 0.21% 0.24% 0.24% 0.26% 0.16% 0.11% 0.12% 0.06% 0.09% 0.06% 0.07% 0.03% 0.02% 0.01% 0.05% 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Q1 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 YTD IBTX Texas Average U.S. Average IBTX Texas Average U.S. Average 12020 YTD numbers are annualized. NASDAQ: IBTX Note: Financial data as of and for the quarter ended December 31, 2019 for peer data and for the three months ended 7 March 31, 2020 for IBTX. Interim charge-off data annualized. Source: S&P Global Market Intelligence.

Loan Loss Coverage - IBTX deferred CECL adoption as IBTX Allowance for Credit Losses provided under the CARES Act until as of 3/31/2020 the earlier of December 31, 2020, or Illustrative Retrospective Impact of CECL Adoption the termination of the President’s national emergency declaration, with a retrospective effective date of January 1, 2020. - Current anticipated “Day One”, ~$58.0 Million January 1, 2020, impact from the adoption of CECL is estimated to boost reserves to approximately 1.26% of loans held for investment $22.0 Million (excluding mortgage warehouse): ~$138.4 Million $58.4 Million $58.4 Million ~1.26% of LHFI (Excluding Mortgage Warehouse) 0.53% of LHFI 3/31/2020 ALLL (Excluding Mortgage Warehouse) - This illustration excludes additional As of 3/31/2020 Estimated Retrospective provision expense to be taken in future Adoption of CECL 2020 quarters. Loan Loss Reserve PCD Credit Mark Est. CECL Day 1 Impact NASDAQ: IBTX 8

Focus on Performance and Results Earnings Per Share (Diluted) Efficiency Ratio $5.08 59.71% $4.47 56.13% 54.99% $4.46 57.49% $4.33 53.01% $3.45 52.35% $3.04 52.34% 51.46% $2.36 50.47% $2.88 $2.97 $2.21 45.95% 2015 2016 2017 2018 2019 2015 2016 2017 2018 2019 EPS (2) Adjusted EPS (1) Efficiency Ratio Adjusted Efficiency Ratio (1) Return on Average Assets Return on Tangible Common Equity 18.85% 1.51% 1.39% 17.58% 1.35% 1.32% 17.06% 15.61% 15.65% 1.12% 16.55% 1.03% 0.93% 13.96% 14.78% 0.98% 0.96% 0.88% 13.47% 13.10% 2015 2016 2017 2018 2019 2015 2016 2017 2018 2019 ROAA Adjusted ROAA (1) ROTCE Adjusted ROTCE (1) (1) Adjusted (non-GAAP) metrics. See Appendix for reconciliation to the closest applicable GAAP metrics. NASDAQ: IBTX (2) The year ended December 31, 2017, includes a $5.528 million charge to re-measure deferred taxes as a result of the 9 enactment of the Tax Cuts and Jobs Act (“TCJA”).

Delivering Shareholder Value 1 We have consistently grown tangible book value Tangible Book Value Per Share ($) per share each year since our IPO. $30.00 $30.08 We have returned capital to our shareholders $28.99 through our quarterly dividend and by repurchasing $27.44 our company’s common stock. $25.00 Our significant insider ownership helps ensure $23.76 that shareholder interests are well-represented both at the board table and on a day-to-day basis inside $20.00 $21.19 the company. $17.85 Annual Dividend Per Share $15.00 $15.89 $16.15 $1.00 $10.00 $0.54 $5.00 $0.40 $0.32 $0.34 $0.24 $- 2014 2015 2016 2017 2018 2019 NASDAQ: IBTX 1Adjusted (non-GAAP) metrics. See Appendix for reconciliation to the closest applicable GAAP metrics. 10

2020Q1 Balance Sheet Details

Loan Portfolio Overview $11,021 Million Loans HFI Construction & LHFI COMPOSITION (3/31/2020) 3/31/2020 Development 10.7% Agricultural Million 0.9% $797 Mortgage Warehouse 3/31/2020 Owner Occupied CRE 29.8% 0.29% NPAs/LHFI C&I 3/31/2020 22.0% CRE 49.5% 0.05% Non-Owner NCOs/Avg. Loans Occupied CRE 2020Q1 Annualized 70.2% Consumer 0.4% 204.97% Allowance/NPLs 3/31/2020 1-4 Family Construction 3.2% 1-4 Family 13.3% North Texas 38.9% 5.09% LHFI BY REGION (3/31/2020) Colorado 2020 YTD Adjusted Loan Yield1 27.1% Central Texas 1Adjusted (non-GAAP) metric. Excludes $982 12.5% thousand of unexpected income recognized Houston on credit impaired acquired loans. 21.5% NASDAQ: IBTX 12

Construction & Development C&D PORTFOLIO Billion LOANS > $500 THOUSAND $1.6 (3/31/2020) C&D Portfolio Size 105% Land/Land C&D / Bank Regulatory Development, Capital 21.7% 3/31/2020 96.2% CRE Loans in IBTX Markets SFR Construction, CRE CONSTRUCTION PORTFOLIO (Texas and Colorado) Construction, 60.1% LOANS > $500 THOUSAND 18.2% (3/31/2020) $2.3 Million Average Loan Size Healthcare, 9.0% 610 Misc. CRE, C&D Loans Multifamily, 23.6% 14.5% 36.2% Owner Occupied C&D Loans Hotel/Motel, 9.6% Retail, 20.8% Industrial, Office, 17.4% 5.1% NASDAQ: IBTX 13

Commercial Real Estate CRE COMPOSITION (3/31/2020) $5.4 Billion Multifamily, 7.5% CRE Loans 3/31/2020 Mixed Use (Non-Retail), 369% 1.9% CRE / Regulatory Bank Capital Office and Office 3/31/2020 Warehouse, 25.4% Miscellaneous, 6.2% Restaurant, 2.7% Mini Storage, 2.8% Retail, 25.8% Convenience Store, 2.6% Church, 2.2% Healthcare, 6.3% Daycare/School, 2.4% Industrial, 8.2% Hotel/Motel, 6.0% NASDAQ: IBTX 14

Retail CRE $1.7 Billion Retail Loan Portfolio Size RETAIL CRE & C&D COMPOSITION 3/31/2020 LOANS > $500 THOUSAND 3/31/2020 Big Box, 2.4% 1,048 Mixed Use, Total Retail Loans 8.9% 3/31/2020 94.2% Loans in IBTX Markets Free Standing (Texas and Colorado) / Single Tenant, 20.1% $1.6 Million Average Loan Size Strip Center, 3/31/2020 68.6% 70 Number of Loans >$5m 3/31/2020 $8.3 Million Avg. Size of Loans >$5m 3/31/2020 Retail CRE has been a core competency of IBTX for decades. The retail book is comprised of over 1,000 granular loans that have been conservatively underwritten with the same credit principles that have guided IBTX through previous economic cycles. NASDAQ: IBTX 15

Hotel & Motel Million - We maintain a granular book of hotel loans in our markets, the majority of $432.3 Hotel & Motel Loan which are branded, limited/select service properties in our core markets Portfolio Size across Texas and Colorado. 3/31/2020 - We have very limited exposure to those segments of the hotel industry that $5.0 Million have been most impacted by the COVID-19 pandemic (i.e. resort and Average Loan Size conference hotels). 3/31/2020 - Construction has continued uninterrupted as an “essential industry” in both 57.3% TX and CO through the COVID-19 pandemic. Average LTV 3/31/2020 Hotel Loans by Type Hotel Loans by Location Hotel Loans by Product Type 40.8% 17.0% 81.5% 4.1% 78.9% 8.7% 18.5% 50.5% Full Service Brand Limited/Select Service Brand CRE Construction & Development Texas Colorado Other Boutique/Independent NASDAQ: IBTX 16

Energy Lending $181.5 Million Size of Energy Portfolio - We have a small, conservatively-underwritten energy 3/31/2020 book that is mostly of recent vintage. 86.7% / 13.3% E&P Loans / Services Loans - By volume, the exploration and production segment 3/31/2020 of the energy portfolio is secured by 46% oil/liquids assets and 54% by natural gas assets. 4.0% Energy Reserve / Energy Loans 3/31/2020 - Energy assets are well-diversified by basin across the United States. 1.6% Energy Loans / Total LHFI - The majority of our loans have hedging in place, and 3/31/2020 those loans that do not have hedging in place are Energy by Type personally guaranteed. $millions $157.4 $24.1 E&P Services NASDAQ: IBTX 17

Securities Portfolio As of March 31, 2020: Our investment portfolio consists of a diversified mix of liquid, low-risk securities designed to help augment the bank’s liquidity position and 2.7% manage interest rate risk toward our target “net neutral” position. Yield 4.36 Duration INVESTMENT PORTFOLIO COMPOSITION 3/31/2020 7.0% U.S. Treasury of Total Assets Securities, 4.6% CRA, 2.7% Agency Securities, 16.0% $1.1 Billion Corporates, 0.5% Portfolio Size Taxable Municipals, 2.3% Mortgage-Backed Securities, 42.0% Tax-Exempt Municipals, 31.9% NASDAQ: IBTX 18

Deposit Mix & Pricing As of March 31, 2020: DEPOSIT MIX $11,883 Million 3/31/2020 Total Deposits 0.95% Cost of Deposits1 Noninterest-Bearing IRAs, 0.7% Demand, 26.6% 1.29% Avg. Interest-Bearing Rate 26.6% CDs >$100k, 7.4% Noninterest-Bearing Deposits 1Average rate for total deposits. CDs <$100k, 2.2% Brokered CDs, 0.5% Interest-Bearing Money Market, 15.5% Checking, 28.8% Public Funds, 13.6% Savings, 4.7% NASDAQ: IBTX 19

Capital Holding Company Capital Ratios as of 03/31/2020 12.05% 10.38% 9.95% 9.67% 10.00% 8.94% 8.00% 6.50% 5.00% TCE Ratio (1) Tier 1 Leverage Ratio CET1 Ratio Tier 1 Ratio Total Capital Ratio Minimum Required to Be Considered Well Capitalized Under Basel III NASDAQ: IBTX (1) Adjusted (non-GAAP) metrics. See Appendix for reconciliation to the closest applicable GAAP metrics. 20

2020Q1 Results & COVID-19 Update

COVID-19 Update Employees, Customers & Communities • The Company is supporting the health and safety of its employees and customers through responsible operations. • All branches currently operate on a “drive-thru only” or “lobby appointment only” model. • The Company has implemented a work-from-home plan where corporate employees work remotely. • Extra precautions are being taken to safeguard health and safety in branch facilities. • To help facilitate the economic recovery, the Company is participating in the Coronavirus Aid, Relief and Economic Security Act (CARES Act) Paycheck Protection Program (PPP) by originating these Small Business Administration (SBA) loans for its customers. As of April 27, 2020, the Company has received SBA authorization for over 4,600 PPP loans totaling over $730 million in aggregate for existing customers. • The Company is working with borrowers on a case by case basis to provide temporary relief as appropriate. • The Company has made donations totaling $100,000 to support food banks across its footprint, which will provide 355,000 meals to those most vulnerable during the crisis. Capital, Liquidity & Credit • Capital remains strong, with ratios well above the standards to be considered well-capitalized under regulatory requirements, with an estimate total capital ratio of 12.05%, leverage ratio of 9.67%, and (non-GAAP) tangible common equity (TCE) ratio of 8.94% as of March 31, 2020. • Liquidity remains strong, with cash and securities representing approximately 13.1% of assets as of March 31, 2020. The Company maintains the ability to access considerable sources of contingent liquidity at the Federal Home Loan Bank and the Federal Reserve. • Asset quality remains solid, reflecting a long history of resilient credit quality and disciplined underwriting that the Company has built over three decades. NASDAQ: IBTX 22

2020Q1 Results For the quarter ended March 31, 2020, the Company GAAP Adjusted1 reported: $1.03 $1.01 - Net income of $44.2 million, or $1.03 per diluted share EPS Adj. EPS and adjusted (non-GAAP) net income of $43.4 million, or $1.01 per diluted share; $44.2 Million $43.4 Million Net Income Adj. Net Income - Return on average assets of 1.19% and adjusted (non- GAAP) return on average assets of 1.17%; 51.68% 51.17% Efficiency Ratio Adj. Eff. Ratio - Return on average equity of 7.50%, (non-GAAP) return on tangible equity of 13.92%, and adjusted (non-GAAP) 1.19% 1.17% return on tangible equity of 13.66%, and; ROAA Adj. ROAA - Organic loan growth of 3.4% for the quarter, annualized. 13.92% 13.66% ROTCE Adj. ROTCE 1Adjusted (non-GAAP) metrics. See Appendix for reconciliation to the closest applicable GAAP metrics. NASDAQ: IBTX 23

2020Q1 Selected Financials $ in thousands, except per share data As of and for the Quarter Ended Selected Balance Sheet Data March 31, 2020 December 31, 2019 March 31, 2019 Total Assets 15,573,868 14,958,207 14,145,383 LHFI, Excluding Mortgage Warehouse Loans 11,020,920 10,928,653 10,692,183 Mortgage Warehouse Loans 796,609 687,317 251,258 Total Deposits 11,882,766 11,941,336 11,239,426 Total Borrowings (Other Than Junior Subordinated Debentures) 1,152,860 527,251 538,425 Total Stockholders’ Equity 2,386,285 2,339,773 2,234,202 Selected Earnings and Profitability Data Net Interest Income 123,241 128,069 121,652 Net Interest Margin 3.76% 3.81% 4.05% Adjusted Net Interest Margin1 3.73% 3.79% 4.01% Noninterest Income 14,511 18,229 16,424 Noninterest Expense 74,368 80,343 86,595 Net Income 44,167 50,236 37,131 Adjusted Net Income2 43,354 56,799 52,028 Basic EPS 1.03 1.17 0.85 Adjusted Basic EPS2 1.01 1.32 1.19 Diluted EPS 1.03 1.17 0.85 Adjusted Diluted EPS2 1.01 1.32 1.19 Return on Average Assets 1.19% 1.32% 1.08% Adjusted Return on Average Assets2 1.17% 1.49% 1.51% 1Adjusted net interest margin, excludes unexpected income recognized on credit impaired acquired loans of $982, $791, and $1,016 respectively. 2Adjusted (non-GAAP) metrics. See Appendix for reconciliation to the closest applicable GAAP metrics. NASDAQ: IBTX 24

NASDAQ: IBTX Contact Information Investors & Analysts For more information, please contact: Paul Langdale SVP, Director of Corporate Development Direct – (469) 301-2637 Email – plangdale@ibtx.com 25

Appendix: Non-GAAP Reconciliation

APPENDIX Supplemental Information – Reconciliation of Non-GAAP Financial Measures (Unaudited) Reconciliation of Adjusted Net Income, EPS, Efficiency Ratio and Profitability Ratios – Quarterly Periods As of and for the Quarter Ended ($ in thousands except per share data) March 31, 2020 December 31, 2019 March 31, 2019 Net Interest Income - Reported (a) $ 123,241 $ 128,069 $ 121,652 Unexpected income recognized on credit impaired acquired loans (982) (791) (1,016) Adjusted Net Interest Income (b) 122,259 127,278 120,636 Provision Expense - Reported (c) 8,381 1,609 3,224 Noninterest Income - Reported (d) 14,511 18,229 16,424 Loss on sale of loans 42 - - Gain on sale of trust business - (1,319) - Gain on sale of other real estate (25) (24) - Gain on sale of securities available for sale (356) (10) (245) Loss (gain) on sale and disposal of premises and equipment 63 - (9) Recoveries on loans charged off prior to acquisition (84) (425) (1,311) Adjusted Noninterest Income (e) 14,151 16,451 14,859 Noninterest Expense - Reported (f) 74,368 80,343 86,595 Separation expense - (3,421) - OREO impairment - (377) (436) Impairment of assets (126) - - COVID-19 expense - equipment and community support (262) - - Acquisition expense (1,008) (6,619) (19,171) Adjusted Noninterest Expense (g) 72,972 69,926 66,988 Income Tax Expense - Reported (h) 10,836 14,110 11,126 Adjusted Net Income (1) (b) - (c) + (e) - (g) = (i) $ 43,354 $ 56,799 $ 52,028 Average shares for basic EPS (j) 43,011,496 42,951,701 43,759,348 Average shares for diluted EPS (k) 43,020,055 42,951,701 43,759,348 Reported Basic EPS (a - c + d - f - h) / (j) $ 1.03 $ 1.17 $ 0.85 Reported Diluted EPS (a - c + d - f - h) / (k) $ 1.03 $ 1.17 $ 0.82 Adjusted Basic EPS (i) / (j) $ 1.01 $ 1.32 $ 1.19 Adjusted Diluted EPS (i) / (k) $ 1.01 $ 1.32 $ 1.19 EFFICIENCY RATIO Amortization of other intangible assets (l) $ 3,176 $ 3,175 $ 3,235 Reported Efficiency Ratio (f - l) / (a + d) 51.68% 52.75% 60.37% Adjusted Efficiency Ratio (g - l) / (b + e) 51.17% 46.44% 47.05% PROFITABILITY (2) Total Average Assets (m) $ 14,965,628 $ 15,091,382 $ 13,975,192 Total Average Stockholders Common Equity (n) $ 2,369,225 $ 2,326,176 $ 2,219,533 Total Average Tangible Common Equity (3) (o) $ 1,276,545 $ 1,230,344 $ 1,111,668 Reported Return on Average Assets (a - c + d - f - h) / (m) 1.19% 1.32% 1.08% Reported Return on Average Common Equity (a - c + d - f - h) / (n) 7.50% 8.57% 6.78% Reported Return on Average Common Tangible (a - c + d - f - h) / (o) 13.92% 16.20% 13.55% Adjusted Return on Average Assets (i) / (m) 1.17% 1.49% 1.51% Adjusted Return on Average Common Equity (i) / (n) 7.36% 9.69% 9.51% Adjusted Return on Tangible Common Equity (i) / (o) 13.66% 18.32% 18.98% (1) Assumes an adjusted effective tax rate of 21.3%, 21.3%, 20.3%, for the quarters ended March 31, 2020, December 31, 2019 and March 31, 2019, respectively. (2) Annualized. (3) Excludes average balance of goodwill and net other intangible assets. 27

APPENDIX Supplemental Information – Reconciliation of Non-GAAP Financial Measures (Unaudited) Reconciliation of Adjusted Net Income, EPS, Efficiency Ratio and Profitability Ratios – Annual Periods For the Year Ended December 31, ($ in thousands except per share data) 2019 2018 2017 2016 2015 Net Interest Income - Reported (a) $ 504,757 $ 326,252 $ 265,478 $ 183,806 $ 154,098 Unexpected income recognized on credit impaired acquired loans (5,120) (3,711) (4,063) (1,765) (1,272) Adjusted Net Interest Income (b) 499,637 322,541 261,415 182,041 152,826 Provision Expense - Reported (c) 14,805 9,860 8,265 9,440 9,231 Noninterest Income - Reported (d) 78,176 42,224 41,287 19,555 16,128 Gain on sale of loans (6,779) - (351) - (116) (Gain) loss on sale of branch (1,549) - (2,917) 43 - Gain on sale of trust business (1,319) - - - - Gain on sale of other real estate (875) (269) (850) (62) (290) (Gain) loss on sale of securities available for sale (275) 581 (124) (4) (134) Loss (gain) on sale and disposal of premises and equipment 585 (123) 21 (32) 358 Recoveries on loans charged off prior to acquisition (2,101) (962) (1,182) - - Adjusted Noninterest Income (e) 65,863 41,451 35,884 19,500 15,946 Noninterest Expense - Reported (f) 321,864 198,619 176,813 113,790 103,198 Separation expense (3,421) - - (2,575) - OREO impairment (1,801) (85) (1,412) (106) (35) IPO related stock grants - (136) (508) (543) (624) Impairment of assets (1,173) - - - - Acquisition expense (42,744) (8,958) (17,259) (3,121) (3,954) Adjusted Noninterest Expense (g) 272,725 189,440 157,634 107,445 98,585 Income Tax Expense - Reported (h) 53,528 31,738 45,175 26,591 19,011 Adjusted Net Income (1) (b) - (c) + (e) - (g) = (i) $ 219,582 $ 132,183 $ 88,878 $ 56,563 $ 41,056 Average shares for basic EPS (j) 43,245,418 29,599,119 25,636,292 18,501,663 17,321,513 Average shares for diluted EPS (k) 43,245,418 29,599,119 25,742,362 18,588,309 17,406,108 Reported Basic EPS(3) (a - c + d - f - h) / (j) $ 4.46 $ 4.33 $ 2.98 $ 2.89 $ 2.23 Reported Diluted EPS(3) (a - c + d - f - h) / (k) $ 4.46 $ 4.33 $ 2.97 $ 2.88 $ 2.21 Adjusted Basic EPS(3) (i) / (j) $ 5.08 $ 4.47 $ 3.47 $ 3.06 $ 2.37 Adjusted Diluted EPS(3) (i) / (k) $ 5.08 $ 4.47 $ 3.45 $ 3.04 $ 2.36 EFFICIENCY RATIO Amortization of other intangible assets (l) $ 12,880 $ 5,739 $ 4,639 $ 1,964 $ 1,555 Reported Efficiency Ratio (f - l) / (a + d) 53.01% 52.35% 56.13% 54.99% 59.71% Adjusted Efficiency Ratio (g - l) / (b + e) 45.95% 50.47% 51.46% 52.34% 57.49% PROFITABILITY Total Average Assets (m) $ 14,555,315 $ 9,478,937 $ 7,966,421 $ 5,469,542 $ 4,395,552 Total Average Stockholders Common Equity (n) $ 2,267,103 $ 1,476,688 $ 1,139,573 $ 635,864 $ 540,489 Total Average Tangible Common Equity (2) (o) $ 1,164,915 $ 751,911 $ 568,071 $ 362,287 $ 294,133 Reported Return on Average Assets (a - c + d - f - h) / (m) 1.32% 1.35% 0.96% 0.98% 0.88% Reported Return on Average Common Equity (3) (a - c + d - f - h) / (n) 8.50% 8.69% 6.71% 8.42% 7.13% Return on Average Tangible Common Equity(3) (a - c + d - f - h) / (o) 16.55% 17.06% 13.47% 14.78% 13.10% Adjusted Return on Average Assets (i) / (m) 1.51% 1.39% 1.12% 1.03% 0.93% Adjusted Return on Average Common Equity(3) (i) / (n) 9.69% 8.95% 7.80% 8.90% 7.60% Adjusted Return on Tangible Common Equity(3) (i) / (o) 18.85% 17.58% 15.65% 15.61% 13.96% (1) Assumes an adjusted effective tax rate of 21.0%, 19.7%, 32.4%, 33.2%, and 32.6% for the years ended December 31, 2019, 2018, 2017, 2016, and 2015, respectively. (2) Excludes average balance of goodwill and net other intangible assets and preferred stock. (3) 2015 net income adjusted to exclude 2015 YTD preferred stock dividend of $240. 28

APPENDIX Supplemental Information – Reconciliation of Non-GAAP Financial Measures (Unaudited) Reconciliation of Tangible Common Equity to Tangible Assets and Tangible Book Value Per Common Share ($ in thousands, except per share information) March 31, 2020 December 31, 2019 December 31, 2018 December 31, 2017 December 31, 2016 December 31, 2015 Tangible Common Equity Total common stockholders equity $ 2,386,285 $ 2,339,773 $ 1,606,433 $ 1,336,018 $ 672,365 $ 603,371 Adjustments: Goodwill (994,021) (994,021) (721,797) (621,458) (258,319) (258,643) Other intangible assets, net (97,565) (100,741) (45,042) (43,244) (14,669) (16,357) Tangible Common Equity $ 1,294,699 $ 1,245,011 $ 839,594 $ 671,316 $ 399,377 $ 328,371 Tangible Assets Total Assets $ 15,573,868 $ 14,958,207 $ 9,849,965 $ 8,684,463 $ 5,852,801 $ 5,055,000 Adjustments: Goodwill (994,021) (994,021) (721,797) (621,458) (258,319) (258,643) Other intangible assets, net (97,565) (100,741) (45,042) (43,244) (14,669) (16,357) Tangible Assets $ 14,482,282 $ 13,863,445 $ 9,083,126 $ 8,019,761 $ 5,579,813 $ 4,780,000 Common shares outstanding 43,041,776 42,950,228 30,600,582 28,254,893 18,870,312 18,399,194 Tangible Common Equity To Tangible Assets 8.94% 8.98% 9.24% 8.37% 7.16% 6.87% Book value per common share $55.44 $54.48 $52.50 $47.28 $35.63 $32.79 Tangible book value per common share $30.08 $28.99 $27.44 $23.76 $21.16 $17.85 29