Attached files

Exhibit 10.21

STANDARD NNN LEASE

[MULTI-TENANT PROJECT]

| 1. | BASIC LEASE PROVISIONS. | |||||

| 1.1 | DATE FOR REFERENCE PURPOSES: | July 22, 2016 | ||||

| 1.2 | LANDLORD: | Gray Peak Fork, LLC, a Nevada limited liability company and Gray Peak Fork, Series A, LLC, A Nevada Limited Liability company, jointly and severally | ||||

| 1.3 | TENANT: | SutroVax, Inc., a Delaware corporation | ||||

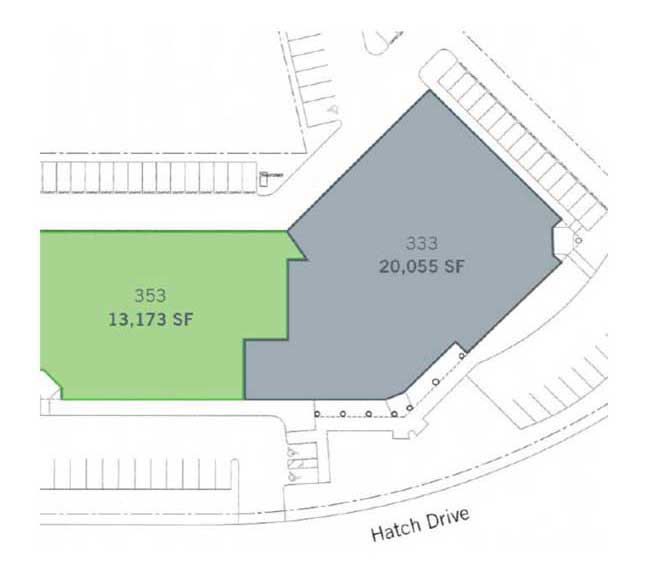

| 1.4 | BUILDING ADDRESS: | 353 Hatch Drive, Foster City, California | ||||

| 1.5 | SUITE NUMBER: | n/a | ||||

| 1.6 | RENTABLE AREA OF PREMISES: | Approximately 13,173 square feet | ||||

| 1.7 | USE: | Administrative and staff offices, research and development, laboratory, production, training, sales, and related legal uses. | ||||

| 1.8 | TERM: | Sixty (60) months | ||||

| Two (2), 30-month options to extend | ||||||

| 1.9 | COMMENCEMENT DATE: | September 1, 2016 | ||||

| 1.10 | MONTHLY BASE RENT: | Commencement Date through | ||||

| 12th full calendar month: $32,932.50 13th – 24th month: $33,920.48 25th – 36th month: $34,938.09 37th – 48th month: $35,986.23 49th – 60th month: $37,065.82 | ||||||

| 1.11 | SECURITY DEPOSIT: | $197,595 | ||||

| 1.12 | TENANT’S SHARE: | 40% | ||||

| 1.13 | REAL ESTATE BROKER: | |||||

| LANDLORD: |

Coldwell Banker Commercial | |||||

| TENANT: |

VentureSite | |||||

| 1.14 | EXHIBITS ATTACHED TO LEASE: | Exhibit A – “Premises”; Exhibit B – “Project Site” Exhibit C – “Verification Letter” | ||||

| 1.15 | ADDRESSES FOR NOTICES: | |||||

| LANDLORD: |

Fred C. Bertetta, III President Gray Peak Fork, LLC 1300 Industrial Road, Suite 2 San Carlos, CA 94070 | |||||

| TENANT: |

Prior to the Commencement Date: Grant E. Pickering President & CEO 400 E Jamie Ct, Suite 205 S San Francisco, CA 94080

After the Commencement Date: Grant E. Pickering, President & CEO Premises | |||||

1.16 INTERPRETATION. The Basic Lease Provisions shall be interpreted in conjunction with all of the other terms and conditions of this Lease. Other terms and conditions of this Lease modify and expand on the Basic Lease Provisions. If there is a conflict between the Basic Lease Provisions and the other terms and conditions of this Lease, the other terms and conditions shall control.

2. PREMISES.

2.1 LEASE OF PREMISES AND DEFINITION OF PROJECT. The “Premises” shall mean the area shown on Exhibit “A” to this Lease. Landlord hereby leases to Tenant, and Tenant hereby leases from Landlord, upon all of the conditions set forth herein the Premises, together with certain rights to the Common Areas (as defined below) as hereinafter specified. The building of which the Premises is a part (the “Building”), the Common Areas, and the land upon which the same are located (which may be multiple parcels), along with all other buildings and improvements designated by Landlord are herein collectively referred to as the “Project.” The Project is depicted on Exhibit “B”.

2.2 CALCULATION OF SIZE OF BUILDING AND PREMISES. While the approximate square footage of the Premises may have been used in the marketing of the Premises for purposes of comparison, the Base Rent stated herein is not tied to square footage and is not subject to adjustment should the actual size be determined to be different. The Premises shall be deemed to contain the number of rentable square feet set forth in Section 1.6 and the number of rentable square feet shall not be subject to change.

2.3 COMMON AREAS-DEFINED. The term “Common Areas” is defined as all areas and facilities outside the Premises and Building and within the exterior boundary line of the Project that are designated for the general non-exclusive use of Landlord, Tenant and the other tenants of the Project and their respective employees, suppliers, customers and invitees, including, but not limited to, parking areas, loading and unloading areas, landscaped areas, roadways and sidewalks. Tenant shall not store any property in the Common Areas or use the Common Areas for any purpose not approved by Landlord, in Landlord’s sole discretion. Landlord may also designate other land and improvements outside the boundaries of the Project to be a part of the Common Areas, provided that such other land and improvements have a reasonable and functional relationship to the Project.

2.4 DELIVERY OF PREMISES. Landlord shall deliver the Premises to Tenant on the Commencement Date, broom clean, in reasonable repair, and with all systems in good working condition, including, without limitation, the roof, HVAC, and the electrical, life safety and plumbing systems, and with the following improvements: (a) removal of the unfinished ceiling in the locker room; (b) installation of a wall to demise the Premises from adjacent office space; (c) replacement of the exterior double-doors [on the East side of the building] and; (d) completion of any Necessary Repairs (as defined in Section 2.6). Tenant shall have access to the Premises on a 24 hour, 7 days a week, basis.

2.5 EARLY ACCESS. Tenant shall have early access to the Premises as of the mutual execution and delivery of this Lease for the purposes of (a) inspecting the Premises in accordance with Section 2.6, and (b) performing Tenant’s Alterations in accordance with Section 7.3(b). During such early access, all of the provisions of the Lease shall apply with respect to such access, except for the payment of Rent. Landlord and Tenant shall reasonably cooperate with each other so as to prevent unreasonable interference with the other party’s work within the Premises during such early access period.

2.6 INSPECTIONS. From and after the mutual execution and delivery of this Lease, and before the Commencement Date, Tenant shall have the right to cause an inspector to conduct commercially reasonable physical inspections of the Premises and Project for purposes of determining whether there is any need for repairs necessary for Tenant’s occupancy and use of the Premises (“Necessary Repairs”).

3. TERM AND COMMENCEMENT DATE. The term and Commencement Date of this Lease are as specified in Sections 1.8 and

3.1 If the actual Commencement Date does not occur on the first day of a calendar month, the term of this Lease shall be extended by the number of days between the actual Commencement Date and the first day of the next calendar month, it being the intention of Landlord and Tenant that the term of the Lease end on the last day of a calendar month. When the actual Commencement Date is established by Landlord, Landlord shall complete the letter attached hereto as Exhibit “C” and Tenant shall, within five (5) days after Landlord’s request, execute the letter and deliver it to Landlord if such letter is accurate.

4. RENT.

4.1 BASE RENT. Tenant shall pay to Landlord, in advance, the Base Rent for the Premises set forth in Section 1.10, without offset, demand or deduction on or before the first day of each calendar month (the “Due Date”). At the time Tenant executes this Lease it shall pay to Landlord the advance Base Rent for the first full month. Base Rent for any period during the term hereof which is for less than one month shall be prorated based upon the actual number of days of the calendar month involved. Base Rent and all other amounts payable to Landlord hereunder shall be payable to Landlord in lawful money of the United States, and Tenant shall be responsible for delivering said amounts to Landlord at the address stated herein or to such other persons or to such other places as Landlord may designate in writing.

4.2 COMMON AREA EXPENSES. Tenant shall pay to Landlord during the term hereof, in addition to the Base Rent, Tenant’s Share of all Common Area Expenses. If less than 95% of the rentable square feet in the Project is occupied by tenants or Landlord is not supplying services to 95% of the rentable square feet of the Project at any time during any calendar year, Common Area Expenses for such calendar year shall be an amount equal to the Common Area Expenses which would normally be expected to be incurred had 95% of the Project’s rentable square feet been occupied and had Landlord been supplying services to 95% of the Project’s rentable square feet throughout such calendar year. Tenant’s Share of Common Area Expenses shall be determined in accordance with the following provisions:

(a) “Tenant’s Share” is defined as the percentage set forth in Section 1.12, which percentage has been determined by dividing the number of rentable square feet in the Premises by the number of rentable square feet in the Project and multiplying the resulting quotient by one hundred (100).

(b) Subject to the limitations set forth in (c) below, “Common Area Expenses” shall include all costs, expenses and fees incurred by Landlord in connection with or attributable to the Project Common Areas, including but not limited to, the following items: (A) the maintenance and replacement of all parking areas, loading and unloading areas, trash areas, roadways, sidewalks, landscaped areas, striping, bumpers, irrigation systems, exterior lighting facilities, fences and gates; (B) the cost of trash disposal; (C) the cost of all insurance purchased by Landlord and enumerated in Section 8 of this Lease, including any commercially reasonable deductibles; (D) the cost of water and other utilities serving the Common Areas, (E) the costs identified in section 7.1 as being payable as Common Area Expenses; and (F) a fee for general and administrative expenses (the “Property Management Fee”) equal to three percent (3%) of the Base Rent, as adjusted from time to time pursuant to this Lease. Real Property Taxes shall be paid in accordance with Section 10 below and shall not be included in Common Area Expenses.

(c) Notwithstanding anything to the contrary contained in the Lease, Common Area Expenses shall be defined so as to exclude the following: (i) all costs associated with defending any lawsuits with any mortgagee or tenant and costs of selling, syndicating, financing, mortgaging or hypothecating any of the Landlord’s interest in the Building; (ii) all costs (including permit, license and inspection fees) incurred in order to construct tenant improvements in space to be occupied exclusively by tenants or in renovating or redecorating vacant space which is intended for the exclusive occupancy by tenants in the future, including the cost of alterations or improvements to the Premises; (iii) leasing commissions and attorney fees incurred in connection with leasing space in the Project to tenants; (iv) reserves for equipment or capital replacement; (v) depreciation and amortization of the Building; (vi) interest on debt or amortization payments on any mortgages or deeds of trust or any other debt instrument encumbering the Building; (vii) bad debt loss, rent loss, or reserves for bad debt or rent loss; (viii) costs of services, supplies or other materials provided by Landlord or its affiliates directly, to the extent that the cost of such services, supplies or materials exceeds the fair market value of such services, supplies or materials; (ix) advertising and promotional costs; (x) Landlord’s income taxes, inheritance taxes and estate taxes; (xi) the cost of repairs or other work undertaken by reason of fire, windstorm or other casualty, or by the exercise of the right of eminent domain, to the extent that Landlord actually receives reimbursement for such costs from insurance proceeds (except that commercially reasonable insurance deductibles shall be included in Common Area Expenses) or condemnation awards; (xii) costs of repair or replacement for any item covered by a warranty if the cost of repair is actually reimbursed to Landlord by the entity providing the warranty; (xiii) costs for which Landlord actually receives reimbursement by its insurance carrier or by any tenant’s insurance carrier; (xiv) fines, penalties, interest or costs resulting from the negligence or willful misconduct of the Landlord; (xv) rental payments and any related costs pursuant to any ground lease of land underlying all or any portion of the Building; (xvi) costs, fees, dues, contributions or similar expenses for political or charitable organizations (Common Area Expenses may include the cost of fees and dues of industry associations); (xvii) costs of items considered capital replacements or improvements under generally accepted accounting principles consistently applied (“Capital Items”), except for the annual amortized cost incurred by Landlord after the Commencement Date for any capital improvements installed or paid for by Landlord and required by any new (or change in) laws, rules or regulations of any governmental or quasi-governmental authority which are enacted or first enforced after the Commencement Date; (xviii) except for the Management Fee, costs associated with the operation of the business of the entity which constitutes Landlord, as the same are distinguished from the costs of operation of the Project; (xix) costs incurred to comply with laws relating to the removal of Hazardous Substances which was in existence in the Project prior to the Commencement Date; (xx) fees payable by Landlord for management of the Project; and (xxi) ) the wages and benefits of any employee.

(d) If pursuant to (c) above Landlord is required to amortize a capital improvement, the cost shall be amortized over the useful life of the capital improvement, as reasonably determined by Landlord.

(e) Tenant’s Share of Common Area Expenses shall be payable by Tenant within thirty (30) days after a reasonably detailed statement of actual expenses is presented to Tenant by Landlord. At Landlord’s option, however, Landlord may, from time to time, estimate what Tenant’s Share of Common Area Expenses will be, and the same shall be payable by Tenant monthly on the same day as the Base Rent is due hereunder. In the event that Tenant pays Landlord’s estimate of Tenant’s Share of Common Area Expenses, Landlord shall use commercially reasonable efforts to deliver to Tenant within one hundred eighty (180) days after the expiration of each year a reasonably detailed statement (the “Statement”) showing Tenant’s Share of the actual Common Area Expenses incurred during such year. Landlord’s failure to deliver the Statement to Tenant within said

period shall not constitute Landlord’s waiver of its right to collect said amounts or otherwise prejudice Landlord’s rights hereunder. If Tenant’s payments under this Section 4.2(e) during said year exceed Tenant’s Share as indicated on the Statement, Tenant shall be entitled to credit the amount of such overpayment against Tenant’s Share of Common Area Expenses next falling due. If Tenant’s payments under this Section 4.2(e) during said year were less than Tenant’s Share as indicated on the Statement, Tenant shall pay to Landlord the amount of the deficiency within thirty (30) days after delivery by Landlord to Tenant of the Statement. Landlord and Tenant shall forthwith adjust between them by cash payment any balance determined to exist with respect to that portion of the last year for which Tenant is responsible for Common Area Expenses, notwithstanding that the Lease term may have terminated before the end of such year; and this provision shall survive the expiration or earlier termination of the Lease.

(f) The computation of Tenant’s Share of Common Area Expenses is intended to provide a formula for the sharing of costs by Landlord and Tenant and will not necessarily result in the reimbursement to Landlord of the exact costs it has incurred. Landlord shall not collect or be entitled to collect Common Area Expenses from all of its tenants in an amount which is in excess of 100% of the Common Area Expenses actually paid by Landlord in connection with the operation of the Project.

(g) If Tenant disputes the amount set forth in the Statement, Tenant shall have the right, not later than sixty (60) days following receipt of such Statement, to cause Landlord’s books and records with respect to the calendar year which is the subject of the Statement to be audited by a certified public accountant mutually acceptable to Landlord and Tenant. The audit shall take place at the offices of Landlord where its books and records are located at a mutually convenient time during Landlord’s regular business hours. Tenant’s Share of Common Area Expenses shall be appropriately adjusted based upon the results of such audit, and the results of such audit shall be final and binding upon Landlord and Tenant. The accountant conducting the audit shall be compensated on an hourly basis and shall not be compensated based upon a percentage of overcharges it discovers. No subtenant shall have any right to conduct an audit, and no assignee shall conduct an audit for any period during which such assignee was not in possession of the Premises. Tenant’s right to undertake an audit with respect to any calendar year shall expire six (6) months after Tenant’s receipt of the Statement for such calendar year, and such Statement shall be final and binding upon Tenant and shall, as between the parties, be conclusively deemed correct, at the end of such period, unless prior thereto Tenant shall have given Landlord written notice of its intention to audit Common Area Expenses for the calendar year which is the subject of the Statement. Tenant agrees that the results of any Common Area Expense audit shall be kept strictly confidential by Tenant and shall not be disclosed to any other person or entity. Tenant shall pay all costs and expenses of the audit unless the final determination in such audit is, or Landlord and Tenant mutually agree, that Landlord overstated Common Area Expenses for the year being audited by more than ten percent (10%), in which case Landlord shall pay all costs and expenses of the audit.

5. SECURITY DEPOSIT. Contemporaneously with the execution of this Lease, Tenant shall pay to Landlord the amount of Security Deposit specified in Section 1.11, which shall be held by Landlord to secure the payment by Tenant of any and all present and future debts and liabilities of Tenant to Landlord and for Tenant’s performance of its obligations under this Lease. No portion of the Security Deposit shall be considered an advance by Tenant of the last month’s rent. If Tenant defaults with respect to any provision of this Lease, including, without limitation, the provisions relating to the payment of Rent, Landlord may, but shall not be required to, reasonably use, apply or retain all or any part of the Security Deposit (i) for the payment of any Rent or any other sum in default, (ii) for the payment of any other amount which Landlord may spend or become obligated to spend by reason of such default by Tenant, and (iii) to compensate Landlord for any other loss or damage which Landlord may suffer by reason of such default by Tenant. If any portion of the Security Deposit is so used or applied, Tenant shall, upon demand therefor by Landlord, deposit with Landlord cash in an amount sufficient to restore the Security Deposit to the amount required to be maintained by Tenant hereunder. Landlord shall return to Tenant the remaining portion of the Security Deposit within thirty (30) days after the date that Landlord receives possession of the Premises, unless a determination of the amount Landlord is entitled to retain reasonably takes more than thirty days, in which case the remaining portion of the Security Deposit shall be returned to tenant within thirty days after such determination. Landlord shall not be required to keep the Security Deposit separate from its general funds, and any interest paid thereon shall become funds of the Landlord, and shall not accrue to the benefit of Tenant. If Landlord conveys, assigns or otherwise disposes of its interest in this Lease, Landlord shall deliver or credit the Security Deposit to its successor, and shall give Tenant notice thereof as required by California Civil Code Section 1950.7 or any successor statute, and Landlord thereafter shall have no further liability for the return of the Security Deposit. So long as Tenant is not then in default under this Lease (beyond any applicable notice and cure period), and has paid rent not later than five (5) days after the Due Date for each of the preceding twelve calendar months, as of the first anniversary, second anniversary and third anniversary of the Commencement Date, the Security Deposit shall be reduced by $32,932.50 (for a total reduction of $98,797.50), and the reduced amount held by Landlord shall be promptly returned to Tenant.

6. USE.

6.1 USE. The Premises shall be used and occupied only for the purpose set forth in Section 1.7 and for no other purpose. Notwithstanding any permitted use inserted in Section 1.7, Tenant shall not use the Premises for any purpose which would violate applicable laws. No exclusive use has been granted to Tenant hereunder. In no event shall Tenant use all or any part of the Premises for the production, processing, sale or distribution of marijuana.

6.2 COMPLIANCE WITH LAW.

(a) Landlord warrants to Tenant that, in the state existing as of the date set forth in Section 1.1, but without regard to alterations or improvements to be made by Tenant or the use for which Tenant will occupy the Premises, does not violate any covenants or restrictions of record, or any applicable building code, regulation or ordinance in effect on such date. Landlord’s representation and warranty that improvements comply with applicable building codes, regulations and ordinances shall mean that the improvements complied with the codes, regulations and ordinances in effect when the improvements were originally constructed. The Premises has not undergone an inspection by a certified access specialist.

(b) Tenant shall, at Tenant’s sole expense, comply with all applicable laws, ordinances, rules, regulations, orders, certificates of occupancy, conditional use or other permits, variances, covenants and restrictions of record, the recommendations of Landlord’s engineers or other consultants, and requirements of any fire insurance underwriters, rating bureaus or government agencies, now in effect or which may hereafter come into effect, whether or not they reflect a change in policy from that now existing, during the term or any part of the term hereof, relating in any manner to the particular use by Tenant of the Premises (“Legal Requirements”). Tenant shall conduct its business and use the Premises in a lawful manner and shall not use or permit the use of the Premises or the Common Areas in any manner that will tend to create dangerous situations, waste or a nuisance or shall tend to unreasonably disturb other occupants of the Project. Tenant shall obtain, at its sole expense, any permit or other governmental authorization required to operate its business from the Premises. Landlord shall not be liable for the failure of any other tenant or person to abide by the requirements of this section or to otherwise comply with applicable laws and regulations, and Tenant shall not be excused from the performance of its obligations under this Lease due to such a failure.

7. MAINTENANCE, REPAIRS AND ALTERATIONS.

7.1 LANDLORD’S OBLIGATIONS. Landlord shall keep the Common Area, electrical, heating, ventilation, air conditioning (“HVAC”), exterior doors, plumbing, fire, mechanical, and life safety systems and equipment, and the roof membrane in good condition and repair, and shall include the cost of the same as a Common Area Expense. Landlord shall maintain, repair and replace the structural components of the roof, exterior walls, foundations, and floor slabs of the Project,. at Landlord’s sole cost and expense (and not as an Common Area Expense). Notwithstanding the foregoing, or any other provision in this Lease, Landlord shall not be required to perform any maintenance, repair or replacements necessitated by the act(s) or omission(s) of Tenant, or Tenant’s employees, agents, invitees, or contractors, or by Tenant’s failure to comply with this Lease.

7.2 TENANT’S OBLIGATIONS.

(a) Tenant shall be responsible for keeping the Premises, including, without limitation, interior walls, floors, ceiling, and exterior plate glass, and all building systems exclusively serving the Premises, in good condition and repair, at Tenant’s sole expense. In addition, Tenant shall be responsible for the installation, maintenance and repair of all telephone, computer and related cabling throughout the Premises, and Tenant shall be responsible for any loss, cost, damage, liability and expense (including attorneys’ fees) arising out of or related to the installation, maintenance, repair and replacement of such cabling. If Tenant fails to keep the Premises in good condition and repair, Landlord may, but shall not be obligated to, make any necessary repairs, following ten (10) days notice to Tenant and opportunity to begin to cure. If Landlord makes such repairs, Landlord may bill Tenant for the cost of the repairs as additional rent, and said additional rent shall be payable by Tenant within ten (10) days.

(b) On the last day of the term hereof, or on any sooner termination, Tenant shall surrender the Premises to Landlord in good condition, ordinary wear and tear and casualty damage excepted, clean and free of debris and Tenant’s personal property. Tenant shall repair any damage to the Premises occasioned by the installation or removal of Tenant’s trade fixtures, furnishings and equipment. Landlord shall have the right to require Tenant to (i) remove any telecommunications or other cabling installed by Tenant in the Premises as part of the original tenant improvements (whether constructed by Landlord or Tenant) (collectively, “Cabling”) or (ii) leave all or part of the Cabling. If Landlord requires Tenant to leave all or part of the Cabling, each individual cable left by Tenant shall be tagged by Tenant both at the end of the cable in the Premises and at the end of the cable in the riser closet so that Landlord can easily determine where each individual cable begins and ends.

7.3 ALTERATIONS AND ADDITIONS.

(a) Except as provided below, Tenant shall not, without Landlord’s prior written consent, which may be given or withheld in Landlord’s commercially reasonable discretion, make any alterations, improvements, additions, utility installations or repairs (hereinafter collectively referred to as “Alterations”) in, on or about the Premises. Notwithstanding the foregoing, Landlord’s prior consent shall not be required for any non-structural Alterations (“Notice Only Alterations”) to the Premises that do not (i) involve the expenditure of more than $25,000 in the aggregate in any calendar year, (ii) affect the exterior appearance of the Building, (iii) affect the Building’s electrical, plumbing, HVAC, life, fire, safety or security systems, (iv) affect the structural elements of the Building or (v) adversely affect any other tenant of the Project; provided that Tenant shall provide Landlord with prior written notice of any Notice Only Alteration at least fifteen (15) business days’ prior to Tenant’s commencement of same. At the expiration of the term, Landlord may require the removal of any Alterations installed by Tenant and the restoration of the Premises to their prior condition, at Tenant’s expense; provided, however, notwithstanding the foregoing, Landlord shall notify Tenant whether the applicable Alteration will be required to be removed pursuant to the terms of this Section 7.3(a) at the time of Tenant’s request for Landlord’s consent to any Alteration.

(b) Notwithstanding the foregoing, Tenant shall be permitted to install the following tenant improvements within the Premises as an Alteration, at Tenant’s sole cost and expense, which may be removed (but shall not be required to be removed) by Tenant upon the expiration or earlier termination of this Lease: (i) removal of the wall recently installed in constructing the newer server room; (ii) update of kitchen and reception area; (iii) installation of lab benches, fume hoods, glass wash, and a water deionizer system; (iv) installation of appropriate tile floor in lab space; and (v) additional offices and conference rooms within the office area.

(c) Any Alterations in or about the Premises that Tenant shall desire to make shall be presented to Landlord in written form, with plans and specifications which are sufficiently detailed to obtain a building permit, if a building permit is required. If Landlord consents to an Alteration and the Alteration requires a building permit, the consent shall be deemed conditioned upon Tenant acquiring a building permit from the applicable governmental agencies, furnishing a copy thereof to Landlord prior to the commencement of the work, and compliance by Tenant with all conditions of said permit in a prompt and expeditious manner. Tenant shall provide Landlord with as-built plans and specifications for any Alterations made to the Premises.

(d) Tenant shall pay, when due, all claims for labor or materials furnished or alleged to have been furnished to or for Tenant at or for use in the Premises, which claims are or may be secured by any mechanic’s or materialmen’s lien against the Premises or the Project, or any interest therein. If Tenant shall, in good faith, contest the validity of any such lien, Tenant shall furnish to Landlord a surety bond satisfactory to Landlord in an amount equal to not less than one and one half times the amount of such contested lien claim indemnifying Landlord against liability arising out of such lien or claim. Such bond shall be sufficient in form and amount to free the Project from the effect of such lien. In addition, Landlord may require Tenant to pay Landlord’s reasonable attorneys’ fees and costs incurred as a result of any such lien.

(e) Tenant shall give Landlord not less than ten (10) days’ advance written notice prior to the commencement of any work in the Premises by Tenant, and Landlord shall have the right to post notices of non-responsibility in or on the Premises or the Project.

(f) All Alterations (whether or not such Alterations constitute trade fixtures of Tenant) which may be made to the Premises by Tenant shall be paid for by Tenant, at Tenant’s sole expense, and shall be made and done in a good and workmanlike manner, and in compliance with all applicable, laws, regulations, building codes and ordinances. Tenant’s personal property, fixtures and equipment, other than that which is affixed to the Premises so that it cannot be removed without material damage to the Premises or the Project, shall remain the property of Tenant and may be removed by Tenant.

8. INSURANCE.

8.1 INSURANCE-TENANT.

(a) Tenant shall obtain and keep in force during the term of this Lease a commercial general liability policy of insurance with coverages acceptable to Landlord, in Landlord’s reasonable discretion, which, by way of example and not limitation, protects Tenant and Landlord (as an additional insured) against claims for bodily injury, personal injury and property damage based upon, involving or arising out of the ownership, use, occupancy or maintenance of the Premises and all areas appurtenant thereto. Such insurance shall be on an occurrence basis providing coverage in an amount not less than $1,000,000 per occurrence and not less than $2,000,000 in the aggregate.

(b) Tenant shall obtain and keep in force during the term of this Lease “Causes of Loss – Special Form” extended coverage property insurance (previously known as “all risk” property insurance) with coverages acceptable to Landlord, in Landlord’s reasonable discretion. Said insurance shall be written on a one hundred percent (100%) replacement cost basis on Tenant’s personal property, all tenant improvements installed at the Premises by Landlord or Tenant, Tenant’s trade fixtures and other property. By way of example, and not limitation, such policies shall provide protection against any peril included within the classification “fire and extended coverage,” against vandalism and malicious mischief, theft and sprinkler leakage. To the extent that Tenant’s policy covers tenant improvements to the Premises, Landlord shall be a loss payee on such policy. If insurance proceeds are available to repair the tenant improvements, at Landlord’s option, all insurance proceeds Tenant is entitled to receive to repair the tenant improvements shall be paid by the insurance company directly to Landlord, Landlord shall select the contractor to repair and/or replace the tenant improvements, and Landlord shall cause the tenant improvements to be repaired and/or replaced to the extent insurance proceeds are available.

(c) Tenant shall, at all times during the term hereof, maintain the following insurance with coverages reasonably acceptable to Landlord: (i) workers’ compensation insurance as required by applicable law, (ii) employers liability insurance, and (iii) business interruption insurance.

8.2 INSURANCE-LANDLORD.

(a) Landlord shall obtain and keep in force a policy of general liability insurance with coverage against such risks and in such amounts as Landlord deems advisable insuring Landlord against liability arising out of the ownership, operation and management of the Project.

(b) Landlord (subject to Tenant’s obligation to pay Tenant’s share of Operating Expenses) shall maintain a policy or policies of replacement cost “special causes of loss” property insurance covering loss or damage to the structural and shell components of the Building and all improvements and alterations to the Building existing as of the Commencement Date (the “Structure and Shell”) for fire and such other hazards (including flood if Landlord so chooses) as are normally included in a “special loss” (formerly referred to as “all risk”) policy of insurance, or which are required by any lender of Landlord, with such deductibles as Landlord reasonably may determine. Landlord shall carry general liability insurance with policy limits of at least One Million Dollars ($1,000,000), which, if Landlord so chooses, will include a Loss of rent endorsement. Landlord also shall maintain an umbrella policy with policy limits of at least Five Million Dollars ($5,000,000).. In addition, Landlord shall have the right to obtain such additional insurance as is customarily carried by owners or operators of other comparable office buildings in the geographical area of the Project. Tenant will not be named as an additional insured in any insurance policies carried by Landlord and shall have no right to any proceeds therefrom. The policies purchased by Landlord shall contain such deductibles as Landlord may reasonably determine. In addition to amounts payable by Tenant in accordance with Section 4.2, Tenant shall pay any increase in the property insurance premiums for the Project over what was payable immediately prior to the increase to the extent the increase is specified by Landlord’s insurance carrier as being caused by the nature of Tenant’s occupancy.

8.3 INSURANCE POLICIES. Tenant shall deliver to Landlord certificates for the insurance policies required under Section 8.1 concurrently with the execution of this Lease using an ACORD 28 form or a similar form approved by Landlord. Tenant’s insurance policies shall provide that the insurance company shall endeavor to provide Landlord with at least thirty (30) days’ prior notice of cancellation, reduction of coverage or other material modification. Tenant shall, at least thirty (30) days prior to the expiration of such policies, furnish Landlord with renewals thereof. Tenant’s insurance policies shall be issued by insurance companies authorized to do business in the state in which the Project is located, and said companies shall maintain during the policy term a “General Policyholder’s Rating” of at least A and a financial rating of at least “Class VII” (or such other rating as may be required by any lender having a lien on the Project) as set forth in the most recent edition of “Best Insurance Reports.” All insurance obtained by Tenant shall be primary to and not contributory with any similar insurance carried by Landlord, whose insurance shall be considered excess insurance only. Landlord, Landlord’s property manager and lender(s) and their respective officers, shareholders, directors, partners, members, managers, employees, successors and assigns, shall be included as additional insureds under Tenant’s commercial general liability policy and under the Tenant’s excess or umbrella policy, if any, using ISO additional insured endorsement CG 20 11 or a substitute providing equivalent coverage.

8.4 WAIVER OF SUBROGATION. Landlord waives any and all rights of recovery against Tenant and Tenant’s employees and agents for or arising out of damage to, or destruction of, the Project to the extent that Landlord’s insurance policies then in force insure against such damage or destruction (or to the extent of what would have been covered had Landlord maintained the insurance required to be carried under this Lease) and permit such waiver. Tenant waives any and all rights of recovery against Landlord and Landlord’s employees and agents for or arising out of damage to, or destruction of, the Project to the extent that Tenant’s insurance policies then in force insure against such damage or destruction (or to the extent of what would have been covered had Tenant maintained the insurance required to be carried under this Lease) and permit such waiver. Tenant shall cause the insurance policies it obtains in accordance with Section 8.1 relating to property damage to provide that the insurance company waives all right of recovery by subrogation against Landlord in connection with any liability or damage covered by Tenant’s insurance policies.

9. DAMAGE OR DESTRUCTION.

9.1 EFFECT OF DAMAGE OR DESTRUCTION. If all or part of the Project is damaged by fire, earthquake, flood, explosion, the elements, riot, the release or existence of Hazardous Substances (as defined below) or by any other cause whatsoever (hereinafter collectively referred to as “Damages”), but the Damages are not material (as defined in Section 9.2 below), Landlord shall repair the Damages to the Project as soon as is reasonably possible, and this Lease shall remain in full force and effect. If all or part of the Project is destroyed or materially damaged (as defined in Section 9.2 below), Landlord shall have the right, in its sole and complete discretion, to repair or to rebuild the Project or to terminate this Lease. Landlord shall within thirty (30) days after the discovery of such material damage or destruction notify Tenant in writing of Landlord’s intention to repair or to rebuild or to terminate this Lease. Tenant shall in no event be entitled to compensation or damages on account of annoyance or inconvenience in making any repairs, or on account of construction, or on account of Landlord’s election to terminate this Lease. Notwithstanding the foregoing, if Landlord shall elect to rebuild or repair the Project after material damage or destruction, but in good faith determines that the Premises cannot be substantially repaired within ninety (90) days after the date of the discovery of the material damage or destruction, without payment of overtime or other premiums, and the damage to the Project will render the Premises unusable during said ninety (90) day period for Tenant’s intended use, Landlord shall notify Tenant thereof in writing at the time of Landlord’s election to rebuild or repair, and Tenant shall thereafter have a period of fifteen (15) days within which Tenant may elect to terminate this Lease, upon thirty (30) days’ advance written notice to Landlord. Tenant’s termination right described in the preceding sentence shall not apply if the damage was caused by the negligent or intentional acts of Tenant or its employees, agents, contractors or invitees. Failure of Tenant to exercise said election within said fifteen (15) day period shall constitute Tenant’s agreement to accept delivery of the Premises under this Lease whenever tendered by Landlord, provided Landlord thereafter pursues reconstruction or restoration diligently to completion, subject to delays caused by Force Majeure Events.

9.2 DEFINITION OF MATERIAL DAMAGE. Damage to the Project shall be deemed material if, in Landlord’s reasonable judgment, the uninsured cost of repairing the damage will exceed $50,000 (in excess of any deductible), unless Tenant agrees in its sole discretion to pay the excess uninsured cost over $50,000. Damage to the Project shall also be deemed material if (a) the Project cannot be rebuilt or repaired to substantially the same condition it was in prior to the damage due to laws or regulations in effect at the time the repairs will be made, (b) the holder of any mortgage or deed of trust encumbering the Project requires that insurance proceeds available to repair the damage in excess of $50,000 be applied to the repayment of the indebtedness secured by the mortgage or the deed of trust, or (c) the damage occurs during the last twelve (12) months of the Lease term.

9.3 ABATEMENT OF RENT. In the event that Tenant is prevented from using, and does not use, the Premises or any portion thereof as a result of damage to the Premises, and the damage was not caused by the negligence or intentional acts of Tenant or its employees, agents, contractors or invitees, then Tenant’s Base Rent and Tenant’s Share of Common Area Expense or Real Property Tax shall be abated or reduced, as the case may be, for such time that Tenant continues to be so prevented from using, and does not use, the Premises or a portion thereof, in the proportion that the rentable area of the portion of the Premises that Tenant is prevented from using, and does not use, bears to the total rentable area of the Premises.

9.4 TENANT’S PROPERTY. Subject to Section 8.1(b), Tenant shall repair or replace all of Tenant’s property at Tenant’s sole cost and expense. Tenant acknowledges that it is Tenant’s sole responsibility to obtain adequate insurance coverage to compensate Tenant for damage to Tenant’s property.

9.5 WAIVER. Landlord and Tenant hereby waive the provisions of any present or future statutes which relate to the termination of leases when leased property is damaged or destroyed and agree that such event shall be governed by the terms of this Lease.

10. REAL AND PERSONAL PROPERTY TAXES.

10.1 PAYMENT OF TAXES. Tenant shall pay to Landlord during the term of this Lease, in addition to Base Rent and Tenant’s Share of Common Area Expenses, Tenant’s Share of the amount of all “Real Property Taxes” (as defined in Section 10.2 below) accruing during the Term. Tenant’s Share of Real Property Taxes shall be payable by Tenant at the same time, in the same manner and under the same terms and conditions as Tenant pays Tenant’s Share of Common Area Expenses.

10.2 DEFINITION OF “REAL PROPERTY TAX”. As used herein, the term “Real Property Taxes” shall include any form of real estate tax or assessment, general, special, ordinary or extraordinary, improvement bond or bonds imposed on the Project or any portion thereof by any authority having the direct or indirect power to tax, including any city, county, state or federal government, or any school, agricultural, sanitary, fire, street, drainage or other improvement district thereof, as against any legal or equitable interest of Landlord in the Project or in any portion thereof, unless such tax is defined as an Common Area Expense by Section 4.2(b). Real Property Taxes shall not include income, inheritance, gift taxes, excess profits taxes, franchise taxes, capital stock taxes, inheritance and succession taxes, estate taxes, and other taxes to the extent applicable to Landlord’s general or net income (as opposed to rents, receipts or income attributable to operations at the Project), or any items included as Common Area Expenses.

10.3 PERSONAL PROPERTY TAXES. Tenant shall pay prior to delinquency all taxes assessed against and levied upon trade fixtures, furnishings, equipment and all other personal property of Tenant contained in the Premises or related to Tenant’s use of the Premises. If any of Tenant’s personal property shall be assessed with Landlord’s real or personal property, Tenant shall pay to Landlord the taxes attributable to Tenant within ten (10) days after receipt of a written statement from Landlord setting forth the taxes applicable to Tenant’s property.

10.4 REASSESSMENTS. From time to time Landlord may challenge the assessed value of the Project as determined by applicable taxing authorities and/or Landlord may attempt to cause the Real Property Taxes to be reduced on other grounds. If Landlord is successful in causing the Real Property Taxes to be reduced or in obtaining a refund, rebate, credit or similar benefit (hereinafter collectively referred to as a “Reduction”), Landlord shall, to the extent practicable, credit the Reduction(s) to Real Property Taxes for the calendar year to which a Reduction applies and recalculate the Real Property Taxes owed by Tenant for years after the year in which the Reduction applies based on the reduced Real Property Taxes (if a Reduction applies to Tenant’s Base Year, the Base Year Real Property Taxes shall be reduced by the amount of the Reduction and Tenant’s Share of Real Property Taxes shall be recalculated for all years following the year of the Reduction based on the lower Base Year amount). All costs incurred by Landlord in obtaining and/or processing the Real Property Tax reductions (e.g., consulting fees, accounting fees, etc.) may be included in Common Area Expenses or deducted from the Reduction. Landlord shall have the right to compensate a person or entity it employs to obtain a Reduction by giving such person or entity a percentage of any Reduction obtained.

11. UTILITIES.

11.1 SERVICES PROVIDED BY LANDLORD. Subject to all governmental rules, regulations and guidelines applicable thereto, and as a n element of Common Area Expenses, Landlord shall provide water and electricity for the Common Areas and trash removal for the Project.

11.2 UTILITIES. Tenant shall, at its cost, provide for all utility service for utilities that are separately metered to the Premises from the appropriate utility service providers. Tenant shall pay all charges of such Utilities actually used on the Premises during the Term of this Lease.

12. ASSIGNMENT AND SUBLETTING.

12.1 LANDLORD’S CONSENT REQUIRED. Tenant shall not voluntarily or by operation of law assign, transfer, hypothecate, mortgage, sublet, or otherwise transfer or encumber all or any part of Tenant’s interest in this Lease or in the Premises (hereinafter collectively a “Transfer”), without Landlord’s prior written consent, which shall not be unreasonably withheld. Landlord shall respond to Tenant’s written request for consent hereunder within fifteen (15) days after Landlord’s receipt of the written request from Tenant. Any attempted Transfer without such consent shall be void and shall constitute a default and breach of this Lease. Tenant’s written request for Landlord’s consent shall include, and Landlord’s within fifteen (15) day response period referred to above shall not commence, unless and until Landlord has received from Tenant, all of the following information: (a) financial statements for the proposed assignee or subtenant prepared in accordance with accounting principles consistently applied for the lesser of (i) the past three (3) years or (ii) the time period the assignee or subtenant has been in existence, (b) a detailed description of the business the assignee or subtenant intends to operate at the Premises, (c) the proposed effective date of the assignment or sublease, (d) a copy of the proposed sublease or assignment agreement which includes all of the terms and conditions of the proposed assignment or sublease, (e) a detailed description of any ownership or commercial relationship between Tenant and the proposed assignee or subtenant and (f) a detailed description of any Alterations the proposed assignee or subtenant desires to make to the Premises. Notwithstanding anything to the contrary contained in this Lease, an assignment or subletting of all or a portion of the Premises: (x) to a corporation or other business entity (“Successor Entity”) into or with which Tenant shall be merged or consolidated, or to which substantially all of the assets of Tenant may be transferred, and provided that the successor corporation shall assume in writing all of the obligations and liabilities of Tenant under this Lease; or (y) to a corporation or other business entity (herein sometimes referred to as a “Related Entity”) which shall control, be controlled by or be under common control with Tenant (any such assignee or sublessee described in items (x) and (y) of this Section 12.1 hereinafter referred to as a “Permitted Transferee”), shall not be considered a Transfer, provided that (i) Tenant notifies Landlord of any such assignment or sublease and promptly supplies Landlord with any documents or information reasonably requested by Landlord regarding such transfer or transferee as set forth above, (ii) such assignment or sublease is not a subterfuge by Tenant to avoid its obligations under this Lease, it being understood that such Transferee shall thereafter become liable under this Lease, on a joint and several basis, with Tenant, (iii) any Permitted Transferee shall be of a character and reputation consistent with the quality of the Building, (iv) in the case of an assignment, such Successor Entity or Related Entity, as applicable, together with the original Tenant, shall have a tangible net worth (not including goodwill as an asset) computed in accordance with generally accepted accounting principles (excluding goodwill as an asset) at least equal to that of original Tenant as of the date of this Lease, and, in Landlord’s reasonable judgment, is otherwise equally able as Tenant to meet the Tenant’s financial obligations under this Lease as and when they are due and payable, and (v) any lender of Landlord’s which is required to give consent to the transfer does so. “Control,” as used in this Section 12.1, shall mean the ownership, directly or indirectly, of at least fifty-one percent (51%) of the voting securities of, or possession of the right to vote, in the ordinary direction of its affairs, of at least fifty-one percent (51%) of the voting interest in, any person or entity.

12.2 STANDARD FOR APPROVAL. Landlord shall not unreasonably withhold its consent to a Transfer provided that Tenant has complied with each and every requirement, term and condition of this Section 12. Tenant acknowledges and agrees that each requirement, term and condition in this Section 12 is a reasonable requirement, term or condition. It shall be deemed reasonable for Landlord to withhold its consent to a Transfer if any requirement, term or condition of this Section 12 is not complied with or: (a) the Transfer would cause Landlord to be in violation of its obligations under another lease or agreement to which Landlord is a party; (b) in Landlord’s reasonable judgment, a proposed assignee or subtenant has, together with the net worth of the original Tenant, a smaller net worth than Tenant had on the date this Lease was entered into with Tenant or is less able financially to pay the rents due under this Lease as and when they are due and payable; (c) the terms of a proposed assignment or subletting will allow the proposed assignee or subtenant to exercise a right of renewal, right of expansion, right of first offer, right of first refusal or similar right held by Tenant; (d) a proposed assignee or subtenant refuses to enter into a written assignment agreement or sublease, reasonably satisfactory to Landlord, which provides that it will abide by and assume all of the terms and conditions of this Lease for the term of any assignment or sublease and containing such other terms and conditions as Landlord reasonably deems necessary; (e) the use of the Premises by the proposed assignee or subtenant is not permitted by this Lease; (f) any guarantor of this Lease refuses to consent to the Transfer or to execute a written agreement reaffirming the guaranty; (g) Tenant is in default as defined in Section 13.1 at the time of the request; (h) if requested by Landlord, the assignee or subtenant refuses to sign a non-disturbance and attornment agreement in favor of Landlord’s lender; (i) Landlord has sued or been sued by the proposed assignee or subtenant or has otherwise been involved in a legal dispute with the proposed assignee or subtenant; (j) the assignee or subtenant is involved in a business which is not in keeping with the then current standards of the Project; or (k) the assignee or subtenant is a governmental or quasi-governmental entity or an agency, department or instrumentality of a governmental or quasi-governmental agency.

12.3 TRANSFER PREMIUM FROM ASSIGNMENT OR SUBLETTING. Landlord shall be entitled to receive from Tenant (as and when received by Tenant) as an item of additional rent one-half of all amounts received by Tenant from the assignee or subtenant in excess of the amounts payable by Tenant to Landlord hereunder (the “Transfer Premium”). The Transfer Premium shall be reduced by the reasonable brokerage commissions, tenant improvement costs and legal fees actually paid by Tenant in order to assign the Lease or to sublet all or part of the Premises. “Transfer Premium” shall mean all Base Rent, additional rent or other consideration of any type whatsoever payable by the assignee or subtenant in excess of the Base Rent and additional rent payable by Tenant under this Lease. If less than all of the Premises is subleased, for purposes of calculating the Transfer Premium, the Base Rent and the additional rent due under this Lease shall be allocated to the subleased premises on a per rentable square foot basis (e.g., if one-half of the Premises is subleased, for purposes of determining the amount of the Transfer Premium, one-half of the Base Rent and additional rent due under this Lease would be allocated to the subleased premises, and this amount would be subtracted from the base rent, additional rent and other monies payable to Tenant under the sublease). “Transfer Premium” shall also include, but not be limited to, key money and bonus money paid by the assignee or subtenant to Tenant in connection with such Transfer, and any payment in excess of fair market value for services rendered by Tenant to the assignee or subtenant or for assets, fixtures, inventory, equipment, or furniture transferred by Tenant to the assignee or subtenant in connection with such Transfer. Landlord and Tenant agree that the foregoing Transfer Premium is reasonable.

12.4 LANDLORD’S EXPENSES. In the event Tenant shall assign this Lease or sublet the Premises or request the consent of Landlord to any Transfer, then Tenant shall pay Landlord’s reasonable out-of-pocket costs and expenses incurred in connection therewith, including, but not limited to, attorneys’, architects’, accountants’, engineers’ or other consultants’ fees, in an amount not to exceed $2,500.

13. DEFAULT; REMEDIES.

13.1 DEFAULT BY TENANT. Landlord and Tenant hereby agree that the occurrence of any one or more of the following events is a default by Tenant under this Lease and that said default shall give Landlord the rights described in Section 13.2. Landlord or Landlord’s authorized agent shall have the right to execute and to deliver any notice of default, notice to pay rent or quit or any other notice Landlord gives Tenant.

(a) Tenant’s failure to make any payment of Base Rent, Tenant’s Share of Common Area Expense increases, Tenant’s Share of Real Property Taxes, late charges, or any other payment required to be made by Tenant hereunder, as and when due, where such failure shall continue for a period of three (3) business days after written notice thereof from Landlord to Tenant.

(b) Tenant’s failure to make any payment of Base Rent, Tenant’s Share of Common Area Expenses, Tenant’s Share of Real Property Taxes, late charges, or any other payment required to be made by Tenant hereunder, as and when due, more than three times in succession, or, in the case of Base Rent, more than four times in any twelve month period,

(c) The abandonment of the Premises by Tenant coupled with the nonpayment of rent in which event Landlord shall not be obligated to give any notice of default to Tenant.

(d) The failure by Tenant to observe or perform any of the covenants, conditions or provisions of this Lease to be observed or performed by Tenant (other than those referenced in Sections 13.1(a) and (b), above), where such failure shall continue for a period of thirty (30) days after written notice thereof from Landlord to Tenant; provided, however, that if the nature of Tenant’s non-performance is such that more than thirty (30) days are reasonably required for its cure, then Tenant shall not be deemed to be in default if Tenant commences such cure within said thirty (30) day period and thereafter diligently pursues such cure to completion.

(e) (i) The making by Tenant or any guarantor of Tenant’s obligations hereunder of any general arrangement or general assignment for the benefit of creditors; (ii) Tenant or any guarantor becoming a “debtor” as defined in 11 U.S.C. 101 or any successor statute thereto (unless, in the case of a petition filed against Tenant or guarantor, the same is dismissed within sixty (60) days); (iii) the appointment of a trustee or receiver to take possession of substantially all of Tenant’s assets located at the Premises or of Tenant’s interest in this Lease, where possession is not restored to Tenant within thirty (30) days; (iv) the attachment, execution or other judicial seizure of substantially all of Tenant’s assets located at the Premises or of Tenant’s interest in this Lease, where such seizure is not discharged within thirty (30) days; or (v) the insolvency of Tenant. In the event that any provision of this Section 13.1(d) is unenforceable under applicable law, such provision shall be of no force or effect.

13.2 REMEDIES.

(a) In the event of any default or breach of this Lease by Tenant, Landlord may, at any time thereafter, with or without notice or demand, and without limiting Landlord in the exercise of any other right or remedy which Landlord may have by reason of such default:

(i) terminate Tenant’s right to possession of the Premises by any lawful means, in which case this Lease and the term hereof shall terminate and Tenant shall immediately surrender possession of the Premises to Landlord. If Landlord terminates this Lease, Landlord may recover from Tenant (A) the worth at the time of award of the unpaid rent which had been earned at the time of termination; (B) the worth at the time of award of the amount by which the unpaid rent which would have been earned after termination until the time of award exceeds the amount of such rental loss that Tenant proves could have been reasonably avoided; (C) the worth at the time of award of the amount by which the unpaid rent for the balance of the term after the time of award exceeds the amount of such rental loss that Tenant proves could be reasonably avoided; and (D) any other amount necessary to compensate Landlord for all detriment proximately caused by Tenant’s failure to perform its obligations under the Lease or which in the ordinary course of things would be likely to result therefrom, including, but not limited to, the cost of recovering possession of the Premises, expenses of releasing, including necessary renovation and alteration of the Premises, reasonable attorneys’ fees, any real estate commissions actually paid by Landlord and the unamortized value of any free rent, reduced rent, tenant improvement allowance or other economic concessions provided by Landlord. The “worth at time of award” of the amounts referred to in Section 13.2(a)(i)(A) and (B) shall be computed by allowing interest at ten percent (10%) per annum. The worth at the time of award of the amount referred to in Section 13.2(a)(i)(C) shall be computed by discounting such amount at the discount rate of the Federal Reserve Bank of San Francisco at the time of award plus one percent (1%). For purposes of this Section 13.2(a)(i), “rent” shall be deemed to be all monetary obligations required to be paid by Tenant pursuant to the terms of this Lease;

(ii) maintain Tenant’s right of possession in which event Landlord shall have the remedy described in California Civil Code Section 1951.4 which permits Landlord to continue this Lease in effect after Tenant’s breach and abandonment and recover rent as it becomes due. In the event Landlord elects to continue this Lease in effect, Tenant shall have the right to sublet the Premises or assign Tenant’s interest in the Lease subject to the reasonable requirements contained in Section 12 of this Lease and provided further that Landlord shall not require compliance with any standard or condition contained in Section 12 that has become unreasonable at the time Tenant seeks to sublet or assign the Premises pursuant to this Section 13.2(a)(ii);

(iii) collect sublease rents (or appoint a receiver to collect such rent) and otherwise perform Tenant’s obligations at the Premises, it being agreed, however, that the appointment of a receiver for Tenant shall not constitute an election by Landlord to terminate this Lease; and

(iv) pursue any other remedy now or hereafter available to Landlord under the laws or judicial decisions of the state in which the Premises are located.

(b) No remedy or election hereunder shall be deemed exclusive, but shall, wherever possible, be cumulative with all other remedies at law or in equity. The expiration or termination of this Lease and/or the termination of Tenant’s right to possession of the Premises shall not relieve Tenant of liability under any indemnity provisions of this Lease as to matters occurring or accruing during the term of the Lease or by reason of Tenant’s occupancy of the Premises.

(c) If Tenant abandons the Premises, Landlord may re-enter the Premises and such re-entry shall not be deemed to constitute Landlord’s election to accept a surrender of the Premises or to otherwise relieve Tenant from liability for its breach of this Lease. No surrender of the Premises shall be effective against Landlord unless Landlord has entered into a written agreement with Tenant in which Landlord expressly agrees to accept a surrender of the Premises and relieve Tenant of liability under the Lease. The delivery by Tenant to Landlord of possession of the Premises shall not constitute the termination of the Lease or the surrender of the Premises, unless agreed in writing by Landlord.

13.3 DEFAULT BY LANDLORD. Landlord shall not be in default under this Lease unless Landlord fails to perform obligations required of Landlord within thirty (30) days after written notice by Tenant to Landlord and to the holder of any mortgage or deed of trust encumbering the Project whose name and address shall have theretofore been furnished to Tenant in writing, specifying wherein Landlord has failed to perform such obligation; provided, however, that if the nature of Landlord’s obligation is such that more than thirty (30) days are required for its cure, then Landlord shall not be in default if Landlord commences performance within such thirty (30) day period and thereafter diligently pursues the same to completion.

13.4 LATE CHARGES AND DISHONORED CHECK CHARGES. Tenant hereby acknowledges that late payment by Tenant to Landlord of Base Rent, Tenant’s Share of Common Area Expense or Real Property Taxes or other sums due hereunder, or payment of any of the foregoing with a check that is dishonored, will cause Landlord to incur costs not contemplated by this Lease, the exact amount of which will be extremely difficult to ascertain. Such costs include, but are not limited to, processing and accounting charges and late charges which may be imposed on Landlord by the terms of any mortgage or trust deed encumbering the Project. Accordingly, if any installment of Base Rent, Tenant’s Share of Common Area Expense or Real Property Taxes, or any other sum due from Tenant shall not be received by Landlord within five (5) days of the date when such amount shall be due, or if any check tendered by Tenant id dishonored by the issuing bank, then, without any requirement for notice or demand to Tenant, Tenant shall immediately owe and pay to Landlord a late charge equal to five percent (5%) of such overdue amount. The parties hereby agree that such late charge and dishonored check charge represent a fair and reasonable estimate of the costs Landlord will incur by reason of late payment by Tenant, or dishonored check. Acceptance of such late charge or dishonored check charge by Landlord shall in no event constitute a waiver of Tenant’s default with respect to such overdue amount, nor prevent Landlord from exercising any of the other rights and remedies granted hereunder including the assessment of interest under Section 13.5. Notwithstanding the foregoing, Landlord shall waive the application of such late charge or dishonored check charge once per 12-month period provided that Tenant pays the delinquent or unpaid sum within five (5) business days after receipt of written notice from Landlord that such amount was not paid when due.

13.5 INTEREST ON PAST-DUE OBLIGATIONS. Except as expressly herein provided, any amount due to Landlord that is not paid within five (5) days of the date when due shall bear interest at the lesser of ten percent (10%) per annum or the maximum rate permitted by applicable law. Payment of such interest shall not excuse or cure any default by Tenant under this Lease; provided, however, that interest shall not be payable on late charges incurred by Tenant nor on any amounts upon which late charges are paid by Tenant.

13.6 PAYMENT OF RENT AND SECURITY DEPOSIT AFTER DEFAULT. In addition to the remedies provided in section 13.1(b), if Tenant fails to pay Base Rent, Tenant’s Share of Common Area Expense or Real Property Taxes or any other monetary obligation due hereunder on the date it is due and such nonpayment results in a default (beyond any applicable notice and cure period), then after Tenant’s third failure to pay any monetary obligation on the date it is due, at Landlord’s option, all monetary obligations of Tenant hereunder shall thereafter be paid by cashier’s check, and Tenant shall, upon demand, provide Landlord with an additional security deposit equal to three (3) multiplied by the monthly Base Rent due on the date of Landlord’s demand. If Landlord has required Tenant to make said payments by cashier’s check or to provide an additional security deposit, Tenant’s failure to make a payment by cashier’s check or to provide the additional security deposit shall be a default hereunder.

14. LANDLORD’S RIGHT TO CURE DEFAULT; PAYMENTS BY TENANT. All covenants and agreements to be kept or performed by Tenant under this Lease shall be performed by Tenant at Tenant’s sole cost and expense and without any reduction of rent. If Tenant shall fail to perform any of its obligations under this Lease, within a reasonable time after such performance is required by the terms of this Lease, Landlord may, but shall not be obligated to, after three (3) days prior written notice to Tenant, make any such payment or perform any such act on Tenant’s behalf without waiving its rights based upon any default of Tenant and without releasing Tenant from any obligations hereunder. Tenant shall pay to Landlord, within ten (10) days after delivery by Landlord to Tenant of statements therefore, an amount equal to the expenditures reasonably made by Landlord in connection with the remedying by Landlord of Tenant’s defaults pursuant to the provisions of this Section 14.

15. CONDEMNATION. If any portion of the Premises or the Project are taken under the power of eminent domain, or sold under the threat of the exercise of said power (all of which are herein called “condemnation”), this Lease shall terminate as to the part so taken as of the date the condemning authority takes title or possession, whichever first occurs; provided that if so much of the Premises or Project are taken by such condemnation as would substantially and adversely affect the operation and profitability of Tenant’s business conducted from the Premises, and said taking lasts for ninety (90) days or more, Tenant shall have the option, to be exercised only in writing within thirty (30) days after Landlord shall have given Tenant written notice of such taking (or in the absence of such notice, within thirty (30) days after the condemning authority shall have taken possession), to terminate this Lease as of the date the condemning authority takes such possession. If a taking lasts for less than ninety (90) days, Tenant’s rent shall be abated during said period but Tenant shall not have the right to terminate this Lease. If Tenant does not terminate this Lease in accordance with the foregoing, this Lease shall remain in full force and effect as to the portion of the Premises remaining, except that the rent and Tenant’s Share of Common Area Expenses shall be reduced in the proportion that the usable floor area of the Premises taken bears to the total usable floor area of the Premises. Common Areas taken shall be excluded from the Common Areas usable by Tenant and no reduction of rent shall occur with respect thereto or by reason thereof. Landlord shall have the option in its sole discretion to terminate this Lease as of the taking of possession by the condemning authority, by giving written notice to Tenant of such election within thirty (30) days after receipt of notice of a taking by condemnation of any material part of the Premises or the Project. Any award for the taking of all or any part of the Premises or the Project under the power of eminent domain or any payment made under threat of the exercise of such power shall be the property of Landlord, whether such award shall be made as compensation for diminution in value of the leasehold, for good will, for the taking of the fee, as severance damages, or as damages for tenant improvements; provided, however, that Tenant shall be entitled to any separate award for loss of or damage to Tenant’s removable personal property and for moving expenses. In the event that this Lease is not terminated by reason of such condemnation, and subject to the requirements of any lender that has made a loan to Landlord encumbering the Project, Landlord shall to the extent of severance damages received by Landlord in connection with such condemnation, repair any damage to the Project caused by such condemnation except to the extent that Tenant has been reimbursed therefor by the condemning authority. This section, not general principles of law or California Code of Civil Procedure Sections 1230.010 et seq., shall govern the rights and obligations of Landlord and Tenant with respect to the condemnation of all or any portion of the Project.

16. VEHICLE PARKING. Tenant shall have the right to 3.3 parking spaces per 1,000 square feet of the Premises, on an unassigned basis within the parking areas serving the Project. Tenant shall have use of the electric charging stations in the Project on a non-exclusive basis. Parking shall be at no charge to Tenant.

17. BROKER’S FEE. Tenant and Landlord each represent and warrant to the other that neither has had any dealings or entered into any agreements with any person, entity, broker or finder other than the persons, if any, listed in Section 1.13, in connection with the negotiation of this Lease, and no other broker, person, or entity is entitled to any commission or finder’s fee in connection with the negotiation of this Lease, and Tenant and Landlord each agree to indemnify, defend and hold the other harmless from and against any claims, damages, costs, expenses, attorneys’ fees or liability for compensation or charges which may be claimed by any such unnamed broker, finder or other similar party by reason of any dealings, actions or agreements of the indemnifying party. Landlord shall pay all commissions owed to the brokers listed in Section 1.13 in connection with this Lease pursuant to a separate agreement.

18. DELIVERY OF CERTIFICATE. Tenant shall from time to time upon not less than ten (10) days’ prior written notice from Landlord execute, acknowledge and deliver to Landlord a statement in writing certifying the following: (a) that this Lease is unmodified and in full force and effect (or, if modified, stating the nature of such modification and certifying that this Lease, as so modified, is in full force and effect) (b) the date to which the Base Rent and other charges are paid in advance and the amounts so payable, (c) that there are not, to Tenant’s knowledge, any uncured defaults or unfulfilled obligations on the part of Landlord, or specifying such defaults or unfulfilled obligations, if any are claimed, (d) that all tenant improvements to be constructed by Landlord, if any, have been completed in accordance with Landlord’s obligations and (e) that Tenant has taken possession of the Premises. Any such statement may be conclusively relied upon by any prospective purchaser or encumbrancer of the Project.

19. FINANCIAL INFORMATION. From time to time, at Landlord’s request (but not more than once in any given 12-month period), Tenant shall cause the following financial information to be delivered to Landlord, at Tenant’s sole cost and expense, upon not less than thirty (30) days’ advance written notice from Landlord, a current financial statement for Tenant and Tenant’s financial statements for the previous two accounting years. All financial statements shall be prepared in accordance with accounting principles consistently applied and, if such is the normal practice of Tenant, shall be audited by an independent certified public accountant if such audited financial statements are then available.

20. LANDLORD’S LIMITED LIABILITY. Tenant acknowledges that Landlord shall have the right to transfer all or any portion of its interest in the Project and to assign this Lease to the transferee. Tenant agrees that in the event of such a transfer (and assignment of this Lease to the transferee), Landlord shall automatically be released from all liability under this Lease; and Tenant hereby agrees to look solely to Landlord’s transferee for the performance of Landlord’s obligations hereunder after the date of the transfer. Upon such a transfer, Landlord shall, at its option, return Tenant’s security deposit to Tenant or transfer Tenant’s security deposit to Landlord’s transferee and, in either event, Landlord shall have no further liability to Tenant for the return of its security deposit. Subject to the rights of any lender holding a mortgage or deed of trust encumbering all or part of the Project, Tenant agrees to look solely to Landlord’s equity interest in the Project for the collection of any judgment requiring the payment of money by Landlord arising out of (a) Landlord’s failure to perform its obligations under this Lease or (b) the negligence or willful misconduct of Landlord, its partners, employees and agents. No other property or assets of Landlord shall be subject to levy, execution or other enforcement procedure for the satisfaction of any judgment or writ obtained by Tenant against Landlord. No partner, employee, officer, director, member or agent of Landlord shall be personally liable for the performance of Landlord’s obligations hereunder or be named as a party in any lawsuit arising out of or related to, directly or indirectly, this Lease and the obligations of Landlord hereunder. The obligations under this Lease do not constitute personal obligations of the individual partners of Landlord, if any, and Tenant shall not seek recourse against the individual partners of Landlord or their assets.