Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Commercial Vehicle Group, Inc. | barringtonconf8k.htm |

EXHIBIT 99.1

BARRINGTON INVESTOR CONFERENCE May 21, 2020 Harold Bevis President & CEO Tim Trenary CFO & Treasurer Kirk Feiler VP Finance & Investor Relations

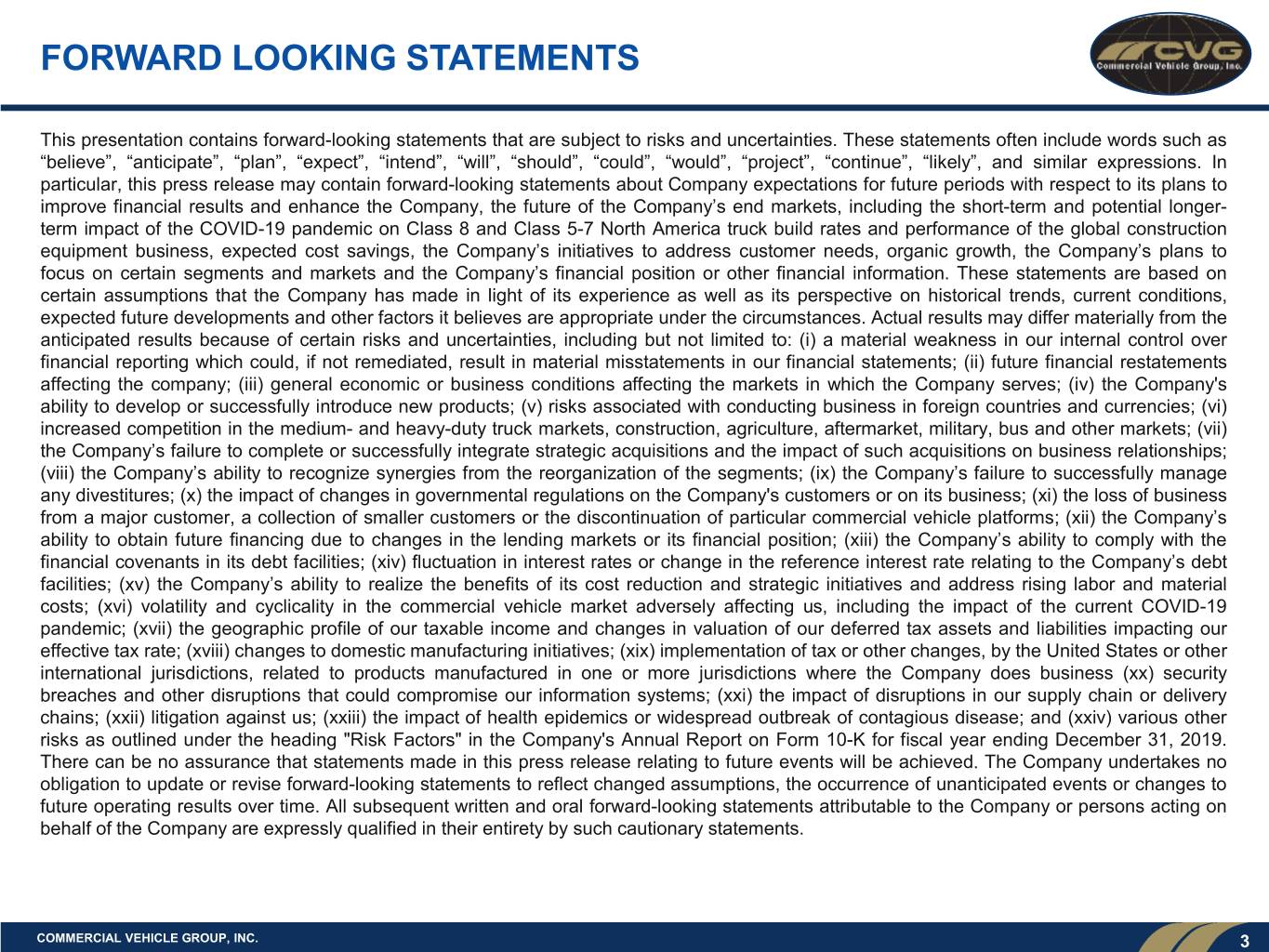

FORWARD LOOKING STATEMENTS This presentation contains forward-looking statements that are subject to risks and uncertainties. These statements often include words such as “believe”, “anticipate”, “plan”, “expect”, “intend”, “will”, “should”, “could”, “would”, “project”, “continue”, “likely”, and similar expressions. In particular, this press release may contain forward-looking statements about Company expectations for future periods with respect to its plans to improve financial results and enhance the Company, the future of the Company’s end markets, including the short-term and potential longer- term impact of the COVID-19 pandemic on Class 8 and Class 5-7 North America truck build rates and performance of the global construction equipment business, expected cost savings, the Company’s initiatives to address customer needs, organic growth, the Company’s plans to focus on certain segments and markets and the Company’s financial position or other financial information. These statements are based on certain assumptions that the Company has made in light of its experience as well as its perspective on historical trends, current conditions, expected future developments and other factors it believes are appropriate under the circumstances. Actual results may differ materially from the anticipated results because of certain risks and uncertainties, including but not limited to: (i) a material weakness in our internal control over financial reporting which could, if not remediated, result in material misstatements in our financial statements; (ii) future financial restatements affecting the company; (iii) general economic or business conditions affecting the markets in which the Company serves; (iv) the Company's ability to develop or successfully introduce new products; (v) risks associated with conducting business in foreign countries and currencies; (vi) increased competition in the medium- and heavy-duty truck markets, construction, agriculture, aftermarket, military, bus and other markets; (vii) the Company’s failure to complete or successfully integrate strategic acquisitions and the impact of such acquisitions on business relationships; (viii) the Company’s ability to recognize synergies from the reorganization of the segments; (ix) the Company’s failure to successfully manage any divestitures; (x) the impact of changes in governmental regulations on the Company's customers or on its business; (xi) the loss of business from a major customer, a collection of smaller customers or the discontinuation of particular commercial vehicle platforms; (xii) the Company’s ability to obtain future financing due to changes in the lending markets or its financial position; (xiii) the Company’s ability to comply with the financial covenants in its debt facilities; (xiv) fluctuation in interest rates or change in the reference interest rate relating to the Company’s debt facilities; (xv) the Company’s ability to realize the benefits of its cost reduction and strategic initiatives and address rising labor and material costs; (xvi) volatility and cyclicality in the commercial vehicle market adversely affecting us, including the impact of the current COVID-19 pandemic; (xvii) the geographic profile of our taxable income and changes in valuation of our deferred tax assets and liabilities impacting our effective tax rate; (xviii) changes to domestic manufacturing initiatives; (xix) implementation of tax or other changes, by the United States or other international jurisdictions, related to products manufactured in one or more jurisdictions where the Company does business (xx) security breaches and other disruptions that could compromise our information systems; (xxi) the impact of disruptions in our supply chain or delivery chains; (xxii) litigation against us; (xxiii) the impact of health epidemics or widespread outbreak of contagious disease; and (xxiv) various other risks as outlined under the heading "Risk Factors" in the Company's Annual Report on Form 10-K for fiscal year ending December 31, 2019. There can be no assurance that statements made in this press release relating to future events will be achieved. The Company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time. All subsequent written and oral forward-looking statements attributable to the Company or persons acting on behalf of the Company are expressly qualified in their entirety by such cautionary statements. COMMERCIAL VEHICLE GROUP, INC. 3

AT A GLANCE WHAT WE DO Sales Breakdown 1 1 ► Leading supplier of BY REGION BY PRODUCT BY END MARKET electrical wire harnesses, seating systems, 9% 15% 17% engineered plastic parts, electro-mechanical 16% 42% 38% products 18% 16% 75% ► Focus on highly-complex, 7% 7% low to medium volume 22% applications 18% Americas Seating Truck ► Growing in material Europe Wire Harness Construction Electro-mechanical assemblies Asia Pacific FSE / Electro-Mech handling, industrial Trim automation, and military Other Aftermarket Other ► Serve global markets including medium- and Business Overview heavy-duty truck, medium- and heavy- Global footprint Leading supplier Growing provider construction vehicle, with 25 facilities on four of electrical wire of control panels and military, bus, agriculture, continents harnesses, seating electro-mechanical specialty transportation, systems and other cab assemblies mining, industrial related products equipment, and off-road recreational products 1 pro forma FSE COMMERCIAL VEHICLE GROUP, INC. INVESTOR PRESENTATION 4

INVESTMENT HIGHLIGHTS Leading supplier of electrical wire harnesses, seating systems, engineered plastic components, and electromechanical assemblies Truck and construction Leading supplier to Expanding into core markets in cyclical sophisticated global new and adjacent markets trough with projected equipment manufacturers leverage know-how, improve recovery and category leaders margins, and mitigate impact of cyclicality Heavy-Duty (Class 8) Build (000’s) 324 345 333 286 189 117 2018 2019 2020E 2021E 2022E 2023E Sources: May 2020 ACT Research Report COMMERCIAL VEHICLE GROUP, INC. INVESTOR PRESENTATION 5

FSE BUSINESS SEGMENTS ARE GROWING ► Quarterly revenue grew 30% sequentially ► Surge in demand from industrial customers driven by increasing importance of e-commerce, and military ► Expanding production from one plant to three, using CVG facilities ► Healthy order book in FSE’s core business ► FSE enhancing CVG sales diversification as expected Q1 2019 CVG Sales Q1 2020 CVG Sales 7% FSE / Electro Mechanical Assemblies 16% 20% 19% Global Construction 18% 14% North American Truck 16% 50% Aftermarket 40% All Other FSE acquisition improves diversification and growth opportunities COMMERCIAL VEHICLE GROUP, INC. 6

Q1 2020 SNAPSHOT AND BUSINESS UPDATE ► Business performed as expected prior to onset of pandemic ► Revenue of $187.1 million, compared to $243.2 million in 1Q 2019 • Cyclical decline in North American medium- and heavy-duty truck and global construction • FSE contributed $13 million in Q1 2020, strength in material handling and military ► Adjusted operating income performance in line with expectations vs 1Q prior year and sequential improvements vs 4Q 2019 ► $33.7 million pre-tax special charges • $28.9 million non-cash impairment, primarily goodwill • $2.4 million investigation • $2.3 million CEO transition • $0.1 million restructuring ► At March 31, 2020, total liquidity was $114 million; $58 million of cash and $56 million of availability on the revolving line of credit ► Q2 Outlook • Second quarter 2020 North American heavy-duty and medium-duty truck build expected to decline 65% to 75% as compared to the first quarter of 2020 • Although the Company's other end markets are not expected to decline as dramatically, we expect revenues for the three months ending June 30, 2020 to be significantly lower than the three months ending March 31, 2020 COMMERCIAL VEHICLE GROUP, INC. 7

COVID-19 IMPACT AND RECOVERY ACTIONS Working Towards Health & Safety Cost Reductions Recovery ► Remote working ► Compensation reductions ► Working closely with customers to restart ► Facility closures ► Furloughs/ reductions in force ► Preserving our capabilities ► Social distancing to grow the business requirements including ► Elimination of travel and group meeting discretionary expenses ► Capitalizing on growth restrictions opportunities in material ► Aggressively managing handling and military ► Heightened cleaning and working capital applications sanitizing processes ► Evaluating further cost ► Amended lender ► Provided personal reduction measures as agreements for added protective equipment necessary flexibility ► Utilized idle facility to produce masks for employees and their families Positioned to emerge from the crisis in a stronger position COMMERCIAL VEHICLE GROUP, INC. 8

ACTIONS TAKEN TO OFFSET IMPACT OF COVID-19 Excerpt from April 13 press release: • 50% reduction of the compensation for Chief Executive Officer, Harold Bevis • 40% reduction of the compensation for the remaining executive leadership team • 20% reduction of base wages for all global salaried personnel through a combination of furloughs and reductions, in accordance with local laws, regulations, and labor agreements • 20% reduction of annual cash retainer compensation for CVG's Board of Directors • Select reduction in workforce and furloughing of production employees • Elimination of discretionary expenses and non-essential capital expenditures • Elimination of 2020 401K matching program • Curtailment of operations at select facilities to align with current demand levels and adhere to state and local government mandates • Reductions in working capital including specific plans to reduce purchases of raw material • Implementation of more aggressive industrial hygiene protocols to protect its workforce; and • Continuation of key R&D projects with top customers. COMMERCIAL VEHICLE GROUP, INC. 9

FINANCIAL PERFORMANCE COMMERCIAL VEHICLE GROUP, INC. INVESTOR PRESENTATION 10

CONSOLIDATED FINANCIAL UPDATE $ millions except per share data $ Q1 2020 Q1 2019 Change Q4 2019 FY 2019 Q1 2020 Notes Revenue 187.1 243.2 (56.1) 189.5 901.2 ► Q1 results in line with Gross Profit 20.3 33.1 (12.8) 10.2 105.1 expectations Gross Margin 10.9% 13.6% 5.4% 11.7% ► Sharp declines in end markets compared to high SGA 17.1 15.2 1.9 13.6 62.5 production in prior year Amortization 0.9 0.3 0.6 0.9 2.0 ► Special Charges $33.7 Impairment 28.9 - 28.9 - - million Operating (loss)/Income (26.5) 17.6 (44.1) (4.3) 40.6 • Non-cash impairment Operating Margin (14.2)% 7.2% (2.3)% 4.5% charges $28.9 million Diluted Earnings Per Share (0.80) 0.33 (1.13) (0.24) 0.51 • Other special charges $4.8 million Adjusted Operating Income* 7.1 17.6 (10.5) (1.3) 44.5 Adjusted Operating Margin* 3.8% 7.2% (0.7)% 4.9% *See reconciliation to non-GAAP financial measures in the appendix COMMERCIAL VEHICLE GROUP, INC. INVESTOR PRESENTATION 11

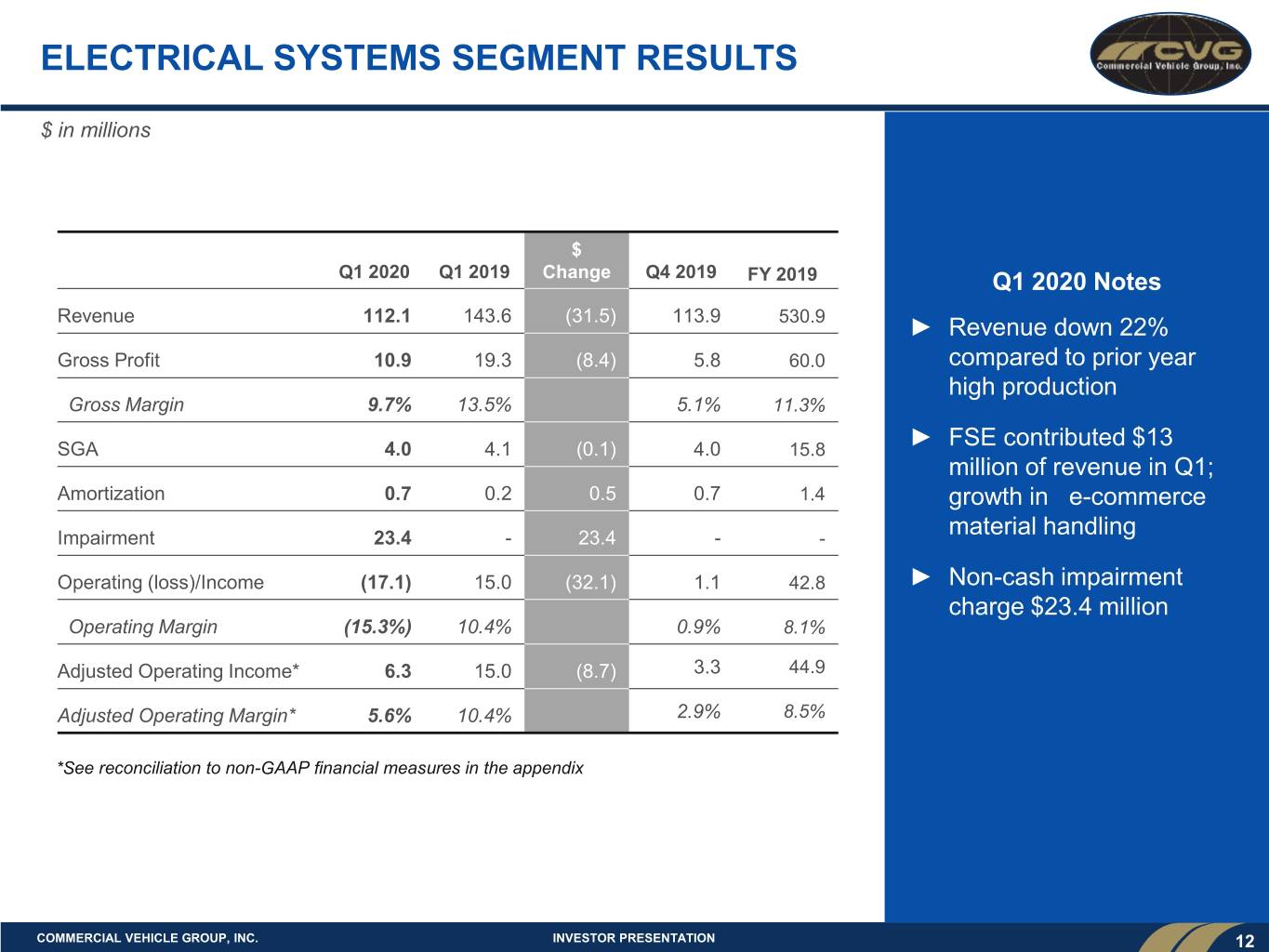

ELECTRICAL SYSTEMS SEGMENT RESULTS $ in millions $ Q1 2020 Q1 2019 Change Q4 2019 FY 2019 Q1 2020 Notes Revenue 112.1 143.6 (31.5) 113.9 530.9 ► Revenue down 22% Gross Profit 10.9 19.3 (8.4) 5.8 60.0 compared to prior year high production Gross Margin 9.7% 13.5% 5.1% 11.3% SGA 4.0 4.1 (0.1) 4.0 15.8 ► FSE contributed $13 million of revenue in Q1; Amortization 0.7 0.2 0.5 0.7 1.4 growth in e-commerce Impairment 23.4 - 23.4 - - material handling Operating (loss)/Income (17.1) 15.0 (32.1) 1.1 42.8 ► Non-cash impairment charge $23.4 million Operating Margin (15.3%) 10.4% 0.9% 8.1% Adjusted Operating Income* 6.3 15.0 (8.7) 3.3 44.9 Adjusted Operating Margin* 5.6% 10.4% 2.9% 8.5% *See reconciliation to non-GAAP financial measures in the appendix COMMERCIAL VEHICLE GROUP, INC. INVESTOR PRESENTATION 12

GLOBAL SEATING SEGMENT RESULTS $ in millions $ Q1 2020 Q1 2019 Change Q4 2019 FY 2019 Q1 2020 Notes Revenue 76.0 104.1 (28.1) 76.5 381.5 ► Revenue down 27% Gross Profit 9.4 13.8 (4.4) 4.4 45.2 compared to high Gross Margin 12.3% 13.2% 5.8% 11.8% production in prior year SGA 4.8 5.3 0.5 4.9 20.4 ► Significant operational improvements protected Amortization 0.1 0.1 - 0.1 0.5 gross margin despite Impairment 4.8 - 4.8 - - market headwinds Operating Income (0.4) 8.3 (8.7) (0.6) 24.2 ► Non-cash impairment Operating Margin (0.5)% 8.0% (0.8)% 6.4% charge $4.8 million Adjusted Operating Income* 4.6 8.3 (3.7) (0.1) 24.7 Adjusted Operating Margin* 6.0% 8.0% (0.1)% 6.5% *See reconciliation to non-GAAP financial measures in the appendix COMMERCIAL VEHICLE GROUP, INC. INVESTOR PRESENTATION 13

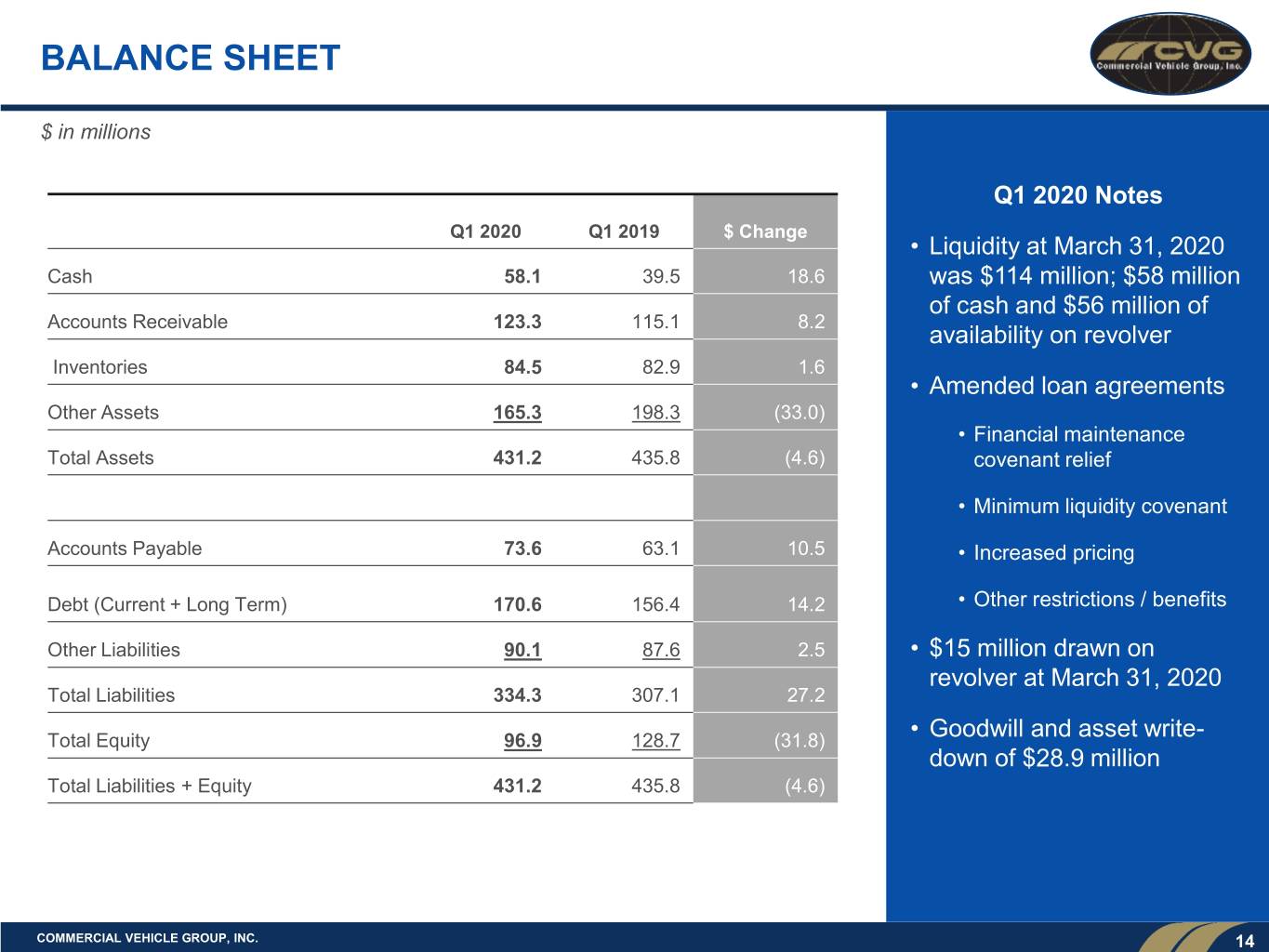

BALANCE SHEET $ in millions Q1 2020 Notes Q1 2020 Q1 2019 $ Change • Liquidity at March 31, 2020 Cash 58.1 39.5 18.6 was $114 million; $58 million of cash and $56 million of Accounts Receivable 123.3 115.1 8.2 availability on revolver Inventories 84.5 82.9 1.6 • Amended loan agreements Other Assets 165.3 198.3 (33.0) • Financial maintenance Total Assets 431.2 435.8 (4.6) covenant relief • Minimum liquidity covenant Accounts Payable 73.6 63.1 10.5 • Increased pricing Debt (Current + Long Term) 170.6 156.4 14.2 • Other restrictions / benefits Other Liabilities 90.1 87.6 2.5 • $15 million drawn on revolver at March 31, 2020 Total Liabilities 334.3 307.1 27.2 Total Equity 96.9 128.7 (31.8) • Goodwill and asset write- down of $28.9 million Total Liabilities + Equity 431.2 435.8 (4.6) COMMERCIAL VEHICLE GROUP, INC. 14

APPENDIX COMMERCIAL VEHICLE GROUP, INC. 15

USE OF NON-GAAP FINANCIAL MEASURES This earnings presentation contains financial measures that are not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). In general, the non-GAAP measures exclude items that (i) management believes reflect the Company’s multi-year corporate activities; or (ii) relate to activities or actions that may have occurred over multiple or in prior periods without predictable trends. Management uses these non-GAAP financial measures internally to evaluate the Company’s performance, engage in financial and operational planning and to determine incentive compensation. Management provides these non-GAAP financial measures to investors as supplemental metrics to assist readers in assessing the effects of items and events on the Company’s financial and operating results and in comparing the Company’s performance to that of its competitors and to comparable reporting periods. The non-GAAP financial measures used by the Company may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies. The non-GAAP financial measures disclosed by the Company should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP. The financial results calculated in accordance with GAAP and reconciliations to those financial statements set forth above should be carefully evaluated. COMMERCIAL VEHICLE GROUP, INC. 16

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES – ADJUSTED OPERATING INCOME For the Three Months Ended March 31, 2020 Electrical Global $ Millions Systems Seating Corporate Total Operating Loss $ (17.1) $ (0.4) $ (9.0) $ (26.5) CEO Transition 2.3 2.3 Restructuring 0.1 0.0 0.2 Investigation 2.4 2.4 Impairment 23.4 4.8 0.6 28.9 Adjusted Operating Income $ 6.3 $ 4.6 $ (3.7) $ 7.1 % Sales 5.6% 6.0% 3.8% For the Three Months Ended December 31, 2019 Electrical Global $ Millions Systems Seating Corporate Total Operating Income (Loss) $ 1.1 $ (0.6) $ (4.8) $ (4.3) Restructuring 2.2 0.5 0.3 3.0 Adjusted Operating Income $ 3.2 $ (0.1) $ (4.4) $ (1.3) % Sales 2.8% (0.1)% (0.7)% For the Twelve Months Ended December 31, 2019 Electrical Global $ Millions Systems Seating Corporate Total Operating Income (Loss) $ 42.8 $ 24.2 $ (26.4) $ 40.6 Restructuring 2.2 0.5 0.3 3.0 FSE Acquisition 0.9 0.9 Adjusted Operating Income $ 44.9 $ 24.7 $ (25.2) $ 44.5 % Sales 8.5% 6.5% 4.9% COMMERCIAL VEHICLE GROUP, INC. 17

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES – ADJUSTED EBITDA $ Millions For the three months ended Trailing twelve months ended March 31, June 30, September December March 31, March 31, March 31, 2019 2019 30, 2019 31, 2019 2020 2020 2019 Net Income 10.0 6.1 7.2 (7.5) (24.6) (18.8) 42.0 Interest 4.6 4.8 3.9 3.6 4.6 16.9 16.7 Provision for Income Taxes 3.2 2.2 0.5 (0.1) (7.3) (4.7) 7.7 Depreciation 3.4 3.0 3.4 3.8 3.8 14.0 13.9 Amortization 0.3 0.3 0.4 0.9 0.9 2.5 1.3 Impairment - - - - 28.9 28.9 - EBITDA 21.4 16.5 15.4 0.6 6.2 38.8 81.6 Adjustments CEO Transition 2.3 2.3 Restructuring 3.0 0.2 3.1 Investigation 2.4 2.4 FSE Acquisition Costs 0.9 0.9 Non Cash Pension Charge 2.5 2.5 Adjusted EBITDA 21.4 19.0 16.3 3.5 11.0 49.9 81.6 COMMERCIAL VEHICLE GROUP, INC. 18