Attached files

| file | filename |

|---|---|

| EX-10.1 - NOTE PURCHASE AGREEMENT - DYNARESOURCE INC | dynr_ex101.htm |

| EX-4.7 - AMENDED AND RESTATED REGISTRATION RIGHT AGREEMENT - DYNARESOURCE INC | dynr_ex47.htm |

| EX-4.6 - COMMON STOCK PURCHASE WARRANT - DYNARESOURCE INC | dynr_ex46.htm |

| EX-4.5 - AMENDMENT TO THE JUNE 30 2015 WARRANT - DYNARESOURCE INC | dynr_ex45.htm |

| EX-4.4 - COMMON STOCK PURCHASE WARRANT - DYNARESOURCE INC | dynr_ex44.htm |

| EX-4.3 - COMMON STOCK PURCHASE WARRANT - DYNARESOURCE INC | dynr_ex43.htm |

| EX-4.2 - CONVERTIBLE PROMISSORY NOTE - DYNARESOURCE INC | dynr_ex42.htm |

| EX-4.1 - CONVERTIBLE PROMISSORY NOTE - DYNARESOURCE INC | dynr_ex41.htm |

| EX-3.1 - CERTIFICATE OF INCREASE - DYNARESOURCE INC | dynr_ex31.htm |

| 8-K - CURRENT REPORT - DYNARESOURCE INC | dynr_8k.htm |

Exhibit 3.2

CERTIFICATE OF DESIGNATIONS OF THE POWERS, PREFERENCES AND

RELATIVE, PARTICIPATING, OPTIONAL AND OTHER SPECIAL RIGHTS OF

PREFERRED STOCK AND QUALIFICATIONS, LIMITATIONS AND RESTRICTIONS

THEREOF

of

SERIES D SENIOR CONVERTIBLE PREFERRED STOCK

for

DYNARESOURCE, INC.

DYNARESOURCE, INC.,

a Delaware corporation (the

“Corporation”),

pursuant to the provisions of Section 151 of the General

Corporation Law of the State of Delaware, does hereby make this

Certificate of Designations and does hereby state and certify that

pursuant to the authority expressly vested in the Board of

Directors of the Corporation (the “Board of

Directors”) by the

Amended and Restated Certificate of Incorporation of the

Corporation (the “Amended and

Restated Certificate of Incorporation”), the Board of Directors duly adopted the

following resolutions, which resolutions remain in full force and

effect as of the date hereof:

RESOLVED, that, pursuant to paragraph 3 of Article IV of the

Amended and Restated Certificate of Incorporation, the Board of

Directors hereby authorizes the issuance of, and fixes the

designation and preferences and relative, participating, optional

and other special rights, and qualifications, limitations and

restrictions, of a series of Preferred Stock consisting of

3,000,000 shares (the “Series D

Preferred Shares”), par

value $0.0001 per share, to be designated “Series D Senior Convertible Preferred

Stock”.

RESOLVED, that each of the Series D Preferred Shares shall

rank equally in all respects and shall be subject to the following

terms and provisions:

1. Certain

Defined Terms. For

purposes of this Certificate of Designations, the following terms

shall have the following meanings:

(a) “Bloomberg”

means Bloomberg Financial Markets.

(b) “Business

Day” means any day other

than Saturday, Sunday or other day on which commercial banks in the

City of New York are authorized or required by law to remain

closed.

(c) “Change

in Control Transaction”

will be deemed to exist if (i) there occurs any consolidation or

merger of the Corporation with or into any other corporation or

other entity or person (whether or not the Corporation is the

surviving corporation), any other business combination, including

without limitation a reorganization, recapitalization, share

exchange, spin-off or scheme of arrangement, or any other

transaction or series of related transactions in which in excess of

50% of the Corporation’s voting power is transferred through

a merger, consolidation, tender offer or similar transaction, (ii)

any person (as defined in Section 13(d) of the Exchange Act),

together with its affiliates and associates (as such terms are

defined in Rule 405 under the Securities Act), beneficially owns or

is deemed to beneficially own (as described in Rule 13d-3 under the

Exchange Act without regard to the 60-day exercise period) in

excess of 50% of the Corporation’s voting power

(provided, however, that if any person is immediately prior

to the Initial Issuance Date a beneficial owner (as determined

pursuant to Section 13(d) of the Exchange Act) of 40% or more of

the Corporation’s Common Stock, it shall not be deemed to be

a Change of Control Transaction if such person increases its

beneficial ownership percentage by not more than ten (10)

percentage points), (iii) a sale, lease, transfer or exclusive

license or other disposition of all or substantially all of the

assets of the Corporation (including its Subsidiaries), determined

on a consolidated basis, (iv) the sale, lease, transfer, exclusive

license or other disposition or encumbrance of any material mining

concession of the Corporation or of any of the Corporation’s

Subsidiaries, or (v) the transfer of 10% of the Corporation’s

interests in any Subsidiary, either directly or indirectly,

including but not limited to direct transfers, issuances by a

Subsidiary to parties other than the Corporation, cancellation of

outstanding securities or otherwise.

(d) “Common

Shares” means fully paid,

validly issued and non-assessable shares of Common

Stock.

(e) “Common

Stock” means the common

stock, par value $0.01 per share, of the

Corporation.

(f) “Common

Stock Equivalent” means

any rights, warrants or options to purchase or other securities

convertible into or exchangeable or exercisable for, directly or

indirectly, any (1) shares of Common Stock or (2) securities

convertible into or exchangeable or exercisable for, directly or

indirectly, shares of Common Stock.

(g) “Deemed

Liquidation Event” means,

unless the Required Holders elect otherwise by written notice sent

to the Corporation at least three (3) days prior to the effective

date of such event, (i) a Change in Control Transaction, (ii) a

“going private” transaction under Rule 13e-3

promulgated pursuant to the Exchange Act, or (iii) a tender offer

by the Corporation under Rule 13e-4 promulgated pursuant to the

Exchange Act. The Holders shall be entitled to thirty (30)

days’ prior written notice before the Corporation effects any

of the transactions described in the foregoing subsections (i)

through (iii). In the event a Change in Control Transaction occurs

in which the Corporation is not a participant, the Corporation

shall provide the Holders notice of such Change in Control

Transaction as soon as possible after learning of the Change in

Control Transaction, and such Change in Control Transaction will be

a Deemed Liquidation Event unless the Required Holders elect

otherwise by written notice sent to the Corporation within fifteen

(15) days after the Corporation sends the Holders notice that such

Change in Control Transaction has occurred.

1

(h) “DynaMexico

Shares” means the Fixed

Capital “Series A” Shares or the Variable Capital

“Series B” Shares issued by DynaResource de Mexico S.A.

de C.V., a Subsidiary of the Corporation.

(i) “DynaMexico

Share Equivalent” means

any rights, warrants or options to purchase or other securities

convertible into or exchangeable or exercisable for, directly or

indirectly, any (1) DynaMexico Shares or (2) securities convertible

into or exchangeable or exercisable for, directly or indirectly,

DynaMexico Shares.

(j) “Equity

Security” means (i) any

shares of capital stock of the Corporation, (ii) any rights,

options, warrants or similar securities to subscribe for, purchase

or otherwise acquire any shares of capital stock of the

Corporation, and (iii) debt or other evidences of indebtedness,

capital stock or other securities directly or indirectly

convertible into or exercisable or exchangeable for any shares of

capital stock of the Corporation.

(k) “Exchange

Act” means

the Securities

Exchange Act of 1934, as amended.

(l) “Excluded

Securities” means (i)

shares of Common Stock or Common Stock Equivalents issued in the

transactions contemplated by the Note, including pursuant to the

Certificate of Designations or the Warrants, other than Common

Stock Equivalents issued pursuant to the antidilution adjustment

provisions in Section 3(b) or Section 3(c) of the Warrants, and

(ii) any Equity Securities issued to a Holder pursuant to the

preemptive rights under Section 9

of this Certificate of

Designations.

(m) “Holder”

means each holder of the Series D Preferred

Shares.

(n) “Initial

Issuance Date” means the

date a Note is first issued by the Corporation pursuant to the

Purchase Agreement.

(o) “Junior

Securities” means the

Common Stock, the Series A Preferred Stock, par value $0.0001 per

share, the Series B Convertible Preferred Stock, par value $0.0001

per share and each other class or series of Equity Security of the

Corporation (other than the Pari Passu Securities), the terms of

which do not expressly provide that it ranks senior in preference

or priority to or on parity, without preference or priority, with

respect to the Series D Senior Convertible Preferred Stock as to

dividend rights or rights upon a Liquidation

Event.

(p) “Liquidation

Event” means any Deemed

Liquidation Event or any liquidation, dissolution or winding up of

the Corporation, either voluntary or

involuntary.

(q) “Maturity

Date” means the date that

is 5 years after the conversion in full of the Notes held by a

majority in aggregate principal amount of the Notes, which majority

shall include the Primary Investor for so long as the Primary

Investor holds any Notes.

(r) “Note”

or “Notes”

means the Note(s) issued by the Corporation pursuant to the

Purchase Agreement.

(s) “Pari

Passu Securities” means

the Series C Preferred Shares and each other security of the

Corporation which expressly provides that it ranks on parity,

without preference or priority, with respect to the Series D

Preferred Shares as to dividend rights or rights upon a Liquidation

Event.

(t) “Primary

Investor” means Golden

Post Rail, LLC, a Texas limited liability company, Matthew K. Rose

and his heirs, or any charitable organization or

foundation.

(u) “Purchase

Agreement” means the Note

Purchase Agreement, dated as of May 14, 2020, by and among the

Corporation and the initial purchaser of the Note(s) and the

Warrants thereunder.

(v) “Qualified

Stockholders” means any

Holder who is an “accredited investor” (within the

meaning of Rule 501(a) promulgated by the SEC).

(w) “Required

Holders” means the

Holders of at least a majority of the aggregate Series D Preferred Shares then

outstanding, which shall include the Primary Investor for so long

as the Primary Investor holds any Series D Preferred

Shares.

2

(x) “Restricted

Change in Control Transaction” means any Change in Control Transaction

(within the Corporation’s control to effect) in which the

cash consideration to be paid to the Holders upon the consummation

of such Change in Control Transaction is less than $2.00 per Series

D Preferred Share (as adjusted for any stock dividends, splits,

combinations and similar events) in immediately available funds,

(i) before any earnout payments and (ii) net of any

reserves for contingencies, such as an escrow, holdback contingency

reserves or indemnification obligation including, for the avoidance

of doubt, any Change in Control Transaction in which the cash

consideration to be paid to the Holders is $0.

(y) “SEC”

means the United States Securities and Exchange

Commission.

(z) “Securities

Act” means the Securities

Act of 1933, as amended.

(aa) “Series

C Preferred Shares” means

the Series C Senior Convertible Preferred Stock, par value $0.0001

per share, of the Corporation.

(bb) “Subsidiary”

shall have the meaning as set forth in the Purchase

Agreement.

(cc) “Tax”

means any tax, levy, impost, duty or other charge or withholding of

a similar nature (including any related penalty or

interest).

(dd) “Tax

Deduction” means a

deduction or withholding for or on account of Tax from a payment

under this Certificate of Designations.

(ee) “Trading

Day” means 9:30AM to

3:59PM on any day on which the shares of Common Stock are traded on

a Trading Market, or, if the shares of Common Stock are not so

traded, a Business Day.

(ff) “Trading

Market” means the NYSE

Amex Equities, the New York Stock Exchange or the NASDAQ Global

Select Market, the NASDAQ Global Market or the NASDAQ Capital

Market.

(gg) “Transfer

Agent” means Signature

Stock Transfer, Inc., a Texas corporation, or such other person

designated by the Corporation as the transfer agent for the shares

of Common Stock.

(hh) “Warrants”

shall have the meaning as set forth in the Purchase

Agreement.

2. Designation. There

is hereby created out of the authorized and unissued shares of

preferred stock of the Corporation a series of preferred stock

designated as the “Series D Senior Convertible Preferred

Stock” (the “Preferred

Stock”). The

number of shares constituting such series shall be

3,000,000.

3. Cumulative

Dividends.

(a) The

Holders of the Series D Preferred Shares, in preference to the

holders of Junior Securities, and on parity with any dividend on

any Pari Passu Securities, shall be entitled to receive dividends

payable in cash, but only out of funds that are legally available

therefore, at the per share rate of four percent (4%) per annum of

the Preferred Stock Original Purchase Price (as defined below) on

each outstanding Series D Preferred Share. Such dividends shall

accrue from day to day commencing on the issuance date of each such

share on the basis of a 365-day year. Dividends on the Series D

Preferred Shares will accrue whether or not the Corporation has

earnings or profits, whether or not there are funds legally

available for the payment of such dividends, and whether or not

such dividends are declared, and such dividends shall be cumulative

to the extent not actually paid. The Corporation shall take all

actions necessary or advisable under applicable laws to permit the

payment of dividends to the Holders of Series D Preferred

Shares.

3

(b) So

long as any Series D Preferred Shares are outstanding, the

Corporation (i) shall not pay, declare or set aside funds for

payment of any dividend (whether in cash or property), or make any

other distribution on any Junior Securities, or purchase, redeem or

otherwise acquire for value or set aside funds for the payment or

redemption of any Junior Securities (except by conversion into or

exchange for other Junior Securities), until full cumulative

dividends as set forth in Section 3(a)

above on the Series D Preferred

Shares shall have been paid or declared and set apart and (ii)

shall not pay, declare or set aside funds for payment of any

dividend, or make any other distribution on any Pari Passu

Security, or purchase, redeem or otherwise acquire for value or set

aside funds for the payment or redemption of any Pari Passu

Securities (except by conversion into or exchange for other Pari

Passu Securities or the redemption of the Series C Preferred Stock

following its Maturity Date), unless full cumulative dividends are

declared and paid ratably on the Series D Preferred

Shares.

(c) In

the event dividends or distributions are paid on any Junior

Securities, the Corporation shall pay an additional dividend or

distribution on all outstanding Series D Preferred Shares in a per

share amount equal (on an as-if-converted to Common Stock basis) to

the amount paid or set aside for each share of Junior Securities.

Payments under the preceding sentence shall be made concurrently

with the dividend or distribution to the holders of the Junior

Securities.

4. Liquidation

Preference.

(a) In

the event of any Liquidation Event, the Holders of the Series D

Preferred Shares shall be entitled to receive pari passu with the

Pari Passu Securities, on a pro rata basis, out of the assets of

the Corporation available for distribution to stockholders

(“Liquidation

Funds”), prior and in

preference to any distribution of any assets of the Corporation to

the holders of Junior Securities, an amount equal to the sum of (i)

the amount of $2.00 per share (the “Preferred

Stock Original Purchase Price”) plus (ii) all accrued but unpaid

dividends on each Series D Preferred Share, in each case as

adjusted for any stock dividends, splits, combinations and similar

events (the “Liquidation

Preference”). If upon any such Liquidation

Event, the Liquidation Funds shall be insufficient to pay the

Holders of the Series D Preferred Shares and the holders of the

Pari Passu Securities the full amount to which they shall be

entitled, in the case of the Series D Preferred Shares, under

this Section

4(a), the Holders of

the Series D Preferred Shares and the

holders of the Pari Passu Securities shall share ratably in any

distribution of the assets available for distribution in proportion

to the respective amounts which would otherwise be payable in

respect of the shares held by them upon such distribution if all

amounts payable on or with respect to such shares were paid in

full. The Liquidation Preference to be paid to the Holders of the

Series D Preferred Shares under this Section 4(a)

on a pari passu basis with the Pari

Passu Securities shall be paid or set apart for payment before the

payment or setting apart for payment of any amount for, or the

distribution of any Liquidation Funds of the Corporation to the

holders of Junior Securities in connection with a Liquidation

Event. A Change in Control Transaction shall not,

ipso

facto, be deemed a Liquidation

Event.

(b) After

payment of the full amount of the Liquidation Preference, in the

case of a Liquidation Event, the remaining assets of the

Corporation available for distribution to its stockholders shall be

distributed among the Holders of the Series D Preferred Shares, the

Pari Passu Securities, the holders of Series A Preferred Stock, par

value $0.0001 per share, and the holders of Common Stock, pro rata

based on the number of shares held by each such Holder or holder,

as applicable, treating for this purpose all Series D Preferred

Shares as if they had been converted to Common Stock pursuant to

the terms of this Certificate of Designations immediately prior to

such Liquidation Event. The foregoing shall not limit any rights

which Holders may have with respect to any requirement that

the Corporation repurchase the Series D Preferred Shares

or for any right to monetary

damages.

5. Issuance

of Series D Preferred Shares. The Series D Preferred Shares shall be

issued by the Corporation pursuant to the

Note(s).

6. Optional

Conversion by the Holders. Each Holder shall have the right at

any time and from time to time, at the option of such Holder and

without the payment of additional consideration by the Holder, to

convert all or any portion of the Series D Preferred Shares held by

such Holder, for such number of Common Shares per each Series D

Preferred Share, free and clear of any liens, claims or

encumbrances, as is determined by dividing (i) the sum of (A) the

Preferred Stock Original Purchase Price plus (B) any accrued but

unpaid dividends on such Series D Preferred Share by (ii) the

Conversion Price (as defined below) in effect on the Conversion

Date (as defined below). Immediately following such

conversion, the persons entitled to receive the Common Shares upon

the conversion of Series D Preferred Shares shall be treated for

all purposes as having become the owners of such Common Shares,

subject to the rights provided herein to Holders. The

term “Conversion

Price” means $2.00 per

share, subject to adjustment as provided

herein.

(a) Delivery

of Conversion Notice. To convert Series D Preferred Shares into Common

Shares on any date (a “Conversion

Date”), the Holder shall

give written notice (a “Conversion

Notice”) to the

Corporation in the form of Exhibit A

hereto (which Conversion Notice will

be given by facsimile transmission, e-mail or other electronic

means no later than 11:59 p.m. New York City Time on such date, and

sent via overnight delivery no later than one (1) Trading Day after

such date) stating that such Holder elects to convert the same and

shall state therein the number of Series D Preferred Shares to be

converted and the name or names in which such Holder wishes the

certificate or certificates for Common Shares to be

issued. If required by Section

11, as soon as possible after

delivery of the Conversion Notice, such Holder shall surrender the

certificate or certificates representing the Series D Preferred

Shares being converted, duly endorsed, at the office of the

Corporation.

4

(b) Mechanics

of Conversion. The

Corporation shall, promptly upon receipt of a Conversion Notice

(but in any event not less than one (1) Trading Day after receipt

of such Conversion Notice), (i) send, via facsimile, e-mail or

other electronic means a confirmation of receipt of such Conversion

Notice to such Holder and the Transfer Agent, which confirmation

shall constitute an instruction to the Transfer Agent to process

such Conversion Notice in accordance with the terms herein and (ii)

on or before the third (3rd) Trading Day following the date of

receipt by the Corporation of such Conversion Notice (the

“Share

Delivery Date”), credit

such aggregate number of Common Shares to which the Holder shall be

entitled to such Holder’s or its designee’s balance

account with the Depository Trust Company

(“DTC”)

via its Deposit Withdrawal Agent Commission system. If

the number of Series D Preferred Shares represented by the

Preferred Stock certificate(s) delivered to the Corporation in

connection with a Conversion Notice, to the extent required

by Section 11

or to the extent otherwise requested

by the Holder, is greater than the number of Series D Preferred

Shares being converted, then the Corporation shall, as soon as

practicable and in no event later than three (3) Business Days

after receipt of such Preferred Stock certificate(s) and at its own

expense, issue and deliver to the Holder a new Preferred Stock

certificate representing the number of Series D Preferred Shares

not converted. The person or persons entitled to receive

the Common Shares issuable upon a conversion of Series D Preferred

Shares shall be treated for all purposes as the record holder or

holders of such Common Shares on the Conversion

Date.

The Corporation’s

obligation to issue Common Shares upon conversion of Series D

Preferred Shares shall, except as set forth below, be absolute, is

independent of any covenant of any Holder, and shall not be subject

to: (i) any offset or defense; or (ii) any claims

against the Holders of Series D Preferred Shares whether pursuant

to this Certificate of Designations, the Purchase Agreement, the

Note(s), the Warrants or otherwise, including, without limitation,

any claims arising out of any selling or short-selling activity by

Holders.

(c) Corporation’s

Failure to Timely Convert. If the Corporation fails to cause the

Transfer Agent by the Share Delivery Date to transmit to a Holder

of Series D Preferred Shares the number of Common Shares to which

such Holder is entitled upon such Holder’s conversion of

Series D Preferred Shares, then in addition to all other available

remedies which such Holder may pursue hereunder and under the Note

or the Purchase Agreement (including indemnification pursuant to

the terms thereof), the Corporation shall pay additional damages to

such Holder for each day after the Share Delivery Date that such

conversion is not timely effected in an amount equal to one percent

(1%) of the product of (i) the sum of the number of Common Shares

not issued to the Holder on or prior to the Share Delivery Date and

to which such Holder is entitled pursuant to the applicable

Conversion Notice and the terms of this Certificate of

Designations, and (ii) the Closing Sale Price (as defined below) of

the Common Stock on the Share Delivery Date, but in no event in

excess of eighteen percent (18.0%). In addition to the foregoing,

if on the Share Delivery Date, the Corporation shall fail to credit

such Holder’s balance account with DTC, then such Holder will

have the right to rescind the Conversion Notice. In addition to the

foregoing and any other rights available to a Holder of Series D

Preferred Shares, if the Corporation fails on or before the Share

Delivery Date to cause the Transfer Agent to transmit to a Holder

the number of Common Shares to which such Holder is entitled upon

such Holder’s conversion of Series D Preferred Shares, and if

after such date such Holder is required by its broker to purchase

(in an open market transaction or otherwise), or such

Holder’s brokerage firm otherwise purchases, shares of Common

Stock to deliver in satisfaction of a sale by such Holder which

such Holder anticipated receiving upon such exercise (a

“Buy-In”),

then the Corporation shall (A) pay in cash to such Holder the

amount, if any, by which (x) such Holder’s total purchase

price (including brokerage commissions, if any) for the shares of

Common Stock so purchased exceeds (y) the amount obtained by

multiplying (1) the number of shares of Common Shares that the

Corporation was required to deliver to such Holder in connection

with the exercise at issue by (2) the price at which the sell order

giving rise to such purchase obligation was executed, and (B) at

the option of such Holder, either allow such Holder to rescind the

Conversion Notice or deliver to such Holder the number of Common

Shares that would have been issued had the Corporation timely

complied with its exercise and delivery obligations hereunder. For

example, if a Holder purchases shares of Common Stock having a

total purchase price of $11,000 to cover a Buy-In with respect to

an attempted conversion of Series D Preferred Shares with an

aggregate sale price giving rise to such purchase obligation of

$10,000, under clause (A) of the immediately preceding sentence,

the Corporation shall be required to pay such Holder $1,000. Such

Holder shall provide the Corporation written notice indicating the

amounts payable to such Holder in respect of the Buy-In and, upon

request of the Corporation, evidence of the amount of such loss.

Nothing herein shall limit any Holder’s right to pursue any

other remedies available to it hereunder, at law or in equity

including, without limitation, a decree of specific performance

and/or injunctive relief with respect to the Corporation’s

failure to timely deliver Common Shares upon conversion of Series D

Preferred Shares as required pursuant to the terms

hereof.

The term “Closing

Sale Price” means the

last closing trade price for the Common Shares on the electronic

bulletin board for the Common Shares as reported by Bloomberg, or,

if the Common Shares become listed on a Trading Market, on such

trading Market, of such security prior to 4:00 p.m., New York City

Time, as reported by Bloomberg, or, if the foregoing do not apply

or if no last trade price is reported for such security by

Bloomberg, the highest bid price as reported on the “pink

sheets” by Pink Sheets LLC (formerly the National Quotation

Bureau, Inc.) at the close of trading. If the Closing

Sale Price cannot be calculated for the Common Shares on a

particular date on any of the foregoing bases, the Closing Sale

Price of the Common Shares on such date shall be the fair market

value as mutually determined by the Corporation and the

Holder. All such determinations to be appropriately

adjusted for any stock dividend, stock split, stock combination or

other similar transaction during the applicable calculation

period.

5

(d) Adjustments

to the Conversion Price.

(i) Adjustments

for Stock Splits and Combinations. If the Corporation shall at any time

or from time to time after the Initial Issuance Date effect a stock

split of the outstanding Common Stock, the applicable Conversion

Price in effect immediately prior to the stock split shall be

proportionately decreased. If the Corporation shall at

any time or from time to time after the Initial Issuance Date,

combine the outstanding shares of Common Stock, the applicable

Conversion Price in effect immediately prior to the combination

shall be proportionately increased. Any adjustments

under this Section 6(d)(i)

shall be effective at the close of

business on the date the stock split or combination

occurs.

(ii) Adjustments

for Certain Dividends and Distributions. If the Corporation shall at any time

or from time to time on or after the Initial Issuance Date make or

issue or set a record date for the determination of holders of

Common Stock entitled to receive a dividend or other distribution

payable in Common Shares then, and in each event, the applicable

Conversion Price in effect immediately prior to such event shall be

decreased as of the time of such issuance or, in the event such

record date shall have been fixed, as of the close of business on

such record date, by multiplying the applicable Conversion Price

then in effect by a fraction:

(A) the

numerator of which shall be the total number of Common Shares

issued and outstanding immediately prior to the time of such

issuance or the close of business on such record date;

and

(B) the

denominator of which shall be the total number of Common Shares

issued and outstanding immediately prior to the time of such

issuance or the close of business on such record date plus the

number of Common Shares issuable in payment of such dividend or

distribution.

(iii) Adjustment

for Other Dividends and Distributions. If the Corporation shall at any time

or from time to time on or after the Initial Issuance Date make or

issue or set a record date for the determination of holders of

Common Stock entitled to receive a non-cash dividend or other

distribution payable in securities or property other than Common

Shares, then, and in each event, an appropriate revision to the

applicable Conversion Price shall be made and provision shall be

made (by adjustments of the Conversion Price or otherwise) so that

the Holders of Series D Preferred Shares shall receive upon

conversions thereof, in addition to the number of Common Shares

receivable thereon, the number of securities of the Corporation or

other issuer (as applicable) or other property that they would have

received had the Series D Preferred Shares been converted into

Common Shares on the date of such event (provided,

however,

that, to the extent the right of a Holder of Series D Preferred

Shares to participate in any such Distribution would result in such

Holder of Series D Preferred Shares exceeding the Beneficial

Ownership Limitation, then such Holder of Series D Preferred Shares

shall not be entitled to participate in such Distribution to such

extent (or in the beneficial ownership of any Common Shares as a

result of such Distribution to such extent) and the portion of such

Distribution shall be held in abeyance for the benefit of such

Holder of Series D Preferred Shares until such time, if ever, as

its right thereto would not result in such Holder of Series D

Preferred Shares exceeding the Beneficial Ownership

Limitation).

(iv) Adjustments for Issuance of

Additional Equity Securities of the Corporation. In the event the Corporation shall

issue or sell any Common Stock or Common Stock Equivalents

including, without limitation, (i) the issuance of Common Stock or

Common Stock Equivalents in settlement or resolution (by judgment

or otherwise) of any litigation or threatened litigation (other

than (A) as provided in Section 6(d)(i)

through (iii)

or (B) Excluded Securities), and (ii)

the issuance of Common Stock or Common Stock Equivalents to any

Subsidiary after the Initial Issuance Date, or if, after any

issuance of Common Stock Equivalents, the price per share for which

Additional Shares of Common Stock may be issued thereafter is

amended or adjusted such that more shares of Common Stock are

issuable under such Common Stock Equivalents, then the applicable

Conversion Price upon each such issuance or amendment shall be

adjusted to that price (rounded to the nearest cent) determined by

multiplying the Conversion Price according to the following

equation:

6

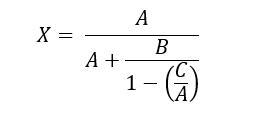

where:

A =

the aggregate number of shares of Common Stock outstanding prior to

the issuance (or immediately prior to such amendment or adjustment,

as applicable) on a fully-diluted basis;

B =

the number of new shares of Common Stock or Common Stock

Equivalents issued (or effectively issued pursuant to such

amendment or adjustment, as applicable), on a fully-diluted

basis;

C =

the aggregate number of shares of Common Stock into which all

outstanding Series D Preferred Shares are convertible prior to the

issuance; and

X =

the number by which to multiply the Conversion Price in effect

immediately prior to the issuance.

No adjustment shall be made under this

Section

6(d)(iv) upon the issuance of

any Additional Shares which are issued pursuant to the exercise,

conversion or exchange rights under any Common Stock Equivalents,

if any such adjustment shall previously have been made upon the

issuance of such Common Stock Equivalents (or upon the issuance of

any warrant or other rights therefore) pursuant to this

Section

6(d)(iv).

For purposes of the foregoing, in the case of the

sale or issuance of any Common Stock Equivalents or in the case

that any Common Stock Equivalents are amended and adjusted as

provided in this Section

6(d)(iv), the maximum number of

Additional Shares issuable upon conversion, exchange or exercise of

such Common Stock Equivalent shall be deemed to be outstanding at

the time of such sale or issuance or amendment or adjustment, as

the case may be, and no further adjustment shall be made to the

Conversion Price upon the actual issuance of Additional Shares

pursuant to the exercise, conversion or exchange of such Common

Stock Equivalents.

In

the event the Corporation shall issue or sell any shares of

preferred stock of the Corporation that are not convertible into

Common Stock, then an appropriate adjustment to the securities to

be received upon conversion of the Series D Preferred Shares (by

adjustments of the Conversion Price or otherwise) shall be made, as

the Holders and the Corporation shall mutually agree.

Notwithstanding

anything herein to the contrary, to the extent that a Holder of

Series D Preferred Shares’ right to participate in any such

issuance of any Common Stock or Common Stock Equivalents would

result in such Holder of Series D Preferred Shares exceeding the

Beneficial Ownership Limitation, then such Holder of Series D

Preferred Shares shall not be entitled to participate in such

issuance to such extent (or beneficial ownership of such shares of

Common Stock as a result of such issuance to such extent) and such

issuance to such extent shall be held in abeyance for such Holder

of Series D Preferred Shares until such time, if ever, as its right

thereto would not result in such Holder of Series D Preferred

Shares exceeding the Beneficial Ownership Limitation).

(v) Certain

Issues Excepted. There shall be no adjustment to the

Conversion Price pursuant to Section

6(d)(iv) with respect to the

sale or issuance of Excluded Securities.

(vi) Adjustments

for Issuance of Additional Equity Securities of

Subsidiary. In the

event (i) the Corporation’s ownership of DynaMexico Shares

shall decrease (by forfeiture or shifting of ownership or

otherwise) or (ii) DynaResource de Mexico S.A. de C.V. (the

“Mexican

Subsidiary”) shall issue

or sell any DynaMexico Shares or DynaMexico Share Equivalents to

any person other than the Corporation, in each case including,

without limitation, as a result of the settlement or resolution (by

judgment or otherwise) of any litigation or threatened litigation,

then the applicable Conversion Price upon each such decrease or

issuance shall be adjusted to that price (rounded to the nearest

cent) determined by multiplying the Conversion Price according to

the following equation:

7

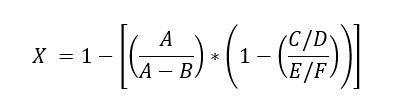

where:

A =

the aggregate number of shares of Common Stock outstanding prior to

the change in ownership of the Mexican Subsidiary on a

fully-diluted basis;

B =

the aggregate number of shares of Common Stock into which all

outstanding shares of Series D Preferred Stock are convertible

prior to the change in ownership of the Mexican

Subsidiary;

C =

the number of shares in the Mexican Subsidiary held by the

Corporation following the change in ownership of the Mexican

Subsidiary;

D =

the aggregate number of shares in the Mexican Subsidiary

outstanding following the change in ownership of the Mexican

Subsidiary;

E =

the number of shares in the Mexican Subsidiary held by the

Corporation prior to the change in ownership of the Mexican

Subsidiary;

F =

the aggregate number of shares in the Mexican Subsidiary

outstanding prior to the change in ownership of the Mexican

Subsidiary; and

X = the number by which to multiply the Conversion

Price in effect immediately prior to the change in ownership of the

Mexican Subsidiary; provided, however, that if X is less than or equal to zero

(0), then X shall equal .001.

No adjustment shall be made under this

Section

6(d)(vi) upon the issuance of

any additional DynaMexico Shares which are issued pursuant to the

exercise, conversion or exchange rights under any DynaMexico Share

Equivalents, if any such adjustment shall previously have been made

upon the issuance of such DynaMexico Share Equivalents (or upon the

issuance of any warrant or other rights therefore) pursuant to

this Section

6(d)(vi).

For purposes of the foregoing, in the case of the

sale or issuance of any DynaMexico Share Equivalents or in the case

that any DynaMexico Share Equivalents are amended and adjusted as

provided in this Section

6(d)(vi), the maximum number of

additional DynaMexico Shares issuable upon conversion, exchange or

exercise of such DynaMexico Share Equivalents shall be deemed to be

outstanding at the time of such sale or issuance or amendment or

adjustment, as the case may be, and no further adjustment shall be

made to the Conversion Price upon the actual issuance of additional

DynaMexico Shares pursuant to the exercise, conversion or exchange

of such DynaMexico Share Equivalents.

Notwithstanding

anything herein to the contrary, to the extent that a Holder of

Series D Preferred Shares’ right to participate in any such

issuance of any DynaMexico Shares or DynaMexico Share Equivalents

would result in such Holder of Series D Preferred Shares exceeding

the Beneficial Ownership Limitation, then such Holder of Series D

Preferred Shares shall not be entitled to participate in such

issuance to such extent (or beneficial ownership of such DynaMexico

Shares as a result of such issuance to such extent) and such

issuance to such extent shall be held in abeyance for such Holder

of Series D Preferred Shares until such time, if ever, as its right

thereto would not result in such Holder of Series D Preferred

Shares exceeding the Beneficial Ownership Limitation).

(e) Notice

of Record Date. In

the event of any taking by the Corporation of a record date of the

holders of any class of securities for the purpose of determining

the holders thereof who are entitled to receive any dividend or

other distribution, any security or right convertible into or

entitling the holder thereof to receive additional Common Shares,

or any right to subscribe for, purchase or otherwise acquire any

shares of stock of any class or any other securities or property,

or to receive any other right, the Corporation shall deliver to

each Holder at least twenty (20) days prior to the date specified

therein, a notice specifying the date on which any such record is

to be taken for the purpose of such dividend, distribution,

security or right and the amount and character of such dividend,

distribution, security or right.

(f) Reservation

of Stock Issuable Upon Conversion. The Corporation shall at all times reserve and

keep available out of its authorized but unissued Common Stock,

solely for the purposes of effecting the conversion and/or

redemption of the Series D Preferred Shares, an amount of shares of

Common Stock equal to 200% of the number of shares issuable upon

conversion of the Series D Preferred Shares at the current

Conversion Price (the “Required

Reserve Amount”). If at any time while any of

the Series D Preferred Shares remain outstanding the Corporation

does not have a sufficient number of authorized and unreserved

shares of Common Stock to satisfy its obligation to reserve for

issuance upon conversion and/or redemption of the Series D

Preferred Shares at least a number of shares of Common Stock equal

to the Required Reserve Amount (an “Authorized

Share Failure”), then the

Corporation shall promptly take all action necessary to increase

the Corporation’s authorized shares of Common Stock to an

amount sufficient to allow the Corporation to reserve the Required

Reserve Amount for the Series D Preferred Shares then

outstanding. Without limiting the generality of the

foregoing sentence, as soon as practicable after the date of the

occurrence of an Authorized Share Failure, but in no event later

than sixty (60) days (or the lesser of (i) ninety (90) days if the

proxy statement is reviewed by the staff of the SEC or (ii) ten

(10) days after the staff of the SEC indicates that it has no

further comments to such proxy statement) after the occurrence of

such Authorized Share Failure (the “Meeting

Outside Date”), the

Corporation shall hold a meeting of its stockholders for the

approval of an increase in the number of authorized shares of

Common Stock. In connection with such meeting, the

Corporation shall provide each stockholder with a proxy statement

and shall use its reasonable best efforts to solicit its

stockholders’ approval of such increase in authorized shares

of Common Stock and to cause its Board of Directors to recommend to

the stockholders that they approve such

proposal. Notwithstanding the foregoing, if at such time

of an Authorized Share Failure, the Corporation is able to obtain

the necessary consent of the holders of its capital stock to

approve the increase in the number of authorized shares of Common

Stock, the Corporation may satisfy this obligation by obtaining

such consent and submitting for filing with the SEC an Information

Statement on Schedule 14C.

8

(g) Fractional

Shares. No

fractional shares shall be issued upon the conversion of any Series

D Preferred Shares. All Common Shares (including

fractions thereof) issuable upon conversion of more than one Series

D Preferred Share by a Holder thereof and all Series D Preferred

Shares issuable upon the purchase thereof shall be aggregated for

purposes of determining whether the conversion and/or purchase

would result in the issuance of any fractional

share. If, after the aforementioned aggregation, the

conversion and/or purchase would result in the issuance of a

fraction of a share of Common Stock, the Corporation shall, in lieu

of issuing any fractional share, either round up the number of

shares to the next highest whole number or, at the

Corporation’s option, pay the Holder otherwise entitled to

such fraction a sum in cash equal to the fair market value of such

fraction on the Conversion Date (as determined in good faith by the

Board of Directors of the Corporation).

(h) Reorganization,

Merger or Going Private. In case of any reorganization or any

reclassification of the capital stock of the Corporation or any

consolidation or merger of the Corporation with or into any other

corporation or corporations or a sale or transfer of all or

substantially all of the assets of the Corporation to any other

person or a “going private” transaction under Rule

13e-3 promulgated pursuant to the Exchange Act, then, as part of

such reorganization, consolidation, merger, or transfer if the

holders of shares of Common Stock receive any publicly traded

securities as part or all of the consideration for such

reorganization, reclassification, consolidation, merger or sale,

then it shall be a condition precedent of any such event or

transaction that provision shall be made such that each Series D

Preferred Share shall thereafter be convertible into such new

securities at a conversion price and pricing formula which places

the Holders of Series D Preferred Shares in an economically

equivalent position as they would have been if not for such

event. The Corporation shall give each Holder written

notice at least ten (10) Trading Days prior to the consummation of

any such reorganization, reclassification, consolidation, merger or

sale.

(i) Certificate

for Conversion Price Adjustment. The Corporation shall promptly furnish

or cause to be furnished to each Holder a certificate prepared by

the Corporation setting forth any adjustments or readjustments of

the Conversion Price pursuant to this Section

6.

(j) Conversion

Limitations. The Company shall

not effect any conversion of Series D Preferred Shares, and a

Holder of Series D Preferred Shares shall not have the right to

convert any portion of its Series D Preferred Shares, pursuant to

this Section

6, to the extent that after

giving effect to such conversion as set forth in this

Section

6, the Holder of Series D

Preferred Shares (together with its Affiliates, and any other

persons acting as a group together with such holder or any of its

Affiliates (such persons, “Attribution

Parties”)), would

beneficially own in excess of the Beneficial Ownership Limitation

(as defined below). For purposes of the foregoing sentence, the

number of Common Shares beneficially owned by the Holder of Series

D Preferred Shares and its Affiliates and Attribution Parties shall

include the number of Common Shares issuable upon conversion of any

Series D Preferred Shares, but shall exclude the number of Common

Shares which would be issuable upon exercise or conversion of the

unexercised or nonconverted portion of any other securities of the

Company (including, without limitation, any other Common Stock

Equivalents) subject to a limitation on conversion or exercise

analogous to the limitation contained herein beneficially owned by

such Holder of Series D Preferred Shares or any of its Affiliates

or Attribution Parties. Except as set forth in the preceding

sentence, for purposes of this Section

6(j), beneficial ownership

shall be calculated in accordance with Section 13(d) of the

Exchange Act and the rules and regulations promulgated thereunder,

it being acknowledged by each Holder of Series D Preferred Shares

that the Company is not representing to such Holder of Series D

Preferred Shares that such calculation is in compliance with

Section 13(d) of the Exchange Act and such Holder of Series D

Preferred Shares is solely responsible for any schedules required

to be filed in accordance therewith. To the extent that the

limitation contained in this Section 6(j)

applies, the determination of whether

the Series D Preferred Shares are convertible (in relation to other

securities owned by the Holder of such Series D Preferred Shares

together with any Affiliates and Attribution Parties) and of which

portion of the Series D Preferred Shares is convertible shall be in

the sole discretion of the Holder of such Series D Preferred

Shares, and the submission of any Conversion Notice shall be deemed

to be such Holder’s determination of whether the Series D

Preferred Shares are convertible (in relation to other securities

owned by such Holder together with its Affiliates and Attribution

Parties) and of which portion of such Series D Preferred Shares is

convertible, in each case subject to the Beneficial Ownership

Limitation, and the Company shall have no obligation to verify or

confirm the accuracy of such determination. In addition, a

determination as to any group status as contemplated above shall be

determined in accordance with Section 13(d) of the Exchange Act and

the rules and regulations promulgated thereunder. For purposes of

this Section

6(j), in determining the number

of outstanding Common Shares, a Holder of Series D Preferred Shares

may rely on the number of outstanding Common Shares as reflected in

(A) the Company’s most recent periodic or annual report filed

with the SEC, as the case may be, (B) a more recent public

announcement by the Company, or (C) a more recent written notice by

the Company or transfer agent setting forth the number of Common

Shares outstanding. Upon the written or oral request of a Holder of

Series D Preferred Shares, the Company shall within one Business

Day confirm orally and in writing to such Holder of Series D

Preferred Shares the number of Common Shares then outstanding. In

any case, the number of outstanding Common Shares shall be

determined after giving effect to the conversion or exercise of

securities of the Company, including Series D Preferred Shares,

held by such Holder and/or its Affiliates or Attribution Parties

since the date as of which such number of outstanding Common Shares

was reported. The “Beneficial

Ownership Limitation”

shall be 9.99% of the number of Common Shares outstanding

immediately after giving effect to the conversion of Series D

Preferred Shares for Common Shares. Each Holder of Series D

Preferred Shares, upon notice to the Company, may increase or

decrease the Beneficial Ownership Limitation provisions of

this Section

6(j); provided,

that the Beneficial Ownership Limitation in no event exceeds 19.99%

of the number of Common Shares outstanding immediately after giving

effect to the conversion of the Series D Preferred Shares held by

such Holder of Series D Preferred Shares and the provisions of

this Section 6(j)

shall continue to apply. Any increase

in the Beneficial Ownership Limitation will not be effective until

the 61st day after such notice is delivered to the Company. The

provisions of this paragraph shall be construed and implemented in

a manner otherwise than in strict conformity with the terms of

this Section 6(j)

to correct this paragraph (or any

portion hereof) which may be defective or inconsistent with the

intended Beneficial Ownership Limitation herein contained or to

make changes or supplements necessary or desirable to properly give

effect to such limitation. The limitations contained in this

paragraph shall apply to a successor holder of any Series D

Preferred Shares.

9

7. Mandatory

Repurchase. If any of the events set forth in

clauses (i) through (iii) below shall have occurred or are

continuing, each Holder shall have the unilateral option and right

to compel the Corporation to repurchase for cash any or all of such

Holder’s Series D Preferred Shares within three (3) days of a

written notice requiring such repurchase (provided that no such

written notice shall be required for clauses (ii) and (iii) below

and such demand for repurchase shall be deemed automatically made

upon the occurrence of any of the events set forth in such clauses

(ii) and (iii) below), at an amount per share equal to the greater

of: (i) the sum of (A) the Preferred Stock Original Purchase Price

plus (B) all accrued but unpaid dividends on such Series D

Preferred Share, in each case as adjusted for any stock dividends,

splits, combinations and similar events, or (ii) an amount equal to

the per share amount the Holders of Series D Preferred Shares would

have received upon a theoretical Liquidation Event occurring at the

time of the Holder’s exercise of the repurchase option

pursuant to this Section 7

had such Holders converted their

Series D Preferred Shares into Common Shares immediately preceding

such theoretical Liquidation Event (such greater amount, the

“Repurchase

Price”):

(i) it

is a date later than the Maturity Date;

(ii) the

entry by a court having jurisdiction in the premises of (i) a

decree or order for relief in respect of the Corporation or any

Subsidiary of a voluntary case or proceeding under any applicable

federal or state bankruptcy, insolvency, reorganization or other

similar law or (ii) a decree or order adjudging the Corporation or

any Subsidiary as bankrupt or insolvent, or approving as properly

filed a petition seeking reorganization, arrangement, adjustment or

composition of or in respect of the Corporation or any Subsidiary

under any applicable federal or state law or (iii) appointing a

custodian, receiver, liquidator, assignee, trustee, sequestrator or

other similar official of the Corporation or any Subsidiary or of

any substantial part of its property, or ordering the winding up or

liquidation of its affairs, and the continuance of any such decree

or order for relief or any such other decree or order unstayed and

in effect for a period of sixty (60) consecutive

days; or

(iii) the

commencement by the Corporation or any Subsidiary of a voluntary

case or proceeding under any applicable federal or state

bankruptcy, insolvency, reorganization or other similar law or of

any other case or proceeding to be adjudicated a bankrupt or

insolvent, or the consent by it to the entry of a decree or order

for relief in respect of the Corporation or any Subsidiary in an

involuntary case or proceeding under any applicable federal or

state bankruptcy, insolvency, reorganization or other similar law

or to the commencement of any bankruptcy or insolvency case or

proceeding against it, or the filing by it of a petition or answer

or consent seeking reorganization or relief under any applicable

federal or state law, or the consent by it to the filing of such

petition or to the appointment of or taking possession by a

custodian, receiver, liquidator, assignee, trustee, sequestrator or

other similar official of the Corporation or any Subsidiary or of

any substantial part of its property, or the making by it of an

assignment for the benefit of creditors, or the admission by it in

writing of its inability to pay its debts generally as they become

due, or the taking of corporate action by the Corporation or any

Subsidiary in furtherance of any such action.

8. Voting

Rights; Directors.

(a) Each

Holder of Series D Preferred Shares shall be entitled to the

number of votes equal to the number of Common Shares into which

such Series D Preferred Shares could be converted and shall have

voting rights and powers equal to the voting rights and powers of

the Common Stock (except as otherwise expressly provided herein or

as required by law, voting together with the Common Stock as a

single class) and shall be entitled to notice of any

stockholders’ meeting in accordance with the bylaws of the

Corporation. Fractional votes shall not, however, be permitted and

any fractional voting rights resulting from the above formula

(after aggregating all shares into which Series D Preferred

Shares held by each Holder could be converted) shall be rounded

down to the nearest whole number.

(b) The

Board of Directors shall consist of no more than seven (7) members.

If at any time the holders of Series C Preferred Shares do not have

the right to elect a director or there are no Series C Preferred

Shares outstanding, the Required Holders shall be entitled to elect

one (1) member of the Board of Directors at each meeting or

pursuant to each written consent of the Corporation’s

stockholders for the election of directors, and to remove from

office such director and to fill any vacancy caused by the

resignation, death or removal of such director. The remaining

directors shall be elected as provided in the Amended and Restated

Certificate of Incorporation as in effect on the Initial Issuance

Date.

(c) In

addition to any other rights provided by law, except where the vote

or written consent of the Holders of a greater number of shares is

required by law or by another provision of the Amended and Restated

Certificate of Incorporation, the affirmative vote at a meeting

duly called for such purpose or the written consent without a

meeting of the Required Holders, voting together as a single class,

shall be required before the Corporation may:

10

(i) amend

or repeal any provision of, or add any provision to, this

Certificate of Designations, the Amended and Restated Certificate

of Incorporation or bylaws, or file any articles of amendment,

certificate of designations, preferences, limitations and relative

rights of any series of preferred stock, if such action would

adversely alter or change the preferences, rights, privileges or

powers of, or restrictions provided for the benefit of the Series D

Preferred Shares, regardless of whether any such action shall be by

means of amendment to the Amended and Restated Certificate of

Incorporation or by merger, consolidation or

otherwise;

(ii) increase

or decrease (other than by conversion) the authorized number of

shares of Series D Preferred Shares (for the avoidance of doubt,

the Corporation may increase or decrease the number of authorized

shares of undesignated “blank check” preferred

stock);

(iii) create

or authorize (by reclassification or otherwise) any new class or

series of shares that has a preference over or is on a parity with

the Series D Preferred Shares with respect to dividends or the

distribution of assets on a Liquidation Event;

(iv) declare

or pay a dividend or other distribution with respect to any shares

of the Corporation’s capital stock, including, without

limitation, any Pari Passu Security and/or any Junior

Security;

(v) purchase,

repurchase or redeem any Junior Security;

(vi) whether

or not prohibited by the terms of the Series D Preferred Shares,

circumvent a right of the Series D Preferred

Shares;

(vii) effect

a Liquidation Event (other than a Change in Control

Transaction);

(viii) enter

into any contract or other arrangement to do any of the foregoing.

In addition, so long as the Primary Investor holds any Series D

Preferred Shares, except where the vote or written consent of the

Holders of a greater number of shares is required by law or by

another provision of the Amended and Restated Certificate of

Incorporation, the affirmative vote at a meeting duly called for

such purpose or the written consent without a meeting of the

Required Holders, voting together as a single class, shall be

required before the Corporation may effect a Restricted Change in

Control Transaction; or

(ix) issue

or authorize the issuance of any shares of Series D Preferred Stock

to any entity or person, except to the extent such shares of Series

D Preferred Stock are issued by the Company to any holder of the

Notes (as defined in the Purchase Agreement) upon conversion of

such Notes in accordance with their respective

terms.

9. Preemptive

Rights.

(a) Except

for the issuance of Excluded Securities or pursuant to the

conversion or exercise of any Equity Security outstanding on the

Initial Issuance Date, if, following the Initial Issuance Date, the

Corporation authorizes the issuance or sale of any Equity

Securities to any person or entity (including any stockholder of

the Corporation) (the “Offeree”),

the Corporation shall first offer to sell to the Qualified

Stockholders a portion of such Equity Securities equal to the

quotient determined by dividing (1) the number of Common Shares

held by such Qualified Stockholder at such time (which are not or

would not be subject to vesting or repurchase in favor of the

Corporation as of or prior to the consummation of such issuance or

sale) on a fully-diluted and as-if converted basis, by (2) the

total number of Common Shares then issued and outstanding

immediately prior to such issuance on a fully-diluted and as-if

converted basis. The Qualified Stockholders shall be entitled to

purchase such Equity Securities at the same price as such Equity

Securities are to be offered to the Offeree; provided that if the Offeree is required to also purchase

other Equity Securities, the Qualified Stockholders shall also be

required to purchase the same Equity Securities (at the same price)

that the Offeree is required to purchase. The Qualified

Stockholders electing to purchase their pro-rata share

(“Participating

Stockholders”) will take

all necessary or desirable actions in connection with the

consummation of the purchase transactions contemplated by

this Section 9

as requested by the Board of

Directors, including the execution of all agreements, documents and

instruments in connection therewith in the form presented by the

Corporation, so long as such agreements, documents and instruments

do not require such Participating Stockholders to make more

burdensome representations, warranties, covenants or indemnities

than those required of the Offeree in the agreements, documents or

instruments in connection with such transaction. If any Qualified

Stockholder elects not to purchase any such securities, or not to

purchase all of such Qualified Stockholder’s pro-rata

portion, each other Qualified Stockholder who has elected to

purchase all of such Qualified Stockholder’s full pro-rata

portion (a “Fully

Participating Stockholder”) shall be entitled to purchase an

additional number of shares of such Equity Securities. If more than

one Fully Participating Stockholder desires to purchase such Equity

Securities in excess of the portion allocated to such Fully

Participating Stockholder pursuant to the first sentence of

this Section

9(a), then each such Fully

Participating Stockholder shall be entitled to purchase up to all

of such available Equity Securities. If there is an

oversubscription in respect of such remaining Equity Securities,

the oversubscribed amount shall be fully allocated among the Fully

Participating Stockholders pro rata based on such Fully

Participating Stockholders’ relative proportionate ownership

of all Common Shares on a fully-diluted and as-if converted

basis; provided,

that, to the extent a Fully Participating Stockholder is entitled

to oversubscription rights in respect of such Fully Participating

Stockholder’s ownership of any shares of capital stock of the

Corporation (other than Series D Preferred Shares), the

oversubscription rights set forth in this Section 9(a)

shall be deemed to include the

oversubscription rights in respect of such other shares of capital

stock of the Corporation and, satisfaction of the oversubscription

rights set forth herein, shall be deemed satisfaction of the

oversubscription rights in respect of such other shares of capital

stock of the Corporation (it being understood, however, that for

purposes of determining the Fully Participating Stockholder’s

pro rata portion of the remaining Equity Securities, such other

shares of capital stock of the Corporation entitled to

oversubscription rights shall be included in the calculation of the

numerator and denominator).

11

(b) In

order to exercise its purchase rights hereunder, a Qualified

Stockholder must, within fifteen (15) days after receipt of written

notice from the Corporation describing the Equity Securities being

offered, the purchase price thereof, the payment terms and such

Qualified Stockholder’s percentage allotment, deliver a

written notice to the Corporation describing its election hereunder

(which election shall be absolute and

unconditional).

(c) During

the 90 days following the expiration of the offering period

described above, the Corporation shall be entitled to sell such

Equity Securities which the Qualified Stockholders have not elected

to purchase to the Offeree at no less than the purchase price

stated in the notice provided under Section 9(b)

hereunder. Any Equity Securities

proposed to be offered or sold by the Corporation to the Offeree

after such 90-day period, or at a price not complying with the

immediate preceding sentence, must be reoffered to the Qualified

Stockholders pursuant to the terms of this Section 9

prior to any sale to the

Offeree.

(d) Notwithstanding

the foregoing, if the Board of Directors (with the prior approval

of the Required Holders) determines that it should, in the best

interests of the Corporation, issue Equity Securities of the

Corporation which would otherwise be required to be offered to the

Qualified Stockholders under this Section 9

prior to their issuance, it may issue

such Equity Securities without first complying with this

Section

9; provided that within sixty (60) days after such issuance,

it offers each Qualified Stockholder the opportunity to purchase

the number of shares of such Equity Securities that such Qualified

Stockholder would be entitled to purchase pursuant to this

Section

9.

10. Rank. The

Series D Preferred Shares shall be of equal rank, without

preference or priority, with respect to the Pari Passu Securities

as to dividend rights or rights upon a Liquidation Event. All

shares of Junior Securities shall be of junior rank to all Series D

Preferred Shares with respect to the preferences as to dividends,

distributions and payments upon a Liquidation Event. The

rights of the shares of Junior Securities shall be subject to the

preferences and relative rights of the Series D Preferred

Shares. Without the prior express written consent of the

Required Holders, the Corporation shall not hereafter authorize or

issue additional or other capital stock that is of senior or

pari-passu rank to the Series D Preferred Shares in respect of the

preferences as to dividends and other distributions, amortization

and redemption payments and payments upon Liquidation

Event. The Corporation shall be permitted to issue

preferred stock that is junior in rank to the Series D Preferred

Shares in respect of the preferences as to dividends and other

distributions, amortization and redemption payments and payments

upon Liquidation Event, provided, that the maturity date (or any other date

requiring redemption, repayment or any other payment, including,

without limitation, dividends in respect of any such preferred

shares) of any such junior preferred shares is not on or before

ninety-one (91) days after the Maturity Date. In the

event of the merger or consolidation of the Corporation with or

into another corporation, the Series D Preferred Shares shall

maintain their relative powers, designations and preferences

provided for herein (except that the Series D Preferred Shares may

not be pari

passu with, or junior to, any

capital stock of the successor entity) and no merger shall have a

result inconsistent therewith.

11. Book-Entry. Notwithstanding

anything to the contrary set forth herein, upon conversion or

redemption of Series D Preferred Shares in accordance with the

terms hereof, the Holder thereof shall not be required to

physically surrender the certificate representing the Series D

Preferred Shares to the Corporation unless (A) the full or

remaining number of Series D Preferred Shares represented by the

certificate are being converted or redeemed or (B) such Holder has

provided the Corporation with prior written notice requesting

reissuance of Series D Preferred Shares upon physical surrender of

any Series D Preferred Shares. Each Holder and the

Corporation shall maintain records showing the number of Series D

Preferred Shares so converted or redeemed and the dates of such

conversions or redemptions. Notwithstanding the

foregoing, if Series D Preferred Shares represented by a

certificate are converted or redeemed as aforesaid, a Holder may

not transfer the certificate representing the Series D Preferred

Shares unless such Holder first physically surrenders the

certificate representing the Series D Preferred Shares to the

Corporation, whereupon the Corporation will forthwith issue and

deliver upon the order of such Holder a new certificate of like

tenor, registered as such Holder may request, representing in the

aggregate the remaining number of Series D Preferred Shares

represented by such certificate. A Holder and any

assignee, by acceptance of a certificate, acknowledges and agrees

that, by reason of the provisions of this paragraph, following

conversion or redemption of any Series D Preferred Shares, the

number of Series D Preferred Shares represented by such certificate

will be less than the number of Series D Preferred Shares stated on

the face thereof. Each certificate for Series D

Preferred Shares shall bear the following

legend:

ANY TRANSFEREE OF THIS CERTIFICATE SHOULD CAREFULLY REVIEW THE

TERMS OF THE CORPORATION’S CERTIFICATE OF DESIGNATIONS

RELATING TO THE SHARES OF SERIES D SENIOR CONVERTIBLE PREFERRED

STOCK REPRESENTED BY THIS CERTIFICATE. THE NUMBER OF

SHARES REPRESENTED BY THIS CERTIFICATE MAY BE LESS THAN THE NUMBER

OF SHARES STATED ON THE FACE HEREOF PURSUANT TO THE CERTIFICATE OF

DESIGNATIONS RELATING TO THE SHARES REPRESENTED BY THIS

CERTIFICATE.

12

12. Taxes.

(a) Any

and all payments made by the Corporation hereunder, including any

amounts received on a conversion or redemption of the Series D

Preferred Shares and any amounts on account of dividends or deemed

dividends, must be made by it without any Tax Deduction, unless a

Tax Deduction is required by law. If the Corporation is aware that

it must make a Tax Deduction (or that there is a change in the rate

or the basis of a Tax Deduction) in respect of any payment to any

Holder, it must notify such Holder

promptly.

(b) If

a Tax Deduction for Taxes other than Excluded Taxes (as defined

below) is required to be made by the Corporation with respect to

any payment to any Holder, the amount of the payment made by the

Corporation will be increased to an amount which (after making the

Tax Deduction, including any Tax Deduction applicable to additional

sums payable pursuant to this Section

12(b)) results in the receipt

by such Holder of an amount equal to the payment which would have

been due if no Tax Deduction had been required. If the

Corporation is required to make a Tax Deduction, it must make any

payment required in connection with that Tax Deduction within the

time allowed by law. As soon as practicable after making

a Tax Deduction or a payment required in connection with a Tax

Deduction, the Corporation must deliver to the Holder any official

receipt or form, if any, provided by or required by the taxing

authority to whom the Tax Deduction was

paid. “Excluded

Taxes” means (a) Taxes

imposed on or measured by the Holder’s net income (however

denominated), and franchise Taxes imposed on the Holder (in lieu of

net income Taxes), by the jurisdiction (or any political

subdivision thereof) under the laws of which such Holder is a

citizen or resident, under the laws of which such Holder is

organized, in which the Holder’s principal office is located,

or in which the Holder is otherwise doing business, (b) any branch

profits Taxes imposed by the United States of America or any

similar Tax imposed by any other jurisdiction in which the

Corporation is located, (c) in the case of a non-US Holder, any

withholding Tax that is imposed on amounts payable to such non-US

Holder at the time such non-US Holder becomes a Holder (or at such

time that such Holder changes its citizenship, residence, place of

organization, principal office, or location where doing business)

or is attributable to such non-US Holder’s failure or

inability to comply with any applicable documentation requirements

or to provide any documents or certifications that are reasonably

requested by the Corporation, and (d) in the case of any Holder,

any withholding Tax (including any backup withholding tax) that is

imposed on amounts payable to such Holder that is attributable to

such Holder’s failure or inability to comply with any

applicable documentation requirements or to provide any documents

or certifications that are reasonably requested by the

Corporation.

(c) In

addition, the Corporation agrees to pay in accordance with

applicable law any present or future stamp or documentary taxes or

any other excise or property taxes, charges or similar levies that

arise from any payment made hereunder or in connection with the

execution, delivery, registration or performance of, or otherwise